Living in a renter’s paradise: Renters now dominate over half of largest US cities. Between 2007 and 2016 approximately 7.8 million homes lost to foreclosure.

It is now official that the United States has turned into a renter’s paradise. Think that is hyperbole? Fifty-two of the 100 largest cities in the U.S. are now majority renter in terms of household composition. And there is no clear pattern here. You have places with incredibly affordable housing like Detroit tipping over into the renter majority category at the same time places like affluent Irvine have tipped over as well. Bottom line, more renter households are forming at a time when real estate values are once again peaking. And where did all of these renter households come from? Well between 2007 and 2016 nearly 7.8 million people lost their homes to foreclosure. Of course this flies in the face of the #YoLo real estate movement and the mantra of “always be buying†real estate because heck, even our current president is a real estate mogul, therefore buy. People have massively short-term memories when it comes to financial spankings.

The renterfication of the U.S.

We have discussed the unrelenting trend of renter household formation for years largely because younger households are having a tougher time paying inflated prices for crap shacks. The flood of Millennials buying households just did not materialize. What did happen is that inventory remained tight, investors stepped in, foreign money hit, and a mania took place. Basically an artificially constrained market made crap shacks look attractive. Look, even old hardened bread must appear like paradise to the starving person. Still doesn’t change the fact that the bread is old and stale.

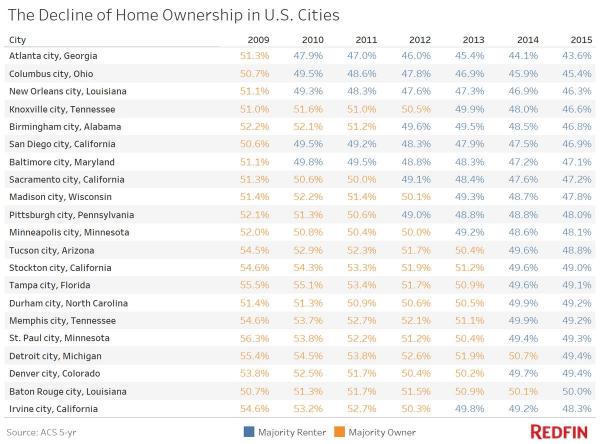

Many cities have tipped into the renting majority category only in the last few years:

Look at how many cities tipped into the renting majority category since 2009. We see a few California cities here like San Diego, Sacramento, Stockton, and Irvine. This will definitely shift the political perception as we saw with local SoCal measures being slammed down that favored current homeowners. Many people including professional couple households are balking at paying ridiculous prices for dumpy old shacks just so they can say they own and “hey, now I can paint my wall magenta.â€

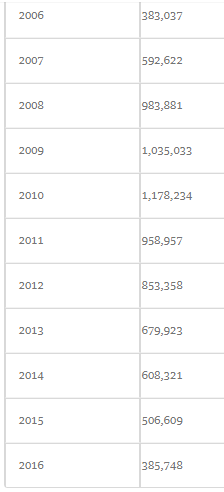

The McMansion dream has probably also soured for all of those people that lost homes via foreclosures. Just look at the nearly 7.8 million completed foreclosures since 2007:

1 million of those foreclosures happened here in California alone and yet you still have people saying:

“Never a bad time to buy!â€

“As long as it is near rent, you are always a winner!â€

“Nothing beats real estate!â€

Yet you have hard facts showing millions got royally screwed betting on housing and this odd mythology built into a deep cognitive dissonance that fails to acknowledge the blind luck of their situation. And many today can’t buy because they simply do not have the money saved for a crap shack down payment. So you have more renter households being formed versus homeowner households. That is how you now have 52 of the largest 100 cities being renter dominated.

We’ve now turned into a renter’s paradise. Many that bought want to own a home and live in a Leave It to Beaver make believe fantasy world. In reality, it is now a grind it out boom and bust market and most simply cannot afford. And those that did buy are riding on a bull market that does look a bit frothy. Many that “own†a home forget that you are basically paying a fixed rent payment to the bank for 30 years. “But once I’m paid, it is all done!â€Â What about taxes? Insurance? Maintenance? What about being locked into a geographic location? Most now early in their career have to pick up and leave to make big jumps. They also play it safer at their place of employment for fear of missing a mortgage payment or angering the boss. Everything has an element of risk but for some, owning a home is the ultimate albatross worthy of sacrificing all. Unlike a stock portfolio or a rental home (big difference) a primary residence is a draw on your bank account. And that equity? You have to sell to unlock it and many Taco Tuesday baby boomers are seeing their grown adult kids moving back home and sticking around a bit longer than expected because things are just that much more expensive. Leave It to Beaver aired for roughly six years – not 35 or 40 years. And by the way, the first two seasons were filmed at Republic Studies in Studio City in L.A. and the final four seasons were filmed at Universal Studios with facades of two houses. In other words, it freaking was make believe with fake houses!

The proof is in the pudding and we are now living in a renter’s paradise. Enjoy!

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

163 Responses to “Living in a renter’s paradise: Renters now dominate over half of largest US cities. Between 2007 and 2016 approximately 7.8 million homes lost to foreclosure.”

based on rents I’ve read about in most cities of the USA, it’s become obvious that i really can’t afford to live here any longer. Adding up just the rent, health care “insurance” (not ‘health care’ but just the insurance that has a deductible so high as to render it all but useless unless i’m dying) taxes (my largest monthly nut by far) and food all the money is gone.

I know a few older folks that are playing the disability game and are doing great, free housing….well almost free, it’s $28 a month for one dude, free health care, free taxi rides and a few bucks left over to buy pot……and tons and tons of free time.

oops, I forgot the free food as well

Interesting – I feel like a damned fool for not playing the disability game myself. I know a guy who’s fit as a fiddle and has tons of money and still is on Disability checks. Get a good disability lawyer and I’d have a nice free ride, but no, I insist on working, something no retrumpican would understand, why work when you can live off of others for free like their hero does?

But you are right about the USA. No wise shopper would consider the USA any kind of a decent deal. I wish I’d had the wisdom to leave when I was just out of high school, but alas I did not. I can at least leave to retire, or hopefully sooner.

Alex has a job? He seems to spend most of the day whining here. No doubt he’s got a part-time job with low wages that allows him to qualify for an EBT card, Medicaid and a Section 8 rent subsidy? Why work hard when you can be like Alex and live off the hard work of others?

Samantha – Bet you can see Russia from your backyard, huh? I work, and I pay taxes, which is more than you can say of the average Republican. As mentioned, and I’ll repeat it as many times as necessary, I refuse to get onto the freebees bandwagon like all the Republicans consider the idea. I moved away from flyover country because there was nothing to do out there but sit around, watch TV, and collect benefits and I’m just too Un-American to consider that a fulfilling life.

Things are setting up nicely for Trump to do the real estate dump. Then he will promote lower prices to the renter nation in ownership society 2.0 just in time for reelection.

I have no doubt that moron will get a second term, however the details work out. He and this nation deserve each other.

I grew up reading Dick and Jane on Cherry Street and I guess I kinda believed Dick and Jane would grow up to be scientists, and the Moon program I grew up watching would have a big moon base and those doughnut-shaped space stations and science and rationality and decency would rule over all.

Instead Dick slings crack and Jane’s an aged prostitute who pimps out her daughters, Dick’s got kids by 13 different women and Jane’s proud of her one son because he firebombed a (fill in any non-Christian house of worship here).

The whole thing’s been a con run by boneheads (with the exception of very few like Lincoln, Eisenhower, FDR) all along.

Alex, what stopped YOU from becoming that scientist? You just expect everyone else to bust their butts making a great society so YOU can sit back and enjoy the fruits? Not how it works and you’re finding that out first hand. Bitter, party of YOU!

Junior Kai – yet another dollop of wisdom from your mother’s basement. Really, you are too kind to us.

Jobs for scientists are just about gone. In the US anyway. What few can be gotten, with a Master’s degree, pay under $30k a year. And I was not clued in enough as a kid to realize I needed to get my ass to a first-world country ASAP – as an example, Israel has free college for citizens, and there’s plenty of demand for scientists there. Remember how, decades ago, you could just go out and get a job? It’s still like that there because it’s a first-world country.

Alex, a citation is needed to support your claim that Master’s degree positions are paying under $30k/yr. Please don’t cherry-pick something like “Advanced Underwater Basketweaving” either. I’m surprised that you’d throw out numbers without references to back them up, it’s so unlike you.

Jeff – Here’s one that actually mentions the pay …

https://sfbay.craigslist.org/sby/ret/6049320150.html

Such a deal, eh?

This is just a technician job … as mentioned, not very far from minimum wage at all. Probably 10,000 guys applying for that one shit job too.

How do you come by your numbers?

This was the inevitable result of bailing out a parasitic financial system at the expense of the larger economy. We didn’t fix any of the problems, but instead just covered up the crimes with a new pile of debt while shifting ownership of the real estate up the food chain. Welcome to your new state of neofeudalism!

Things are getting interesting here in Texas. With sky-high home prices and sky-high appraisals to go with them our state legislators are grasping at straws on how to mask the escalating property tax burden (state’s primary source of revenue), while avoiding the necessary overhaul of school finance. The latest ruse is SB-2 sponsored buy a Senator who also happens to own a property tax protest firm. LOL! Pay no attention to the conflict of interest there, but he’s going to “reform” the Texas wealth extraction system also known as ad valorem taxation where you rent your home from the state even after you have paid off the loan. These fine Texas senators never met a business subsidy or handout they couldn’t support, like Chapter 313 that has diverted billions away from public education funding into corporate “economic development.”

Interesting times!

“This was the inevitable result of bailing out a parasitic financial system at the expense of the larger economy. We didn’t fix any of the problems, but instead just covered up the crimes with a new pile of debt while shifting ownership of the real estate up the food chain.”

Just when Obama and MSM were saying that Obama fixed all the mess from Bush, now this, you tell us the the criminals were just covered by Obama. You’ll make lots of snowflakes heads explode who were worshiping their savior Obama.

Everyone on this site thinks Obama should have let the entire economy burn to the ground in March 2009 correct? That’s essentially what you wanted.. no bail outs, let interest rates soar while housing is tanking to basically free. Let the bank ATM rush occur, and credit cards stop working overnight. Cause all that would have happened and we’d have a lot of chaos and confusion for a year or so… then build back up from the rubble. I’m sorry, but I can understand why the first black president might not want that to happen under his watch.

Bush, jr., Obama, Hillary — all part of the same globalist corporate agenda.

Da comrade! Don’t worry, Fake President Trump will fix it all. He has been cleared by the Russians, so we’re good to go.

“Cause all that would have happened”

bullshit, bullshit, bullshit. I’m not even going to try and be realistic with you, based on the rest of your reply, you’ve drunk the kool-ade

America is some debt shit man……

“Everyone on this site thinks Obama should have let the entire economy burn to the ground in March 2009 correct? That’s essentially what you wanted..”

That’s the narrative nonsense that alarmists and elitists would have you believe — that everything was going to hell in a hand basket.

“no bail outs, let interest rates soar while housing is tanking to basically free. Let the bank ATM rush occur, and credit cards stop working overnight.”

It’s called a free market and capitalism. Recessions/contractions are inevitable and necessary. Economic contractions wring out excesses from the expansion. It allows the stronger companies to prevail while removing the weaker, reckless ones. Eventually, the economy would have reached an equilibrium — just like during previous recoveries.

“Cause all that would have happened and we’d have a lot of chaos and confusion for a year or so… then build back up from the rubble. I’m sorry, but I can understand why the first black president might not want that to happen under his watch.”

What do you call the economy now? Wage and job growth have been the weakest of any recoveries”. ZIRP has cost savers close to a trillion in lost income, while most of the economic gains have gone to the .00001 percenters. Freddie and Fannie are still costing billions in taxpayer support. Global debt is at record highs. The cost of housing, medical care, education, etc., have soared for the middle class in great part because of the proliferation of cheap and easy debt.

Voters obviously did not like Obama’s economic agenda and voted against his selected successor. And why didn’t Obama jail the perpetrators of the economic fiasco from 10 years ago?

Here there are lots of charts showing with facts that Obama policies enriched ONLY the 0.0001%. I know they say 0.5% but that is just to mask the REAL beneficiaries, the 0.0001%.

http://www.zerohedge.com/news/2017-03-30/trickle-down-has-failed-wealth-and-income-have-trickled-top-5

Yes, the best policies for the middle class was to let the TBTF banks to fail (kind of anti trust policies) to avoid the moral hazard we have to deal with today. However, the Clinton, Obama and Bush governments were the best governments the money can buy.

I know a lot of people are talking about house price inflation in Texas, but the Demographia median multiples don’t have any TX city hitting 4 yet.

It is good that people in TX are sensitive about house price inflation, hopefully this will ensure something gets done about it before it gets as bad as CA cities in 2007 where the median multiples hit 11, and are back to around 8 now (coastal libbewwals obviously NEVER learn). Coastal libbewwal cities elsewhere are all around 6.

Every Australian major city is over 6; Sydney and Melbourne are 10; Auckland NZ is 10; Vancouver is 10; Toronto is 7; London is 9 and every UK city is over 6.

Just for perspective; millions of people with no hope of obtaining their own home in their entire lifetime would swap places with Texans in an instant.

Fortunately, most renters do not vote. Otherwise, owners would be screwed because renters would support a number of laws that flip the advantage from owners to renters. For example, if renters voted, Prop 13 would be gone, and affordable housing would be popping up everywhere. Owners would find their property values would take a hit if renters voted..

Owners in California are getting more outnumbered every day. Must explain why you’re here in a desperate bid to slow the trend. Prop 13 days are numbered but at least you’ll be close enough to the water’s edge to collect all of those tears.

Because of the still powerful homeowner and Real Estate sales voter blocks, the first thing to go will be the Prop 13 limit on reassessment of commercial property. That will be an economic disaster for brick and mortar business in general and small business in particular. No worries, the tech industry will come to the rescue in the only areas that count. [Sarcasm Alert!]

I’m pretty sure that my Prop 13 is safe for at least another twenty years.

Agreed, Prop 13 for residential properties is safe no matter how much you want to cry about it. In fact other states are copying CA and implementing similar laws capping property tax increases, see AZ for example. If there was to be a change in Prop 13 it would be most likely aimed at commercial property and that would just drive out more business from CA.

Sure it’s safe just like things we’re a safe sure bet that no one in 2005 could have seen coming unglued!

If you attend a much better than average college, and you get a degree in a marketable field, then you can buy safely. For example, in Los Angeles, an engineer or computer science major can always get a job in LA/OC, if you are willing to drive drive. So, you can buy.

But, if you went to a substandard college, or you get a degree is a lower demand field, then you must rent. For example, if you attended Occidental college, you might need to move far away to get a job if you lose your current position. This person needs to be a renter.

In some cities, the economies are dominated by a single industry or company. For example, Portland OR is a big Boeing town. If Boeing starts major layoffs, there are no jobs for anyone, and everyone needs to move away. Eventually, Boeing will have a big layoff, so I would never buy a home in Portland.

Bottom line is there are situations where renting is your only smart option.

What are you talking about Boeing being in Portland? Everybody knows that it is in Seattle. It used to dominate the Seattle market but not anymore. It is now only a small percentage of the total Seattle economy. Think Amazon, Microsoft, Nordstrom, Starbucks, Costco and a slew of high tech and biotech companies. Just the biotech industry is close to 20 billion dollars per year.

At this point, all the impact from Boeing is a little bit of softening in the overall King County economy.

Boeing has big operations in Portland and Seattle. Seattle is large and diverse, so if Boeing has large Seattle layoffs, your Seattlle property value and job prospects could survive. However, large Boeing layoffs in Portland would be a Portland job and real estate killer.

There you go, parroting the old canard of Portland and Seattle being different places. Wake up, people! They’re the same place. Two ends of the same town, one of ’em has that space tower needle flying saucer thing, just like the movie theater’s at one end of your town. Portland, Seattle, who can tell/smell the difference?

@ JT. When I was in high school 1973-77 there was not much talk about getting a good degree, it was mostly just getting good grades to get into a college. Well, I partyed my ars off in high school and ended up at the local Santa Monica College. But after fumbling around in junior college, I realized I better get my act together and that was where a lot of students started to contemplate what they are going to do with their lives. Even back then, I recall people questioning what they would do with a degree in history or music or sociology… Anyway, I ended up getting a degree in engineering and have had no problems getting jobs in high tech companies. I find it funny that even today, some students dont realize that their BA degree might not lead anywhere.

Kids going straight from Highschool to a 4 year college are generally a bit dumb about what to expect or how the working world works… So I would guess few do an honest cost analysis of what return to expect on a philosophy degree.

A BA can be worth big bucks if you are say talented and get a law degree afterward. You could also roll straight into business school with most BA degrees and try to get in on a management rotation.

Its kind of up to parents and maybe some school advisers to nudge youth in the right direction and remind them they have to make money if they want more opportunities and to pay for their education. College is not just a spirit journey to find yourself.

OR you can go to a sub standard school like occidental, claim you’re from kenya to transfer into harvard, and then blackmale (lol!) your opponents all the way to the presidency! Funny how that works.

Take that over a genetically mutated, bloated orange shmuck with erectile dysfunction who takes out his lack of sexual prowess on immigrants.

Property taxes mean we’re all renters, serfs really, who can complete their obligation to the lender, but still have to pay “rent”, property tax, until the day we die.

I agree, the “rent” never stops but a homeowner will have a rent of $200/month for property taxes when they pay off the mortgage and retire, and a renter neighbor will have a rent of $4000 per month if they are lucky. The landlord for the neighbor house will be retiring on the $3800/month from the renter and happily paying the $200/month in property taxes. Maybe not quite that simple but as time goes on, it is close.

exactly. people are acting like taxes are going to be just as big as the mortgage. Also if you are renting when you retire you will live on a fixed income but rent will continually rise.

Interesting theory, but that’s it. In reality people use their house for an ATM and burn up the equity as fast as it accrues.

Property taxes will skyrocket to pay for all the municipal pensions that are unfunded. In many areas of America, it takes a full time job for one person to pay the property taxes, utilities, maintenance and repairs for a paid-for house. At that point, renting can seem a good option.

I just know the current facts. My mother has a SoCal house with mortgage paid and her Prop 13 property taxes and insurance are $100/month. Her neighbor who is near retirement and has been renting her entire life is now paying $3500/month for a similar size house. If Prop 13 were to be repealed, my mom would be paying $700/month based on 1.5% of property value. It is possible the neighbor has saved multi-millions to afford this, but I think my mom is more secure. Some may say that property values are too high now. Most have been saying that since the late 80’s and have been wrong. The only exception is for people who bought at the peak of the 2007 bubble. I personally would buy a house but not now.

Ignorance is bliss for many living in L.A. or S.F.! The biggest threat to your home’s value is the ever increasing liabilities of the State, County’s, and City’s you live in, and the inability of your taxes to cover the growing bill! You can’t pay your promised pensions, you can’t fix all the roads, you can’t fix all the water and sewer mains, you can’t replace an aging electric infrastructure, you can’t solve your water problems! You won’t be able to rely on Fire or Police, you can’t afford the cost to build out mass transit, and all the while, your government is more worried about building a bullet train in the middle of nowhere, immigration, and oh, by-the-way, by many accounts the precious ocean along the entire west coast is dying! I’d rather be a renter anywhere along the west coast, so I could say ‘see ya’ when the SHTF!

Bullet train could be a bullet for coastal real estate. Why would anyone even consider 1.5Mil crapshack in some shitty SF neighborhood when much better house costs less than half mil somewhere around Modesto. To someone saying that Modesto sucks lets consider how much it sucks if suddenly you have 1 extra million. It could be your retirement money, three vacation houses, yacht and an airplane or amazing dining and vacations for life!

” In reality, it is now a grind it out boom and bust market and most simply cannot afford. ”

The conclusion is then to wait during the boom and buy during the bust. I always did that and it worked like charm. The only difficult part for most people using this strategy is the “PATIENCE” factor.

Not true. Often, in a bust, banks do not want to write a mortgage to you unless you have a massive down payment, because they are worried about the value of homes may continue to decline. So, you can’t get in during a bust unless you have much much more than 30% down. Furthermore, sellers know about the difficulty in getting a mortgage during a bust, so they always go for mostly cash offers at a lower price. If you only have 20% down, during a bust, you will find the only properties you can get are the ones that no one else wants.

I purchased a NB home in the last bust. There were many offers … most were heavy cash. Fortunately, I pulled it off because of a slippery realtor on both sides of the deal AND I had mostly cash. And, that was my 8th attempt to get in during the bust. Outbid on the rest.

The best strategy is buy for the long term … 20+ years, and get in when you find the property that presents the best long term investment. People that bought the 2007 peak in better beach cities have huge gains. People that bought the 2007 peak in marginal areas may still be under water.

That’s why people are stacking cash at the moment contrary to your advice, you moron. Not everyone plans to use a mortgage.

“Often, in a bust, banks do not want to write a mortgage to you unless you have a massive down payment, because they are worried about the value of homes may continue to decline. So, you can’t get in during a bust unless you have much much more than 30% down.”

Not true at all. Lenders only care that you qualify for a given payment at that moment, and that they’ll then own a quality mortgage that they can potentially sell to another bank. They don’t try to forecast market direction and then lend based on that. I had no problem qualifying with 20% down during the last downturn.

I generally assume as you note that though it would be great to buy in the middle of a housing bust, the truth is most of us with 20% down payments in need of a mortgage have to wait a few years for a recovery to kick in and lending patterns to return to some normalcy.

So if the housing market tanked tomorrow it would still likely be another 2-3 years before I could jump in and get a traditional loan. Even then certain popular areas might be swamped with investors which make it very hard to buy.

Best strategy is not to buy real estate right now, have patience, wait out this mania fand then buy for some discount..

like all other assets, timing is the key…

i have many friends who bought in 2005-6 are still underwater keeping all expenses on the table…

@Joe, @John D

Actually, mortgages are sold to investors through TBA securities. And, if investors think home prices and defaults are a problem, they will step back and prices will decline which means a jump in interest rates. That is the game. I know people that had a very difficult time getting a mortgage in the last bust.

By standing back and waiting for a bust, you are betting there is no inflation spike in the cards. Because if there is an inflation spike in the future, you lose. And if there is a deflation spike, you win. Personally, I would not bet on deflation because the central banks are printing like wild. But, I could be wrong.

The fed is hinting at 3 or 4 rate hikes this year. This means the Fed thinks an inflation spike is possible. I bet they have some insight.

It is not true, JT.

MOST loans are conforming loans and if they meet the secondary market guidelines imposed by the government, they sell them as soon as the ink is dry. Unless it is an in house loan (very, very rare), the bank does not care because they don’t take the risk. They just get the fees for processing the loan.

JT, you contradict yourself in the 2 posts. In one you state that the investors in the mortgage market will back off. This assumes we still have traditional banking which is not true. The largest investor by far is the FED.

In the second post you acknowledge, correctly, that the MAIN investor in the secondary market is the FED and they can print at will. The FED is the main investor but they can not print at will, because their first goal is to preserve the system they worked on for over 100 years. There are instances when they fight conflicting goals like in 2008 and that is when they focus on the first one, first and foremost. They act on their goals in a certain order and that might take years of opportunity for those ready to buy low.

Pretty sure everything you’re saying can be summed up as incomes don’t matter anymore because it’s different this time.

“Buying for the long term” sounds great, if you have a fully functional crystal ball. Half of all marriages end in divorce. People get job offers and career opportunities in different areas. A lot of things happen that make a person move to another area.

Being underwater on a mortgage is an awful thing to experience when you have to turn down the best opportunity of your life. At that point, a house becomes the biblical millstone around your neck.

I went through this in the Eighties. As a Realtor, I had also sold everybody I knew or was related to a house. Most of them were also upside down with their mortgage. It took ten years for the market in CT to retrace. I felt like I had a target on my back even though I was in the same boat.

Don’t be so quick to claim that home ownership is always a good deal.

Banks do not hold mortgages. By the time a lender makes 6 payments, the loan has been sold and the bank is off the hook. they get the cash back to loan out again.

If they think you will make 6 payments, you are gold.

Flyover, during the last bust, he Fed started doing massive mortgage buys because no one else wanted the that paper unless rates were sky high. The conditions you mention are normal market conditions when investors want mortgage paper.

JT, I agree to a point. Where I don’t is that in the last 10 years we had anything but “NORMAL” market conditions.

When, we’ll get again “Normal” market conditions, or when the current market manipulation snap, I’ll be the first one in the market. In general, like you, I agree with RE investments, especially in very good location – that is how I built my wealth.

Today we have a hyper manipulated “market”, where everything is “marked to fantasy” instead of mark to market. Unlike you, I don’t believe that the FED is omnipotent, I do dare to bet against the FED (I did in the past and won) because the FED is there ONLY for the biggest banks (it’s owners) and if they have to throw the main street economy under bus for the benefit their owners, they will do it. They pursue all sorts of goals in a certain priority order, but they are there by the bankers and for the bankers.

Sometimes their actions build in the system so strong tensions that they don’t know how to deal with them and then their only goal is to save themselves at the expense of all others. I always try to put myself in their shoes in order to guess what they are going to do. Things like unemployment, inflation and GDP are secondary. Like in any game, self defense is very important and to save themselves and their gig is the most important goal.

Flyover, so based on your comment history and your often zerohedge-like analysis, are you of the opinion that after this year’s rate hikes, that we will see a leveling off of prices that will precipitate a decline to some type of normalcy in price discovery and market conditions?

Eckspat, I don’t have a crystal ball and nobody can tell you exactly “WHEN” something will happen. There are too many variables in the system for anyone to tell exactly when.

What I do know is that everybody is levered to their eyeballs: federal government, cities, businesses and individuals. Any black swan will pop this bubble. Remains to be seen what is going to pop this bubble. The interest hike could be “the last straw on the camel’s back”

Current trends of borrow-happy investing, unfortunately, look much like they did prior to the dot com bust in 2000 and the housing market crash that occurred in 2007.

What’s most worrisome about where we find ourselves now, is how thoroughly the coming economic storm will affect all segments of the U.S. population.

If everything goes at once, it won’t just be greedy bankers who pushed bad loans, or foolish buyers who made McMansions a status symbol losing everything. Boomers will get clobbered by pension defaults… anyone with a car payment will feel auto finance unraveling… millennial debt-to-job ratios will eliminate any hope of a stable future for much of the middle class… and investors lucky enough to be both working and making a living today will re-learn what paycheck-to-paycheck feels like.

Why paper over such a massive financial crisis? Among contrarians, there’s a popular belief that Trump is about to become the face of a financial fraud years in the making. The endgame, by their reckoning, is a globalist restructuring of U.S. economic policy that can only be brought on by total collapse and universal desperation. And it would make sense. For now, many Americans who were previously extremely concerned about the economy feel relieved by rhetoric from the new administration. After all, it’s a new era of real hope for anyone disgusted by the massive financial irresponsibility of the previous administration. Unfortunately, viewing Obama as a boogeyman and Trump as the purveyor of economic rebirth in America is as naïve as it is shortsighted. The bubbles continue to grow…

@Flyover

+2. Massive bubbles as far as the eye can see. A pathetic ~2% GDP growth even while the Fed throws everything, including the kitchen sink. Yet, the media does little or no reporting about such dire economic conditions. In what universe do high housing costs, corporate speculation, and consumer over-leveraging equate to a successful economic recovery?

Another factor that may be at play here: The current generation of home-buying age grew up constantly being told that the suburbs were lame and just so uncool. Even those with the means to buy just aren’t buying (as indicated by the data for cities in which homes are still affordable).

They would rather live in an urban setting with short commutes, plenty of distractions, and, most importantly, “diversity and culture.” I put diversity and culture in quotes because they eventually end up living in buildings and/or neighborhoods that are overall pretty homogeneous; but, of course, there’s always the more colorful building/neighborhood around the block.

The baby-boomers, meanwhile, get a hard-on every time another crapshack sells in the neighborhood for a new record price. They’ll keep holding off until the time is just right to sell and then take their money to AZ or OR. Of course, a lot of them have the same plan so we’ll have to wait and see if there’s a massive sell-off sometime in the future.

My only question is who will buy? Investors? The Chinese? Maybe the Japanese will make a comeback? Weren’t the Iranians once gobbling up prime RE in BH? Is that still a thing? Will there some sort of millenial revolution?

Deep down most of these idiot leftists’ idea of culture and diversity begins and ends with food.

Millennials eventually grow up. Most of my friends are early stage Millennials and as soon as they started popping out kids they traded their apartments in the City for a home in the burbs. I find myself in this bucket too and have noticed views in my social group becoming less progressive and more conservative as slowly we become our parents.

I think the idea that most young people who are liberal turn conservative simply with age is mostly BS. What most of us more likely see aren’t drastic ideological shifts, rather we become more center left or center right. The new left and right fringes seem wacky to us.

Things like many 30+ year old millennials are completely cool with gay people. But you won’t hear many of us give a shit or get riled up about whatever gender confusion stuff is being spread around college kids these days…

But most of us still want to live in a suburb because, gasp we don’t want to raise or kids in a downtown area riddle with homeless people coked out office monkeys. If you are seeing less young people buying homes in suburbs initially it is more likely because fewer 20 year olds are starting families.

I am 31 with my first kid now 1 year old, and among my fellow parents I am on average about 4 years younger than most. So the relocation to the suburbs is probably getting pushed out.

I would say they seem wacky because they are wacky, much more so than even 5 years ago. My position has never changed (socially a classic liberal, financially conservative), but the new far left is literally crazy. Even if you agree with 99% of a modern progressive’s stances on issues, you’re still a pariah to them. You either agree there should be 50 different gender pronouns, or you’re an evil waste of oxygen, deserving only of extreme condescension and insults. Zero compromise. And yet they’re somehow surprised when they can’t make things work out with the right, and proceed to blame the right for that, too.

The far right is just as crazy, but in a brainwashed, low IQ sort of way, not a venomous, chaotic way. Both as corrupt as the day is long. It would be comical if this wasn’t really happening to us.

the tiny house movement is the millennial revolution.

When white hipsters say they “love diversity,” what they mean is, they want to live around other white hipsters who say they “love diversity.”

The local Santa Monica paper is full of news stories about the “great diversity” that is in Santa Monica. Every news story touts “diversity,” as if that was the real story being reported.

A new park opens, and the headline is, “Tovanga Park Attract a Diverse Crowd.”

A school holds a science fair, and the headline is, “Science Projects Reflect a Diverse Student Body.”

An art gallery opens and it’s “Diverse Crowd Attends Gallery Debut.”

Fact is, Santa Monica is one of the whitest areas of Los Angeles. The dirty little secret is, its very whiteness is one reason so many people want to live here. Yet all the white people who come to Santa Monica, who vote with their feet, they love to think of themselves as a “diversity-loving people living in a vibrantly diverse city.”

Funny but slightly oversimplified. The hipster is probably generally happy to see a diversity of racial backgrounds around them. They just want to be surrounded by people with similar education, wealth and ideology.

But that is kind of part of the joke about it being hip to live in the inner city. Its not happening because hipster love poor people so much. Its because gentrification fills poor areas with social homogeneous groups of young, educated, and wealthy people.

So its still a form of tribalism, the just get to claim moral suppository because they are happy living with Blacks and Asians… As long as they share similar social views and incomes.

So you know half ass “diversity”. Very few people want complete diversity in their home or work life.

All jokes aside I think it is a form of progress to be somewhat color blind and not flee a neighborhood because you see an Indian guy. But its not exactly socially righteous because there is plenty of good old socioeconomic tribalism in play.

They want the different foods, period. They DON’T want their kid getting the shit beat out of them daily for being white. They don’t want their kids to go to schools that are mere holding pens to keep the kids off of the streets until they’re old enough to join the military or go to jail.

I’ve lived under real “diversity” and it sucks ass. I’d wish it on my worst enemy because that’d be funny, but no one else. It is absolutely horrible.

The liberal crowd use the PC language religiously. It is almost a cult where you have to use the right words if you want to belong regardless if you believe or not in the true meaning of those words. PC is a form of control (censorship) against the first amendment. However, the liberals never practice what they preach. Look at Al Gore who was preaching left and right about a minimalist lifestyle and carbon footprint and his “walk” did not match his “talk”. He lives in a McMansion, when I saw him in our area he was driving a Suburban, flies personal jet instead of commercial planes and he is preaching about “global warming” – hypocrite. I agree that people do not need to use so many resources, but he is the last person on this planet to preach that “PC gospel”.

“Diversity” is a secret code word for “White hate”. Everyone knows this. Trump is in the white house because hated whites got fed up and voted for Trump. Enough is enough.

The white hate crap is ruining job and life prospects for whites under the age of 44 and they have turned to drugs. White suburban drug addiction is skyrocketing.

@son of landlord …very true. Although my kids went to the only public high school in SM and it was at least 30% Hispanic…probs all from the Pico Neighborhood which is gentrifying at a fast clip of course. And if you cant take the diversity of Santa Monica HS, there is always lots of private school options in the Westside.

That being said…someone posted how in Woodland Hills, house sellers were not getting their asking price. Location. location.location? I thought it mattered in SM too. Apparently not…Look at this house on a corner lot on a busy thoroughfare in Santa Monica…asking 1.595…sold for 1.907…bubble much???

http://www.themls.com/mlslistingphoto/listing/slideshow/#/17-207312

Please, Please… Boomers! move to rural Oregon and buy my house there after the prices go up! up! up!… please!!!

All the Boomers downsizing will cause a glut on the market that will drive house prices down. This will pretty much fix the problem of homes being unaffordable.

We’ve been hearing this for 5-6 years and hasn’t materialized.

Renter’s paradise indeed.

I remembered a wisdom words deep in my bone: “when everyone thinks something is great, that thing is bad.”

Why do so many people want to buy a house in Socal? Because of the limited of land, but they ignore if there is no job, no real estate anymore.

Everyone follows rich dad, Grant Cardone or “real estate” guru’s advice like this: buy & rent and you can make few hundreds $$ cash flow, so if you have plenty of houses you got few thousand a month.

Here is the thing, according to most urban places market, average cash you can net from a UNIT is $400. This is the money if you got lucky the tenants didn’t ruin your shit.

$400 a month x a year= $4800, $4800 x 3 years= $14,400. Then in the 4th year renters breaks the contract, doesn’t want to pay and ruined your house. Now you need $10K to fix the house. At the end you net $4.4K, I believe this numbers can’t even cover your downpayment. Which means you earn extra $122 every month.

What a joke, that $122 hasn’t covered any unexpected repairs.

If your only netting $400 a month from your S, Cali rental you’re doing something VERY wrong.

So what. The point is that if a critical mass of people are doing it that way the entire system is chained to their foolishness. Then doing it the so called right way becomes more fleeting.

After a decade or two, rents have at least doubled, much of the mortgage is paid off, and you now have a cash cow. Get a few of those puppies going, and you are set for life. Its all about the long term. In the short term, you might be negative for a few years.

A cash cow still needs to be fed and makes manure which has to be cleaned up.

And then there’s the pasture that cow needs to graze on. Some get overrun fallow seasons are an unavoidable fact of life in perpetuity.

“$400 a month x a year= $4800, $4800 x 3 years= $14,400. Then in the 4th year renters breaks the contract, doesn’t want to pay and ruined your house. Now you need $10K to fix the house. At the end you net $4.4K, I believe this numbers can’t even cover your downpayment. Which means you earn extra $122 every month.

What a joke, that $122 hasn’t covered any unexpected repairs.”

Tenants don’t ruin your unit if you picked the right tenants. Which means pricing it below market, so that you DO get the best tenants, and checking references. No one with 10 years on the job and good credit is dumb enough to take a hammer to your walls. There is a “renter by choice” class and then there is a “trash” class. Vet them personally and don’t let the trash in.

I agree 100%, when I looked at buying a tri-plex i started to run the numbers and even with a very low down payment (using FHA) it was a very poor ROI. I made an offer on what ROI i am willing to take based on rent data. It was rejected with no counter offer. They wanted full price. I said “peace” to them and my real estate agent and have never looked back.

If I wanted to blow $50K I would start a real business with real margins and not some poor margin “i want to own and i don’t care what it takes” mentality. Those $30,000 rentals in BH and Bel Air? Someone is renting those, someone very successful. Someone who got extremely rich (beyond anyone on this blog) by NOT buying housing and instead starting something of their own.

And that doesn’t include the lost rent between renters and your time cost factor due to ongoing problems that need attending to. We sold our rentals and banked the money and never looked back. It would take 20-30 years in rent money before we would have close to the amount that we sold them for. I know that is against the conventional thinking about how great rentals are but it was the best decision for us. A big relief actually to be rid of them.

Reverse Mortgages, SENIORS/BOOMERS will be tapping into their homes equity and not moving. Less is more with the younger generations, they dont want the 5000 sq ft homes, sets up for a very interesting future market, housing looks bleak in 2018

Agreed. Anecdotal but as an early 30 something, most of my friends are not interested in big houses and big mortgage payments and big utility bills and yards to mow and spare bedrooms that see no use. I see us as the post-HGTV generation.

Doctor, don’t you really mean to say “Rentiers” paradise rather than renters paradise?

It certainly is a paradise for rentiers.

Not really. The more people want a piece of the rental pie, the smaller each slice becomes.

“…places like affluent Irvine have tipped over as well…”

I have lived/owned in Irvine for 37+ years.

I can assure you that the rental situation is actually much *worst* than the official numbers would indicate.

Here’s why: Households are doubling up and sharing space on a scale unheard of even just a few years ago. In my immediate neighborhood unrelated families rent a single unit. Other homeowners rent out rooms. Garages are illegally converted to living space.

Statistics like these are hard for government to track. I know about it because of my involvement with my HOA and by observation.

My neighborhood area is always short on parking space because some garages are now somebodies bedroom and all those extra people drive cars. (often leased BMW’s, but that’s another story in itself). And I live in one of the nicer older areas of Irvine. It’s starting to look a bit like 3rd world Los Angeles.

If you look at income $$ census data for my zip (92604) you would think everyone has plenty of money. In reality, many folks are struggling.

But why? Well, I have heard 2nd hand stories of IAC 1-br units rent @#2k/mo near the Spectrum where units are stacked 4 high anchovy style.

And the Irvine company is building even more.

There is a limit to what people can actually afford.

Sounds upsetting to see… Can’t the HOA boot people who doing shady garage conversions. Or is a multiyear legal battle form hell trying deal with those people?

A thousand foot view is that the HOA does *eventually* prevail.

The key operative word is *eventually*.

Every situation is different. For example, how do you define “bedroom”. Does simply moving a mattress, some furniture and a carpet into a garage meet the legal definition of a conversion or is it just “storage”? People can be really inventive.

Most conversions are found by chance (ie. termite inspection, etc). HOA cannot just walk in and demand inspection. Down the street from me is essentially a UCI student animal house and has been for years. This is in a neighborhood where the last couple of sales are $1mm+. Go figure.

There is a reality TV series in here somewhere.

I’m convinced there area shitton of bunk beds being sold here in the Bay Area. People are paying $1200 for a single room. Hell yeah people have got to be bunking it to make it work – that $1200 room with two bunk beds, makes for $400 each. Most of the jobs here pay minimum wage or not much above it – 1x-1.5X minimum and it takes years or a young strong back and good eyesight to make that 1.5X.

So a hell of a lot of people are only grossing about what I do, about a grand a month. After paying taxes, because the little guy pays a ton of taxes, $400 for an indoor place to sleep is about right. If you’re on Disability, $400 for your (upper or lower) bunk leaves $200-$300 to live on and that’d do-able.

I’ve looked at places outside of California, for instance, New Orleans is supposedly cheap, and I know a guy there, but they’re charging California rents there too. And the economy is like the economy of San Jose, tons of $10 an hour jobs and maybe up to 1.5X that and that’s it unless you’re really connected.

They’re charging California rents is places like Ohio and Iowa and Michigan, etc.

If anything, moving from flyover to out here means the winters won’t kill you (we lose a few of the old and weak but meh) and there’s enough going on that you can always mop floors, clean windows, do odd jobs etc and get by.

It tends to work out the same as living in some flyover hellhole but with free rent.

I don’t need the good Dr. to tell me that the large US cities like LA are predominantly occupied by renters. With thousands of SFH every year being taken off the market and turned into rentals (thanks Air BNB) it just further decreases inventory and fuels property prices. The populated cities of the US are destined to become like the premiere cities of Europe, ex. Paris, Berlin, London where approximately 50% of the population (38% in London) actually own property and the rest rent. As our population swells our future consists of a country occupied by “Have’s” and “Have Nots”.

LA’er. – This. We’re becoming very much a country of haves and have-nots. I don’t know how many people remember this but for a while in the 50s and 60s the class structure was flattening. In other words, a lot of blue-collar people were making really good money, approaching and surpassing what a lot of white-collar people made. Since the mid-70s though it’s been downward, the class structure hardening and the standard of living for non-oligarchs getting worse.

30-40 years ago, there were hardly any homeless people. There are legions of them now. You can’t convince me that suddenly 10,000 people in my town (San Jose) have decided it’s really fun to live in a tent along the creek bottom. That sleeping in a doorway downtown has it all over living under a roof.

Yes there are drinkers and druggers but there were always drinkers and druggers. The 1960’s and 1970’s were awash in drugs. But people still lived indoors with very few exceptions.

What’s this country going to look like in another 30 years? When your kids are middle-aged? If we’ve gone from nearly no homeless to huge numbers of them, what’s it going to look like in coming decades?

Contrary to popular belief on here, I don’t have any illusions. I should have gone into the military and stayed in even if all I ever did was peel potatoes. Or gotten the hell out of the US when I was young and could “wetback” it in France or somewhere, learning the language to a native level and eventually having citizenship. Or, once I was away from Hawaii and where it was possible for a white person, gone to work for the post office and hung onto that job with white knuckles. I didn’t do any of these things. I have a place to live and some work for now but my back and my eyesight are not improving. The guy I work for is not getting younger and the economy is not going to undergo some amazing rebirth. As Orwell described English workmen as knowing the workhouse awaited them and it was only a matter of staving it off as long as possible, I know the homeless camps await me. People are homeless now who are veterans, were good workers, are tech-trained. I know; I talk to them. They had marriages and small businesses and even voted Republican. Some still do, if they have their papers in order enough to vote. If San Jose has 10,000 homeless now, it’s sure to have 20,000 or 30,000 in a decade or two and I am not too good or intelligent or hard-working or well-meaning to end up right in there with ’em.

And this is assuming they’re not all rounded up into some kind of government/corporate work-farms in Kansas or someplace. There I’d go, right along with ’em.

The only way I can see to avoid this is to somehow acquire a lot of money, that thing that erases all sins, makes the stupid smart, the unethical pure as driven snow, or to get the hell out of the US. The second thing looks a lot more attainable, at least for now. Keep in mind I think Trump’s wall will be to keep us in, so I’m watching things like this carefully.

Reality Check

Median household income in San Jose: $101,980 (source: U.S. Census)

Average salary of a software engineer in San Jose: $104,516 (source payscale.com)

Median Electrician III (high school + 5 years experience) pay in San Jose: $68,373 (source: salary.com)

You see a lot of homeless in San Jose because of the liberal policies of the northwest. It’s their Mecca. Where I live, I can drive from one end of the city to another (about 25 minutes) and maybe see one or two homeless on the street. Our median household income is $78,535. The few that are there don’t get hassled, we just don’t ASK them to come the way you do.

@ alex in San Jose…I get it now. When you say you are in ‘IT’ that means you are working minimum wage at the Geek Squad/Apple Genius Bar…I thought you worked in a real IT job.

So you never will have a chance at a house in the Bay. Unless someone puts you in their will. So you are on here to bitch about what exactly? The price of your rent?

Alex, write a book. You are the latter day John Steinbeck.

BTW, Santa Monica is the ‘home of the homeless.’

John D. – We don’t ask them to come, most of them grew up here or spent decades living and working here, and none of them woke up one morning and said to themselves, “Gee, I know what I’ll do, I’ll become homeless and take a chance on freezing to death in the winter, panhandle for $8 a gallon drinking water (because that’s what bottled water costs in San Jose and there are no drinking fountains) and run a risk of being doused with gasoline and burned in my sleep by bored frat boys”.

Then why is it that we have a tiny fraction of the homeless population of the northwest, when our weather is nearly ideal year-round? Because we don’t coddle them, while the bay area does.

People aren’t homeless in your area because they can’t afford to have a roof over their heads. They’re there because the bay area is where they will get the most free stuff/services/sympathy. It’s not like I’m making this up – take a look at your local ordinances and the behavior of authorities around homeless. Liberal courts routinely block any attempt at regulating vagrancy. If someone likes to panhandle in front of a convenience store or defecate on the sidewalk, they’ll move to a place that allows it.

Unemployment in San Jose is about the same as Temecula (low). The homeless camps in the bay area aren’t populated with poor techies, they’re populated with career homeless from all over the northwest. The techs that are employed are well-compensated, the stats prove it, and they do fine with a roommate, or live with a commute. If an unemployed or underemployed tech has a choice of living on the streets in Town A or finding greener pastures in Town B with less job competition, far lower rents, and slightly lower salary, they’re not going to choose Town A unless they have a mental illness. Those are the people you’ve talked to. And they certainly wouldn’t choose Town A if the pay was $10-15/hour, which it isn’t.

“The populated cities of the US are destined to become like the premiere cities of Europe, ex. Paris, Berlin, London where approximately 50% of the population (38% in London) actually own property and the rest rent. As our population swells our future consists of a country occupied by “Have’s†and “Have Notsâ€.”

Gee, I heard this song before … 10 years ago at the height of the bubble. [Insert city name] is becoming an international city like Paris, New York, London, etc. The sell side narrative loves to recycle their stories.

@Prince It’s a fact that homeownership in the US has declined to the lowest point in 50 years as the number of renters has increased. This is what happens when home prices increase dramatically along with higher costs of living and a influx of unskilled workers.

https://www.bloomberg.com/news/articles/2016-07-28/homeownership-rate-in-the-u-s-tumbles-to-the-lowest-since-1965

http://blogs.wsj.com/economics/2016/07/28/u-s-homeownership-rate-falls-to-five-decade-low/

https://www.forbes.com/sites/samanthasharf/2016/08/08/sorry-trump-the-lowest-homeownership-rate-in-51-years-isnt-tragic-but-inventory-woes-might-be/#4618b0157b40

Nice strawman LA’r he’s not saying the ownership percentage isn’t low. Prince of heck is right because last time it was LA is becoming like New York Paris London etc. Paris has got big problems these days and pricing in London is cracking so that’s what world class is these days. Let’s not forget Tokyo. New York and SF rents are sinking. There are probably a zillion Chinese who think Shanghai’s bubble pricing is backed up by a new found world class status of the likes of London and so on.

I found this gem:

https://www.zillow.com/homes/for_sale/Woodland-Hills-Los-Angeles-CA/house,condo_type/19945320_zpid/48570_rid/0-600000_price/0-2275_mp/globalrelevanceex_sort/34.179607,-118.563509,34.120651,-118.620759_rect/13_zm/0_mmm/

Yes, I do feel that it is listed pretty competitively. Apparently the buyer backed out (maybe trouble getting financed?). Even after they cut it by $100K! I started looking at other houses nearby and a huge portion is now offering price cuts. Yes CUTS. I think this is a good indicator of things to come.

To those who say there are all these “vultures” waiting in the dark to snatch up houses please stop kidding yourself. This is Los Angeles, where most 50% can’t afford their rent and those who can, blow any extra money on $15 drinks and that BMW lease.

Wow, this is a pretty competitive listing and still they had to cut price by $100K …

Why buy a home when you can lease a $50k car, rent a 2 bedroom condo, live pay check to pay check and pretend to be rich… 0.o

Reductions heading into the selling season. Can’t say I’ve noticed anything like that the last couple of years. Reductions in rent too.

All these new giant, modern, money laundering, concrete boxes should convert nicely into triplexes and such in the coming years.

According to redfin, 41111 saltillo st. is pending. At that price, they probably had multiple offers. Zillow has a lot of problems.

Sometimes it is hard to determine why there is a huge price drop. Maybe the inspection revealed half the house is sinking and half the house is full of black mold being eaten by the rat infestation on the other half of the house. Way back when in the 80’s we looked at an incredibly discounted house in Santa Barbara that had a peculiar step in the living room that was due to half the house sinking. In some area of Colorado, the entire house is sinking into an old mineshaft.

I bought a house a few years ago in a so so area. I’m happy, paying $2056 per month for PITI and I have a little equity. Does everyone need a 750K home? I think if you can afford a small home in a so so area, you buy it, live there and maybe move up or just stay put and be happy. Just my 2 cents. BTW. my house is not an investment, it a place to call my own, $2056 is low for a 3 bed, 2 bath today and it will be a smaller amount 5-7-10-15-20 years from now when I’m paying this amount.

My wife and I just closed on a place and we do think prices will drop but plan to be there until the kids get out of school. It all came down to good schools for us. We managed to get a 4 bed 3 bath in Anaheim Hills. 13,500 sqft lot with pool! We are really excited. Our payment is not an issue and our rate is @ 3.5% VA loan.

Nice, but does your payment match or is it below equivalent rent ?

congratulations; great area

No one else cares.

There’s nothing wrong with renting. The big question is how much of your income are you throwing down on housing? Whether you buy a home or rent in coastal CA, a lot of people are squatting out half their income for a roof over their heads. I’m still clinging to the 1/3 of my income rule. It may be worth spending half your income on a studio apartment in Irvine. It’s just so clean, beige and orderly. All the world makes sense in Irvine. You can hear the Koreans next door smacking around their kid for getting an A- on a test.

+1. Owning real estate is not the key to wealth. Good wealth management is.

You are actually correct! If you are sinking 50% or more of your income into providing a roof over your head, I’d question your financial aptitude! Too often on this blog, people comment on renting vs. ownership, which is a bit of deception! The real key is paying yourself first! If you can’t do that, you are just fooling yourself!

I hate Irvine. It is like someone sat down with a computer and maximized the number of people they could shove in that space. And, since I am a hated white male, the diversity is too much for my taste. Newport Beach, Huntington Beach, or bust.

jt – I thought Irvine was all Asians? I mean, sure they hate your guts but they’re very subtle about it. It is that much to put up with, in exchange for getting to live in a “Stepford Wives” real-life computer simulation with Lego-perfect lawns? Isn’t that the allure of Irvine?

LA still one of the top destinations for Millenials

http://la.curbed.com/2017/3/29/15109370/los-angeles-millennials-realtor-housing-ranking

That may come as a surprise if you assume that millennials are avoiding big cities like LA because of the high rents and impossible housing costs. But LA clearly has other appeal, Realtor.com said:

“There are some very specific things you see millennials looking for in a community right now,†says Jason Dorsey, chief strategy officer for the Center for Generational Kinetics, a marketing firm in Austin, TX. On the list of must-haves: supershort commutes, and amenities like parks, cultural centers, and restaurants. And yeah, maybe even some really fun stuff to do on a Thursday night. That’s because many of these 25- to 34-year-olds are delaying marriage and even a serious career and want to enjoy the single life, he says.

There’s the lure of a career in Hollywood, not to mention the attraction of tech employers such as Snapchat, Google, and Oculus, which all have a presence in LA’s Silicon Beach, the site said.

And there are even housing alternatives in a region where the median home price is $672,000, including Northeast neighborhoods such as Highland Park and Atwater Village, not to mention South LA.

There are articles all over the place for about how nearly every city is a millenial destination. Well yeah of course there are a ton of millenials and a ton of places for them to go and this is one of them. Wow thanks for the breaking news Sherlock.

There are a lot of apartment buildings being built in LA (mid city, wilshire, beverly-grove, et) that are high occupancy buildings. Supposedly this is to meet demand but they are not fully occupied at all. Several new buildings in our neighborhood sit mostly unoccupied. One just to the north knocked down a depression era home and built an 8 plex that was finished over a year ago, sold for over 3 million and to this day sits completely unoccupied. Another south of us knocked down two 4 plexs, evicting mostly elderly jewish ladies on fixed income and built a 30 unit building that might have one occupied apartment. The apartments are far more expensive than they would have been just a few years ago. Maybe part is AirBNB. People were subletting and fixing up existing places here making money. Homeowners cheer because it makes their own property value go up. Rents have skyrocketed. Lots of fixing up and flipping going on with single family homes. Lots of mansions built up on lots that are sitting for sale a long time on market too. So with renting apartments now it’s four or five just out of college kids moving in just so they can afford rent. Or units totally unoccupied. Families already in neighborhood can’t move and hope they aren’t forced out because they can’t afford the new rents. Lots of construction though so good time to have a job in that.

Rents used to be for a two or three bedroom around 1500-2500. Now smaller places with fewer amenities want between 3,000-7,000.

Last time I posted someone responded that we want more buildings and it will lower prices. Yeah…that’s in a traditional or sane market. But that’s not what’s playing out now at all. For the past four or five years more buildings have only raised rents not lowered them. Is it REITs? Is it AirBNB? Have salaries suddenly gone up so much that it justifies the cost increase? Definitely strange times…

There are a ton of for rent signs in that area these days and that sort of thing hasn’t been seen for quite a few years. Looks like the rental market is cracking.

Denver is becoming prohibitively expensive. A one bedroom, one bathroom apartment in a decent area is at least $1.4k, unless you want to live in an unsafe neighborhood. If you want to live in the trendy urban core, you can expect to pay upwards of $1.8k for something nice. You might be able to pick up a 2 bedroom for $1.8k/mo, but they’re harder to come by. Not only is it expensive, it’s very competitive. Multiple offers and all cash bids are still very common, making it hard for the common person to win an offer.

I’m looking to move elsewhere, but trying to decide where that would be. I like AZ and NM a lot, but the problem with those places is that jobs are a little harder to come by.

I live in PHX AZ and it’s.growing like gangbusters. Part of our growth is because other cities become to expensive to live. We basically become a overflow of CA. I’m tired of our growth. We are going to.have an overabundant amount of luxory apartments here in a few years. While cheap compared to CA standard these apartments are 1100-1500 for a cramped one bedroom in a so called trendy neighborhood. On a side note it’s too hot and sunny here. can’t wait to leave here

yes, the slackers and the losers will never own that “crap shack”. This is Darwinism. The stupid lose, the smartest win.

Smart people would buy at the right time…..

It is worse than that. Southern California losers and slackers will never be able to live in a safe area. You can thank the Democrats for their open border policy. That policy flooded Southern California with criminal activity. It is now an expensive privilege to rent or own in a safe area.

The hope is Trump turns this around by deporting the criminals. The Democrats will fight him … they want the votes and will sell your safety to win elections.

people are prisoners in their own neighborhood due to the heavy traffic. I hope that Trump deports a few million in SoCal to clear the freeways for me when I drive.

Indeed you are right the government is the real owner.

Hello Doc. it’s been a while since we have seen a REAL HOMES OF GENIUS.

Check this one out. a 2bd 1.5 ba near the hood just sold for $650K

https://www.trulia.com/property/1093618927-5721-S-Harcourt-Ave-Los-Angeles-CA-90043

That house pays out like a slot machine:

05/16/02 Sold $228,000

06/15/07 Sold $600,000 Winning!

03/16/10 Sold $260,000 Sorry you lose 🙁

03/29/17 Sold $650,000 Winning!

Over the past 15 years $762,000 has been pulled out of that ugly small house near the hood with no central AC. Now that’s what I call winning!

Another great example of how you can get rich buying and selling the same house, over and over. Thanks for that.

Note to realtors, pick up palm branch before shooting photo of house. This realtor likely does Crossfit three times a week but won’t bend to drag a branch for 10 seconds.

Here’s a Santa Monica house: https://www.redfin.com/CA/Los-Angeles/13233-Dewey-St-90066/home/6747542

Sold last month for $1,137,500.

Relisted this month for $1,395,000.

The seller expects a $257,500 markup for “new grass lawn, new windows, tankless water heater, stucco smooth coat, re-finished floors, rain gutters, landscaping, kitchen cabinets, washer/dryer, and new range.”

Seller also hopes to benefit from the airport due to close in about 12 years. Listing says “Positive major changes happening at SM Airport (check w/ city). Please see private remarks.”

$1.3 M for a sad, ordinary little WW2 era tract house that probably cost all of $12,000 when it was built for the GIs returning from war and establishing their families. Even with the tasteful upgrades, this drab, featureless little house is LOWER MIDDLE CLASS HOUSING, yet you have to make $400K a year to be able to afford it, an income 5X what most Los Angeles households make. I find it very sad that a high tech professional would pay half his gross income monthly at least, to live like this, but since the 80s, we Americans have been successfully conditioned to pay much more and work much harder for much, much less.

I can remember when conditions were the opposite in the L.A. era. When I was growing up in the 50s and 60s, Los Angeles was a cheap market- cheaper even than my native St Louis- and wages were high there and growing, thanks to all the aerospace and shipbuilding that dominated the region’s economy at that time, and employed hundreds of thousands of people, mostly high school grads, in high wage jobs. And if you were a college-educated professional or manager, you lived in luxury, in a large, beautiful home that cost no more than 2.5X your income.

What a sad mess this country has been made by our financial cartel and its tools in the government and at the Federal Reserve.

Laura – I’m gonna bet when that house was built it was sub-$5k.

Houses were for sale in Huntington Beach, with tons of jobs nearby, for $6k or so in the early 60s.

Alex, the 50s and 60s were the time to move to SoCal. There has never been and likely never will be a time in history like the U.S. in that time, especially California. I always wondered why my young parents bought their tract house in the St Louis era when my father, fresh out of the Air Force, could have easily scored a great job out there, and our little MCM tract house would have been cheaper. But family connections exert a very strong pull, so we stayed on as the St Louis area lost much of its population, and its place as one of the largest and most prosperous cities in the nation, through the subsequent decades, and it, too, bled tens of thousands of defense and manufacturing jobs.

But the California Dream began to fade in the 70s, and when the defense jobs were cut by the hundreds of thousands in the 80s and 90s, and the income divide began to yawn wider than the Atlantic Ocean, it was no longer the same world.

Laura – you hit on the head. Working in electronics surplus (not IT so think vintage oscilloscopes, rather telling numbnuts to “turn it off and then on again” all day) and I get to read the occasional electronics catalog from the 50s or 60s and man, it was a whole different world. There were a shit-ton of jobs for one thing. Manufacturing was done here, and it seems a lot of housewives would work building electronics stuff while the kiddos were off at school; first shift would be 7-3:30 which would be just right. Yeah school would get off at 2:30 but you get the kids into Scouts or something that keeps ’em an extra hour or two.

A friend of mine had a house in El Toro and it was something like 20 minutes to the Los Angeles airport back in the day.

There was just tons of cheap land, tons of jobs, tons of room for advancement, and tons less people.

I grew up in Westchester in the 60;s and 70;s. when we sold our house in Westchester in 1975, it (and most other 3bd 1 ba homes in Westchester) sold for about $30k. The higher end homes in Westchester (near LMU were selling for $40K).

Now for any boomer owning a home in Westchester, they can convert all 3 bedrooms into a bunk situation (2 beds per bedroom x 3 rooms) and rent it out to LMU students for about $1000 per bed.

Alex, school used to end at 3:30 pm, and begin at 7:45. Actually, the kids would benefit greatly from a later day- say 9 pm to 4:30, for it has been discovered that most children are non-functional in the morning- I certainly was- and are routinely not getting enough sleep. But public schools are notoriously unresponsive to their customers and care more about their own priorities, than the welfare of the students or their parents, and since the administrators and teachers alike prefer an early day, that’s what it has to be.

Is the website you’re referring to The Automatic Earth. It never ended- I’ve been a faithful reader for a decade, and my neighborhood Transition Town group brought Nicole Foss herself to the neighborhood to speak a few years back. She and her husband Ilargi are two of the most astute and subtle people commenting on current economic and resource issues, and I was appalled when our local alderman did not attend- I thought every politician and mover/shaker in Chicago should have shown up, but they only want to hear “happy talk”, something Ilargi and Foss are not noted for.

Laura and Alex,

Manufacturing is mostly gone from the US. That has allowed me to buy a 60″ flat screen TV today for $500 when my 32″ tube TV in 1986 cost $600. I’m not counting inflation. These are real prices. We are paying less but still paying the price for manufacturing leaving the US. What amazes me that when I worked in Mil-aero in the 80’s. there was a requirement that all manufacturing be done in the US for parts and electronics in case of a global war. (you can’t really request your enemy to supply you with parts when your jets and tanks break.). That drove much of the SoCal aerospace business and employment in the 70’s and 80’s. This seems to be relaxed now. It will either be a disaster if a war breaks out or will prevent a war with Asia since why would a country start a war when we are sending them billions of dollars for parts?

It had me at “walking distance to airport.” The garage door is pretty slick, so slick that it amplifies that the house itself was built as a run-of-the-mill cracker box for normal joes and not some high end McMansion.

This is NOT is Santa Monica…big difference in LA vs. SM …schools, city services, etc.

I bet it sells for around asking and probably fairly quickly.

This is how our economy works these days of central planning. It is not the free market economy your parents told you about. You have to unlearn what they taught you if you want to be successful.

https://www.theautomaticearth.com/2017/03/our-economies-run-on-housing-bubbles/

The fuel in this economy, where FIRE is 50% of our GDP, is “bubbles”. ALL bubbles burst – that is a fact. What NOBODY knows is when; but when they do, are you very well position to take advantage of them!?!…You can no longer look in the past to project what will happen in the next 20 years. Housing today is no longer a shelter like in the past. It is run and rigged like the stock market.

Great article. Glad I don’t carry any debt. By renting I save a ton of money and have little to no liabilities. The dummies buy houses they cant afford during the bubble and the crazy ones even buy their second home now and think they can retire earlier if they rent it out.

Soon, when it all crashes, the reality will sink it and it will hurt once again. The majority of people just does not understand the simple concept…..all bubbles pop….just a matter of time.

I think some bulls are coming around to accepting the inevitability of a bust. But they rationalize their position based on the belief that 1) the bust will be shallow (<=15%) or that 2) the bust won't arrive until 20 years from now (or whatever time frame is convenient to jump ship beforehand).

That’s interesting I thought that web page had died years ago.

I think another factor that has to be considered is wages will likely shrink from the debt/correction. If homes are cheaper then your buying power should likely fall in place with the are you are in. If homes that were half million to a million+ would have needed a salary of nearly 200k. However, the housing reset that comes with a 50% or more cut off I am guessing your income would be cut in half as a result? Can’t have it both ways. Have 200k salary with under priced homes. Won’t happen unless homes are not darling of Mainstreet in my opinion.

Even if debt could shrink deflation would need to happen to destroy all sorts of asset prices. mark to market accounting would have to be used and then I guess the reality check comes into play for everyone that the game is over.

In the end if people have nothing to gain from owning or getting a better job this whole model about getting a better degree to better your livelihood would make our economy feel like communism. Why better yourself if there is no light at the end of the tunnel? Maybe why the Fed was created? Who knows.