Real Homes of Genius: Today we Salute you Buena Park. 717 Square Feet for $465,000.

I know many of you must be feeling overwhelmed with all the hard-hitting housing data from recent weeks. The sky isn’t falling, but home prices are. Foreclosures and short-sales are hitting the market daily and adding up like an abacus. I’ve decided that it was time to get our feet placed solidly back into reality with another fantastic and spectacular deal here in sunny Southern California. Today we salute Buena Park with our Real Homes of Genius Award.

If you are not familiar with short-sales don’t worry, soon you’ll be reading and hearing many mainstream articles discussing this growing phenomenon. A short-sale, for the sake of simplicity, is selling a home at a loss. Typically, this happens when a seller needs to unload the home but finds that their mortgage(s) has put them underwater. Unlike the Fed, the IRS isn’t one to give bailouts so sellers still need to pony up even after a short-sale is executed. You may be wondering why you haven’t heard much about short-sales in the last few years. For one, a rapidly appreciating market as we have here in Southern California masked a lot of financial irresponsibility. For example, someone bought a home for $350,000 but after 2 years, was unable to pay the mortgage; the mortgage may have adjusted or simply the carrying cost started weighing on the owner. Either way the owner is feeling the pressure to sell. They appraise the home and find out it is now worth $510,000. Instead of dealing with a bad purchase, they are given a nice cashier check for all their woes. With such rapid housing price growth, the market hid the fact that many people were unable to afford the home that they bought. But what happens when appreciation disappears? This is were we discuss the Buena Park home.

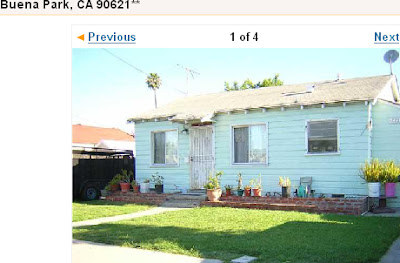

This majestic 717 square foot home includes 2 bedrooms and 1 full bath. The fresco color gives you the feeling that you are in a Monet painting. Supreme Scream isn’t only a ride at Knott’s Berry Farm, but also your reaction when you realize you bought at the top. Let us take a look at the sales history of the home:

Sale History

03/08/2007: $510,000

05/05/1995: $110,000

What are we to make of this? Well for one, the purchase of the home was only five months ago. At the sale price in March, this gorgeous home fetched a whopping $711 per square foot! No bubble here. The current price is $465,000. So already in five short months, we have a reduction of $45,000. Not bad for waiting a few months to purchase a home.

But the magnitude of the bubble is highlighted even further when we look at the neighborhood data. Let us dig deeper in the anatomy of this microcosm of the housing market:

Average Household Income: $57,022

Monthly Net Pay: $3,811 (filing as a married couple with 2 federal exemptions)

Monthly PITI: $3,066 (Assuming 10 percent down and 30 year fixed at a generous 6.27 percent)

So what does this added information tell us? A family buying this home putting down $46,500 (what it dropped in 5 months) is looking at spending a whopping 80 percent of their net pay on housing. Talk about crazy ratios. If it is overpriced at $465,000 what were people thinking at $510,000? The only logical explanation is we are in a bouncing bubble. What does a comparable rental go for in the area? The median 2 bedroom 1 bath rental goes for $1,425. Owning this home will cost you twice as much as renting a similar home. In economics, we call this the substitution effect; if something is too expensive and there is a respectable alternative, many people will flock to the lower priced item. With tighter credit standards, the substitution is already happening by force since people in the local area cannot qualify to purchase a home. In addition, no investor would buy this place. Think about it. Your carrying cost is $3,066 and your monthly rental income is $1,425. You are in the red for $1,641. You don’t need to be Rene Descartes to figure out that the math doesn’t work on this one.

With all the chatter regarding the subprime debacle, Fed intervention, and collapsing mortgage operations why isn’t the mainstream media stating the obvious? Incomes in many metro areas do not justify the current prices and hence the market is viciously correcting. In other words, massive credit speculation allowed people to buy more than they could afford.

Today we salute you Buena Park with our Real Homes of Genius Award.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

27 Responses to “Real Homes of Genius: Today we Salute you Buena Park. 717 Square Feet for $465,000.”

Love these posts!

For what it’s worth I don’t think the average income in the area is all that relevant. You’re including people who rent and also people who bought a long time ago and have a small or non-existent mortgage.

Mike

http://www.four-pillars.ca

I am a Real Estate Appriaser.Let me tell you cold hard facts on what’s coming , It’s all over my friends , 50% decline over the next two years with a serious recession , maybe even a depression.So put away those rose colored glasses and polyanna pants and save yourself.PS We did not cause this crash so don’t throw stones..

In other countries you can’t own more than one house without paying a huge premium, maybe even twice what the home would cost otherwise. Houses are for living in, not investments. Perhaps that’s the type of legislation required to prevent this mess in the future. I’m not for gvt intervention, but there probably was good reason to enact such laws elsewhere.

If the average or median income for the area isn’t relevant, what is?

Since the “average” and “median” figures for the entire U.S. are skewed by people who make S$200MM yearly salaries, then we can suppose that the run of people in this area make way less than the average for it.

Can you pay for this house with a welfare or SSI stipend + proceeds of “street” business?

Zoning,maybe? When I saw houses like this listed in LA, I thought, aaaah, must be zoned highrise, so they can tear down and “gentrify” by building new bldgs.

I can’t imagine anyone with an average or better income living in this.

Hey,

I just got back from visiting the folks in Eastern Iowa. I picked up a flyer for laughs — a new 4,200 sq.ft. overlooking the Mississippi, with a theatre room, 1/3 indoor basketball court, and a panic room (…for laughs, I guess) for $10,000 less than this fine SoCal home. Thanks DrHB, good work.

Great blog!

It appears that the purpose of this blog is to make people aware of what is really taking place in SoCal. (thanks!)

It also appears that we should wait 12-24 months before even considering a purchase.

If we wanted to move back it also seems like REO’s are the way to go.

Would it be possible to draft an article on a typical family wanting to move back to SoCal, and how they would take advantage of the current market decline? (Using real numbers?) 92127 area code for example

Dr. Bubble! I really enjoy your blogs, you give such good examples and cold hard facts about the housing situation. Like many of you here, I listen to the weekend RE sales people encouraging people to buy. They talk about all the fancy financing available to first time buyers. They sound no different than they did 6-12months ago. However, on Bob Brinker’s moneytalk show today, there were callers who were calling in for advice on getting out of home sales that haven’t closed escrow. One lady was in the process of purchasing a home for CASH in Ventura for $1,100,000. The asking price was $1,200,000. They THOUGHT they got a bargain at the accepted price. Now she discovers that the home is worth much less than what the accepted offer was for. They put down a $20,000 deposit, and she’s trying to figure out a way to get out of the deal and get her $20,000 deposit. I don’t know about you people, but I couldn’t sleep at night knowing I would lose $20,000! But then again, paying cash for a house for over a $1 million, maybe she can afford to take the hit.

Hold onto your money and home. Rent don’t buy, that’s what I tell my kids.

That woman needs to apply cold-blooded logic, which is:

a) I made a mistake.

b.)How much less is the house worth than what I offered?

c.)If it’s worth more than $20K less, then the deposit is a small loss.

d.) If the place is really that unique and I really love it, then being a little underwater won’t matter since I don’t have a loan to worry about.

d) But if it is worth $100K less then I better just toss the $20K and be glad I got out so cheap.

Taking a loss is the hardest thing to do in the world. Most traders bust out because they do not learn to take a loss early. Take the loss while it is still small. Learn to cut your losses while they’re babies or you will take the mother of all losses.

There’s nothing wrong with being wrong as long as you don’t stake your life on it. Just make sure you can afford to make a mistake-give yourself wiggle room. That’s what was wrong with all the exotic loans- there was no margin for error there.

As the old saying goes, if you’re not good you better be right.

Dr. HB:

I think they lowered the price on this winner because it’s missing those essential metal grates on the windows and the special protective fencing around the property. I would at least want that for my money!

As to eastern Iowa and other markets…yes, the price-quality ratio is much higher. All that is good, but even people in those markets will not escape this bubble — their banks, retirement funds, pension funds, etc. all invested in the same CDO’s and toxic waste. When the consumer stops dancing, those folks are gonna lose jobs too. No one is immune.

Recession? We’ve been in a recession for years. I bet the IRS could tell us exactly what’s been happening via W2 based income.

Here is my guess:

Corporate downsizing / Expensive Union Labor / Off-Shoring has significantly reduced the number of high paying jobs (note I didn’t say high skilled jobs) since we had LOTS of fat to trim with low skilled folks making tons of $$

Now what should have happened is that we formally tip into a recession and folks get smart real quick regarding the economy. They realize that it’s not a personal thing and they swallow their pride and get to work in a lower skilled job.

Eventually that approach pays off. 80K Union job -> 40K construction job -> retirement. So we get a soft landing.

So it’s the year 2000, you just lost your high paying job, but everything on the news says that you screwed up. Economy is running great! Lots of money thanks to Mr. Greenspan. Your house is going up in value, so you even feel like you’ve got some cash.

Now it’s 2007, you maxed out your credit cards and mortgage as you bounced around as a “consultant”.

Oh crap.. we’ve maxed out our credit because someone forget to tell us we were in a recession for the last 5-7 years.

Time for a DEPRESSION!

@four pillars,

Thanks for the comment. I have to respectfully disagree that the area income does matter significantly. After all, monthly rents are a good indicator of the income of those seeking to live there. If a landlord can charge $4,000 a month, I can assure you they will charge this amount. I have seen a new strategy hitting the market. Instead of selling, many peak buyers are trying to rent their homes for absurd prices. What happens? The home doesn’t rent. They will need to lower the amount to reflect the current demand of the market. The problem with the exotic loans of yesteryear is that they artificially lowered the actual monthly cost of a home. Take the ever popular 2/28 loan. A buyer had a below market monthly nut that more accurately reflected the current rental market; yet after the rate reset and amortized at a full rate over 28 years the cracks of the bubble begin to emerge.

Keep in mind California is very different. We have one of the lowest homeownership rates. The state is at 57 percent while the country is at 70 percent. LA County has a renting majority. And many people that came close to paying off their mortgages tapped into their equity via equity withdrawals. Take a look at the growing short-sale and foreclosure numbers.

@realitycheck,

Even Mozilo at Countrywide has said that this oncoming housing correction will tip the economy into a recession. At this point, there are so many players in this bubble. I don’t think it is fair that Democrats are isolating mortgage brokers as the problem in the housing market. There are many folks that got wealthy in this game: hedge funds, banks, agents, construction, government, and even buyers and sellers. So this is more complicated than just one group.

@musnbny,

We already have plenty of legislation on the books. It just wasn’t enforced. Looking at 100 years of data housing has trended upward with inflation. Only in the last decade has it taken a different track. The problem right now is the housing industry was happy to keep the government out when things were going hot. Now that things are going down, they want the government to jump in and protect them. You can’t have it both ways. At this point any intervention is corporate welfare. Even the talk of having a foreclosure fund in LA County is absurd. They were looking to give $10,000 to people facing foreclosure. Which will buy someone maybe 3 or 4 months. Then what?

@the north coast,

Agreed. Income does matter. In fact, the last loan I got I had to fully document my entire income. Even as late as February of this year I was able to go stated income and get a good rate based on a high FICO score. Since approximately 50 percent of those in California rent, income is very relevant in terms of paying the monthly nut.

@al,

Whenever I’m in the Midwest, I’m shocked at how distorted our logic has become from living in Southern California. We need to realize that this bubble has targeted highly populated metro areas. There are many places in the US where this bubble had very little impact. The house you speak of overlooking the Mississippi would probably go for $3 million here in SoCal. Instead of the Mississippi you can over look the San Gabriel River.

@we_miss_san_diego,

I was listening to a real estate show on the radio this weekend and these “experts†were telling people to buy. A caller was asked about his $600,000 loan that he jumped into with no money down. “What index is your loan based on?†the host asked. “I’m not sure but I think it is an option-ARM†the caller replied with doubt in his voice. And you wonder why there is so much pain in the market.

If you are looking to come back to California, I wouldn’t buy right now. You can low-ball sellers but there is still massive denial in the market. My view is we won’t see prices near fundamentals for 2 or 3 years. Keep in mind when markets go down it is important to have solid income, credit, and a down payment. Yes, this may sound like some foreign language at the moment but these things will matter in the next few years. Focus on your number one asset, yourself. More specifically, your career. Whether it is a business or profession this is where most of your leverage for buying property will come from. Plus, it pays to do something you love. Manage your credit wisely. Even though folks laugh at down payments this will be important in the next few years. Even in buying investment properties, I have more leverage with 10 percent down as opposed to going in 0 down.

@reality check

I think you’re correct. It’s called ‘fundamentals.’

@ the north coast said:

“Taking a loss is the hardest thing to do in the world.”

I agree with almost everything you said in your post. You obviously trade the equity markets and it sounds like you’ve picked up some pretty good habits. I may just be nitpicking here, but that’s not my intent. Taking a loss while trading should be programmed into the formula before the trade is ever initiated…that way, emotion, (the enemy of trading) is removed. The mere fact that we are even discussing trading losses and the psychology of trading losses on a housing blog is quite revealing. Most have been programmed by the REIC to think that “real estate only goes up.” Ergo, they do not program in advance taking a loss. Ironically, this is the quandry that the quant, black box hedge funds on Wall St. find themselves in today. They “marked to model” (or myth) while abandoning the basic rule of “mark to market” accounting of the underlying assets of their “structured product.” i.e. MBSs et al. That is why even a MONEY MARKET fund like Sentinel filed for bankruptcy. To meet redemptions from nervous investors, they would have to sell some “product” at pennies on the dollar they had “marked” at 100% value.

This is a virus that has infected all of Wall St. Even the big boys caught it. So now, the Fed is giving them time to get their biggest and bestus customers out while the “little guys” ($500,000 net worth) get to get caught holding the bag in whatever end game they dream up for a bailout. This is the “moral hazard” that we will finally be hearing about from the MSM in future months. The bottom line is we should never have allowed our housing market to become a speculator’s haven. To do so produces the results we are all seeing now.

@Dr. HB

Another outstanding real homes of genius. I’ve read where you have out of state income property. One thing I haven’t heard much about is, with all the “free” mortgage money floating around in the past few years, has it been available for commercial properties? If I want to buy a shopping center or office building, can I get a no doc liar loan for 50 million or do they dray the line on that sort of thing?

Dear covered,

I agree with you that housing should never, ever have become a trading vehicle.

However, since some folks out there still view it as such, it would behoove them to start thinking like traders.

Yet there is an even more fundamental mental shift that all of the rest of us, including mineself, must make, and it is very difficult. I haven’t really gotten into it, and the emotions are still at war with the mind.

What we must now realize is that we might have reached some limit in terms of economic growth, due to shrinking resources and expanding population, at least for the time being, and that if we want real growth we will have to make a difficult transition back to manufacturing and growing our goods and food.

You will notice that for the past 25 years, every since we lost our manufacturing base, we have kept the economy going on financial rackets, by generating speculative rampages that are exhilirating for SOME folks while they last but almost always end in ruin that affects people who were not players but have to walk behing the playas picking up the pieces.

We’ve at last maxed out. We’ve ruined our credit and bled the country of resources, so what will we use to rebuild on a different basis?

I lie awake thinking about this as I contemplate a massive career shift in middle age. I’m in the financial area, which is due for some pretty severe contraction, IMO. That’s where my experience is, and switching to a totally new field will be challenging. And it’s not like I ever made a fortune- being risk-adverse, I switched from straight commission brokerage to being a salaried functionary, which took doing.

I’m sure I’m typical. Tens of millions of people out here are either confronting major life disruption or are still reeling from past shifts.

What a mess we’ve made for ourselves.

@jaye,

It is interesting you bring up that topic. Someone had a deposit on a $600,000 home in the Inland Empire (must have been a big home) and they had put a $30,000 deposit. They looked at current market prices and the home was now appraised at $525,000. The advice from the talk show host? Don’t lose that $30,000 because prices will jump up next year! In the Inland Empire. I’m not sure what reports she is looking at. The sad part is the soon to be buyer actually took this advice. Instead of losing $30,000, if they need to sell in the next 3 years they may be down 6 figures.

@the north coast,

Agreed. It is hard to leave money on the table. Same thing happened with folks who bought technology stocks and rode them all the way into the ground. They kept expecting them to bounce back even though market fundamentals didn’t justify any rebound. Never have we as a nation been so dependent on foreign credit and localized debt instruments. If you talk to some of the new generation, they wouldn’t know what to do without credit cards. In fact, they look at you with disdain when you whip out cash. “You’re using…cash†they say as you pull out a green $20 bill.

@thamnosma,

Things take time. There is always a lag from what happens on Wall Street, to what happens on main street. I don’t think we’ve seen any significant hit in the economy yet. But it is trickling down. These 40,000+ lending jobs lost are all high paying jobs. It isn’t like these people can easily find another $100,000+ annual job. This will put more pressure on consumer spending. Our economy is larger than just housing. But this will impact construction, banking, consumer goods, and other areas. Consumer spending is two-thirds of the economy.

@steve,

I’m sure once the excess credit is washed out, we will bounce back. But this is a multi-year cycle. I think paraphrasing Reagan’s view on job losses is apt; that your neighbor losing his job is a recession while you losing your job is a depression. I think certain sectors of the economy will be hit much harder than others.

@covered,

Believe it or not it is sometimes harder to get a conforming loan than it is to get a jumbo $600,000 mortgage here in Southern California. The logic goes that you are more willing to pay for your own home as opposed to an investment home, even if the price is $200,000. This is another symptom of the bubble. Just because you live in your home doesn’t mean you can afford it; especially with exotic mortgage products that delay the actual price of the home from being paid. When you mention larger complexes and commercial loans, typically they require 10 percent or more (with people that I know in the industry they won’t go above 80 percent loan to value). And with income properties, you normally have to justify why the apartment you are buying is worth $1 million via income statements and market capitalization reports.

I stick with single family residential properties. Either way, loans out of state require more documentation than for loans in your own state. I found it ironic that banks were willing to lend me $1 million dollars for a SFR here in California while having a challenge getting a ridiculously lower loan for an out of state investment property that cash flowed from the first day. Go figure.

Maybe you can still realize your dream of owning a shopping center. Give a hard money lender a call. They’ll charge you 25+ percent but you’ll have a piece of the action.

Dr HB,

Ha. I was being a little facetious inquiring about the commercial loans in today’s market. I still own “pieces” of a couple of strip centers I developed back in the day.

You mentioned people riding the tech bubble into the ground. I was in early on that one and sold April 14, 2000. I’ll never forget that day. It was the top of the Internet bubble and I still managed to lose more in one day than most people make in years. I told all my friends to sell, too, but of course, they didn’t…and they ended up as you describe.

I bought a house in Del Mar near the racetrack that I had contracted for a year earlier with the traditional 20% down and a 30 year fixed. I bought it to sell, but my expectations were to make 50% on it in 3 or 4 years, not 300% (more if you factor it in as cash on cash return) in 5…which I took. I was literally asleep during the housing bubble (as to its cause, anyway.) I didn’t pay any attention to the infomercials and teevee shows. I didn’t know about liar loans and -0- down. When the realtors started putting comp sheets on my front doorstep, I started paying attention. I put a WTF price on it and it sold almost instantly. That turned out to be the top, but it was pure luck.

I’m very comfortable now with suitable rental quarters, and having owned six houses previously, am not looking for “The American Dream.” I was lucky enough to be taught at an early age by a very wealthy investor to “sell euphoria and buy despair.” Those five words have held me in good stead during my investing career. Buying a sales pitch or “hype” is the last thing I would ever do–the concept is so foreign to me you might say it’s against my religion.

Now that the smoke has cleared, at least for me, I’m more interested in the socio-economic implications for our society and our country. It’s going to affect so many people, like our friend the North Coast and millions of others like him that are going to be forced into making choices that I, thankfully, won’t have to make. I consider myself very lucky.

Dear Dr. Housing bubble

Here is a Building-of-Genius here in Chicago, for your amusement:

http://morsehellhole.blogspot.com

Take a look at this place. Have you ever seen such elegance in mid-century modern human-warehouse architecture? This place has everything- low ceilings, mingy little windows, ugly stone and brick work, all perched on concrete pilings over a parking garage. This type of building could not be built in Chicago now.

Vew today’s post on the craphole at 6610-6628 N. Sheridan, Chicago, 60626,two blocks from my place. The building is now vacant and being renovated. The apts pre-rehab rented for $600-750, to nice, poorer, working people.

The ownership wants $2,000,000 TIF funding from the Loyola-Devon TIF to tart this dump up and fill it with Section 8 voucher tenants. The neighborhood does NOT want this!

On 12/20/2005, National City Bank loaned the 6610 N Sheridan LLC $12.2 MM to buy this craphole. That’s right, Twelve million two hundred thousand dollars.

On 09/01/2006, National City Bank gave a SECOND mortgage of another $500,000 to the N Sheridan LLC.

Now, these people want the taxpayers of Chicago to give them $2MM worth of future taxpayer’s money to renovate this piece of garbage (which we would like to see demolished).

These types of “bailouts” are taking place via TIF district financing in cities allover the U.S., in case you were wondering why your city is ever more strapped for the money to pay for basic civil services like schools, fire and police protection, and essential water and transportation infrastructure, while your taxes get hiked every year.

You seem to pick on houses at the lower end. Not everyone can afford higher end homes.

Hi Dr.HBB,

I continue to enjoy the numbers you post in these articles. For someone like me, it puts everything in better perspective.

Thank you and keep up the excellent posting.

@stups,

I think your statement says a lot of the current atmosphere surrounding housing. If you think a 717 square foot home in an area with a median family income of $57,000 is lower-end, then we have some serious issues in our current market. The problem is the idea of “lower-end†is so distorted here in Southern California. I’m going to write an in-depth analysis on the entire county, multiple pages long showing the unbelievable nature of the current bubble. A half million dollar home is not low end in my book.

@chessnoid,

Thanks for stopping by and joining the community. Glad you can find some perspective in this insane market. I think this quote is apt for many lenders:

“If you owe the bank $100 that’s your problem. If you owe the bank $100 million, that’s the bank’s problem. “ –J. Paul Getty

@covered,

I know you were only talking in jest. You have a great perspective on the market. At least your honest that you made a profit with a little touch of luck. No harm in that. I’m betting many people are wishing they sold when they had a chance. Maybe the CEO of Century 21 should talk to you:

“A $200,000 ‘loss’ – and happy with it

Century 21 CEO’s home is worth 15% less than when he turned down a cash offer in ’04, but he’s focusing on the gain.”

Full Story

I love how he assumes the equity in his house is “profit.” It isn’t profit until he unloads the home, closes escrow and has a cashier check sitting in his hand.

@the north coast,

Excellent find. Again, this mentality that the government should pump money into anything is absurd. The government is us folks! If they raise the money on this place through taxes we will pay via inflation. I’ve noticed inflation is the only tax the government can get away with. It turns out, having something a tad bit complicated will numb the brains of the public. Folks will hang you for raising the income tax by 1% but inflation on housing in the double-digits doesn’t seem to matter.

By lower-end, I was not referring to the price, rather the house itself. I don’t believe rundown houses are anyone’s first pick. Generous use of sarcasm in describing these homes seems a bit off-putting.

Stups,

I don’t think there is any ‘cherry picking’, as you seem to imply, going on at all with the doc’s examples.

I can go on to any real-estate website, and I can not find house under a half million dollars that is NOT run down.

Here’s what 400K gets you:

http://homes.realtor.com/search/listingdetail.aspx?zp=91106&ml=3&typ=1&sid=f355638093934de3ad29b4c33b479230&sdir=1&sby=2&lid=1083346449&lsn=3&srcnt=34#Detail

720 Sq Ft next to the I210

Here we go, 1bed, 1 bath, 620 Sq Ft:

http://homes.realtor.com/search/listingdetail.aspx?zp=91106&ml=3&typ=1&sid=f355638093934de3ad29b4c33b479230&sdir=1&sby=2&lid=1084091323&lsn=4&srcnt=34#Detail

And… it’s for $490K

And that’s it, nothing within 3 miles of my zip under $500K, here’s the next one up:

http://homes.realtor.com/search/listingdetail.aspx?zp=91106&ml=3&typ=1&sid=f355638093934de3ad29b4c33b479230&sdir=1&sby=2&lid=1081307072&lsn=5&srcnt=34#Detail

785 Sq Ft for $538K

And…. It looks like the pictures taken for this were done covertly, or perhaps in a ‘drive by’. So, It is possible the agent had some reason for not really wanting to get out of the car. In more sensible/pre-bubble times, a place listed for more than half a MILLION would have evoked much more effort out of the listing agent, it would have been considered a ‘showcase listing’.

In the entire city of Pasadena (and not all of it is posh), there are only 10 listings with 2 bedrooms under $500K, None under $400K.

All 10 of these look rather run down:

http://homes.realtor.com/search/searchresults.aspx?cmid=1091872&ml=3&mxp=29&bd=3&typ=1

Thus, I think everything the Doc has chosen for his ‘Real Homes of Genius’ awards, are all typical of SoCal.

And to be ever more clear, each ad every one of these would rent for no more than $1400, and I think I’m being awfully generous with that figure.

I guess I would like to see nice, decent well-kept houses with inflated listing prices being profiled and included under this thread too instead of just these thrashed-up places.

“With all the chatter regarding the subprime debacle, Fed intervention, and collapsing mortgage operations why isn’t the mainstream media stating the obvious? Incomes in many metro areas do not justify the current prices and hence the market is viciously correcting. In other words, massive credit speculation allowed people to buy more than they could afford.”

This is the smartest thing I have heard yet on the whole housing debacle. Thank you! Common freakin sense.

“I guess I would like to see nice, decent well-kept houses with inflated listing prices being profiled…”

@Stups:

Is that short for stupid?

This is the entire point of this man’s blog. If they were well-kept houses, whose to objectively say they were inflated?

Besides, well-kept, nice decent houses are don’t really exist in SoCal. These are pre-war, stucco huts, sitting on fault lines.

Moving on.

Sorry.

short for stupid? LOL. 🙂

I get the point of this thread. it is to highlight how absurdly decrepit houses command those inflated listing prices.

My remarks are solely regarding the way these houses are described — with lavish use of sarcasm. it comes across as condescending. *somebody* lives in those houses. that somebody is there because of circumstantial, financial reasons, whatever. those houses mean something to them.

simply because some of us may be able to afford better or have better “class”, doesn’t give us the right to put someone else’ house down in that manner.

pointing out flaws and defects is one thing, but to do it in such a demeaning way is not OK (in my opinion).

I just checked this on realtor.com and it is now listed for $300k. Interesting to follow-up on these genius homes.

Leave a Reply