Housing Groundhog Day: A homecoming for low down payment mortgages and record breaking year-over-year median home price gain in Southern California.

The housing mania is in full swing here in Southern California. A headline reads “record yr/yr gain for median price†in reference to Southern California. Keep in mind that only a few short years ago we had the biggest housing bubble ever pop in spectacular Hollywood fashion. Well the bubble is back. Not the same kind but a newly evolved real estate fever. The players are different this time. In the previous bubble, the easy money came from duped global investors and a NINJA loan market while today, the Fed is basically giving out free money to large banks to leverage in the real estate market. The gig is now only accessible to a small portion of the population in prime markets. Those with good credit and a desperate desire to buy are jumping in as the thunderous momentum rolls along. Largely because of investors, renting has become a more popular option. There is now something in the air. Over the last year, I’ve heard many times that “housing is the best investment†and “the Fed will never let housing prices go down again!â€Â The emergence of low down payment loans outside of FHA insured loans is now coming back in fashion since household incomes are simply not keeping up. Where do we go from here?

Sales are slowing down while gains reach a feverish pitch

With mortgage rates rising sharply and prices going up at record levels, something has to give. Inventory has been steadily increasing for a large part of the year. At the same time, prices have turned around sharply:

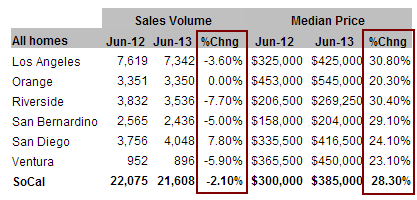

A couple of important points to make. Some have said that the change in the median price is largely being pushed by the change in the mix (as if this was the main reason). That was true in 2011 and some of 2012 but foreclosures in many areas are a small part of the sales mix because banks are leaking these out slowly. So the gain in prices is real on many fronts:

“(DataQuick) It appears that around three-quarters of last month’s record 28.3 percent year-over-year gain in the Southland median sale price reflects rising home prices, while roughly a quarter reflects a change in market mix.â€

So only about 25 percent of this mania can be attributed to the change in mix. The rest, 75 percent is coming from hot investor money, artificially low interest rates, squeezed supply, and the whiff of mania from buyers. Take a look at the gains. Los Angeles is up 30 percent year-over-year (so is Riverside). Orange County is up 20 percent with a median priced home now selling for $545,000. But look at the sales column. Something is definitely changing. First, we have yet to see the impact of the more expensive FHA insured loans that hit in June. This will hit the lower-end of the market. We are already seeing this hit the market where 19 percent of all sales were FHA based (when a year ago they were closer to 30 percent). You also see inventory rising (partly because home sales are slowing and partly because sellers are jumping on the bandwagon and realize this might be a good time to unload a property).

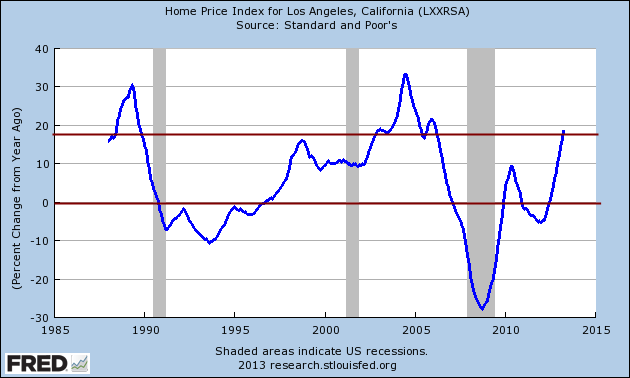

These are real price gains contrary to some analyst acting like apologists for the army of big money investors acting like a vacuum for the easy money being pumped out by the Fed. If you look at the Case Shiller data which looks at repeat home sales, we see a real trend here:

Home prices in the LA/OC area are now moving up at roughly a 20 percent annual pace. This is flat out unsustainable. Yet the momentum is real and the price changes are definitely something to behold. Of course, last month 30 percent of all purchases came from the all cash camp.

The return of low down payment mortgages

Instead of realizing that the Fed has engineered another housing mania within a decade, the financial system is pulling out an old card trick. Low down payment loans:

“(Yahoo!) Remember the 10 percent down payment on a house? After virtually disappearing for years, it’s back.

Around the country, some lenders are offering 90 percent financing again on all loan types. For example, San Francisco-based RPM Mortgage resumed offering “piggyback” loans in the first quarter of 2013 after discontinuing them during the height of the credit crisis in late 2007, according to Vice President Julian Hebron. (A piggyback loan enables a home buyer to put only 10 percent down without having to buy mortgage insurance. This is done by getting two loans totaling 90 percent.)â€

Of course FHA insured loans only require 3.5 percent down but these are seen as the modern day subprime loan. Good luck trying to get a home in a prime market with a FHA insured loan. Yet banks, seeing this trend are now resurrecting conventional low down payment products and using them in large fashion in some markets:

“In Monroe, NY, Rosalie Cook of Weichert Realtors says she is seeing buyer down payments range from all cash to as little as 5 percent. Mortgage lender Tom Gildea of Prospect Lending in Rockland County, NY agrees, saying that he’s doing loans with as little as 5 percent down “all day long.” Those 5 percent down deals are with private mortgage insurance, are only for conforming loans (less than $417,000) and are reserved for borrowers with excellent credit, verifiable income and little debt.â€

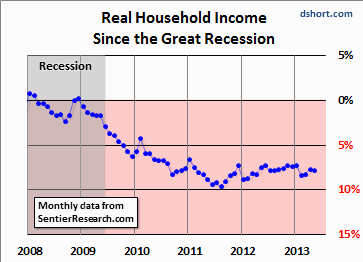

At the same time this is what is happening with household income:

Yet there is plenty of easy money in the hands of large global financial institutions so it is hard to say how much longer this can go on especially when the Fed is trying to go into QE infinity and the coming back of low down payment is back in fashion. I don’t need to tell you that Americans are willing to go into debt up to their eyeballs and that clearly their incomes cannot support the current momentum without the crutch of the Fed being in place for a very longtime. Heck, the Fed is digitally printing money to give to banks that they clearly cannot afford but when gambling with OPM, why worry? Remember the banking motto “IBGYBG†– I’ll Be Gone, You’ll Be Gone. From talking with many people in the last year this is the mentality now permeating the market. Try to grab some of this easy money as real assets are inflated once again. Just remember, the Fed was at the helm of the last housing bubble as well but financial amnesia is part of the game. Just remember how bananas the last housing bubble was and tell yourself that we just set an annual year-over-year record in SoCal when it comes to annual price changes. The musical chair timing is back in full effect.

Are we witnessing another tipping point or does this real estate run have more in the gas tank?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

87 Responses to “Housing Groundhog Day: A homecoming for low down payment mortgages and record breaking year-over-year median home price gain in Southern California.”

It’s hard to understand how this game can go on indefinitely. It’s like the Federal government decided they have to bring housing back at any cost. The chart that shows real income falling is amazing. People are getting in over their heads again. Didn’t we just do this 10 years ago? We have kids graduating from college with an average $30,000 in tuition debt and baby boomers retiring and downsizing. Where is this going? Somehow it just doesn’t add up.

Well yeah. Higher values = higher property tax payments, it’s that simple.

If the median home price fell to 150k, they’d probably start raising tax rates. Either way their gonna get ya.

Wassup DG? I’m still in my house after two modifications and playing the game according to their rules. This site was very helpful in clarifying the decisions I needed to make in order to CAPITALIZE on the current corrupt market.

After getting the 39k HELOC forgiven, and the 2nd modification will forgive 51k after 3 years of payment, it looks like I’ll actually be about EVEN since my purchase 9 years ago…who woulda thunk it?!?!

Now with them pumping the value up on speculation alone, I only hope it holds for a few more years so I can sell and sell every damn thing I own, retire, and move to Costa Rica.

Swiller, it sounds like you took on too much debt and lived beyond your means but got a personal $90,000 bailout and you’re getting back on your feet. I guess that’s one way to work the system. I prefer to live within my means and take on as much debt as I can pay for. I don’t feel entitled to put my hand out if I lived beyond my means — that’s living on other taxpayers’ money.

It can’t–it’s a slow-moving train wreck. Eventually, federal policy will not be able to sustain current practices, and with state policy the way it is, that’ll also squeeze residents as taxes continue to rise, services are cut, and job prospects dim.

I think it doesn’t add up because we’re missing something. Something right in front of us that’s too seriously scary to even consider; but here goes. Let’s take a look at a few of Doc’s words:

“the Fed is basically giving out free money to large banks to leverage in the real estate market.”

“I’ve heard many times that ‘housing is the best investment’ and ‘the Fed will never let housing prices go down again!'”

“The rest, 75 percent is coming from hot investor money, artificially low interest rates,”

“Instead of realizing that the Fed has engineered another housing mania within a decade”

“Yet there is plenty of easy money in the hands of large global financial institutions so it is hard to say how much longer this can go on especially when the Fed is trying to go into QE infinity”

Are you thinking what I’m thinking? The hedge funds that came in to prop up the market are using FED money; meaning the FED is not only setting rates but they’re actually in our market physically through the hedge fund fronts artificially pushing prices up for its member banks by competing with us for the homes.

The Fed is actually DIRECTLY scooping up houses to fake this rally through their hedge-fund fronts. Think about it – when you’re bidding on a home, one of Bernanke’s henchman is in the room to screw you and tear your heart out. Mission accomplished.

You talk about a scandal… it’s torch and pitchfork time.

No, the Fed is not in the business of buying homes. It is in the business of buying mortgages, and manipulating rates so banks can borrow money on the cheap. (Ultimately watching out for its favorite member banks) The Fed creates the environment that promotes risky behavior without fear of loss, because big brother Fed got their back.

Ultimately this is not even about housing. It was merely the vehicle of choice for this great debacle, and what a great vehicle it was. The American Dream. But now, it seems all it really is is the great American sham. Either play with the big boys or dont play at all. Complaining is only a waste of your own personal time at this point

@ThePaine, ed is correct on this one. It’s not hedge funds, it’s the Fed and the Fed’s member banks.

All nationally chartered banks are required to purchase non-transferable stocks in one of the regional Federal Reserve banks. Regional and local banks have to option to become a member bank of the Federal Reserve.

The Federal Reserve is buying mortgage backed securities from member banks. The member banks then park the money from the Fed back into the Fed and collect interest for having excess reserves. Other member banks will use the Fed money as Monopoly money and play the markets.

Basically, the Federal Reserve is buying mortgage backed securities that no one else will touch with a 50 foot pole because everyone suspects these MBS’s are loaded with toxic non-performing (i.e. foreclosed properties) that the banks are still carrying on the balance sheet because the banks still have possession of the REO. By Federal law, the banks can hold these foreclosures for up to 10 years. Changes by the Federal Reserve policy allows the banks to rent out these foreclosures.

I agree with ed. The fundamental problem is–wait for it–when the government effectively takes over a market, the market becomes distorted from economic reality, and thus becomes entirely unsustainable without increasing government intervention.

My parents bought a house in the South Bay for $80,000 in 1970–a lot of money back then. Assuming a compound annual inflation rate of 5% (pretty generous), that means it would be worth around $652k nowadays, given Shiller’s point that housing more or less keeps pace with inflation over the long-term. Instead, it’s worth roughly twice as much. Why? Because of FHA, Fannie/Freddie, larger conforming loan limits, and the litany of other federal programs that tried to make housing “affordable.”

If housing had remained “unaffordable”–you know, 20% down, 30-year mortgages, etc…–then that would have tamped demand and kept prices in check. Instead, you have a “winner” generation and a “loser” generation–the former being those who bought ahead of all of these federal programs and the latter being those buying under the terms of such programs and now saddled with incredible leverage (debt to “equity”) on a depreciating asset.

“Over the last year, I’ve heard many times that “housing is the best investment†and “the Fed will never let housing prices go down again!â€

Whenever you heard this kind of talk in the past, it indicated that the bubble was about to burst. I wonder what it means this time?

It’s speech verbatim of the last bubble. “Frothy, no bubble”, etc etc…

Since 2008, I’ve felt that the crash of the economy was not a single event, but a paired event, like passing through one edge of the hurricane (2008), into the relative calm of the eye, where we are now, with us yet to pass through the other edge of the hurricane. Same as the Great Depression. It did not start in 1929, when the stock market crashed. Things did get bad, but they were getting better for a few years until the feces seriously hit the oscillating device in 1933, just after Roosevelt took office. I just hope the second half of the game is not as serious as it was 80 years ago …

End of the run. This thing is about to Tank. I am seeing better properties at better prices in the bay area now. Demand is easing and supply is growing. Once the sellers see this is their last chance to get out we could have a rush for the exits with no one in line to get back in.

Sure, cash investors sitting on 30% equity cushions could (should? ;)) say, peace, I’m outta here, I’ll take the appreciation and forget the own to rent model. However, what about the folks who are currently underwater with mortgages? What about the folks that would be underwater if things go down another 10%? Or folks that become underwater at 20%? And then again at 30%? How exactly are they selling? What about all the Chinese using the homes for visas or to have their kids in certain school districts? Are they selling in a huge panic? I get the rush for the exits concept, especially in stocks or bonds when its a piece of paper and how nasty it can turn quickly, I just think housing may have a floor due to sellers that can’t or won’t sell. Where that floor is, we’ll see eventually bc assets dont take a straight path to the moon, but what if things go up another 20% before then. Now that dude has a 1.5 million house and even more of an equity cushion. Or what about those that bought before last year but post bubble? They now have some nice equity cushions too.

Also, many that claim theyll just do a strategic default if the sht hits the fan, are really just talking sht if they have a job or other assets of value. They’ll bitch and moan (like us Americans do over every little thing) and go to work, pay their mortgage and put the TV on, as most folks are scared of a lawsuit (which banks would start bringing in greater frequency to get some precedent/case law on their side, even if it means lobbying for changes in the law).

This is not an endorsement to buy a home now AT ALL in Cali. I mean i moved to texas because i didnt want to play the CA housing (and other) costs game either, but just feel like the doomsdayers take things perhaps a little too far. I mean part of me wants it all to crash to because then you can say ‘I knew it,’ but be careful what you wish for. Sometimes being right ain’t worth it and having all assets go down…along with your job or wages, your friends and families homes and jobs, etc.

“Also, many that claim theyll just do a strategic default if the sht hits the fan, are really just talking sht if they have a job or other assets of value”

Probably true, but then again, you will have many like me, same employer for 20+ years, wake-up and tell the whole system to F-off. No credit for me for 3 years now and life is just great! And I defaulted on my house not once, but twice. My whole attitude has changed because of this fraud against us.

I try to use cash for everything and pay as little of Ceaser Obama’s taxes as possible. Bartering works really well.

Agreed, with caveats. At least from my weekly house hunt expeditions in the East Bay. Suddenly a flood of inventory appears on my radar – at the end of last week, for the first time I had multiple houses to bid on! Now I have another long list of houses to look at this weekend, all in the sub 350K range. Looks like sellers holding off in anticipation of “ever” higher prices are suddenly rushing to sell “at the top”, or so they think. I’ve even seen the first indications of price reductions, albeit on marginal properties I wouldn’t bid on.

On the buy side I anticipate (because Americans are brainwashed by corporations to be secretive about their incomes, savings, debt and therefore buy capacity – really dumb if you think about it) OTOH some competitive backwash from over-leveraged low-down pay bidders from the middle tier who change plans and move downstream into my area; OTOH I anticipate some FHA dropout in the bottom tier.

So right now I see a temporary “seller panic” window. I have no idea if it will continue – rates will have to continue to rise for it to stick. My preferred target would be 6% on the 30yr fixed to blow out more of the marginal bidders.

I got lots of dry powder on a 15yr fixed 20% in the face of rising rates: raise the downpay %age, raise the points paid, etc., to control the total debt & interest for payoff in 10 years.

http://mhanson.com/archives/1386

Matt thinks that Americans are brainwashed by corporations to be secretive about their incomes, savings, debt? HA! How are corporations brainwashing Americans? If anything, some Americans are being secretive about their incomes because of big government spenders that want to tax Americans endlessly! Matt sounds like a typical SF Bay area leftist liberal who has been brainwashed by the Democrats who control everything in Cali. Matt deserves to be taxed heavily!

Americans being brainwashed by corporations? Now that is far fetched, NOT!

Although some houses are still at ridiculous prices per sq ft, they are just sitting on the market. We are seeing more houses that were pending put back on the market (BOM), as well as price reductions, and many newly listed homes at lower prices per sq ft than we’ve seen in many months.

Rental Parity vs No Parity:

Rental Parity

1. Great for new/existing owners (investment or savings)

2. Provides competition for the rental market.

3. Good for renters.

No Parity:

1. Bad for new/existing owners except maybe flipping the property or long term use.

2. Little bargaining power for renters.

3. Good for Landlords.

I have a feeling if Rental Parity disappears is the FED or BANKS going to rush in to save the middle class until after the fact or before? It seems like it will be well……after the fact.

The only reason the banks would ever do anything to save the middle class is if the 1% wanted to eat us. Not yet! They need us to work in the serfdom.

Mortgage applications are down 45% from a couple of months ago.

Escrows on home sales typically take 60 days to complete. If a potential buyer locked in a mortgage rate in advance, they would have about 30 days to find a property. Therefore the massive increase in mortgage rates will probably not show up in completed home sales for at least three months.

So I would not expect to see a plateau in home prices until August at the earliest, with September and October being the more likely months to see this current real estate bubble peaking. And peaking/plateauing prices should not be confused with crashing prices. There are still enough FHA/VA buyers and foreign buyers so that the bidding wars are reduced from 15 to 20, down to 5 to 10 potential bidders.

What I really meant is there are enough FHA/VA and *all* cash buyers (not just foreign) buyers out there that the bidding wars will be diminished but not eliminated.

Federal law 12 U.S.C. §29. Power to hold real property allows banks to withhold foreclosed properties from the market for a maximum of 10 years. 2005/2006 were the peak years for garbage mortgages. So banks are not required by Federal law to release the worst of the shadow inventory until 2015/2016.

So anyone expecting a massive downturn in real estate prices in mid-tier regions in 2013 will be very disappointed.

Most of those properties from 05/06 didn’t actually foreclose until 09/10. So, we’re looking at another 5-7 years until those will be released.

What happens when people who have paid cash for a SFH need the money for retirement or medical expenses or any of the other surprises life can hand out?

Most who pay cash immediately finance the house to get their money back out. They just pay cash to get the house.

If this is your personal residence, it would be quite easy to get a HELOC or even a mortgage if you need emergency cash. If this is an investment property it is difficult to get a HELOC, and mortgage terms will be less favorable, however it should be providing a nice retirement from the cash flow.

Does anyone else have family in the mortgage and/or realtor industry? I understand the double edged sword here, or quite frank hypocrisy (lol!) but I must ask, mainly because a family member wouldn’t lie (hopefully!)

An uncle of mine is a loan officer. He told me in 2004 not to buy because prices would fall 20 to 40%, which came true in 2008. (Yes I could have played the flip game but that’s not me.)

I didn’t see him again until earlier this year! I thanked him too, and asked him about now. This time he said #1, don’t get in a bidding war. #2, we’re at a point where yes prices will probably fall again, but monthly payments will probably remain the same throughout, so long term buying is a good choice.

Now since then, this year, prices shot up even a bit higher. Couple that with mortgage apps falling off as of late due to higher rates, I see a bit of a bubble again. 5% to 10% as of today, over the monthly payment scenario my uncle gave.

Thoughts?

P.S. Investor cash drying up eventually and hedge fund investments coming to market in the future will play a factor as well, yet unknown.

That is why it is smarter to buy when rates are high and prices are deflated. You can always refinance on the rate downswing later but you can never lower the price that you paid. If you buy when rates are low and prices are inflated as people are doing right now in SoCal, you’re more exposed in down markets should you need to sell.

It’s so simple yet all the housing shills are like little kids with their fingers in their ears yelling la la la la la. Instead of admitting that today’s SoCal buying decision advances emotion over financial prudence and patience, they will come up with all sorts of straw man arguments in an attempt to justify why those of us who point out the obvious are so stupid. My favorite are the “former bears” who respond much like a newly enlightened ex smoker does about cigarette smoke.

Joe, I’m sure everybody agrees that it’s smarter to buy when rates are high and prices are low. However, that really hasn’t been an option for over a decade and likely won’t be anytime soon. Many people on this blog still are holding onto nominal prices, but are forgetting about affordability (unfortunately that’s all the commoner cares about).

I agree it is riskier to buy today than one or two years ago; however, everybody’s situation is different. Asset classes of all type have been turned into a casino for the past 15 or so years, I don’t see any change in sight here. Good luck with whatever you do.

Perhaps this maybe a reason for the quick flipping going on?

http://hereandnow.wbur.org/2013/07/16/new-glass-steagall

This doesn’t surprise me. Anytime there is regulation on the horizon or some sort of impediment in the works people do what they must before things change. Think when the Nation Parks were being created while business deforested acres of land before there loss in an unregulated market.

PN, the flipping game wasn’t for you because, as you have openly revealed to the board over the years, you haven’t compiled an adequate 20% down payment to purchase a house yet, let alone have the heavy funds to fund a flip. You’re “not for me” smacks of dis-ingenuousness, unless you’d like to share the scenario where you had the means to flip but decided against it.

I could have leveraged a property and held it for a few months like everyone else did, however my Midwest morals and finance kept me above such sillyness.

And you are very correct about not having 20% down. I never have, nor will I ever, have 20% down to buy a home. Between raising a family, Costco, gas, and traveling to the Midwest for family, we barely make it as it is. And that with $100k in income. Our home is highly leveraged now, but like Joe said, I guess we’re only on this planet for a short time so no big deal.

I’m not sure why you think it would crash. I think prices will go down equivalent to compensate for however much interest rates go up, but I doubt a crash would occur. The crash from 2008 was due to fraud fraud fraud. Lots of equity atm cash pullouts thanks to fraud and that is no longer an issue. Home equity cash pullouts aren’t as easy as before and the ones that do exist are very strict. I know from personal experience trying to get a HELOC isn’t simple and cash out is easy but only if you have LOTS of equity in the house up to 80% LTV. Loans are being doled out but with a lot of due diligence to the borrowers so again that alleviates a lot of the fraud. I’m generally a bear on economy and housing but I think you are being too extreme in your forecast.

Hedge funds bidding up properties with counterfeit FED notes and then securitizing said properties based on fantastical claims of future rental revenues isn’t fraud???

All cash buyers? Not sustainable. Decreasing sales volume with a rising price? Mortgage applications down 45%?

These are all indicators of a party coming to an end. Will it drop off a cliff? Cash buyers and highly qualified borrowers suggest that the price rise will stall, but not drop. That may take another couple of years as the economy is looking like it’s headed south.

This is not a problem isolated to housing, just to clarify. In banks have, in a nutshell, stolen money from the middle class so they can loan it back to them. Everyone wants to know why wages are stagnant and where all the money went. Look at who has the money, that’s where it went. There is a inference that Americans like being in debt or rack up bills buying stupid thing but in most cases I think credit card debt is car repairs, medical bills, groceries, gas and other living expenses. My husband recently got a raise and his check is actually SMALLER then before the raise. They stole our money and they know if they dry up credit it will tip the populace over the edge into revolt. Until then they will keep us hanging on a string, until we all have the balls to revolt against the big banks, MasterCard and Visa.

Right. There is rarely ever a tie so when there are losers you always have winners. For example, all of the money that was “lost” in the last housing crash didn’t just disappear into nothing. It went somewhere. Where did it go? It had already went to those who made the risky bets that precipitated the crisis. Both Wall Street interests and imprudent borrowers.

In an honest system, those entities would have taken haircuts. By and large, they didn’t. That was the outrage. The official story was that it was done to save the system.

So who pays? We all do because we all participate in this monetary system. The same monetary system that has been and continues to be perverted in order to maintain the status quo which prevents those who made the earlier risky bets from their deserved haircuts. This is what QE is all about. They are skimming off of the top of the value pile that is backing the monetary units and hoping it’s not enough for you to notice right away.

The closest thing to a revolt was Occupy Wall Street, which the monied interests quickly and expertly framed through their oligarchical media as a bunch of stoned, dirty, drum-obsessed, lazy drop-outs…and we all bought it and laughed.

I loved the Occupy kids they gave me hope for the

First time in a long while. I found myself watching on the web cams for hours. Great speakers I learned about derivatives there. We all should have gotten behind them. Honestly I think they might have been our best hope. Now they are buying medical debt debt for pennies on the dollar and forgiving it. They a it the rolling jubilee. I’m sure Sam will attack me but caring about people and a just and sustainable world is not loony. If I were to call your side names these days I would just say the right reminds me of the Taliban

Nope, I think the opposite; the media loved the Occupy crowd and covered them endlessly; unfortunately Occupy appeared, at least to me, to have the organizational skills and passion of an amoeba. Bless their hearts.

Oh please, the oligarchical media portrayed the Occupy stooges for what they were: a bunch of stoned, dirty, drum-obsessed, lazy drop-outs! They were organized by far left Communist front groups. It’s no wonder the current neo-Marxist fascist regime in Washington liked them and had nothing but kind words for them!

Of course Ann loved the Occupy stooges and found herself watching them on the web cams for hours. Who else could watch that nonsense for hours? Who else could afford to spend hours watching that unless you’re on welfare living off of hard working taxpayers who don’t have time to watch a bunch of spoiled leftists having temper tantrums? The left not only calls side names, but they completely want to silence their opposition! Look at what corrupt government agencies like the IRS and the EPA have been doing to conservative groups. Corrupt leftists in those organizations have been trying to silence conservative groups while giving favorable tax and regulation treatment to their far left cronies. The corrupt regime in Washington is all about stealing tax money from taxpayers and giving it to their cronies. These days I would just say the left reminds me of the Taliban: they are corrupt, authoritarian, totalitarian, and they want to completely silence all opposition. The left and their leadership take after evil dictators like Stalin, Hitler, Mao, Pol Pot, Fidel Castro, Hugo Chavez, etc. who all killed millions of their own people in an attempt to silence the opposition trying to make it more “fair and just.”

Hey Doc – echoing the huge jump in YOY home prices in LA, here it is in LAT

“Southern California home prices skyrocketed more than 28% in June compared to a year ago, real estate information firm DataQuick reported Wednesday. The dramatic 28.3% jump was greater than any year-over-year pop seen during the housing boom and the most since January 1989, the first time DataQuick generated the figure. The Southland’s median sales price reached $385,000 last month, 4.6% more than May and the highest dollar amount in more than five years…”

http://www.latimes.com/business/money/la-fi-mo-home-prices-soar-20130717,0,254160.story?track=rss

Yup. Same garbage that was printed last bubble. Are people that short sighted?

Apparently they are, but hey just “pencil out” where rents will be in 30 years and it will all make sense. Worst case, it’s easy being a landlord so you can rent the place out should you make a stupid financial decision. But since life is short, don’t worry a out being held to account on any of these things.

Nobody on this board is saying renting out a home is easy, but if you have a little money in the bank as reserves(in the case of non-paying tenants). Buying rental properties that pencil out immediately is a great way to make money long run. None of the homes in ’06 made sense, but there were great deals 2009-2012. It takes some work but very few moneymaking ventures are easy.

Lets stay on track, shall we?

I can only guess that you’re referring to BFE as I’m concerned with L.A. and O.C.

My point is in regard to the homeowner occupied scenario where one becomes an accidental landlord.

OK Joe, there were absolutely no homes that you could have purchased in L.A./O.C, that you could have cash-flowed on if you became an “accidental landlord”. When you buy a home in these areas you should have some money in the bank to withstand the initial hit of becoming an “accidental landlord”. This should be a factor in every purchase decision. Fact of the matter is there were plenty of deals to be had over that period of time, may people on this board are pissed they missed the boat. (I suspect this includes you).

Not sure why you’re bringing up the past. I thought we were discussing today’s reality.

But if that’s where you need to take it in order to feel good about your arguments, I guess no one is stopping you.

By the way, I don’t believe any boat was missed. What goes around, comes back around.

You missed it: the X factor is hot Chinese money.

The absolute insanity of Beijing real estate pricing is refluxing out towards all markets attractive to the Chinese.

That’s why it’s LA — and not Minneapolis, et. al.

Famously, the Chinese are ALL CASH buyers.

Something like this was seen in Honolulu decades ago when Tokyo went crazy. The hottest money was crooked money.

The Yakuza even went so far as to buy old man Kaiser’s estate for $44,000,000. When the criminal connection was established — the government seized the property — some years later.

What you’re looking at is flight money. Chinese, like the Japanese before them, want to have an anchor in America.

They are even going so far as to fly in to give birth — and then flying back to China.

We have to change our citizenship laws — quickly.

>>”We have to change our citizenship laws — quickly.”

Right! We can’t have industrious rich people moving to this country! We barely have enough space for the fat people to turn their scooters around in the Wal-Mart parking lot.

Steve,

Fly-by birth certificates confer fake citizenship: no acculturation can possibly happen.

The Founders never imagined jumbo jets.

America, as a culture, as a polity, must break down if it becomes so hip, so multicultural, that it doesn’t even hold on to its own.

There is NO nation on Earth that has remotely the open entry of the USA.

We’re not an empty land anymore, not by a long shot.

Not all rich people are “industrious”; Paris Hilton.

That aside, I love it how our lawmakers provides Visas for those who have the $ and build electrified fences for those who don’t.

I’m being pushed out of buying a home in my own country, and frankly I’m not looking forward to moving to China and working/living in an Apple factory. I can see why people are pissed off…

You’re kidding right? The 10million + illegal Mexicans that have dropped taxpayer funds out of the system wasn’t enough for you to be outraged but suddenly the wealthy Chinese investing in American properties is the reason you’re suddenly outraged?

When hedge funds start making big bets shorting the housing market you will know the gig is up. Watch out for building inventory and sales going through from big wall st buyers playing in the housing casino..

Its always scary when the top three stories on cnbc (paid for by ads by financial institutions) are all about housing.

http://www.cnbc.com/id/100896253

http://www.cnbc.com/id/100895581

http://www.cnbc.com/id/100889767

But mortgage rates down again too with several lenders at 4.25-4.325% on a 30 year.

http://www.mortgagenewsdaily.com/consumer_rates/316952.aspx

Armageddon postponed it seems yet again and the housing bulls still in charge for now.

Well, foreign investors have price up Texas, still a lot cheaper than California but Texas is moving from below the national average to the national average in housing costs. Utah, Colarado have better poverty rates than Texas which means that Texas has more problems with the poor, its below Colardo and Utah in schooling. Its also Humid while the other two states are colder.

Texas if fine unless you like being in the path of Tornadoes or maybe a hurricane? It’s a gamble regardless of where we live.

All you people sitting on the sidelines speculating are stupid. Bottom line don’t follow the trend and compare what it costs to rent or own. I purchased a townhome last March when everyone had a huge hardon about single family homes. My Mortgage is $650 cheaper than what the place rents for (according to the last person in the unit who was a renter), and that includes monthly property tax and HOA. I bought it as a short sale, which I researched how much was needed to be forgiven (a lot of people are afraid of even going for a short sale) on a conventional loan, which is exactly what they look for in short sales, they don’t want some all cash buyer to cheap out on them. In the end because I did my research including reading this blog, and I was able to buy a nice place before I turned 30 in Socal in a neighborhood that has the top public schools in southern California with a mortgage cheaper than rent, now my GF can quit her job and we can move forward with our lives. Or I could have been bitter for years and years and say the bottom will fall out soon.

Now the question is will your job be around 10 years from now to pay that 20 years left…

That question has been around since day one if you sign up for a 30 year mortgage. Why is it any different this time? What if remain a renter and lose your job…what then?

I don’t think everyone is in disagreement with you on this. Iit’s just that the Fed having to be involved with every market is not exactly what people have in mind with fundamental growth in homes sales or the economy. People are looking for bargains just like what you believe you found. If it works for you. Great. However, for a majority of the others on this board I think most may have been expecting longer slower growth returns than this whipsaw rebound. Having the FED get involved with a market that should not need stimulus is just creating more bubbles that should not happen. We will never really know how this market would have turned out if the FED left QE out of the picture and no tight inventory. The market has to be what it is. Not controlled to the extent where people don’t have a true picture of what value is.

Glad to hear you are enjoying your purchase. Can’t wait to see how you feel 12 months from now.

Enjoy the deflation that’s coming

In my opinion I think more sequestration in the government sector maybe needed to keep a lid on this artificial growth. Tax payers need to stop bailing out state/Fed pensions when it should be the state/Fed that should be consolidating and stream lining their services just like corporations have done. I do see some public services in the parks have been doing their part. However, there has got to be a line drawn some where on how much things can go on. Lifetime benefit is an omen for disaster unless you have tax money to cover it. Otherwise it is just another debt we can’t sustain at it’s current levels.

Yes, we should wipe out pensions like corporations have done and give all the company profits to the CEO’s that wreak havoc and leave with a gazillion dollar bonus.

Your statement that taxpayers are bailing out pensions is either a paranoid or a hostile fantasy. You literally do not know what you are talking about. I predict your reaction to be one of outrage and to double down on your delusion.

As usual, the good doctor, half truth…

The inventory is 30-70% below of what it was a year ago. The biggest reason for declining sales is that there are no properties on the market. The once that are priced well are sold in 1 day, and the only once that seat for over 2 weeks are overpriced by at least 20%.

As prices rise, i expect inventory to rise within the next 12 months, and this is when the prices will stabilize.. sales will probably stay flat to up a bit.

Stable prices is one thing . Fair value is another. Restricted inventory is not necessarily a solution to this problem and may go on for years. All the homes that are coming on to the market will have a bit longer to wait or may never sell for the current market rates. However, if the banks are picking which ones to release seems more like collusion. You can’t expect any bargains if this type of market continues.

It’s not a matter of if the market can absorb this new inventory on the market and sustain it’s pricing but when will interest rates will dictate what real value is. I suspect homes will languish on the market for some time with interest rate creeping up. 20% to 30% gains in a very short time frame seems to me that sellers found their top? Perhaps.

There are very few bank-owned homes in upscale areas. I think I only saw 2 shortsales in 9 months that we spent shopping and no foreclosures. Even as I ran through the areas that we are interested in (which is kinda fun, look for houses while staying in shape), i never saw ANY homes, that were in obvious foreclosure.. as I saw when i was in Colorado.

@moshennik I purchased a home in Western LA in Dec. 2012 and every now and then, (using the same search criteria as when I was looking to purchase) I do a search and find the following: the nicer neighborhoods inventory is same or a little less than 8 months ago. But in the rougher neighborhoods, inventory is higher than 8 months ago.

@QE,

I just bought a house in Westwood (we also looked in West LA, Brentwood, Santa Monica). There are a few more homes on the market now in 90049 (which was our focus zip code).

8 Months ago I would see only 1-2 houses come in under $2m per week. Now it’s about 4. Yet, they sell almost immediately, unless there is a major problem or if they are well overpriced.

Dear Dr.,

Have you noticed how many more replies there are to your recent articles? Are more people searching for “housing bubble” on the internet?

Can you tell us what the traffic to your site has been over the last 12 months? It would be very telling of market perceptions.

AK

Actually, inventort is at an 11 month high in Orange County. The sellers are trying to jump on the band wagon, but I believe we will start to see price declines come October. If the Fed cuts back QE in Sept, causing rates to increase further, combined with rising inventory = price decline of 10-15%

http://finance.townhall.com/columnists/politicalcalculations/2013/06/30/as-the-second-us-housing-bubble-inflates-month-10-n1630857/page/full

Has a nice graphical display on the wage/price velocity. In the last 10 years ave. wage going from 42k to 50k is believable due to inflation alone (though it’s not an increase in purchasing power). The 2010 prices may actually make sense given that chart.

What does not is the subsequent run-up (from an income standpoint but we know investors are involved).

Velocity due to the anticipation of more upward velocity is the essence of the speculative bubble. A few players are exiting now and when we hit that inflection point where the majority stop thinking it’ll increase more, then the fun begins.

In my opinion the best solution to solving this wage problem is put a Fortune 100 or 500 company in every low income town and see what happens to the peoples wages. I suspect that would cause a surge in wage inflation and increased home prices just like what happened in Silicon Valley.

More unintended consequences, but there’s no plan B. Civilizations rise and fall. Bet you can get some Detroit municipal bonds cheap right about now…

There is a huge billboard near Balboa and maybe Sherman Way that has a picture of a smiling man and several smiling children and it reads something like ‘Buy a house with 0.5% down payment!’ and gives some number to call.

I just saw this. How silly of us to think that the young had financial issues. Sounds like everything is great for the Millenials:

http://finance.yahoo.com/news/rise-young-buyer-232900991.html

There are parts to capitalism that i’m not a fan of: kids that ‘do’ interior design, that ‘do’ fashion design, that design purses, etc. that catch a lucky break and all of a sudden are pimping it out in Brentwood. Meanwhile some civil engineer, keeping the whole party running in the background, with designs of a less flashy, more practical nature is getting paid bread crumbs compared to these guys, and is subject to higher liability risk if one if their creations fails.

This type of article is just more icing for the top. I can’t see how this home along with many bidded up homes could be if adjusted over 30 years be potentially $10-$20 million. Think of what would have to happen for all the people who work median income jobs. Can an average business assume incomes will ever keep up with inflation with this speculative assessment? It’s not sustainable.

One thing that city/county’s should be careful as more wealthy move into lower income areas is not a reason for them to overnight say all you locals have to pay this new tax or prices of a home since Mr. Success moved in next door? The businesses that employ people in these local towns/counties should dictate what real inflation will be. Not from outside speculators or people wishing to retire in a cheaper area. The cash crowd should be excluded from this number.

Maybe we are overestimating the financial problems of the younger generations…. wonder if the good Doc can run some stats on age of buyers over the last couple years?

Also, it seems that the people who all lost their homes in 2009-2010 are now up for re-qualifying for home loans again (something about a 3 year period in which people who lost their homes can now requalify).

The top few % of baby boomers tossing money to their kids helps for sure, especially in big cities, so you get not only successful millennials, but you get some dumb dumbs with rich parents helping out too. Confidence of youth plays a factor im sure. I saw a very similar article in the wsj and it felt a little forced to me. I dont consider myself a tin hat wearing guy, but sometimes i just question why certain articles are run/are they written with an agenda (aka keep the party going perhaps). Like why not add some other quotes from an opposing voice or stats showing more downside risk.

Agenda or not the article was obviously timed and feels more like a sales add. Why put this type of article out maybe in 2011 before QE was announced? Seems the whole thing was staged. In my opinion, the NAR maybe playing a role here as well to change the view of owning over renting which is typical about now and sure fits in with the 2005-2006 debacle.

Housing has become a stock purchase like a anything else and the hope is that everyone will constantly watch housing prices. Used to never be this so glorified before lending was unregulated.

Leave a Reply