The politics of the underwater homeowner – the impact of negative equity on the balance sheet of Americans. Top 5 markets to purchase foreclosures.

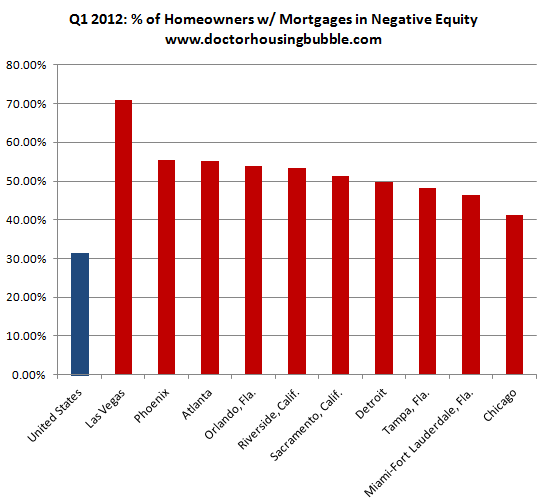

The housing market is sending mixed signals in 2012. Time can sneak up on you and if you rewind to the last presidential election cycle the housing market was already moving lower. So here we are in 2012 and the housing market is still weak. A recent report shows that 1 out of 3 Americans with a mortgage is still underwater owing $1.2 trillion more on their home than it is currently worth. Keep in mind that the 5 to 6 percent cost of selling a home is shouldered by the seller and that isn’t reflected here. In spite of this, most underwater homeowners continue to pay their mortgage dutifully. Even in Las Vegas where 71 percent of homeowners are underwater, many by twice the current home value, only 14 percent are 90+ days delinquent. With so many homeowners underwater what implications will this have on the 2012 election?

The underwater nation

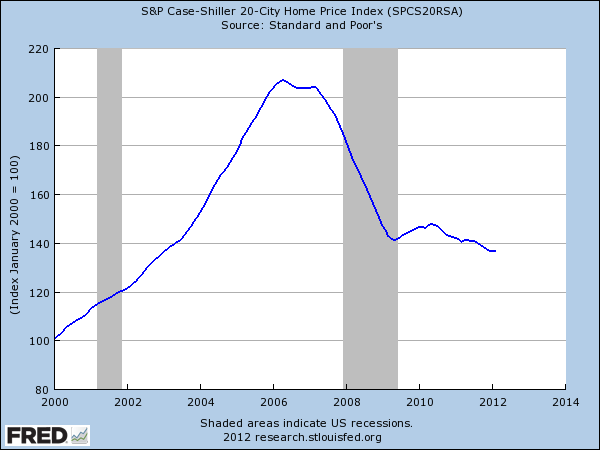

Home prices are still at their nadir on a nationwide scale:

The Case-Shiller is a repeat home sale index which captures the best price movements since it tracks the same home over time. The index is delayed by a few months and given recent changes, it is likely that prices are reaching a nominal bottom nationwide. However, we should take a look at the top 10 underwater regions in the US:

Source:Â Zillow

California, Arizona, Nevada, and Florida still dominate the list. These are the states also with the largest share of shadow inventory. Many of those focused like hawks on home prices rarely examine the inseparable connection of household incomes to the value of housing. Part of the continued weak pricing power in housing stems from the sluggish economy. If you look at the chart above, many of the top underwater regions have negative equity rates of 50 percent or higher for mortgage holders. While many continue to pay their mortgage, you can rest assured that many are seeking alternatives.

The politics are already heating up around this issue. HARP 2.0 is getting major activity especially with refinancing underwater homeowners. Again, these artificially low rates are helpful for those already in homes but looking forward, what larger impact will this have on the economy? If you think low rates for very long durations are good just for the sake of saving the banking and housing sector you can take a glance at Japan and see how that turned out. It is interesting that HARP 2.0 is taking on much more momentum in 2012 versus the initial HARP version.

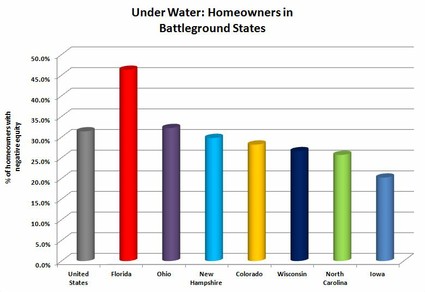

Housing will be a factor in the upcoming election however many battleground states have negative equity rates below that of the overall national rate:

The discussion online now revolves around housing reaching a bottom on a nationwide scale. Yet the vast majority of reputable analysts conclude that just because a bottom has been reached this does not mean home prices are set to skyrocket or suddenly move up. Shadow inventory will keep prices in check for a few years and these low interest rates are giving buyers more perceived purchasing power since many only focus on the monthly nut. What happens when rates go up even slightly?

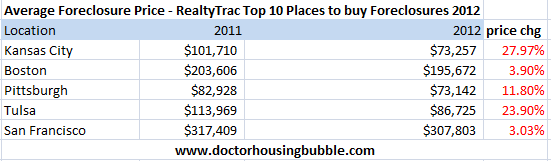

To provide evidence that distressed properties will keep a tug on prices at the low end, a RealtyTrac report listed a few top places to purchase foreclosures:

*Based on sales price

The above is interesting because many places that were already presumed affordable in 2011 continued to fall well into 2012. Distressed properties do sell for discounts and many times for deep discounts. Here in California we are seeing banks more willing to sell homes via the short sale process and avoiding the REO channels of releasing real estate. Just because home sales are picking up and inventory is moving doesn’t mean housing is in good shape. The housing market appears to be better than it is because of the massive amount of support from mark-to-market accounting suspensions, the Fed intervening and pushing mortgage rates to record low levels, and a banking system that is leaking out shadow inventory. In other words, the housing “market†is one of the most controlled systems in the economy and prices are still near the bottom after many years of intervention.

It’ll be interesting to see how politics will show up in the 2012 housing market. HARP 2.0 and other refinancing programs are a big win for anyone with a GSE mortgage. For those deep underwater it still does not make sense. If you bought a home for $500,000 and it is now worth $250,000 what big benefit is there if your mortgage drops from say 6% to a rate in the 3% range? Sure your monthly nut drops but the home price tag is still inflated. It is likely better to walk and purchase the home at $250,000 and take the hit on your credit report. Unfortunately these odd controlled market games are now par for the course. Yet of the 16,000,000 underwater homeowners 9 out of 10 continue to pay their mortgage on time. This is likely another reason why principal reductions are not part of the bailout equation years later. Banks are willing to walk away quicker than a cheetah on a bad bet but it is apparent that even Americans deep underwater on their homes are willing to pay for an asset that is clearly overvalued. The new name of the game is refinance at the artificially low rate and ignore the data showing a less affluent younger generation that is more focused on quality jobs than purchasing a property.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

64 Responses to “The politics of the underwater homeowner – the impact of negative equity on the balance sheet of Americans. Top 5 markets to purchase foreclosures.”

I’ve heard that B of A sent out letters to 200,000 mortgagees telling them that they could get a mortgage reduction. So it sounds like movement is underway. But I know 2 people in NorCal with underwater mortgages and they continue to pay.

With unemployment still so high, housing has got no traction. Only investment groups are really eager to buy at this time.

My friend works at BofA in the Short sale department. They apparently have a new program where they are allowing “owners” who are underwater to live in their houses “free” for six to 12 months while they negotiate a short sale.

My other friend works for a Title company and she tells me that the majority of ownership is going directly to big Hedge fund investment groups. They deal directly with banks and get the best properties. The stuff they pass on goes to the MLS.

That my friends are two huge reasons why there is such a shortage of decent inventory.

Sounds like a setup designed for graft and inside deals. Are these “investors” just sock puppets for the big banks and GSEs?

Did anyone tell you this is a free market? This country is becoming a third world country, no matter how you look at it.

You can read about the requirements and how to be qualified to get in on those programs from the Federal Reserve website.

I know other people have tried to address this but “Hedge Funds” don’t take positions like this. A hedge fund tends to be long/short to some degree (how does one short rental housing cash flow without tremendous basis risk) but forget that – most every hedge fund has quarterly or at worst annual liquidity. Buying wholesale home packages to rent is totally inconsistent with a hedge fund strategy and liquidity provisions. Investors would riot if this was done in any significant size.

NOW – a private equity type structure where someone commits capital and management draws down the commitments over time as they put the money to work is whole lot better. Fund life can be 8-10+ years with no liquidity and this is a lot more consistent with the opportunity. That said, I don’t know too many big/giant funds out there pursuing this strategy – landlording is not exactly easy management so you need concentration in an area and lots of connections. Not that easy in a lot of areas.

Not sure exactly where demand is coming from (local investor groups maybe – S. Cal has lots of $$) or maybe the banks are just holding for now, but I can guarantee you it’s is absolutely not the “big hedge funds” although a couple may have put together small private equity type pools and offered it separately if they know something about this market.

One of the many things that sucks about these principal reduction deals is that we taxpayers are paying for it. Tim Geithner is funneling money over to the banks to cover the principal reductions. So except for keeping Tim’s friends out of jail, what was the pupose of the mortgage fraud settlement? Let’s see. I as a bank agree to provide principal reductions and you the government drops criminal fraud charges, and the taxpeyer pays for the reductions. What a bunch of crap.

Manipulation of inventory by banks (govt) is the name of the game. The idea is to create an illusion that housing has finally bottomed (again) and bidding wars for properties will propel prices upward again. That combined with low interest rates, and FHA financing will re-inflate the housing casino (bubble), especially during election time. After 5 years, it’s not working. Nobody want’s to get burned again and their is no fake financing anymore.

Buying at this particular time is futile, unless your getting at least a 50% discount off 2006/2007 prices. Even then, you better be prepared to spend at least 5-10 years before moving again Something most are not willing to commit to during a worldwide recession.

Playa Vista, the urban model of development for the future on the Westside of Los Angeles, just witnessed a condo built in 2005 sell at less than 1/2 price and $627,000 less than it’s original price in 2006.

http://Www.westsideremeltdown.blogspot.com

Why should it matter to people if they’re “underwater” on their house unless they’re being forced to sell? They simply continue to live where they’ve been living, paying the price they agreed to pay.

Many people are “underwater” on their cars the moment they drive them off the lot. You’re pretty much immediately “underwater” on everything you buy with a credit card.

With houses I think it’s often a psycological issue rather than a financial one.

@Benny – A lot of the people who are underwater now bought with interest only loans and with the idea of being in the property for a few years at most, making minimum payments while they added granite counter tops, stainless appliances, some paint and then a For Sale sign. They never anticipated that they’d actually have to MAKE real house payments.

It’s one thing to know that your $35K car will only be worth $15K in a few years, while it’s quite another to realize that your $650K house is only worth $400K in a few years. $250K loss is much harder to weather than a $20K loss.

one of the most popular programs was a 30 year fixed rate, with a 10 year interest only program. many of these were 5-7% fixed rates. the problem on year # 10 they recast with the ramaining, many times full principle balance, but the term is now 20 years and full amortised = huge jump in payments! others were 10 year fixed rate with 10 years interest only payments and 30 year terms. same thing but the rate is adjustable after year # 10. with the fed’s monotary policy that may be better than the fixed rates as interest rates will move downwards. still have term adjustment to 20 years and fully amortised payments = huge jump in monthly payment. ticking time bombs….

I really feel it needs to be pointed out for those who honestly don’t know.

A LOT of people with underwater mortgages are trapped because they had some type of loss of income due to the economic downturn or other misfortune, and under normal circumstances, they could just sell their house and move somewhere cheaper, but with an underwater mortgage they can’t do that.

I say this because I have an elderly family member with an underwater mortgage in foreclosure process. The reason this happened was because her husband died, and her income was immediately cut by more than half. In a normal economy, she should’ve been able to just sell the house and buy a smaller house, condo, or rent a smaller house or apt. Because the house was underwater, that was no longer an option. Paying the mortgage, which was previously COMPLETELY REASONABLE, became impossible.

LOTS of people are in these situations through no fault of their own, when UNDER NORMAL CIRCUMSTANCES if they had a wage reduction, wage loss, income loss, death, job loss, or whatever they should’ve been able to sell and move. Now people can’t. Worse, it prevents people from being able to move to find work in addition to that.

I know MOST people around here are well aware of all this.

But it seems like SOME visitors to this blog are still labouring under the delusion that the only people hurt by the housing crisis are risk takers who spent beyond their means and deserve it or something. It’s so not true.

Oh Benny, Benny, Benny! How sweet but naive. The equity these homoeowners thought they had was stolen in an equity stripping ponzi scheme. This was the homeowners nest eggs, and biggest savings and asset they though they had! Until you learn about money and the way money is created from debt you are missing the ball game my friend. PLEASE Google Money As Debt for a Money 101 on the fractional reserve banking system, a good place to start. Also check out the free resource guide at http://www.economicsurvivalguide.org and learn how the equity stripping ponzi scheme is done. It is done with everything from housing to countries sovereign debt. That is why Greece, Spain, Italy, and more are collapsing and it is coming to America.

It makes a difference because if you are underwater, your mortgage payment is essentially the same as rent. You are paying to live in the house but not gaining any equity with each payment. In most underwater neighborhoods, it is cheaper to rent a home down the street then continue to make your inflated mortgage payment. You can get the same home for less money monthly.

Are you saying it is time to buy now?

I don’t think the underwater epidemic plays at all this presidential election cycle, outside of maybe Florida. Both R & D power brokers are beholden to their FIRE overlords and are essentially different heads of the same coin. The underwater zombie homeowners span the political spectrum as well, so there’s no advantage for Obama or Romney pandering to a certain sect (say, tea party whites), or demonizing others (hispanic/undocumented poor).

I asked this in the last post but what does everyone think will happen to Westside real estate if both the Governor Brown tax increase goes through and so does the tax increase by letting the Bush tax cuts expire. Sounds like a six percent tax increase for anyone making over $250k and a hit like that can’t be good for Westside prices, right?

How many people do you think are actually MAKING over $250k a year? I’m not sure it’s as many as you seem to think.

In Brentwood, there are 4200 tax returns with AGI over $200K. In Westwood, there are 2400 tax returns with $200K+. In both West Hollywood and Westchester, about 1400. Same for BelAir. About 3300 in B.H. 90210. 1700 in Santa Monica 90402.

IOW, they are a sizable minority in all of these communities. The question is, how many of them are dissatisfied with their current spread, and how many new ones are looking to get in?

Is it a coincidence that houses are being withheld from the market during a major election year?Obviously the fix is in to reelect the incumbent as the shortage of houses on the market has caused a temporary spike in prices in high foreclosure states.Then the massive bailout can be sold a success during the re-election campaign.

Do you think the shadow inventory is a new phenomenon that was created this year??? Where the hell have YOU been?

Put down the Cheesy Poofs, slip some sweats on over your boxer shorts, come out of the basement and head towards the light.

who are the main financial contributors to the current occupant of the WH? Here’s a hint – it’s not the citizenry. As always in these scenarios, follow the money. Regardless of what party affiliation is involved, the vested interests will always do whatever they can to keep their main person in charge. They’re only performing financial due diligence on their part, while it just looks like more crony capitalism/corruption when viewed by anyone outside of the system.

I have been buying and selling homes from trustee sales and have witnessed a huge drop in homes available to purchase when there are many vacant homes in areas I track that get postponed,cancelled etc..obviously your the couch potato that can’t see the huge drop in inventory during in election year.

DMAC. For real? Obama’s 2008 nomination bid (since the start of 2007) relied on bigger donors and smaller donors nearly equally, pulling in successive donations mostly over the Internet. That’s a fact.

Do you seriously think that that Mr. Bain Capital/Cayman Islands tax-shelter/I like firing people/Corporation are people, my friend/Romney will be a better steward of the citizenry’s interests than Obama?

Please, lay out your thesis. I’m dying to hear it.

I have to believe that the re-election crew is going to try every trick in the book to hold things together through to the end of the year. Whether it’s the Euro PIIGS , housing, MOPE, etc….

What makes this masterfully orchestrated transfer of private debt to the public so incredibly unpalatable is that it’s become political. Tax payers lose, politicians win and the bankers are once again, the smartest guys in the room.

I have been following this blog for several years. Finally we are selling our inherited home in CO and will have 100K to put down on a house in the SouthBay, Los Angeles area. And now I am more confused than ever. Selling prices seem to be all over the place. I feel like we’re going to start this process and just be battling a bunch of vulture investors. So sad the so called “American Dream” has come to this.

$100K downpayment? Good luck getting anything remotely worthwhile with that paltry pittance down…

Sorry Candace, but I’m assuming by South Bay you mean Torrance and not Manhattan Beach. Unless you’re buying a 2 bedroom condo you’re looking at 1 – 1.5 million for a nice single family home in Manhattan, Hermosa or Redondo beach. Sure there are 2 bedroom shacks on the outskirts for 800k, but it the defeats the purpose if you buy one of these and live 3 blocks from Lawndale. If you’re buying that 2 bedroom fixer condo you’ll be fine with 500-600k. Good luck!

We had breakfast in Atwater yesterday, across the street from this new complex. Starting prices are $899K in a crummy ‘hood close to two fwys.

http://la.curbed.com/archives/2012/05/atwater_crossing_glass_metal_abode.php#reader_comments

Just for the record – Harp 2.0 is another joke! The idea, a good one on the surface, allows those faithful paying home owners the opportunity to refi at today’s current interest rates. (currently 3.875%). Guess what? I gave it a shot, and the best rate I was quoted was 4.75%. Plus a impound acct. is required PITI. The bottom line: My monthly payment would actually go up because of Impound acct. The higher rate is allowed because of negative equity risk to the lender. My suggestion is; Instead of offering a another so called band aid fix. Give those underwater homeowners a tax write off equal to their negative equity loss??

Sorry man, but you need to take the hit, i wanna a tax break, i have to take a new underwater refinance @ 4.75%, have to pay my prorated taxes and insurance in impound acct. btw, your impounds concern is a joke, like buying a candy bar once a day. Today you buy two, one for today and one for tomorrow, but you complain the cost is double. i feel this intitlement, i wanna, i wanna, is the reason we are in this mess. the reason you bought an overpriced home was because you either paid taxes or paid interest/wrote it off. if you do not like you payment or value, short sale…..

“My monthly payment would actually go up because of Impound acct”.

Maybe, but your annual nut remains the same.

“Give those underwater homeowners a tax write off equal to their negative equity loss”??

How about, you made a bad finacial decision while the rest of us saved our money, and now you pay

What?? You want a tax break because your “investment” lost value? Can I get some of YOUR taxes to cover my stock losses? My car’s additional depreciation because gas goes up? How about the fact that my home hasn’t appreciated the ‘guaranteed’ 10% per year? Do you realize how ABSURD it is to ask the taxpayers to pay you because you made a bad choice???

F Why should you get a tax write off? I choose to rent and not buy into this ponzi scheme. I can move every 2-3 years and have invested in my business. Why should you get a free pass and not me. Burn.

i

I had to smile at the above post that mentioned Obama’s friend’s on Wall St.

Sorry to tell you but Romney’s biggest contributors are also from Wall St.

By the way, I’m not a liberal. I don’t like BO at all.

But it looks like the moneymen play both sides for sure, and we lose either way.

It sickens me that regular working people are not able to find a decent deal in California, because the bankers give the good deals to their friends. I’ve hated bankers all of my life, and the hate just seems to grow in intensity as the years go by.

I am searching for a low tiered home in San Diego County near coast as I can’t deal with the heat. But the investors have gobbled up everything and prices are rising now. I am sure this is temporary but the banks are actually refusing good offers on short sales and insisting on the asking price – which are obviously over priced since even the investors won’t touch them. Some have been on the markets for two years. I thought the banks were trying to clear out inventory but I guess not in this area. I sold a townhouse in Boulder, CO last year without any trouble to a resident buyer. And I find now that prices are low in CA there is nothing decent to buy so I have decided not to be panicked by the low inventory but I meet people who tried to buy with huge (50%) down payments were outbid by an all cash investor. What is this going to do in the long run to home owning. Some condo developments have so many renters that the banks now refuse to finance.

The reason I want to buy is that it is cheaper and I have a best friend dog. Seems there are restrictions on pets everywhere in southern California even when the property is owned. What’s with these dog hating communities – either no pets or only 10 pound drop kick dogs. (Sorry, Chihuahua owners.) So what do you think will happen to all these investor owned properties? Will they be rentals all over the country or will the investors dump them on the market in a few years and create another housing crisis? Any ideas about this?

Investors dump cash-losing properties, and only a dummy drops a cash-producing asset. Do you really think the properties you have lost-out-on recently are producing enough rents for these “investors”? Everything is a gamble to some extent, but it seems unlikeley to have a positive rate of return for ANY of the homes inside of 10 miles of the ocean I see at current prices. YES we can still call these investments> but with a negative ROI.

“Seems there are restrictions on pets everywhere in southern California even when the property is owned. What’s with these dog hating communities – either no pets or only 10 pound drop kick dogs.”

Answer: lazy-ass dog owners who refuse to pick up their dog’s shit. And I mean it. Walk around even the nice apartments and condos with well-maintained grounds, and near every damn shrub, plant, bush, is dogshit. Same with public athletic fields too, it’s getting worse. Go for a walk, yep, there’s dogshit right on the sidewalk. I’ve seen a couple of them do it, and I’ve called them out, right to their face.

I see this *regularly* in Southern California, and it enrages me. These owners are simply too goddamned lazy to pick up after their dogs.

Here’s what our inspector found while checking out an eye candy regular sale for us. The sellers did a nice curb appeal job.

*Abestos – HVAC/Ducts were shot and very old. Abestos was visable around the ducts.

*Possible Toxic Mold (drywall and bathroom rip out to get

to the leak fix, even if it’s not toxic). Black “Chit” in the walls.

*Slab has no rebar – 1960’s slabs aren’t so earthquake proof

*Flooding issue in backyard

Just to name a few issues. No offer on the house.

We don’t like wasting our money for an inspection

after a sales price has been reached. This place was

a $60K fix minimum.

Go through the joint carefully upfront.

Ask the right questions. Go back for a second go through.

No remorse for the “we’ll pass”.

This is a perfect example why banks like to sell to all cash investors. When an investor makes an offer, he closes the deal. Every house has defects, even a new one. When I view a house, I show up with my ladder and flashlight, I look in the attic, inspect the furnace, and look for water damage under the sinks, THEN I make an offer AS IS.

That sounds like my house! Did you tour my house while I was at work?

I have a friend that never got a response after putting in an offer on a house in Pasadena. He called the realtor to find out what was going on and the realtor stated that the owner was only interested in cash offers. He did some research and contacted the owner directly only to find that the owner never received his offer nor did he state that he was only interested in cash offers. The owner only received one offer for much less from a contractor friend of the realtor. I knew realtors where flopping REO’s but I did not know that they were doing this with non-distressed sales as well…

This unfortunately happens quite a bit. I have seen some of them exactly like you said. The realtor is screwing both buyers and sellers.

Scumbag realtors. If I were you, I’d make it my personal mission to get that realtard’s license revoked.

Paul & Pete

In this case the listing agent was a friend of the seller, and we don’t think she was very seasoned, but a very nice and sexy young gal. Once you’ve locked in a price, movement when there is “trouble brewing” with the property is hard to move down a lot. So we try and nail the issues of major costs before we put in an offer. Our buyers broker is good at some construction issues, and we believe keeps his mouth shut with others.

New homes (and we’ve bought two as former residences) do have defects, but what we learned from this weekend’s inspection is about slabs. Although we love older homes, we aren’t going back past the 70’s. Rebar fraud and requirements got better after the 1971 quake.We can fix and tolerate many fixes, but slabs are not fixable.This neighborhood got nailed in 1994. Meeting the neighborhood always pays off. We declined a beauty once due to a pit bull issue.

Gotta do your research. The Long Depression was from 1873-1896. Great Depression was from 1929-1938. It’s been a long while since this happened, the introduction of credit kicked the can 30 years.

For hundreds of years, contractions happened every few years and lasted a year. This is healthy. For the last 70 years, they have been farther apart but worse in effect. As far as 10 years (thanks to credit)!

Bottom line – people “just wanna know”. Contraction, stagnation, inflation, monetization of debt…WHAT IS IT??? Knowing this will start a true recovery right there. This current “recovery” is nothing more than gambling with a printing press and smoke and mirrors.

Obama’s favorite word is ‘folks’. Well I say “folk off!”

Yes, things are CRAZY, Investors seem to be dominating the housing market right now, but how long will that last? It seems like a bad business tactic that the banks are still holding on to inventory, they are banks not landlords. Also the FED is definately in on it. By keeping rates low, the FED is forcing people to act, they are trying like hell to keep the Stock market up and thriving. It is based on lies. Good example (IPO Facebook) I believe all the madness will continue until after the elections – then the S**T will hit the fan and all will be revealed, Hmm, who could be blamed on the worst recession that the U.S. has ever had? Maybe the president? That would be a very smart business tactic, from the banks, gov’t and the FED.

The Fed has also been battling to finance two U.S. wars. War is NOT cheap and it effects all of us.

I also find myself at the Planning Dept for permit info (’94-’95 especially), Building and Safety for grading and other info, and I sometimes find a nice neighbor who recently bought, and will share their Natural Hazard Disclosure Report info with me. I take the due diligence very serious. I try not to be “granite-ized”. (I’m Ca R E Licensed for my career.)

Check out this headline Are We Witnessing the Death of the Big-Box Store? http://business.time.com/2012/05/24/are-we-witnessing-the-death-of-the-big-box-store/?

If this piece turns out to be proven correct, it will be desasterous for commercial real estate as well as the residential side. Look at this logicly – as Best Buy & other big box retailers shed oversized stores, how many of them can reasonably be filled 10%? 20%? maybe 30%?

Now regular readers already know what has happened in such places as the IE, but this is another way to look at things.

Hey, why don’t we convert all the big box stores into loft condos? The NY transplants love living in crappy converted spaces as long as they can overpay. We will have to get rid of most of the parking because they would be very uncomfortable with not having to fight for parking.

None can be filled and with all due respect, DUH.

The whole point of Big Boxorama was to harvest as much money as fast as possible through commercial real estate/retailing, much of it in the form of tax breaks and infrastructure concessions, and get the hell out as fast as possible.

It was never intended to be a long term strategy. Just a powerful model for bling skimming.

Sean

Thanks for that interesting link, but BB isn’t a HD, Lowe’s, or even Costco. There is a lot of consumer psychology to big box shopping. Circuit City and Best Buys, maybe, but not the home or food stores in that retail sector.I just don’t see it.

Fry’s is probably hammering BB. It’s a better experience.

Oh don’t get me wrong, I personally thaught the artical was questional at best. I posted it just for comparitive reasons. Besides to draw conclusions solly on Best Buy & what the future might hold for them is poor journalism.

Sean

Got it. I read your reply.

We went to BB to pre-shop fridges and got lot a lot of 1/2 truths and mistruths about warranty info on major fridge brands. I got the real scoop at Fry’s, where we pre-shopped as well. BB gave me a load of horsesh*t. I don’t much appreciate that. IF BB fails, they got what is coming to them, imo.

Most of the people I know are underwater but refuse to admit it to themselves. As long as they still have work and can pay they will because they believe that the market will come back any day now and the days of double digit appreciation are just around the corner. They still believe buying a home is a great investment, one that will provide them with money to retire on one day. Home owners are like that. Their belief system is their rock. It’s like religion, you either have it or you don’t.

That’s why I am still holding my tulip bulbs… I believe that the tulip bulb market has bottomed since I saw two bulbs for 99 cents at the 99 cent store. The recovery is just around the corner! We are back baby!!! Can I get an Amen???

Or, some people “still have work and can pay”…and do…because they believe in paying back their debts.

I bet most people underwater continue to pay not because double digit appreciation is right around the corner, but because they think it’s the right thing to do.

Many Americans who are underwater on their mortgages do not walk away because they’ll never qualify for a mortgage in an environment of stricter loan underwriting. Furthermore, a default also affects their ability to find work as many employers will not hire candidates with poor credit.

Interesting from Business Insider today.

House prices still winding downward in metro areas

http://www.businessinsider.com/another-housing-collapse-is-coming-soon-2012-5

I’ve been a real estate broker for 24 years. Back in ’03 I thought I’d be a stand up broker and do the right thing. Seeing prices rise at an unconfortable rate then I warned my furst Buyer. Soon after having a conversation with a mortgage broker friend, she explaned the requirements of ‘No Doc’ loans. After we laughed and rolled on the ground for a few minutes I gathered myself up and wiped the tears of hysteria from my checks and said, “You know, being self employed I should go for one of those.’ She helped me. It was a lot of work. The loan required my signature. No income tax forms to mess with. It was like voting without have to show my ID.

I lived in a ‘best I could find for the bucks’ home for about 6 months and sold it in the easy to bet on rising market. I made about 25k. After than it became a very serious concern of mind. Local bankers who understood markets, savvy realtors and mortgage brokers could see the bubble blob growing monsterous. But all the ‘national’ economists were lying as big as the bubble or were stupid as big. By 2005 I KNEW all hell was going to collect on the interest of consequences. I called my intelligent oldest brother to confirm my intelligence. HE didn’t see a bubble. I realized that not enough people were paying attention. If you were on the ground you saw it but even many of those in the business relied on the ‘expert’ opinions of those trained at some proper school or who writes columns for a big newspaper to know more than they saw and felt with their own hands! It was maddening. Anyway, the point is this: The ‘Recovery’ has NO legs. There ain’t no recovery! Another thing, the growing debt is ERASING any chance of a recovery. Now I know the writers of MSM newspapers aren’t saying this. They didn’t say anything about the housing bubble either until it smacked them in the jaw. Use your common sense, and for whatever reason the opinion leaders are without guts to speak of the reality you and I can see, don’t bother yourselves to read them, or listen to them. We’re getting to the place where you’ll have to gather your family and friends and talk about those ‘just in case’ plans. Our leaders have no experience dealing with close up reality. Trust them at you own peril. Read Rothbard if you want to understand what’s wrong with our economy. Go to Amazom search by author. Murray Rothbard. Just read the reviews of his books. You’ll be able to pick the right ones. You might find used for a few bucks. Well worth the education. Rothbard an Austrian Economist not to be confused with the Keyhesian fools who have steered our economy directly toward the cliff ahead.

I feel inclined to re-post this here (posted on another thread, but it is from a while ago). There is a lot of judgment cast upon those who walk away from their severely underwater homes. The truth is that, in order for the market to correct itself, it needs to happen. Furthermore, there will be NO buyers for homes because we are all stuck, either underwater or ineligible for neglecting our Herculean and hopeless debt. We are prime examples of those who could easily help to repair the problem, steady jobs, solid down payment, but will not be able to for some time. I just wanted to offer a profile of someone who is considered a deadbeat for being smart. Judge away.

This is a bit late but thought I’d chime in as we recently left our condo in Monrovia (which borders Arcadia). Bought in 2007 at 410k. We both were set in our careers, first time home buyers, and ready to get our own place. All we heard was that housing is the best investment and can only go up. We were conservative and got the condo thinking it was a starter and, 5 years from now, we’d be able to buy up. Fast forward to the present; we up and left our condo in Feb. after our neighbors short sold theirs (identical unit) for 250k. This was not a quick decision and, honestly, should have been made years ago. We never re-fi’ed (couldn’t with our negative equity anyhow), our loan is an 80/20 (although we still put a little down) and all non-recourse. I love when I hear “they used their homes as ATM’s;” yeah, baby–put in new countertops and a sliding glass door with my teacher salary, which I will never see again. The entire time we were in our condo, we had been socking away money for a down payment for our next place. When we actually started to look for a place about a year ago, we realized we had at least 10 years until we recovered any equity. Coupled with a balloon payment, due in 4 years or so, it was a lose-lose (signing loan docs, “Pssh, you’ll be able to take care of that balloon payment with your equity!”). A short sale was unlikely, given our income and savings, which we do not care to share with the banks. Plus, lots of things to repair in the condo and a weak HOA unable to even enforce parking rules. We did not even bother to stay in our place; we are renting a house at a lower payment than our condo. Haven’t even received our NOD. We are ready to send the keys to the bank in a velvet lined box.

This was not a decision we would have even imagined or entertained 2 years ago. We had perfect 800+ credit in our mid twenties (I’m now 29), paid for college, grad school with our own money, no exorbitant debt, live within our means. We still have a beautiful down payment that will continue to be socked away as we will be in the foreclosure penalty box for some time. This was not an emotional decision; it was a rational and financially savvy one.

I share this because I have obviously learned a lot and I realize that a down payment and income should be the primary indicators of who purchases a home. Even with the falling value, had we put down at least 80k on the condo, we probably would have stuck it out. Even with our looming default and foreclosure, we are better candidates to purchase a home with 30% right now than half the people with 3.5%. I imagine there are TONS of people in our situation, stagnant, great candidates. Once the foreclosure is said and done, our credit will be on par with most of the nation. We make 140k (which will rise each year with our education levels) a year and have managed to save 100k for a down payment (make that 200K in 3 years) but won’t be eligible to buy for 7 years. HA.

Until you are in a similar situation, I suggest you consider the various facets before distilling it to a simplified and immoral decision.

Leave a Reply