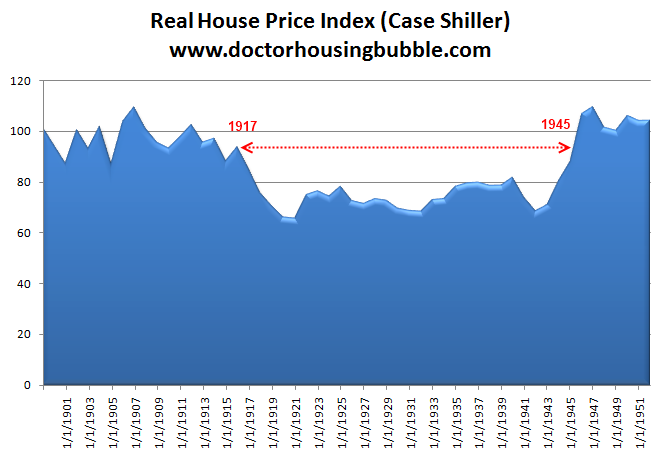

A protracted winter is imminent for housing: Lessons from the Great Depression Part 36. From 1917 to 1945 home prices lagged the overall inflation trend. With one decade in the book, can Americans stomach a stagnant real estate market for another 20 years?

Imagine home values being stuck for 30 years or even falling behind the overall rate of inflation. Does this seem outlandish? Something similar happened to U.S. real estate between 1917 and 1945, the generation before the baby boomers. Much of the stagnation that occurred during this time was due to the painful economic damage caused by the Great Depression. But even before the Great Depression real estate had been losing its luster. It was a gripping time for the nation. I was digging through pages of data looking at long rate information from that period and found interest rates at that time were also extremely low. Of course residential housing did not play such a big role in the scheme of global finances like it does today. Nonetheless you have to wonder with nationwide home prices falling and mortgage rates at generational lows, what more can be done to spark the housing market? Unfortunately not much, unless the economy including wages starts to stabilize and increase for most Americans. What did it in 1945 was the baby boom and the economic fortune that had fallen the U.S. because of other industrialized nations trying to rise from the rubble of war. Similar to the Great Depression years with low interest rates and many people losing their homes, it is hard to create a housing boom when more and more of household income is consumed by other costs of living. In real terms we have already lost one decade in housing. Are we starring at another 20 years of stagnant home values adjusting for inflation?

This is part 36 in our Lessons from the Great Depression series:

31. When government and financial institutions become one.

32. Housing prices continue to fall as other costs eat up disposable income.

33. The McDonald’s and paper-mill education economy funded by a too big to fail bank.

34. Tracking housing values from 1940 to 2011.

35. How will mood be impacted for the next decade because of the real estate bubble bursting?

The lost generation of housing

I was curious to see how housing held up in the first half of the 1900s. It is an interesting trend:

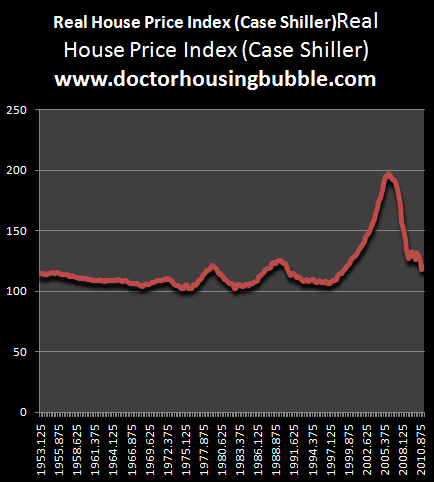

What is even more fascinating about the above is how real estate underperformed the overall market and actually fell below the 100 baseline for over 30 years. When bubbles pop things tend to also over correct to the downside and we really haven’t seen that on a nationwide scale even with this current housing bubble popping. Real estate historically has been a very good barometer at tracking inflation. Just take a look at the second half of the century up until today:

The recent mega bubble starting in the late 1990s coincides with many things but in particular, the repeal of Glass-Steagall. The ability for banks to take unholy amounts of leverage and mingle it in with their more stale investments put our entire financial system on the brink of collapse. Do people still remember the memorable days of the U.S. Treasury Secretary Hank Paulson begging on bended knee to Representative Nancy Pelosi to bailout the giant banks in our country? You also had Federal Reserve chief Alan Greenspan lowering mortgage rates to insanely low levels in the start of the 2000s. The two above charts show for over 100 years of data housing has been a good measure of overall inflation of the nation but not much more. That is why for such a long time buying a home was second nature for most and didn’t require obscene levels of debt. This notion of taking on so much debt at a household level is a novel new concept. I doubt the Egyptians were buying McPyramids with jumbo mortgages trying to keep up with the Pharaohs.

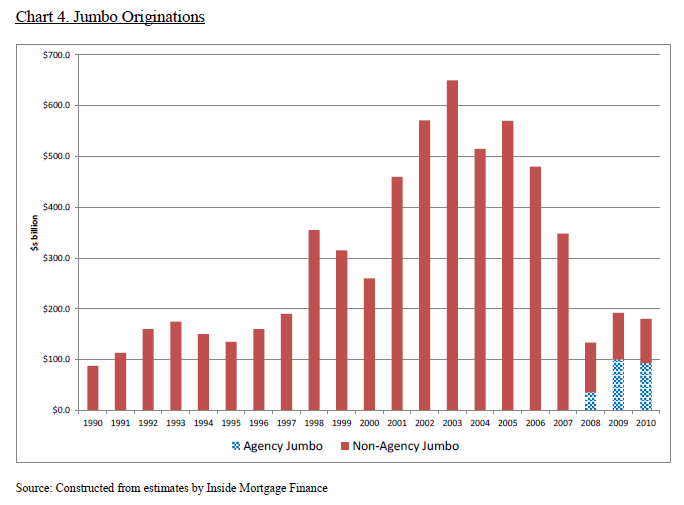

Betting big on jumbos

In a previous article we discussed that the Senate went ahead and extended the heightened loan limits for conforming mortgages. This act of comedy was done even though the amount would have dropped from $729,750 to $625,500. Even this was not enough and you have pundits with no sense of perspective claiming that this was somehow okay to help high priced areas. Since when has it been the government’s job to subsidize sky high housing markets? I was trying to find some data on the push for this and found something rather fascinating which sheds some more light on this issue:

Agency debt was practically non-existent in the jumbo market for the last 20 years. Even at the peak of prices, most of the jumbo debt was taken on by the private banking sector. But look at 2009 and 2010. The jumbo market, a decent sized market with nearly $200 billion in originations in 2009 and slightly less in 2010, suddenly was made up of half-agency debt. In other words the government is entering into uncharted territory here to aid the banks and keep their business brisk.

I’m not sure this is the best use of resources trying to prop up the many markets that still resemble and show signs of bubbles. The only reason the government dove in here is to keep prices inflated regardless of market forces trying to adjust prices to a new economic reality hitting most Americans. It is a fascinating trend and early data shows the same pattern for 2011 in the jumbo loan market.

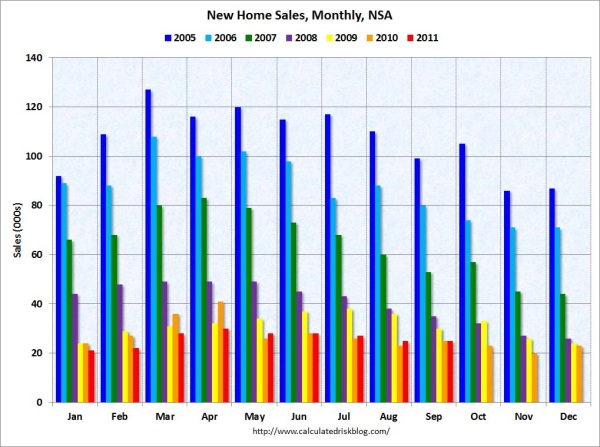

New home sales not budging into fall and winter

New home sales are on path for another horrible year. In spite of all the financial trickery and smoke and mirrors new home sales are merely a shell of what they were in the bubble years:

The red columns are sales for 2011. Just compare that to the dark blue of 2005. We are no where remotely close to those sales numbers and it is highly unlikely we will see those figures emerge again even in the decade ahead. A large part of it stems from the new amount of housing coming online from baby boomers downsizing. This will happen and there is little that can be done to pause this inventory unlike the shadow inventory. Slowly the market is working its way through on a nationwide scale but what about those markets that still have bubbles? Banks may try to recapitalize on a larger scale and slowly move on inflated markets as their balance sheet becomes better (aka more taxpayer backing). The future demand is likely to come for lower priced homes just like we are seeing today. There is little evidence showing household income stabilizing or moving higher in recent years. This would be the first place to examine if we were to see future changes in the trend of housing.

I know that 30 years must seem impossible for those nursed at the hands of this decade long housing mania. Yet look at the data and you will find that this was a complete anomaly for housing. If history is any guide even minor housing bubbles over corrected to the downside. What is more important unlike the wild swings in the stock market, there is unlikely to be a wild push for prices upwards. What we have today on a nationwide scale is a disjointed real estate market where some areas may be stable, some barely experienced a bubble, some are foreclosure centrals, and some are still in flat out in bubbles. Those expecting a return to the bubble days are largely mistaken.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

62 Responses to “A protracted winter is imminent for housing: Lessons from the Great Depression Part 36. From 1917 to 1945 home prices lagged the overall inflation trend. With one decade in the book, can Americans stomach a stagnant real estate market for another 20 years?”

3/2 stucco boxes are still going for well over 700k on my block in LA. They’re going for below asking but still going, and not to all-cash investors but to regular buyers – the “young families” are still drinking the kool aid. The house I rent from is still “valued” on Zillow close to

Same here in So. Pasadena…craziness.

Not so in Lake Elizabeth, there is a forclosure in my friends neighborhood, it sold for $407,000 at the peak; Now… $129,000!

The same is true of SFRs in Culver City (a frequent target of Dr. HB). All the decent SFRs are still 600K and up. But the movement appears to be happening in the condo market. 1 bedrooms in CC breached the 200K barrier about a month ago (those are prices last seen in 2003). In addition there is price inversion in the Culver City condo market where 2 bedroom condos are being listing at prices equal to or less than 1 bedrooms in the same HOA.

Give it time. The correction will come sooner or later, despite the efforts to prop up the market. I’m currently looking for a rental in the Bay Area community of Walnut Creek. Looked at a 2br condo for $1,695/mo. On Redfin the same unit shows as sold in August 2011 for $224k. WC is one of the nicer communities in the East Bay Area. There wasn’t much of anything for under $1M at the height of the bubble. Looking at these numbers makes renting tough. According to Redfin (I haven’t confirmed) at the sales price of $224k with 3.5% down, the monthly payment is $900 & change. The unit has association dues of $350/mo which the owner pays. It obviously cashflows if the owner can rent it for more than $1,500/mo, however a unit with identical floorplan sold in September 2011 for $177k and zillow shows value at $204k, although zillow has been notoriously slow to reduce in falling markets. That’s the part that keeps me renting. Although buying is cheaper than renting on a monthly basis right now, that particular condo buyer lost potentially $47k in 1 month. Depreciation must be factored into the rent vs. buy equation, but no one knows for certain how far it will fall or when.

I agree…I’m up in the North Bay (Santa Rosa/Petaluma area) and rents are unreal.

I’m paying $1100/mo for an average 2/1 apartment in a complex….while houses are renting for $1700/mo…..and I look at nearby homes for sale and they’re going less $225k and condos for well under $150K…..the slumlords have everything prices perfectly so that its really hard to buy because saving up for 20% down is near impossible with these rents…..so…3.5%…..here we come.

Real unemployment in CA is in the low 20% area. As long as this persists, the residential real estate market is going to suffer.

It appears that the govt is now the mortgage market. What else will be needed to “save” real estate prices?

Who says unemployment wont improve? California is one of the largest economic engines in the world!!!! It can all turn around rather quickly with some innovations in green energy.

I don’t see or hear anything about employment getting better in CA. In the near or distant future. Hope is not a strategy.

Solyndra.

Solyndra, Enron, Fisker, Tesla, all cut from the same cloth.

Even without the dirty dealings to “earn” your taxdollar “investments,” California needs somewhere around 700,000 – 1,200,000 jobs to reach the 5% unemployment mark generally considered to denote full utilization of a healthy work force. Best case scenario, “green jobs” on a very generous estimate might count for 30,000-50,000. It’s pissin’ in the ocean. And when you consider the overhead associated with government job creation programs, we’ll probably have to spend a 10-11 figure taxdollar amount to operate those jobs.

Technically California is a bubble economy state. From 1981 to 1990 it was a defense bubble with Reagan building weapons and planes like crazy in order to bankrupt Soviet Union. Bubble burst in 1990 with fall of Soviet Union and military and bases were cut or closed. Then in 1996-2000 we had had the Dot Com stock market bubble based on speculation. Then the Feds lowered interest rates to zero and housing took off from 2000 to 2007. Defense, dot com and housing bubbles are now history. We are back to a normal economic time, until the next bubble…

And, re: Mike’s comment about the California permabubble economy–the next bubbles will be “health” “care” and further housing- and other consumer-debt-related derivatives.

Also speculation on food, and the flustercluck unfolding in the Eurozone.

Well, this is a timely article. Diana Olick had a recent article, which backs up the information about New Home Sales. These were touted loudly in the headlines last week:

http://www.cnbc.com/id/45048478

New US Home Sales Improve, Prices Tank:

“[Stock prices of the big builders] then dropped off pretty precipitously, as analysts weighed in on what is behind that nice headline number.”

“the bad news is that 25,000 [new sales] is a pitifully low number of sales, actually tying a record low.”

Pwned, the top 1% have to live somewhere.. They will pay a premium to live with the other top 1%. Some areas of LA will always be out of reach. The San Fernando valley is now affordable for compared to rents… Show me a home in san fernando with similar square footage as a rental unit that isnt comparable to own vs rent.

Also if home prices stayed flat for another decade it would still make sense to buy now.. Unless u really think the stock market will out perform housing. I think if housing crashes further… Stocks will drop twice as much… We will see DoW 6000 again cause it will crush financial and consumer spending stocks further. Owning the dollar, ownomg stocks, owning assets like housing… All are losing propositions. But u need a roof over your head and are already paying for it with rent…

How long have you had your realtor’s license?

…as soon as dey lern 2 spell.

CaliOwner – Sure rents are higher than buying in some areas, but see my earlier comment above where I looked at a 2br condo for rent in the East Bay Area and the owner potentially lost $47k in 1 month. I would rather pay a little more each month in rent than lose $1,500 per day in principle. Sure the unit will still cashflow for the owner, but he is trapped. What if the association assesses each unit $10k for rotting decks for example. What is that owner going to do? Refi and take the cash out? Sorry you’re $47k underwater. He would have to sell at a loss, come up with the cash, allow the association to foreclose on him or become a gigolo.

Hah sadly my hood is not for the 1%. These are standard stucco boxes that rent around $3,500 or so. I do think there’s a lot of inertia in the market. Families that can’t resist temptation after waiting several years, or who have a down payment from a previous sale or mommy/daddy help. It is a good sign that they’re paying below asking. We rent for $2,500 but have a good deal – landlord hasn’t ever raised the rent. No way I’d buy a similar house for $750k. Like Taz says, sure prices are getting close to rental parity, assuming 100% occupancy and no major repairs. But those are fools’ assumptions.

I’m almost certain equities will outperform housing for the next ten years. Over that time I am certain my house will pay me a negative dividend to the tune of about -2% in the form of property tax, maintenance and insurance. In contrast, the S&P 500 index is paying a dividend of 2.17%. That is a 4% yield difference even if they both go nowhere. Next, if you look at historical returns for real estate vs. equities over the last 100 years, you will see real estate is essentially flat, whereas equities appreciated at about 7% CAGR. (Apologies if I am confusing before and after inflation figures here.)

The reason I own a house is that I need a place to live and a good school for my kids. I certainly am not expecting to make any money from it, any more than I expect my car clothes or breakfast cereal to appreciate.

What Ian said, exactly. NOBODY expects their car to appreciate, or their vacuum cleaner. We buy these things because the promise to serve as tools in our lives. This is exactly how I view any house/land purchase. Know your fundamentals and stick to them, and empty out any silliness about conspicuous consumption. For me a house/land is a place where I live just as I did in the 25+ years I rented…with the bonus that I can do small for-profit enterprises without having to rent office or shop space, or do other productive work that I can barter for things I want.

We have GOT to come off of this idea that somehow the financialized model can work for us poor sods at the grass roots. It may work for a few people sometimes here and there. But all in all the system is rigged to skim profits to the top. And the top consists of a bunch of robo-traders moving shares according to algorithms, in nanoseconds, involving huge amounts of money, at wholesale and insider prices you and I will never get to see at the retail level.

Terminal patients can live for a long time before they die. So too the bubble. It will be a slow death. Like a terminal patient, there will be times of a rally, but the direction is down. When I was born, America had 50% of the world’s GDP. When Bush Jr. took over it was 30%, now it is 25% and when I leave in 20years+, it will be close to 15%. So goes the vanishing of the American Empire, much like the British. SoCal is already Mexico.

Porter Ranch, Granada Hills, Northridge, West Hills, Woodland Hills are three nice LA areas to live that have fallen in price to be fair in terms of prices to rent. They are the best schools in LaUsd.. All 8-10 out of 10 on great schools.net.

Some bad pockets… But in general prices have dropped 40-50% from peak. They are not falling more than 10-20% more based on media income. Median income in Porter Ranch is 120k a year.. Median income in Granada Hills is 83k a year.

Nice family homes go for 300k fixers- 500k upgraded pool homes with large lots.

Glendale, Burbank and Pasadena are still in bubbles because they are over-rated school districts compared to overlooked high performing schools in the west valley.

Ahh, optimism. So what happens when the Feds stop backing new home loans, especially given that these loans are 90-95% of the market today?

If you think that the Feds won’t do this, that must mean you think the debt problems in Greece and the rest of Europe won’t hit the U.S.. Care to explain how that can happen?

This explanation should be interesting.

Oh, I’m not super optimistic… But I’m more of the belief that I locked in a 30 year mortgage lower than my prior rent after taxes deductions… I’m building $6500K in equity a year… if i lose all that equity each year for say 5 years… I’m still not losing a terrible amount more than rent.. because I’d still only be paying out of pocket $150-200 a month more than my rent for a much smaller place after deductions.

I love how your SO confident that the government can’t keep passing policies that hurt renters…When I was renting i wished there was not an MID deduction too… So i could buy a home for less. But I woke up and realized our government is gonna to continue to support this housing market and make getting any kind of return on your money near impossible. Housing is far from the worst investment one could make right now… And whose to say if housing started sliding aggressively again that the government wouldn’t INCREASE the MID to help put money in the pockets of households. They are already thinking of ways to ease the burden on college debtors… do you think they’ll pull the rug out from under homeowners really?

If i were a gambling man.. I would bet the government will keep throwing everything including the kitchen sink at this housing crisis.. and as long as your buying no more than 3x your household income in housing… then you’ll probably make out better than 99% of renters moving forward from here.. starting in late 2011… thru 2025.

@CaliOwner:

“$6500K” in equity per year is impressive. That’s $6.5 M per year. I presume that’s a typo.

Also, I said absolutely nothing about the Government passing policies that hurt renters. Please don’t attribute false quotes to me.

It sounds like you didn’t understand a word I said, or the implications of it. The Government can only throw money at a problem as long as they can sell Bonds. When the Bond sales fail (these do happen, have happened, and are happening right now in Europe), the party ends. The Feds cannot use money to solve the problems. And what happens is that they have to cut spending. Such as with frivolous things like funding the entire mortgage market and thus the housing industry.

Your $200 a month that your spending is basically throwing money out the window on a depreciating asset. Lately housing has been going down around 3-5% per year. For a $500,000 house, that would be around $18-25K per year. So what you’re saying is that you’re spending $2.4K per year so that you can lose $24K.

Ouch. Forgive me if I am unimpressed.

The Fed can keep buying bonds a lot longer than most people think. The US$ is the worlds reserve currency and look what still happens when there’s a contraction in the markets….money runs to the Treasuries. I agree that it’s crazy, but it still is what happens. The govt will issue Treasuries and the Fed will buy them.

Legally, the fed can print money to buy US government bonds indefinitely. This will lead to inflation or hyperinflation, but it can do it. The bond sales can only fail because the government wants them to. While I doubt the US is likely to enter into hyperinflation, some prolonged period of high inflation seems likely at some point, or even beneficial. Several things will happen. Currently the fed is dumping a lot of liquidity into the system in the form of quantitative easing and “the twist” and low interst rates, etc. These policies are becoming progressively less effective — “pushing on a string” — and a lot of the liquidity is just freezing on contact, because investors are looking at cash as an investment unto itself. When inflation finally starts, hoarding cash will suddenly look like a bad idea. Cash is not a great investment when it is losing 7% of its value per year! So much of the frozen liquidity will become liquid again. Now we have too much liquidity and inflation starts to bite hard. Interest rates will go up, if for no other reason than because not many are going to lend at rates below inflation. Let a year or three of that go on, and suddenly our debt soaked consumer notices that his debt has become smaller because of inflation, he’s (hopefully) locked in at a fixed interest rate below inflation, and his salary is going up (we hope) to keep up with inflation. He’s starting to feel pretty good! it’s probably heresy to say so, but at this point having some private bond auctions fail is quite possibly a good thing.

@CAE: I agree; this can go on longer than most people expect. But the Fed is far from omnipotent. Powerful, yes. All powerful, not at all. They are constrained far greater than many think.

It’s the Bond markets which rule Central Bankers, and set interest rates; and not the other way around. Always has been, and always will be. If you’ve looked at history, even recent history, you’ll see that the Bond Markets eat Central Bankers for lunch. Indeed, if you look at even the currency markets, you’ll see that they slapped the Bank of Japan around in less than 24 hours yesterday. Europe’s grand cure-all lasted less than a week.

Even the Reserve Currency Status is no cure-all. While Bernake can print up an endless supply of paper, he can’t print up an endless supply of oil. And higher prices there have a negative effect on the economy. As well as degrading the viability of the dollar as the Reserve Currency.

And to top it off, the Fed is being run by a guy who helped nearly bring down the world economy back in 2008, and has been incredibly wrong on his predictions.

So yes, the Greece situation will indeed come here. But I agree, they can kick the can down the road a little farther. In the end though, not even the Fed can solve a debt problem with more debt.

The end result is that housing still has a lot farther to fall. And that doesn’t even include the Shadow Inventory coming back onto the market.

@Ian:

Re: The Fed legalities about printing money and buying bonds.

That’s exactly what they did with QE II. They had a nearly failed bond auction the year before, in June of 2010 IIRC, and so they set up a fake auctions via the Primary Dealers. You might have noticed that it was spectacularly unsuccessful. And most of that money went to European Banks, btw.

Regarding the rest of your piece, the key thing you left out is the ongoing collapse in Credit. That’s far more significant than money. Bernake hasn’t been able to offset that, in spite of the QE programs. This will collapse first, before one sees hyperinflation. And that’s a very strong negative for housing.

No, Pasadena has a terrible school district. The city of South Pasadena has the good one…

And home prices are much lower in Northern pasadena.. and altadena… as a result of crappier schools..

South Pasadena homes are actually out of control.. but that’s where the top 1% live.. lots of doctors and lawyers per capita.. so it’ll drop.. but very very slowly.. because of the wealth in the area.

Haha, I think the top 1% are living a little larger than the SGV!

Cali,

Have you actually looked into Pasadena schools? Or do you mean South Pasadena or Arcadia or San Marino schools.

Pasadena has the worst public schools in the area outside of the city of LA.

I’ve been a long time resident and worker in Pasadena….

I couldn’t agree more. But I’ve read deeper into a lot of things and realize now that we never really have progressed as a species. Individuals have learned how to harvest the masses, but the masses have grown progressively ignorant–or at least in proportion to the increase in knowledge requred to maintain oneself in an increasingly complex, parasitic world.

We not only need increased income but increased knowledge and understanding to emerge from this morass…the inability of people to believe the downside of germaine issues will continue the housing/princess mentality that defines America.

“housing/princess mentality”….Priceless! May I borrow?

I’d be flattered…

I think our civilization has been as ignorant as it always have been through history, and despite the label of ‘the information age’ slapped onto the 21st century, people have, in general, kept up with the kardashians moreso than the economy and current political state. Even worse is that many of those who are knowledgeable enough to understand the situation don’t care as much to stir up a movement against this form of oppression and abuse.

Our country has done well to go above physical oppression, but has a long way to go before going above an intellectual one.

Ed, my profession (mass mind engineering) has been very strong for the majority of the past 20th century. Now you don’t even have to bother flogging the masses with ads–they pay to view ad content. This is not a mindset that cottons to more complex or difficult analyses, broader viewpoints, or deeper stretches of time.

Used to be that schooling could provide some counterpoint to the increasing commercialization of American culture…but now schooling is just a pawn in the system, and more obsessed with teaching postmodern identity /differance/ mapping and victimization strategies than the mental toolkit first assembled so beautifully in the classical liberal arts.

But it doesn’t help that the root meme in agricultural civilization is various forms of real estate scam–from starving in this life for pie in the sky in the next, to a wide range of serfdom/rentier schemes.

“I doubt the Egyptians were buying McPyramids with jumbo mortgages trying to keep up with the Pharaohs.”

This is why I have been an avid reader since you started this site. Honest, and darn funny, but it aint no joke!

When will PEOPLE snap-out-of the mindset that LOW price is a BAD thing? I would LOVE to get a house or 2 for CHEAP, and Throw-in a Porsche for $500 while you are at it> am I the ONLY smart one it the room? The little guy benefits from cheap stuff, the indebted, is (are) the one(s) that gets punished!! Who is that? Use common sense, all the world govts, FIAT, debt-slaves, etc need to be punished, haircuts on their holdings!! There are no guarantees in life, and yes it IS FAIR, that is how it works…you eat too much you get fat…you take on too many risks, you might get rewarded, but you might sink too!!

The low prices are attractive to those with cash and not the assets being priced downward. There’s the problem.The majority of people own a home and a solid 40% of them have lost all equity or are underwater. So that’s what’s wrong with lower prices…..it means a bunch of people will realize going BK. This is too hard for our govt to accept and hence the craziness that has ensued.

It always reassures me that simple minds are simple to fool, and keep silent. Good job America, keep up that good edumication.

The world could go to hell in a hand bucket, but hey, as long as WE get ours, f em….right? Too bad we couldn’t allow the rich to charge for surfing, that wouldn’t be fair, but it wouldn’t affect me so I don’t give 2 sh1ts…hurrah for corporations! Everyone has to make money so let’s do it!

No problemo, if I’m upside-down, I walk away, and buy the place next door. I WIN, the bank/debt-holder loses!! This is so-freaking-simple, even a dumb surfer can figure it out!!

Kudos to Doc on all levels. This is so so so correct, top to bottom, left to right, back to front and into the Nth dimension.

I was born late in my parents’ lives, and they late in theirs oddly enough…and my paternal grandparents and father told me often about what their family went through in the period between the coming of fiat currency/the Federal Reserve as it generated WWI, and the Depression as it generated WWII.

I have been saying all my life–as a liberal person who usually is in the company of institutional-access-class people (usually liberal/Democrat)–that the worship of FDR overlooks the fact that he built the New Deal on an industrialization devoted to the slaughter of some 100 million people.

We simply do not have the option of warring our way out of the present economic crisis. Wait, I guess we do, and I guess that’s what scares me the most. The convergence of things, including a ridiculously high number of humans. Slaughtering 100 million for progress wouldn’t even make a dent in the 7 billion. Biowarfare that killed off humans at a Spanish flu rate would make even less of a dent (epidemiologists’ estimates are that another H1N1 pandemic would take out about 60 million humans).

This is what we are faced with. The focus on whether one’s housing will go up so one can make an easy profit just seems so…ridiculous.

DHB, overlay your numbers on this chart:

http://users.rcn.com/mwhite28/atrox.htm

And I think you can see what I’m getting at. Looks like the Great Depression was good for one thing for sure: the hemoclysm came to a screeching halt.

sigh

rose

The economic benefits from war are HUGELY over exaggerated. We will do fine with peace. What we need to do is settle down, and stop being so panicky, this will happen eventually out of boredom. Just watch the ^VIX.

Ian, I do agree with you that the economic benefits of war have been exaggerated. But be that as it was, it STILL was the predominant model of the Cold War for the superpowers, and many of the economic regimes we grapple with reforming or sustaining today got their character from those times.

I personally am not panicky (in my circles I’m the fiscally calmest person)…but I do have a deep crawling horror sensing what rough beast slouches toward Jerusalem, etc. History is also cyclical in that respect.

Spengler has a great piece today on Asia Times where he finds that Americans pay more in property taxes than they do on mortgage interest, largely due to rising tax burden..

Now Proposition 13 in California helps (but not prevents) that so much in our state but the overall state deficit shows that stable property taxes doesn’t mean they have to restrain spending!

This can help to lock in renters too. I’ve rented for 12 years now to the same owners. If the house had been sold to a new owner, his property taxes would have jumped and so would have my rent. The current owner is happy to have his mortgage, maintenance, and taxes paid by a guy with a decent, steady job.

We just paid our biannual property tax. Majority of it goes to the public schools, about equally split between regular budgets and the referendum stuff.

Two of the referendums we’re still paying for included building Olympic-sized swimming pools for several of the high schools, paving the kiddies’ parking lots at the high schools so they wouldn’t have to get their Nikes muddy, and building a giant vast shiny new “instructional technology center” at one of the high schools. The latter had a flat roof. A couple winters ago we got three feet of snow, interspersed with a lot of rain (i.e., typical winter weather, though more snow than usual). Did anyone think of shoveling the flat roof? Hell, no. So it collapsed, destroying the “instructional technology center” and most of the expensive computers, multimedia crap, etc.

So of course the renters and those with sprogs decided that home buyers and child free people should have to buy them another “instructional technology center.”

Meanwhile, the products of these high schools are about 1/4 dropout, and 3/4 highly sensitive victims with special needs who want a gold trophy for showing up.

Buying a house around here at non-bubble prices was a great deal till the Ed Biz got hold of it. I wish we could have checkoffs for our property taxes. For starters, I’d rather the $3,200 a year we pour into the school system go to community gardens.

This all just confirms to me that I’ll be where I’m at for a long, long, long time. I’m thinking that its a good thing I bought acreage – at least with acreage I can feed myself and cut firewood off of it. I’ve lost 35% overall with the value of my piece of property, but the value for me is well beyond the $ I paid to get it.

With declining housing prices, there will have to be another way to squeeze tax money off the electorate to fund the budgets of the politicians. I’m curious to see what develops with that – taxes can only go high enough for people to stop paying them, and with a deluge of shadow inventory and declining home prices…there just might be a total “reset” button pushed.

Banana republic, anyone? (with or w/o a war)

I’m with you on all that, Rose.

Property tax is very attractive to local govt because it’s a captured environment for them. The property aint going anywhere. People can cheat and work around many other types of taxation, but property tax is a sure thing for govts to collect on.

CAE, you are right, but I think Ohiogal and I would have similar experiences in that when your county assesses your property, you have the option of stirring some merde IN PERSON. Around here, a lot of us more prudent and productive landowners fought for and got huge devaluations, because our houses were being assessed at bubble and luxury rates, when we have in fact very modest houses on productive land. (Though unlike gal I do everything I can not to cut our trees. That’s for the other little peeples who live on the land.)

So maybe in some places house tax payers are captive…here we’re more like feral wild things being held just barely in check, and well grounded in organizing to keep from being victims of our local politicoes. And our local politicos know it. There’s been a HUGE and widespread movement to check a lot of the silly vaporous spending and expectations of the bubble years. How the essential stuff will get paid for is still up for grabs of course–but democracy tends to be messy. As Doc keeps reminding us, jobs jobs jobs. But we shall see about that as well. In the past week or so The Fed has announced various policies to shunt money toward the flustercluck called the Eurozone, and has said that the US cannot expect ANY help from our bankster overlords. But let me not digress. Just agreeing with Ohiogal: there are more currencies than the fiat kind, and the reboot will not be as sleepwalkydreamy as the past 30 years of Reaganismo and consumption.

But we just may see many good things come out of it. Already I’m seeing widespread evidence of people waking the hell up and remembering what really, truly is important. DIY, barter, gardening, and exchanging skills has exploded in these parts. Too bad it took something like this to make that happen.

Funny, I was walking my dog in Lacy Park in posh San Marino today, when I was accosted by a realtor. She came up to me and asked for a few minutes of my time. She then told me she was a realtor and asked me if I knew anyone who was planning to buy or sell in the near future…Of course I said “no, my friends are smart – – they rent!” She gave me her card just in case…jeez, what a weird thing to happen in a park.

“Are we starring at another 20 years of stagnant home values adjusting for inflation?”

I’m sorry DHB, but if you look at the last 100 years of housing values adjusted for inflation, they are essentially flat. How is this unexpected?

“Since when has it been the government’s job to subsidize sky high housing markets?”

Since the government came to be the lender for nearly all mortgages.

I’m almost certain equities will outperform housing for the next ten years. Over that time I am certain my house willay me a negative dividend to the tuen of about -2% in the form of property tax, maintenance and insurance. In contrast, the S&P 500 index is paying a dividend of 2.17%. That is a 4% yield difference even if they both go nowhere. Next, it’s you look at historical returns for real estate vs. equities over the last 100 years and you will see real estate is essentially flat, whereas Equities appreciated at about 7% CAGR. (Apologies if I am confusing before and after figures here.)

The reason I own a house is that I need a place to live and a good school for my kids. I certainly am not expecting to make any money from it, anymore than I expect my car to appreciate.

It is true that the price of a house may not go up, but when you add the rental value(see Zillow) it is not a bad investment. If I was not living in my house I would be paying 30K a year in rent. I figure I get a 5% return, which is not bad. Party on.

The stock market is very high risk now… The run up in the stock market dwarfs the housing run up. Stocks can crash much faster than housing….

What’s more likely scenario… We have another CRISIS and stocks start crashing… Boomers cash out their 401Ks entirely and sit on the cash… rather than lose the money. Or boomers sell their PAID OFF IN FULL homes for 50% discounts instead of their 401K which also took a 50% haircut…

People are already giving up and saying.. Well, I guess I’m going to die in this home… might as well make the best of it! You don’t die inside your stock portfolio.. People will sell stocks in the next panic LONG before they start a real estate fire sale.

Yepp, stocks more liquid & more volatile…at least that is what they taught this dumb-surfer in school….

Stocks are FAR more over-valued than housing… Baby Boomers are not going to sell their HOUSES which are paid off for the most part… They are going to be forced to sell their STOCKS first…

Who in there right mind would sell their home and start paying rent?

Paper assets will be sold far sooner than hard assets like housing. Housing will be a safe bet for the next 20 years… You will lose most likely lose more in your 401 percentage wise moving forward than in your home’s value.

Well, I’m just going to sit on my stock portfolio of dividend payers and earnings growers and let them tank if they must while I keep feasting on the higher dividends and slowly dollar cost averaging to a lower price. Over time, an asset will be valued at the income it generates, period. Housing is not there yet. Some stocks are.

Hope you’re right Jay. That’s my strategy as well. What’s amazing is that they’ve held this giant facade up for at least 40 years–just printing money and pretending this can go on forever. When you got a 2,5,7,9,J and they ain’t all diamonds, you either raise, fold, get the other players drunk or pull a gun and leave with the loot. We’re on the last one now, but that’s not a long-term answer. Can we bail out all the banks? I doubt it. This mess could unravel by morning. Put your seat belts on–this plane ride is going to get bumpy…

Leave a Reply