Real Homes of Genius: The Culver City Mortgage Equity Withdrawal Machine. The Hidden Southern California Housing Disaster.

Mortgage equity withdrawals accounted for billions and billions of consumer spending in California this decade. The home became a private ATM that seemed to pump money out every year like clockwork. This was a win for the homeowner since they were able to spend beyond their wildest imagination and the state enjoyed those wonderful sales tax revenues while local agencies enjoyed the higher property tax rates. As we all know, all of this was built on sand and now the state is grappling with a $26.3 billion deficit and issuing IOUs like Wimpy haggling for another hamburger. The large problems we will face with option ARMs and Alt-A mortgages will kick the California housing market down once again. But you will need to know where to look to see this crisis unfold.

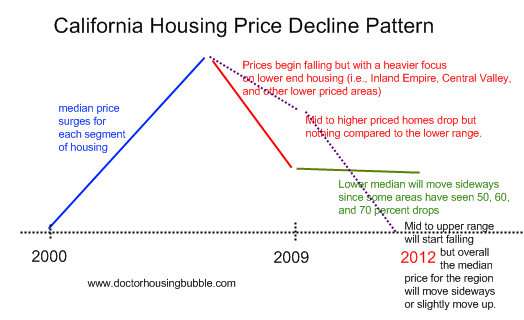

If we look at the current decline, it would look something like this:

We’ve seen countless charts and this one isn’t drawn to scale but simply highlights the next phase of the housing decline. The surge occurred in every segment of housing; low, medium, and high all soared to the stratosphere. But since the bust, we have seen the low end take the brunt of the price decline while the mid to upper priced areas remain stubborn. They have started to fall and with the Alt-A and option ARM tsunami coming online later this year we will see these segments begin to fall. Just be warned that you will undoubtedly hear pundits say, “the median price has gone up” but in reality what is happening is higher priced homes instead of sitting with delusional sellers asking for yesteryear prices and not moving, will now be competing with a surge of foreclosures in these areas that will be sold by anxious lenders.

Today I want to focus on Culver City again because this is the next prime candidate area to take a major hit in the next cycle of the bursting bubble. These are your mid to upper range areas but not enough to be called “über prime” like Bel Air or areas of Santa Monica. Let us first look at an example home that is in pre-foreclosure and has already had a notice of default filed on it. Today we salute you Culver City with our Real Home of Genius Award.

Culver City – The Home Equity Machine

The home we will be examining has a Zestimate of over $1 million. To give you a sense of the area, the home on the left sold for $860,000 in 2004 (2 beds 3 baths) and the home to the right sold for $385,000 in 1995 (3 beds 3 baths). The home we are looking at has 3 beds and 3 baths but this home went through what we would call the mortgage equity withdrawal machine. Now keep in mind all 3 homes have a square footage of 2,600 to 2,700 and this area looks planned so I would imagine many of these homes are built by the same builder. To confirm, I look at the date built and find that all 3 homes were put up in 1980. In California, that is a fairly new home.

So that should put this home in context. According to estimates, these would be $1 million homes. But let us see why the Alt-A and option ARM issues are going to explode in these areas over the next few years. The mortgages on this home tell us a story of an epic bubble.

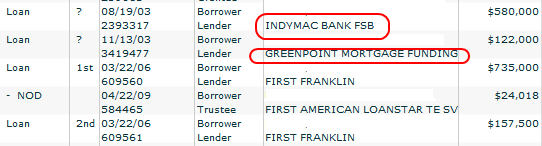

IndyMac was sure busy in Southern California! The home sold in 1998 for $500,000 and then was either transferred or sold in August of 2003 for $580,000. At least in this respect, IndyMac wasn’t the biggest gambler on the list which is probably one of the few times you will ever hear that said. But after that, the home equity withdrawal machine kicks it into the next gear.

Only 4 months after closing, Greenpoint Mortgage Funding issues a $122,000 mortgage on the place. At this point, in a matter of months some $702,000 in mortgages are placed on this property.

We are now in 2006. The California housing market is burning at a fever pitch and anything and everything is rising in value. So in March of 2006, the borrowers on this place get a 1st mortgage of $735,000 and take out a second for $157,500. So simply adding up these two mortgages, the home would have a lower range value of $892,500 assuming they went with 100 percent financing. This looks like an 80/20 situation but the numbers don’t exactly add up. Either way, this home went from $580,000 in 2003 to approximately $900,000 in 2006. This would mean that in 3 years this home went up $106,000 each year! Why work when your home brings in six-figures for you just sitting in it?

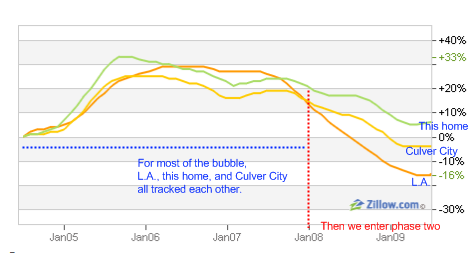

Well as we all know the bubble exploded. The Zillow chart for this area shows exactly what I am talking about regarding the tiered housing crash:

For most of the bubble Los Angeles, Culver City, and this home all trended neatly together but once the bubble burst, we start seeing home price falls segmenting out. Now this area is in a prime location but prime doesn’t mean $1 million.

Going back to the loan history, we see that in April of 2009 a Notice of Default was filed on this home with $24,018 payments in arrears. Now for this zip code in Culver City we find that the median home price is now at $637,000 a drop of 21 percent from a year ago. Here’s the thing, only 5 homes sold in May in this zip code and obviously the homes that did sell are at the lower range.

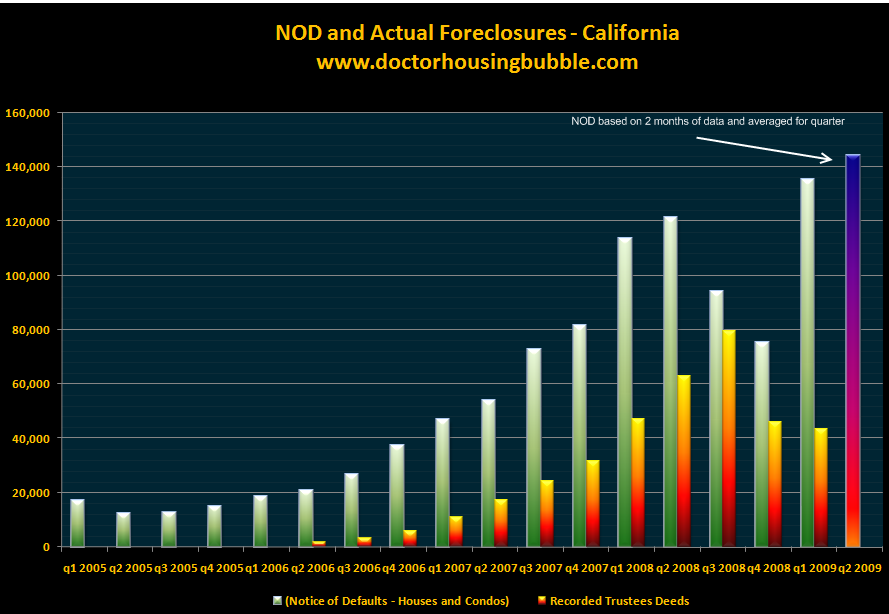

I looked in this immediate area and there is only one home for sale and it is a 4 bedroom with an asking price of $1.1 million. Of course, it has only been on the list for 3 days. As I have discussed the Notice of Defaults are surging in California and this will provide ample inventory in the mid to upper priced areas to depress home values:

This home is a perfect example of the mortgage equity withdrawal machine. Let us assume they try to sell this home for $900,000. What would your mortgage look like? We should assume that you will have 20 percent to buy this place:

Down Payment:Â Â Â Â Â Â Â Â Â $180,000

Mortgage:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $720,000

PI:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $4,911 (assuming 7.25 percent jumbo 30 year financing)

TI:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $937

Monthly Payment:Â Â Â $5,848

Many of the government loan mods (aka kicking the can down the road) try to get the mortgage payment down to a 31 percent debt to income level. So how much income would you need to purchase this home?

If we use gross you would need:Â Â Â Â Â Â Â $18,864/per month or $226,368/per year

To stay relatively within safe prudent standards, you would need an income of $226,000 a year and this is assuming you are coming in with an $180,000 down payment. The median family income in Culver City is $82,000. I dug deeper in the data and searched for this specific zip code and found that for 2006 some 8,035 tax returns were filed with an average adjusted gross income level of $73,694. However you slice the data, you will have a tiny number of buyers for this home depending on the price. If the price were set at $900,000 you would need a household income of over $200,000 and this is only a 3 bedroom home. This isn’t your prime Beverly Hills location or some home in Rancho Palos Verdes.

You don’t need to be a rocket scientist to realize that prices are going to fall and fall hard in these areas. Today we salute you Culver City with our Real Homes of Genius Award.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

38 Responses to “Real Homes of Genius: The Culver City Mortgage Equity Withdrawal Machine. The Hidden Southern California Housing Disaster.”

I think you have proven pretty conclusively that house prices are set to fall.

What I don’t understand is why there are not more houses on the market in pricey areas. If a homeowner doesn’t sell now then they face a definite loss later. However, if they put the house on the market now and are prepared to sell at a discount they may be lucky enough to find a delusional buyer who thinks the worst is over.

What I’m really saying is that I’m surprised that there are not a lot more people cutting their losses. Obviously everyone can’t do it or they’d crash the market but you’d think they’d be a few more.

I thought that a jumbo loan in Culver City has to be above $729,000 because this is a high cost area?

I am also under the impression that California is a non recourse state for original mortgages. If the owner refinances, the loan becomes recourse and they cannot just walk away from the house. The bank will have the legal right to collect all the outstanding loan from the homeowner, but of course it is much easier to collect it from the unsuspecting taxpayers.

I live in Culver City. I can tell you, over the last 5-8 years, TONS of homes have been bought in the $880K – $1.15M range that should really be in the $400K-$600K range.

And most of them were bought by middle-class 20-somethings or 30-somethings with an average household income of around $100-$120K based on what I know of my friends and neighbors. Not $250K. Plus many of them have recently gone from DINKs (Dual-Income, No Kids) to Single-Income w/ Kid(s) — instant HUGE financial strain.

There is going to be a wave of foreclosures & housing turnover on the westside like we’ve never seen in the history of this country.

Grab a seat, buckle up, get your bag of popcorn, the best fireworks of 2009 are yet to come.

The ATM home machine is the heart of the current mortgage debt crisis. The FED flow of funds report reflected an increase of total mortgage debt from 2002 at 4 1/2T to 2008 around 11T. Clearly this was neither a subprime nor first time buyer spending spree but a national debt binge using the home as a ATM machine.

What is going to light a fire under these banks.

True story. I was complaining to a friend of mine this weekend about this ordeal. He said he has two friends that have received at least 3 NOTs and there has been no sale and no eviction. These friends of friends have been living rent free for now nearly 6 months. Banks keep threatening, nothing is happening. I imagine this is rampant and really addresses Dr. B’s latest chart that indicates growing defaults, but foreclosures are down. I’ve asked it before, but will ask again, what is it going to take the banks to take action here or are we just going to have hundreds of thousands of bums sitting rent free in their homes for the next umpteen years.

I can definitely see defaults continuing to rise for the next two years (especially when banks are doing nothing and people have no real threats to them) and then one day the banks wake all of a sudden are looking at the true power of compounding and instead of seeing 2, 4 or 6 billion in defaulted loans they are looking at 12 billion all at once.

Cash flow has to eventually really start taking its toll on the banks and then what–beg for more bailouts? mass foreclosures? file BK?

At what point in time is the bank doing nothing bubble going to burst?

There clearly is a slowing of demand in the $1,000,000 to $1,500,000. range.

I live near San Francisco Bay.There is a beautiful 25 year old home right on the Bay, with views of the San Francisco skyline. House was remodeled inside.

It went on the market in April at $1.3MM, and my wife and I expected it to go in one or two weeks. It is still sitting. A larger home, same view,at $1.6MM has been unsold for 4 months.

Even one year ago, with demand falling, these homes would have been gone within a month. When even people who have money do not want to “pull the trigger”, you can be sure that something strange is afoot. The economy is much worse than “official” figures state. The average person now has a small pit of fear in their stomach. Anyone who “needs” to sell their house- Do it NOW. You may not get what you think you should, but a year from now, you will realize that you made the best decision in your life.

This house is located in a tract called Studio Estates located at the corner of Culver Bl. and Elenda St. It actually sits on the former landfill of MGM studios. There are actually methane alarms in the tract. The side yards, backyards and front yards are very small. These houses are not worth more than $500,000.

Regarding the comment about dual income families:

If a family with kids decides to remain dual income they will have to pay for child care which itself is very expensive.

Comment by matlock:

“””What I don’t understand is why there are not more houses on the market in pricey areas.”””

Hey Matlock, I think Dr. Bubble’s article points-out that owners in areas like Culver City are the true believers in the housing bubble, so maybe they’re sitting there saying, “Real estate always goes up, so let’s sit tight until the market turns around in (pick a date and fill-in here). Then we can sell (flip) and not only avoid a loss but realize the appreciation in price that all true believers in the housing bubble are due, as a reward for our unwavering faith. Amen.

As Mr. Pink Floyd used to say:

Hanging on in quiet desperation is the english way, or in this case, the american way.

Best blog on the net, thanks Dr. HB!

I wanted to finish that last comment (for it to make sense):

Oh, by the way, which one’s Pink?

The next time you’re seeing green shoots, listen to Bob. Well worth the 4 minutes.

CRASH TEST ECONOMY

.

I have a military friend from Camp Pendleton that lived 16 months rent free. He knew he was up for orders and put his condo on the market just as 2 others were foreclosed upon in his building. Two lawyers advised him to quit paying and the banks would foreclose: your credit will be ruined but you’ll no longer have the liability. Well, he quit paying and they never foreclosed. Moved out (to his new duty station) last month and left the keys with the building manager. 16 months rent free…. think about that for a moment. Orig lender was CountryWide.

The banks cannot foreclose because they’ll finally have to mark the crap on the B/S down from par where they currently have it marked. If they mark it down, they’ll be once step closer to admitting what we’ve known all along: they are bankrupt. What do insolvent mean anyway?

What is needed is the kind of panic (but from a reverse perspective) that we had at the height of the bubble, when people were stampeded into buying ridiculously priced houses because they feared that they would never get one unless they jumped in. If homeowners started to really fear that their houses would depreciate another 25% this year, then they would start becoming more reasonable. But I think that all these stupid and misplaced efforts to “help homeowners stay in their homes, and maintain the value of nearby properties” is sending a message that the government is on the side of the current owners, and obviously not on the side of the would-be buyers. So that gives the former the incentive to stubbornly wait it out.

My purely intuitive sense is that most of the houses on the Westside are way out of the range of a legitimate (not playiing with paper money/nothing down/teaser rates of bubble times) buyer. How many people actually have $200,000 or more to put down; and how many are earning $250,000 or so, which would be the fiscally responsible salary necessary to afford the payments? Few ever did, but of course they were playing with Monopoly currency, and they drove the prices into the stratosphere. They could stay there forever, if owners refuse to accept the true situation; because there aren’t people with legitimate credit and jobs who can afford them.

I can’t wait for these prices to start dropping. I’ve been eager to own a place larger than my 1 bdrm westwood apt for some-time now and been saving up money while everyone was living beyond their means.

I’ve been making some offers for detached townhouses in torrance but people are overpaying for them like crazy above asking price. patience is key here I believe.

dashing I’m in the same situation. I’m now at 7 months of no payments (not bragging just stating a fact) and no NOD. My next door neighbor is about the same. The bank called me this weekend to see if I was going to magically send in a payment. I told them I would only be staying in the house if they offered some form of principle reduction. The lady told me that they don’t do reductions under any circumstances. I said that is fine with me, but when can I expect to see an NOD? She tells me they currently aren’t really initiating foreclosures. I was eventually told that I should do a short sale. My house is worth maybe $150,000 in a short sale on a combined 1st/2nd of $370,000. The moronic part is that I’d be willing to keep it for $250,000, but instead the bank would rather lose another $100,000.

I understand I was definitely one of the morons who thought if I didn’t buy in 2006 I’d be priced out of the market forever and I deserve to be punished for that alone, The banks to me seem like they are doing everything in their power to lose as much money as possible, but not have to write it on their balance sheets. Are we going to start hearing about people living rent free in foreclosure limbo for 2-3 years at this point? I’d personally like to take the big final credit hit and move on.

None of this should EVER have happened. You can thank a criminal hands off government, a criminal banking system, and the criminal real estate cabal. Kill them all and this country can start over. This mess is so utterly ridiculous, senseless, and sad. Look at all the pain for NOTHING. Short term gains for the lousy few.It still infuriates me. My God.

Long time reader – first time poster. I cannot believe the above poster stating he can’t wait for prices to start dropping. What an idiot! After reading all the info you give us Dr. HB – who in their right mind would buy? Save your money – home ownership is worth the wait if you REALLY want a home to stay in. Let all the overbidding suckers lose their money.

Thanks for always giving us the “real” news. This is truly one of the best blogs on the net!

If the zip is 90232 on those houses in the pictures, you could say there all in JEOPARDY! with a Wheel of Missfortune. LOL

I don’t get it. These people trying to sell their million dollar homes don’t seem to understand that Americans don’t have that kind of money to spend anymore and can’t afford to get those kind of loans anymore. Yet they are still trying to sell them at that price. It just boggles my mind. They haven’t come down to earth yet. I’m waiting for 2011 to hit.

The loans, and loan companies, that allowed people to take out mortgages at 10X their income don’t exist anymore. Neither do move-up buyers who just flipped a house at a 50% profit. I know that, you know that, but the average seller doesn’t know that. They just know that the home next door sold for a million two years ago, and they want their million too.

What sellers should do is try to find out using today’s “strict” loan standards if they can qualify to buy their own house. Whatever price they can qualify for, they should put that price as the sales price.

Wow Wonderwoman, talk about rude. how about you properly read the comment? I said I can’t wait for prices to start dropping because according to everything posted here it’s obvious they will. Maybe if you got beyond your own “retarded” delusions you would realize some people are willing to wait.

I believe the reason they are fighting cram-downs tooth and nail is that if there is a crack in the dam, the whole think will collapse. The people that are making stoopid payments on underwater homes will say, “Marge, Brandon and Brittany just got 150k of principal chopped off their mortgage…let’s do likewise.” They are holding back the Tsunami as long as they can, hoping for a miracle that ain’t coming.

Just as the banks are desperately waiting for another sucker to unload a property on a little mermaid and her PW’d mate, they are all holding out while underwater breathing through green chutes.

The scenario that I see playing out is that we all start writing and trading IOU’s because when the dam thing breaks, we’ll all be underwater. Those green chutes will be kelp…

One aspect that it seems like people are forgetting or ignoring… a 3 bd 3 ba house in Culver City (at least in this section) is not a “starter home” or even likely to be anyone’s first home. Most likely the buyers will come with money they made off a previous home and put down $300-400k to bring the payment to a much more reasonable level.

Certainly doesn’t mean that this house is not overpriced or that home prices won’t continue to decline… just that the math is not always that of a 10-20% down, first time buyer situation. “Starter homes” in CC in decent neighborhoods can be had for $500k-$750k.

I think the reason the banks are resisting cramdowns is because a cramdown means the bank eats the loss. Not the homeowner. Not the taxpayer. The bank. Every other solution is better for the bank than a cramdown, even foreclosure, because with a foreclosure the bank decides what value to put on their balance sheet under REO. One they do a cramdown, that’s it. The value they agree to is the value on the books. They can’t lie.

How about doing a column that covers the Cheviot Hills, Rancho Park area. Prices have softened, but only a small bit. We are still seeing homes that are going for over asking. What do the numbers look like is this area?

This Culver City neighborhood looks to be the former MGM Studios backlot, north of Culver and west of Overland, that was redeveloped into houses.

Good comments about banks’ reluctance to cram-down or foreclose.

Prices in Santa Monica have finally been turning down, some 20-25% so far, based on low-end north of Montana sales this spring. See Westside Bubble and Santa Monica Distress Monitor for more.

There is no difference now between Washington and Wall St. under Obama/Geither/Summers (CHANGE?). Bank losses will be taxpayer losses sooner or later. They will either tax more or print more money – I’m betting on the latter because an inflation tax is easier politically. The banker and the tax man will get you one way other the other.

Here’s delusion for you.

http://www.redfin.com/CA/W-Hollywood/148-N-Swall-Dr-90048/home/6814874

Looks like the home had a big fire inside and the buyer is asking over a mil. It’s bubble price in 2005 was 964000.

Melissa, Look again. There are no starter homes anywhere close to 500k in Culver City. In CC there isn’t much under $700k.

I live in CC just a bit south of here and while I think this house is a bit overpriced, the neighborhood in general is well worth the money. Where else on the Westside can you get a three bedroom home with a small but nice yard with low crime and an excellent public school system. Plus there’s the savings of not having to pay for the gas for long commutes. I think that’s worth $750K for a young family that’s planning to stay in the area (as is my situation). There really are very few homes that stay on the market in CC when they are priced in this range.

Yike. A few thoughts. One, this area, for whatever reason, has ALWAYS been more expensive than other surrounding neighborhoods. I believe it must be because of the date of build, 1980, which as has been pointed out, is a “new” house for this area. The homes are bigger than the standard 1940-era 1100 sq ft homes that are typically available around here. Apparently this means a lot to the buyers over the years – as I said they’ve always been expensive. Really though, the homes are very dated and don’t feel good inside. Very pre-McMansion. I looked at them twice when I was buying and could never bring myself to seriously consider a purchase.

Two. It seems that most of you are vultures, waiting to grab what you think you are “entitled” to: a nice home in a superior neighborhood at a price you deem acceptable. Guess what? Ain’t gonna happen. You aren’t entitled to anything, youngsters, and that’s your problem. You’ve gotta EARN stuff. Do like many of us who have been homeowners for awhile have done ( I’ve been an owner since 1994 – NEVER a speculator); buy a fixer in a dodgy neighborhood, fix it up and move on to a better neighborhood. It took me four houses and 15 years, but now I live in an awesome neighborhood (Culver City) in an awesome house. Sure, plenty of people have made bad choices and are reaping their just rewards. But for you to think that you can start off in Culver City (or any other “nicer” city) for some bargain price and not have to make some concessions is just plain idiotic.

Chill out richierod. 1. Most of us just want to responsibly buy a little house. My wife and I work in CC and would love to buy a place close to work. Read the article again. Hardly anyone makes $200k+, so these prices are unsustainable. 2. It wasn’t your hard work that enabled you to move up over the last 15 years. It was the bubble!

Very few individual homeowners will sell at these reduced prices. Denial is too powerful. The prices will be driven down by banks who have reposessed homes in this price range and are willing to sell for what they can get.

Well said Kevin…

Like I posted before, can’t wait for prices to get to what they should be at. vultures is hardly a proper term, we’re just buying responsibly.

The house in question is in Studio Estates. Just finished a 2 yr corporate lease for 5k per month. WAY OVERPRICED as there is a house that sits empty 2,000 sq ft 3bd for $3,500 per month (recently reduced from $3,800 per month). The house in question is 4bd and 2,600 sq ft. The owner does own another house and live in the neighborhood. I have one issue with your calculation – as of 7/1/09 a $729,000 could be obtained at 5.125 resulting in a monthly payment of $3,969.31. If you don’t get down to the 729k number, then rates shoot to norht of 7%. Still don’t think it’s worth it, but to even consider it…you better but down a down payment to get to 729k.

You can really tell in this thread who owns and who doesn’t. I have only lived in California since 2001 but has seen the prices double where I am now in that time frame. I am not on the coast like the rest of you but I can’t believe people are trying to justify 3/4 of a million dollars for anything that small, or over a million for a burnt out piece of crap. The cool aid has run deep and wide in California for way to long. Anyone who thinks these are or were decent prices need a piss test. Even hear in the valley (desert really) they think 1100 sqft houses are worth 200k or more.

It amases me the way californians demand everything for nothing then complain because the schools are failing. It’s only going to get worse so if you own a house now hope you don’t have to sell in the next 10 or more years. If you do do it now so your credit will be good again by the time the housing even starts to become viable again.

I came of age on the Westside and lived at the time these were built in Carlson Park. I can say IMHO at that point when these places were under 350K they to me were grossly overpriced. My biggest question off this particular thread is who I ask WHO in their right mind would pay anything over 250K to live in strictly average housing especially as is seen in most of Santa Monica and Culver City and even parts of lower Beverly HIlls? Or for that matter in any city? None of this made or make any sense whatsoever because to me the pricing was not real or valid in terms of honest value it was based on other questionable factors. I now question each transaction because if so many people made so much money why is everyone in the country especially LA so hard up? Investigate on. I rest my case on the fact that the renters were the smart ones in this scenario as they now don’t have that half a million or more debt on their heads (did anyone even consider how much money is being talked about with most of these places? I don’t think so.)

I came of age on the Westside and lived at the time these were built I lived during high school in Carlson Park. I can say IMHO even at that point when these places were around 350K and most houses were 150K they were to me grossly overpriced for what they were and how they were built. My biggest question off this particular thread is who I ask WHO in their right mind would pay anything over 250K to live in strictly average housing? That is all is seen in much of Santa Monica and Culver City …and even parts of lower Beverly HIlls to me. None of this lunacy jelled to me whatsoever because in my view the pricing was not real or valid in terms of honest value it was based on questionable factors including greed and stupidity. I now at this point in life watching this fiasco question each transaction. Consider if so many people made so much money why is everyone in the country especially LA so hard up? Investigate. I rest my case on the fact that the renters were the smart ones in this scenario who didn’t fall into the bullshit as they now don’t have that 500K or 750K or more debt on their heads with a dump worth half or less and quickly falling more each day. Did anyone ever consider how much debt they were eating with most of these places? I really don’t think so. A fool and their money are soon parted now they can pay for being the sucker.

Leave a Reply