The reluctant California home seller – 35 percent of homes bought pre-2000 in California yet sellers still expect unrealistic prices. Market dominated by distressed properties of foreclosures and short sales. La Mirada wakes up to mid-tier shadow inventory correction.

One aspect that is largely left out of the California housing market dialogue is the reluctant and often delusional home seller. The conversation has been dominated by distressed home sales because really this is where the action has occurred. You also need to realize that most foreclosures, not all of course, but the vast majority of distressed sales occur because people simply do not have the economic means to continue supporting their home payment. The shadow inventory is a very real indication of this troubling reality. Yet you also have a cohort of home sellers that are enamored by the peak prices of 2005 and 2006 and somehow want to recapture that incredibly inflated sales price. Many of these sellers are part of the cohort that bought pre-2000 and still actually carry some equity in their property even after the massive California correction. Today I want to examine this group and look deeper into the figures here.

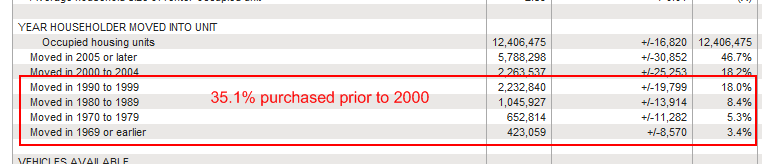

Census – who bought prior to 2000?

A lost decade is virtually in the books for California real estate. So let us safely say that many of those that bought pre-2000 have some equity in their property. How many of those people exist in California?

Source:Â Census

The number is surprisingly low. I have gotten numerous e-mails from people stating that “the majority of home owners bought before 2000†so this group would somehow be a force to reckon with. The data doesn’t really support this. First, many of these people won’t and do not want to sell. Next, how do you know these people didn’t refinance and tap out their equity? Ultimately the market can only support what local household incomes can adequately carry and if you haven’t been paying attention, the California economy isn’t exactly booming.

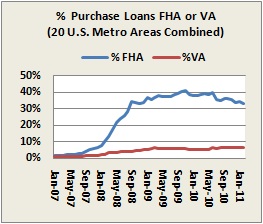

The current sales in California are being driven by all cash investors in low price areas like the Inland Empire and those diving in with low down payment mortgages like FHA insured loans:

Source:Â DataQuick

I noticed a few homes in mid-tier cities being yanked off the market. These were non-distressed home listings and probably had a good number of sellers from this pre-2000 group. Yet this group tends to have the most delusional assumptions as to what their home is worth. After months of probably no contacts, they yanked their homes from the MLS especially now that we are entering the seasonally slower fall and winter markets. Maybe 2012 will be better is the assumption. Really? Unless we see household incomes rise, we can expect more of the same.

This correction will go deeper for a couple of reasons and it also involves the public and the access to data. Keep in mind, most buyers now understand how easy it is to find the previous sales price of a home. So someone that bought in Culver City in 1995 for say $200,000 and is asking for $600,000 is now contending with the reality that most buyers that can buy a $600,000 home have the ability to go to Zillow and check the previous sales price. The ability to find this information is keeping folks from drinking the housing Kool-Aid especially after millions have been burned.

Redfin see agent sales history and activity

Speaking of this transparency, you are now able to view sales by an agent over at Redfin. Redfin calls this the “Scouting Report†and you can view selling and buying history from an agent in your area. I pulled up a few people that claim to be selling like gangbusters in this market and one turned out to have one sale in the last 24 months. An interesting tool no doubt that I’m sure many of you will be using.

What do tools like the Redfin Scouting Report show? Information is the name of the game and many potential buyers can access virtually every piece of history on a home. The fact that mortgage rates are low might have worked when the MLS had a virtual monopoly on sales history and people had to go in person to the county clerk to lookup previous sales records. That is no longer the case. The reluctant seller is thinking that they are living in the 1980s where they can fluff their way to higher prices while the buyer is completely in the dark.

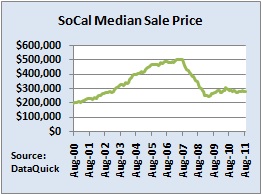

This also plays into the fact that home prices have cratered in California. Take a look at the Southern California median home price:

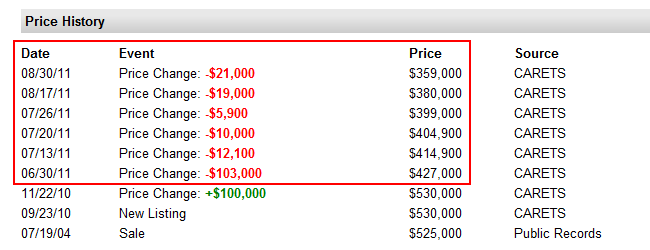

Give this market one more year and we will have a nominal lost decade (the Inland Empire is already there and inflation adjusted we are there as well). You also have these reluctant sellers contending with banks eager to move shadow inventory. Take a look at this La Mirada short sale:

Listed   09/23/10

Beds     4

Full Baths            3

Partial Baths      0

Property Type  SFR

Sq. Ft.  2,732

$/Sq. Ft.              $131

Lot Size 6,305 Sq. Ft.

Year Built            1958

This home is listed as a short sale. But if you look at the pricing action you realize very quickly that banks are getting serious:

So here is the history.  The home last sold for $525,000 in 2004. At this point the bubble was already going strong in the state. It was a new listing in September of 2010 for $530,000 and someone was simply trying to optimistically escape here. Nine months later, reality kicks in and a $103,000 reduction is given. No bites. Then it becomes a chasing the market down game. Eventually the home is reduced by $166,000 from the 2004 sales price. Yet the home is still sitting on the MLS and we have record low mortgage rates. Why? Because the economy is a mess and household incomes have contracted for well over a decade. If household incomes were solidly rising and unemployment wasn’t above 12 percent then maybe we start making an argument. The only argument delusional folks are making now is about the artificially low interest rates the Federal Reserve is trying to push.

Many reluctant sellers will remain reluctant until either they get real and stay put in their place, or actually realize this is a market where inventory is flush and households are largely getting poorer because of the economy. The leaking of the shadow inventory will put a wet blanket on the California housing market for years to come.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

117 Responses to “The reluctant California home seller – 35 percent of homes bought pre-2000 in California yet sellers still expect unrealistic prices. Market dominated by distressed properties of foreclosures and short sales. La Mirada wakes up to mid-tier shadow inventory correction.”

This, to me, is the real shadow inventory – the millions of homes people are stuck in after the massive “trade up” musical chairs game of RE sales ground to a halt in 06 and beyond. Many will be able to survive in these homes, and slowly come to the realization that they are in their last house, but spending their last years still pining for the greener grass somewhere. That may take a decade or two, and, in the case of the Boomers, will result in estate sales that will bring the home back down to market price, because the kids will take whatever to unload the old thing, with the now outrageous property taxes attached to it.

Unless the kids can be grandfathered in to inheriting Prop 13 tax rates.

Kids can. It’s called a Proposition 58 Parent-to-Child exemption. Kids inherit parents’ Prop 13 assessment.

Prop 13 transfers will likely be a small percentage as most estates will leave the equity in the home divided amongst multiple descendants necessitating its sale.

That’s certainly a fresh way of looking at it Mike. Very perceptive.

Great article, delusions die slowly. Reminds me of a quote from the classic book “Extraordinary Popular Delusions and the Madness of Crowds” by Charles Mackay.

“Men, it has been said, think in herds; it will be seen that they go mad in herds, while they only recover their senses slowly, one by one.”

The first 100 pages should be required by everyone before they receive their first paycheck.

Ha. Before they graduate from highschool.

Never in the history of mankind has a generation been more apropos to the thesis defined in “Extraordinary Popular Delusions and the Madness of Crowds†than the boomer, baby-bubble herd.

The Ivy League Hermanos, i.e. the Banksters and their Politeer enablers, have successfully hoodwinked close to 80 million “Free” citizens, conning them into voluntarily surrendering their wealth, country and even their children’s future!

Here’s the truth, written in detail, if anyone wants to get up-to-speed:

http://market-ticker.org/akcs-www?post=195434

NOTE: This is not entirely the fault of the banksters and their politeers – who only followed their greedy, duplicitous nature – THIS is entirely the fault of “We The Sheepleâ€, who continued to vote for the the (D) & (R) Free Crap Empireâ„¢ and signed on the dotted line for “FREE” money, with the hope that they’d get a chunk of meat off the table of the rich, rather than the crumbs they JUSTLY earned…

Caveat emptor indeed!

Your second paragraph pretty much negates your first not that your first is a paragon of accuracy. Let’s see in the first paragraph you blame a whole generation of people for the trouble and in the second you blame an insider group for it and tell us how “hoodwinking 80 million….”. I tend to agree with your second scenario. But there is no evidence anywhere that the boomers are unique in being crowd reactive. Clearly your 80 million are not even alleged to be boomers. Yet it seems clear you have a prejudice against boomers – one that I see here all to often. Perhaps you are unaware that one of mankinds greatest knee jerk crowd thinks is “us vs them”.

Additionally if you want to look at a crowd think in it’s most supreme example you need to study the Tulip scandal. Perhaps you are unaware that people were paying for Tulips what would be the equivalent of 100 times more than the bubble amounts spent on housing at the peak. And that sad con occurred way way before anyone even dreamed of a boomer generation. When you grow old I wonder what the young turks will slur you with.

I think the resentment against the boomers is mostly jealousy: the boomers were in the right place at the right time, to have a lot of advantages if they played their cards right. They had advantages no younger Californian especially has now. Affordable housing (and housing as an incredible investment). Affordable and readily available education etc..

Also when people pass laws that deliberately screw the younger generation (that would be Prop 13), they can expect some resentment, even though of course not all boomers voted for Prop 13.

…delusions die slowly…

If they ever start giving out Academy Awards for price delusion, Irvine (Orange County) will be nominated in all 10 catagories.

Even today, at open houses you are greeted with pontificating arrogance by the sales agents.

What’s truly amazing is that I really believe these people believe their own hype.

Certain areas (Shady Canyon, Turtle Rock) have properties that have been listed

on/off/on again for years. A few price drops for sure, but nowhere near market.

How these agents actually carve out a living [from commisions] is beyond me.

That delusional dieoff can’t start a day too early.

Thanks to Dr. HB for another very timely subject.

I believe a lot of the market was realtors. So, they are sitting on the properties for a while.

Yes, a hundred times yes. If this book were as widely read as Harry Potter the nation would be in far better shape.

Great article, but in our area (Ventura County) there is hardly any inventory for sale and the junk that is, backs up to a fwy or busy street, and is overpriced, that’s for dare sure.

We are cash (sold (regular a long time ago/waiting), so when we bid, it’s not OPM.

Case in point, a $370K listing for an almost right home.

Our agent (being the A-hole he is-scare tactics no doubt) says there are multiple bids.

One for $375K (FHA down payment of $13,125).

Another one at $385K FHA down $13,475) -notice the delta is no sweat, and of course you can throw the closing costs into the loan or get uncle sugar to take care of it (maybe). Then there is us. Not a walk away, but a real buyer. With little inventory, prices are still way, way, too high.

This sucks. We’re 825+ FICO, no debt kind of folks getting .25% on our $.

Most of our competition I meet are howmuchamonth idiots.

You have to get over how they use your hard earned savings, and good faith and credit (after taking a healthy cut for themselves), to back people you are competing with to purchase a home (who will never pay the loan back), or your head will explode.

I’m right with you SpeedItUpPlease….

It is super frustrating that money is so easy to get for people with almost nothing down. What ever happened to 20% down payments? Now it’s 3%? Well that makes the pool of potential buyers about 100 times bigger. And 1000 times less responsible.

When our trusted Federal Gov’t decided that home price appreciation was much more important than the stability and worthiness of the existing homeowner, we started down a long path of destruction.

DHB is so right, that it is infinitely preferable to have much lower home prices accompanied by higher interest rates and higher down payment requirements, than high prices and low interest rates.

The Gov’t WANTS people to be indebted up to their eyeballs, permanently (just like they, or really we, are).

Your right but confused on the perpetrators. It isn’t the govt but the bankers. It’s really quite simple. Govts don’t profit. Banks do. Not to say govt is not complicit. Govt is like a bunch of roosters who are conned into turning to the wolves that prey on their hens for the means of protecting the hens from preying wolves. Not hard to imagine how that turns out.

We are in the same position as you are here in Santa Clarita. There’s nothing but crap or way-overpriced homes on the market. When one good bank-owned shows up on the MLS, everyone wants it, and then you’re in a bidding war. We sold in ’03 and have been renting now for 8 years, and I’m sick of it. But what the hell do you do?

I’m over in Castaic. Renting here since late 2004. Then we started getting foreclosure notice despite the property management company insisting all was well. It turns out the owner had died about two years ago (our estimate based on when the mortgage payments stopped) and a girlfriend claiming to be his wife was pocketing the rent money forwarded by the property manager after the HOA fees were paid. The deceased owners estranged daughter got wind of the situation and are trying to make claims on the estate, which means for there to be any money for them there needs to be a profitable sale of this place.

So we’re in limbo. The auction has been called off at the last minute at least four times now. The property management company says they’re holding our rent payments in trust for whoever eventually comes out on top. This holds out a sliver of hope that a significant chunk of money could come back to us and help us get into a new place when that day comes. In the meantime, we don’t know from month to month what to expect. Our lease is up next April. Will we be told to leave? Will we be invited to stay under the same terms Will we be ignored and encouraged to turn squatter rather than leave the place empty?

Meanwhile, we’ve been looking around in preparation to jump if things change unfavorably on short notice. But almost everything we’re seeing in our price range is junk. And overpriced junk, at that. I’m not accustomed to a high-end accommodations but I’ve some standards. When I see the condition of some of these place it isn’t much surprise the previous residents couldn’t keep up with the payments when they couldn’t manage basic hygiene.

We see the same thing, Fannie and Freddie homepath. It’s tme to let the chips fall where they may and let real investors get in. We offer all cash, yet get beaten out by a few thousand by people on contract, if you can’t come up with 20% down then you should not be allowed to buy a home. Skin in the game.

Home prices are unlikely to recover before 2020 and mortgage defaults will persist for years, says a survey of bank risk managers out Friday.

In addition, 73 percent of surveyed bankers say they expect mortgage defaults to remain elevated for at least another five years.

Patience is a virtue.

Once again, please define what a home price recovery would be. Are we saying that home prices get back to 2007 levels? I am still waiting for the NASDAQ to get back to 5000 and tulip bulbs to get back to being worth an entire farm.

http://www.cnbc.com/id/44735283 The survey conducted by the Professional Risk Managers’ International Association for FICO, found that 49 percent of respondents do not expect housing prices to rise back to 2007 levels for another nine years. Only 21 percent of respondents said they would. The findings, which authors called “a decidedly pessimistic outlookâ€, are a sharp reversal from cautious optimism the survey respondents expressed late last year and in early 2011.

When do you suppose the NASDAQ will recover (get back to 5000)? I believe we are past the 10 year mark and counting…

Even if the home prices were to go back to a 2007 price tag in 9 years, the money will not be worth what it was in 2007. Thanks to the printing press at the Federal Reserve. Every time Bennie B turns on the presses for his QE1 and QE2 and now planning QE3, it devalues the dollar . So, if in 9 years you actually got the same price tag as the house sold for in 2007 the dollars won’t buy the equivalent in purchase power they had in 2007. Either way your profits are GONE!

I don’t think the prices will “recover”. Typically housing value appreciates very, very slowly (1%) once inflation is corrected for. If you look at historical housing prices measured in inflation adjusted dollars, the houses are right priced now. DHB has some valid points to make about income, and California prices are out of whack compared with the rest of the ountry. They might go down some more. There is no reason to expect their value to climb in real terms any time soon. The housing bubble was a once in a lifetime event.

If a bubble buyer is waiting for the dollar figure sales price of the house to match what he paid for it before he sells, he is basically asking for inflation to mask the loss that is all but locked in. This is just alternative reality thinking. We have a fiat currency. The value of the dollar is arbitrary. $1M in 2006 will not have the same purchasing power as $1M in 2016. In real terms, that bubble house is and probably always will be a loss. I don’t think the greater fool theory works for bubble buyers. It seems event the fools might have noticed that real estate might have been overpriced for a bit there.

A fantasy, by my definition. Those numbers should never be seen again unless double-digit inflation shreds the dollar for a good while.

The first home I can remember from my childhood is a good example. (584 Galsworthy, Thousand Oaks, CA 91360) My parents moved in for something like $15,000 in 1967. In 2006 some lunatic bought it for $565K!!! Unless some amazing stuff was done to the place since we left in 1974, this was nothing more than utter bubblicious insanity. Don’t be fooled by the lot size. Much of it is at a 45 degree angle with three levels. It looks like the huge oak trees that took up much of the second level are gone, as are the horse corral my older sister built and were still in use until the early 90s.

Given, Thousand Oaks has become a pretty desirable address but this is an older, cheaper part of town. Barring drastic inflation there is no way that price should ever have existed. Until it sinks in to one and all that the market high was a gross distortion and isn’t coming back without another form of economic disaster, we’re going to keep hearing these silly claims.

John CPA JD

I agree 100% with your post and your closing statement, but we have 5 rents going right now, and our incomes took a major hit, so to speak. We need affordable shelter. And of course, we are Baby Boomers. A fair priced home that would work would help not only our cash flow, but protect our capital. IMHO, this is a Depression. This is not a liquidity issue, it is structual. The way I look at overpaying (which we will) is how much time I have behind me, and in front of me. Time is clicking away. But you’re right.

I think it is liquidity. The problem is that because inflation is so remote, cash has become seen an investment with intrinsic beneficial advantages all on it’s own. The Fed can keep pouring money into the system, but it is self freezing. it just builds up.

Imagine what will happen to all this cash when the specter of inflation returns. A hint of inflation will melt all this frozen liquidity and cause more inflation.

This is my response on a similar thread on patrick’s site – similar topic:

[Begin Quote]

You have to understand that an entire generation (Boomers) grew up and lived most of their adult lives under a real estate scenario where RE prices went up, sometimes spectacularly.

Yes there were a few years of backwardation (early eighties and mid-nineties) but generally prices went skyward, especially after the dot com bust and Boomers determined to use their home values as an alternative to savings to fund their retirement accounts.

This is a generation of 76 million, of which only 10 percent has passed away.

Old habits die hard and the fact that RE going up is primarily what this generation experienced and benefited from is the main reason why the bubble mentality, imo, will be with us for at least another 10 years.

“You can’t teach an old dog new tricks.”

[End Quote]

~Misstrial

I think you’re dead-on here. I hear many Boomers talking like this is a standard recession and soon things will be good again. Home prices will rise and people will want to buy. When I mention that absolutely dismal unemployment figures, they don’t want to hear it.

Is boomers another word for stupid? I’m just asking. It seems to me, smart people live frugally, pay off their debts, regardless of their birth-year.

CAE–

Again, has less to do with unemployment than most people realize. It’s a demographic argument – employment #s would just partially mask the real problem.

CAE

No way on God’s green earth is this a garden variety recession. No freak’in way. This took 30 years to build up, and the core of our economy is gutted, our monetary system is in shambles, out jobs are either outsourced or insourced, and we are collapsing in low motion. We have now approached the end game, imho. They can mentally m*sturb*te the masses with prosperity is coming back, but I think we are modeling Japan and Japan’s housing market. (I deleted my GDP rant.)

Housing is way out of whack from reality. Not only do I think we’ll see reversion to the mean, it will overshoot, as all bubbles have.

I bet my purse collection on it. LOL

Does anyone think a hedge fund will buy the shadow inventory (rentals), or something else will make it go away?

This is a fun and informative thread. Dr Housing Bubble-THANK YOU!

Speed It Up Please:

Over the past year and a half, hedge funds and REITs have purchased huge lots of bank-owned properties in Phoenix and Las Vegas.

As I understand one of my current investment newsletters, the “hedgies” are losing their shirts; not sure if this is real estate investment-related or due to recent moves in the precious metals markets, stocks, etc.

But yes, hedge funds have been buying homes by the lots. To clarify, these homes are not in Fortress Cities or in desirable areas such as the CA coast or in high-performance school districts.

As an investor, I have been approached, probably 1/2 dozen times to invest in lot-buying and on each occasion the homes are in low to lower-middle income areas.

Loved your comment about betting your purse collection! 🙂

~Misstrial

“You have to understand that an entire generation (Boomers) grew up and lived most of their adult lives under a real estate scenario where RE prices went up, sometimes spectacularly.”

Ummm, no. You are conflating effect with cause. There was a perpetual growth RE pricing environment because of the Boomers. It’s called 74 million homebuyers being dumped into a market that never had close to that many customers before.

It’s also why the banks are looking at another decade of down pricing: because those 74 million boomers are trying to sell to 51 million Xers. Until GenY hits the house buying point of their lives, in about a decade, there simply isn’t enough market demand to support the pricing that Xers are used to.

C’mon, folks, this is econ 101. Lots of sellers, smaller # of buyers, lower prices. Lots of buyers, small amount of inventory, pricing gets bid up. Until you can replace the demographic gap with a new generation of buyers, there simply isn’t enough demand.

Chuckles: Well said.

“surfaddict

October 4, 2011 at 4:06 pm

Is boomers another word for stupid? I’m just asking. It seems to me, smart people live frugally, pay off their debts, regardless of their birth-year.” No boomers is not a word for stupid, boomers is a word to denote, guess what? a bubble. Yes, a bubble. A bubble in the number of births. Chuckles and you both have it right. The number of the new generation is smaller than the number of the old generation and smart people do what you say they do with money. Some of those smart people are boomers. Some are Gen Xrs. We are all however in the same boat because the political and economic actions described by this blog have happened – jobs lost to overseas sources, regulation lost to bankers wishes, lack of will to rein that in and the blindness of all those that thought a boom in the number of consumers was the new paradigm. The world of the next generation will look different to the current just as the current looks different to the greatest generation’s.

Chuckles- When we look back, I doubt the size of the boomer generation will be seen as the cause of RE prices rising and falling. The bubble grew because of delusions & herd mentality.

While demographics is important, the number of buyers and sellers is mostly determined by other factors (the economy, jobs, income, rents, and most importantly-prices).

Would you expect prices to drop for a decade if the job market was strong and the average home was priced at $200k? Probably not, even with the boomers liquidating.

@Chuckles

“C’mon, folks, this is econ 101. Lots of sellers, smaller # of buyers, lower prices. ”

::Sigh:: No. There are plenty of buyers, citizens plus legal and illegal immigrants. The problem is less a demographic one and more an income one. Buyer income is way below the level that would support these prices and they can’t borrow the difference.

Demographic are the macro trend. No doubt about it. But in the near term, there can be massive migration. Like what CA saw from 1980 to 2000. The population of CA about doubled. That’s about jobs. And it was the driving factor in RE prices.

I can speak from experience that the availability of information on that had only available to title company’s a few years ago is a definite game changer. No matter if the data has faults or not more information helps. More complete knowledge of the market is surely causing the banksters and realtors a lot of heartburn.

Zillow & Redfin are giving people the ability it see through all the “Now is a good time to buy.” horses-t and truer pictures of equity (positive or negative) and the comps. Homeowners are able make a cold calculus as to whether to walk or park.

Hank-

As a buyer (who is also licensed-not hung) I was all for the DOJ lawsuit that opened up information and options for selling and buying via the internet. I am elated to be able to see the truth, get some data points, and proceed with a clear view of what is really going on. I wish the County Recorder’s Office (in my area) would open their data base up with a minimal fee and registration. I also wish MERS wasn’t a firewall to information. But I agree with you, the transparency is great. (Real-turds may not like it.-boo hoo)

+2.

Another great article on Transparency, RealTurd Scouting Reports, and my favorite – the 2.7% jumping to 7.9% annual price appreciation statistics on homes that sold in 1997 -2000 vs the 2011 ask.

Once that year over year price increase gets back to a historic 2.7-3.3% appreciation going back to 1990, we will know that those black tulips are just as good as the variegated ones. So somewhere between 2013 and 2020 it will be time to buy some RE to plant those bulbs without fear of the lingering bubble burps vaporizing our 20% down.

Heres to transparency and data point power for all prospective buyers to give that pesky RealTurd a shot in the eye when they start up the yammering “buy, buy, low rates, this one is going tonight, etc.” scare tactics. Better yet, find a FSBO and really add some value back into the equation.

Dr. HB – Real American Hero.

A buddy just bought a short sale on an 89 year old house in Sacramento. 2007 sale price of $306000…he got it for $135000. A doctor owned it and wanted out…took a month and the bank was freaking out because he paid 20% down. They want that PMI and the extra interest.

You got that right! They want the interest and PMI and they are also doing a new little trick called the suck and flop. The banks begin in a short sale transaction. The buyers agent brings a qualified buyer and things are progressing along. Suddenly ther bank negotiator closes the file and forecloses on the seller. Then they collect the PMI, they also can file a deficiency against the seller (not in all states) and then after they sucked the property into their folds and collect the PMI and file for a deficiency they turn around and sell directly to the buiyer without the realtors. It’s BS!!! This whole housing scam is one of the reasons for the Occupy Wall Street. Are you sick of the lies yet? Are you sick of the congress highjacked to thew highest bidder? Are you sick that corporations are “people” and money is “free speech” according to our US Supreme Court? Wonder what corporation bought them?

Lynn, thanks for the info, on that. I’ve been in several shorts, still in one now, couldn’t figure whats up. Three offers above the sold price, I’m all cash. Do they even look at the othe offers? Love the good Dr.

The graph showing FHA & VA loans as a percentage of total sales seems very ominous. One bubble popped and another one formed. For those of us frustrated that the RE bubble persists, that is likely our answer. The zero down/exotic financing bubble has been replaced by the FHA/VA bubble.

If people with equity, those who have owned pre-2000, want to relocate but they cannot sell their house for what they feel it is worth, then instead of just staying put forever, I would see many of them being creative about their means of escape. Probably by renting out their house and using that rent money to rent their own place in their desired location. Kind of a swap-thing.

that might be something we consider. Refi’ed my payment down to 500.00, don’t really care if it gets paid off, and could easily rent it out for 1500.00. That extra 1000 would go a long way in rural washington state on another place, bought or rented. Use to pay extra on the principal, but would rather build up my reserves than pay on a losing asset.

I still think it’s several years out before Homesellers will come to reality. Also when the banks…one day….start paying 5% or more interest on their CD products, until then you will still have some speculation buying.

Finally, the change in Administrations in 2013 will be interesting, hopefully we will get someone that privatizes Fannie and Freddie, end the FHA program, reduces the mortgage interest tax deduction, and endsTo Big To Fail….

Redfin is a VERY good. Check it out and see if it’s in your area. Lots of data on one page. Very informative.

I recommend subscribing to Property Shark for access to copies of the original financial documents. It can get a bit tedious, but you’ll gain a clearer understanding of the loan-owners’ financial positions on RE properties around here.

Beginning in 2003, the vast majority of loans in Manhattan Beach were Option-ARMS and Interest-Only loans, most with <10% down.

Foreclosure Radar has pretty much shown the same number (66) in foreclosure for well over a year, but only 2 are listed for sale on Redfin – both under $500k. Banks are very slow to move on the higher-end because they can't take the $ hit. There appears to be a lot of "squatting" going on here on the beach.

Despite record-low interest rates, most financing appears to be 30 to 40 year interest-only loans – but with 30% down. I've seen very few 30yr fixed loans on anything over $1.5M.

There were ZERO new sales this last week. It seems like 1/2 the "pending" properties return to MLS after falling out of escrow, I assume.

Things ain't as ro$ey as the Po$ers here would like everyone to believe. Unfortunately, our own "Manhattan Beach Confidential" Dave became a RE agent last year and his wonderfully informative site has unfortunately morphed into yet another "cheer-leading" RE site. However, the site's "archives" do contain some insightful posts from a few years back, in which he discusses the prevalence of funky loans due to the inability of local incomes to support RE prices.

My family bought our building in 1963, and we are not selling it for another twenty years or so.

good for you,my parents bought many rentals back in the 60’s and 70’s and 80’s and 90’s stop after that.they knew wages can never keep up with rents.now they are starting to look around again.full cash offers take it or leave it.so far its been leave it but they know what true values are,no rush,sit and wait. don’t get rich by paying their price.

UNLESS… it becomes a blighted property, is declared as such, and is then foreclosed on by the municipality and/or county in which located.

This is always a very real possibility when charging “under market” rents. There’s books and studies on the topic.

Just sayin’…

As to banks “getting real” I would beg to differ. Chase—yes, I said their name–pulled the plug on our short-sale b/c they’d rather get the PMI pmt and/or fed subsidy for which they’re eligible rather than make a realistic effort to sell the home.

They admitted to our realtor that their ask price was unrealistic and that their BPOs were inflated.

Doesn’t sound like they were serious about anything…

Took a bath on a house we bought in 1999 and sold in 2010 but you pays your money and you takes your chances.

Now we’re looking in North Carolina (don’t ask – it’s a job thing) and there’s just nothing for sale, except for idiots who can’t handle reality. Anything decent that comes up at a reasonable price gets snapped up in 20 minutes and there are darn few of those. People are scared to buy, scared to sell and scared of what’s coming next.

What I’m hearing from realtors is that while interest rates are indeed wildly attractive banks aren’t approving anybody so it doesn’t matter.

A little investment advice for those in the 35%. Take your loses at the market price and move on. In the stock market, stocks are sold when they are losers. Housing is a bad investment and will be for years. Take your money and put it into a REIT if you insist upon being in real estate. Rent. Renting gives people freedom(e.g. like to move to Austin).

John CPA JD you are a solid contributor to DRHB….but the Texas thing. Come on, we get it already. You think Texas is a better place to live and raise a family than is California. You might think your constant harping is endearing. Perhaps I’m alone in finding it more akin to water torcher.

Texas is on fire. Literally!

John is right. Texas is the promised land. Keep Austin weird. Go Longhorns. In Texas housing is very affordable. There is no future in Irvine.

Austin has culture for sure, but it also had 70 days a year of triple digit temperatures. Toto, we’re not in L.A. anymore.

I work trustee sales. There is a nice form that will remove the trustee sale price paid from the recorded deed. Yup, we white out the price on the deed, and the transfer tax, so buyers do not know what we paid at the sale. Before we started hiding the price paid we have had buyers back away when their moron realtor would gossip that the buyer is paying a 35-30% premium.

The loan buyer is able to inspect the property, the property is turn-key, and they are able to finance and yet buyers balk and huff at the new market-for-loanowner price. Then they go chase down another short sale wasting months and months and in the end they save nothing.

Landlord:

“Yup, we white out the price on the deed, and the transfer tax, so buyers do not know what we paid at the sale.”

Having worked as a trustee sale officer some years ago, if I found out that a bidder changed my Trustee’s Deed with white-out before recording it our attorneys would be contacting him. The deed is issued by the trustee pursuant to the exercise of a power of sale through “Public” auction. That is why the amount paid by the bidder is on the deed. It’s a title issue and has to due with presumption of compliance with CC 2924 et seq. This is why I believe the trustees should be required to record the deed directly after sale as part of the TSG (Trustee Sale Guarantee) title policy procedure.

Escrows don’t hand the deed to the buyer, they send it to title for recording. Trustee’s deeds should be handled the same way so people don’t change them AFTER they were executed and notarized. The Trustee did not issue it that way and would not have had the successful bid at sale been missing from the deed. That’s why their software puts it in automatically.

No bueno landlord; not a legitimate practice and could get you sued.

I live in a 55 home subdivision in Michigan, outside of Ann Arbor. As recently as 2008 there were always 6 or 7 houses for sale at the same time. Now, I don’t think there are any, maybe one.

Everyone is either underwater or close to it. There is no way out, except to walk away. But go where? Unemployment is high everywhere. So everyone is standing pat for now.

Exactly right.

This is the Great Depression…only everyone has food stamps and no one can relocate to find a job because they can’t sell their house.

Why can’t they move? Of course they can, just walk away, or rent it out> What you can’t cover the mortgage with a renter? Stupid-YOU!! Very Very stupid, and this happened while the bubble grew….and buyers, banks, everybody took that dumb gamble. I was jumping up and down screaming it didn’t make sense. Nobody listened, they became flippers instead. I tried to stop it, but couldn’t!!

It is not that easy to rent a house. Someone that is managing an apartment building, is already in the ‘landlord’ mode. Renting out one more apartment is not that much incremental work, and requires no extra expertise.

But someone with little or no landlord experience might find it difficult. Also, there is the problem of lack of scale. If you are managing 100 units, and a few are empty, that is no big deal. If you have one property, your own house, and it is empty, you will soon go bankrupt.

Another problem is that some subdivisions and condo associations don’t allow renting at all, or only to relatives. Obviously as conditions worsen, rules will be liberalized.

Finally, to rent you need a job, and a pretty good job to rent a decent house. If there were a lot of jobs out there, do you think house prices would be going through the floorboards, lol?

Everywhere proudly advertising they take EBT cards (food stamps), like it was some kind of advertising strategy. You see it all over now. That is what I call a sign of the times!

Interesting post Dr. RE sellers had become used to using inflated RE sales proceeds to enhance their lifestyles, clearly this option is off the table in the majority of cases which is why sellers continue to pull listing. What exactly is a fair value for most of Calif RE is still an open question given many years of government/banking/FED pumping and probably most of us have no real idea except as the Dr. as mentioned time and again its all about middleclass income levels so best to keep our eyes on employmentl.

Looks like the Scouting Reports for Los Angeles (as well as other areas) have been extirpated from Redfin.com. This feature provided consumers with information on agent transactions for individual homes, both on the selling and buying side. It could help you decide what local agent to work with, and showed, for example, if an agent was involved in short sales, bank-owned homes, or standard sales. Agents from outside the greater L.A. were not identified, but, overall, I think the Scouting Report feature was a great enhancement, and the transactions which I checked appeared accurate. I get the feeling that Redfin got a lot of pressure from realtor groups to pull this feature after only a week or so of operation.

R.I.P Scouting Reports, and thank you, Dr. Housing Bubble, for continuing your great work in keeping transparency alive in real estate.

Ha, that’s crazy! Well, it was fun while it lasted – I’m glad I got to experience it first hand yesterday 🙂

Yea so the scouting report was taken down: http://www.redfin.com/real-estate-agents/search-scouting-report

I’ve been actively looking to buy in San Diego since February but a) I refuse to pay more than the cost to rent and b) Since I know I’ll be living there indefinitely, I HAVE TO BE VERY SELECTIVE. A phrase that wasn’t heard of 5 years ago. In fact, in 2007, I had a realtor tell me “Will it work for at least 2 years? Until you can sell it?” Glad I didn’t take that advice.

Heh. Redfin has yanked its info off the internet promptly after your blog’s linking to it.

How many of these “unrealistic” expectations stem from the banks’ insistence that they are still due what their appraiser said it was worth? I suspect that the prices show more desperation than anything as I’m sure many of these sellers are actually downsizing because their homes are so underwater they aren’t able to refi. Seriously, who would sell at such a loss if they didn’t have to?

I’m sure glad the banks were bailed out though. Imagine what the housing market would be without it. (sarc)

My question is: what are the politicians going to do about the housing crisis in CA? What can they do that could be a big game changer? My gut feeling is the banks are holding on to property and not loaning money because they are lobbying for a bail out behind the scene. Baby boomers want to be able to unload their homes for rediculus prices on to the next generation and we have a large group of people who are drowning in their upside-down home. Solve these people’s problems and the politician buys himself another term. Banks, boomers, and the upside down home owners. I was looking on Redfin I got the feeling that in the poorer areas of Orange County there is many more underwater homes than in other parts. How will the government pander to whole communities of poor who drank the Kool-Aide and bought homes they could never afford? Seems like the only way out of this mess for the politician is to find a way to bail out the banks, keep prices inflated and forgive those who over paid. Why not sacrafice the vote of the few people who have been responsible and living within their means to save the banks,boomers and the under water homeowner?

The question is: will the upside down home owner get bailed out befor or after Christmas of this year? This is going to be a big election year…Oh and why did Warren Buffet just dump $5 Billion into Bank Of America?

Pre-emptive measure. He owns much much more of Wells Fargo, who some say has even more exposure to mortgage losses. But maybe even Warren can’t huff and puff enough to blow this thing back up.

And, well, a campaign contribution, in a way. He’s that rich.

Can someone explain mortgage insurance to me and how it relates to the housing crisis? If you put less than 20% down you have to pay it so why are the banks in such bad shape when it is mostly the people who put less than 20% down? If this is real insurance then who overseas it? and why are the banks in trouble and not insurance companies? Why don’t banks just charge higher interest rates for people who put less than 20% down? Why does the loanowner need to buy insurance to insure the bank? Shouldn’t the bank insure itself from loss? When you buy a car and finance it you don’t pay insurance premiums in case you default.

The problem was that most borrowers used 80/20 loans and thus paid no PMI. I would suppose the magnitude of the money borrowed is the reason for repayment insurance on a house versus a car. It’s interesting though because we know a car decreases in value the second it’s off the lot but we don’t assume the same for a house. The bottom line is make good loans or suffer the consequences. They won in both directions.

First Post, long time lurker…Can anybody please answer this question???? This is the exact Insurance issue that has mystified me for years!

thanks in Advance!

As Jessica stated, subprime loans don’t usually involve PMI. Most zero down loans were of the 80/20 variety, which involved 2 loans (and therefore no requirement for PMI). The same can be said of the subsequent wave of toxic loans in the form of option arms, which often times involved 80-15/80-10 loans.

Also, PMI doesn’t cover the entire loan amount. Usually insurers draw up contracts with the lender to cover up to X amount, and in order to get covered for loss, the bank needs to bring a short sale or foreclosure to completion first, thus acknowledging the loss ahead of time. (Not a good thing from an accounting perspective)

That said, mortgage insurers have been taking a beating since the subprime crisis (some more than others). If you follow some of the insurers (like PMI), you’ll see that this is certainly the case.

As for your remaining questions:

Why does the loanowner need to buy insurance to insure the bank? Shouldn’t the bank insure itself from loss?

The bank IS insuring itself by requiring the buyer to purchase insurance. Basically the bank is passing the cost down to the buyer.

Why don’t banks just charge higher interest rates for people who put less than 20% down?

Why do that when you can pass on part of the liability to another entity? Raising the interest rate will increase risk of default since payments go up. At the very least, if there’s a default, some of the losses incurred will be covered at no extra expense. Doing so many not minimize risk, but minimizing loss makes the risk relatively safer to take

“Redfin is suspending access to Scouting Report, the online tool that publishes deal histories and performance metrics for agents across the United States. We will continue to show this information for our own agents.

Our primary reason for excluding other agents is that the data we exposed has too many inaccuracies, mostly because agents work informally in teams, or don’t formally record who represented a buyer in a deal. You can read more about the decision.

Glenn Kelman, CEO, Redfin

Tuesday, October 4, 3 p.m. PDT ”

http://www.redfin.com/real-estate-agents/search-scouting-report

I checked my agent just before it got pulled. He checked out as represented.

Agreed. In the short time before its untimely demise, the Redfin Scouting Reports for my agent as well as several others with whom I’ve had contact were accurate and complete. As I understand it, Redfin used data from MLS sources which constantly tout their usefulness and accuracy. Yet now it appears that MLS sources are saying their information systems are faulty and inaccurate. You can’t have it both ways.

I rented a house in Tarzana from roughly years 2000 -2010, and I believe my observations there form a nice snapshot of the whole Southern California housing debacle in miniature.

I lived on a street of 2bed/1bath ranch houses originally built in 1950. By the time I moved there, many had expanded to 3bed/2bath, with roughly 1000-1200 square feet of living space on 5500 square foot lots. In 2000, you could buy one of these houses for around $225K…

…but by 2005-2006, they were going for $650K – $750K.

That’s TRIPLE in about half a dozen years.

Then came the “crash”. I put the “crash” in quotes because it seems to me that when something appreciates by 200-300% then only depreciates by 30-40%, the asset holder is still WAY ahead of the game. In any case, the 30-40% “crash” came…

…and people in the neighborhood STILL want $600-$700K for their 60-year-old 1000 sq. ft. houses.

“But mine has granite countertops!”

It may be “largely left out of the California housing market dialogue” as you state at the beginning of your article, but the “delusional home seller” is alive and well in Southern California.

Great comment, but the crash was a lot more than 30-40%. I purchased my home in 2002 for 345k it went up to about 900k and now is down to 230k. thats over a 1005 loss. Also houses are not assets unless you own them free and clear, until then they are liabilities.

oops sorry for typo meant to say over a 100% loss. not 1005 loss. lt’s hard to type well when you are pissed off. lol

Lynn, the whole point is that the crash is different for every area. Huntington Beach for example has barely lost 30% (I wish it was more, ha ha)

BTW, a loss/gain is always calculated from your starting point, so by definition a 100% loss is a loss where you go from full price to zero. A drop from 900k to 230k is a 63% loss in the accounting and finance world (570k loss divided by 900k in original value). Also, if you gain 100%, then lose 50% you’re back to where you started from 🙂

@Dave:

This is actually an interesting opportunity to highlight what the Banks are doing.

From her perspective, she started at $345K, and is now at $230K. That’s a loss of 33%. There was no real loss from $900K, except in terms of opportunity. A virtual loss of about 75%. But the loss at $230 is real money, that she’s on the hook for, if she didn’t put 33% down.

My suggestion is that she use REAL accounting, just like the Banks do. I.e. mark-to-model accounting. That way her house is still at $900K, and she can feel as rich as the Banks.

Accounting is a funny business, isn’t it? 🙂

The endgame for the “delusional home seller” will be FAR beyond their wildest nightmares!

“If you love wealth more than liberty, the tranquility of servitude better than the animating contest of freedom, depart from us in peace. We ask not your counsel nor your arms. Crouch down and lick the hand that feeds you. May your chains rest lightly upon you and may posterity forget that you were our countrymen.” ~ Samuel Adams

“Facts are stubborn things; and whatever may be our wishes, our inclinations, or the dictates of our passion, they cannot alter the state of facts and evidence.” ~ John Adams

“Those who give up essential liberties for temporary safety deserve neither liberty nor safety.” – Benjamin Franklin

“Associate yourself with men of good quality if you esteem your own reputation for ’tis better to be alone than in bad company…Guard against the impostures of pretended patriotism.” ~ George Washington

If there ever were a massive potential market open for tech startups and venture capital, a replacement for RedFin’s scouting report would be it.

http://www.geekwire.com/2011/problems-nag-redfins-scouting-report-ceo-we-screwed-up

Yes, CEO can point to the red herring of “unreliable data” but we all know that’s a charade.

Actually this is true. If you are listing agent you get credit but if you are buyers agent or work in a team it won’t show up. So a perfectly great agent that concentrates on buyers or works in a team will be looked at unfairly based on faulty information. Or an REO agent that lists 1000’s of repos will be looked at like a great agent because they have a ton of listings when it most cases the REO agents are the worst!

But no information cannot be prefered to information needing further context.

Sites like Zillow are ok for full disclosure states, but I would not rely on them for the nine non-disclosure states.

Americans have never had it sooo good as right now, better than 1947.

Your sharemarkets are at screaming buy levels

Your 30 year bond yields are under 3%

Your property values in so many areas are under 3x earnings

Your dollar is weak promoting greater exports

You have amazing amounts of shale gas

You have the best location to europe asia and south america

You have sooo cheap holidays

You have the largest oil reserves of any country hidden under your national parks and military reserves

You have sooo much food

Your rents are really cheap

You have really cheap labor costs (minimum wage $7)

Buy buy buy buy buy buy buy buy usa

You’re obviously not part of the daily bloodshed most of us are experiencing.. It’s like a game of Battleship in the office and people get sunk all the time. We’re two left out of five in our team, and I’m on my fourth boss.

“You have the largest oil reserves of any country hidden under your national parks and military reserves”

This is the part where I concluded that you really are delusional.

And, sir, don’t you realize that Americans have no money to “buy buy buy” anything with? All they have is massive debt, which must be worked off before we get all enthused about buying up the world. Now, if you were standing on a soapbox in The middle of Shanghai or Beijing doing your little sales pitch, well, I would understand.

How much will America be “Buy buy buying” with a wage of $7/hr, bubba?

Funny man. Interesting how Germany can export like the dickens…and have a “minimum wage” @ 4x that, eh?

Yes, bonds pay 3%…what a very good inducement to save…right? And yes “sharemarkets are at screaming buy levels”…because earnings and purchases are dropping off the table…hence the mass exodus of insiders selling off their shares…hence the “screaming”(ly) horrid share price declines….the market is telling us to sell…and you are saying “buy”…interesting….

Mind specifically detailing all this humungous “oil reserves” under OUR national lands and military bases? I am ALL EARS and AWAITING EAGERLY MY CHECK for MY SHARE of OUR resources. Plenty of out-of-work Californians will gladly drill and tap it FOR US ALL to share.

Have a nice day, Mr. Wilson.

Michael is more or less right about this. If you do have money, prices are inexpensive, labor abundant. Traffic is reduced. The next few years as things bottom out will be a great time to invest! America will bounce back, if only because some countries will and we are better positioned than most with sovereignty over our own fiat currency, abundant natural resources (including fabulous untapped self renewing solar in the southwest), an educated hungry population and top notch rule of law.

I don’t support tapping carbon fuels under national parks, near our coasts or even in Alberta. I think we’ve burned enough carbon, and there is nothing intrinsically wonderful about the stuff, that it is to our benefit to do so. I just fundamentally do not get the “drill baby drill” crowd. The oil is best left where it is.

I also see food becoming an important resource. With global warming advancing, dependable food supplies are likely to be harder to come by. As long as we can keep our own production up, which is probably a function of Ogallala aquifer reserves — likely more dependable than Himalayan glacier melt, for example — we may be able to feed the world and get rich doing it.

This is a depression for the bottom 80%. Unlike the 1930s, the well to do — and by this I mean those good at saving wealth, not those good at spending it — are not jumping out of windows.

Many an financial empire was born in the depression. The Kennedys come to mind. I just recently read of someone, and, I’m sorry, can’t remember the name, who lost it all in the middle, by thinking he caught the bottom of a certain asset. That’s my fear right now, and, I’m sure, a lot of others. I guess that’s how you define a deflationary spiral.

“You have the largest oil reserves of any country hidden under your national parks and military reserves”

This is where I began to suspect sarcasm and snark and burst out laughing. Yes indeed, lets drill Yosemite. Well done.

Faring, whether you see 3% yields as good or bad depends on whether you are a issuer or a holder of bonds. If I was a holder of bonds, I’d be selling immediately, because I think they have nowhere to go but down. (Negative bond yields are implausible, though they do happen for brief windows.) Also, when inflation does finally return, bonds are going to become hot potatos that nobody wants at anything approaching current prices.

If on the other hand I was an issuer of bonds and had some idea for what to do with the money (say I run a company and want to buy equipment or a competitor at firesale prices) then I’d be issuing them as fast as I could.

Yeah right

stocks are a buy only because of increased liquidity running into the markets. Fundamentals for companies doing business in the US is crap.

shale/petroleum in national parks – so tear up the country to get an unsustainable resource is the answer to our problems?

yes, the US has some things that are amazingly cheap and should be: basic medicine, vacations, and some housing, but the issue is that no one has enough money to even afford these things

housing at 3X income – if your income is $0, no one is going to sell you a house for $0

Not so. Medicines are actually much more expensive here than in single payer countries. We provide the profits that (what’s left after 5% dividend pay outs) go on to fund the next round of research.

What is more, US companies are quite profitable now. They used the down turn to fire the workers they didn’t like and got the rest to work harder. It really is a Dickensian tale of two economies. “It was the best of times. It was the worst of times…”

Apart from the lunacy, the occupy wall street people do have a point.

Here’s an article which is a must read for every Californian. It’s by Michael Lewis, no less:

“California and Bust”:

http://www.vanityfair.com/business/features/2011/11/michael-lewis-201111

Sorry if it’s not about housing, directly; but it is more about the big picture for this State. And that does affect housing. If you can read it and think that the excess debt of this State is good for the economy and housing, you’re just not connecting the dots.

Someone was disagreeing with me earlier that excess in Government pensions wasn’t the problem. Here’s a quote by the mayor of San Jose:

‘The [pension] problem was going to grow worse until, as he put it, “you get to one.†A single employee to service the entire city, presumably with a focus on paying pensions. “I don’t know how far out you have to go until you get to one,†said Reed, “but it isn’t all that far.†At that point, if not before, the city would be nothing more than a vehicle to pay the retirement costs of its former workers.

… This wasn’t a hypothetical scary situation, said Reed. “It’s a mathematical inevitability.‒

You are correct on the Pensions – this is the major factor at all state/city/muni levels. For every one of these, it’s just a matter of time. There is no escaping or hoping the way out, if there was it would have happened already. Mathematical inevitability that something must be done and restructured. If you try to pay it, you break the entire system and bust – just doesn’t work so these are going the hard disruptive way or the smooth restructure way to get them rational.

Typical example is that a certain city has roughly 50% of all tax revenue going to fund already massively underfunded pensions, nearly taken over by the state in the past year or so – narrow dodge. Taxes are already high so if you raise them, you only increase the flight of people and jobs outside the “tax lines” or to other places entirely. This is not good for tax revenue nor property values. If you try to cut services to divert more money to the pensions, well, it’s already a low level of service so same outcome. Who the hell wants to stick around for a final death spiral of entitlement mismanagement (votes for promises) going on for 40+ years. These entities are better off facing reality right now and getting in front of the problem. Of course this is a difficult platform to run under but reality stinks sometimes and difficult decisions have to be made.

There is no out or plan B in this one for the majority of cases. The problem is too big and growing bigger/faster every day.

I would like you to cite cases when you state this. 50% of taxes going to pensions? Where please? I am retired from a large municipality in So Cal and collecting a modest pension. My understanding is that that pension fund is self sustaining and quite solvent – in the billions of dollars. The city has an obligation to pay into it for current employees and an agreement to meet shortfalls in that funding plan from the general fund. This was reported to be in the amount of approx 5% of total budget income. That is no where near 50%. Other cities may have funding schemes and pensions funds co-mingled or whatever that cause serious problems. I think tho that if the majority of cities were dumping 50% of taxes into pensions it would be really big headline news. This is why I ask you to give facts. Remember that post above about facts not being denied. When you show facts and not chicken little rantings we can talk.

If you replace “pensions” with “entitlements”, the federal government is approaching something like that now.

FY2010:

Social security: $701B

Medicare/aid: $793B

Interest: $197B

Other mandatory: $416B

————————

$2107B

Tax receipts: $2162B

The problem here is that the $2107B expenditures figure doesn’t include the cost of the defense department($689B), or most of the other things that people think of when they think of government, like the department of the interior, justice dept., state dept., etc. ($660B)!

http://en.wikipedia.org/wiki/Federal_budget_(United_States)

So, essentially if we actually attempted to balance the budget without raising taxes and without cutting social programs as both parties want, literally nothing that we think of as government would be left, except an infrastructure to pay the debt, collect taxes, and send out those checks to our seniors. (Most Boomers haven’t even retired yet!!!)

This can’t last. Somebody’s gotta pay the bill. Since retired boomers vote, and the least wealthy 40% of the country have 0.3% of the wealth (turnips!), and we can’t borrow money at this rate forever, you can see why the Republicans are so desperate. They see that laserscope dot painted right on their wallets.

Put the popcorn in the popper and get ready for the show.

“The leaking of the shadow inventory will put a wet blanket on the California housing market for years to come.”

Indeed, and in more ways than one: not only with the shadow inventory going to market putting downward pressure on pricing, but the fact the banks are stepping up foreclosures will dampen the economy, as many have been using the mortgage payments they aren’t making to make other needed purchases like transportation, food, medicine and health insurance.

When tossed out…they will need to use any income to find shelter, and any discretionary spending they were making (movie, restaurant, sporting events, new autos…etc.) will come to screeching halt.

Not that I am saying they should be left alone and never have to pay….but had we “bailed out” all the mortgages holders in US instead of bankers, we could at least have a stable housing market, and shelter for everyone…and hey: I’d rather have my neighbors beholden to me through loans extended by the Fed….and perhaps find ways to delay payments for a while, maybe refi into 50-60 year loans, with the caveat they can’t market them for that period (unless they pay off mortgage) then to see it given in “Bailout bonuses” to the very bankers making these horridly awful “Liar Loans” and betting against the CDS’s they assembled to surely fail (making money both ways…Fraud at it’s worst)…then giving themselves “bonuses” for blowing up the economy. And the “Ratings” agencie’s execs needed investigation and prosecutions too…

Honest to goodness, every bank that approved loans without the same guidelines used in the pre-bubble decade? ( housing price no higher than 3 years of gross income, payment no higher than 1/3 of net monthly income, minus all other living expenses taken into consideration) …they should have all bonuses clawed-back, and those approving those gawdawful loans restricted from any type of financial related profession for life.

And William Black should be allowed to assemble a Fraud Enforcement team…and turned loose on the Mozilo hucksters and Blankfein conmen. ASAP.

Enough already…..let’s find solutions…and jail those responsible for drilling holes in the housing market ship.

This has been a thoughtful and interesting thread. Thanks to all.

Yesterday, I learned Redfin is a day late with posting new listings, so

I am going to use Real-turd.com. It cost us a home that flew out a nose bleed

list price, that I hope wasn’t the settlement price.

In the area we’re interested in,

the homes went out at approx $276K in 2002. Now they are pushing $400K for a 1970’s

pos rancher. Nice neighborhood, but come on, these are blue collar homes.

In 1998 we bought a view newly built *home, an almost 4,000 sq ft garage mahal for $400K. Our home had a fireplace in the master, french doors to view deck from master, and a built in refridge. 1st class all the way, but we aren’t a garage mahal couple. We’re a picket fence, garden in the yard couple. You live, you learn. (HOA’s are a sheeple’s totalitarian wet dream-clueless twits)

Anyway, welcome to The “Long Depression’ (1870 -reading up on it now. It started with easy $ and a real estate bubble.) It’s origin seems different from the GD.

Here’s to good health, being debt free, and knowing what ever happens in our future, we will survive (one way or another). Thank you DHB. Love your following.

*It is down 430K from the bubble’s peak. What’s insane, and it’s still overpriced.

Forget Realtor.com for listings. Try Californiamoves.com. It gives you updates much faster than Realtor. So you will learn that all those great houses in those great areas at those great prices you were interested in, are already SOLD or PENDING.

Th best thing about Redfin is that it sometimes provide realtor comments on homes, so you find out the real reason something in the Hollywood Hills seems so underpriced – that it’s next to the 101 and needs a major overhaul. But other than that, Redfin does not cover all the homes available and doesn’t give the most up to date status info.

Coldwell Banker?

Try a little Prime sub a la California. Make that extra mung beans.

http://www.zerohedge.com/news/primex-time-next-subprime-trade-has-come

There is good info. on ZH, but all the Fight Club seems to care about is how they can profit from any disaster.

Doctor, a question.

Are the US census data you present based on home “owning” households or all households?

http://factfinder.census.gov/servlet/QTTable?_bm=y&-geo_id=01000US&-qr_name=DEC_2000_SF3_U_QTH7&-ds_name=DEC_2000_SF3_U

Your data is all households, about 12.4 million in California, NOT owner occupied households. Which only suggests there are even more longer tenure home owners in serious denial.

Leave a Reply