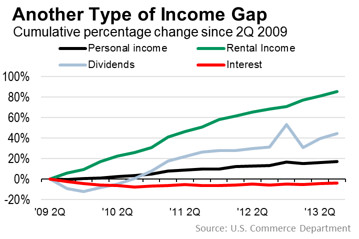

Gains to the Real Estate Lords: Since 2009 Landlord income up a stunning 85 percent. Interest income has gone negative because of Fed monetary policy. Big money selling into momentum.

The recovery in real estate has largely gone to big institutional players. Â Recent data from the US Commerce Department shows that rental income grew the fastest compared to other asset classes since 2009. Â Of course as we have chronicled over the last few years, most of the distressed property buying has gone to the investor class. Â The gains in rental income only impact a small portion of the population but the growth has been astounding. Â Rental income is now up 85 percent since 2009. Â Even stock dividends up at 44 percent have not met the pace of change in rental income. Â The trend is reflective of the insatiable demand from Wall Street for rental property over the last few years. Â Right on time however is the small investor jumping in at a tipping point as inventories rise, big money slows down, and interest rates have an impact on the housing market. Â Some big funds are even selling into momentum.

The big windfall to investors

It isn’t that rents are soaring that rental income is up overall.  The big jump is coming from the fact that fewer hands are controlling larger portions of residential real estate and these hands have converted these properties into rentals.  Since home building is still weak, you have limited inventory that was yanked off the market.  No surprise that over 1 million new renter households have been added since the crisis hit (more income to those that own rental property).  Let us look at the growth in income here:

Source: Â WSJ

The jump is dramatic. Â Very few households actually own rental real estate. Â Much of this gain has gone to investors buying up large portions of real estate since 2009. Â As we have seen in some markets, the marginal buyer is coming from the all cash crowd. Â Mortgage applications are down by nearly 60 percent from their peak this year yet home prices continue upwards largely on momentum from the non-mortgage buying crowd.

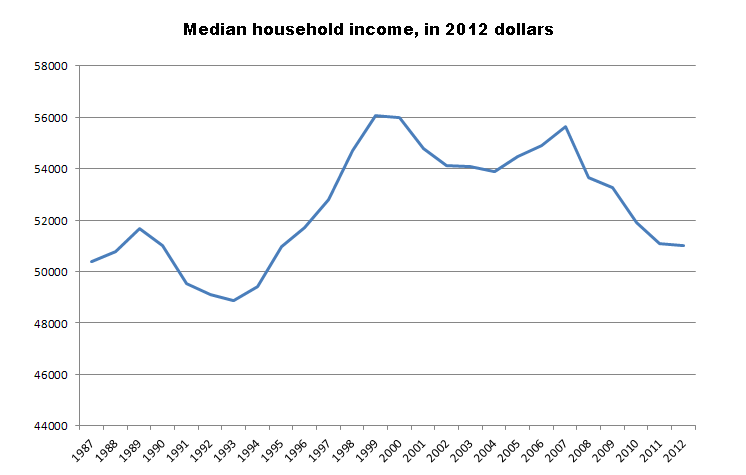

Is this healthy overall?  Not if you are part of the middle class.  The trend of income inequality between the very wealthy and the rest has accelerated over the last decade.  This isn’t to spur some kind of class warfare debate but it is merely an undeniable fact.  The Fed has chosen to make the banking class the winners here and has succeeded.  That is why in the chart above, interest income has gone negative since 2009.  Many retirees and those labeled as savers have been fully pummeled since the recession ended in 2009.  Rents are also rising while household incomes have gone stagnant:

The above chart shows a weak environment for most households. Â Incomes adjusting for inflation are back to where they were 24 years ago (a lost generation if you will). Â Obviously with income insecurity and weaker employment prospects, renting has become a larger option for more households. Â Yet many of these big institutional buyers may be looking to exit as large gains slow down and might be reaching an apex.

“(Bloomberg) The low vacancies and occupancy gains are drawing institutional investors who are more focused on steady returns, Stuckey said. Potential buyers of Carlyle’s holdings include pensions, life-insurance companies and real estate investment trusts, he said.

“Investors really want the new Class A properties so we’re selling into that demand,†Stuckey said.â€

And why wouldn’t investors take some profits off of the table especially with the economic headwinds of higher interest rates, more inventory, and economic challenges face the nation?  People do realize that these government shutdowns and debt ceiling issues are only going to become more frequent given our giant liabilities?  We’ve just had one of the biggest bull markets in stocks right after the biggest crash since the Great Depression.  Some people seem to have fully forgotten this.  The gains in real estate are moving as they did in the early 2000s.  You are even seeing naive money diving in at the tailend of the housing boom trying to mimic the Wall Street crowd.

The massive gains in rental income merely reflect more landlords largely in the form of big banks and institutional buying.  This is the result of the Fed’s bailout efforts.  Good luck finding reasonably priced properties with these policies in high demand areas like California.  The boom and bust cycle is here to stay.  It should be abundantly clear who the bailout was targeted for.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

27 Responses to “Gains to the Real Estate Lords: Since 2009 Landlord income up a stunning 85 percent. Interest income has gone negative because of Fed monetary policy. Big money selling into momentum.”

So anyone wanna take a guess when we’ll reach a top, especially in the So Cal market? And when prices will start coming down again?

Also, anyone want to take a guess when we’ll hit bottom? What do you think the bottom would look like? y2k prices?

I think eventually, hyperinflation of the dollar, will cause a nominal price increase in homes.

I think that we have reached a top and that 1) homes and their respective monthly payment are somewhere between 10% and 20% overvalued. 2) After that, I believe home VALUES succumb to interest rates but after the 10-20% devaluation, the monthly PAYMENTS will remain the same with values inverse to the rates.

The wildcard is increased Federal socialism to a scared, weakened population that is the new America.

My instinct on this for some time has been that we will see the return of the subprime market before the next large drop. Either way I keep one eye trained on rates because I suspect that once they move up enough to make other asset classes more attractive, many will dump their rentals onto the market in a mad rush for the exit. By then, Wall Street will probably have already left the building as they are well aware that rentals are a total pain in the ass compared to many traditional investments.

With the squeeze of incomes going down, gas prices over $3 a gallon for a record 300+ days, part-time jobs replacing full-time jobs, and forced enrollment in heathcare insurance plans affecting the youngest members of the rental class, how can rents continue to go up?

They can’t. And that’s the best case scenario, to let free market fundamentals work out and STOP the manipulation.

Worst case scenario? Is people increasing the rate at which they have multiple families and/or multiple generations in one home. This would be a disaster for society as a healthy marriage (i.e. family) requires the privacy and solitude of a happy couple leading happy, educated kids.

Most of societies breakdowns are spawning from the fact so many are in broken homes.

Rents could keep going up in real terms, but as you mentioned, this will feedback into other areas with potentially ill effects. The global economy is rebalancing and there’s simply no escape for most of us.

They go up for a few reasons.

First is that housing is a very local monopoly – an landlord owns a piece of land and can charge whatever they want to renters. Basically, the “You have to live somewhere” rule.

Second – how do landlords keep this up? With the internet, they can see very easily what other properties are offered for. By knowing one another’s prices, landlords can “collude” and create an artificial floor for rents.

Thirds CAP rates. If I buy a property for $1 million, and I need a 6% return to satisfy my investors, I must get $60K/year out of the investment. Rents in that case must equal $5k/month. Since I have a very local monopoly on housing, and I can collude through sending pricing signals in a very public way, I can extract these rents.

This last one is the most important. Home buyers will state that there is no difference between a house bought for $500K and $1 million as long as the interest rate on the $1 million price is low enough to compensate for the higher price. As a renter, high sale prices are reflected in your rent as an increased base for the landlords’s CAP rate calculation.

@LAer, landlords cant just charge what ever they want for rent, they can only charge what the market will bear. You are correct that people have to live somewhere but when rents are high that somewhere might be their parent’s basement or in a cheaper area.

Rent is therefore a function of incomes, if incomes go down, rents need to go down as well; if incomes go up, then rents can go up as well. If this function gets out of wack then overall community will suffer. Local business get less business because if people spend all their money on rent they shop less and go out to eat less which harm the local economy and causes rents to drop.

The other Joe is right, if landlords get too greedy, there are feedback loops inherent to the marketplace that will hit the bottom line in different areas. People are free to move about and they can choose either to take their business elsewhere or cut spending in other areas (which can come back to bite in the damnedest ways).

One of the important lessons I’ve learned over the years as a landlord is that getting greedy comes back to bite ya in the ass. There is a tendency in the marketplace to attract lower quality tenants as the rent is raised proportional to the value proposition of the given property.

“Home buyers will state that there is no difference between a house bought for $500K and $1 million as long as the interest rate on the $1 million price is low enough to compensate for the higher price.”

— And then the inevitable happens – you put the property on the market to sell. Buyers don’t care about your interest rate.

@JoeKnowIt

Income sets a hard cap, but rents can be inelastic to income depending on other factors that contribute to demand. While your statement is correct in that rent is a function of income, and that landlords can only charge what the market can bear, the suggestion that the relationship between income and rent can only be inversely correlated is false. The fundamentals will dictate an inverse relationship, but outside intervention will always have an impact on messing with the natural balance

LAer, just because some idiot pays 1 Million for a 3bd/2ba house doesn’t mean he can get $5k in rent.

Let’s look at San Clemente, where I live. Here there’s some houses like that for a million. But nobody would pay $5k to rent one since there are 10 other 3bd/2ba available for $2.5k. Now if he’s got a big yard, ocean view and/or nice upgrades he can charge a little more, but definitely not more than $3k, $3.2k if he’s lucky. Afterall for $3k you can find plenty of 4bd houses in the same area.

Now there are plenty of $4-5k houses on the market here in San Clemente, but there seem to be few takers, most of them have been sitting since I started looking in June…

@LAer, “…a landlord owns a piece of land and can charge whatever they want to renters. ” Boy do I wish that was the case. No, you can’t charge whatever you want. I have a house that I rent (because I have been unable to sell it.) I would love to charge more for rent. At best, I break even. It is a loss if there are significant repairs. I could ask for much more rent but it would remain empty. I rent it for what the market will bear. If I charge more, people will rent elsewhere.

Spot on again as usual,Ben. You could also note that its not just the recovery in real estate that has gone to the big players but almost any gains in the economy due to the QE bailonomics program has gone to the big players.

A simple to change in the tax code would reduce speculation in single family homes, the over bidding by investors of family home buyers, and the use of excessive credit leveraging during booms and bubbles.

Investor have many opportunities to invest in multi-unit housing. Eliminate all tax deductions for investors on single family homes. Give homeowners the ability to deduct the cost of repairing a home. Homeowners will hire contractors to make repairs thereby maintaining neighborhoods. These changes will increase home ownership for qualified buyers and maintain single family home prices at the purchasing power of the home buyers that are going to live in the homes.

To help eliminate deep recessions and high inflation cycles, we should enact the Zero Appreciation/Inflation Taxation Policy. This policy would help eliminate the wide swings in interest rates which are very damaging to a capitalist economy. The Policy would work as follows: As capital asset appreciation rates increase, the tax on interest earned would decrease based on the asset appreciation/inflation rate. At the same time the deduction for interest paid would decrease based on the same asset appreciation/inflation rate. One person would pay a little more tax and the other person would pay a little more tax at the end of the year. The balance of values between the debt holder and the asset holder would remain in closer balance. The buildup of this imbalance of values would not build up over the years therefore higher interest rates would not be required to encourage people to hold debt as an investment. In this way we could slow down the velocity of money, during the inflation cycle, without raising cost. The normal production and consumption economy could continue without creating a deep recession. Employment could be maintained allowing production the time it needs to balance supply with demand. The extra demand would be eliminated from the top of the economic ladder as people maintain their savings and bond purchases to finance increases in production to re-balance the economy. Less poverty would be created because the value of the money that working poor and the middle class would maintain its purchasing power as supply and demand are maintained in closer balance. Employment would be maintained therefore people would be able to retain the assets they have obtained helping to eliminate government dependency. The Policy would make our economy more productive and less speculative.

Interesting idea.

The flaw is that banks would want the rule applied to them as well. They would pay less tax on interest earned, basically all their revenue. This would incentivize then to lend more, increasing asset values.

You know what would help more? If California instituted a rule like Phoenix, AZ did several years ago (around 8-10 years ago) where if you bought a new home you had to live in it for the first two years.

Not sure if that rule effective or not, but if one like that was actually followed in California, think how quickly the market would right itself here.

Corrected Comment

A simple change in the tax code would reduce speculation in single family homes, the over bidding by investors of family home buyers, and the use of excessive credit leveraging during booms and bubbles.

Investor have many opportunities to invest in multi unit housing. Eliminate all tax deductions for investors on single family homes. Give homeowners the ability to deduct the cost of repairing a home. Homeowners will hire contractors to make repairs thereby maintaining neighborhoods. These changes will increase home ownership for qualified buyers and maintain single family home prices at the purchasing power of the home buyers that are going to live in the homes.

To help eliminate deep recessions and high inflation cycles, we should enact the Zero Appreciation/Inflation Taxation Policy. This policy would help eliminate the wide swings in interest rates which are very damaging to a capitalist economy. The Policy would work as follows: As capital asset appreciation rates increase, the tax on interest earned would decrease based on the asset appreciation/inflation rate. At the same time the deduction for interest paid would decrease based on the same asset appreciation/inflation rate. One person would pay a little more tax and the other person would pay a little less tax at the end of the year. The balance of values between the debt holder and the asset holder would remain in closer balance. The buildup of this imbalance of values would not build up over the years, therefore higher interest rates would not be required to encourage people to hold debt as an investment. In this way we could slow down the velocity of money, during the inflation cycle, without raising cost. The normal production and consumption economy could continue without creating a deep recession. Employment could be maintained, allowing production the time it needs to balance supply with demand. The extra demand would be eliminated from the top of the economic ladder as people maintain their savings and bond purchases to finance increases in production to re-balance the economy. Less poverty would be created because the value of the money that working poor and the middle class receive would maintain its purchasing power as supply and demand are maintained in closer balance. Employment would be maintained therefore people would be able to retain the assets they have obtained helping to eliminate government dependency. The Policy would make our economy more productive and less speculative.

Very difficult to remove interest deduction for investors, since that is a business expense they incur.

Interest is not a true business cost if the asset you have invested in is appreciating at a rate greater than the interest rate you are paying. If the asset is increasing in resale value by 10% a year and you are paying only 5% interest and the interest is 100% deductible, the paper profit is paying the cost of the interest. This is completely different when interest is a cost of production.

And now, we have Vampire Foreclosures:

http://blogs.marketwatch.com/capitolreport/2013/10/02/vampire-foreclosures-are-whats-keeping-bank-inventory-high-analyst-says/

Running out of names? Halloween theme?

Hey Doc, this listing here has the smell of a tail-end investor, coming into the market late. Purchased at a high market price of $460K a few months ago. NOW, with some lipstick on the pig (I own a home in this area and looked at it when it was on the market for $460K) it is now back on the market for $665K. Wow, this is amazing, either at the guts of this flipper OR the fact that IF this house sells for $665K then my home will sell for $50K more than what I paid for mine in 2012. Either way, I’m amazed 🙂

http://www.trulia.com/property/3115999071-3866-Alsace-Ave-Los-Angeles-CA-90008

All I know is today I just read from the Bryan Ellis Real Estate Blog that 47%of homes that have been already foreclosed on, the homeowner is still in their house after foreclosure. Where are they going to move to? Can’t buy a house I am sure. Possibly are unemployed or under employed which is mainly why they lost the house to begin with. Yes not all of them were subprime borrowers like the propaganda machine likes to say. (The banks did this on purpose, it was planned and executed and this is still all part of the plan!) I outlined it all several years ago in my Economic Survival Guide. The plan was strip the equity the day the borrower closes escrow on an over priced asset funded by the suckers, er I mean investors. Give over priced purchase money contracts to anyone breathing. Then bet against the bad bets so either way you will win I.e. Credit default swaps. Then when the bubble burst go hat in hand asking for a bailout (if the banks win they keep the money, when they lose they say awww gee that was your bet, sorry) so they rig the bailout so that nothing helps the robbed homeowner or investor ( till they started suing the banks and at least getting pennies on their dollars the banks gambled with). Then the Fed creates a “special program for large institutional investors only “. They are allowed to buy up large vats of homes, a certain percentage per metropolitan area I do not recall the exact percentage but the program may still be available for you to read at the Federal Reserve website, anyway, they must keep the homes as rentals for a minimum 5 years and may renew for an additional 5 years. Now keep in mind this is a program that excludes the taxpayers but it is the taxpayers that bailed the banks out (not that they needed it) and we also are the ones buying up all the toxic mortgages that we are on the hook for to the tune of 85 billion per month to infinity. There is a currently about a quadrillion dollars in derivatives debt, AND just to top it all off with a layer of extra corruption for those that maybe completely naive as to our monetary policies, when you deposit your money into a bank, Congress created a law, at their banker buddies request no doubt, that states it is no longer your money. It is the property of the bank. You become an unsecured creditor. When the derivatives collapse, depositors are LAST IN LINE to be paid. You will be lucky to get pennies on your dollars. But with the buying power of the dollar being chipped away at a frantic pace now, we are being robbed from both ends. Google Web of Debt.

Been struggling a little with what exactly the concept of ‘rental income up 85%’ since 2009 really means. It doesnt mean the average person’s rent is up 85% since that time. It doesnt mean the avg landlord is now making 85% more than he used to either. Seems like most of the amount would be a shift from people owning to renting, so its an aggregate number of increased rental income in the US. Not really sure such a stat adds much of anything other than a continuation on a previous theme that home ownership rates are down in the US and we’re moving to renters. A tad deceiving, imo

The implications are captured in the headline, “Another type of income gap.” It’s not a matter of home ownership rates (as has been discussed, there’s no evidence that higher rates or lower rates mean the population as a whole is any better or worse off from a quality of life perspective), it’s growing income disparity that’s anathema to a country by the people and for the people.

LAer I believe banks will not be making more loans after we enact the Policy. I will explain. First by lowering the amount of the interest deduction that is deductible, this will discourage people from taking on more debt because the full cost of the interest will be paid by them. If you decrease the tax on savings, and money investments to the same tax rate as the long term capital gains tax rate, during the inflation/appreciation cycle, this neutralizes the lower long term capital gains tax rate. Less people will be using credit to create leveraged paper profits. The lower long term capital gains rate will still be available to people that want to make capital improvements to capital assets. As the economy begins to slow down the tax rates on interest earned, and the interest deduction will return to there previous tax rates, and the interest deduction will become 100% again. Interest is a fee that banks charge for keeping track of all the credits, and debit that occur in an economy. Those fees should remain fairly constant like most cost in the economy. We should rely more on the tax code to increase, or decrease the value of money (debt), We should not be relying only on the Fed’s monetary policies. The idea is to reduce the number people who want to receive a loan during the asset appreciation/inflation cycle, because once the cycle gets started it is like a snowball rolling down a hill. The imbalances get larger and larger until it all comes crashing down. The banksters and Wall St. walk away smiling as asset prices go up, and as asset prices go down, collecting their fees, interest, bonuses and commissions.

…then the Treasury Secretary goes to Congress with a three page loan application of $700 billion to buy “troubled” mortgage-backed securities, some of which were held by his former employer. Sweet system!

We’ll see what happens to interest rates after Janet Yellen takes the reins. We know the Fed simply cannot allow prudent savers with coherent, disciplined homelives to earn interest on their savings.

Real agenda has to be liquidating pensions and savings and bringing everyone into the rentier/serf paradigm.

Sorry to write so tersely…and hope it doesn’t come across too bizarrely. 😀

rose

Leave a Reply