Real Estate Olympics: Cliff Diving Prices in California. Median Price Down 30 Percent Statewide.

The California Association or Realtors on Friday came out with another press release showing how dismal the market has gotten. Sales have fallen 24.5 percent from a year ago but the more shocking development is the price of a median home in the state is now off by 29 percent. This is shocking in itself but if we are to look at the peak price reached in April of 2007, we get a more stunning picture:

California Median Price

April 2007: $597,640

March 2008: $413,980

That translates to a stunning 30.73 percent drop in less than one year. Is it time for us to throw in the white towel and call the bottom? After all, we had so many folks telling us that the bottom would be reached once prices dropped 20 or 30 percent. Aside from these people smoking peyote and having visions of housing past, we are nowhere close to a bottom. There are more nuggets of information in the release:

“Highlights of C.A.R.’s resale housing figures for March 2008:

* C.A.R.’s Unsold Inventory Index for existing, single-family detached homes in March 2008 was 11.6 months, compared with 7.6 months for the same period a year ago. The index indicates the number of months needed to deplete the supply of homes on the market at the current sales rate.

* · Thirty-year fixed-mortgage interest rates averaged 5.97 percent during March 2008, compared with 6.16 percent in March 2007, according to Freddie Mac. Adjustable-mortgage interest rates averaged 5.12 percent in March 2008, compared with 5.44 percent in March 2007.

* · The median number of days it took to sell a single-family home was 56.7 days in March 2008, compared with 52.9 for the same period a year ago.”

Things still look grim and the fact that we’ve increased inventory by 4 months over the past year will only put additional pressure on prices. You would think that a massive 30 percent drop would humble a few pundits but here come the bottom callers!

“Alan Nevin, chief economist for the California Building Industry Association and San Diego-based MarketPointe Realty Advisors, predicted foreclosure sales could account for as many as 15,000 out of 25,000 total sales this year. But at some point, the foreclosures will drop off, he Nevin said.

“Anybody who’s going to walk away from a house or condo has already done it,” Nevin said. “Now it’s just a matter of the pig going through the snake.”

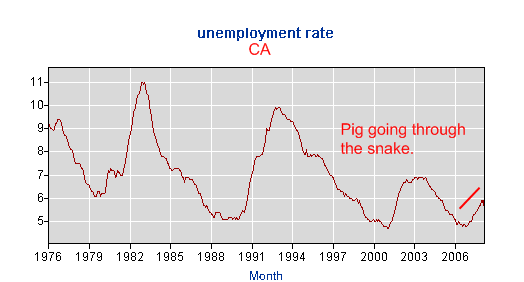

Bwahahaha! Let me catch my breath again. Bwahahaha! Anyone that is planning to walk away has already done so? This is amazing given the fact that California now has the 3rd highest unemployment rate in the entire country:

The trend in regard to unemployment is quickly increasing. Given the enormous dependency on housing especially in the state, many jobs are now being shed off like snake skin (if we want to continue with that imagery) and more public sector jobs will be lost as well given the precarious state of our $16 billion budget short fall in the state. We can debate that we are reaching a bottom but how are these phantom buyers going to buy their homes? Also, don’t you think that these people would have already bought? I’m simply amazed how people think we are at a bottom especially here in California.

In the first quarter of 2008, we had 110,392 homes with notice of defaults out. Given the default rates on these we came out with the following estimate:

(110,392 individual homes with NODs for Q1 of 2008) x 68% will not go current = 75,066

Clearly we are nowhere near a bottom and all signs are pointing to more challenging times ahead. But wait! What’s that? It’s A Bird, It’s A Plane, It’s Super Wal-Mart Voucher Checks!

“Tax rebates are starting to arrive in bank accounts. But many economists doubt that they will keep the economy from recession.

The stimulus package, passed with overwhelming bipartisan support earlier this year, will give rebates to about 130 million Americans, costing the U.S. Treasury more than $110 billion. Married taxpayers earning $150,000 or less will get up to $1200 while single taxpayers earning $75,000 will receive up to $600.

But since the measure passed Congress, there have been growing signs that the U.S. economy has already fallen into recession.”

Don’t get too excited when you get a notification telling you a nice $600 or $1,200 arrived into your account. This money is being pulled out of thin air and will only put more inflationary pressures into a market where everything is going up. I’m amazed how some folks truly believe that this tiny amount of money is going to help budgets like this $25,000 a year budget or this $100,000 a year budget. I’ll leave you with a poster based on those inspirational one’s you always see (forgive my poor Microsoft Paint skills):

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

12 Responses to “Real Estate Olympics: Cliff Diving Prices in California. Median Price Down 30 Percent Statewide.”

I’m curious how these stats are compiled. Here we have the unsold housing inventory increasing almost 50% from 7.6 months to 11.6 months yet C.A.R then tries to say the median time it takes to sell a house has risen less than 4 days, from 52.9 days a year ago to 56.7 days currently. I don’t think the rise in unsold housing inventory has all occured in the last 60 days. Does Lawrence Yun do the econometrics for C.A.R. too?

Residential project will be finishing up this summer. In the fall commercial projects will be finishing up. With no future of any new construction.

More job losses. of course Nevin figures that everybody who could walk from their mortgage did walk. But he forgot to mention all the new people who will be running from their mortgage.

My story:

I go the loan officer today and ask for a loan with 100% financing. “Oooh. We don’t do that anymore. We need 5% down.” Ouch. That’s a lot of money, no matter how big the house.

Next question: “How much do you want to spend on monthly payments?” I answer honestly: “$2000” I’m told that I can borrow $250,000 on a fixed-rate thirty year.

I tell him I can’t buy a shoe box in the ghetto with $250,000. He replies: “Sellers are becoming more reasonable.”

I announce that I’m not getting a house this year. See you next year.

On my way out, I notice how deadly quiet that office is. Nobody is getting loans, which means nobody is buying houses.

Seriously, how long can this last?

Whoops. It now turns out that our $16 billion deficit increased to $20 billion:

“Schwarzenegger says Calif. faces $20 billion budget deficit

Just last week, the governor said the state would face a potential $10 billion deficit in the next fiscal year. His spokesman, Matt David, said Schwarzenegger misspoke at that time.”

A Freudian slip. What’s a few billion amongst friends? Talk about digesting the pig…

“In his remarks, the governor said he expected home building to pick up in the next year.”

More bottom talking. And just to show you how clueless these folks are:

“The governor’s statements about the deficit have fluctuated by billions of dollars in recent weeks.

On Thursday, he said next year’s deficit probably will be more than $10 billion, while the current year deficit is $7 billion. According to his staff, that’s incorrect. There is no deficit in the current fiscal year. ”

How much do you suppose this budget short fall is caused by this 30 percent median price drop throughout the state? Those last second tax payments didn’t come in time for May. These folks were betting on the gravy train and now the next stop is quickly approaching. Two options: raise taxes or cut back (which will only add to our unemployment). Time to pay the piper amigo.

Great Comment about the Guv’nor above Doc. Since I live in the Sacramento Region and work in Sacramento I hear all kinds of crazy things on a daily basis. For one, I’m not sure if Arnie is really tuned in to what is happening. Probably smoking peyote as you mentioned with visions of his most stellar role as Conan. Second, he was on TV the other night with Leno propping up “Going Green” which is really going to mean tax increases on all living in California. With unemployment rising in the State, who the hell is going to be paying the taxes? On another note regarding the stimulus package, I was talking with a friend who had mentioned that the money coming from “thin air” as you have stated is part of some weird deal (loan) our Fed Govt concocted with China. Have not confirmed that, however, if that is the case the whole ship is sinking.

worm….

How do you know that residential projects will finish up over the summer, and that commercial projects will finish up this fall?

Thanks,

DJR

It totally amazes me the degree of cluelessness of our elected leaders & the public at large when it comes to the finantial situation the US is in. We have no idea where we will get the money to keep up our current lifestyle, because once our jobs hop overseas they wont come back.

Don’t get me started on the so called tax rebates, what a joke.

Some of the comments on the post on the family with the 100k income were down right laughable, oh sure you can cut out the entertainment & save $6000 a year, you can drive less & stay closer to home, heck you can even cut out all junk & fast food, but is that truely realistic? Once the housing market finally hits bottom what will the social impact be? How high will employment go, & what kind of employment landscape will emerge.

I live in the NYC metro area where you can commute to most places buy bus or train saving money on gas, but in So Cal it is far more challenging to pull off. As gas prices continue to rise citieswill have to condence, build up & become more transit friendly like San Francisco to remain viable in the 21st century.

worm,

“esidential project will be finishing up this summer. In the fall commercial projects will be finishing up. With no future of any new construction”

while i agree with you i watch the cragslist adds for architect/engineer/CAD jobs and there seems to be add after add for achitects with an occasional add for an engineer. so somebody some where is is planning new projects.

here’s an example:

Tue Apr 29

Draftsman – Auto CAD/Solid Works – (Santa Ana, California)

Commercial Construction Manager/Superintendent – (Southern California)

Electrical Senior Designer – (Newport Beach, CA)

Lionakis – Project Manager – (Orange, CA) img

Lionakis – Senior Associate – (Orange, CA) img

Laborer, Finish and/or Rough Carpenter/ Stucco & Concrete –

Mon Apr 28

Designer/CAD Drafter – (Newport Beach)

Job Captain – (Newport Beach)

Project Architect – (Orange County)

Solidworks Designer – (Santa Ana)

Remember we are still not using the “R” word – we just call it an

Economy that has slowed down… Slowed down? That car is in reverse

and the transmission just died because you threw it in reverse before

you came to a stop.

Just watched the news… guess what “Housing Market has finally

hit rock bottom according to the big wigs… yeah right. So some desperate

developer finally priced his lousy condos for 199 000. Gee… it isn’t worth

80K to begin with. But everybody has to announce that there is a “One”

before the K… and that is supposed to be the bottom.

And then of course we will see another “bottom” once they are sold

for 150K and then 100K. Don’t listen to the nonsense… that bottom

isn’t going to hit until 2011 or 2012. By then finally all the “bad loans”

are gone to default heaven and the first wave of defaulters will have their credit repaired and hopefully have a decent down payment saved up.

That of course can only happen if the economy turns around and everything from gas to groceries starts stabilizing again.

Did you know that we haven’t built any new refineries in 30 years?

That we could if we wanted to produce enough gasoline for a decent price?

Isn’t is weird how the average person doesn’t even know the name of a refinery in his/her vicinity? Or who owns them and who runs them?

…

Basically if anything happens to one of them the price on the pump will jump within seconds. Over the last 6 to 7 years you will have one or more go down for repairs, etc. usually around January//February and then again June/July…

Strange coincident, isn’t it?

Congress doesn’t want to even discuss the option of building new refineries…

I wonder why… Supply and Demand wouldn’t be such a cruel game if there

were more refineries competing with each other. Instead they all hold their

monopoly for their specific area and any hicup translates in fewer gallons

delivered to the stations or… more specific a higher price per gallon because of the ensuing bidding wars for the finished product.

Isn’t it strange how little the American Public actually knows about

Refineries? This is not a subject that is willingly discussed on the media.

You only hear very briefly that a Refinery in Texas went down and therefore we are paying higher prices in California.

Reena

Reena writes about oil “Supply and Demand wouldn’t be such a cruel game if there were more refineries competing with each other. ”

*** Sorry but that is a false urban myth that more refineries would magically produce lots of gasoline unto to eternity. The real force driving the lack of supply in the US is (a) the expotentially increasing demand in India and China and (b) the aging oil fields – particularly the Mexican field that supplies enormous quantities of fuel to the US and which Mexico expects to ehaust in about 2-5 years.

*****Can’t keep being 6% of the world’s population who uses 25% of the oil produced and not expect to have to pay through the nose for the privilege.

I totally agree with Alan Nevin. Foreclosures will drop off. He just forgot to mention that it’s going to take a couple more years before all the bad loans are gone. Honest mistake, I’m sure. 🙂

Reena wrote: “By then finally all the “bad loansâ€

are gone to default heaven and the first wave of defaulters will have their credit repaired and hopefully have a decent down payment saved up.”

I hope that the first to buy once bottom is hit are the first people to have defaulted! I would like to think that we, the hard-working “good people” who didn’t gamble with poker-chip houses and got priced by the greedy, will have first dibs at any house we want. Make it so the money grubbing scum can never buy a house again (except for the boxes in South Central).

Leave a Reply