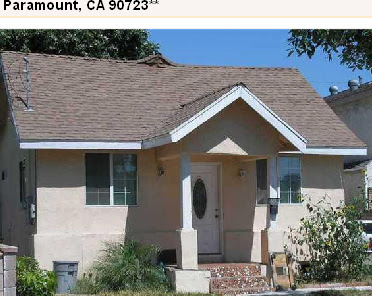

Real Homes of Genius: Today we Salute you Paramount. 768 Square Feet for $324,900. Buy, Withdraw, Sell, Foreclose. The Cycle of Life.

Countrywide took what seems to be am emerging trend from the playbook of public relation spinning and market damage control for many housing related companies. On Friday, after the stock market had closed and took a beating because projections for 110,000 added jobs turned out to be a net loss of 4,000 (the first loss in 4 years), Countrywide waited until the market was closed and released a statement that it is looking at cutting 10,000 to 12,000 people from its workforce in the coming months. American Home Mortgage also used this last minute end of the week heroics when they announced they would be holding back on their dividend. We know how that story goes. Many folks in lower to moderate priced areas throughout this country are scratching their heads wondering why things are deteriorating over night. They hear about derivates, collateralized debt obligations, hedge funds, foreclosures, private equity firms, and wonder how can a simple thing like a home, turn into the beacon of mass speculation guiding us head on into a recession? Oh, let us count the 768 ways. Today we salute you Paramount with our Real Home of Genius Award.

Flipping ain’t an easy job and someone has to do it. This spectacular 2 bedroom 1 bath home is what we call in Los Angeles, posh living. With 768 square feet, you’ll be wondering what to do with all the extra space. In fact, we are told that this place has an “open kitchen that flows into the living room.†I’m not sure if that means you’ll be able to watch TV in your recliner while reaching over to open the refrigerator to grab a beer, all without getting up. This place according to the ad is a “fixer†so you can mold this place into your ideal dream home. The price tag? Only $324,900 or $423 per square foot. Look at the bright side, this place now qualifies for FHA financing. Are you sold? Well let us look at the previous sales data:

Sale History:

05/10/2006: $415,000

09/19/2005: $47,000

03/30/2005: $340,000

This is where you see the symptoms of the housing mess we are currently living in by jumping into the trenches. First, the home was artificially high in 2005 for the area. Then, 6 months after the purchase we have the fabled housing ATM machine being used for mortgage equity withdrawals. These folks probably realized that they bit off more than they could chew so what do they do? They simply listed a price that would cover the mess, sort of like sweeping dirt under the rug. Don’t think this is the case? Let us do the math:

Since they probably went zero down with some sort of banana republic financing the math works out as follows: Mortgage #1 ($340,000) + Mortgage #2 ($47,000) + 6 percent selling cost ($24,900) = $411,900

Hey, this figure is really close to the sales price in 2006, what a shocker. Since we were living in Wonderland and people simply priced homes at whatever they needed to get out of their chaos, this tactic worked in a bubblicious environment. In this example, these folks actually made a few thousand dollars even though they were digging deeper and deeper into debt. They had the benefit of being at the right place at the right time. This isn’t the case for the buyer in 2006. Some lending institution thought it would be a brilliant idea to lend $415,000 for a home that would rent for $1,100. Does this make sense? Of course not. You don’t need your Ph.D. in Finance to know this deal is not going to work. In fact, let us take a look at the neighborhood statistics:

Average Annual Household Income: $48,991

Let us run the hypothetical numbers of the average family in this neighborhood buying this home with conventional financing:

Monthly Net Income: $3,324 (Filing Married with 2 Exemptions for Federal and State).

PITI: $2,864 (5 percent down payment of $20,750, 95 percent LTV)

So this family has monthly disposable income of $460 for a 768 square foot home built in the Great Depression! What about automobile costs? Food? Healthcare? After all, they are only spending a mind numbing 86 percent of their net income on their home! And we aren’t including maintenance cost such as gardening, trash, and other fees that sneak up on property owners. Is it any surprise foreclosures are exploding in California? Who in their right mind didn’t see a disaster like this coming? Now, the home is priced at $324,900 or $90,100 less. This is a whopping 21.7 percent decrease in one year, and that is assuming it sells for the current price which is doubtful because someone can rent a similar place for $1,100 as opposed to carrying a nut of $2,336 (at the current price). And why would a real estate investor buy this place? They would be negative cash flowing by $1,236 in a market where prices are trending downward. Is it becoming apparent why this housing market needs to correct and this is no minor bump in the road? Do you still think that a bail out is a smart idea? If it isn’t obvious that prices need to drop in certain areas by 40 to 50 percent then we may consider investing in an introductory finance course. Unless incomes in the area increase by 100 percent, prices will adjust lower now that lenders are being forced to use more conventional financing. In other words, prices have to reflect the income reality of the people in the immediate area. And reality is so passé after living in a fantasy world of easy credit and hyper speculation.

Today we salute you Paramount with our Real Homes of Genius Award.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

19 Responses to “Real Homes of Genius: Today we Salute you Paramount. 768 Square Feet for $324,900. Buy, Withdraw, Sell, Foreclose. The Cycle of Life.”

I was watching channel seven news yesterday when they had kramer from “mad Money” on the show. He said that Inland Empire will be the hardest hit area which he has commented on before but he also mentioned that Rancho Cucamonga especially will be hit hard! I just moved to Rancho Cucamonga and after a year I still can’t figure out how these morons bought their homes. My wife and I are professionals with an income of about 150000 a year and in my book I cannot afford a home. Something wrong with this picture. I have fired 9 real estate agents because they are all idiots.

My latest agent told me in an e-mail that prices in Rancho will not simply come down!! I cannot wait to prove her wrong!!

Thanks,

Tom in Rancho

Dr. HB:

This situation has gone so far beyond “subprime” that the term seems already anachronistic. We are approaching the collapse of a worldwide financial bubble or the creation of another, even more gigantic bubble, to cover up this one (though I don’t see how, but I imagine the banks will try).

The way I see it, every single home in the entire Southern California region is priced like a real home of genius. It isn’t just the ones sold to subprimers or altA-ers. The environment jacked all the real estate up and none of it is worth anywhere near the general price level.

How is this going to play out? Won’t most homeowners, if the ones who have paid-off mortgages, start demanding re-appraisals downward to lower their property taxes? At some point when the market has clearly dropped, I would imagine this is going to occur.

A big drop in property taxes will start to put pressure of junk municipal, county and state bonds and we know how irresponsible the California legislature has been over the years in mortgaging our future.

Aren’t we headed for very uncharted and dangerous financial waters on many levels?

Things just as bad up here in NorCal. The BofA bailout sure didn’t help Countrywide much. The 2 billion they dumped into that mess did push Countrywide’s share price up about 6 bucks but it’s dropped back down to below 18 I think. Wonder if that $ went in the front door and out the back like a mob-owned restaurant ? Why else try to prop up such a loser ?

I just started reading your blog a couple of weeks back and it has been highly informational. I am up in NorCal, and I was planning to buy a SF home in January of this year. When I went looking around, there was hardly a decent one that was less than 650-700K. When I did my calculations, I figured out it was way beyond my means. At the time, I used to wonder that with a combined income of 120K (my wife works too), its still beyond my means, how do people manage to buy it? Now, after reading your blogs, it makes sense. I am really happy to read your blogs and realize that what I had thought then about prices being too high was correct.

-Mentalic

Tom – by the time you’re ready to buy the agent who told you that Rancho prices won’t come down will be working as a cocktail waitress in some sleazy dive bar in Fontana or Rialto. The leased BMW will be gone, replaced by an aging Korean subcompact crammed full with half her remaining worldly possessions and carrying way too many miles on it’s clock. She’ll be living out of a crummy studio apartment because the house she “bought” on a zero down, interest only loan was foreclosed on. The french manicured nails, beautifully coiffed hair and brand name makeup will all be a thing of the past too. You might not even recognize her in her cheesy cocktail outfit.

If however you do manage to find her don’t bother rubbing it in. She might break a beer bottle over your head out of frustration.

I just found your blog, and it cracks me up! I live in Seattle, and the same crapola has been going on here. In my neighborhood, recent sales imply a value of $800K+ for my house, but rents haven’t budged since 1996 when I bought it for $260K.

The house next door sold for $700K+ about six months ago. When I walked through it and picked up the flyer, I asked the agent if they had made a typographical error, or maybe someone was on drugs. No, he said, Seattle’s a bargain.

The house sold on the first day, for the asking price. This assumes that someone didn’t phony up the documentation. I congratulated my neighbor and thanked him for raising the value of my house by $200K+, but since it’s paid off and I have no intention of moving, the whole thing is theoretical anyway.

I think we’re going to have the mother of all real estate crashes.

Incidentally, according to this calculator, assuming a 5-year holding period (which is pretty heroic for 768 sq. ft.), that dump is worth $80,000.

I went to Willy’s rent calculator, and ran some numbers through it, on places I’m looking at.

I notice that the calculator is figuring 30% depreciation into all prices.

I wish someone would wake up the sellers from dreamland and let them know that prices are falling. I was looking at Zip in the Sherman Oaks area. Out of 40 or so home listed under $700k, there were at least 6 short sales, probably more. All of them had dropped their prices (they were the only ones). All they other sellers were still holding on to their hopes and dreams of 2005 prices. Even the ones with some pretty steep price drops were still sitting on the market. I saw one short sale that had dropped from an original listing price of just over one million $ to $699k – last sale price of $949 (I think – definitely 9-something). It’s amazing. However, even with all of this going on around them people in the surrounding areas are listing their homes just like they were last year. When homes in the surrounding area are listed higher than Sherman Oaks – people are definitely not paying attention.

The Valley has its pecking order and Sherman Oaks is at the higher end. Homes in Van Nuys, North Hollywood, and Burbank are not supposed to be more expensive (Burbank Hills not withstanding). The housing bubble with its price run ups did not erase this invisible, intangible, reality that is Valley living.

Here’s some good news from today’s LA Times Business Journal. BTW, I really do believe this is good news as I want this entire market to be shaken out and brought back to reality. Only in this way can hard working prudent people once again purchase homes.

Here’s a snippet:

“The expanding mortgage crisis and credit crunch slammed the Los Angeles housing market in August, with home sales plunging 50 percent from the same month last year and 25 percent from July.

Sales of new and existing homes in Los Angeles County slid to 4,107 units in August, just under half the 8,246 units that sold in August 2006 and well below July’s 5,458 units, according to figures compiled for the Business Journal by Melville, N.Y.-based HomeData Corp.

The pain was widespread, as only a handful of the county’s nearly 300 ZIP codes managed to eke out any sales gains. August’s plunge was even more dramatic considering that the month is traditionally one of the more robust for home sales.

The number of houses that changed owners represents the second-lowest monthly total since HomeData began compiling Los Angeles County data in January 2004. Only the 3,661 homes sold in February – one of the slowest months for sales – was lower.

Similar carnage took place in the condo market with year-over-year sales plummeting 40 percent to 1,168 units. Sales were off 27 percent from July’s 1,601 units.”

Wouldn’t this still be a first stage in all this? That is, sales drop and those in trouble are still holding on hoping for a turnaround. Anybody who doesn’t have to sell isn’t. However, the longer this stage lasts, at some point, more and more distressed owners will have to sell or foreclose, so prices then will start dropping. Is that how you all see this?

Here’s another Sunday excerpt, this time from the weekly column of Ellen Brown’s Web of Debt (link after excerpt). This part is about Countrywide.

“That was when the central bankers extended their $300 billion lifeline. Among those financial institutions rescued was Countrywide Financial, the largest U.S. mortgage lender. Countrywide had been branded the next Enron, not only because it was facing bankruptcy but because it was guilty of some quite shady practices. It underwrote and sold hundreds of thousands of mortgages containing false and misleading information, which were then sold to the international banking and investment markets as “securities.” The lack of “liquidity” in the markets was blamed directly on the corrupt practices at Countrywide and other lenders of its ilk. According to one analyst, “Entire nations are now at risk of their economies collapsing because of this fraud.”10 But that did not deter the Fed from sending in a lifeboat. Countrywide was saved from insolvency when Bank of America bought $2 billion of its stock with a loan made available by the Fed at newly-reduced interest rates. Bank of America also got a nice windfall out of the deal, since when investors learned that Countrywide was being rescued, the stock it had just purchased with money borrowed from the Fed shot up.

Where did the Fed itself get the money? Chris Powell of GATA (the Gold Anti-Trust Action Committee) commented, “[I]n central banking, if you need money for anything, you just sit down and type some up and click it over to someone who is ready to do as you ask with it.” He added:

If it works for the Federal Reserve, Bank of America, and Countrywide, it can work for everyone else. For it is no more difficult for the Fed to conjure $2 billion for Bank of America and its friends to “invest” in Countrywide than it would be for the Fed to wire a few thousand dollars into your checking account, calling it, say, an advance on your next tax cut or a mortgage interest rebate awarded to you because some big, bad lender encouraged you to buy a McMansion with no money down in the expectation that you could flip it in a few months for enough profit to buy a regular house.”

http://www.webofdebt.com/articles/market-meltdown.php

BofA did make a short-term profit when Countrywide went from 18 to 24, but it’s down below 18 now.

@Tom,

I agree with Kramer on this point for a couple of reasons. Many people that live out in the Inland Empire commute into the surrounding cities to work. The employment base in the IE is not strong enough to support the current prices. Also, the rental market isn’t as strong so we’ll see a faster and more precipitous drop in prices. For example, an owner on the margins in LA County can still rent their house and slowly bleed while someone in the IE simply doesn’t have this option. It is going to be painful out there. In addition, incomes do not justify the current outrageous prices. You can scroll through the archives and see I was predicting this burst hitting in Q3 and Q4 and we aren’t skipping a beat. And it wasn’t some magical guess. Looking at the MBA data, income information, negative savings rate, it was pretty obvious this would be happening.

Tell your agent you’ll give her a call back after Christmas. By then, we will see negative year-over-year median home prices in every single county in Southern California, mark my words.

@thamnosma,

You are absolutely right that this is beyond the subprime market. Even back in May when Big Ben wanted folks to believe they had it contained it was like tying up a lion with silly string and expecting it to hold him down. Now it is spilling over throughout the economy. This is a credit bubble. Take a look at the dollar that is now below an 80 support level. Who knows how much deeper it will fall since the employment picture is bleak. If the Fed drops rates it is at the expense of the dollar. We will see what happens.

And the government is having a hard time dealing with all the adjusted numbers and drop in sales. We won’t see any major public service impacts until 2008 but rest assured this will happen. Want to guess that they projected optimistic scenarios?

@oso,

My guess is BofA or some subsidiary has huge short positions in Countrywide. They are simply doing a short term hedge. It is a smart move. If things improve they benefit and if they go down, they can cash in on their short positions.

@mentalic,

Welcome on board. It is hard for me to believe but the entire state is over priced. We are going to face a massive correction. We have a serious problem where families with incomes of $100,000 are having a hard time buying a starter home in the state.

@pdq2,

I’m not sure many agents and brokers saw this coming. At least not this fast. Too much debt is flying around in this economy. The only way to do that is purging the debt. In the last housing bubble in SoCal repo’d cars where going for 30 to 40 percent off. Maybe you can score one of those BMWs in the near future. I know of a few folks who are sitting on cash ready to pounce on a used luxury car next year.

@willy,

Thanks for that calculator. This bubble is global. In fact, it is a high dense metro urban housing bubble. From Seattle, LA, Miami, London, Barcelona, and New York we are all living it up in this credit bubble. Glad to hear your home is paid off. You are probably one of a few homeowners in Seattle that can say this.

@the north coast,

What areas are you looking at? Here in SoCal we’ll probably see 40 to 50 percent drops in many areas. Of course prime location will do better.

@on the sidelines,

Prices will come down by force. We are starting to see a jump in short-sales and prices are moving lower. Since I started keeping track of short-sales 2 months ago each consecutive week more and more inventory is hitting the market. This only means that sellers in wonderland are now competing with REOs and short-sales. Banks still have a deluded sense of self but they are quickly realizing that this isn’t a simple buyers market. They smell fear and we are starting to see quick pricing action down on the few units on the market. This will only grow in the next few months. The bottom won’t arrive until 2009 but that doesn’t mean that we won’t see a negative price slope in the upcoming months.

Some light reading from Ben Stein:

Item: One of my best friends, a blue-eyed, red-haired stunner and a math whiz, is married to a builder and mortgage broker near Naples, Fla. She flew into town, and I had lunch with her today. “How is your husband taking all this stuff?” I asked her.

“He doesn’t sleep. At most he sleeps from 5 A.M. to 7 A.M. We built two spec homes near Naples. We spent $2.7 million on each of them. We had them listed for $4 million each. We haven’t had one prospect in a year. We lowered the price by a million each. Still no prospects. We’re losing $60,000 a month on the two of them. My husband has no business. None. The phone never rings.”

“Horrible,” I said.

“I’m leaving him,” she said. “He’s grouchy all the time. I want a guy who’s rich and cheerful all day and all night. Why should I have to suffer because his business is bad?”

Doc, that is hilarious. So – whose fault is this anyways? Any misogynists want to jump in on this? Of course, Ben’s ‘show not tell’ illustration essentially tells us what he might think about the bubble.

Two questions about the median income statistic you cite – does it include only W-2 / 1040 AGI figures?

Would inclusion of Self-employed people who shelter their income from the IRS, but who actually earn more than the AGI figure on their 1040, raise that ‘median income figure’ – and provide a supply of borrowers who can and will pay a higher price?

Or is that just a canard supplied by the RE industry with the hope that such SE borrowers will help cushion the fall, by buying the higher priced homes?

Ouch. That Ben Stein story makes you cringe, but you know it’s true across America – how many prom queens married what they thought were to be perpetual real estate riches and a never ending party?

Hopefully after the economy turns around she’ll be left by her next guy for a 19 year old, because after all, who wants to be around someone old and demanding?

Just kidding. 😀 Seriously though, get prenups kids…

@exit,

Who says true love doesn’t exist anymore?

In regards to self-employed being able to afford current home prices, the Census Bureau factors in the self-employed into their median household statistics. In addition, many real estate agents are considered self-employed:

“1135.1 Are real estate agents self-employed?

Effective January 1, 1983, certain qualified real estate agents are treated as self-employed persons. To be considered self-employed, you must:

A. Be a licensed real estate salesperson;

B. Derive substantially all payment received for services performed as a real estate salesperson directly from sales or other output, such as appraisal activities, rather than from the number of hours worked; and

C. Perform the services under a written contract or agreement which stipulates that you will not be treated as an employee with respect to the services for Federal tax purposes.”

Social Security Handbook

With over 538,598 licensed agents and brokers in California, I’m not sure looking at self-employed data will make a difference in a state where properties are overvalued by 40 to 50 percent.

Dr HB, the areas I put through the calculator were all Chicago zip codes I am interested in buying in: 60657 (Lakeview) 60660 (Edgewater) and 60626 (Rogers Park).

Lakeview is prime, Edgewater medium-good, Rogers Park very “marginal”. All are north lakefront nabes.

I tried my mother’s suburban St. Louis zip, same thing. St. Louis area sf home prices are drastically cheaper than those in Chicago burbs, but the local fundamentals don’t support their prices anymore than our fundamentals justify ours.

I wonder if credit has become ultra-tight because lenders across the board are factoring in steep depreciation in the coming months, in all locations.

I like to “visit” other metro areas to see how their prices and local economies are stacking up, via sites like realtors.com. What I am seeing is unrealistically high prices absolutely everywhere. If it looks “cheap” compared to Los Angeles or Chicago, it is because it is an area with a bad local economy. A house that looks cheap to you or me is pretty darn expensive when you are unemployed, and relative to the local fundamentals, areas like Cleveland and Detroit are very expensive.

Yes, the worst bloodbath is yet to come.

Just want to share some news from Encino. I am keeping a close eye on ten houses/townhouses both side and north side of Ventura Blvd. Since labor day, all have gone down on price.

Most of them didn’t go down too much with the exception of a new townhouse/condo complex which went down from $599,000 to $479,000. That was a decent cut but still not enough. They finished this building in Jan and it’s been sitting empty since Feb except 2 units. It’s on the cheaper side of the blvd, next to a post office. The units are cute but smaller than my apartment and they want $275.00 monthly for HOA fees… but all they have is a water fountain in the center. No pool, no court yeard, a couple of rose bushes, that’s all.

Leave a Reply