Real Homes of Genius: Today we Salute you Pasadena. 61% Price Dive in Pasadena Coming to a Prime City Near You. BYOB. Bring Your Own Bulldozer.

The economic and financial delusion runs deep in California. There was a cohort of people that believed in the sun god just as the Aztec once did with Tonatiuh. They would like to think their economic justification was somehow connected to some meteorological reason since financially, it made as much sense as swimming in the San Gabriel River. A reason was necessary for this social mania. People over compensate for many things in life especially if it stands to benefit them. This is know as the fundamental attribution error.

We saw this error or bias played out many times. I would speak to people during the peak and get responses like, “all those other people paid too much and are stupid with getting a fixed mortgage. But see, we are smart because we got an option ARM and are going to sell it off in 3 years at a nice profit.” After all, this belief is central to any mania especially in a speculative bubble. People want to believe that an endless pot of gold is at the end of every rainbow and don’t want to think about a greedy penny pinching leprechaun who is ready to take their credit cards away.

This error is now in full formation here in California. I am amazed at those in prime areas who still feel they are somehow immune to this global calamity. Here is a newsflash, you are not immune. The progression of the bubble went something like this:

(a)  Early birds: Got in the game from the ground level. Saw the potential, made good profits.

(b) Early bird specials: Lenders and Wall Street felt a niche was emerging. Play off the biggest pipe dream in America. That of homeownership.

(c) Snake oil salesmen: Who is going to promote this to the masses in an easy to read book or downloadable Podcast? Simple, an entire industry elevated these people to rock star status even though many of them did not understand the entire economic scope of the bubble.

(d) Going mainstream: The masses believe real estate never goes down. The media saturates the airwaves usually bringing on snake oil salesmen to prime the pump. Now, not only does real estate only go up it goes up big. The bubble inflates exponentially.

(e) Manic rush:  Everyone races in. Mortgage equity withdrawals. Flipping by amateurs is not only done, but has a television show dedicated to it. Real estate is now romantic like stocks during the 1920s.

(f) Pull up your pants, the crack is showing: Cracks start showing up in the system. Sales begin to decline. Anyone who brings this up is a party destroyer. Off to the forest! The vast majority now have a stake in the game and have a hard time (fundamental attribution bias) of separating cause and effect. Plus, who wants to ruin a party?

(g) Game breaks open:  The floodgates open and now the battle is whether the decline is temporary or permanent. The camps start separating out. One by one some regain their sanity. Yet many cling strongly to this delusion since they are so heavily vested. The mainstream media starts making an attempt to offer balanced coverage

(h) Three strikes and your out: Game over. It is widely recognized how stupid and idiotic it was to get into this bubble. $500,000 for a Real Home of Genius shack? Not me! I bought a 1,000 square foot home in a prime area! It’ll never happen to me but my sympathy to everyone else.

(i)  The revelation and despair: We are in this moment. Now, people are seeing the writing on the wall. It slowly starts out as a shadow but quickly fills in with a bright red color. Many are going to find the writing not pleasing.

This for the most part is how the bubble unraveled over this decade. In the moment, much of what I discussed even 3 years ago seemed out of the mainstream. Now, it seems like common sense. Try telling that to people during the lead up to the Great Depression or our current economic malaise.

Fannie Mae and Freddie Mac, otherwise known as Tweedle Dee and Tweedle Dum announced that they are going to do a massive loan modification program. The details are preliminary and I’ll do a much more in depth report on a future article but suffice it to say these are the details:

(1)Â Modify mortgages for those 90 days late

(2)Â Extend mortgages to 40 years

(3)Â Lower mortgage payment to 38% of the borrower’s annual income

(4)Â Lower rates to as low as 3%

(5)Â Need to make 3 consecutive payments in order to be permanent

This thing is fraught with so many problems. First, it is geared to the uber toxic mortgage markets of California and Florida that account for well over $300 billion of the $500 billion Pay Option ARM market. In addition, they mention that this money will come not from the $700 billion TARP program. Which means more money from tax payers. Although most of the problem loans come from California and Florida, it looks like many loans will not qualify for this program. Of course Sheila Bair at the FDIC wants access to TARP cash to bailout toxic mortgages. Not subprime mortgages but Alt-A yuppie mortgages on California McMansions. I’ll leave it on this final note but don’t you think this is going to induce certain borrowers to purposely miss three payments? There are many people on the edge who are being prudent and making their home payments but barely. Now isn’t this a large enough incentive to stop paying and get this great deal? Frankly, I want to sign up and put some of my mortgages in here! Unfortunately, for the majority of prudent mortgage holders who pay on time your only parting gift is the good feeling that you are helping Wall Street banks and lenders stay afloat for making horrible mortgages.

Let us now move on to a delusional home in a prime area here in California, Pasadena. Today we salute you Pasadena with our Real Home of Genius Award.

Home Roses in Pasadena

Pasadena California is a city with 133,936 people in the Los Angeles County area. It is one of the nicer areas in the county known for hosting the Rose Bowl football game and also the famous Tournament of Roses Parade. Pasadena is also home to Caltech which is one of the most prestigious institutions in the world. So the city definitely has a lot going for it. And it also has a deep well of delusion.

The median income for the city is $86,523 which is relatively high for any city in the United States. The median household income in the United States is slightly over $46,000 but will probably drop given the current economic collapse.

This above home is 1,200 square feet and has 3 bedrooms and 1 bath. This “gorgeous” home has been sitting on the market for 285 days which you would think would give someone a hint. It may be a good idea to invest $50 bucks with a gardner to also cut the grass:

You would think that someone would understand that these kind of homes are simply not moving in the market. This would have been the perfect example that we would have seen showing up on Flip this House. But now, the lenders are flipping out. We really need to have more truth in advertising here. The ad tells us, that the home has been “lovingly and completely gutted and now stand as good-to-go exterior shells ready for your creative touch, or byob (bring your own bulldozer) large lot, school in close proximity spectacular mountain views.” Want to see what “lovingly” gutted looks like:

Â

If that is how people gut a home with love how in the world would a home look like if it was gutted with indifference? And what is this BYOB? Bring your own bulldozer? Oh funny. Good one. Nice chuckle but I ain’t buying. And apparently everyone else feels the same way. Let us look at the magical pricing action on this BYOB home in Pasadena:

Price Reduced: 04/09/08 — $479,000 to $450,000

Price Reduced: 04/26/08 — $450,000 to $375,000

Price Reduced: 05/01/08 — $375,000 to $360,000

Price Reduced: 05/24/08 — $360,000 to $279,000

Price Reduced: 06/22/08 — $279,000 to $249,000

Price Reduced: 07/17/08 — $249,000 to $239,000

Price Reduced: 10/24/08 — $239,000 to $219,000

Price Increased: 11/03/08 — $219,000 to $230,000

The first thing you should realize is that someone actually thought this place was going to move at $479,000. Take a look at those pictures one more time. This place is not worth that. They listed the place in January and wallowed 3 months in delusion before they made any price concessions. Once April hit, the price reductions came fast and furious. You know the irony here? If they would have listed the price at say $300,000 in January some sucker would have paid it at that time. Now, they are chasing the bottom. In fact, Zillow has this home listed at $199,000:

So what did this home sell for in the mania of the bubble?

Sale History

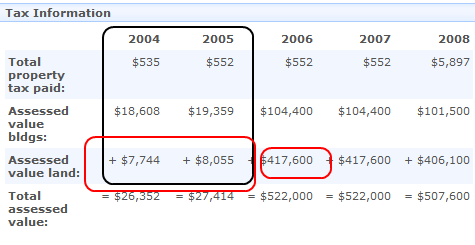

08/23/2006: $522,000

That is a stunning 61% price dive in a so-called prime area. Now, we will enter into the next phase of the delusion which is the California housing market. You’ll have folks telling you, “yeah, well of course. This home is in poor quality. But my place is nice and in good condition therefore it will stay high.” Here’s a quick lesson for those of you who don’t invest in real estate. Building a home is cheap and getting cheaper. Has anyone been following the commodity markets? Out of work construction workers are seeing their wages depressed because of the flood in the market. In some areas of the country, you can buy a brand new home for $80,000 to $100,000. I’m talking about brand new 1,400 square foot homes with faux granite countertops, all brick, garage, nice lot, and fireplace. Plus, they are brand new. Why are they so cheap? Land is basically free.

In California, the delusional sun god worshippers thought they had found the most exquisite plot of land in the world. For a time, enough Kool-Aid drinkers believed that which led to someone willing to pay $522,000 for this “home” in Pasadena. In addition, there were enough lenders smoking peyote who actually thought making a loan at this level was smart. Don’t believe me? Take a look at the assessed value:

Welcome to the absurd bubble era. The home was never worth much. Heck, take a look at it. Land, land, land as the cult would say. But now as it turns out, it does matter what home you have on the land. The lower assessment before the 2006 peak mania buy simply reflects California’s backward way of assessing home values. The state was complicit as well. They loved assessing homes at higher values. More money into their coffers. And if you haven’t noticed, we are now in a $11.2 billion deficit only 6 weeks after the longest stalled budget passed in our state history. Property tax revenue will go lower after many decide to forgo their tax payments for next year trying to qualify for the above freebie loan program from Fannie Mae and Freddie Mac. Now assume you “BYOB” and knock this home down. In effect, you are stating the home value is zero since you will need to construct a new home on this lot. Now what is the true value of this land? That is the new question we are trying to figure out.

One thing is certain, land isn’t worth a damn if you can’t cash flow as an investor. The current $199,000 price is basically saying the plot of land is worth $199,000. Do you think it is worth that much? If you construct a modest home it will cost you roughly $200,000 in California. Is this worth $400,000? Maybe. But you’ll have to wait and have the funding ready to build the home.

If you decide to buy this place bring your bulldozer but also bring some booze since you are going to need it in the long months ahead. Today we salute you Pasadena with our Real Homes of Genius Award.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

21 Responses to “Real Homes of Genius: Today we Salute you Pasadena. 61% Price Dive in Pasadena Coming to a Prime City Near You. BYOB. Bring Your Own Bulldozer.”

The taxes increase ten fold and now are at almost $500 per month.

Good luck with that!

Hey Doc! Great post, as always! Well… I lived in pasadena briefly in the 1990’s and one thing I would point out: the house wasn’t gutted so much as sold for scrap! It looks like all the architectural details were removed. Those had value, especially the tile work from around the fireplace which is usually sold to someone that wants “authentic” details in a new McMansion being built to look historic.

Given the condition of this house, the fiscal condition of CA, the taxes in L.A., and the median income of buyers in Pasadena, I’d give $30K for this house.

This house needs a real gut rehab to be even liveable as a cheap rental-figure $150K worth of work because this place needs EVERYTHING. I don’t know about the neighborhood it’s in, but the photo leads me to believe that it’s not the choicest part of Pasadena. But that’s a nice town, so the taxes are probably hight and due to go much higher, against a repidly deteriorating economy with ever more jobs and income being lost, especially among the classes of people who are the likely residents of this house.

Looks like it would be a good place to have a reenactment of the Alamo. “Watch out Davey, Santa Ana is on the march!!” “We will give you one hour to let your women and children leave in peace…..”.

That is one piece of crap house.

But you got us all wrong, using the People of the Sun in your article. We indios (I am a People of the Sun) have it right and believe that the sun “does affect all of us”.

It’s you the gringos who STILL don’t heed the discoveries of 1616 by Galileo (which we discovered long before but shhh because you guys discovered America – right?). Let me remind you what Galileo stated “We revolve around the sun or in a more complex or simplex version, YOU are not the center of the universe”.

Good article though. Mucho love.

If Santa Anna is on the march, who gets concord first Newport Coast or Irvine? either way Orange County doesn’t stand a chance. Today! Newport Coast! Tomorrow! Coasta Mesa! then Passadina! LOL

Actually much in Pasadena and the San Gabriel Valley is holding out. It’s annoying as it should have already popped, but there are still condos going for 600k in Pasadena (admittedly in better condition than that house). So I wouldn’t really say the better areas have popped, as I’ve seen a lot of prices holding steady.

As for the 40 year mortgages that Fannie and Freddie are now going to be renegotiating: it’s a way to mitigate the problem, but the precedent of 40 year mortgages is a very very bad one. It makes people lifelong mortgage slaves paying massive amounts of interest. Maybe that was the plan all along.

The guts of love spillith over the innards of this palace but nary even a chaste smooch for the yard. I’m with Jim Nelson above…one of the studios might pay 10-20k for a couple of days rent to shoot a re-enactment of “The Alamo” here.

If someone cut the weeds, the place might make a decent crack house.

Doctor, here is the deal. People may have begun to cut their spending and started to live within their means again; perhaps even saving a little. Banks, may have started to act prudently and actually require documentation for loans and are back to evaluating risk.

But the government, in their wisdom, believes saving and prudent loan practices are deflationary. So if people and the banks don’t have enough patriotism to spend and make frivolous loans, the three stooges (Dubya, Hank and Ben) with Nancy P. are going to do it for them.

Do I have it right?

Anyway, don’t worry, Osama is going to save us isn’t he?

That front door stuff is dope, holmes! The new chainsaw welcome concept. I’m gonna try that for my front door – I’ll get all da honeys fo’ sho’.

OILWELLDOCTOR

I am not much of an Obama supporter but why the hatred? Osama? Bitterness I suspect.

You didn’t mention where this house is. My guess is it’s in the gang infested area of Pasadena. Also the public schools are absolutly bottom ranked. Factor in another $12-15K/yr for K-12 education.

Yet strangely enough, the lust for Pasadena continues.

Osama?

Uncool Oilwelldoctor. Very uncool.

Pasadena is still bubbled, sellers still delusional, and still a good number of knife catchers around. But it won’t last. Pasadena is drowning in unsold properties. The most interesting trend I noticed: barely a day passes by without a million, multi-million dollar home coming on the market.

Right on Gayal!

Gael Sean and others,

sorry, I didn’t mean to type Osama. An honest mistake.

My guess is also NW Pasadena or a portion of “unincorporated” Pasadena (did not follow any links to find it). What you pay for in Pasadena (what we paid for in 1992 for $240K) is a city with great amenities, smart people, tremendous weather, open minds, and great views. I’m obviously prejudiced about my feelings for the city. Biggest problem is one shared by all of Southern California, Nevada, and Arizona: NO WATER.

The neighbors across the street bought what was in effect a tear-down for $795K about 18 months ago. (!!!) It’s a faux Tudor on a tree-canopied street, very sweet to look at. We look at the homes on sale in the neighborhood, however, and have started to wonder if we can get $550K out of it. And it makes 3/5ths of its own electricity…might be a selling point right there.

Today was “The Great California Shakeout” – a huge exercise to prepare Californians for “the Big One” (earthquake). If we could get $550K and relocate somewhere within two hours of New York or Philadelphia, it might be worth the trouble. At least we’d be able to have water.

I wonder what length of time would be too much for people to consider for a mortgage. Again I’m concerned that 40years will become the expected norm.

That’s a find! I would love to be in the mind of that person over the course of those months…medicated? Perhaps. Another day, another rental hits the laguna beach market, yet home values are remaining the same which prices me out. Im renting…but to buy the house I rent I would be paying 3k more a month with a traditional 20% down/30 yr fixed. What gives?

John M, the problem with your plan–of cashing out and going elsewhere–is that you will contribute to the creation of the same gentrification/bubble economy in the fabulous cheap new place you move to. After abandoning the place where your wealth was created.

~

Your dream, John, is to flip your hometown, as well as your house.

~

This kind of thinking is exactly what caused the problems we’re facing.

~

rose

Pasadena is a big enough city that parts of it is very “prime” while the other parts are dangerous ghettos. Looking at the iron gate on the front door, this house looks to be in the part of Pasadena where gunshots are not uncommon…

Looking at the tax assessment does not give you a complete picture, since the official property assessment value can only go up by a small amount each year, and can diverge quite a bit from the market’s valuation.

When was the last time that this house sold before 2006?

Leave a Reply