Real Homes of Genius – Culver City and the next Phase of Housing Price Declines. Home for Sale at $779,000 and Home Across the Street Sold for $200,000 in 2000. Bubble Priced Homes Entering Precarious Financial Test.

The median home price of a home sold in the U.S. is now down to $165,000 sending us back to nominal levels not seen since 2002. While the stock market is up 70+ percent in one year, housing as the store of most of American’s net worth is still limping along at the bottom. No bounce in this asset class. This of course should not be a surprise given the magnitude of this housing bubble, something not seen since Florida in the 1920s. Only difference this time is that it went national. During the Great Depression roughly 40 percent of Americans were considered home owners. Those that owned actually had to come in with more funds and ironically, they did better that time around with homes maintaining 70 percent of their value while stocks fell 89 percent. California as a state has surpassed that mark with real estate values down nearly 50 percent from their peak values. More Americans this time around are also home owners which spreads the pain around.

Let us look at what is going on at a national level, and then drill down here in Southern California:

Source:Â Bloomberg

It is interesting to see the bump from HAMP and also the tax credit. That was short lived of course since the employment situation hasn’t really improved much in that time. Most of the jobs added last month were low paying positions. As the chart above clearly shows, we are now back to the low point again. People simply cannot afford to pay higher prices for homes as their wages cut back. Yet the $165,000 median price is starting to make sense in many states across the country. However here in California some areas are blissfully in a state of peyote induced delusion. They are still in bubbles and will soon pop. Culver City is one of those markets. Today we salute you Culver City with our Real Homes of Genius Award.

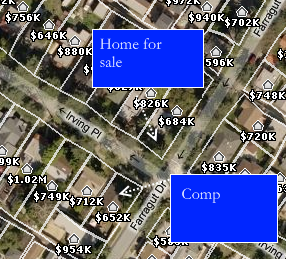

Culver City – $779,000 or $200,000 across the Street

The above home is in a nice part of Culver City. This isn’t a distressed sale. The price tag will reflect that. This home is a 2 bedrooms and 1 bath home listed at 1,012 square feet. It was built in 1922 during the Roaring Twenties.  It has been listed on the MLS for 2 days. The current list price? $779,000. The bubble mentality is back in force.

I tried finding sales history on this home but didn’t see anything listed which seems odd. So I decided to look right across the street:

The home right across has the following details:

2 bedrooms

1 bath

1,078 square feet

Built in 1938

Seems like a reasonable home to use for comparison. Now this home is not for sale in Culver City but it did have some sales history. Fortunately for us the sale took place right at the birth of the California housing bubble:

Sales History

Sold 01/28/2000: Â Â Â Â Â Â Â Â Â Â Â Â $200,000

So my question to you astute reader is this, did the house that is currently selling for $779,000 really appreciate some $579,000 from 2000 to 2010 in what is arguably the worst economy for California in the last century? Or in other words, the home went up in value on average $57,900 per year for ten consecutive years (the median household income for California each year simply for being in Culver City). When you look at things like this, you know full well these cities are still in massive bubbles. Income in the area certainly did not go up to this level and unless we have some gold plated toilets in the home, this current price is in a bubble.

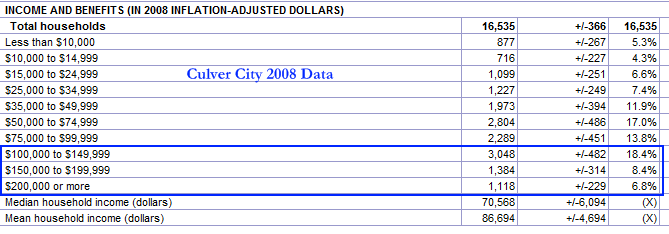

But let us assume you are a working couple with a household income of $120,000. This is higher than the mean household income for the city.

Source:Â Census

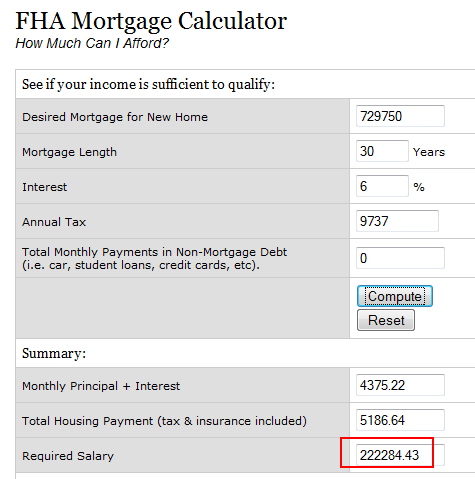

So how many people can afford this home? Let us run the numbers first. Thanks to the geniuses in our government and their corrupt henchmen in Wall Street they have decided that even though the nationwide median price is $165,000 that FHA insured loans should go up to $729,750 in some areas. This nonsense that home buyers are putting down big down payments is baloney. In Southern California last month nearly 40 percent of all homes were bought with FHA insured loans. The CAR had data showing that the vast majority went with the minimum 3.5 percent down payment just like option ARM borrowers make their minimum payment. The all cash buyers were buying properties up in the Inland Empire and other depressed markets.

So let us run the numbers now:

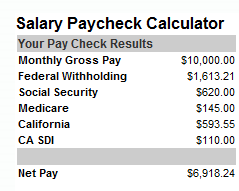

The above is assuming we are putting down $49,250. The required salary to purchase this 2 bedrooms home is over $200,000 and only 6 percent of current Culver City residents even fall within that category. That working couple making $120,000 has no way of buying this place at the current price. This is their monthly take home:

The mortgage payment is nearly $5,200 per month yet they bring in $6,900. In other words, the housing payment eats up 75% of their net pay. This won’t even fly. Yet I somehow find it hard to believe that someone making $200,000 or more wanting to buy this place in Culver City. So what will happen? One option is suddenly wages fly through the roof and everyone is a six figure household. That doesn’t seem likely given our massive state budget fiasco and the fact that new jobs are lower paying with fewer benefits. The other option is prices come down and come down by a lot. For some of these areas that is the next road ahead.

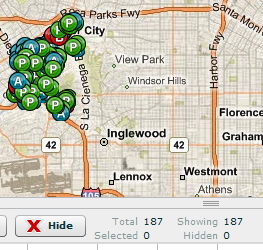

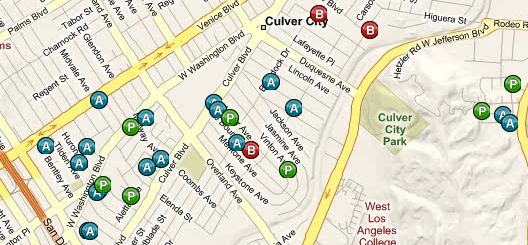

And if you don’t think this is true you are mistaken. The MLS has 113 homes listed for Culver City. But when we pull up the shadow inventory we find 187 homes listed:

Oh and how the problems run deep.

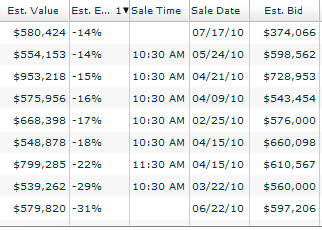

Now how can a supposedly prime area have so many problems? And many are scheduled auctions and the bid is far from the estimated value which is inflated:

In other words, prices will go lower. But you probably already figured that out if you read this far.

Today we salute you Culver City with our Real Homes of Genius Award.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

27 Responses to “Real Homes of Genius – Culver City and the next Phase of Housing Price Declines. Home for Sale at $779,000 and Home Across the Street Sold for $200,000 in 2000. Bubble Priced Homes Entering Precarious Financial Test.”

Prices will go lower. But not just yet. If you get an FHA loan and you only need a 3 1/2 % down payment. And if you get a $10,000 tax credit California is now giving to some home buyers, you can practically get this house for free, just like in the good old days of 2007. What? You can’t afford the mortgage. Don’t worry. The taxpayers will come to your rescue.

I’m not too familiar with Culver City…what is so speical about it that commands these premiums? If these houses are truly selling for this price, we are back in major bubble territory. Most people just can’t seem to get the notion out of their heads that housing at it’s current prices in some of these areas is way too expensive. When you need a 220K+ plus income to buy the featured POS…there is something really wrong!

Awsome article Doc ! We salute you for the insight.. Similar trend here in Burbank too where I have been renting for 10 plus yrs and still cant afford a home with $136,000 annual income..

Worked there in 1990-91. Not a place I would like to buy a home. When I was working in Culver City, we lived in Tustin (Orange County) and endured painful commute on 405 before giving up and moving to north San Diego County.

What happens when FHA loans start to go bad at a massive rate? FHA is already seeing a much larger than normal % of loans go bad, mostly recent vintage loans. Fed Gov is basically buying up all MBS on the market because no one will buy it at these inflated prices. If FHA is not able to loan anymore, funding will dry up and prices will drop. If interest rates go up in the near or long term, buyers now are decimated. Now is not a good time to buy at these prices at all.

Also take into consideration that the current generation of 20-somethings will face lower earning power over their lifetimes meaning fewer qualified buyers at these prices into the next decade and beyond. The LA market is also facing economic pressures due to the fact that there are no growth industries in Southern California, and SoCal has a huge supply of workers which further depresses wages. The industries that currently employ many people in LA are all hurting and finding ways to cut costs, which means layoffs or hiring/wage freezes. If you look back 10 years, $780K would have bought you a mansion in Los Feliz, and now it buys you a crapshack in Culver City. This is not a sustainable price considering wages in LA are pretty low, which was fine when it was cheaper to live in LA than other major west coast cities, but is patently ludicrous considering LA County UE rate is 12-13%.

If someone wants to buy a closet in Culver City for $700K, I’m not going to tell them not to, but the house will depreciate and it will be difficult to pass their bad mistake onto a greater fool.

I live in Culver City and I can confirm that the Bubble Mentality is still alive & well here!

Denial ain’t just a river in Egypt, eh? 🙂

Even more astonishing is the info in the article — I haven’t been staying current, but it’s shocking/saddening/maddening to learn that a) FHA loans can now go up to $729K, b) that most of these are 3.5% down (GET SOME FRIGGING SKIN IN THE GAME), and c) that nearly 40% of homes bought last month were under such terms. This is extremely troubling.

God, when is it going to stop? Our government has sold us down the river….

Its fascinating out there….try talking to some of your co-workers….its as though the bubble never ever occured….

Delusional is the key word of the day….Just check out this realtor’s blog:

http://sfvrealestate.blogspot.com/

Hey Doc,

I appreciate your website, but please stop fudging numbers on your side of the argument to make a bigger point. I have 20% down to put on a house up to $600,000. Many others have that amount for their purchase as well. That’s not to say others won’t purchase with a minimum 3.5% or something similar, but you ought to error on the best scenario rather than the worst. Same with calculating at a 6% interest rate when it’s currently at 5.25%. Your point will still be made.

One last adjustment. The huge tax deduction from the interest. The buyer in your example will have an extra $1000 a month in pocket when he deducts property tax and interest. That’s another big chunk your leaving out of your argument.

I attribute the California homeowner delirium to progessive education, processed food, and sensory overstimulation combined with a drug induced sense of entitlement. Picture if you will the typical California homeowner as the offspring of a union between Brittany Spears and Homer Simpson.

I think this is selling for land value only. I drove by though and if you tore this down and built a new house you would be the nicest thing in town. Almost every single house in the surrounding neighborhood feels like it is pre-war construction. The other houses that have sold in this price range are livable and as others have said it doesn’t require much to get into the game. Developing this land though is a totally different story. It’ll be interesting to see if anyone buys this thing.

How long can the govt keep a floor under this real estate market? The private wants nothing to do with these loans. The ten and 30 year treasury are starting to creep up and if they continue on this path, the US Govt may have to stop support. But it could go on for a while yet.

Just today the MSM is speaking openly of short sales. Of course they could have read about that here a long time ago. A wave of short sales could not help but change comps. Oil approaching 90/bbl. Even if there were a recovery under way, which is just semantic nonesense from what I see on the ground, $3 gas will pull the rug out from under that. Funny they can’t seem to give natural gas away and oil pushes 3. It is all bull.

The free market, if there really was one, is so far away from the current reality it is absurd to even mention it. Like saying the weather man can change the weather by forecasting rain. Unless you can figure out the games going on behind the scene it is futile to think things will ever be simple cause-effect, supply-demand–not going to happen. There is no room for rational thought anymore.

None of my friends read this blog. They tell me stuff like,”Why don’t you buy now?” “The prices are going up.” You’ll be priced out.” “This is Culver City (Burbank, Pasadena, Santa Monica). Prices will go up here.” “This is not San Bernandino. Nobody wants to live there. Everybody wants to live here.” “Buy now. You are stupid to rent.”

When I tell them to read Dr. Housingbubble, they tell me. “Who is he? Does he have a real name? I cannot trust anybody who does not have a real name.”

This is the reason we still have a bubble. Most people are like my friends, and not like the people who actually read this blog, or base their opinions on data. They just base their opinions on the myths that inflated the bubble.

http://imgur.com/QD7ie.png

40% of homes bought last month in SoCal were FHA. Median down payment? 3.5%. Conventional loan median down payment $92,000 (this is likely due to move up buyers using equity from a home sale because this group represents 40% of move up buyers).

So the reality is, there may be people with large down payments but the data tells us otherwise. This is the exception, not the rule. Also, we were assuming a near $50,000 down payment for a 2 bedroom home, no chump change. This loan will fall under jumbo status and good luck finding a 5.25% loan at this level without paying points out your back.

Nickhandle….same EXACT thing I hear.

I almost want to punch people in the gut for their advice that clearly wishes to cause me harm financially and emotionally.

I find there is a huge disconnect on this issue, between people over 45 and those under 45. If you are under 45, you have NEVER seen a severe recesssion, and have not seen how long theycan last.

In the early 80’s, the State of Oregon lost population,, house prices dropped, and STAYED there for 10 full years. My neighbor, with a master’s in engineering, worked as a landscaper.

People under 45 do not read daily newspapers, or watch the national news in the evening.They do not read economic news (Boring!) They text, tweet, and watch utube.

And for the most part, Robert Cramer, they figure that the gov’t is going to bail them out when things go south. I guess they’ll learn!

Unfortunately, with the entitlement society we are living in, and the awful precedents the government has already set in terms of bail outs, hand outs, welfare and entitlements going to the least deserving – those bums thinking the gov. will come to their rescue may be right!

People like us, who work our asses off, live frugally, save, and sacrifice for a better tomorrow that won’t come from instant gratification but patience, diligence, hard and smart work, ethics etc. – WE are the ones who get screwed and have to pay for those bums’ bailouts, ohiogal!

Foolio;

That’s true in the shortterm, but in the long run, if you own that home (paid for), we are a KING, as we are no longer linked to the same racketeering by the banks and financial institutions that keep this insanity going.

I only see the younger having a lot of pain, and having to learn from us seasoned veterans, how to survive, and it isn’t going to be by credit card or home equity.

Cash and what you own will get you through, until cash collapses, and then its what you own.

Yo, John, stop fudging what Doc is doing!

~

Nobody with a $120K down payment in their pocket is going to buy this teeny tiny gilded hamster hut! They’ll put their down payment to something that won’t go POP SPLAT the moment the ink dries on their paperwork.

~

If you don’t comprehend that, you haven’t been reading DHB for long, or you’re one of those RealTorz still mainlining the sweet sweet syrup of Denial. The action is largely FHA, not so much bubbles as a thousand points of foam propping up the deflation of this mess. Which is what he’s trying to warn people about.

~

And even if someone DID have $120K to flush down the toilet on this box, at $779K that means financing $559K??? Good gods, I want some of what yer smokin’, mah man!

~

And how will the property taxes on $779K swallow up that “big interest deduction”??? Like a hungry fucking Komodo dragon, that’s how.

~

rose

“Like a hungry fucking Komodo dragon, that’s how.”

hahaha, seriously just laughed out loud….real ‘lol’ stuff……nice……

Speaking of welfare queens:

Bank of America, Wells Fargo probably won’t pay income tax for 2009

http://www.charlotteobserver.com/2010/03/26/1337021/billions-in-tax-benefits-for-banks.html

How can it be that you pay more to the IRS than General Electric?

http://www.forbes.com/2010/04/01/ge-exxon-walmart-business-washington-corporate-taxes.html

But hey, if you want to delude yourself into thinking it’s people under 45 who are looking for entitlements go right ahead. I’m sure when you’re cashing your social security check and receiving medicare no one will notice the irony.

You think social security and Medicare are entitlements? Do you even know how those systems work? You paid into social security and Medicare with tax dollars. Most people die before recovering all the money they paid into those programs. Get your facts straight or you’ll continue looking like a putz.

you wrote:

“Unlike the federal government states (and certainly cities) don’t have the liberty of using the Federal Reserve and U.S. Treasury to print their problems away.”

I completely disagree. The states know, IMO, that they will be bailed out. Our gov’t bailed out GM among others, so there is no way they will allow the states to default. Therefore states have access to the printing press. Everything argues for a low dollar in the long-run.

What bunch of incredeble fools we are turning into if majority buys this!

http://finance.yahoo.com/news/Homebuyers-scramble-as-apf-1207806452.html?x=0

Mortgage rates are going higher and the realturds are triing to make of it buying urgency. When the rates go higher will you be able to find greater fool than you to sell the “investment”?

Some insight from Trulia for a 2 bedroom in Culver City is helpful here.

The median sales price for homes in Culver City CA for Jan 10 to Mar 10 was $435,000.

The average listing price for Culver City homes for sale on Trulia was $547,000; so the auction prices are in line with average listing price.

I have to question, will be banks sell the properties at auction at the current market price of $435,000?

The sensible rent; for example, Craigslists provides the rental listing at 1636 Colby Ave in Silver Lake for $2,0000 a month; and the new rental section of Trulia provides the 4140 Vinton Avenue in Culver City for $2.900 a month.

Some insight from Trulia for a 2 bedroom in Culver City is helpful here.

The median sales price for homes in Culver City CA for Jan 10 to Mar 10 was $435,000.

The average listing price for Culver City homes for sale on Trulia was $547,000; so the auction prices are in line with average listing price.

I have to question, will be banks sell the properties at auction at the current market price of $435,000?

The sensible rent; for example, Craigslists provides the rental listing at 1636 Colby Ave in Silver Lake for $2,0000 a month; and the new rental section of Trulia provides the 4140 Vinton Avenue in Culver City for $2.900 a month.

Leave a Reply