Real Homes of Genius: Today we Salute you Brea. A Home that Shows Each Phase of the California Housing Bubble.

You may have noticed that my most recent Real Homes of Genius examples have shifted from inner city $500,000 homes to struggling high priced “prime” areas like Beverly Hills and Culver City. The reason is that this housing correction is impacting properties in every corner of California. In 2005 and 2006, it was not uncommon to put a hand over your eyes, plunk your index finger on one of the 88 cities in Los Angeles County, and you could rest assured that area had 20+% year over year gains. It didn’t matter. It reminded me of the investment firm ad pre-tech bust where a chimp is throwing darts at a stock page and outperforms the market. Yes, it was literally that easy to make money in this speculative fervor.

The evolution of the housing decline is now engulfing the entire region. The California Association of Realtors came out with their monthly report stating that California is now down a whopping 35% on a year over year basis:

Single-family Detached Home

May 2007: $594,530

May 2008: $384,840

Nominal Decline: $209,690

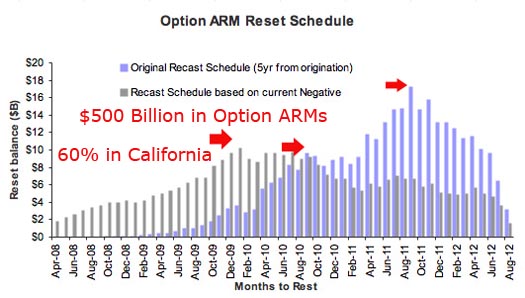

How is this not a crash? Even if there is debate that the nation as a whole may or may not be in a recession California is definitely in one. With an unemployment rate of 6.8% and a heavy dependence on housing to boost our economy, we are going to face a serious challenge these upcoming years. That is without even looking at the $300 billion in Option ARM mortgages just itching to recast during the 2nd half of the year. There are reports highlighting the increase in sales for California which is true for two reasons:

First – A large number of current sales are distressed properties that are priced at a heavy discount.

Second – We are seeing the typical spring and summer selling season trends which aren’t as strong as other years.

So those are important caveats. And it is also hard to assume how many homes that are REOs are making it fully into the MLS data. Clearly there is a discrepancy when MLS data shows a decline in inventory while the amount of REOs is sky rocketing. Let us look at the current data and see if we can put our finger on the pulse of the market:

Total Southern California Inventory: 140,842 (MLS data)

Total Sales for SoCal in May of 2008: 16,917

Total months of inventory: 8.3 months

California Distress Information for May 2008

Notice of Defaults: 41,965

REOs: 20,237

NTS: 9,728

So here’s the raw data. The overall inventory numbers have been steadily falling since September of 2007 yet the sales numbers haven’t increased fast enough to compensate for the increase in distress market action. In fact, given that the foreclosure process takes months and the notice of default is only one of many stages, you can expect a flood of REOs and foreclosures hitting the market in the next few months just in synergy with the onslaught of option ARM mortgage.

You may say that the NOD number is over stated and people will bring this current. Thik again:

“(DQ News) Of the homeowners in default, an estimated 32 percent emerge from the foreclosure process by bringing their payments current, refinancing, or selling the home and paying off what they owe. A year ago it was about 52 percent. The increased portion of homes lost to foreclosure reflects the slow real estate market, as well as the number of homes bought during the height of the market with multiple-loan financing, which makes ‘work-outs’ difficult.”

That means 68 percent (at least from the last report in April) will not become current and go through the entire foreclosure process. The market conditions have only worsened since April and I can assure you that people in option ARMs will default at these levels or even higher just given the toxicity of the mortgages. Let us take a look at the chart once again:

Not a pretty picture for California. Now let us look at a home in Brea that documents the history of the great California housing bubble. Today we Salute you Brea with our Real Homes of Genius award.

Housing Archeologist – Digging Up the Past

Brea is a city in Orange County California that is also extremely close to Los Angeles County. Once started as a crude oil hub ironically, the city has become a nice place for families to search for starter homes. Young professionals usually find this city a good place to start. Many in Southern California have been to the Brea Mall. The cities population of 39,560 makes it one of the more moderate sized cities in Southern California.

Given the nature of the current housing explosion, Brea is not immune to the damage of the housing market. Let us look at the current data on this area:

May 2008

Brea 92821 Median Price: $447,500 (down 22.8% from $579,663 last year)

Brea 92823 Median Price: $517,000 (down 29.4% from $732,295 last year)

Now for people outside of the area these price drops must be stunning. After all, the price drop for 92823 is a stunning $215,295 in one year; a price in itself that is higher than the median priced home in the United States! But given California as a whole is down 35%, this is actually very common. Areas once thought prime are no longer in that category. In fact, many of these areas are the main culprits of the option ARM bonanza.

Many of the inner city loans have already imploded and these were largely due to the sub-prime loans. After all, how is someone making $14,000 going to get a $720,000 without fudging the math. But these so-called prime areas have people with decent to good credit with okay incomes but no way in the world could they afford a $732,295 starter home. That price correction above folks is the market correcting a massive bubble. That sub-prime talk is hogwash and a Trojan horse to cover the real mess of nationwide speculation.

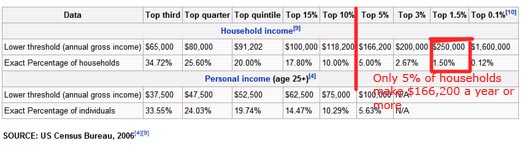

For the large part as much as people want to believe Californians all make $250,000 a year, this is absolutely wrong. I remember in 2006 I kept getting these commentators on a monthly basis say “see, prices went up because they are simply reflecting higher wages and demand.” Which I would quickly say, “no, prices are going up because of speculation and rampant crappy loans. Incomes are not going up.” This massive correction is simply a reflection of that reality and those commentators have gone the way of the zero down mortgages. Even a cursory look at national income statistics would tell you this:

*Source: Wikipedia, Census Bureau

Only 5% of all U.S. households take in more than $166,200 a year. For that $732,295 price tag buyers in that area would need to making $250,000+ to afford a comfortable mortgage. So what are the stats for the Brea area?

Brea Average Household Income: $80,480

A tad bit short from $250,000 don’t you think? So this above place documents the entire mania that went on in California. This home is a 3 bedroom 1 bath short sale at 1,100+ square feet. The current sale price is $420,000 and is located in the 92821. What is the sale history on this place?

12/02/2005: $575,000

04/04/2002: $300,000

08/31/2000: $242,000

Now take a look at the peak for the 92821 area code above? Now look at the current median price. Notice something? Banks and lenders are basically trying to follow a declining market and lowering prices with median ranges. Of course, this is as idiotic as paying an inflated price on a home simply because 3 local comps justified a higher price. All that meant is 3 people drank the Kool-Aid and jumped in the market. Now we are seeing the reverse occurring. Let us do a quick market analysis. First, a similar home in this area with 3 bedrooms would rent for $2,100 a month.

Rent: $2,100

PITI: $2,958 (with 5% down and a 6.5% fixed mortgage)

Given you’ll be able to write-off much of the interest, this deal is getting closer to a more logical price range. In reality, the actual solid range would be $275,000 to $350,000 given the current market conditions. At that point, it really is up to you whether you should jump into the market given your life circumstances. Yet to run into the market right now is simply cashing in your chips to early. Look at how the price doubled in 5 years. This makes no sense. Let us be generous and say that the $242,000 price in 2000 was a good starting point. At the rate of inflation after 8 years the price should be $357,000, well within our range.

However you slice things, right now is not the time to buy. We’re getting there but jumping in right now would not be the most practical thing to do.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

3 Responses to “Real Homes of Genius: Today we Salute you Brea. A Home that Shows Each Phase of the California Housing Bubble.”

Alright!

My home town.

Gold. The final frontier. To boldly go where no man has gone (since 1981). Look for house prices and rents back to 1997? levels. Expect short term hardcore inflation to drive the US economy into deep recession, followed by an equally painful and longer lasting deflation. What did you expect from Wal-mart jobs, anyway.

Dutchtrader, I’m from that area as well, and am a graduate of Sonora High School.

One thing Dr. H-B didn’t mention was that the local economy has traditionally had very few oil related jobs. Most people who live there are commuters, and the mall mostly has lower end service jobs. Quite a few Breans are in the Real Estate industry as well.

The tax base was always good because of the Mall, but you can expect that revenue to drop off for awhile, so there isn’t much left to rescue the local economy. That will lead to more people moving away or being underemployed.

Brea always had a lot of new money and big attitudes, so it will be nice to see some humility return to the area. In fact, it would be nice to see it happen for all of Southern California.

Leave a Reply