Turning the nation into permanent renters: Stagnant household incomes and growing renter class strikes at core of home ownership.

The summer selling season has now come to an official close. Not that it had much substance behind it. The sales volume has been wickedly low for all the hoopla being bandied about how great the housing market is doing. Much of the momentum from investor demand has started to wane significantly. At a certain point, the well does run dry and many investors were buying to turn units into rentals so local area incomes absolutely matter especially when prices increase so quickly that they put a damper on cap rates. Many flippers are looking for the next lemming to purchase their pig with lipstick. Crap shacks are selling for $700,000 and we are starting to see that some sellers are hitting a brick wall. Stepping back and looking at the bigger picture however, we find that we have slowly become a nation of renters since the housing bubble first popped back in 2007. Wild financing glossed over the fact that the middle class in the US has been steadily declining. Now that you have to actually show some real income, the numbers don’t look so great especially when you look at mortgage application volume. Census figures also show that we are definitely in a trend of adding more rental households versus people owning their homes. Until the trend reverses, we are seeing many areas become renter hubs.

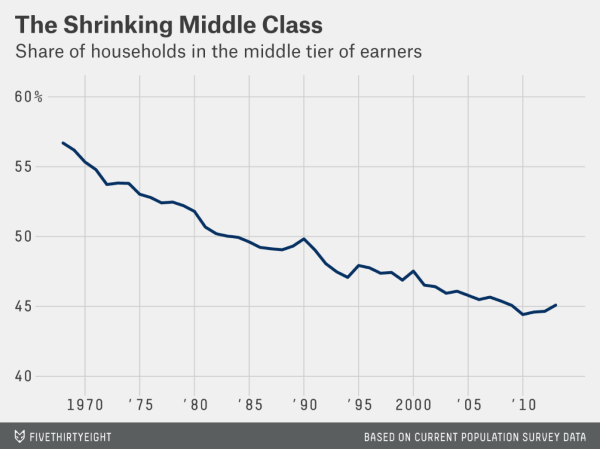

Middle class shrinking

Probably the most obvious reason for the lack of demand on the home buying front from regular families stems from the shrinking of the middle class. This trend isn’t new. What is new however is that the easy financing years are long gone and this has taken a direct hit to regular family demand when it comes to buying homes, even with ultra-low interest rates.

Take a look at the trend here:

Yet when households have access to debt, it peppers over the reality that many are actually running backwards when it comes to their future buying potential. Take a look at the cost of tuition or even buying a new car. Easy financing allows for larger price-tags with lower monthly payments. In the end however, you are still paying the underlying cost over many years.

It might be useful to look at the housing math first:

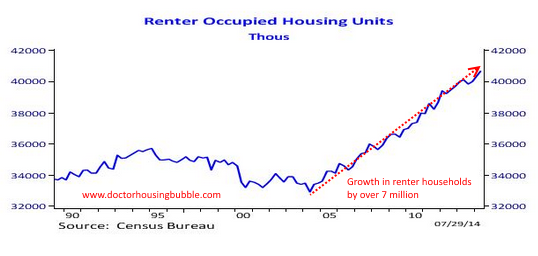

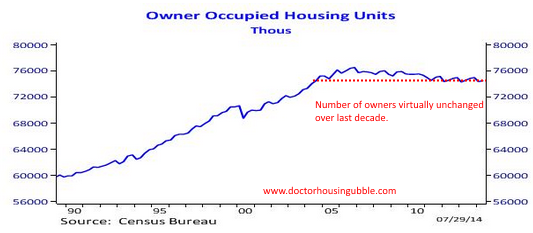

Since the crisis hit, we have added 7 million renter households. Not a coincidence that we have witnessed 7 million foreclosures over this time as well. Then, you will find that the home ownership rate has gone stagnant over this period:

Most Americans derive their net worth from their equity in their home. It gets tricky to use your residential property as a source of retirement funds because first, you have to sell to unlock that equity. If you slap on a HELOC, you are merely taking on more debt secured by your asset. Not exactly wise financial planning. And you also have running costs associated with owning including taxes, insurance, and maintenance and these costs usually rise with the general rate of inflation (i.e. a roof today will cost more than a roof installed in the 1970s). In essence, the only true way to unlock the wealth is by actually selling the property. In many cases in California, people are sitting on goldmines yet find it hard to move. This is your Purina Dog Chow eating home owner that has a property valued at $1 million but is scrimping by with their Social Security check at the 99 Cents store.

Younger Americans are also well aware of this trend. They are taking on larger debt via student loans and have lower incomes overall. This is why in California for example, you have 2.3 million young adults living at home with their parents. Most are at home because they are too broke to even branch out into a rental. Even highly paid workers in San Francisco rent and typically rent with other people to curb the costs of high rents.

Owning a home is not a right. I think that goes without saying. So it is troubling to see so much intervention in the housing market in terms of special tax treatment, bailouts, and special programs for financial institutions that essentially hide a true market value (if you even believe in a true market). After all these years of program what is the end result? A push to renting households, more single family homes in the hands of investors, and higher prices with stagnant incomes. Special tax treatments are simply added on to the base cost of the home.

The Fed has turned everyone into a speculator on housing. If you rent, you are basically short on housing. If you own, either a primary home or rental, you are long housing. The fact that so many investors bought property in the last few years changes the game from one where housing was a stale purchase largely driven by growing households to one that is heavily treated as a part of a larger portfolio. The fact that demand is so low after investors pulled back signifies that many people simply cannot afford to venture out and buy (that shrinking middle class figure). It is interesting to see some people plow every penny they have into a down payment for a home (and home payment) yet neglect putting money away in the stock market because it appears “risky†in the scheme of things. 7 million people lost their homes in the last few years and 1 million of those here in California. That sure doesn’t sound like a risk free bet. And when you buy and are leveraged, try missing one payment to the bank and find out who really owns the property. Or better yet, pay off the bank and miss your tax bills.

Housing used to be a safe bet practically in all corners of the US. The fact that housing has become a highly leveraged and speculated upon segment of our economy has caused many more people to carefully calculate buying versus renting. Plus, in cases like San Francisco, many people realize they will only work for said company for a short number of years (certainly not 30). So the trend of corporatism after World War II where people started and ended their careers in one company is long gone. Some companies have already picked up and left. And for many of the high tech companies, some will burn brightly but for only a short period of time.

When all of these larger trends are combined, it is hard to see a sudden reversal of this renting momentum.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

139 Responses to “Turning the nation into permanent renters: Stagnant household incomes and growing renter class strikes at core of home ownership.”

HOUSING TO TANK HARD IN 2014!

Slight tank in 2014 then a hard tank in 2015 I think.

If the rent to price ratio was crazy, like in 2005-7, then I would agree with you. But at the moment rents have just risen, and keep rising. The ratio between house price and rents is actually pretty reasonable. I do not see a housing crash unless rents crash. And with the demand for rentals high, as the Dr. states, it is hard to rent prices decrease.

bb, it’s called rental parity. As long as the cost of owning is near renting…no crash in sight.

The ochousingnews dot com blog has a nice feature on rental parity and even gives a shout out to Dr. Housingbubble. Larry, the blog author is a straight shooter, he gave a giant buy signal back in 2011…did anybody listen? There are some nice rent vs buy examples at the end for the math challenged. Things are much different in 2014 than they were in 2007 (rates, rents, bad loans, inventory, PTB policies, etc).

http://ochousingnews.com/blog/oc-housing-news-clarifies-rent-versus-buy-decision/

“it’s called rental parity”

BAAAHK!!!

The rent to price ratio is not the same everywhere. So where is it not crazy?

Hard tank in 2016, 2015 will be the momentum of 2014. 2015 will be a “plateau”, the prices will remain same as in 2014, then 2016 I would expect prices to start tanking…

@Lord Blankfein,

Rental parity? My rent is less than 50% of what PITI (prinicipal-interest-taxes-insurance) is in my neighborhood.

In many parts of the U.S. (non-bubble areas, not SoCal) PITI is less than rent, but not in the better parts of SoCal.

“But mortgage interest is an itemized deduction, so you get no benefit if you don’t itemize. Plus, if your income is too high you are subject to “phase-out,†meaning your deductions are trimmed.”

http://www.forbes.com/sites/robertwood/2011/04/20/how-much-is-your-tax-deduction-worth/

I’m in discovery research mode now — “Misconception 2

Even for homeowners who itemize their taxes and qualify for the mortgage interest tax deduction, the amount of the deduction is a mere fraction of the amount of interest paid on the mortgage. Once again, a little number crunching is required to fully comprehend the situation because the deduction is not a tax credit – you don’t get a $1 tax break for every dollar spent; you get pennies on the dollar. Unlike a credit, which provides a dollar-for-dollar reduction on actual tax amounts owed, the mortgage interest deduction reduces the amount of income subject to tax owed based on the taxpayer’s tax bracket. (From community-based services to free software, there are many free resources to help with your taxes, read 6 Sources For Free Tax Help.)

For example, a taxpayer spending $12,000 on mortgage interest and paying taxes at an individual income tax rate of 35% would be permitted to exclude $12,000 from income tax liability, resulting in a savings of $4,200. So, the homeowner paid $12,000 to the bank in interest in order get a third of that amount excluded from taxation.

Mathematically, spending $12,000 to reduce the amount of money you will pay taxes on by $4,200 simply makes no sense. Worse yet, an honest assessment of the actual bottom-line savings should factor out the value of the standard deduction. The table below provides a comparison.”

http://www.investopedia.com/articles/mortgages-real-estate/11/calculate-the-mortgage-interest-math.asp

ernst blofeld – that’s the unfortunate truth of the matter and this has at times been the moment of deflection where the rental parody crowd would crow about their purchase in 2011-12, as if that somehow means dick to anyone looking to buy now or later.

tolucatom – another thing that rarely ever gets mentioned is that with low rates comes less potential deduction in the aggregate. What’s better, a high price with low rates and a lower deduction or a lower price with high rates and a higher deduction?

7 things you think you know about money — that are actually completely untrue

6. Buying a home is better than renting.

This really depends on a lot of factors, like how long you plan to stay in the home and the details of your mortgage. But certainly it’s not true across the board that buying is best. TheWall Street Journal reports than in many places — including large metropolitan areas like Phoenix, Austin, and Sacramento — renting is the cheaper alternative.

Most people think that investing in homeownership pays off over time, but the financial crisis proved that the value of your home can take a nosedive, and if this happens at a time you need to sell, you’re pretty much screwed. When they consider the cost of buying v. renting, many folks don’t calculate the costs of things like maintenance, fees, property taxes, and repair.

If you rent, you have more flexibility in terms of moving, which can be the key to taking a job with higher income. And because many renters pay less per month than buyers, they can invest the extra money, as well as the money they would have used for a down payment.

http://www.salon.com/2014/09/25/7_things_you_think_you_know_about_money_%e2%80%94%c2%a0that_are_actually_completely_untrue_partner/

Nice!! @@

Serious question on my part. A 1400 sg. ft. house with a huge backyard, a fountain, koi fish, abundance of trees, etc. in one of the nicest neighborhoods — the neighborhood has everything rents for 3K. Zillow has the house at 900K. To own would run about 5K a month mortgage (guessing) after down payment. The same 3K a month (rent) would buy a condo anywhere from 1000 – 1300 sg ft but definitely not in the same quality area OR a house Compton adjacent (West Adams). Where’s the rental parity in this scenario? I don’t understand if rental parity factors in the size, location, and type of housing. Thanks!

Tolucatom you’re on to them. It’s all to easy to say that rents are in line with ownership costs without making it clear exactly where it is the case. Thats not being honest.

I was actually being extremely generous with what a 3K mortgage payment can buy in LA and where. I always wondered if “quality of life” is factored in along with size of property, location, condo or house.

The 3000K a month rental I used as an example would cost exactly $4,694.83 a month for the mortgage after putting down 180K. But again, that 3K can get you about a 475K property after 20% down — in a marginal area. I don’t really understand this rental parity concept.

I have seen some “luxury” rentals of $1.5Mil home sitting for months in my my area. The rentals start at $6K+ per month on those. I wonder who would rent at $6K+ a month…

@Toluca. Comparing monthly rent to monthly gross of owning is not valid. You really need to dig further into the numbers. For your hypothetical scenario of buying a 900K house that rents for 3K per month:

Monthly cost to own:

20% down, loan amount 720K @ 4.5%

principal = $948

interest = $2700

taxes @ 1.2% = 900

insurance = $100

maintenance and upkeep = $200

Gross monthly cost = $4848

The monthly tax savings will be significant since over 43K per year can be itemized deductions (mortgage interest and property taxes). It’s all situation specific (maybe AMT comes into play), but getting $1000/month tax savings isn’t out of the question. Then account for principal that is almost $1000/month. That is nothing more than forced savings.

So if you were going to rent this place for 3K per month and be forced to put 1K per month into a savings account it would likely be no different than buying it. All the hypotheticals of I can invest the down payment in gold or Apple stock or the housing prices will tank are not taken into account. I’m just bringing up some valid points of paying 3K per month in rent and likely still saving for a down payment versus buying a place. And 900K isn’t a starter house anywhere, anybody buying these types of places needs very healthy incomes and bank accounts. Now crunch these numbers again circa 2011/2012 and you will see how good of time to buy it was. Just my 2 cents of course.

tolucatom you have to do a little more math which will include some estimates that nobody can possibly guess correctly. Take both scenarios (renting and owning) and put down all costs over some period of time, say 7 years. You’ve got to factor in the opportunity cost of the down payment, taxes (and the effect of your mortgage on income taxes), increases in rent over time, etc.

A few years ago I was paying 3k/mo in rent in South San Francisco. So in 1 1/2 years, that was $50k… I didn’t buy because my employment was uncertain but I sure didn’t like all of that money going to a landlord.

@Lord Blankfein – Thanks for breaking that down for me.

@Jim – I’m renting right now. I went through a divorce where I basically gave my wife everything and simultaneous with that and quite surprisingly my small business which specializes in working with “middle class” businesses has lost about 60% of it’s revenue. People talk about the disappearing middle class but seldom does one of businesses that way. But since 2007 we’ve seen the rise of the 1%’er businesses e.g. Amazon and the gradual downsizing or disappearance of those middle sized businesses. They can’t compete for PPC or display advertising anymore — too expensive because the Amazons can always pay more because they have so many ways to monetize on the backend.

So, I’m renting. I have a down payment saved. I’ll jump in when I see a property I love in an area I feel comfortable in. Heck, I may have to move back to Detroit but guess what? Chinese money is now flooding the market there. One Chinese businessman said that Chinese mistakenly think real estate will always go up no matter where they buy as long as the buying price is low.

@Jeff — I meant @Jeff instead of @Jim. BTW, I lived in SSF years ago. It was a pleasant working class town. But then San Mateo and Burlingame were quaint back then. I imagine Brisbane is pretty much the same simply because of the geography.

“It’s all situation specific (maybe AMT comes into play), but getting $1000/month tax savings isn’t out of the question. ”

Once again the rental parody parrot rears its ugly head. This has now become a silly conversation. I love the glossed over “maybe AMT comes into play” which has to be the understatement of the century. ANYONE that can afford a 870sf depression shack in a “prime” area like Palms, Culver City, Mar Vista, blah, blah, blah would have to earn 250k house hold income minimum. AMT will take back ALL of your “tax deduction”. Next, I love the “forced savings” argument. Investment 101 teaches us what class? Do not invest all of your money in a single asset class never mind a single, yes single asset.

Well, I guess the rental parody parrot does break up the comment section making it easier to read…

@What,

Some how I knew you couldn’t resist to take the bait…LA Haters are gonna hate. You don’t need a 250K income to qualify for a 720K mortgage at today’s absurdly low rates. Sorry dude, you are way off base there. Like I said, it’s all situation specific. Some may get hit with AMT and others will not. You may get all your tax savings, you may get half, you may get none. Clearly any buyer needs to check this out before signing the contract.

Investment 101 says diversify your portfolio. Owning a primary residence is part of that equation. Most of these people already have plenty of stocks, bonds, PMs in their retirement accounts. Is your advice to stay a renter and go all in in the Wall St. casino? Most people just don’t have what it takes to save money unless they are forced to. Paying a mortgage guarantees that, unless you want to lose your house. These aren’t hard concepts here…

Next!

tolucatom – you mentioned Detroit and the rich Chinese. I do wonder if Detroit’s chapter of the local feelgood promotion squad is telling people how much sense that makes due to Detroit being such a world class international city where the world’s rich and elite insist on staking a forever play.

What? – funny thing is, I mentioned in another comment that this would be the moment of deflection where the rental parody crowd would crow about their purchase in 2011-12, as if that somehow means dick to anyone looking to buy now or later. Lo and behold, I now see that it had already come true.

Here’s something you can take to the bank – the government will change the rules of the game right in the middle of it. We’ll see if the home interest mortgage deduction fares better than other interest deductions that have been axed from the tax code over the years.

@Mike Jones, Jim Tanks, did you change your name?

Here’s a Sepember 22 article in the LA Times that says runaway student debt is limiting home sales by $83 billion, and student debt is growing. Put that together with flatlining personal income the last 7 years; growth in poor paying new jobs instead of well paying new jobs; and now interest and mortgage rates are starting to increase — I’m shorting real estate, except for income rental property, which is doing well.

http://www.latimes.com/business/realestate/la-fi-student-loan-debt-housing-market-20140922-story.html

How can house prices crash if rental incomes increase? To my mind there is a strong correlation between house prices and rent prices.

@bb, rents have bifurcated. In the well-to-do areas (Santa Monica, Marina Del Rey, Hollywood Hills, Beverly Hills, Brentwood) rents are going through the roof.

In the not-so-great areas (Inglewood, south Los Angeles, north Long Beach, Compton, Paramount, Van Nuys, Canoga Park) rents are stagnant or declining.

I feel the same way. Others think that if housing purchase demand goes up, then rentals go down. But I’ve never seen it happen that way. If housing purchase goes up, rents go up as well.

I lived in NYC from 1999- 2002. When I first got there, you could buy a huge loft for $500K – and that seemed a little high. Rents were high of course but during downturns you could get a place for under $1500 in Manhattan. Rates were at 10% or so. Now with rates at below 1%, that same loft is over $2 million (you could buy a whole building in Manhattan for $2 million in 2000) and rents are crazy. It’s all about interest rates. Money supply is everything. Unfortunately, little of that money is coming to regular folks.

“I lived in NYC from 1999- 2002. When I first got there, you could buy a huge loft for $500K”

pfffftttt……I lived in NYC from ’75 to 81. You could buy a two bedroom co-op on 72nd and Madison (my boss’s at the time) for 78,000. I’ll never forget going to a party on White St. in Tribeca at a nice, 3000 sq ft work/living loft in ’77, and the tenant (he was a renter) was laughing about the fact that he had to move because the place was being sold for, get this, 22,000. I kid you not.

@bb,

We might not have strong single family residence construction, but we have a very strong rental multifamily construction all over the area. I see new apartments popping up like mushrooms after rain. Here, in Bellevue, we have multiple towers being built and some just finished few months ago and still plenty of vacancies. How many did we have two years ago? None… Remember, the bubble would be in rental properties just as well as in single family residence. Guess what is going to happen if all those newly built rentals won’t rent out, right, the prices will have to go down and now the rentals will have to compete. I remember during the last bubble lots of rental units were converted to condos because there were too many rentals and the housing demand was too high. I guess, the history will repeat itself and soon we might see all those rentals coming to the market as condos…

“Guess what is going to happen if all those newly built rentals won’t rent out, right, the prices will have to go down and now the rentals will have to compete.”

WRONG!!! The fed will print new wealthy renters to fill the vacancies…

While we often joke about the ‘it’s different this time!’ meme, I’m skeptical that we can simply apply historical rent/price ratios as a measure of value. Rent/price seems to me a metric that may well be different this time.

In many places there’s just been too much shift in how rents are being met:

1) Landlords are demanding higher and higher rents as a percent of income. A decade ago people would have though I was crazy to be spending 32% of net income on housing, but many contracts now allow up to 50% of gross.

2) More households are meeting rent by taking on non-traditional structures (extended family, roommates, etc.). That’s easier to coordinate when filling a lease than applying for a conforming mortgage

3) Some of that rise in rent is dog-chasing-tail – landlords (particularly the larger investors) pushing up stated rental prices to cover their investment, and as above, perhaps accepting more risk in exchange. They can pull it off in part because of the consolidation in the market, the fact that new construction stalled out for many years, and because there’s still some inventory that seems to be held off the market entirely (foreclosures in limbo).

Man. It’s Depressing, It’s infuriating, It’s nauseating… thinking of putting a roof over my head.

I’m 31 soon 32. for the past 18-24 months… I’ve watched this rigged market. I have about 90K down-payment , 10K E-savings… 10K Stock and a 401K mid-5 figures.

I lost a couple of bids on houses in 2013. I have not even tried in 2014… some went for 50-75 over asking… I’ve added 55K to my down-payment fund in the last 14 months or so.

I’m single, but engaged will marry summer 2015. future wife is 23 and will not work, will go to school. I only make 80K. I have no student loans, no credit card debt. I do have an auto loan for 13K, which I will pay off now, that buying a house is hard as chite.

I don’t care about school districts and fancy places… all I want is a normal even chitty house to fix a little an live there with my wife… my rent keeps going up in my crapp apt.

I’ll move to Texas before I pour my hard-earned money into a condo…

I live in south bay – SFbay area… (I’d like to commute from any town 35 miles radius from SJ) cause that’s where I could possibly afford a home.

this is whacked..

I hear ya. Just wait. Think about it. If someone in your financial shape can’t buy then the market will have to come back down to make it possible. Housing cannot be rigged forever. It needs organic growth which it does not have right now.

Couldn’t agree more about SFR vs Condo. Condo is not only a glorified apartment, but with the HOA’s its a liability. When the market tanks this time without the FED to bail it out again, all the people living there that stop paying their mortgage and HOA will drive down the complex. The other owners will have to pay higher and more exuberant fees, or the complex will be run into the ground.

Keep building that downpayment and wait until a good SFR makes sense. Shouldn’t be much longer IMO 🙂

Housing TO Tank Hard in 2014!!

Yes. this is my same thinking… this charade can not go on forever…

I know that there are a lot people here in Cali that make a LOT of money. In SFbay and LA, OC… (i.e., dual income 80-120K each and 200k -300K is not uncommon…) plus the 5%ers… but that is not the majority.

I’ll continue to save…

@jim tank, you are missing one fact is that a regular guy like you or I have to work there asses off to save enough for down payment or buy a house, where as black rocks type of folks get Bils of newly printed $$$ from the FED at 0% interest. How can you compete with those? The regular joes are not participating in the last bubble run up. The 2007 bubble was driven by the main street, the 2012-2016 one is driven by the wall street. That’s the difference!

You’re itching to buy a fixer-upper when you make $80k and your significant other will not work and will be going to school (i.e. will be racking up bills)? Unless you can acquire an extraordinarily cheap place or realize a significant increase in income, renting sounds like it might be beneficial until you have more income. I’m quite amazed you were able to even save what you have, given that you stated you rent (and don’t live somewhere for free). Do you not eat?! You might be surprised at how quickly repairs (some unexpected), upgrades and property taxes can add up.

Also, not all condos are that bad in my opinion. In fact, I almost prefer them to single family. Example: my parents own a single family in a pretty well-to-do neighborhood. Two of their neighbors have had dogs that bark incessantly (I see/hear this issue even while walking around with my wife in some very wealthy areas of Newport Beach). There have also been other noise issues as well at my parents’ place. I rent a condo currently (I also own rental property; long story). When we recently had a barking dog issue, I simply emailed the property manager and the issue was taken care of within a week. The way I see it with condos, when you have an issue (noise or otherwise), you have two tiers of enforcement to remediate the problem: property management and then the city/county. With single family, you only have one tier: city/county (and they aren’t always very responsive). Lastly, while I work hard, I’m otherwise lazy- I don’t like to worry about things like exterior maintenance and landscaping. I’ll gladly pay a bit of a premium (via reasonable HOA fees) to have those things taken care of.

Best of luck to you, whatever you choose!

Yes.. I am itching… life in an condo is not the best if you’d like to have a garage to work on a dirt bike or car, if you’d like to grill a damn steak on a Sunday, after working hard all weak.

I don’t think I’m delusional wanting to buy… have 100k cash, 10K stocks a make 80K (i know is peanuts in Cali) NO Debt but an auto loan for 13K left. I’m 32 I think that most 30 years old would like to be somewhere in my position.

I was able to save that much by:

saving a lot

No dining out every week (sushi…

No drinking out (I don’t go out a drop $10 per drink every weekend) it can add up. I was moonlighting at a bar-grill on weekends for ca$h… (to have money for eating and utilities) I witnessed chumps paying tabs for 80-100 bucks within 1-2 hours just a that place.

Not buying multiple gadgets and computers and clothing. My desktop is from 2008, my laptop from 2010, I still have the iphone 4…

I’ve also sold all the chite I don’t need on Craigslist and eBay. (you’d be surprise what people would buy.

I sold an older motorcycle in mint condition (this one hurt) … 🙁

I could go on… my point is that I’ve made sacrifices to be able to buy a home. I don’t want to leave the area because my family is here… even if I live 1-2 hours away I could still hang out 2 a month or so…moving to another state… all you have is Thanksgiving…

You gonna tell me that to buy a starter house within 35-50 miles from a Jobs area you need: 200K DP, 200K income, 0 Debt ?

I just got back from Costa Rica this July. Most people are so broke paying 50% income on rent can’t even go on vacation…

The reasons for condo living you just described are still not as attractive as renting. When renting you have tier 1 and possibly 2 depending on where you are renting. But the ultimate tier 3 is you can move on a dime! I think that is worth something. If awful people move in next door, then you move out to somewhere better. No waiting on the city / HOA to drag their feet.

I’d focus on jamming as much as possible into your retirement funds and renting. Way down the line, you’ll have some security regarding your retirement and can then start piling up after-tax money, and then you can decide whether or not to use those savings to buy a house. Basically, buying a house is optional, whereas building a nest egg for your family’s future is mandatory.

I hear you on the frustration part. You’re story is similar to mine but honestly I am changing the way I think about home ownership. Don’t get me wrong, it’s a long process and I still struggle with it from time to time since we’re so conditioned to think owning a home is the ultimate American dream and end all to be all. However, so much has changed since 60-70s when middle class flourished and yet majority of us never realized home ownership might not be the best choice? All we all doom to be lemmings in this society and chase after an impractical dream? Think of the pros and cons of renting and decide what will work best for you. Renting will allow you to have that flexible when you change jobs or decide to move to a different neighborhood, in the meantime, the $90k you have saved up, why dump it in an Illiquid asset when you can invest in stock, gold or whatever else that end up having a bigger return in 10-20 yrs than a house would? You just have to do your homework and be smart about it but let it be known following everyone else down the cliff might not be the smartest thing to do..they might get their laugh now but at the end when another bubble burst and they all get hosed again, you’ll be glad you’re not the one upside down with your money.

come buy my house in manteca, 1 acre , house, pool house and mobile home rental, 30×60 3 car garage 399,999

Thanks, but no Thanks.

1. I don’t need a house with a pool or 3 car garage. (too much maintenance)

2. I don’t want to live in Manteca too far out. Livermore as far I’d go… 😉

3. 400K in Manteca – no comment

Livermore is a solid 80 minutes from SJ during rush hour now, I would say that’s a no go. Plus, 60’s ranchers are going for $600k…no thanks.

Tequilini, that’s kind of the point. Look at your own response. Look at how much you give up in your life (dining out, an old motorcycle you love, enjoying little things here and there) just to save money to get a house as if that’s the rite of passage. Not saying, you should spend money like no tomorrow by renting but I don’t believe it’s worth it to give up all the things you enjoy to obtain this so called American dream. Now if a house is a sure bet on generating positive cash flow then by all means I understand the appeal, but it’s not as we all know that’s why we are reading this blog. You have to ask yourself, is it worth it at all or can the $100k be use somewhere else that can generate better return (stock, small business, retirement savings…etc) Home ownership is not the end all, I for one is sick of this mentality, kind of reminds me of those lemmings waiting in line for an iphone..when will it end?

Tequlini,

Dont be frustrated. Stay liquid. Stay Calm. Wait for the correction.

Most of the time I stay cool and calm about it. It’s only when something happens at the Apt complex, with the low-class neighbors, the parking, the dram that goes on that set me off about moving to a home.

I’ll sit this one out and wait for correction…

it always gets worse before it gets better…

The lesson from the last downturn is that first time buyers lose out to ‘investors’ for every decent house. If it is deal then an investor will offer cash, and the seller will take their cash over your contingent offer. In a year you can pay the investor an extra 20% for shitty upgrades.

You will have zero chance of getting a distressed property in SoCal. There are too many vultures with connections and knowledge.

Try and remember that buying a house doesn’t make all of life’s troubles go away. It’s not a magic castle in the sky. Right now those troubles are often neighbors in your apt compex.

If you buy a condo it will be neighbors in the condo, or the condo association, or the fact that the elevator repairs will require increasing the HOA by 20%, etc.

If you buy a house it’s the neighbor’s dog, or property tax rates, or what you can’t do in your own house under a CC&R, or a leaking septic tank. Or the furnace/HVAC going out. If there’s one thing that’s true in life, it’s that there’s always something that will get under your skin.

the only reason to live in the LA area is the weather and the food.

if you can live without the sunshine and you are not a foodie, move out and stop complaining

“There’s no point in living in Los Angeles unless you work in the movies, and in a big way.” — mobster Bo Catlett in Get Shorty

The food sucks in LA. Most restaurants use low quality ingredients and add stuff like mayo, butter, tons of salt and other things to make their food taste better. I like food trucks as much as the next guy, but the religious devotion to them in LA is ridiculous.

I have to disagree, I do not know where you are eating or spending time.

Why Los Angeles Is the Best Food Town in America

http://www.thedailybeast.com/articles/2013/11/16/why-los-angeles-is-the-best-food-town-in-america.html

Food & Wine Magazine named Los Angeles “America’s Best New Food City†in a 14-page article in its March 2014 issue

To each his own, but I have lived in a few cities, and I love Los Angeles. I like the interesting people, the hills, the weather, the canyons, the restauraunt choices, the variety of people from everywhere, etc…. My Au Pair just came back from the hollywood bowl and was mesmerized (she is from Sao Paulo Brazil).

To each his own I guess, I hate the suburbs and chain restaurants. The only thing I like about the south bay is the ocean. I do not understand why people live in a city they hate for longer than is neccessary (school for example).

Butter and salt! There are lots of great restaurants in LA. I will list a few in my area.

Pizza – Garage pizza in SilverLake, Nicky D’s, Brownstone in Eagle rock, Maximilliano in highland park.

french – canele in atwater

‘hot dogs’ – links and hops in atwater

american – the york in highland park, little beast in eagle rock, bar verde in Nordstrom at americano, glendale.

fast food – Tacos villa corona in atwater, oinkster in eagle rock, spitz in eagle rock

@Mr.Smith in Ktown,

I agree that’s its crazy to live in a place you don’t love, but it’s difficult to leave. In our case, it’s because of family and friends, but we’re finally coming around. While having both sides of the family close is fantastic, particularly for our 2 year old, our baby boomer parents seem to be in a bubble when it comes to housing costs. They don’t seem to understand why we need to leave, and talk about how they had to “stretch” to buy their $35K homes in the ’70s. I don’t think they understand just how bad it has become in Los Angeles. I make six figures, and my wife is a full time mom, and it is still very difficult to buy a property that has any appeal for us.

I’ve lived here for 15 years, and my wife is from here, but, in our eyes, Los Angeles doesn’t hold a candle to Portland, where we plan on moving in the next couple of years, but everyone likes different things.

@GZ, look at you! Congratulations, you have found a city you prefer and are making plans to move. No reason to stay in a city you hate longer than neccessary!

I am curious as to what community you will move to in Portland that is a desirable community without long commutes that is imminently more affordable than LAs hoods compared to salaries there? I would look at moving as well, as Portland is pretty cool. My sister lives close by in WA.

A lot of the SoCal/AZ transplants I know don’t end up enjoying Portland nearly as much as they did when they were just visiting.

Some love it and stay, but it’s not unusual to hear people moving on (back to CA, or up to Seattle) after a year or two.

@Mr.Smith in Ktown,

I own a business in LA that allows me to live anywhere, so I don’t have an in-depth analysis of commute times and salaries in Portland, but, like any of the mid-sized cities in this country, it is considerably easier to buy a house when compared to LA. For $400K, you have TONS of options, from nice craftsmans in the NE and SE areas of town that are surrounded by shops, restaurants, etc., to larger, mid-century homes in the SW located in wooded, hilly areas. There’s also Beaverton, if you’re looking for a more suburban setting, and $400K gets you a lot of options.

The thing that I like about Portland is that everything just seems so well done. Beers, food, bars, retail, graphic design, parks, transportation, etc., are all done with such a great attention to detail (and the city is very clean and safe feeling.)

Like LA, Portland is one of the great food cities. I think the difference is that, in LA, you have to search out the great food amongst all of the bad, whereas, in Portland, it almost seems like everywhere is great (slight exaggeration.) It’s kind of a distilled version of LA. That being said, my best friend here in LA may not like Portland as much as I do, because he enjoys seeking out the good spots. In Portland, there’d be no sport to it, for him, because everything is pretty good.

I think the weather is really the big deterrent (assuming one finds a job.) My wife and I love cool, wet weather, and we get frustrated whenever the temp goes over 80 degrees, so it’s no big deal, for us, but we may be unusual in that regard. The weather is actually one of the reasons we chose Portland.

you come on over to Texas. It is the promised land for many California refugees.

lol, too funny, but i may just jump ship soon, when i unload everything!

There’s plenty of great food to be found in many other cities. The weather is pretty good, except when it’s not, like last week. There’s great weather all over the Mediterranean yet the majority of the worlds population doesn’t live there by an enormous margin. If you can’t understand why someone who dislikes a place would remain living in it, then you’ve not spent any time in their shoes. In other words, it’s more complicated than you’re willing to put forth the effort to believe.

A fact of life is we always have a choice. Staying or leaving are both choices.

I agree that their are many great cities, and I would move for the right situation and money. But then again I would move to China for the right money.

I know that there are many great cities out there in the US, for me they are Chicago, Seattle, San Francisco, Boston, New York, even Austin, Atlanta or New Orleans has its charms. Unfortunatley all of them have the same issues as Los Angeles when it comes to housing prices in desirable urban areas compared to salaries. Even Portlands desirable urban communities ae not affordableat the moment.

LA at all costs? No. But is LA great? Yeah, yeah it is. There are many places to live just outside of LAs urban desirable areas that are much more affordable if you do not mind the commute, same with the other cities. So if you hate LA, leave it for Valencia. Your still in SoCal.

So he asks if LA is great? and answers himself “yeah, yeah it is.”

Maybe some parts of LA are livable–if you have enough money to insulate yourself from the polluted gangland ghetto that is most of LA. The weather no longer compensates for the hellhole that it has become.

Actually, since the 1990’s LA has a had a reduction in violence and one of the offshoots of housing bubble has been the gentrification (opinions vary on the positives/negatives of genrification) of once considered to be dangerous neighborhoods like east Hollywood, Echo Park, Venice, etc…

LA is a very segrated city historically and presantly, the police have been used by the wealthy business and social elite to keep the city that way, in conjunction with redlining and housing covenants. Starting in the late 1960s through the early 1990s LA saw a horrible period in crime and crumbling infrastructure, as most major city centers in the US did.

So I am curious as to what period of history you are reffering to when you say LA has become a hellhole, in many ways LA has always been the Hellhole you so vehemently describe. Yes, it does take some money to live in the nicer areas, good LA neighborhoods hav never been cheap, even during a housing downturn.

We’ve lived in West LA our entire lives (since the 1970’s) and the livability of the city continues to get worse. Housing costs in desirable areas are ridiculous. More people, more congestion, and in certain areas more crime.

http://spotcrime.com/ca/los+angeles

Violent crime rate in 2012 for Los Angeles is 271.6 vs. U.S. Average of 214.0

It’s a polluted city full of mostly delusional people who are totally dependent on having fresh water being shipped into the city from hundreds of miles away. How many people in LA are really prepared for the next big earthquake?

We are actively planning our escape.

We have nice weather in Seattle (when it is not raining :(), the food is better here too…

guy from Seattle…When we moved to Denver said the same thing, “when it is nice it is nice” of course most of the time “something is always falling from the sky at almost always at a planned event. Places like that have weather not climate.

Thus we moved to consistent climate, you can’t beat dry roads and driving nice cars 340 days a year.

?? WHAT HAVE YOU BEEN SMOKING!?

Ben…Sunshine and food, looks like a good reason not to move to lousy climates don’t you think?

In Germany and Switzerland, only about 40% of the people own homes. They have not been programmed to own homes. They also have some of the highest standards of living in the world. Copy them.

It’s not so simple. We have the landlord from hell. We will NEVER rent again. This a-hole cured us of that. We will buy when the lease is up next June or sooner. We did due diligence but it didn’t work. Be careful folks, renting is not the promised land – there is no “perfect.”

Just wait until you get the neighbor from hell while being an owner.

I would echo the sentiments of LA SUCKS. A neighbor from hell may be worse than a landlord from hell when you own. At least when you rent, you can leave reasonably easily with only minimal impact on your wallet. When you own, you might be trapped!

Just wait until you own a house and the slumlord who owns the tear-down next door rents to lowlifes who don’t cut the weeds/grass, who leave pizza boxes and beer cans in the street, who tie their dog out in the yard so they can bark for hours…

Renting means flexibility. Nothing ties you down like owning a house.

We got our house at a great price, fantastic interest rate, but it’s not all roses.

@Bay Area Renter – that’s the point, right now whatever ‘from hell’ you have – you have mobility. Now you’ll be super tied down, and neighbors from hell can haunt you like crazy. HOA’s from hell. Whatever it is – you’re giving up mobility because you had a bad landlord, and going to lock yourself down to other things? Doesn’t make sense!

In the past I’ve had the landlord from hell too. Crazy as a cut snake he was. Talk about harassment. All started when I called him to report the carpet was coming apart at the seams (5 wks after I moved in) and he went nuts. I did it, he was going to make me pay, I’m ruining his house, etc. After that he was calling continually and “dropping in” to do “an inspection” – no notice or valid reason. Of course I told him to take a hike. He made life hell. After warning him in writing he was not allowing me peaceful enjoyment of the property, I gave notice, broke the lease and moved out. He kept my entire deposit then refused to advertise (for free on Craigslist) the property for a new tenant, so I advertised it myself then he refused to show it. I had taken 300 high def pics when I moved in to prove the condition of the property when I took possession. Anyway, I sued the pri*k in court, and the judge agreed with me. Got my deposit back plus 2 extra months as penalty.

Rule # 1: I will not rent from a landlord direct, only through a property manager. This way I can just about be assured the owner considers the property a business vehicle and will not get personal about it.

Rule # 2: Take hundreds of photos of property before move in, and complete inspection report, certified mail disk of pics and report to landlord/prop manager.

Last week my brother informed me the plumbing in his “dream home” is shot. Got to have the entire house replumbed to the tune of $7,500. A few months ago his swimming pool was leaking ($1,800), his hot water heater went out ($1,100) and last year the A/C croaked it ($4,000).

Renting is not so bad sometimes, if you have a silent landlord 🙂

I spend a lot of time in Germany and in Scandinavian countries and the quality of life is impressive, given their taxes are so high and many are eternal renters. What is impressive is that given the high taxes, the nearly free access to education (K through PhD) and medical, dental, elderly care and pensions offsets the 40% – 60% tax rates. Of course, anyone can find problems with their health care system but no one goes bankrupt in the process of staying healthy. I myself do not want to live in those countries for other reasons but anyone here who complains about their tax rate does not see the whole picture.

FREE? Nothing in life is free. Taxpayers are paying for that “free” access and it’s one of the reasons why so few people in those countries can afford to buy their own homes.

The Scandinavian countries like Norway benefit from the vast North Sea oil reserves and their governments can afford to provide more social benefits to their relatively small number of citizens. What happens when they run out of oil and other people’s money?

” What happens when they run out of oil and other people’s money?”

Since Texas, like most red states, gets more funding from the Federal gummint than its citizens pay in Federal taxes, you could ask the same question about Texas … Why do you think the Texas economy is doing so well? Oil and gas.

etherist claims “Since Texas, like most red states, gets more funding from the Federal gummint than its citizens pay in Federal taxes, you could ask the same question about Texas …”

Wrong.

The states most dependent on the Federal Government are mostly BLUE states like Illinois, Minnesota, New Jersey, Connecticut, California, etc.

http://wallethub.com/edu/states-most-least-dependent-on-the-federal-government/2700/

http://www.economist.com/blogs/dailychart/2011/08/americas-fiscal-union

Subprime Loans Are Back!

http://www.slate.com/articles/business/moneybox/2014/09/the_return_of_the_subprime_loan_believe_it_or_not_it_s_a_good_thing.html

They have never left in the first place…

Nations and their economies are organic systems. What happens in one has, like the spread of concentric circles on the surface of a pond spreading out in all directions from the impact of a stone, influences the economic system. Consequently, it dies a slow death impacting the entire system.

This fine website site keep helps in my struggle to understand one organ in the economic creature – housing. And for that insight, I, for one, am very grateful to the people who write it, who read it, and who comment on it. Cause I’m struggling to understand what the hell is going on in my country.

Pardon the typos.

August’s numbers are in. Down 2% from July, and down 5% YoY. Kerplunk.

http://online.wsj.com/articles/u-s-existing-home-sales-fall-1-8-in-august-1411394672

You are quoting national numbers and this is a SoCal blog. But I’ll comment regardless: volumes are down only 5% YOY in the face of ridiculous asking prices from sellers. Hardly a tank. And sales prices from the same article you quoted? Up 4.8% YOY. Kerplunk? I think not.

Sales volumes were down in CA for Aug as well CAB. It’s all right there on the internet for you.

“Prices are still up YoY”. This is the only bright spot left for bulls, and it is fading fast.

The percentage of properties in LA County with a price cut in Aug was 33.3%. The last time the percentage was that high? December 2011. Look out below.

@CAB, SoCal sales are worse than you realize, and much much worse than the U.S. as a whole.

http://www.dqnews.com/Articles/2014/News/California/Southern-CA/RRSCA140911.aspx

“A total of 18,796 new and resale houses and condos sold in Los Angeles, Riverside, San Diego, Ventura, San Bernardino and Orange counties last month. That was down 7.7 percent from 20,369 sales in July, and down 18.5 percent from 23,057 sales in August 2013…Last month’s sales were 28.2 percent below the August average of 26,169 sales. …”

@ blo & dom –

more blah blah blah about sales volume being down (yawn). this is like all the blather i’ve been reading from commenters on this blog for the past 5 years about how rates are going to go up and this whole ponzi is gonna crash.

of course volumes are down geniuses: asking prices are freaking ridiculous right now. sellers are getting greedy and going for the a pounder and it isn’t happening unless they have something really special, which they typically don’t. properties priced reasonably are the ones that are closing. so, closed prices? still up. no tanking yet.

go ahead and respond with “that’s all the bulls have left.” Newsflash: closed price is what counts.

even funnier Blo this is from the link you posted: The median price paid for all new and resale houses and condos sold in the six-county region last month was $420,000, up 1.7 percent from $413,000 in July and up 9.1 percent from $385,000 in August 2013. Last month’s median was the highest for any month since December 2007, when it was $425,000. The median’s 9.1 percent year-over-year gain in August was the highest in three months.

@CAB

Before real estate prices historical plunge in SoCal, 4 things normally happen:

1.) Quality jobs disappear (check)

2.) Real estate sales drop (check)

3.) Home affordability drops into the teens. (We’re not there yet. About 25% of SoCal’ers can afford a home at current prices so prices should continue to go up.)

4.) Recession. (1st qtr GDP was -2%, 2nd qtr GDP was +4%, so no recession yet)

That’s about 2.5 out of 4 factors. So no real estate tanking in 2014, except in a small number of isolated pockets.

“many people realize they will only work for said company for a short number of years (certainly not 30).”

I haven’t heard a lot of discussion about this topic, but I think it has a much more negative impact on household formation and first time buyers than many realize. And it could be a main factor in why renting has gained so much popularity within the past 10 years.

If job stability is non-existent, and companies have no loyalty anymore, employees are less inclined to commit to a certain geography than they used to. After all, they may get laid off tomorrow, or they may have to move halfway across the US (or possibly halfway around the world) to get that promotion or new job. Because of this, they need to stay somewhat liquid and have a larger than normal emergency fund. All of which encourages renting, discourages owning.

I guess my point is, maybe there are reasons why rents are rising, and Owner Occupied housing is flat or declining (other than the conspiracy theories about the Fed and Wall St. hedgefunds wanting to permanently destroy middle class homeownership.) BTW, I am no apologist for the Fed, i hate their policies…i just think there are other factors in this economy which are causing people to favor renting vs. owning.

You have to have a job to buy a house. Here http://www.foxnews.com/leisure/2014/09/23/mercedes-benz-driverless-truck-coming-in-2025/

Mercedes-Benz driverless trucks rolling in 2025… Do we have any truck drivers around here? I just wonder how soon before 50% of the population is unemployed?

Are you suggesting half the population is made up of truck drivers?

I robot with will smith

Nope, it is not What? I have suggested. I have suggested that with more automation we will see fewer and fewer well paying job remain and moar people unemployed. Lots of manufacturing jobs were replaced with automation, soon all the operating jobs will be replaced too, like truck drivers, taxi drivers, excavator operators, fork lift operators, airplane pilots, etc. This is why I suggested how soon until 50% is unemployed?

An analysis of the internals of yesterday’s existing home sales report shows that the market is even weaker than advertised:

http://investmentresearchdynamics.com/august-existing-home-sales-tank-despite-lowest-mortgage-rates-in-year/

As this excellent Dr. Housing has reflected upon over the years, we created a Frankenstein monster in “housing” post WWII. The use of the tax code has guaranteed the mis-allocation of capital to SFR, when we would have been far better off as a nation to allow free markets to have more apartments and denser cities. Instead, the glorious fossil fuel burning autos and asphalt streams to carry them have literally “burned” us all. Only the land developers and big oil has feasted on this carcass. In the past few decades, greater schemes of “financialization” have manipulated markets into a casino, not reflecting real supply and demand. Distortions abound.

America will either “grow up” or perish. It has only been a few hundred years after all.

Rent?! Why rent when you can OWN! The professionals that I work with on a day in and day out basis are saying the sky’s the limit! They are saying there’s never been a better time to buy a home. And you know what, I believe them!!

No one here likes you. Beat it!

@GetRetard, don’t believe everything you hear…

GetShillTard, We need more cowbell!!!

one always needs to be mindful of exponential math when reading these percentages because they are all based on a growing population.

The truth and nothing but the truth (with entertaining analogy) Yay!!!

We have all been saying on this site, the dismal prospects that young people have with respect to work and home ownership, but this survey sounds more optimistic.

Zillow’s Housing Confidence Index: Will Youthful Exuberance Today Mean More Sales Tomorrow?

More than 80 percent of young adult renters aged 18 to 34 are “confident†or “somewhat confident†that they will eventually be able to afford a home.

Slightly more than one third (36 percent) of renters aged 18-34 said they expect to buy a home within the next year. But more than half (54 percent) of 18-34-year-old renters said they expect to buy a home in 1 to 2 years or 3-5 years.

Nearly two-thirds of young adults said they think that owning a home is necessary to live “The Good Life†and the “American Dream.â€

When asked about their expectations for home value appreciation over the next decade, young adults appear to have exaggerated expectations. They are more likely than older age groups to think that home values will rise rapidly, and they are also more likely to think that home values will fall dramatically.

Despite the housing market tumult that marked their formative years, young adults remain optimistic about homeownership and, in some respects, hold more conventional views than older generations, according to results from the latest Zillow Housing Confidence Index (ZHCI).

The ZHCI is sponsored by Zillow and developed and administered by Pulsenomics LLC. The index is based on the results of the Housing Confidence Survey, which consists of more than 10,000 interviews across 20 different metro areas.

curious what that confidence level was back in 2010 or 2011

I stopped reading after “but this survey sounds more optimistic.”

Speaking of Zillow, I noticed Zestimates of houses in the South Bay are up 10% in the last 6 months. Hope this doesn’t ding the confidence of those 18-34 years olds…

Confident just like the same morons that are confident they’ll stay in a house for x number of years only to property ladder up sooner or get sideswiped by a major life event forcing a sale.

Reminds me of how Greenspan, Bernanke, and Paulson had soundbites of confidence leading right up to the previous crash.

A FIRE organization putting out optimism rhetoric, who’da thunk it?

One factor that I continue to see ignored on this site is actual inflation vs. public inflation as released by the Fed. Home prices entered a bubble in 2008-9 and came back down to reality and actually dropped below levels they should have been at during 10′-12′, hence the reason why hedge funds and investment groups jumped all over the housing market.

When you take into consideration that inflation is probably considerably higher than what is being publicized, today’s home prices are probably just slightly over where they should be. If there is a correction, it will be a correction in the price sellers are listing their houses for but buyers are buying for what they believe these houses are worth as well as appraisers and lenders doing the same.

There will be no massive price decrease unless of course another 2009′ financial crisis occurs and millions of people lose their jobs…. which very would could occur.

The reason for low first time home buyer participation is affordability plane and simple. Home prices are too expensive.

Home prices are high, there’s no doubt about that but I do think there are other variables involved other than affordability for first time home buyers in determining value.

I don’t agree. Use your own handle troll.

True the Troll. I like the alliteration there. Anyway, True’s point may or may not be valid, but it certainly is the opinion of quite a few folks in here. If you see the world as being in a deflationary cycle, then it most certainly is true. My Wife sees price inflation in a lot of the economy today. (That does not include the price of motor fuel, though.) The only thing we’re lacking to make your inflation case is a new round of wage inflation. 2009 was a massive deflation.

I meant that at TheObserver, not to be confused with The Observer.

The constant talk of inflation is the bait for RE investors. Yes we have inflation in many areas of the economy, but inflation in housing has been super high for many years. It has already happened. RE will eventually find the same level as the rest of the economy.

If we let it play out properly, RE would start to deflate and then the other areas of the economy would rise to meet it. You might even have a healthy and real economy again. QE and ZIRP need to end for that process to start and it won’t start until the banks are able to let it happen or their lobbies lose power in Washington.

investors moved into housing because yields on fixed-income investments were lower than the yield they believed they could make in the housing market

You guys are always going on about how the government is trying to hide inflation, and about how prices at the grocery store are going up, or you get less product for the same price, but the truth is the average household spends less of its after-tax income on food now than any time in the past. Get over it:

1900: 42% of after-tax household income spent on food

1950: 25%

2003: 12%

2009: 10%

Gas: From 2001-2007 inflation-adjusted GDP rose 18 percent, as gasoline demand went up, the price went up. No new US refinery since 1976! In 2001 the not-inflation-adjusted price of gas was $1.43 in 2007, it was $2.81. (Bush’s “fault?”) When demand cratered, 2009 price was $2.35 – fed’s fault?

Live in an “auto-dependent exurb?” 25% of household after-tax $ for transport. “location-efficient environment? (urban core)” – 9%! Average US family: 19%.

Per the AEI (conservative): real price of clothes DOWN 41% in 20 years!

Energy: ” U.S. homes built in 2000 and later consume only 2% more energy on average than homes built prior to 2000, despite being on average 30% larger.”

Does that look like stealth inflation to you?

Lol, I didn’t realize that name was already taken. Don’t flatter yourself good sir. :). But great minds do think alike.

Just read on Zero Hedge http://www.zerohedge.com/news/2014-09-24/new-home-sales-explode-higher-thanks-record-high-average-new-home-prices. The article says New Home Sales Explode Higher Thanks To… Record High Average New Home Prices?

So, I see not tanks in 2014…

To the moon?

http://3.bp.blogspot.com/-KEwDgbgql9s/VCKsokKg3DI/AAAAAAAAOl8/fW81xpZG0a4/s1600/Screen%2BShot%2B2014-09-24%2Bat%2B8.35.42%2BAM.png

Oh seattle. Fake data from the usual suspects. As someone posted in the comments — real data ”

Mortgage Originations Down By 60-70%”

http://davidstockmanscontracorner.com/mortgage-originations-down-by-60-7…

tolucatom…Mr. Stockman is a straight shooter, I enjoy his no nonsense takes.

https://confoundedinterest.files.wordpress.com/2014/09/nhs092414.png

A) if you read the article the author states that it is a “seasonal adjustment” which is being kind. B) reading gloom and doom can be a hazard to your health. Side effects include massive canned good purchases, inability to shave or shower, digging concrete bunkers, barely legal firearms hording, seed hording, and most of all, uncontrollable fascination with the precious… my precious… they don’t understand the precious like we do…

https://www.youtube.com/watch?v=Iz-8CSa9xj8

I’ve no idea about tanking or not, but something seems way off-base. As usual the devil is in the details. Headlines don’t give many details.

http://investmentresearchdynamics.com/censusbureau-con/

Quote:

Furthermore, based on regional reports from both the Bay Area and Southern California – which I’ve detailed in some previous posts – the housing markets in both those areas are starting to deteriorate significantly.

It’s election year. Both political parties manipulate economic numbers in election years. Expect massive revisions after November. It’s unfortunate many government entities have become politicized.

Based on this article…I guess we’re all wrong..it will only go up and up…

http://seattletimes.com/html/businesstechnology/2024615480_apxnewhomesales.html

Just like I said above, no tanks on the horizon (@Jim Tanks has been hallucinating tanks since the beginning of the year). So, folks, sit tight for the next 2 – 3 (4, 5, 6 ???) years. The tank hard is not coming sooner any time soon. DOW hasn’t reached it $20K “all time highs” yet. China is unwinding another round of “QE” for its failing economy, Japan does the same (keeps buying equities), the PMs are at all time lows, the FED has never tapered in the first place. And… no rate hikes in the foreseeable future. All said, there is still music playing, so, we keep running around the chairs for the next couple of years 🙂 at least.

Phoneix_Ikki …Yes this surprise me, the jump in increase was significant , especially given the poor showing for resale’s.

Builders were giving ground as to incentives and reductions on the always ridiculous lot premium scam. 18% up, well maybe this fall the hope of a bounce back for new and resale’s will exist, but based on my many insights into housing the past 9 months I don’t see a robust or lust for buyers to run and buy.

last spring I had a different outlook, but as each month passed and buyers just didn’t look at houses it got to be the old, keep putting money in the slot machine it has to pay off eventually?

LATEST BEHEADING: Group linked to

ISIS kills French hostage in Algeria….I shouldn’t do this on a housing site my apologies to Dr. and bloggers, but this is getting me down everyday, killing another innocent person.

Don’t get me even started on this!!!

You are right, not suitable for housing blog, otherwise can be discussed on Zero Hedge

No worries. It puts everything into perspective. Death takes millions everyday and yet most of us act like it’s not going to happen to us. Not today. Friend of mine gave up a high paying, high pressure fashion job to focus on her spiritual life — to clean out the garbage in her and — yep — you guessed it — she was run over by a garbage truck. Ridiculously ironic. Point being I got my health, I got life, and I have a heart full of gratitude today. The rest of this is — if we’re on this forum we have gold plated problems.

Plenty of homeowners in LA will get financially beheaded soon. Film at 11.

Remember context. People get innocently killed everyday. And way closer to you then the guy that’s bumming you out. Media makes money by contorting context.

Public beheadings are probably not the way people way closer are being killed.

I’m seeing more Short Sales on the market here on Orange County.

I have noticed more cloudy days in SC county…

Leave a Reply