Private equity and Wall Street planning their exit from the rental business? Lower yields, IPOs, and packaging current deals to sell into a hot stock market.

The whispers about private equity exiting the rental market are now out in the open. A few reports are highlighting that some private equity investors are testing the waters for an exit via IPOs. Some have asked why it is necessary for these investors to hold onto properties for a few years before exiting. One of the main reasons is for valuation purposes given that it takes a few years to gather enough workable data on say a block of 1,000 homes and their overall vacancy rates, rental rates, and expense ratios. This would be important if this pool of homes were to be converted into an income stream for investors. Yet many are now looking to exit given how hot the stock market is. You want to sell into momentum. A few other key points include rents falling in places like Las Vegas where investor demand has been incredibly high. Is the hot money planning an exit?

Rental prices

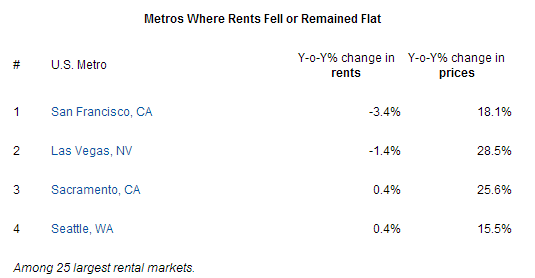

Many of the projections that I have seen assumed that rental prices would continue to move up between 3 and 5 percent on an annual basis in many locations. Yet this assumption is being put to the test in many markets as employment growth is still weak and wage growth is nearly nonexistent:

You can see that while prices continue to move up in a manic fashion, rents have fallen in some key markets including San Francisco and Las Vegas. The fall in San Francisco has to do with prices being so absurdly high to begin with but with Las Vegas, it has to do with more than over half the market being bought and sold by investor money.

Some interesting perspective on the exit of private equity from the rental business:

“(Naked Capitalism) The most popular view I heard last fall was that an exit via an IPO, with the rental business as an operating company, was the easiest and cleanest route. A portfolio of 1000 houses would be large enough to make for a decent-sized deal. But interestingly, back then, the assumption was that the portfolios would also need to have reached “stabilized yields,†meaning they were rented up and had seen a fair number of lease renewals so investors would know the turnover, vacancy rates, and costs associated with both making homes ready for the initial rental and freshening them up when a lease expired. That would take two to three years. We are well short of that timeframe. That means that investors will be buying a pig in the poke.â€

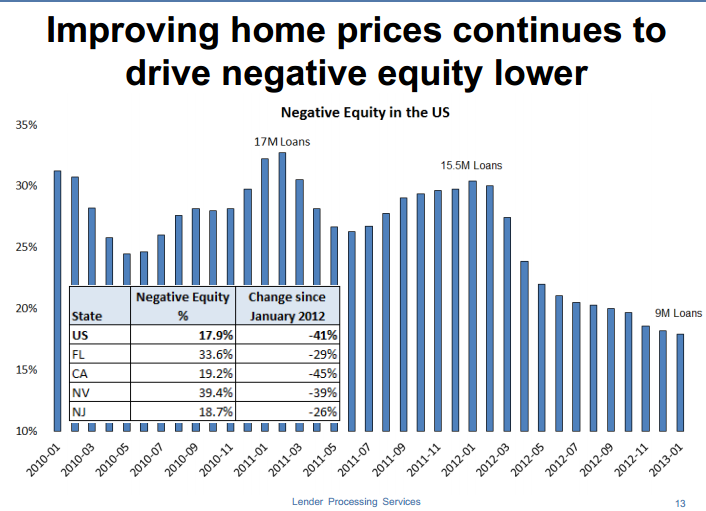

This is the primary reason for big investors to hold properties for a few years and gather enough data to package a deal. However, with falling rents, projections need to shift. As prices continue to rise, the number of homes in a negative equity position continues to decline:

Only 17.9 percent of US homes are now in a negative equity position whereas in 2012, it was closer to 30 percent. Investors and banks have a good reason to sell into this momentum especially with supply being so low. California’s negative equity percentage is down to 19 percent yet places like Florida and Nevada still have 33 percent to 39 percent of their homes in negative equity positions.

The rental market tipping point is a big deal:

“(Naked Capitalism) Now mind you, the falling rentals story is an even bigger deal than you might think. At a real estate conference at which I spoke last year, one institutional investor who was on the receiving end of PE pitches for single family rentals sniffed that many were forecasting 5% rent increases for several years running. That’s wildly optimistic given high unemployment and continuing weak wage growth.

And of course, as we pointed out in earlier posts, the very activity the PE landlords are engaging in is bound to undermine their market. Tight rental markets have resulted from many homeowners losing their house through foreclosure, as well as the properties themselves being removed from the market via the foreclosure process. Buying and converting formerly owned homes to rentals increases rental supply which reduces landlords’ ability to maintain high rental rates.â€

It is certainly an interesting dynamic. There certainly has been a shift between home owners and renters in the last few years:

Census 2011

Owner-occupied:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 74,264,435Â (64.6%)

Renter-occupied:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 40,727,290Â (35.4%)

Census 2007

Owner-occupied:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 75,515,104Â (67.25%)

Renter-occupied:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 36,862,873Â (32.8%)

The above addition of renters is clearly from the 5 million completed foreclosures that have occurred over the period. With foreclosure starts dropping and negative equity falling, will there be an unending supply of new renters to fill this new rental demand? Plus, in many markets across the US it makes more sense to buy than to rent given the low interest rates and subsidies that are given to home owners.

It is clear what has happened over the last few years. While the US lost some 1.2 million home owners between 2007 and 2011 it has added 3.8 million renters. I’m sure this trend has continued given the large number of rental investors purchasing homes for the specific purpose of converting them into rental units.

Wall Street and private equity money has no interest in staying in a business where cap rates are being compressed and rental prices are showing signs of weakness especially when the stock market is on a rocket ship up. Since the hot money has been in the market for a few years now, there is probably good data on overall rents, vacancy rates, and expenses for prospective investors to make a solid decision to buy a giant block of properties. The stock market is incredibly hot so there is probably no better time than now to unload into this momentum especially if the plan is to exit via an IPO. While mom and pop investors are entering the game late, the top in the rental business may be in for big money in certain markets.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

44 Responses to “Private equity and Wall Street planning their exit from the rental business? Lower yields, IPOs, and packaging current deals to sell into a hot stock market.”

Just noticed another flipper property here in LA.

Property was purchased for $295K (3bd, 1ba) 5 months ago.

http://www.trulia.com/homes/California/Los_Angeles/sold/1862481-3601-West-Blvd-Los-Angeles-CA-90016

then add a bathroom and upgrades, and now in escrow, with a list price of $484K. I guess the remodel and additional bathroom was about $80K tops? This flipper is looking for about $100K profit?

http://www.zillow.com/homedetails/3601-West-Blvd-Los-Angeles-CA-90016/20587176_zpid/

Anyway, the property is pending so someone is in escrow …. noisy street and likely the need for bars on the windows with all the riffraff strolling down Rodeo Rd at night.

Its obviously smoke and mirrors.. The early 1990s and 2000s possessed new construction like gang busters, where are the new homes now in Southern cal mainly the West valley? I really dont want to hear “its all open space” thats BS.

And, if you look at the trend of housing starts, it is apparent that building has slowed down and never really got that good since the early 2000’s. (I suggest looking at the trend from 1980 to present, to really get the picture.)

http://www.tradingeconomics.com/united-states/indicators

My Daughter and her husband have been getting unsolicited offers to rent their now vacant Orange Co. town home. I think nice rentals in the safe suburbs are still very much in demand. Nevertheless, we are urging them to sell ASAP so they can pay my Wife back the temporary loan on their new house and still get a relatively low interest rate for the balance. The place (all 1800 sq ft) should be ready to sell by next week. A similar town home diagonally across from them got multiple offers even with the owner’s stipulation that the place will not be vacated by them before August. The Realtor’s sign now says “in escrow”. It only went up for sale near the beginning of May.

I see this market lasting until interest rates rise. A lot of pros were predicting rates going up to near 4% by the end of 2013. There will be a point where waiting for a price rise will be futile because the interest rate on the balance they owe my Wife will cost them more than they will make from the higher price (if any) they get on the town home.

A burst of inflation would cause both the price of housing to rise and the cost of financing to rise at the same time. I’d rather lock in the low rates available for the next couple of months than risk waiting on either side of this equation.

Joe, you are right and I hope they are able to sell this season.

When interest rates rise, given the stagnant incomes and high unemployment, housing prices will need to fall, because for the average non-investor it is about their monthly cost. As long as flipper investors are still in the market buying, that will help prop up prices. But the ‘smart money’ on wall street is probably out of the market by now.

They are attempting to achieve the same ‘package and re-sell’ process they used for mortgages. There, they knowingly lied about the quality of the income streams and value of the collateral. They are doing the same here, making unreasonably optimistic assumptions about low cost of maintenance, notional rent increases, and the like.

I lived in OC (HB) until three years ago, and my rents in a nice upper apt near the ocean were flat or dropping for the last 3 years I was there, and before that never increased more than 3%/yr, usually 2%. Now live in an ocean penthouse condo in LA (Palos Verdes peninsula) and my rent has been flat for 3 years. Lots of ownership churn in this complex the last two years, with some bottom buyers from 2009-era lucky to get out flat on price, and all the rentals are cash flow negative by at least 30%. I don’t know where the statistics on rentals come from, but renting has been a very good deal for me, especially given my need to be mobile in this job market.

who would do this? who would knowingly buy a home for almost $200k more than someone who bought it 5 months ago? that sure seems stupid to me.

I know of people who recently paid slightly over 100% markup on a flip in a so-so LA neighborhood. I think it was a desperate act of financial recklessness. That is the same type of ridiculous shit that was happening only a few short years ago yet some are saying it’s premature to call a bubble.

Can’tafford…….Lots of morons out there, they don’t value houses, they just buy them on the monthly cost. In 2005 and 2004 my wife and i were looking for a winter home in the palm springs area. We thought the Californians were crazy to pay those prices. In 2009 we thought these Californians are crazy to sell houses at these prices.

I saw many houses selling at half the cost of construction. As a builder of almost 40 years i know what it cost to build a house.

Tillamooktim, when that monthly nut of owning gets equivalent or less than renting the same place, many morons (myself included) will throw in the towel and become buyers. Rents barely budged in the prime/near prime areas when the world was coming to an end in 2008 but the cost of ownership went way down (monthly housing nuts of 4K went down to 2.5K). As we have seen, cash buyers and investors circled the kill and got first dibs on all the good deals. Nobody knows what the outcome will be, but if you are buying anwhere close to rental parity with a healthy downpayment, I would imagine you’ll be fine if another downturn hits. Just my 2 cents.

People were not crazy or stupid for trying to sell their home in 2009…these were largely short sales by people who bought more home than they could really afford anyway and were underwater as well and looking for a way to get out from under their mortgage. I was in the market looking to buy a short sale in that time period and nobody knew what they were doing (on buy side or sell side). Soon, home-owners figured out they could game the system by constantly moving the target and short sales sat for 12-18 months.

@Lord Blankfein wrote: “…when that monthly nut of owning gets equivalent or less than renting the same place, many morons (myself included) will throw in the towel and become buyers….”

This really is the correct answer.

Right now the 3.5% mortgage + hoa dues + property taxes minus the Schedule A deductions for interest and property taxes is bringing the monthly nut at or below rent parity in many of the mid-tier SoCal areas.

Unfortunately many people don’t think about it this way. Instead they look at the monthly nut, and get excited about the granite countertops and the fact that they can move right in – and they’re afraid that prices will keep going up and they will miss the boat. And it’s not like there’s a 250k fixer sitting on the market next door they can pick up instead. So, following the advice of their friendly Realtor, they bid away on that flip…

The pump is in absolute full swing……not too far from here, we will see the dump.

@CAE,

(+) plus the maximum number of years that banks can hold on to foreclosures per Federal law 12 U.S.C. §29 is 10 years so in 2014 we will start seeing the garbage mortgages percolating up the pipeline. 2005/2006 were the peak years for garbage mortgages so that means 2015/2016 will be the years that these will have to unloaded per Federal law.

The main difference I see in this current market is that the buyers are either cash or highly qualified loans…..which translates into owners that will probably not be under duress to sell should the market top/recede.

I think the IPO’s of the REITs will probably just see huge drops in the stock market price of the REITs due to the yields not living up to the hype they were sold with. But that may translate into liquidations of home as well……

I think dump will come too. I think it will after the stocks in the SFRs tank, which I think will be soon after the 10 years of holding foreclosures rule is up. They’ll just say “oops, can’t control the market, sorry it tanked”. The initiators will have made their money and the common man shareholders will take the losses.

Thanks CAE and Ernst for your informative posts. Ernst, what you’re finding is similar to what I’m finding (though you’re finding a lot more – thanks).

Doc, some hedge funds have already floated their IPO on this thing. It’s very interesting to see how quickly they are moving. Transferred wealth, check.

It seems to align also with the Fed’s latest statements on not doing all that much more QE. It’s weird because in some odd way, the Fed’s moves these last 7 years seem to be working – at least in the sense that it’s looking less likely that the U.S. will go into a great depression and that other countries will suffer more. (Though many, many are and will continue to struggle.)

Anyone remember that John Candy movie “The Great Outdoors” where the “rich” uncle shows up uninvited, makes everyone feel bad, rents a jet boat… and then hits up the other family for a great “investment opportunity”?

Yeah, it’s a little like that. IPO before anyone gets a good feel for the fundamentals, and hope like hell that the second/third quarter is moving in the right direction. If not, bail out assets until you show a positive cash flow.

It’s going to end badly, and take entire neighborhoods with it. In five years we’ll see Waypoint, Blackstone, American Homes 4 Rent, and Colony American Homes, etc in very different light.

The irony is lost on poor Mr. Ganem:

http://finance.yahoo.com/news/flippers-ride-housing-wave-231000715.html

# # #

Robert Ganem beat out four other offers this year when he paid $600,000 for a short sale—in which a home is sold for less than the amount owed on its mortgage—in Ladera Ranch, in southern Orange County. He made cosmetic renovations—fresh paint, new hardwood floors and kitchen tiles—before selling it a few weeks later for $755,000.

“A year ago, I couldn’t give them away. I was definitely swimming against the current,” said Mr. Ganem, who said he flipped 20 houses last year, double the previous year. Before he became a full-time real-estate investor, Mr. Ganem worked as a mortgage broker in Los Angeles. Flippers get a “bad rap” in the public eye, he said. “Most buyers want a home that’s move-in ready. We come in and make repairs that a bank or an underwater owner is not going to do.”

# # #

Thanks for the $155,000 worth of fresh paint, new hardwood floors and kitchen tiles, Mr. Ganem

NYT – ‘homes see biggest price gains in years’

“All 20 cities tracked by the Standard & Poor’s Case-Shiller home price index posted year-over-year gains, as they have done for three consecutive months now. The 20-city composite index rose 10.9 percent over the last year. That is the biggest annual increase since April 2006. Several cities – Charlotte, N.C.; Los Angeles; Portland, Ore.; Seattle; and Tampa, Fla. – had their largest month-over-month gains in more than seven years.”

“Economists generally expect home prices to continue rising, particularly as the economy improves and more young people move out of their parents’ homes. And many dismiss concerns of a potential bubble, because housing prices remain well below their highs. Even after 10 straight months of year-over-year gain, the 20-city composite price index is 28 percent below its previous peak in July 2006. ”

http://www.nytimes.com/2013/05/29/business/house-prices-show-largest-gain-in-years.html?hp&_r=0

@QE abyss

You may thank or curse the Federal Reserve for these price moves. In 2011 the interest rates were at 5%. Today the interest rates are at 3.5%. If you keep the monthly mortgage payment at the exact same amount, the difference between 3.5% interest and 5% interest is an increase in selling price of 20%.

That is a point missing from all the analysis is that a 20% jump in home selling prices is attributable to interest rates going from 5% to 3.5%. The monthly nut has not changed but the selling prices have.

I am a total newbie and have never posted on here, just have read and kept up for a while.

But is this really true? The jump from 3.5% to 5% is equal to a 20% increase in overall price?

One can argue that the lack of inventory is really helping this price run-up, but I agree that the real fuel is 3.5% mortgage rates. Just think if the rates were 2%!!

All the experts out there calling the bottom in prices probably did not have inside information about the rates going to all-time lows. This is a game changer…..at least for a while. Without wage increases or job increases, this will fall flat …..as it did in Japan.

Yes exactly, so good luck getting another +20% next year for “no reason”. When the velocity slows people will question purchasing into a stale market. Part of the mania is the headlines about “it just keeps going up!”

Agreed. What if interest rates go back to 5%? Prices tank 20. Scary that many buyers today cannot see this.

Succinct observation. So long as wage and employment remain flat, it’s all hocus pocus.

And it is better to have higher interest rates and a lower house price — this results in lower property taxes, insurance, etc.

Plus, even if you have a higher interest rate you can elect to pay off the house early thereby reducing interest paid anyway.

All my training on holding onto the ‘fundamentals’ of economics is paying off. I sold my house in Sept 2009, expecting to lose money. Anyway, sold for 330k in a nice area, but 1988 homes (large lots) in Corona CA.

The rich bastards thought, ‘Hey, all those fools lost their homes, have to live somewhere. We’ll buy up the houses now, used cheap money, grab a bunch of foreclosures from the banks in bulk, and make a killing.’

They forgot the two factors mentioned; unemployment and a false economy, obviously propped up by 5 trillion in funny money. There is no ‘recovery’ happening, millions more will lose jobs when the Fed money shower is shut off and interest rates dramatically rise, as millions of jobs are FUNDED by Federal dollars, even down to the city level.

JP Morgan and Team Comex are pounding the ‘price’ of gold / silver down, and millions are buying at the artificially low price.

When the real economy comes back, the real depression will hit. Per research on the 1929 Depression, rents were very LOW because nobody had any money. Wages were cut dramatically, as the whole cycle resets, as is NORMAL. The major focus was on FOOD, which was very expensive. Also note the difference is the depression lasted 10 years longer than it should have, BECAUSE of the same Obama-like Feds taking over the economy and directly (and falsely) manipulating it, thinking they could ignore the laws of basic economic fact (supply and demand, expansion and contraction)

I’m hoping that physical silver and gold will hit normal levels as fiat currency falls apart. Note we are talking about the physical price, not the COMEX paper contract price. They can SAY silver is worth $5, but with no jobs, apples at $10 a lb, etc., metals will keep food on the table. The disconnect is already happening, premiums for silver and gold are up, and THAT is the real price of metals.

That’s why central banks keep gold in vaults. That is always why they have done it, because gold is what people value most as a source of wealth, as it has been for 4,500 years and since man walked the earth.

We looked at houses a while back that were short sales and we put bids on them never heard back. Now those same houses are back on the market for 50-80k more than they were sold for before. Funny thing is there has been nothing do e to the houses as far as improvements or repairs. People are buying and instead of living in the house they are already starting to to “trade up” or “they outgrew the place.” Just like the first time of the housing craze we just look at each other a d say this is crazy. Especially when all the realtors sound like a broken record all repeating the same must buy now and bid higher otherwise you won’t win. My wife and I sit back now and wait. We didn’t buy into the craze last time we sure as hell are not gonna jump in it this time.

Ditto.

Small time investors/developers are still at it. Let’s see how long this type of activity will last.

http://www.redfin.com/CA/Monterey-Park/508-Brightwood-St-91754/home/6979633?utm_campaign=listings_update&utm_content=address&utm_medium=email&utm_source=myredfin

On the demand side, add to this the expected spike in PMI in June, the coming increase in interest rates as the Fed winds down QE. No wonder unit sales are up – Sheeple are panicking and garbage loans are back. Nothing new, DHB has already covered this in great detail.

Rates rising: http://www.marketwatch.com/story/30-year-mortgage-rate-highest-in-a-year-2013-05-30-11103222

On the (short term) supply side, many foreclosures have been bought out by ‘investors’.

Welcome to Housing Bubble 2.0. This time it’s different (yeah right).

Oh and don’t look now, but the fleecing is about to start as the big boys cash out and sell properties at inflated prices. Builders are buying into the hype and building more, more, more. Grab the popcorn folks, it’s going to get ugly in 2014 as supply increases and demand goes down.

No one mentions the shadow inventory anymore. Is this number going up or down?

South Pasadena flip up for sale. New paint + new cabinets + new appliances = $240k.

http://www.redfin.com/CA/South-Pasadena/842-Monterey-Rd-91030/home/7005551

Bubblicious.

http://blogs.wsj.com/moneybeat/2013/05/08/american-residential-properties-to-test-demand-for-reit-ipos/

ah yes… anyone up for a quick swing? ey batter batter!

I figure since we have the “become a flipper with no money down” and “buying mortgage backed securities has never been better” commercials, the end might be near. I HOPE. There’s always hope…

Finally someone gets it. Peter Schiff’s doomsday scenario seems to be spot on with most of the other posters on this website:

http://blogs.marketwatch.com/election/2013/05/30/peter-schiff-doubles-down-on-doomsday-views/

Stock Market Investor Alert

http://www.westchesternews.us/national/International_News/Entries/2013/5/30_Bank_of_America__Biggest_Scam_in_America_Investors_Beware!.html

I’m starting to see a split in housing prices in my area (Central Coast, California). Mobile homes, condos, townhomes, PUDs are relatively a lot lower than the dumpiest SFR.

About half the mobile homes are down under $150K, with several around $50K, but a few still asking $300K. Condos are in the $200 and $300Ks, with a few at ridiculous $750K prices. SFRs, 1200 s.f. even, are still at least $400. With dual pane windows and a home depot kitchen, $700+K.

I see this split as a good sign. I mean some of the 3BR, updated PUDs or townhomes are really nice, with 1500 to 1700 s.f., and in the upper $200/low $300K’s. It’s gotta mean that eventually the 1100 s.f., 1960’s unremodeled homes will have to get into the $300K’s soon, doesn’t it?

These scammers are going to find enough buyers of these REITs in a yield starved fixed income market. Plenty of private pensions have mandated return targets and insurance companies have seen small returns on their mortgage and UST holdings. It’s sad to see these jerks rewarded, but they will count the cash and Bernanke will celebrate a phantom ‘win’.

Long time no comment. Congrats on the growth of the site.

Aha! Did you see this article on Huffington Post about private equity fixing foreclosure auctions? Another piece to add to the mix of shenanigans.

http://www.huffingtonpost.com/2013/06/01/foreclosure-scams-auction-crackdown_n_3371595.html

Classic bubble. Although this time it is entirely manufactured by Wall Street and the Fed. Most people remember the last bust only 6-7 years ago, as it almost crashed the entire global financial system. Fortunately, most have learned their CA boom and bust lesson. Leave it to the FED to bring in more suckers to the game and bail out the thieves for another round of musical chairs. Don’t take the bait unless 20% down and more is of no consequence, in hopes of locking in a low interest rate right now.

http://Www.westsideremeltdown.blogspot.com

http://Www.santamonicameltdownthe90402.blogspot.com

We have been looking to rent near the second of two high schools in Burbank, but haven’t had any luck, as there aren’t too many rentals available, and/or they’re really overpriced. It’s incredibly frustrating. Plus there’s a lot of competition for these rentals. You should see some of them! They’re awful and overpriced, but with it seeming like a landlord’s market, they can do pretty much what they want as someone will be desperate enough to rent from them. I just don’t understand how people are affording it? I mean, we have a lot of low income people living in Burbank. How do they do it?

I was reading through everyone’s comments, which were very interesting. I’m not an expert on this, but I believe that there’s still a lot of inventory out there that’s hidden, housing is totally being manipulated forcing even us renters to pay a higher price, whether we created this housing bubble mess or not. (I never bought a home during the boom, but I’m still paying for it). I can see where someone might think that they might as well just buy a home, if they can pay a little bit less than the average $2200 & up a month price for home rentals here in Burbank. I had a realtor try to convince me of such. Still, I see that as a trap. What if the prices finally come down? Then what will they do? I still don’t believe the homes are worth the price people are paying for them, but still people buy. As long as they do, and as long as home prices and supply are manipulated, I guess this will continue to be the case.

It’s depressing!

Leave a Reply