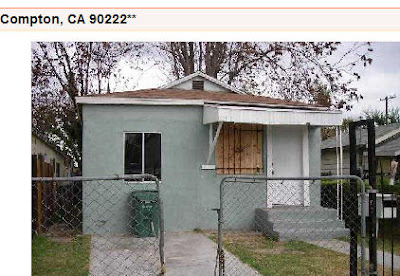

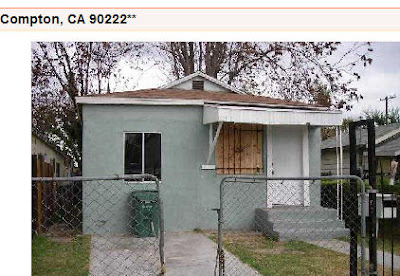

Word on the grapevine is, now that Paris did her time in Lynwood, all other cities in the proximity are going up in Hollywood value. They are hot. Today we salute you Compton, with our Real Home of Genius Award. This 768 square foot palace will wet the appetite of any hungry home buyer. Take a look at the gates. Doesn’t it remind you of the entrance of Windsor Castle? I’m glad we both had the same initial reaction. In addition, this place has some uncanny ability to squeeze gold out of turnips. This place has 3 bedrooms in 768 square feet. How they do this is like asking Oscar Mayer’s how they make hot dogs, you probably don’t want to know.

As we read the description, we realize that this is a motivated seller. In addition, they may offer you a repair credit. Isn’t that nice? Well I may not buy this place. Since this place is in Southern California and less than $300,000, ergo this is a good deal. Forget the fact that area rents go for $800 a month. This place was built during World War II. While Europe and Russia where being bombed, we had this glorious piece of construction coming up from the ashes.

Let us take a look at the sales history:

Sale History

1/13/2006: $293,206

04/19/2005: $282,000

06/20/2003: $1,000

Fascinating. So you are telling me we have a place in Southern California with 2 years of zero appreciation? Blasphemy! This goes against the sunshine tax laws and all things that make this world spin. But here is the real kicker. The Zillow Zestimate is $418,000! Bwahaha! Who are we to believe? Zillow, the current price, or our gut? My gut likes the 2003 2nd note or refinance.

This is a great example of how many urban areas around Los Angeles are coming down quickly while the median price keeps rising like a Phoenix. Speaking of Phoenix, many home builders out there are giving cars with a home purchase. How smart. Give you a $40,000 car so they don’t have to knock the price down and affect comps. Too bad this tactic isn’t working because look at the inventory from last week (can you say sign of the beast?):

Today we salute you Compton with our Real Home of Genius Award.

Subscribe to Dr. Housing Bubble’s Blog to get more housing content and your full dose of Real Homes of Genius.

Subscribe to Dr. Housing Bubble’s Blog to get more housing content and your full dose of Real Homes of Genius.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

28 Jun, 2007

real-homes-of-genius

Subscribe to Dr. Housing Bubble’s Blog to get more housing content and your full dose of Real Homes of Genius.

Subscribe to Dr. Housing Bubble’s Blog to get more housing content and your full dose of Real Homes of Genius.

Subscribe to feed

Subscribe to feed

27 Responses to “Real Homes of Genius: Today we Salute you Compton. $279,900 for 768 Square Feet.”

the guy that bought in Jan of ’06. Look no further for a greater fool.

Previous sale of only $1,000 in 2003? WOW!?! Is this right?

$1,000??? A pound of “Compton Chronic” sold for more than that in 1993…

You are sure that this is not just a Hollywood prop with no walls antwhere else..??? Haaaaa

I love finding houses in this neighborhood – they are so stunningly awful. If you look at the income stats for the neighborhood there is no way anyone who lives there can afford to buy (esp now that banks are taking more than a pulse before putting the approved stamp on the loan papers). And the crime? Off the charts – three or four times the national average (in fact, last year it was named the murder capital of the country).

My wife and I own a 3bd condo in Lake Forest CA, however I am currently on a six month work assignment in eastern North Carolina.

$279,000 goes a long way out here.

http://homes.realtor.com/map/search/listingdetail.aspx?pg=17&cmid=1087773&typ=1&sid=4713f84d4d9e40f6b1dd6d92395e72fd&lid=1082321528&lsn=161&srcnt=170#Detail

Here’s the amazing logic of today’s realtor . . .

I was out looking for a larger home to rent for the next couple of years waiting for the downturn. (We sold our last place at the peak in late 2005 and have decided to just wait.) She said now is a great time to buy because there is plenty of inventory, prices are down and interest is going up. HUH!

I asked her to explain if prices are going down and inventory is up why I shouldn’t just wait and see how far prices would go down and how many more options I might have if these trends continue.

And now the logic . . . “with interest rates rising, it’s going to cost you more for those houses even if they go down a little in price. Better to lock-in now before interest really goes up. Besides, all the experts believe that the correction is about over and once things start really rolling again you’ll make it up in equity . . .”

And of course my follow-up was:

“How many properties have all of the agents in your office purchased this month?”

Silence . . .

http://www.mlive.com/columns/aanews/index.ssf?/base/news-1/1183128720238600.xml&coll=2

not exactly main stream media, but Michigan is having more than it’s fair share of problems. What a breath of fresh air!

The trash can out front is worth more than the house.

Seriously, thats a 50k house.

I rarely laugh out loud when listening to the radio but I was driving on the 10 freeway in So. Cal on the way home from work when I heard a DiTech add. They apparently like to lend people money to buy houses and they act as a conduit to your House-ATM.

I actually almost couldn’t stop laughing at the new DiTech punchline: PEOPLE ARE SMART.

HUHH? So, this is the new marketing thing that they are trying to convince us of.

PEOPLE ARE SMART.

I still almost pee my pants laughing.

I guess they’ll tell you anything in the lending business for you to feel good about yourself no matter what you do.

I agree with the majority of posters here… it really depends on how the summer ENDS. If this summer ENDS with sluggish sales, I think we are in for some better deals in 2008.

this may be news to the housing bulls, but californians are increasingly starting to realize there are nice places to live outside the state…places where houses are affordable, the schools are good and the neighborhoods safe. Could that be why outmigration has been increasing over the past five years? btw, wages aren’t all that much different either. the coast here will always be expensive, but Compton!? The IE and the desert!? I remember thinking when I was kid that those places were uninhabitable. Maybe we’ll end up with more ghost towns after the great housing rush of 2001-2006 goes bust.

Snappy Dressa!!!!

Do ya think the latest buyer knew it sold for a grand 4 years ago?

Maryland has it’s highest inventory in history but we at least don’t have houses of cards like this one.

the ditech tv ad is even better. they show a man in a turban cutting your house in half with a sword while they say ‘people are smart’. Maybe they really pissed off their marketing guy…..

Prices in Compton should drop at least 67%. Who wants to live in a crime infested dump where shacks cost a quarter million or more? That kind of money can get you an upper middle class 3000-5000 square feet house with acres of land in correctly prices states.

To Anon 9:01 am —

I scratched the seedy tip of the iceberg three years ago in nowheresville, upstate NY, trying to look at the cheapest reno’s available. Shortly after describing that she and the husband were into fixer-uppers, she decided she didn’t want to work with me and threw me out of the office.

If Paris went away, can we have a Guantanamo for the real-tards ?

I went to San Diego for a week last week for the GIS conference. It was my first time to the West Coast. I live in Orlando and feel all of your pain. SD is AWESOME. I still wouldn’t buy a house their, but i’d love to live and rent. The rent is the same out here, but Orlando is a dump! San Diego was so clean, the people were friendly, and there was so much to do. I will never bash So Cal again! It’s going to take a long time before prices go back to normal. Housing bubbles don’t pop, they deflate.

You are right. SD is awesome. Especially the crab sandwich at Point Loma Seafoods (my kids like Sea World, I like the sandwich). Pop or deflate, the air is coming out!

That’s a real sweet house. But you could buy here, instead. Vancouver, B.C. is the new paradise on Earth.

Everybody in the world wants to live here because of the 2010 Winter Olympics.

You could pick up this gem

Don’t worry about the total lack of sunshine in this city; views from this home takes in fabulous industrial plants.

Hurry! This will sell fast.

Sorry, forgot to mention, the price of that lovely tear-down is a mere $668,000 CDN. Even in american $$$ that’s some serious coin.

I found your website that captures my interest while searching the internet for particular keywords related to real estates. This is a very informative blog of yours. Keep up the good work. You may also check Real Estate Investments and TIC Investments if it interest you for additional information’s. Thank You…

Quite a few houses closed in Rancho Cucamonga, California, last weekend. 20 homes closed, but 13 of them are less than 500K. The ones in my price range closed for a little less than the sellers asked, but I was hoping it would be much less. In any case, I’m going to watch this very closely to see if prices come down this summer or hold steady. I was a bit surprised at all the activity this last week, though.

With so many homes languishing on the market, I am interested to know if anyone is bothering to offer $250k for a home listed at $350k. Sorry would-be home-buyers, but I have to think that part of the problem with the bubble deflating slowly instead of popping quickly is our own reluctance to play hard-ball with sellers who are still living in ’05. What’s the worst thing that could happen? The seller will laugh at your offer? Who cares? On the flip side, there’s always that slim possibility that the seller could say yes… Go forth and find yourself a buyers’ agent with guts who is willing to submit a reasonable (non-inflated) offer.

Agreed. Buyers should not be lemmings, either. I have had several conversations with the new home builder people in Rancho Cucamonga as well as realtors who represent sellers of existing homes. The homes are getting very little traffic though them on open houses and I would bet many sellers would be willing to accept something significantly less than asking.

I am a potential buyer and there are a few homes on the market for about a million that I would buy tomorrow for 800K. I would prefer to wait and rent rather than offer the 800K though just because I have this preconceived notion that the sellers would reject such an offer. Perhaps I’m wrong. Time will tell, though.

Got tired of Socal, dumb people, cost of living, traffic, taxes, dumb people, traffic, dumb people, traffic…so I packed my car, drove to Seattle and bought a house. Now I live in a great home in a great neighborhood in a city with a great quality of life and I don’t pay CA taxes supporting lazy assed slackers and wetbacks. Best thing I ever did.

You can do a lot better tyhan settle for socal.

Seattle invented the “slacker”, dude.

In 2002, I wanted to submit a reallly lowball offer for a rehabbed condo, that I knew went on the market for a much lower price 9 months previous to my viewing it.

The agent said she would not submit it and suggested I work with someone else. She was terrified of violating the unwritten courtesy code that apparantly operates among real estate agents.

I said, fine. My offer was only $20K under the ask.

This was not a particularly good rehab, and I could see I was going to have to do serious work to restore the original appearance of the apt.

Only at the peak, 2005, did this unit sell for the owner’s ask.

Now I wouldn’t take it as a gift, for there is much better stuff coming to the market in better nabes at lower prices.

There were 4 places that got away from me over the past 4 years because I thought the prices were absurd and I wanted a fixed rate loan I could afford.

Glad I waited. I might wait a few minutes more.

Professional real estate agent with access to MLS listings and homes for sale. Buy homes and

condos in Phoenix. Buy or sell a home more effectively in the Phoenix, lendale, Peoria,

Surprise, Avondale areas. You can also search for your ideal home by viewing current listings with detailed descriptions and photos.

Check it once and see the difference: http://www.phoenixareas.com

Leave a Reply