Real City of Genius: Case Study of the Middle Priced Los Angeles Housing Market. Pasadena in Focus. The Alt-A Mortgage Debacle Gearing Up.

The mainstream media is finally taking a notice of the Alt-A and pay Option ARM issues that await the California housing market late in 2009 and will run deep into 2012. A few of you have sent articles that started appearing within the last month. This is a really important factor in determining a housing bottom. And more to the point, Fitch Ratings came out last week stating that they project prices will drop 12.5 percent nationally from Q1 of 2009 but more importantly, they stated that California prices still have 36 percent further to go down. They also stated that prices will not turn around until the second half of 2010. This coincides with our prediction made last summer that California will not face a housing bottom until 2011. The exact date is irrelevant since prices will remain depressed for years but I am glad seeing the mainstream media coming more in line with more realistic projections instead of conjuring up back of the napkin calculations.

To quell the housing bottom callers, I did a detailed post of the Westside of L.A. showing how more prime areas will start facing declines in late 2009 and all of 2010. This still doesn’t seem to be enough. Anecdotal stories of people over bidding and paying top bill for some reason get people worked up. The reason I’ve been trying to put out dates on a bottom is so people can take a deep breath and relax. For some reason some people are just itching to blow through two or three years of savings just to buy right now. I’ve gotten a couple of e-mails of people looking to buy in Pasadena and this is the exact place where prices will be coming down late this year and into 2010. Why? Current prices do not reflect local area incomes.

Pasadena has a population of 146,518 and is located 10 miles north of downtown Los Angeles. A nice city famous for the Tournament of Roses and the Rose Bowl football game, which is a familiar scene for many local college football fans. Pasadena has 51,000 households and is what many would consider a “prime” middle-class location. Of course, in the last few years prime and L.A. meant you would be shelling out $750,000 for a Real Home of Genius.

Here is where things get interesting. The median household income as of 2007 is $66,465 and the average household income is $92,125. Not bad for aggregate figures. In Pasadena only 48 percent of households actually own. This is typical of L.A. County which is a renting majority county. The bubble started in 2000 so how many people bought or moved into their new location between 2000 and 2007? A stunning 58 percent. So keep all this data in mind as we move along.

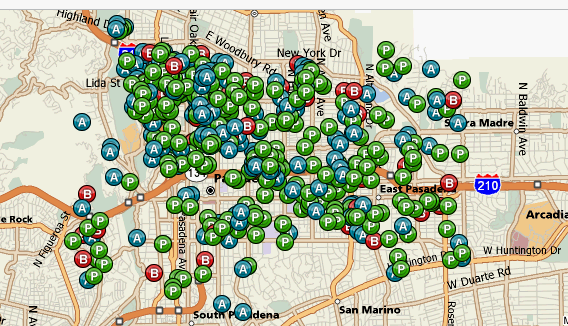

The distress sales are now making their way into the market. How so? I’ve put together all homes in the pre-foreclosure stage and the amount is astounding:

Source:Â Foreclosure Radar

When I ran this report, there are 348 homes in Pasadena that are in pre-foreclosure. What does this mean? It means these places have those infamous notice of defaults (NOD) I keep talking about which will hit the market like a tsunami later this year. This is important because most of these are flying under the radar. Many don’t show up on the MLS. Many aren’t even being sold. As we now all know, lenders are so behind that your typical 3-month NOD filing may take 6 to 9 months meaning many people are living payment free. Consider it a personal mini-bailout.

The data from the chart above is troubling because this is a giant amount for this city. Currently, there are only 277 single-family homes listed on the MLS for Pasadena. If we include condos and multi-family units we are up to 570. So that 348 number is big. If we are to include bank owned homes and notice of trustee sales for Pasadena, we add another 300+ homes. In total, we have over 600 distressed properties in the city while the current listing only gives us 570.

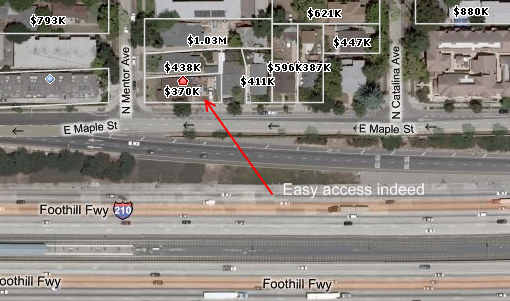

Here is how you realize how screwed up the data is. The current MLS only has 11 homes showing up as foreclosures. How can that be when we have REOs and scheduled auctions above 300? Alt-A and pay Option ARMs are rampant in these areas. Take a look at one of those 11 foreclosures:

This home is a 2 bedroom and 1 bath home. It is 1,038 square feet and was built in 1911. Yes, prior to the Great Depression. We are told that there is easy access to the 210 freeway. Let us take a look:

Any closer to the freeway and you’d be in the center divider. This home is currently listed at $369,900 and has been on the market for 46 days. Let us look at some sales history here:

09/08/2005: $462,000

08/23/2000: $145,000

So we see typical bubble behavior here. It is hard to say how much this home will sell for but it is already down nearly $100,000 from the peak price. Just think about that. In many places of this country, $100,000 will buy you a home. But this is a home already in foreclosure. What is going on with those homes in pre-foreclosure? Ah yes.  This is where the action is taking place.

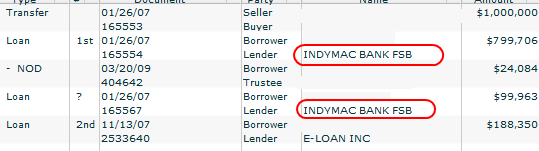

Let us take a look at a $1 million condo in Pasadena. $1 million for a condo? That is correct. This one gets really at the point of what we are going to face.

There are many units in this place. This condo has 2 bedrooms and 2 baths. It is a good size condo coming in over 2,000 square feet. It sold in January of 2007 for a stunning $1,000,000. So who made the loan on this place? None other than old faithful IndyMac Bank:

This is really where you can dissect what is going on. IndyMac first made an $800,000 mortgage on this place plus a $100,000 loan. Looks like a 10 percent down deal on a million dollar home. Only six months later after the purchase, E-Loan allowed the borrower to take out an additional $188,350 from the condo basically rendering this a place with no equity. So that would assume of course that the condo had a value of:

$800,000 + $100,000 + $100,000 (down) + $188,000 = $1.18 million.

This is the kind of math that was occurring during the bubble. So in six months this condo went up in value by $188,350? Come on now. I can’t tell what kind of loan this is but Indymac was an option ARM specialist and that is one of the reasons they have imploded. Well as you can tell, a notice of default was filed on March of 2009 with payments of $24,084. This is what I was talking about that once someone misses a few payments on a place like this, the aggregate amount gets big quickly. Do you really think this place is going to fetch anything close to the peak price? Who is going to buy this in this market? You would need jumbo financing which is much higher than conventional financing. No doubt this condo is very nice and has some extensive work done but is it worth $1 million? You tell me.

Looking at Pasadena carefully you realize that there will be many foreclosures coming online in the next few months and accelerating in 2010. The Alt-A and pay Option ARM tsunami is building up and is going to hit with full force. Just look at these examples. Last month, over all zip codes Pasadena had 78 homes sold. If you look at the MLS figure of 570, we would have about 7 months of inventory. Not bad right? Wrong. Just take a look at the pre-foreclosure, REO, and NTS data above and you double the amount of inventory. I’m glad Fitch is now in our camp. California will see no bottom until 2011.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

41 Responses to “Real City of Genius: Case Study of the Middle Priced Los Angeles Housing Market. Pasadena in Focus. The Alt-A Mortgage Debacle Gearing Up.”

As someone who lives in Pasadena, all I can say is “It’s about damn time!”

Prices have been pretty sticky here, but I knew it’s just been a matter of time before the roses hit the fan.

The mainstream media is finally coming around. Instead of the usual recovery lies they have decided to be more honest. Time is calling it the “fun-free” recovery now.

Good thing we have a foreclosure moratorium now. It will give these people a chance to get current again. Also, I’m sure the govt. is not going to let all these people actually foreclose, it would be a disaster, especially to surrounding home prices and, hence, the economy as a whole. We cannot let home prices fall any further. No, they’ll just have to ramp up the loan modifications, no matter how much it costs. We must keep these people in their rightful homes, no matter the cost!

Welcome back, Doctor. We all missed you!

~

That entry for “E-Loan” on the condo sets off the alarm. They were one of those outfits that specialized in no-doc, no-meet, pure-formula “loans.” The flood of unqualified money these outfits churned out is the sole reason there was a housing bubble in the first place. (I thought E-Loan folded last year but their website is still up.)

They can loan mod all they want. Throw in taxes, insurance and maintenance people are still going to bail. It cost alot more to own. Reducing princ and interest is still going to make the monthly cost to high when there is going to be no financial pay off in the future. Also median home price in OC is 410K. Has not been above 400 in a long time. Must be nicer areas starting to feel the pressure.

Thank you for another good read DHB.

I hope more will find your site and save themselves $$. I am afraid with Obama’s $8K first-time give away, many are taking the bait. They are fools and so is the govenment for trying to reinflate the bubble. I have yet to see anything that will replace jobs created by the housing/banking/insurance bust. I find your 2010 bottom quite optimistic.

I definitely agree prices in s.c. are unsustainable.

But….since when did NODs ALL turn into foreclosures? From what I understand only 30 to 40% do, am I wrong?”

Also, as someone else put it, the Gooberment will try to keep these houses out of foreclosure.

The problem with people like you and me is we look at how things ought to be based upon the facts, our life experiences, our intellect and our common sense. So we see that the facts and common sense dictates housing prices MUST correct in the coming years just as 1+1 must equal 2.

I myself am finding it harder and harder to use my common sense in the equation of housing since the Government is changing the rules, pulling things out of their &*^es and are literally changing the rules of mathematics so that 1+1 no longer equals 2.

Who can come to any concrete plans/conclusions when Congress could pass a law tomorrow giving 100K kick backs to home buyers in “housing depressed areas”? Or Congress could pass a law tomorrow, refinancing anyone who can prove hardship at 30year rates of 2%?

I know it sounds ridiculous but all they need do is preach how if your neighbors house goes in to foreclosure not only will your house plunge in value but the economy would be harmed. In fact, it sounds about as crazy as the monetization of about 300billion to force 30year rates below 5%, would have a year or two ago.

What I believe I can count on, despite the government manipulation of the market place is that housing absolutely will not outpace a modest investment like a 10year Treasury (or just about anything else) for years to come. So, even if housing never corrects as it should in nominal dollars it certainly will, over time, in constant dollars.

As a 29 year old professional that’s been renting, saving, and waiting for this bubble to pop since forever it feels like, thank god the prices are finally starting to drop. After a year of hearing that the low end of the market is down 50% or so I wondered, is it ever going to happen in my neighboorhood? Well, it looks like I just have to be patient for a little longer. 2010, baby!! Dr., do you think you can canvass Sierra Madre in the same depth? That would be awesome. Thanks!

Why is the bottom being called for 2011 when Alt-A and Option Arms issues “run deep into 2012” ?

If only the Fed would start printing more money and drop the interest rate to -6 everyone could get on their feet again and buy a million dollar condo over citibank..

This is exactly what I’ve been waiting for. I grew up in the Yorba Linda area (OC), I hope now in a couple of years I’ll be able to afford in this area.

.

Only two words to describe this article…

True Dat!

.

.

OT: Thanks for your mention and link to the BLS inflation calculator.

Martin: Somewhere from 70-90% of NODs were expected to turn into foreclosures for two reasons: once you get behind, its hard to catch up. Historically people could always sell. Two, banks are taking typically 6 months before issuing NODs these days, instead of 3 months. By that time most people are so far past due, there is little chance of recovery unless a miracle comes.

The large number of lenders are trying to stem the tide with loan mods, but it’s just delaying the inevitable. It may prevent a foreclosure for the next year, but it’s not like people can or want to afford a house at double what it’s worth.

Theres a lot of factors when I think the bottom will come… but I think it’ll probably happen around the time we start getting new jobs again. Without new jobs, I think real estate will whether away closer to national averages as people move away and we have simply too many houses and no incomes to pay for them.

Hi:

What did you think about the June 18, LA Times article Southern Ca Home Prices Rise Slightly in May? I’m not sure what to make of it.

Nobody seems to care that we might not see any appreciation for 5-10 years (Japanese style) in real estate. Why would anyone buy now, with so much downside risk, compared to upside? The mid to high-end on the Westside has slowed to a crawl, and it’s only a matter of time before major price cuts are needed to move anything…..

http://www.westsideremeltdown.blogspot.com

Phenomenal post.

I’m in the camp that we keep seeing declines well past 2011, but like you say the exact date is irrelevant. By that time the RE bulls will be flushed out of the system.

I’m thinking that condo above City National Bank will ultimately fetch under 600k. A knifecatcher may step in prematurely, but the bottom may be lower than that. Fugly.

I worked in Pasadena for 9 years. 80% of the city is a damn GHETTO. Honestly, its scary to even walk thise streets at night.

You can have Pasadena. You can buy crack cocaine in Pasadena, what does that tell you about the city?

Burbank is the city of choice in that area. Its got $$$, youth, and a Mayberry like atmosphere.

Pasadena has Crips & Bloods shooting it out on the street corners, no thanks…

Ever heard of PDL, Pasadena Denver Lane Crips and the Squiggly Lane Bloods. Dodge their bullets as you pay $600,000 for a ghetto fabulous house.

I think you are missing the point. Sure, house prices are dropping and will drop much more, but the essential point is that you are not buying a house, you are buying a home. A home is worth more than a mere house. Furthermore, the more prices drop, the more they will ultimately go up later. So, now is a great time to buy (or sell) a home (if not a house).

Yours truly,

David Lereah

I think you are missing the point. Sure, house prices are dropping and will drop much more, but the essential point is that you are not buying a house, you are buying a home. A home is worth more than a mere house. Furthermore, the more prices drop, the more they will ultimately go up later. So, now is a great time to buy (or sell) a home (if not a house).

Yours truly,

David Lereah

Gosh, that David Lereah is one smart cookie!!!

Who can afford a $600,000 home? By today’s lending standards you need $120,000 down payment and you are still faced with AT LEAST $2400 a month at 6% interest… and that’s just the mortgage not taxes, insurance and maintenance. So let’s see:

if $28000 per year mortgage is 30% of your gross, the person needs to earn $96,000 a year. First, how does a person earning $96,000 a year save up $120,000? If you do make $100,000 ish a year, you’re paying almost $50,000 to the state and Uncle Sambo in taxes, plus about $7000 in property taxes. That leaves a little over $10000 for all your other expenses like a car payment, food and groceries. Fat chance of making that happen. All those knuckleheads saying everyone in California earns $200,000 a year are straight up bullshitters.

Homer you were just in the wrong part of Pasadena. Did you know that Pasadena actually extends south of the 210? Well believe it or not it really does.

dashingdwl – nice to see someone point out the “sticky little detaisl” of having money “left over” for all those other “minor expenses” such as food, clothing, groceries, car payment, etc., (and any real old-fashioned savings anyone?). Folks in California for decades have supported price to income ratios well above the usual 2.3- 3.2 (typically 2.8). My guess is they’re going to have to learn to live within the guidelines of the rest of the country for a change. When I was a kid, the local banker wouldn’t loan to anything much above a ratio of 2.5 without a “serious discussion”…….

Home Price to Income

Ratio

1.5 Extremely affordable

1.75 Very affordable

2.0 Affordable

3.0 Marginally affordable

4.0 Unaffordable

5.0 Very unaffordable

6.0 Extremely unaffordable

(And to think they reached ratios of 10-12 in California at the peak!) What did folks do? Not eat, etc?

Even an overall nationwide ratio of 3.1 in 2007 was apparently too high.

Region Median Home Value Household Income Ratio (for year 2007)

United States $194,300 63,059 3.1

(Source: U.S. Census Bureau)

@ dashingdwl: Indeed. A 100,000 dollar salary in SoCal does not make one rich given the high cost of living in the area and all its added expenses.

I know many who are looking to have their homes appraised lower in order to cut the cost of property tax. Interesting that homeowners are suddenly welcoming a reduction in the worth of their home. Speaks volumes about the extent of the financial crisis dontcha think?

Re: Ms. Kukumente

The sale of lower priced homes is diminishing & more higher priced homes are being sold, thus bringing the average up. This article explains the rise.

http://seekingalpha.com/article/144195-southern-california-home-prices-rise-beware-of-misleading-medians?source=email

I am one of those caught in the ARM mess. Large downpayment, $300,000, and with new rules for refinancing and the home appraised at current loan value there is no way to refinance. Payments are going up every year over $300 per month each year and a deadline to pay off the ARM in 2 more years looming. Can’ sell. Within 24 months I will join more of California who will default on a loan and send prices of higher valued homes down. The main issue is that the COFI has not dropped in 3 years with this loan. The banks are making a fortune right now off of these loans. Anyone not think there is fraud in the banks COFI?

Anyone know if it’s possible to see stats on existing Option ARM / Pick A Pay type loans in Palo Alto? Wondering what the ratio is, so I can gauge the effects.

thanks

Although the prices in Pasadena will likely come down, do you think the savings will be substantial enough to offset the also likely rise in interest rates? We have been looking in the nicer pockets of Pasadena for awhile and haven’t seen a large reduction in asking prices. Also, we constantly have the Realtors regaling us with stories about how cute houses in the nice areas of Pasadena are getting multiple offers. We just don’t know what we should do. Pasadena is a big city and we don’t care about falling prices in the garbage parts of town. I wish we could get a sense of how much will prices fall in the more coveted areas of Pasadena.

Angie: You always need to focus on the price. Even if your monthly payment is the same once prices drop and interest goes up, you’re still better off with a lower price. If you overpay for a nice home in the Linda Vista, Madison Heights, or San Rafael parts of Pasadena, then you’ll be stuck with a home you can’t sell in the future should you go through a divorce or require relocation due to work, since you’ll be underwater in terms of equity and future market price.

If you would’ve overpaid $1.2 million for a just “average” nice house in one of these nice parts of Pasadena with a 6% jumbo loan, your monthly mortgage payment would be around $7,200. You’re still worse off than if you wait 2 more years till the Alt-A Option S&*T hits the fan and buy the exact same home in the same location for $900k at 7.5% jumbo loan, with a monthly payment of around $6,300. I can guarantee you every home in the nice areas of Pasadena will drop 25% from where they are today. Plus, you can actually sell your home that you bought at $900k with a 7.5% loan should you be forced to relocate due to divorce, death, job, etc. These are very rough estimates of course, but they only get more favorable with the lower price once I include the property tax and insurance savings

And did I mention that you can always refinance your loan in the future when the rates drop…and they always will once there’s a future downturn in the business cycle. So P-R-I-C-E is always K-I-N-G!

Could you please cover San Marino, Arcadia, and South Pasadena?

Values of houses in Arcadia rised like 15% compared to May 2008? is it ever gonna drop?

Angie –

As a fellow house hunter looking in the nicer areas of Pasadena, I am pretty confident that there is a long way down left in home prices in those coveted neighborhoods. Prices are falling like dominoes. Less desirable areas first, followed by the nicer areas. Be patient. The time is coming.

Ignore interest rates. You are not “saving” anything by buying now when interest rates are low. When interest rates inevitably increase, home prices will be pushed down even further.

Jason

@ Angie: Remember that your principal is much more important than interest rates since it is the basis of how much you will need to borrow and what your property taxes will be based on. Prices have dipped downward from imploding banana republic mortgages over the past couple years in spite of relatively interest low rates and this trend will only accelerate once rates start to rise. A 10-15% unemployment rate isn’t going to help either! You may hear that real estate is “local” but remember that lending is national and no area, regardless of how “charming” it may be, will be immune.

As the Dr. mentions, there is no reason to think that we’re not going to see any sort of “jump” or quick recovery in prices once we finally bottom out, so I wouldn’t worry about “missing out” on anything. So I would suggest finding some new friends and sticking to your guns by not letting yourself fall victim to any Realtorâ„¢ hype.

Oh yea, and be sure to use Redfin or some other similar service when you’re ready to buy anyway!

I wonder how long it will take for prices to come down in the nice parts of Pasadena. We have been waiting patiently on the sidelines for years and saving our money. I hate the idea of sinking our hard earned money in something that will continue to lose value. That said, I really don’t want to wait much longer. We are ready to own our own house.

Angie – It’s going to take a couple of years for prices to bottom out in the nicer neighborhoods of Pasadena. I owned in Pasadena in the Madison Heights neighborhood and sold in 2007 and am now renting. Renting is the new black . . . super cool and super smart.

I don’t know what you mean by “we are ready to own our own house” and that you can’t wait much longer There isn’t anything magical about it. Just suck it up and wait it out like the rest of us. You could buy today to satisfy your urge and by next year all of your years of savings will vanish into thin air.

Angie,

I know exactly how you feel, believe me. My husband and I just backed out of escrow on a $570k home as we read more and more on this blog and on socalbubble.com about the Alt-A loans. The toughest part of deciding to wait two MORE years before we buy was the emotional element. Financially, the math was easy once we really started looking at it (and stopped listening to our RE agent and mortgage broker!).

Don’t make a financial decision for emotional reasons. A week after walking away from that purchase, we can’t stop patting ourselves on the back (or talking about this blog). 🙂

I agree whats been said. I work at an Assessor’s office (won’t say which one) and the home prices are plummenting. After reviewing transfers it appears most are from home owner no bank (REO). In my opinion I think there will be a 25% drop this year. And possibly another 15-20% drop next year. Hold onto your money.

Ruby- You are so right. At this point the decision has been more emotional. Both my husband and I went to college, have good jobs, good credit scores, money saved, and we feel like it’s time to have our own home. We have so many friends that live well beyond their means who have homes and a part of us thinks it sucks that we still don’t own a home when people like them do. That said, you are probably right. We should wait. Anyone got the inside scoop on renting a cute house in Pasadena? The place we are in feels like it gets smaller everyday.

I was wondering how are you able to see all that information about the Pasadena area? Is there a specific website or list you need to join to get access? The home prices in the Alhambra/Arcadia/Monterey Park area are still pretty high and they don’t seem to be letting up. I want to see if there is an impending storm of defaults come up in those areas too.

Re: 6/20–Kudos to all of you who are taking a deep breath, swallowing hard, and basing your buying and other real estate decisions on fundamentals, rather than emotion. Doc, you make a difference in the world, providing rationality for those who crave it!

~

rose

As a Pasadena real estate broker I have read your article with much interest and have posted a reply to some of the points you have raised.

http://www.up2daterealestate.com/2009/06/29/the-bubble-doctor-makes-a-pasadena-house-call/

Leave a Reply