A reversal of mortgage rate fortunes: Mortgage rates have another historical one day move as affordability begins hitting constraints.

On Friday the mortgage markets had another historical move reaching a multi-year high when it comes to the 30-year fixed rate mortgage rate. The move was gloriously inspired by an employment report that witnessed a record surge in part-time workers. This all seems to fall into the longer term challenges of extreme quantitative easing given that Japan with many years on us in the QE game has an enormous part-time workforce. Yet this dramatic reversal in mortgage rates is going to impact the market. To what degree? That will be seen but we are already seeing a decline in mortgage applications and of course refinancing activity is slowing down dramatically. A big change is going to come in the psychological department. Many were starting to venture into the market with ARMs but with rates rising, these affordability products are now much more risky. Also, the amount someone can buy has just been squeezed (around 30 percent) with the recent move in the mortgage markets.

Mortgage affordability

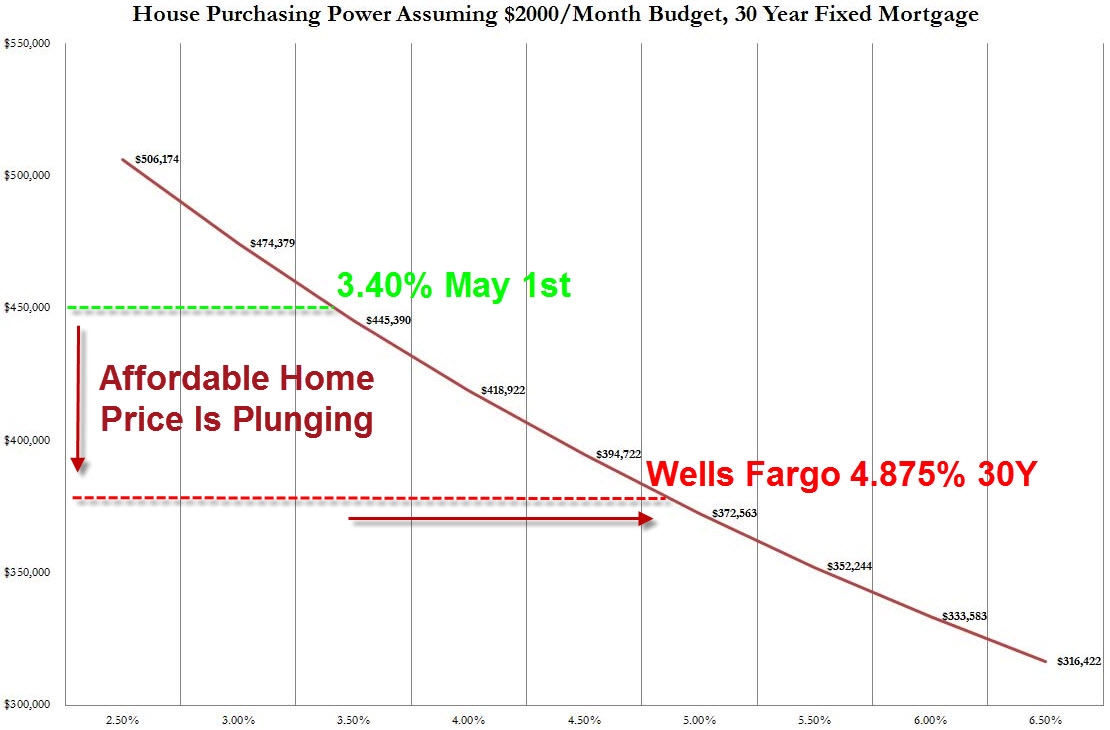

It is extremely clear that one big reason why housing values have picked up is the low rate environment. The big abrupt move in the mortgage market will begin showing its effects in the second half of the year if rates remain this high (or higher). Take a look at what someone can afford at various rates:

Source:Â ZeroHedge

Execution rates are now in the 4.75 to 4.85 percent range. So take a look at the chart above. Based on someone being able to purchase with a $2,000 payment, $450,000 was doable at 3.4 percent (just in May) versus $375,000 to $380,000 this month. In other words $70,000 to $75,000 would need to be shaved off in price to keep the affordability in the same playing field. While investors in California purchase a big number of homes (30 percent or so) that means 70 percent are being purchased by income constrained home buyers that depend on the whims of the mortgage market.

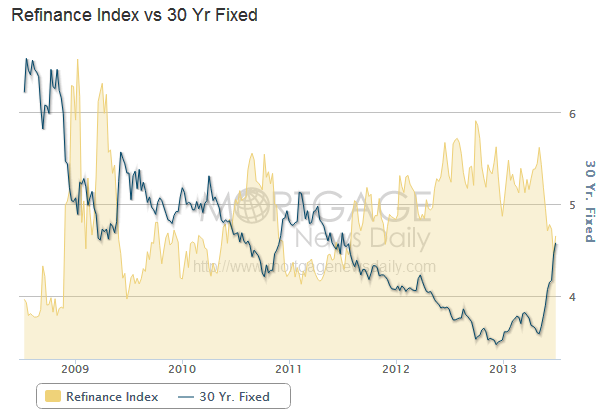

This minor rate move will need to shave off 15 percent in home prices to maintain similar affordability levels. Higher rates will also inspire many of those investors to look elsewhere for higher yields. Mortgage rates since 2011 only did one thing:

This reversal is unprecedented so we will see in the next few months what impact this will have in the overall housing market. Also, in places like California, many thought that lower rates were here forever similar to Japan. In this regard the recent market moves differ. Many bought and kept refinancing to lower rates so the risk was largely ignored. But now new buyers do not have the flexibility of previous sellers. The refinancing party has quickly shut down.

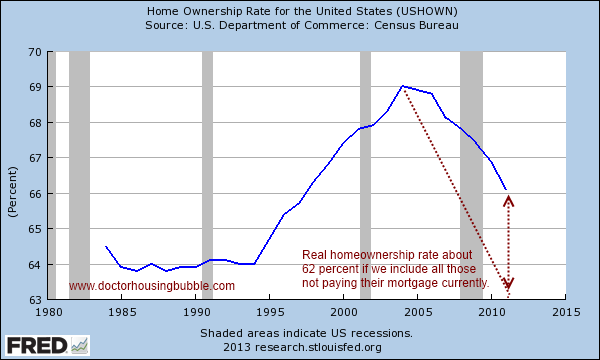

Home ownership

Of course since the housing market began a long correction, home ownership has continued to decline:

A big part has to do with record low supply and over the last few years investors gobbling up a vast portion of available inventory. If we include home owners not making payments on their mortgage, the real home ownership rate is down to 62 percent and that is a multi-decade low.

We are now going to find out how resilient the underlying economy truly is to justify the current run in real estate values without the full fledge paternalistic instincts of the Fed.

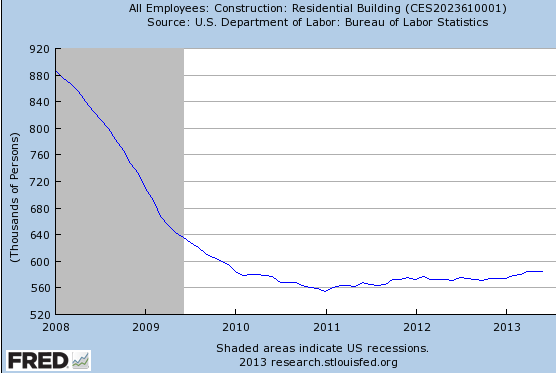

Where are the construction jobs?

One of the interesting items from the recent jobs report is the record number of Americans working part-time gigs. In the data, part-time jobs were up 360,000 over the month while the full-time job figures dropped by 240,000. Of course, jobs are jobs and the market rallied. Will this large number of part-time workers suddenly be interested in purchasing a home in the near future? Even home builders seem reluctant to hire construction workers:

Where is the growth to reflect the last few years of rallying home values? The tripod of this rally was based on:

-1. Low interest rates

-2. Investor demand

-3. Constrained supply

For number 1, we now see a big jump in interest rates. For number 2, we are already witnessing many larger investors pulling back interest from the market while mom and pop buyers enter the game late as usual. For number 3, supply has started to increase in the last few months so the tripod of the rally seems a bit off balance. We’ll now see how important household incomes are and the impact of higher rates in the market. Does any of this news really inspire anyone to rush out and buy especially given the manic nature of the current sales market? I think most people would rather have a higher interest rate and a lower home price.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

69 Responses to “A reversal of mortgage rate fortunes: Mortgage rates have another historical one day move as affordability begins hitting constraints.”

“Does any of this news really inspire anyone to rush out and buy especially given the manic nature of the current sales market? I think most people would rather have a higher interest rate and a lower home price.

”

Actually, as you suggest, the opposite. My wife and i are placing our wallet back in our pockets and starting to discuss alternatives to our housing dreams with the recent changes. It seems that the fed and banks have successfully rigged the market into a mania and after 2008, we are not so short sighted to forget that over 1/3 over your wage being spent only on housing is starting to not only get tight, but just plain sucks. Will the sellers take on some of these dynamics…no…instead you will have a myriad of realtors, sellers, local papers cheering that now is the time to buy. Of course, they all make money off it. Where it really hit me is hearing a realtor say the phrase that i thought i wouldn’t hear again for years … “buy now before diminishing returns makes it so you can’t afford a home tomorrow”. My wife and I are well into the 6 figures for income, so why on earth would I take that statement as a sign to buy…maybe its a suckers market again like in 2006… and yes, there is one born every second.

Now like the question is posed above, will buyers actually shy off the gun to shift that burden to the seller? Depends on the overall feeling about housing. The slogans and risky loan types are all starting to creep back. We have encountered many smart individuals out there that see all the issues and are shy like us to just take the biggest purchase of their lives and just throw it to the wind saying it will all work out …Real Estate only trends upwards. The unfortunate issue is there is always that one person that will say .. “hell, i’m jumping in before this gets any worse”. They either had more money to their name or way lower standards, but either way it happens.

Time will tell the real story, but these 2 house hunters are happier going to open houses, working out the payments and walking away if it doesn’t make sense. If more people would get out there, look, and get “disgusted” with the dynamics, then maybe more negative sentiment would push to the sellers. Perfect example…took my folks to some open houses so they could get a taste of what we are seeing. Their eyes were opened as we discussed how far off from a reasonable deal these homes were … especially with the rate. They couldn’t believe the condition, the price . The Realtor was even agreeing to all their statements of dislike but saying that it would go at that price (this was back @3.5% rate too, i should take them again). Bottom line is that from this potential buyers eyes, i refuse to buy from here moving forward even if the values increase more… my rent is locked in so far below the line that i’m better off where i’m at and investing elsewhere for some yield.

Good luck buyers and sellers. Try to look for an equity purchase from the 90s or earlier. You will find that people are more reasonable in that realm. I hate the 2010 flips and the 2005-6 recovery sellers. Always weak situation for the buyer as they just try to pawn off the home for quick cash to get out of their situation. Almost EVERY SINGLE ONE…

It’s a non-starter for my family. Both my sons have held off buying because they both feel house prices are still too high esp in light of soaring property taxes and home owners insurance costs. Add that to the ‘sequestration’ going into effect for hundreds of thousands this week and we expect a serious correction (drop) in sales and prices.

While foreigners may be bringing in cash to Cali, that’s a very local and special market. Most of the buyers in America still take out a mortgage, esp the younger folks.

Generally my sentiments and experience up here in the BA as well. I assume that the average non-investor buyer has as much financial sense as the average American. Meaning not much. Hence the bidding craziness. I don’t play it.

I only hope that the recent rate hikes blow some of these overbidders out of escrow over the last month. Serve them right.

[..]I hate the 2010 flips and the 2005-6 recovery sellers.

I couldnt agree more.

I sold in 2004 and have been reluctant to buy back in ever since. Prices in the Sacramento area never really came back in line with real wages unless you were happy to live in less than desirable areas.

Approaching retirement and witnessing the echo boom my wife and I are looking at alternatives to purchasing.

You touched on an important point regarding frustration of buying:

Even if you realized the place is not a good deal, you’re still competing with dozens of other people that either do not realize this, don’t care, are less financially responsible than you, etc. that are either directly making bids against you or are buying up places around your home of interest and are driving up comp prices.

I would love to resell by box back to a sucker at the price I paid for it in 2005 (I was the sucker, moving from an east coast town with virtually no bubble, with no knowledge of the LA market, back then). But even if I did, I’d still lose because I haven’t seen any appreciation for almost 10 years. At any other point in near history, I should have seen at least 100k+ in appreciation at the 10 year mark. At this point, I’ve already thrown in 150k+ in principle and interest and have -50k to -70k from the purchase price to show for it, even after the Fed. I’ll eventually let a renter burn off the rest of the debt I owe on it, even if it means negative cash flow. I’ll never give another scumbag realtor, selling up the ‘virtues’ of ARMs and such, another opportunity to profit from the sale of it again.

Yes, the home builders don’t seem to be buying into this housing “rally” as their new start numbers are still very low. July is the peak buying month and it’s down hill from here on out. Couple that with rising rates and the housing rally may be into a big stall mode.

Great observations once again

Time will tell how this all will play out

JVP

Everyone talking about the current Real Estate situation is talking about “affordability” is some Universal Constant that never changes.

What if it’s not? What if the new SoCal reality is that “Middle Class” means a 2BR condo in NoHo instead of a 4BR house in Pasadena?

I think a 4bed house in Pasadena has been out of the question for the middle class for many many years unless the “middle class buyer” has lots of cash. The issue is not a middle class buyer affording the 4 bedroom house in Pasadena, it is a middle class buyer not even being able to afford a 2 bedroom condo that is the issue!

Or, as in my case, a middle class buyer priced out of the 4 bedroom market despite having half a mil to put down. Yes, I could stretch and pull it off but my life is much superior renting a 4 bedroom house I don’t have to pay taxes on or make repairs on.

In San Diego the house I want runs about 5K a month now with all associated costs, while I rent a house for 2100 a month. Yes the house I rent isn’t as nice as the one I want to buy but even the house I rent would cost 4K a month to buy and would require 100K in remodeling costs.

At this point paying rent of 2100 a month and then buying 1900 with the savings of GE stock makes more sense.

GE really? You’d be much better off stacking silver @ sub $20/oz.

Thank you for your advice on how to invest my huge amount of savings I am reaping from renting versus buying. But I bought over 3500 ounces at an average of about 5.25 an ounce (won’t go into gold) .

Do you mind if I don’t have all my eggs in one basket?

Good point! I wonder about that too.

I think the new middle class IS a 2-br condo, and 3-BR if you’re lucky. As we continue to urbanize – which is a GLOBAL trend for cities like Los Angeles/SoCal coastal region – land and homes will be at a premium and more people will turn towards condo living, much like in urban Europe or the East Coast. Having lived in a few countries and East Coast cities, and as an environmentalist/energy market watcher who cheers the (slowly) growing rail system here, I don’t have an issue with these trends. Life is actually somewhat simpler with less stuff/less space and the feeling of neighborhood/community can be strong with increased walkability. There are tradeoffs, for example: we’d love a garden/yard but would have to make do with community gardens and parks. I think the “status” implications of condo living will change over time with economic trends (for example, fewer millennials are buying cars and more are looking for walkable neighborhoods with character and community), but it will be a slower shift for SoCal given our entrenched car-centric culture.

And still, condo living continues to be out of reach for my family (we gave up on the SFH hunt a year ago). We’re in the $160+K income range with a two earner family (pre-bonus) and 20% down, and we can’t find anything reasonable near our jobs on the Westside. Small dingy condos in good school districts start at $650K, which never works out on the rent vs own scale. NoHo is very doable, and increasingly attractive for the new millennial/Gen Y approach to life. I’d just like to see more of the same in central or Westside LA where so many jobs are located. I think the real problem is that so many middle class jobs are clustered in Culver City/WLA/Santa Monica (look at business development policies of the last 25 years for these geographic trends) and there’s no middle class housing – even in condo form – within a reasonable commute. These workers are stuck with untenable commutes/quality of life in order to own or are members of a permanent renting class. We’ve chosen to rent. We have undermarket rent in a central LA 2-br duplex that will work until our child is school aged. We still commute, but it’s manageable. We’ll keep renting and plowing our extra money into savings/investments for the forseeable future, while continuing to look for an affordable condo lifestyle. We can play the long game, and I know it may take 10 years before the dust settles on this market manipulation/interest rate madness/buyer and seller bubble reactions/low-rate-refi-inducement-to-stay-put craziness of the last ten years. But I want a better understanding of the market fundamentals before I buy, and I haven’t seen any true fundamentals in a while.

What a communist. Look at all your tree hugging terminology that no veteran in my family fought for, ill tell ya that.

On the RE note, thank you though for saving me some gas. I commute 60 miles via car to an a/c guzzling home in Rancho Cucamonga and love this city. You could get 4000 sq ft for your budget out here. You couldn’t pay me $650k to live in western L.A, mostly because of liberal freekazoids destroying it.

Maybe “papanow” can find some other blog to troll?

If west coast cities had density, no one would want to live in them. Having lived in SF and LA, I can tell you that a lot of people dream of someday getting that nice house with a backyard and still getting to live in an urban area. It’s what contributes to their being destinations. Even with density, transportation would still be a problem. Building a subway in LA costs around $1 billion/mile or more, and there’s just so much area to cover.

You’re better off waiting. Housing prices will go down – interest rates, lack of demand, boomers selling. Just wait, you’ll probably end up in a better position. The other alternative is to go to a more convenient city if your jobs allow. I know parents in LA who go through hell each and every day getting their kids to school in traffic, then go to work, rush to pick up kids at daycare, then battle traffic home. It’s so much stress, and it lasts for decades.

PapaNow, he said that condos start at $650K, not that his budget was $650K, and he’s renting. I think his post hits the nail on the head, and it’s why we’re leaving L.A.

aimeel, with all due respect, I’ve been on this blog a couple years now, troll I am not.

Look at the OP’s use of terms such as “COMmuniuty, status, community gardens, condo, referencing socialist Europe, and even their name “dreaming green”. None of these terms imply rugged individuality or “to each their own”. In my free America which seems to be dwindling, none of the OP’s ideologies exist.

After we were back to back champions in two World Wars, we purposely expanded our culture to be specifically “car centric”. Levittown, NY anyone? Route 66? The great American roadtrip? Los Angeles freeways? This is how it’s supposed to be.

Now if the Gov would back off and stop manipulating, take away food stamps (SNAP/EBT), campaign contributions (bribes), and make everyone know the meaning of individual strength and earning a living, then none of these problems would be happening.

Wow DreamingGreen, you are in the exact same boat we (my family) are, and prices are a little lower than the west side (not much!). We have the same financials and rent a large 3 bedroom two level apartment for $2150.00, buying a SFH or Large Condo is completely unrealistic at the moment.

We have friends in Valencia, we just visited, they have the American Suburban Lifestyle for $400,000.00. The problem is My wife and I would spend couple of hours a piece extra in the car each day, their goes our quality of life out the window.

So renting it is I guess.

“aimeel, with all due respect, I’ve been on this blog a couple years now, troll I am not”

True enough — being new to the blog I would not know how long you have been contributing here. However, one of the things I thing is great about this blog is that the vast majority of people are really nice and don’t need to insult one another. Pretty unusual to have such a high level of consideration, from what I’ve seen on the Net.

So even though you may have some valid points, they get LOST in the nastiness. There is just no reason to be unkind.

the “green” movement is a communist movement in disguise. How else would the invisible hand get you to fall for it?

Myron Fagan covers part of this topic in his illuminati exposed recording from over 50 years ago. Listen to it on YouTube.

The word ‘liberal’ is also another word to disguise ‘communism’.

The entire Los Angeles metropolis is a socialist conspiracy which started in 1908 when bureaucrats/socialists/communists decided to spend the equivalent of 0.5 to 1.5 Billion dollars (depending on how you calculate inflation) on the Los Angeles Aqueduct to supply water to the region.

The socialist conspiracy continues to this day, where major water utilities often hold the cost of water well below true market price (and often run at a loss), subsidizing real estate, farming and business development.

http://en.wikipedia.org/wiki/Los_Angeles_Aqueduct

And that ain’t the only big socialist expenditure regarding water in the state. The whole state is one big socialist project to move water around to develop farming, business and real estate. Socialize the cost. Privatize the profit.

I won’t even mention the socialist conspiracies to give public land away to railroads and fossil fuel companies, or USGS surveys, etc. so that the true costs of developing and energizing societies aren’t seen directly by the end users.

These things must have had an enormous tax burden on makers of horse drawn carriages and buggy whip makers – good, free market businesses of their day. Probably hurt a lot of the private water drilling businesses and the folks that made windmill pumps to pump the water out of the wells – all good and fair capitalist businesses that probably because of these tax burdens and socialist plots got shellacked to the point of near extinction. I won’t even mention the nice wind driven tall ships, schooners, etc. and other sailing vessels that died off in the face of steam and diesel ships whose energy came from the subsidized coal and oil markets.

http://bit.ly/12mZEG3 (Venture Capitalist group’s assessment of historical fossil energy subsidies)

Anybody living or making money here is a socialist.

Anybody using tap water to bathe themselves instead of purchasing their water from a bottling company that didn’t use any government muscle to secure their water sources (good luck finding one of those), is a socialist. It’s just that the T.V. tells them they are not.

———————————————————————————————————-

By the way which is more socialist?

When the price of oil skyrockets, causing an economy built on cheap oil to tremble,

A) The market reacts with innovation and creates new technology that uses less oil (efficiency).

B) Society reacts by spending trillions of public dollars to ensure whatever is left over is ours via wars in the middle east, socializing a large amount of the true cost of oil, which artificially suppresses innovation and planning for energy efficiency.

Maybe Papanows veteran’s should sit down with VietNam vets against the war and wake up to the real point of fighting for freedom as if USofA has done that since WWII.

Papa there was not a whiff of communism in dreamingreens post. Something must be drifting in the fumes on your commute. Your right wing politicians by the way are the ones who shook hands with the devil communists you loath to create the economic world we inhabit. today.

You’ve always come across as a bit angry in your posts – remember you were going to leave Calif because of affordability close to work, head to Texas and live the good American life. Now you’ve bought into the SoCal commuter life style and 50’s American knee jerk world view. Chill out and let green share the tribulations of California real estate without the hostile response.

Wyeedyed,

You are incorrect. I believe communism, at the very least I’ll say socialism, and both are evil. CA is proof.

The 50’s were the peak of America, lets bring them back!

And I never said I’d move to Texas, I loathe Texas. Your confusion is with St. Louis and Des Moines.

P.S. Do you agree the current corrupt state of fascist market manipulation is acceptable?

The fundamental problem with SoCal is that there are too many people, period.

Whether the issue is affordable housing, pollution, schools, congestion, whatever, the discussion gets centered around symptom relief instead of the source of the problem.

I’m not sure which camp is worse – those in positions of power, influence, and wealth who push “growth” for us and convienence for them or the density advocates that think it’s up to them to decide for the rest of us on how to live.

Papa might feel some anger about the current state of affairs. Not enough people are, yet.

Interest rate rose Friday and have risen because there is a growing consensus that the Fed is going to “taper” QE.

Friday’s job report pushed even more people to think so as the initial reaction was that the report was really good and an indicator that the economy really is recovering.

Yet as you point out the jobs created were ALL part time!

Will the Fed accept part time growth as evidence that the economy is on the mend.

I’ve pulled some stats on the job report here and provide copious commentary and even a pod cast:

http://smaulgld.com/part-time-usa-how-part-time-employment-is-impacting-the-economy/

Might it be that rates are rising not because lenders think the economy is improving, but because they realize “the jig is up” and rate suppression will fail?

This is interesting. But I think the FEd will jump in-can’t have affordable housing for the masses, the bankers need to suck every drop of blood from us peasants.

And wait til this kicks in:

Middle class squeezed by historically high debt loads, stagnant incomes, increasing job loss,, student loans eliminating natural rhythm flow of investment and a net worth largely dependent on housing.

Enter the EPA>

The EPA, along with destroying businesses, granting millions of tax dollars to the UNU-ISP (your taxes back door funding the UN), is about to destroy home ownership.

On February 4, 2013, the Obama government issued a press release on how it plans to gain access into your home. What follows is an edited snapshot of the government’s planned intrusions onto and into your private property. I would love to be a ‘fly on the wall’ at the next Blackstone meeting after they get wind of this:

“Additional costs will be added to how new homes are built, whereas the sales of older homes can be stopped in their tracks until they meet stringent government codes.”

“The new federal EPA, HUD and DOE home regulations filter down to local inspectors who are required by law to impose them or fail the home inspection. Unnecessary and unreasonable code can be imposed on homeowners who find they “can’t fight code.†There is virtually no appeal.”

“…the Environmental Protection Agency will have power to force many homeowners to virtually rebuild their homes to meet stringent environmental requirements before they can sell them. Living in a house that does not meet the EPA’s “green†regulations for roofing, windows, doors, insulation or heating and cooling systems will be slapped with fines. Electrical companies are now installing “smart monitoring systems†to track usage of energy by residents.â€

Homeowners vs. EPA Home Invasion

Posted: 11 Feb 2013 04:02 PM PST

By: Sharon Sebastian

This is part of a much bigger plan, when thousands of people are forced to ‘walk away’, and that includes the hedge funds like Blackstone that have been buying thousands of single family homes, the federal government will ‘have no choice’ but to seize the properties (Agenda 21). IMHO

The EPA and the rest of the federal regulatory agencies and Obama’s 32 czars are working more for the advancement of the UN’s take over of America than for the American taxpayers.

The rumor about the UN taking over the US has been around for decades – Google it. The far right trots out this tired horse every so often. Please focus on data and facts, not the propaganda put out by the far right (or far left, for that matter).

Typical. Democrats are always blamed for destruction of our country.

Who signed into law the EPA? Nixon

Who was the author of the biggest power grab, The Patriot Act, in the last 100 years? Bush Administration

Who gave automatic u.s. citizenship to millions of illegals which only encouraged more to follow? Reagan`

Who got NAFTA passed and Glass-Steagal repealed? Clinton.

The two party system is a sham and set-up for suckers to think they have something to believe in and a side to take.

CAE,

I feel you, but there is no “two party system.” Political parties aren’t mentioned in the Constitution. There is no limit to the number of political parties permitted to exist.

What’s the root of our ills as a society is an ignorant and apathetic populace. Beyond that, it’s political funding and campaign finance policies that favor the status-quo, incumbents and global corporate interests.

My wife and I were on the wrong end of the last bubble….long story short, we foreclosed.

We are now able to qualify for an FHA loan again as of this month, we have been saving up for the last 3 years for this moment, AND here we go again, home prices here in CA are ridiculous again!

We are already pre-approved, the home prices that looked so tempting 2 years, hell, even last year, are gone, homes were going for $200-$300k in the areas we wanted, now they are well into the $400-550k range…

NO THANKS, we have learned our lesson, investors can keep their homes, rent is only $1200 monthly, we are saving $1500-$2500 each month easily, once home prices get back to normal and we are ready to try again, we will have a nicer down payment

@aguerr211

There is a big assumption on your part that houses in Cali will return to ‘back to normal’. Like Jim M posted earlier:

“…What if the new SoCal reality is that “Middle Class†means a 2BR condo in NoHo instead of a 4BR house in Pasadena?..”

I purchased a house I will live in the rest of my life (self employed, kids off on their own) for an affordable price. Given that, there was no point in me holding my breath for an unknown about of years to wait for prices to improve. Besides the places I wanted to really live (Venice, Santa Monica, Culver City) will never again be ‘affordable’.

We’re similar in that we’re self employed, which, I think, provides us with a more genuine “reality check” on the economy than most. While I agree that those are great areas to live, it is not populated exclusively by those who are financially independent. So, as jobs are chased out of the state–or incomes come more in line with the rest of the nation–I think there will be pressure on housing prices across the board. We are fortunate, as the self-employed, that we get to keep the profits from our business. Most employees are commodities, more or less, and the Southern California economy has shown e cost of that reality ever since the aerospace bust.

interestingly “this is intentional.” hmmmm. “don’t worry…it’s for your benefit!”

Question for the pros… Would you try to jump in in this environment? In the NorCal market. We don’t have tons of money to put down, and are single income. Mid 6 figures but if that stops (and it doesnt take long for that to happen) we’ll be up the proverbial “creek” pretty quick.

One thing left out the picture, banks can and do make money when rates go up. And, the big boys make money shorting on the way down. The real sucker is Bill Gross who apparently loaded up his clients at the ten yr. 1.36% earlier this year. It hit 2.76% today. That is around 20% loss of principal at this point.

Thank you Dr. Housing Bubble for the excellent explanation of interest rates and mortgage costs. I think now everyone gets it.

Deflation in housing prices as a result of higher financing costs is a huge boogeyman for the Fed. Such an event would reset all the issues of strategic defaults from the 08-09 period. Bill Gross was betting the Fed cannot allow that to happen, especially with all the effort the Fed and banks have gone through to put housing on a growth footing ; i.e., low interest rates and constrained availability of foreclosures. So far, Gross has been proven wrong. Longer term, he could very well be correct.

The only important question is whether the major central banks are in the early stages of losing control. Personally, I am completely baffled as to whether that is the case. But my hunch is that we are going the way of Japan’s 20+ years of stagflation and that international events….political and economic… could easily trigger a flight to perceived safety in the US Treasury market, driving the 10-year below 2% once again before year’s end.

In the new normal era, anything can happen…that’s the only sure thing !

The bond market has the final say, and it seems the risk premium is widening. Don’t think so? Let me ask you a question: Would you accept 3.5% returns on what we now know can be a risky asset – housing? I wouldn’t and I don’t think MBS holders would either.

“Middle Class” means commuting to Rancho Cucamonga and Riverside, if you want to own, period. Do the research on class status and income levels, it takes $100k a year in income to break into the “upper middle class” bracket. And even $100k a year in SoCal is not that great standard of living wise. Looking at the nicer areas, with people that are doing it honest (not “fake it til ya make it”), they are pulling household incomes of $150k or more. I know this from experience. Now in SoCal, there is plenty of room for those high level people, no doubt about it. But so many people want to live here, they are not all “winners”, so you have a lot of slummy areas.

There are also the legacy folks, people who have passed homes down 2 or more generations from the good ol days. They are blessed in that sense. But i’ll tell ya, for Jow Sixpack that gets recruited to his first post-college job with little to no family support, it’s an uphill battle making a living in SoCal.

Yeah, the problem we’re facing is, if, with our lower six figures income, we can’t live in some of the nicer areas of SoCal, why be in SoCal at all? I don’t expect to be able to live on the beach, or in Beverly Hills, etc., but there are amazing cities all over the country where that kind of salary goes a long way, so despite me being here for 15 years (and my wife was born here,) we’re headed out of state. I’d rather live in a beautiful, 3000 sq. ft. Tudor show house in the best, old neighborhoods of a large midwestern city for $400K+, rather than in a small house in Corona. It really isn’t even close.

The key thing you misunderstand is that most of the 6-figure jobs are in the film/entertainment industry in L.A… And those jobs don’t exist outside of L.A., atleast not with the 6 figure salary attached. So moving to a large mid-west city and expecting to make the same or even find a job is a fallacy.

It’s the entertainment industry salaries that inflates home prices in SoCal.

Socal-

I believe there is truth to what you say, but I also believe it is much broader than that in some senses. There are way more than just entertainment jobs that pay 6 figures in SoCal areas. And on the flip side, I lived in Hollywood for a bit and most people are hourly wage earners that are barely making it. Key Grips, makeup, sound, etc.

There is a lot of auto, aerospace, and electronic engineering in this area that pays quite well, I know engineers well into the 6 figures. The “public sector” pays quite well too but lets not even go there. Lots of lawyers, head chefs, and athletes from all states have homes in West LA and OC too.

Even the IE has it’s share of good paying jobs, but certainly not for the masses. Every warehouse out there has upper management, there are some successful business owners, lawyers and doctors as well. Those nice neighborhoods with nice big homes are all good and well, (anything touching the 210 fwy or south of the 91 fwy) but when you look deeper and see there are far, far more apartment homes and older small neighborhoods with graffiti, it starts to come together.

Lastly, about the Midwest, it’s my former home and we just returned from a trip there. Many economies are doing well like Omaha, Des Moines, Minneapolis, etc. There are good jobs there and cheaper cost of living. Factories still exist, and $17/hr is a livable wage. $30+ an hour is acheivable with certain skill sets or years of experience, and you can live quite well of $30/hr in the Midwest. A lot of Cali jobs don’t even pay $30/hr, and the unemployment rate is quite low relative.

Homes range from $100k to $300k depending on size, neighborhood, and condition. I know many with $100k homes that are just doin the grinf, livin the life if you know what I mean. Home was built in the 50’s or 60’s, probably hasn’t been upgraded much, has a nice finished off basement though with plenty of yard and garage space. 3/2 and about 1500 sq ft average. $250k gets you a nice late model home with all the amenities. Most commute less than 20 minutes to work, and a line of 20 cars at a red light is aggrivating. A “sig alert” is the extra traffic after 5 pm in December as everyone is rushing to the mall.

I actually own a small business in the entertainment industry, but, like many jobs in the field, the all digital work flows have facilitated the option of living and working from anywhere. My business has gone from medium sized office, to small office, to home office in L.A., to, now, a home office anywhere. While I’m sure the entertainment industry does help keep home prices high, I think people in the industry still spend outside of their means, and it still doesn’t make me want to buy a $400K box in a bad part of town, or my neighbors 1630 sq ft home in Studio City for $1.2 million, when I can just move to Minneapolis, Indy, Cleveland, etc., and live very well. I’d probably need to be making millions to justify staying here, but I understand that I’m in a somewhat unique position.

Chinese buyers flood U.S. housing market:

http://money.cnn.com/2013/07/08/real_estate/chinese-homebuyers/index.html

Chinese buyers accounted for 18% of the $68.2 billion that foreigners spent on homes during the 12 months ended March 31, according to the National Association of Realtors.

Japanese investors dumping U.S. treasuries:

http://blogs.marketwatch.com/thetell/2013/07/08/surprise-surprise-japanese-investors-are-dumping-u-s-treasurys/

Rates poised to jump again:

http://blogs.marketwatch.com/capitolreport/2013/07/07/mortgage-rates-poised-to-jolt-up-again/

Mortgage industry weeps:

http://www.mortgagenewsdaily.com/consumer_rates/315494.aspx

The rate increase wipes out that 15-20% gain from last year (in more sane markets that only went up 15-20%), for that 70% of the people who finance. That percentage will be increasing if investors flee, and it seems now the prices can only go down, which I expect would signal others to sell. Even with ‘unconventional’ loans, I think we’ve seen the top of many markets. We’ve seen that foreclosures don’t ‘flood’ most markets, the banks are taking their time. Inventory is increasing a bit for summer but I don’t expect it to be substantial – yet. After summer if it continues to increase that might be a sign that people are exiting their investments.

Given that the Fed can almost immediately change the rates by promising to extend QE instead of tapering off, it’s very hard to determine whether we are in another round of lowering prices over the next couple years. My best guess is that the Fed will taper off and then announce another round of QE as they realize the system is still hemorrhaging, and we’ll go through another trough before the cycle repeats.

All of you on the fence should wait and see how this goes, and time your entry at the next trough. It’ll be decades before the fundamentals restore what was once available historically, if at all. I think we all need to decide whether we are willing to ‘overpay’ to own a home in this generation, or simply give up on the idea and be happy with a rental. The way I see it, while home ownership requires some good financial judgement, it shouldn’t be treated as a financial investment, especially when most people are emotional tied to the concept and not so much financially.

It was always my belief that there was a benefit to buying a home. There should be something you are gaining by putting a sizable amount of money down in return for home ownership. Perhaps….a lower monthly payment!?

I exited the market last month in trying to buy a Condo in South Orange County and decided instead to become a renter. My budget I had when I was buying was $250,000 when I started looking in February 2012. My criteria was 2 Br, 2 Ba with a 1 car garage in a good neighborhood. There were quite a few properties to pick from last year but unfortunately too many buyers with cash were participating and forced me out of the market (You all probably have similar stories). At the time, if I ever wanted to rent the property out it would have translated into roughly a 7% return.

In the first week of looking for rentals, I found a 2 huge dual master bedrooms, 2 Ba Condo, with a garage about 3 miles from Laguna Beach for $1675/mo. Similar properties in my complex are currently listed anywhere from $375,000 to $450,000 which translates to about $2,300 per month if you put 10% down. With HOA’s this payment comes out to $2,650. If you were to buy one of these places today and rent it out, you would earn around a 4% yield. That’s over 40% less than what you would have earned if you would have bought the same property last year!!

That’s a heck of a sales pitch to try and make to potential buyers…

Potential Buyer Talking to Realtor: “Let me get this straight, I can pay about $50,000 upfront, AND an extra $1,000 per month for the same property I was renting with NO money down for $1,000 cheaper!?”

I saw similar $1000 monthly payment rent vs buy discrepancies in West LA in May, which is when we quit the market for the time being. Except in WLA, the condos were $650,000. We had a sizable downpayment, but it would still have cost us $3300 per month, versus $2300 for comparable rents on the same street in similar condos/apartments. When we realized we’d never be able to rent it out for remotely what we were paying (at least not for the next 20 years with inflation) it made no economic sense. And you were only talking about a $50k downpayment!

More than anything else, it will be the blowup of jobs that will effect the price of everything the mostl

Dude, totally. Cost of living to incomes is already at a breaking point. Look at the younger generation with almost nothing. How the hell are they going to afford anything?

I have to chuckle when I see people panicking about 4.5% mortgages. I bought my first home in 1982. I had a private 12.5% mortgage because banks were charging 18%. In 1986 I became a Realtor and rates were 12%, but dropping. Houses were selling fast-average days on market (DOM) was 18 days. Nobody whined about rates.

It was all 30 year payments, manipulation, then in the 80’s too, houses were 100k – 130k in good neighbors near the beach in San Diego. We bought one.

I remember thinking I was so thrilled, ha, to be paying my older cousin’s appreciation from 35K house, bought in the 70’s, in irvine to over 100k. Talk about being caught in the Matrix, as I like to call it, lol.

We are all part of the 30 year+ credit living structure, yeh! Thanks to the Bretton Woods agreement, made by the Mary Poppins bankers up in the upper room!

I am proud of all the young people walking away on the 30 year payment, one year, price increase rise gimmick. What a country.

Roddy, I think people in part are panicking because rates have gone up and prices aren’t coming down at least not what I am seeing in my neighborhood. Here’s a little example, I bought last year and have a 3.5% 30 year fixed for 417K. The payment is $1872/month. If I were to buy the same house today using the same down payment I would likely have to get a loan for 500K and likely a 5% interest rate since it is no longer a conforming loan. Payment for this example is $2684/month. That is a whopping 43% monthly payment increase for the morgage. Most people just look at the monthly payment and a 43% increase in one year is HUGE. This can’t be refuted!

@Lord Blankfein wrote: “… I think people in part are panicking because rates have gone up and prices aren’t coming down…”

Prices are stickier going down than they are going up. The people who locked in the 3.25% rates in May are probably closing escrow right around now. So those selling prices do not reflect today’s 4.6% (50% increase).

What will happen next is the buying frenzy drops to a trickle or no buyers at all. Eventually sellers adjust their asking prices to reflect the higher rates.

So I would not expect a plateau in prices until August/September since most escrows are 30 to 60 days and those that locked in the 3% rates are still in the process of closing escrow.

If you’re looking for price drops, maybe October would be the earliest time frame.

No offense Roddy, but your post reminds me of insufferable guys I see/hear rambling on about how they moved to Cali in the 70’s in a VW van, rented a room in Newport for $100/mo, in a year or two scraped together a down payment (with a middle class job/wage) to buy a beach shack in 1980, they can’t understand the younger generation and their worries. Achieving the Cali dream is easy…chuckle, chortle, snort!

A lot of dynamics have changed since 1982.

A lot has changed in CA since 1980. Not the least of which is a doubling of the population.

Roddy, house prices were about x10 less expensive then. Chuckle all you want about people being concerned about 4.85% rate when the mortgage debt they require to modest home, probably similar to the one you bought for a few dollars, is often $400K+.

What % of those sale were done with assumable mortgages?

240,000 full-time jobs (i.e. 35 – 40 hrs /week) lost b/c Obamacare is kicking in soon. Employees must work no more than 24 hours or less to avoid mandated “benefits”. So let’s just create 360,000 part-time jobs and companies dodge paying for it, GENIUS!! Healthcare premiums are poised to triple for current workers to offset the newly covered employees, GENIUS!!

So, more part-time workers making less income will go out and buy mania condos/homes?

And full-time workers with higher insurance premiums, and offered higher interest rates will still purchase mania priced homes?

WTF?

The data is coming in:

Go to the trends section toward the bottom of the page and take a look:

http://www.redfin.com/city/14498/CA/Pasadena

Pasadena Highlights:

A) Sales down 8% from May to June!!

B) Sales down 7.5% vs. June 2012!!

C) Price per square foot, down 3.2% vs May!! This may be seasonal and price per square foot drops if houses listed are bigger. However, looking at data, smaller, not bigger houses are being listed at the median price.

Pasadena is one of the forerunners in the “recovery,” with prices back up to over 88% of peak. Other cities in area are lagging and may still be climbing in price.

Has the housing worm turned over?

For anyone thinking that the Federal Reserve can hold down interest rates forever, they are dead wrong. Japan is a special case. Most of the Japanese debt is held by citizens of Japan. The U.S. debt is held by the Federal Reserve, foreign countries, and the Social Security trust fund. The U.S. debt situation more closely resembles Greece, Spain, Portugal and Italy than Japan.

A huge chunk of the U.S. citizenry, as opposed to the Japanese citizenry who are net savers, are up to their eyeballs in debt. If it weren’t for petrodollars and the U.S. dollar being the world’s reserve currency we’d be looking at some very nasty interest rates right now.

Congrats to these flippers, $405K bump in nine months. Wowza!

Bought November 2012…$495K

http://www.redfin.com/CA/Los-Angeles/2000-Panamint-Dr-90065/home/7074676/itech-22165434

Sold July 2013…$900K

http://www.redfin.com/CA/Los-Angeles/2000-Panamint-Dr-90065/home/7074676

Even the cnbc lead story online now eludes to higher mortgage rates ending the party or basically the party ended, but wot be reflected in nums for a few more months. Unless bernacke can do magic PLUS the bond market cooperates, we’ve peaked it seems.

http://www.cnbc.com/id/100876300

Real estate agent I know also just admitted finally that things may have peaked as well in super prime LA. I guess we’ll see how far this thing goes down soon enough bc I have little faith in the Fed convincing bond markets all is well, especially with china going down.

The cheerleaders are still saying higher rates are not a problem-from business insdier a long standing cheerleader for QE and the “recovery”: http://www.businessinsider.com/impact-of-rising-mortgage-rates-on-housing-2013-7

I disagree here:

http://smaulgld.com/you-cant-get-there-from-here-straining-to-regain-real-estates-promised-land/

It is unfortunate that humans, of all spectrum of intelligence, view the world so linearly.

I can just picture, back in ’03/’04, some actuarian/economist with a PHD running a linear regression model using stats that describe a system built upon irrational stimuli, forecasts positive numbers several years into the future. I wish I can tap him, or her, on the shoulder and say, “Hey, YOU’RE AN IDIOT”.

Leave a Reply