Real Homes of Genius: Rancho Park and the zero down $775,000 2 Bedroom Home – Deconstructing the Westside of Los Angeles. The 310. Foreclosures moving up to Prime Markets. Notice of Defaults Second Highest Quarter on Record.

There is something surreal in the air in California. With the warm summer weather and gorgeous sunsets it is hard to come to terms that the state has a $26 billion budget deficit that will be solved with massive cuts and borrowing.  The state is issuing IOUs which should be a warning sign to most that the state isn’t flush with excess revenues. Yet for some reason, there is this belief that we will once be back to the bubble heyday. I was talking with a person trying to sell their home. They had pulled the home off the market and told me, “I’m going to wait for one or two years when the market bounces back.” Bounce back to what? The manic easy credit induced bubble days? Those days are long gone. In fact, in this particular area the homes are littered with Alt-A and option ARM loans. How can you tell? You see massive additions to the home and remodeling projects that have costs upwards of $100,000 courtesy of a HELOC. This is not Beverly Hills but your mid-tier market.

Today we’ll look at another Westside area in Rancho Park. So far we have looked at:

In each of these areas we are seeing the early signs of a foundation cracking at the edges like poorly applied makeup. Yet many in these areas believe in the housing bubble like some kind of underground cult. They know something you don’t. In their world, math doesn’t apply and supply and demand are words left to boring analysis. Who needs analysis when you have the almighty power of the granite counter-top? Who cares if the state has an 11.6 percent unemployment rate, the highest in modern BLS record keeping history? That is a minor footnote. Who cares that nearly 50 percent of option ARM loans sit in California anxiously waiting like ticking time bombs to level equity in mid to upper priced areas? These are minor inconveniences and roadblocks to California housing bubble version 2.0 which will come to a theater near you. It won’t be the first time in history we have a jobless recovery but it will be a jobless recovery with a housing boom. At least that is the perception in this parallel universe.

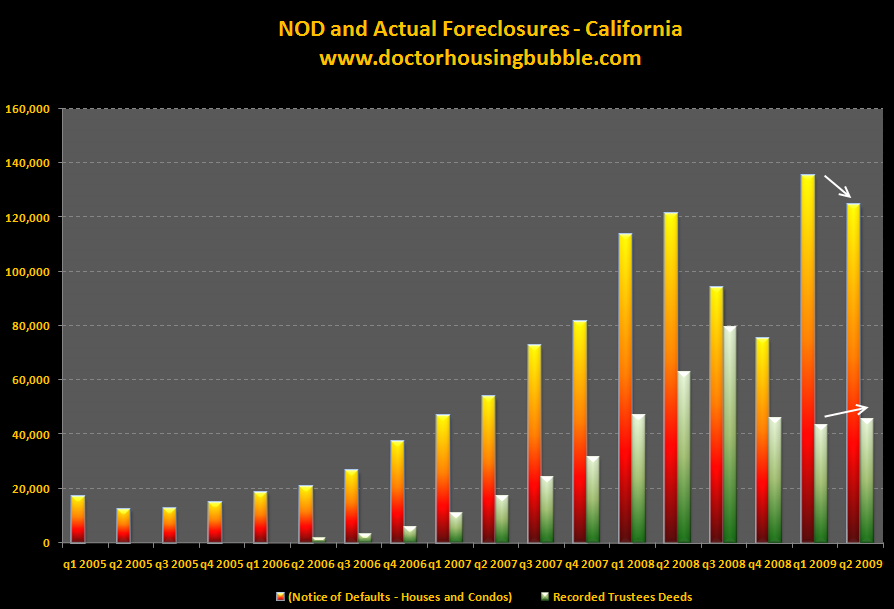

The budget is a mess. The fact that we have a gap the size of one-fourth of our general fund is something beyond comprehension. Notice of default data was released for the second quarter and it was the second highest quarter on record:

Although notice of defaults decreased from the first quarter, they are still sky high. However, foreclosures did increase. Keep in mind there is some serious funny business going on since some banks don’t even bother to start the notice of default process for half a year. We’ve had many comments posted on this site of people sitting in their home, missed payments and all, and have yet to hear from their lender (please share if you have a similar story in the comments). Yet things are supposedly fantastic. 124,000 notice of defaults were filed in Q2 of 2009. In these cases, the bank has sent a notice. When do you think the Q1 and Q2 NODs will hit the market as inventory? Try Q3 and Q4 of this year. This aligning of the planets including the Alt-A and option ARM tsunami will engulf the mid to upper tier markets.

It is easy to drink the housing Kool-Aid since the system is still largely present. Banks have only changed names and colors yet the mentality is still the same. The S&P 500 is now up 300 points from the 676 low reached in March. Hey, if the S&P 500 can increase 44 percent in four months why not housing? In no other place is this silo-cover-my-ears-and-eyes philosophy more prevalent than in the Westside of Los Angeles. Today we salute you Rancho Park with our Real Home of Genius Award.

Rancho Park – Translation: the Expensive Ranch

During the housing bubble, it was typical to hear people ask during cocktail parties, “so, where do you live?” Of course, this was code for, “how much money do you make?” Some enterprising bachelors would say, “I’m in the 310 and live in the Westside.” They didn’t have to clarify that they got a T-Mobile phone in some strip mall shop with a 310 area code and live in a tiny studio. The illusion of wealth is just as important as actually having it for many in the Westside. Rancho Park is one of those areas that benefitted from being part of the Westside but really has very little in common with Santa Monica and Beverly Hills for example. This is what many would call the all hat and no cattle crowd.

Today’s home is an example of someone who sold at the peak (and conversely someone who bought at the peak). Now who can really tell if they timed it perfectly or if the cosmos merely smiled upon the seller. This above 2 bedroom and 2 bath home sold for $775,000 in 2005, near the peak of the bubble. The last sale on this home was in 1978 for $90,000. Does anyone doubt the diluting power of the Federal Reserve and U.S. Treasury? The home as you can see does not look like a home that is worth three-quarters of a million dollars. It is 1,134 square feet. Yet these are the homes that are still sitting on the market.

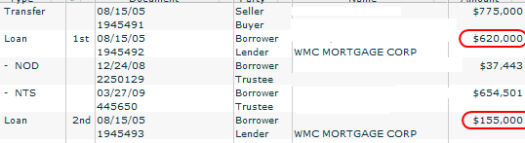

But when we look at how this home was purchased, you will see why this home is now in distress:

I’ll do the quick math for you:Â $620,000 + $155,000 = $775,000

A zero down deal on a $775,000 home! And this isn’t even like they used two lenders for the piggyback loan. These lenders were so eager to lend that they made the 1st and the 2nd mortgage. Now you may be asking, who is WMC Mortgage? WMC Mortgage was GE’s defunct subprime mortgage business. This operation ceased sometime in late 2007. With loans like this I know you must be stunned.

Well as you can tell, a notice of default was filed in December of 2008 for some $37,000+ in missed payments. A notice of trustee sale was filed approximately 3 months later in March of 2009. Now the home is on the market for $679,000. The ad tells us the following:

“2bed,2bath home. Rebuild or remodel. Sold as is. Great area. Foreclosure sale pending august 9, 2009. Owners seeking loan modification. Possible short sale pending lenders approval. No showings at this time.”

What is there to modify? As we have discussed the payment modifications being undertaken amount to government sponsored mini-option ARMs. Possible short sale pending? Who in their mind would pay $679,000 for a 2 bedroom home in Rancho Park? And here is another point. Those 100 percent deals are long gone. This is jumbo financing here. So if you were to buy this place and put 20 percent down you would need $135,800! In the middle of the state printing money and unemployment skyrocketing. All you need to do is look at areas like this and you will see that we are far from a bottom. Those Alt-A and option ARMs are coming and are largely attached to homes in these areas. The 310 is no longer immune.

Now let us assume you managed to get a loan with 10 percent down. How much will you pay for your new 2 bedroom home?

Down payment:Â Â Â Â Â Â Â Â Â Â Â Â Â Â $67,900

PITI:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $4,569

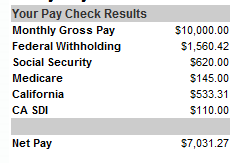

Now I looked at some average gross income data and it looks like households in this zip code pull in $100,000 to $120,000. Keep in mind this is the average, not the median. But let us be generous and use that $120,000:

The above is a quick analysis. We didn’t contribute any funds to a 401k or anything of that sort. No healthcare is in there either. So even with that, the PITI will eat up 64 percent of the net income of this household that pulls in $120,000 a year. Do you see why home prices still have a long way to go down?

Today we salute you Rancho Park with our Real Homes of Genius Award.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

35 Responses to “Real Homes of Genius: Rancho Park and the zero down $775,000 2 Bedroom Home – Deconstructing the Westside of Los Angeles. The 310. Foreclosures moving up to Prime Markets. Notice of Defaults Second Highest Quarter on Record.”

There are still many people who could afford your home shown above.

There are literally tens of thousands of government workers who make over $100,000. and do not have to contribute to retirement 401K (retirement is fully paid by the taxpayers) or health care (lifetime medical benefits are free to all Calif. state employees).

Over 5,000. retired Ca. state employees make over $100,000.

This group of workers provide a base under all housing prices.There jobs will remain, as they all have the tenure of years on the job, and senority rules regarding layoffs will protect them.

If you knew that you would never have to worry about retirement, or health care, you could spend every paycheck without a second thought.

Another winner for the doctor. Just last night a (normally reasonable) friend of mine tried to explain that a $120,000 family could afford an $800,000 home. I’ll send him this link right away.

Also, could you write on the tragedy unfolding in Congress, that discussion of financial regulation is being tabled until 2010, i.e. there aren’t going to be any new regulations on the banks whatsoever?

First?

DHB, I want to thank you for your always well-written and informative essays, which are a pleasure to read.

The point you make is irrefutable, and it is the one I simply cannot understand being glossed over by the media or the public at large. The bidding up of prices during the bubble was done with “monopoly money.” It didn’t exist. You can bid anything for a house if you don’t have to pay anything down, and if you figure that the value will appreciate so quickly that you can refinance or sell before your ARM kicks in. But now people have to actually come up with real money (what a concept) to buy a house. At least 20% down in most cases; good credit. And then they have to keep paying the mortgage month after month, because the odds that they can refinance or easily sell are much less. And when we talk about real money and not the idiocy that recently went on, it is a whole different and sobering story.

I am one of many people in So Cal who looked at the prices during the bubble and thought it was some kind of surreal joke. A million dollars for houses which I knew were $400,000 or so a couple of years before. Of course, I intended to actually live in and pay for my house, the old-fashioned way. But now there are people like me who were patient, who look at such a house “reduced” to $800,000, and think that they had better jump right in, because “inventories are shrinking” (something someone from NAR said on the national news yesterday). These people are more foolhardy than the bubble buyers, because they are going to terribly squeeze themselves as they continue to pay real money and earnings for their house. The bubble prices were a mirage made of funny money, not real cash, or actual ability to afford them.

it is the same here in coronado ca! people raised prices on homes, i heard a real estate agent say that we are on the way back up, lol! I guess some people live without reading what is going on outside.

I’m with Bank of America (formerly countrywide) and I’m closing in on my 8th month with no NOD and I have a co-worker also(BofA) at 10 months with no NOD. It appears some lenders such as Wells Fargo are working to clear the backlog more quickly. Another friend with Wells is at around 8 months and already received an auction notice. My neighbor is also with Wells Fargo so I guess we’ll see if they move as fast on him since hes at about 5 months. I’m amazed I know so many people in foreclosure and as much as people want to say its job loss every person I know including me going through foreclosure still has a job. The bank keeps sending me notices for the making home affordable plan, but I can’t really see any point to even trying if they absolutely refuse to write down principle(as I have been told many times). As if I really want to take my non-recourse loan and make it a fully recourse loan to save $100 a month for 5 years.

Great work Dr. I would add the recent revised LA Police Dept crime mapping website to your arsenal. If you check out Rancho Park, seems it is a “GTA and Vehicle breakin” haven within the past 7days. (Data is only available for prior 7 days).

Check it out for your self.

http://lapdcrimemaps.org/

My NJ police dept retiree, living in Baja for the past 10 years states it best. When asked what he thinks of his fellow patriots back in the USA, “no, no, no my people are crazy”.

Keep up the great work.

saludos,

In my experience, the mentality of friends of mine (mid 30s, average professional – $70 – $90000/yr salaries) that did buy a home within the last 4-5yrs is that of general acceptance of a very high LTV ratio. Approximately 65% or more of their take home goes toward mortgage and they have a “that’s just the way it is” attitude about it. I’m pretty sure none of them are able to save, and this is before the introduction of kids, which I know they all want in the near future. They think I’m crazy for not buying now, especially with the $8000 tax break. I just refuse to overpay for what will most likely be an instantly depreciating asset.

Houses like that might sell for $80,000 tops where I am from, and I live close to a major city (within the top 5 biggest cities in US).

What a pity, to live like THIS when you make $100K a year or more.

Terms like “average” and “median” are inapplicable to this shack. This is a deeply sub-average house.

God, how much does a PRETTY little bungalow of the type Los Angeles is so know for, sell these days?

Looks like we have a long drop ahead of us yet.

Dr. Housing Bubble, Please indulge me on this question: When you talk about these inevitable resets, wouldn’t those who hold the notes perceive that it was in their best interest to show forbearance and waive these resets as opposed to inevitably ending up with the houses? Granted, the paper has been sold to millions of investors, etc., but somehow creative minds can prevail?

Thank you, very much. This has been on my mind for weeks as you have been warning of the tsunami approaching. I have presumptively used this opportunity to get this question to you.

“the almighty power of the granite counter-top”

Makes me think of an alternative version of Clarke’s 2001: A Space Odyssey where the Monoliths are actually sentient granite countertops from the future come to warn us of the impending apocolypse.

This was a great Real Home of Genius. Keep ’em coming. Zero down on $775,000. I hope we never see this kind of staggering lunacy again. WMC Mortgage Corp? More like WTF Mortgage Corp.

Enjoy this video which has been going around fast lately.

I give more credit to Ratigan now than before.

http://zerohedge.blogspot.com/2009/07/ratigan-spitzer-and-toure-clarify-feds.html

Ok. When does the state begin to modify salaries and benefits of gov. workers? It’s obvious it cannot continue. Someone said a while back that if those benefits were protected by law then they can be UNprotected. Or is this going to be another problem ignored by our legislature much like the illegal problem? And hey, I’m a nurse. I see and hear firsthand what that situation is….our small (very small) facilty bills the state over $2M per year for reimbursement of SOME of those costs. I cannot fathom what larger hospitals/clinics are doing. Or are we going to save money by releasing more criminals from prison? What are they going to do when they get out? Get jobs????

I think ,oo one would call the current status of the California real estate market good, but it is showing improvements.

“The median price of southern California is still a 35.8% drop from last year. However, California real estate is slowly making a comeback. From January of this year through December, qualified first time home buyers will get a tax credit of $8,000 or 10% of the cost (the lesser of the two) of the home.”

This tax credit can also be used to contribute to the down payment, which is a primary reason the sales of homes have increased for the third consecutive month. Low mortgage rates and reasonable home prices are also strong contributors to the increase in sales.

Read more http://www.housingnewslive.com/mortgage-rates.php

What a pinhead this “president of Coldwell Banker Residential Brokerage”, or maybe not a pinhead, but smartass pushing people to believe we got to the bottom, jump in, buy a house and bring some money my brokerage.

quote:

==

A total of 215 luxury properties changed hands in June, up 45 percent from the 148 sales in May. Although sales still trailed last June’s total of 288, the year-over-year decline continued to shrink. The $1.315 million median sale price last month was off 6.8 percent from May and 6.6 percent from June 2008 as home buyers gravitated toward more affordable properties.

“With sales continuing to move higher, there are growing signs that the housing market – including the high-end – is leveling off and possibly starting to recover,†said Rick Turley, president of Coldwell Banker Residential Brokerage. “The low end of the market has been in demand for a while now, but the improvement is beginning to cascade to other segments of the market, including the move-up market and luxury segment.â€

Turley said open houses are attracting strong turnouts and buyers appear more confident about the economy and the housing market in particular. Although move-up sellers may not be able to get as much for their existing homes as they could have a year or two ago, the savings on their next home more than offsets the difference, he said.

===

end of quote

That place is a dump. It’s still a 90,000 shack at best. No yard, close to the street, cruddy cheap window. It’s smaller than my rent controlled apartment and costs more than three times as much a month. Oh 310 you are so very overrated.

Hi Dr HB ~~

Great article. Was wondering if you could explore what the current situation is in regards to MERS.

Also, another topic, what is the CalPERs connection to California, Arizona, Florida, Nevada real estate?These are the same states that have sunk the quickest. I can remember in the mid 90s an executive with a escrow/title company in Phoenix took me aside and told me that there were big plans for development for the surrounding areas outside the city. I laughed at the time but a decade later it all happened. After much research, it seems to me CalPERs had a huge hand in this bubble. What are your thoughts? Thanks!

For those that are curious, this 1948-built real home of genius is at:

10609 NORTHVALE Rd, LOS ANGELES, CA 90064

And get this: Zillow thinks it’s still worth $793,500 (slight less than the county appraisal of $806,310)!! Down from a peak Zestimate of just a touch over One Million only 8 months ago! Well, their estimate is only a “starting point”, after all.

http://www.zillow.com/homedetails/10609-Northvale-Rd-Los-Angeles-CA-90064/20499831_zpid/

Green shoots people! Green shoots! Believe it!

I know of some people (relatives) in California that have not made payments since August of 2008 and have not received any notification of default. They receive the normal Country Wide/B of A payment in the mail that does not show any indication of missed payments or penalties? What is really going on? We are starting to wonder in the bank has any idea that they even have a mortgage?

hahaha. Thank goodness I live in kentucky where housing prices are more reasonable. $120k for a 1,700 sq ft 2 bed, 2 bath, corner lot and a stones throw from a middle and a high school. People in California, Arizona, and Florida are crazy.

“primary reason the sales of homes have increased for the third consecutive month”

That may be part of it but home sales ALWAYS increase from spring to summer and then taper off in the fall and bottom out in the winter. Wall St. who rallied almost 200 points the other day on this “news.” Total insanity.

Wasn’t it Oscar Wilde who said “Nothing succeeds like address,”?

What price a 310 area code? I guess we have one data point.

One of my friends started his own firm doing credit card debt settlement. He takes a couple hundred calls a week from people seeking relief from credit card bills. He states that about 40% of his callers are behind on their mortgage. Although it varies, some callers have been foreclosed on in as little as 5 months while others go much, much longer without being foreclosed upon. The current record is 26 months without a mortgage payment and still living in the home. TONS of callers have gone 12-16 months without a payment. It’s really helping his business, as he makes his fee if the client can stay with his program for 6 months. Green shoots!!!

The banks are hiding a lot of inventory. I sold a town home in Valley Village in 2006. Fast forward to 6/29/2009 where the buyer was finally kicked out by the bank. An old neighbor told me the delinquent buyer bragged about not making mortgage or HOA payments for 7 months. I saw the property last week. They stripped it of everything, including the toilet flusher handles? They left the granite counters, go figure. The property is being shown to potential buyers yet its not on the MLS??????

Can someone tell me where I can view the specific data a houses finance history? ie. tells me if they took out a HELOC or how it was originally financed. Like the info the DR used in this article above showing the 1st & 2nd Loan, NOD, NTS.

It’s amazing to hear about all these yahoos not paying their mortgages for a year and still not hearing complaints from their lenders.

I paid my rent eight days EARLY last month (i.e., according to my bank, the money actually left my checking account eight days before the due date) but my bungling corporate landlord still managed to sock me with a $75 “late payment” penalty. This will be disputed, of course. I guess I should have bought!

You people are all crazy. The market is coming back! Big time! I mean, it has to be! The NAR says so! Bottom!!! BUY NOW!!!

~

I laughed when, last week, the NAR was being breathlessly quoted by the corporate media (who relies on advertising paid for by realtors) because they said sales were up from the previous month. WOW! Who’d ever think that sales increase in the summer? Buried in the report was the real truth: sales were down from the same month last year. But the talking heads just glossed over that in a hushed dismissive and rapid aside. Then it was back to “this SURGE in home sales is sending wall street into the sky!!!!”

~

Comrades, in case you haven’t noticed, we are living in a country named Potemkin.

“There are many people who could afford the home above.”

-but why would they want to? The ability to overpay for this shack is not the equivalent of being stupid enough to buy it. That person bought in 2005 – and Robert, that person could not afford the house. Hence the 80/20 and the NOD.

Think before you type, Bobby.

This is the tip of the iceberg on the Westside, as banks probably feasted on loans to more affluent and customers over the last decade. Just last year, everyone said it was mainly a subprime problem and the Westside was different. I guess it was different in that it took longer for foreclosures to arrive, yet they could possibly be worse. With Jumbo financing difficult to get, Alt-A and Prime defaults beginning, the end of summer gets even more interesting.

http://www.westsideremeltdown.blogspot.com

There are lots of financial reasons to buy a house. What we see here is the dream of capital appreciation. That didn’t work out very well for the bag holder.

Some people will buy for cash flow. In California, cash flow hasn’t been positive on mortgaged property for many years in most places. But that could change. And besides, if one has cash one has to choose between options. If you anticipate big time inflation, then parking your cash in a CD or a mattress is just having it waste away.

What I’m seeing is people with cash deciding that owning California rental property offers considerable hedge against further erosion of the dollar from inflation. The real asset remains and the cash flow will track employment and income to some degree.

So what if the market value of the underlying asset falls? Some cash flow will remain barring massive depopulation in areas like Silicon Valley.

Just like bonds, people buy with a 2% coupon when they could wait for the lower price but yet, they need to buy now.

I’m just saying that we shouldn’t think that EVERYONE has to buy an appreciating asset.

Of course, some of us just want a house to call our own.

With the Dow >9000 how could anything be wrong? Still wondering if it might be a great time to be a squatter? Drop 120k down and start making massive payments on a diminishing asset? Plus where property taxes will go in a nightmare CA budget? I’m going to guess ‘not down’

Folks, I don’t think this is some garden-variety housing bubble. As the Carpenters (who are either in the unemployment line or have gone back to Mexico) might have sung, We’ve Only Just Begun. People didn’t by this home–creatures like Frankensteinburg and Mozilla did. The zombie banks will come looking for flesh the next few years. Everything has changed. And everything is the same–ever since Satan at Edenwide got Eve to put in stainless appliances and granite countertops in the first RHG with the first HELOC. Too bad for them they got foreclothesed on right away.

Re: 7/23. Mind boggling. DHB is as always spot-on, and Indy observes that the county’s assessment on this palace is over $800K! Hell’s balls! What does that translate into for taxes?

~

William’s comment cuts right to the marrow: whereas housing prices were inflated many times in the funnymoney era, “recovery” and “market stabilization” are supposed to happen now on the backs of people paying REAL money, via REAL income or savings. This simply can’t work, and wouldn’t if somebody suddenly threw 30 million high paying jobs at the economy.

~

The ratcheting up of funnymoney valuation and principal amounts–which few ever expected to have to pay–is now not only in place, but so is interest on that inflated principal! Welcome to Fantasy Island!

~

In my view the housing bubble is one of the ugliest passive inflation manipulations in American history. It has turned people’s houses into their debt prisons. This accounts for the NAR and MSM pumping the notion that falling prices are somehow a bargain and they’d best hurry hurry hurry to buy. Convincing people of that, and manipulating them into urgency around that, despite all common sense (20% off three times too much is still 3x – .2 too much), is lethal and irresponsible and should be criminal. Yet on it goes.

~

It is also the case that these new buyers paying REAL money and REAL savings for these overpriced shacks will be paying three times the three times too much principal, what with the interest loaded on the front end of these huge amounts, some of them stretched out to 40 years. So it’s not just that the prices are MORE, they’ll cost the buyers exponentially more.

~

What a scam! The powers that be systematically used deregulation to get political power, pretending not to increase taxation, while actually inflating prices, though calling that “equity enhancement” or whatever despite the fact that most people will never get their original equity out of their houses (unless they had the good fortune to buy very early and have very-un-late-20th-century income/wage/job stability).

~

And finally, if anyone wants to bust union workers’ salaries, benefits, and pensions, I suppose I’ll go along with you provisionally…inasmuch as you also produce a plan for nailing the richest 10 percent, who hold some 80+ percent of all wealth. I don’t think state workers in the Profligate Spending Capital of the known world–CA–pulling down $100,000 fall anywhere near that richest 10 percent.

~

But yet again, people will fall out with each other over dimes and dollars, while the big-ticket fraudsters literally walk off with the bank. Anybody see the Sarasota (FL) Herald-Tribune’s outstanding series on the white-collar crime ring of house flippers in Florida?

http://www.Heraldtribune.com/flipping

~

I’d like to see a little more bile reserved for these thieves, who scammed their way to money they never earned. Anyone who leads the charge for “reform” with slashing workers’ pay is, in my view, showing their true colors: bashing workers. You could strip every public sector worker in CA of their jobs, their salaries, their pensions. And you’d STILL have the big boys mopping up the gravy. THAT is the problem. Not a few thousand WORKERS making $X per year. And California would STILL be posting vast deficits.

~

rose

We rent in that neighborhood, same size house, for >2K less than the PITI. I’m just sayin’.

it’s still a shitty house assuming you could find a retard who could actually afford it and want the house…. I’d imagine you could live far better at 1/2 of the PITI and rent.

Leave a Reply