Real Homes of Genius: It Takes a Pink Home to Lose 80 Percent in Value. 3 Sample Compton Homes Showing the Magnitude of the Housing Bubble and Subprime Mess. Going back to 1990 Prices.

Most people have a difficult time conceptualizing the magnitude of the housing problem. I hesitate to call it a housing problem since we do have homes, plenty of them actually. At the root of it all is we have an affordable housing issue. The bubble simply exaggerated the problem where it became too large to manage. Folks keep hearing about companies losing billions and bailouts reaching into the trillions. Some choose to ignore the crisis and some wallow in it too much causing psychological distress. Or as many others are reacting, they are simply frustrated and angry. The bottom line is you would be hard pressed to find a large group of people who think things are going well in our current economy. I’ve put together three Compton homes on the market to help you understand why we are in the mess we are in. Examples usually help to make things more understandable or at least put a picture to the insanity. Today we salute you Compton California with our Real Homes of Genius Award.

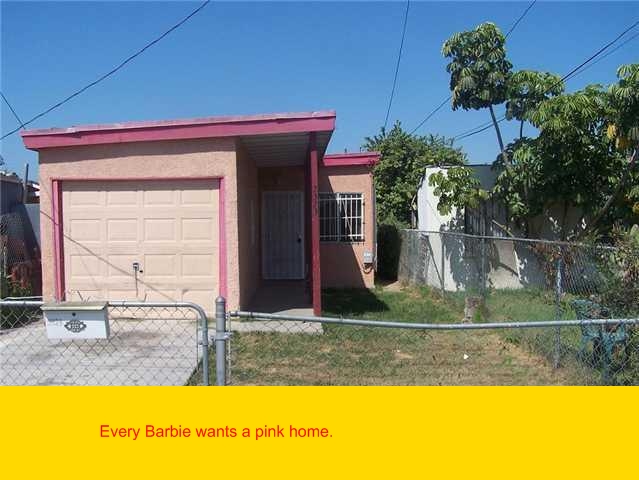

Dreaming of 1997 – 80 Percent Price Decline in Compton

Pink homes usually go hand and hand with Malibu Barbie. Here is a great home for your Malibu lifestyle on a beer budget. This home has taken this housing bubble on the dance floor and performed every move imaginable including the price decline tango. Looking at the sale and price history, we can only imagine the stories it has to tell us. This home is a foreclosure, one of the many thousands in California, and is listed as having 2 bedrooms and 1 bath. It is 817 square feet and is now going for 124 days on the market. I know, what a shocker. Let us look at the wonderful pricing history over the past 124 days:

Price Reduced: 01/08/09 — $144,900 to $139,900

Price Reduced: 01/21/09 — $139,900 to $114,900

Price Reduced: 02/12/09 — $114,900 to $109,800

Price Reduced: 02/24/09 — $109,800 to $74,800

Price Reduced: 04/06/09 — $69,800 to $64,800

This totally makes all the sense in the world. Let us list this home for $144,900 in January only to drop the price to $64,800 in April (a reduction of 55 percent). One important thing people need to ask is why in the world would you list the home for $144,900 in the first place? Is that the amount of the first mortgage? Only the seller can know for sure. However, dropping the price like this tells us the state of the current housing market. Is there no Barbie looking for this home? Heck, your PI payment on this place will come out to be around $350! Car payments are bigger than that.

You may be saying to yourself, “okay, they mispriced the foreclosure. So what? What does this have to do with showing us the history of the housing bubble?” Oh, you have no idea! Let us look at the sales history with a bit of running commentary:

Sale History

09/02/2008: $184,800 < Lender taking place back.

01/26/2006: $312,000 < What the heck? $312,000 for this place? Bwahahahaha! Whichever bank made this loan should be taken by the FDIC immediately.

02/10/2003: $138,000 < Nice little jump here for a few months. Bubble picking up steam.

08/30/2002: $85,000 < Whoops. That only lasted a few months.

01/03/2002: $104,682 < Hey, this home actually appreciated!

11/13/1997: $93,000 < Get the price back up and ready to go.

07/30/1997: $41,000 < A 50% drop in the pre-bubble? Oh yes, these things do happen.

03/27/1997: $85,000 < Pre-bubble days

That pretty much sums it up right there. The lender who made that 2006 loan needs to be taken into receivership ASAP. How do you make a $312,000 loan on this place?! If the home sells for the current price it is an 80 percent loss from the peak and puts us back to the early 1990s price range.

Garbage Can Photography Version 3.0

I’ve been baffled by this garbage can photography marketing technique. Maybe I skipped class that day when they were discussing Waste Management techniques in selling real estate. Some agents have e-mailed me about other Real Homes of Genius saying, “I’m not getting out of my car to take a picture in this neighborhood.” Well, you are working for a commission and now it means doing some leg work…like moving the trash can from the lawn before you snap a picture! And believe it or not, $70,000 is still a good amount of money for millions of Americans.

This home is another foreclosure. This home is “sold as is” which is always a great sign of a quality product. This is a 2 bedroom 1 bath home with a gigantic 546 square feet. How do you get 2 bedrooms in 546 square feet? Math wizards please enlighten us.

This home has been on the market for 78 days and has already seen one price reduction:

Price Reduced: 04/02/09 — $79,900 to $69,900

A $10,000 drop is 12 percent for a home in this price range. That is a big deal. Aside from the great garbage bins (I count 4 in the picture) you would wonder why in the world a lender would put loans on this place of:

Sold (12/23/2008): $185,066 < Home taken back by lender

Again the question is which lender made this loan of $185,066? Incredible. Don’t you feel excited that you are bailing out institutions that made these kind of loans? According to the U.S. Treasury this home loan is a “legacy asset” instead of toxic waste. In addition, through the public private investment program, the American taxpayer will be the proud recipient of many of these loans including those garbage cans. I’m sure many of you are just itching to buy these homes! Oh, and they happened to take the picture on a rainy Southern California day! We have approximately 10 days out of 365 where it is raining and they decide to take a picture with garbage cans and rain! They are really doing their absolute best to market this place. Don’t try to sell this home so fast!

We’ll Beat Any Advertised Price or Your Mattress is Freeee!

Those comedians at the U.S. Treasury and Federal Reserve are going in complete circles as to the best approach of tackling this problem. Money for Bank of America? Goldman Sachs? JP Morgan? Wells Fargo? AIG? So many choices! Why give out trillions to your crony banking buddies when all you need to do is give a free mattress with every home purchase? Now with this home, we get a nice combination. Not only do we get Garbage Can Photography 2.0 but we also get Mattress Photography 1.0.

This is a larger home. 4 bedrooms and 2 baths and is listed at 1,314 square feet. It has been on the market for 126 days. Let us see the pricing action again:

Price Reduced: 02/04/09 — $169,900 to $159,900

Price Reduced: 02/24/09 — $159,900 to $139,900

Price Reduced: 04/01/09 — $139,900 to $114,900

Great price right? Small caveat. The stinking unemployment rate in California is 11.2 percent!   Have you taken a look at Detroit home prices? There is a reason why some homes are priced at very low levels. Unemployment does not help in boosting prices. And this is one key point I want to drive home to all the bottom dwellers. Until you stabilize the employment situation, you can focus all you want on mortgages and cheap credit but what use is that when people are struggling to find employment? You’re going to make your mortgage payment with a $300 weekly unemployment check? I’ve seen various sources talking about job growth during the housing bubble decade here in California and estimates from 40 to 50 percent of all job growth can be attributed to housing, finance, and industries tied to the real estate market. With that said, it is important to look at places like Compton since it is good to have an idea of what we have been purchasing through bailouts of the banks and Wall Street. I think I answered my question as to why banks aren’t dolling the homes up. With all these bailouts given to any bank, why fix a home when the government is gearing up to buy them as is?

Today we salute you Compton with our Real Homes of Genius Award.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

32 Responses to “Real Homes of Genius: It Takes a Pink Home to Lose 80 Percent in Value. 3 Sample Compton Homes Showing the Magnitude of the Housing Bubble and Subprime Mess. Going back to 1990 Prices.”

You can bet the farm that Merit Financial, New Century Mortgage, Carrington Mortgage Service and Deutsche Bank are hand-in-hand on these examples.

Hey Doc,

I live in 90277 and noticed a lot of properties going into escrow and sold. Still at pretty high prices, some with multiple offers. Also see this in other areas in the South Bay – I am assuming it is from low rates. Just thought you may have some comments on this.

Thanks

I think you can buy the first one with that unemployment check. So in a reach-around way, the govt owns YOU, the place you live, and your means of $$ in one fell swoop!! Welcome to communism, american style!!

So, I am going to take a different perspective on this article. I think this is a positive. I mean lets face it, we all know we are in a bad situation. Markets are all screwed up, who knows what these bailouts are really going to do to us. Now, applying these examples to other areas for example.. I will use my local city. Salt Lake City UTAH. I will confirm what you have found. Here in UTAH you can basically wipe away all of the “BOOM” years, and we are back to pricing of before 2001. I am going to take the positive stand point and say this is good for the consumer that is actually qualified to buy. I mean face it, we need people to continue to buy homes.. Lets take your statistic you gave us, 40% of the job growth in Cali. in some way shape or form was tied to the Real Estate industry. We need people to continue to live and buy and contribute to the market, so on the upside people who can buy are getting a good price, or at least we know a fair price?

It is going to feel good to one day buy a home, that is just 3-4 times my DOCUMENTED INCOME. I say let the high interest rates come and wash this bubble clean once and for all. Lets see rates above 7%, I think that will finally clean out the mess drop prices and begin responsible lending again.

Zen do not forget Option One, countywide and 1st Franklen

surfaddict–

You’re confusing totalitarianism with communism; we in America tend to confuse totalitarianism as practiced by countries such as China with the “egalitarian, classless, stateless society based on common ownership” posited Karl Marx. Sadly, true communism–ideologically contrary to human nature–can never exist, and is inevitably doomed to some iteration of totalitarianism. Seems that George Orwell was correct in his observation that “some animals are more equal than others.”

Well I’ve rented apartments that looked like that, but in much better neighborhoods :).

After all this doom and gloom…and the over supply is bought up and absorbed…do you know what a new home will cost? They are still making kids and not building homes-supply/demand will equal at some point. That is when homes will have to go up-no one can build a new home for under $100 a foot…yet we are selling them for $50. a foot in this market. Cannot last…and we have been through these markets before-everyone just keeps forgetting. So yes…values will take off again…bet on it.

My wife and are still renting in the 90039 zip code and have been watching the prices near us for a year or so. We’re seeing A LOT more home & condos for sale but not many sales. Sellers are being a bit stubborn about lowering their prices. I wonder how long before we start to see some serious movement?

Last weekend Los Feliz Blvd near Griffith Park had so many open house signs on every corner that you couldn’t count them all. How long before they start hiring kids to flip signs in the air like they do for new developments in Temecula?

Brian – by any chance are you a realtor?

JB> Thanks for the definition, whatever we call it, i dont like it.

Brian> It costs more than $500 to make a car, but I can buy used beaters all day long for $500 that run fine.

Spencer> Yes Defaltion is GOOD!! Cheaper stuff for the little guy!! Govt meddling is BAD.

Brian–

As a contractor, I can tell you in fact a home can be built for less than $100 a square foot–much less. It might not have marble flooring or gold plated fixtures, but certainly would be more livable than many of the foreclosed trash piles masquerading as housing that as yet remain ridiculously overpriced. But you are right: “values will take off again,” just in time for Christmas, 2025. This, of course, is but an estimate of a galled crank, and very much obliged to the number of years necessary for the public to forget they can’t realistically afford that “value,” and so turn to extortionate lenders offering easy smiles and even easier credit. Hurry, they’re not making anymore land!

Thanks for the honesty. Who in their right mind believes that people will ever be able to obtain loans again for a home costing 20X their annual income?

Brian is a realtor or needs his medication NOW.

I was going to ask Brian the same thing! Haha!

Yeah Brian, SOME day the prices will go up again…after we face many years of a flatline/bottom there will be increases that will go back to tracking inflation, say 3% per year or so. If Japan is any indication, housing fell for YEARS and still hasn’t come back significantly. And our monkeys are doing the same things that their monkeys did to no avail…

Northern California (beyond Sacramento) is still holding on to bubble dreams.

We are hit with unemployment just like anywhere else but my neck of the woods is mainly “retirement communities”. The older folks that sold their houses in the Bay Area for $400K and up and then started buying up north to retire.

Their “home prices’ still dictate the market – only problem… nothing is moving.

Sacramento on the other hand is dropping like a rock. A 30 mile difference can mean that the same kind of house is sold in Sacto. for $100K while up here they are still dreaming of the $300K and way above price stickers.

If the realtor wasn’t afraid of stepping out of his car, he could have walked up to the mattress and taken a tighter shot from right over top. Or maybe it looks worse close up?

Comrade Housing Bubble, our housing “problem” is not just that we have too much housing overall (which we do) but that we have the wrong kind of housing in the wrong places. Have you seen the Realtytrac maps of where the highest foreclosures are? It’s the the fringe zip codes where cheap land existed but where horrific commutes made living there less affordable, not more.

At some point in the game, one must consider that the buyer of the homes featured in your post are simply looking at the finished lot cost plus demo. Who cares if there is a garbage can in front? A few hours with a front loader and voila, trash (and house) be gone!

Cities evolve though redevelopment and recycling and one of the necessary ingredients to do this is land cheap enough to assemble for the next real estate enterprise at a higher and better use (multi-family, commercial, etc.) My point is, places like Compton’s only hope for revival is dirt cheap land to stimulate investment. This process can take decades.

The same case cannot be made for many (though not all) fringe zip codes. Without any meaningful employment base, a total and absolute dependence on the auto, and a housing stock composed mainly of beige McMansions, they’re ill suited to serve current and future needs. Their decline into the slums of the future has just begun.

The 21st Century will look very different from the 20th Century and our cities will reflect that as much as anything else. Be brave Comrades!

The house with the mattress out front is really an attractive old house, and it looks roomy. Too bad about the neighborhood, which you can tell some things about just from the prevalence of window bars as well as all the trash out front. No decent neighborhood would tolerate a display like this. If the neighbors don’t want squatters in that place, they’d better step in and clean it up ASAP.

Do they expect to sell these places to ANYBODY, with the way they’re staged?

The sellers in many cities still don’t get that people aren’t going to do just anything or buy just anything to say they “own”.

NY Times April 22.

For Housing Crisis, the End Probably Isn’t Near

By DAVID LEONHARDT

The closest thing to a real estate crystal ball in the last few years has been the house auctions that are regularly held around the country.

In 2006 and early 2007, the official housing statistics were still showing that house prices were holding up. But that was largely because so many sellers were refusing to sell. The auctions, made up mostly of foreclosed homes, showed the truth: house values were starting to plummet in many places.

So a few weeks ago, I decided to go to an auction at a hotel ballroom in Washington — and to study the results of several others elsewhere — with an eye to figuring out whether prices may now be close to bottoming out.

That’s clearly a huge economic question. Last week, JPMorgan’s chief financial officer told Eric Dash of The New York Times that JPMorgan, and presumably other banks, would be under pressure “until home prices stabilize and unemployment peaks.†As long as home prices are falling, foreclosures are likely to keep rising and the toxic assets polluting bank balance sheets are likely to stay toxic.

There are reasons, though, to think that prices may be on the verge of stabilizing. Relative to fundamentals, like household incomes and rents, houses nationwide now appear to be overvalued by only about 5 percent. You can make an argument that the end of the housing crash is near.

But that’s not what I found at the auctions.

•

“This is a perfect storm of opportunity,†Bob Michaelis, goateed with a shaved head, told the 300 or so people who had come to downtown Washington for the auction.

Mr. Michaelis, the auction manager, spoke from a lectern on stage, and his goal seemed to be to persuade people that they might never see a buyers’ market as good as this one. Prices have plunged, and interest rates, he said, are at “generational lows.†(The National Association of Realtors has been running a radio commercial this spring making a similar case.)

“Look around to your left and your right, and you’ll see someone who sees an opportunity just like you do,†Mr. Michaelis said. “We’re approaching the bottom of the market, I think. We’re approaching the bottom of the market, if we’re not there already.â€

He then told the audience that, in the last 100 years, house prices have recovered from every downturn and gone on to reach record highs. Oh, and Wells Fargo and Countrywide were standing by, ready to offer financing to qualified auction buyers.

If nothing else, this sales pitch certainly had chutzpah. It combined the old bubble-era notion that house prices always rise over time (ignoring the fact that incomes, stock values and the price of bread do, too) with the new postcrash idea that houses must be a bargain because they’re a lot cheaper than they used to be. Even Countrywide, which was taken over by Bank of America after so many of its subprime mortgages went bad, is still part of the housing pitch.

Yet as soon as the auction began, it was clear that the pitch wasn’t working.

The winning bid on the first home auctioned off, a two-bedroom townhouse in Virginia Beach, was $115,000. Just last July, it sold for $182,000, according to property records. A four-bedroom brick house with a two-car garage in Upper Marlboro, Md., went for $375,000. Last year, it sold for $563,000.

Throughout the evening, such low-ball prices continued to win the bidding. At one point, the auctioneer, Wayne Wheat, interrupted his sing-song auction call to cheerfully ask, “Where are my investors?â€

The tables that had been set up around the edges of the ballroom, reserved for people planning to buy multiple houses, were mostly empty. Many audience members, like the man in a camouflage baseball cap just in front of me, were attending their first auction.

On Sunday, my colleague Carmen Gentile went to a larger auction, in Miami, to see if my experience had been unusual. It wasn’t. The homes there also sold for just a fraction of what they would have even a year ago. The rate of decline in Miami hasn’t even slowed noticeably in recent months, according to data kept by Real Estate Disposition Corporation, known as R.E.D.C., which runs the auctions.

A recently transplanted New Yorker named Michael Houtkin won the bidding on a one-bedroom condominium on the outskirts of Boca Raton, a few blocks from three golf courses, for the incredible price of $30,000. “Things were almost being given away,†he said later.

As is often the case at these auctions, the seller of the condo — Fannie Mae — retained the right to refuse the winning bid and keep the property. But Mr. Houtkin told me he was optimistic his bid would be accepted. An R.E.D.C. employee suggested to him that $30,000 wasn’t much below the minimum price that Fannie Mae had hoped to receive.

How could that be? Because Fannie Mae, like many banks, is inundated with foreclosed properties. In recent weeks, banks have begun accelerating foreclosures again, after having held off while waiting to find out which homeowners would be eligible for the Obama administration’s assistance program.

The glut of foreclosed homes creates a self-reinforcing cycle. Falling prices lead to more foreclosures. Foreclosures lead to an excess supply of homes for sale. The excess supply then leads to further price declines. Jan Hatzius, the chief economist at Goldman Sachs, says that the “massive amount of excess supply†means that home prices nationwide will probably fall an additional 15 percent.

This estimate hides a lot of variation, too. In Miami, Goldman forecasts, prices could drop an additional 33 percent, which is pretty amazing since they’ve already fallen 50 percent from their 2006 peak.

Nor is excess supply the only reason prices still have a way to fall. Nationwide, homes may not be overvalued by much. But in some cities, including New York, San Francisco, Los Angeles, Boston, Chicago and Miami, they remain very expensive. So while Mr. Hatzius and his Goldman colleagues are somewhat more pessimistic than most forecasters, the difference isn’t enormous.

I’ll confess that this bearish picture isn’t exactly what I had hoped to find. A year ago, as part of a move from New York to Washington, my wife and I bought our first house. We did so fully expecting prices to continue falling (though perhaps not as much as they ultimately will, given the severity of the financial crisis). But we decided they had fallen enough for us to take the plunge. We preferred buying before the bottom of the market instead of renting and having to move again in a year or two.

Still, when I wrote about that decision last spring, I argued that anyone who didn’t have to move probably should not buy yet. Prices still had a way to fall.

They don’t have as far to fall today, but the great real estate crash is not over, either. So if you are part of the 30 percent of American households who rent and you’re trying to decide when to buy, relax.

The market is still coming your way.

Comment by Brian

“””So yes…values will take off again…bet on it.”””

Not in our lifetimes, Brian, no way. A body in motion stays in motion and that motion is straight down for house prices. Remember, it has been announced that there will be 2,000,000 more foreclosures in 2009 in total, which is more than in 2008, Dr. Bubble has written time and time again about the hundreds of millions in option arms that are set to reset in 2009, most or many in Cali, not to mention all the good Doctor has written about Cali’s skyrocketing unemployment, Cali deficits, etc.

Next stop on the ride down could be the price level that existed in the mid to late 80’s, say a 3/2/2 SFR for around 80k. How long it takes to get down to that level is anyone’s guess, it could be 2 years, 3 years, 5 years, 8, 13, who knows, it’s an “unknown unknown.” But, for sure, there cannot be an uptick in home prices.

I keep seeing the job loss thing coming up, but I’m not sure if it’s as big a detractor as it’s being made to be. First, we’re already up to 11% unemployment. Suppose we get up to 20%. Going on odds alone, you’ve got about 90% chance of remaining employed. That’s not a very dangerous bet. But people don’t take big loans if they expect they’ll soon be on the chopping block. While many are getting blindsided by layoffs and wage cuts, I would expect that most people who actually care about their employment situation and are capable of the long-term planning necessary to put together the down payment necessary to qualify for a mortgage right now would probably have the sense to understand where their company is headed in the next few years.

–

Now just to be clear, I’m not saying that the uncertainty generated by massive unemployment is completely negligible. Of those that have a good understanding of the security of their current employment, there will be many who don’t feel enough certainty to push forward into major purchases. I believe most of these people have already retracted from the housing market, and that the effect of unemployment is currently in full swing regardless of any monthly swings up or down in employment. For working-class areas where prices of 250,000-300,000 were well-supoprted in ’97-’02 and peak prices reached up to around 500,000-600,000, prices are now back down to about 280.000-350,000, and properties are moving fairly quickly. The current prices are on the high end of affordability for median wages, and that has provided perhaps not an absolute floor but definately an upward pressure on prices.

–

So to people who have stable jobs and have been saving the last few years, buying a house in the current situation is not necessarily crazy and foolish. A 3 bed 2 bath priced at about 350,000 in garden grove, for instance, would run about $1800/month after taxes and insurance. Multiply that by 36, and we see that a $65,000/year wage can comfortably support it. A $55,000 would have to stretch a bit could probably make it work, even. Compare that to what $1800 can rent in a similar area, and it makes even more sense.

–

But – and this is the important part – those prices are on the highest end of what the local wages can afford. With mortgage rates so insanely low right now, we can expect further significant declines soon as we’re now reaching a point where the fed has to stop throwing such much new money into the economy. When this happens, if we assume mortgage rates rise into the double digits, those same wages will only be able to support prices up to about $215,000 with the standard 20% down. The only hope at that point is that the money that gets thrown into the economy will filter down to higher wages for everyone. Then again, it might also mean that the losses sustained by previous bad loans will be filtered into losses on current good and footed by the borrowers of today rather than the lenders of yesterday. Now that’s a horrifying though.

Compton’s property values will not rise until all the Crips and Bloods are gone.

Brian has to be a Butt-munch Real Estate Agent trying to enthuse people to “buy now!” with his nonsense about prices “taking off”. IF his prediction is accurate, it is years down the road and will be very gradual demand curve.

The way I see it, there is only one cure for the fringe areas. Let them become crack houses, then it is up to all of us to become crack addicts.

By doing so, we will be giving these homes to homeless transients, as well as financing the next bubble, which will be the creation of Sober houses.

See, all these homes can be put to good use.

This is quite a hoot! My city didn’t have a housing bubble. Home values usually went up about 2-4% a year. For $350,000 you could get a real mansion, not a McMansion. What was in the water out there with people thinking an interest-only loan was a great invention? Obviously, wages out there aren’t that much higher than here (back east) to support the kind of housing prices you had.

I had a great laugh at the comment above which said they won’t sell these houses the way they are “staged”. Staged? They are in one of the most dangerous neighborhoods in the country! The first one may be worth $50K since it will need ALOT of work. The second one…why buy ANYTHING in friggin Compton? If you value your life that is.

While I agree Housing prices will continue to drop for another year or so, I am concerned that by that time – when the bottom does come – interest rates will be much higher, so the cost of owning a home may not change too much.

From the bottom callers at the National Association of Home Builders:

NAHB director of forecasting Bernard Markstein threw his thoughts into the ring, joining the optimists in the group. “We expect this quarter to mark the end of the decline in residential construction. While not a return to normalcy, 2010 should mark a significant improvement, although the pain will not be over for the formerly hot markets and the upper Midwest.”

Along with NAR, Cramer and the other leaders of the United States of Denial, whatever they say, do the opposite. Be brave Comrades!

Wow I seriously can’t believe the high % of price drops on the homes, in such a short time

House prices in the South Bay of Los Angeles are still really stubborn. Two-or- three on a lot townhouses (mini-macs) that I would consider undesirable due to the lack of yard space and common driveways, are still selling to “the rich” almost daily. (To me, if you can afford a 600k+ house without any fishy financing, you’re rich) I don’t know how there can be so many “rich” around who don’t want or need a real house with a real piece of land. I also find it interesting that, if you put it into National perspective, Compton is a very brief drive from wholesome and upscale areas like Torrance, and North Redondo Beach, except that in one zone the prices have zoomed towards zero, and in the other zone (just a couple miles away), prices are holding very strong. Even rather stodgy cities in the South Bay bay like Hawthorne and Lawndale are holding the line on pricing at levels that I would never consider paying for (in those areas). Location, Location, Location, is the mantra, but I am certain that even these last bastion areas are going to come down like a brick when people capitulate.

The pink house is now listed on realtor.com for $59,800, discounted another 8%.

In engineering we are taught critical thinking–what if everything you thought was wrong. What is common:

Paulson, Giethner, Goldman, Lewis, Dimon, Rothschild, Murdoch.

There are particular people that are parasitic in nature–they do not produce, only consume. Few of us are consumed by the predators we fear, but the parasites consume us all. They are the power brokers of the world. We know the answer, we always have, we just can’t do anything about it because they own the banks, the legal profession, medical, politics and media. And some are my dear friends.

Leave a Reply