Buyer traffic slows down and the great housing standoff: Buyer and seller traffic declined substantially to start the fall real estate season.

The latest figures from the National Association of Realtors show that both buyer and seller traffic declined substantially to start the fall selling season. The assumption was that the mania of 2013 would carry forward and slapping on a faux hardwood floor would suddenly add $50,000 in value to your crap shack. This lipstick on a pig trickery is not getting the mileage it did in 2013 when people were full on delusional about buying housing, even though volume was incredibly low. The current meme that is now floating is one of “well you missed out in 201x to buy and are now priced out!†Ironically these people are not out in the market buying today as you would expect if they truly believed in the mantra that they keep preaching. In this housing market, timing and luck intertwine with speculation. There are many factors to examine including structural, location, opportunity costs, and mobility. There is a clear demand for rental housing and this has pushed rental prices higher although we are also seeing a limit here as well. The NAR reporting on a slow start to the selling season this fall signifies what we already know. There is a standoff going on in the current housing market.

Buyer and seller traffic drops

One of the interesting things about the jump in housing values over the last couple of years is that it has been driven by low volume, tight inventory, and investor demand. Investor demand is waning. Inventory has picked up slowly. Yet sales remain low. For these reasons, the NAR would like to see more volume churning since real estate agents make money on transaction volume. You make more selling two homes at $400,000 than one at $600,000.

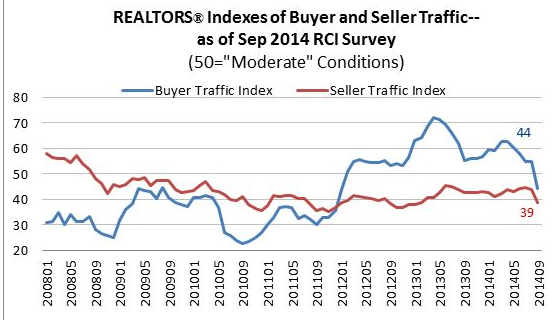

The fall selling season is not off to a good start nationwide:

Source: NAR

Buyer traffic is now back to where it was in 2012. Seller traffic although falling is within the range going back to 2010. This is a large reason for the increase in inventory across the nation. Since investors are no longer driving the show and Americans are cash strapped, we hear about the FHFA gearing up to make it easier for people to borrow more regardless of household balance sheet health. The nature of this mentality is to get people precariously close to the financial edge when buying a home. A tiny slip up or of course the inevitable recession is going to cause foreclosures to jump. I’m always surprised that some people think that housing bubble 1.0 never happened. We had 7,000,000 completed foreclosures since the crisis hit! In fact, there are many homes in some stage of foreclosure today. According to RealtyTrac there are 1,052,235 homes in the U.S. that are currently in some stage of foreclosure.

The majority of people that lose their homes in foreclosure lose their property because of financial reasons. This is why in previous decades banks were more cautious about lending their own money to borrowers. They had a vested interest in getting paid back. Yet today, we have the giant government sponsored entities trying to buy up practically every mortgage out in the market. The Fed’s QE adventure is largely one in which they are purchasing nearly every MBS hitting the market. Is this good? It certainly created an investor boom from 2008 to 2013 but what about support for regular families?

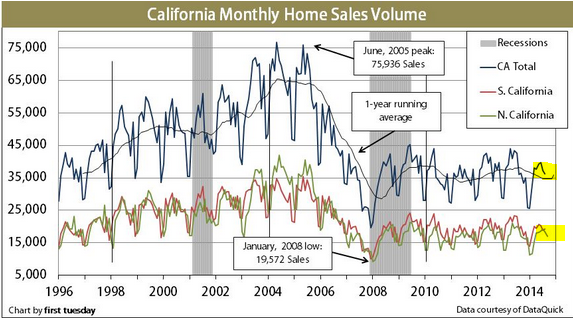

California sales volume is also extremely low despite a massive surge in prices:

From 1998 to 2007 the running monthly sales average was hovering above 45,000 sales per month. From 2009 to 2014 we are running at 35,000. This is the same number of sales we had back in 1997 when California had 32 million residents. California now has over 38 million residents (a growth of 18.75 percent). Yet housing sales today remain the same as they did back then.

We also have the shift nationwide of households becoming renters versus homeowners. This is a big change and as we noted, while Millennials are struggling with paying off big student debts, Generation X is the large reason as to why the housing market isn’t humming along. It isn’t that the lack of desire to buy but the fundamental economics driving this forward. A young professional couple making six-figures may balk about buying a crap shack but would rather rent in a better area. The property ladder mentality only works if the market keeps running up and your equity continues to build up quickly. Otherwise, you end up like the 1,000,000 foreclosures that hit in California over the last bust.

The fact that buyer traffic is dropping at a time when prices in some markets are nearing peak levels should tell you something. This is a typical standoff after a nice interim run. So go out and get your hands on that crap shack! Help bring back that lemming buyer traffic back up.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

110 Responses to “Buyer traffic slows down and the great housing standoff: Buyer and seller traffic declined substantially to start the fall real estate season.”

I’ll throw in my two cents. I was born and raised in San Diego, 27 years old with a secure $100,000+ career and $110k in savings with absolutely zero debt. I spent the last few years living blocks from the beach with a great roommate and very cheap rent. I just recently moved in my significant other, still steps from the beach and with a total rent of just under $950 with utilties/wifi etc. after splitting it with the girlfriend. Granted, it is a very small cottage that lacks some amenities like a washer/dryer, or even a garage, but how can you beat that overhead in this market?

I’ve been looking at houses for years now, and at this point have basically given up on owning a home in the next few years at least. I would really love to own a home, but can’t justify paying $500k for a starter home in a less than desirable area of SD. My plan is to continue stacking cash and maxing my 401k as I have done for the last several years, and hopefully buy if and when there is a 10-15% minimum correction.

I’m starting to have a more positive attitude on the whole thing, where previously i’ve been pretty bitter about it. I rent in a location I could never afford to own, steps from the beach, and have plenty of money leftover monthly to save and enjoy life. Who could complain about that?

Sounds like a great life to me. Live it worry free and keep renting. If you keep putting money into your 401K you will save just as much or more than you would by buying a house, which at this point in time is really like putting all of your chips onto one number. Yes, you really could lose hundreds of thousands of dollars if you buy now. It’s not guaranteed, but why would anyone take that risk, especially in a market as expensive and overpriced as San Diego?

But a 401K is no sure bet either.

Im kinda in the same boat as you are, except i have a G/f who makes peanuts in comparison, i gave up on buying a home as well, since i can’t afford to live in a desireable area. I live in Santa Clara,CA and rents are very high we currently live in a 1bedroom apt and rent is about $1800 and thats on the lower end, go figure. I am maximizing my 401k as well as my IRA, it helps to save some money on taxes. I really hope to own a home some day as i lived in appt all my life and im sick of it.

Just thinking out loud…

you are in a place that is 1900 per month = 22,800 per year.

You”ll wait for a (fingers crossed) 10-15% correction. on a 500k place, that’d be a savings of 50k.

Doesn’t that mean if you wait for more than 2 and a half years that the savings is essentially a total wash?

eden: ‘Doesn’t that mean if you wait for more than 2 and a half years that the savings is essentially a total wash?’

_____

Buy at a lower price with less of a mortgage, less to pay in mortgage repayments over the partial/entire term (at these rates), landlord covering costs of repairs and other, freedom to move, perhaps a bigger House Price Crash on its way, or selective opportunity to find much better value, and some return from investment in other assets of savings/deposit whilst waiting for better value.

Borrow $350,000 on a 30 year term mortgage at 4.2% rate. Total to repay = $616,161 (Total interest as % = 43.20%) (Total interest in $ = $266,161)

Borrow $300,000 on a 30 year term mortgage at 4.2% rate. Total to repay = $528,138 (Total interest as % = 43.20%) (Total interest in $ = $228,138)

Eden,

Don’t forget that pesky property tax, insurance, maintenance, etc.

Assuming the calculations would actually work out as you suggest, he would be living in a less desirable location. Based on what he is telling us, he’s arbitraging the lower cost of rent vs higher cost of ownership in a better area. If we were to compare apples to apples, we would compare an equivilent ownership position in the same area of similar type. I think what he is getting at is that to “get in” and own (in a less desirable location) would be to lower his standard of living and limit his potential for mobility.

Let’s not forget the initial forget the 20% down, or $100K. That’s quite a hefty deposit for a consumption item.

Right but that $500K place is in a crappy neighborhood and probably small and old to boot. It’s scary to think that you could get locked in to that over 30 years if rates rise. Your “equity” in that case would take a hit and so would your credit if you bailed.

Who could complain about that?

No one should!

Keep up the good work, as long as rates are low, the market will grind on, up and down, QE is now in Japan and Europe, travel with some of your cash and the strong dollar, reward your self in some way..Let’s see where the dollar goes and how far down they take commodities down. If somehow inflation starts to pick up and you see it, I would look to get a house with land if possible, maybe faster than planned, somewhere, a college town, near water..

debtpushers are much worse than drugpushers.. stay debt free, your PTI and DTI along with work history are strong loan approval magnets when your ready to buy…somewhere..

Japan and EU QE won’t work. They don’t have the ability to get the money into hands of those who would spend it. We tried QE and it didn’t really work unless you already had wealth. This is carry trade money if anything.

You are right. Don’t be a lemming and rush into home ownership. In this life we pay money for a place to live. Renting, owning, it doesn’t matter. What is important is that your home doesn’t become a millstone around your neck.

“What is important is that your home doesn’t become a millstone around your neck.”

Hands down one of the best comments I’ve seen here. This statement really simplifies everything. If you are going to buy, buy where you want to be and buy what you can easily afford.

“If you are going to buy, buy where you want to be and buy what you can easily afford.”

That seems like a shallow platitude that ignores the issues being brought to light. What DHB is blogging about is how productive and upwardly mobile people can’t afford to buy or won’t buy where they want to be. Then there are the questions about what that means for those people and those areas.

It’s like telling someone to not eat more calories than they expend. While it’s comforting and convenient to resort to simplistic explanations, the reality is dynamic and varied.

No one said it was simple, skeptic.

Back in the 50’s my parents bought a small two bedroom/one bath in Clairemont. By the 60’s they bought a new house in University City. By the 80’s they had one of the less nice houses in La Jolla. It never crossed their minds that they could live near the beach. They slowly built up equity and at the end of their lives were quite comfortable. I’m not judging your choices but I think it’s a matter of priorities (and luck of course). You’re in a great position financially but you may need to take a step down for your first home or you could find yourself renting near the beach when you’re in your 40’s.

@ Marcia

Your parents probably would have been better off, if house prices had remained flat. Each trade-up probably cost them more money because of house price inflation.

Building equity, to put against a superior house which costs even its value has gone up even more with house price inflation? Better off for them if prices had remained stable. That’s the thing with HPI. People love the fact 10% HPI means their $400,000 home worth $440,000 a year later – when too often means the $800,000 gone up to $880,000 – $1million in such hpi markets… requiring a lot more money for anyone wanting to upsize.

Obviously it has worked out for many doing that upsizing to superior more expensive homes, because market was rapidly reflated to prevent a real HPC, and HPI-wealth at the top all locked in (or so some people believe).

_____

Everything Wrong With Die Hard (1988)

https://www.youtube.com/watch?v=Lk8skZQC8po

“Kids take a trip back to the 80s when hand guns were allowed on planes, smoking was allowed in airports, pregnant women were advised to drink by their female bosses, 14-year-old teenagers were allowed to work as limo drivers.. and gas was f*cking 74 cents a gallon!”

Live cheap at the beach while you can. As life goes on and if you marry or have kids you will look back at these years as the times of your life. Not many people want to raise kids the way you are living now so enjoy it while you can. Kids makes everything harder and more expensive, I guess that’s why people are marrying later, not getting married or not having kids or fewer kids. I can only say for myself, getting married and having a child was the best thing I have ever done and I’m really glad that I did not miss out because financially it was unattractive. I am divorced now but would not change a thing in hind sight.

Kris,

I think you are doing the smart thing.

Simple math shows that every $100 difference between mortgage and rent invested in 401k at 6% will give you $100k in today’s money after 30yrs (even more if you adjust for inflation). So basically if you invest at least $300 in 401k you should have $300k which can be used to support $1k rent *indefinitely* at 4% yearly withdrawal rate (or buy a house for cash should you wish). Oh, and as an added bonus you get to keep the 20% down payment.

Just to be clear, I’m talking $100/month.

Who says you have to live in the house you buy?

Look at your real estate investment and your home as two separate things. Buy a $110k rental that yields a 10% net return on your money, won’t lose value due to inflation, and gets you a foothold in the market.

There will always be plenty of gamblers willing to rent their million-dollar investment for a small percentage of what you’d pay to own that same place. (Even less if you can travel during the summer so they can get vacation-rental income.)

No offense but you don’t sound very intelligent. What do you do earning 100k a year at 27 years old? Having $110k in the bank and with that income you are in the perfect position to buy a house. You are in San Diego by the beach how cheap do you think housing is going to get? If you have plan on staying where you are for a while buy a house. Things probably aren’t going to drop much further in prime so cal markets. Even if they do rates are likely to go up. It’s a catch 22 so instead of bragging about how much money you make and if you really do have that much in the bank 2015 would be a great time to buy a beach front SD home at your age. Put some renos into it and sit on it for 10 years and you’ll be golden.

What..? Is this a joke or are you realtor?

The traffic to buy new or existing homes is like the sign says ” dead end no outlet”

SoCal monthly home sales volume is back to 1996. The volume never recovered from the 2008 downturn. This is the new normal. Nothing to get excited about. I know that many people wish for the good old times, but they are not coming back. Settle down to the new normal and make the best of it.

The last housing bubble has skewed our idea of where housing prices should or shouldn’t be. Housing prices have always been going up with the population, cost of building materials while adjusting itself to inflation. Perhaps we’re entering a new age where only a few will be able to afford a home. Also take into consideration people are not as fiscally responsible as they used to be decades ago. We live in an age of pay check-to-pay check instant gratification.

Anyone want to take a shot as to where housing prices should be had the last bubble never occurred?

Look at where prices were at pre-bubble 1.0 and ARM loans and that’s where prices will eventually land. Add a generous 40% on top of that for inflation. We’ve got a long way down once prices start dropping.

I think this makes sense. If one is to extrapolate over the long term trend line (even accounting for what the bubbles have added to that), prices are still quite a bit out of step on the high side. If one is to argue that prices won’t correct back to the long term trend line, then the suggestion is that less historical data is now more indicative of the future than more historical data. A reasonably critical thinking person probably wouldn’t accept that notion. That might be why we get a lot of comments from entrenched interests which attempt to muddy the waters with suggestions that something about the location is a new exceptional factor thus invalidating the long term historical data. It’s difficult to argue with because the new exceptional factor would be so recent (compared to the long term historical data) that we’d have to wait out a lot of time to know if its true.

@ True-

So, around a 60-80% drop is in the works, eh? Sure, yeah, that makes a lot of sense…I’ll make sure to hold off on purchasing any other properties until that happens. It’s not like that kind of a decrease in property values would be accompanied by a total financial meltdown or anything…

With that tidbit and Russia with love assuring me housing is already tunking and loosing value who needs any other advice?

Rates will ultimately dictate how fast and how low prices bottom.

CAB since you have a crystal ball why even bother reading this blog? Oh that’s right you’re simply offering an alternative point of view for the non believers. There couldn’t possibly be any concern that the issues and points being raised on this blog might portend the future to come. No that couldn’t possibly have anything to do with it.

Hey no sense-

I haven’t made any predictions. Put that in your pipe and smoke it.

Read the LA Times article today, 11/8, about the percentage of households that are doubled up. Almost 50% of California households contain roommates or extended family, or grown kids living with parents. That is all you need to know about why housing sales volumes are lagging, and even high rents may hit a limit. The article says as the economy improves, more people will ‘move out’ on their own, which I find a big stretch of the imagination! Wages will either have to increase significantly, or housing costs will have to drop precipitously!

I read that LA Times article too… I see people all around me doubled up because they can’t afford to live alone. The article made it sound like it was a lack of available rental units but it is a lack of affordable rental units.

The reason for doubling up is very simple: median rent on a 1 bedroom is now $1750 per month in the Los Angeles-Long Beach-Glendale region. That means in order to qualify using the formula most real estate management companies use (no more than 1/3 of the gross monthly income can go to rent), this $1750 a month rent would require a monthly income of $5250 or a yearly income of $63,000. The median household income in the LA-LB-GD region is $53K per year. That means the average household cannot afford a 1 bedroom apartment in the SoCal region.

“California sales volume is also extremely low despite a massive surge in prices”

CA sales volume is also extremely low because of a massive surge in prices.

There you go, Dr. Corrected it for you.

Once again, just when you think the market is going to stall, offers are hitting homes in my area again ( Beach ). Renting is a losing game.

You’re a loser, successful in spite of yourself

@RS

“renting is a losing game” as a blanket statement is just moronic.

bought a house in 1991, inland, was upside down until 2000, once back to “zero” equity that lasted until 2004 and then the house exploded higher, sold in 2005, made some nice profit, the X got all that many back in child support payments, in 2005 i pleaded with her NOT to buy but to rent for a couple of years just to see what happens in the market but she decided to listen to the “professionals” her house appreciated for 1 year and then crashed hard, she is still upside down

so since 1991, my experience with socal real estate is only 6 years of NOT BEING UPSIDE DOWN….I’ll rent until reality returns to the real estate market and if it doesn’t i’ll move.

but i only have 1 question to the RE bulls, who are the boomers going to sell all their real estate to? $9 an hour gen xers? most of the boomers i talk with wouldn’t be able to afford the house they live in on their current income and a couple even said “i couldn’t afford the taxes on this place if i had to buy it at current price levels”

this simply can not end well, it s just math.

I think that what you’re saying is more likely than not. The two big wild cards however are inflation and immigration. Either of those by itself may keep prices going higher. I don’t give much credence to immigration driving prices higher (except in a few select areas), but inflation certainly seems possible. There is an awful lot of money sloshing around, even if it isn’t in either of our pockets.

QE has drained the cash out of America. At one time, having a CD produced a reasonable return for no risk, up to $100,000 pre crash. Now, America gets nothing for cash, without risk. And everything has risk these days. Does anyone know a person that has gained in real money in the past 10 years? I know, some people claim to be making the “big bucks”, but they are at great risk of going back to “0” again.

I don’t know a lot of people in California, but those I know are also doubled up. Garages turned into apartments, out back sheds turned into bedrooms… it’s getting creative.

And who are the people moving into California these days? I know more living wage earners moving with their company to parts East, and being back filled several times over by low income folks from south of the border. How will they ever be able to afford real rent? Living wage earners are leaving, needy people replacing them, the income tax base in California has to suffer? Where does this end, and when it does, it’s not going to end well……

I have no advice, just lots of questions about the future.

Didn’t you get the memo? Everyone’s rich now! Solid gold Chinese, celebrities and athletes, Google, trust-funders and lottery winners. Everybody is now one of these things and they all want to live in California. They can afford anything and price is no object.

@RS, oil prices and gasoline prices are in rapid decline. Whenever that has happened, recession is close at hand. The top 5%’ers living near the beach will be fine but the bottom 70% will not be.

Oil is a global commodity. Oil prices tanking means the world economy is tanking.

I don’t deny what you say in light of history. However, this time, are you sure is not a chess game between US, Saudis, Ukraine and Putin???…Putin doesn’t have anything to sell except oil and gas. Two major payments are due in December and January for his debt. Is he going to default???!!! The way the rubble is sinking he might. Then he will be forced to sell even more oil or people will starve. Putin at this point does not have any good options.

On the bright side it has stimulating effect on the economy now that QE is gone: more disposable income for the local economy instead of trade deficits. …..just saying; it’s not like I believe in “green shoots” and other Obama propaganda.

China’s electricity usage is down 2% year-over-year. Car sales are slowing in China. China has been cracking down on fraud and corruption starting in the year 2012. Irvine, Arcadia and a few other SoCal cities (havens for corrupt Red Chinese money) have seen housing prices start to go negative year-over-year. While the Red Chinese government continues to publish GDP growth of 7%, the items listed above cannot be faked. This eventually hits the GDP of Australia and the mineral exporters to China.

It really looks like a slowing world economy is driving oil prices lower not Saudi Arabia or U.S. shale/fracking.

Housing TO Tank Hard in 2014!!

Way to stick to your convictions Jim :p

2014 is about 84% over and done with. Not much time left for a hard tank in 2014.

Now I agree with you Jim…. The correction starts tomorrow…. Right after election. And the blame game starts on Thursday.

I agree with you both. So many more questions than answers. Everyone I run into is having trouble getting by. Flexibility and employment have been the name of the game for the last few years. They will continue to be going forward.

@JW, in SoCal household incomes were around $63K in 2007 before the recession hit. Today household incomes are around $53K. Adjusted for inflation, household incomes should be around $75K. So there is a massive loss of income that has not been factored in by the various media pundits.

RS,

Get a clue. Once the democrat leaders are done raising your parcel taxes you are screwed. Oh yeah you are a revenue source. You deserve them.

NO Housing Tank in 2014!! Jim Taylor is searching for new ID for 2015……

It is not about standoffs, it’s about negative feedback loops and positive feedback loops:

Positive feedback loop: buy because prices are increasing, don’t put your house on sale because next year you can get 15 percent more. All of a sudden you have low inventory and rising prices, further feeding the loop.

Negative feedback loop: prices are stalling, let’s wait to see where they are in a year. Let’s sell that house now before prices fall further.

Let’s not forget, there is a lot of investor housing bought that will quickly make it back on the market once the price gains stall out.

Bottom line is that home prices will be higher in 10 years from today, even if we have a 10%+ correction occur in the next 10 years. That is just how it is. So think about this. If you wait 3 years to buy a home, and home prices continue to go up 5% a year, you will still pay more then today. I wonder how many people will be crying in 2016 wishing they had bought in 2014. Renting is for suckers. Your basically paying someone else’s mortgage while they reap the appreciation in value and tax benefits. While you wait and tuck money under your mattress, home prices continue to rise. Hope you are tucking 20K+ a year away to make up for the yearly increase in home prices.

BTW, Keep the dream alive Jim!

Your assumption home prices will rise 5% a year in a deteriorating economy with potential for rising interest rates is erroneous.

Ayup, them thar rates gonna be shootin up any day now.

http://www.zerohedge.com/news/2014-11-04/interest-rates-cannot-rise-heres-why

Prices higher in real or nominal terms?

Crying? Is that what you’re doing here? Crying about so-called cryers?

Go ahead and ask the upside down folks who were forced into being an accidental landlord how they feel about their renters paying their “appreciation in value.” While you’re at it, ask a seller who has been chasing price drops down for months on end how smug they’re feeling.

It’s not black and white. One could just as easily state that eating waffles is a losing game, pancakes is the only sensible option.

This rent vs. buy comment from Patrick.net still makes as much sense as it did when it was posted years ago: The only true sign of a bottom is a price low enough that you could rent out the house and make a profit. Then you’ll know it’s pretty safe to buy for yourself because then you could cover the mortgage expenses if necessary, eliminating most of your risk. The basic buying safety rule is to divide annual rent by the purchase price for the house: Annual Rent/Purchase Price = 3% means do not buy, prices are too high, 6% means borderline and 9% means ok to buy, prices are reasonable.

So for example, it’s borderline to pay $200,000 for a house that would cost you $1,000 per month to rent. That’s $12,000 per year in rent. If you buy it with a 6% mortgage, that’s $12,000 per year in interest instead, so it works out about the same. Owners can pay interest with pre-tax money, but that benefit GETS WIPED OUT BY THE ETERNAL DEBTS OF REPAIRS AND PROPERTY TAX, EQUALIZING THINGS. It is foolish to pay $400,000 for that same house, because renting it would cost only half as much per year, and renters are completely safe from falling housing prices. Subtract HOA from rent before doing the calculation for condos. In rich neighborhoods, annual rents are typically only 3% of purchase price while mortgage rates are 4% with fees, so IT COSTS MORE TO BORROW THE MONEY AS IT DOES TO BORROW THE HOUSE.

I had rentals for decades. Listen to someone who has real life experience through all kinds of markets and geographical locations. Forget about those who talk just about theory.

The rule of thumb for borderline is for the rent to be 1% of the purchase price. The reason for this is because you have to pay prop. taxes and insurance and lots of maintenance (if you don’t want to let the property to deteriorate). Just because you milk the cash flow for a better return does not accomplish a good return. You just defer maintenance which is going to cost you way more in the future – it is the same like with your health. If you try to dump the maintenance cost on the next buyer, you’ll lose a lot on the selling price and deal with bad renters who don’t mind living in a dump.

A good rental property produces 1% per month after expenses.

Your question may be: where do you find those? Answer: there are more opportunities out there than most of the bloggers here have money.

If you don’t follow these rules, you’ll have lots of headaches and losses, sooner or later. The opinions of one or another (so called “experts”) don’t mater. In the end, what counts is the reality of life. There is no substitute for experience. I followed these for decades and served me very well. When I was borderline, usually I was compensated with fast appreciation. It takes experience, lots of patience and lots of leg work.

If you are very handy, if you price your work at zero, then you can discount my advise. Personally I don’t like to work for free. The profit has to be after labor is paid – to me or another. A business without profit is called – nonprofit (see Housing Section 8, or Habitat for Humanity). If you are involved in those, you can discount my advise.

For those without experience in rental, I hope it helps.

Interesting what you are saying. I saw this one come up last week…

https://www.redfin.com/CA/Alameda/945-Eagle-Ave-94501/home/1865325

I actually rent a house on this street a few blocks down in the Bay Area for $2000/month with a roommate it’s $1000 each. It’s a similar style.

Will be following this one closely. They bought in 2006 for 480 and asking 479 in 2014.

Does this make sense to buy at 480? When you can rent similar for $2000 a month? Would investor look at this…it doesn’t make sense for a family with kids to buy 2bed 1bath.

And how do you know the prices will go up in 10 years…we see facts now:mortgages 14 years low, no real jobs…..I live in Newport beach, renting, best schools in the nation, nice 2 bedroom apartment for 2200……there is condo comples right across the street, same size like my appartment $637000…run the numbers with 50k down you monthly payment is 4200 for 30 year!!! Good luck…..

HOUSING ALREADY TUNKING,to buy now and see you place loosing value of 30 percent is not for me, safer to wait.Prove me if I am wrong?

Do you think your rent will 2200 in ten years? I think that might be another advantage to a mortgage. If it’s conventional, like you wrote, it’s like locking in your rent cost forever.

Ugh, no it’s not locked in. I’m a landlord so let me tell you that rents can move in two directions, up or down. As a homeowner I can also tell you that my taxes and insurance are certainly not static numbers as time moves forward. Then there’s my replacement, repair, vacancy, and other business costs. Some of these things are fairly recurring, others come up when I least expect them.

Hi Skeptic, thanks for your input re: repairs, etc. I really like reading all the different input on here from landlords.

Do you have any data showing any significant long term decline in rents around here over the past 20 years? I understand that it’s supposed to be a 2 way street. It’s just that I’ve never seen rents go down in my area in SoCal.

Unless you live in rent controlled area of LA it’s pretty much a sure thing that your rent will increase over time.

I heard an ad for a payday advance loan company on the radio today. It started with a woman’s voice saying, “I’m a realtor and I’ve got a house to sell, but in the meantime I’ve got some bills to pay. Thanks (Loan Company)!”

hahaha

“I’m a Realtor, I have bills to pay and the lease payment on the S-Class is due. Thanks, payday loan company!”

It’s interesting and telling that so many of the Dr’s and other blogs on real estate and economic topics typically escalate into generational warfare. Once the Millenials and GenX actively find the resolve to work together things will change. The Boomers that made a mess of our country while kicking the younger generations in the teeth will either get extreme payback or modest sympathy. For example sooner or later the voting populace will have a critical mass of realization that prop 13 needs to be repealed. Do you really think the good or bad side of GenX really cares if that entire generation dies homeless in filth? We’re course. And we couldn’t care less. And we literally have nothing to lose. Trip on us all you want. The apathetic elders made us this way. The Greatest Generation was great. Deal. The Silent were lucky and most will luckily be dead when this plays out. The Baby Boomers are about to learn the lesson they should have been taught in elementary school; and when gramma and gramps are whining about it the teacher will put *the* question to them: what did you do to them?

Greenspan bullish on gold? He’s a lifelong banker. Bankers hate gold because it makes them honest. By some after it goes below 1000 because that right there is a warning sign.

Housing will tank. Big time. But that’ll be the least of our worries.

I don’t think GenX and the Millenials will empower someone compassionate like Elizabeth Warren. It’ll be a nutcase like Rand or Sarah. I say like because Adolf is more likely closer to the mark.

ak, I also think investors will list their properties when they realize real estate is not appreciating; especially if it’s depreciating.

I really can’t see what everyone is fussing about. I have owned various properties since 2002 and I have made money and/or continue to make money on all of them, which were all purchased in Southern California, Los Angeles County (as referenced below).

1. Condo. 2 bed 2 bath 1043 sq ft – in 2003, I purchased this condo in 2003 for $185,000. I lived there for approx 3 to 4 years and rented one of the rooms out which almost covered my mortgage. I sold the condo in 2006 for $350,000 and made a hefty profit.

2. Townhouse. In early 2007, I purchased a 2 bed two bath townhouse approx 1200 sq ft in Encino/Tarzana ca for $365,000. The last three comps before this townhouse were $425,000 and I was buying a foreclosure so I figured it was a decent deal. Well we all know about the financial collapse that followed and crippled house prices. People were telling me to sell it, do a short sale, foreclosure, etc. However, this was my home, i liked it and I continued to live there and stuck with it while mainaining my perfect credit score of 850. I lived there and again rented put the extra room which tremendously helped with the mortgage, property tax etc. I continued waiting out the market and saw all the market deals all around me which led me to buy more property when others were fearful as outlined below. The price on this townhouse slowly started to appreciateand the market turned around. By 2011, i purchased a house; however, I kept the townhouse and started renting out townhouse. The rent took care of all my expenses including the morgage, property taxes, insurance etc. The townhouse price eventually increased to $357,000 (pretty close.to where I bought it)

and I sold it in September of this year after it was on the. market for 10 days. I got most of money back plus all the equity I gained while the unit was rented out and being paid by others.

3. Condo – encino ca. I purchased

That’s okay, we’ll forgive you for not being “able to see” how your situation and circumstances don’t exactly correspond to everyone else.

Don’t forget to thank us, taxpayers, for getting your underwater townhouse back into the black. BTW, did you count the rent you collected as income on your taxes?

And there you have it. Most households are doubled up. Hence the price can double before the pain is felt financially. A lot of these households are doubled up based on culture not necessity. Some cultures like multi generations in one home.

If everyone here is waiting for a good deal in Southern California you’re just kidding yourself. Go back to flyover country and find yourself a nice home in the Midwest for under 200,000 and live your dream out there. But if you want everything Southern California offers you have a much higher cost to entry.

Rents housing prices everything in general is going to keep going up. Come back five years from now everything will be higher than it is today. Prices will go up until people begin to leave. And from what I can tell they haven’t left yet.

The key to buying a home running in this market is to get a better paying job. If you can’t then you’re in the wrong spot. Living in California is not entitlement it’s a choice for the choice you have to give up something then and most of our cases it’s a large percentage of our income to housing. And if you’re a buyer today 30 years from now people will want your home and they will be complaining that this 3 million dollar home was only $1,000,000 15 to 20 years ago. Why didn’t we buy back in 2014? We were too busy blogging and Dr. housing bubble.

I’m not a realtor I’m a realist. California market always fluctuates but in the end it continues to trend upward.

Bloggers….Will tonight’s voting results make a difference?

the .1% run this country and the average voter is too stupid to vote for what’s best for them. nothing changes

Truly. We deserve Ted Cruz and the rest of the clowns.

Joe, we deserve Rick Perry, the next President of America. Rick is going to run now. Ted will step aside, because he knows that Rick can ride high in the saddle. Break out the beer barrels and celebrate. Cousin Jethro’s Tenn. White Lighting is too strong for me. On the ranch, we are really partying today.

here’s the problem with Rick Perry.

1. He’s nuts.

2. He’s dumber than a sack of nails

3. …. uh,… I can’t… oops!

No. Voting in American elections is a waste of time

Best hope is for gridlock in government so that the damage can be minimized moving forward. For the elite, bribe money has no political allegiance. Saw this same song and dance when the pendulum turned from red to blue in the last decade.

Preach, brother!

Blue vs. Red – same s**t, different smell. The game is rigged.

You would have to be a fool to believe in the false left/right paradigm.

Republicans sweep elections. Commence the TANKING.

Tanking of RE or stocks? I saw today that the markets hailed the new elections with “all time high” for stocks.

Just an observation, no opinion.

Hi BubblePop

I thought it was the other way around

if Republicans win they will juice the ekonomy and house prices will be backed up by consumer sentiment. Isnt it big biz (that includes banks, realtors, etc) that always wants republicans running house/senate?

No tanking but new ATHs are on the horizon for stocks. Apparently Mr. Market like Repubs and gridlocks. That does not bode very well for real estate tanking when rate increase is no where to be found.

Apathy, that is what we all know in this country. The powers to be have made just a mess of everyday American lives what do they expect from the electorate, they we run out to vote either party in to hear the rhetoric year after year,” we want to make your life better” sure you do???

Housing out, stocks in

https://homes.yahoo.com/blogs/spaces/san-francisco-330-square-foot-tiny-house-sells-for–765-000-in-bidding-war-013050037.html

yeah whatever

I wonder if it is me or are the comments starting to look more and more like personal adds/dating site descriptions…

Here goes my personal ad…

I recently completely got out of the market. The funny thing is that when I talk to others around me about my change I find that they have moved to all cash as well. Even some day traders have moved to all cash. WTF? I know it is all anecdotal but it seems odd to me.

I wonder sometimes if waiting for the “black swan event” is a fools errand. Could it just be that we have been in a “collapse” for that past X years? Could it be that this is what a collapse in a global economy looks like? Most of us believe that GDP, CPI, U1-U6, DOW, NASDAQ, etc. are manipulated/doctored. So, who’s to say that we are reading false signals while events are unfolding…

Housing prices never recovered from 2004 where they picked.

Just saying.

“Peaked” that is.

this listing states up front “this is not a flip!!!!”

https://www.redfin.com/CA/Encino/17407-Califa-St-91316/home/4760752?utm_source=myredfin&utm_medium=email&utm_campaign=listings_update&utm_content=view_details&

let’s see … bought it for 440K originally listed for 669K four months later. they’ve made some improvements with “love and quality” for their son who was suddenly relocated to ny. no sale so now they’ve dropped it to 639K so they are still expecting a 200K profit in four months …. but remember “this is not a flip!!!!”

Bs this is not a flip. Am I the only one that is turned off from buying a home from flippers? First thing I look is the price history of the home. I refuse to buy from flipper

No you’re not the only one turned off by these greedy leeches. Just like most of the homebuilders these days…get the most profit for the absolute least amount of effort even if it means stretching any and all boundaries of ethics. There’s no craft or dedication to the whole picture just a quick fucking buck riding the coattails of mania in >95% of the cases. That’s fine for cheap shit from China but not the biggest purchase most families will ever face. There will be plenty of attempts at justification because hey who is anyone to care about details in the face of profit motive and potentially negative long term effects be dammed.

Of course it’s a flip because it has all of the classic hallmarks of a flip. Let’s see it’s got the classic five to six month quiet period between the last close and the first new listing. It’s surfing the price wave down right on queue because hard money Mike is getting 10% interest. It’s got all of the cheapest Home Depot HGTV remodeling trends du jour with french doors in the back and red fucking wood chips for a yard. But no everything is great and it’s just a leveling off that’s why flippers and their RE partners are resorting to new heights of lying.

California always goes Democratic because of the minorities and bleeding heart liberals in LA. Los Angeles has become a cesspool of poverty and urban blight. And what do our elected local leaders do? Throw more money at the problem. Look at the horrible school system, decaying city streets, ancient sewer and water system, soaring numbers of welfare recipients, but hey what we really need according to our elected leaders is a “bullet” train. That will solve all our problems. This place is lost. Might as well give it back to Mexico, already looks like it anyway.

Apparently Hunan, you have not traveled much to the developing world. You are right, L.A. is like a developing world city(don’t say 3rd world). But on the westside, we are use to this, since we travel to the developing world to party. When I go on the 405 to LAX, I really don’t see much of the developing world city, because technically, I have not left the westside. Same for when I take PCH to Zuma(the Paradise Cove side, not the other side.) and the Malibu Country Market for Coffee. The weather will be great. tomorrow.

It looks that CA is following the same script like Detroit. Maybe the LA leaders suffer of the same disease like Detroit leaders. The texans call that disease “liberalism”…personally, I don’t know, I am just observing the same pattern. Oh, I forgot, it has the best climate…oops, I forgot that Tijuana has the same climate…

I love multicultural, global Los Angeles, or the cesspool as you call it. I do not believe any major (not minor) metropolitan area in the country is not experiencing similar issues. You sound like a newspaper editorial from 100 years ago decrying the conditions in New York, Chicago, or Boston.

Sounds like you hate urban living. Please stay out in your gated community and enjoy your meal at Olive Garden. We don’t want you here anyway, you sound like no fun.

It’s too bad Mr Smith in Kraptown didn’t directly challenge any of the claims you made instead of leveling shallow personal insults. If you don’t love it then leave it is the directive. No fuck that we won’t leave and we will continue to point out all of the ugly shit that others prefer to turn a blind eye to.

Calif is not as liberal as many people allege. Only parts of LA, SF and the coast are truly liberal. Many areas of Calif are conservative and the two more or less cancel each other out. A recent poll has 42% of voters as moderate independents or potential swing voters.

The rise of the Democrats coincides with the Repub’s lurch to the right. Moderate Repubs get screened out in the primaries by the Tea Party or “true conservatives.” So, faced with the choice between a Dem or a Repub hardliner, the independents and swing voters have been choosing the Dems.

California has and will elect moderate Republicans — Schwarzenegger was the last. Kashkari is a good candidate but Brown has successfully built up a “tough frugal old guy” image and Kashkari couldn’t overcome it. If the Repubs shift more to the center they will win more statewide offices.

The problem here in L.A. is that it can’t make up its mind what it wants to be. Rapid population growth wasn’t a huge issue with residents as a whole until after the 1984 Summer Olympics. We were even proud when we briefly surpassed New York City as America’s primary city that year. But we regret it now since we inherited all the issues that go with it. Now we live in denial, hoping somehow it will go back to the way it was.

It is what it is now and we can choose to either accept the situation or reject it. But if you reject it, there’s nothing you can do about except live somewhere else.

Of course, since then, NYC has taken that position back. LA is falling farther and farther behind. The average working family can’t save enough money to live here.

According to recent statistics, domestic migration is going in the other direction away from California. California is losing more residents to other states , then any other state in the country. Many Californians are finding greener pastures in Texas, Arizona, and other states with lower housing costs, better job prospects, and lower taxes for businesses. The majority of the migration coming into California is the illegal kind and Asians hiding money from the Chinese government. Makes one wonder what LA will look like in 50 years.

We don’t want to hear about any of the potential negative realities LA faces because we’ve mortgaged ourselves into the ideal of LA. Please let’s just focus on how many noodle and taco joints are around the corner. If anyone brings up anything that calls the package deal we bought into question we’ll just make it about the messenger and say they’re upset that they missed the boat.

Leave a Reply