If you build it, they won’t come – Why are new home sales not getting the summer bounce with 30 year mortgage rates at historical lows? Prop 13 and the housing lottery in California.

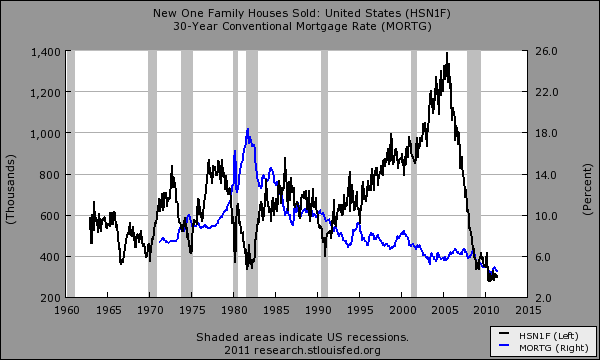

The U.S. housing market did not benefit from any sunny summer bounce. What makes this even more troubling is the glaring reality that mortgage rates are at all-time record lows courtesy of The Ben Bernank. The Federal Reserve has run out of options in the Whac-A-Mole system of bailouts because you can’t print your way into prosperity or somehow magically increase home prices by snapping your fingers. The big banks have done well and have survived this deep financial impact by simply stealing from the taxpayers. A simple yet effective strategy. They don’t call it stealing and would rather label it “bailout†to calm the delicate sensibility of the mainstream watching audience. I rarely watch the morning news but when did it become necessary to have a Jersey Shore edge to it? Everything is about 5-minute money/makeup/bathroom makeovers and trying to solve complex economic problems has become as trivial as eating carbs or not. People get worked up about their favorite coffee chain upping prices but many seem oblivious to the trillions of dollars given to the banking sector. And guess what? The bailouts have done absolutely nothing in regards to improving the housing situation. Why? Because the economy still stinks and incomes have gone stagnant for well over a decade. Not only has income stalled like an old car, but the cost of food, education, and energy all has gone up. Every gimmick that is offered up is simply a banking and political ploy with little regard to the deeper problems in our economy. The deeper problem is the government, both parties in particular, are deeply captured by the financial interests in this country and those interests don’t align with the success of the majority.

If you build it, they won’t come

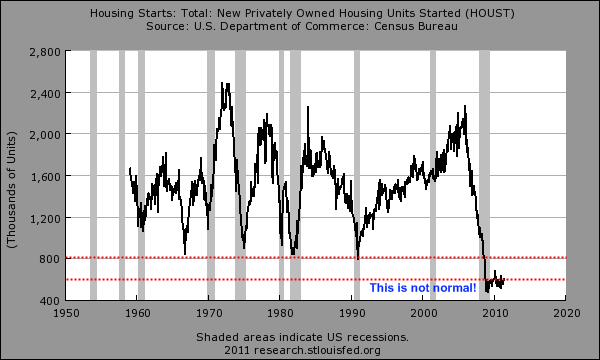

A good leading indicator of a future hidden demand in housing will come from new private housing starts. These are folks that typically know the business and will build only if they expect demand to pick-up:

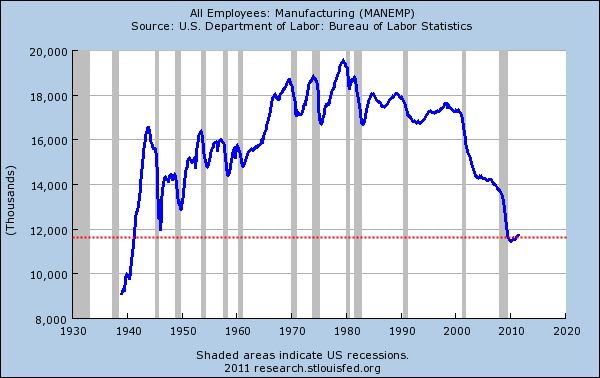

Don’t worry if you don’t have a Ph.D. in Economics because the above chart is dismal. Housing starts have never been this low and we have data going back to the 1950s! Keep in mind the population is much bigger as well but with 6,000,000+ homes lingering in the shadow inventory why would people demand new more expensive homes? The demand is for low priced foreclosures (where there is demand). You also may have a new kind of demand coming from younger professionals unwilling (or unable) to pay for very expensive homes in prime areas and would rather choose to live in more luxury apartments or scaled down condos closer to their urban jobs. In this difficult economy mobility is key and the McMansion dream was built on cheap fossil fuels but also a large manufacturing base:

The U.S. is still the largest manufacturer in the world but what they don’t tell you is that this is based on output. In other words, you may have robots doing the job of 1,000 people with 10 highly skilled engineers powering the machinery. Good for the bottom line but doesn’t really help the person looking to have the white picket fence.

I also hear an argument that somehow immigrants are going to sop up the excess demand in the housing market. This is absolutely not the case. Although the population will grow it certainly won’t come at a level to purchase the entire overpriced inventory sitting out there. A commenter “greg†addressed this issue:

“Ron, that’s not true. In 2009 (the last year of data), 1,130,818 people obtained legal resident status in the U.S. The average number of legal residents admitted over the last 10 years of data is 1,029,943, or about 47% less than your 1.5 million figure. In fact, the only years in which 1.5 million or more people legally immigrated into the U.S. were 1990 and 1991. (Source: 2009 Yearbook of Immigration Statistics). Even invading two countries and creating two huge populations of refugees over the past decade couldn’t pump up that number.

And, not all the immigrants are single. So you can’t assume 1 million immigrants are going to buy houses. The average family size in the U.S. is 3.19, so you’d better likely divide the pool of homeowners by about 3. So now you’re down to about 350,000 potential homebuyers. Also, over time, only about 1/2 of legal immigrant heads of households are college educated, so divide again: or 175,000. Considering that the average homeownership rate in the US is say, 65%, make it about 113,750 homebuying households. That group would be able to absorb the 6,000,000 vacant homes in about 52 years.

Oh, and your statement that “that 30,000,000 people that we will add in the next decade have to live somewhere†is substantially true, but they could just be living on the streets or in a van by the river.â€

I think the last point is probably the most key. If you have a large increase in immigrants the demand is likely to be heavy on the lower more affordable end of housing (aka apartments, multi-units, etc) and a very small sliver of that will be for higher end homes. The people that make these pipe dream assertions usually have very little data to back up their pedantic and dogmatic beliefs but again, the evidence is rather clear and the trend is obvious. We have anecdotal evidence of foreigners buying high priced real estate but this argument occurred as well when Japan was booming in the 1980s.

With that said, let us talk about legislation like Prop 13 here in California. So many people have this backward and a commenter “Edvard†brought up some key points here:

On Prop 13

“Prop 13 wasn’t passed to save lil’ old ladies from losing their homes. At least that’s what it was touted as, but the truth is that it was more for corporate real estate and the windfall benefit they would get from passing such a law.

The reason I dislike the law is because it was passed in an unintelligent way. It was passed universally- meaning EVERYONE was placed under its umbrella. Why was this wrong? As mentioned before, this law has been repeatedly touted as the law that saved old people from losing their homes. In almost all other states residents of a certain age get their taxes lowered or frozen on their properties- the idea of course being that retired people have limited incomes. This works in the approximately 48 other states that do so. But in California the law was passed for ALL residents. Instead it should have been passed only for those that it was touted as being for- elderly residents.

This in turn basically created a single generation of homeowners whom enjoyed windfall appreciation and had to pay no more in taxes as a result. This in turn meant hardly any pressure for them to sell or downsize. But this also mean out-of-control appreciation and less and less ability for later generations to purchase.

But let’s look at another state for comparison. TX has some fairly high property taxes. But that said, prices are still within reason. Why? Because there is a penalty for appreciation and this in turn tends to put a tamper on rampant, out of control appreciation. This means prices stay more inline with real incomes because the tax bill will always be due and the more those prices go up, the more the owner has to pay. This works out nicely as a sort of check and balance system. This sort of situation doesn’t exist in California. Instead there are zero consequences to the owner if their values go up. But buyers on the other hand have to stomach that additional cost in the form of ridiculous home prices.â€

This is absolutely right. As usual, the real crime is hidden behind some marketing PR piece. If you wanted to protect “little old ladies†and retirees from eating dog chow in old age, we could have written the legislation much more intelligently and capped rates at a certain point. Instead, you have this lottery given to those who bought way in the past and effectively gives a giant subsidy to buy. The only problem is you have younger professionals either choosing to move or over paying for some basic home.

Not only is subsidizing housing retroactively an issue, but it largely protects commercial real estate that has little to do with residential housing. Is it any wonder why California has such historical run-ups and busts? The unfortunate situation is you have brainwashed people voting for causes that actually hurt their bottom line because they are wedded to the “team†concept of politics. Think about it, does it really make sense for someone that bought in 1970 to somehow get a subsidy to own while new buyers in the same exact area have to pay full market rate taxes to compensate? This is why in California you have an odd phenomenon where you have really old homeowners living with a mix of young professionals in places like Culver City or Pasadena. Many would never be able to purchase in their neighborhood again and the new households are stretched to the hill with debt. What a toxic imbalance and the more troubling aspect is how commercial real estate can be offloaded to other family members, corporations, or connected entities and the tax rate goes with it.

I find it amazing that those who usually champion this also enjoy the amenities of California yet don’t want to pay for it and obviously those that bought in the past enjoy this subsidy. Make no mistake, someone is paying here. Clearly younger professionals looking to buy don’t understand this but this is another item that has inflated home prices in the state. But guess what? The budget is so bad that the third rail is now being discussed:

“(Bloomberg) It’s time to address the unfairness inherent in a system that allows Wall Street hedge-fund managers to devise complex real-estate investment trusts that give the super-rich a free pass on taxes every ordinary homeowner in California has to pay,†Villaraigosa said in a speech at the Sacramento Press Club. “Let’s apply, as an idea, Proposition 13’s protections to homeowners and homeowners alone.â€

I’m sure they can figure out a way to fix 1978 legislation to protect old retirees while not subsidizing others through these loopholes. You’ll find out that this issue is more than protecting gramdma and more of an old political mantra.

New family home sales and mortgage rates

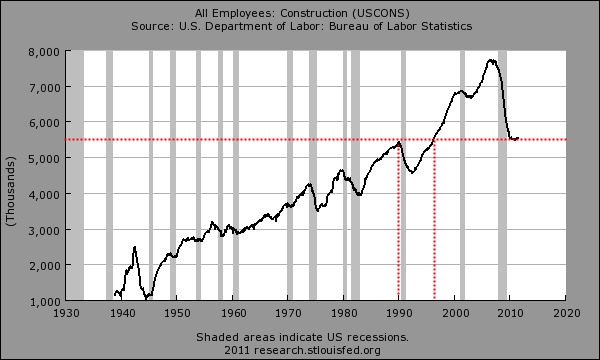

This is an amazing chart because mortgage rates are at historical lows yet new home sales are also at historic lows. Again, the demand is for lower priced homes and we have enough inventory in the shadow inventory to last us years. Incomes are stagnant and households are confronting a darker future when it comes to prosperity. Lost decades like those experienced in Japan are very likely. Instead of confronting these issues head on we have ideas being thrown around about carpet refinancing for people and turning over homes into rental properties from the current administration. Why not let the market dictate those prices and save yourself those trillions of dollars to truly revamp the corrupt financial system? We have seen in areas like Arizona to Florida that if prices get low enough, investors and buyers will jump in. Yet the goal is to protect the banks at the expense of the public. From the banks to the government why is there no trillion dollar focus on jobs? Look, if you are funneling money into the QE inferno don’t you think it would be better spent at least on building bridges, schools, and roads? At least you’ll put some of these construction workers back to work:

Then again, the government/banking system is only looking to unload the toxic waste to taxpayers so don’t interrupt their failing momentum.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

60 Responses to “If you build it, they won’t come – Why are new home sales not getting the summer bounce with 30 year mortgage rates at historical lows? Prop 13 and the housing lottery in California.”

The first paragraph is (in my merely humble reaction) great, concise, edgy, humorous, and everything I think of what is going on and happened, rolled up tight. We not only aren’t out of the woods, though, I don’t see the slightest organized attempt to dump overboard in the name of survival, those who got us here and keep us in this morass and they are repeating and continuing it (wholesale looting with impunity). England has like one in five jobs tied to the “financial” industry; home prices at an all time high. One cannot have a country where the main production is “finance” of the bulk of the people who work, and health care and government employment a close second, if not first. I saw the US bubble and corruption arise and kept out of harms way economically, but I never saw coming how the European banks and their governments were equally in a fake-books and fake-profits and fake-home building bubble and would take us down with them. I mean, come on, Iceland and Greece and Ireland damn near destroyed Western Civilization? We have been at war most of my adult life and now we are the broke mercenary army of Europe’s banks, doing the bidding of war in Libya deemed appropriate by France, for example. This is just nuts.

When London finally fails as a “financial capital” of producing nothing at full speed, as is Dubai and Zurich and Frankfurt and Stamford Connecticut, they take all of us down with them (thus the US fed pumped money to everywhere in europe and even Libya!). Well thanks for the first paragraph and what followed, any ideas how to invest or live to survive this unfolding mess most welcome.

I was listening to discussions about prop 13 and one thing that was said surprised me. It seems that many large business that normally buy property to develop or build their production facilities by-pass California because of prop 13. This is because they are at a competitive disadvantage with the direct competitors who have been in the state for a long time. Think about General Electric. They own huge amounts of very valuable property here. The property tax on just one large property may be less than half of what a typical homeowner pays. If a company tries to set up shop here they will face prohibitive cost disadvantages compared to their chief competitors based here before prop 13 was implemented. Just one more big reason big business no longer sees California as a suitable place to base their operations.

Another outstanding article Dr. HB.

I used to be an owner in Mission Viejo, CA and my assessed taxes were at one time over $6000 a year. I bought in 2004 @ $545k and a couple of years later with a 3% lawful increase, I was at that level. My neighbors, who bought in 1972 were paying $800 a year for the same public services, I was pissed off twice a year thinking about the scam in Prop 13 and how business skate by as well. To make matters worse, they rent the house out, they haven’t even lived in the house since 2006. Of course they rented the house to a hill-billy loser and they can keep the rent low because they are not paying their portion of the tax burden. There is zero chance that I think my taxes should’ve been raised, in fact I appealed the assessment and eventually got it down to $3700 a year, which is more reasonable. The only penalty the old owners received was the homeowner exemption, which is approximately $75 a year. So when you hear about all of these old people complaining about eating rice and being homeless, think about the actions that they do and the scams they take advantage of. Another neighbor a few houses down inherited 3 houses in a row, it’s a jungle, parking lot and complete mess. Mission Viejo and the ignorant Code Enforcement department don’t want to do their jobs; and yes, he’s another one who’s only paying $800 a year for each house. I think if you rent out your house you should be paying 1% of the comp’s, that way there’s a level playing field to potentially get people to sell and get new blood into some of these distressed neighborhoods. Landlords are not in the business of doing upgrades, thus they are adding zero to the economy. New blood are the people who will be doing upgrades and buying supplies and services, thus the housing economy starts to pick up.

Seniors also receive social security (now paid for by us future generations) and pensions 2(husband&wife)x1200/mo + 1100×2(husand&wife)/mo = 4600/mo approx that you and I will never see. Eliminate prop 13 – seniors and heirs not paying their share of property taxes are a burden to other “age” groups and future generations which is unequal and unconstitutional according to US GAS (Government accounting standards).

” Mission Viejo and the ignorant Code Enforcement department don’t want to do their jobs.”

You don’t say.

Even $800 a year for lunch baggers to do nothing is too much.

Well done, non-partisan and hard hitting as always.

I’ve really come to think home ownership makes very little sense in Los Angeles. Professional jobs that might put people in the income bracket where home ownership could be feasible (at least with 2 incomes) are often PRECISELY the type of jobs where if you lose your job you have to move to get a new one OR take on an L.A. style bumper to bumper horrendous commute. Meanwhile lower wage jobs may not require as much moving to get a new job but in no sense pay enough for home ownership in L.A. to be anything other than financial suicide.

How much of the gridlock, bumper to bumper traffic, all the waste of fossil fuels, and all the smog it generates, basically so much of what is wrong with L.A., is a DIRECT result of home ownership I have to wonder. Yes even if everyone rented some people would choose to commute even long distances because they like living in certain neighborhoods (there is also the infamous “living in a good school district” issue). But it is hard to deny that home ownership locks people in to a greater degree than renting does and so more people are forced to commute longer distances than they otherwise would. People love to cite all the benefits of home ownership as why the mortgage deduction is needed (greater community stability etc.), but it seems even if all the social benefits of home ownership are real, the costs of home ownership in a world where jobs are unstable are at least as high (just the gas alone wasted in commuting ….. what an incredible waste of a wonder substance, that can perform the work of many men).

Good points! I will never buy a house. Not interested in the upkeep period!!

Exactly right. We live in Orange County and we would never buy a house here, though we could, because of the uncertainty of our jobs. We could get new jobs if ours dissolved, but those new jobs might be far away and we would lose so much reselling a new bought house in the current sales environment.

I work in real estate, and I see the poorer working classes snapping up lower end post foreclosure houses like candy (we sell out in the Coachella Valley where prices are low). These people are paying less for a mortgage than rent would be, and they can just get another job in the area if they need to. But professionals like my husband and I, we are more wary about buying.

Dean’s observation about Prop 13 repelling new business seems plausible. And the structure of Calif’s personal income tax repels persons who actually have money. Indeed, the high personal income tax might be part of what caused the housing bubble there to be larger than elsewhere: people had an extra incentive to “bury” their money in some appreciating capital asset that didn’t produce any cash income. That may be one reason why Calif house prices REMAIN above any reasonable parity with rents.

I think prop 13 is a minor influence on housing prices in CA. IME, the thing that keeps housing prices high is lack of proper information and emotional buying. I have seen many young couples get suckered into buying due to family/social pressure and intentionally bad advice from real estate agents. I have seen this a lot in areas like Marin County and West LA. It’s kind of funny to see people running around to open houses, literally running, to get in an offer. Anecdote: a friend bought a house in the Valley for 500K a few years ago in a rush because baby was on the way. Tiny place, fixer-upper, but now he’s locked in forever. A few posts ago on this blog, there was a much bigger house for a little more $$ in what looked like a better neighborhood. Be patient.

Another thing that keeps prices high in CA is the large number of transplants. People from Pennsylvania, Minnesota and other places that have no history and no knowledge of appropriate pricing levels. A lot of these people get bamboozled because they will do almost anything to prove to family and friends back home that they “made it” in CA. No way I would buy a place in WLA for 800K when I can remember that the same places used to go for 300K in 2002.

Plus, they listen to the realtor’s mantra, “Now is a great time to buy. Prices will only go up!”

I am kind of shocked that in this forum there is a discussion of proposition 13 like this. The underlying argument is WHY did you need to protect granny from property taxes? Because the local governments were whimsically and arbitrarily raising rates. It put government on a budget, which is fine with me. During all those years of housing bubble boom, property taxes were very high and they have ever so slowly gone down. Why on earth would you WANT higher property taxes? I like putting government weenies on a diet. I’m not sure why you consider it toxic to have people on the same street paying different amounts of taxes. The moron next to my granny paid a lot of money for their home with bubble money and thought they were the masters of the universe, and property taxes were an incidental expense because, of course, real estate always goes up.

Allowing retired persons on fixed income to remain in their houses until they die is one thing. If you make this the plan for EVERYONE at a fixed point in time, then the baton is not passed to the next generation to benefit from the same things that you benefited from. You are in essence promoting the interests of people born during one time period at the expense of everyone born later.

It also causes people to be too far removed from the realities of funding and the cost of services. If you think government is spending money too fast, then vote them out.

I think people react strongly to Prop 13 because many Americans value success and accomplishment by hard work and perseverance, not by being born at the right time.

You’re pointing out only the sustainable, positive, non-controversial aspects of Prop13. What’s being discussed here, quite cogently, are all the grafty, market-distorting, non-sustainable and generally unwise aspects.

Looking at the SYSTEMIC flaws of Prop13 (which dates back to 1978), Florida learned the lessons, and passed a much wiser version, circa 1992, called “Save Our Homes”, that applies ONLY to primary residences, zero hog feed for the commercial RE interests, very limited benefits to heirs, etc., thus it works much as intended for seniors on fixed incomes, and those non-flippers who stay in their ‘hoods long term. In 2008 we ammended it to allow up to $500k “portability”, thus removing an obstacle to upsizing, or downsizing, or just generally moving, within the state.

It’s probably also a major reason FL, being a large, diverse and populous state, has a budget in the black, while Cali’s is approaching a crippling $30BILlion DEFICIT! HMOG! =:O

Yes Virgina, some of those REITs paying CASH for props in FL *used* to be in CA, but the future there looked too bleak and MISmanaged. ;’)

Your support for Prop 13 as stated is similar to, you have an infection in your finger so you cut off your arm ”TO SAVE YOUR LIFE. WHY WOULDN’T YOU?”

Maybe not the best analogy but I had to come up with something……………….

It is quite simple.

The vast majority of commercial property is benefiting from Prop 13. And, if less than 50% interest of a commerical plot of land is sold, it does not initiate a reassessment. That means a chunk of land can be sold in its entirety over a short amount of time (in percentages) and still not have its assessment raised.

If Disneyland, Warner Brothers, Universal Studios back lot, and tens of thousands of other long term commerical property holders were paying their fair share of property tax I wouldn’t have to make up for it in my tax bill. Why should I have to subsidise big business?

Ideally what would happen if we get rid of 13, the property tax on many would rise, and the property tax on those who bought in the last 7to 8 years would fall dramatically.

A provision to protect granny is a must. Prop 13 does protect Granny, as a side benefit, the true benefactor of 13 is commercial realestate.

Government needs limits but a sloppy law like 13 is killing Ca.

Having a 700.00 a month property tax bill on a 700K average house in San Diego is something even the most Conservative person would think is wrong. The way to fix it is FAIRNESS but in a way that gives no new net revenue to government.

Property tax rates in California have been constant throughout the entire bubble, so they clearly are not a driver of the massive price fluctuations.

There’s no doubt Prop 13 (and property taxes in general) aren’t fair, but the fairness of taxes goes well beyond property, and is an entirely different topic.

Please forgive my poor grammar.

Due to the incentive P13 provides people to stay in their homes (or second homes) is part of the reason why supply has been restricted in California. Restricted supply in any market increases prices as long as demand stays constant. This is particularly true in the RE markets within the up-and-coming communities over the years, such as Culver City, Santa Monica, South Bay, etc. Once upon a time a middle class family could afford a small place in Santa Monica or Hermosa Beach. Are these folks moving? Hells no. The life is too good and their taxes are dirt cheap. Now, Did Prop 13 have anything to do with the Inland Empire price run-up 1997 to 2007? Probably not. There was plenty of new construction going on there on very flimsy foundation (lots of cheap land, long commutes to employment, poorer weather, etc.).

Joe, another reason why prop13 helps inflate housing prices is that it makes it attractive for people to rent out their pre-2000 homes instead of selling them.

Regarding Prop 13: I recall when it was being touted as a way to save granny from being tossed from her home by high property taxes…and I recall Jerry Brown was rightly against it…until he looked at polls, then was “fer it.”

Fact is: it is nothing more than the old “Welcome Stranger” laws of the old west, where the existing residents taxed the bejesus out of newcomers. These laws were properly dismantled…then that f4ker Jarvis the conman came along…

Can’t tell you the heated arguments I had back in the 80’s and 90’s after selling and relocating to different parts of NorCal with existing residents…basically, I stated I could see no logic or rational why I should pay YOUR taxes….just because you lived here longer. And, that their greed was short-sighted: their kids would have to pay the price too: presto, here we are!

My brother and I own a property housing apartments and a couple of businesses. Our dad bought it in 1963 and it now belongs to us after we recently lost our mom (dad died over twenty years ago.) I’m very glad that our taxes were not reassessed when it came to us. We do not plan to sell, since it is long paid off, I live here, and it generates income. If the day comes where we do sell, it won’t be until we are in our sixties or so. In our case, I’m glad for the benefits of Prop. 13!

Still, there is no denying you’re being subsidized by newcomers, the “arrivistas” which Cali has always relied on, not to mention folks who just want to move from one locale to another, to increase their salary, shorten their commute, etc.

Also, you don’t mention that you’ve risked any capital buying properties beyond what your parents bequeathed you, nor sold the ones you have, even though you’re actively “in the biz”… could it be that the much higher “new” taxes are a significant inhibiting factor to you? Can you see far enough beyond your own self interest to realize how this sort of stagnation is NOT beneficial to your locale or the larger state? (Not to mention the tax shortfall SHELL GAME, which creates all sorts of state.gov make-work bureaucrats, further dragging down the real economy.)

Of course we haven’t bought any more property! My brother is a plumber and I’m disabled and can’t work. Sorry, but we are very fortunate to have this place. Once we pay taxes, maintenance, water, trash, etc. it doesn’t add up to much. Jealous much?

Also, we are in our late forties and mid fifties age wise. Who knows how much time we have left. Everyone else in the family died in their 60s. Get more info. before you make judgements, moron.

Rhiannon, at least I think you realize you are getting a good deal with Prop 13. I’m not really sure of what being disabled or plumber has anything to do with this topic. Should all disabled people and plumbers get breaks on property taxes?

I have argued the Prop 13 debate with countless people and I have not received one answer making a viable case for the fairness of Prop 13. Property taxes pay for services (roads, sewers, water lines, public safety, schools, etc). All the people who bought long ago and grandfathered in by Prop 13 use these same services as the new buyer next door to you. Why should this new buyer pay 5x the amount you are paying? Now if anybody can answer that question, I would love to hear it.

For all the people benefittig from it, great. It absolutely screws the younger generation and first time buyers…there is simply no refuting this. As far as keeping grandma in the house during her elder years, how about this: why doesn’t Prop 13 kick in when the homeowner reaches the federal retirement age (65, 67 whatever it is). There you have it. Stop the corporate welfare and gifting 1970s tax levels to heirs!

Prop 13: not a huge factor in pricing, older folks who need to stay put could if they wanted to transfer their “basis” to a new property but they are not big movers anyway. Most of the newer/younger folks who bought since 2003 are not paying their property taxes anymore than they are paying their mortgages. Net result: huge boon for commercial assets.

Mortgage Interest Deduction: Pretty minimal impact, you feel better writing off your mortgage interest versus renting but if your property has taken a %30 hit you have lost a lot more than your next door renter paid in taxes. And of course you cannot deduct the interest IF YOU AREN’T MAKING A PAYMENT ANYWAY.

REO Pipeline: with all due respect the numbers above may only tell half the story, this is like having the INS tell us 2,000,000 folks snuck over the border last year. If they admit to 2,000,000 it is more likely 4,000,000. Banks are allowing mortgages to go delinquent for more than 2 years and have not even filed a NOD, there is simply no way to add up the real delinquencies because they do not volunteer that information. We will see the states sell the properties for back taxes (5 year limit in CA) before the banks are forced step in and foreclose to protect their investment.

GSEs to rent to borrowers to avoid foreclosure: Please….I can hardly breathe for laughing, stop: “Hello, Uncle Sam, my toilet is backed up can you send someone over? I am not going to pay rent until you do”. Plus, once a renter pays his rent the landlord (you and I) become subject to rent control ordinances which differ from state to state and county to county-only someone as inherently dense as Barney Frank could come up with this idea. If they aren’t paying the mortgage what makes you think they will pay rent?

Sovereign Debt: This is the real problem, unlike the 80s when Brazil and Argentina walked away from 80,000,000,000 (count the zeros) the chances of Greece, Ireland, Iceland, Spain or Italy bringing down the global banking system were pretty remote but made much less remote every day as the cadre of inept politicians set to wrangling over the right steps to take to calm markets. This is a confidence game remember, no confidence means you are isolated like Bank of America is today. Having Warren Buffet buy your stock is a sign of WEAKNESS not strength and this Group of Whatever have roiled not calmed markets with their bungling. Germany France and Britain and their inexperienced Politicos look set to cause real havoc globally by screwing up any deal and doing %30 of what is required, as usual. A camel is a horse, designed by committee.

Remember when Japan was going to take over the world? The Emperor’s Palace was worth more than all of CA. We scolded and wagged our fingers at the Japanese government and bankers telling them to own up and write down the losses, you cannot stabilize or put in a bottom until you do. They have lost 20 years and all of their global esteem, are not even a factor today on the world stage as they refused our advice. But are we not doing the EXACT same thing ourselves today? Of course we are, we are a nation of hypocrites.

Pick your pet peeve: unemployment, manufacturing, education, infrastructure, climate change, healthcare…..do you see the group of asses in DC getting it right on any of them or just a bunch more camels?

You can tell the politicians are getting very hungry now. Prop 13 was the third rail just a few years ago and now they’re putting out more and more feelers to see how they can tweak it. It matters not what your opinion is about it, it’s money they see as “lost tax revenue” ….

Well, in all objective fairness, if it’s providing an entrenched windfall to large-scale COMMERCIAL RE owners, then indeed it IS MAJOR lost tax revenue. I’m studying up on Prop 13 from over here in FL, and it looks like the slimy Donald Trump types had their lobbyists all over Sacramento’s finest while this was being drafted. As Doc says above “As usual, the real crime is hidden behind some marketing PR piece.”

It is well nigh impossible to argue that a 60,000 sq. ft. office bldg. erected in 1975 should be paying less taxes than one of equivalent size built in 1995. Those 2 bldgs. are creating the same demands on police, fire, bldg. inspection dept., water, etc… (in fact the older bldg. is provably a higher demand on fire dept. inspections, incidents, etc.)

The “Third Rail” would be going after primary personal residence, i.e. “Granny”… no one is going after Granny, they’re going after Century City skyscrapers. 🙄

The main impact that Prop 13 has on the real estate market is to reduce supply in the more desirable areas. Thus, house prices increase. If taxes were higher, few retired workers could afford to stay put. They would have to sell. With Prop 13, the longer you stay, the more incentive there is to remain. This artificially suppresses supply and shifts the price curve based on steady demand.

Maybe grandma should lose her home. It’s too big for her to care for, and the next generation needs to the room to raise its family. Her house is probably in a good school district, and close to employment centers. So, the next generation must commute long distances to work, or pay high prices and high property taxes. This means fewer children since there is less time to care for them and less money to pay for their food, clothes, shelter, education, etc. And since GDP grows mainly with population we can expect slower growth in CA for years. Of course, we do have all the uneducated illegals having ten anchor babies each. That should just about seal our fate!

I guess the human race has peaked at the baby boomer generation: it’s all down hill from here!

Those are all good points. Prop 13 has definitley caused low turnover in desirable pockets of CA. Many people who bought 30+ years ago are just staying put (even though the house is probably not ideal for them anymore). Many of these old timers are virtually living free due to Prop 13, it also doesn’t hurt that they won the CA housing lottery on the way either and then there is always the option to gift the winning the lottery ticket to one of their offspring so they can live there free as well. But the poor first time buyers take it in the shorts…totally unfair if you ask me. Prop 13 needs some major revisions…too many to list. But this is definitely a reason we continue to have housing bubbles and overinflated prices here in CA.

Clearly, you’re not a senior citizen. I don’t understand why some people seem to think that those who are older don’t deserve to live in the home that they’ve known and loved for many years. In any case, I live in Pennsylvania where property taxes are NOT protected by something like Prop. 13, and yet many, if not most, older folks (at least those who don’t retire down south for the better weather) stay right where they’ve been for years. Same in New Jersey, which unfortunately has some of the highest property taxes in the country. One reason is that people become atttached to their homes and their neighborhoods, family may be nearby, the churches and cultural amenties they enjoy are still there, etc. Another issue that gets overlooked–certainly in your post–is that not all people live in homes big enough to downsize to something smaller to make someone like you happy. In our case, if property taxes become too much for us to handle, my husband and I would be forced to move into an apartment and a not particularly desirable one at that or move out of the city we live in to the fairly distant suburbs, a prospect that chills the soul. Some friends in NJ who live in rather small houses would probably have to move to a trailer park. Great prospect, right? Even before reaching senior citizen status myself, I’ve believed that we should find some way to protect seniors from soaring (or even modestly climbing) real estate prices, possibly increasing tax rates, or the combination of both. However, that protection needs to be intelligent and not an excuse for giving businesses or long-time residents who are still in their prime working years an undue economic advantage over newcomers. I’m not sure what the answer is, but I do know that Prop. 13 is an absurdity. How much it contributed to the run-up in California real estate prices is an open question, though.

“In our case, if property taxes become too much for us to handle, my husband and I would be forced to move into an apartment and a not particularly desirable one at that or move out of the city we live in to the fairly distant suburbs, a prospect that chills the soul.”

You spelled out what most young people in any decent part of Califonia are forced into due to Prop 13 which has helped inflate the prices of many areas of CA. It’s either rent an apartment close to work, buy a place and sit on the freeway for 2+ hours per day or leave the state entirely.

There is a whole generation or two here (people in their 20s and 30s) who have got the short end of the stick. The message we are getting is “if you can’t afford it here, move somewhere else.” All things being fair, this can pertain to some fo the other age groups too (boomers and seniors)!

Thank you, Doc, for quoting my comment on the effect of immigration on the market for houses.

With regard to Prop 13, I have a couple of comments:

As to your comment, “I’m sure they can figure out a way to fix 1978 legislation to protect old retirees while not subsidizing others through these loopholes,” that might be true if it were, in fact, legislation. It is not “legislation” for two reasons. First, the Legislature did not adopt it; the voters did. Second, the language of Prop 13 is not in the Civil Code, the Government Code, the Revenue and Taxation Code, or any other of California’s 29 codes; rather, it is Article XIIIA of the California Constitution. The Legislature can’t change it if it wanted to. Even tinkering with Prop 13 will take another constitutional amendment.

You might remember that there was talk of a new constitutional convention in order to fix the state’s budget mess, and there were a number of theories about why it didn’t happen, usually focusing on differences between various political constituencies (Latinos v. Blacks v. Asians, etc.). I believe that the real reason it never got any traction is that once the convention convened, everything, including Prop 13 would be on the table.

As to farang’s comment about Jerry Brown that “I recall Jerry Brown was rightly against it…until he looked at polls, then was ‘fer it,’†I suggest your memory is a little faulty. Jerry Brown favored a balanced budget amendment and remained opposed to Prop 13, but stated that he would faithfully enforce it if it passed. He did as he promised and slashed state spending, used the $5billion state surplus he built up to help out local governments after Prop 13 decimated their finances, and predicted that Prop 13 would cause serious economic problems for the whole state in 15-20 years. He was right, but a little optimistic, since it was 1990-91 (12-13 years) when the first Prop 13 shocks hit. He also neglected to mention that Prop 13’s bad effects would be cyclical – we got hit again 15 years later when the housing bubble popped.

I think we are about to see a new phenomenon coming with regard to delinquent homeowners who haven’t been foreclosed: adverse possession. I’ll bet that there are at least a few people who moved into abandoned foreclosures and have been there for 5 years. If they pay or have paid the back taxes, they can take the properties free and clear.

I also think that homeowners who have been sitting in their homes for years without paying might be able to do the same thing if they make the right legal argument. I call it “constructive dispossession” in that at some point after a homeowner defaults, the lender ought to have done something about it, and after a certain point, the homeowner can be treated as a constructive trespasser. That homeowner may also have a strong case for adverse possession of his or her own property.

Actually, that’s a situation the Legislature could address, by allowing a foreclosed homeowner in possession to obtain the property by adverse possession. I am pretty sure that would stimulate the banks to get on with the foreclosures they’ve been sitting on.

Prop 13 are a master stroke of success.

It keeps an ignorant populace fixated on the stupid concept of resentment that they are “paying someone’s taxes”.

They should be asking why the taxes would be that high for anyone.

Kallyfornia, yeah

To me the biggest issue with prop 13 is that its basically a piece of legislation that once passed, couldn’t possibly be repealed because the situation it created meant huge rewards for those that happened to be lucky enough to own a home when it was passed. This in turn created a cycle whereas with each passing generation that also got locked into a stable tax rate comes the lack of desire to change the law because why would they want to? I know I certainly wouldn’t.

I have to put myself in the shoes of the probably 70% of my neighbors that whom are all elderly. Most bought back when the cost of housing was more inline with incomes. They all pay incredibly little in property taxes. They get to enjoy what amounts to an upper level income lifestyle in a large home now worth $800k that gets taxed for a $30k rate. None of course could ever afford their own house now, so of course any mention of altering Prop 13 brings immediate protest because again- why not? Its worked out great for them and if other younger buyers now have to pay out the nose, well that’s not their issue. I personally don’t blame them. If I was in their shoes you’d better believe I’d be happy. But I’m not and instead the situation for people like me is totally opposite and we’re the ones that now have to pay out the nose.

Another thing I’ve wondered about for years is why the high cost of housing has not really been discussed in general as a problem? If you were to ask me what I thought the biggest problem was in California or what was the largest threat to its future economic success of California I’d put the cost of housing as the biggest issue. I’d go as far as to say expensive housing is THE single single biggest problem period. Yet this is another subject the state and local governments never discuss even though its so incredibly obvious. Sure- there are smaller token “affordable housing” projects thrown here and there. But the problem of the housing situation here is never dealt with in any meaningful way or even officially recognized. Perhaps its because if someone buys a house- even if they know its too expensive- then they’ll be hard-pressed to believe that the price they paid was a mistake. They “manned up” to the table and joined the club. Its the idea that if they had to pay out the nose… then surely it was worth it and everyone else should too- because they did. Its a self-perpetuating cycle. I’d also imagine that if the topic of overpriced real estate were to become officially recognized that this would make homeowners a bit unhappy because what would this say about them and their decision?

But aside from the unlikelihood of the housing cost problem being recognized it IS in fact a problem and most everyone-including those that bought even recently- probably know it.

All I know is that I’ve lived in Cali for 12 years. I make a more than decent income and so too does my Wife. Its not like we can’t afford to buy here but more that where I came from nice houses in historic old neighborhoods can still be had for 150k or less. Its not because the area is undesirable nor that jobs pay drastically less either. The same home would easily be 700k in the Bay Area. I’ve given up on seeing real estate in the Bay Area as ever being remotely affordable. There’s simply too many people who are eager to pay whatever the price is- so long as they can secure the loan- to squeeze into whatever tiny working class home their upper middle class incomes can afford. As long as Prop 13, the attitude amongst hopeful home buyers, and the lack of realization that housing is a problem here exists the cost of housing here in the Bay Area will never be at levels near reasonable. Thus we’ve been saving and will continue to save and then we’ll move away. The Bay Area can say bye-bye to yet one more young couple that would’ve contributed to the state’s economy but instead left.

Yea I think it’s one of the reasons businesses leave the state for other states. Employees are cheaper elsewhere. And yet those cheaper employees live just as well or often better than they do for much higher salaries here. That’s the end result of a very high cost of living driven in large part by the high cost of shelter.

Although I agree, DHB, with your view on “capping appreciation” as a key to economic sustainability–by definition!–I must also point out to you that makes all of us who agree horrible communist socialist crazymuffins bent on the destruction of all that is decent. For everyone knows that PermaGrowth Uber Alles is good.

Which of course translates into PermaGrowth Uber Alles for the plutocracy class, and the rest of yall scrambling for the trickledown crumbs. But obviously if you were a valuable and important member of society, you’d be part of the plutocracy class, and if you’re not, you deserve to be scrambling because, obviously, you don’t measure up morally, which if you did, the bling would come to you. It’s god’s way of rewarding her/his Chosen People. Reaganismo/Greenspanomics is, after all, the new secular religion.

Kat’s point is worth re-reading. “Housing always goes up” was really a proxy for other inflations, most notably property tax, and the burden of services placed on the shoulders of homeowners. Every time the Ed Biz folks around here get a bee in their bonnet about something, there’s a bond issue, and it’s not for the Ed Biz, it’s For The Chilllldrunnnnnn. Every time the Construction Biz finds a way to skim a few hundred million in government handouts off of an area, suddenly there’s a bond issue for infrastructure. These things have cooled considerably in the past couple years, but they will be back simply because it’s easier for voters to rob their neighbors at the ballot box than to organize to put pressure on the banksters sitting on piles of cash and refusing to lend them.

On DHB’s coffee-price note. I’ve been hearing an astonishing number of people complaining that the price of their Netflix addiction increased. They are so much more cranked up about this than the larger economic picture, or the much larger losses they are suffering as a result of bankster and Wall Street crimogenic culture and welfare. The ones who seem to be reacting on that front have mostly taken a tiny-minded contrarian approach–“Vote ’em all out!”–as happened in Wisconsin last fall. I.e., they’ve allowed the visigoths even further into the heart of the only mechanism the public has to rein in corporate rapacity.

Then there’s the crisis of leadership–where the GovBots are too busy preparing for their next election and baking up crusty rich loaves of partisanal bread, to be served in sacred communions of emotional frenzy, to actually LEAD.

The need for a First National Credit Union of Infrastructure Funding has never been keener–the work is needed, the jobs are needed, and the cash is there. Even more could be collected with a combination debt jubilee AND assets jubilee. In other words, any bank that got government handouts must lend it within 24 months, or be fined for nine times as much. That’d quickly dislodge the plutocratic roosters from their lofty perches of taxpayer cash.

CA has always been a boom and bust state. That’s what put it on the map in the first place. For starters, there was a big run up in values a couple of years before Prop 13 was even passed so I don’t see how anyone can make the argument that going back to assessed values annually (or however often) would have held prices in check. Furthermore, there are plenty of other states (as noted) that assess annually that had a big boom and the subsequent bust to go along with it as well, which leaves us with even more recent evidence to examine.

As one of the posters (correctly) pointed out there was obviously a need for some type of reform because of assessments that were skyrocketing due to out of control spending. Prop 13 has its flaws and is far from perfect, but I would add that annual assessments are far from perfect either. I own a number of properties in TN, which has the highest property tax rates in the country, including pretty much a whole block where the homes are identical in every way, including the year in which they were built. They were even purchased at the same time as well. The assessments on these vary widely without rhyme or reason. Anecdotal and limited as this might be, I think it pretty clearly illustrates that no system is perfect.

Prop 13 should be revised so all properties with an assessed value over $1 million to $2 million pay 1.5% of value, $2 million to $3 million pay 2% of value, and hence forth. The revision would raise billions of dollars of additional revenue to the government to pay off debt and rebuild infrastructure. Government needs to begin extracting the wealth from the ultra rich assets.

The always trenchant DrHB keeps minting the one-liners:

“The deeper problem is the government, both parties in particular, are deeply captured by the financial interests in this country and those interests don’t align with the success of the majority.”

“As usual, the real crime is hidden behind some marketing PR piece. ”

I can almost hear the “bah-DUM-TSSSsss!” (*rimshot*) 😀

That line stood out to me as great bumper-sticker material. A big bumper-sticker, but a goodie.

Right on the money. The only magic words keeping this article short from perfection is “wedding coverage/planning/debt”. One must always leave room for improvement I suppose.

Doctor, I appreciate your non-partisan political analysis. I just don’t get it when people take sides on one political side or the other. I have several friends who believe that the entire housing bubble is the fault Democrats via the Community Reinvestmetn Act. I also have other friends and coworkers who believe “it’s Reagans’s fault and the Republicans”.

Are we becoming a nation of “ditto heads”? People who can not even think for ourselves? Most arguments I hear are straight out talking points from each respective party or whatever Glenn Beck, Rush Limbaugh or MSNBC personalites stated.

when everything under the sun (stock prices ,real estate ,commodities,gold ,currency,…etc)

is market driven price why should the fed determine

the interest rates?the fed should intervene only during abnormaltimes

and let the market determine the interest rates during normal times

keeping interest rates at zero is the equivalent of communism

Ans:

Because most Americans have chosen to put their wealth in real estate.

Its all political due to vote-buying from the real estate and home construction lobbies and individual homeowners who are unpatriotic and put themselves first before country.

~Misstrial

Enough already!!! When will prices come down? If what is before our eyes were in another country, people would have had revolted against it by now. We are nothing but slaves to banks and big corporations. By the way, anyone interested in a 7 series BMW, Walmart has reduced my hours and can not longer afford it.

In Massachusetts, around the same time, Prop 2 1/2 was passed which said that you can’t raise property tax rates in your town more than 2.5% without the town voting to do so. There’s a ton of grumbling about it but, frankly, it seems to work quite well. It’s not easy to raise taxes but if there’s some worthwhile project, new town water service to a part of a town, then you bring the issue up before the town for a vote.

Your Prop 13 seems ridiculously unfair in comparison. Why exactly is some little old lady supposed to be subsidized by everyone else when she has a TON of equity at her disposal any time she wants to sell her house? Let her take a nice photo album with her to her new condo and stop screwing over young couples so that Granny gets to stare at the pencil marks on the doorway wood marking each kid’s height on their birthdays.

Big gov’t types *hate* it, but I think a slight majority of the Prop 2 1/2 overrides pass anyway. It just doesn’t let anyone expect that it’ll be easy. Town finances in Massachusetts are usually fairly reasonable. It’s the state that’s insane.

James T, you are right about the granny comment. I personally don’t know of anybody who would be forced to eat dogfood or sell their house if their Prop 13 tax basis were changed. In my old neighborhood in Huntington Beach, the long time owners there were far from starving. These folks lived the good life, happily retired with fat pensions and social security, new Escalades and BMWs in the driveway and they pay almost nothing for property taxes while the new buyers pay 5 to 10x as much. That’s real fair isn’t it?

When Prop 13 passed in 1978 this was going to be one of the unintended consequences. It was going to be so far down the road, no one cared at the time. Well here we are today and you essentially class warfare going on (baby boomers and older folks versus younger folks). The oldtimers still hold the voting power, but when that starts to fade away, I could see major changes brought on by the currently screwed generations.

I tell you that it’s a crying shame. All the folks benefitting from Prop 13 know it isn’t fair, but they are out for their own self interests and want to keep the status quo. Absolutely pathetic!

California is a great state to be old and retired in. If you bought years ago and you are covered under prop 13 you are paying almost nothing in property taxes and houses were even somewhat reasonable priced when you bought. Also you’ll pay no state taxes on your Social Security income.

But California is a hard hard state to be working age in. The unemployment figures are so high it’s scary, you’ll definitely pay state income taxes on your wage income and it hits hard, and who can afford a house these days or the taxes that come with it?

‘Prop 13 wasn’t just for grannies.

In 1954 my parents bought 1 acre for $3,000 in the Bay Area and built their own house.

However, by the mid to late 60’s – property taxes were getting so high that people who had acreage or small farms or horse ranches had to sell their property to the builders who were building all the tract homes at the time just to cover their taxes.

There were plenty of people who bought a home and then ended up with a higher monthly tax bill than their mortgages.

Thanks to all the building corporations – it became very difficult for anyone to buy an individual lot and build their own home.

Those homes in our area that were $9,000 – $14000 in 1954 were about $35,000 – $45,000 by around 1972 and by 1980 were probably around $150,000 and during the bubble were probably around $550,000 or more and are now falling under $400,000.

Two people making minimum wage could have purchased a home back in the 50’s and 60’s. Now it seems like we look down on people making minimum wage like they don’t deserve to own a home/shelter.

Many things need to change – not just Prop 13

I know exactly what you mean. When Prop. 13 passed my mother had become a 48-year-old widow the previous year with three children under 18. (I was the youngest, turning 13 just days after my father’s death.) We could make the mortgage and the bills but the skyrocketing property tax was not only going to drive us out of our Thousand Oaks home but out of the state. Sure, my mother could sell for a big profit over what they’d signed on for when we moved in back in ’74 but any place we’d go to was going to have shot in price and tax rate as well. So it meant leaving the state, really. And quite a few others in the neighborhood had the same fear.

Prop. 13 wasn’t just about the elderly. Keep in mind, it’s been over 30 years. Those retirees down the street with the sweet property tax rate likely had a bunch of kids in the house back when this was on the ballot.

And as for Jerry Brown, he knew people were getting clobbered by the housing bubble du jour but his bunch offered NOTHING in terms of a solution. The alternative was Prop. 8, a grotesque joke that only required that the legislature talk about the rapacious property tax rise a bit, not actually DO anything. If the people running CA then had really cared about families like mine they would have offered an alternative of some substance. For instance, completely separating the residential and commercial properties into different bills so as to head off corruption of the intent. But strangely, they seemed unmotivated…

Compare the housing market of SoCal with say Gadsden AL. I bought a house there last week. After spending some $ 37,000 a net rent of ~ $ 600 per month is doable. Smoke that!

Home prices are still way too high IMHO and home ownership makes little sense. To be honest, I bought homes in anticipation of some inflation as a result of Helicopter Ben’s actions. (Remember the general consensus, blaming Greensoan’s 1% rate for the subsequent bubble? Now think what years at 0.25% will trigger).

Who is buying 10 years’ Treasuries when they yield less than 2%? Is anyone buying 30 years’ bonds? *** Not the president and not the Ben Bernank can dictate yields at the long end. Watch them fail in their attempt to dictate terms to the market!

As a fifty year resident of California, I’d like to add my defense of prop 13. Put on your google eyes and look up “California companies flee state” and you’ll see it’s taxes, regulation and a general unfriendly business environment. As jobs go, so goes it’s residents.

Seriously, do you think giving this state more money will help the current housing situation?

Giving the state more money is not to help any housing situation (you made an empty rhetorical statement to get a reaction – there is no correlation), it’s a tax. Everyone must pay their share of tax to maintain infrastructure, etc. It’s not about giving the state more it’s about YOU paying more and not sucking off of younger generations.

Included in your list should be the cost of doing business which translates to paying employees a salary so they don’t have to live under a freeway overpass.

As property owners and landlords cashed-in on ever growing home prices and rents, companies began moving to less expensive states because they could not afford to keep up with rapidly rising real estate costs for employees.

This flight began back in the 1980’s in California.

As much as property owners want to shove off blame onto government or agencies, they are actually the most to blame. (Yes gov’t and agencies are to blame too, however the government doesn’t set rents throughout California, certain cities yes, but most places, No.)

~Misstrial

Interesting talk about taxes. What give the government the right to tax private property? Before you call me a moron and talk about public services answer this question what is the purpose of government?

Is it to help people? (The welfare state/ public education, public roads, health care, food stamp…) or

Is its role limited to protect certain unalienable rights… The rights to life/liberty and the pursuit of happiness…..

In all of the conversations above you are giving up your right or someone else’s right to life/liberty/pursuit of happiness (ie… their right to live on their private property and die their if they want to so the government can steel their money (taxes) to “help” people)

Always remember before 1913 there was NO income tax and No Federal Reserve bank and there were not mass starvation’s in the USA. Roads were built and commerce and business still went forward. Was it a perfect world…NO, but individual right were not trampled upon the way they are today.

Charity (due to our Judeo-Christian heritage) built hospitals, colleges, schools, etc…. Who do you think feeds more people per dollar taken in… The Union Rescue Mission or the Food Stamp program? We have willingly allowed our rights to be stripped away to allow the government to do what charity has always done in this country.

Charity is a much deeper word then you think. So before you scoff at what I say think about what charity means and what it is. As true charity is restored and individuals take responsibility for their life grandma can stay in her home and we can get the government out of our personal lives.

why do we need more housing?we only have so much water and power, should my quality of life suffer because city government needs more tax money.bottom line we only can support so many people and they need to go else where.California at one time was a great state, it can still be.

Ditch Prop 13. Replace it with a flat tax. Why? Why should property even be taxed at all? Why should only homeowners pay for the services that property tax currently pays for? Why shouldn’t renters also pay for those services? Worried about little old ladies eating dog food? Exempt them from the tax. Simple, fairer.

Oh come on! Why shouldn’t renters pay property tax? Um . . because it’s NOT their property.

But just the same, they DO. Or do you not think that the landlord has factored his property tax overhead into how much he charges for rent?

Believing that renters aren’t paying the property tax for an apartment building is like believing that a pizza place is really giving you free delivery and just absorbing those costs without ever passing them on to you.

Pete, renters do pay for services indirectly through their rent check. I agree that something needs to be done to change Prop 13. The way it stands now, it is competely and utterly ridiculously unfair.

I wonder what would happen if the IRS came up with a new tax law that required all people over 55 to pay an extra 3% in taxes, there would be rioting in the streets. Prop 13 screws the younger folks under the guise of saving granny and having people not being taxed out of their houses.

Leave a Reply