The Rental Market SPV: Bring out the memories of CDOs and Special Purpose Vehicles. The start of selling rental income through Wall Street.

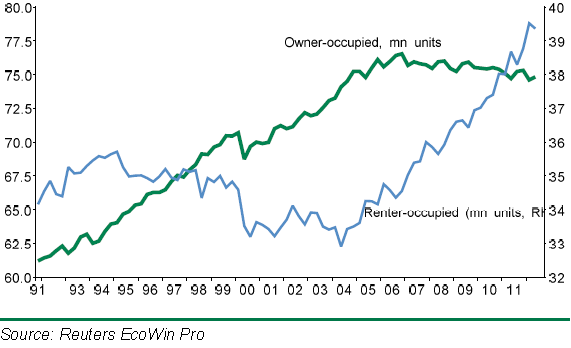

The number of Americans renting has grown since the recession hit. The nation has shifted from one where everyone should own to one where many should rent (and rent from a large hedge fund or Wall Street investor). We have become a renter nation. The demand from investors buying through large financial institutions for the purpose of renting out single-family homes has never reached this manic level in history. Even last month, roughly 30 percent of all home purchases continued to go to the investor crowd.    So it should be no surprise that the first-ever bond backed by US home-rental cash flows is now being backed by Wall Street. This is a $500 million deal for Blackstone and is being structured by Deutsche Bank, Credit Suisse and JP Morgan. The deal is listed under “Invitation Homes 2013-SFR1†bringing back the days of the CDOs and complicated derivative structures that imploded on the balance sheets of many banks. These REO-to-rental structures seem good on paper but anyone involved in the rental business knows how fickle these markets can become. Plus, should the economy ease up again what do you think will happen to those rental cash flows? Also, some of these hedge funds have focused all their attention in areas like Nevada and Arizona that fully depend on the housing market going up and up and for these areas, investors have been buying upwards of 50 percent of supply.

The demand for rentals

There is little doubt that more Americans are now renting for a variety of reasons:

The recession caused the foreclosures of more than 5 million households. Since 2009, roughly one third of all home buying has gone to investors. So this has been a shift from overburdened households to big money investors, many that got in with some extremely great deals courtesy of favorable bank financing. The Fed made this bed; force rates to incredibly low rates to make saving a horrible option and chase money into speculative realms.

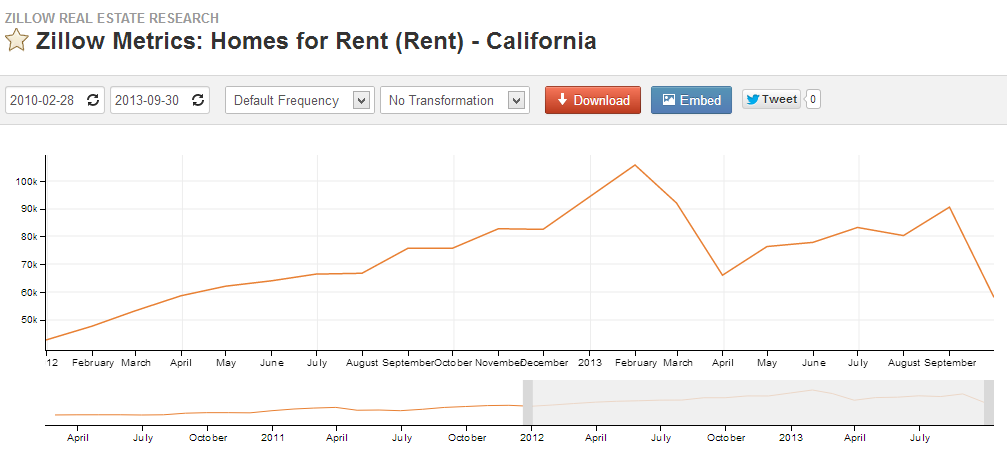

As you would expect, the recession has caused people to shift from buying into renting. Because of this demand we have seen rental supply decrease as well:

Source:Â Quandl.comÂ

In California last year we had 94,311 homes available for rent. Today, it has dropped to 58,157. At least for California where the middle class is visibly struggling and affordable housing is out of reach for most families, renting has become a viable option (the only option for many). As we are seeing with the prices for homes over the last year a very constrained supply is going to push prices up especially with hungry investors diving in. The special purpose vehicles (SPV) for rental cash flows is probably the golden prize of many big investors. Many appear to be making that final hurrah like those dumping CDOs in 2006 and 2007.

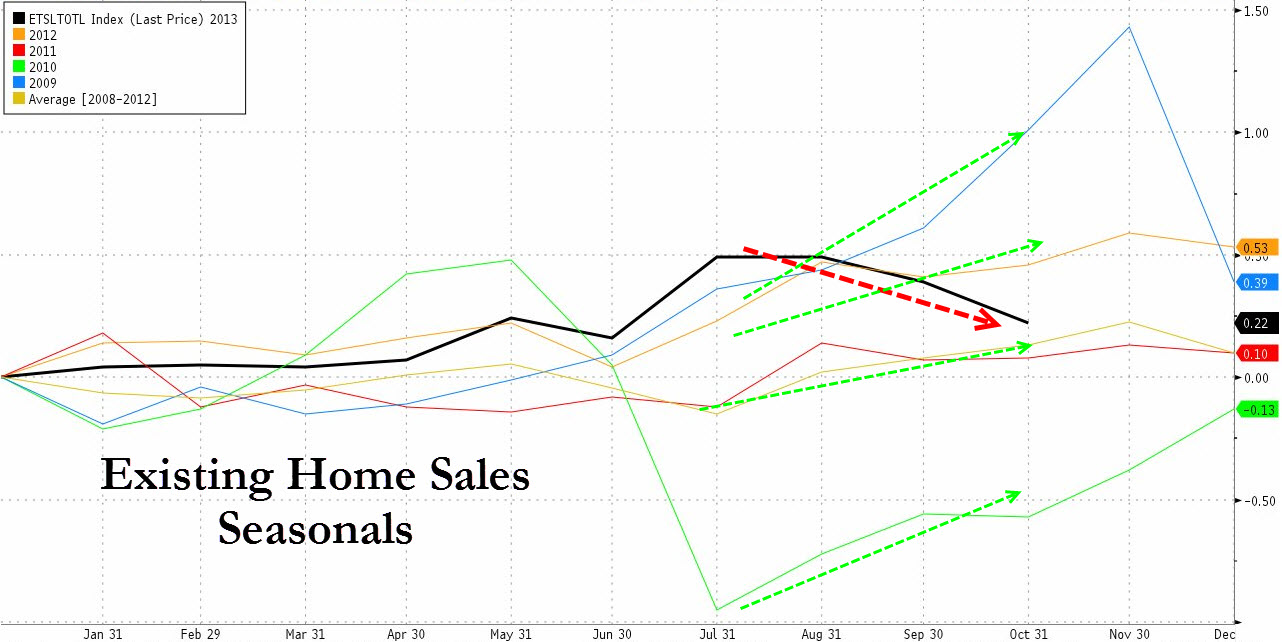

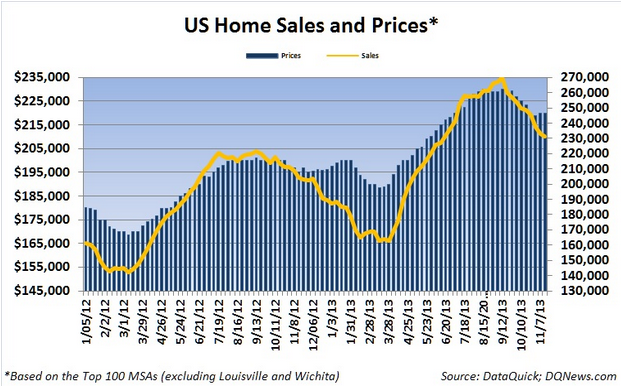

The market is already showing some signs of weakening both on prices and sales:

Source:Â NAR, ZeroHedge

For the first time since 2009 we are seeing a drop between the July and October sales numbers for existing home sales. These are always seasonal, or used to be at least, but over the last few years the demand trend has been bucked. This year, there is definitely something that is shifting.

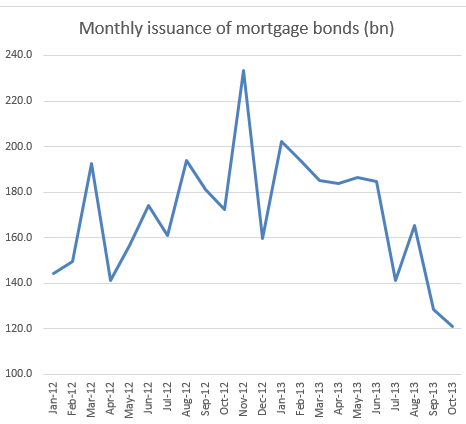

We also see this in the form of mortgage bonds being issued:

Source:Â SoberLook

Where is the demand coming from? The investor demand that largely avoids mortgages has alternative sources of financing. Yet for the public stretched with weak household incomes everything depends on low interest rates and other gimmicks that lower the monthly payment. This is why we have seen the resurgence of ARMs and FHA insured loans are still a popular option for many cash strapped buyers seeking to purchase a home. It is also a reason why a modest move of 100 bps with rates still in the low 4% range has hit the market hard (even though these are fantastic rates).

Without a doubt, we are seeing a softening of sales and prices (whether this is seasonal or something else is yet to be seen):

Typically the fall and winter are slower selling seasons but as you see from the previous chart of existing home sales, this is a trend reversal from the last five years. The fact that we are now seeing rental SPV is very reminiscent of the CDO days of the housing market. Many renters are on a razor’s edge so this is a very sensitive market if a recession were to take place. How will these SPV respond? This is an untested market and with prices softening and sales slowing down, the yields may not be so lucrative especially with the mortgage rates soaring 100 bps in 2013 in spite of the Fed basically owning 12 percent of the mortgage market via QE.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

61 Responses to “The Rental Market SPV: Bring out the memories of CDOs and Special Purpose Vehicles. The start of selling rental income through Wall Street.”

If you can avoid it stay away from renting, in the long run anything you actually own is much better then making the landlord richer and his or her equity in the property going up.

Of course in the short term or special circumstances renting has a place in the market, but over all, folks made their fortune in real estate, commercial property, and rental units.

The trolling is picking up, this tells me we’re already past the top 🙂

So tell me Mr Robert, are all those lucky “Home Owners” who bought in 2006 better off? How about those who bought in 1989 in Japan? It seems the FED is determined to follow the Japanese model. While I don’t doubt the wisdom of you and the Casey Serin’s of the world, the fact is you either rent money from the bank and assume all liabilities and risk, or you rent the property from the landlord with the ONLY risk being losing out on appreciation and a tax deduction.

The sheeple got fooled once this decade already. That’s why the only activity driving the market is foreigners laundering money and specuvestors. Everyone arguing a second bubble uses math and basic economics. Everyone proclaming the “New Normal” is in effect chasing unicorns. It wasn’t real in 2006. It’s EVEN LESS REAL now.

You are looking back at event 7 years ago. Why don’t you go back to the 1929 crash. People move on capitalism moves on, no way America will not be a place to invest in.

Just ask any person with money in the world ,America is still the place, and American dollar is still standard of the world till that changes America is still the land of opportunity including buying a house.

Again Robert, what does that have to do with the math of the current housing market? I’m arguing imperial facts, your talking unicorns and rainbows.

You proved the point of my previous post in incredibly exacting fashion.

NihilistZero – ownership has nothing to do with rent, equity, etc. It involves control of a property. Sometimes that control, can screw you, other times it can make you rich. The statement below is asinine to anyone who has had 15+ years in REI:

“the fact is you either rent money from the bank and assume all liabilities and risk, or you rent the property from the landlord with the ONLY risk being losing out on appreciation and a tax deduction.”

As an owner, you assume some liabilities and risk. The most is covered by insurance and local laws. Anyone who puts significant time and effort into real estate investment has a much better chance of succeeding than someone who saves.

A better chance of succeeding at what?

Looks like march is a good month to buy a house! Last chart…like clockwork

I just can’t see it. Horrible investment. Makes no sense. It’s not as though incomes are going up, and the economy is strong. Maybe in Silicon Valley or the oil and gas boom towns of the Dakotas and PA., and, of course, NYC, but, elsewhere? Nope. Especially since some of these funds (I haven’t seen the prospectus on the one mentioned) are pitching for other people’s money by claiming that they will be able to raise rents 5% a year. Really? I don’t think so. I have been a renter since a divorce in ’01, and, believe me, when a landlord finds me, they avoid raising rent, because I’m a good, no hassle tenant who pays on the first without a miss. My present rent hasn’t been raised in five years. Believe me, if I was looking at a 5% rise in cost of housing every year, I’d constantly be shopping for other places in the market, and my landlord might be dealing with the third or fourth tenant in five years.

Talk to any small landlord. First and biggest problem is finding good tenants who keep the checks coming. One bad apple, and a year’s profit, maybe two is gone. How can these cube jockeys in Manhattan and Greenwich possibly screen so many tenants from a thousand or two miles away, in an economy where even the well paid are a month or two away from poverty if they get laid off, because they are deep in debt and have no savings? OK, so they hire a management company locally. Those people don’t work for free. Then, of course, there’s the whole issue of maintaining a hodgepodge of older homes scattered about in a large area. That has to be expensive. The small landlord does the work himself. Imagine the high cost of hiring out the work for all of that in mismatched homes. There’s a reason apartment buildings exist and are profitable. One or maybe two supers doing all of the work. One roof to replace. One plot of landscaping to maintain. etc.

The only bright side I can see to all of this is that the structures being bought up and renovated will, well, be maintained now for probably five to ten years, instead of slowly crumbling away. This is even more important in Florida and areas in the south, as one good hot, humid summer can destroy a home with mold. Probably, in five to ten years, when these “investments” turn out to be the turkeys that they are, these homes will be dumped onto the market in better shape than they would be if nobody bought them. With better kitchens and bathrooms.

Oh, I forgot. I saw this a week or so ago:

http://huff.to/1g9QWlN

“”You can not get in touch with them, you can’t get them on the phone, you can’t get them to respond to an email,” said Culpepper, whose family has lived with the problem [sewage smell] since the day they moved in five months ago. “My certified letters, they don’t get answered.””

Something tells me that you’ll be hearing many more stories like this in the next few years. Suburbia is now turning into the new slums of America.

As soon as we get a round of Layoffs these tenants are not going to pay rent, better yet they won’t be able to pay rent with no job.

they could be in the rentals for months, and the court will not evict them. I know a guy that has a rental in Nor Cal and the tenants have been there for 9 months. He has been to court 2 times @ 3 mo and @ 6 mo and the tenants got an extension to say going on 10 mo. now… each time the judges says: they have no job, they have no Money how they’re going to pay you?

the Landlord guy I know is furious. He’s a family man, hard working guy… works everyday alot of hours….including weekends.

So judges dont care if landlords lose a few thousands

the question is?

Are these hedge funds playing landlord with American working families, like American Home 4 rent too BIG to fail???

If they (investors) won’t answer the phone or respond to certified letters, in California you can just move out! Without penalties if it is a habitability issue.

Then the SFR can sit empty for a new months before some new sub-prime renter comes along.

I myself am a renter but I know of plenty of deadbeat tenants.. have a few in my neighborhood. They were approved to lease these homes after I watched the houses sit empty for months and months because the greedy landlord was asking way too much in rent.

The market will bear what the average person can afford to pay. Most renters of SFRs like myself will just downsize to a nice apartment if the SFR landlords get too greedy.

+1. Excellent post, Mike M.

Doc wrote:

“Plus, should the economy ease up again what do you think will happen to those rental cash flows? Also, some of these hedge funds have focused all their attention in areas like Nevada and Arizona that fully depend on the housing market going up and up and for these areas, investors have been buying upwards of 50 percent of supply.”

“The fact that we are now seeing rental SPV is very reminiscent of the CDO days of the housing market. Many renters are on a razor’s edge so this is a very sensitive market if a recession were to take place.”

Bingo!

How easy is it to find stable renters with solid employment/good credit especially in areas with high UE? How many of these tenants (with little/no savings) eventually can’t/won’t pay rent, possibly ignore unlawful detainer notices, possibly declare BK, possibly trash the SFR, and possibly not worry much as likely they’ll find a Mom/Pop landlord who won’t run credit/needs cash who will take a chance?

SFR’s as rentals? Multiunits much better IMHO; no big yards where unpermitted trampolines can be installed, two aggressive dogs appear even though signed lease states “no pets”, etc. Anything can happen anywhere but seems easier if all in one place, especially with an on site manager.

75% of Americans live from paycheck to paycheck. So any downturn in the economy is going directly to a downturn in paying rents.

Mike, before you consider something a “terrible investment”, you have to consider other circumstances. My friend is also paying roughly $300 down per month in principle on the not. That brings a total return of about $550 per month. He is self employed (150k + income yearly) so being able to write off $8000 or so per year also helps his tax situation. Since he has good income, he can ride out a non-paying tenant if he needs to. Most mom and pops buying these are looking at a 10 year + horizon(maybe a little different than the big banks). I used to live(10 years ago) in the area he bought and I paid $1700 per month rent for a 3 bedroom. FTB, rents can go down short term, but I think likely he will be getting over $2000, 10 years from now. It’s not a great investment for someone living paycheck to paycheck, but he has a cushion. As far as how he found the property, it was actually a neighbor down the street who was selling the house(so he had a bit of an inside track) I did a quick search and there were about 3 other homes that sold in the same price range within the last 6 months. I manage about 11 homes myself and I have a family member with 25+ SFR’s. I am quite experienced with bad tenants and turnover. We wouldn’t be in the business if there was no profit to be made. It is a little tough right now, but someone creative(and open to location) can still find a way to make a nice return.

KC2-owning 11 or 25 rental homes is great, but when you purchased those houses would be key no? I would think you bought them over time, thereby helping manage your risk. If you bought them all in 2006/2007 you may not be doing quite as well, just like someone if they bought 11 or 25 homes to rent starting today, in my and many others opinions. CA is boom or bust so timing is much more crucial there, IMO.

FTB, bought sporadically since 05. Some major losers for a while but I have I.O. loans for a couple of them bought during the peak. AT this point, they should be okay when they amortize in a couple of years. I have had bad tenants, but I do get great tenants as well who make up for the bad ones. If I didn’t have extra money in the bank, I would be sweating it, but that’s not the case. If there is a drop of 5-10% and rates stay low, I would buy another. Once you have the management experience, the fear of bad tenants lessens a bit. If you have a lawyer ready and don’t screw around with negotiating, the damage can be limited. (Although I do not deal in rent control markets). The biggest mistake you can make is to negotiate with a tenant after a missed payment. It is habitual for them(unless they have been with you for a while).

There is no need to have rents rise 5% per year to make there business successful. Landlords are not taking on inflation(other than maintenance and 2% Property tax increase max). If an owner is making $300 in profit on rent for a $2000/month house, just a 3% increase in rents will jump their profit 20%. Everyone on this blog needs to realize that the whole economy is being manipulated by the rich. There is plenty of room left to go before people get the nuts to stand up to it. I am sick of hearing how the billionaire landlords are going to take it in the ars. Not going to happen. They are smarter than us. If you can buy a house with 10% down, for what you can rent it for, buy it. If not, switch locations or try something else.

“They are smarter than us.”

Really? Why, because they have more money, and are willing to gamble with it? From what I can see, these are the same people who almost brought down our financial system five years ago, thinking that RE would never go down, and betting the farm on it. Was that “smart”? I don’t think so.

With a profit of only $300/month, even a small increase in rents cant help a landlord with bad tenants who all of a sudden cant pay rent. Many states have VERY favorable tenant laws. Now if rents go flat or decrease at the same time and it could get ugly. The margins are just very small to begin with, so any disruptions can have big impacts. Remember, it may not feel like to most, but (due to QE and nothing else) we are currently in a stock market bull run that has lasted over 50 months already and a housing market that is up to or even above pre-bubble housing prices. and during this bull run, many people are struggling mightily. how well do you think people already doing sh+tty in a bull market are gonna do in a bear market? wouldnt you think maybe more would be laid off and they might have a hard time meeting rent payments? who knows, maybe the govt starts paying the rent. if not, this piece of securitized sh+t will crash and burn.

Lastly, the heavy majority of the folks on this blog are talking about CA real estate. I’m very curious where you, Lord B and a few others on this blog are currently (like right now, not last year or 2011) finding homes for rental parity, even with 20% down in the CA towns any of us are talking about. I looked for a long time and saw nothing. Please feel free to go to Zillow for us and show us all some examples of homes sold recently where rental parity can be found in places the folks here are looking. And by rental parity, lets use real numbers that include all taxes, insurances, maintenance bc we’re talking homes from the 1920s mostly (and note these nums you provide still wouldnt account for the risk of finding and keeping “good” tenants).

Owning apt buildings and being a landlord is VERY different than doing the same with single family homes.

We’re already splitting hairs when we talk about the slim margins of 300 a month. Sure, a 3% increase, if allowed by law and the market, would keep you somewhat in the black, but, how about turnover? When I hear the back of an envelope people argue with their numbers, I never hear about turnover. It’s as though they all live in a world where one tenant moves out, and bam, the next month another tenant magically appears, paying a little more than the last, barely skipping a beat. I doubt it works that way outside of very hot rental markets, and the country is not full of very hot markets at all. Let that property sit vacant for two to three months or whatever, and bye bye slim profit margin. Of course, the landlords could be not so picky in choosing tenants to avoid those financial black holes, but that will most likely result in some very bad things happening down the line.

I’ll bet that, if one of these landlords did a thorough credit and criminal check of all tenant applicants in a town like, Phoenix (or, lord, Vegas), they would probably reject at least half. And I’ll bet the half remaining represent a lot of misfits, too. But, if the cube dweller in Greenwich has to show good numbers for the next quarter, something tells me those rules are bent a little to get the money flowing.

I’m wondering if Wall Street “numbers that pencil out” factor in “black swans” such as landlord renting 3bdrm/1bath house to “Tenant X”, who is a good tenant for a few months until Tenant X’s Daughter with a thing for “bad boys” suddenly arrives with her kids because Baby Daddy violated parole, back to prison. Tenant X’s Daughter evicted from her place, couldn’t pay rent with her income as a backyard breeder of pit bulls, Baby Daddy’s “all cash” income disappeared. Tenant X’s Daughter has nowhere to go, hard to find a place with an eviction, pit bulls so moves in with Tenant X until she gets life “sorted out”. Property manager unaware of situation until he/she gets call that a visiting neighborhood child has sustained a nasty dog bite while playing in back yard of rental property.

Good news is Baby Daddy due for early release, he’ll be stopping by soon to help out.

A friend of mine closed in May on a 2 bedroom/ 2 bath SFR in Alta Loma for $290k. He is currently renting it at $1750 and put 20% down on the purchase. I do not know what rate he has, but at 4.5% it comes pretty close at a P.I. payment of $1175. It was built in the 80’s, so it has a pretty standard tax rate(my guess is 1.1%. This is about $250 per month. No HOA, so maybe $1500 all in? It’s a box(about 1200 square feet). I thought he overpaid a bit, but he plans on adding a 3rd bedroom when this tenant leaves. I have not bought anything myself since 2012, so this example would be my best answer to your question(FTB).

“A friend of mine closed in May on a 2 bedroom/ 2 bath SFR in Alta Loma for $290k. He is currently renting it at $1750 and put 20% down on the purchase. I do not know what rate he has, but at 4.5% it comes pretty close at a P.I. payment of $1175. It was built in the 80′s, so it has a pretty standard tax rate(my guess is 1.1%. This is about $250 per month. No HOA, so maybe $1500 all in? It’s a box(about 1200 square feet). I thought he overpaid a bit, but he plans on adding a 3rd bedroom when this tenant leaves. I have not bought anything myself since 2012, so this example would be my best answer to your question(FTB).”

Well, there you go. Skating on thin ice already, and leveraged to boot! Now, imagine that owner is a cube jockey in Greenwich. He has to hire local people to do everything, from tenant screening to plumbing to landscaping. Factor in all of those costs, and, well, I just don’t get it. And, your numbers are supposing that the tenants are little darlings who do no damage to the home and pay their rent on time.

Like I said, awful investment.

KC2-thanks for sharing. first question would be did your friend just purchase the house on the open market with competing bids or was he an insider. Obviously an open market purchase would be most helpful for those in the forum. I don’t know the area, but for a house at that price, that seems like pretty solid rent, especially when I think of how its almost the same price in better parts of LA. Is it a married couple? Two buddies?

Then assuming your nums are correct, you went from 1175+250=1425. Then we need homeowners insurance; maybe that’s how you got to $1500? What about maintenance? Maybe he can do all of it himself, but thats rare for most folks these days and sometimes you need parts and not just labor. Is there a yard? For those that do their own labor when they can, sometimes homes arent local so we may need to include gas money to the home as well. Then, most importantly, is the risk of tenants. Even missing one month’s rent, your buddy is down $1500 minimum (using your nums). With how little his profit is a month ($250 max if we use your nums, but its actually likely less with the risk of going negative), it would take 6 months to make that money back (assuming your nums again and assuming nothing else goes wrong during that time). Seems like your friend has a chance of making money assuming a lot of things go his way (what if rents go down, btw? they did big time in bubble 1.0 in cali when I lived there). Even then, it seems like a heck of a lot of risk and work (we’re assuming he does all maintenance and finds all tenants) for a best care scenario of $250/month. I do wish him luck though. i respect hardworking entrepreneurs and its not easy making a buck these days.

Thanks for the example. Any other than that one would be great by anybody else.

@FTB:

“I’m very curious where you, Lord B and a few others on this blog are currently (like right now, not last year or 2011) finding homes for rental parity, even with 20% down in the CA towns any of us are talking about. I looked for a long time and saw nothing.”

There was a blogger named JP that posted this during Dr. HB’s last article:

“34, wife and two little kids ages 2 and 4. Work as a lead engineer making 114k in Orange County. In the neighborhood where we rent the cost of a basic home is in the high 500s for a three bedroom. These are modest 1600 sq ft on 6000 ft lots in an average neighborhood… At the same time I’m spending 2,500/month in rent ”

For JP’s case, buying in his neighborhood with 20% down likely makes sense. So either you do one of the following:

a. Rent for $2500 per month.

b. Own the same place with 20% down for $3138/month gross total. Then take into account the ~$500/month tax savings and $634/month principal being paid.

Purchase price: 575000

Loan Amount: 460000 (20% down, assume 4.25% for 30 years)

Principal: 634

Interest: 1629

Property Tax (@1.2%): 575

Insurance: 100

Maintenance and Upkeep: 200

Total: 3138

Clearly owning makes sense when doing the rent vs. buy equation for the same property in this case. Your question was where do these houses exist: I’ll save you the time. Go on redfin and do a search between 550 and 600K in the following OC cities: Huntington Beach, Fountain Valley, Costa Mesa, Mission Viejo, Tustin, Lake Forest, Fullerton, etc. I would consider all these places to be decent, safe places for a first time buyer looking for an SFR.

The numbers are hard to argue with, curious to hear responses on this one…

@LB

You present a simple breakdown, although it’s not a useful exercise since the basis is formed from a weak anecdote. There’s not enough information presented by that other poster to determine if said rental and for sale home are equally comparable living experiences. So many necessary inputs are being glossed over that it wouldn’t be intellectually honest for a critically thinking person to consider seriously.

Joe, I’m very familiar with some of the cities in OC that I mentioned. A house valued near 600K will generally rent for around $2500/month. 1 bedroom apartments in these areas rent for $1600/month plus. Go on Craigslist and search for rentals in these areas and then go do a Zillow estimate on the property. If you have a better way of doing this, please let me know.

Thanks for the nums, LB. $2500 rent for a 600k home sounds a tad high in those neighborhoods (unless its super close to the beach) based on what I and my friends paid/pay in prime LA (from sunset on the north through 3rd street on the south with say la cienega on the west and a few blocks east of Bronson on the east) and what I was predicting I could rent my house for in that area if I bought there and things went sour. That being said, I haven’t spent any time researching things so I’ll trust your nums.

Also, rents can stay down for YEARS. When I moved to LA years ago, my rent was listed as $2500 (meaning at one point during housing bubble 1.0 that’s what someone was collecting as a landlord), but because the market crashed, I was getting a credit and my rent was down to $2000 a month. Only when I finally moved out in June did they finally get close to the 2500 (they tried getting 2450 in my last renewal). That means that timing is very crucial. If a buyer/landlord is using 2500 in his calculations and then boom, off a cliff it goes to 2000 and then 4 years later, its still not 2500, how is that an endorsement for rents usually go up? I think you mean we are currently noticing rent increases so the trend is up, but trends change on a dime.

In regards to the ‘principal’ part of your mortgage payment, can you really do what you did for your comparison purposes? I own a home and I guess I don’t consider my principal as automatically increasing. It seems like its more at risk, then guaranteed up. Ask many people who bought in bubble 1.0, how their principal is doing. As we know many people are still underwater. Also, think about how people’s principal would be without QE, which NO ONE could have predicted, yet many seem to forget is happening currently and that it can and will be shut off again (until we are Japan, lets stop assuming we will become it). If you keep adding principal (more investment essentially) into a home, its great if the home goes up. Its not so great, however, if you keep contributing principal to an asset that is losing value. We talk about long hold times, yet people who bought 6 or 7 years ago are not even all above water yet. Another downturn or just flatness could put these people down again for YEARS.

I also see many landlords talk of the expenses they write off. This is true, but then just like any other business wouldn’t the rent (revenue) your receive be taxed as well? Therefore, you can’t use an example of collecting 2000 or whatever in rent a month, claim certain expenses, and still count the full 2000. Pretty sure you’d be paying fed and Cali taxes on that 2000….or maybe not 😉

That being said, people can and will get rich in real estate, especially in boom/bust places like CA. Its been happening forever. Same with stocks. Best just know what you’re getting into and as KC2 said be prepared to lose money for time if you are a landlord because of being a landlord was that easy, everyone would just do it.

FTB, I agree that buying investment properties today is not a good idea. That ship has already sailed a few years ago. Like you said, the key to buying CA RE is getting your entry point right (2006 was an awful time to buy, 2011 was really good). However for somebody like JP, it likely makes sense to buy a primary residence with 20% down instead of renting a similar property for $2500/month. When you factor in a good down payment, rental parity, job stability, plan on staying for at least a decade it points to buying. JP could wait in his rental for much lower home prices or rental prices. There is no guarantee for any of that.

LB writes “When you factor in a good down payment, rental parity, job stability, plan on staying for at least a decade it points to buying. JP could wait in his rental for much lower home prices or rental prices. There is no guarantee for any of that.”

He’s correct that there is no guarantee for job stability and planning on staying for a decade. See how that works?

By the way, how many folks are buying at 20% down vs 3.5-5%? Most I know are stretching to fit into low downs right now.

Great logic Joe. Since NOBODY can look out 10 years into the future, NOBODY should even think about buying. Just keep renting folks. Nothing to see here!

Perhaps you’re missing the point, LB. You wrote “nobody” – I didn’t.

Dr. HB has been pointing out in his/her series of posts that the aggregate inputs into housing’s future, which suggest that as you wrote, “a good down payment, rental parity, job stability, plan on staying for at least a decade” are hinting as ever elusive, especially in SoCal.

How many traditional home-buyer class Americans today have a “good down payment” saved up? You and others point to “rental parity”, although that’s a simple attempt to place a metric on a very dynamic and complex equation, which does little justice to the highly individualized question of buy vs rent.

On job stability, do we even need to go there?

Perhaps the most ignored factor is planning to stay in one place for some given length of time. Is that an increasing or decreasing trend. What changes in the world do we observe over time suggest that less mobility will become an asset in our nation’s workforce, especially in the shadow of increasing global competition?

What I am suggesting is that a sense of stability is a fundamental psychological factor into personal risk aversion and my sense is that the people are more likely to opt for renting when they don’t feel stable. The financial side of the equation for buying has to be even stronger to overcome that, and I don’t think that it currently is for most people.

Joe, all good points. However, I think you are underestimating the “desire” people have to own. Desire is certainly not a need, but people have become preconditioned to “owning is good”, “renting is bad.” Having your own place equals stability (maybe not financial stability), people are willing to pay for this. To each their own.

LB, there’s a line between desire and will. I don’t doubt that the desire to purchase a house is any less today than before. What I do doubt is that the will is as strong today as before the last bust.

It really doesn’t have anything to do with each having their own. It’s about estimating potential aggregate demand.

Smarter than us? N0, just better connected to the people that print money….and far more corrupt.

I too would like to know how these “investors” can bake in 5% rent increase figures into their calculations when the average paycheck is going up a mere 2% to 2.5% per year.

When the economy turns, the Courts side with disadvantage out of work renters and will not throw the children onto the street. The landlord Wall Street investors or foreign investment companies can better take the hit than the local California government and society as a whole.

Don’t hold your breath on the courts not throwing them out. They do and they will in the future.

Depends on the market’s political climate.

In New York City, with its draconian rent control and rent stabilization laws, a landlord is lucky to evict a tenant after 6 months of them not paying rent. A year of them not paying rent (sometimes longer) before they’re finally evicted is not uncommon.

Listen to the statements made by several other people, regarding the economics of rental units. You need a large building with many rental units, since every year, some of those units will be in the red with non-paying tenants, no tenants, or destroyed property that the landlord must pay to repair, as the tenant has left and the security deposit is not enough to cover it.

Every year, the money-earning units must cover the cost of the (hopefully few) money-losing units, and after all the other taxes and expenses, still leave a net profit for the landlord.

And don’t forget, evictions also cost money. Lawyers don’t work for free. Indigent tenants might find a lawyer who’ll work pro bono, but not landlords.

And should the economy tank, other localities will likely follow New York (and Berkeley and Santa Monica) and enact draconian “tenant protection” laws, delaying evictions for months on end — all the while obligating the landlord to continue providing heat, electricity, and other services to the non-paying tenant.

Oh, and then there are the fines.

In New York City, if a tenant violates a building code, the landlord is often liable.

My late father had tenants (the immigrant Chinese do this most often) who’d subdivide their units with curtains, then sublet portions of the unit, so multiple families ended up living there. If a building inspector discovers such a violation, the landlord is fined $10,000. The tenant is liable for nothing, even if he sublet without the landlord’s permission.

Fortunately, in one case, the building inspector was Chinese, and the guilty Chinese tenant said he could arrange a deal whereby if my father paid a $1,000 bribe to the inspector, he’d waive the $10,000 fine.

New York City government officials are as corrupt as any former Eastern Bloc country.

Daniel, not in L.A.

Also, I live in the north bay. In the smaller local newspapers for Vallejo and Santa Rosa which are heavy renter areas….I read about 10-15 rental houses burning down from weed grows. And those normal cookie-cutter houses on cul-de-sacs in developments. Ouch…can’t be good to have a rental go up like that.

@son of a landlord,

Evicting tenants in Santa Monica and West Hollywood for not paying rent is simple enough.

Evicting renters in the People’s Socialist Republic of Santa Monica so that an apartment building can be converted into a condo is a huge mess as is tearing down a multi tenant building and replacing it.

Hey Doc, those young renters (saddled with debt) that have been crying the blues here in LA, LA, LAnd, are in the same boat as other major world cities. This news from Financial Times today on London:

http://www.ft.com/cms/s/2/ad4ef6a4-503d-11e3-befe-00144feabdc0.html#!

High quality global journalism requires investment. Please share this article with others using the link below, do not cut & paste the article. See our Ts&Cs and Copyright Policy for more detail. Email ftsales.support@ft.com to buy additional rights. http://www.ft.com/cms/s/2/ad4ef6a4-503d-11e3-befe-00144feabdc0.html#ixzz2lDVP7n4x

“British graduates today are saddled with debt and have starting salaries below those of the pre-recession cohort. To make matters worse, those who secure a highly sought-after job in central London will struggle to find an affordable room to rent unless they move out to the suburbs and take on a lengthy commute…”

Before the govt got involved in the mortgage business, the home ownership level in the US was below 50%. So, we’re reverting back to the mean.

History will probably show that the economy of the few decades of post WWII was the “golden era” for the US standard of living.

“Probably, in five to ten years, when these “investments†turn out to be the turkeys that they are, these homes will be dumped onto the market in better shape than they would be if nobody bought them.”

Try 3 years max. Just because these investors bought with cash doesn’t mean it wasn’t borrowed. The bill is coming due and these IPOs an Rental Backed securities are the surest sign the smart money is exiting and dumping the trash onto the retail investor. No need for a bank bailout when Housing Bubble 2.0 pops. The specuvestors are holding the bag this time.

Going IPO and floating new debt is Wall Streets favorite way to “monetize” an investment and get the hell outta Dodge.

Housing Action Speak Louder Than Words… For years the rental theme has been here because we simply don’t have enough qualified home buyers, especially when housing inflation rises on both fronts with this low wage job cycle recovery

http://loganmohtashami.com/2012/04/02/housing-actions-speak-louder-than-words/

I live in an area of FLA (Palm Bay-Melbourne-Titusville MSA) where they (Independent Homes & American Homes 4 Rent) have purchased 100’s of homes this summer. They are buying mostly newer homes built in the past 10 years, some are pool homes.

I see the same problems that have been mentioned – maintenance on properties that are spread miles apart, management that doesn’t come cheap, no ability for bulk buying of appliances, and lack of oversight on tenant activity (grow houses & meth labs). Another thing that can spell disaster – a large tropical storm or hurricane. The one company does not even have a local office yet. The nearest one is in Tampa, and everything appears to be done via their web site.

While rents have risen here since their lows in 2008, they appear to be as high as the market will bear, and, with near 8% UE, there is no way they will be rising 5% per year. What is guaranteed to rise are property taxes (since they bid up the prices), and property insurance.

This will not end well – and I can’t wait to laugh my ass off about it!

Rents going up 5%? Good luck on that. Even in my region (metro Sacramento) – there are so many rentals – and so many vacant rentals, I find it hard to believe any landlord – Wall St fund or small mom and pop – would be stupid enough to try that on and have empty rentals producing zero income. Bird in the hand….

I rent a great 8yo, 1550 sq ft house in one of the better areas of Sacramento. My rent is actually under market a little, due to the fact it was a filthy pigsty with an overgrown yard when I moved in. Not anymore – they gace me written permission to paint and clean it up and now it looks like MY home. My landlord is a mom and pop outfit – this is the only rental they own. My 18 mth lease recently ran out and the property manager asked if I would like to renew it. Of course I did – its in the school district I need it to be for my son and I actually love living there. The house and the street is perfect.

I told the PM don’t even think about putting up the rent and gave him some local rental comps where they had sat empty and had multiple rent reductions before they were finally leased. I reminded him I pay the rent on time and in full, directly into his bank account on the 1st of every month. The place is spotless and the yard is manicured. I have one little non-visious dog (in the lease) and my car is parked in the garage. Only myself and my son living there… BIRD IN THE HAND. The PM has been in the business a LONG time and he’s not stupid – he agreed and I ended up signing another 12 mth lease at the same price and terms so I’m happy. I chose 12 mths because I’m going to watch the resale market in my area closely and if it goes down to where I think it will, I’m going to buy.

I have absolutely no problem renting but I will buy if I can at a price comfortable to me.

These Blackstone-esque outfits hugely overestimated the rental market and ROI in my opinion. And I think the halfwits who thought up this scheme have never dealt with finding and retaining a good tenant in their life, let alone maintaining multiple SFRs.

hhahhaah, calling **halfwits** these greedy mofos in wall street is probably not a good idea. These guys make money and often they do it upfront… for all I know they could sell** the government the needs to rescue their hedge fund as pulling the plug is bad for the economy…if you know what I mean.

The Wall Street guys are not half wits! They are evil geniuses. We don’t know yet who the bag holders will be. Probably, in the end, the taxpayer. Again.

These guys, over the last 4 years, used near free Fed money to build a plausible investment story and are now financializing it, ie hiding the risk by pooling the sub prime renters with the well-employed who choose to rent for the time being. Then, after creating these dubious paper instruments, sell hard to unimaginative pension fund managers.

In the end, as the economy continues to stall, many of these homes will have been destroyed by neglect (cutting costs on the property management is about the only wiggle room they will have.) When the whole thing goes kaput no one will be able to determine who really owns the home anyway, or Blackstone et al. will be allowed to become a bank overnight and bailed out, and the execs walk away with golden parachutes.

The group here conmenting on this site who fiddle with the math of buying versus renting and do their own thinking is not the Wall Street guy’s market. It is the unimaginative fund managers who invest the paper promises for the worker bees (State employees, lets say.) The bag holders will be those who wanted to retire on magical profits made from investments they can’t hope to understand. And the fund managers will walk away, acting as if they too were surprised by it all. (Being a fund manager is a perk of being born in the upper class, BTW.) These State workers probably have no idea what their retirement savings are invested in or think they are guaranteed a payout that will maintain their lifestyle. All they really know is that the Dow is going up so all must be good.

As for sales pitch by the Wall Street boys to the fund managers, I’d love to be a fly on the wall. Probably they are told it is safe as the risk is spread through a wide geographic distribution so any downturn in one area will be offset by an upswing in employment in another area. Heck! Instead of a fly on the wall, I’d love to sit down with a bottle of something strong and have fun writing the prospectus, just for kicks. How about this line: Now that health care costs will be coming under control, people will have no problem paying the rent. Or this: Renters are great because they just got their first job but have delayed forming families so they don’t have any kids in college yet, loaded with student debt. Remember when you were 25! And now these smart ass, i-kids have cheap streaming video, so they don’t spend money going out to the movies like we did when we were young. Or . . . boomers who overbought were able to sell their houses, thanks to the federal government handling the ’07 anomaly so well, and now these boomers, being sensible, have downsized and have a comfortable retirement cushion that will help them pay rent under any conditions. In fact, boomers have realized such gains in the stock market that they can rest easy knowing they can sell a few stocks to cover a month or two of rent if need be. In fact, what with the stock market in a permanent bull upswing, anyone who is anybody is actually much richer than ever before and how could anything go wrong? I would add that this fine, respectable company does not deal with Section 8 rentals, never have, never will! After all, we are white and go to ‘work’ with pressed shirts!

Actually the pitches you speak of just need to be made to the (bribed) rating agencies like Moody’s, s&p, Fitch, etc. The key, like the last junk securitized and sold in CDOs, is the AAA rating. You need the AAA rating to sell to the entities you wrote about like pension funds, etc as their by laws require ‘safer’ (sarc) investments. Otherwise your buyers would be hedge funds. I’m not sure the rules of most sovereign funds. Unfortunately we know rating agencies are paid for by the banks and banks shop for ratings (now kroll and others entered the ratings agency game) so my hunch is at least one tranche of the securitization rent will somehow get the AAA rating.

I’d like to think that these guys have it all figured out, but I’m skeptical. Seems to me that a lot of the business of financialization boils down to throwing shit at the wall to see what sticks and for how long.

your either a homeowner/landlord or a renter,this argument about which is better is null.as in any business you run it right or go broke,period. some of you will succeed and the rest of you will always be renters. nuff sid.

Reading the comments at this site one learns that the key to landlording is having great tenants. One might have better results if a renter is considered a customer rather than a ‘loser.’

A landlord’s attitude won’t change the quality of a tenant.

As KC2 correctly notes, you do NOT negotiate about non-payment of rent. If the rent is overdue (or 10 days overdue if that’s your policy), you hit them with the predetermined late fee and stick to it. Once a landlord negotiates rents or late fees, the tenant is encouraged to think that EVERY month’s rent is negotiable.

SOME renters are good customers. And SOME are losers. It has nothing to do with a landlord’s attitude. Naturally, you should try to find good tenants, and avoid the bad, before the lease is signed.

Lost on many: the SFH renter is a vast step above the typical apartment tenant. It’s just a fact of life. They tend to be older — by a decade — and much more settled.

This means that many of the norms known by apartment landlords just don’t hold for SFH tenants.

The flip side: to lose a tenant is to have a rental property with no rents at all. This situation can only be tolerated if the cost of the property was actually quite low — and the financing was sweet.

Only a few times in ones lifetime will it be possible to latch onto such properties at such prices.

One famous gambit that ran on for years: purchase a fixer-upper — and perform the repairs pretty much solo. This takes some real skills — across the board. However, once you’re established the progressive debasement of the US Dollar makes you a persistent winner.

I would regard most of these markets as seriously overheated — and no longer suitable as buy and hold rental properties.

Many of the comments reflect the widespread opinion that the hedge funds want to buy and hold these vast real estate empires. That’s only an illusion. The big game is shorting the dollar. That’s where ALL of the mega monies are being made today.

This explains why the smartest players on the planet are accepting properties that are uneconomic on a cash flow basis. They’re in fact, mega-flippers. Their cost of funds is so low that they’re in a different universe. And being hedge funds, the management is not exposed to any downside should the funds blow up. Keep that in mind.

It gets little remark, but the Fed is actually cashing out the US Treasury market. Securities that once larded the balance sheets of the insurance industry are now on the books of the Fed. This effect is now getting so pronounced that failures to deliver are now cropping up in the US Treasury market! That’s truly strange.

Taking out the 30s — the ‘duration’ — means that when the interest rate flip occurs, the Fed will be the bag-holder. The other players will receive their pain in other forms: crashing equity valuations, debenture defaults on a grand scale, and such.

When you screw around with interest rates by mega money printing the pain builds until it breaks out in a rash across all of the markets. Just ask Mugabe. (Zimbabwe)

Because the US Dollar and its associated electronic money transfer system is the rock upon which the ENTIRE modern world operates — it’s destruction will create EPIC suffering. We actually don’t have enough gold and silver — or bitcoin — to paper over the calamity. That’s just how large the money flows are relative to the amount of metal available as collateral.

This can’t be good:

“It’s a chart that overlays the S&P 500 SPX and its latest run against how equities traded in late 1920s, just ahead of and after the (gulp) big crash…”

http://blogs.marketwatch.com/thetell/2013/11/22/the-sp-chart-thats-spooking-wall-street/

When the Fed is MASSIVELY printing money into existence — the rules have changed.

In the roaring twenties, America was on a hard currency standard — and gold coinage circulated widely.

In real terms, the NYSE is actually in a bear market — and has been for some time. It’s just that the metric — the US Dollar is not being marked to reality.

Try deflating the NYSE or S&P500 by the real erosion of the US Dollar — and you’ll see the markets actually bending down — into the ground.

The stock market and the real estate market are the two broadest ways of shorting the dollar. In real estate, you get to put a mortgage on the property — a straight short proposition. On Wall Street the firms, themselves, short the dollar — which position become embedded in the stock price. Apple’s recent debt issuance is but one of the many — and just for the purpose of establishing a short against the US Dollar.

Those who buy stocks — all cash — normally fail to recognize that the very firm they’ve bought into is intrinsically leveraged. It’s this leverage that entirely explains the rocking profit explosion on Wall Street. Every firm and its brother are rolling out of high cost debt — and spewing out trash debentures and whatnot.

Should one take the time to do so, backing interest rates towards classic norms would cause corporate profits to utterly crater.

This is not the first time America went down this road. The Confederacy took it to the limit. The destruction of the Confederate currency was the PRIMARY source of Southern poverty in the generations after the Civil War. Whereas the battlefields were tiny – -and concentrated — no-one was left unmolested, financially, when their liquid assets were wiped out, entirely.

This was famously recreated on the silver screen when Scarlett can’t even raise a pitiful few hundred dollars to keep Tara from falling to the tax man!

And, of course, who could forget the destruction of the Continental Dollar, which informed the Founding Fathers — Thomas Jefferson, in particular — as to the evils of fiat currency. He found that his assets had evaporated — utterly. Serious obligations to him were settled for a pittance as the Continental was worthless.

Nations go broke slowly, slowly,… and then all at once. Just ask Argentina, Russia or Weimar Germany.

The Fed is printing $1,000,000,000,000 per annum into the economy.

Money-Printing = hyperinflation

Real estate CRASHES during hyperinflations. It’s priced in consort with mortgage originations, but during hyperinflation the mortgage market EVAPORATES.

The economic distress inflicted by massive money-printing causes the proles to lose their jobs — rents stop coming. The government always jacks up real estate taxes, of course. The result is that the rentier class is hung out to dry. The ONE blessing is that the real value of the old mortgage is destroyed.

Naturally the rental stock becomes devastated. No-one can afford to maintain their properties. The bleeders are sucking down landlord finances.

We’ve all seen photos of Weimar currency stacked up on prams/ wheelbarrows/ etc. That end stage — 1923 — while absurd — did not encompass the bulk of the economic destruction. The mark was being destroyed every month after the war ended. Most of its value had been lost before 1922 even got started.

These ramping asset markets are reflecting the destruction of the US Dollar.

So you should look upon Wall Street as placing short bets on the US Dollar. Collecting rental income is NOT their game plan. Real estate permitted them to place mortgages into the hands of the US Government/ Fedsury. THAT’S the game plan.

Buying these securities is for the brain dead. They just have to blow up.

Leave a Reply