The land of the permanent renter:Â More single family homes are now rentals with households moving less.

There has been a massive trend towards renting. The vast majority of household growth since the housing bubble imploded has been with rental households. I know this is hard to believe for Taco Tuesday baby boomers but this is simply the new reality. And all of those investors that bought up single family homes for rentals are living it up. There are now a few major changes impacting the housing market – many more single family homes are rentals and many more renters are staying put. In other words, many are not looking to buy and builders realize this. There is now a large category of permanent renters since many people live and work in more expensive metro markets. Short of forking out an insane amount of money to live in say San Francisco, people are opting to rent. The proof is in the numbers.

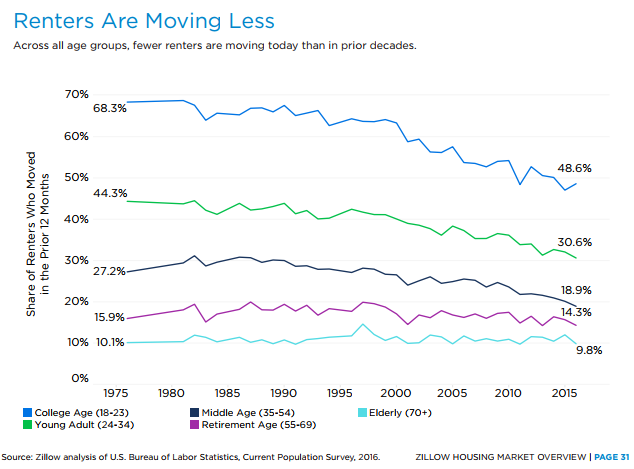

More renters are not moving

Many households used renting as a bridge before venturing out and buying a home. But more people are renting and staying put:

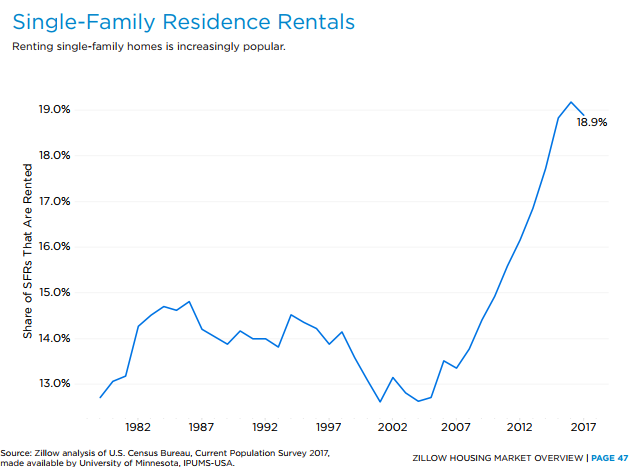

Across all age groups, people are staying put longer in their rentals. And this is being pushed by investors renting out single family homes:

Look at the chart above. This is an anomaly in terms of how many single family homes are out in the market as rentals. In terms of how many SFRs are rented as a percentage of the entire SFR pool, this is an increase of 50% from the 1980s.

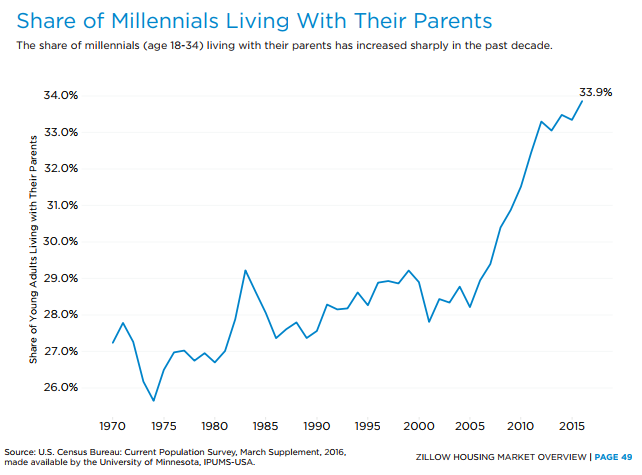

You have many young adults that simply cannot move out on their own even for a rental:

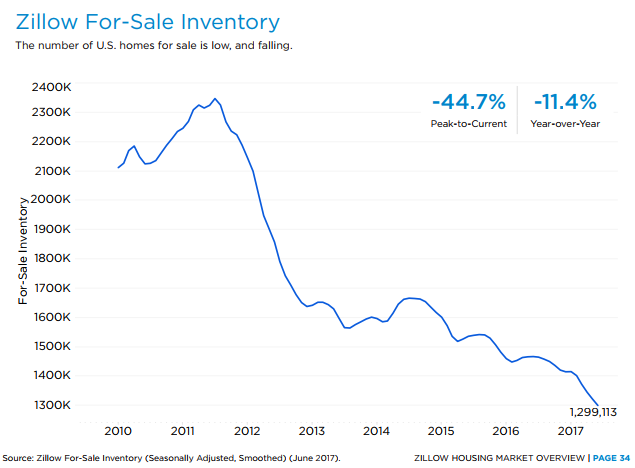

And if you are looking to buy in today’s house humping market be prepared to pay a premium because inventory is pathetic:

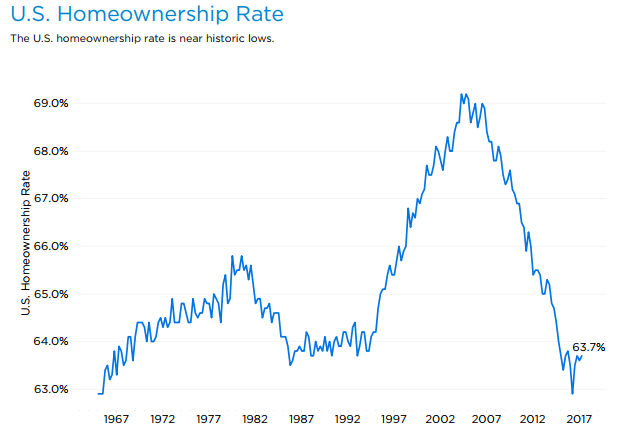

Which leads us to a generational low homeownership rate:

So what you have is a rental market that now has many more single family homes as rentals and many more renters are viewing these places as permanent versus transitory apartments. The fact that many more renters are staying put reflects this change. And why would a landlord argue with this? It is great to have long-term tenants. And for many, this meets their needs instead of buying an overpriced crap shack.

Inventory remains pathetically low and younger American adults in large numbers are simply staying put and living at home with mom and dad. This is not a typical housing recovery. This is a distorted market and this is the outcome of mapped out bailouts with the banks, hedge funds buying up single family homes, and builders becoming reluctant to build.

People try to paint this recovery as a broad one but what this is highlighting is that this “recovery†is essentially jamming 100 hungry people into a restaurant and saying that the first 20 people that get to the counter will get a cold taco. Everything is relative and right now, that dump of a home with crappy construction and toxic mold is looking appealing at $1 million.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

371 Responses to “The land of the permanent renter:Â More single family homes are now rentals with households moving less.”

Housing To Tank Hard Soon!

Exactly! Until the crash comes, I encourage everybody to live at home with their parents. I see no reason in moving out….just stay put until the market tanks. Eventually, the houses get handed down to us Millennials anyway….I don’t get all the emotions and drama. The easy fix is living with your folks until we see better times. That’s just what we have to do during rough economic times. Plus you are saving a ton of money!!

That is good advice, I lived with my mother in my early to mid 20’s while I started my real estate business. Could never have gotten wealthy through RE investment without doing that. Your friends will laugh at you perhaps but you will get the last laugh 🙂 Cheers.

“…Until the crash comes,…”

I sincerely hope you are right. An acquaintance told me 3 years ago to hang in there because it’s a cycle and prices will correct.

3 years later, and prices just keep going up.

Life is too short to put it on hold for years while living in your parents basement. Let me get this straight … instead of marrying your girl and having a family, you are going to live in your parents basement. What happens if real estate rises for three or more years before it drops? You still lose and you wasted your life.

Not much good for those who move cross-country to follow a dream. I’ve been learning improv at the Westside Comedy Theater in Santa Monica, CA, and there are a fair number of those. Life can be quite hard for them. They have my sympathies.

“instead of marrying your girl and having a family, you are going to live in your parents basement. What happens if real estate rises for three or more years before it drops? You still lose and you wasted your life.”

That made me laugh out loud! Not sure where you are from but here in California we dont have basements. I live with my parents and stay in a beautiful big room. If I were to rent this room I would have to pay over 700 dollars at least! That money is better invested or spent instead of wasting it for rent. Not to mention the incredible overpriced mortgages. The only way I move out is when we get a real estate crash.

Marrying and buying an overpriced house??? lol…go ahead! If you think being a debt slave means living I feel sorry for you!!

There are only 2 scenarios possible. Every pension fund on planet Earth is going to implode unless one of two things occur.

1) Interest rates go up dramatically.

2) Local taxes that fund pensions go up dramatically.

One of these is inevitable. Either will crush asset prices.

This means the only 2 things that can save pension funds will simultaneously crush pension funds when asset prices collapse.

Good luck Federal Reserve system. You’ll need it.

“That made me laugh out loud! ”

trumpian

I love the sound of a child’s laughter.

2 things that don’t make sense these da for men: Don’t get married and Don’t buy a house. Mgtow

“have to do” should be more like “get to do”. I came from a fucked up family, was forced to move out in my teens, and dont have that luxury. what you “have to do” in my mind is a luxury of what you “get to do” which I cannot do. No house is ever going to be handed to me “when the parents die” either. People like me are seriously fucked. Not too mention the ridiculous student debt aquired just to be able to make a livable wage to afford rent. Its a giant scam. fuck the government. time to go off grid.

HUBERT,

I 100% agree. There are only two solutions here….a violent revolution or voting for the most leftist person we can find. Socialism , communism, whatever….anything is better than what we have now.

Prop 13 is the biggest scam of all times. You have people living in their million dollar homes and they pay next to nothing in property taxes??? We need to tax the shit out of people who have properties. They should be paying 5% of current market value of the house.

Is there nothing but trolls here now?

ya’ll are easy to spot.

@HUBERT

You are totally right. It seems to me everyone talks about parents are always helping them out as adults, down payment, living back at home for free, free childcare, loans, ect.

There are a good portion of people who don’t have parents who are able or willing to do any of that. There are even some millennials, that actually have to worry about supporting their parents in retirement.

I mentioned this before, but it has to do with the permanent nature of rentals.

This is happening next door to me. An old shack in my neighbor’s backyard is now being legally converted into a rental unit which will disrupt my life no-end. I hate this new law…

https://la.curbed.com/2017/1/9/14219298/granny-flats-new-rules-state-back-house-in-law

Whereas most new laws represent government meddling and destruction of private property rights, this one appears to actually protect them. Hopefully your neighbor’s renters will be respectful and your life will not be disrupted. Wishing you all a win-win.

I’m using Burbank’s ADU code to tear down my existing garage and attach a new garage to the back of my house and build an ADU above the garage. We live on a busy street and I’ve been fighting the city to allow the new garage which will allow us to pull out instead of backing out into the street. We will also be able to have our master bedroom and bath above the garage via the ADU.

Before Burbank was making us install a Tetris fitting atop the garage to avoid their antimcmansioning planning method. It’s a win, win for us.

My brother lives in Westchester (near LMU) and across the street from him is a very large lot, kind of pie shaped, probably 10K sqft lot. he noticed that when the house sold, the buyers demolished it and built a massive 2 story home, even beyond mcmansion size. The buyers are using as a drug rehab facility and apparently got City of LA approval because the City will allow a Rehab facility in some R1 zones if there is limit to the guests for rehab (I think it is 5 residents). The neighbors were up in arms about this and had lots of discussions with the rehab managers. Fortunately the past few years the managers of the facility do run an extremely tight ship and there have been zero problems in the neighborhood.

I love this! We need more available rental units, Every Single family home should add a unit for a renter in the backyard or in the house! Tank this market and help millennials out!

One problem with these accessory units is parking. There is already limited street parking in many neighborhoods!

The going rental prices for an SFR in a decent neighborhood in socal is astounding. Unlike 2006, rents are much higher and the cost of ownership is generally lower (lower rates and decade of inflation). Given these high rent prices, ultra low rates and no inventory, I highly doubt we will see any tanking hard soon.

Yeppers. real rates still negative. disgraceful

I rent an SFR in El Segundo for 2800/month all in. Market value of the house is ~1.3m which equates to a 6500 mortgage.

Nice deltadelta! That’s a steal to rent that place! You would be crazy to stop renting! I keep saying that…. Buying got so overpriced that even the sheeple understand renting saves a ton of money. I am in a similar situation. My rent is soo much cheaper than PITI. I keep hearing from RE Cheerleaders how expensive rent is…muhahaha. That’s their wet dream and the only argument left to buy???! We are due for a recession. We can already see it at my work. YoY sales are softening and everything points to lower demand in 2018. Watch what will happen to rents and house prices during the next crisis hahahaha.

Sounds like you are getting quite the deal on rent. Enjoy it while it lasts, you are one of the few lucky ones. I hope you are saving every last dime and put it to use when we have the 50 to 70% crash.

“the cost of ownership is generally lower (lower rates and decade of inflation).”

That would true only if wage growth had greatly outpaced inflation (it has not).

“Given these high rent prices, ultra low rates and no inventory, I highly doubt we will see any tanking hard soon.”

The only low inventory lies in affordable properties. Plenty of properties for sale, but little or no qualified buyers.

Prince: when you say “Plenty of properties for sale”, what are you basing your assertion on? It was my understanding that the number of listings in the MLS has been on a downward trend across the nation.

@Jeff

Take a look at the monthly supply of homes chart from the St. Louis Fed. The last time it was higher, the downturn of the mid 2000’s was in full blown mode. When supply is limited, sales usually go up due to competition. The RE cheerleaders would like to have you believe the opposite.

https://fred.stlouisfed.org/series/MSACSR

National supply going up is interesting because Calculated Risk publishes local supply for a number of index markets for the previous bubble (like Las Vegas and Sacramento) and for the current one (California coastal metros). They’ve been going down, generally. Are things going south in the rest of the country?

“decade of inflation”

LOL everyone is so full of shit it’s laughable. It’s either you OR the FED…..because the smartest people in the country have been whining and crying that they can’t get to their inflation targets and that’s why they have held rates far too low for far too long.

I just read an article about how “low inflation” is here to stay.

so which is it?

My opinion is RE is the most manipulated industry I have ever seen. The FED is lying about inflation and this going to all end in tears yet again. EVENTUALLY what you earn will be what drives home prices and that means a 80% drop. NOBODY i know can buy a house and can ONLY get one thru inheritance. That is insanity.

Plenty of reasonable rentals but you have to sacrifice something. Check the MLS for all of SoCal for your desired rent range. Take Metrolink to work and do your web surfing on the train. Spend your non-commuting time with your family.

All well and good, as long as you’re working and bringing in enough to pay an exorbitant rent. Do you just never get to retire? Or do you just expect that you’ll downgrade to a tiny senior studio apartment in your golden years?

Move out of that area. There are thousands of cities where retirees can live affordably.

Atlanta GA, low cost of living, 4 seasons, lakes, mountains, big city, small towns, close to gulf and east coast, couple of large lakes, growing economy, sports teams, and Atlanta is #1 in the world for film production, movie, tv, commercials, and a world class airport. The down fall, traffic and crime, but thats to be expected.

There are quite a few senior apartments going up around me, both 55+ and assisted living. It seems the obvious choice to me – less house to keep up and you get to stay near friends and family. Why move to Arizona or wherever to spend time alone cleaning and mowing?

The home ownership rate looks pretty normal and healthy. The author uses the term “generational low homeownership rate”. This is another term for bubble rate. Long term, going back to 1967 and longer, the current rate constitutes reversion to the mean, and is where it should be.

Exactly, we are at normal home ownership rates to history. They were only inflated in the bubble.

Also Los Angeles has always been 60-70% rental units. It is a landlords paradise. Similar to SF renting is by far the majority.

You only have 30-40% home ownership rates historically in LA and SF. Not a lot of inventory for owning. Plenty to rent.

“It is a landlords paradise”

with 4 families per house. You better keep an eye on that property.

The latest drivel to come out of the main stream media … No One Wants Suburban Homes. What a bunch of garbage being written by socialist leaning individuals who think everyone should take up residence in a soviet style building. No thanks.

https://www.cnbc.com/2017/10/13/boomers-worry-they-cant-sell-those-big-suburban-homes-when-the-time-comes.html

The author has a point. I live in a rural part of San Diego county where most homes sit on at least one acre with many being 3+ acres with fruit tree groves. And while everything has gone up in price and the market is hot in this area with people from OC and LA moving in droves, the larger 3,000+ sq ft homes on multiple acres with pools, multiple garages, mancaves, workshops, extensive landscaping, etc. are sitting on the market for much longer and getting considerably less than asking price. I have seen many of these homes get prices slashed multiple times as they sit for months and smaller properties with less maintenance selling within days of hitting the MLS. I think many home buyers today are more practical about what they are buying and don’t want to be tied to a money-pit of a house that must be continuously fed. Prospective buyers now ask about average utility costs and other ongoing expenses. Times have changed.

Wheelin Dealin,

When I first got into real estate a client asked me to appraise a home in Bonsall… but be real careful, we are nervous about stuff that far out!

I read that a lot from liberal millennial posters on another real estate forum. “Everyone is moving to the city.” They say it so often that they seem to actually believe it – it’s their diversity lifestyle fantasy. The actual numbers show otherwise. They eventually get married and realize it’s a terrible (and terribly expensive) place to raise a child, and off to the suburbs they go.

These articles are written by 24 year olds who think living in 400 sq ft apartment is the epitome of life. These same 24 year olds have been writing about the death of the suburbs for 50 years. But like all 24 year olds eventually they turn 34 and 44 and move to the suburbs.

I think the writer of the article has a point, too. YES, many people will always prefer to own their homes, and in nice suburbs. However, they might not want to own a house 2500 sq ft or larger. We forget that, before the 90s, almost no one who didn’t have an income well above average lived in houses with this kind of space.

During this country’s so-called “golden age” during the Post WW2 era 1945-1975, during what time we were not only more prosperous, but much more fiscally conservative, most middle and even upper-middle class people lived in homes with less than 2000 sq ft. My grandparents were quite successful, but didn’t buy their house until the end of WW2, and that house was a 1,500 sq ft Cape Cod with – HORRORS! -just ONE bathroom. Two baths were considered to be luxury; and 3 or more, positively wanton. Folks then SAVED THEIR MONEY, and the revolving credit machine was only just getting warmed up (though it was luring enough people, especially young people just married, into trouble even then.)

The oversized “McHouses” and “McMansions” of the 90s and 00s would have been considered ridiculous and over-the-top, and are. People who aren’t rich really can’t afford to live in 3,000 sq ft houses with massive acreage and huge utility and tax costs, and when you grow older and don’t have kids in the house, you really can’t justify stretching to the end of your income and beyond to carry this… and neither can young people starting out with piles of student loans, who will want to save for their own retirement and help their own kids with college. I see a major movement back to more modestly scaled houses, like the rancher my family owned in the 50s.

Jed, I’m sorry. That is a horrible law! Two years ago, the house next door to mine was converted to an assisted living facility! No notice, and according to all my talks with the city, they don’t need permission of any kind. Just a business going in next door in your quiet SRF neighborhood! My main issues are the vans that come and go every day to take the residents to daycare, the parking habits of the people who work there, and the fact that the owner doesn’t maintain the exterior of the property. It looks like a crack house! I HATE California, and I am plotting my escape!

i have one of those across the street. Very disruptive to the neighborhood. Steady rent for the owners, while the rest of us accommodate the best we can.

People love to bitch about HOAs but this kind of stuff is why I like HOAs. Yeah you get the busybodies telling you the grass is 1/16″ too tall. But you also don’t end up with businesses or apartments next door.

Then sell Laura, goodbye. There will be others waiting to buy your home. Mine as well move while the market it hot.

I walked past this mansion in Brentwood. House has a Zillow value of $6,590,000.

They had a garage, both doors open. Inside I saw car lifts. (Is that what they’re called?) The kind that professional garages have.

There were small cars — Jaguars or Porches — parked in the driveway, along the street, on the grass. And in the garage.

Apparently, this Brentwood mansion owner is running a specialty garage out of his home. Is that even legal? Does L.A. zoning permit garages operating in a residential neighborhood?

There are no signs. Nothing to indicate that this is a commercial automotive repair center. But seeing all those cars, and the heavy industrial car lifts in their garage, it seems to be a high-end, professional operation.

Could be a rich collector whose hobby is working on sports cars a la Jay Leno. I used to live across from an old man who collected old cars, especially Studebakers. He had a three car work bay and a pit under an old shingle mill built on a hillside with a lifting device to pull engines. Drive in the car and go down under it or hoist out the engine with pulleys attached to massive cedar beams above.

Report him, simple

“They had a garage, both doors open. Inside I saw car lifts. (Is that what they’re called?) The kind that professional garages have.”

They may have the lifts both to fit more cars and be able to work on them – could be a rabid enthusiast with several different projects going. I know a guy who has a 5-car garage and keeps one car on a lift just so he can park something else underneath it.

Also 911s and Boxsters require a lift for some of their maintenance.

Or the owner just has lots of cars. I know one couple that has 5 cars. 4 of them are high end exotic sports cars, plus their daily drivers. So 6 cars in total.

And since they don’t have room for a 6 car garage, they built a 2 story garage with a lift. It’s pretty cool. But there’s nothing nefarious about it, they just have a lot of cars and not a lot of room on their property.

“This is a distorted market and this is the outcome of mapped out bailouts with the banks, hedge funds buying up single family homes, and builders becoming reluctant to build.”

I think that the third one is a response to the heavy FED manipulations. If prices for SKILLED labor, materials and land go up because of QE, then builders can not make a profit building homes or they will. Some, who bought land years ago still build, but the profit is in the land appreciation not construction. It is easy to cash in on that land appreciation by building because that housing market is juiced by the FED through FANNIE and FREDDIE. For raw land you have less profit because there are not many banks financing for lots and if they do, they ask for high downpayment and offer portfolio loans.

The builders did not distort the market. The market was distorted by the FED and builders are just price takers.

So the builders response is indirectly a cause but also an effect of the FED policies. They don’t make the market, they respond to it.

I think the market was distorted by an all-too-eager population of home buyers who were lured by no-down-payment, adjustable rate offers, who just had to have 3,500 square foot houses that were priced well beyond what they could afford. They all wanted to live like the Kardashians. It was fueled by the sales pitch delivery device (television). And thanks to Henry Cisneros in Bill Clinton’s administration way back on 1993, the government, in their infinite wisdom, thought that everyone was entitled to own a home. So they coerced the banks into making it very easy for people to qualify without putting any skin in the game. Enter Wall Street and mortgage-backed securities. They were making boatloads of money by packaging and selling these mortgages in the market, and everyone was fat, dumb and happy until the bubble burst. This blog often blames the baby boomers for the mess, but I blame everyone who knew better. And as for the Taco Tuesday Baby Boomers, what else can they do if they want to stay in California? They’re sitting on a gold mine (at least for now), but they can’t afford to buy anything else. I say to anyone who complains about the home prices in California to move to another state. Your life will be much better in many ways. I left California in 1991 and have never regretted it.

Good post, Nix. However, the principle cause of the gross deformation in the housing market in the 00s, and the credit markets in general, was interest rate repression, and the willingness of our government to bail out financial companies from the results of their insane risk-taking.

As it is now, in spades. Only now, the extreme interest rate repression and total lack of price discovery has distorted not only our housing market, but all of our asset markets, and has rendered the earnings AND the savings of our population, almost worthless. The super-low interest rates mean that you can get a “return” on your investment only at extreme risk, not only in today’s hyper-bloated stock market, but in all asset classes. The result is not only more people being pushed into poverty, but enormous mal-investment in anything that looks like it could offer a yield of more than 3%.

My guess is that when interest rates rise to a point where a low % return on a rental property is too risky versus putting the same money into a low risk bond returning 5%, a large number of rental properties will be put up for sale.

@Laura

+1

Exotic lending and easy credit are the underlying factors during the modern era of price inflation. Only the participants are different. Exotic borrowing fever has shifted from specuvestors to organic buyers and now back to specuvestors.

“but they can’t afford to buy anything else”

I don’t know anyone who owns a home that can afford to buy that same home at their current income. Not one single person. One said he could not afford just the taxes if it was assessed at it’s current value.

This insanity can only end one way. It’s just simple math actually

I think it’s time for rent control, if a investor does not live in the house within two years of purchase the purchase is forfeit. Time to end monopoly rent seeking.

Rent control creates slums. Look at LA. If you want government controlled housing maybe you should move to another country where people have less freedoms to do what they want with privately owned land.

Great. A Government “solution” to a Government caused problem!

Agreed!

“I think it’s time for rent control, if a investor does not live in the house within two years of purchase the purchase is forfeit.”

He wouldn’t be an “investor” then, would he, if he isn’t allowed to invest? Nobody would, in Soviet-style So-Cal.

@Eduard:

Translation: it is time for soviet style communism; here comes Bernie!!!….

It will end like in all other communist countries – 0.0001% slave masters and everyone else an EQUAL poor slave.

New York City has rent control and rents are like $400/mo for a 3 bedroom apartment right? LOL. Rent control is like socialism. It has never worked. It will never work. Yet for some reason some people still want to try it.

https://www.economist.com/blogs/economist-explains/2015/08/economist-explains-19

“But economists, on both the left and the right, tend to disagree. As Paul Krugman wrote in the New York Times in 2000, rent control is “among the best-understood issues in all of economics, and—among economists, anyway—one of the least controversialâ€. Economists reckon a restrictive price ceiling reduces the supply of property to the market. When prices are capped, people have less incentive to fix up and rent out their basement flat, or to build rental property. Slower supply growth exacerbates the price crunch. And those landlords who do rent out their properties might not bother to maintain them, because when supply and turnover in the market are limited by rent caps, landlords have little incentive to compete to attract tenants.”

Flyover, I have seen where you are coming from and I understand.

Communism is evil. True. But it has been historically born from a majority of the people who are starving and homeless under extreme brutal dictators. The communists provided hope for a people who had no hope. (Cuba, Russia, China)

The end result of Communism is oppression.

Pure Capitalism is also evil. The US had this with sweat shops and manufacturing sites with no safety and extremely poor pay. Pay that was not enough to support rent. ie 60+ % of salaries or Capitalists who had company housing that took all of their employee’s pay. After breadlines, and people starving in the streets, people in the US had a choice and voted for a Socialist President FDR who was far more Socialist than Bernie. The US was a strong Democracy with a strong Constitution that enabled this.

Another capitalistic Democratic country, Germany, without a strong Constitution voted for Hitler who:

1) Promised to make Germany great again.

2) Promised to close the borders and exile any undesirable people.

3) Promised to to rebuild the military.

What happened to Germany after that?

Where are we now? I fear for our great country

We should have voted for a milder Socialist FDR. ie Bernie.

@Bob

Yes because Sanders is such a saint. It’s not like him and his wife were caught embezzling money from the college she ran and giving herself a higher salary. Germans were happier under Hitler’s leadership than they are now with Merkel’s multiculturalist nightmare. More than half of the German population wants him back.

Eddie, Eddie, Eddie. Communism has failed each and every time it has been tried. Literally 100% of the time it has failed. It has never failed just a little. It has always failed spectacularly, leading to misery for hundreds of millions of people. Stop making an imbecile out of yourself.

Finally, something we can agree on. I hate communism too. Of all forms. And this is where we diverge vigorously: I reject the centralized planning of the Federal Reserve. So communism works for you as long as it enriches you. You are both a hypocrite and a narcissist. Go away.

Yes! We absolutely need rent control! It’s past due! The government should also give out incentives for sfh to add rental units in the backyard, garage or inside the house. You should get a hefty tax cut if sharing your space with other renters. This is will help to increase supply and a greater good for the society! Also we need to change zoning laws and allow to build much more multi-family skyscrapers for low income families. California has gotten out of control with their capitalistic methods with are a cancer to hard working families. We need to reverse course as soon as possible.

“…and allow to build much more multi-family skyscrapers for low income families.”

A spectacularly bad idea which hypocritical liberal big city governments would never allow to happen. “Help the poor, as long as it doesn’t involve getting too close to them.”

“California has gotten out of control with their capitalistic methods”

@ Bernie, there is nothing capitalistic about the housing market in socialist CA. It is a HEAVILY manipulated market by crooks elected by you in Sacramento. All those crooks in Sacramento are communists not capitalists.

You can not have capitalism without free markets. There is no free market in CA RE. It is by the cronies and for the cronies. You mean Proposition 13 is about free markets? What about mirriad of regulations passed by Sacramento !???…What about Central (Bank) Committee (FED) interventions in the housing market. What about FANNIE and FREDDIE MAC? Are they about free markets?

Everything you see is socialism at its finest. There is nothing capitalistic about. If you went to college, ask for refund; they failed you.

But Prop 13 is a form of rent control, in that as rents can’t go up or only go up so much, so do property taxes.

Exactly. That and the fair taxation of land. But that will never happen in a country that worships money and everyone scrambles for the crumbs left over by their capitalist masters.

Mark, are you saying that taxes on land in CA need to go up? Santa Clara’s assessment said that my home was worth $120k and the dirt was $520k. How much more should that dirt be valued at? This was a typical mid 50’s 3 bed 2 bath 2 car home.

Is the real estate market rigged so that the rich can buy more and more of it at after each real estate crash? Will the powers that be (TPTB) crash the market again or are they satisfied with what they already have acquired? Time will tell, but I am personally betting on TPTB engineering another real estate crash soon.

As a landlord, this is music to my ears.

STFU.

You mad bruh?

Yeah, because you are a parasitic leech who was happy to accept socialism as an acceptable form of government so long as it benefitted you and your rentier class. If capitalism had prevailed, you’d be singing a different song. So shut up with your smug bullshit.

How long will it stay like this?

The price of homes is determined by demand for housing. For the purpose of home prices, it doesn’t matter if the demand is from renters or buyers. Every home that is rented out, is still owned by someone. Look at NYC, where the rental rate is astronomically high. And still, real estate is out of this world expensive. As long as the demand for housing is there, prices will keep going up.

So you really have 2 options:

1. Pay rent for the rest of your life

2. Collect rent for the rest of your life

It’s a no brainer.

mr landlord, we need the lazy zombies to make our landlording profitable, if there weren’t stoners i would have empty buildings. We also need greedy undisciplined lemming buyers to overlever into real property so that it is later sold at a discount to us. Don’t motivate them bro!!!

Heh. I like your philosophy.

The homes built in the roaring 20’s the age of excess, are superior to those built during the depression years, the war rationing years, the cheap housing for the vets, post WW2. The houses build during the 20’s have oak wood lath, oak wood floorboards, and crown molding and molding around the doors, not to mention the solid wood doors. Of course, the hard wood floors. The plaster is thick, on the outside you have the redwood planks, overlaid with thick cement. The walls will stop a 9mm.

I suspect that renters don’t move because if they are good tenants and pay their rent on time, the landlord is less likely to raise the rent. The renters look out at the other available rentals and decide it is better to stay put. Landlords will typically raise rents to market value after their tenant has moved out and they’ve put in new carpet, paint, etc.

If rents start falling, there will likely be a shuffle of renters trying to catch the best deal.

And moving a family’s worth of stuff is expensive, time consuming, and a pain in the ***.

I had a good tenant and I had no rent increases for the three times the lease came due for renewal. Unfortunately, they got a better job in Montana and are moving this month. The agency I’m using is upping the rent asked for by $225/mo. (That is more than 20%.). It is 25 miles out in the Country from a small Oregon city where rents are jumping. It is probably $500 to $800 less than a house in town.

You are correct Bob. If I have a solid tenant, I’ll keep rent as is for as long as the tenant wants to stay.

As for tenants chasing some mythical lower rent, it would have to be substantially lower. I don’t think many people want to put up with the hassles/cost of moving to save $50/mo on rent. Next to a death in the family, moving is the most stressful event in people’s lives. Not worth a few hundred dollars a year.

This was us… we live in an apartment that was supposed to only be a temporary landing place between selling our condo and buying a house. We were too picky in early 2014 when we sold and the market went above what we are willing to spend. So, we are stuck in a fairly crappy LA apartment, but at least our landlord (a guy who inherited the building from his dad) was friendly when we would see him come check on the building once every couple weeks, left us alone, and didn’t raise our rent. Most other tenants in the building were very long term- oldest had been there 25+ years, newest besides us had been there 7 years. All in all, not too bad, at least the neighborhood is nice and safe.

UNTIL a few months ago nice landlord decided to cash out and retire, and sold the building to a property management company. Within two weeks of the sale closing, everyone got a rent increase letter. Luckily the building is rent controlled, so they could only raise 3%, but one of our neighbors is on disability and I don’t think he will last here more than a couple more years if they raise the rent each year.

And, they have brought a contractor around a couple of times already and are making noise about temporarily relocating people and renovating the units.

Now millennials can buy shares of my investment friends’ stock in the firms owning and renting homes cheaper than buying homes themselves. It’s called capitalism, you dopes

Southern CA rents expected to keep rising through 2019 at least 3% per year for next two years. The large millennial generation was singled out in the USC report as one key reason rents will rise over the next two years.”With more millennials entering their late twenties and early thirties, demand for multifamily property should be particularly strong,” the report said.

It’s a good time to be a landlord.

http://www.latimes.com/business/la-fi-southern-california-rents-20171011-story.html

“It’s a good time to be a landlord.”

Bbbut bbbut bbbbut STUFF!!!

– Perma Bears

Several of these charts are exaggerated as differences are only about 5% from traditional trends. The number of homes for sale is the one that is stark, as well as homeownership, which begs the question, was the 90’s – 2000’s an anomaly? However, underlying all this is ‘affordability’ … which is the real problem. California, the liberal ‘republic of’, has one of the largest affordability gaps in the nation. L.A., stands out on-top of the heap! Those established in their homes and jobs may be content, but you are slowly starving your future if people can’t afford to live there. Consider those well paid geeks working in Silicone Valley who have to share a bedroom because rent is so expensive … this can’t be sustainable!

Housing is NOT overvalued and it won’t tank. If you want to see something with a high value and low worth, look at bitcoin. There is no comparison how much you could have made in Bitcoin compared to a house.

But you can’t live in Bitcoin, you can only cash out and buy 100 homes.

Housing won’t tank until at least another generation or two. People NEED housing now to raise the next generation. There is no other choice, you need to pay up.

“Housing won’t tank until at least another generation or two.”

You’re either a real estate agent or just choosing to ignore the last 50 years of a fluctuating market. Maybe both.

“Housing won’t tank until at least another generation or two. People NEED housing now to raise the next generation. There is no other choice, you need to pay up.”

Sarcasm?

I agree with Sean regarding Bitcoin. Actually, my litecoins and ethereum a went up big time as well. Regarding housing….nobody needs to buy a house. It’s a lot of money to maintain and right now it’s totally overpriced. Every ten years or so the market tanks. I just live with my folks until we see a hefty crash. Then I will decide to either move out or stay put. I am saving a ton of money by living with my folks. They like it as well.

Why buy an overpriced crap box if i can live for cheap in the same place and have no liabilities/responsibilities in maintaining/fixing stuff? My landlord is giving me a huge gift.

No problem in sight. If builders, realtards and banksters want me to purchase so they make their commission….lower prices by 50% and I am in. Otherwise…hell no!

I don’t think banksters and realtards care about you. You are in your own little bubble and your situation applies to no one but yourself. In forever predicting a 50% drop, you are proving to be just as naive as Jim Taylor.

Not sure when the bubble would pop but I can tell you for sure.. People are really really stretched to live in SoCal.

The high paying jobs are going away.

it is wishful thinking that people can afford this.

A big trouble is coming for sure and would be so big that housing bubble bust would look quite small..

BTW: In the last 60 years, housing has been busted many times before in SoCal to the tune of 50% or more . Every time people thought it’s diff..

I don’t know this time may indeed be different

You must be kidding Jed.

My situation applies to literally every Millennial in California. Since there is no rental parity its much wiser to rent a cheap apartment from a private landlord or live with your parents. You do that until we get a nice economic collapse which will bring prices down by 50-70%.

I have not said this forever and i wont. My timeline is between 2-5 years but can be extended if we haven’t seen this crash by then.

So, Jim Taylor is basically right on the money with his Housing to tank soon. 2-5 years is nothing compared to a lifetime.

Realtards seem to care a lot….i just need to open my email account and read the stuff they keep sending me….since a few years they are trying to convince me that NOW is the best time to buy….very entertaining. LOL

He won’t own until he inherits, and only if he’s lucky enough that both parents don’t have a catastrophic illness. When the market finally adjusts, he’ll still be convinced that it will drop further, and when he finally does start putting in offers, they won’t be accepted because there are 15 other offers and his aren’t high enough. “Why should I offer 5% over? It’s not worth that much!” Ignoring the fact that prices are 30% lower than they were, but forever chasing that magic 50%. He may catch it if he’s okay with a desert condo.

Or maybe he’ll meet a girl. One who won’t tolerate his obsession with crashes. Ten years after they buy their first house, when he realizes they saved six figures over renting, he’ll be thanking her.

“My situation applies to literally every Millennial in California”

Literally every millennial doesn’t understand what the word literally means.

Agreed, nobody in finance or sales cares about you Millennial. I don’t think any realtors are aggressively pursuing your business. The RE market is not orbiting around you, sorry broseph.

I’m sure the water cooler talk at the local Remax is not, “So guys, any progress with Millennial????? Has he purchased yet??? I’ve been dying to land that whale Millennial so we can do massive amounts of high-end repeat business!!!!!!!”

Your investment strategy, if you want to call it that, is by your own words on this blog to wait for your parents to die so you can inherit their house–that is a ridiculous investment strategy. It will do absolutely anything to create longterm sustainable wealth for you.

Nor Cal Fella,

“Agreed, nobody in finance or sales cares about you Millennial. I don’t think any realtors are aggressively pursuing your business. The RE market is not orbiting around you, sorry broseph.”

We have very low sales numbers. Realtors are starving for commission. Same as lenders. I am just like any other potential client. Yes, Realtors do follow up with me on a regular basis. I do enjoy the conversations. Of course, they just go down the list of contacts. I never claimed to be special interest so I am not sure why you are getting so excited.

“Your investment strategy, if you want to call it that, is by your own words on this blog to wait for your parents to die so you can inherit their house–that is a ridiculous investment strategy. It will do absolutely anything to create longterm sustainable wealth for you.”

You must have misread my statement/strategy. I repeatedly said, that I am saving and maintaining a debt free life/frugal life in order to be prepared for a RE crash. RE cheerleaders clearly don’t like that. They want you to buy now. They tell you:

1) you will rent or live with your parents until you die / you will never own

2) you will never build wealth

3) you are a loser

4) this time is different, buy now or be priced out forever

In regards to #1) and #4) I respond that since my parents own several houses I would simply own at the point of inheritance.

My point is, you cannot lose by waiting for the next crash. No matter how much creativity and effort RE cheerleaders put into their arguments.

Another common RE cheerleader strategy is to put words in your mouth or pick only certain statements out of context.

Surely, this is not just directed at me but the response to a frustration realtors and lenders share lately: Low sales numbers and consequently low commissions…..

and imho,,,,,when your parents die you better have that will/trust locked up tight or your fathers illegitimate child will come forward in probate and force the sale of that home your leeching off of, your folks must own google to afford you ,, sickening,, hope your app will teach you to grow food,,, btw if i was your parent and read what you write, you would be on the street in five seconds flat and you would be looking for that rental today! yeah love it up in mommy and daddys place,,, wonder how –unless they do own google—-you are going to attract a mate?/gold-digger,,,our milli started having all the best electronic toys but no savings and no plan to move out after one year,,,it may sound harsh but it is the real world and he is having to figure it out now,,,,also when and if you inherit your parents home,,, You will be unable to maintain it as you have said ,,,, within 5 years the paint is peeling in 10 the roof is leaking , in 15 the dry rot sets in in 20 it is condemned for black mold,,,,, see where this leads? there are no apps to fix these things, they are called maintenance as in “”no liabilities/responsibilities in maintaining/fixing stuff?””” this is a no win for you yeah, see ya dont wanna be near ya,, you will devalue my neighborhood

beeman,

you sound so angry….why? And what app are you talking about? And why would I be unable to maintain inherited RE. You lost me somewhere in your post.

I am not sure what you are trying to accomplish with your post but I am still not buying an overpriced crapshack. The next crash is around the corner. When that happens i’ll buy….Just have some patience.

I’ve been watching this housing bubble happen for my 22 year working life… now 44 years of age.

I lived in San Diego from 2002 to 2009. During that period of time housing prices tripled… after the “Great Recession†they fell 20 to 30% for a year or two (still more than double from 2002).

I had the same hope for a blood bath after 2008 but I finally accepted that it wasn’t going to work out for me in California, so I left for greener pastures in 2009. Those pastures aren’t really green for first time buyers anymore now. I guess you could say I panicked first. Bought in 2012 in a prosperous non-bankrupt undisclosed state.

I realized a couple very general lessons regarding the way things work in this country regarding wanting to own a home in California that I hope you’ll find of some use (just my personal experience and observations as a one-time youngster and lifelong “Cubicle Muleâ€).

1) Once you get your “piece of the pie†no one cares about the folks they left behind. It’s true… your perspective changes once you get your piece and you realize nobody really cared whether you got your chance or not. Nobody gives a crap about what you or I want or think is fair.

2) Every working “Middle Class†Joe thinks the same way you do (and the way I did). When San Diego burned in 2003… everybody ran out and bought in the areas that burned down… then they burned down again in 2007. The same thing will happen in Sonoma. There’s tons of people sitting on the sidelines waiting for their chance to vulch someone else’s misfortune. It’s really the way the world works and that mindset is pretty much pervasive everywhere.

3) Pursuant to lesson number 2: Things have drastically changed regarding immigration and property purchases since 2008. They’re letting over a million people into the country every year to compete for the same limited number of houses you’re looking for. That’s right… non citizens the world over can buy property in this country…but you can’t do the same! The Main Point of Lesson 3 is this: You won’t be able to compete with our international “friends†and the “whale†insiders waiting for the next downturn… just like you can’t NOW. Big Fish… little Pond… BTW if you’re middle class 100kish…you and I are still the little fish… before or after a correction in Cali.

4) California is a playground for the Nation’s and Worlds wealthy… they don’t really care if you rent for the rest of your life… or preferably die tomorrow to alleviate traffic… See lesson #1.

I know the joy of daydreaming of indulging in some Schadenfreude and someday being a “Winner†in Cali… just don’t be surprised if it doesn’t work out that way… you certainly won’t be alone.

Here’s the problem everybody wants the exact same thing you and I do in California… it’s just not possible.

My life drastically improved once I realized I was a “Loser†in California and moved on.

A loser (AKA “Middle Class Tax Donkeyâ€) from Cali is generally a winner anywhere else. By “winningâ€, I mean being a “loaner†of a house that’s only 27% of your take-home pay in mortgage, insurance and taxes.

Maybe we’ll get a 2008 Reduxe, maybe not, maybe something worse.

Just be sure not to be the last one to panic if things don’t go according to plan.

CUbicleMule,

that’s a lot of life lessons.

Here are my favorite ones.

The worst mistake one can make is to marry the wrong person.

The second biggest mistake is to buy an overpriced house during a bubble.

Trust nobody, do your own homework and research

Think positive.

So far I got along just fine following these.

What I dont get is, why do you think waiting for a crash and buying a house at a deep discount is so hard to achieve? Many people I know have done it that way. Gosh, I could even buy now. But if you save so much money by renting why would you decide to be a debt slave and overpay?

I’ll never understand that. Nothing keeps going up forever. Every second person on this blog tells you RE is all about timing and cycles. Patience will pay off….just come back in a few years to this blog and I will share my experience/purchase with you.

One last lesson….people dont give advice that is meant to benefit you. People pretend they give you good advice but somehow it benefits themselves….So, the fact that soo many people try so hard to convince us to buy now tells me its a terrible time to buy. If buying would be making sense nobody would have to convince you and come up with all these reasons.

You speak the the troof Cubicle.

As far as buying after the fires, that was my first thought…wonder if I can get some cheap Sonoma property after the smoke clears out. Nothing wrong with that thinking, by the way. What are we supposed to do, just leave the place empty for the next 100 years? What happened after the SF and Chicago great fires? People rebuilt and a lot of people made fortunes doing so. Again, nothing wrong with that.

@CubicleMule

That’s one of the best posts I have read on this board. One thing that really helps is that your writing is well-organized and clear.

I totally agree with you on just about everything you have written.

The only comment I have is that a new situation is developing with increasing homelessness and poverty. CA is indeed a playground for the wealthy but more visibly it is a state of extreme poverty, filth, and destitution.

Super post, Mule. And amen! I’m in your age group, and a cubicle mulette! The writing has been on the wall for a long time. And now with the homeless and all their various problems freaking everywhere, I’m just looking for someplace clean. All the “cool” places to go around DTLA are no place I’d take my kids, or leave my car! Even the suburbs have a lot of issues now. Out of state it is!

You forgot something.

5) Coastal Southern California will continue to be oversold to the uninitiated masses by those with vested interests – dream following/disenchantment escaping emigrants stubbornly clinging to post-purchase rationalization, frightened in-place native born residents, and anyone else with enough money directly at stake. They’ll tell you how desirable it is, just as soon as they get a break from the congestion they’re overpaying their government to help make worse. In other words, almost no other place is better at deviously selling a losing proposition as a winning idea.

It’s hard not to panic, but Warren Buffet has made millions by not panicking when prices crash. Never sell low and buy high. Take a deep breath wait a few months after Jim Taylor is finally correct, and buy all you can afford.

Leaving California? No thanks! I love it here. People get too dramatic, too quickly and have this drive-thru mentality….wanting to have everything right now….these people only see three doors:

Door 1: Buy now

Door 2: Rent forever

Door 3: leave the state

What about the prettiest door,#4? Its called frugal living, saving money and waiting for a beautiful crash!

Mr Landlord, how come we were thinking the same thing at the same time in regard to empty land in Sonoma and Napa Valley??!!!!…..tst, tst…these investors have the same mindset!….

“The only comment I have is that a new situation is developing with increasing homelessness and poverty. CA is indeed a playground for the wealthy but more visibly it is a state of extreme poverty, filth, and destitution.”

@oceanbreeze, I was stating here years ago that if you want to see the future of SoCal go to Sao Paulo in Brazil. What you say above is what you see in Brazil – extremely rich and extremely poor; few guys play golf here and drug lords and favela over the fence.

In the end, the result of central banking will be the same everywhere; the corruption from the top will spread to the masses.

@Millenial

It seems that you have misread what I was trying to communicate.

My point was this…

I thought prices would revert to 2002 levels after the 2008 crash… They Didn’t.

Also, (for @MrLandlord’s benefit)…I wasn’t putting anyone down for vulching others’ misfortune… just pointing out that everyone else is also hoping to do the same thing at the same time. Tons of people just as eager and clever as you and I.

I wasn’t really giving advice per say, but rather sharing my observations with someone in the same exact position as I was 10 years ago. I truly empathize.

As you can see from some other replies, most people took my observations as rather refreshing and insightful.

It all really depends on what kind of income level you have as to whether the coming correction will benefit you. I’m fairly certain it will correct, but I laid out the factors (in my personal observation) for why prices didn’t correct as far as I had anticipated last time… hopefully in an entertaining sort of way.

Back in 2007, I was running around telling everybody how smart I was for waiting to buy and that I was going to get a house in San Diego for 50% off because it was obviously a bubble… it Never happened.

They were still amazed that I predicted the downturn though. It just wasn’t big enough for me to capitalize on at my income level.

For me personally… buying a house for more than $350k for 1,500 to 2,000 square feet just isn’t a good decision… so I left San Diego.

Anyway, I just wanted you to know that I DO think you’re Right for NOT buying now, but that things might NOT present as big an opportunity as you’re hoping them to.

I have no vested interest whether you buy now or wait. Just good old fashioned commiseration for having been in a similar situation.

I told all my older associates in 2007 that they were full of crap too when I told them of my plans to come in and get a 50% off deal… and they said I was nuts. Unfortunately for me, they did turn out to be right in my case.

BTW I think all of your Life advice tips are Great and I have already followed them ALL!!!

Except I would like to point out a potential flaw with this one… “Think Positiveâ€.

Too many inadvertently conflate “thinking positively†with thinking “Magicallyâ€. There is a difference. I might change that one to:

“When things don’t go according to your plans, see your setbacks as a doors to other possibilitiesâ€

Anyway… I hope you get the big opportunity I wasn’t able to secure.

Ahhhh… to be young again!

Heehaw!!!

CubicleMule

“… this “recovery†is essentially jamming 100 hungry people into a restaurant and saying that the first 20 people that get to the counter will get a cold taco.”

… while restaurant owner eats beef in the cabinet with his fellows and deduces that from his taxes as ‘business expense’, of course.

I am in the process of suing a landlord in claims court. Maybe its because she thinks she is above the law? Point is that landlords get sued. They can get sued for a ton of money. With all the tenant rights laws it adds up quickly. Land-lording is not for the faint of heart. It’s definitely not for me.

A lot of people on here talk big about how being a landlord is the end all solution to life. My family is wealthy but the only property in the family is 1 house and 1 lake home (never rented out). RE averages about 6% returns YOY, stock market is 10%. Look at the top richest of the rich. They did not get rich by buying houses and renting them. Even DJT says being a landlord is a waste of time. Work smarter not harder sheeple.

“Look at the top richest of the rich. They did not get rich by buying houses and renting them. Even DJT says being a landlord is a waste of time.”

The point in being a landlord is for steady, passive income, and using other people’s money to finance your retirement. It isn’t a “get rich quick” scheme, although the wealthiest people I know did it via coastal real estate. There’s a lot less risk in (for example) buying a $200k 3/2 in Florida with significant positive cash flow than there is going all in on the stock market right now.

With that said, it’s always smart to not put all your eggs in one basket.

Stock market averages 10%? Not really.More like 6-7% historically and that is assuming all dividends are re-invested and you don’t do stupid shit like panic sell.

Real estate isn’t for anyone. And nothing in life is guaranteed. But you have to really work hard to lose money long term as a real estate investor.

Look, the Fed clearly caused this bullshit. And anyone who happened to already be in possession of assets which benefitted from the Fed’s asinine policy got LUCKY. I wouldn’t be crowing about it like you’re some sort of genius. In fact, all you’re doing is participating in one of the most immoral money grabs in human history. I say that as a capitalist — if the Fed would have let the markets alone, assets would have been liquidated (including yours you smart ass), prices would have cleared, and we would have reverted back to real markets.

You can blame the Fed all you want. CA RE on a monthly cost basis was the cheapest in decades back in 2011. People got greedy and wanted another 20% price reduction…we all saw how that worked out.

‘Calling BS” is 100% CORRECT!

However, as I said to “Millenial”… “Nobody gives a crap what you or I want or think is fair”. I think that what the Doc has been trying to do through this blog is to get people to just walk away from the line of suckers and thus hasten the correction. It’s hard to do and timing the market is a bitch. It will definitely never happen when you want it to.

The way I look at it… I was born 20 years too late. I can blame whoever I want and envy those born before me, but waiting on a dream dependent on things outside of your control for too long just means you’re wasting your life, not following your dream.

California didn’t care about me… so I stopped caring about California. Life isn’t fair, but life doesn’t begin or end in a California crap shack.

The hardest thing in life is to realize the journey IS the destination and that your “turn” isn’t owed to you or may in fact never come. I have certainly appreciated the commiseration this blog has afforded me and seen so much of myself reflected back in all of you. At least those of you priced out… like I was.

Thanks Doc for your gentle steering these past 10 years… hard to believe I’ve been lurking here that long.

Remember… “Nobody gives a crap what you or I want or think is fair”. After all… they got there First.

Cube,

I’ve been instilling this into my kids since they were old enough to complain. Life isn’t fair. Life owes you nothing. Depend on nobody but yourself (and family most of the time) to succeed in life.

There’s nothing in the Bill of Rights about being able to afford a nice 4 bedroom home near the beach in Orange County. Yet somehow a lot of people – I’m looking at you Millennial in particular – seems to think otherwise.

Not to go too much off on a tangent on the entitlement mentality, but…..I live in a small town/suburb. It’s upper middle class, one of the highest median income zip codes in the state. The kind of place liberals loathe. Single family homes, nice parks, good schools, virtually no crime. This weird place where everyone has a job and nobody lives off the govt. A throwback to yesteryear America. So it must be destroyed!!!

One day a developer had this wonderful idea to build apartments in our town. The towns-folk went ape-shit over it, and eventually we forced city council to not approve the plan. But the people who were pro-apartments used the argument that it was somehow unfair that only evil rich (mainly white) people could afford to live in our nice town. And it was soooooo unfair that low and middle income people couldn’t enjoy the benefits. And I wanted to b-splap these people every time I head that nonsense. I worked my ass off to be able to live there and you just want to give some Section 8 asshole the same thing I have just because? FUCK THAT.

Ok rant off…

Hey @MrLandLord:

The town you live in doesn’t happen to be _ _ _ _ _vale, is it?

I’m not that far from you if that’s the town.

Sorry for the discretion everyone, but me and MrLandLord sound like kindred spirits and possibly neighbors.

We’ve had problems with political infiltration and sabotage of our cities by out-of-state progressive transplants who want to bust out our city budgets and turn them into freeloader ghetto havens like they came from.

Once you allow public transportation (aka buses) into your town… it’s only 20 years to implosion. My city is in 10 years so far.

You know you’re pretty close when the “people” just start walking directly across the streets in oncoming traffic… and glare at you when you have to slam on the breaks to avoid hitting them at 40 mph.

A never ending battle to keep what you earned and paid for from being given away to Section 8 parasites.

It’s not just California… it’s everywhere.

Cube,

Nope, not _____vale. I’m not sure where that is to be honest. But stuff like that is happening everywhere. And I agree 100% on the public transit thing. Another good example: Cobb County, which is suburban Atlanta vehemently fought any expansion of MARTA (their subway system). And of course it was was called racist and anti-progress and the rest. Well, 30 years later, Cobb Co still has no MARTA trains running to and from the downtown ghettos, and by an incredible coincidence has the best schools in the Atlanta metro area. Crazy how that works huh.

One reason the leftist scum want public transit is to bring Section 8 trash to nice areas. But another is their hard on for trains and buses. After all, Europe has public transportation everywhere. And if Europe does it, it must be good***. What they forget to mention is, everyone in Europe takes the train not by choice but by necessity. It costs 20% VAT on the price of a new car. $40K car = $8K in taxes (before you register it which is also exorbitant). And then gas is $6+ a gallon. So of course very few people drive, nobody but the very rich can afford to. This is the end goal of the leftist scum here. Price cars out of existence and get us all into buses and trains. And once everyone is in buses and trains, the next logical step is to get us all into Soviet style apartment blocks. After all who wants to commute 20 miles to work via bus, when you can take a quick 5 min bus ride from your apartment to your office downtown? Their lust for public transportation has nothing to do with saving the environment or any of their usual bullshit. It’s about control, pure and simple.

*** DOES NOT apply to abortion laws where every European country has some limit on when a woman can get an abortion. Nor does it apply to corporate tax rates, where every European country has a lower rate than ours.

You are exactly right. Most don’t realize how lucky they are. Much easier to think they are brilliant. Not.

That is true. I am saying this as someone who benefitted from it. I can’t control the FED. All I hope for is to benefit from their moves.

Nothing keeps going up forever….even though every time we are in a bubble they tell you this is different….if you go back on this blog to the last bubble 2005-2007 you see the same posts as nowadays. And if you dig further back in time you will see how people thought during the 80’s that the Japanese will buy America.

http://articles.latimes.com/1992-02-21/news/mn-2588_1_japanese-real-estate

http://www.businessinsider.com/japans-eighties-america-buying-spree-2014-9

The Japanese lost their shirt in the 80’s and in the last bubble we had 7 MIO foreclosures. The only trend i see is that bubbles get bigger and bigger over time. Consequently, the crashes are extremer as well.

Just wait a few more years and you will see the same headlines. Just switch Japanese with Chinese or domestic investors. Its the same spiel over and over.

People who lost faith should ask themselves how hard can it be to save money in good times and buy during downturns? Who cares if this takes 5 years, ten years or 15 years?

For those who think that putting yourself under a mountain of debt to buy a house in SoCal is the path to riches:

http://theeconomiccollapseblog.com/archives/how-the-elite-dominate-the-world-part-1-debt-as-a-tool-of-enslavement

There is no shortage of units to live in. I’m tired of this false narrative. We don’t have thousands of people becoming homeless each day randomly because their housing was taken away.

We don’t need hundreds of new units to be built. We already have enough. But the market has been significantly impacted by REITs, foreigners, and extremely low interest rates. Affordable housing gets snatched up by these three groups as much or more so than it does by resident homeowners.

Mr. Landlord likes to state that the demand is there. But what demand? There’s no demand from homeowners to pay over $1m for crap. However, when you factor in the three groups above, then there is no choice.

This is an important distinction. There is no shortage of places to live. There’s only a shortage of reasonable places to buy because of outside market interference that’s way beyond the norm.

Yeah we desperately need property ownership reform in CA. Only US citizens may buy, you may only own one single family or townhouse, and a high vacancy tax.

This is all that will work.

In addition to the REITS and investors, the lack of inventory is due in part by the inability of current homeowners to move up the property ladder. As their starter home went up in value so did everything else. Combine that with locked in tax rates due to prop 13 and many people are entrenched in their current home unable to afford another unless they move out of state. There is a surge in home equity loans as people remodel and add on to existing homes instead of buying new ones. Back in the day people would have bought and sold multiple homes during their lifetime as their family and lifestyles expanded. Doesn’t seem to be the case anymore.

+1

The inventory for sale is the same or higher than it was prior to the last downturn. If there was a shortage because of demand, why do lending standards continue to fall? The government wants to extend its manipulation of the market in contravention of free market principles required for a vibrant and healthy economy.

It comes down to affordability! Two articles in the last week referencing San Francisco. One, said S.F. has the highest wages/salaries in the U.S., yet it is very difficult to live on those wages! A second article created a family of 3, one parent a well paid professional, the other a teacher, with one child. In S.F., again the most expensive place, they would be 10’s of thousands of dollars in the hole after one year given the high cost of living expenses!

Teachers in SF are well paid too. I wouldn’t call them professionals, but definitely well paid. Starting salary is $55K and increases each year up to $95K. Add in the best health insurance around, 3 months vacation and they get to retire at 55 with full pension/benefits.

But somehow we are still under this fake news narrative of the lowly paid teacher just trying to get by. And we need to increase taxes to help them out. And if you disagree you have children and education.

hate not have

Yet SF has a population that is at an historical high and only increasing, As are NYC and Seattle and a host of other high cost cities that once declined in population and are now recovering.

Mr. L.

Are you saying that a 26 year old teacher making 60k in San Francisco could purchase a home?

Could a 36 year old teacher making 90k afford to buy a home?

How would that work? Assuming they share a 2 bedroom apartment with a roommate.

Lowly Teacher

@Lowly Teacher

I’ve heard this argument from some of my neighbors. Oh, teacher salaries are 60-90k… that’s pretty GOOD. Then I point out that there is no way they can live in our area for that. Then they say, oh they can live somewhere else. Somewhere else meaning neighborhoods where gunfire at night is not uncommon.

@ocean breeze

Imagine if a shrink, an accountant, or an eye doctor assisted 35 clients every hour. Crazy! But teachers must teach 35 youthful individuals at various academic levels, with different needs and circumstances, simultaneously. Maintain order, a positive and cheery disposition, and teach: as in get results that show up on test scores that are made public.

But as Mr. L. points out, they do not receive professional pay. I wonder why that is. Perhaps it is because people think that a teacher (like in the example above) are some professional’s wife. And they should be grateful to receive a stipend for what is perceived to be glorified babysitting: Math, Reading, Writing, Science, Social Studies, Health, Art, Music, Dance, P.E. Maybe we should frame it as a smart male 32 year old with a Masters in Physics. How can we entice this male scientist to become a teacher? What can we offer him? What would he make elsewhere? You get what you pay for.

Lowly Teacher

Lowly Teacher, when I was in grammar school, in the late 1960s to mid 1970s, in a New York City Catholic school, normal class size wasn’t 35. It was over 40. I remember that, because my student number was always in the 40s. My name came toward the end, alphabetically, so my assigned number was toward the end.

Nevertheless, the nuns did a great job maintaining discipline, while providing a first rate education. Catholic schools always out-performed public schools.

And yes, we had “diversity.” Lots of Puerto Rican kids who spoke mostly Spanish. Even a kid who spoke mostly Polish. The nuns managed, and very well.

Of course, back then we had discipline. The nuns could smack students around. And they did so. One teacher liked to pull hair. A male teacher banged a kid’s head against a blackboard a few times for not doing his homework.

Parents never complained. Teachers were expected to discipline students. Smacking students around was considered a valuable part of our education.

SOL,

I agree. For good performance of schools the discipline is critical. All private schools have strong discipline. I grew up in a communist country and discipline in school was like in the army. The education and performance of schools was excellent for a small fraction of what taxpayers pay for public schools in US. Of course, at home the students received discipline from parents, too. The child services did not take the kids away because parents dared to discipline their children. They were expected to be disciplined.

Here in the states kids grow without learning to be subject to any authority. Then, suddenly they are expected to be subject to the authority and discipline of employers and government authorities. A large percentage of them can not keep a job for a month. The “correctional” institutions are not going to correct an adult who never was corrected as a child. All the screaming brats you see in the stores, will be later clients of those “correctional” institutions and then they wonder why the US has more population in prison than other countries; it starts with total lack of discipline in school and at home. This is the reality regardless of what those idiot “psychologists” say.

With the 1-12 education in US the way it is, you can triple the funding and nothing will change. It is not a problem with the funding, but the system. The asian kids perform well in school because in their culture the parents discipline the children.

Mr. L.

We were talking about apples, and you seem to now be talking about oranges.

We were talking about how much teachers get paid. Whether they should be paid professionally, whether they indeed deserve to be paid professionally, and whether that means being paid enough to purchase a home. You felt that a teacher getting paid 55-95 thousand in San Fransisco over a period of 15 years should be satisfied with their pay. Since this is a real estate site, it’s worth addressing whether this teacher could ever buy a home or whether only bored housewives should go into teaching.

Your response is to take it a step beyond lowly paid women/nannies/housewives and remember the women who taught you for no pay. Who had literally taken vows of poverty. And who slept in a twin bed owned by the archdiocese. Ahhh the good old days!!! If you didn’t want a pesky husband, you could settle for 60 students and a toothbrush. (And a scratchy habit that blocked your vision like a city horse.)

Yes that is what professional teachers should aspire to: Owning Nothing.

My dad showed me his class of 60 kids with his teacher Sister Mary Aloysius. My parents went to 16 years of Catholic school each. My 4 siblings and I attended 12 years of Catholic school each.

Well, moving on to 2017. Teachers are highly educated professionals. With monumental tasks, responsibilities, and challenges. They are expected to produce outstanding results with young minds as measured on state tests despite layers upon layers of mitigating circumstances. Yes, teachers should receive professional pay. They should afford to be middle class home owners in middle class neighborhoods. Sister Aloysius is not coming back.

Lowly Teacher.

Flyover. Can I just say you “hit the nail on the headâ€. Don’t know if you use that expression in Amercia. I was working in South East Asia before moving back to the UK. My British teacher friends told me exactly the same thing. The culture of hard work.

My own opinion and Ive been proven wrong on many things. Is the UK and maybe USA should copy Finland? It has the most succesful education system in the West. Look at how much they spend in education and teacher pay.

Lowly Teacher, “We were talking about apples, and you seem to now be talking about oranges.”

No. (For a teacher, your reading comprehension is pretty poor.) I was directly addressing an issue that you raised.

You said: “Imagine if a shrink, an accountant, or an eye doctor assisted 35 clients every hour. Crazy! But teachers must teach 35 youthful individuals …”

You were complaining about the “Crazy!” burden of teaching 35 students at once.

I observed that 35 students are not all that many. Not if you exercise proper discipline.

The nuns had a much tougher job than you do, and they handled it with great success. (How little they were paid is irrelevant to that success, although admirable for other reasons.)

Lowly teacher,

How much a teacher is paid does not have anything to do with his/her worth. Each real job is worth a lot, because we can not do without it. How much is the job of a garbage collector worth? Or the job of a guy who pumps the septic tanks? We can’t live without them. Although a lowly job, I really appreciate those guys who do that work for me. It is worth a lot to me; still, they are paid what the market bears. It has to do with supply and demand.

My opinion is that teachers have a very noble profession and if they don’t have calling, don’t do it. I have 2 daughters teachers. They don’t get paid much in flyover country, but they do it as a calling. They love their job. I know for sure that they will never get rich off of those jobs, but that is not the reason they do it. I have a son doctor. I told him the same thing – don’t do it for money because you will hate your job. He is doing it with a passion because he loves it. He earns a lot because of shortage for doctors. He also wants to go to the Amazon jungle to work for indians, free of charge – volunteer. That is his calling.