Renting in feudal America: The new American Dream. The incredible momentum to renting continues even after many years of economic recovery.

I’ve lovingly called the new movement of people leasing homes as Rental Armageddon. A truly first world problem between buying an inflated crap shack or having to rent a property. God forbid you have to lease a place. People quickly lose perspective and that is largely one of the reasons we oscillate between booms and busts in real estate. But the data is very clear and that is, we are in a deep renting trend. We’ve added 10 million renter households in the last decade while being net neutral on adding homeowner households. That is a big deal. The housing market is also facing some massive demographic headwinds. Younger buyers are cash strapped and home builders realize this (this is why home building is lagging the mania because builders realize the demand is for rentals, even higher cost places). Also, you have Taco Tuesday baby boomers entering the twilight of their lives and they certainly won’t be upgrading their properties. A recent study by the Urban Institute sheds some light on this renting trend. There are some serious demographic and economic headwinds favoring the renting trend. One key finding is that for the next 15 years, rental household formation is going to outpace homeownership formation. Let us see where things stand today.

The raw numbers

You have to follow the numbers. If buying was such an easy decision, why isn’t everyone diving in head first to purchase those lovely crap shacks? First, common sense is probably pulling at your gut and telling you that 30 years of a giant monthly nut in a subpar home is not likely to be the best option, especially when you are stretching your budget like Gumby just to get in. The house lusting HGTV shows are back to peak levels today.

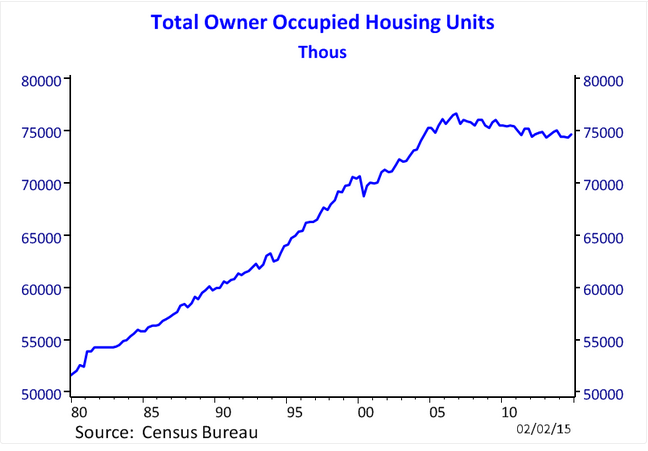

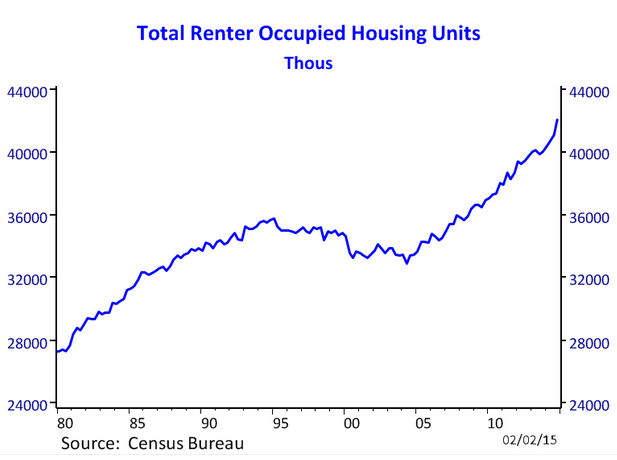

When I look at the raw numbers, there is absolutely no question that we are in a deep renting trend. Take a look at the number of renter households versus homeowners:

The last 10 years have seen 10 million added renter households while being net neutral for homeowner households. That is a big change.

Here is some key data from the study:

“From 2010 to 2030, there will be 4 million more new renters than homeowners; 22 million new households will need homes to rent or buy—13 million will rent, 9 million will buy.â€

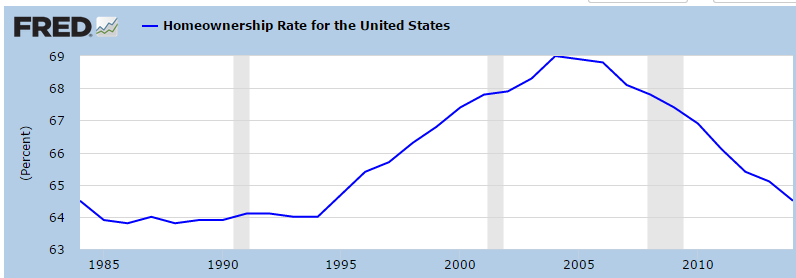

The homeownership rate is moving in one clear direction:

The study found that the homeownership rate will continue to fall:

“By 2030, the homeownership rate will have dropped to 61.3 percent from 65.1 percent in 2010.â€

There are a few reasons given in the study.

The psychology

It should come as no surprise that women and men are waiting longer to start families. When they do start families, they tend to be much smaller. No need for the McMansion model of housing. Because of this delay, many will spend less of their time as homeowners. This also has deeper ramifications. People will become more comfortable with renting and their mobile lifestyle. Also, many of the younger future buyers likely witnessed the insanity of the last housing crisis and probably witnessed friends or family lose their homes in the foreclosure graveyard that apparently has been easily forgotten.

The study also found that some people are just not into home buying. It looked at prime candidates to buy, those making at least $95,000 annually and have at least one kid:

“Even for this group, after controlling for race and ethnicity, the homeownership rate declined from 87.3% in 2000 to 80.6% in 2012,”

This is simply the reality.

The money

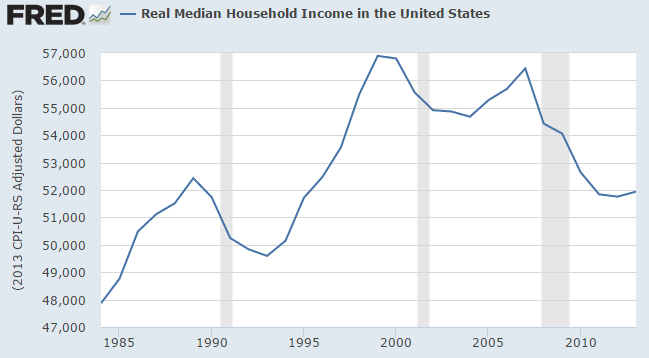

Of course you have the “income doesn’t matter crowd†but apparently it does matter to future buyers and that is why we are in a renting majority trend. First, take a look at wages:

It is probably no coincidence that the current homeownership rate has fallen in line with real household income. The renting trend is simply reflecting deeper profound changes to the housing market.  Â

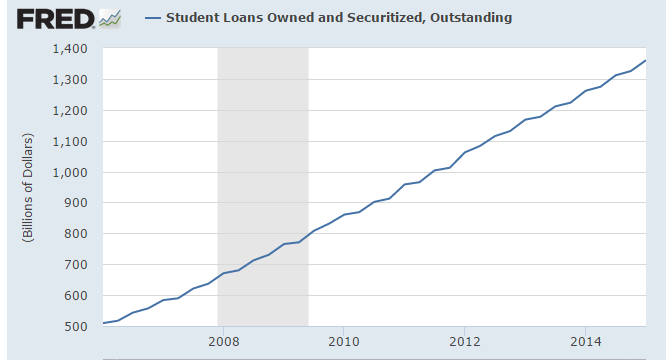

Another big factor is that we have millions of young Americans, the future buyers with deep levels of student debt:

I had to do a double-take on this. Total outstanding student debt is now over $1.3 trillion. Student debt is now the second largest debt class in the US, only behind mortgages. So it is fully understandable that people are balking at massive mortgages when they are already carrying what is equivalent to a baby mortgage before entering the housing market.

A fellow commenter on this site had some interesting things to say about lending standards:

“(USA Today) It also suggests that mortgage lending standards be relaxed to nudge more would-be renters to buy their homes.

That conclusion doesn’t sit well with everyone, however.

Logan Mohtashami, a California-based loan officer, says the notion that lending standards are tight is a myth.

“There remain a number of highly respected housing ‘gurus’ who continue to profess that it is unfairly tight lending standards, not the lack of qualified buyers that are suppressing a housing recovery. The difference is not academic,” he says. “A quick review of the requirements for some of mortgage loans available may surprise you.”

Hopefully Logan will chime in here but I agree with him regarding lending standards. Lending standards are as free flowing as they can get. Mortgage rates are low and as long as you have documented income, you are in good shape. I think there was some hedonic adaptation to toxic mortgages where people now say “hey, at least we check their pulse AND their income.â€Â So suddenly, this somehow means that lending standards are tight. Need I remind you that most of the foreclosures that hit actually were of the bread and butter variety mortgages – those 30 year fixed rate mortgages. Sure, the toxic funky junk imploded in epic fashion as well but the bulk of problems were people simply unable to pay their mortgage. As a reminder, you don’t own your home until the mortgage is paid off. Millions found that out the hard way. Also, even a paid off home has insurance, taxes, and maintenance costs – unless you plan on being the Purina Dog Chow eating boomer living in your paid off home with no cash flow, this is probably not the best choice in retirement planning.

The study is simply reflecting what we already know: future buyers are more cash strapped, are having smaller families at later stages, and many are simply opting out of buying. The fact that we’ve added 10 million renter households versus a net neutral gain of homeowners over the last decade speaks rather loudly. Well played Wall Street on buying those rental homes in bulk from banks. You have what appears to be an unlimited number of future renters coming down the pipeline.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

90 Responses to “Renting in feudal America: The new American Dream. The incredible momentum to renting continues even after many years of economic recovery.”

Logaaaaan!!!! What say you in regard to the future of low cost loans and the inevitable blow up that follows should the lucky ducky Millenials come to the table down the road?

The bit about lending standards is interesting. When we were shopping for homes last year, we wanted to see what we’d qualify for with just ONE of our incomes, so we chose mine, because I make less than my husband. Using my income and credit score/FICO alone, I was approved for a mortgage that was 7 times my annual income. I have a pretty good job and excellent credit, but it surprised me. The bank also offered to increase the lending amount after 6 months because we hadn’t found anything in our price range (because of bidding wars). Little did the bank know that we had given up and had already decided to keep renting.

Out of curiosity, why would you bother applying for a mortgage and not use your spouse’s income to qualify? Are you planning a divorce or something? Maybe your credit score is too high and you need to lower it a tad by applying for a loan?

I understand borrowing less than what you qualify for to keep things affordable in the event of a job loss etc., but not including a spouse’s income to qualify seems a bit extreme!

Husband is self-employed. We started with my income only just to see, and we were approved for more than enough (in terms of what we ideally wanted to spend) based on my info alone. Not planning a divorce. Just trying to be cautious. (And trying to avoid unnecessary paperwork…one of the many headaches of applying for a mortgage loan when you’re SE.)

Have always enjoyed the Doctor’s articles over the years and this is another one of those perfectly timed articles that sums up the impact of recent emarket pressures.

As a home owner in Yorba Linda and an owner of a rental in OC I have enjoyed the uptick in home values and fully expect a big down turn within the next 12 to 18 months. That being said I know the yo-yo game of real estate in So. CA. will always be supported by greedy real estate agents that will always find foreign investors eager to hide their money in real estate so I have no worries about short term periods where I might be underwater over the next 10 to 20 years. Check out the link below with the latest where a foreign investor bought a home in Yorba Linda a few weeks ago and already has it up for rent for less than a mortgage, maintenance, HOA, and taxes cost. If you are looking for American pride in this tough business environment don’t forget foreigners are always looking for a safe parking spot for their Ferrarris, Mercedes, BMW, and their life savings. Viva America!!

http://www.zillow.com/homes/21460-via-espana,-yorba-linda,-ca_rb/

What’s the median and avg rent in L.A? In prime real estate areas like S.F. (median rent $4,200) and L.A., even with rents going up, rental parity factors and, depending on a buyer’s long term plans (e.g. family, mobility needs), it seem to favor renting as making the most sense except for a small class of buyers. But buying also makes sense if you assume the market will always go up, or always recover and over the long haul continue its upward trajectory.

I went to Des Moines last summer. a top-5 rated city in terms of economy, jobs, and housing affordability, and in west des moines they were building rental townhomes and apartments like crazy. So much open land was being built on with mostly rentals. Maybe due to transient young professionals moving in for corporate jobs (e.g. Facebook, Wells Fargo). I backed out of an accepted job offer there for stupid reasons but I know that if I did move there, I would have bought within a year on what would have been my modest 50K salary–no brainer because of rental parity and rents skyrocketing there (and everywhere apparently) due to demand and apparently a lack of (willing or able) buyers. Buying still appears to make the most financial sense in NON prime areas. If I were working in L.A., no way I would buy and I would be looking for ways out through work even at my relatively young 30 years of age.

Rents in the central valley are slowly creeping up for both SFH and apartments. Lots of SFH were bought by cash investors 2012-2014 which kind of flooded the market for a bit but it’s still creeping upwards. Despite not wanting to commit to the valley long term, buying made too much sense based on rental parity alone. PITI $850, same price as a soulless 1BR apt in a decent part of town. Purchased in a low-income neighborhood, full remodel 3BR/2BA. Owning would be a pipe dream just about anywhere else in Cali and most parts of the country, and I can’t believe my married friends making twice as much as me still rent here. I’m still mobile, can sell tomorrow and break even after closing costs or rent it if I get married and have kids or relocate for work. I’ve been in California all my life (bay area first 24 years) and I hope to end up in more moderate localities in the midwest/south regions because the real estate in the even moderately desirable locations here are just ridiculous. What point is there to live in the bay and L.A. if you can never own? Who wants to be approaching retirement with no equity or paid off home and nothing but a measly 401k?

My favorite (global) travel writer/author comes from Des Moines. A lot of it, from his descriptions.. I really liked the sound of. Apple Pie, friendly welcoming neighbors.. (I read these books in the 90s and early 00s).

William McGuire “Bill” Bryson, OBE, FRS (born December 8, 1951) is a best-selling American author of humorous books on travel, as well as books on the English language and science. Born in the United States, he was a resident of Britain for most of his adult life before returning to America in 1995.

Bryson was born in Des Moines, Iowa. (“I come from Des Moines, Iowa. Somebody had to.” – Bill Bryson, “The Lost Continent”). In 2006 Frank Cownie, the mayor of Des Moines, awarded Bryson the key to the city.

______

[The Lost Continent] I COME FROM Des Moines. Somebody had to. When you come from Des Moines you either accept the fact without question and settle down with a local girl named Bobbi and get a job at the Firestone factory and live there forever and ever, or you spend your adolescence moaning at length about what a dump it is and how you can’t wait to get out, and then you settle down with a local girl named Bobbi and get a job at the Firestone factory and live there forever and ever. Hardly anyone ever leaves. This is because Des Moines is the most powerful hypnotic known to man. Outside town there is a big sign that says, WELCOME TO DES MOINES. THIS IS WHAT DEATH Is LIKE. There isn’t really. I just made that up. But the place does get a grip on you. People who have nothing to do with Des Moines drive in off the interstate, looking for gas or hamburgers, and stay forever.

{48 states later} I drove on into Des Moines and it looked very large and handsome in the afternoon sunshine. The golden dome of the state capitol building gleamed. Every yard was dark with trees. People were out cutting the grass or riding bikes. I could see why strangers came in off the interstate looking for hamburgers and gasoline and stayed forever. There was just something about it that looked friendly and decent and nice. I could live here, I thought, and turned the car for home.

Des Moines is a nice town and the rest of Iowa is good old Midwest living if you’re into that sort of thing.

Vibe I got in Des Moines was very positive. People were warm, friendly, family-oriented people. A growing city, a vibrant middle class and educated populace, no homeless to be seen. Very white, but that’s a breath of fresh air from the abundance of minority poverty and ghettos in the valley and Cali generally. All Cali has is the weather. Culture is overrated when it smells and creates conflict and havoc. Different people who can’t get along.

What point is there to live in the bay and L.A. if you can never own? Who wants to be approaching retirement with no equity or paid off home and nothing but a measly 401k?

Exactly. The issue which keeps giving me a headache. Even carrying a jumbo mortgage to own, in this market.. at these prices.. no thanks. Either rent-to-wait-for-better-value then buy, or keep mind open for some alternative for retirement.

There’s certainly some value there, even in the fair-to-good parts of Des Moines (West) on Zillow. (Property Tax?) Part of me is attracted to having an easier life – buying and owning outright at value; home for life.. then ticking over for income with less stress. Then again it’s different culture there… 25 years your children would be all like Johnny Utah (Point Break) small-town Iowa (actually it was Ohio for him) boy coming to California… seeing the ocean for the first time.

“Then again it’s different culture there… 25 years your children would be all like Johnny Utah (Point Break) small-town Iowa (actually it was Ohio for him) boy coming to California… seeing the ocean for the first time.”

I think a move to Des Moines could be a poor idea for you. Perhaps I’m wrong, I get a subtle “Elitist Californian” vibe from that quote. Folks from other states are often not receptive to Californians moving in, regarding locals as “Johnny Utah” when describing their “different culture”. My apologies if I’m incorrect, just my opinion.

I was in Utah last year, struck up a conversation with an intelligent, handsome young man. We spoke of SoCal; he’d visited for the first time recently, and was in no hurry to go back; “too many people, graffiti, traffic; everything felt dirty”. He did say it was nice to see the ocean and Disneyland, but was happy to return to Utah.

Point Break was released in 1991. California has changed a lot since then.

That’s right, I’m so very elitist lol. The point I was badly communicating is.. complicated. Many love California for all it offers (and rightly want opportunity to own at far more reasonable prices without stimulus interventions). To leave when you love California.. may be a big culture wrench. Yet prospect of forever global stimulus and high prices andrenting forever and not buying at these prices… was just looking at where some may choose to relocate within the US as an option. (I don’t want to be really want to be renting into my 60s). Yet then I was considering the culture change for their children as they grow up.

For Des Moines I’d consider Beaverdale.. maybe Windsor Heights (there are more expensive areas of Des Moines of course). School-ratings are something I’ve not looked properly into.

Homes in Windsor Heights have more character than the cookie-cutter housing developments in “taupetown.” Moreover, a lot of these older brick homes were built to last, in contrast to the cheap construction that’s gone up lately in outlying suburbs. Most lots in Windsor Heights have mature trees.

Maybe something like this

http://www.zillow.com/homedetails/6701-Carpenter-Ave-Windsor-Heights-IA-50324/847563_zpid/

Interesting article about water in SoCal:

http://www.zerohedge.com/news/2015-06-16/were-not-all-equal-when-it-comes-water-rich-californians-blast-conservation-efforts

Like the loan officer and I said before many times, financing is not an issue. I can get financing, anyone with legitimate income can get financing.

The problem is with the demand side. People can not afford the new cost of land, materials and cost for SKILLED labor based on salaries flat due to global competition. If you get 1.5% OFFICIAL inflation (about 15% for what people actually buy), year after year, while salaries stay flat due to globalization, eventually the middle class disappears.

Our politicians all push for globalization regardless if they have D or R after their name. The benefits of globalization go to the 0.01% while the rest suffer. I wrote to our senators and representatives (some D and some R). They all support Obama for PTT and all other soup of global agreements. Pretty soon, US will look like Mexico – few billionaires and everyone else dirt poor. It doesn’t matter how much you earn (those in Zimbabwe are trillionairs); what matter is what standard of living can you afford based on your earnings – money are not wealth – you can not eat money.

Eventually, the Wall Street crooks who bought all our politicians will buy all homes in SoCal and other expensive places and all serfs will be renters. This is the new feudalism.

This is what the doc is explaining in his article and he is right.

In conclusion, forget about D and R when you vote. Vote for anti globalist. Every politician sold by MSM (main stream media) is a globalist and it makes zero difference if you vote for Bush or Hitlery – they represent the same gang (same for Obama, McCain and Romney). Vote for someone who stand against globalism like Ron Paul (too bad he is not on the ticket). Of course you are free to vote for Bush or Clinton; just don’t complain when your “high” income doesn’t buy anything in a safe area. When your neighbors will compete with those working for $2/day and they can’t buy food, they will steal it from you – just like in Mexico. Minimum wage increase will not do anything for the poor. It will just create more poor and benefit ONLY the 0.01%. If you can’t understand the correlation you have to take a course in Economics (the posting is already too long for that; just trust me). Any honest economist understands that.

ownership rates are down due to fanatical speculation, investor and foreign money, low interest rates and inventory. Some people’s financial standing have not recovered from foreclosures/short sales. Raise interest rates, let prices fall. Then investors will come back and fuel another run…

@FresnoResident

Let’s not forget that it is because of the lack of investment alternatives due to ZIRP that investors pile into risky assets like RE. Raising interest rates will most likely encourage a shift towards more liquid and safer investments.

This is not true that loans are easy to obtain, maybe if you are an employee. If you are self employed there are tons of hoops to jump through, miss 1 and you get rejected. Mortgage lenders are having. Hard time right now for this exact reason. Banks are cautious right now

No tax return or “stated income” loans are available you just have to pay to play. 30% down w/ 720+ fico and reserves in the bank post closing. They are available for those business owners that show little to no income but have the cash and credit.

BUILDER +1 Excellent Post

The US empire is crumbling. Some bloggers laugh and say “which country will become the next empire?”

My opinion is that it will not be another country to become an empire. The whole globe is becoming an empire under the new global financial cartel. The people in Europe and US no longer have a real democracy. All politicians are bought and they do the bidding of this financial oligarchy for whatever serves the interests of the cartel not the national interest or the interest of the average citizen.

You may deny this all you want, but that is not changing the new reality we live in. All these new trade agreements are not serving the interests of the US workers or small business owners. They just serve the interests of this new financial oligarchy of 0.01% from the top. The MSM and all the candidates with a chance for ellection serve ONLY this 0.01% form the top. Some people say the top 1%. I don’t believe it, because the 1% is over 3 millions and the real power is not in the hands of over 3 millions. In this large group there are lots of doctors who don’t have any real economic or political power.

When the 0.01% say they want to increase the taxes on the rich, they mean doctors and small business owners not those part of the financial oligarchy (0.01%). For themselves they vote loopholes. Crooks don’t like competition. They like a central planned economy like in communism where a very small group of crooks love to controll all people – what you get is a more and more tyranical government and no freedom for the people. Agenda 21 was born out of the same sick minds of the 0.01%.

When you vote, if you care for your future or your children, vote against any establishment republican or democrat and those favoring “trade agreements” (shipping your job overseas). You will know them by how much they are promoted by the MSM. Otherwise, don’t complain that your “high” income is not buying anything where your daughters are safe to walk on the streets.

All politicians who promote the massive imigration we have today (legal and illegal) to overwelm the system are also serving the same puppet masters who want to change US into a banana republic – a colony of the international banking cabal. If you get massive diference in culures, the serfs can not get organized against the cartel – divide and dominate. Vote against all these politicians (there is no diference between them if they have D or R after their name). These politicians don’t want any financial and political tranquility for the average US citizen; they want total enslavement.

Few decades ago the financial sector in this country was 20%. Today it is 40% and soon 70% with the rest 30% working for the government – I am talking about those still working because half of the population can not find full time work above minimum wage; they either don’t work, have part time work with no benefits or minimum wage.

Absolutely right on the the money with this post, Builder. Americans are really good at whining about the state of affairs on blogs like this one. We’re great at finding fault with others too. Why won’t the Iraqis fight for their freedom? We’re also really good at bombing people from 50,000 feet in the air and occupying about 2/3rds of the globe with over 700 bases. We love to encourage colored revolutions in other people’s nations, but in our own? Crickets. Moral cowardice reigns. Not only will we not do anything about it, but most will probably cast their vote for the same oligarchic clans that have been ruling and intend to continue to rule us in perpetuity. Land of the brave and home of the free? Good one.

Builder, +1, again.

I may write in Kayne for President. We need Kardasians in the White House; the US will have its first Porn Star First Lady, Mother Kris for Secretary of State and Catlyn can be Cabinet Member of LGBTX affairs. The Inauguration could feature Katy Perry singing the National Anthem, flashing bare breasts to the crowd to wild applause (CNN reporter Anderson Cooper will giggle and receive 10 million likes on Instagram); Miley Cyrus in a g string and pasties wrestling a red white and blue painted live pig onstage could conclude the ceremonies. President Kanye then releases a photo of him and Jay-Z smoking a blunt in the Oval Office, captioned WE DID IT BITCHEZ. Let’s get this party started!

I am so on board with this.

i agree with you that it’s the .01%. but i said 1% to include powerful puppet masters like kissinger. i don’t think kissinger is a billionaire. and the new money billionaires like the chinese or zuckerburg are not puppet masters

Very well put!!! Agree 100%

BUILDER, we each ‘vote’ for or against globalization with our wallet. I wonder where that computer or smartphone you’re using right now was manufactured? I wonder if you’d be willing to pay 2 or 3 times more just for the label “Made in the USA”?

So many people want to point the finger at politicians, when it’s the everyday choices/purchases we make that we need to scrutinize instead.

@tbags “BUILDER, we each ‘vote’ for or against globalization with our wallet. I wonder where that computer or smartphone you’re using right now was manufactured? I wonder if you’d be willing to pay 2 or 3 times more just for the label “Made in the USAâ€?

I am not sure your statement holds water, as so many things are not even made in the USA anymore, especially electronics. Scrape all of the “Free Trade Agreements” tell companies they have to make their stuff in the USA to sell it here and I believe many of this countries issues would change for the better.

Yes, a few prices may go up 50%, but that isn’t a deal killer for me to support American jobs rather than kids working in a Nike sweat shop.

Look at cars, Toyota and Honda make very competitive products in the USA. I think every other American industry could be very competitive if our politicians were not bought and paid for by the corporations.

Better yet – vote for Bernie Sanders

Bernie Sanders for president if you want to turn US into N. Korea or Venezuela. Communism always ends the same – in total failure. It was proven beyond any reasonable doubt that without respect for private property and free markets and freedom, the economy colapses. It doesn’t mater the country or the culture.

Bernie Sanders, regardless of what he is saying he is 100% communist.

Vote for an old socialist/communist like Bernie Sanders who has been in big government most of his life? NO WAY!

He thinks the public is too stupid to handle their own money so he’ll try to trick them into giving Washington the power to confiscate it so that he and his leftist cronies can allocate it as they see fit (and also confiscate some for themselves).

may very well vote for him.wall street and their banks are out of control and if he can bring sanity back, i’m all for him.

Who is out of control? It’s the left and their corrupt big government! Why do leftists always support oppressive leftist dictators who end up bankrupting their country’s economies.

I am self employed and tried for 3 years with 5 different lenders to try to get a small home loan for a median priced home in my area of Southern California. I offered to put up as much as 40-60%. They all gave me low approval figures or rejected me. So, I said fuck it and paid cash. This besides the actual process of finding a decent home to live in at a reasonable value was miserable. I totally understand why people chose to rent. You can have a much higher quality of life

So if you add up all the numbers we simply see an environment where gen Y and after are more or less forced to work to support the boomers instead of working for a new generation…

Yep, that’s partially why the economy is stagnant at best. The bailouts and other ongoing federal and Fed programs are directed towards bailing out and preserving the lifestyle of the past generation and its ruling class at the expense of the new generation.

Thus, the new generation has to work and sacrifice far more than the past generation just to afford the same lifestyle (i.e. RE).

Believe it or not that’s exactly what us boomers were saying about the generation we supported back in the 70’s. As long as people support social security it will continue to benefit society. I do agree that more support should come from wealth; especially the wealth that was created by the workers who need social security in the end and that accrued in exponentially greater percentages to the masters of the universe.

Boomers have really screwed everything up–especially delusional leftist boomers from SF.

Need I remind you that most of the foreclosures that hit actually were of the bread and butter variety mortgages – those 30 year fixed rate mortgages. [……] Well played Wall Street on buying those rental homes in bulk from banks.

It certainly seems the Wall St won for now, and their backers. I’m hoping it will be a future “well played” to the banks for getting a good price for assets and getting them off their books into a reflation. As I see it, many of the rental stock has been bought by investors, and some sold back via REITs back to market yield chasers.

Lot of investor-groups hot-footed into housing stock rentals past few years… those investors/businesses… well the banks are not going to put other investor groups interests before their own future/profits.

Mainstream banks are now in a stronger position to handle any crash – pump and dump – investor groups holding more of the market – and banks much better positioned to offer lending to those in a position to buy during/after the low-mid-high prime real estate crash. Banks exist to lend. Remember the chart last year on level of mortgage lending?

Mortgage Application Gauge at 14 year low:

http://www.doctorhousingbubble.com/mortgage-applications-14-year-low-housing-drops-decline-mortgage-affordability-index/

One European central bank (UK) said last year it has no policy about intervening on prices, but is concerned with ensuring monthly sale transactions go up from very low levels. Same applies to US low-mid-high prime for me. Only way I can see that is via lower house prices.

The Gov thinks that renting is the Green way to go. Renters are so much better for the environment than home owners.

I have been in the home loan industry since 1984. When I started we did offer 5% down loans along with FHA (3.5% down) but the big difference back then was the DTI ratios were 28% max for the PITI payment and 36% max for PITI + debt of your monthly gross income.

Imagine how happy everyone was when FNMA rolled out their automated underwriting system back in the mid 1990’s and the system allowed a dti up to 50%!!!!

By the early 2000’s lenders rolled out the stated income loans and that is when anyone could buy anything which resulted in the eventual bust in RE.

Now conventional loans are limited to a 45% dti unless the client has 12+ months PITI for reserves. Buyers going FHA/VA may still get an approval up to a 55% dti.

That said, lending standards are no where close to as strict as they were before the 1990’s. Yes, lenders want to verify everything, which can be paperwork intensive, but lending standards are still pretty lax in my opinion.

Renting demand curve is very real but don’t let anyone convince than this is due to Tight Lending … Tight lending is the biggest myth in American economics today, primarily told by people who have never worked on a loan in their life or have any financial background

The standards are liberal today, evidence right here

My evidence here

http://loganmohtashami.com/2015/04/09/tight-lending-and-other-urban-legends/

My recent interview explaining in details to banking professionals that the modern day tight lending crowd are jesters at best and have been lying to Americans for years on this topic

Mark Zandi and Laurie Goodman to name 2

http://loganmohtashami.com/2015/04/13/interview-with-david-lykken-slaying-the-tight-lending-myth/

Throw in Yun as well.

I’ve been reading this website for about 2.5 years now waiting for the market to dip, but instead it has continued to go up.

I had an opportunity to buy a place with a good school district in December 2014 that was listed at about $660k. I didn’t want to pay more than $650k – I used December 2012 zillow value as a sustainable and fair price point; therefore, I inputted an offer at $650k and submitted a love letter.

The seller countered me and two others for our best and final. I didn’t budget because I didn’t want to play the bidding war game. Additionally, I already own two other places.

This place was going to be a place I was going to move into and where my toddler can grow up with plenty of space. The place ended up selling for $701k. At first, I was glad that I didn’t counter and start a bidding war, but then I realized that I could’ve lived in a decent place for only $51k more than my “fair” and sustainable price. Considering that monthly rent for a similar place is about $3,200 to $3,500 right now, it would’ve only been about 1.5 years worth of rent. I am currently contemplating renting because we need the space.

When is this going to start crumbling?

What a sob story lol. Keep bidding higher to get that 3rd property.

That’s what I thought too, Brain. 2 1/2 years is not a lot of time and frankly kids are very adaptable to space constraints, it’s the parents whom tend to have issues with it.

prices are going up in my hood.. bidding wars on every home on the market. the house up the block from me listed for 560 and sold for 640. just sayin’..

The mythical “My Hood” argument 🙂 Never a Redfin link to be found in these posts. Bifurcated market should continue though. If his “Hood” is really a SoCal prime area it could very well be true that there are bidding wars. That said, the great swaths of SoCal where most people live are already correcting. I believe someone on ZH posted a link to Zillow showing a prices down 6% YOY in Chino Hills. that “Hood” is not only a fairly exclusive enclave, but has seen it’s Chinese community grow whit spillover from Diamonds Bar. It would seem even the Chinese hot money is willing to pay less for SoCal housing 🙂

Chino Hills 5/2014 median sold price $565K; 5/2015 median sold price $619K

5/2014 avg sold price $601K, 5/2015 avg sold price $648K

I should have clicked the link because the poster was incorrect. However, according to Trulia Chino Hills 3 bedrooms are $462,250 -2.4%YOY. Supports that bifurcated market hypothesis in regards to the median in general.

http://www.trulia.com/real_estate/Chino_Hills-California/market-trends/

None the less it would seem Even in Chino Hills sales volume is quite low vis-a-vis historical averages, just as everywhere else. I wouldn’t expect an extreme drop in price in this neighborhood during a correction. The neighboring communities of Chino and Ontario will be a different story.

http://www.movoto.com/chino-hills-ca/market-trends/

Real Estate is local..

This is the crack-up boom stage for me.

Well the action in individual tracs is telling something the median isn’t. IE…

Rancho Cucamonga 680K Oct 1, 2014

https://www.redfin.com/CA/Alta-Loma/6134-Indigo-Ave-91701/home/3993509

Rancho Cucamonga comp 590K May 15, 2015

https://www.redfin.com/CA/Rancho-Cucamonga/8159-Rosebud-St-91701/home/4054056

I’m seeing more and more of these closed sales. Once again, all it takes is a McMansion or 2 to really skew the median. I believe this is the beginning of the correction. The sales traffic nose dived last year now we’re seeing the beginnings of price action.

RE: alta loma listings posted above:

6134 Indigo is 350 sf larger, 10 years newer and has a view. It also has a fully equipped mechanic shop in the garage with a mechanized car lift, finished concrete flooring, etc. etc. Indigo was on the market for 321 days. They started at $750K ask price dropped to 698 and finally got 680. It was overpriced to begin with and they got more than I would have thought they would. Most likely they just found the right buyer willing to pay for the view, specialty garage, etc.

Rosebud was only on the market for 10 days and is slightly inferior. From the history it looks like the owner got sick of having it as a rental and decided to cash out and be done with it. Agent comments say “priced to sell, sold as is” and “if repairs are requested price will increase.” That and the fact that there were only 12 pics makes me think there was probably some work needed.

The bottom 95% of proles are too busy with Caitlyn Jenner and sports to care about the 1% robbing the serfs. What’s a revolution when we have bread and circus?

Rents keep going up and up. Housing to buy is ridunkulos!!! I do have money for a downpayment for 20% for a 2200 to rent an apt. or buy a 700k + house… not worth it.

Some of you talk about a crash or rather a correction… but I am not economist. I’m 32 so got a bit of time to wait it out.

Again, these articles imply that renting is somehow inferior to buying. I am a homeowner in SoCal…. renting is not inferior, and is superior in many, many cases.

Can the author please offer some insight as to why he heavily slants these articles against renting??

Not sure why he’s got such an axe to grind against renting. At this stage in my life, I don’t mind having a mortgage. Once I retire with a paid-off mortgage, if we move, we may well rent.

Nothing ties you down like owning a house. Except maybe owing a condo.

Tight lending, ahh no stated loans are back.

Sold our home in 2015. 150 people came through in first open house. Every one Asian. 10 offers immediately. House sold as is for 50 thou above asking. Our daughter, an architect, can barley afford rent in a shit area of LA. It’s totally crazy to allow deep pocketed foreigners to buy real property in this country. I know what im going to be accused of by the liberals among you. It’s OK your generation has paid nothing for the privileges you enjoy. Maybe a new crop of immigrants will be an Improvement. So far it seem so.

This is what happens when you try and maintain an empire. The US printed cash like confetti, spread it across the world to try and control other countries and it worked for a number of decades. Now that cash is coming back in a tidal wave to destroy the (mostly) younger generations. I would not be surprised at all if in the next decade or two it gets so bad that the Feds mandate a stipend in this banana republic. It will be very much like Venezuela.

Can’t tell if you’re complaining or not, how does that extra $50,000 feel in your pocket?

never did understand their kind.

@ Curt

hey Curt, where is your home located…? San Gabriel Valley?

Hey, I’m a liberal, but I agree that it’s a problem, regardless of the country or race of the people coming over in droves. If the rules aren’t followed in regards to illegal immigration, and the rules aren’t changed in regards to legal immigration/investments, things are going to get tougher and tougher for the native middle class. Granted, there is a litany of other issues hurting the middle class right now, too.

The charts for number of renter households versus homeowners are certainly interesting.

One related chart that I have never seen is what I would call “Total number of home square feet per individual”

In other words, if we were to add up the total livable square footage of all homes and divide by the total number of people living in that space, what would that number be?

Similarly, if were to add up the total square livable square footage of all rented spaces and divide by the total number of people living in those spaces, what would that number be?

Even more interesting would be to overlay those those number plots on the same timeline as the Total Owner/Renter Occupied Housing Units charts as well as price per square foot charts.

My hunch is that both owner and renter alike are getting less square feet for more money over time. To wit, notice the increased congestion in all areas, more traffic, parked cars, longer lines at the super market, police activity, roommates, families doubling [or tripling] up [in some cases].

In response to Janet Yellen Today

Yellen: “Credit availability remains quite constrained for mortgages.†Those without pristine credit ratings find it quite difficult

Yellen: “housing “remains quite affordableâ€

Cough Cough water please… 4 charts to show Yellen lies still live

http://loganmohtashami.com/2015/06/17/yellen-still-needs-a-course-in-residential-lending/

Logan, is she lying or is she genuinely misguided?

I could have misunderstood but I thought in one of your radio interviews you mentioned that there isn’t a bubble due basically to the quality of today’s borrowers vs in the previous price run-up. Which non-existent bubble were you referring to – price, volume, or both?

So I was checking out this place for rent in West Covina. Turns out it was a chinese person that just recently bought the place for $420,000 and now renting it out for $1900+. Of course I didn’t want to put 20% down on a crap house $420,000. But these chinese man, they are buying properties and renting them out to Americans. We are paying for their profits because we don’t want to pay for homes worth 1/2 the price. Let alone homes that are 10x greater than median income.

shipped them our jobs and buy their crap.yup,makes you wonder what happened.

Come to Irvine where the homes are made by Mexicans for Chinese buyers.

I think we are pointing finger to cover our own deficiencies here. First of all, how do you know this Chinese man is not an American? secondly, “shipping job to oversea” really means that while you are siting on couch watching Monday night football, these Chinese are breaking out sweats working hard producing. third, you only see this Chinese man make profit but not seeing his is carry the risk of buying home half price of what is worth (according to you). From what I can see, I see socialists complain about capitalist on this forum too often.

Heck, with the number of times I have had to move for work – NO way would I buy a house. Just got a notice that we “may” be moving again – sigh.

Not only will I not buy a house but I refuse to pay the corporate apartment management (Pirates) inflated rates. It takes a while but you can rent out some really nice spaces from suckers, cough, I mean people who have purchased a house. Why in the world would you pay the apt rental pirates?

I know of several well educated millennials who are extremely well paid – at the moment. Not one feels they have the job security to tie themselves to a 30 year commitment. There is no job security anymore and the option of being able to relocate is an option they would like to keep open.

this link is usually over the top, but here’s what they say about Ca. real estate.

http://www.naturalnews.com/050101_California_drought_property_values_real_estate_collapse.html

Sounds plausible, but so many doomsday scenarios don’t come true.

* In the 1960s, people were predicting that due to the Population Bomb, by the year 2000 there’d be NO fossil fuels left, NO livable space, NO clean water. Harry Harrison’s 1966 sci-fi novel, Make Room, Make Room (basis for the film, Soylent Green), set this bleak future in 1999. New York City population at 35 million. People living in corridors due to lack of space. Rationing of polluted water. All the land outside of cramped cities used for militarized farmland.http://www.amazon.com/Soylent-Green-Make-Room/dp/0425023907/

* In the 1970s, scientists were predicting a coming Ice Age. All the “science” pointed in that direction. I still have a couple of those old paperback bestsellers.

* In 1987, Oprah Winfrey predicted that by 1990, 20% of all Americans would be dead of AIDS: http://fumento.com/aids/pozaids.html

* In 1991, “great scientist” Carl Sagan predicted that if Saddam was to burn Kuwait’s oilfields, it would darken the sky around the world and bring out the equivalency of Nuclear Winter. Saddam did, and it didn’t: http://articles.baltimoresun.com/1991-01-23/news/1991023131_1_kuwait-saddam-hussein-sagan

* Let’s not forget the Y2K panic. Civilization to collapse in 2000, due to computers going haywire.

I too worry about drought, California’s financial woes, and the coming Big One. Then I look around and see that all of the rich and powerful live here, and I think, they gotta be smarter than me. They have inside information. They’re still buying real estate here. So it must be safe.

But really, who knows?

“Then I look around and see that all of the rich and powerful live here, and I think, they gotta be smarter than me. They have inside information. They’re still buying real estate here. So it must be safe.”

You’re kidding, right?

I know you’re probably kidding about the wealthy being smart, but just in case… the rich and powerful didn’t necessarily get that way due to intelligence. I’ve seen some spectacularly stupid self-made rich people. More often that not, it’s some combination of determination, luck, work ethic, narcissistic personality disorder (little if any empathy), and sheer obnoxiousness that takes a person from rags to riches. Intelligence is a nice bonus, but not needed, and is sometimes a hindrance.

Rancho Santa Fe is a prime area. So much for “prices in prime areas have no major correction”….!!!!

I believe that the CA drought will be a black swan for CA real estate for prime areas as well as IE.

More renting isn’t necessarily a bad thing. While certainly there is a case for building equity, given the times we live in, there is significant risk that homes could become giant anchors. In fact they are still boat anchors for some 4 million Americans who are still underwater. At least renters only have a 12 month commitment should their job disappear or the economy hit the rocks again. And, the next housing bust may in fact take down some heretofore cash rich people … they had cash, sunk it into real estate, and then may take a loss if they have to unload those properties. What I don’t get is why more homeowners in So.Cal. who’ve owned for a long time, aren’t cashing out, moving out, and pocketing a substantial amount of that equity for their retirement!

I think a review of history is in order. Protectionist sentiments to either protect shrinking industries, nurture young businesses or save jobs has been a clarion call by captains of industry or politicians on a regular basis since the early 1800’s. The Smoot Hawley Tariff Bill in 1930 doubled down on the Depression.

Usually all that happens is foreign goods still come in but cost you and I more. Free trade should enhance every countries standard of living if done fairly.

We are still big exporters of oil, software, intellectual property and aircraft. We can do a lot more but tariffs don’t work well. We need better (not more expensive) education. We need to stop running business off with stifling rules and instead work with them to be cleaner and pay well. We need to stop fighting and dividing among politicians and look for solutions.

I was excited to sell my house on the Westside in 1987 for $185K and later in San Jose in 1991 I was excited to get $285K for our nearly new house then. Both are worth around $900K today.

My point is to take the long view. Buy a house that works as a location and your budget.

You might be waiting a long time for the next big crash. Don’t trust any politician (D or R)

“My point is to take the long view. Buy a house that works as a location and your budget. You might be waiting a long time for the next big crash.”

I would be very surprised if similar statements weren’t being made in 2005/2006. If prices are in bubble territory (like they appear to be now), my guess is that a crash might arrive sooner than later.

Exactly, and some of those people whom bought on location and budget in that era are still waiting a long time to not be upside down. Works both ways. This long run stuff is an example of how some from an older generation are completely out of touch with the realities young potential homebuyers face today. There is no more long run that can be reasonably counted on, hello!

I think if housing doesn’t continue to deliver it’s punch as it has done for the last 40 years people may just become complacent about moving and will likely see a long grind in no real appreciation in home prices.

Welp…we’ll see how much all these investors like being landlords after 5 pr 6 years from now.

Here in the East Bay a balcony on an apartment owned by Blackrock collapsed and killed 6 students. Reading the article it seems crazy how many people are skimming off the rents but want none of the responsibility…something has to give.

http://www.sfgate.com/bayarea/article/Berkeley-mayor-says-water-damage-probably-to-6333561.php

“Representatives of Greystar, the South Carolina company that manages Library Gardens, did not return a telephone call Wednesday. In an earlier statement, Greystar said it would work with authorities and an independent structural engineer to learn what went wrong.

A similar statement was released by BlackRock, which bought the complex in 2007.

The architecture firm that designed the complex, TCA Architects of Irvine, did not return calls

Court filings show that Segue Construction, the firm that constructed the building, paid $3 million in 2014 to settle a lawsuit over “water penetration†problems on dozens of balconies on a San Jose apartment complex.”

So a company from South Carolina manages a property in Berkeley (have fun with that)…for Blackrock…that was designed by a company in Irvine and build Pleasanton construction company…that has settled for building crappy apartments.

Good fickin’ luck investor landlords.

I saw in a Bloomberg report “How long before the billion house is listed” that is as crazy as it gets. As a former auto dealer I have to laugh when auctions sell past pony/muscle cars that sold for 3k to 6k and today many bring upwards of 250k or more and these folks never drive them on the street. Is it all relative to the times or people with crazy money stupid, because if you are the 1%, you are supposed to be so smart, really????

Hi Robert, Come on down to my neck of the woods. I will drive you around Bel Air and the Mulholland Corridor. We will see the house that sold for 85,000,000. We can preview the new listings at over 100million, and see the ongoing construction of the home that is set for a 500 million dollar list price. Growing up in this area I believe the sellers will get their money back and then aome. “If you build it, they will come” is on the mark… Or should I say yuan.

2010 prices ain’t ever coming back folks. There may be some ups and downs but this is pretty much the new normal in America. “The best time to plant a tree was 20 years ago. The second best time is now.†Chinese proverb

Wow, I have learned more about the long and short terms real-estate trends reading this blog than I have over a 10 year period reading and listening to the mainstream media. I’m an SF resident, renting, and I assume the bay area is not much different than SoCal. Is that an adequate assumption to make with respect to California-wide housing booms and busts?

Leave a Reply