Real Homes of Genius: 751 Square Foot Home in Norwalk Half Off and Still Over Priced. And the Worst Housing Idea Yet.

I’m sure many of you watched the second Presidential debate moderated by Tom Brokaw. For any of you following the election, we have heard the positions of both candidates in many shapes and forms. But Senator McCain came out with a left field idea that is the sum of all fears in regards to propping up the housing market. Not once on the campaign trail have we heard him talk about stabilizing home prices with market intervention [which is a bad idea]; that is until the second debate. I’m sure that when many heard this “new” plan many wondered what it entailed. Well the campaign released a summary of the plan and it involves paying lenders face value for mortgages, giving homeowners a new loan, and having the taxpayer cover the rest.

This is the ultimate fear with the $810 billion bailout and why the vague language in the bill requires incredibly strong oversight. Instead of oversight, he just wants to flat out give irresponsible and corrupt lenders the full price! I’ll go into the proposal later in the article and why it is utterly careless and frankly, smacks of the most desperate pandering to voters.

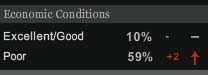

The economy without a doubt is the number one issue driving this election. A recent Gallup Poll found the following:

*Source:Â Gallup.com

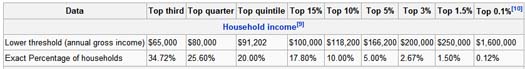

The first thing I want to ask is who in the world are those 10% that think economic conditions in this country are good or excellent? I mean even if you are doing well and have a secure job, you only need to look around and you will see that a vast number of Americans are falling further behind. Even if we look at the income breakdown, only 10% of all U.S. households make more than $118,000 a year:

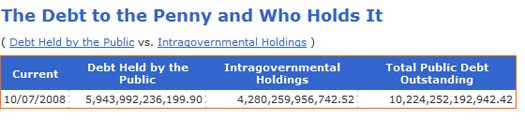

Too bad they didn’t breakdown the survey by income level and region since I know many families here in California that make $100,000 a year or more yet are not supportive of the bailout bill and do not think economic conditions are good in this country. Our own Governator is back asking for more dough and we just passed the budget a few days ago. Our current national debt is now over $10 trillion:

*Source:Â U.S. Treasury

What this works out to is $33,550 for every man, woman, and child in this country. If we look at the national personal income, 33% of Americans actually make less than $37,500 a year! Yet the rich get richer and CEOs are still jumping out of wrecked businesses with nice golden parachutes. So once again we are spending way more than what we are bringing in. To highlight how out of line things got, let us welcome our Real Home of Genius. Today we salute you Norwalk with our Real Home of Genius Award.

Real Homes of Genius Norwalk Style

Dear Comrades, this glorious 751 square foot home has 2 spacious bedrooms and 1 bath. This home is located in the Motherland of Los Angeles County and has been hit hard like the majority of the 88 cities in the county. The current median price in Norwalk is $325,000 down 29% from last year.

I never realized that a concrete driveway now constitutes a “front yard” but this is California! Once again, we are delighted to see that people are employing the wonderful marketing tool of garbage can photography:

Now really, do you think this is going to help sell the home? Can you at least spend two minutes and move the bins to the side? This is like those folks who have ads with online dating sites and put up pictures with their ex’s yet they have it blotted out with Microsoft Paint. Moral of the story? Take the garbage out of the picture first! Remember, digital cameras make taking multiple pictures free.

In this other photo, we get a new style trying to employ the GQ blurry motion technique trying to make the missing kitchen appliance look airbrushed:

The current list price for all 751 square feet? How about $164,900. Again and again I am seeing many areas break the $200k mark here in Los Angeles County. I have seen many homes in the Inland Empire go under the $100k mark. Just so you remember how things were a few years ago if you are new to this and want to have an idea how we got here to this now global economic mess, here is the sale history:

Sale History

03/28/2008: $306,000

03/22/2006: $345,000

08/11/2000: $112,000

The place has been on the market for 97 days. Three months ago we were in July. The March line item is the foreclosure. Someone purchased this home for $345,000 at the peak which makes absolutely no sense whatsoever and now, we are quickly approaching the 2000 price. The current price is off by 52%. Essentially at the current price should the home sell, it has only kept pace with inflation. That is it and that is normal. So even though this price drop seems significant or shocking it is merely reflecting historical trends in housing prices. Remember, this was a bubble and in no other state was this exemplified to the next dimension than here in sunny California. Average household income for this area is $58,000 so the new price is about right. It puts the home at about a 2.8 price to income ratio.

Now let us walk through mathematically what the new McCain plan calls for. Let us hypothetically say that the people that bought this home were still living here. In fact, they want to continue living here but cannot afford the $334,000 mortgage (we’ll assume a 3% downpayment). Let us look at the balance sheet:

Lender:Â Â Â Â Â Â Â Â $334,000 mortgage note

Borrower: Â Â Â Â $334,000 mortgage

Okay, that is rather simple. But let us assume this family can only afford the current appraised price which is $164,000. With this new plan, the lender makes out the best followed by the overstretched borrower, and then the taxpayer is royally screwed to the next dimension, which is only seen in sci-fi movies:

Lender:Â Government check of $334,000 [Awesome for them and assigns zero responsibility for their negligence if not downright corruption]

Borrower: Â New $164,000 loan from the FHA [Not bad because they keep the house even though they face no adverse impact from their financial irresponsibility]

Taxpayer: Bill of $170,000 since that is the difference and it has to come from somewhere. [All the punishment goes to the taxpayer and that is WHY we need to point fingers big time]

In the scheme of this mess, the lender makes out like a complete bandit, irresponsible homeowners do well, and the taxpayer pays for both parties. Now imagine someone who bought a home in an overpriced area of Orange County for say $1 million and the home is now only worth $750,000. Should this plan include them as well if they can prove they can only afford $750,000? You can see what an absolute boondoggle this is. According to the L.A. Times:

“According to the outline of McCain’s newest proposal, the federal government would pay borrowers and lenders in full, regardless of how wise or fair the original transaction was. Lenders would be able to remove the bad mortgages from their balance sheets, and borrowers would be able to refinance into government-guaranteed loans. Mortgage holders would have to prove they lived in the home and had good credit at the time of the original loan.

This approach has been largely rejected by both Democrats and Republicans because it would be likely to reward the kind of bad lending and borrowing practices that caused the housing crisis while doing little to help stretched but conscientious homeowners.”

One more thing, are they serious about the good credit thing? Freaking cats were getting credit cards so we know how absurd credit standards got during this bubble. People making $14,000 a year were pulling down $720,000 mortgages. Many lenders should fail and be liquidated. Many current homeowners especially in over priced bubble areas like California speculated and lost. Remember that over 30 percent of Americans that are homeowners own their home free and clear with no mortgage. Why should they pay for this mess? Approximately 32 percent rent and why should they subsidize the delusional American dream crammed down the throats of many by these lenders? And finally, many Americans bought reasonable homes at reasonable prices and are current on their mortgage. Why should they bailout corrupt lenders and borrowers that never should have qualified in the end?

The Obama campaign fired back today on this plan [via Politico]:

“Senator McCain’s first response to this economic crisis was to say that the fundamentals of our economy are strong. Since then, he’s acknowledged that there is a crisis and offered multiple plans, sometimes conflicting. Last night, in his latest attempt to get it right, he threw out a proposal that appeared to give the Treasury authority it already has to re-structure troubled mortgages. But now that he’s finally released the details of his plan, it turns out it’s even more costly and out-of-touch than we ever imagined. John McCain wants the government to massively overpay for mortgages in a plan that would guarantee taxpayers lose money, and put them at risk of losing even more if home values don’t recover. The biggest beneficiaries of this plan will be the same financial institutions that got us into this mess, some of whom even committed fraud.”

The $810 bailout bill was a bi-partisan failure from day one. Yet the reality of this is McCain is simply revising history and trying to change his stripes. He has always been for big deregulation. His former economic adviser Phil Gramm wrote the bill that repealed the Glass-Steagall Act in 1999. In fact, this is the title of the act:

Gramm-Leach-Billey Act

The bill was introduced in the Senate by Phil Gramm and in the House by James Leach. The bill passed in the Senate via a strict party vote 54-44 and in the House by 343-86. I’ve heard a few people trying to lay the entire blame on Bill Clinton who signed the final bill. Frankly, those that originate the bad ideas hold more of the blame. That is why McCain pushing this “new” idea which really isn’t new since Comrade Paulson already has this authority in the $810 billion bailout, is absurd and frankly skips over the oversight portion of the bill which pathetically is our only protection now. Is he not aware that purchases need to be made public electronically? Can you imagine how the public is going to explode if say a home like this Real Home of Genius shows up as it will and is paid for at face value?

By the way, do you want to see how the market has done since the bill was signed?

Since the open on Friday when the bill was signed the Dow has lost 1,225 or 11% of its value! And I’m not factoring in the wild 777 point loss of Monday here. Weren’t we told if we didn’t sign the bailout that the market would collapse? Well guess what? It is going down either way because there are thousands and thousands of these Real Homes of Genius sitting on the books of many banks. Banks are so broke they are simply not lending because the transparency isn’t there because of bills like the Gramm-Leach-Billey Act.

Today we salute you Norwalk with our Real Home of Genius.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

16 Responses to “Real Homes of Genius: 751 Square Foot Home in Norwalk Half Off and Still Over Priced. And the Worst Housing Idea Yet.”

I will not vote for either of them. They both voted for the bailout. I detest both parties equally. We’re screwed either way.

a note on the general situation:

Did you see this? Reminds me of stories from the Great Depression:

CHICAGO, Illinois (CNN) — Sheriff Thomas J. Dart said Wednesday he is suspending foreclosure evictions in Cook County, which had been on track to reach a record number of evictions, many because of mortgage foreclosures.

I am very disappointed at Senator McCain and Gov. Palin even I was supportive to them. It is very reckless for him to have his “American Homeownership Surgence Plan.”

The last thing I want is to see McCain lose the election. What can I say to help them understand the situation when I see it is a big mistake they did? I have never written a letter to a presidential candidate. But, I have to release what I feel now.

Enclosed here is a link: A letter to Senator John McCain http://activerain.com/blogsview/730915/A-letter-to-Senator

Yeah, who needs kitchen appliances anyway? I can see the listing “great kitchen if you dine out a lot!”

what chain stores do you expect to die, now that linen n things is folding?

Read this article.

Why Housing Is Far from Bottoming:

Depression, Demographics, Defaults and Dumps (October 8, 2008)

The thesis stated again and again in the mainstream media (MSM) is that the U.S. economy can’t get back on its feet until housing “recovers”–which makes the question “when will housing recover?” of paramount importance.

The reasoning is simple: for the vast majority of middle-class households, the equity in their residence represents a major chunk of their wealth. When housing was skyrocketing in value, homeowners felt wealthier and thus they spent freely, even if they doidn’t extract the equity via HELOCs (home equity line of credit). That’s called the “wealth effect.”

Now we have the “reverse wealth effect.” As equity has declined–in millions of cases, to negative net worth–homeowners feel poorer and thus they are spending less. Since equity extraction, which once flooded the economy with hundreds of billions of “free money” year after year, has now shrunk to near-zero, they also have less money to spend.

As we can see in the chart, household real estate wealth is set to decline for the first time in 50 years. Financial wealth is also set to go negative, an unprecedented (in post-WW2 era) double-whammy to household wealth.

Construction, remodeling, home furnishings, real estate financing and sales together make up a big percentage of the U.S. economy. As each of these components shrinks, the toll on the U.S. is huge.

OK, so isn’t housing set to “rebound” next year, or in 2010 at the latest?

No. For as correspondent Pangolin notes, while mortgages may just be paper, the paper is based on real physical houses and neighborhoods. the “paper losses” are hitting the real houses and neighborhoods hard in four ways: Depression, Demographics, Defaults and Dumps.

Here are Pangolin’s incisive comments:

Is it me or we all ignoring a fifth elephant in the financial living room? All of this debt is secured by assets, houses, on land, that were built with the presumption that well-employed people would live in them at about the ratio of 2.6 people per 2500 sq. feet. (sources: U.S. Census 2006, Square Footage Measurements and Comparisons Energy Information Administration)

That’s a lot of volume for two people and when our various cousins, brothers, mom’s, sisters and best friends lose their steady jobs that’s a lot of space to rent or share. This is especially significant if other, non-optional expenses like food, heat and medical care continue to get more expensive. Meaning the occupied number of residences in the US could contract by a third overnight with little hardship.

Think of one fourth of the buildings in a neighborhood vacant and you have a place begging for scavengers to come and remove the rest of the neighborhoods property value. I tell you as a fact a crew of three guys can strip a house overnight and leave the neighbors clueless. Appliances, wires, pipes and fixtures gone; boom. They’ll do it in contractors vans and they’ll show you a printed work order. Easy as pie. In ten minutes an arsonist can be in and out and the place won’t show a flame until it’s too late hours later.

If somebody’s not living in the house next door you, as a homeowner, now have a permanent source of worry; real big worry.

Some time soon homeowners (as opposed to mortgage paying tenants) are going to descend on local governments in a wrath and demand that vacant properties be occupied or maintained in a reasonable standard. Lawsuits will pile up, HOA liens will fly like fall leaves and town councils will get slapped awake by irate citizens.

Then there will be a proliferation of proposal that will amount to “use it or lose it” laws. Your vacant property may be seized, sold at auction for cash on the barrel-head to anybody who can demonstrate that they will a) occupy the property and b) have sufficient income/reserves to maintain it. There is nothing at all that makes this illegal. To the contrary laws have been adjusted to allow crony capitalists to seize property and build baseball stadiums, mini-malls and ‘factory-outlets’ with minimal fuss. It’s also quite simple to tell a besieged banks legal department that the value of the property is exactly it’s auction price in lieu of evidence of other buyers.

For several years banks will scream murder and property prices will dive but nobody is going to leave an empty house in their neighborhood if they can avoid it. Of course the results of this will make the bailout last week amount to a fart in a hurricane.

Thank you, Pangolin, for raising/addressing profound trends. I have previously addressed the demographics of U.S. housing, following the same line Pangolin traces:

Housing’s Headwinds: Demographics, Rising Rates, Peak Oil and Oversupply (July 23, 2008). What we have right now: Depression (falling employment and household wealth), Demographics (falling number of households), and Defaults (foreclosures, walk-aways, etc.) reflected in the following:

1. massive oversupply of housing

2. falling “residents per household” in the U.S. is reversing

3. a tidal wave of housing-mortgage-related lawsuits which is already threatening to swamp U.S. courts

Let’s start by recalling that there are 18.6 million vacant homes in the U.S.–a staggeringly large number. Here is the Census report: CENSUS BUREAU REPORTS ON RESIDENTIAL VACANCIES AND HOMEOWNERSHIP

There were an estimated 129.4 million housing units in the United States in the first quarter 2008. Approximately 110.8 million housing units were occupied: 75.1 million by owners and 35.7 million by renters.

Of the 2.1 million increase in total housing units, 1.1 million were occupied and 1.0 million were vacant units. Of the 1.0 million additional vacant units from last year, only 20.5 percent were for rent or for sale.

The number of total vacant housing units, 18.6 million, was higher than the estimated number in first quarter 2007. Of these vacant housing units, 13.9 million were for year-round use and 4.7 million were for seasonal use. Approximately 4.1 million of the year-round vacant units were for rent, 2.3 million were for sale only, and the remaining 7.5 million units were vacant for a variety of other reasons.

There are a number of interesting facts presented here. Only 4.7 million of the vacant dwellings were “seasonal,” i.e. second-homes/cabins; 14 million homes are available right now for occupancy.

A million new units sit empty, and only 20% are for sale. We can presume the builders/developers/lenders are hanging on to the other 800,000 empty new homes, hoping and praying that some miraculous turn-around in the housing market will enable them to sell a million vacant homes in the near future.

Even as the “downturn” worsens, over a million new dwellings will be constructed and added to the inventory this year. So let’s just round up and say there are (or soon will be) 20 million vacant residences in the U.S.

With an average household size of about 2.6 people, we have room for 50 million more citizens without building a single additional home. If we subtract the 5 million vacation homes, that leaves 15 million vacant dwellings, and I think it is safe to say that is a massive oversupply of housing.

Household size has been dropping for 100 years: Census: U.S. household size shrinking Wealth, looser social restrictions contributing to trend, experts say. But as the “wealth effect” reverses, this trend is reversing, too.

How many elderly and not-so-elderly people live alone in a big house? A lot. How many couples bounce around a big house, now that the offspring have left? Take the humongous national wealth reduction we are just starting to experience and add in 60 million retiring Baby Boomers, and what do you get?

It seems to me you get a lot of reasons for household size to increase. Kids move back home, creaky retirees open up the house for a live-in assistant, and unable-to-retire folks start renting out all those empty rooms for extra income. And if household size even edges up slightly, that will greatly reduce the number of dwellings the nation needs for actually housing people as opposed to investment/gambling schemes. An increase in household size would radically increase inventory of unwanted/unsold/unrented dwellings.

Last but not least, let’s ponder the consequences of lawsuits: against the builders of shoddy/defective homes, against fraudulent lenders, predatory lenders, investment banks which packaged high-risk mortgages and sold then as low-risk “investments,” and on and on.

When tottering builders are pushed into liquidation by lawsuits, their inventory (those 800,000 empty new homes) will not be allowed to sit around waiting for better times; they will be auctioned off and the proceeds given to the bondholders and lienholders. What happens to a shaky market when hundreds of thousands of houses get auctioned off, no-minimum bid? It drops.

What happens when insolvent lenders who have been hoarding and hiding hundreds of thousands of foreclosed/distressed properties are finally forced into liquidation? All those distressed properties get sold off, too. More inventory, more auctions, and prices which will be dropping to near-zero in many markets.

Pangolin points to a number of serious downsides to the last trend: Dumps, as in abandoned/vacant dwellings. Nothing saps value as quickly as eyesores appearing in a neighborhood. Invoking (as we so often do) the Pareto Principle (a.k.a. the 80/20 rule), we can anticipate that when a mere 4% of the homes in an area are vandalized/stripped/occupied by undesirables, then 64% of the homes’ values will be negatively affected.

And should the number of abandoned residences hit the threshold of 20%, then we can anticipate a severe decline in the values of fully 80% of all housing in the vicinity.

This also works within highrise condos, as once 20% of the units are not just vacant but essentially unowned, then the common-area expenses will rise for the remaining 80% of the owners.

As Pangolin insightfully observes, we can anticipate a rising political furor as homeowners demand that government “do something.” Local government’s typical response is a toothless “warning” to owners of abandoned properties to maintain the dwelling.

But recently, some cities have taken a much tougher stand, especially against bank-owned foreclosed homes (so called REOs, ‘real estate owned’). Empty Homes Spur Cities’ Suits (law.com)

Cities now dealing with scores of abandoned, foreclosed homes have started suing banks and mortgage companies to recoup their costs, while other cities are hauling lenders before code enforcement boards and county courts to force them to maintain abandoned properties.

The innovative legal tactics are designed to recoup the city’s lost property taxes as well as the cost of fire departments, police, code enforcement or even demolition — any city services needed to clean up or deal with the foreclosed properties.

Cleveland; Baltimore; Buffalo, N.Y.; and Minneapolis, Minn., have all filed lawsuits against lenders or developers based on the devastating effects foreclosures have wreaked on their communities. The lawsuits were filed in recent months under different theories, in state and federal court.

Cleveland and Buffalo filed suits under public nuisance laws. Minneapolis’ suit was brought on consumer fraud grounds, while Baltimore took the unusual approach of filing suit in federal court under alleged Fair Housing Act violations.

In addition to filing a lawsuit in February, Buffalo city prosecutors routinely haul banking officials before the local housing court to force them to fix up foreclosed and abandoned properties.

Thanks to HADD – Homeowners Against Deficient Dwellings, we can also track the many legal actions being taken again builders of shoddy/deficient new dwellings.

Just as cities are under increasing pressure to address vacant/vandalized housing, their property tax revenues are plummeting along with valuations. This puts cities which are trying to “do the right thing” on the horns of a dilemma: enforcement and lawsuits cost money, just as revenues are dropping.

Do you reckon cities will be fighting tooth and nail for banks and lenders to pay “their fair share”? As lenders go through various shotgun marriages, the lawsuits will simply shift from WAMU (Washington Mutual) to JP Morgan, just as the suits against Countrywide shifted to Bank of America, which just reached an $8 billion settlement with various municipalities and government agencies.

Those Bulls who are salivating over all those fat future profits flowing to banks might want to reconsider their faith in future profits. No one can know how much money will be bled from banks by lawsuits of every type and size, but we can anticipate the amounts will be huge and the filings will fly for years to come.

The law is also politically influenced. As public rage builds, juries and judges will not be immune; we can anticipate the surviving banks being hit with staggering punitive judgments.

One issue which is virtually ignored by the MSM: how much will it cost the surviving banks to maintain and pay the property taxes on these millions of foreclosed properties? As if tightening credit and systemic distrust/opacity weren’t bad enough, now the surviving banks are being saddled (and rightly so) with enormous carrying costs.

So what happens to these millions of empty, vandalized, unmaintained or stripped dwellings? Pangolin suggests that political pressure from remaining homeowners will power a “use it or lose it” movement in which eminent domain will be wielded by local authorities to acquire homes and then auction them off with the caveat that the buyer must occupy the residence.

Another possibility is that the Federal government, via its Fannie Mae and Freddie Mac divisions, will become a massive owner-of-last-resort of U.S. real estate. Frequent contributor Harun I. recently sent in a link to an account of Home Owners’ Loan Corporation (Wikipedia), a New Deal agency established in 1933 to refinance homes to prevent foreclosure. Harun’s comment:

“The HOLC did not prevent the Great Depression even though it was created as early as 1933.” A telling point; and I would add that the agency didn’t finish its mandated business until 1951: fully 18 years after it was formed to “resolve the crisis. If history is any guide at all, we can thus anticipate all these “rescue” operations currently being thrown into place lasting until 2026.

Here is another take on the HOLC from the Washington Post of 3/14/08: A 1930s Loan Rescue Lesson:

Today’s economic situation, while serious, is minor compared with the financial collapse of 1933. That year, about half of mortgage debt was in default. On Dec. 31, 2007, serious delinquencies in the United States were 3.62 percent of all mortgages. In 1933, the unemployment rate had reached about 25 percent (compared with 4.8 percent today). Thousands of banks and savings and loans had failed. The amount of annual mortgage lending had dropped about 80 percent, as had private residential construction. States were enacting moratoriums on foreclosures. The average borrower that the HOLC eventually refinanced was two years’ delinquent on the original mortgage and about three years behind on property taxes.

While it existed, the HOLC made more than 1 million loans to refinance troubled mortgages; that was about a fifth of all mortgage loans nationwide. By 1937, it owned almost 14 percent of the dollar value of outstanding mortgage loans. Today, a fifth of all mortgages would be about 10 million loans, and 14 percent of outstanding mortgage values is about $1.4 trillion — approximately the total of all subprime mortgage loans.

The HOLC tried to be as accommodating as possible with borrowers but did end up foreclosing on about 200,000, or one-fifth, of its own loans.

Since that article was written a few months ago, unemployment has shot to 6% and the number of foreclosures has increased. How high unemployment and foreclosures will rise is unknown, but the trend is definitely up for both–way up.

Fannie and Freddie already own about half of all residential mortgages in the country. (Roughly $5 trillion of the total $10 trillion in residential mortgages.) It’s not too difficult to foresee the Federal government owning outright (and thus playing landlord/auctioneer for) hundreds of thousands, if not millions, of residences.

We may yet become a nation of renters again, as we were in the Great Depression, when home ownership was around 44% compared to today’s 64%.

If there are so many of us that don’t agree with the bailout program… then why didn’t Ron Paul win instead of McCain? If there are still so many of us diagreeing then why haven’t our voices been expressed in newspapers or someone voicing our opinion on Television? We are writing, we are calling, but someone doesn’t want us really heard. If it wasn’t for the internet we wouldn’t be heard. We need someone to stand up for us and rally a large enough number to prevent what is about to happen. I can not accept that we have no power to do anything about it. We just need to know what to do.

The iron bars, cement, and copper wiring are worth more than the house itself.

My .02 on politics: If you don’t vote, then STFU and GBTW. I’m holding my nose and voting McCain for two reasons only: Supreme Court nominees and a check against a Democratic Congress. A Republican Congress did some positive things along with a Democratic President. I don’t want a single party running legislative and executive branches. Once again: if you don’t vote then STFU and GBTW

Vote for Bob Barr then!

Im not voting mccain because palin will be president and she is one arogant stupid b****. he is also pretty foolish and losing his cool. there rallies are kkk ralies and those who will vote mccain – fools. we will be the laughing stock of the world. im not going to the stone ages.

Good gracious. Is McCain really using the term “surgence”?

~

That alone should disqualify him from consuming oxygen.

~

Ron Paul didn’t win because didn’t get enough votes.

~

Which you have to expect when he does things like alienate voters of any or no party who think that big government should stop politicizing women’s health issues to build power/terror coalitions of the yonically impaired. Or when his Conspiracy-Loving-Wingnut-Attraction Quotient is so high, even conspiracy-loving wingnuts like myself, the personal friend of Bigfoot who just KNOWS that JFK was killed by the Franklin Mint Illuminati Templar Mafia to generate commemorative plate and coin sales, get scared.

~

John W, you are missing the lifeboat that Doc is trying so hard to keep afloat here in Titanic Nation USA, anno domino 1.

~

One party DOES run the legislative AND executive AND judicial branches.

~

That party is the party of money.

~

The whole POINT of Doc’s painstaking blog (correct me if I’m wrong, DHB) is how the religion and politics of Money has derailed this nation. How people have bought into it. How stupid everyone gets when money is on the table…or disappears from it. How reluctant people are to talk about the data, the numbers, the trends, when it’s so much easier to pose and posture and strut and rant about Candidate A Red Coke versus Candidate B Blue Pepsi!

~

With all due respect, let’s get back to Doc’s points. WAKE UP, everybody, and see that what we are lacking is thinking, complex, progressive populist candidates who champion the wants and needs of the productive, the prudent, and the responsible over scammers of all politics, races, colors, creeds, religions, and economic levels.

~

And we’re not going to have that quality candidate till the votership evolves to vote for them. Till then, the Russ Feingolds of this nation will be excluded from the mainstream process by all parties.

~

Hey, I just got political!

~

rose

(Feingold 2012, 2016, 2020)

sorry, but the repukes own this mess.

They ruled the world and Congress for 12 of the past 14 years, the White House for 8, everything they stand for has been proven to be a sham. EVERYTHING.

So for 2 years the dems have a 51-49 majority? And one of them is Lieberman. Sorry Repukes, but you are failures, you’re good at sliming the opposition and winning elections, but retarded as hell when it comes to governing!

Sean should cite his source rather than just (what appears to be) reprint copyrighted material. FYI, anything written is copyrighted–with or without the (c) notice. Other than that, great blog comments by the Dr. and overall good dialogue.

Dear Comrades,

~

I must apologize for something I said in a recent post that turned out to be tragically wrong. In making the case against the Paulson Plan, I stated that it would keep the mother of all bubbles inflated a little bit longer while making future generations the bagholders. As it turned out, the bubble self destructed within 5 seconds of doing the deal as if it was some kind of device from Mission Impossible. Who knew? At least I had the second part right (sorry kids).

~

Above all else, this is a crisis of faith. From a financial perspective, when there is no faith, there is no means for setting a rational fair market value. This can be seen is the huge volatility in the market. One thing being under reported is the interday swing from high to low. Today was a great example. The Dow had a trading range of nearly 900 points! As things trade lower, the lack of faith is reinforced and the downward feedback loop keeps going until something signals the bottom and faith in the value is restored.

~

From a leadership perspective, nobody believes anything that comes out of Washington or Wall Street. And why should they? We were warned of grave consequences if the Paulson Plan did not pass. Would those consequences have looked any different than what we are facing now? All shred of faith has been crushed. I heard someone on CNBC say tonight that faith could not be restored until someone goes to jail for this mess. I’ve been arguing that we need to get past the blame game and get on to the solutions. What I hadn’t considered is that the blame game (i.e. accountability) IS the solution. After all, market forces in a capitalistic society will take their course despite all the shock and awe rhetoric.

~

It will be painful. It’s suppose to be painful. But those who created this disaster should feel the most pain instead of walking away with their pockets lined with other people’s money. At the end of the day, we need to believe that good will overcome evil and that leaders will act in good faith.

I BELIEVE that the most important idea behind Mc Cain’s refi program is that it makes these loans (most of which are not right now) into RECOURSE loans… which therefore would tend to stabilize the housing market as people wouldn’t be so highly motivated to walk away, an action which now we keep hearing over and over just makes “business sense” but puts all the rest of us in utter peril.

I know I choked when I heard him introduce this idea too but now I’m seeing that there could be important advantages that aren’t readily apparent.

As I’ve heard it said before just ‘cuz someone starts a fire in his room you don’t let the whole house burn down to teach him a lesson.

Even if we HAVE paid all of our bills on time and live within our means we can’t use that as an excuse when we’ve allowed our spouse to run up hundreds of thousands of dollars of debts through gambling and reckless spending just because we were too busy to monitor and regulate THEIR behavior as well as our own. That’s just an obligation of being in a situation TOGETHER.

If we had been more vigilant about what our government and our neighbors were doing we wouldn’t be in this mess.

And you probably don’t like hearing it anymore than I like writing it-

Dr. Comrade Housing Bubble. Thanks for the real home of genius. It was just what I needed. Spasibo.

Leave a Reply