Rent prices drop in 10 of top 12 US Markets: Rental Armageddon taking a brief break for the election.

The last decade has added 10 million renter households. This has happened at the same time that the homeownership rate has fallen to a generational low. Since builders realize that broke Millennials are not going to save the housing market certain markets went into housing mania 2.0. Many people are unable to buy given prices and in many markets home prices are above their pre-market bubble peaks. So with investors and foreigners crowding out the market, we are now left with the current predicament. High home prices and high rents. Rents in many markets seem to be softening. This might be a summer lull or a slight turning point. It is amazing to hear people talk about “stability†but look at this election year! Would you call this predictable? So let us take a look at some rental data.

Rents soften in many markets

Rents are paid with after tax income. What they don’t tell naïve future landlords about rents is that sure, rents are stickier on the way down but vacancies can eat deep into profits. And normally when business cycles turn, people realize how weak or strong their cash reserves are.

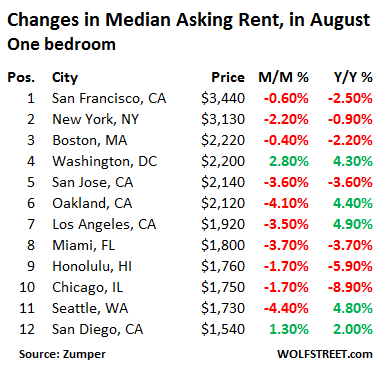

So I saw this report highlighting rents from Zumber looking at 1 million active listings:

Source:Â Wolf Street, Zumber

This is actually interesting. You see some big monthly dips in places like San Jose, Oakland, and Los Angeles. The biggest monthly drop is in Seattle. Many markets are now in year-over-year down territory like Chicago and Miami. This is the more telling sign that something is going on in their local markets. Rents have gotten out of control just like housing prices. This is why in California you have 2.3 million adults living at home with their parents. Can’t buy a home. Can’t afford the rent. Moving back into the childhood room.

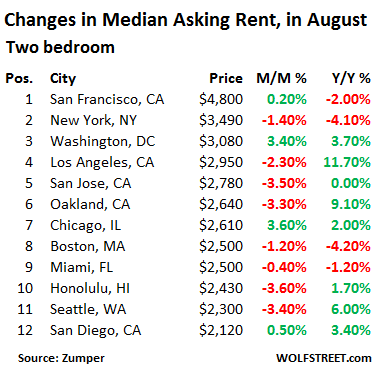

The one bedroom market is probably a better indicator of individual income performance. However, if you look at the two bedroom market, rents seem more resilient:

The difference? You can get roommates or have multiple streams of income supporting the rent here. It is crazy to look at San Francisco and see that the median rent on a 2 bedroom is $4,800. Even manic Los Angeles is $2,950 and we’re in the most unaffordable rental market in the country. Well shouldn’t San Francisco clearly be more unaffordable than Los Angeles? No. Because people make more in San Francisco. Two tech workers can swing the monthly rent easily. But in Los Angeles you have lower incomes even though “entertainment†is a big industry. $2,950 is hard to swing on an Uber income.

There is also an interesting trend going on in California. Many decades ago saying you worked at a start-up was code for being unemployed. Today there are many that say they are “consultants†which in many cases, means people are not working. I’ve ran into a few of these consultants and they live at home with their parents. Why this matters is that when you look at income data, it really doesn’t support current prices unless you enjoy living with multiple roommates or buying a crap shack in the hood hoping your market gentrifies quickly.

Rental Armageddon seems to be taking a tiny breather for the election. What an odd year. I look at articles from 2015 and probably less than 2 percent would have seen this current scenario play out. Yet you look at what people say for housing, and you would think that they have a better crystal ball than the Fed (a Fed that pumped up and allowed this last bubble to pop!). The fact that rents turned down in many big markets does say something.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

108 Responses to “Rent prices drop in 10 of top 12 US Markets: Rental Armageddon taking a brief break for the election.”

The number that really sticks out to me is the 11.7% yearly increase for a 2-bedroom in LA. That’s just plain crazy!

$3000 a month for a two bedroom is close to a $700,000 house. Very reasonable. The “entertainment ” industry is very big in the San Fernando Valley . Vote No on Prop 60 so the industry can continue and the people can pay the big rent or purchase the “crap shack”.

All kinds of new corporate property manipulation companies these days. Management. I meant to say property management companies.

I believe that rents are in a bubble, and I keep my rents slightly under market because honestly I don’t want to gauge people. However, what factors do you think are causing a softening? I mean, inventory of rentals doesn’t seem to be up and there has actually been some wage growth (if you believe the latest reports…I’m on the fence.) I personally cannot identify what factors will lead to a rental armageddon although I believe it is necessary and will happen at some point. Just not seeing the factors personally yet.

Gouge people!

There are a lot of new house/apartment being built. There are a lot of investment properties out there, and many landlords are in fantasy land right now. As they pay pump up price recently for a piece of property, and they expect the rent that property fetch has to covered his overpriced mortgage and tax plus maintenance. When they realized demand for rental is reducing, due to people who can afford to buy are buying, and people who can not afford to buy are living with their parents or finding other alternatives like sharing places with roommates. Unless there is a population boom, It is natural to see the rental demand shrink in near future.

I don’t expect the housing market to crash soon though, as long as interest rate not jumping up drastically.

Housing to Tank Hard in 2016!!

Jim Taylor is going to predict the house market crash wrong in 2016!

Except in Vancouver, B.C.

Thanks for finally picking this up, Doc. I’ve been mocked and derided by some for communicating what has been actually happening with falling rent asks. The tide began turning on rents in Los Angeles over a year ago, so now that the unreliable formal data sources have begun to catch up in the aggregate, it’s on. July to August asking rent decrease will be spun however the cheerleaders feel is most convenient, but something is up when this happens during the busy summer moving months. Mortgage accordingly.

I track employment in construction industry where I do part time work and all of the ads are now asking for project teams for multi-family housing. May be yet another indicator of more supply and translated into lower rents.

These rent stats are beyond lunatic.

Unless you are in the top 10% of income earners you can’t afford the rent. period.

But what about the other 90%?

Cash money has to come from somewhere.

One theory I have is that the 90% are cheating themselves by *not* funding retirement accounts, deferred auto maintenance, skipping health checkups, etc.

In other words, Dr. HBB’s ‘taco tuesday’ people.

But yet by observation,driving around –restaurants are packed, folks are driving new (leased?) autos, taking vacations.

It’s like $$ are falling out of the sky.

Are we now living in a world of fuzzy math in which 2+2 = fuzz?

I simply don’t get it.

Couldn’t agree more. First, you are 100% correct that the vast majority of luxury automobiles (BMW, Porsche, Mercedes, Tesla, Audi, etc.) are leased. Second, you are right that the vast majority are certainly not contributing enough to retirement, and not coming close to maxing out their 401K.

Of course, most people are now stretched to the limit on TWO incomes. If one of the people either gets their pay cut, hours reduced or laid off….POOF, mortgage and rent go into default.

I was once offered a job a few years ago at a certain Mountainview, CA internet search company. When I told them the salary was not enough to afford a basic cost of living, HR said “Well, you have to have two incomes!”. Ok, well then, how about you give me a second income and double my pay so I can afford the rent??

As a long time LA resident who works around the entertainment industry I can tell you that there is a is lot of very creative financing going on for people to justify the rents.

Case in point a yoga instructor/model/single mom I know has a rent-controlled on bedroom in Santa Monica that’s a walk to the beach. She has outgrown the apartment but knows that on AirBnb that one bedroom will bring in ~$4500 in income. Her neighbor only pays $600 in rent and will not rock the boat.

She plans on taking the $3000 in profit and using that as income to rent a house in nearby Mar Vista. The three bedroom house will run ~$4500. Her logic is that her monthly cash flow of $1500 stays roughly the same.

This is happening all over the city. Whether it’s an AirBnb subsidy, a few hours a week driving Uber or the continued hope that they will book one national TV commercial this town is always filled with people living on the financial edge.

People living beyond their means in LA? This has been happening for DECADES. This is a city where first impressions mean quite a bit to many people. Driving a fancy car, owning nice clothes, going to the right gym and having all the latest gadgets. These same people will only live in certain areas of the city no matter what…and those areas cost a pretty penny. Some will wash out, but there will always be more to take their place. You can count on this for the foreseeable future!

Another point that has resonated with my observations – many jobs nowadays simply do not pay enough to cover the cost of living in that area. Example: relative that got a job as an airline stewardess, based out of the SF bay area. No way could she make that work, and she quit after 4-6 months. Another example: software developer for a university that requires a minimum of a Masters degree, with a top salary of 40K – in one of the most expensive cities in the country! No way anyone who can do the math will take that job unless they have a spouse that can earn a decent wage, otherwise there isn’t enough money after taxes to rent a place that isn’t a hovel. This whole economy is a scam unfortunately, but as is typical few are willing to question it.

junior_bastiat: many jobs nowadays simply do not pay enough to cover the cost of living in that area.

That’s true of publishing. To become an editor at a New York City publishing house, you generally start as an intern. An unpaid intern.

But to get this golden opportunity to work for free, you need top credentials. Many Ivy League graduates compete for those unpaid internships.

If you work your way up from intern, to administrative assistant, to assistant or associate editor, your salary is about $20,000, give or take a few thousand. In New York City.

This was explained to me years ago by someone in publishing. Perhaps now the salaries are at about $25,000?

As a result, prestigious NYC publishing jobs generally go to trust fund babies, or to spouses (usually wives) of high-earning professionals. For people with prestigious university degrees who don’t need the money, but rather, want to keep busy at a glamorous, stimulating, and influential job.

This creates a lack of diversity in the publishing houses, because college graduates from poor backgrounds (often kids of color) can’t afford to work for years on end, earning only a token salary.

your exactly right. I am a millennial, unfortunately I dont have the luxury of living with mom and dad that most people my age are still doing to save money etc, i am the only one that i know of that completely takes care of himself and i have many friends both younger and older anyways……… for the millennials in my shoes things are even tougher. I am nurse and make 50k a year, however in order to get by I am not paying my student loans at all, I am not saving for retirement, I am not saving anything in my savings account, and I am leasing a toyota, not a BMW, oh yeah and I live in the ghetto because I cant afford anywhere else. California sucks and I want out. I am hoping the market crashes again by 2020. I have no choice but to sit back and wait for it to crash again, there is no other way I will buy a house. FHA loans etc are a joke because all the lower priced homes, the ones I can afford, are given to people that have huge down payments, or are all cash investeros, and now every house I see in my price range is labeled as a “investors specials”. Housing market is a huge scam, I am guessing they are creating another bubble, and will sell all these newly created loans off to china, along with the student loan debt as well.

You are absolutely right, Joseph. California DOES suck. If you are a nurse, I would suggest getting the hell out of here and moving somewhere more affordable. On a nurse’s salary, you could certainly buy a nice home and save for retirement in most other parts of the country. I have lived all over the country and this place, Burbank/SOCAL is the absolute worst for cost of living. We will certainly be leaving within the next couple of years. We have a combined income of 250k and STILL can’t afford to buy here. Screw this. We are outa here!

Get OUT of clownifornia, or look to work some place away from the major population centers (coastal central cal, or the real northern cal). As a nurse you should be able to work just about anywhere. Maybe even look at working overseas on some military outpost, likely a chill job (don’t pick the mideast!) and you can start to gain on life, instead of just getting by.

You should go work for Kaiser. I know about a dozen RNs that work for Kaiser and they all easily clear 110K, with someone of them making 190K. The starting pay is like 50/hr with some of them making 75/hr. Add in the benefits which is equivalent to govt benefits and you are better than 99% of the population.

The hipsters make 80,90,100k+ a year, dont save or buy much of anything except cute little cars and iPhones. They DO spend a lot of time in bistros pretty much every night of the week however. Oh and don’t forget the tight clothes and shiny oversized shoes.

Rents are still rising insanely in the Eastern Sacramento suburbs. $1,500 a month for a crap one bed apartment. $1,850 for a 2 bed. 3 bed apartments In my area are renting for $2,500 a month. THIS IS SACRAMENTO I’m talking about.. not SF or NYC.

SFH 3 bed/2 bath old, fugly dumps renting for $2,700 a month – a year/18 months ago (last tenant turnover time) same homes were $1,700.

I don’t know who can afford these rents, and I don’t understand WHY anyone would be willing to pay them.

Dear, Sacto is still called “cowtown” by some. Don’t compare Sacto to The City.

In the Bay we always referred to it as SackTown, ha ha…

I live in sacramento and cowtown its not anymore. The downtown with new arean is booming and pushing rents all over the city up despite drops everywhere else in northern california. 10 to 15 percent increases in just the last few months is over the top and you will see the “cowtown” pop back up in the next rising rents surveys. Yes its not SF, but not many places are and this area is the usual dumping grounds for people escaping the bay area housing.

Who can afford the rent? Those that have Section 8 vouchers! The rent doesn’t come out of their pockets–it comes out of the taxes you pay!

http://www.gosection8.com/what-is-section8.aspx

http://portal.hud.gov/hudportal/HUD?src=/states/california/renting

The problem with HUD and Section8 programs are that they are disconnected from what a person or group should be allowed to apply these vouchers to. A $4800 rent doesn’t make sense for our tax dollars. Where this type of rent is more realistic to someone making six+ figures. Trying to accommodate individuals into areas where the income doesn’t support the area does not fly unless you have Walmarts or cheap forms of shopping near the places to live in my opinion. It’s no surprise you have Walmarts or strip malls near apartment complexes to provide low cost living.

Section 8 vouchers are all about “fairness” and “diversity” rather than being connected to reality.

Despite that the fact that neither federal nor California law prohibits discrimination against Section 8 voucher holders, the leftists on the Santa Monica City Council approved an ordinance that prohibits housing discrimination based on a tenant’s source of income, including Section 8 vouchers.

Denise McGranahan, senior attorney at the Legal Aid Foundation of Los Angeles, said that “We see the refusal to accept Section 8 as a form of tenant harassment.”

Those landlords who violate the Section 8 ordinance could be forced to pay between $1,000 and $10,000.

http://smdp.com/council-outlaws-landlord-discrimination-section-8-vouchers/147773

“Section 8 vouchers are all about “fairness†and “diversity†rather than being connected to reality.”

In my opinion, Price of a rental does not have to conform to fairness or diversity. It should create a level at what HUD or Section 8 could subsidize. If a landlord wanted to keep the rent high just to avoid potential voucher candidates they could do that without having to put out a sign saying “no hud here”.

“Despite that the fact that neither federal nor California law prohibits discrimination against Section 8 voucher holders, the leftists on the Santa Monica City Council approved an ordinance that prohibits housing discrimination based on a tenant’s source of income, including Section 8 vouchers.”

That’s fine, but again it all comes down what the government is willing to subsidize for potential tenants. I would be shocked if these vouches are being used for $5k or higher rents for one family.

“Denise McGranahan, senior attorney at the Legal Aid Foundation of Los Angeles, said that “We see the refusal to accept Section 8 as a form of tenant harassment.â€

That depends on how the message is delivered to the potential renters. No Rent Sign or Rent price?

“it all comes down what the government is willing to subsidize for potential tenants. I would be shocked if these vouches are being used for $5k or higher rents for one family.”

Section 8 vouchers pay market rates and sometimes offer even more than rental asking prices. This puts upward pressure on rents and play a role in driving up prices in the rental market.

A Section 8 voucher is for life. Once you have it, you don’t have to qualify again.

LA County Board of Supervisors voted in 2015 to allow parolees and those on probation to be eligible for Section 8 vouchers.

http://www.scpr.org/news/2015/04/07/50842/la-supervisors-lighten-criminal-background-checks/

CCTV America just did a news story that you can watch about weathy chinese are building pricey high rises in houston texas,other wealthy foreigners are building real estate projects too.the rent has gone down a lil bit in some areas of houston,renting is expensive in houston.my mortgage is only $639.00 per month in the heights a hood close to downtown,if i wanted to rent a house in the heights the same size home that i own i would have to pay $3,000 per month or more.to rent in the popular areas in houston is so expensive,whether it’s downtown,the galleria area or the popular hoods close to downtown.people who haven’t bought a house yet in the popular areas in houston have to pay way more than just a few years ago or pay alot in rent in those popular hoods.im so lucky i bought early $$$.

Well, Houston we have a problem…you are stuck between a row of chemical refineries and prospect of long-term depression in oil prices…also I remember that flat as a dishpan strip mall hell, and the beautiful backdrop of chemical refinery smoke trails in the distance from the nice view I had atop One Shell Plaza. Give me the ocean any day with a dash of mountains in the background.

every city has chemical refineries,but every city dont have a beach.googe houston chronicle real estate news,there is a story about foreigners bought $10 billion dollars of real estate in texas from march 2015 thru april 2016,also google houston texas home sales report.i read several months ago some developers are going to create a man made beach in the houston area, there a some beaches in texas but several minutes away from houston.i have family in los angeles,they bought a houses decades ago.i got some bad news i have read home values will increase in the future.i could use my equity from my house to buy a house or condo in los angeles or i could use my equity to rent a house in brentwood,beverly hills or another nice area in the los angeles area.buying a home close to downtown houston texas is a great investment,because if i would of bought a house in another area of houston or the burbs, i wouldn’t be sitting on several hundreds of thousands dollars in home equity.many of you who are renting in los angeles could of bought a house in houston,sell the house move back to la with huge sums of money in the bank.yesterday i read a story you cant even find homes for sale in austin for $200k anymore.people who want to buy a house in houston,dallas or austin need to buy now or pay alot more for a home.

“Give me the ocean any day with a dash of mountains in the background.”

Ok. How about the South Bay, Palos Verdes and Torrance areas which are near the ocean and the mountains in the distance can occasionally be seen on clear days.

Some of the drawbacks of that area are the refineries which occasionally blow up and that fact that it is built on the Palos Verdes, Cabrillo, and Redondo Canyon earthquake fault lines.

http://scedc.caltech.edu/significant/palosverdes.html

http://www.latimes.com/local/lanow/la-me-ln-emissions-torrance-refinery-restarts-20160509-story.html

Despite these facts, the median home value in Torrance is $744,600 and the median list price per square foot in Torrance is $445, which is higher than the Los Angeles-Long Beach-Anaheim Metro average of $389.

http://www.zillow.com/torrance-ca/home-values/

Crazy in La La land.

This is simply not the case where I live in San Diego. The rent here is increasing so fast my landlord does not want to give people year long leases because he sees that as losing money. I was given my lease renewal agreement last month and if I sign a 6 month extension my rent is only going to increase by 13 %. But if I sign a year long lease it’s going up 18%. When I moved in here two years ago you could sign a 15 month lease but they no longer allow that. I looked into not signing the lease and moving to another apartment in the same area with the same amenities but then my rent will go up 35%. I’ve had it with this place. I’m trying my best to relocate to another part of the country. My income has dropped 8% this year and the freaking rent is going through the roof.

So what is your point? Are you saying that rents and incomes should somehow be magically intertwined? I’m sorry, you will have to break it down for me. I just don’t get it. All of the real estate experts we have interviewed here at the San Diego Union Tribune have informed me that no such relationship has ever been discovered.

My point is this article does not reflect the reality of the market. Rents are not dropping. They are going up in many places. That’s my point sunshine.

I would dump that place if I were you, I know it’s not easy sometimes but I refuse to give into a deal that is completely taking advantage of me. Before I was married, I went through some crazy rent hikes, what did I do? I found a room at a house with other dudes my age, I didn’t love it but my rent dropped 70% or $1000.00 per month, however you want to look at it.

I was making 75K at the time, and It felt great having that much more after tax money, I was able to pay off all debt and buy new things I needed/wanted. I did it for a year then I went back to a 2bd apartment but that year made a big difference in lifestyle and was debt free. If I hadn’t gotten married, I would do it again today but that’s life.

This is the craziest lease/rental story I’ve ever heard. Many rally against Rent Control in the Bay Area (and there’s many valid economic arguments on both sides), but who the hell can live somewhere with the 2-Ton Gorilla of arbitrary rent increases and displacement hanging over their head? People need some sort of stability in their domicile. We all have to be able to simply come home from work with a simple roof over our heads and not have to worry about moving every single year…

I hear ya. I just don’t see it. I actually have waiting lists for my rentals in SD and the IE. Recently I had someone offer to pay 6 months in advance just to get to the front of the line. A 2-3% monthly decrease in asking is nothing but a blip on the radar at this point. I don’t see any decreases in asking prices or increase in vacancies in my hoods.

Sounds about right for SD. The apartment complexes gouge people who don’t move out after a year. You’ll find some cheap rentals in November & December because not many people move then.

I hear yah. I rented for a short period and after seeing a large property group come in I predicted correctly and left. Rents went up almost 50% by a year later.

I’ve been working part time by choice and doing things I was never able to do while living in S.D. since leaving 3 years ago. Best decision I could have made was to leave. Your mileage may vary but if you do it right your standard of living will increase dramatically if you leave. It’s essentially a choice between living like a third world person or having a nice home of your own with time to enjoy it. There are many other nice places in the US where you can live comfortably and insulate yourself from this madness.

I totally hear you about leaving SD. I’m working very hard to leaving this place. I’ve been here almost a decade now and the great weather is no longer enough to justify staying here. I’ve applied to jobs in Tucson, Charleston SC, Savannah GA and Wilmington NC. Hopefully I’ll end up somewhere back in the southeast but I’ll settle on Tucson if I have to. I could have a mortgage on a nice home in any of those cities for hundreds less per month than what I pay for a little 2 bedroom in the eastern suburbs of SD. I’m sick of this crap and I’m determined, one way or another, of getting out of here in the next 12 months.

Its so nuts down here that some places are using monthly rental agreements and changing the rents according to the latest lease rates. Apartments around Cal State San Marcos are using this formula.

Thats crazy about Sacramento. I grew up there and paid $300 a month for my first 1 bedroom apartment after college back in 1992! Even San Diego is less expensive which amazes me as much nicer place than hot as hades in summer and cold as ice in winter Sacramento.

What’s a 1 br going for in the Sac?

“The entire increase in young adults living with their parents over the past twenty years can be explained by demographic shifts. That means the high share of millennials living with parents today might be the new normal.”

http://jedkolko.com/2015/11/23/why-millennials-still-live-with-their-parents/

I live in Oakland, a city that’s seeing massive gentrification. Just by looking at these stats you can see the overspill from SF proper. Looks like rents are stabilizing there (as the absurd prices have clearly hit a ceiling). Eventually you’re going to run out of millionaires to pay these prices. Now those priced out of SF are migrating over to cheaper, industrial, crime-ridden Oakland- hence the 9% yearly rise in rents there. I’m happy for the convenient commute into downtown SF, but the rent I’m paying is seriously not worth it for a neighborhood rife with gunshots, potholes, bums and abandoned houses… Sad, I’m a 5th generation Bay-Area local, but if my aging mom wasn’t living here, I wouldn’t stay for All the Tea in China. It’s just not worth the fight 🙁

I suspect this is the result of the federal reserve program that was instituted in 2009 that allowed large institutional investors to purchase all of the foreclosed upon or pre-foreclosure homes and turn them into rental units. In fact they had to turn them into rental units for a minimum of five years and then could renew for an additional five years at that point they are supposed to sell. So it will be interesting to see what happens around the 10 year mark. All I know is these large institutional investors i.e. Goldman Sachs J.P. Morgan Chase were turning the rent rolls into securitize Asian products for investors. So they are doing with rent rolls what they did with mortgages pre-2008 economic housing collapse. On top of which we have a problem getting any interest on your money. One used to be able to throw it in a CD and make 6% interest easy, now you get .01% so you got to find somewhere to park your money that will at least allow you to keep up with inflation and so a lot of people jumped on the rental bandwagon. As per usual it is all done purposefully and intentionally so Caveat emptor. A lot a rental units with high asking prices are sitting empty. But I’ll bet money the large institutional investment banks are not telling their investors about that little fact. I’m sure on paper it all still looks great LOL

In my opinion this is what is coming with all these bought properties.

The other word to look for “securitized rents”.

https://www.thestreet.com/story/13416648/1/reits-likely-to-benefit-from-inclusion-of-real-estate-in-the-s-p-500.html

http://www.cnbc.com/2016/08/22/the-sp-500s-new-sector-could-be-a-really-big-deal.html

http://www.wsj.com/articles/when-the-s-p-500-breaks-out-reits-you-may-get-a-tax-bill-1467990564

I sold all my Vanguard REIT ETF shares about a month ago, after they went up about 10% YYD, because

a) I am not greedy

b) I see the stock / real estate bubble popping soon again

https://www.google.com/webhp?&ion=1&espv=2&ie=UTF-8#q=vgsix%20stock

Exactly. It amazes me that no one is talking about it. No media source, not grassroots orgs, no candidates. Pension plans are investing in these REITs, so I guess they will end up holding the bag.

Lots of empty houses owned by LLCs. I know, I sought out the owners a while ago in an attempt to buy a run down empty house I could fix up.

Please correct my comment above to securitization not security Asians lol

One of the things that’s keeping us in our rental up in here in Portland is that the value of the 3bed/2bath SFH that we’re renting has apparently gone up $150-$200K since we moved in a couple of years ago (a comp just sold for that a block away,) and our landlord has yet to raise the rent, so now our rent is noticeably lower than rental parity on an equivalent place (not to mention the huge downpayment.) So, we’re stuck with the decision of either saving more cash and renting this place longer, or buying a place in a “lessor” neighborhood. We’re staying put for the moment, and I’m going to see how the economy plays out until next summer, then we’ll reevaluate.

I am in PDX as well. We moved here in 2014 and have been renting while watching property prices skyrocket. We plan to re-evaluate next summer as well. I have the feeling some Fed hikes are coming.

Except for foreign buyers of U.S. real estate, here are the facts!

1. Household incomes adjusted for inflation are essentially at 2000 levels despite the Bureau of Labor’s announcement that incomes median incomes rose over 5% last year!

2. Around 1/2 of Americans have no retirement savings accounts.

3. The median net worth of Americans (excluding their homes) 35 – 44 is $14,266, while the median net worth of those 55 – 64 is $45,447.

4. The average Social Security check is $1,294/month.

If you own your home, you desperately hope those home prices continue to climb!

I have small homes with back yards near the beach. I raise the rent $750 per year. I am trying to do a favor for my long term renters. But, the market rents are going up much faster. At some point, I will be raising them far more than $750 in order to catch the market rate. However, this is insane. I don’t understand how rents could be rising so fast in Manhattan Beach and Corona Del Mar. Something is not right with this … and the government tells us there is no inflation. Not true.

What I don’t get is that that most renters, along with the news media, will be the first to scream “racism!” if there is any mention of enforcing immigration laws, or of reducing legal immigration to a digestible number (such as two million legal immigrants per year). You lot want open borders, and at the same time complain about rents and housing prices going up. Make up your minds!

We’re our own worst enemy. Now they want more refugees too lol. S.D. already has 70,000 Iraqis and most of them are subsidized too. No one seems to care.

Landlord in SD and I’m content with the averages. I maintain rent below market for nicely upgraded properties… Creates demand for my properties, thus, zero vacancy and can afford to be highly selective- result is near zero turn-over. Raising rates is a simple win for me without having to be the bad guy. Is what it is…

I know there are plenty of S. Cali landlords posting here. What I’d like to know is if anyone is having a hard time finding renters and/or having to lower prices to attract renters?

I’m a landlord in California. I have over 15 houses and units in the IE. No issues attracting tenants. I can easily get over a 100 calls in one month (with first 3-5 days receiving 10-20 inquiries per day) for even properties in the outskirts of the IE. That is not the issue. The issue is the quality of the tenants. I sometimes still discount my rent (eg., $500 off first month for “serious/ready to move in” tenants. And my rents are under-market by about 3%-7%. Just like “Mr”, I do it so I can be selective. My properties are also upgraded. I’m no slumlord, that’s for sure.

If you’re looking to rent, I highly advise to do it during the holidays. You can easily get $50 or even $100 off a 1000-1700 rent. And if the LL is like me, you’ll likely keep that rent for years to come. I’ve never raised the rent on any of my tenants, only after they move out do I adjust to market value. At the very least you can often find big move-in discounts during the holidays.

For those of us who have keen interest in real estate development in LA, here is the best website I have found.

enumerating countless apartment and condo and commercial developments in LA, LA, LAnd.

http://urbanize.la/

enjoy

Moving from a 2d to a 3d world now. Urban sprawl makes it harder to commute to town. Makes sense to do this long term.

IMHO, we continue to accelerate into a world of “haves” and “have-nots”. Home ownership has fallen to historic lows after the 2008 bubble burst. Wall Street pounced on this opportunity to create a new investment diversification strategy for the “haves” who have seen tremendous and scary-wonderful growth in the stock market. Investment firms like Blackstone gobbled up foreclosed and distressed inventory from the “have-nots” and rewarded the “have” investors with remarkable returns on rental properties. I was listening to Patriot on Sirius Radio yesterday and the ads for investment diversification opportunities in “Real Property” are played multiple times per hour. Home builders will eventually stabilize this situation but the material and labor cost for new homes and apartments seems to be above rental parity. Wages have to go up or it is likely Trump or some other Trump-like candidate will be elected. We haven’t reached a “Hoovervile” state yet like in the 20’s but we are getting close. When that happened, FDR promised and delivered the US a socialist economy for 4 terms. Obama, Hillary, and Trump are not socialists but a candidate like Bernie will likely win the next election if this continues.

“Blackstone gobbled up foreclosed and distressed inventory from the “have-nots†and rewarded the “have†investors with remarkable returns on rental properties.”

Blackstone was in deep trouble during the crisis, but somehow they managed to put their troubles behind them and started gobbling up thousands of properties throughout the US. Where did they get the money? Deutsche Bank. But Deutsche Bank was about to go under; where did they get the money to not only save themselves, but to loan money to Blackstone? Take a wild guess: Deutsche Bank was bailed out by ___ ___.

WHERE’S half a trillion dollars, Ben? Grayson hammers Bernanke

https://www.youtube.com/watch?v=uGs_Qn5yEgs

Where did the Bailout Money Go?

https://www.youtube.com/watch?v=9CGAGgFKDUM

Good point- in Oakland where I live, about 10,000 families (mostly working-class AA and Latino) lost their homes in the crisis. Many of these foreclosures were bought up by corporate/large scale Real Estate investors in the depths of low-prices in 2010/2011. My current landlord owns something like 200 properties that he bought by raising $70 in cash from various investor groups:

http://www.eastbayexpress.com/oakland/neill-sullivans-oakland/Content?oid=3879812

He then simply slapped a new coat of paint on these buildings and raised the rents by $1000. These areas are not pretty or pleasant by any means, and no real improvements have been made on these properties- just now everyone is paying a larger and larger % of their take-home pay for a simple roof over their head. All the while a few fat cats rake in the millions.

As the the middle-class shrinks, this country could go either way: a more European-style/FDR New Dealt state, or a right-wing Trumpian/Pinochet quasi-fascist business state. Politics tend to get more extreme and polarized on either end of the spectrum when the majority starts to feel desperate…

“As the the middle-class shrinks, this country could go either way: a more European-style/FDR New Dealt state, or a right-wing Trumpian/Pinochet quasi-fascist business state.”

LOL! The US has $20 trillion in debt and cannot afford the current entitlement programs let a massive European-style socialist welfare state. Even the European Union can’t afford their socialist welfare state with many EU countries like Greece, Italy, Spain, Portugal and France that are teetering on collapse and will need to be bailed out.

Only a brainwashed leftist idiot from the SF Bay Area would compare Donald Trump with military dictator like Pinochet. The U.S. has a Marxist dictator in the White House now with Obama who ignores laws that he doesn’t like and make up his own laws and regulations without the approval of Congress. If anyone is a fascist, it is Hillary Clinton whose pay for play schemes involving her Clinton Foundation is blatant corruption that is typical of a fascist dictator.

Actually, Obama and Clinton are corporatists — just like every one of their conservative and liberal predecessors. They put corporate interests, those of the richest .00001%, above any political interests. I suspect that Trump is one as well. But his agenda and political constituency does not match those of the establishment, which is why he is unpopular within the GOP leadership.

These are the ads I’ve been hearing on Sirius. It offers the small investor (a low as $500) to jump on the bandwagon and invest in rental house. The Rich Uncles take your investment money and cash-buy rental housing and provide a return on the rental income (According to the comments, they keep the tax benefits of depreciation.) This means that more cash is flowing into the real estate market and will likely drive up prices. The poor renter who wants to enter the housing market has a much more difficult time with this competition. http://reviewopedia.com/workathome/rich-uncles-reviews-legit-or-scam/

Which is why I keep saying that the market has PLENTY of room to go up! Just because it’s over-priced now doesn’t mean it’s due for an imminent correction. Everyone on this forum keep saying “people are so quick to forget what happened in 2008” but they themselves forget how much higher prices reached in 2008 (over 33% higher than current prices by my estimate). And now, with this crowdfunding real estate trend, you get a lot of cash from much more people which drives the prices further up! I truly believe that all the other real estate booms were just trial runs to get us into this state of perpetual prices increase and I think this time, the powers that be nailed it.

Another warped way to look at this is that a small investor who is renting and has $10K (not enough for for a down payment) sees real estate prices rising and may decide to invest in the Rich Uncles. It is possible the Rich Uncles may buy the poor renter’s home and raise the rent on that same house to increase the ROI for the Rich Uncle investors. After fees, etc, this will not likely be good for the small renter investor (have-not) but will likely reward a homeowner investor (have) with increased property values and a modest ROI.

I live in the SF east bay (not Oakland). There is a lot of construction around. In my town there used to be 3 large apartment complexes renting 3 bedroom units. This summer two more came to the market and two more are near completion. Eventually the business cycle will take its toll. If rents are very high, there will be construction, then over-construction, then when recession hits… That’s capitalism. Granpa Marx explained it two centuries ago.

Yep, I work in planning for construction projects throughout the Bay Area. My office is out at San Ramon but I travel to construction sites all over. There is a absolute ton of huge complexes going…acres and acres of multi-family housing…Dublin, Concord, Pleasanton, parts of Milpitas, Fremont, Emeryville..and more on the Peninsula around Redwood City, Foster City up through Burlingame.

Oakland and Berkeley missed the train for the most part. Some construction but not nearly what it should be and now it’s too late to start many more large complex from the Rockridge BART to downtown, uptown Oakland to Kaiser is pretty much fully built out and they didn’t go big enough. A few buildings but nothing serious. I count 2 cranes in Oakland…meanwhile DT SF has over 22 cranes I counted the other day from the Bay Bridge.

Plus I know of lots of millennial/gen-x…aka…my age that are moving out to Sacramento and of course Seattle/Portland.

The non-SF rents will and are starting to come down. Or at least remained flat and I definitely see it.

Yes, and Portland is almost as bad as SoCal now. Exploding rents and home prices, traffic worse than LA and fewer high paying jobs as in the other west coast cites. Hipsters with part time jobs and homeless galore, a real recipe for long term success. At least we have the far, far left progressive government here to make sure that everyone gets his share from the poor hard working, barely making ends meet taxpayer. I have been here 20 years now and it ain’t changing for the better I can tell you that.

It will be fascinating to watch this all come crashing down. Seems like it will be worse than 2008, in that people are in a more precarious position than at that time. The aftermath will be a mess with politicians trying to bail out their benefactors and putting us further into a hole.

Apres Obama, la deluge!

Shhh…didn’t you know, this time is truly different?

Should we be surprised that at some point prices for rent and purchase will hit a wall? Except for those rich foreign buyers, reality is as follows according to a new article in Bloomberg … roughly 1/2 of those making $100k – $149k, have less than $1,000 in the bank. Of those making over $150k, roughly 1/3 have less than $1,000 in the bank! Combine that with the fact that household incomes are still no better off than they were at the beginning of the new millennia, and recent overall assessments that over 1/2 of the population have less than $10,000 saved including retirements! These numbers don’t include residences, so all those who do own a home, are praying that the real estate market doesn’t crash again or there goes their last hope of a ‘pay day’!

Still waiting for the pent up demand from high, middle, and low wage earners to permanently fuel real estate prices to new heights. Kinda makes it hard for organic buyers to qualify if they have little or no money saved.

The inventory is still sh*it in Bay Area all the way to Vacaville in both buying and renting. After moving back out and checking rents for anything decent, we just bought in Fairfield, you have more time to chose what you want for dinner than you do to buy a decent house in a good neighborhood.

Praise be to the Fed and Housing Gods we didn’t just buy at the top, as is my suspicion. I at least hedged my bets by buying a house I could love to live in for the next 30 years and has a rental income unit on the property.

You did buy at the top. But at least you’re aware of it.

I call national market peak/recession starting in Q1-Q2 2017. As soon as the election is over, the Fed will start raising rates and bring it crashing down.

2017 will be 8 years past the last recession, which is the average since the 1960s. On top of that, receive are twice as likely in the year after a presidential election.

Why has no one mentioned collusion?

With the REITs having bought up an enormous amount of residential inventory, isn’t it possible that we’re not experiencing anything close to a competitive, free market?

That’s the point that recent organic buyers continually miss. It doesn’t matter whether mortgage standards for them and their peers were stringent. They were retail buyers compared to the highly leveraged financial institutions that had the inside tract on acquiring multiple RE tracts. When RE prices go down, it will partially be because these investors are selling, well ahead of retail buyers.

See my post above. But as always, the “free market” get blamed.

A rigged market is not a “Free Market”. If it was a free market the housing market would have collapsed back in 2008 and not bounced back until the organic home buyers income recovered and they started buying homes to live in. Not wall street corporations backed with 0% Fed money so they could pimp homes out as rentals and package them as securities which will eventually fail terribly and bust this current housing bubble, again.

Are you kidding? Housing hasn’t been a free market for decades, since the government got into the mortgage business with Fannie and Freddie, and then expanded big time after 2008 with the stated objective of manipulating the market.

It’s only a “free market” to the news media, real estate agents and so-called real estate economists (must be like the home econ degrees of old).

I think REIT’s are very capitalistic. They just take investment cash from people who have cash and invest in rental housing. They raise the competition to a new never-seen-before level. With REITs and foreign investors driving up the market with cash buys, and current homeowners hunkering down with their Prop 13 tax benefit, inventory is low and prices keep climbing (along with rents). There will be a point where prices for houses can’t provide a decent investment return for the REITs. This will flatten rent prices (Maybe now). I don’t see a bubble because the demand is still high and REITs, foreign investors, and you and I will be waiting for any small drop in real estate to pounce and stabilize it. A REIT will not likely be a kind and caring landlord and will not keep their rents low. They want maximum ROI to keep their business running.

In other words, things are different now because prices could never ever fall precipitously like they have several times in the past. Never mind that investors are already over leveraged or that organic buyers may be not be looking to catch a falling knife. Never mind that one of the largest REITs has been reporting falling revenues for several months. Perpetual price booms are here to stay.

Cheap and easy credit tends to numb critical thinking.

The rent stats for Chicago are absurd. I can get you a nice one bedroom in Chicago in a nice neighborhood, Andersonville, Logan Square, or NW among others for $750. I have a nice studio for $550 in Logan Square

I know it’s median rent but there has got to be some huge downtown apartments inflating these rents. Perhaps it’s right for California, but for Chicago it’s way, way, WAY off the mark

Hi Eric, West Ridge-Rogers Park denizen here. I hate to tell you, but one- beds in this area range from $900 to $1100 a month, and even studios are $750 at least, for apartments in older buildings, while new buildings in the Rogers Park-Edgewater area rent for at least $1400 for a one-bedroom unit. Trendier areas such as Logan Square & Wicker Park sport much higher rents, while you can count on paying at least $1700 for a decent one- bed in “green zone” neighborhoods like Lakeview, Ravenswood, or North Park. And of course, the sky is the limit in the wealthy neighborhoods close to downtown, from Lincoln Park to the Near North and Streeterville.

Worse, many condo buildings are “deconverting” to rentals, because their owners have discovered that if they de-convert their buildings back to rental buildings with one PIN number, and sell them, they can fetch a per-unit price substantially higher than if they sold their units as individual condos. Thus the supply of available condos is shrinking drastically, in a complete reversal of the trend of 1978- 2008, of converting rentals to condominium. That happened when rents would not rise to cover the costs of running these older buildings.

San Diego is very on point here except the inflection point was the suspension of accounting rules requiring banks to mark properties to market. Now its all extend and pretend.

Has anyone else noticed that Berkshire Hathaway is now selling a lot of inventory? In my area they are popping up everywhere. in my opinion, this is a huge leading indicator of something very obvious, like a good old fashioned market peak. Anyone else seeing this? I’ve only noticed this the last two days.

Wouldn’t surprise me, especially since Buffett recently claimed that there was no real estate bubble. Say one thing, but mean another; be fearful when others are greedy. Sam Zell’s REIT has been selling off its properties since last year. Blackstone is now issuing subprime-type mortgages to prospective buyers of its properties as well. Must be running out of all-cash buyers.

That sounds about right.

Blackstone like other REITS that went on buying sprees when prices were low, realized that not all rental property was profitable and started selling off the properties in lower-income urban neighborhoods to streamline their portfolio. While doing so, they realized that can make even more money by offering these properties to the current tenants via sub-prime mortgages and doing in-house financing.

http://www.bloomberg.com/news/articles/2016-07-05/blackstone-s-tenants-get-a-chance-at-buying-their-rental-houses

Let me guess, Blackstone will sell these subprime loans to the government (us).

Mr Miyagi,

I think GH bought colddell banker, so those are brokerage signs

wax off

Obviously they are brokerage signs, what did you think we were saying they were?

And what is GH? Sorry, my acronym guessing app is acting up.

I’m in one of the Invitation Homes – these are the blackstone properties. They sent out a Letter delivered Fed Ex advising me I could buy this house with their creative financing. No mention of price. I guess this appeals to the same people that go to a car dealer and say “I have $350 for a car payment” mentality”. Funny because down the street there’s a Berkshire Hathaway real estate sign trying to sell the house that was foreclosed and vacant for a year – then refurbed in 5 days and put on market. It aain’t going anywhere the market is cold and getting colder

Over the last two years in Orange County (Tustin, Costa Mesa, Mission Viejo to name specifics) I have seen many large “luxury” apartment complexes built and many still currently under construction. It feels like these developers are in the process of overshooting the rental demand…

Just watched a program on NHK World called Asian Insight. Today’s episode was about the housing boom in Beijing. If you were to take all the Doc’s blogs, and all the comments here over the past few years, but substitute Beijing for Socal, you’d see they are an exact mirror of us. The young and newly marrieds complain that they cannot start families or buy a place to live. One had to have ‘rich parents’ in order to make ends meet in the city. People are convinced that prices can only go up, so they purchase crap shacks for outrageous prices. Exactly like us.

I’m old enough to remember Nixon’s trip to Red China. Heavily covered on TV. Looked like there were almost no cars in Red China, despite wide, clean highways. But hordes of bicyclists.

Bicyclists in blue “beetle suits” (as those Mao jackets were sometimes called). Everyone looked and dressed identical. It looked like “true Communism,” where everyone was equal. Scary, in that there appeared to be no individual identities. But True Equality.

Now, no longer, I guess.

Those are interesting numbers. However I’m not clear on how rents of apartments in Miami are higher than in San Diego. Perhaps there are not many apartments for rent in Miami. Pretty sure you switch that to houses and San Diego prices are higher.

I’m in central Florida in a very desirable county. When I was first signing the lease on my current apartment last year, the agent at my somewhat upscale development mentioned that future lease renewals would see rents increase but never decrease…I just got my lease renewal today and my rent is actually going down by $20. On the company’s website, there are about 10 units available with my floorplan (there were only about 2-3 when I was looking last year). Something is definitely starting to shift.

Leave a Reply