A shifting of the real estate tides: Does negative equity matter? The case is being made for a Q1 bottom in housing inventory.

There has been a distinct momentum shift that has come from two major events in the mortgage markets. The first had to do with FHA insured loans becoming incredibly expensive even though these products are targeted as options for working families. As if a working class family is really in the market for a $729,750 property (the FHA max in high priced markets). That is one event. The second larger event has to do with the Fed hinting at a QE taper which sent the mortgage markets into a tizzy. This has definitely tempered the nearly unrelenting real estate mania that has been gripping the country. Incredibly, even after the quick turnaround in prices 14 percent of US homeowners with a mortgage are still underwater. Banks have leveraged a low supply market coupled with selective disposal of properties to their advantage. However, with inventory now rising thanks to the quick turnaround you are seeing some brakes being applied to this market.

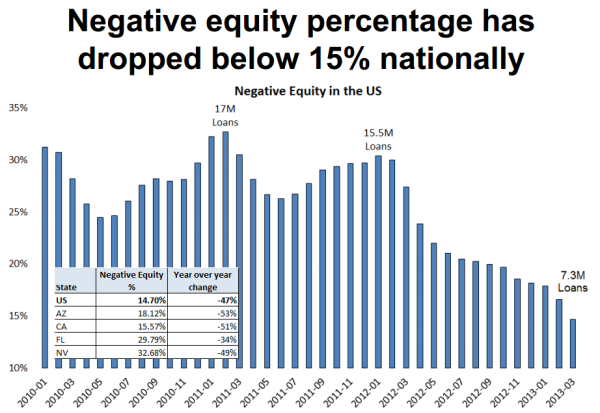

Negative equity still a very real issue

Somehow the media has forgotten that millions of Americans still owe more than what their homes are worth (just because the trend is falling doesn’t mean we are out of the woods):

Source:Â LPS

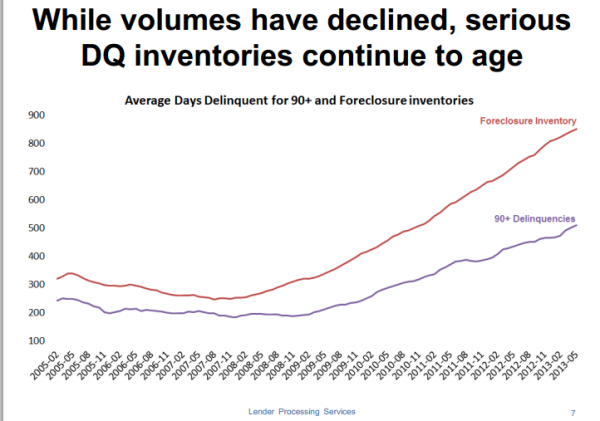

This is a very interesting report. You’ll notice that places like Nevada where investors are piling in hand over fist still see a market where over 32 percent of mortgage holders are in a negative equity position. But if you are underwater by $100,000 does it help you that you are now under by “only†$70,000? Ultimately you are in the hole. This is one reason for the historically low supply for the last couple of years. Banks have turned the foreclosure process into a purgatory while constricting supply and creating a feverish bidding market for the properties that are available. Don’t think so? Look at the age of some of these delinquent loans:

Yet that absurdity is slowly changing.

Welcome back inventory

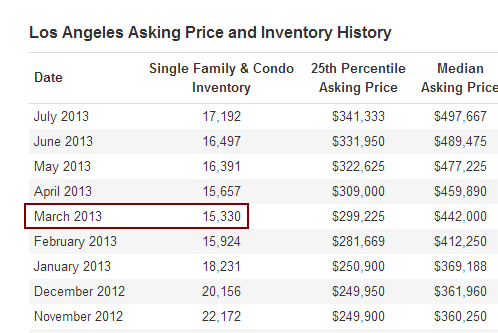

Nationwide inventory bottomed in early 2013. This trend is now being seen even in hotly fought after markets:

Inventory in the Los Angeles market is now up 12 percent from the low reached in March. Take a look at a selective market in Orange County:

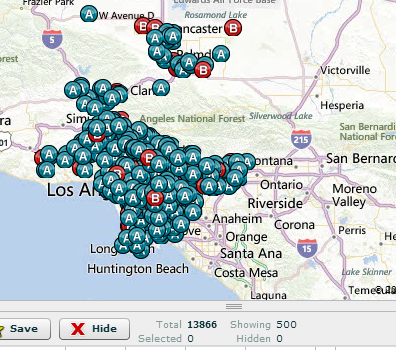

Inventory in Irvine is now up over 100 percent since the low made in March and is now back to levels last seen in early 2012. You will also find that distressed properties are still a thing of the current environment:

Los Angeles County has roughly 17,000 non-distressed homes for sale while 13,866 homes are in some form of foreclosure. The trend has definitely lowered but there is still a sizable amount of problem homes relative to available inventory.

Tiny signs of a shift

Sales usually fall first, inventories rise, and then if any changes occur you will see them in prices (and data on market trends will always lag one or two months since the escrow process lags a bit). I found this bit of market reporting interesting:

“(Redfin Blog) In LA, Redfin agent John Venti won three straight offers last weekend with no counter-offers or competition. “That hasn’t happened,†he said, “since December 2011.â€

Keep in mind the market has been in “the zone†since 2011. It can do no wrong. We recently had a headline that year-over-year home price increases set a record in SoCal. We also had a few months ago set a record on all cash purchases. Hot money is floating throughout the real estate market but something is definitely shifting. Does the mania have more to go or this something more substantive? Household incomes absolutely matter especially when many investors are buying to rent out (you pay rent from actual real world income and not leverage). You saw how quickly the market bent when rates simply went from the absurdly low 3% range to 4%. It was as if mortgage Armageddon had arrived. Which proves the point that households are fully stretched with easy Fed leverage so the Fed has to keep their foot on the gas pedal (but what use is it if the ultimate outcome is a benefit to big banks becoming large landlords and outbidding regular buyers)?

I’ve noticed the tide shifting a bit as well in the last couple of months. I’m seeing more price reductions and properties lingering (although many of these are priced at mania like levels). Yet these were moving in 2012. Are you seeing any shifts in the markets you are tracking?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

69 Responses to “A shifting of the real estate tides: Does negative equity matter? The case is being made for a Q1 bottom in housing inventory.”

The viewpoint from Miami is that similar processes are takin place.

Homes/condos are on market longer and I am seeing more “price reduced” on MLS listings sent from our realtor. But most of those properties are larger more expensive properties. In general though, there is a feeling of slowing down.

I know of one property, a duplex of 2br/1bath’s that was put on the market exactly 2 years after buying it. Asking price is more than the 2 rentals could pay to cover a mortgage. It’s now 4 months later and no price change. They obviously put a lot of money into and want to be compensated for it, but as you repeatedly mention, people don’t pay more rent then they can afford. So the current owner may be making some small yield, but the next buyer won’t be able to at the current price.

My feeling is 2014 is the year small investors try and cash out after tiring of having so much capital tied up.

Just keep in mind that this little rally has been completely engineered by the Fed — as the Doctor has pointed out, the fundamentals do not support it. Incomes are flat after falling for much of the last 8 years. We have an education debt bubble that keeps growing (the average college graduate starts out on average $30,000 in the hole). Baby boomers are retiring and downsizing, many don’t have enough to retire on. The rich are doing well, the stock market is doing well, but the middle class are struggling.

We are going to hear good news about prices for another month or two because the information is lagging. Then it will flatten out. Then it will start to sink again. The quick-hit investors and flippers are done — they got their pop. Soon we’ll be back to the slog.

I agree this run up in home sales right around the elections seems to be all engineered to look like a political stunt. Why was it done sooner? That equates to another 4 years of this QE going forward in my opinion. However, it should start tapering off this new term and maybe further reduced or ended near the end. The other possibility is the next president is saddled with QE to infinity. Let’s pray it ends sooner than what we would like to believe. We don’t need to copy Japan’s model.

Speculation: I wonder if there will be a vendetta to make the second term for the president not so rosy for home owners? Seeing some of these bills coming out to restructure Fannie Mae and Freddie Mac to makre it harder to get loans would certainly put a damper on this market if they ever got passed.

Lots of houses are coming on the market now where I live in San Diego. The most I’ve seen in years but they are all listed at the highest prices I’ve seen since the crash. The prices are not dropping one bit either, but nobody is buying them anymore. They just sit on the market for a few weeks then the seller removes them. And I don’t think for one second the fed is going to taper. If the fed does rates will go through the roof and wall street will crash. The fed has painted itself into a corner. One day the free lunch for wall street and the banks will end and its going to be ugly but the fed will have run the US dollar into the ground before that happens. God help us all.

Thanks for another good blog by Dr. HB. Like him, I’m apprehensive of a change of the financial tide. As I believe even the FED is not capable of keeping rates down that low for very long. And rising rates will lead to a bloodshed in more than the bond market. The impact on RE will be catastrophic, too!

In 2012 someone bought a condo I was renting in Bangkok sight unseen. But now the PM company cannot even fix the elevators as it has been unable to collect some 25% of the HOA fees for many years and counting. They publish the apartment numbers of the deadbeats – many of them own penthouses on the top floor. Those of you buying in a condo (overseas) need to check out this issue…

I am a Broker in San Diego County. The inventory situation in the zip codes I’m most familiar with increased dramatically. In the 92071 (Santee) inventory has spiked in both SFR and attached homes.

But, but, Doc… My crystal ball says that you’re all stupid for having any sort of prudently skeptical foresight and a couple years ago the boat made it’s final stop forever! Forever!

Joe, this boat certainly didn’t make its final stop and leave forever. It will come back to port one of these days. This thing has a lot of inertia and making a 180 degree turn takes lots of time…especially with Captain Bernanke and his henchmen at the controls.

The tragic part of these bubbles is that they usually last much longer than logic or reason say. Housing bubble 1 should have seen a peak in 2003, but it lasted another 4 long years. Then there were several years of unwinding where people were still nervous to buy. That is a big chunk of time! We will see how this latest upswing ends.

I believe you are both right for what may happen short term and in to the future.

However, considering what NAR along with the FED , FHA, etc need to do to get all other non-cash buyers to take advantage of this once in a life time opportunity to get one of these immaculate homes either the realtor has to be very convincing to sell to someone that may want this type of lifestyle or tell them to wait for the market to cool down or try some other location less desirable. The housing hysteria is not permanent and it is already showing its cracks. Returns in homes since the years of 2005-2007 were not sustainable even though it has been repeated within the same time frame now. Low interest rates started this problem and now we are in the bottom of the 9th inning with interest rates starting to creep up which was analogous with how the last housing crash eventually occurred. Of course this time around cash buyers will only have themselves to blame if properties drop. We’ll see if the cash buyer was buying a home for long term ownership. If not they probably knew it was not sustainable.

Here’s a July 24 article about rising mortgage delinquency rates in June, after falling for the last four months —

http://www.thestreet.com/story/11989057/1/mortgage-default-rate-spikes-in-june-lps.html?puc=yahoo&cm_ven=YAHOO

Absolutely seeing a HUGE shift in inventory in my suburban area east of Sacramento. I get email alerts for new listings and price changes and they are coming thick and fast now. On average 6 new listings a day and as many price reductions daily.

Still seeing some stupid/hopeful listing prices but most end up making on average 10% price reductions before they go pending. And its taking a lot longer to go pending. A few months ago ANYTHING that came on the market in Folsom/El Dorado Hills went pending the same day.

The rate move and FHA rules sure affected the market where I live. I reason it to not a lot of investor activity here due to can’t get the rent to cover the mortgage in these middle to upper middle class homes, So mostly families buying the local inventory, and I’m betting a lot of those families are using FHA or even conventional loans, and that rate rise make a huge dent in affordability.

Absolutely there has been a shift in the sacramento area. Inventory has risen 30% from 45ish to 67 homes over the past 45 days in my filter. Granted the quality is very poor for the price and rates have now risen. I think sellers will continue to face this as we weren’t prepared for 30% to be taken in a speculative fashion on the prices all in 1 year. That’s about 4 years of responsible equity all in 1 year. Someone entering the market today probably understands the dynamic is a little crazy and doesn’t necesarily benefit them. With the rate shift and price increase I had worked out the math to challenge the housing bulls. The scenario was a 300k home 12 months ago compared to today. I did 25% increase in price and changed the rate from 3.5 to 4.5. $600 more in monthly payments plus an additional 170k paid in interest over the life of the loan is what I think the difference was. Pretty substantial difference for the exact same home 12 months later.

Either way, with relatively flat wage this rocketship to the moon called housing seems like it will reach some limitations. Investors are pretty much gone because there is no yield left to squeeze I think, which doesn’t make it good for Joe homebuyer either. But at least for now it is taming. Maybe the fed tamed the market to prevent momentum for another crash. Who knows?

Maybe this is the soft landing approach to the housing crash? Prop homes up a little for others to get out at a smaller loss then the new buyers pick them and then take another small loss. So not all buyers are down 50% but will be down about 10-15%? That would probably be a safer approach instead of getting everyone all in and then have everything crash once again even further down. Seems it bit fantasy but it seems the FED might be doing this to ease the housing issue. Adding interest rates to the mix will temper interest as people look for new entry points.

I agree with HOMERUN

That’s this selling may help many people reduce losses.

I think the question DR HB is chronicling is that with all the quick flipping

You eventually run out of flips. Someone will get caught high and dry. Maybe this time

It will be the flippers and investors who are in for all cash. Or even the hedge funds as well.

I think a lot of small investors will want their cash back soon. Higher home prices lead to higher tax assessments. Here in miami it’s close to 2.5 % to make up for having no income tax. Some people will see their taxes double or triple of they bough from a flipper in the last year.

I have friends who bought a home for 300k in January. It was last assessed at 50k and the taxes were $1500 before they bought it. Their first tax bill will be close to 6k at end of the year . That’s going to happen to a lot of these recent buyers and investors .

We will see how it plays out at the beginning of next year.

Or It all may be wishful thinking on my part.

Tank this market! Time to tank! F the Fed.

Yes, I hope everyone who bought looses, looses big! I can’t believe how badly I want them to all go BK. Hooray for housing’s downfall!

I hope they don’t.

Someday we might be able to fight the FED. However, it will need the occupier movement to do it along with a lot of disgruntled tax payers from all fronts.

Most investors now believe three things about the Federal Reserve, money and interest rates. They think that the Federal Reserve is artificially depressing rates below what would be a “normal” level. They believe that in the process of doing so the Federal Reserve has enormously increased the supply of money and they believe that the USA is on a fiat money system.

All three of those beliefs are incorrect. One benchmark rate that he Federal Reserve has absolute control of is the rate paid on reserves deposited at the Federal Reserve. That rate is now 25 basis points, after being zero since the inception of the Federal Reserve in 1913 until recently. If the Federal Reserve had left that rate at zero t-bill rates would now be even lower than they are now. The shortest t-bills rates would now probably negative.

Paying interest on reserves combined with the subsidy to the banks of providing free unlimited deposit insurance on non-interest bearing demand deposits is keeping t-bill rates positive. Absent those policies the rate on t-bills would be actually negative. The Chinese and others all over the world are willing to pay anything for the safety of depositing funds in the USA. Already, Bank of New York Mellon Corp. has imposed a 0.13% charge on large deposits.

An investor who believes that interest rates are headed up may respond that the rate paid on reserves is a special case and that the vast increase in the money supply resulting from the quantitative easing must result in higher rates when the Federal Reserve reverses its course. The problem with that view is that the true effective money supply is still far below its 2007 level.

Money is what can be used to buy things. Historically money has first been specie (gold and silver coins), then fiat money which is paper currency and checking accounts (M1) and more recently credit money. The credit money supply is what in aggregate can be bought on credit. Two hundred years ago your ability to take your friends out to dinner depended on whether or not you had enough coins (specie) in your pocket. One hundred years ago it depended on the quantity of currency in your pocket and possibly the balance in your checking account if the restaurant would take checks.

Today it is mostly your credit card that allows you to spend. We no longer have a fiat money system. Today we have a credit money system. Just because there is still some fiat money does not negate the fact that we are on a credit money system. When we were on a basically fiat money system there was still a small amount of specie in circulation. Even today a five cent piece contains about 5 cents worth of metal, but no one would claim we are still on a specie money system.

Fiat money is easy to measure; M1 was $1.376 trillion in 2007 and was $2.535 trillion in May 2013. The effective money supply is the sum of fiat money and credit money. Credit money cannot be precisely measured. However, When the person in California whose occupation was strawberry picker and who had made $14,000 in his best year was able to get a mortgage of $740,000 with no money down and private equity could buy a company like Clear Channel in a $20 billion leveraged buyout, also with essentially no money down, the credit money supply was clearly much higher than today. A reasonable ballpark estimate of the credit money supply is that it was $70 trillion in 2007 compared to $50 trillion today.

The effective money supply is the sum of the traditional fiat money aggregates plus the credit money supply. Thus, despite the clams of Ron Paul and Rick Perry to the contrary, the effective or true money supply has fallen drastically over the last few years.

The decline in the total effective money supply is why the recovery from recession has been so sluggish.

http://seekingalpha.com/article/1514632-federal-reserve-actually-propping-up-interest-rates-what-this-means-for-mreits

Flippers and investors have left the building. It will be interesting to see what kind of sales will be left. All indications point towards a peak in the market. Banks have 2 years left before the suspension of mark to market begins to expire in 2015. I’m curious where interest rates will be by then.

http://Www.westsideremeltdown.blogspot.com

http://Www.santamonicameltdownthe90402.blogspot.com

… and let us not forget 12 U.S.C. §29. Power to hold real property allows banks to keep foreclosures off of the market for a maximum of 10 years.

Unless banks get cold feet and decide to start dumping inventory today, the largest volume of the garbage mortgages were issued in 2005, 2006, 2007 and 2008, so we are getting closer to the end game.

We are in the eye of the hurricane. 2009/2010 was the leading edge of the hurricane, 2015/2016/2017/2018 will be the tail of the hurricane.

i wouldn’t be surprised if a new provision is added to allow the banks to hold a certain portion of inventory indefinitely, or the holding period be extended another decade. that’s the way things have been going it seems. or who knows, maybe banks get around the issue by packaging and selling delinquent accounts to each other and figure out a way to reset the timeline.

like the 100 other things that should have, but did not happen according to rules, logic and fundamentals… it’s hard to predict activity on a set schedule. they occur at odd times at points where the Fed decides systematically (but seemingly random to us) to cut losses.

The question is which numbers that are available to the public (if they are at all) are relevant to what they plan on doing next.

Exactly, the Fed/PTB have a completely unfair advantage here. As witnessed, they can change the rules to get their desired outcome anytime they want. This is what is driving people up the wall…this behavior isn’t going to change anytime soon. Why not just accept it for what it is and base your decisions on that. I highly doubt we will wake up one day and the financial world will all of a sudden be based on logic, reason and fundamentals. We haven’t seen this for over a decade!

Yes, the banks will certainly lobby for an extension. In the TBTF “public interest” of course.

So are we reaching Stage 3 already? If the general masses and your locak barber are noticing, I would think so. I’d say with rising rates and inventory, coupled with autumn coming, its probably topped out now. I think prices are about 10 to 15% overvalued right now, not too gross but we will see.

Culinary curveball – does the fed have a hat trick left? Federal socialized 2% loans for all?

Another person clueless about the definition of socialism. You do know the FED is just named “the Fed” right? He’s actually out there for the benefit of his banker buddies.

What are you talking about?

No way Papa, how would the banks make money off of such loans?

For the sick fun of it I told my husband that “May 2013” + maybe a couple of extra weeks was my vote for top of the closings, in North San Diego County. The only place I really pay attention. Carlsbad Oceanside Fallbrook Bonsall.

The commenter mentioning the extra amount of prop taxes is so right. Another round of buyers will be buried in PT, Ins, lawn, water, G & E. and Home Depot/ Lowes trips.

Will Ben just drop the rates right back down pretty soon, if he gets scared. I guess so, unless the bankers with their hands on his neck say no way. Or they ignore him with long term rates staying higher anyway.

Trying to catch tops and bottoms are fool’s errand. Nobody know where it is. And those who say they do – are wrong almost every time.

You buy a house when you want is and when you can afford it.

Dr. HB asked for opinions. I gave one as an observer (worth nothing, but fun). I own my home and hope things get cheaper for the young

How can someone purchase this place in Mid City for $80,000. I watched the flippers work on this place for 1 month and they have not been back to take care of the place. The new grass is almost a foot high.

http://www.zillow.com/homedetails/1238-S-Muirfield-Rd-Los-Angeles-CA-90019/20606630_zpid/

Price History

Date Description Price Change $/sqft Source

06/19/2013 Listed for sale $488,000 510% $383 Coldwell Banker Dynasty Arc.

03/23/2013 Listing removed $80,000 — $62 Auction.com

03/08/2013 Listed for sale $80,000 -73.1% $62 Auction.com

Auction shows no history of this sale. Unless they only show active material. This may have been an inside transaction? The bank is probably the lucky winner of this home. Another thing the price is a good clue into this. Any other person would have easily bid this higher. Something you and others don’t have access to.

Pretty much every home that comes out through Redfin lately is a flip. Bought a month/two earlier for $300, trying to sell it for 480+. They are nearly as overpriced as they were in 2006.

“That men do not learn very much from the lessons of history is the most important of all the lessons that history has to teach.” Huxley

Cash buyers,all was done is pump money into “the money pit”

Frontrunning today – US home sales down 1.2% in June.

Now one thing I don’t understand, is all this reporting that “home prices are up but still down XX% from their peak”. This makes no sense, the “peak” was a funny money induced sugar high that included fraud from all sides of the table, and creative loans not meant to be used by Joe Sixpack. All the 3% rates in the world can’t bring back 2 years of fake low payments (2/28 loans that had the 100% default rate at the end of the bubble).

I also don’t subscribe to the theory that home are undervalued in any way. The American consumer walks into a bank, gives his income, and they tell him how much home he can buy. If it’s $250k at 3.5%, it will be less at 4.5%, therefore home values are unsustainable.

If we lived in a society where it was known fact that people spend less than they should, then sure I would believe homes can go up. But we don’t, so I don’t believe it. The proof is happening in front of us and has been for 9 years now. And even more in some markets like consumer credit. Research “leverage” and find out how f***** most Americans are.

“all this reporting that “home prices are up but still down XX% from their peak— makes sense from the denialist POV that there was no bubble. From this POV the job of financial policy is to get prices back to their peak and then beyond.

Negative equity does matter. Those with negative equity would still have to either get approved for a short sale or come up with the difference to make whole of their loan. Though it may be the smart move now, I doubt many folks have or are willing to throw away their remain savings to get out of their negative equity homes.

Here in the back woods of oregon this is what i’m seeing. Many vacant houses with no for sale signs in the yard. Flippers that bought in 2009 on FHA (farmers Home ADDmin.) having loans at 2 1/2% sitting on houses and asking 100k over what they paid.

Having gotten in for nothing down and paying 2 1/2% they can sit on their property for a long time. Two that i liked were priced 100k over a full 40% over their purchase price in 2009.

I will not feed flipper madness.

Existing home sales dip in June:

http://money.cnn.com/2013/07/22/real_estate/home-sales/index.html

@Janum, and the June sales figures are based on escrows that opened in April when interest rates were at 3.25%. Escrows typically take 45 to 60 days to close so the October sales figures with mortgage rates at 4.5% should be very interesting as they will reflect one full month into the higher rates.

Mortgage applications plunged 40% last week so I’m smelling market top.

I foresee a day a few years into the future where there is NO demand for high-priced housing and this whole thing will crash. In the Bay Area I see tons of homes owned by baby boomers and older people. I don’t think their kids have the income to buy similar places, so they will inherit their parent’s places. This will mean those children won’t be in the market for a place of their own lowering overall demand. I see a lot of Boomers selling houses, but refusing to sell for anything less than exorbitant pricing – eventually the damn will break and their will be a flood of inventory. I also see a lot of urban areas becoming so gentrified that they start to lose their appeal. SF is basically dead for me – just a bunch of rich, boring tech people, not the artists and creative types that made the city interesting for a person like me.

There are many ways this party could end. However, four visions come to mind:

1. Inflate to infinity until Rome collapses again.

2. Inflate and hope the economy comes roaring back with the next great innovation.

3. Deflate while new innovations come to market.

4. Deflate and accept Ponzi schemes don’t always work and a more meaningful way of living must be adopted to sustain society.

inheriting a home might lower the number of buyers, but that also limits the number of sellers. boomers aren’t gonna hold on forever. home’s gonna do them no good after they are dead. they’re eventually going to sell if they have no one to give it to (in exchange for some side income from the kiddos)

After having lived in both the LA area and the SF Bay Area, I think anyone who buys a house in those areas are crazy. There are millions of people crammed into unsustainable cities that are totally dependent on bringing in huge quantities of fresh water, food, and other essentials from long distances. If there is a major earthquake, a financial meltdown, or some other major calamity, it will get ugly very quickly. Those areas are death traps waiting to happen.

I hope all the flippers get stuck holding the bag.

My thoughts are that high housing prices result in greater perceived wealth, therefore increased consumer confidence for this so-called “recovery”…which is a reason for low interest rates. Gotta keep the cycle of consumption going somehow.

I also think the nature of currency has changed in our world – my brother’s girlfriend works for a company that seeks out properties to buy for cash and rent out. She searches for them, files the paperwork, and if the company buys them she gets a $500 “commission”. What I think these companies understand is that money in the bank does nothing for them, the stock market is a rigged casino so putting cash into a hard asset that produces cash flow is the main goal. I’ve read stuff in the past where big names (Peter Schiff, Jim Rickards type people) have suggested investing in things that produce a monthly cash flow. Whether or not this is what’s happening, I don’t know – it’s just an observation from connecting the dots.

Papa, perhaps I misunderstand your anti-left/government rantings in regards to the FED?

You seem to be of an opinion that the FED is somehow part of the leftist/socialist/government plot, and that the “Free market” is the way to go. While many see the “FED” simply as the corporate bank crony.

Well here’s a good article to explain what the “FED” is doing to all of us. (How Quantitative Easing Helps the Rich and Soaks the Rest of Us)

http://reason.com/archives/2012/09/13/occupy-the-fed

Interesting article and data from Zerohedge today:

“no country for first time home buyers’

http://www.zerohedge.com/news/2013-07-23/no-country-first-time-home-buyers

“The depressed level of first-time buyers could prove to be a drag on the housing rebound and the broader economic recovery over the longer haul. First-time home buyers are the foundation of the real-estate market and are major contributors to their local economies, often buying up older homes, revitalizing communities and spending money on furniture and renovations.”

This seems so familiar with the student loan debacle. Price students out of affordable college and then take on student loans they may all likely never pay back depending on job prospects. This definitely feels like the same game being played with housing. In my opinion i expect we will see exotic loans and arms reappear in mass to get these people to buy again.

My instinct tells me that we will see the return of subprime mortgage schemes soon enough. Perhaps labelled differently than last time, but the objective and the players will be the same. This type of creative financialization is so persuasively built into the systemic structure of the government/banking partnership that it’s simply their default option.

That’s the sell signal I’ll be on the lookout for.

It’s not really shocking if you live (or want to live) in an area of SoCal without bars on the windows, but interesting to see that this may be a national trend.

I gave up some time ago as the only way we’re seeing a title in our name is if it somehow ends up being passed along to us. I realize that is a depressing thought, but it’s a little easier to digest than strapping on a 400k+ debt with no guarantee that I won’t lose it in a year or two.

My new goal is to develop a somewhat passive income stream and avoid a home purchase.

That’s smart. One does not need a land deed in order to be happy.

Sorry to tell you guys but as long as a $500k house with 20% down @ $2.5k/month after PITI , you’re not going to see houses drop until interest rates shoot up. That’s the ONLY thing that will make house prices crash.

Gee, thanks, Nostradamus. Alert the press, the crystal ball has been found!

So Joestradamus, what date should we expect the housing crash and by what percent will housing go down? It would be nice to hear specifics from those that seem to have all the answers other than the same stuff on here rehashed over and over forever like fundamentals don’t support current home prices, banks like to make money without morals and will likely lower their lending standards, the fed is a corrupt private entity owned by its member banks, etc.

Seems to be the only way to appease the natives is give them what they want. Make sure politicians are looking out for new buyers or the middle class that need financial assistance or special bent/lending standards to keep the wheel spinning. Sure sounds like a great deal? I think once bitten people wise up to this and usually try to avoid making the same mistake.

Question for the Psychic and sideline buyers is how high are banks and the FED willing to go for the middle-class to feel the pain of “being left behind” until they cave in and sign on the dotted line of one those sub-prime loans again? This is a simply a test of patience and/or defeat. Red or Blue Pill.

Someone or group will probably intervene before we get to that stage or maybe your local Tea Party advocates?

In my opinion, there is still the question of value in these homes that is still going to come into play here. If wages are not keeping up with inflation then home values should contract to meet that demand. Of course it will depend on what job you are in and where you live that will make all the difference.

Yeah, FTB, it would be nice to know how the future is specifically going to play out. I reckon if any of us actually had that ability, we wouldn’t be here debating the possibilities.

Something I won’t do is make a guess and frame it as a fact.

I foresee ‘occupy that house’ or ‘ occupy that yard’ coming to town. The occupy movement may have something else to gripe about.

Call them what you will (ineffectual, misguided, naive, etc.), but by accurately describing Occupy as a “movement,” you are also inaccurate in attributing what they were doing as merely “griping,” dismissive tone notwithstanding.

The Hollywood Hills/Santa Monica markets just seem to have fewer short sales than in the recent past. Homes are selling fast at close to bubble prices. Not much sits on the market for long and the inventory is still low in the under 1 mil range. I just saw one bank owned home for sale over the weekend. There were huge problems with it, but the bank was asking for over 1 mil for it.

In my opinion it seems that the banks/FED will drag out this artificial growth at the time Obama leaves office. However, something tells me this correction could come sooner. Since the FED started this QE plan before the next presidential cycle makes me believe this will probably last to about the beginning of 2015. By that time we may have interest rates higher and more tapering off of QE.

I have recently noticed many more homes in So Cal with reduced pricing changes. I also noticed a little more inventory overall, but it still turns into Pending in less than 1 week usually. I also noticed the Agents are doing Open Houses on Saturdays and Sundays again. Clearly there is still a strong buyer demand, but it does seem the tide is slownly turning…

@ MarcoT I had lunch with a successful active real estate broker (specializing in listings in Santa Monica, WLA, Mar Vista, Culver City) last weekend and we talked about the surge in home prices. He said the surge in prices is due to “all the arrogant people (buyers waiting it out) who thought house prices would continue to fall deeper than they did in 2010, 2011. Now they realize home prices may not go down again and are in a flurry to buy this time”. Interesting comment. I asked him his opinion on what will happen when interest rates rise and he said: “there are so many of these first time buyers still eager to buy and all the people who were foreclosed on last time who can now quality to buy again that prices will stabilize but not crash again”. Anyway, I dont support or condone him, but there was the perspective of a successful listing broker who has been making lots of money for the past few years.

Your friend is biased, of course, and needs rose colored glasses to maintain their choice of career! lol. *I note your last sentence you don’t condone him.

OTOH, as I’ve said before, an uncle in South County has the exact same career. He at least has a vested interest in not seeing me get financially hurt, and yes there is hypocrisy as he makes his money doing those very things “people want” regardless what happens in the future, but I digress…

He told me the latest surge is no good. Things were pretty stable 6 months ago, and prices would fluctuate inverse to interest rates, with monthly payments staying the same. However, now prices have a good 10% to fall and maybe more in the IE. Not good.

Another Realtor perspective http://youtu.be/8-EEKlrgDqQ

It may take a while but hell Troy wasnt destroyed in one day either. This sellers market will slow just for the simple facts that as more people put their houses for sale it places pressure on other sellers and buyers having more to choose from are going to be more willing to get up and walk away from the negotiating table. As more inventory comes up for sale it will put pressure on prices. If too many pople try to sell at once the market floods and demand simply drops because of the flood of homes. Never mind the possible hike in interest rates which will seriously hamper purchasing power from buyers who are stretched to the limit who will abdicate and sit on the sidelines. So at that point you have a shrunk pool of buyers and possible surplus of homes.

Unless lenders start bringing sub-prime loans back which is always a possibility. I’m sure they will have some creative name. If there is one thing bankers and lenders can do is screw the average consumer out of money.

Anyone see that movie clip about how the banksters robbed us? Take a circle of 10 people and give them $100, thus each owns 10% of the money supply. Then make one of the 10 a banker, and another the Gov. Put them in cahoots with each other, the Gov “gives” the banker permission to print money, in exchange for some of it. Suddenly the banker and Gov each have $500, but the other 8 still have $100. So now they only own 5% of the money supply. They can only buy 1/2 as much as before.

Ya got robbed and they didn’t steal a dime of yours.

21st century “white collar crime” on the population is so sophisticated most people don’t even know they are being robbed. Unlike purchase decisions, participation is involuntary here. This fiat currency “game” appears to be global, someone really has a lot of brains if it was engineered on that scale. The desperation of (foreign?) investors to get money into hard assets kind of tells me they expect that situation to worsen.

I am an active Realtor in the So. FL region. Not many of your responses related to medical issues which have a very significant bearing on all potential buyers. New huge medical expenses, family or parents create significant changes in location, property type and financial resources. My activity of late has required a more intense evaluation of every aspect of a transaction.

Leave a Reply