Real Homes of Genius: Today we Salute Burbank Housing. A $905,000 Foreclosure that Lasted 18 Months. Now Listed for $699,000.

The housing market in many areas in California is still in a solid bubble. Yes, in a speculative bubble. In the last report we looked at shadow inventory for Los Angeles County in great detail. This generated a lot of questions and hopefully shined more light on what really is going on in the housing market. People in manias have hard times judging things correctly. First, even if nationally home prices might be correcting to more reasonable levels, even in hard hit areas like the Inland Empire, many counties like Los Angeles and Orange are incredibly overpriced. In short, they are still in a bubble. Now this might seem stunning given that the median California home has fallen in price by 50 percent. But keep in mind the fall was not evenly distributed.

It helps to put the numbers in perspective:

Los Angeles County Peak Price: Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $550,000 May of 2007 (DataQuick)

Los Angeles County Current Price:Â Â Â Â Â Â Â Â Â Â $329,000 November of 2009 (drop of 40%)

Orange County Peak Price:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $645,000 June of 2007

Orange County Current Price:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $436,500 (drop of 32%)

Yet as we showed in our last report, most of the drop has occurred for two primary reasons:

[1] The bulk of home sales have come from lower priced homes thus skewing the median price lower

[2] Higher end areas have large numbers of shadow inventory because homes are not moving as fast (aka the volume of buyers is low)

Now when the MLS lists about 19,400 homes for Los Angeles County yet in total close to 100,000 properties are either on the MLS, have a notice of default filed, are scheduled for auction, or are bank owned you know something is sketchy. Plus, we have additional properties that are 90+ days late that just don’t show up anywhere. The fact of the matter is that prices are too expensive in many areas regardless of government intervention. All the government is doing is prolonging the inevitable correction while propping up the failed banking sector. Keep in mind the California unemployment rate is 12.3 percent and if we include underemployment, it goes up to 22 percent. Have people forgotten how households actually pay for the mortgage? You pay from actual income yet somehow this is all lost in the hustle of bailouts.

Today we are going to look at a zip code in Burbank to really deconstruct what is going on. Today we salute you Burbank with our Real Homes of Genius Award.

Burbank California

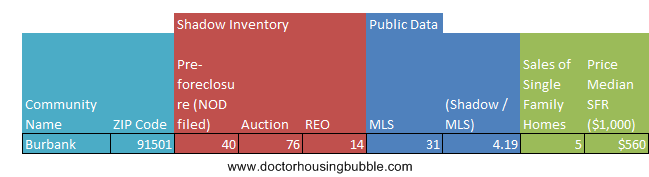

Let us examine the 91501 zip code of Burbank. This is one of those areas with nice homes that many professionals are looking at but prices still seem to reflect a bubble. Now many real estate agents are now buying the argument that the government has saved the housing market. Really? Let us look at the real data for this zip code in Burbank:

In the latest month of data five homes sold for this zip code. The MLS has 31 homes listed. A little over 6 months of data. On the surface this seems healthy. But look at the shadow data. 130 homes are here. Now one of the big concerns in the last report was how many homes are double counted. Not much. The 91501 has 3 foreclosures listed publicly of the 14 REOs. That is a tiny number. So in total we have 161 properties listed minus the 3 double counts (1.8 percent of the pool) and we have over 31 months of housing inventory if we use shadow inventory figures. Plus, how many homes in this area are 90+ days late with no notice of default filed? But you are skeptical. Fine. Let us run an example. In fact, let us run a fresh example (just listed on 1/5/2010):

Given the e-mails I get from readers, this is probably a sample of the most sought after “starter home†for people that read Real Homes of Genius. They’re looking for a prime city with the cache that’ll make them feel like they’ve made it. It is the same fuel that led many to over leverage but this time, you actually have to have the income to back up your bet and not go gangbusters with an Alt-A or option ARM product to leverage yourself into disaster. Yet prime mortgage defaults are now soaring because the fact that you can buy something doesn’t mean that you can afford it or that employment is still hemorrhaging.

The above home is one example of why we still have much correcting to do in many markets. This is a 4 bedrooms and 2 baths home that is listed at 3,219 square feet. A rather large sized home for a starter but a good structure for working professionals. This home is banked owned but the history of what occurred shows us that delaying the inevitable doesn’t delay a meeting with financial reality:

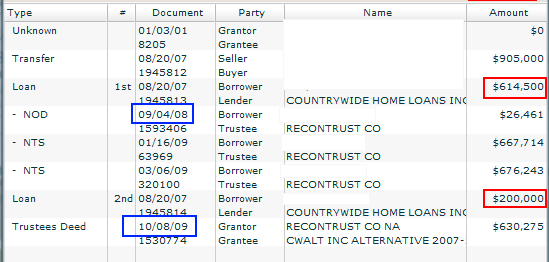

Let us walk through what happened here. The home was purchased in August of 2007 for $905,000. Amazing and thoughtful Countrywide thought it would be prudent to make the first and second mortgage on this property:

First Mortgage:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $614,500

Second Mortgage:Â Â Â Â Â Â Â Â Â Â $200,000

Total:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $814,500

So it looks like these buyers actually came in with 10 percent down ($90,500) if I’m working the numbers out correctly. So even in August of 2007 right when the market was in full implosion Countrywide decided to make a loan at peak value on a property that was “valued†at almost one million with only 10 percent down. Is it any wonder why many Alt-A loans are simply exploding on the balance sheet of banks?

So the home is now purchased. Less than one year in, the borrower is already having problems. The notice of default was filed on September of 2008:

09/04/2008:Â Â Â Â Â Â Â NOD Filed for $26,461

Now this is what people forget about mega California mortgages. If you miss a payment on say a home in practically any other state, you fall behind $1,000 or so a month. So after the NOD if it is filed after 3 months, you may owe somewhere around $3,000 to $4,000 depending on late fees and penalties. Catching up on that is doable. Try catching up to $26,461 when you are already struggling.

So if the NOD was filed in September of 2008, this probably means the borrowers started missing full payments back in June or July of 2008. Now here is where the process drags out and shadow inventory builds. So the NOD is put on the place in 09/2008 and the first auction is scheduled in January of 2009. Then, it looks like another auction is placed in March of 2009. When is the home finally taken over? By October of 2009. Now do you think this borrower was making payments all that time? Yet the process isn’t complete. Only on Tuesday of this week was the home listed! So let us recap the time it took from first missed payment to MLS listing:

June/July of 2008 first missed payment to January 5, 2010 MLS (18 to 19 month process)

And what is the current listing price?

List Price: $699,900

So the bank is simply writing off that second mortgage completely and hoping to recoup on the first. These kind of cases simply point to a major drawn out housing market for the state. When we consider all the option ARMs and Alt-A loans, many people are going to face similar problems.

It is troubling to see so many people eager to jump on any home even if they have to spend every hard earned penny they have saved during the bubble times (they assume the bubble has fully burst). They somehow think the market has already bottomed. It has not.

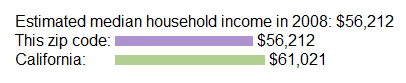

Now you might say, people in this zip code of Burbank must be making tons of money. Let us take a look:

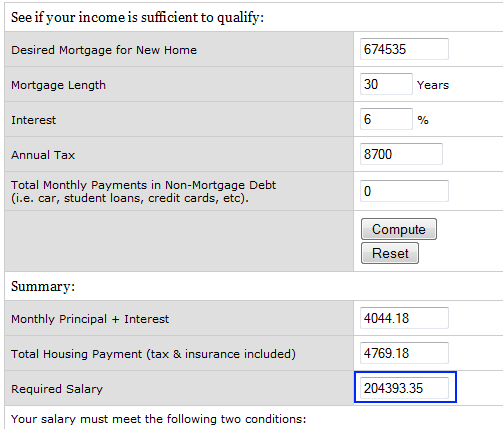

It would take over 12 times the median annual income of this zip code to purchase this home! That is flat out bubble land to the next dimension. I mean run the numbers. Let us assume you go with an FHA insured loan with 3.5 percent down:

Down Payment:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $24,365

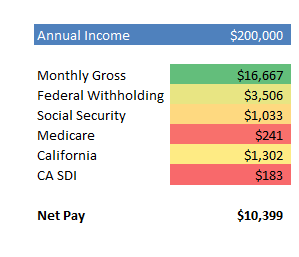

The family looking to buy this home will need an income of $200,000 which doesn’t seem to be reflected from the income tax data pulled for this zip code. Let us run the net income numbers for someone not living in the area:

So even assuming a family with a $200,000 household income wants to buy this home, nearly 50 percent of their net pay is going to their housing payment. That is nuts! Plus, the median household income for the area is not even close to $200,000 but $56,000. This is why California is still largely facing major pocket bubbles in areas like Burbank, Culver City, and Pasadena to name a few.

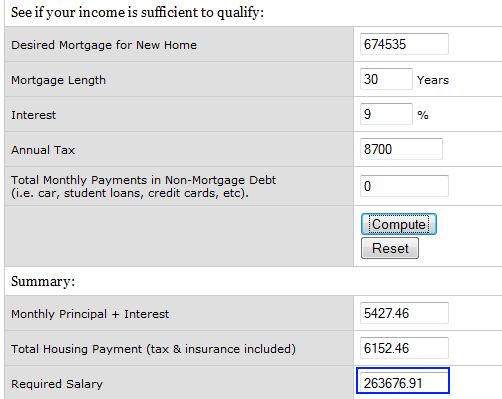

Incomes do matter by the way. And one thing people forget is that over 40 years, the average 30 year fixed mortgage hovered around 9 percent. You want to run the numbers at 9 percent?

Let us assume you buy this home. In a few years, rates go up to 9 percent. A family looking to buy this home at the current price, no price adjustment, will now need an income of $263,000! And keep in mind mortgage rates can’t go any lower. The Federal Reserve has now gambled the entire security of our nation’s well being. They have purchased some $1.25 trillion in mortgage backed securities since no one else in their right mind would buy these toxic products. That game is going to end badly and rates will go up once that hits as is typical in any high risk investment. When? Who really knows but making a bet on California housing right now is a major gamble. If you feel the need to gamble go to Vegas and satisfy your need. At least there your odds in some games are close to fifty-fifty. In California housing, it is hard to see how you’ll win in many cases.

Today we salute you Burbank with our Real Homes of Genius Award.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

47 Responses to “Real Homes of Genius: Today we Salute Burbank Housing. A $905,000 Foreclosure that Lasted 18 Months. Now Listed for $699,000.”

Thanks Dr. B – keep pounding the drum. Reality is a hard thing for people to face. One reason Texas is not currently experiencing what is happening in California is that we went through this process in the late 1980’s – aka the S&L Crisis with an employment bust in the Energy, Defense and Construction industries. After the dust settled It took 20 years before housing prices regained their peak. i.e. – 1st peak – 1987 – second peak – 2007. My opinion is that disciplined patience is going to be required to get a house at a realistic, affordable price. It took about 6 years to go from the peak in 1987 to the bottom in 1993. Keep up the good work.

Now – if we can just keep the California real estate vultures, excuse me, investors from screwing up the real estate market here. We are currently experiencing an influx of economic refugees from California at the current time. We welcome people looking to work – we do not welcome carpetbaggers looking to flip properties.

The Fed’s going to end its mandate to purchase toxic MBSs in March. Rates will skyrocket at that point since no private investor would want these junk assets at such ridiculously low returns. There’s rumor the Treasury may pick up the baton and become the major purchaser at that point. The Treasury has already guaranteed Fannie and Freddie an unlimited amount of money. Print, spend, tax, rinse, repeat.

Dr. HB,

Would you do a feature on the Santa Clarita Valley? I am interested in the state of things in 91355 and 91321 zip codes. Thank you.

Thanks again Doc.

I have basically given up the thought of ever owning a home in LA. I live next to Burbank and see this type of silliness all the time. I just saw a two bed two bath not too far from this neighborhood go down in price by $150,000 in one week! Down to what you ask? To $699,000! People have completely lost their minds. I’m renting and saving my cash for retirement. Which is another huge problem we’re going to have when Gen X’rs hit 65 and realize that they have no savings with which to do so.

The Doctor strikes again. A beacon of sanity in this deafening chant of “bottom – bottom – bottom.” The market is Wiley Coyote run off a clip and here in this brief moment when Wiley get’s his pre-gravity closeup, his eyes convey the realization of his pending fate. ………………… pffffffff Like the late great Chickie Baby, The Doctor is giving us the play-by-play; that’s why we can’t resist tuning him in.

I find it amazing that a homeowner/debtowner can go for over one year without making any mortgage payments. The bank must be losing a lot of money, but they still try to delay the inevitable. If you rent and you are ten days late you get an eviction notice. No wonder people are trying to be homeowners.

I read this with interest because I live in this zip code, 91501. Actually I’m somewhat familiar with this house. It was on the market for a long time pre-foreclosure, as a short sale probably.

One thing to note about this house is that there is no yard. None. Who wants a house with no yard? Very few people. Certainly no one with kids. In the past year we were looking to upgrade to a bigger house within Burbank and I didn’t even bother looking at this house due to the lack of yard.

So on the lack of yard I think it certainly qualifies for a Real Home of Genius.

That being said, I think there’s a few things you are glossing over when you run the numbers. Yes, an income of $200k is needed if this is your first home. But what about all the people out there with plenty of equity in their homes already? They are out there. Not as many as there used to be, but Burbank is a very established neighborhood. I’ve lived in Burbank for 8 years now and I have never met anyone underwater on their mortgage. Of course I try not to associate with stupid people, but still… most of the people I know have been in Burbank longer than I have. That means they have equity as long as they didn’t do any dumb re-fi.

So I think a market for homes like this is people with equity that want to upgrade. That’s exactly what we did, moving from a 3/2 in 91506 to a 4/3 in 91501 this summer. Yeah, perhaps risky, but I had equity going back to 1998 from my first real estate purchase at age 21. Our mortgage is only about 40% of our home’s purchase price. There’s got to be others out there like me. Now, take note: when we moved, some first-time purchasers bought our old house. It had an affordable price for the couple (who I think both had full-time jobs). All in all a pretty good starter home for them, just as it was our first home (after a condo).

So I think this chain of people moving up is slightly undercovered in your blogs, especially in established neighborhoods like Burbank. Is the whole thing still scary and in danger of collapse? Sure. But it’s difficult to get a mortgage right now, yet folks are still buying. In fact in Burbank, if a house is priced correctly, it sells immediately. When we sold our 3/2 1750 sq ft house this past summer we got about 12 offers in less than a week. It’s a HUGELY desirable area because it’s got great schools and is an independent city but next to L.A. and Hollywood.

One other thing worth noting is the folks that bought our house did not live in Burbank prior. So whatever salary they made is not in demographics. Same goes for us when we bought that house… we came from 30 miles away (Agoura Hills).

I currently live in Toluca Lake and am in escrow for a house in the Inland Empire. Me and my wife have no kids and together make over $225k . We initially started our search in Burbank/Glendale but as your article states things are still so expensive there that it makes no sense. Even going as further out things still are not within reason. I think reality will hit this state hard and fast but it will probably be another 5-6 years. By then we hope to have our house in then Inland Empire paid off so that we can rent it out and move back closer to L.A. We seriously thought about buying 4 years ago but I knew the bubble had gotten ridiculous when our office secretary (a single mom) bought a house for $500k.

Just a minor correction to the income numbers: SDI and SS are limited to some maximum income, both of which are around $100k. This will increase take-home by around $600/month on average over the course of a year.

Note that this correction still doesn’t significantly alter the point being made in regards to housing expenses vs. income.

It’s amazing how people forget the basic fundamental of TOTAL MORTGAGE/ANNUAL INCOME when buying a home. The ratio historically has been between 3 and 4. On the Westside of LA, your income needs to be almost 200K in order to buy a fixer in Culver City or Mar Vista. I’m sorry but most people living in these areas aren’t pulling down that kind of cash. Something is obviously out of whack.

http://www.westsideremeltdown.blogspot.com

http://www.santamonicameltdownthe90402.blogspot.com

I’m interested in the Rancho Cucamonga area. Unfortunately the “border cities” (Upland, Chino Hills, Rancho Cucamonga) appear to be acting like L.A. County as far as pricing goes. I’ve seen a few new listings the past few days where owners seem to think that we are back to the peak of the housing bubble once again. They only way these delusional sellers are going to get their overinflated prices is the current lack of inventory combined with uninformed buyers. That’s why I keep sharing blog posts from this site and others via email and on Facebook so that more people can see what is really going on here.

Hi, Dr.

I have some confusion about the house price and household income issue. I fully understand that income should support the house price. But the loan is not necessarily the house price, it’s the house price minus the downpayment. If I put a huge down payment I do know whole bunch of people, who made a fortune by selling their first house at the peak and used the profit as down payment for the next bigger one, so their loan principle is way lower than their house price due to the big down payment.

Maybe my observation is biased because most of my friends are prudent in term of financing.

Is their any chance when you compare the local household income with the size of loan not the house price? I know many people used zero down payment, and tapped from home equity loans, but comparing to loan amount makes more sense when calculation burden of a family.

thanks

Norman

Carlivar,

you are making some great points, but I do not think that there are too many people who have enough equity to move up. Do not forget that it costs probably about 10% to buy and sell a house (commissions, fees, etc.), and you need a large down payment. People like you are keeping the market alive, but there is more supply (shadow inventory) than demand, so I think at some point the prices in mid to upper areas will have to come down. Of course, if you plan on staying in your new home a long time, you get to enjoy your new home, and prices in your neighborhood will not matter to you since you are not selling.

Latesummer, is the historical 3-4 ratio a nationwide figure? Seems I’ve read the HB doc mention that more desirable areas in Southern Calif historically have much higher ratios.

@William, I assume a 1700 sq ft 3/2 in Burbank or Glendale was not acceptable to you? Because that is certainly affordable for you at around $500k. If you want bigger, yes, Inland Empire might be a better option.

carlivar .. burbanks school system is about average at best. I definitely wouldn’t consider them to be great. Great would be more along the lines of San Marino, Temple City, Arcadia. If you compare the various test scores, you’ll be able to see just how average it is. The only reason I know this, is because I was looking at places in the burbank area for a while now. You can view and compare all kinds of good info on all the public schoolls in CA @ http://www.schoolfinder.ca.gov/ Enjoy!

@carlivar: Your argument of building upon your equity requires a continual stream of new folks buying entry level properties as you did as a youngster in 1998. It is these starter properties, or “starter areas†like the IE or Riverside, that have been hit the hardest thus far. I’m 27 and never had the opportunity to enter the market during this past decade since I wasn’t willing to live in Banning or take on a Banana Republic mortgage. Even at a 200K discount, this RHG is still priced about 3x too high for the “target audience†of working professionals (those who have managed to keep their job) to afford with a conventional mortgage. This affect will trickle up, so if nobody “below†you on the “property ladder†can afford to buy your place, then your equity will disappear, even if you never hit up the HELOC ATM during the good ole Greenspan mega-bubble days.

@carlivar: One more thing: I’m not sure that “I have never met anyone who is underwater†is at all relevant since most people who are really in trouble financially are really going to start conversations about their problems. According to your logic, none of the people that I know flatulate or watch internet porn, so, therefore, these things do not happen where I live.

There are 16 homes on my street, values between $725,000. and $1,100,000.

6 homes are owned by retired people, fully paid off, and could “move up” anytime they wanted. 8 of the homes are owned by people who have been here 10 to 20 years, so they have plenty of equity, and could “move up”. 2 of the homes are owned by young professionals, less than 4 years on the street. Their driveways are full of big SUV’s, boats, and jet skis. Although they make more money that most of the people on the street, they spend it as fast as they make it. One layoff, and they will likely be in deep “do” very quickly.

@carlivar: Even though we could afford a $500k house in Burbank or Glendale it doesn’t seem rational. One of our requirements was two stories and very few of the properties we looked at in these areas had that which I’m sure is in large part due to the age of the area. Plus, maybe I’m just really naive or disillussioned but in my head I have a particular vision of what a $500k house is supposed to look like and nothing I saw in that area fits the bill. And regardless of income, $500k is way too much for a “starter home” regardless of where it is located. I really feel sorry for the middle class folks who have kids because they are the ones taking it on the chin. Luckily, we were able to move without regard to the school system otherwise we might have been renting forever.

Ironically, I’m working in Tampa this week at none other than JP Morgan Chase. Heard a few residents talking about the bubble that burst here. Lots of folks we so jazzed their house was so ‘valuable’ they sold and moved on up to an RHG rather than sell high, wait a bit and buy again low when it crashed. Now they are all looking to lose their RHG and the windfall from selling their first home.

This is such an unmitigated disaster because we are all so foolish by nature. If the bubble hadn’t happened, folks would have stayed in their first home and not been tempted, but now they have lost everything or soon will.

I used to write my mortgage check to Chase every month back in the day…just taxes now. I don’t like to pay interest even if I get a tax deduction. And I hate paying extra taxes because the local idiots think their homes appreciated 100% in the last 12 months…We’re destroying one another. Potter’s not selling, Potter’s buying.

I think Tampa is later in the bubble than CA so it would be a good idea to study one of these other areas to see how this plays out.

I can attest to the bank shananigans for sure. We rented a house here in the Oakland Hills in April 2007 and started to see Notices of Default posted on the property as early as August 2007. In October 2007 the house was auctioned back to the bank. We held on to the lease thanks to the city’s Just Cause eviction controls. We finally left in November 2009, but before then the bank never put it on the market. Now finally the house is on Redfin for $437,000. For perspective, the last sale was $689,000 in 2006.

To Norman: Someone who is prudent and saved $500,000, would be stupid to risk and put a large down payment to afford the mortgage on this house. Property values will continue to decline and their equity gets eaten away. If they lose their job, then they are really screwed unless they have emergency funds. Even if they do, today, when someone loses a job, it will be hard to find another job with a comparable income.

Renting is much cheaper. So many vacancies..

I am a renter up on the hill in the Burbank (91504) who is waiting for the right opportunity to find a 1200 – 1500 sqr.ft. home for around $500k. So far anything near that range has either had a freeway or high tension lines for a backyard or needed significant repairs. I my current rental is a very nice 3/1 home with a large lot and a detected garage big enough for my cars for significantly less (at least $1k a month) then the mortgage for any comparable home I have seen in my search. So many of the homes on the market here are in miserable disrepair, have shoddy work done, or need significant maintenance, I think the only thing keeping prices alive at all is the lack of inventory and false hope.

@ carlivar Show me the 3/2 for $500k?

http://www.redfin.com/search#lat=34.19935537560752&long=-118.3098325360723&market=socal&max_price=500000®ion_id=37892®ion_type=2&sf=1%2C2&time_on_market_range=1-&uipt=1&v=5&zoomLevel=14

And Dr.,

don’t forget to mention that you would need that 204k or 263k annual salary for the next 30 years!!

And Dr.,

don’t forget to mention that you would need that 204k or 263k annual salary for the next 30 years!!

Who’s paying the 18 months of property tax for that house?

Great article and thank you.

I wish California realtors (the CAR) would agree to layout a compelling argument that supports buying a 4 bed, 2 bath, 2000+ sq ft SFH right now in Orange County for $500K-$650K utilizing the same mathematic methodology and deductive logic that you’ve shown above as associated with real take home incomes here and the prospect of much higher mortgage interest rates in 3 to 5 years.

They won’t do this because the numbers damn them well before they ever utter the first word of their argument.

Some argue that the “devil” was in the details of these Countrywide mortgages, but shouldn’t the ridiculous mortage payments (50% of actual income) have been a massive red flag to the buyers from the start? It’s so obvious, it’s like stubbing your toe on a Howitzer in a haystack. I’m trying to register in my own brain how rational home buyers could have decided to turn a blind eye to this kind of thing.

How can any one have viewed these payment numbers back in 2007 and still have thought to themselves: “Alright! This is such a no brainer! Where do a I sign?”

Sorry carlivar – Burbank is a ” HUGELY desirable area” only if you happen to live there or you are from Watts. As an avid golfer I have never played with trashier people than at De Bell. Whenever I see truly appalling behavior I ask where they are from and they are always locals.

As to Burbank being “next to Hollywood” you may want to consult a map.

Your main point that lots of people are sitting on big piles of equity is totally untrue in my experience. I have access to peoples mortgage data and being nosy I check it. Even people with huge incomes and profitable trade up histories tend to have played the refi game. Are you really that naive that you will take your neighbors word that they are sitting on equity? In an environment like this how would they even know themselves?

A few Burbank 3/2’s (or more) < $500k from the past couple weeks of Redfin's email updates to me:

http://www.redfin.com/CA/Burbank/1533-N-Catalina-St-91505/home/5320475

http://www.redfin.com/CA/Burbank/1831-North-AVON-St-91505/home/5319448

http://www.redfin.com/CA/Burbank/1430-North-MAPLE-St-91505/home/5319043

You guys make good points. I know it is "people like me keeping the market alive." That may be true. I just find it interesting that 1) nice Burbank houses are selling immediately and 2) mortgages are hard to come by. So the money's coming from somewhere.

If I were looking to buy my first place I'd get a condo in North Hollywood near the Red Line probably. There's going to be a lot of development there (and already has been).

I use Burbank school ratings on greatschools.net. Our local elementary got an 8/10. BHS got a 9/10. I don't care about test scores as much as class size and attitude/philosophy/interest of the staff.

@ Bob Crane:

Retired folks could move up? Really? They make a lot each month while retired? They could trade in their home for something better for no additional money? Their pension plans aren’t in danger? Their retirement savings unaffected by economic upheaval? No support to family members who have lost their jobs?

I agree anyone spending their money like there is no tomorrow is a fool but this does not afflict only the young. My parents have refinanced and refinanced a home bought in the seventies that by all means should have been paid off twenty years ago. So just because one has been there a long time doesn’t mean they have equity or superior financial sense. It doesn’t paint a complete picture.

I would be cautious in thinking one is protected from the economic storm just because they have been fortunate so far.

Great work again Doc,

Until we get back to the “reality ceiling” of prices where mortgage payments are 35% of the take home income we are still on thin ice.

Are there any areas in LA where prices have hit that point yet?

Down here in sunny Sandy Eggo there are a few places where payments are less than comparable rent….but this $8000 tax credit silliness is pushing folks to compete, and even in the least desirable areas prices are increasing.

Thank you for your reply, and I agree with your comment. Matt,

I just want to clarify my points:

1. It’s the loan amount not the house price directly connect to affordability, esp. for those move-up buyers. My friends, who paid 50% down payment of their $800,000 house, only need $100,000-12,000 income to cover their 400,000 mortgage, not $200,000.

2. Due to their big down payment, they have more room to wiggle and very difficult to get foreclosed.

3. I think it’s more convincible if Dr. can use loan amount to calculate the affordability.

4. Since they are my friends, I only can say, if I had $500,00 at that time, I wouldn’t buy that house. 🙂 If they need emergency funds, I will lend the money to them, since I am a renter with cash. 🙂

Norman

Comment by Matt

January 6th, 2010 at 11:05 pm

To Norman: Someone who is prudent and saved $500,000, would be stupid to risk and put a large down payment to afford the mortgage on this house. Property values will continue to decline and their equity gets eaten away. If they lose their job, then they are really screwed unless they have emergency funds. Even if they do, today, when someone loses a job, it will be hard to find another job with a comparable income.

Renting is much cheaper. So many vacancies..

Randor, thanks for the laugh.

@ carlivar the middle house you linked sold for $620k. Not even close to sub-$500k.

@Johhny – No that was the 2006 sales price. You can see in the sales history that it was on MLS for one day (multiple times). Not sure why the sellers are doing that, but they had it listed for $449k on 1/5/10.

This isn’t an average home, so comparing affordability to average incomes is absolutely useless.

T. Paine=== it was Chickie Burger not Chickie Baby……….all Jim Healy fans remember that one.

Terri,

Regarding Santa Clarita (Santa Credito) Valley, there will be numerous homes available soon. I used to live up there and thanked God I could get out of there with my money. Even though most people have government jobs up there, the culture dictates a spend, spend, spend, credit environment. There are too many “no money down ” or FHA people that live there. I know many folks up there that have NOT been paying their mortgages and have yet to receive a NOD, after almost a year, but still drive the BMW’s! Be careful of corporate packed communities and Mello-Roos fees!

Can’t believe that you moved from Agoura Hills to Burbank, especially when you claim that it’s desirable partially because of the schools. The public schools in Agoura Hills are vastly superior to any school in LA, Burbank, Sherman Oaks, Studio City, etc. Don’t even get me started on the difference in crime and the difference in number of registered sex offenders.

And even though I’m in the entertainment industry, I consider it a plus to be farther away from LA and Hollywood. My wife and I just moved to Agoura Hills from Sherman Oaks a few months ago, and our only regret is why we didn’t move earlier.

Re: 1/6. I echo bubble boy’s question: who is paying the property tax on these defaults? The debtor-renter?

~

In our county in Pugetopolis, people in strategic or real default pay the taxes and the utilities, in that order, because the county is happy to slap a lien on the joint faster than the electric company will turn off the electrons.

~

This means that technically the county has little incentive to reduce assessments…but nevertheless our county has done just that for 2010. Whether it ends up meaning actual tax savings is unlikely; they’ll probably just unilaterally up the mil rate.

~

Fun with numbers.

~

rose

let’s wait and see what will happen in “history”. whatever happens, be super brave. happiness or suffering all is just temporary. same as the desire to “live”. desire to “live” will cease at some point, won’t it? simply and frankly, “life” as a “perception” will cease at some point anyway and eventually, won’t it?

be supper brave, my human kinds. whatever happens

The commutes are terrible in Agoura Hills. I moved out of Agoura Hills before I was married, much less thinking about kids. If I was going to live way out there it would be somewhere with a train station like Simi Valley or Moorpark. Besides, Agoura/Westlake/T.O. is not my vibe. Too many Lexus SUV soccer moms.

Another 3/2 under $500k listed in Burbank today!

http://www.redfin.com/CA/Burbank/2101-N-Buena-Vista-St-91504/home/5361396

Yeah. No full social security guarantee and the house that does not have value. Double whammy.

Fantastic Work. DHB, mind taking a look at perhaps the most insane market in the state- Santa Barbara? With the new info about the coming high end collapse, this market is fascinating and terrifying.

Let’s wait and see for further developments on the stats of the housing market in California. Doc, thank you for this excellent article. I’m looking forward for more. Keep it up.

Leave a Reply