Rent or buy conundrum – Renting a home in Pasadena versus purchasing real estate – Market analysis of a California housing bubble city. Purchase a home for $640,000 or rent a similar home for $2,100.

California real estate has taken a beating since the peak in 2007. Home prices statewide are down by 40 percent but many markets in lower priced areas have taken bigger hits like the Inland Empire. Even prime triple-A areas have seen their fair share of price corrections. Yet more is stocking up in the pipeline. The next round of price reductions is happening in middle tier locations. These include cities like Culver City and Pasadena which we have covered extensively over the years. Today we are going to look carefully at a few city blocks in Pasadena and pull up rentals versus recent home purchases to show why the bubble is still in full bloom in these areas. Examples like this show us that California real estate in many cities will have a challenge maintaining current valuations going into 2011. Let us take a look at a rental and recent purchase in the 91104 zip code of Pasadena.

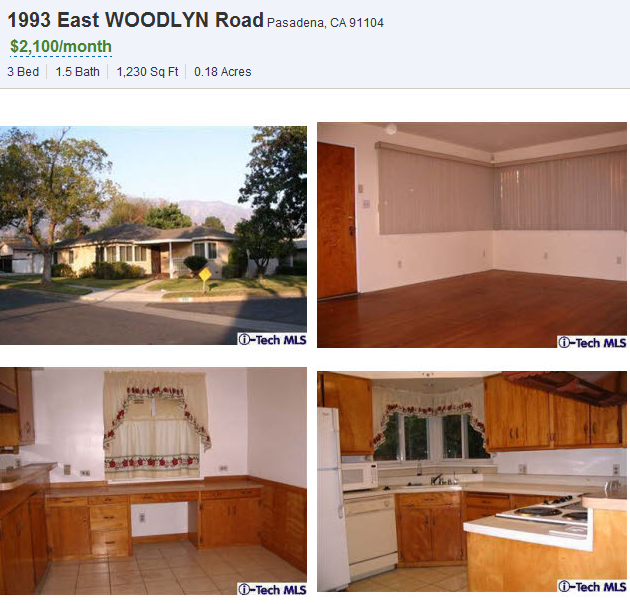

Before we examine the map, it is important to note that buying a home will carry a premium. Yet how much should this premium be? That is the question and usually the benefits of owning a home include tax breaks and assumed appreciation. This is why a home is bought from an economic perspective. The emotional part of excellent schools and having a place to establish roots is important only if incomes are there to back up the purchase and not some flimsy pie in the sky mortgages. This is where you scratch your head and see $80,000 leased cars in front of apartments or European autos in front of homes of folks making $100,000 for their combined household. It is all debt or borrowed time in the world of smoke and mirrors. First let us examine our rental property:

This is a nice rental in a good Pasadena area. This isn’t Newport Coast but some readers were saying that it was near impossible to find a decent rental in these mid-tier markets. It took me all but 2 minutes to find this place. Let us look at the sales history here:

Sold:Â Â Â Â Â 07/26/2000Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $270,000

So whoever owns this place with the current mortgage feels that $2,100 is sufficient to cover all the maintenance, principal, interest, and taxes on the place. Keep in mind that these people are renting out the home which puts them in the investor category. You will have vacancies and repairs but this is part of the business of being a landlord. So as it stands, the price to rent ratio works out to:

$270,000 / $2,100 Â Â Â Â Â Â Â Â Â Â Â =Â Â Â Â Â Â Â Â Â Â Â Â 128

The current home price is the equivalent of 128 months of rent. For this, the lower the number the better. For example, if the place was renting for $3,000 the ratio would be 90. Let us look at a recent home sale in the area that is very similar:

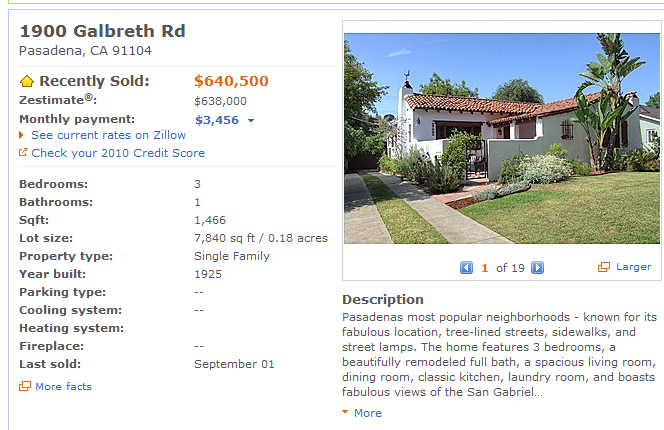

This home sold for $640,500 on September 1, 2010. As we have documented before, over 36 percent of all recent home purchases in Southern California are done via FHA insured loans because of low down payments. Let us just hypothetically say that this purchaser put down 10 percent which is more than many current buyers are putting down:

Down payment:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $64,500

Taxes for 2010:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $4,428/per yr

Principal and interest:Â Â Â $3,183/per month

Total PITI:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $3,702 (including insurance)

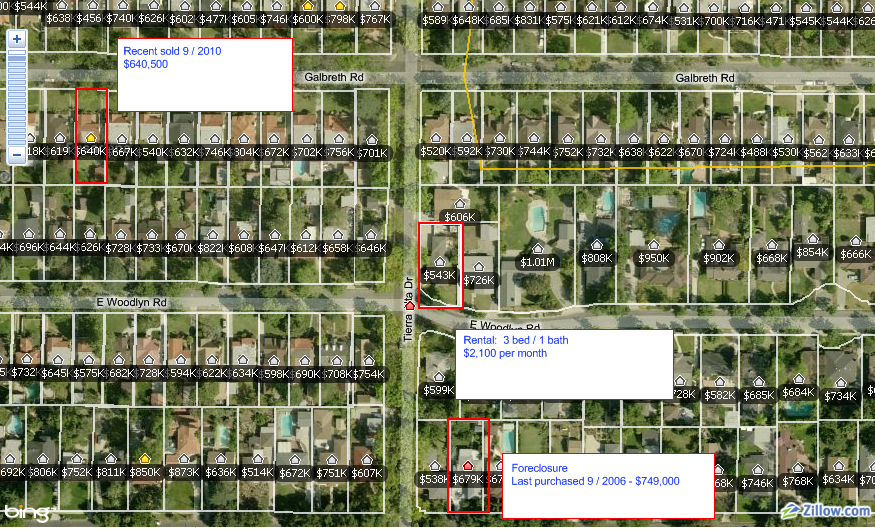

The total monthly net payment is $3,702. Now think of this in relation to the other home that is on the market for rent at $2,100. This home doesn’t even come close to being a good investment deal. In fact, the current ratio on this place is up to 305! Let us plot these homes out on a map:

You can visually see how disconnected market fundamentals have become. Not only that, you can see that a foreclosure a few homes down is on the market. The home was purchased for $749,000 in 2006 and who knows what it would fetch in today’s market. The foreclosure is only 2 bedrooms versus the 3 bedrooms for the recent sale and the rental. So if we use the recent sale as a comp, we are looking at a low $600,000 sale here. But even that is overpriced.

This is the interesting dynamic going on. The rental was purchased at a pre-bubble or early bubble price of $270,000. The rental market is an excellent way to get the pulse of what someone can actually pay out of their net income without going for some government or Wall Street gimmick loan. The benefit of renting is living in said house and enjoying the amenities of the area. You don’t get to write off the various tax deductions of owning a home but you also don’t pay for maintenance, insurance, and yearly taxes (which are likely to go up given the massive state budget deficit). You also don’t carry the risk of being underwater which is now a new variable given that 1 out of 3 California mortgage holders are swimming underwater on their mortgage.

In 2005 and 2006 I ran similar numbers for some of the lower income areas that had Real Homes of Genius selling for astronomical prices. A home selling for $500,000 in an area where it would fetch $1,000 in a lucky month was very common. The numbers here are holding up more so because these are desirable neighborhoods but looking at fundamentals it is clear a correction will hit. The owner of this place is happy renting it out for $2,100 a month. It probably turns a profit or breaks even here. Also, this is the only price the market will take otherwise the owner would be commanding a higher price. With rent, you don’t have any artificial stimulus or government gimmicks to back up the price. This is what a person looking to live in this area without buying is willing and able to pay.

As a rule of thumb, a great value is a home that can pull 1 percent or more of its purchase price per month. So that recent $640,500 would be a great deal if it were to rent at $6,450 per month. Obviously that isn’t the case.

Are you seeing similar examples in your current city?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

62 Responses to “Rent or buy conundrum – Renting a home in Pasadena versus purchasing real estate – Market analysis of a California housing bubble city. Purchase a home for $640,000 or rent a similar home for $2,100.”

long time reader of your blog. In NorCal (East bay) rent house for $2,700. A very similar home in the neighborhood is on the market for $700K.

I horked some of the numbers but it looks like this to me using the comprehensive mortgage calculator…

570K loan… 5.25% FHA thing… 8k$ per year on taxes… 34% tax rate…

Renting… 25200 per year total rent

Purchase… 46764$ per year total payments

Subtract equity from loan balance…. 8000$

Subtract interest and property taxes from income tax…. 13206$

Adjusted payment price…. 25558$

So, this is kinda sorta on par with renting. Normally renting is at a premium because you don’t have all the owning drawbacks. Neglecting time value of money or other calculations. Assuming flat values for a long time. Need 150K of income for that kind of house and that is well above the median level for that area.

Note here that Pasadena is a nice area but still really over priced. I’m guessing the math works out for some people to be willing to pay that price. I don’t know how sustainable incomes are in SoCal and that is the inflation deflation wildcard that can really cause things to break open.

We have extreme variability due to long term owners benefits from prop13 and neighboorhood variability in a place like Pasadena. I know the area just North of the 210 around downtown is ghetto, at various points. People from modest areas of the east coast would refust to live in most of the median/eliete areas in Pasadena because of poor lifestyle it affords (high crime, gangs, traffic, not children friendly exc, few parks).

There are some nice spots over by the Rose bowl though.

Huge amount of bubble ripple effects over years might reduce incomes to university professors, aerospace workers, govt employees, retirees exc. Not to mention they might get rid of prop13.

So, if you got the house down into the 500s it probably works out. 2100$ a month is a high rent as well. Plenty of 3-2 apartments for less and other options.

An interesting case study for area would be Inglewood vs Roosmoor vs Torrance for relative values.

I’m very curious about this statement:

People from modest areas of the east coast would refust to live in most of the median/eliete areas in Pasadena because of poor lifestyle it affords (high crime, gangs, traffic, not children friendly exc, few parks).

Are you saying that the east coast is just nicer in general? Or simply that you get more for your money there?

I’ve never lived in the east, although I have visited. Is it really a better place to live than Pasadena (where I haven’t lived either)?

One text described Los Angeles as the most envisioned city but the least planned. So, you get some effects from that.

There are not enough green spaces or parks in LA, or borders between major roads and houses. Housing density is quite high and the lot sizes are very small. Traffic is very bad and road design is often poor. Infastructure investment in schools has been abysmally low or at least the return on money has been really bad.

There is a lot of crime related to black and Mexican population that spills over to other areas (sorry but gang related problems are high amoung them). You get a lot of homeless. Lots and lots of them. Smog.

Thing with LA is they sell it as the sunshine tax. If you are out of the house a lot then the area is a little more improtant than the house. A lot of LA has the problem of too far to walk but too much of a PITA to drive. In the summer my family makes the effort and goes to the beach or hikes every weekend. Into the rest of the year as well.

And for what it is worth, I like Pasadena pretty well. Hike north of there and stop down for dinner in the city all the time.

@Enzo… proping up the prices… hot air, shadow inventory, FHA loans, people living on the edge, prop13 (huge), bad road system and too high density housing. Means the 210 is almost always backed up, the 110 is a disaster and 134 is a parking lot. Not sure about the commute but probably 50+ minute drive to/from downtown. Again it makes Pasadena a far flung area from downtown… unless you have that tolerance for 2 hr commutes.

So, I guess I’m saying it is not safe enough, family friendly enough or a great value.

Most places if you have an hour commute, outside of say NYC and even in NYC, you get a lot more value for your money. Heck NY and NJ have a better rail system and you can get to the Oranges in well less than 45 minutes.

Oh well. Nothing will stop the flaming by the Pasadena lovers here.

Safety is hardly a concern if you reside in the nicer areas in Pasadena. I lived their for a couple years off Orange Grove, down the street from the Tournament of Roses office. There are still apartments there that do not have gates out front, and lots of people walk around to jog around and exercise. I’d love to have a home in that area. It’s just unfortunate that the homes are just too expensive. Compared to east coast homes out in the suburbs, you’re looking at maybe 2~5x the amount for a pasadena home for a similar home out in the east coast. But on the bright side, you get to live in LA, enjoy the weather and live in an equally beautiful neighborhood with tree lined streets and nice scenery. (not many parks though… so that i concede haha)

It is overly expensive to live in LA. Having to send your kids to private school in order to avoid the abysmal public and charter school system is a large problem and an extra expense.

However, there are many great homes with large lots in many parts of Los Angeles. The crowding you speak of is mostly related to the white ghettos that have sprung up in places like Culver City and West Los Angeles. White people like yourself are so scared of people of color that they cram themselves into 900 foot bungalows and and swear they have made it just because they have surrounded themselves with other white folks.

That said, I have noticed that some of the smarter and more affulent white people have started to speckle some of our upscale African American neighborhoods. This blog however is mostly full of the westside white folk types.

Sad that such an intelligent blog is infiltrated by such narrow minded bigot readers.

I lived in Pasadena area for 21 years. Safety is a REAL issue. I loved my home, but had to get out to protect my family and get into a better school system. I lived in a great part of Altadena (just north of Pasadena) and the crime is awful. No one talks about it. And the commute to LA is only 20 minutes or so. That’s why it is so expensive.

SJ, I wouldn’t live north of the 210 either unless it was further up north in the nicer parts of altadena. The place to live in Pasadena is South Pasadena and the southern areas that border San Marino.

I don’t think you should be subtracting the equity from the loan balance it is a cost and coming out of your pocket. Plus you interest deduction will be decreasing over time.

I know it’s not the mortgage rate, but I try to use closer to 8% when I do these analysis, which is closer to the historical 30-year fix Feddie Mac rate. But who know when we actually hit 8% again? My point is that there is a lot down size for purchasing a house that will probably have a lot of maintenance. However, I did like your analysis.

I moved from Pasadena when I got married, since I wanted to live in a neighborhood with better schools. That’s another cost of living in Pasadena with a family.

Hello Oilcan,

It was not a really indepth analysis but a quick ballpark figure that is similar to the amount of analysis people are putting into this. Huge potential for price swings based on demographic changes, social preferences, social and political upheaval, monetary policy changes exc.

… for 70K down on a 570K loan @5.25%…

If you ignore the tax break, and I suggest that is a good idea, then it’s a far different story. Basically the “tax break” is something you never see. You get a break on spent money that just goes to the bank. I’m guessing the good Dr would probably agree on that, particularly in a declining value enviroment. In that case you are eating 1800$ a month for the next few decades. Compare that to your situation if you take the 1800$ and put it into a 401K. After a decade you have 165,000$ saved up plus what ever returns possibly something like 270,000$ based on 3.5%. Compare that to 100K or so in equity, not to mention any reutrns on the initial downpayment money. You also have huge the downside risk with owning. You lose money on a forced sale, have to pay a commision, credit gets risked, decreased opporitunity exc.

In other words you take it in the shorts really badly.

I also believe a lot of the rentals are places purchased on I/O loans and you can work the numbers and see those rental rates pop out. Those properties will sift into and out of the market for a long time. Seems like two lost decades is in the books.

Please note aware of WAG on incomes and prices being flat for a while. Assume that even with significant inflation, housing will be flat due to over supply and demographics.

For an average of mortgage rates look at mortgage rates from 1800 thru 1960.

Oil Can, I think the principal shouldn’t be included in the monthly nut when doing a rent vs buy analysis. Sure you have to come up with it every month, but it’s actually doing something. This is nothing more than forced savings.

The maintenance cost is something that is underestimated in most cases. I have owned several homes and they are all money pits. Roof replacements, plumbing, electrical, slab leaks, leaky showers stalls, root infested sewer lines, water heaters that flood houses, etc. And don’t forget about hiring a gardener unless you plan on going to your rental every weekend and mowing the lawn yourself…that’s another $100 per month out of your pocket. And collecting rent is income which is taxable. In cases where you get a bad tenant that squats for a few months and causes damage, that might eat up a good year’s worth of rental income. No thanks.

Subtracting equity?! Doesn’t that presume the value of the property is stable or increasing? If so, that is a highly suspect assumption… values are dropping. Even the OC Register (which is among the worst R.E. Cheerleaders) concedes that statewide the values of houses are declining.

The point of the post was this is how a large number of investors, some with long term horizons, calculate these things.

They “subtract” the equity portion of the payment from the cost portion of the payment.

My point was with the rent relative to this analysis and stable value for housing you took it in the shorts. The analysis is FAR more horrible if you took your money from the stock market and put it into housing.

The trick I’m using here is housing stays flat in value, a VERY reasonable assumption considering rates, forclosures, rent to prices ratios.

If you use a slight down trend in values of say 1% a year for a 10% drop over a decade then it’s worse. Also I’m assuming the people in question are planning on defering maintinance in an effort to catch the next boom.

Should note other people are buying as the armeggedon option in case of a currency collapse and it is another hard asset.

I’d love it if someone with better finance understanding would jump in. Of course surprised we haven’t heard from a realtor… they have a hard time claiming values never go down.

Long term I’d also note plenty of cases in places like NJ where you see many decaying mansions in places like East Orange or West Trenton. Beautiful homes that you have a hard time imagining turing into a slum. People would point out riots and racial demographics but we have plenty of unrest from Mexicans and demographic shift there.

Not trying to hate here, not at all, but at the current time we are dumping resources into inner cities and placating Mexicans and there kids. Eventually we will get sick of the racism (from “minorities”), publishing stuff in spanish and the corruption. So, expecting those areas and adjacent areas to decline. Firm believer in the Space A and Space B people theory(see Adam Corola on the subject). Once support is withdrawn, things will go downhill in rapid order.

Just a suggestion: Add the annual 10% that homeowners should budget for maintenance and repairs. The cost of owning includes replacing appliances; along with repairing leaky roofs, windows, foundations, etc. Also, owning your home guarantees you’ll pay for all utilities, trash removal, and sewer; whereas, again, renting may include all of these expenses. I pay only for electricity, and hot water is inlcuded in the HOA the owner pays. I still can’t make the leap back to owning yet.

The problem with your calculation is that it takes all of the 13206 and subtracts it from your income. You forgot about your standard deduction with makes the house not a break even but 12000 more a year to own. Would you pay an extra 1000 a mounth for this place. I think not.

James says he subtracts 13208 property tax and interest from his income tax.

In Texas, one subtracts the the 13k from one’s gross income, which taxed at a 35% max rate for an actual recoup of $4622 which adds another $8000 a year or more to your actual cost of buying.

Being in a different (but equally notorious) RHoG/Bubble Zone (Miami-FtLaud-WPalmBch) which is able to pretend no longer, I’m wondering if the good Doctor could dig up the details (financing format, buyer demographic) on this slice of Pasadena that sold for $437/sq. ft.! (1900 Galbreth Rd.)

Sure, it’s a cute and classic “Mission” style bungalow, somewhat botched per HGTV trends, but I mean really, NO covered parking and ONE whole bathroom for 3 BRs? Is it all the Fed/Military/JPL/SPAWARS jobs out yonder? WHO is propping things up? i.e. is the buyer two senior RNurses/ARNPs? Three nursing home LPNs? Tenured USC prof?

I have no doubt this was THEE charming place to live… in the Golden Era, 1925-1955. ;’)

A really odd dynamic is going on in my neighborhood. I rent in a nice, old neighborhood in the north bay. It’s centrally located, virtually without crime, and the schools are good. Having lived in the area my entire life, I can say with confidence that while it’s not one of the most desirable places to live in the wine country, it’s one of the best in my city.

The units themselves come in two categories- extremely well maintained and perfect, and… not so much. Some people must’ve put millions of dollars into these things, while others, like where I live, are a little funky.

Rent in the area is universally cheap, regardless of the quality of the house, while the cost to buy is universally expensive. You can rent a 3 house with a 600k asking price for $1250/month. A very nice, perfectly maintained 6 bedroom down the road rents for $2,800- I’d hate to see what they’d ask for that.

I’d love to buy a place here, and if I’m reading this right, the disparity is a sign that my area is still inflated to all hell. Buying now is a bad idea, but perhaps there’s a light at the end of the tunnel. Am I right on this? Or am I better off just completely abandoning the neighborhood?

From where I sit, Pasadena looks like a mixed bag.

I searched stuff there just to look at exotic real estate and get a handle on the prices compared to Chicago. I was struck by a really pretty condo at 457 South Marengo, in a really lovely complex. It is a 1600 sq ft 3 bed 2.5 bath listed for $630K and it looks to me like it is not too overpriced, but I really have no idea. So I’m asking you all:

http://www.realtor.com/realestateandhomes-detail/457-South-Marengo-Avenue-Unit-12_Pasadena_CA_91101_M10040-85625

What would this unit rent for?

Don’t know, but that’s not the best neighborhood. It’s on the same street as Blair High School…tooo noisy for my tastes.

Perhaps around 3000? Here’s a somewhat comparable unit a block away from your 630K home (on the other side of California):

http://www.apartmenthunterz.com/details/129011062

That one rents for 2500.

Hi Laura, I live on Marengo, a block or so north of the place listed for 630K. Marengo Ave. is a mixed bag, with newer overpriced amenity-filled condos situated alongside older condos/townhouses which have been standing for 20+ years. There is a huge disparity in rent prices as well. Say… $1300/mo for a 1200SF ‘older’ place vs. $2200-2400 for a newer 1200SF 2 Br/2Ba. All on the same street. I haven’t looked much into 3Br places, but my guess would be that this place would rent for about $3000 IMO.

This dynamic is much the same throughout the better spots in Pasadena. It can be a great renters market with fair prices, however there is a flurry of new construction (esp 2, 3Br condos) which are largely going unsold and unrented. Its a catch 22. Most banks will not extend loans unless these buildings are 75% occupied or under contract. Builders will not accept renters to ‘lower’ the supposed property value of the units. Lots of them sit vacant (anyone who is familiar with the area can attest to this… think about the complexes on Lake/Corson, Arroyo/Cordova for example)

As a 6 year and current resident of Pasadena, HELL YES the city is overpriced. Thanks to the Dr. Housing Bubble for making this a bit clearer.

I was so mad when they ripped out the Salt Shaker on Arroyo Pkwy and put up condos…which I’m sure are just sitting there empty. So. Pas. is full of empty condos, too, one complex that I know of is bankrupt and just sitting there chained up.

Laura – I would not want to be the owner. What about HOA fees? Back in the late 1990s, I studied a town house on Longboat Key FL, considering renting it out and living there when it is vacant. It was a money pit at around $ 150 k at the time. ** An aquaintant just bought a top floor condo for 1.3 m which she would have trouble renting out for 8 k, Thai baht that is. Often, it’s madness. This high end condo would be a loss maker even if someone paid $ 4,000 rent, which would be way too high. With the LL paying the HOA fees, the annual loss will be a 5-digit amount!

WTF?

You’re comparing a townhouse in Florida for 150k to a Top Floop Condo in Thailand for 1.3M Thai Baht that rents for 8K THB.

What’s the rent/vs buy on a house in Manhattan to a hut in Kalahari, Africa?

Should I buy an igloo in Alaska or should I rent it?

Oh…and 1.3M thai baht is $43,000.

How would they lose money renting it out at $4,000?

I like this game. Let’s try it in the Bay Area with a super-dooper school district. I found a 3 bedroom/ 2 bath in Cupertino, CA with an asking rent price of $2000/month. The absolute cheapest 3 bed/ 2 bath house in Cupertino, CA on Redfin is $619,900 as of 12/22/10. I figure the rental couldn’t be worse than the cheapest house in the city. Do I buy or do I rent?

Rent. I see about the same rent/purchase price numbers throughout the south bay (san jose, willow glen, campbell, los gatos, almaden).

Been here all my 46 years and still wouldn’t want to live any place else!

Native, I’m with ya! I moved away in 2008 and moved back in 2010. So what if I pay almost the same to rent a room as I paid to rent a house in Florida? Californy is the place you wanna be! All kiddin’ aside, I wouldn’t live anywhere else but California. I love the weather, the people, the recreational opportunities… LOVE IT HERE! But would I buy a house? NOT UNTIL IT MAKES *FINANCIAL* SENSE! Read the mast head of this blog and think about it: Happiness happens when you forget the bubble and learn to love Southern California. Oh, and BTW, not kidding on the rental comparo…. I paid $800/mo for a suburban house in Bradenton FL. No State Income tax and Electricity was cheap too! But you know what? I missed California!

Both examples appear to be somewhat overpriced although the home that sold is nicer (IMO) than the one for rent. I wouldn’t use MLS rental listings as comps either as it is easy for a (r)ealtor to list the rental at some pie in the sky asking price in order to say “Look at what a great deal buying is!!!” I’d be willing to bet that you could negotiate the rental price down quite a bit.

Pasadena is nice but the air quality there is pretty bad.

You can buy condos in Phoenix area for $40,000-50,000 that rent for $800-900 per month, a ratio of 50!!!

Don’t forget to add in 300 for HOA, 200 for property taxes (the state doesn’t care what you paid for it) and remember that you’ll have a giant special assessment sooner or later.

I can’t get some condos to pencil out even if they were given to me for free.

The big picture in California is declining prices. We’re in a precarious position statewide, with massive liabilities and dwindling assets. Given a sudden dramatic reversal, It doesn’t appear property will be appreciating anytime soon. Why would you take on so much downside risk unless you are just emotionally attached to an area? (Big mistake right now IMHO). Everyone now, seems to be-e revaluating their lifestyle, now that our economy is in question. FAct is e are in deflationary mode, now, which effects the rest of the world, which effects us back again. Why not rent a nice place year to year, with less worry and out of pocket expense. With a solid income, you are holding all the cards.

As Dr HB has mentioned before, patrick.net has a great tool for evaluating most of the variables in buying versus renting. I have set it up for a Westside Starter home and it is truly eye-opening. A must see for anyone even thinking about purchasing a home right now.

http://www.westsideremeltdown.blogspot.com

http://www.santamonicameltdownthe90402.blogspot.com

It was alway a standard formula of your monthly rental being a conservative 1% of the homes value. That could vary due to location, but the formula is what investors used to determine value. That was lost in the bubble. Traditional investors invested for cash flow and appreciation was a bonus. The unsophisticated residential investors invest at break even or negative cash flows, banking on appreciation as their goal.

I have always felt that this market would stabiize when rents brought a return on investment. Great article, you always bring us to reality after coming out of a fantasy market

All these are in the same development in Laguna Niguel, Orange County. Only differences are upgrades, pools and views. Oh and delusional buyers and sellers.

A. Approx 3200 sq ft

Rental –

3200 sq ft.

$3750

http://www.zillow.com/homedetails/29442-Ana-Maria-Ln-Laguna-Niguel-CA-92677/25568208_zpid/

Rental –

(currently renting) 3201 sq ft

$3200

http://www.zillow.com/homedetails/24102-Snipe-Ln-Laguna-Niguel-CA-92677/25569474_zpid/

Sold – 12/2010

3156 sq ft

$755,000

http://www.zillow.com/homedetails/24042-Rail-Cir-Laguna-Niguel-CA-92677/25569207_zpid/

Sold – 3/2010

3283 sq ft

$750,000

http://www.zillow.com/homedetails/23982-Cormorant-Ln-Laguna-Niguel-CA-92677/25569355_zpid/

Sold – 4/2010

3212 sq ft

$725,000

http://www.zillow.com/homedetails/24002-Eider-Ct-Laguna-Niguel-CA-92677/25568905_zpid/

For Sale –

3200 sq ft.

$949,000

http://www.zillow.com/homedetails/24115-Nuthatch-Ln-Laguna-Niguel-CA-92677/25569366_zpid/

B. Approx 2700 sq ft

Rental –

2407 sq ft

$3500

http://www.trulia.com/rental/3000585560-24062-Ironhead-Ln-Laguna-Niguel-CA-92677

Rental –

2674 sq ft

$3700

http://www.trulia.com/rental/3000592600-24141-Snipe-Ln-Laguna-Niguel-CA-92677

Sold – 8/2010

2650 sq ft

$697,500

http://www.zillow.com/homedetails/23882-Longspur-Ct-Laguna-Niguel-CA-92677/25568837_zpid/

Sold – 4/2010

2727 sq ft

$815,000

http://www.zillow.com/homedetails/28802-Woodcock-Dr-Laguna-Niguel-CA-92677/25569278_zpid/

For Sale –

2683 sq ft

$749,000

http://www.zillow.com/homedetails/28446-Shrike-Dr-Laguna-Niguel-CA-92677/25569052_zpid/

For Sale –

2727 sq ft

$665,00

http://www.zillow.com/homedetails/29372-Bobolink-Dr-Laguna-Niguel-CA-92677/25568947_zpid/

Care to hazard a guess what appropriate pricing should be? Is dropping to 1999 prices realistic?

According to my calculation using http://patrick.net/housing/calculator.php the premium, not including buy/sell costs and using $3400 rent, is less than $5K year difference. That seems a reasonable premium to me to be the proud owner of a very nice home in a fantastic neighborhood. To pay no premium pricing would need to drop to 1999 prices. Could that happen?

I’m not sure I understand the relevance of comparing rental prices for homes in desirable neighborhoods. First, desirable locations are stable; they are places where people want to move up to. Second, following from the first, there are not too many rentals in these sort of areas.

In the example used above for the Woodlyn home bought in 2000, even $270K is a tad high using the 1% to purchase price ROT. Assuming the Zillow comp is in the ballpark, the house is now worth $540K. The sale of the house around the corner for $630K confirms the neighborhood continues to be desirable and that people are willing to pay a premium to live there. And what is that premium? Not much actually: around $500/mo.; or $32K/year to own vs. $25.5K to rent.

Desirable locations are not rental neighborhoods and shouldn’t be compared to them. I do think it is worthwhile to discover the premium paid to live in a desirable neighborhood and determine if it is out of whack with what is going on in rental neighborhoods, say the good parts of Pasadena to other parts of Pasadena.

Qualifying incomes! That’s another conundrum. If you go to:

http://projects.nytimes.com/census/2010/explorer

and type in the 91104 zip code and lookup median income and median home price. I don’t see how the incomes support the median home prices. The example properties used above are in a $85k median income area which is gentrifying. Even so, how are house prices in the $550k-$650k range substantiated? Forget about 3.5 X income to guesstimate qualifying house price; these are around 7X.

Meh, Take a look at the thumbnail calculations.

It is far more expensive to rent than to buy and the homes are about 1 block apart, almost identical and the premium in a flat market is almost 50% or more.

Desirable goes only so far. You get too expensive and places get undesirable quick or there just isn’t a market. Works out better for me in the end. The more people who commit financial suicide in house purchases or investment the better.

It’s that fake out from the tax credit that fools everyone. The money is gone either way. The bank gets it or the govt gets it. We don’t.

Whopps…. far more expensive to BUY than to rent…. oye

Nice post. I agree. There are a lot of people here who cannot afford to buy a house in a good neighborhood so they delude themselves into thinking they are holding “all the cards” by renting when in reality they are residing where they can afford to. Nothing wrong with that. But dont try and fool yourselves into believing that a rental neighborhood is the same as one where people own. Its not all about running the numbers when you have a family. You want stability and people with means are willing to pay for that “premium. The rest, rent.

Prior to the bubble people were buying in good neighborhoods and they will again as the bubble deflates. Home price discovery is difficult for everyone: banks, appraisers, real estate people, buyers, sellers, lenders, etc.. What to do?

Why are we checking in at Dr. HB’s blog? Because we would prefer to buy rather than rent. That’s why I’m here. I want to buy something in a good neighborhood and am at a loss determining if this is a) the right time to buy, b) what are fair home prices. I accept good locations will have a premium over other locations. Does anyone doubt that once real estate turns around the good neighborhoods will be in demand.

Patrick.net’s handy calculator is useful: http://patrick.net/housing/calculator.php

I zero out the sale and buy costs, hold for 1 year, enter in appropriate data. For the house on Woodlyn, assuming Zillow’s Zesstimate of $540K is in the ballpark, I can see what’s the premium paid over renting the same property. It’s around $8K/year. That’s the extra paid over renting for: 1) mortgage reduction with eventual payoff, 2) control over my own living space, 3) ownership in a community, and 4) protection against future housing cost (purchase or rental) inflation. It doesn’t seem way out of whack to me.

Before basing your life on patrick.net, it is important to realize he is an EXTREME bear, and has on-camera in interviews telling people that it’s never made sense to buy over the past 30+ years.

“Housing is a poor investment” – http://www.youtube.com/watch?v=yDqCEyysOu0

Obviously this is not true. Patrick completely misunderstands leveraged gains. If he was rich, perhaps his advice would be more compelling.

On top of that, his calculator is very very very conservative. The long-term price-to-rent in CA has been 4-to-1, not 3-to-1. Many places are at 4:1 now, so looking for a good deal is not a bad idea.

How good does a neighborhood have to be? Does everyone there have to drive a luxury car to be considered a “good neighborhood”? I think we are experience an inflation in the term “good neighborhood” if that is your criteria. Does a place require good public schools to be considered a “good neighborhood”. By that criteria, NONE of Pasadena is a “good neighborhood”.

Isn’t it enough to live in a neighborhood where you can walk at all hours and have pretty much zero fear of crime. Trust me there are plenty of rental neighborhoods like that and in fact the whole rental/ownership dichotomy is false. Rental homes often exist right besides homes for sale and what’s more condos often exist right near homes, right near apartments. I really think you are rather clueless about what rental opportunities actually exist out there.

RE: “official” sale prices… just remember, ALL the “players” involved have a vested interest in gaming/inflating/LYING about the sold-for price… from the Real-tards to the taxing authorities to the school district bureaucrats to the BANKS/lenders to the Obama Admin to the magicians at Duh FED. LOTS of lying going on in FL, and I’m sure in CA too, with buyer getting under-the-table “rebates”, expensive cruises, cars, furniture and/or unwanted TIMESHARES folded into the deal, plus, naturally, a low enough down-payment and enough POCKET CASH to keep mum… =:O Oh yeah, word up… nose around, you’ll see.

FBI couldn’t keep up even if they wanted to… and they don’t want to. As Matt Taibbi @ Rolling Stone has famously said about Wall St. and the USA (in his OUTSTANDING investigative reporting): “We live in a gangster state, and our days of laughing at other countries are over.”

I could not agree more with that quote from Matt!

And of course the Good Dr knocks another one out of the park.

But even with the Doctor laying all the facts out very clearly some still over look the facts.

Still some would blame the dark people or the Mexicans.

He pointed out that you had people with high school diplomas making tons of money, now I am pretty sure the majority of those people did not have much color in their skin lol.

Here is a little history lesson, during the great depression. the blame was on Black people, that was when many of the racist cartoons come into being. It was nothing but misdirection. So trying to blame Mexicans because of bad home prices is ridiculous. Poor people of color in the so called ghetto are pretty much living the same way and this bubble is not hurting them in the way its hurting other people.

I have watched this for thirty years and not surprised at what is happening at all. I am not shocked.

I realize many of the readers here are sharp and don’t fall for the rope a dope, but for those who do.

In my opinion this is what you had, you had lets say an average white guy who had different titles, account exec. senior vp, western regional director. and basically it was nothing but a sales man job. And what he sold didn’t matter, whether it be widgets or fidgets, but he would go to another guy who was buying whatever he was selling. And his buddy on the other side would buy a ton of whatever junk he was selling. Most likely he was not even a good salesman, but he was part of the group.

Now those widgets are made overseas by slave labor so that high six figure job is gone for ever. And since he had no real job skills and has never really had to look that hard for work he has to blame someone. uum lets see who is the scapegoat?

Remember the Nazis did the same thing.

I for one think America is doomed really, because what happens when everyone is out work and everyplace becomes a so called ghetto?

With interest deductions it is about a wash. But there’s the down payment that gone and it’s not free to maintain a house every year. More importantly, ask yourself “Is it going to be going up in price for the next few years?” People can rationalize all they want about rent vs. buy. But in the final analysis buying a home is a leveraged investment. These should only be made on things that are appreciating on a y-o-y basis.

Zillo puts the value at $542 K, because it is 1230 sq feet. $2100 is a reasonable rental for this value. The Galbraith place is 1466 sq ft, about 20% bigger and a higher value. It also is a Spanish style which brings more, and it may have better views. The rental and the Galbraith place are certainly not equal. It depends upon the person. Basic shelter can be cheap, but to live in a home of character will cost.

Excellent article! Take this home in my neighborhood in SE Asia. The ad says the rent is kind of negotiable for a longer lease. 270 months means the owner is subsidizing the tenant big time. And after 270 months, the place may be a tear down. http://www.thonglo.com/CW/Chaeng_Wattana_House.html

My own higher end rentals in Yucca Valley perform badly, too. A $ 220 k place rents for $ 1,350 and a $ 380 k house for $ 2,600. Now take one of the Murray Lane duplexes which cost $ 334 k in the bubble. I got one for $ 115 k (including repairs and a paint job). Now the rent is $ 1,400 for ~ 1,800 ft and 2 car garages. From a LL’s perspective, 2 such duplexes @ $ 230 k would beat the Pasadena rental hands down.

For another perspective, I live in a central location in Shanghai. My rental is approx 1/6 of 1% of the flat value. Maybe less now. Before the financial crisis the ratio was 1/4 of 1%.

MERRY CHRISTMAS. A time to celebrate and enjoy the company of those closest to you. May the appreciation of your lives rise exponetially as you appreciate others increasing the value of their lives. For regardless of whether house prices rise or fall, whether you rent or own, whether you have many things or just a few, you are wealth beyond compare if you have a loving family and caring friends to share your life.

House prices will continue to plummet to affordable levels for many years to come. 2011 foreclosure rate is expected to set another record making 3 years in a row of new records being set.

RealtyTrac: Foreclosures Drop in November But Will Come Roaring Back in 2011

http://finance.yahoo.com/tech-ticker/realtytrac-foreclosures-drop-in-november-but-will-come-roaring-back-in-2011-535730.html?tickers=XHB,BAC,JPM,WFC,C,TOL,DHI

As more and more homeloanowers go underwater many more will “walk away†helping to drive prices down even more.

More see walking on mortgage as a viable plan

http://www.msnbc.msn.com/id/40704053/ns/business-real_estate/

Keep in mind rental rates are in direct competition with house prices and rents are falling much faster than house prices and will continue to fall as more apartments go into default.

From the article link below;

“Apartment building mortgage defaults, which are not included in the overall commercial mortgage default number, hit a record high, rising to 4.67 percent in the third quarter. With $1.2 billion worth of apartment properties going into default during the three-month period ending Sept. 30, the rate was up a full point from 3.6 percent a year earlier and 4.13 percent at midyear.”

Commercial property default rate rises

http://www.bizjournals.com/kansascity/news/2010/11/30/commercial-property-default-rate-rises.html

I live in the Brigden Ranch area – the Galbreth/Woodlyn neighborhood. Disclosure: I want to sell my house because of a relocation. That said – I bought in 1982 and added on to the property. It’s no longer a 3 BR / 1 BA – much more comforrtable. All homes (almost?) have one-car garages and very deep lots, allowing for plenty of off-street parking. On-street overnight parking is not allowed except by permit. The shops (supermarket, Starbucks, dry cleaners, banks, etc.) are three minutes by foot. Light rail to downtown LA is 1.5 miles south. The neighbors are pleasant; we have annual block parties. There are a lot of neighborhoods in Pasadena which people consider “nice”. This is one of the nicest. I’ve watched home prices – they’ve softened a bit. A major loss in value, though – only with the end of the mortgage deduction. I’m no economist. This is a comfortable, safe place and kids do well here. It ranks with the best of the East Coast neighborhoods if your kids get into the right public schools.

Unfortunately it’s not so simple in the zip codes where we are shopping. We need a 4 br house and/or minimum 2000 sq ft due to the size of our family. In the three zip codes where we’re watching the listings, there are all of 3 homes for rent that meet that need for under $3200/month. Meanwhile, there is a listing we have our eye on that is currently quite overpriced. It has been on the market for 10 months. The sellers are chasing the market down. We’ve viewed the property and it is in pristine condition, practically turnkey. But it’s priced way above the comps, and the sellers have dropped the price three times at $50k intervals. If they drop it once more, we might try to get it in the low $600s. Looking at comps based on price per square foot (because this home is bigger than most in its neighborhood), it’s currently worth about $630k max.

The price to rent ratio, for us, then, is much closer to favoring purchasing a home.

Our only (major) fear is what to expect in terms of depreciation over the next few years. I’ve seen so many huge price decreases in the $600-$800k price bracket just in the past few weeks. $50k to $100k at a pop. Since we really hope to leave Southern California in about nine years, it feels pretty risky to hope that we could absorb, say, a 15% loss in home value after purchase, then make back the difference (or even a tiny gain) within a 9-year time frame.

Did you see this article posted recently by the Dallas Fed? They’re now saying there is no real fix for the housing market except to let prices correct an additional 7-23% before stabilization can occur.

http://dallasfed.org/research/eclett/2010/el1014.html

We feel stuck. We don’t want to rent but we probably will, at least for another year.

That’s almost exactly our situation. We live in San Diego and were actively looking for a house to buy for over 6 months before decided to rent. We pay $2500/month for a house of which one of same model sold for $590,000 earlier this year. It’s a wash, rent v.s. buy. But we decided to rent for a year and are willing to wait and see how 2011 will unfold.

Just rented a home in the Linda Vista area west of the Rose Bowl for $2400/mo which Zillows for about $900k. To have a similar payment on the purchase of such a home I would need a $400k+ down payment! No Thanks.

Nice area to live in, esp. w/out a mortgage!

Merry Christmas and a patient New Year.

Look im really disappointed with this.

Three things,

1. If you’re priced right you sell

2. lack of inventory

3. desire of geographic location

Of course prices will jump up and jump down. Home ownership is not for everyone , just like religion is.

Some people are catholic , some are Christian, some are Muslim.

Bottom line,

Some will always be renters, some will always be homeowners and some will be investors.

Being in the real estate business and having much experience as taught me not to give an opinion, rather give facts.

We can all sit here and give all the examples as to why or why not.

The question should be, do you or do not want to be a homeowner???

I live in the neighborhood of 1900 Galbreth Road. I know the house. I know the sellers. I know the reason for sale. In fact the house went fast, at a lower price, due to certain external circumstances that are unrelated to housing bubble issues. Had the sellers waited even one more day to accept an offer, I think they might have done better on the price.

Leave a Reply