Real Homes of Genius: Culver City and the Housing Stockholm Syndrome. Approximately 5 Percent of Current Home Price is related to Government Bailouts.

Only looking at economics for an answer to the housing bubble mania will leave you with many questions unanswered. As in most manias, there is a large element of speculation and irrational exuberance as the godfather of bubbles Alan Greenspan once said. Yet what most on Wall Street and the government lack is some basic understanding of human psychology. There was very little reason to believe in the economic long-term viability of a product like option ARMs for example. These mortgages derived from an economic model that was operating in a mania. They assumed the mania would run forever. The Alt-A and option ARMs were simply manifestations of a human speculative fervor that believed in the housing mammon. In fact, there was a large contingent of people that simply believed that housing values would never fall. No basis in economics or market fundamentals. In other words, it was a classic bubble.

Yet what is currently occurring in the housing market is similar to a victim suffering from Stockholm syndrome. Stockholm syndrome is a response seen in some hostages in that they feel some sort of loyalty to the abductor. Why does this even occur? One of the theories is based on the framework of cognitive dissonance. People don’t like being unhappy for long periods of time so the idea goes, that some of these victims start loving or identifying with their captors. Now I see many elements of this in the way we are dealing with our current financial crisis. All of a sudden, the government, Wall Street, and many Americans are starting to sympathize with the actual perpetrators of the biggest fraud in a generation. Instead of punishing and fixing the system, many are looking to the banks for assistance.

As it turns out, some of the pricing in housing is now based on government intervention:

“(WSJ) Uncle Sam’s interventions in the housing market have pushed home prices 5% higher on a national average than they would have been otherwise, Goldman Sachs estimates in a report released late Friday.

The government over the past year has slowed the pace of foreclosures through moratoria and the drive to modify mortgage terms to keep more borrowers in their homes. It also has pumped up demand for housing by giving tax credits to many first-time home buyers and by driving down mortgage interest rates. As a result, home prices in some areas have risen in recent months, particularly for homes that appeal to investors and first-time buyers. Bidding wars for the more attractive bank-owned homes have become common.â€

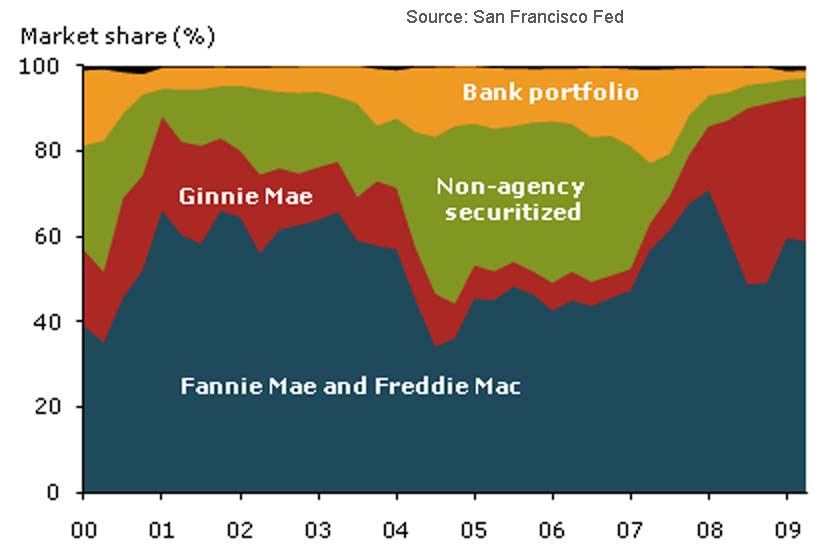

If we break down the mortgage market further, the government is the housing market:

Source: San Francisco Federal Reserve h/t Calculated Risk

95 percent of the mortgage market is now backed by the government. As we know, a large part of this growth also occurred with highly risky FHA insured loans that are now imploding at record levels. Last month in Southern California 36 percent of mortgages were FHA insured loans. Now applying the Stockholm syndrome, it would appear that many instead of being angry and calling out the banking fraud for what it is, are starting to believe in what the abductors are pushing. They say things like, “see, the banks are now holding off on the shadow inventory to help the market. Prices are now going up!â€Â As if the banks are concerned about the average American with some banks charging 79.9 percent on credit cards before dealing with the tougher legislation coming in 2010. As you can see from the above chart, the mortgage market is the government which raises the question, why do we even need banks if 95 percent of the mortgage market is directly subsidized by the government? We don’t and certainly not at the too big to fail level. If anything, we should get on the move to start breaking up the banks and renewing a new stronger form of Glass-Steagall. Until the government moves in this direction the current financial deep capture will continue and will siphon off the life blood of the real economy like a leech.

The California Dream Delusion

It is interesting that many people now think the housing market is in the clear. Here in Southern California, we have a fleet of people now starting to love their captors. Some are even capitulating and saying, “enough of this waiting. I’m going to buy because the government seems to have an unlimited buffer to stop housing prices from falling.â€Â They also have given up on the fact that banks are simply not moving on foreclosures in a timely fashion or programs like HAMP have stunted a more normal flow of the market. Yet the question remains, has this really aided the overall economy? It hasn’t. We now are hearing talk of a job-loss recovery. To that I say this, are you kidding me? Sure, people are going to have sufficient money to pay for their mortgage without jobs. Makes total sense if we were in Wonderland. This is the kind of logic you start getting when you start loving the people that have abducted our financial system into some perverted rabbit hole of economic waste.

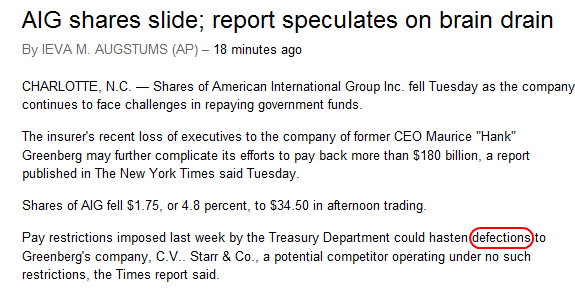

In fact, there have been a few articles talking about the “brain drain†because of compensation limitations on Wall Street! You have got to be out of your damn mind! People mistake “intelligence†in kleptocracy, cronyism , and financial engineering with actual smarts. They are smart at screwing over our economy so this brain drain argument is absolute insanity. It would be one thing if they were creating life saving drugs or consumer goods but instead, they are an albatross on the rest of the economy sucking taxpayer dollars into their balance sheets. Yes, let us feel sorry for our financial kidnappers. How can they live on a few million dollars a year after all the good they have done? Let us allow them to have the same system that gave them the key to drive our economy off the financial edge.

Look at some of this crap:

Oh no! Our top commanders are leaving the ship. As it turns out, they were on their laptops all day ignoring the financial iceberg ahead. When it came time to jump ship however, they were the only people with lifesavers. This is absolute nonsense. What the above is saying is that AIG for example, will have a tough time paying back their government lifeline because some of their top gamblers will leave to work for another organized crew of financial misfits that apparently will allow more kleptocracy and cronyism since that is how they make their money. Heck, even the notorious Al Capone had this to say about the stock market decades ago: “Its a racket. Those stock market guys are crooked.”

Let us take a look at an area of Southern California where Stockholm syndrome is in full force. Today we salute you Culver City with our Real Homes of Genius Award.

Culver City

Not all areas have felt the brunt of the housing decline. Do people forget that Southern California as a region is still down by 45 percent from the peak? The median price at the peak was $505,000 and we are currently at $275,000. What an amazing recovery. The “bottom†was supposedly hit a few months ago at $247,000. If you factor the 5% artificial increase from the government, we are basically still at the bottom.

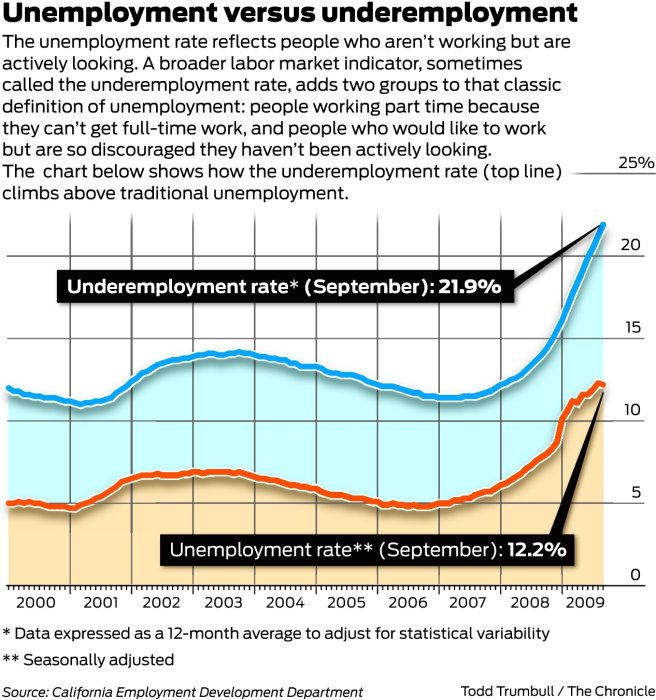

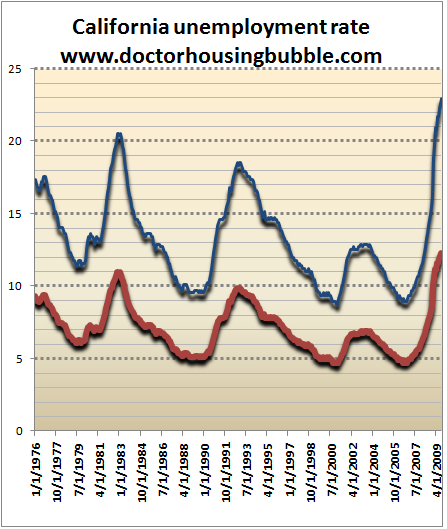

For months, I compiled my own home brewed U-6 for California and my rate was roughly 23 percent. Well guess what? I wasn’t so far off:

“(SF Chronicle) Because she works, Duran doesn’t count in California’s 12.2 percent unemployment rate.

But her situation is captured by a broader measure, the underemployment rate, which, in addition to the jobless, includes people who could get only part-time work as well as those who want jobs but were too discouraged to look.

The state Employment Development Department estimates that this underemployment rate hit 21.9 percent in September.”

The chart they use is even similar to the one I have used in discussing the state of the economy:

Apparently job losses are good for real estate. Give me a break.

Yet here is the issue. You have people focused on one niche market and they fail to see the overall trend of things. Forget the fact that the entire region is still near the bottom. They want their piece of Pasadena, Culver City, or something in the Westside. Well guess what? Prices are still not in line. Yet is that reason enough to buy a home just because you are tired of waiting? Then do it. No one will stop you. But don’t make an economical argument for your purchase because it isn’t there. Prices are still too high in these areas if measured by local area incomes and employment trends.

Plus, the dynamics are all over the map:

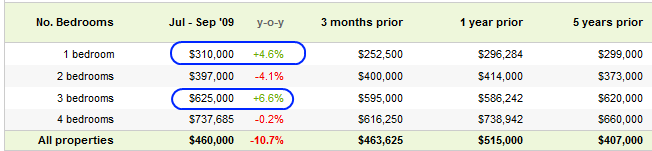

The median price that includes condos is $460,000 for Culver City. This is misleading because the 3/2 “starter home†market still has a median price of $625,000 – an increase of 6.6% on a year over year basis. Say what? If we look at the data in terms of housing prices, this is the latest data:

Median Price Homes

90230:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $541,000 with 9 sales last month (-17.8 percent y-o-y)

90232:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $753,000 with 6 sales last month (15.9 percent y-o-y)

Median Price Condos

90230:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $353,000 with 18 sales last month (-8 percent y-o-y)

90232:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $418,000 with 1 sale last month (-11.6%)

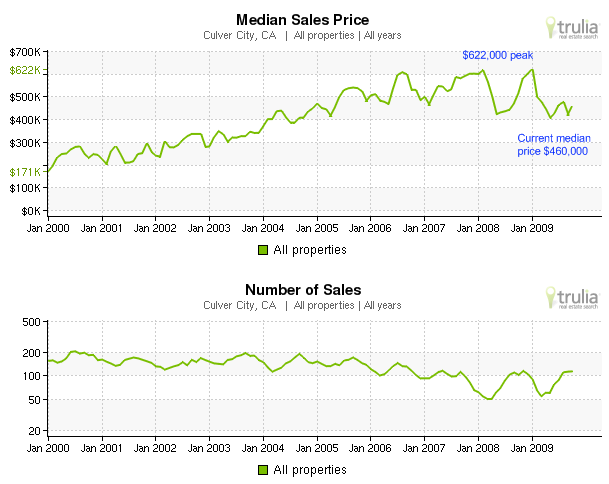

And there is your current break down. If you look at the overall trend however prices are only moving sideways and this is in light of the massive financial bailouts:

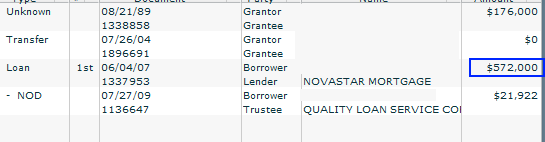

Culver City peaked at $620,000 (including condos) and is currently at $460,000. Another way of looking at this is the entire region of SoCal is still down 45% while Culver City is down 25 percent from the peak. As I have said, not all areas are created equally. Yet this is an area full of Alt-A and option ARMs and many of these will recast in 2010. Need an example? Look at this preforeclosure that took a loan from a toxic mortgage specialist, Novastar:

This home last sold officially in 1989 for $176,000. This is a 2 bedroom 1 bath home and is listed at 798 square feet. This isn’t on the MLS but is a pre-foreclosure. Take a look at the ridiculous loan on this place:

Novastar has long imploded but look at the ridiculous loan amount. $572,000 on a 2 bedroom 1 bath home with 798 square feet! This was done in June of 2007 to the original owners. The notice of default was filed in July of this year. You can rest assured this won’t be selling for $572,000. And don’t think this is the only inventory on the market. Culver City has 173 homes in distress. The MLS lists 80 homes, 12 of which are part of the 173. So for Culver City, shadow inventory is twice the size of what the public can see.

I always defer back to local area incomes and jobs. People ask for an answer and I have given it many times but people don’t want to hear it. Prices in many areas are still too high. The government is trying to prop prices up but unless incomes grow, it will eventually fall again. The overall region has fallen nearly 50 percent. But like I have said, some people choose to ignore the macro trend for their pet areas. Does anyone have a crystal ball of when prices will go lower? Of course not. But is that reason to jump into this highly artificial market? I would say no.

Some say that the declining U.S. dollar will help real estate values. Really? If anything, this might provide a tiny boost for commercial real estate but do you see some foreign investor paying top bill for this Culver City home for example? Of course not. They won’t be living there. As a rental? Okay, you might get $1,700 to $1,900 on this place which puts a true value of something in the low $200,000s. We are far from that price point. Clearly people that see things like this don’t understand how difficult it is to manage rental property from a distant location. Plus, your renters get paid in U.S. dollars so they seem to forget that your tenant isn’t going to be paying you in Euros.

Now what do you think will happen when mortgage rates rise as they will? Will the tax credit be forever? The new proposed tax credit has a cap of $7,290 which is tiny in some of these mid tier neighborhoods. Or what about the option ARMs which don’t even qualify for HAMP because of income and LTV ratios? Many will recast in the next few years. There doesn’t seem to be a lot of reasons to believe in prices rising in this area.

Today we salute you Culver City with our Real Homes of Genius Award.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

21 Responses to “Real Homes of Genius: Culver City and the Housing Stockholm Syndrome. Approximately 5 Percent of Current Home Price is related to Government Bailouts.”

job-loss recovery? I think you meant “job-less recovery”.

Thanks Doc – I needed this article today – it does not make sense to me why people would be so inclined to buy and bid up properties right now. I read a lot on the housing market and watch what is happening and it really confuses me – I question what I read, including your posts. But when I think of it realistically and look at the actual data, things still do not make sense.

–

I live in 90277 and we have 17 SFR’s in escrow – that is a huge number for us. The SFR’s that recently closed were approx 150K + above where they were earlier this year – (example – an SFR’ approx 1000 sqft with a 6000 sqft lot sold for the low 600K range. Similar properties now are selling for upper 700K / low 800K).

–

I have a friend who is a local realitor (who doesn’t) and I ask him what kind of money do these people make to buy these 800K SFR’s in my neighborhood – it is shocking that many of them do not make more than my wife and I. This really bothers me b/c either I am to “chicken” to buy or these people have absolutely no financial brain. I am not originally from SoCal, but have lived out here for over 15 years and I am amazed at how much risk people are willing to take.

My spouse and I made six figures in 2005-2007. We were that typical family that could qualify for a home around 800K. We went into escrow for a house back in 2004; I got cold feet. The payments were around $4K a month; a voice in the back of my head kept saying…what if? We backed out. Someone else bought the house and we watched it go up over $1M; I felt like a fool who failed my family. We saw another house for 850K; I remember the Realtor advising us to get an interest only loan, she said, I guarantee you’ll make money on this house; sell it in a few years for a nice profit. It reminded me of that commercial where Suzanne Researched This. Thankfully my spouse was not as easily swayed as the husband in that ad; we bought nothing. My spouse’s company was bought out shortly thereafter, “streamlining” began. We relocated out of California with a 30K pay cut and thankfully saved every dollar possible; relocated back after two years due to health issues with parents, who have since passed away. The ax fell. We’ve been looking for decent jobs since 2008. I recently found a PT job at a local retailer for $8.50 an hour. It was a little embarrassing until I found out some coworkers have Master’s Degrees. My spouse is an engineer who sends out resumes daily and networks relentlessly. Most of the responses are from Nigeria requesting personal information so they can do a “resume review”. I wish our story was unusual, but I know so many in the same situation. Those that still have jobs live in fear of a pink slip. The other day at I was helping a customer at work, she saw my name tag stating “new employee in training”…she was a professional woman in her thirties…she said, wow, you got a job, congratulations! Lucky you! I saw envy in her eyes and thought, this is tragic. Yup, the recession’s over. Go “purchase a property” (I love the way Realtors say that in hushed tones, instead of simply “buy a house”…it sounds so impressive!) with that 8K credit, party time.

It seems statistically we are considered fully employed. Odd how so many geniuses didn’t see this coming, but many average folks did. We had to transfer money THREE TIMES in the past year as two banks we did business with failed; one is still going, but has a one star rating and is on the “watch list”. We won’t take that chance. Will the FDIC be solvent? Politicians tell us things are improving, we’re supposed to believe them? Just print more money for some new, poorly conceived program and push it through…everything’s gonna be great. We have no trust in any leader in either political party. Electing a new governor for California is a joke…the state is run by the unions.

Whew! Sorry about the soap box. I’m just tired of all the spin.

For a laugh…California politics at its best…

http://www.tmz.com/2009/10/28/schwarzenegger-the-hidden-f-bomb-attack/

RE: Pete

No I think he meant job-loss recovery. That non sequitur pretty much sums up whats going on.

Yes, thanks for the brief respite from the insanity. My wife and I together make over $200K, rent and eventually would like to buy somewhere on the Westside. We could afford to buy now, but there is no way I am stepping into this highly manipulated market of idiots. I think it’s important to keep in mind that California represents the extreme in housing — the rest of the country’s housing markets (with a few notable exceptions) will normalize and Los Angeles will remain significantly distorted. When it becomes apparent that the subsidies are helping primarily California homeowners and Wall Street banks, the nation’s appetite for further subsidies will disappear. It may take a while, but I can be patient.

Regarding RE agents’ income.

3% of $200k per house in 2000 = $ 6k per house

3% of $800k per house in 2006 = $24k per house

3% of $500k per house in 2009 = $15k per house

They want us to buy any houses, I guess. I hope they don’t lose their houses.

Hi Doc. Can you track number of RE agents and their income reports on tax return by year?

@Gus:

“this highly manipulated market of idiots”

Nicely put. That sums it up perfectly!

Who but the very rich or very insane would be buying a starter shack for $700k? Oh, of course, the $8k tax credit. And there’s your manipulation. It’s like buying a brand new car because they’re offering a free tank of gas.

Rookie question:

When you say: “173 homes in distress. The MLS lists 80 homes, 12 of which are part of the 173.” How are can I find the homes in distress but not listed in the MLS?

Thanks.

A weakening dollar can help the housing market – indirectly – if we can translate that into more manufacturing and more exported goods. Sadly I see no one in government even talking about this.

No, he meant job-loss recovery.

The manipulation goes far beyond the $8K tax credit — quantitative easing, generally, and the specific Federal Reserve purchases of mortgage-related assets; institutionalized extend-and-pretend, which is intended to keep distressed houses off the market, supply constrained and prices up (e.g., suspension of mark-to-market accounting for assets but not liabilities, expansion of eligible collateral for various Fed lending programs and other programs which generally making it easier for banks to remain liquid so they can ignore losses in their asset portfolios); massive direct intervention in the housing market via the FHA, Ginnie, Fannie and Freddie, including the significant expansion of loan limits. There are probably others that I am forgetting. And these are just the new, allegedly temporary subsidies — let’s not forget the existing subsidies that help distort the market. There is the mortgage interest tax deduction, property tax deduction, depreciation deductions on real estate held for investment and last but not least, Prop 13, that 500lb weight around the neck of the young and new to the state.

Can you explain how you get that a rent of “$1,700 to $1,900” would equal a value in the low $200k’s? Mortgage + tax/ins. for a place at that price would be way lower than $1700, at least at today’s rates.

Yeah, job-loss. Exactly what happened the last time when the housing bubble began around the time that the dot-com crash happened. It defied logic to think that house prices could go up in the Bay Area with the massive unemployment there at the time, but through manipulation and shady tactics it did.

I think there are a lot of people, self included, who know that now is not a good time but have families and want to move on with their lives. Who are just so weary of the endless games that they’re ready to give up being vigilant. I’m not saying I’m one of those. But I am tired of all the Culver City and Mar Vista nonsense and ready to look in other sort-of-coastal areas like Torrance. Perhaps there are folks there who are not stupid enough to take on 3/4 of a million dollars worth of debt just to have a house – well, an apartment with a root, let’s face it.

@Matthew

Dr. HB is referring to what makes sense to a foreign investor holding “cheap” dollars in that paragraph. Yes, the monthly payment on a 225K property (let’s say @ 5-6% w/ 10% down) would be less than $1,800, but a landlord must have postive cash flow after property and income taxes as well as insurance, maintenance, and property management costs on top of currency conversion fees and vacancy periods. Bottom line is that no investor, foreign or domestic, looking for and acceptable cash flow would pay more than $240,000 or so for a place like this as a rental. Even from a bank REO, (in a world free of shadow inventory) the current asking price would be double that.

Uh, “At today’s rates?” Is that a phrase from your NAR “talking point” propoganda pamphlet?

OMG! The economy is growing at 3.5% Bubble-mania lives! We just can’t get enough of this stuff. Take one good last whiff Comrades cause this might be it for a while. In fact, it is going to be downright ugly.

Word around the banking industry is that the Federales (aka FDIC) are coming in 2010 for the big smack down. They are staffing up to start the long overdue task of taking down insolvent banks, not in the hundreds, but in the thousands (over 1000 banks failed in the S&L crisis). By one one estimate, of the 8000 banks in the US, only about 4000 are expected to survive. The FDIC will repackage their assets and sell them off at 10 to 30 cents on the dollar. Mark to market will be in full view. To fund this, the FDIC is asking banks to pay a full 3 year assessment today (taxpayers likely to fund the balance when that is dried up). If you think any of this will be good for real estate valuations, you’d be wrong!

@Brawndo has Electrolites:

Great job deflating Matthew’s uninformed assertion. You are totally right, he must either be a Realtard ($7k a year these days), or just someone who has no clue about what the “real world” formula is for an “acceptable” [rental] real estate investment. Renting is no fun at all, and you really do have to account HEAVILY for vacancy periods, which are becoming more and more common in this great recession era, which, contrary to the phony-baloney GDP numbers, is nowhere near being over. A few months without a “good” tenant will murder your profit in no time.

“at today’s rates”…Something about that statement irked me as well.

blutown,

Limbaugh claims the 3 percent is entirely due to Govt spending.

No real growth.

Your numbers are frightening.

Then again, what isn’t these days?

I’d have to agree with Gus. THe extend and pretend by the large banks is astounding. My friend works at BofA and told me tonight that they’re so busy taking phonecalls by distressed homeowners that they’re too overwhelmed to foreclose on people. I asked her “How can this possibly go on?” and she responded with the “Banks aren’t being truthful”.

It’s pathetically corrupt. My prudence has been rewarded watching the greedy and stupid live in homes payment free… INDEFINITELY…. while I pay rent to a landlord… who may or may not be paying anything to the bank.

Jeez, calm down, people. I’m not a realtor or an investor, or involved in RE industry in any way. I’m just a normal guy (and prospective house buyer, tho not in California) who was trying to understand the article.

Thanks for explaining, no thanks for the hostility.

OMG. Ima buy a house right now.

Leave a Reply