Record Number of Young Adults Living at Home: Active Listings Rising, Price Cuts, and New Inventory Coming Online.

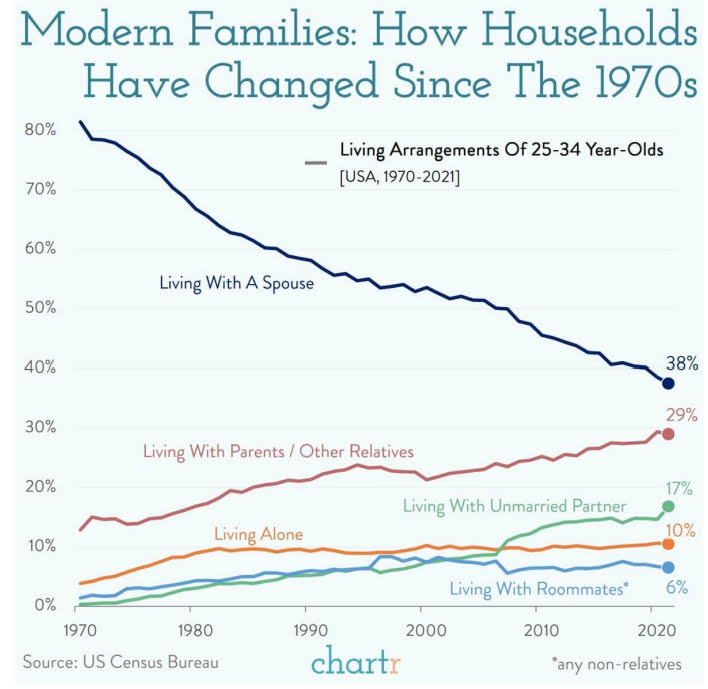

The pandemic while being hard on many industries, created a boost and flood of capital into the real estate market. Housing has been one of the hottest sectors since Covid-19 came on the world stage. Now that we are overheating with inflation, those juicy low mortgage rates are no longer here. People are now maxed out on easy credit and the bill has come due in the form of inflation – we now need to tame it. The Fed has nearly no choice now but to boost rates as more in the public start realizing the challenge of using funny money to jack up home prices to crowd out young buyers. In fact, nearly 30 percent of young adults now live at home with their parents. This is a record in our modern era and speaks to the current housing market. Higher rates are cooling the market down at a time when Americans are debt strapped.

New Homes Coming

Homes take time to build. To build many homes takes a lot of labor and capital and the Great Recession put a cold blanket on home building for many years. But now, we have a flood of homes that are hitting the market when consumer confidence is at very low levels:

The last time we built this many homes was right before the Great Recession hit. Is this the time you want a flood of new homes hitting the market? Maybe. In a way, this will certainly help with inflation by driving home prices down. The Fed’s stated policy now is to tame inflation (aka slow price growth). But the question is, can they now stop this runaway train? And of course the Fed can’t openly say they want lower home prices given the optics of that but make no mistake, that is what they are aiming for. Housing is the biggest piece of the CPI pie. The big money has most of their wealth outside of real estate, unlike most Americans. So they are trying to cool real estate and not let the capital markets implode, where most of their money is tied up.

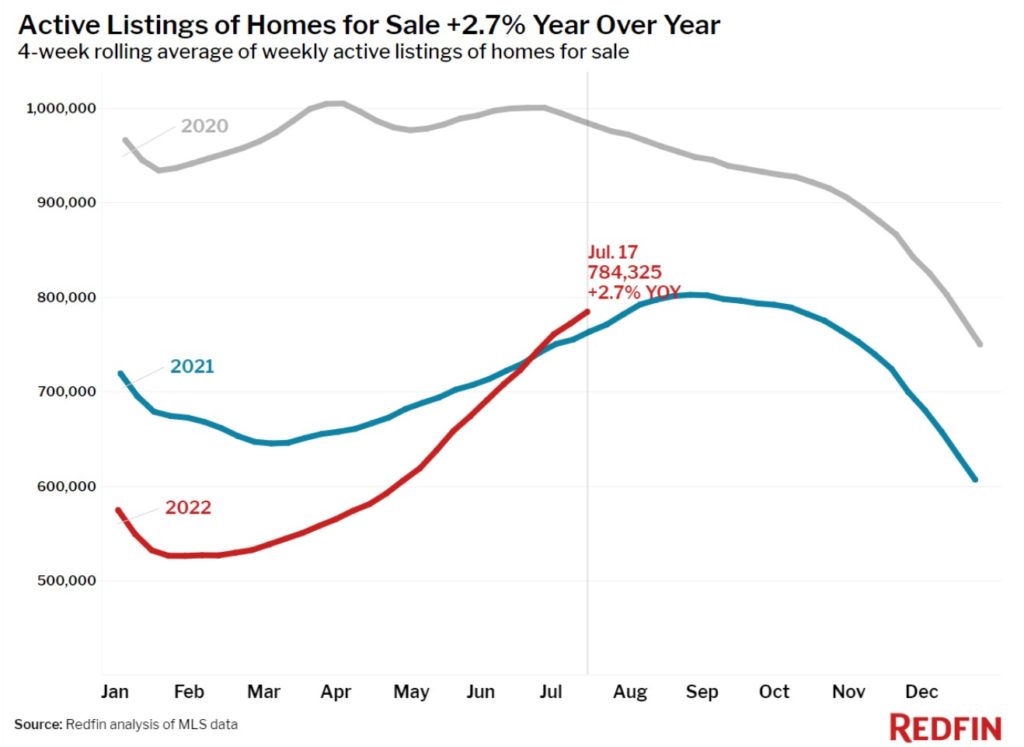

Inventory Rising

Without a doubt, inventory is rising and the housing market has cooled off a bit:

There are two things that will determine the depth of the housing correction. This will depend on the ability of the Fed to tame inflation and the employment market. If we start seeing sizable corrections with employment and we have a long recession, then housing will face a noticeable correction.

Living at Home

For the last few years, every article made it seem that everyone was buying and young professionals were buying up homes in mass. Yet the trend is telling a different story:

In modern history, we have a record number of young adults living at home. That is a challenge for the housing market and keeping the momentum going. Price gains have been largely had by record low interest rates, low inventory, and the stay at home policies. Yet all of those trends have now reversed. So will these young adults go out and buy in mass? Most indications are that they are debt strapped with credit cards, student loans, and auto debt.

All the leading indicators in housing indicate an inevitable correction. The question is, how deep will this go?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

94 Responses to “Record Number of Young Adults Living at Home: Active Listings Rising, Price Cuts, and New Inventory Coming Online.”

My daughter lives with me as rental costs are out of her budget. She has a county job, makes a good income. She has taken this time at home to pay off the last of her student debt. She pays rent and half of the household bills. She is very structured, focusing on savings, investment into her retirement. Her car has lasted 16 years and she plans to keep repairing it as needed. She is frustrated about living at home (very independent!) but is planning to still purchase or build a home in the future.

Sounds like your daughter is doing great and levelheaded. I commend you both. If she is willing to add a little risk, might I suggest also putting some of that (cash) saving into an index fund with the caveat that she maximizes her retirement options first.

Give it to the Rothschild Zionist bankers? No thanks.

That’s wise. My current car is also 16 years old. My laptop is 6 years old. My previous smart phone was 5 years old before it died and I had to replace it.

It’s smart to always use things till they wear out.

And old people tend to hang on to outdated things (in general). Things like landlines.

My wife’s Tesla has a “pet mode”. You set the temperature of the car while running a quick errand. The oversized display inside shows clearly the temperature so that outsiders see the pet inside is well taken care of. Technology is a beautiful thing.

Another example: we are in control of our own bank: a trezor or ledger nano s lets you store your bitcoin in a cold storage that nobody has access to except us.

We live in amazing times!

Some technology is nice. Much of it is useless, and even destructive.

We have invited in, even paid for, a Big Brother beyond Orwell’s worst fantasies. We are voluntarily allowing our movements to be tracked via GPS in cars and cell phones. Ring cameras are the eyes of the state; the cloud can always be accessed without a warrant.

I’m glad my car has no built in GPS. I have one mounted on the dash, but can unplug it whenever I want, which I usually do.

My iPhone is turned off most of the time, and tucked safely in a faraday bag to prevent tracking.

I avoided laptops with cameras until they all came with cameras. But the first thing I do whenever I buy a new laptop is tape up the camera, so no hacker can spy on me.

Naturally, I always use a VPN. And recommend a TOR browser.

Social media is particularly destructive, encouraging the worst of human behavior.

Free men are not dependent on technology. Slaves are addicted to it. Turn off the internet and smart phones for a week, and watch them panic.

Hey! I still have a landline with the same phone number for almost 30 years. Grandma still calls on this number. It is a “Classic” number.

However, it is now a VoIP connection from our internet provider for less than $10/month.

Much better clarity than the cell phone connection through a tower.

However, I was VERY upset when I noticed that my old rotary phone no longer worked over this connection. I had to sacrifice something.

“ My iPhone is turned off most of the time, and tucked safely in a faraday bag to prevent tracking.”

This made me laugh so hard! Thank you SOL!

I am pretty sure nobody cares where an old grumpy boomer goes, not goes or takes a dump. Obsolete, like his landline.

Millennials are the largest group of homebuyers in todays market. Many Millie’s are left behind and rent. I believe 1/3 of the population will be lifelong renters. I plan on benefitting from such large volumes of renters by offering housing to them. So far I only own one primary residence and one rental. In other countries they enforce strict rules around housing investments to discourage investors from buying up real estate. Luckily, we live in the US.

The level douche in your posts is truly other worldly. Congrats

Thanks Pine! Currently my rental is rented out but if it’s becomes available I’ll let you know!

She should have put those student loan payments into an IBOND earning 10%. Why is she paying off 0% interest loans that have been 0% for the past 2.5 years. That’s terrible financial planning.

How will she feel if say $10k or more of student loans for all get forgiven in a few weeks?

I’m not saying she shouldn’t have saved the money to pay them off… but I wouldn’t have allocated the funds to the student loans until she has to start paying them back.

If they were private loans… scratch what I said above and good job!

Maybe she’s principled and believes in paying her debts?

If your daughter has saved enough money to put a down payment on a house within the next 6 months then this would be a golden opportunity for her. Home prices are at or near 2021 levels price wise but payments are significantly higher without 2021 interest rates. They’re still in lone with the ever-increasing rent but during periods of higher than normal inflation, home values tend to appreciate at about twice the inflation rate.

More family dysfunctionongoing: now days spoiled and lazy adults expect parents to “raise them, wait on them” ongoing, because they never were taught responsibility at home growing up, now loser parents are paying the price of having to pander to them 24/7. What losers. Young adults need to be on their own working and living normal lives like my generation.

I hate to tell you but it’s a different world than it used to be. When I was 18, I brought home $2400 a month had a nice rental house and drove a 76 Porche. That was 79. I make 3x that now and can’t afford a house or a new car. The middle class is being destroyed.

You make $86K a year and can’t afford a new car? Odd…

They, their family, and their friends keep voting the status quo every election cycle so they get what they vote for. Let them eat cake!

And when they live at home with their parents, they don’t need to have a job which is why there are all these jobs that don’t get filled. I kept wondering how these people who choose not to work survive, but the answer is they live with their parents and don’t have bills as a result.

The one I know has no job except occasional tutoring gigs with high school students. His lenient folks let him sponge off of them. (Dad does keep trying to get him into some sort of technical program but he knows Mom won’t let him get kicked to the curb.)

Don’t look now, HOUSING TANKING HARD

https://www.youtube.com/watch?v=9gZliFj3EZ8

got popcorn, show is just getting started

LOL

Yeah! Epic crash!! Soon you can buy Your dream house with a 50% discount, realist! Just keep believing it!

Approach this advice with caution.

When we first moved to the South Bay in 2008, housing was still high. We waited until 2012 and got the house we wanted in the location at a 40% discount from 2012 and at about 1.5x salary (what we owe now is significantly less than 1.0x). Our house payment is half what rent would be. Low cost, low interest = very sustainable lifestyle.

We spend $1500/month on 15 year old’s sports activities. We could not afford that if we had done things the way that you propose. Again, if your lifestyle is flexible enough to go into big debt on housing, then go for it.

However, if you want your housing just to be a part of your lifestyle, then you need to consider other options.

I do kick myself for not buying a house in 2012 and then buying the one we own now shortly thereafter. It would have been a great investment.

Realist,

Please provide real data last time like you did last time in your moment of weakness.

We’d like to see real data, and not some internet quack/troll spouting that houses are tanking hard or that they won some election.

We all know what “Tank Hard Soon” Jim Taylor did. He bought a house 6 years ago and is happily living in it.

Houses could tank hard soon but my crystal ball broke in the Northridge Quake of ’94. I’ve been wrong ever since so I need to look at real data.

There is no real data. All data is tailored to someone’s viewpoint.

With targeted correction to bring housing prices down, it is not helping anyone to improve affordability.

I think the good Dr has real data above.

It is not anecdotal and it is not hysterical screaming from an “End is Nigh” internet poster like Realist.

It shows we are not back to 2020 yet.

I think the Fed goal is pre-pandemic 2019 for normal.

However, in 2019, I was predicting a drop in housing prices (darn Northridge quake). The Housing Bubble became super-real from 2020-2022. M’s gain and my loss. For now….

My friend has a garage apartment her son, and his wife and they have a three years old child live there. Both are college educated, and are paying off $150,000 college loans. The wife works in medicine makes good money. Both suffer from depression, anxiety and panic attacks, so do most of theri friends. They just act like that is a normal part of life. Because they are so busy. My friend buys groceries for them, light house cleaning if needed, and is a baby sitter three days a week and also makes dinner from them few nights a week. They are called the “Lost Generation” for a reason. Can this generation be such late bloomers, that by the time they get it together, get a house. get married and have blossom into an adult in their late 40’s will most of the women biological clock have passed the point of being able to conceive, or many childless couples due to not being able to afford it.

I come from a large family which immigrated here decades ago. All my siblings, children, nephews and nieces, all got married, bought nice homes in nice neighborhoods and they have them paid off or almost paid off. Of course, none went through a divorce, which can be financially devastating. Also, none of them live in Southern California (they used to, but they moved out).

Insisting to live in a high cost of living is financial suicide for the vas majority of people. Without financial discipline, life discipline, hard work and a plan, you never get anywhere. The victim mentality never helped anyone. There were crooks in power since the beginning of humanity.

Most of the problems stem from insisting in living in a place which doesn’t make financial sense for most people if they really think about all ramifications of their decisions. If they think that it does make sense, then they should be happy with the outcome of their own decisions.

I posted this at the very end of the previous thread but I think it is probably more related to this one so I’ll re-post it. (Also, no one will see it there since they’re all here now.)

Four important articles in the OC Register’s RE section today:

1) Columnist Lansner writes about shrinking foreign deals in RE. Last year 99000 US deals by foreigners were the lowest since the trade group started tracking them in 2009. International buys were 51% below the average from 2018 to 2020. In CA , foreign purchases were 11 % of the national total, down from 16% the year before. But CA is still #2 after Florida in total purchases by foreigners.

2) Financing columnist Lazerson writes about the collapsing reverse mortgage market. Ted Tozer, the Ginnie Mae president under Obama, says “The reverse mortgage business is teetering on collapse because there is not enough loan volume”. Rising interest rates and rising fees and insurance reduce the amount of money that older homeowners can tap. The upfront cost of mortgage insurance on a typical OC house could be over $19K.

3) Writer Jeff Collins writes about soaring rent due to low vacancy rates. Vacancy in OC is 2.5%, 2.7% in the IE and 3.2% in LA Co. The average for the region during the decade preceding the pandemic was 4-5%. One of the reasons for low vacancy rates may be the government programs to assist renters during the pandemic. Rates for vacant apartment soared 18.5% in the last year. This is echoed in other SoCal counties, with the lowest rise in LA Co (14%). Rents on single family houses are also up big time with the highest rate in OC and the lowest in LA Co. Priced out homebuyers is creating a larger pool of tenants.

4) Michael Casey and Carolyn Thompson write about investor interest in mobile home parks around the US. Older parks owned locally are being bought up by national companies. Renters at one park in Montana had space rents raised by as much in two years as over the previous 20 years.

Milli, are you still living at home?

Of course! Thanks for asking! We love our new home! Bought it in Q1 2020 and it has appreciated tremendously! And this year we finally bought our first rental!

Funny story: when we bought our first home (brand new build) the masses told us we bought the peak! And a crash is coming. This year, people are telling us the same thing.

See a pattern? Do the opposite of what people tell you. Buy houses and wait. Don’t wait to buy real estate. Thank me later 🙂

IIRC, Riverside was the California canary of the 2007 correction. I suspect the IE has a high percentage of multigenerational households.

“Riverside, CA has the highest chance of seeing its housing market cool further if the U.S. enters a recession. It has an overall risk score of 84, the highest of any major U.S. metro. That means a combination of housing and economic data indicate it’s more likely than other metros to see prices decline year over year during a recession or continued economic downturn.”

https://www.redfin.com/news/metros-recession-risk-housing-downturn-2022/

I’ll never forget driving down 215 and seeing a billboard advertising new construction “starting at $190K”. Probably a bit over 10 years ago. It was shocking.

Lennar has been pushing their “NextGen” homes in Riverside county for a while now. Just another creative “solution” (can you imagine the strife?) to “help” desperate buyers.

The good Dr. always has relevant data.

However, wake me up when supply reaches 2019 levels. It hasn’t reached 2020 levels yet since houses have been flying off the shelf with low interest rates, crypto peak cash-outs, and a few early Boomers leaving millions to their Millennial heirs. Crazy prices have been the “normal” since 2020.

We are still so far from the “normal” that I am used to. 2019 levels is the Fed’s goal.

Prices will stabilize

Spot on Bob! Inventory levels are still not even back to 2019 levels. But don’t say it too loud. I kinda enjoy the crash-Bros to get all excited and in hopes of a big crash!

You remind me of Kevin Bacon in Animal House, ” all is well, all is well, all is well” lmao

“The number of homes in foreclosure jumped 116% in a year in California as restrictions end on the ability of lenders to move against seriously delinquent borrowers. The U.S. number was even higher, surging 153%. Given the opportunity, after roughly two years of foreclsoure moratoriums, lenders are acting. California ranked only 36th with its 116% jump in foreclosure activity vs. 2021’s first half. The biggest jumps were seen in Colorado at 595%, then Michigan at 497%, Minnesota at 268%, New Jersey at 245% and New York at 227%.”

The Previews are over and the Movie is starting, got popcorn :))))))))

Foreclosure forebearance was still in effect in CA until last month.

I agree that an increase in foreclosures is to be expected, however, I’ll let you do the obvious math when foreclosures go up from 1 to 3. It is a Realist DREAM!! Foreclosures have increased 200%!!! The End is Nigh! Please post some real data, Realist. Otherwise, I will keep yawning at your posts. You can can continue hyping ALL 3 houses that went into foreclosure in CA but most of us know better.

I also have my popcorn, but if the Fed really does have a soft landing, we will get back to a normal 2019 level of supply and foreclosures. Prices are tricky. Inflation has been eating away at prices for 2 years at about 10% per year. Real prices will be flat or slightly up since January 2022. The demand is still very high even though the flood of Bitcoin and Tech stock cash is falling. Houses are no longer inflation protected for their value, and investors are realizing this. However, rent is still rising with inflation. That will keep demand up for buying houses as a primary home. Buying a house as a primary home is normal. Buying a house for 30% appreciation in one year to flip it, is no longer a Reality.

Soft landing her we come.

Curious on the popcorn. Stale by now or do you constantly replace the popcorn throughout the years? First time I heard you getting popcorn ready was a few years back. Instead of wasting money on popcorn that you never actually eat, might as well put the popcorn money in your downpayment-glass-jar so you are ready to buy when the market crashes 90% (or whatever the expected % is in your world of realism)

Bob, You forgot to include demand in your 2019 comparison. The balance of supply and demand drives home prices.

Bob assumes the demand is the same regardless of the interest rate increase, drop in crypto values and drop in tech stocks. Soon, the tightening financial conditions will influence employment and GDP more than it did so far.

You are correct, that you can not look only at the supply or only at the demand. It is the balance between the two which dictate the price.

I don’t know the future prices because the economy is no longer going based on fundamentals, but based on the policy pursued by those of the FED. Do they really want to cut inflation, or are they just talking about it? Probably they don’t know either because there are so many factors world wide and sometimes they use finances as a weapon of war regardless of the casualties.

You are correct, Demand is required to maintain and grow housing prices.

Demand has decreased due to affordability

We have gone from 50 people trying to bid full price on a house down to 5.

All you need is one person willing to pay full price to maintain demand. The 5 people bidding full-price on houses will maintain prices. Just ask Realist about his excellent example of the house on Covello that had a a few buyers willing to pay full price. Full price was up 16% from March.

Eventually, less than one person will be able afford full price. Probably at 10% interest rate. another 20% increase in house prices, or all of this insane Crypto money up 1000% in 3 years is flushed out of the system. We ain’t there yet. Just ask Realist.

Excuse me! “Without a doubt, inventory is rising and the housing market has cooled off a bit”! Talk about an understatement. Housing is not selling. Inventory is growing exponentially. One family relative has been completely blind sided while building their new home. They HAVE to sell their old one to finance the new one. This is in Northern California. It is not happening. In another case, a family friend purchased a home for retirement right here in Napa county about six months ago. They were confident they could sell their very nice ranch style home, with some land attached, in a desirable area. They haven’t got even one offer after lowering the price substantially, twice. In fact, they have only had one person look! It’s a nice home.

Anyone who doesn’t realize that this market has completely turned needs to wake up.

The ungodly price gains spurred by the FED are shrinking fast! For those who have been patient and have some money saved there is opportunity ahead! A super buyer’s market is heading your way. Be patient!

Curt, so many false statements in your post.

Inventory isn’t even back to 2019 levels…..just what are you smoking?

“ A super buyer’s market is heading your way. Be patient!”

Lol, quick reality check, prices are up 11% yoy. You do realize, credit profiles are fantastic and owners are sitting on loads of equity, have jobs and are nowhere near in a hurry to sell?

In the greater neighborhood that I live in, 36 houses have sold in the last 3 years. There are currently 3 houses for sale all for over $900K. The longest listing is 43 days. There is one house for rent for $4200/Mo (3Br 2Ba 1300 sq ft!). The area is 0.8 miles wide and 0.25 miles deep. I can’t say I see any evidence of panic here.

Joe R, sounds like you live in a small coastal CA area. Am i correct?. Thanks.

I don’t live in a beach town, but I do live in Orange County. The area I described is just the area I live in and is part of a much larger city. I wanted to include only properties located about the same distance from shopping, so an area of about 0.2 sq miles seemed appropriate. There are millions of people living in OC.

I forgot to say that the data was from a Zillow search.

Financial writer Corey McLaughlin wrote an article about the part time job boom. He starts with a story about a worker who got a second part time job (janitor) to pay for his commute working at an Amazon warehouse. That is exactly the kind of younger worker who ends up living with relatives, I’d like to add. Mr McLaughlin goes on to dissect the non-farm payroll jobs report of the US Bureau of Labor Statistics for July. Out of 500K+ jobs added, 384K were for part-time work! And 92K people took a second job. During the same time, the economy LOST 71K full-time jobs. The unemployment drop was offset by a decline in the work force participation rate.

The biggest gains month-over month were in part-time service jobs. Temporary jobs (less than 3 months) increased, but jobs of other duration decreased. Wages were up 5.2% annual rate but less than inflation (9.1%). The New York Fed consumer credit report showed a 3% jump in balances from April to June ($46 Billion), with more new accounts (credit cards and personal loans) opened in the second Quarter (233 million… about one per adult) than any time since 2008. Total credit cards now exceed 500 million. Most new accounts are among 18-25 year olds and sub-prime borrowers. He asks “how long can this last?” …Well, as long as there are jobs…..

I guess we can expect more young people, including young families to be moving in with Mom & Dad in the coming year. Will that help lower rental costs for those who don’t have to move back home?

Great article, Joe. Thanks for sharing. I suspected those 500k+ jobs added were not signifiant to the economy. Cohabiting of all kinds will be on the increase for sure as the economy continues to contract. Greedy landlords will ultimately pay the price.

I’m a landlord, no greedier than the average I suppose. We use a rental agency to manage the rentals because they are out of the area. We raise the rent less if they will sign a one year lease. We have made improvements to both houses., and we like to maintain them so we can sell if the lease isn’t renewed. The tenants in the houses are related to each other. I think they are getting a good deal.

Thanks for sharing Joe. Since you’re not a “greedy landlord”, my comment does not apply to you. I have friends that are landlords, some greedy and some not.

“Pigs get fed and hogs get slaughtered.”

Inflation has historical affected low wage earners the most. This time isn’t any different.

Either inflation will subside. (Not likely quickly)

Or, wages will continue to grow which will alleviate price pressures (and cause more entrenched inflation).

CA’s inflation limited COLA payment to the poor will help without making wage growth permanent. Is that good? I’m sure the poor would like a higher wage instead. Businesses are likely rejoicing over this. Is CA actually helping the WalMarts not to raise wages to keep and hire employees?

You have to look at where the demand is that is causing inflation. It is not with the poor. It is not with the financial conservatives. It is with the people who have excess cash from somewhere (Covid bailouts, Crypto gains, Refi cash, HELOCs, Job hopping for higher wages, …..) and are spending it and driving up demand for everything. This is the middle class and wealthy. There is so much pent-up demand after Covid lockdowns. They are not happy with higher prices but are spending all of the cash they have. Until they run out.

The government doesn’t need taxes. The FED can provide the cash as debt. The effect is the same as a tax – the government has the money (like in collecting the tax) and the people have less purchasing power than they had before – same effect as a tax.

Inflation is a stealth tax. 90% of the people don’t understand that. it is the most REGRESSIVE forms of taxation. The politicians have these choices and they know VERY well the outcome of their choices:

1. Tax the rich who pay for their political campaigns – increase interest and asset values decrease; or

2. Tax the poor and the middle class through inflation; they chose the second type of tax.

OC Register columnist Lansner had two columns today. One was answering letters from readers about his comments on the slowing real estate market in CA. He had people who accused him of colluding with hedge funds to convince readers not to buy now (so investors could snatch up properties at lower prices). And he had readers who backed his cautious approach to getting a house now. I’m always in the cautious camp. You should make decisions based on a realistic understanding of your financial situation, and reject hype in both directions.

The other article is on foreclosures. The rate has jumped locally and nationally over the year, which he says is in part due to COVID era restrictions ending. The California ranks 14th in foreclosure rate per unit. That rate is 116% higher than a year ago. Illinois is #1 followed by New Jersey and Ohio. The Bottom 3 are the Dakotas and Vermont. A research firm (ATTOM) says that the current foreclosure rate is 40% below the historical normal level. Core-Logic reported that 1.9% of CA mortgages are 30 or more days late (May 2022), which is half the rate of May 2021. This is across the board in large CA markets. Industry and government assistance during the pandemic seems to have worked to prevent foreclosures. I’m thinking that the cost of this to the general public could be partially reflected in the current rate of inflation which is particularly devastating to renters; one component of the massive government spending boom in the COVID era.

Lanser has great articles.

I did not agree with with his rent vs buy article. He had good data on the average rent vs mortgage data for “now”. It definitely pointed to renting being a better advantage now vs a mortgage.

His extrapolation into the future was misleading. With numbers like “70K savings over 5 years” if you rented vs buying. Rental amounts assumed there would be no rent increase over the next 5 years. Mr Landlord is increasing rent 10+% per year.

By my simple calculations, if you rented from Mr Landlord, your mortgage would be cheaper than rent within 3-4 years. Your mortgage is fixed (prop taxes only go up 2% max). Your rent is not and is unbounded. You are gambling against the odds and Mr Landlord by renting.

A break-even for rental parity in 4 years is a great deal IMHO for a purchase of a house as a primary home. As long as you have savings during down times and job losses. Losing the house after 4 years to foreclosure is the worst catastrophe possible. As the Good Dr said back in 2012, it happened to 10+ million homeowners with traditional mortgages.

Nobody knows the future but we bet based on the odds. Buying now has great long-term odds based on a soft landing and rents increasing with inflation. Renting now has worse odds but would be the best choice in a housing crash and with recession job losses.

I look at long-term older renters now and have pity that they didn’t buy in 2012. I pity myself for not buying a fleet of rentals in 2012. We all have our flawed reasons for not doing it back then.

If Realist is correct, and housing crashes back to 2000 levels, people will be pitying me and praising Lanser for his foresight. I should have rented.

Who in the heck knows? I am convinced that it is highly likely that buying a house now is not a get-rich-quick method.

I agree with Lansner that prices for average houses will drop some in the near future. I think this is because of rising interest rates. Therefore, the monthly payment if not paying cash will stay about the same. If you are economically secure enough to take the plunge, I say go ahead, but be sure to have some savings to get through rough patches, and don’t take on too high a debt load. I agree with you that his projections on renting vs buying are based on flawed assumptions. Nevertheless, you do not want to jump in without a good financial plan.

If record number of adults are living at home with parents, then there is a true housing shortage (not enough housing units).

It is basically a household compression.

If it is driven only by high prices, then this compression would increase vacancy rates (due to folks choosing to live with Parents). In that cases, rents would fall.

This is not happening, since vacancy rates are low and rents are up.

So, at the same time, we have both: 1) very low vacancy rates and rents up 2) More young adults living at home with parents).

#1+#2 is pointing strongly to a lack of housing inventory in general

I’m an old guy who witnessed many people in SoCal who bought RE at the peak in the late 80’s get smashed in the 90’s recession – lost jobs, home and many moved away. About 5 years later I watched many euphoric dot.com “investors” get smashed by the crash. About 5 or so years later even more got smashed by the MBS/stock market crash/recession.

COVID devastation was avoided by a combination of trillions upon trillions of money printing and payment moratoriums that have radically altered the short-term landscape. But rest assured there will be a resulting crisis that cannot be avoided, it is never smooth sailing forever.

Overall I have been a SoCal coastal housing bull, but there are eras to wait it out and we are in one of them now. Stay employed, work hard, keep you overhead low, take it easy on the $7 Starbucks drinks, and much better buying opportunities will arrive. It’s going to be awhile, so patience.

Great Advice! You should change your name to “Seen it All Before, Falcon”

My family got crushed by the early 90’s recession in SoCal when I was a kid. That has really stuck with me. My wife and I waited until 2012 to buy our first house in Oregon, despite relatives telling us to buy earlier at the height of the last bubble. We sold in 2020 to move back to SoCal for work and have been waiting for things to return to some sort of normal. The sooner the better, but it’ll probably take a while.

The economy works something like Newton’s third law. It’s never different this time. You print money, suppress interest rates or some other Tom Foolery and there will be a consequence. There’s no magic, only reality – in the long-term.

Well folks, the housing ‘bear-crusher’ Logan dishes out the dope on housing.

He tends to be more right than wrong over the past decade

Today’s podcast covers a possible soft landing in housing and the likelihood that we won’t see a 2002-2011 credit crisis because we never had a credit housing boom in the first place. As always, the biggest thing I have seen missed this century in housing economics is understanding what credit profile risk looks like and the dangers of residential lending. During the previous expansion, part of my housing work was that we would have the weakest recovery ever based on one factor: lending is back to normal, which is a good thing, not a bad thing. While demand wasn’t booming in the previous expansion, homeowners’ quality was being set in stone in a very positive way. Today’s podcast discusses the likelihood that more and more housing crash addicts will promote 2008 foreclosure crisis marketing gimmicks as they have done for over ten years.

https://loganmohtashami.com/2022/08/15/podcast-foreclosure-fanatics-are-back/

Century to a kind of destruction:

This study reeks of FOMO. ATH prices coupled with ATL interest rates will keep most of these recent home buyers locked securely in their homes/prisons. Unless of course, some life changing event forces a sale.

https://anytimeestimate.com/research/american-home-buyers-2022/

The article seems to a bit negative and implies that people have locked themselves in a prison. The spin on this article is impressive.

Here is some positivity to the article negativity.

American Home Buyer Statistics

70% of buyers in 2021–2022 bought a home for the first time. Among new buyers,

one-third (33%) thought the process was more difficult than expected.

67% of new buyers thought the process was easy!

Nearly 1 in 4 buyers (22%) were not satisfied with their home-buying experience.

78% of new buyers are happy with their experience.

Survey respondents paid a median amount of $495,000 for their home — about 15%

more than the national median of $428,700.

Almost one-third of buyers (31%) paid over asking price. The median amount buyers

paid over the listing price was $65,000.

Capitalism works! 🙂

80% of buyers made more than one offer, with 41% making five or more.

More than 1 in 3 buyers (36%) made an offer on a home sight unseen.

1 in 3 buyers spent three months looking for a home, while 1 in 8 spent six months or

more.

Capitalism works! Good thing the government didn’t step in and give everyone a free house.

80% of home buyers had to compromise on their priorities.

The No. 1 priority for half of buyers (50%) was finding a home in a good

neighborhood, but 1 in 5 (20%) settled for a home in a worse location.

80% of new buyers purchased their forever home in the location they chose.

Three-fourths of home buyers (72%) have regrets about their home purchase, with 1

in 3 (30%) saying they spent too much money.

OK, 72% is a problem. But hey, 70% think they got a fair price.

More than half of buyers (55%) bought a fixer-upper, but 1 in 4 (24%) regret it.

Heck, every house is a fixer. Even a new house. I also regret at times having to work Saturdays to improve my house.

1 in 10 buyers paid for their home in cash, with nearly half of all-cash buyers (43%)

saying they make enough money to afford it.

But 29% of all-cash buyers had to withdraw money from savings, and 27% had to

borrow funds from their investments.

29% had to use savings to buy an all-cash house? Where did the remaining 71% get the cash?

Of those who financed, 40% of buyers put down less than or equal to 20% on their

home.

40% put down 20%. 60% put down more than 20%?? There will not be a crash this time with NINJA loans.

This is interesting.

Consider this Calabasas house: https://www.redfin.com/CA/Calabasas/23100-Park-Contessa-91302/home/3496551

Listed for $1,790,000.

Sold for $1,580,000.

It is hard to say if they asked too much with their initial listing.

It was contingent at full price 1.75M on 8/3 and closed on 8/19 for $1.58M.

What was it contingent on?

The buyer getting financing or appraisal values? If so, then prices are dropping from insane list prices shows a weakening in prices.

Contingent on an inspection that uncovered 500+K in immediate repairs needed? This still may show a weakening if sellers are allowing inspections.

The house sold last in 1999 for 537K. There isn’t any other history.

A similar size house 2 houses away that backed up to water, sold for 1.8M in October 2021. The sellers maybe thought prices were still rising which raised their list price.

Another similar house 5 houses up the street sold for 1.4M in June 2020.

It gives me hope that prices are maybe flattening. This is a good example.

OC Register columnist Lansner is at it again with two articles about housing that in some sense contradict each other. The first is about a bill from Utah Senator Mike Lee to open up BLM land near cities (nearly all in the West of course) for development of housing. His thesis is that the affordability crunch is due to a shortage of housing. The report of the committee sees a huge shortage of housing which is larger than other estimates. The committee based their shortage estimate on the amount of housing needed to drop the price of housing to an affordable level. Therefore CA is 4.6 million units short instead of 2.5 million according to Sacramento. Lee’s bill also limits adjacent cities’ control on zoning and gives big discounts on the price of the land. Lansner seems to like the result of this and says that this affordable housing bill admittedly lowers the overall value of housing. I’d say in the Southwest that they’d need a ton of xeric landscaping materials to make these new communities water feasible.

The other article is on Fitch, the financial rating service that does credit worthiness of companies and bond issues among other things. They have released a study of housing values, and have found overvalued housing throughout the US. Fitch says San Diego is CA’s most overvalued market at 22%. Nationally, 57% of metro areas are more than 10% overvalued. Fitch sees a correction, but not a crash. They still see a constrained inventory market and don’t see homeowners with locked-in low interest selling en masse. But Lansner still gives a four bubble rating to the current market. I think he assumes the real values will fall because of massive inflation which will slowly (or even quickly with the current gang of idiots running the show) take the air out of the bubble.

I’d say that Mike Lee’s bill would further puncture the bubble out West, but will not have a chance of passing without regime change in 2024.

Popcorn – The Orange County Register in California. “Orange County home prices are 5.1% off their peak after the worst July sales on record. Basically, Orange County homebuying has cooled 38% in a year as house hunters were scared off by 48% higher house payments. The median: $1 million for all homes was down 2.4% in a month while increasing 11% over 12 months. Record O.C. high? $1,054,000 set in May. So, prices are 5.1% off their peak.”

munch munch munch :))))))))

You can’t be serious. Rates up almost 2x and only damage is 2%-3% so far in pricing. I do not understand why everyone is so hung up on the actual price of the house, it almost has no bearing

Realist is eating the stale popcorn finally!!

So the crash is here?! Did I miss it?!!

“ increasing 11% over 12 months”

Aaaah we are celebrating that house prices are >>only<< up 11% year over year! Hey, that’s better than being up 20%+ yoy and worth celebrating….I guess!?

What an epic crash! Just epic!

The peak was in April 2022.

As you pointed out with the Covello house, prices are still up 16% from this time.

Yawn….. Wake me up when prices are down 25% from January 2022.

Not yet. Keep munching.

Headline: US housing market in ‘much worse shape’ than Fed admits: economist

https://nypost.com/2022/08/24/us-housing-market-in-much-worse-shape-than-fed-admits-economist/

The Federal Reserve’s policy tightening has nudged the US housing market into a slump — and policymakers have yet to fully acknowledge the extent of the trouble, according to a prominent economist.

Ian Shepherdson, a chief economist at Pantheon Macroeconomics, provided a bearish outlook for homeowners after federal data showed sales of new single-family homes hit their lowest level in nearly seven years in July.

Sales fell 12.6% to a seasonally adjusted annual rate of 511,000, well below consensus expectations.

“The housing market is in much worse shape than the Fed has been willing to admit,” Shepherdson said in a note to clients. “But policymakers have made it clear that inflation is their primary objective, and housing is collateral damage.” …

The FED has a dual mandate. (maximum employment & stable prices)

FED’s priority right now is getting inflation under control. Raising rates is their main tool. That might not be enough though.

The housing market can be summarized in muted demand (due to unaffordable prices) and low supply. Prices yoy are still going up while sales volume decreases. Just ask many owners who listed and don’t get offers. Sure, they reduced their prices but are they willing to go much lower? Nope. They usually tell you they will just take it off the market and wait until rates come down.

Homeowners today are on fantastic shape (loaded w equity). Look at me. Both of my houses I bought in Q1 2020 and in 2022 appreciated well. My primary is worth well over a million but I wouldn’t sell it below 3-5M at the moment. Owning a new, big home in a prime location like SoCal is priceless. Better never sell and work on accumulating more houses is my goal.

The FED also wants to reset housing. M is going to get reset right into the poorhouse, on paper.

https://fortune.com/2022/07/08/housing-market-reset-by-the-federal-reserve-is-working-2023-2022-housing-prediction/

Fed is finally done pretending, expects hardship for individuals and businesses. They know they can’t play games with inflation any longer. Expect huge interest rates. They’re going to kick inflation’s butt and that will come with a huge cost.

Don’t fight the fed, right? So get ready to lay down and take it if you’ve been doing stupid things for the last three years, like buying real estate and crypto. Good night and good luck.

Charlie, interest rates have more than doubled compared to last year. But Inventory is down big time. People don’t move and are not interested in buying. And why should people sell? To do what?! Lose their locked in 2.75% rate? Homeowners sit on a ton of equity. Nobody wants to sell to be homeless and nobody is forced to sell.

This is poison for the housing crash boys. Prices won’t come down significantly.

“Don’t fight the fed, right? So get ready to lay down and take it if you’ve been doing stupid things for the last three years, like buying real estate and crypto. ”

Yes, don’t fight the FED. They will destroy demand. Interest rates (fed funds rate) going higher doesn’t necessarily mean mortgage rates will go up significantly from

Here. Mortgage rates are tied to the bond market and if the economy weakens bond yields go down. For significantly higher rates (bond yields and mortgage rates) you would need the economy to boom. Many people don’t understand this. Many think that if the FED keeps raising rates, mortgage rates will go significantly higher. The current mortgage rates have already priced in FED rate hikes. And no matter where mortgage rates go, purchase demand for housing is already down big time. What you need for lower RE prices is more inventory, more inventory and a lot more inventory.

You don’t have forced selling in this market like in 06, 07 and 08. You have the opposite, we never had such good owner credit/equity profiles.

This is all a giant buying opportunity SOON for stocks and crypto. Stocks and crypto probably see a lot more downside. RE could flatten out and even me slightly negative YOY (so far there are no indications of that as inventory is way too low).

The older I get the wiser I become.

This RE crash talk is a bunch of bull crap.

Inventory has peaked for the

Year and is starting to come down. We are not even close to 2019 inventory levels.

Housing will remain unaffordable. Potential sellers are not willing to give away the fort for a discount. Remember, a home seller is in most cases also a homebuyer. Nobody sells to

Be homeless.

Those that sold and rent and hope for a discount f’ed up in an astronomical way. They will never recover financially from that mistake.

Inflation is your friend if you own a home and your worst enemy if you are renting.

Right now is actually not a bad time to

Buy as you have less competition and you are in a position to negotiate a little.

If you hope for a 20-30% discount on houses you need inventory to go

Way above 2019 levels. You need rates to further increase and you need a JOB-LOSS recession. Good luck if that has your name on it.

Wrong

Wrong

Wrong

Wrong

Wrong

Wrong

Wrong

Correct

munch munch munch popcorn :)))))))

Nothing to see here, munch munch munch :)))))))

KFMB in California. “The real estate days are gone, where you once could offer $100,000 over the asking price, multiple offers, and two days on the market, according to real estate agents in San Diego. Meaning, homes with fantastic views are staying on the market 30 to 45 days which was typical pre pandemic. Panoramic views of San Diego Bay, Mt. Soledad, and the Pacific Ocean, yet a 2, plus bedroom, two bath, 2,500 square-foot smart home priced at $2.3 million in Bay Park has been sitting on the market since May.”

“‘The house is brand new, plumbing electrical kind of surprises me and the view,’ said Kim Alger, homeowner. ‘We are not really motivated. We love our home. We’re retired so it’s time to get out and travel and do things and see if we can sell it.’”

The Los Angeles Times in California. “If at first you don’t succeed, slash, slash the price. That’s Joel Silver’s strategy in Brentwood, where he just relisted his hot pink mega-mansion for $49 million — a 35% discount compared with his previous ask of $75 million.”

moving the deck chairs around as the band plays on, the Titanic still sunk :0

Corporate greed and desperation disguised as altruism.

“Bank of America said it is now offering first-time homebuyers in a select group of cities zero down payment, zero closing cost mortgages to help grow homeownership among Black and Hispanic/Latino communities.

The option will first become available in certain neighborhoods in Charlotte, Dallas, Detroit, Los Angeles and Miami. The new mortgage, called the Community Affordable Loan Solution, aims to help eligible individuals and families obtain an affordable loan to purchase a home, the bank said.”

https://www.nbcnews.com/business/consumer/bank-america-zero-down-payment-mortgage-first-time-buyers-details-rcna45662

This is right up there with pay day loans, pawn shops and hard liquor billboards.

got popcorn ……

The Modesto Bee in California. “The new owner that took over the Diablo Grande development two years ago is delinquent on more than $2 million in property taxes, according to a Stanislaus County tax collector listing. Angel’s Crossing LLC owes $2,072,208 in unpaid taxes on 65 parcels at the resort community in western Stanislaus County. Mike Crumb, a homeowner since 2006, said the clubhouse is closed and the two golf courses that once were the glory of Diablo Grande are dead. ‘That supposed developer has not spent one penny on this development,’ Crumb said.”

munch munch munch :))))))

Cool story bro.

Enjoy the popcorn for the next 6month while prices yoy are still up.

What an epic crash this is!

Greed and poor management is everywhere and all of the time.

2 years ago they started defaulting? 2019/2020? Who can we blame?

Headline: Bank of America announces zero down payment, zero closing cost mortgages for first-time homebuyers in Black and Hispanic communities nationwide

https://www.nbcnews.com/business/consumer/bank-america-zero-down-payment-mortgage-first-time-buyers-details-rcna45662

Bank of America said it is now offering first-time homebuyers in a select group of cities zero down payment, zero closing cost mortgages to help grow homeownership among Black and Hispanic/Latino communities.

The option will first become available in certain neighborhoods in Charlotte, Dallas, Detroit, Los Angeles and Miami. The new mortgage, called the Community Affordable Loan Solution, aims to help eligible individuals and families obtain an affordable loan to purchase a home, the bank said.

Applicants do not have to be Black or Hispanic to qualify for the product, a bank representative said. …

The loans require no mortgage insurance — the additional fee typically charged to buyers who put down less than 20% of the purchase price — and no minimum credit score. Instead, eligibility will be based on factors like timely rent payments and on-time utility bill, phone and auto insurance payments.

Prospective buyers must also complete a homebuyer certification course provided by Bank of America and federally approved housing counseling partners before they apply for the loan program, the bank said….

For real? It’s either for 100 years or the interest rate is 17%.

The desperation attempt to return to loose lending to drive up bank mortgage initialization fee income. BofA should have learned in 2008. Of course, they probably don’t hold the loans. Who does? They are likely selling them to FHA who has the same requirements.

“Instead, eligibility will be based on factors like timely rent payments and on-time utility bill, phone and auto insurance payments.”

Awesome! At least they aren’t giving away loans to the homeless sleeping on park benches like last time.

I know many responsible people who would like to get into their own house. Part of it is lemming-like behavior. Everyone else is buying, so we should too! The other part is a steady job with a good income. Buyers need a great income currently.

OC Register columnist Lansner has an article on home buying sentiment. Both buying and selling sentiment is down from last December. But more people think it is a good time to sell than buy. Even though sale prices are down since May, they are still way above 2019 in California, Southern California and the Bay area. Lansner attributes the current swoon to less inclination for upgrading and high interest rates.

Lansner points out that sentiment for buying is down nationwide. And he gives the current market 3 bubbles on his 0-5 scale. He notes that sellers are getting the current situation and cutting prices to make a sale. In July, Sacramento had 31% of homes for sale with price cuts, San Diego 25%, Inland Empire 23%, San Jose 21%, LA/OC 20%, and San Francisco 18%.

High interest rates are a big factor in my opinion. Also a stay put attitude of people with 3% or lower interest rates. I think that monthly payments will not fall much unless we have a big recession. And then the number of people with the income to move forward will drop. Hasn’t happened yet, but not improbable given the inflation rate.

An article by OC Register Mortgage columnist Lazerson is tracking the trend to adjustable rate mortgages(ARMs). The percentage of ARMs (according to research by Zillow) is now at 12% of borrowers, which is the highest since Aug. 2007. Contrary to what you might think, ARMs are more likely to be affluent and have a large down payment. The median income of ARM borrowers is $165K compared to $91K for all borrowers. The downpayment are also different, a=with wealthier ARM borrowers putting down 23.6% vs 10%. ARMs are being used by affluent families to get more house for their money. Lazerson says an ARM is worth thinking about when the loan balance is above ~$600K. He gives an example of a million dollar house payment:$4732/mo for regular and $4108/mo for an ARM. Rate locks can vary between 3 to 10 years. Rate caps and interest only periods can also vary. Other variables include points and the index used for adjustment.

In a future with a big recession the ARM is a good bet, but it might not be so good with runaway stagflation. Pick your poison!

It’s over for the RE crash Bros.

Inventory is too low. We are back to severe housing shortage. Next spring session will be tough for buyers since we are going to start 2023 with another super low inventory level.

Those who hope for a crash or even prices to decline YOY. Keep waiting a year and see. Nothing happening anytime soon.

We used to have one mine of household work to support the family. Now we have two working parents. Now we have children living with parents in order to support our consumer habits and inflation. What’s next. Me thinks we are nearing the end of the rope here. MMT is coming home to roost. I hope the dollar isn’t next….

Leave a Reply