Renter nation: The 2000s are highlighting a big shift from homeownership to renting. The number of single family homes now used as rentals is at a record high.

There has been a very strong trend of shifting from homeownership to renting over the last decade. This is a dramatic reversal from the peak reached in the 2000s where homeownership reached a historical apex. Sure, this was brought on by making up income, taking on massive leverage for the biggest purchase of your life, and pretending the middle class was not shrinking but it was fun to act as if everyone was rich right? Clearly that is not the case and we now find the homeownership rate of today is now back to where it was 20 years ago. Baby boomers overall are not pleased that their kids are now part of a hyper competitive market and many of their offspring are now back living at home rocking out in their rooms with Nirvana and Pearl Jam posters. They’ll need to make some room for the younger kids as well since many of these are coming back home to their Britney Spears inspired rooms. People are still itching to buy but their incomes simply cannot support those $700,000 crap shacks. This is the large reason for why sales are down and inventory is up. The assumption is that many of these younger households are slowly going to pop out of their parent’s home and makeup a new part of the buying pool. So far the data does not show that to be the case and you would expect that to be happening right now since technically, we’ve been out of recession since the summer of 2009. The US is in a massive renter nation trend.

Renter nation galore

There has been a big shift from homeownership to renting and this trend started at the apex of the last housing bubble. What is also interesting with this trend is that more single family units are now available as rentals courtesy of your new feudal landlords. This is another trend to follow since the allure of being a feudal landlord with renting serfs is losing some draw in high priced states and investors are voting with their dollars. In the past, big money focused on apartments for rents versus single family homes to leverage economies of scale (i.e., one property manager, one roof, one area, etc). This trend of big money buying single family homes for rentals for a sustained amount of time (since 2008) is rather new.

It might be useful to take a look at this trend with actual Census data:

The trend is rather clear here. We hit an apex early in the 2000s and then the shift started as more households were unable to buy in spite of every imaginable toxic mortgage product you can think of. Of course, it took a few years later for this reversal to show up in prices.

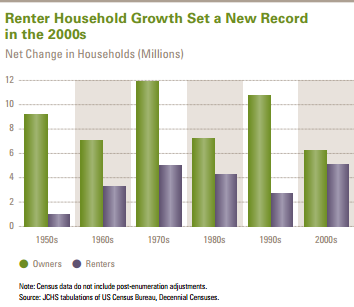

This trend of renting versus buying is actually a new one looking at historical data. Take a look at household changes over the decades:

Every decade going back to the 1950s saw a lopsided win between buying versus renting. This trend held steady all the way until the 2000s. What is interesting is that we can argue that in the 2000s, this was the easiest time to purchase a home given there was no need to substantiate income, had the ability to go 100 percent LTV (and higher on some products with costs rolled into the loan balance), and simply needed a pulse to buy. Can’t get much easier than that right? What happened of course is that the shrinking middle class wanted to pretend that incomes were not truly shrinking and the American Dream still included homeownership. So what to do? Leverage up baby!

The young and the homeless

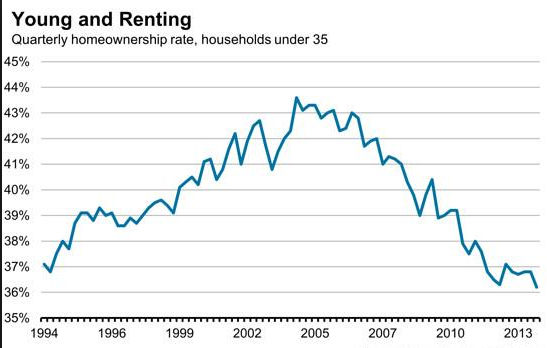

There are reams of data showing that young Americans are very likely to be less affluent than their baby boomer parents. In California alone, you have 2.3 million adults shacking up with parents. No, we are not suddenly becoming Italy but simply put, people can’t afford to buy or even rent in most cases. And this is why we have this trend:

It is no coincidence that the peak of homeownership for the young coincided with the peak homeownership rate overall. Younger households took the brunt of the housing bubble. They had lower incomes and went into deeper leverage to purchase. They probably were also more junior in their careers and did not have a war chest to weather an economic hiccup. Many lost their homes in that graveyard of 7,000,000 foreclosures.

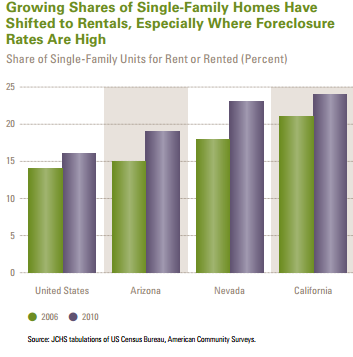

What is also fascinating is that since the market crashed, big money investors have purchased a large share of single family homes to convert to rentals. The trend is rather clear. Many are too broke to buy so why not rent? Take a look at this chart:

California has one of the highest share of single family homes for rent as a percentage of all single family homes available. Nevada and Arizona also have a very high percentage. It is no surprise this has happened in states that took a front hit by the foreclosure crisis. A large percentage of buying since 2008 has gone to investors, many with the idea of turning these places into rentals.

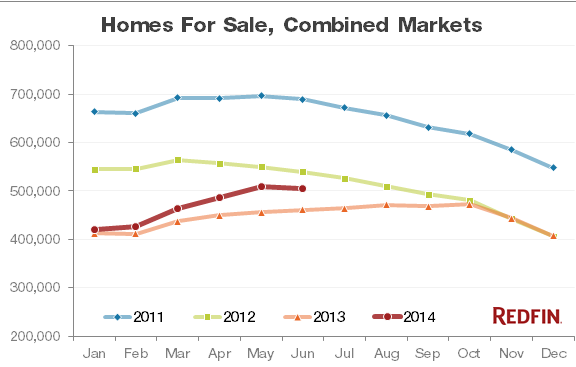

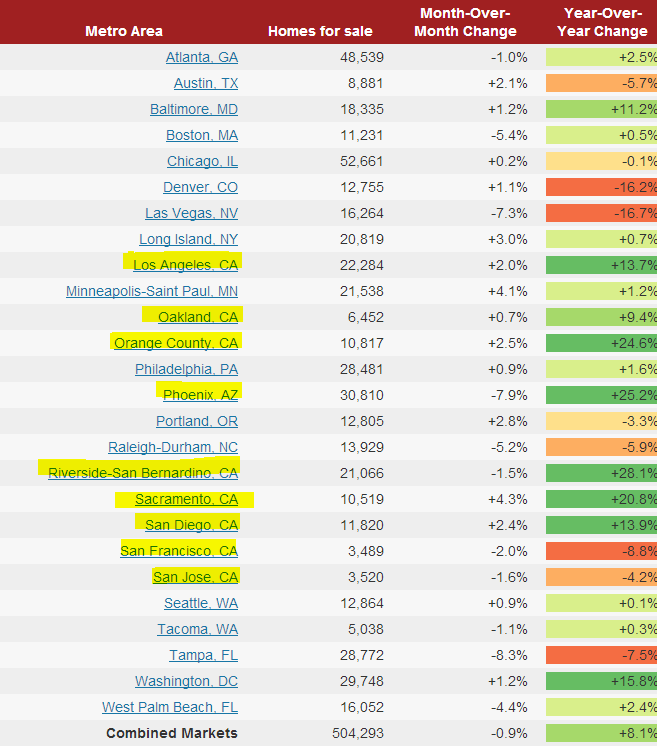

Starting in the middle of 2013, there was a clear shift that investors were pulling back from the single family home market. Because of this, we have seen inventory rise:

Source: Â Redfin

This trend is a reversal from the last four years of data. What you also find is in areas with manic price increases inventory has jumped up even faster:

Source:Â Redfin

Virtually all of SoCal has seen a big jump in inventory. As a buyer, you have more to pick from but you also have to pay the current price. The only California location that has seen inventory drop is the Bay Area (the tech boom is still sizzling).

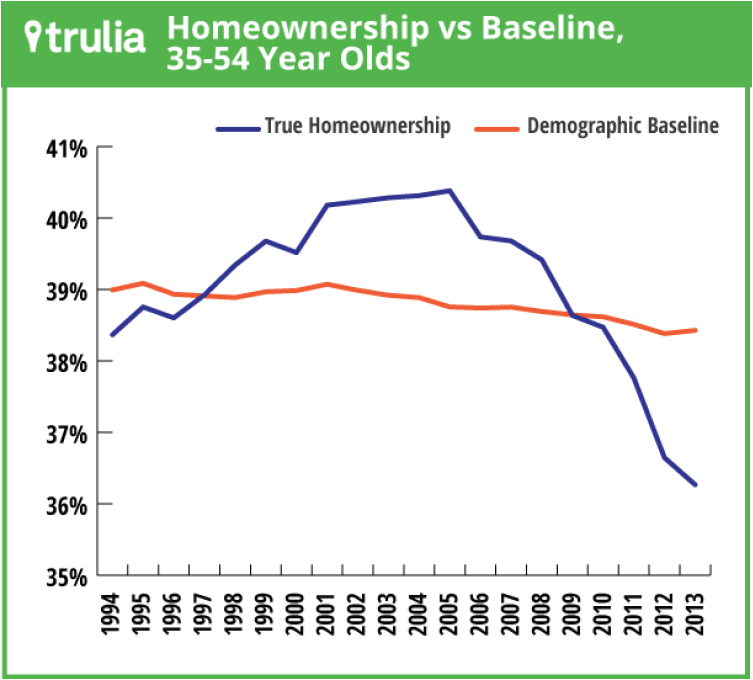

Some would argue that the youngest of potential home buyers is the big problem here. But look at those 35 to 54 (not exactly the young and the restless here):

The only group that has held steady has been baby boomers and those in older generations. Of course given current income trends and the multitude of data above, it should be rather clear that this renting trend is here to stay at least for the next few years.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

144 Responses to “Renter nation: The 2000s are highlighting a big shift from homeownership to renting. The number of single family homes now used as rentals is at a record high.”

I kind of wonder, I see a number (a quite significant number) of new multifamily residential units popping up every months all around Seattle as well as in the city. Who is going to rent all those units? I see a big shortage in rents here, almost no vacancies for below mid level units and complexes, but all these Black Rock and Home For rents should also add to the pool, correct? Where are those millions of rental homes purchased by big guys? I live on the East Side and see a plenty of office rental space and they still keep building new offices in downtown, when there is excess of commercial rentals just 2-5 miles away. I really look forward for situation to change in the next year when all these rentals flood the market. In my city (Bellevue, WA) only, I see a couple of thousand of new residential units (apartments and condos) coming to the market. I have also noticed that some of the newer constructions that were finished 4-6 months ago still have signs of “leasing available”, I wonder how long does it take for a brand new apartment community to lease out completely?

Anyways, the prices are still very high here for rents even though significantly moar rental inventory is coming to the market …

I’ve noticed this same dynamic in my corner of NC. Ever more units with ever higher rents. The WSJ had an article recently that talked about how stricter lending standards have essentially trapped those with bad credit and/or no down payment in the rental market. They have no where else to go. They can either pay up or move to a lower-rent district. Of course, there’s no jobs there, but whatever.

I also figure that from an investor’s standpoint owning rental units is better than housing. It’s an evergreen revenue stream. The property is policed, so you don’t have to worry about someone trashing your investment. You can evict more easily than you can foreclose.

I hear all this talk about how renting is better than owning. (Coworkers looked at you like you were a freak if you rented back in 2005.) But, no one can answer me the question as to what MOST people will do when they want to retire. Most are paying rents so high, they will never be able to save for retirement–much less a 20% down payment on a $250K house.

If we expect most Americans to seriously knuckle down and save for retirement and home purchases, we will collapse the economy. We’re already running on credit-fueled vapors as it is. Just try suppressing retail consumption another 10%-20%.

It’s gonna be a wild rise watching how all this sorts out.

Why save for retirement when the government demonstrates time and again that saving is for suckers?

I think the philosophy is that you save some money in the present by renting rather than buying. By saving and investing this extra money wisely you are meant to have a large sum of money by the time you retire. If bought a house you did not invest as much, and have less money in 30 years.

I would be curious if people that rent actually invest or save more than home buyers (obviously looking at same demographic)?

bb – renters don’t save much, as a general rule. maybe the people on this blog who perceive themselves as upper middle class and are renting, but these aren’t the folks who really could easily afford to buy anyway because otherwise they would just do it. It’s a rare person who sits on several hundreds of thousands of dollars in savings/investments and rents as a long term housing strategy.

Many assumptions here. Many peopel do sit on many hundreds of thousands and not buy. There are better vehicles for investment than real estate. And let me tell you, I am not really a fan of buying something, have it lose a couple hundred thousand dollars in value because interest rates have gone up or the next recession, which will _inevitably_ hit in the next years has come.

People don’t overpay for things just because they can. Many of the “rich” who have recently bought have sold one overinflated house to buy another. Hence, the abscence of first time buyers.

I can tell you from experience that 97% of the people who are renting apartments are doing so because they cannot buy or are saving the down payment to buy. I never saw savvy investors choose renting over buying, didn’t happen, especially long term. Sounds good in theory.

I never saw any renters by choice in Texas, California or Arizona markets I worked in. So if you are one of the few who rent over buying and made great investments along the way you truly are the minority, dare I say unicorn.

Most everyone fit in a few different categories, change of life-divorce, new to town, poor job history, didn’t earn enough to buy, bad credit/poor financial decisions. Any one who could buy, did.

Singles in private rentals is another story, they are usually single for life and carve out a little niche that works for them. Anyone with a family or a spouse wants their own home.

Jobs and income matter for homebuying but as far as rentals go the bar is so much lower. If you have a stable job…six months or more. It is easy to rent and you will get approved for rent at 50% of your gross income as long as your credit is not jacked.

Small 100-200 complexes are completely leased out in two to three months and the bigger communities take more time depending their size. 1500 units can take up to 1 1/2 years to hit full capacity. Sometimes an owner does not price the units right or hire enough staff or good management which can slow a lease up but most know what they are doing.

New home starts are down but new apartments being built is way up because there is current demand and future demand looks good also. More renters, less homebuyers. With home inventory being controlled, demand for rentals will stay strong.

Home prices are supported with low inventory, cash buyers and stricter loan approvals. This market will crash because of a catalyst outside of housing. Even if buyers start rejecting prices at current levels and inventories rise, it’s not enough to crash this market. Loans are strong now, not to say housing won’t crash again but it will for different reasons than the last crash.

“I can tell you from experience that 97% of the people who are renting apartments are doing so because they cannot buy or are saving the down payment to buy. I never saw savvy investors choose renting over buying, didn’t happen, especially long term. Sounds good in theory.â€

This 97% sounds like a made up number. Do you have study that supports this statement?

“I never saw any renters by choice in Texas, California or Arizona markets I worked in. So if you are one of the few who rent over buying and made great investments along the way you truly are the minority, dare I say unicorn.â€

I live in California and am a renter by choice and have done very well over the years. Actually, I have done significantly better than the home owners in my wider circle. So I guess I will need to change my handle to “Unicorn What?â€.

“Most everyone fit in a few different categories, change of life-divorce, new to town, poor job history, didn’t earn enough to buy, bad credit/poor financial decisions. Any one who could buy, did.â€

I do not fit in any of those categories.

“Singles in private rentals is another story, they are usually single for life and carve out a little niche that works for them. Anyone with a family or a spouse wants their own home.â€

The choice for the wifey is own in a crappy area or rent with an ocean view. Guess which she chose…

“Jobs and income matter for homebuying but as far as rentals go the bar is so much lower. If you have a stable job…six months or more. It is easy to rent and you will get approved for rent at 50% of your gross income as long as your credit is not jacked.â€

In my area it is actually harder to get a good rental then to qualify for a loan. I was required to show bank statements, pay stubs, references, credit score, etc. I actually learned to create a packet to submit with the application. This is pretty much the case for the majority of the bay area.

“Small 100-200 complexes are completely leased out in two to three months and the bigger communities take more time depending their size. 1500 units can take up to 1 1/2 years to hit full capacity. Sometimes an owner does not price the units right or hire enough staff or good management which can slow a lease up but most know what they are doing.â€

Don’t care.

“New home starts are down but new apartments being built is way up because there is current demand and future demand looks good also. More renters, less homebuyers. With home inventory being controlled, demand for rentals will stay strong.â€

Until the masses realize we are in a recession and credit growth stops…

“Home prices are supported with low inventory, cash buyers and stricter loan approvals. This market will crash because of a catalyst outside of housing. Even if buyers start rejecting prices at current levels and inventories rise, it’s not enough to crash this market. Loans are strong now, not to say housing won’t crash again but it will for different reasons than the last crash.â€

I disagree with the premise but completely agree that the crash will be due to a “catalyst outside of housingâ€. The plate spinning performer is concentrating on the housing plate but it is near impossible to concentrate on any one plate while keeping all others spinning.

I think you are wrong on many levels here. I am not sure what 97% of people you know, but I save 15,000 a year by not buying and choose not to buy due to the fact that I don’t think I can sell back and don’t want to be an accidental landloard. Many people have done the math and the “benefits” of home ownership are dubious at best. Sure, if you are an undisciplined spender, housing does force savings.

However, peoeple who do have six and seven digit bank accounts tend to be good savers and also understand different opportunities that are out there. Some choose to buy real estate and others don’t. I just think the math doesn’t add up at these prices, and once again, I have not interest in becomeing an “accidental landlord” in the future.

Housing follows wages and when it doesn’t, it eventully does.

To buy the same house we’re renting, which is in a good neighborhood with good schools, it would cost us about $1K more per month than our rent, not to mention the downpayment. If I knew for sure that we’d be staying for dozens of years, I might consider buying, but the Los Angeles market makes such dramatic short term swings that it’s pretty risky. We’ll probably rent here another couple of years and then move up to Portland or Seattle, which are just “normal” expensive cities, rather than f*&#@$%’ing crazy expensive like Los Angeles and San Francisco.

Yep What? That is my experience managing large scale apartment communities 200-2000 units.

You are a unicorn what can I say but congrats! That is awesome!

WHAT? It makes sense now, you have an old car…don’t knock the nineties they were good years! Live in an apartment complex…so weird I would not have pegged you for that… you rent because what you could buy would be a crappy house…I would have guessed that you lived in a private rental or something like 25 units or less. Apartment life sucks I feel your pain but it sounds like you have done well with your circumstances and a beach apartment sounds nice!

I did not say that renting does not have its place and can be strategic when housing is very expensive. Strategic renters did not usually rent in large apt complexes, they usually gravitate towards private rentals.

I was not speaking to your exact classification. Every time I write something you always comment like I am just speaking to you…you crack me up 🙂

In my experience I did not meet many renters who were renters for life by choice and instead of buying a home they took that money and invested it successfully.

The fact that you put together a nice neat packet of financial documents in order to qualify for your rental should tell you that the rental market where you are located is very strong and rents are good for the owners in that market.

Rentals are the new hot ticket, more people than ever are interested in renting. It’s good to be a owner now, renters see the benefit in renting. I have increased all my rents but still below apartment rents. Life is good!

I’m an investor so many of my comments come from that point of view. What? is a renter and it is good to see his point of view as a renter. I feel for for those that want to buy but it does not sense to buy or what they can buy is crap. Never settle for crap.

Ahhhh Christie Simpleton, you disappoint me. I thought you might actually have some insight. You pretty much got everything wrong on your read of my circumstance but you have never really shown much aptitude for analysis. Oh well I can continue to believe that someday you will get it. A friend of mine use to say that it’s good to dream.

What? You are such an easy mark, I’m just messing with you. 🙂

Chris, you mentioned a wsj article. Interesting that the artical places the onus on strict lending regulations rather than root causes like low earning and over-financilaiztion of real estate.

Well wonder no more Seattle guy. Basically you and many other American tech workers are being replaced by H-1 work visa holders from India, China and where ever they can find them because they will take 23k/ year part time no benefits vs you that’s asking 35k/ year.

Wellcome to Obamas America!! While Americans are being layed off by the thousands the government replacing them with work visa holder foreigners!

Employment number’s solved company profits solved , housing problems solved!”Change you can believe”

Actually, both Democrats and Republicans have long promoted globalization and free trade. Democrats just as much as Republicans, though they don’t brag about it so loudly.

The only “major” presidential candidates of the past 22 years who’ve taken a more protectionist position (e.g., anti-H1 visa) have been Ross Perot and Pat Buchanan.

I would agree. In the bay area we face similar issues with excessive office space. Plus the rent is going up very aggressively! Its went up 22% over the last 2 years.

The reason they keep building is a hungry search for yields.

I get emails from RE Brokers everyday all hot and happy to offer cap rates in the 4 – 5% range on a variety of commercial properties. Remember getting 5% on a passbook savings account? Now you barely get there with a huge ill liquid investment that has downside.

Those office buildings are being financed by Money looking for a yield. The Money is looking for a yield, the builders and the deal makers are happy to take the money.

If that office sits empty the builders and the deal makers still take a profit, the Money suffers not the deal makers. I don’t get why investing in risky RE for 4,5,6% expected ROI (that is the rosy scenario) is attractive, but the Money is hungry for yield…

aka picking up pennies in front of a steam roller…

One of the future events that is often posted on this site is that ‘someday’ BlackRock and their ilk (who purchased thousands of homes at deep discounts in bulk from the banks) will someday shed all their SFH and this occurrence will cause a significant decline in home prices… e.g. a sudden surge in SFH on the market will cause price erosion.

Doc, please tell me why BlackRock (or others such as Waypoint, Oaktree, etc) would sell these homes if they bought at 50cents on the dollar and are now giving BlackRock a solid Return On Investment.

Even if they do sell these homes… wont they sell them enmasse WITH tenants under contract to another investment firm as an asset-play rather than kick out the tenants and sell them as empty homes?

QE abyss – I am sure I will be checked if I am wrong, but the idea is that Black Rock is securitizing the homes, selling off parts of the “company” that owns them to the next greater fool. Black rock makes a hefty profit, and walks away ( like what happened in before the first bubble burst)

When the the new “owners” realize that being a landlord is not simple, and that rent control laws and income levels does not mean you can raise rents every year by 7% plus. Their “investment will not be producing signifigant returns if any. They will sell in a fire sale sparking a collapse.

That I believe is the theory. Big (institutional) money and wealthy people don’t like to make under 5% return, which I cant imagine + 5% (even +2%) would be sustainable for very long.

This. Securitize and sell it off to retail before people realize it’s junk. Enough Joe Bob’s trash the properties, don’t pay and holdover, turnovers become high… holding costs get out of hand – no longer BlackRock’s problem.

In a nutshell, Blackrock is securitizing the rental payments into a bond that they sell. The security is backed by a loan and buyers of the bonds have different levels they can buy into with different returns and risks.

The securities were new a year ago, but thus far have performed well. Well enough that I think there are 5 different securities sold already, with a 6th one coming soon.

Main Street is understandably skeptical of the bond rating agencies after the last debacle, but the bonds are surprisingly well-rated.

I don’t know if Blackrock started out with this being a long-play from the inception, but given the current returns, it looks securitization of rental properties is going to be around for quite a while.

There will be no collapse if blackrock sells every home they own. Brush up on scalability. They own less than 20k homes which is less than a percent of a percent of sfh in America. While an already low cost city in AZ might get impacted because their buying was centralized to certain cheap states, the overall market won’t be impacted.

“There will be no collapse if blackrock sells every home they own. Brush up on scalability. They own less than 20k homes which is less than a percent of a percent of sfh in America. While an already low cost city in AZ might get impacted because their buying was centralized to certain cheap states, the overall market won’t be impacted.”

This is the funniest comment yet… Yea school me on “scalability”… ahhhhh what percentage of the entire stock is sold each day/month/year/etc.? Wow! Markets are manipulated on the margin not on the entire stock. This isn’t pork bellies where the entire stock NEEDS to be sold…

Don’t fret my shillfriend, housing will go up forever…

Yes, Wall Street could sell them to pension funds looking to invest in RE vs stocks or bonds. Lots of pension funds like LACERA have 20-30% in real estate holdings. I realize that the returns in CA might not be that high but it get compensate with lower vacancy rate. If the yield math beats buying bonds than they could buy RE for rental instead. At least with RE there is no threat of default and less susceptible to higher rates. RE might be up and down but like stocks, it’s a good hedge against high inflation which the FED is hell bent on trying to trigger. If you can get a net return of 4-5% for rental than it beats buying bonds which I think is achievable in most states excluding California.

This is actually a good question. Being a landlord is no easy business and Invitation Homes, a branch of Blackstone is seeing rental vacancies rise:

“The vacancy rate for the homes in Invitation Homes’ $1 billion rental securitization is rising. According to the latest data from Morningstar, the properties’ cash-flow vacancy rate rose from 5.4% in April to 7% in May, an increase of nearly 30%.

By property count, the month-end vacancy rate as of May 31 was 7.3%, up from 5.5% as of April 30. That’s an increase of nearly 33%.”

http://www.housingwire.com/articles/30513-vacancies-surge-in-invitation-homes-1-billion-rental-securitization

Most of these investors like Blackstone started buying in 2011-12 with a 5 to 7 year horizon. They targeted lower priced property and are probably seeing some healthy appreciation in their portfolio.

I wouldn’t be concern if the vacancy jump like that since it doesn’t impact the overall net return of the investment by that much look. What’s the different between getting returns of say 5% vs 4.8% because that’s what the vacancy jump would translate to a negative 3% in net return. Not that much.

4.8% vs 5% might make enough difference if competing opportunities are doing better. I dunno, just seems like there’s an assumption that investors will react rationally, and that’s not always the case. All it takes is one unexpected thing to spook the crowd and then everyone is trying to offload. Not saying that will happen, but only a fool wouldn’t consider the possibility.

The vacancy numbers will jump around a bit. I think a month later the vacancy rate dropped down to 6% or so.

Invitation homes itself alloted a vacancy rate of about 10% in it’s presale reports, so it’s still comfortably within their expectations.

@QE abyss: “Doc, please tell me why BlackRock (or others such as Waypoint, Oaktree, etc) would sell these homes if they bought at 50cents on the dollar and are now giving BlackRock a solid Return On Investment”

For home prices to start crippling down you don’t have to sell a plenty of homes. Having relatively low rents is good enough reason for most people not to buy. When rents are too high, moar people would consider owning vs “throwing” money away, where as if rents were low, you would save moar money by renting. I would, actually, love black rocks to flood the market with rentals – lower prices for everybody, less insensitive to buy… High rental market is good, it makes residential moar affordable and less money to the landlords 🙂 🙂

Go on,… tell us moar…

@Polo, moar woar is all we need. Remember, the world woar II pulled us out of the Great Depression, right?… right?

Didn’t Black Rock recently purchase Realogy? Realogy is the parent company for Century 21, ERA, Coldwell Banker and Sotheby’s International. Warren Buffet bought Prudential in 2012. The plot thickens!

oh Christie… I was hoping that you could be taught… I still have hope…

Ok I’m answering my own question, lol… Fabian Calvo wrote “John Paulson, we know he made billions of dollars betting against subprime; he knew the handwriting was on the wall. What’s he betting on now? He just put in a half billion dollars to buy a big company called Realogy.”

Your myopic view of the world is killing me… I still have hope that you will show some insight one day… A man can hope…

“The only California location that has seen inventory drop is the Bay Area (the tech boom is still sizzling).”

I realize this is a SoCal blog, but it’s interesting to see how Northern California compares to the other areas shown in the above Inventory Chart. San Francisco shows -8.8% inventory, San Jose is -4.2%, while Oakland, which is within the “Bay Area,” has +9.4%. I’m surprised that inventory is not lower for Oakland. Given that among the problem areas, flawed politics, schools, and crime, considering it is such a huge city, are these pockets of really charming neighborhoods with architecturally detailed homes, some adjacent to BART and other public transportation, a lake, and regional parks. (There are the professional sports franchises as well, but that’s not exactly related to housing.)

Are outlying cities such as Oakland not attractive enough to make them acceptable alternatives to living in the tech mecca? Or in fairness should I consider that Oakland’s (as an example of an outlying city) increasing inventory is a lot lower than it “normally” would be if the housing market were closer to “normal”?

Inventory is down in the Palm Springs area as well. Of course, so are pendings, sales, and prices and been tracking that way since the beginning of the selling season which is now over. Weird market here. Complete stand off between buyers and sellers.

As a Local I can give you more info on Oakland:

The long and the short is that its a little of all of those factors.

Inventory is still well below long-term levels, just as they are in the rest of Alameda county. Oakland’s listings, just like it’s neighborhoods, are highly bi-polar. You can get a house for 200k or less in oakland, but you’ll be dealing with boderline-condemnable property in a warzone. The good neighborhoods were the subject of local drive-time radio news reports of fierce bidding wars into the 700’s.

The prices are still “too damn high”, and given a choice between 580-1.1 mil for oakland where your kids can hob-knob with the most colorful gangsters in america, or 680-900 for pleasanton where you can eat off the sidewalks, the choice is obvious.

If you look at housing supply: inventory versus sales. SoCal is at about 3-4 months worth of supply. Historically this is an low level of supply. 6 months is thought to be normal.

I’ve been looking to buy but I’m holding off for a bit. I’ve noticed in the last few weeks there has been in increase in inventory in the West end of the San Fernando Valley (Woodland Hills, West Hills, etc.) For some reason though inventory and prices have not budged yet in Agoura Hills, Oak Park, Calabasas, and Westlake Village. Anyone who is familiar with these areas think that eventually these markets will soften up as well?

It all comes to whether the FED is going to start the real taper (not the current ponzy taper where Belgium keeps buying) and for how long the prolonged interest rates will remain the such. Nobody can predict the next move, this is why nobody knows where the housing goes. Who would’ve though that the housing will “grow” moar than 30% over two years? Until the ponzy US economy scheme (bonds, stocks, etc) collapses, I don’t see any real changes in the housing market to the historic norms. I would love to see the “@Housing To Tank Hard in 2014”, but not gonna happen, until all the other bubbles pop. For how long this can continue? I don’t know, but as long as the FED got paper, the “Show Must Go On”!!!

The thermometer in my car read 108 as I drove through Woodland Hills this afternoon and was down to 92 when I got home in the Conejo Valley. There are some very nice neighborhoods on the western edge of the SFV, but summers there are hotter than almost anywhere else in the LA County. Pick your poison…

Woodland Hills is officially THE hottest (temperature wise) area of the City of Los Angeles: http://www.laweekly.com/informer/2014/05/15/why-is-it-always-hottest-in-woodland-hills

That’s why an efficient A/C system and pools are a must have for a house in Woodland Hills…. The upside of HOT as hell summers in the valley.. Is the spring and fall are much warmer and nicer than anywhere else in L.A too. it extends the in between seasons.

March, April, May and June were awesome in the Valley… I can put up with hot, dry July/August/Septembers…If i get a 70-80 degree days from March-June…

Question for GetAPool: How much is your electric bill during the summer months? Probably the only advantage of living in my tiny 1200 sqft crapbox is the reduced cost of cooling – and even with a newer A/C system in the somewhat cooler Conejo Valley 10-15 miles west of the SFV I still spend $100-120/month (mostly in A/C costs) from July through September.

Since these are real costs that prospective homeowners will bear it would be helpful to get a reading on this from various posters here.

Having grown up in Agoura/Calabasas/Westlake I’ll say it not very prone to turnover in general. Good schools and few first-time buyers. The street I grew up on didn’t have a single sale between 95-05, and there are still original owners from the mid 60’s on every corner. North of Moorpark rd and south of Parkway Calabasas are probably your best bets..

AMgen laying off close to 700 people here in NBPK/TO/WV, should affect the housing market, shouldn’t it?

I dont think AMgen laying off 700 people will impact housing in the Cornhole (Conejo) Valley. It would be interesting to know how many were renters and how many homeowners. Perhaps half are homeowners and half of those will find work for other hi tec firms in the region. Within driving distance of Cornhole Valley you have a lot of hi tech employers from Ventura all the way to Burbank and up into Simi Valley.

So that means those houses are going to be sold soon since their owners are getting old.

We moved from the east side of Studio City to the Northridge/Porter Ranch area six months ago, and I didn’t think the temperature difference would be all that noticeable, since it’s all “the Valley.” Man was I wrong. Northridge, which is just about the same temp as Woodland Hills, is more brutal than I expected, and I’m just trying to get through the next couple of months. I don’t even like the high 70s, so this was kind of a dumb move, in terms of climate, but we get a much larger property and fantastic schools, so that was the trade off. I can’t wait for December.

Gosh, how will I ever find something to rent in Los Angeles? There just seems to be nothing available.

http://www.zillow.com/homes/for_rent/Los-Angeles-CA/house,condo,apartment,duplex,townhouse_type/12447_rid/1-_beds/1-_baths/150-_size/days_sort/34.13511,-118.275976,34.020937,-118.442831_rect/12_zm/

I believe, it is rather a question of affordability than a question of availability. I can find a plenty of available apartments here, in Seattle, but at what price?

For a city with so much of what some point to as having a strong international brand, you’d think the for sale inventory would be down and the rentals few and far in between. Not to mention the amount of zombie inventory still being held back off the market and it still looks this way. Maybe after the banks start realizing this party is starting to suck, they might start restricting inventory a bit more. Next couple of months should be telling as to which way it goes.

I see more and more units also stop by a few, very high rents, they want your complete history, job picture for last two years, full disclosure and to boot very arrogant. In other words renting a nice place isn’t cheap or the answer either, I hate to be in the shoes of a lot of people today,damn if you do, damned if you don’t?

Revolution the song by the Pretenders play it, sounds rapporteur for today’s mess we are in.

Housing To Tank Hard in 2014!

Housing to go up FOREVER!!!! This time is DIFFERENT!!! It will NEVER end!!! Rents can ONLY go up!!! Blackrock will hold the inventory FOREVER!!!! Too late, you are priced out FOREVER!!! We will NEVER see another recession!!!! NEVER!!!

The DOW is down 300+ today on the “good” news… who knows, Jim Tank would be correct after all… 🙂

http://www.zerohedge.com/news/2014-08-01/suddenly-wall-street-bailing-housing#comment-5036325

Renting makes a lot of sense for most people(like in the more advanced European countries). Renting fits the generations who don’t like responsibility, the generations who value their liberty and freedom. Home ownership is so out of fashion, it is something for the immigrants(from intellectually backward countries) and investors, and people with “old fashioned values”.

Wait until you are old Ashley…..

Ashly, how does renting equate to “liberty and freedom”? Doesn’t ownership provide for more freedom than rent?

Are you really sure that ownership is out of fashion? If the downturn in ownership among younger folks is due to finances, that’s a statement of affordability, not fashion. I think we all agree that if the NINJA loans came back, there would be plenty of renters clamoring to own – or at least make a mortgage payment rather than a rent check.

I’d love to hear more of your thoughts on this. I’m not trying to just say “you’re wrong”, I’m interested to hear your take as it’s completely different than my own.

Ownership provides more freedom than rent if you got a good deal. The ones who say otherwise are renters.

My PITI is $1,227 for a place that would rent for $1,900-$2k. That’s a lot of extra freedom – and just imagine when it’s paid off in 5-10 years.

Ashly is expressing the (appropriate) nihilistic attitude of the younger generation. They see the older generations willfully ignoring the key truth of our day: resources are not infinite and are running out. Their core concern it that owning a home only pins you down, limits your ability to flee environmental breakdowns and war. They don’t expect to have a job that is stable anyways so why bother to plunk down their savings into the “trap”.

Meanwhile, the older generation concerns itself with “responsible” concerns of earning “compounded interest” and saving for retirement. So, who is right? Is the world overpopulated and the resources running out fast to the point that food/water scarcity will be an issue 10 years down the line? Are CO2 emissions acidifying our oceans to the point that shell fish will cease to exist within our lifetime? Are toxic blooms of hydrogen sulfide going to massacre ocean side property values within the next 20 years?

Or is the conventional and “responsible” vision correct? Is the world really just the mathematical model that we have unconsciously pinned our hopes on, a model that clearly underlies all our assumptions? Is this bankers’ view of the world correct? Is it “respectable” to think that a view in which graphed returns of earnings just go up and up exponentially (if properly shepherded) rising to the moon could ever be true?

Seriously, here we folks in America don’t even own our own democracy anymore and have clear documentation that only the interests of the powerful and wealthy are considered yet we pretend like, somehow, this will all end well for us, as though someone is “responsibly” working on wise solutions. Who is the real “crazy” here?

Who is more delusional? The youth who can’t find a job that pays the rent or the home owner who ignores the plight of their own kids ” ’cause everything will work out”?

Young people move to where the jobs are. With a house, you just can’t pick up and move for a better job. Look at the rust belt and other places. I don’t want to end up like those people. You can buy a house and find out your neighbors are not to your liking. Being a renter, it is so much easier to just move. Who wants to have kids anyway? Most parents I know, would be happy to trade places with me.

John D, is there rent control in your area? Is that how much rents were when you bought your house? We started renting a new place 6 months ago, as I mentioned in another comment above, and renting was $1K less per month than buying, and that doesn’t include dealing with a huge downpayment here in San Fernando Valley.

As Ashly said, much of it has to do with mobility. I’m 37, own my business, and make a pretty good living, but I’m not so confident to think that my business will last forever, and renting makes moving pretty easy, should business head south and we need to high tail it out of this expensive city. The short term market is so volatile here that you can really ruin your financial life if you buy and sell in a short amount of time.

GH – we’re in Temecula. Ratio of owners to renters is about 70/30, no rent control that I’m aware of. We bought in 2009 for $250k, rents are up 15%+ since then.

After years lurking here…let me just say, Ashley’s comment has to be the silliest, most weird comment I have ever seen here. Moarover, it indicates a resignation of hope.

Guess what youngins…..there are NO FREE LUNCHES! Get up off your specially designed gaming chairs which you spend hours in, get motivated and learn a skill that you can offer to an employer.

P.s.- The opinions of posters here are certainly entertaining, yet nearly worthless. If people really do fee such low self esteem, and have such a lack of goals and hope……and it results in an attitude like—–gee, I want to live in a rental, WITH NEIGHBORS, forever….. that is exactly what you will get…..

Hey, I live in a house with NEIGHBORS, and let me tell ya, it ain’t all it’s cracked up to be. Both my neighbors SUCK. Do I sell the house? Not that easy when you own…

Why can’t a stay on my gaming chair AND develop skills worthy of a decent job?

After all, boomers stayed under their hot-rod hoods and still managed to do that, and exers were fine doing that while sniffing coke in a disco from 10 pm to 3 am every night.

You don’t like your neighbors – so you keep the house and rent it out (for a profit, if you were smart when you bought it). You then rent somewhere else yourself. Let’s assume you’re burned on owning and decide never to buy again, but keep that one long-term. 30 years of profit and increasing rental income later (inflation that will pay for your own rent increases), you have a paid-for property that supplies you with a huge chunk of retirement income. That could mean the difference between living in a nursing home slum or a nursing home resort. Or pay for extensive travel.

The really fun part? Someone else bought it for you and paid for the maintenance.

The population keeps growing, but very few new homes or apartment complexes are being built in Southern California. This is creating a shortage of property that inflates both prices and rent. That is where we are now. Hard to imagine this changing, especially since inflation is running.

“especially since inflation is running.”

Run inflation run!!!

Yea I get like 30% cola every year! Wage inflation is completely out of hand…

Really? They aren’t building any new apartments? I’ve never seen this much building construction in twenty years.

http://la.curbed.com/archives/2014/05/mapping_18563_condos_and_apts_on_the_way_in_la_right_now.php

You mean that 200,000 a person year growth in a state with 40,000,000 residents? You forget to mention all the people leaving. California is not having a large population boom. That was the 60’s to the 80’s. This is readily accesible info.

Well, it looks like 30-year mortgage rate is jumping up after the recent July Fed meeting. Home sales no doubt will continue to be sluggish with higher rates.

People just can’t move on with their life. My credit was trashed on a bad deal in Vegas and the bank is still to foreclose after 4 years of non-payment (fwiw, my ex-partner won’t agree to a short sale because she is living rent free)! As a result, I get to rent.

I’m on the condo board of 2 buildings in Atlantic City – same deal. Years of no condo dues from underwater owners and no foreclosures in sight. The associations can’t foreclose and the owners can’t reset their credit.

On the other hand, the wonderful banks are racking up service fees to pass on to the bondholders while avoiding having to pay property taxes and condo fees on units they foreclose on. Nice work if you can get it!

Same story Sacramento Eastern out suburbs/foothills. Lots of new condos/apartments built with INSANE rents. And I mean insane. I pay $1650 for my 3 bed 2 car garage 8 yo house down the street from new “condos” stacked 3 floors high, can’t swing a cat in them they are so small. 3 beds they want $2100 a month, 2 bed $1700 a month.

Who would pay that? For a rental apartment? Out of interest I went in and inquired. When they started giving me rental rates I literally laughed. The girl responded “well we actually have a waiting list”. Waiting list for what? To go bankrupt paying rent for a shoebox 30 miles East of Sacramento?

This is not sustainable. This county’s biggest employer’s average salary is $49,500 a year.

Yes, it is very odd. We have studios going for $1200 in UTC/La jolla. 1beds starting at $1400.

I really want to find out who is renting at these prices?!

Same thing in LA. The staff of 5 in the leasing office will show you around, show you all the different layouts in some empty units. Then give you some stupid high rates and tell you there is a waiting list. Step outside and look at the balconies and it looks like half the building is empty.

What percentage of renters would go on a waiting list for a rental? Most renters are looking to get into a new place within a narrow timeframe. If something is not available, they find something that is.

It’s all just a ridiculously bad and transparent sales tactic. The main thing is to get you to put down a deposit on the spot, you know, to get on the list right away!

Plus the old, make them want it more by telling them they can’t have it. That will also prevent them from negotiating down the high asking price.

But if you tell them you need something by next month or you are moving on, they will quickly tell you they know one that is coming available. After you leave your deposit, they likely have a guy waiting at your car with the lease ready to sign, and he’ll tell you, “congratulations your name came up on the list!”

And now we have dozens of these buildings.

My atf (all time favorite) landlord game is when the landlord schedules a viewing and they have their friends show up “acting” like perspective tenants who are interested in the place to get the real perspective tenant to move quickly. The biggest mistake that these landlords make is that children are really bad actors and always give away the game. This has happened EVERY time to me in the past five years. It is actually kinda embarrassing to watch at this point. I love turning the game around on the landlord by totally ignoring the “competition” and act totally cool showing no signs of panic. One time I told the landlord that it was a beautiful house, left and didn’t call back; they ended up calling me.

WHAT? Different landlords all sending out fake prospective tennants every time you have looked for a rental in the last five years.

Whoa, you have a conspiracy on your hands.

Do you hear voices too? I think I know what they are saying…”housing to go up 30% in 2014″

Stocks to tank hard… Check that, “correct” in 2014- so too, will housing. Nothing will tank as the dollar has devalued in parallel with inflation that has quietly perpetuated our lives. If you have invested your money in the market, then you are happy. If you invested in homes, then you are happy. If you did neither, then you are well behind, and likely destined to remain there.

If it helps your evaluation in any way, we are baby boomers who own nothing. No house no car no nothing. Two twentysomethings live with us, one of them is somebody else’s kid. These kids own a 20 year old used car they paid cash for.

All of us are squirreling away everything we can -in cash- because we all see what’s coming. In the emerging US third world banana republic, liquidity will rule and debt will be ruinous.

All of us can be out of here in a week flat. To anywhere.

Not all baby boomers are suffocating in a gilded sarcophagus. Some of us live in cheap apartments and are ready to flee.

(We come from generations of working middle class Americans. It is pretty obvious that which we came from will not be continued)

gardener1

What do you say to those who, with good reason, believe hyperinflation is coming our way? Do you have some of your nest egg in other currencies? Keeping it all in a U.S. mattress like that would be extremely dangerous, whereas having a mortgage would offset inflation. With all U.S. cash, when the ish hits the fan, you would pretty much have no choice but to leave the country asap and likely take a bath on that desperate money exchange.

What if most of the rest of the world goes down with us? An acre in the country with a well, solar, chickens, goats, and a shotgun would start looking awfully good.

Would you not feel safer having a paid-for house where your total outlay every month would be $300-$500? Renting it out while you live in a shack (or under a bridge, or out of the country) is then a possibility. If I become an ex-pat, which I’m seriously considering, that’s my plan.

a rate of inflation in the 6-10% range would have been implemented 6 years ago if we had policy makers who care about the middle class US citizens. But we don’t have those good folks. We have not had them since the Eisenhower and FDR administrations.

Wealth inequality is historically solved by three methodologies or a combination of these: Taxation, Inflation, and Confiscation. All serve to prevent the worst solution which is Revolution.

Inflation is the least painful (but there is pain) and usually requires direct food subsidies to keep people going for the few years of this “inflationary correction”. But in return, national debt disappears, underwater mortgages are solved and employment skyrockets. Things are reset under a new currency.

Hey, but that is history. We know better, right? RIGHT?

Novictim, I think real inflation (as opposed to govt stats) is pretty high as is, perhaps in double digits.

A few years ago, a 6 oz can of boneless pink salmon used to go for $2.19 at the Santa Monica Vons. Now it’s still normally $2.19 — only now the can is 5 oz.

Ditto a whole lot of other products. Several years ago, a 21 oz can of Planters Deluxe Mixed nuts would go for $9.99. Later it was 18.5 oz for $9.99. Now it’s 18.5 oz for $13.99.

I think we’re already in double digit inflation, and have been for several years now.

gardener1, if you think the dollar will tank and there will be inflation, why hold USD’s in savings? In that scenario hard assets (like Real Estate) will normally do better in the long run. Rather than focusing on today, focus on what you want 30 years down the road. Trust me, a paid off home really helps later in life.

Real estate is is an arduous manipulation if you want to get your money out of for some reason. I lost $26,000 on the last place I sold in state excise tax, real estate fees, and related costs. That was my cash tied up in that house and my $26,000 is gone. I saved the rest from the sale, still have it. I can now use that money anyway I want to without having to pay a third party to access my asset or pay the government a percentage.

I’ve owned big properties with land, twice. The first time a nearby city forcibly annexed my property into their city limits, told me what I could do with my land, and sent me a bill. The second even larger property was rezoned by the county against my will, rendered useless with the new zoning, and they too sent me a bill. That’s not looking like wealth creation to me.

And, currently my mother is in a nursing home with advanced dementia, on Medicaid. In order for her to qualify for Medicaid her husband was forced to sign over all of their assets to the state. The state took the deed to their little house, the title to the car, and mother’s social security payments. Her husband has been stripped, they have nothing.

So tell again why real estate is a solid investment and a good hedge for the future?

I’m sitting on my money which I will damn well spend any way I please, and paying the landlord his rent.

You’ve had some unfortunate setbacks, but the re-zoning you describe is extremely rare with a typical (smaller lot) SFR.

The point is that holding only U.S. dollars is FAR more dangerous than the danger you’re trying to avoid. What will you do if hyperinflation causes your rent to double and your savings to be worth a quarter of what it was? You’ll be spending it any way you please, but it won’t last long.

If you had a mortgage, your payment wouldn’t budge, and the value of your principal (debt) would go *down*.

why is no one talking about all of the floundering homes that are just sitting in some banks shadow balance sheet somewhere homes that haven’t had a mortgage payments in over 5 years and that HOA’s have already foreclosed on the deed is no longer in the borrowers name and the note has been passed along to a third party debt collector and is just charging fees every single month for supposed inspections and have increased the loan by hundreds of thousands of dollars for over 5 years and are not foreclosing. Sure wish we could read an article on that!

I’m in Las Vegas, too. In regard to the still occupied ones, NODs are scheduled to double in the next few months. http://www.vegasinc.com/business/real-estate/2014/jul/25/banks-moving-more-aggressively-against-delinquent-/

Lynn, I assume you’re referring (yet again) to your own personal foreclosure woes. About your failed flips in Las Vegas, which you couldn’t sell to a greater fool, and were left holding the bag when the banks foreclosed.

So why don’t you write this article and submit it to the doctor? Maybe he’ll publish it.

I must admit, though, I have scant sympathy for failed flippers. Most people here simply want a nice, reasonably-priced house to live in.

I’m not if I’m interpreting this correctly but it seems as if people are buying flipped properties and trying to flip them a month later for 55K more, http://www.zillow.com/homedetails/12416-Moorpark-St-UNIT-A-Studio-City-CA-91604/20026052_zpid/

Or this one in Burbank. Bought 1/2014 and for sale in July, http://www.zillow.com/homedetails/431-S-Main-St-Burbank-CA-91506/20049543_zpid/

Can someone explain what’s going on to me? Are they really buying, holding a more or so, and flipping? Also, I see house that were for sale for 400K in 2013, listing pulled, and then put up again at 550K. How can a person have any confidence in a price even with comps when people seem to be just picking a price based on Zestimates.

I mean I’m all for people making profits but just can’t bring myself to deliver someone a $55K margin for one month of ownership.

I want to buy but can’t find anything near as nice as what I’m renting for the same monthly nut or even a few hundred more.

The burbank property was sold for 272,000 in june 2013, after a foreclosure for 379,000 in 2012. Then resold for 460,000 in january 2014.

I suspect structural damage that was found after the foreclosure. Someone then fixed this damage to sell for 460,000.

I would recommend a good home inspection, something is weird about this house.

Margin i burbank would cover closing costs, and agent fees. They are not making anything at 499K.

Thanks bb for the feedback. So he/she bought it for 460K in January. Tried to sell it for 549K in June and dropped it to 499K in July. And this is just one example of people listing houses at prices all over the map or buying and selling in a few months time. There are more. I have no interest in the house — the black white theme is not my taste.

The 55K is the price you pay for not being an insider. That’s the price. Take it or leave it.

lol Yep, that’s the price. But what is he an insider to? It looks like he bought, extrapolated gains, and decided even after costs he could walk away for maybe 40K for the month. So he gambled that some housing hungry person would think 399K is a deal after having their perception distorted by the media and other outrageous prices. That’s what it looks like to me. But I’d wager he loses because I’ll leave it and I suspect so will many other buyers or they will low ball him on an offer. In this price range I am seeing houses stay on the market for weeks. Every day I get notifications of price reductions in my alerts. The west side, million dollar houses, probably not so much. What’s a 200K loss on a property when you’re worth millions? Guys like me — it’s devastating.

Teresa – Put down the Rich Dad/Poor Dad books. They’re killing your brain cells.

BubblePop, I have not read the Rich Dad, Poor Dad books. It may not have come across, but I was kidding in my remarks.

I’ve noticed that recently purchased homes — 2013 or 2014 — that are being resold for high markups are sitting longer than similarly priced homes, only blocks away, that were purchased many years earlier. Not necessarily in Burbank, but everywhere I’ve checked.

Many potential buyers are revolting against flippers, against the notion of paying high markups after less than a year.

Thanks for the feedback. I’m glad I’m not alone. I’m all for profits but it seems some people are cynically trying to leverage perceived buyer weaknesses to make a quick buck. They add no value to the property and then mark it up. I have 20 properties on my watch list for the past 45 days. None of them have sold and 3 have been pulled off the market. Price range from 350K to 500K in about 10 different areas of the city. heck, I’m seeing price reductions on condos in SM. Last year I went to look at one and 40 people were there already.

US seasonally adjusted home prices fall in May: S&P/Case-Shiller

http://www.cnbc.com/id/101874477

Kerplunk.

Dow Down 271 3:43 ET

-317. That makes this a GREAT time to buy!

Right?

And we close 317. Tanking to begin very soon!

I hope you’re right Jim. It will probably be after mid-term elections.

BTFD!!!!

I will say, lets see how long the “tank” will last first. I am 100% sure, id DOW drops below $16K over the next few days, the tank is guaranteed, everybody will run for exit. If it “recovers” to the previous “all time highs”, then we would need to wait for the real “tank” to take place. Remember, the Housing will tank ONLY after bonds and stocks do…

I made the mistake of asking myself the question “what happened” when watching the DOW go up -300 points yesterday. The answer to my misguided question was nothing. Then I remembered that the stock market is rigged and that this is just a ploy to get the shorts back in. Keep in mind that shorts are the only retail position to make money on these days. Wait for the short squeeze in 5, 4, 3, 2, 1

We need to see the DOW go up by -1000 to -700 points to have a real collapse. Anything else is just a ploy to get fools to play again…

In regards to all the retarded buy verses rent comments, I must first qualify buying as financing and not buying outright. Some time back I went to work for a big management consulting “firmâ€. Very quickly I noticed that there was a lot of pressure being applied on me to replace my 1992 car with a new car in 1996. Also, many managers were pushing me to buy a new home and offered to drive me around some up and coming neighborhoods. Wow! These guys/girls were so nice to want to “help†me! I quickly paid off my car loan and never took another loan since. The truth is that a person that is in debt is a slave. You will NEVER be free as a debtor. NEVER! You “own†NOTHING until you get the deed/pink slip/etc. otherwise you are renting money/house from the bank. Enjoy servitude my friends…

I hope those comments didn’t upset your delicate disposition 😉

When mortgages are available at 2.8% and fixed income assets are at 6.6%, taking on a mortgage even if one can afford not to might not be so bad. I believe the word is arbitrage, but I’m sure Blert can explain in terms none of us will understand.

Although I find clowns kinda creepy they sometimes do make me laugh. Thank you for the laugh…

no wife no kids no mortgage no car payment …. to freedom. oh and i have FU money, i can take a year off leave of absence from work if i choose and still have my job waiting for me

housing recovery is still very much in its middle stage says real estate website that just gobbled up its biggest competitor http://www.zillow.com/blog/q2-2014-market-reports-155924/

Why buy? It is very possible me and my wife might loose our jobs in a year’s time. If I was in a cheaper area then it might not matter. In SoCal I’d like to keep the option of getting out, open. Money is not the object here; any bank would give me money for a mortgage on a cracker-box. However, the price premium of buying a house here combined with a tether to a desert with a high cost of living is a problem.

Real estate has become so expensive in parts of the country (California as an example) that many persons have no choice but to rent.

Rent now or be priced out FOREVER!!!

Dow up or down doesn’t relate to housing, different animal of investor, what does relate is the fact that the longer housing lingers the more reason for creative loans or a disguise sub-prime market returns.

Look, the country can’t absorb another 2008, housing is so important to all people even if you don’t plan to sell or buy.

I believe a equity rebate to sellers with a discount to buyers may be a way to get the ball rolling. It may be something like this:

Seller must discount list price at least 5% or more to be eligible. A max 5% check to seller of their list price for discounting their home at least 5% or more.

Home must be under 1m dollars, homes over 1m not eligible. By owner sales also not eligible.

Example:

Home list price 500k

At least 5% discount to buyer 25k in this case

Seller gets check of $25k (5% of 500k list price) max no matter what the house closes at.

On the topic of retarded robbie advise/analysis, I have come up with a great idea if I do say so myself.

As we know from blert’s friend Steve Keen, GDP equals income plus change in debt. We know that incomes are flat and we have not made any progress on that front. Well, we have been hearing a lot about “peak debt” as the bottleneck to future unbridled growth. I say we take a lesson from the “peak oil” solution and force very high pressure water deep into the US consumer to release the deep hidden pockets of debt tolerance.

So… where is my Nobel prize in economics?

What? So… where is my Nobel prize in economics? You take the prize alright, is just isn’t Nobel?

That’s the best you got little robbie? Really? That is your response. Where are they getting these shills from? I could hire an undocumented non English speaking day laborer in front of Home Depot that would be a better shill than you day one…

God help us…

robert, I’m not really sure what you’re trying to get at here. Are you trying to put a limit on the profit a seller can make? (re: the “max” in your last sentence)

How about we go towards the light of less interference/laws/regulations/manipulation in the market? Crazy concept, I know.

The “market” IS “interference/manipulation”…

No Jeff this is a separate check issued to the seller for reducing the price of the home at least 5%, the seller list the home for lets say $500k doesn’t matter what the closing check is, sellers receive additional 5%. It is a incentive to reduce the price of a house and the buyer knows they have a built in 5% reduction, the buyer still offers what ever they want to offer.

jeff..How about we go towards the light of less interference/laws/regulations/manipulation in the market? Crazy concept, I know.

If you have never gone please go to the Scandinavian Socialist Countries, everything thing is on the up and up???, people all look alike, act alike, think alike, the only time they got caught was buying sub-prime American loans, you see Jeff even they thought America was the place of investment and make money.

But we manipulated them, that is what capitalist do, make something look real good but behind the scenes it isn’t so good. So Jeff think about a harmonize society of robots like you think America should be, no regulations just honest Switzerland businessman LOL, report back Jeff, you will find even socialist can be crooks and they have very less interference ??

Robert, that is the dumbest solution I read on this forum so far and I read it for years. I read many dumb ones and I kept quiet. But yours hits the record.

What about if the house should sell for 200,000 and I list it for 900,000? You were talking about list price, right? Should I sell it for $850,000 and get another 50,000 from the taxpayers?

Before you talked about a stalemate between buyers and sellers, which is correct. There are plenty intelligent options for government to interfere if they want although I think that government should stay out of the market. Every time the government interferes, everyone looses and the bankers win regardless if the people understand the process or not or how that interference affects them in a negative way. They feel the effects on their lower and lower standard of living but can not trace it back to the root cause. A smart economist or educated person with common sense can trace it back to the root, but most people are fooled by bankers everyday. It is a sad reality created mainly by uneducated people who elect politicians who tells them what they like to hear, politicians who are working for the banksters.

I stopped reading after “Robert, that is the dumbest”…

I believe you share that distinction, matter of fact you wear it on your sleeve?

Good for you…. Did I ask you where you stopped?

I stopped reading after “I believe”…

I think there was another comment but I didn’t read any of it…

Flyover… Look that is why my wife and I have a great life and retired at 45, if you want to get ridiculous with the 200k scenario Mr. Phi Beta Kappa all of this would be spelled out in the proposal it isn’t cut and dry it is called disclaimer which the provision will have?

Remember 0% interest on car loans everybody said can’t be done, sometimes to get the ball rolling you get creative in life?

Ok don’t laugh. As previously posted the home I’ve rented for the past 2.7 years is going to be put on the market to be sold. Even though I doubt they will get what they “need” to get for it, I’ve started looking.

Today had an appointment with a property manager at 1pm to look at a house. Husband met me there, he texts me when I’m in the car saying he’s there and there’s 4 other families looking at it. So we went in, had a look around and yeah, its ok. Not great but ok. Price is ok but not cheap, not too expensive. The other 4 couples are literally elbowing each other out of the way to get an application in.

Competition for a 30 yo rental house???

Meanwhile all the For Sale open houses every weekend are deserted…

How about we go towards the light of less interference/laws/regulations/manipulation in the market? Crazy concept, I know.

Sometimes in life a helping hand helps, such as 0% financing of cars or leasing which is just another way a person rents something and pretends they have money all these schemes work Jeff, capitalism is regulations/manipulation etc.

Otherwise I can direct you to the Netherlands Socialist countries where everybody walks in goose step and act alike, look alike are they really happy, you go there and make the call?

I stopped reading after “robert”…

robert, I don’t even know where to start. You want more government interference: rebates, interest free loans… and who do you think has to pay for this? Then you roll out a socialist country as the example of it all going wrong? Don’t you realize these are one and the same?

Is this all a setup for a punch line that is yet to come? I’m now just completely bewildered.

Oh, and can I still get the $25k even if I sold back in April? I’m against handouts unless I’m the one getting the handout…

Hmmm, Shiller has a price decrease for May. Prices are getting back up to their 2006 peak. That is 8 years with no significant appreciation. $600,000 in 2006 is $709,000 today using an inflation calculator. Without appreciation what is the reason for buying? Wouldn’t it just tie a load a money in doing nothing. Worse is with interest you often are paying double for the place for the loan. Why would I tie up $1.4 million? When the economy looks like crap why would I want to promise a bank $1.4 million? The advantage of leverage only works with appreciation and what do people really think the price increase will be 2014 and 2015? All the renting isn’t pent-up demand, just a buyer revolt. Good thing about the economy is that without a job I can live anywhere.

Jeff… No, Socialist doctrine is in the countries manifesto, a socialist program that gets the GDP going then goes away is Capitalism?

My buddy sold 6 places 5 years ago and it renting now, is he dumb, I think NOT.

Leave a Reply