Real Homes of Genius: Today we salute you Compton and Pasadena. Construction Quality and Location Actually Matter for the Economy.

It would seem that many people are now going on a Shaggy “it wasn’t me” tour regarding their culpability in the economic crisis. Some real estate agents blame appraisers for not digging deep enough. Lenders blame the borrower for not reading the 10,000 page manifesto of print that they didn’t even read. Wall Street blames those yield hungry foreigners (hey, all they did was collect billions in fees). Foreigners blame U.S. institutions for not regulating the industry. Rating agencies blame Wall Street for mispricing the assets they were receiving. And borrowers blame the lenders because who would have thought that buying a $600,000 when you make $60,000 was going to be problematic down the line?

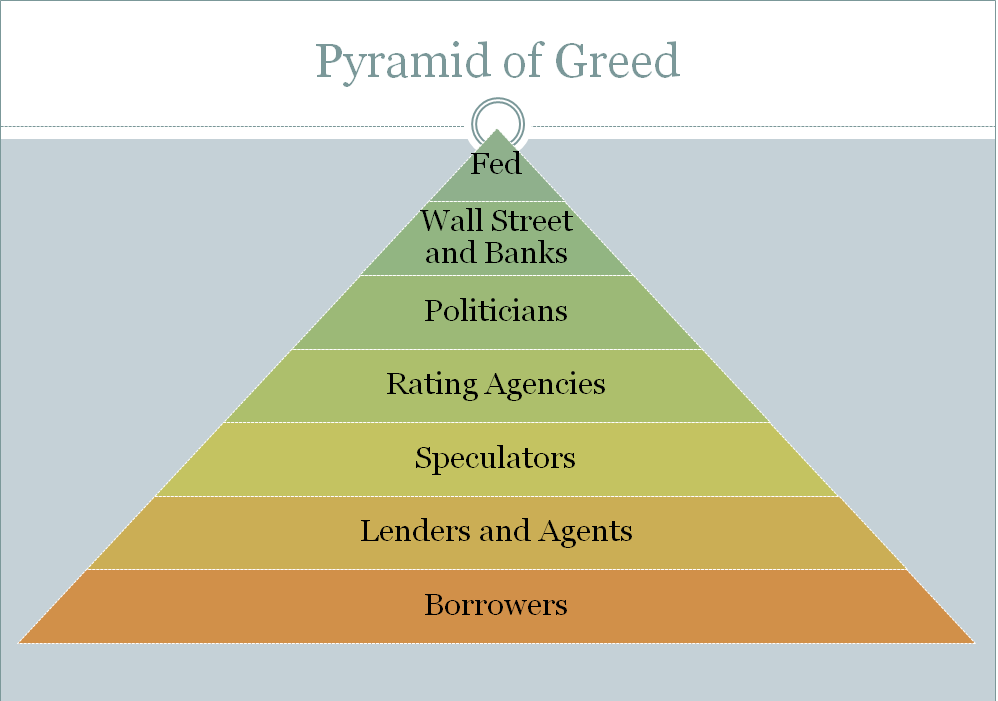

If we had a real estate and credit crisis derived from Dante’s Inferno, it would look something like this:

In this mea culpa tour, I have heard Alan Greenspan, the former maestro of the Fed argue that the Fed wouldn’t have been able to do much differently because to do so, would have caused an economic contraction and unemployment to rise. You have to read between the lines with the master of obfuscation, but what he really is saying is that we had to collectively remain in denial until the bubble exploded on its own accord. Now that it has burst, we can fix it. This is sufficiently ignorant and ignores the reasons that during the Great Depression, we had put in place tougher market enforcement and regulations which was eroded over each subsequent decade. The system was never equipped to deal with credit default swaps or the intricacies of mortgage backed securities and no one seemed to care because everyone seemed to be getting rich. It was a mania and the above pyramid tells you who you should go after first.

In the first place, if the Fed had held on to a tighter rate policy we would have had a recession but nothing like we are facing now. With higher rates, this would have put a chokehold on Wall Street. Without Wall Street, former Circuit City employees turned loan gurus would not have been able to push toxic loans onto a public that clearly was ill equipped to take on such tremendous debt. So this system needs to be reformed from the top down.

Today I’m going to show you two homes that encapsulate the aftermath of the housing bubble bursting here in California. One home is in Compton California and the other is in Pasadena. Both L.A. County homes but an entire world apart. Today we salute you Compton and Pasadena with our Real Homes of Genius Award.

Prime and Non-Prime Equal Decline

The first home takes us to Compton California. You always hear agents saying “location, location, location” but during the bubble, as long as a home was in California it was golden. This above home has all the qualities of a major mania gone wrong. This 1 bedroom 1 bath home with a stunning 500 square feet features the new trend in real estate, garbage can photography. I’m not sure why agents or banks don’t spend ten seconds moving the trash can from the actual photo of the home.  This is another reason why I support the abolishment of percent fees for real estate agents and advocate a low flat rate fee. This home has been on the market since August of last year. First, let us see the insanity that lenders brought on this home:

Sale History

07/21/2008: $235,060 *

09/27/2007: $340,000

The July data is most likely the lender taking the place back. Yet you should be flabbergasted at that September 2007 sale price. $340,000 for 500 square feet in Compton! So what is this home now selling for?

Price Reduced: 11/17/08 — $83,900 to $78,900

Price Reduced: 01/22/09 — $78,900 to $69,900

This home has fallen 80% from the sale price of 2007! You would think that at this level, an investor may be interested but now you start realizing that many investors are now being extremely picky regarding the homes they will purchase. Most of the housing porn shows never talked about buying a home as a cash-flow property for the long-term. No. These shows were obsessed with the instant gratification culture and every property was a fix and flip example. That is now finished. Now, the few shows that remain are basically a reality show with neurotic wannabe actors trying to make a name in the entertainment industry.

Thank you Compton for showing us that we should have more faith in lenders and agents. After all, look at the good job on this home!

Pasadena – When a Good Location Isn’t Enough

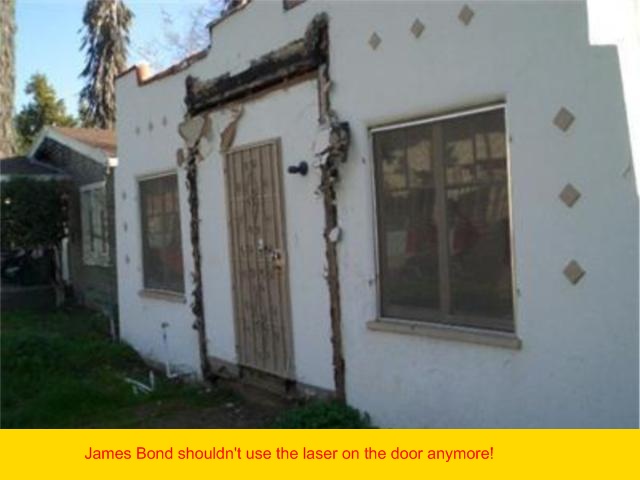

Pasadena is a good area in Los Angeles County. So good in fact, that 007 tried to break in this home with his laser pen. He should have just knocked! This 1,200 square foot home has 3 bedrooms and 1 bath and shows us once again the fantastic staging going on by people in our respectable housing industry. Let us take a look at this glamour shot of the bathroom:

I can see myself taking a bubble bath right now! What about for those frigid 60 degree nights we have in Southern California?

I love it! Maybe we can tear out the wall and use it as fire wood. I love the ad for this place:

“Both have been lovingly and completely gutted and now stand as good-to-go exterior shells ready for your creative touch, or byob (bring your own bulldozer) large lot, school in close proximity spectacular mountain views .”

Lovingly gutted! Bwahahahaha! BYOB. Bring your own bulldozer. Oh man, do these people actually think this is going to work? This home has been on the market for 379 days and yes, I know that you are absolutely stunned. Let us look at the sale history on this place:

Sale History

08/23/2006: $522,000

Half a million for this? Well, it is in Pasadena and you can just imagine someone watching one of those hype housing shows thinking that they will “lovingly gut” the place and slap on some granite countertops and some grass and you can then flip it for $900,000! Let us see the pricing action on this place:

Price Reduced: 04/09/08 — $479,000 to $450,000

Price Reduced: 04/26/08 — $450,000 to $375,000

Price Reduced: 05/01/08 — $375,000 to $360,000

Price Reduced: 05/24/08 — $360,000 to $279,000

Price Reduced: 06/22/08 — $279,000 to $249,000

Price Reduced: 07/17/08 — $249,000 to $239,000

Price Reduced: 10/24/08 — $239,000 to $219,000

Price Increased: 11/03/08 — $219,000 to $230,000

Price Reduced: 01/02/09 — $230,000 to $199,000

Bwahahahaha! I love how they raised the price in November of 2008. A little bit of reverse psychology eh? Didn’t work! Freud is broke and isn’t falling for psychological gimmicks found on over the counter real estate books. The home finally broke the $200,000 mark and is now selling for $199,000. That is over a 60% decline from the peak in Pasadena. So not only does location matter, but the actual home itself.

Do you need any more proof why trying to support any price bottom is absurd? What do you think is going to happen to comps when these homes sell in these areas? Prices will fall! That is why I have given you 10 reasons why the bottom for California housing will not be here until summer of 2011.

Today we Salute you Compton and Pasadena with our Real Homes of Genius Award.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

19 Responses to “Real Homes of Genius: Today we salute you Compton and Pasadena. Construction Quality and Location Actually Matter for the Economy.”

“””That is why I have given you 10 reasons why the bottom for California housing will not be here until summer of 2011.”””

You mean 2111, right? Seriously, prices can, and should, go all the way down to 1970’s levels. There is nothing to stop the price drop. We need prolonged deflation, as we’ve seen, in my opinion, rapid inflation that was not reported over the Bush/Clinton years. Health care, education, food, gas, housing, stocks, autos, all have exploded in price and only in housing have we began to see a correction.

Location, Location, Location ! The real estate mantra. But, yes the house does matter, if someone plans on actually LIVING in it. All of the warts for houses with bad floorplans, bad additions, external obsolescence (Next to freeways, liquor stores, commercial parking lots etc..) and that are overbuilt for the neighborhood, will suddenly be noticed. A 60% drop will not be uncommon for these “Dog” houses. The Westside sees these Dogs penalized first, then it moves up the housing chain to the overpriced top end properties. Last January, we saw a huge (60-80%) drop in sales volume YOY from Bevely Hills to Venice. Next to follow are the huge price declines. Sellers who bought from 2004 on, are already @$#%^ by the time they afigure in commissions and holding costs. Next is 2003, 2002, 2001, probably back into late 90s pricing, where it all began.

http://www.westsideremeltdown.blogspot.com

http://www.santamonicameltdown.the90402.blogspot.com

If there should be any cram downs beyond wall street bankers, banks and investors, it should include the biggest beneficiary: the general contractor and home builders. They walked away with huge profits from 100% loans on a property cost of maybe 60% of then appraisal. Where is all those funds? I can tell you they are buying up entitled land at fractions of two year ago values and they are laughing all the way to their free and clear estates. Trust me.

The cities? How many recent retirees are ex city managers and planner, fire, police and on and on. The benefits packages are obscene and they walk away acting so pious and self righteous. Oh PLEASE!

Any licensed person should know that liar loans and option arms were products developed from the greediest of places: Wall Street and Orange County. Stupidity and arrogance. What a combination. These all should have been written with recourse back to all profiting parties. That would have kept the process in check. But too late, they are all LLC’S and they are gone like vapor with no liability our shame as they sit their and say “its not my fault”. Welcome to the Land of Alfred E Newman: What? Me Worry?

Good luck to us all, and my heart goes out to the so many families who are going through so much hardship whether fully comprehending the risks or not.

Dr Housing B, your blog is such a great read. All of a sudden the truth is coming out in “the mainstream media” of what has really been going on with the economy as a whole (Derivatives, Hedge funds, Deregulation). Make no mistake, I like you, agree this is not going to to be pretty. Like the Housing bubble it has been a false illusion case in point “the ownership society”? I do laugh that the Republicans (Grand OLD Party) all of a sudden are fiscal Conservatives, now that the “truth” is slowly coming out, and this is only the beginning folks. Yeh its all Obama’s fault, not. Keep up the great work your blog is always appreciated.

Slam dunk, Doc. Though I take exception to one layer of your impressively punk, nipple (?) pierced pyramid.

~

That is, you have yer Speculators there in the Bile Green area. In fact, speculation was a disease of many in the layers below and above, the sea in which they all swam.

~

By the way, I’m coming to conclude that the presence of curbside waste cans in these photos is meant to trick prospective buyers into thinking there are still infrastructure services in CA. Have they started handing out IOUs yet in lieu of the garbage collection everyone paid for?

~

Forgive me if I’m repeating myself with this item from The Onion–the Midwest geniuses who Lovingly Gut inflated human self-regard with the bulldozer of Menckensian satire. But DHB, you started it, mentioning Dante:

~

Tenth circle added to rapidly growing Hell

http://www.theonion.com/content/node/28898

~

Excerpt below.

~

rose

~

~

“Prior to the construction of the tenth circle, many among the new wave of sinners had been placed in such circles as Hoarders and Squanderers, Sowers of Discord, Flatterers and Seducers, Violent Against Art, and Hypocrites. Hell authorities, however, say that the new level, the Circle of Total Bastards, located at the site of the former Well of Giants just above the Frozen Lake at Hell’s center, better suits their insidious brand of evil.

~

“Frigax The Vile, a leading demonic presence, is one of the most vocal supporters of the new circle.

~

“‘In the past, the underworld was ill-equipped to handle the new breed of sinners flooding our gates–downsizing CEOs, focus-group coordinators, telemarketing sales representatives, and vast hordes of pony-tailed entertainment-industry executives rollerblading and talking on miniaturized cell-phones at the same time. But now, we’ve finally got the sort of top-notch Pits of Doom necessary to give such repellent abominations the quality boilings they deserve.’

~

“Among the tortures the Corpadverticus Circle of Total Bastards boasts: the Never-Ending Drive-Thru Bank, the Bottomless Pit of Promotional Tie-In Keychains, and the dreaded Chamber of Emotionally Manipulative Home Shopping Network Products.”

As I’ve said before, if house prices hadn’t been dropped out of the inflation calculations, interest rates would have gone up when the bubble started – natural cool-off!

If the Pasadena house was intact, then 200K is about right.The Compton house – that’s what Sub-Prime was supposed to be about. You can pay off 70K at 8%.

If you think garbage can photography is bad wait until you see over-the-dashboard garbage can photography.

Here in Mesa I saw an example of abandoned-shopping-cart photography a few months ago on a local MLS site.

Is USD 199,000 a high price for a building section in Pasadena? How much does it cost to bulldoze the lot? If the economy weren’t in free fall, this would almost be reasonable.

Building sections in the older, better neighborhoods of Auckland cost more than that, even with the exchange rate.

The Compton transaction to me looks like it was outright fraud, rather than bubble mania. If a house gets foreclosed on only nine months after purchase, how likely is it that the seller made any of his monthly payments at all? I would bet that the seller was fly-by-night speculator who made a lot of money in a short time flipping houses at unrealistic prices, and the buyer was a local drug addict and/or illegal alien who disappeared shortly after his “purchase”, if in fact he ever existed. They simply defrauded the bank (and now the taxpayers) out of the mortgage money.

Even in the bubble, that Compton price was obviously fraudulent. The damage to the Pasadena house also looks criminal – looks like the homedebtor took salable upgrades like door decorations, fireplace tiles, and bathroom fixtures. Stealing fireplace tiles and door decorations is almost Mobutean (under Mobutu thugs stole utility wiring to sell for copper) because the value of the components is small next to the value of having them in place.

Been reading you right from the beginning Dr. HousingBubble… excellent diagnosis of the calamity that is rapidly unfolding. Prognosis? Ineluctable collapse and a new Depression far far worse than the 1930’s one. The horrific cultural degeneration and adoption of impotent swindlers theories of economics to replace physical production… The calamitous error of popular opinion on every front.

—————–

The solutions? No solution can be found, let alone implemented, within the currently existing framework of Global Political incompetence. Measures that would begin to address the underlying cause of this collapse would… drive millions into the streets in rioting outrage. Such is the deadly predicament we now face. Only Rome of the 2nd and 3rd centuries offers an acceptable precedent. The tragedy is that the very people themselves stand in the way of a solution. They would fight any viable solution tooth and nail – they would call such measures the hallmark of a Fascist Dictatorship. For it will generally be understood and confessed, in the decades and centuries to come, only such sweeping measures as found in past Fascist Dictatorships could have saved the West from collapse in the early 21st Century.

—————————-

Examples: The currently doomed stimulus package ought to have been centered upon a crash program of Nuclear Power plant construction, mass reindustrialization, mass Science driver Space program initiatives, A Manhattan style project on Fusion Power, and serious public education to eradicate the error of Global Warming. So you see… such “outlandish†measures would be instantly opposed by a vast majority of the populace for environmental reasons alone. It’s all rather hopeless at this stage. Only vast course corrections can save this dying society. Only a handful understand this… Only a handful grasp the virtual impossibility of such a paradigm shift… Only a handful know that great men struggled to save Rome, too, during it’s calamitous slow decline. They failed for the same reason we shall fail – the problem, the failure, is in the culture itself, the people and their errors.

I think your prognosis is a little (I’m thinking the middle of 2011) but I agree with you on your reasons why. There’s another round of foreclosures left to consider as well, here’s hoping for something a little more creative in the stimulus.

Here’s a view from outside SoCal. In Seattle yesterday, cruised around all the in-progress condo development downtown, as fieldwork research. Came home and did a little searching. Take a look at this GIF:

http://stroupeblog.files.wordpress.com/2008/04/condo-sales-new.gif

~

Now tell me whether y’all are Seattle condo bulls at present, the way this Realtor-blogger James Stroupe apparently is. Or anyway was as of last April. Look here, and scroll down to “What’s next.”

http://www.stroupecondoblog.com/2008/04/condo-boom-bust-or-wishfull-thinking-supply-vs-demand/

~

I’d say even the folks over at Seattle Housing Bubble are a tad optimistic:

http://seattlebubble.com/blog/2009/02/17/bottom-calling-dollars-per-square-foot-linear-forecast/

~

Remember, when a trend digresses far enough below the line of the mean (which is a smoothed abstraction of central tendency, not a representation of it), it will pull that entire line downwards. Everywhere I’m reading people viewing the old mean-line in charts of this nature and going, “Well, we’re below it now, so everything will start going up again.” Nope. Sorry. That “historical trend” is a function of the past AND the future. We must live in the future, relative to the past. If we also plotted an historical trend line that didn’t include the bubble, it would be well below the present one. And with the relative economic health of that time pretty much destroyed, we cannot expect the same trend lines as have been constructed WITH THE BUBBLE BUILT INTO THEM.

~

Over on the Boglehead (Vanguard fan) forums, they’re still crowing about how the market will return 11% over the long haul. Um, maybe if you started investing in 1970 or 1930. Today? You’ll have to live to 2200 to average those returns. I’m being hyperbolic, but only as an indication of how primitive is most people’s thinking about the numbers that measure these trends. Most people don’t even understand what a mean IS, never mind how it differs from a median, and more complex issues like regression toward and away from a mean, standard deviations, and so on. No wonder the Real Homes of Genius industry moved everybody’s cheese!

~

rose

@Rose: Bile Green area — Very funny. Love your writing style.

@Ronduck I think that reelturds are afraid to get out of the car to take a picture.

I saw six vultures along a house ridge this weekend–the six vultures of the apocalypse, perhaps? I was thinking that would make a great Realtor Magazine cover. Dow has retraced 7500 tonight. Only a few hundred points to 7082–50% of the Oct. 9, 2007 all-time high. With stocks and houses down 50% we will soon be in buy one-get one free territory. That should turn things around…

First – James Bond line is brilliant.

Second – weren’t these homes already featured on this site?

“I’m not sure why agents or banks don’t spend ten seconds moving the trash can from the actual photo of the home.”

Because in Compton you don’t even want to get out of the car, bro.

I’d have to say the 500 ft2 home in L.A. needs to fall all the way down to the $20,000 – $25,000 range before it’s “a deal.” (A GREAT DEPRESSION LEVEL) California home prices have nearly ALWAYS BEEN BEYOND CRAZY for decades now. Time to “face financial reality!”

Phoenix Listing: 5BR/3.5B / 3240 ft2 / Built 2003 / A Single Family House offered at $109,900

You do the math. Just UNDER $34/ft2 for a modern 2005 home located outside Phoenix! (This makes similar $50-$60/ft foreclosed Phoenix homes look expensive!) Use link below to see picture.

http://phoenix.craigslist.org/evl/reb/1002879109.html

Hunt Highway & Cooper Mine, Queen Creek, AZ

BANK OWNED Property ID #056.1

5BR/3.5B2003 A Single Family House offered at $109,900

Year Built

Sq Footage 3,240

Bedrooms 5

Bathrooms 3 full, 1 partial

Floors 2

Parking 2 Car garage

Lot Size Unspecified

HOA/Maint $0 per month

DESCRIPTION

——————————————————————————–

Spacious 3240 sq ft. floorplan with 5 large bedrooms and 3 1/2 bathrooms. Gigantic bonus room upstairs. Great home for a large family.

K-Man,

“””5BR/3.5B2003 A Single Family House offered at $109,900″””

Go for it, bro. In another 5 years, maybe 10, this house will be “offered” for $10,990.

Oh my, I can’t believe the condition of these homes in Pasadena. Looking at that home in Pasadena, and considering how much lower it can possibly go, it would be an excellent candidate for a flip. A flip though… that is bought at the right “bottom” time, and then sold later down the line, I can see huge profits from that!

Leave a Reply