The Treacherous Path for Housing – 42 Percent of California Mortgages with Negative Equity: $1 Trillion in Mortgages Submerged Underwater in California. $3 Trillion in U.S. Mortgages Underwater and Risking Foreclosure.

$1 trillion in California mortgages are underwater and swimming in the Pacific Ocean. $3 trillion in U.S. mortgages are in a negative equity position. What this means is borrowers owe more than their home is worth. A few research papers have shown that the number one factor in determining potential foreclosure is being upside down on a mortgage (job loss is up there as well). You can rest assured that all those Alt-A and option ARM mortgages in California are underwater to the point of touching sea bottom. How bad can it get? One area in Southern California, the Inland Empire has an estimate total housing property value of $222 billion. Only problem is there are $238 billion in mortgages attached to these properties. Two enormous counties with negative equity.

Take for example the larger Los Angeles and Orange County areas. We have some $1.077 trillion in housing property yet a total of $311 billion of mortgages are underwater. This does not mean they are currently in foreclosure but the likelihood is extremely high. Given that the Alt-A and Option ARM loans are more prominent in the so-called “prime” markets, a large number of these loans will implode on first recast. Many are defaulting prior but once the recast hits, it will be game over. Banks know this and that is why they are hiding foreclosed properties from the public view.

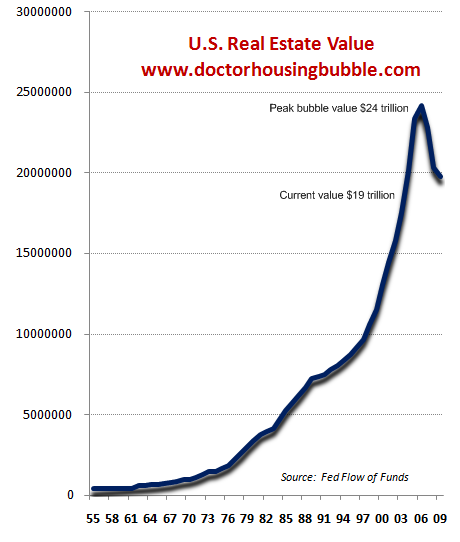

I’ll try to make this a comprehensive review of the nationwide housing market and will also focus on issues specific to California since it makes up one-third of the face value of mortgages underwater. First, the main cause of this problem is the real estate crash:

The Federal Flow of Funds report shows that over $5 trillion in real estate value has been wiped off the map since the peak hit. That is a quick way to put a tremendous number of mortgages underwater. The incentive to pay on a home that is worth less than you paid for is a psychological jolt. We are conditioned to believe that a home is the greatest investment ever so when we are then told that a home is underwater, it strikes at the core of an American mantra. What should have been expressed is housing is a great investment if purchased at the right price and not inflated casino values brought about crony Wall Street and their epic bubble machine. It is hard to predict the ramifications down the road of this wealth annihilation. We’ve never seen so much household wealth disappear. The stock market crash has also hurt but there is something intrinsic about a home that is going to shatter consumer confidence for a very long time. Let us look at the overall household balance sheet since the recession started:

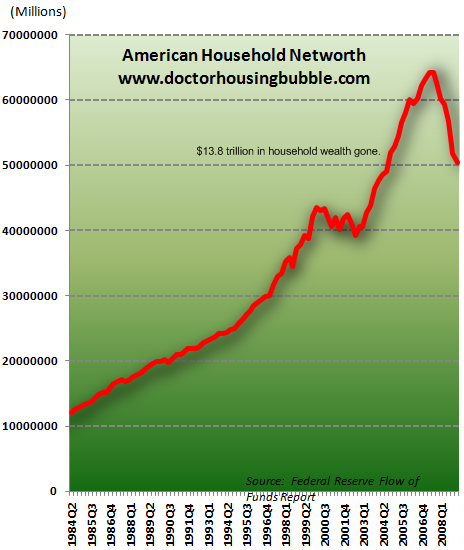

Now think for a second how big $13.8 trillion is. That is the amount that has evaporated from the American household balance sheet. Sure, the stock market has rallied since the March lows but we are still 36 percent down from the 2007 peak if we look at the S&P 500. At the same time, housing values have continued to decline and this makes up a large portion of the American balance sheet so the gains from March will probably be offset by the continued decline in household wealth. The most recent data released from the Fed for this set only goes up to Q1 of 2009. A lot has happened in Q2 of 2009. Let us look at the Case-Shiller Index:

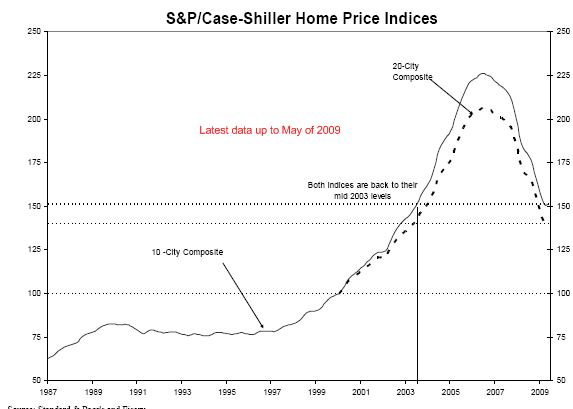

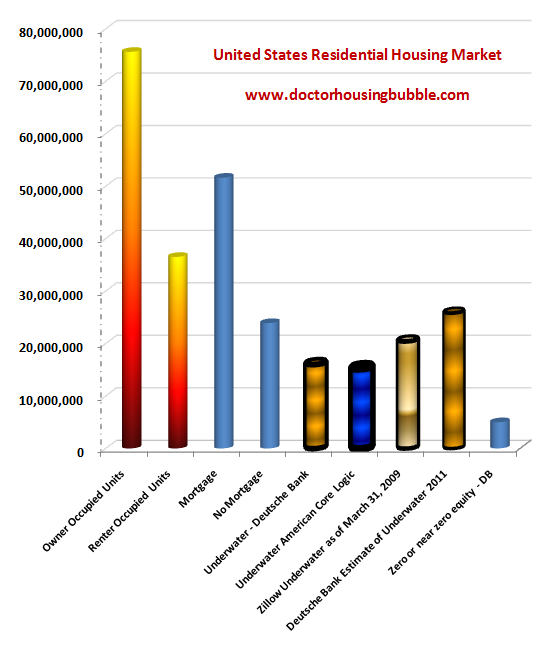

Couple of things regarding the recent stabilization. A large part of this was seasonal and also, the tax break for clunker homes has worked to entice people back into the market. Yet how long can these gimmicks hold up $3 trillion in underwater mortgages? We have yet to see those Alt-A and option ARMs come home to roost and they will. I’ve been reading many reports about the raw number of underwater homes. The three major reports I have seen come from Deutsche Bank, Zillow, and Loan Performance. I’ve decided to put all the data in one spot:

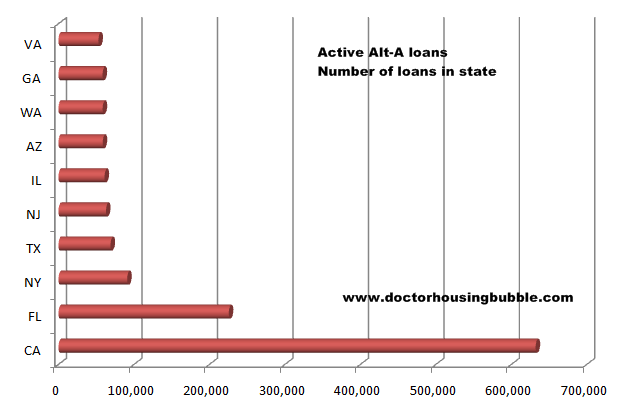

It is a curious find to see nearly all three of the reports coincide with each other. The reports show that some 15 to 16 million mortgages are underwater (Zillow is a bit higher with a 20 million current estimate) and the Deutsche Bank report predicts that the bottom will come in 2011 and at that point, 25 million mortgages will be underwater in the U.S. I tend to agree with the Zillow estimate. Why? First, as we had initially highlighted $1 trillion of the $3 trillion in U.S. underwater mortgages are here in California. Given the still delusional world of places like Culver City, Pasadena, Palms, Rancho Park, and other areas prices still have a way to go down. A Loan Performance report shows that 2.9 million mortgages in California are underwater. Given the amount of Alt-A loans in the state that number seems about right (we also have prime loans that are now underwater).

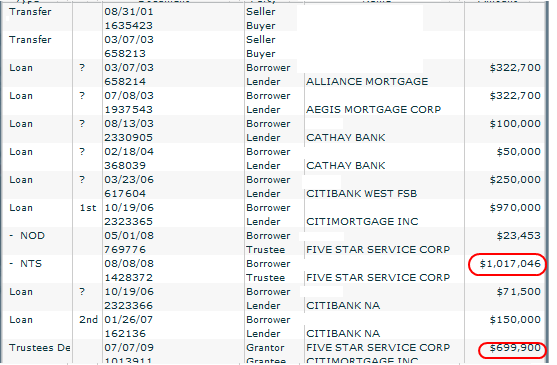

Now you want an example of this insanity in a prime area? Let us look at a bank owned home in Pasadena:

Sale History

8/31/2001:Â Â Â Â Â Â Â Â Â $558,000

03/07/2003:Â Â Â Â Â Â Â $655,000

Not a big deal right? Pasadena is prime Southern California. Oh, but this is where it gets interesting. This home is now bank owned. This is another example of the home ATM machine. The initial data I am seeing has this place listed as a 2 bedrooms 2 baths home but on more recent data, I’m seeing it come in at 4 bedrooms. When we look at the loans you can tell this was a HGTV time here:

This is the kind of insanity that is going to implode the mid to upper priced market. Keep in mind, this home isn’t listed on the MLS and is part of that hidden inventory. Seriously, from $655,000 to over a million in loans on a 2 bedrooms 2 bath home (initially) in Pasadena.

Now why am I putting all this data in one spot? Because this is crucial in understanding where we are heading. This recession was brought to us by housing but housing will not bring us out of it. That is a big mistake being made with propping up failed banks and lenders. The solution does not come from housing or the finance industries. Alt-A and option ARM loans should fail and they will fail in epic fashion. I’ve gotten a few e-mails now that it seems the public-private investment program (PPIP) is set to go but at a more trimmed down version. My response is this: Okay, let us assume all the toxic crap mortgages are put off onto the taxpayer. 100 percent. Let us just say we dump the $3 trillion in underwater mortgages to the U.S. Government. Now what? You still have to sell the homes. You still have to go through price discovery. Someone still needs to eat that loss. I’m amazed that some people think that once the toxic assets are shifted to the government that some mysterious Midas touch is going to turn these toxic mortgages into gold. This is the same idiotic logic that allowed Wall Street cronies to create collateralized debt obligations and junk filled mortgage backed securities. Their idea was “let us mix crap mortgages with mortgages that are less than crap” and somehow it will turn into a glorious triple-A rated security.

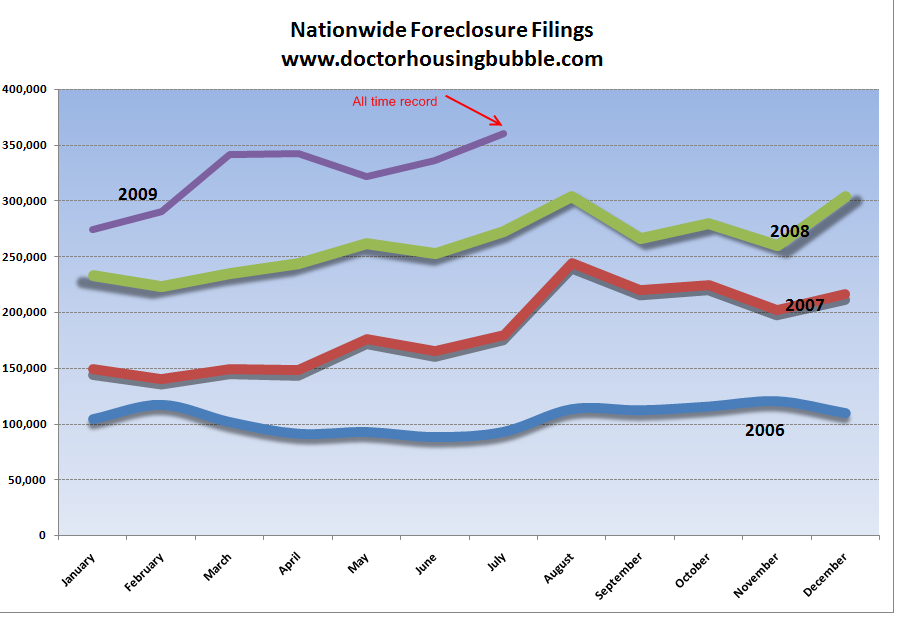

And by the way, all those bailouts are doing absolutely zilch in stemming the foreclosure crisis. Last month we hit an all-time record in foreclosure filings:

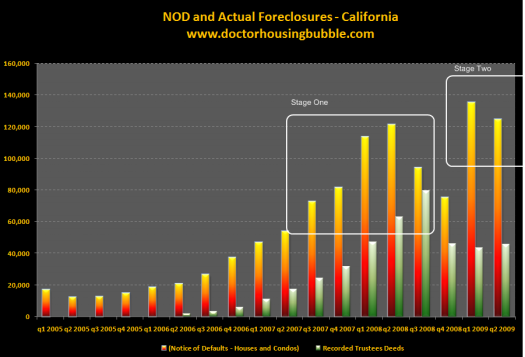

So much for stemming the issue and we are approaching one year since TARP. We have thrown some $13 trillion in bailouts and commitments to Wall Street and banks and all we get is a 50 percent stock market rally. Guess who is making out like bandits right now? It sure isn’t the American homeowner and worker. Talking about jobs, it might be important to get people working because without a job, it might be hard to make the mortgage payment. California is entering stage two of the housing implosion:

The vast majority of those notice of defaults will turn into REOs that will go into the hidden inventory. But looking at foreclosure data, there is a record number of homes going to auction in the next few months. The only question is, will they actually be put on the market or will banks keep on holding them on their books at inflated prices? At this point they don’t have much of a choice. The cash flow is going to stop in 2010 once the loans recast. I would venture to guess that many people are paying the artificial teaser rate and many are already mentally prepared to stop paying once the payment recasts. At that point, banks are going to be struggling for capital and if the stock market rally ends, they are going to need another casino to raise easy equity from suckers chasing P/E ratios in the triple digits.

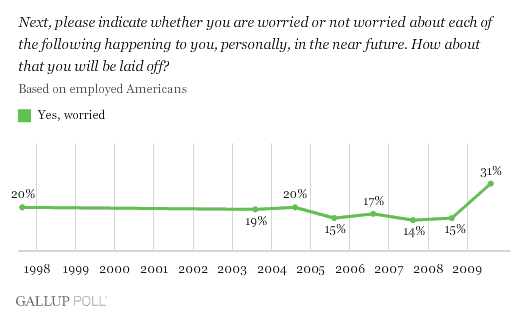

Now where does this leave housing? The number one reason for the increase in home sales is lower prices. It boggles the mind that people then think that rising home values will keep the gig going. Most of the lower priced homes are coming from foreclosure re-sales. So as long as foreclosures are running high, there will be pricing pressure on the downside. This is simply the new reality. Also, much of the jump in home sales was brought on by gimmicks like the U.S. Treasury and Federal Reserve tag teaming up on the mortgage markets and buying up some $1.25 trillion in mortgage debt. Okay, now that is coming to an end. Also, the tax break for buying a home is simply another subsidy to homeowners at the expense of non-homeowners. That will be coming to an end. Unemployment will remain high for another 12 to 18 months (at least). So there goes more potential home buyers. If you look at this objectively, there is little reason to believe housing will rebound any time soon. And when we say rebound, we mean prices. Sales will keep increasing so long as prices keep falling. We have a poorer country that will look to buy homes that reflect their new net worth. And a worried consumer is reluctant to buy high priced items:

One stat that simply is not quantifiable but I am certain is present, is how many folks are sitting around the dinner table at night and saying, “once this payment recasts we will stop paying.” In California, I am certain many have already had this conversation especially if they have an Alt-A and option ARM. Attorney General Jerry Brown is cracking down on numerous loan modification operations. For the most part, any loan modification is going to benefit the bank, not the homeowner. Most people are strategically defaulting and this is the right business move. Some shills in the industry will start arguing morality but they were largely silent with duct tape over their mouth when the housing bubble kept going up. All of a sudden banks want to enforce standards and tighten up credit and those in the industry suddenly went from bank robber to reformed officer. Wasn’t the point of the bailouts to increase credit? Please, it was to mend the balance sheet of banks under a larger pretense.

The solution is simple. Housing prices must come down further. People must put 10 to 20 percent down on a home purchase. There is a reason for this. If you are buying a $500,000 home it will pain you to see $100,000 of your own cash evaporate if you walk away. Going with a zero down Alt-A loan you will simply walk away if that home is now valued at $300,000.

The math on this is simple. When you put the entire housing situation into perspective you realize that there will be no long term recovery and we are still in for another tough round.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

35 Responses to “The Treacherous Path for Housing – 42 Percent of California Mortgages with Negative Equity: $1 Trillion in Mortgages Submerged Underwater in California. $3 Trillion in U.S. Mortgages Underwater and Risking Foreclosure.”

So mark to market is allowing big banks to not book losses.

Low interest rates allow big banks to kick the can down the road.

The government is tackling the larger mortgage back securities which is what is helping the big banks.

Now, the mid to small banks are falling left and right (including Colonial which had 25B in assets and nearly 350 branches. What’s more, we all know that commercial real estate is about 6 months from really tanking.

And how are we paying for this. Unemployment continues to remain high and our government says it will be higher by year end. Federal income tax revenues will be lower and hey by the way so will Social Security revenues for all those who are likely going to be retiring soon and will start drawing those benefits.

Speaking of benefits, the fed is flipping the bill for extended social security benefits. We still have a couple of wars going on, plus we got some guy in North Korea that likes to shoot missiles our way every now and then.

So how do we pay for all this? Oh the same way this mess was created in the first place–let’s borrow it. Or in the US’ case, let’s just print more money.

But in terms of debt financed problems, who do we turn to? Europe–pretty much more toasted than the US right now? Japan–still in the midst of their 20 year recession. China–yes China–8% GDP increase this year. Still a strong economy. But look behind the smoke and mirrors. China’s GDP is skyrocketing because the government is pressuring smaller districts to show positive growth. People their are finding out what debt is all about and driving their own bubble. Trade with the US and most of the rest of the world continues to decrease because of demand. China is probably 1-2 years away from saying no mas, we can’t buy any more of the US’ Treasuries that aren’t paying anything.

Obama made a mistake by not pressing taxes now (not that I want to pay a dime more than I already do). But he has no option next year, and the economy is going to continue to in the tank.

Don’t get me wrong. I think the recession is over (for the timing being). I don’t think its over because the US is growing, but I think that because of government spending–for jobs, for cash for clunkers, for just about everything–we will experience a quarter or maybe two of positive GDP. Smoke and mirros isn’t just for the Chinese. Meaning the recession is officially over. The US will really press spending for 2 quarters in order to show the recesssion is really over, hoping that the US people will regain confidence and begin spending again. But the reality is, unemployment is still too high and you can’t buy a car without an income. Real estate will continue to tank. Commercial real estate+prime+alt A–which will continue to keep credit tight and spending down.

As for loan mods. Give me a break. If you could get a loan mod (ie. you have a job, or you care), you did so in the spring when rates were low. The banks are continuing to do loan mods, because they are overburdened with stuff. I have a loan mod that I began in April and is still going on (neither credit, nor amount is the issue, the banks are just inundated right now).

Now, the million dollar question is not whether we will have inflation, higher interest rates and falling real estate values (meaning at the upper end, which will increase the mean). Even if banks won’t sell, people will and there won’t be enough money to buy what normal demand will be, so prices must fall.

The real question is when, which I now think is mid 2010. Why? Positive news this quarter, positive news next quarter (starting 2010 with a positive note). I think what happens next April is the feds realize just how badly the economy performs when it trys to reconcile its revenues with expenses. The government hopefully will realize at that point in time that it can’t borrow anymore because spending to fund the deficit will exceed revenues (I’m half joking about this). The news goes to the banks that the government can’t fund the facade anymore. Oil starts taking off when they realize the US can’t sustain itself anymore and then we see recession part 2, which may actually become a depression.(ie. spending goes into the tank, more companies fall, more unemployment, etc.)

I truly hope this doesn’t happen. But in light of current policy and what is going on, there isn’t much to think about on the bright side. Again, the question is time and that’s my guess. Anyone have a better one?

I am wondering how many of these “underwater” houses are worth less than the owner paid for it, vs. they are just worth less than the last refinance. I know of people who refinanced three or four times, each time taking $150,000 or so of “profit” to spend on various indulgences. Finally, they refinanced one time too many, and the house is worth less than that refinance price. But some of them may have $500,000 or so that they already took out of the house. Many may have spent it on fun times that the rest of us eschewed because we are not stupid and greedy idiots. But some may still have some of it, or have even banked it. They are not truly “underwater.”

The question of people simply not paying their mortgages is fascinating. If enough people get away with it, then more will follow. And those who are not truly underwater altogether, but just as compared to their last refinance, could come out ahead. They might lose their house, or they might not. Some are hoping for the government to forgive principal; others for some more loan modifications. If they don’t come, they stop paying rent for a year or so, bank all the extra money, and then leave. Their credit is hurt, but with millions of people’s credit being hurt, it may not mean much. And they can use the saved and previously banked money to buy a new house. I think that the government and the banks are playing with real fire by implementing policies which delay immediate foreclosure on mortgage non-payers. Remind me again, what is the rationale for paying one’s mortgage in the first place?

Was at a dinner last night with a couple of CPAs. Here’s another part of the puzzle- with all these people walking after they’ve tapped their equity, will there be tax consequences? The CPAs felt, that absolutely, the Feds will go after defaulters to pay their capital gains obligations, minus the $500k exemption plus improvements. I personally know a few folks in this situation- their basis is around $40k and they’ve refied into loans of $1 million plus. Now they’re walking. Doc, et al, any thoughts on this? And what about the rest of us, who have done the right thing- if they get a freebie on this obligation, why should we be required to eventually pay capital gains on real estate? As usual, Doc, keep up the good work- it’s invaluable.

Do you have more charts of different banks showing their Option ARM loan amount of Metro Area in California like the following chart of WaMu that was posted last year?

http://www.doctorhousingbubble.com/wp-content/uploads/2008/09/wamu-option-arm-by-area.png

Another great article, I don’t know how you find the time to research & write so many in-depth articles, but please keep it up!

Anway, the crux of the whole issues comes down to the last 2 paragraphs (bingo, every writing instructor would give you an A+ for coming back to the main point at the end):

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

The solution is simple. Housing prices must come down further. People must put 10 to 20 percent down on a home purchase. There is a reason for this. If you are buying a $500,000 home it will pain you to see $100,000 of your own cash evaporate if you walk away. Going with a zero down Alt-A loan you will simply walk away if that home is now valued at $300,000.

The math on this is simple. When you put the entire housing situation into perspective you realize that there will be no long term recovery and we are still in for another tough round.

~~~~~~~~~~~~~~~~~~~~~~~~~~~

The point is this: let the loans fail. Put the homes into foreclosure. Sell homes for 50 cents on the dollar. Ruin the credit of people who speculated/used the home as an ATM/had bad luck.

Honestly, when I bought a home 10 years ago, there was no guarantee of “all upside, guaranteed appreciation, if the market tanks we’ll prop you up.” If you buy a home for a long-term place to live, this shit is in the noise. If you bought it as an investment, well…. like any other investment, it can tank. The only difference is that one person’s selfishness or stupidity can put a family on the street. That sucks & it saddens me, but the same could happen if daddy (or mommy) went to Vegas & put it all on black.

The point is that there have to be consequences, that’s always how it’s been done & it works.

If enough people feel enough pain, home prices in SoCal will return to levels where responsible folks can buy them, the speculators & liars will have such deep scars that they won’t want to go down that path again, and equilibrium will be (eventually, mostly) restored.

LET THE F***ING MARKET WORK.

No sir, the government won’t do anything because the inmates are now running the asylum. Because the majority of our fellow Americans are fat, drunk and stupid, that is the only voting block that counts. Those of us who did the right thing; saved our money, didn’t spend it on the “must have things”, etc…. will be stuck with the bill.

I know several people who think their home hasn’t lost any value. And others who know they are underwater but feel that the market will turn around and home prices will go up again before they need to sell. I wonder what percentage of people either don’t know or don’t care about their home being underwater?

William,

You’re comment reminded me of the Oropezas. Their plan was simple: tap that sweet home equity and flee to Texas (it has homestead laws).

Here is their story. Enjoy!

Tap That Sweet Equity

.

I don’t see any holes in what you say. There is one group of people who are consistently left out of discussions like this: the people who sold their homes at or near the top of the market. There are quite a few people out there who did well in this mess. (And I’m not saying they are villains.)

Underwater, underwater, underwater. When will you consider some more complexities here? If the direct rental income or renting fee alternative to occupying the house is larger than the mortgage payment then it makes sense to stay in the house. How many % is that? Do you consider it at all?

Then consider that people are hopeful (whether reality based or not) and will want to stay with their hand in the game rather than just becoming a renter. Further – people who are in their underwater homes feel that at least they can set their own rules and not have a landlord hovering over them. Other emotional arguments exist but the importnat thing is; many will follow them.

The idea that millions upon millions will simply walk away from their homes like an army of zombies is as naiive as the people who think the recession is over. I think Dr. Bubble is in somewhat of a schadenfreude echo bubble.

Nobody saw this coming? The Mayans even saw the bottom of the real-estate-bubble collapse:

“This grand cycle of evolution will culminate winter solstice, December 21, 2012 AD. This time we are now in has been called The Time of Trial on Earth, …”

@hidflect

Your points are well taken, but there is a heck of a lot of turmoil yet to come. This is not the 9th inning unless this is a double-header. Most of the exotic mortgages were taken with the expectation that they could roll the house and make a fast buck. If you’re underwater, you’re burning cash and the equity-ratio is the factor that asserts the recast–then the gamblers are called and their holding a bobtail-straight, joker-high. We will see. All the government’s intervention in the equity and real-estate markets are more like 70’s Red China than US. We’re up fecal creek in a submarine without a rudder. Nobody knows how this shakes out, but it can’t be good.

Hidflect, my son was approved for a 729K house in Socal. He is NOT buying. He is afraid that the 900k house that fell to 700k could still fall to 550k. Given that the payments could be about the same people do not want to be that extra 150k underwater. The stabilization of the housing market at the high end will just bring gridlock. And we have “disinflation” everywhere right now. Very dangerous to buy a house at the high end or middle high right now. Very dangerous.

Mark makes an interesting point – dramatic market shifts always imply both winners and losers. People who bought and/or had substantial equity positions in properties in real-estate-frenzy locations before the bubble and sold anywhere near the top made enormous capital gains – large portions of which (up to $500K for couples) were tax free. Home-as-ATM refinancers also potentially extracted large amounts of cash without reinvestment into their residence.

So where did all the money go – and what does that mean for the economy? I thinking most of the money went into three places: A. The stock market, B. Non-durable consumption, and C. Other houses.

But to the extent this flow of funds could not go on indefinitely – it implies that the initial housing bubble helped blow further bubbles, fated-to-pop, in all those categories. The stock market and housing market downturns probably wiped out a lot of that wealth – and to the degree that consumer activity was propped-up far beyond sustainability by all this extra cash, there can be no rapid return to that level of consumption.

So, probably, most of the “winners” have lost most of their winnings, and enjoyed perhaps a few years of luxurious self-indulgence. Unfortunately, the companies that provided these goods and services were living on borrowed time. Some folks, like any frenzied gambler, probably doubled down on their gains, and used all the cash to make a down-payment on a much more expensive “super-move-up” property with the help of an Alt-A/Option-ARM mortgage.

There are probably a few folks out there who took their gains and dumped the bulk of it into stable, low-risk investments, but I’m guessing for the most part the bulk of the proceeds are gone with the wind.

Regardless of what will happen, what is happening now is of great concern. It is clear the numbers do not make sense. The banks and the government absolutely know that housing is doomed. They keep smiling and talking about a recovery while the ship is clearly going down. So the question is why are they hiding it? Clearly in my mind it is because they know something we do not. There must be a plan. The question is what is it and can it possibly work? Can the federal government tap down mortgages to “market value” en mass? Do they have that power? What would happen to the banks if they do. What is going to happen to all these REO’s sitting not on the market? Will they just let them rot rather then risking another crash? And as too all of the homeowners sitting and not paying still without a NOD, does the sheriff ever come knocking or is it an indefinite free lunch? It would be nice to believe that the greedy and foolish will have their day of reckoning while the responsible planner will have his day. I think that will not be the case. The equity drawing man sits in his expensive car on his way to his boat smiling while the rest of us sit in our cramped little apartments with our declining dollar bank accounts feeling stupid. I think the “nice guy” is definitely finishing last in this equation. Anyone have any educated guesses about what the next “bailout” will be?

Banks are “slow walking” their defaults. I have been following higher-end NODs in a prime area of Ventura County. Lenders are typically re-scheduling auctions up to 8 -10 times (8-10 months). Then not recording ownership for months. Then not hiring agents and listing on MLS for many more months. There is no other explanation for a well run national bank to be so slow to move their defaults through the process. THE BANKS ARE SLOW-WALKING THEIR DEFAULTS INTENTIONALLY IN HOPES THAT BLEEDING OUT THEIR LOSSES OVER YEARS WILL BE BETTER FOR THEM.

No, you got it about right, I kept wondering week after week, what idiot/idiots are buying US Treasury bonds? Well as it turns out, Central banks and governments and the uber wealthy are still buying our debt and taking out Credit Default Swaps on it. If the US defaults on Treasuries, the Big Banks have to pay out. This is going to end very very badly.

Everyone knows the Emperor has no clothes, but it’s a big flipping nudist colony, so who’s going to call out the Emperor? In the 80s the Japanese bought Hawaii and stuff all over the CONUS. Then OPEC. Now it’s China’s turn. Then India. I’m sure financials are trying to buy time until they can unwind all this. This could easily turn into the lost generation if someone doesn’t stop kicking the can down the road, as DHB might say. I think the next bailout will be state municipal obligations. Most of the country thought this was the new paradigm and states went nuts. Now they’re all broke, have declining tax bases, are out of unemployment money with U6 growing like a SoCal wildfire. The whole GM thing is a precursor to the pension bailout. Healthcare is a sideshow because everyone knows GS, pharma and HMO own enough congress to block anything. Next bailout? How about multitasking, multithreading bailouts. Everyone but the working Gentile.

Kel-mag, the government can just use all those houses they own the mortgages on for low income or chronically unemployed housing.

2010 will be a very interesting year for real estate. for now, banks slowly bleeding out their losses is the strategy of choice with the financial and regulatory backing from the fed. responsible earners and savers are the last ppl the fed and banks are thinking about. Fed and banks are just trying to get the real estate market back up and standing. For those who are responsible, just rent a house for now IF you REQUIRE more space for your family, spend frugally, and SAVE and put it in low risks investments. In 3-5 yrs yrs time you will be in a solid position to buy a decent house on par with your income level and down payment.

We are up sh*@# creek without a paddle. Plain and simple. Deflation continues to dominate the landscape for awhile. Save your dollars amd get ready to pounce on real estate and precious metals once the markets capitulate. Then, hold on to your hat as we hyperinflate like never before in our history.

The day of reckoning for Westside real estate is approaching fast. Big drops are on the way.

http://www.westsideremeltdown.blogspot.com

I fear that if PPIP actually happens that it will joint Fannie, Freddie, FHA and other government programs as the holding tank for toxic waste. Unfortunately these agencies do not need to mark to market, sell or do anything that happens in a rational market.

Do you really think you can get a bureaucrat to kick someone out of “their” house? Do they really care if they collect the mortgage payment? What is the incentive to do anything except wait for inflation to take care of the problem?

It is much easier to pass some legislation to pull more money from paychecks. What happens when they pass a law that makes it illegal to discriminate against someone who has defaulted on a mortgage?

The government is well on its way to becoming the housing market. Get in line for your apartment comrade. Hope you are friendly with commissar of condos.

Comment by hidflect

August 15th, 2009 at 7:33 pm

Underwater, underwater, underwater. When will you consider some more complexities here? If the direct rental income or renting fee alternative to occupying the house is larger than the mortgage payment then it makes sense to stay in the house. How many % is that? Do you consider it at all?

Then consider that people are hopeful (whether reality based or not) and will want to stay with their hand in the game rather than just becoming a renter. Further – people who are in their underwater homes feel that at least they can set their own rules and not have a landlord hovering over them. Other emotional arguments exist but the importnat thing is; many will follow them.

The idea that millions upon millions will simply walk away from their homes like an army of zombies is as naiive as the people who think the recession is over. I think Dr. Bubble is in somewhat of a schadenfreude echo bubble.

__

Sigh…. first you have to understand HOW a property is valued. Longstanding rule in property valuation is the relationship of the price to what it can bring in rent. If the rent from a property could not cover the principal, interest, taxes, insurance, repairs and maintenance, and the alternative-opportunity return on the amount of a downpayment (ie: putting the money in munis instead of using it for a downpayment), it is priced too high.

>>

ANd therein is the crux of the bubble-problem. The houses could NOT RENT for enough to cover those costs, let alone rent for enough to return a profit. (It is that postive cash flow thing since it is never a good business plan to go into a business which loses money every month.)

>>

Take a good look around and you will find that the rents in your area for the single-family do not justify the prices even now let alone at the height of the bubble . Rents are much more reflective of what the population can really pay for housing. And, as a rule, RENTING IS STILL CHEAPER than buying in all but 3-6% of the areas in the US (and in Southern California, it is probably more like only 1-3% of the areas where buying is cheaper than renting.)

>>

Pricing now and particularly at the height of the bubble did not accurately reflect the real cost of owning the place—- the taxes, insurance, the water heater that croaks, the roof that needs repaired sooner or later, the plumbing lines that start to leak, the painting, the landscaping maintenance……. When those costs are factored in, the house is much more expensive than it appears at first glance. That list price in the MLS does not show all those costs – rent does.

>>

Methinks you are sitting in a house whose value has fallen and you are in denial that there are far far fewer people who could afford the place than your realtor lead you to believe.

>>

Housing prices do not go up by some magic alchemy and independent of the real world and real economy. They are extremely dependent upon the ability of the population to pay the price. And the households in the US are a lot poorer than they thought when they were living on credit. Household incomes in the US have stayed flat or fallen when adjusted for inflation for the past 30 years and particualarly for the the past 15 years. If household incomes did not go up 10% a year, then house prices can not go up 10% a year.

>>

It doesn’t matter how many people there are who need housing. That alone will not send prices up. What matters is how many people there are who want the housing and who can PAY FOR IT.

>>

You can easily look up the data yourself. Start with the ‘for rent ads’ in you community, go to you local MLS site and look at the listings and then pull the income data for your community on the US Census website through the American FactFinder section. Unless the prices are such that the PITI (principal, interest and taxes) will not exceed 28% of the gross income of the buyers, the houses are overpriced. When you have a community with say a median household income of $60,000 and a median list price of $500,000, the house prices are still too high in that community. If the rent for a house is not enough to cover PITI and leave 20% of the rent for maintenance etc, the prices are still too high. DO your homework or otherwise you are just fantasizing.

@AnnS

Always a pleasure to read your pieces. It’s like staying in a Homily Inn Express–I feel a little smarter now…

According to new research from the University of Chicago’s Booth School of Business and Northwestern University’s Kellogg School of Management.

“26% of the record numbers of home mortgage defaults across the country are “strategic” — that is, calculated economic decisions to bail out of loans by owners who actually have the money to make the payments but can’t handle the negative equity they’re carrying caused by local property value declines.”

Nationwide, according to data from Zillow.com, 22% of all homeowners were underwater, with mortgage debts that exceeded their home values, in the first quarter of 2009.

In some parts of California and Nevada, more than half of all households have negative equity.

“In a few localities, the size of the equity deficit is staggering: In the Salinas, Calif., metropolitan area, for example, the median equity for people who bought their homes in 2006, near the peak of the boom, is now a negative $214,305, according to the study.”

Read More: http://www.housingnewslive.com

AnnS, I think you totally missed hidflect’s point. He/she inferred that yes, renting often costs less in the short term, but despite being underwater there is a price people are willing to pay for (1) Their Fico score (2) Not having to move (3) keeping their kids in the same schools (4) not being beholden to a landlord (5) stability (6) other emotional considerations. What is it worth? It could mean a 10-20% premium in monthly payment and still staying in the home could make sense. And, remember that the “quality” of borrower with underwater prime and Alt-A loans dictates that these considerations are more important to those currently in distress that to the sub-primers of last year. In that respect, I do believe that DrHB and many others have a vested emotional interest in seeing an apocalyptic foreclosure crisis that may never happen. We will all stay tuned…

Remember that you can rent and send your kids to schools where they can get only the cleanest dope and not get beaten up more than once a month. For a high income career you better be prepared to move (renting good, 40-year mortgage, neg equity, bad). And you don’t hurt your credit score by renting, as far as I can tell (although FICO was just an excuse to lend 800,000 to some Tzarbucks manager because he always paid his credit card balance every month) Of course I know stupid people who think they have lots more money than they do and there will always be some of them, but it takes a lot of buyers and sellers to move a market, and in case it hasn’t sunk in yet, this was the mother of all housing bubbles. I’m not at the high end, and folks I know are in serious trouble. If you’re not a Goldman, better get some popcorn because Planet of the Alt-Apes is the scariest movie ever, and this thing has a long, ugly way to go. If Mozilla Gorilla didn’t scare you, you’re either fearless or ignorant…he was the scariest of the Alt Apes yet, but there’s still the giant BOA lurking in the bushes that’s not done digesting Mozilla’s giant turd.

@hidflect:

To buy a home in the same neighborhood I currently rent around the same size would mean more than tripling our monthly payment. Maybe not the case for every neighborhood, but it’s easy to see that where I live it is far far better to rent.

Still there are many who are in denial about the worth of their home and you’re right in guessing that those who can continue to pay and don’t need to move probably will.

Doctor Doctor,

How many of those underwater mortgages are non-recourse loans?

Why would any bank write a non-recourse loan, especially in the past 2 years? Are they still being written?

William’s comment makes the craziness plain: take out $0.5m of equity, bank it, and walk away from the house.

I’m surprised the CPA’s you talked to weren’t aware of this, the feds aren’t getting shit:

The Mortgage Forgiveness Debt Relief Act of 2007 generally allows taxpayers to exclude income from the discharge of debt on their principal residence. Debt reduced through mortgage restructuring, as well as mortgage debt forgiven in connection with a foreclosure, qualify for this relief.

This provision applies to debt forgiven in calendar years 2007 through 2012. Up to $2 million of forgiven debt is eligible for this exclusion ($1 million if married filing separately). The exclusion doesn’t apply if the discharge is due to services performed for the lender or any other reason not directly related to a decline in the home’s value or the taxpayer’s financial condition.

If you take out equity from a house it turns into a recourse loan. The only way to protect yourself then is bankruptcy or Mexico.

doc, what about Venice??? There’s no or very little inventory on the market and with so many Venice mortgages under & banks not reacting I foresee one huge co-op city in the very near future.

What is a co-op city?

Jonah wrote “If you take out equity from a house it turns into a recourse loan.”

That’s interesting. A study came out a few weeks ago showing that most foreclosures were the result of people taking out massive equity, not due to people buying at the peak of the boom. These people must have had their savings wiped out or been bankrupted in many cases.

Have personal bankruptcies shown a big spike then?

In California, it doesn’t matter if a bank characterizes a loan as a non-recourse loan. If the loan was made at the time of the home purchase, and the proceeds of the loan were purchase money funds, then the mortgage/deed of trust on that laon is automatically a non-recourse loan.

Bankruptcy filings per quarter for California:

2001 38,543 42,616 35,485 33,819

2002 37,510 38,411 37,032 36,897

2003 36,622 38,052 34,511 32,417

2004 32,863 32,638 29,927 27,050

2005 29,593 35,812 43,358 57,946

2006 6,543 9,704 10,983 12,055

2007 15,041 17,050 18,778 21,758

2008 25,727 Â 32,387 Â 37,083 38,011

2009 Â 42,992 53,505Â

The spike at the end of 2005 and subsequent plunge are due to the bankruptcy law reform at the end of 2005 that made it much more difficult to file for personal bankruptcy to escape your debts. People with disposable income were allowed to keep their assets but still had to repay their debts – you can see how appealing this option was!

How about “Bankruptcies up 717%” for a headline?

Leave a Reply