Real Homes of Genius: Ed McMahon Decides to Lower Price on Beverly Hills Home by $1,900,000 This Week.

Back in June of this year, we talked about the financial difficulties facing Ed McMahon. At that time, Ed McMahon was in arrears on his Beverly Hills home by a stunning $644,000 on his $4.8 million dollar home. As we worked out the math on the place, we approximated that the carrying cost alone on the home was $30,000 to $35,000 given the size of the mortgage. The home has been on the market for 537 days.

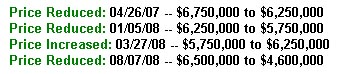

In what has to be the largest one day decrease in price, the home on August 7 was reduced from $6,500,000 to $4,600,000. A $1,900,000 price reduction in one day:

*Source: ZipRealty

Clearly even prime area zip codes such as the 90210 are having their difficulties in this housing market. What is stunning about the price action is during the financial turmoil, the price of the home was lifted by $500,000. I’m not sure if they thought given the media coverage of Ed’s financial difficulties that someone would be feeling bad enough to dish out $6.25 million.

The problem of course was that as it turns out and as time went by, living beyond your means doesn’t only apply to middle class workers. It is possible to be a “millionaire” and live beyond your means. This home had a second mortgage and was maxed out.

Let us do some quick math on the home:

First mortgage: $4,800,000 at 5.25% principal and interest = $26,505 per month

Taxes and Insurance = $5,200

Total monthly nut = $31,705

Yearly housing cost = $380,460

The yearly carrying cost of the first mortgage on this place is higher than the price of a median priced home in California! The Wall Street Journal reported that Ed was $644,000 in arrears back in June. Mr. McMahon unfortunately was injured 20 months ago and has been unable to work. So if we are to break the math down:

$644,000 / 20 = $32,200 per month

Too bad the Zestimate on the place has it much lower even after the nearly $2 million price reduction:

So we are close in estimating the monthly payment. Here are the details from the Wall Street Journal Article:

“(Wall Street Journal) ReconTrust, a unit of mortgage lender Countrywide Financial, on Feb. 28 filed a notice of default on a $4.8 million Countrywide loan backed by Mr. McMahon’s home. The notice was filed with the Los Angeles County Recorder’s Office but hasn’t previously come to light. According to the filing, Mr. McMahon was then about $644,000 in arrears on the loan. It isn’t clear whether Countrywide still owns the loan or is acting on behalf of investors who acquired it. Public records also show that Mr. McMahon had a separate home-equity line of credit from Countrywide of up to $300,000 secured by the same house.

Mr. McMahon’s home has been on the market for about two years, his real-estate agent Alex Davis said. Mr. Davis said the price had been reduced, but he couldn’t immediately provide details. The Christie’s Great Estates Web site, which includes homes listed by Mr. Davis, lists the asking price at $5.75 million and says it has a canyon view and a master-bedroom suite with his and her bathrooms.”

So as you already know, Countrywide is now owned by Bank of America so what was once Countrywide’s problem is now Bank of America’s problem. So let us do a quick recap:

1st mortgage: $4,800,000

2nd mortgage: $300,000

Total mortgages: $5,100,000

Current price as of August 7th 2008, $4,600,000. You can kiss that second mortgage goodbye. This is the problem that in order to get the home to sell, they need to make drastic measures. Since this home has been on the market for such a long time it looks like Bank of America is going through the junk on Countrywide’s books and is simply cleaning house. Dropping the price by nearly $2 million in one move will get anyone’s attention. This may be the move that was needed to move Ed McMahon’s home.

Today we salute you Bank of America with our Real Homes of Genius Award.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

17 Responses to “Real Homes of Genius: Ed McMahon Decides to Lower Price on Beverly Hills Home by $1,900,000 This Week.”

What did Ed pay for his McMahonsion and when did he buy it? Seems kind of odd to me that a man of his age ( over 80 now?) would need or want a mortgage of any kind much less a $4.8 million dollar one. Prior to his housing problems Ed

was not exactly a hot commodity yet this loan ( and property upkeep) would seem to require an income of close to $1 million. That’s pretty big money even by TV ad pitchman standards I would assume. Was Ed a ‘con man’ as well as a pitchman who talked Countrywide into giving him a 100% LTV no doc loan?

Ah, the Schadenfreude! Is it wrong that these stories make a renter like me so happy?

hey, maybe he’ll win the Publishers Clearing House Sweepstakes!

Correct me if I’m wrong, but wasn’t he loudly suing someone claiming that the home was infested with black mold?

If so, is it any wonder that he’s short on bidders now?

Too bad. I hate to see seniors get nicked on the way out. Just goes to show….you can’t live high on the hog forever. I meet friends at a local Las Vegas haunt once a week – we sit outside on the patio – we watch the new implants and the new lips, and the expensive cars roll by; life is good as long as the implants stay up and the lips stay puffed and the cars don’t get upstaged by someone else. It’s kinda funny and sad. Where will they be when they’re Ed’s age? No money in the bank, no gas in the tank, deflated implants and rusty lips.

Data Quick: Orange County median price a year ago 645K. This week 469K. At this rate they will be free in a couple years.

Slightly off-topic, but your mention of Bank of America’s Countrywide purchase reminded me of the thought I had earlier that BofA may have bought Countrywide in order to cover up the extent of its exposure to Countrywide’s toxic loan brew. Just how it might accomplish this is beyond my knowledge, but perhaps the financial geniuses at the bank have some way of offloading the worst stuff to some off-the-book entity. Otherwise, that purchase makes no sense at all. Why would they pay billions for a company that almost certainly has negative net worth?

I read somewhere on landlord/tenant internet site regarding mold that McMahon was in some kind of lawsuit alledging that the developer or builder or someone was responsible for the mold which eventually killed his dog and made him really sick. So in the process of the lawsuit, he had to paint a picture that his property was extremely infested. Later on, he did get some kind of settlement out of court. If this is all true, then he succeeded in making his property so undesirable that no one wants to touch it! Especially, if you have that kind of money to look for a house during this hard time.

I believe that the BofA-Countrywide union was a shotgun marraige orchestrated by the Fed. At times like this, solvent banks are pressed by a combo of carrot and stick measures to absorb a failing institution. This was also done in the S&L bust of the 80s.

Back to the topic- McMahon’s problems, like the similar situations of many other upper-income Americans, are a measure of how swinish we have become in this country. Here is someone who had choices and options that most citizens could never imagine, who still managed to spend himself into bankruptcy.

I mean, I can understand some struggling working-class family grasping at straws to lift themselves into an ownership situation in a half-decent area, and lacking the skills and knowledge to know when they’re walking into a trap. Not that I condone their actions. I don’t believe they should be bailed, either.

But it’s beyond sick when people who could still live really lush lives on a quarter their yearly incomes deal themselves into situations like McMahon’s, especially when you consider that the large majority of Americans DON’T have debt problems, and DO manage to accumulate a respectable nest egg and build decent lives with reasonable amenity in good housing, on working class incomes, which is the kind of income most people in this country have.

This particular homeowner is a bellweather: we are going from bad to putrid, and my bet is that the pressure to engineer a bailout came from the more affluent segments of our society; the banks and affluent, overextended homeowners.

Ed McMahon may no longer live lushly because he’s an old lush. Yup, Ed’s an alcoholic. Alcoholics often suffer delusions of grandeur and make god-awful mistakes in judgment. He may have once owned $200 million in real estate; he’s earned about that much over his lifetime; he sued his insurance company over mold and won more in damages than he owes on his home now; and he’s broke. I’d say “go figure,” but it’s just another classic case of latter-stage alcoholism, when the chickens come home to roost. I explain this and much more in my online addiction report; McMahon is top story in the July 2008 issue and I connect the dots between the real estate bubble, the mortgage mess and alcoholism in the August 2007 issue.

BTW, Dr., you’ve got the best housing bubble blog. Keep up the great work. I hope you’re planning on writing a book about what will likely go down as the greatest bubble in the history of mankind.

–Doug Thorburn

Why can’t Ed tell us how he broke his neck.

He was most likely doing stupid and perverted

while drunk and on pills.

People in show business, such as Mr McMahon, have always lived in fantasy land. They make more money in a year than most of us make in a lifetime, they tend to drink more, spend more, marry more and do more drugs. I’m not going bash him while he is down. He may have some character flaws, like most of us, but it’s just that he has made so much money for so long that he probably thought it would never end and now it has. I, on the other hand, do not feel sorry for him either.

Us “normal” people will never understand how one can go thru this

much money – even in a lifetime – and still have nothing to show for.

So he is famous… who cares?

To use his mold invested, overpriced McMansion in relation to

the overall housing problems in California is misleading.

Let’s worry about the median house being overpriced not the top

1 percent of the housing pyramid. What the heck would you want with

this much space anyway? Could you imagine what it costs a month

to run such a house? You need a staff of employees just to keep it

clean and looking good. No thanks… I bitch enough at the PG&E bill

of my rental. I would probably faint if I ever got Ed’s electric bill.

No wonder he drinks…

Are there any normal people left in L.A.? Are there any middle class people left in L.A.? With the ridiculous cost of everything STILL, honestly sometimes I wonder.

He got a $7 million settlement for the toxic mold death trap. Won’t that pay for a bulldozer?

That’s a pretty big drop in price, it’s almost in my price range now, lol.

McMahon’s McMansion is a gift to the girl-toy he married. It really is hard to imagine that he has no rainy day fund or insurance that would help him live his lifestyle now that he has injured himself. I just can’t muster any sympathy when he is in his 80s and spending money he doesn’t have on a house that ridiculously priced. You could get a good sized condo in the same area for a quarter of that price!

Leave a Reply