Renting the California Dream – Typical Southern California mortgage payment down 54 percent from peak. Rents move up in the face of stagnant household income.

It seems like an odd combination that you have rising home prices, higher rents, and a stagnant household income all coming together under the same economic landscape. Yet the perception on the surface of higher home values is somehow mixed up with higher incomes. In fact, what has really happened is extreme leverage via negative interest rates by the Fed. This clearly has impacted the housing market. Yet how is this messing with the rental equation? Los Angeles County has a majority of renters and rent is paid via net income with no subsidized deductions so is the rise in rents a sign of higher incomes? According to Census data the answer is no. However, a study by none other than the Fed shows a large number of those who lost a home via foreclosure shifted to renting single-family homes. Contrary to what many believe, people largely stayed put in California but a big shift in home ownership did occur.

The magic of lower interest rates

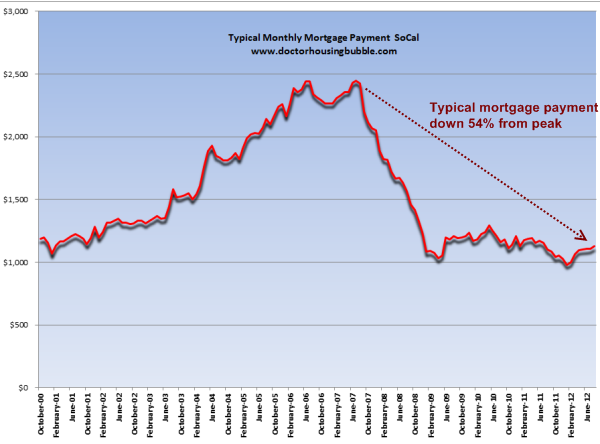

Some people are brainwashed with the current euphoria that they think current sales are somehow an underlying reflection of larger household incomes. Some even believe no housing crash occurred! First, Let us take a look at Southern California housing and examine the typical mortgage payment people have committed to for over a decade:

Last month, the typical mortgage payment of those that bought in Southern California came out to be $1,124 according to DataQuick. I’m not sure if this is simply principal and interest but let us assume that this is the case. According to this data, the typical SoCal mortgage payment for sales has fallen a whopping 54 percent from the peak in 2007. What is more important to note however is we are back to levels last seen in the early 2000s.

The above is a better reflection of what households can actually afford. The bubble is obvious and the pop is also very clear. Yet what is telling is that California households are no better off than they were over a decade ago at least when it comes to affording a bigger mortgage payment. Sure they can pay more for a home but this is merely a magical trick courtesy of the Fed’s insanely low interest rates. The pop has resulted in a shift of home ownership. Let us drill down even deeper into data for Los Angeles County alone.

The data behind Los Angeles County

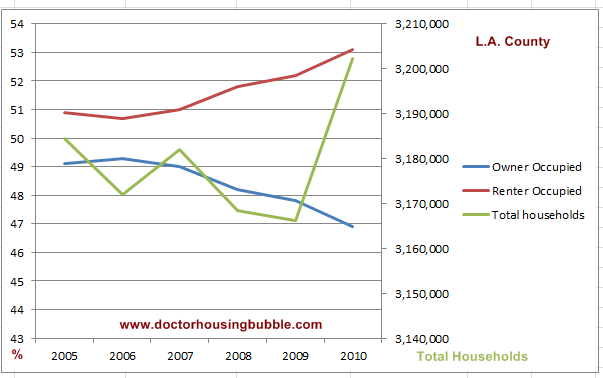

It is helpful to note that even throughout the biggest housing bubble people largely stayed put especially in Los Angeles County. What occurred is a shift from owning to renting but it is hard to tell if anyone really left at least at a statistically significant level:

Source:Â Census

The chart is not to scale obviously but is set to drill down on two points:

-1. Today Los Angeles County has more households than it did during the peak of the housing bubble in 2007

-2. The number of renter occupied households has gone up from below 51 percent to over 53 percent

The above is important because it coincides with data from a new study. A Fed study suggests that householders that experienced a foreclosure from 2006 to 2008 ended up renting a single-family home (up to 60 percent) and a good amount (up to 23 percent) ended up renting a unit in a multifamily structure.

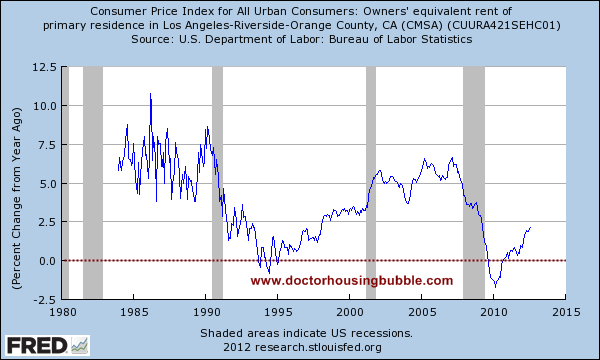

So it should not come as a surprise that many of these families ended up looking for rentals after a foreclosure hit. With many investors buying up places as well the rental market has become tighter but not for the reasons one would typically associate with rising rents. SoCal rents are going up:

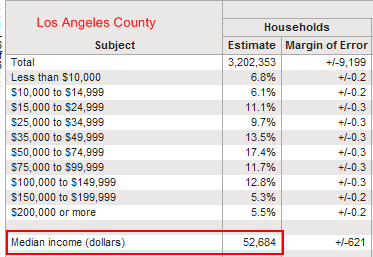

The above is for SoCal in general. How are rents doing in mid-tier to upper-tier neighborhoods? It is hard to get any aggregate data on specific cities but overall, household incomes in Los Angeles are only slightly higher than the US median:

To put it bluntly, of the 3.2 million households in L.A. County half make less than $52,000 per year. And what is fascinating is that 23 percent make more than $100,000 per year and for many that are looking at homes in the $500,000+ range, I would suggest a household income of $150,000 and higher is a smart starting point to begin with and only 10 percent fall in this range.

So what has driven rents and home prices up? Rents are being pushed up because of those who have been foreclosed shifting to rental units (more rental demand) and home prices are largely being driven up by lack of inventory and the Fed pushing interest rates in negative territory. Again the typical mortgage payment chart above is important because it underlies a bigger trend. Household incomes are stuck. So how are rents being sustained here? I think you are seeing many California households that clearly could not afford the prices they paid on bubble valued homes but can afford the current rental market and want to stay in the area. This group is likely a big push on the rental side.

The Fed is trying to unlock the wealth effect by pushing home values up with lower interest rates. What you are getting is rising costs in food, energy, healthcare, college, and once again housing with no impact on wages. In other words the standard of living is falling. What is clear is that Californians are apt to spend more on renting or owning for a piece of the California dream, even if their incomes do not keep up.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

59 Responses to “Renting the California Dream – Typical Southern California mortgage payment down 54 percent from peak. Rents move up in the face of stagnant household income.”

crazy. the fed is trying to reinflate a bubble that has popped…and instead is setting up the USA for a MASSIVE double dip in house prices. incomes continue to fall…once the big box store model collapses..it has already collapsed in most of the USA…then the fin de siecle will have finally realized it’s total lack of moral ambition.

This is interesting DHB.

Seems like (i) rents go up, (ii) income stagnant or decreasing, (iii) house prices going up because of banks holding inventory enabled by QE3 to infinity and low interest rates. Hedge funds and others with some income can leverage on cheap money and buy an inflating housing inventory. Seems like a nice wealth transfer from working and poor folks to the rich. Nice trickle up economics of the past 30+ years in continuing.

Seems to be like Bain Capital on steroids style leveraged buyout of the entire US

housing inventory.

So what is new lately? Doesn’t seem like much!

Too bad more Americans are not “Curious Cats” maybe we wouldn’t have allowed the wolves to guard the hen house. Great comment.

Here is some perspective for you. These numbers are from Martin Armstrong’s book “The greatest bull market”. The numbers for 2012 are from google search of internet.

GNP DOW index Gold CPI M1 public debt

1929 103 (b) 340 20 51 26 (b) 16.9 (b)

1985 1.67 (T) 1500 327 322.8 596 (b) 1.8 (T)

2012 ~16 (T) 13500 1770 690 2.3 (T) 16 (T)

You can draw all kinds of conclusions from these numbers. But one thing is clear that the US dollar is losing purchasing power.

Exactly. (And well said.)

The only missing item in your inventory of abuses is that the “money shortage” also impacts the public realm. So Sacramento proposes to sell $500 million in parking revenue for $250 million so it can fund a (private) stadium. Chicago “leases” its parking to Bear Stearns for 1/10th the expected revenue to deal with current budget shortfalls, and German banks propose that the Greeks mortgage the Parthenon and their Ports.

The idea is to transform society into a series of tollbooths. No more free college education, we’ll privatize the schools!

Ultimately, the rentiers sit ’round the pool clipping coupons and looking at their toll receipts while the rest of society is transformed into debt peonage. (says economist Michael Hudson)

It’s my very humble opinion that rents are up due to everyone being foreclosed on and not being able to buy another home immediately. As soon as their 3 years are up to qualify for another FHA or thereafter, I think rents will start going back down. Otherwise it makes no sense.

During 2002 to 2008 La and Orange did have a lot of native born leave to other locations, La and Orange for the past 20 years have received more foreign born than native born and during that period more native born left than came in since they are an expensive market. Oc lost about 200,000 of the white population which is more native born. Inland Ca does better in keeping better since its cheaper but now more so without jobs. I know someone in Arizona seeing the Ca plates more often again. The recession caused more peoplr to stay put than before.

La had been for the past 20 years a place of extremes in income as mention above immigration is a factor and there are some poor whites.

Just bought a house in Antioch, CA (Bay Area). Previous owners paid $668,000 and I picked it up for $255,000. As it was a short sale, it took over 7 months for the transaction to complete, and am told I could turn around and sell for over 300K already. Crazy. I doubt you could actually build the house for what I paid as it is 2800 square feet, 5 beds, 3 bathrooms, a pool, and over 7600 square foot lot. I wish I could have bought something in LA, but I am not willing to pay $500K for an 800 square foot condo.

Congratulations! I’m not familiar w/ Antioch but I see it’s near Walnut Creek – which is $$ and near SF. So why are Antioch prices so low?

Antioch is about 30 minutes from Walnut Creek. It’s not considered a very good area and most have to commute a fair distance to work. Although it does have a BART station in the general area these days. Just a year ago, the average price for a decent 3/2 (1500 sq ft) was about $160K-$180K. Not sure what they’re going for now.

Because it’s the hood…

The BART station is in Pittsburg, which isn’t far from Antioch, but during rush hour, Hwy 4 is the only way to get there and it gets pretty backed up.

Hello Doctor Housing Recovery,

Great analysis but I think you missed the point on this one. Let’s assume for a household that income = spending – debt. It is my understanding that personal debt has been on the decline since 2009. It is also my understanding that incomes have been flat at best over the past decade. You state that necessities like food and fuel have gone up. Your analysis also shows that the cost of housing (renting\buying) has risen during 2012. I would guess that we would see less spending on other items (i.e. crowding out). This would most likely have a negative effect on economic activity. We know that the Bernanke is concerned given the new and improved QE. Are we to believe that we are in any real recovery at this point? I know the Fed is signaling that we are not.

Punish the prudent, As retired people and prudent savers we must bare the burden of a government run a muck. Not only can’t we purchase houses at a good reasonable price due to competition fostered by unreasonably low interest rates and the holding of inventory. We can find no safe investment vehicle that pays anything at all.

Not to be snyde but if you’re in retirement, don’t you think buying a home is something that should’ve been done a long time ago? If so prudent, why didn’t you?

It is snide. Not every persons life path follows the same exact pattern. Different circumstances for different individuals. One commenter here in the past has suggested that one life strategy that would work well would be to rent through peak earning years, investing money rather than paying 100s of thousands in interest and then buying a home for cash at retirement. Life also happens and people have to sell and move and buy another house.

I would like to know what the hypothetical low market might be like. For instance if owning really became cheaper then renting wouldn’t people just frenzy again driving the whole thing back up? Hasn’t LA county typically had a boom/bust economy? Here’s my prediction: the minute everyone who “lost” a house to f

Looks to me that at least half the families in LA County are incapable of running a leveraged buyout fund. This is a very serious problem. How are we, as a country, going to create wealth if more than half the population does not have a Harvard MBA? Sorry Ben, but all the quantitative easing in the world will not change the skill sets of these families. We are doomed.

Oops…on my phone, apologies…the minute the folks who lost their homes to forclosures, (but gained however many rent/mortgage free months) are able to get another loan, they will buy again. It seems if the Fed has created a safety net for bank lending then this could happen. How many years have to pass before I prior forclosure doesn’t wreck your chances of approval. I found the process frustrating and my family was squeaky clean with 10% doWn. Can’t imagine what it’s like for anyone with blemishes.

From my personal experience, those who have foreclosed can buy a home again in 3 years (FHA guideline) as long as they don’t have any late payments after foreclosing. More often, I’ve seen these deadbeats stashing enough $$ from not having to pay any mortgage over 3-4 years to buy a house using conventional loan and pretty much air tight approval because of the large down payment. Other times I see them buying inexpensive homes outright in cash. So the savers who’ve saved a measly 10-20% cannot compete.

I’ve seen a couple of people buy homes in the last few months because their rents were more than the PITI on a house they could and want to buy.

That’s a pretty strong incentive to anyone sitting on the fence about buying. Then add that they’re paying 3.7% on a 30 year fixed and it’s almost a slam dunk.

I’ve now heard that with QE3, mortgage interest rates may go even lower…..

That’s what I’m in the process of doing. It will be cheaper to buy a 3 bedroom/2 bathroom/2 garage SFR in a very nice beach city than it is to rent a 1 bedroom apartment in the same area. Before anybody starts screaming, how is that possible? I am bringing a very large down payment into the game and am taking a 3.5% 417K 30 yr loan. I see putting my money into a house as a better play than anything else at this time. Are you going to go all in the stock market, gold, AAPL? Not to mention my quality of life will be much better than sharing walls with idiot neighbors in my apartment. Simply put, the Fed forced my hand into buying. I could keep renting, but for my situation it made more sense to buy. And from what we have seen, the Fed and PTB will treat “owners” much better than renters.

In 2009, the 40 unit complex I live had 20% vacancy. The last year and a half there has been no vacancies, so the landlords have the upper hand. And rent has been going up like clockwork. Add into the mix the ultra low inventory, super low rates, many people upsidedown in their house unable to sell, squatters being able to stay free for years and the high desirability of the beach cities…this will lead to higher rents in the short term.

You should have told the landlord I won’t agree to an increase. I used to do that, worked every time. I paid my rent on time every month, so they agreed not to increase my rent. How many of those people in the compex are not paying at all? Probably, around 10%. Asking not for a rent increase works because they like to keep their paying renters.

You have to remember that the FED has a “rent to own” scheme brewing. After the election they will sell the shadow inventory to the 1%ers who will rent it to the 99% with a carrot that in a decade or so they can convert the rent into equity.

THE FED WILL NOT UNDER ANY CIRCUMSTANCE ALLOW PRICE DISCOVERY ON HOUSING.

The trickle down theory is literal when it comes to housing. It will drip drip forever.

I just bought a flip in the IE. Appraisal came in below my offer, 95 LTV and no PMI.

I will be paying PITI below my rent now for 3x the house. I will hunker down and wait it out for the time being. Room enough for the entire immediate family if the SHTF. If the FED keeps all the plates spinning then I can rent it out at break even or better later on if I have to move.

The 1% writes the rules, play them accordingly.

EXACTLY: “the 1% writes the rules, play them accordingly”

As difficult as it is I think for people to detach and filter information about the unfolding economic horizon with that statement, it is the absolute truth.

Any of us “benefitting” from their self enriching economic “long con”, is purely a side effect and just table scraps… my grandmother, luckily, sold at the TOP of the market back in 2007… so happy for her, but TOTAL blind luck. It had everything to do with health issues and nothing to do with economic forecasts.

And speaking of the grand / elderly generation, it’s beyond disgusting they’ve wiped out savings accounts % rates, and short/long term CD rates — the truly ONLY financial choice many elderly had to hold onto their money value in lieu of inflation… disgusting! But there’s no outrage, because the media by their silence has told us “this” aspect of the financial hardship is a non-story…

Remember, it’s all about “fleecing” us every 10 years or so… the ‘trickle up economics we’ve experienced for 30 years” as someone on here stated… again, so true!

The FED announced the $40 billion MBS purchases monthly now, the QE3 the media kept saying “might” not come… but we knew it had to — so this completes the circle… closes the loop… banks writing loans, offloading the MBS to Fannie, FED purchases from Fannie or others, and round and round we go.

The FED creating more and more digital money to do all this surely is going to push the dollar down down down – intentional debasing our currency…. which they want, we’ll all be eventually paying for everything digitally in their economic system… the result is, yes, us normal savers are punished — actually there is no ‘savings’ process anymore with our currency, it’s impossible, inflation and rising food/energy prices… so standard of living continues to move down. But ultimately, look at the FED balance sheet as it grows and grows — they are now the owners of “REAL ASSETS” … and then remember the FED is just made up of private member banks…so it’s their own creation that allows them to rig the economy as they have.

But even all of the above is just very small ‘details’ of a bigger picture.. it’s all about lowering standard of living, and going more ‘feudal’ with regards to assets and property for us serfs… We see it everyday in article on Yahoo even! “The richer are getting richer”

Along with companies paying jaw dropping compensation to their top brass who oversee and continue the “long con”…

And the media message is that we’re to keep asking these sample people, “okay, what do we do next ? more FED power ? okay… bail out the banks again, this time guaranteeing purchases of their time bomb MBS’s, okay… what else? ”

We’re so far into this con we have no idea where we are… and who to trust. The media just spins us back to FED and financial industry talking points… staying on message, and on plan.

We all probably agree, but seriously, this ‘usury in the 21st century’ thing has got to be changed. The forefathers broke up the banks for a reason, because they saw this type of activity happening even back then, be it on a much smaller scale… but these institutions as we know them – Chase, BofA, Citi, even VISA, Mastercard — that’s the real reckoning we need — all these ‘housing problems’ are just the symptoms of the disease we’re saddled with from this financial jackals…

Realizing the above is the idealistic rant portion, but it may help explain to those here who continue to ask – “why aren’t prices falling ?” “and here, look at this graph and that, the market makes no sense!”, “we’ve saved all our cash for years, but I’m still unable to benefit from my diligent financial habits and patience” SIGH….

We’re not in the “big club” that Mr. Carlin used to talk about, that’s why.

It’s wild to fathom that the 1% are still chomping away and want more and more… but they do… and again, like Mr. Carlin said, they WILL get it all. The game is set up and designed to keep playing until they have it all…

If the past 10 years has been a barometer on the ‘average intelligence & understanding of Joe Public” … we’re TOTALLY screwed in terms of who wins this economic fight.

Ha, they’ve convinced people to BLAME the masses (ie: ourselves!) that it was US who caused the problem… oh you know, people signing loan docs, lying about incomes…. HA! check your big bank balance sheets now… This is the long con… I only can fathom the X factor the media plays in keeping everyone nodding along to all this.. it’s ludicrous….

The immense greed that’s the elephant in the room, and how it is literally built into the system is beyond calculating…

Surely we all can see this system is created, run, and continues to bend to the needs of the private banking cartels and financial industry offshoots… we expect this pendulum to swing back our way? Really ? mental check people…

So run with the “1% make the playbook/rules, so where’s my cheese for me in this maze” – and you’ll navigate better than the others.. even though Yahoo front page says the housing market has recovered because of X or Y graph…

Enjoyable post. The 1% say they hate the French, but they should remember where their beloved form of capitalism (Laissez-faire = completely free markets) was born:

According to historical legend, the phrase stems from a meeting in about 1680 between the powerful French finance minister Jean-Baptiste Colbert and a group of French businessmen led by a certain M. Le Gendre. When the eager mercantilist minister asked how the French state could be of service to the merchants and help promote their commerce, Le Gendre replied simply “Laissez-nous faire” (“Leave us be”, lit. “Let us do”

Great posts and a big thanks to Dr. HB for continuing to provide us with great data and insight.

If you can’t beat ’em – join ’em. One of the best risk/rewards investments I am currently making is lending “hard money” (ie. short-term loans) to house flippers for 6-12 months. You can get 3 points upfront + 12% quite easily. 1 turn per year gets you 15% – 2 turns gets you 18%. You can max out at 60-65% loan-to-value and have some great downside risk protection. That is how you keep up with true inflation of 11-12% right now and frankly that’s how you take advantage of “being the bank” in this new era.

Like in any part of the economic cycle, there is always a way to make money and stay ahead. Unfortunately the Fed is helping to “stabilize” housing prices (or at least kick the can down the road YET again) at everyone’s expense in terms of inflation so you have to protect yourself. If you have the means and you’re making 0-1% in a savings account then I would highly recommend looking at other options. It doesn’t have to be what I mentioned – there are PLENTY of other ways to take advantage of the current situation. I just feel bad for everyone who is clinging to the safety of their Savings account or Bonds at their ridiculous yields, as they have become victims of the Fed’s incessant money printing and are falling behind in real (ie. inflation-adjusted) terms every day.

The currency debasing is going to continue for YEARS so be sure to protect yourself. Don’t become a victim – do some research and you can profit from the current environment. I have absolutely nothing to pitch to anyone – just trying to open some eyes so others can see what’s out there. It’s just a question of getting out of the weeds of the media…

Good Luck To Everyone,

Investor J

http://www.meetup.com/investing-363/

http://www.meetup.com/FIBICashFlowInvestors/

Ahey – if there’s any consolation, severe economic inequality causes a market system to collapse. We’ll get there the hard way.

I know a lot of people who are split from their ex’s and have kids in the area. Many people want to leave but can’t because it means leaving their kids too. Single fathers shacking up together, or multi-family homes just to pay rent. They would leave to cheaper cities if they weren’t in the boat they are in. Bottom line though I guess is they are here, they have to pay for something, so their dime counts in the equation.

As far as looking for our next home, we are still stuck. Rents in 92377 are $1800+, there are no homes on the market, and yes asking prices are up slightly, around $10k per home.

How people can afford $1800 to $2500 per month on rent is beyond me, and we make about $100k household income. $4500 to $5000 take home to be exact, but after food and fuel and commuting and utilities, there is not enough to pay that kind of rent and still enjoy life. Keyword – enjoy life. Being house poor or even rent poor in SoCal is so not worth it…I’d rather shovel snow out east and at least be able to go out to eat a few times a month than be stuck in my CA home broke.

And people brag about CA? I don’t get it…

PapaToBe, if you can’t afford $2500 rent on $100k income, something is wrong with your finances. It’s not ideal, but you certainly should be able to afford it.

$100k in annual income is $4500 per month after taxes, benefits, and 401k.

$1000 rent

$500 utilities

$250 car payment

$225 cell phones

$500 fuel

$500 food

$400 credit card

The other $1100 goes to stuff that always comes up. Kids events, modest clothes, oil changes, family member birthdays, there is always something that needs to be done. So paying $2500 for rent is not possible, I’d rather be shot.

You must be putting too much into your 401k or someone is screwing you on your taxes. $4500 x 12 = 54,000$ . That means you’re paying ~1/2 your income on taxes and 401k. If you are really putting that much into your 401k (which I doubt you are), then that is bad decision making. You shouldn’t be stashing that much into retirement if you cannot afford to setup a foundation now. What happens when you get to retirement age and don’t have a nest? Prioritize , my friend – right now you have no excuses.

Btw, why don’t you just buy a house in Rancho Cucamonga already? Here’s a nice home only $325k and no melo roos. http://www.zillow.com/homedetails/7598-Windsong-Pl-Rancho-Cucamonga-CA-91730/17601761_zpid/

Mortage ~$1200 + ~$325 property tax + ~50 insurance = $1600 month. You surely can afford that. I see you always on here complaining I don’t see why you just buy already.

You’re assuming $70k down. I have $20k. So with a smaller downpayment and the PMI they throw in, my PITI on that home would be $2026 per month. I can’t swing that, we have kids, bills, and debt to pay. (The $20k down is a gift that is waiting for when we’re ready. I have no savings but do have a 401k.)

I used to make more so I leveraged myself on that assumption. Now I have to pay off the past, maintain the present, and save for the future. Very hard. But either way, I don’t care if we make $150k/yr, paying over $2000 a month for a home is LUDACRIS.

Funny, living elsewhere, there is always money to take a vacation, but living in SoCal you can not have a home and take vacations as the COL in SoCal is too high.

Pop, so you have nothing in savings. And the downpayment is going to be a gift. Don’t complain about not being able to buy until you get your financail house in order…it’s a mess right now.

I saw your monthly bills from above, you need to start cutting costs.

Seriously, if you think $2k per month is too much for a home, I don’t think anyone can help you. If I were you I’d just cash out my 401k, it should be at its peak right now and|or borrow against your 401k to pay off all of your debts. Lord knows the credit card interest rate compounded right now is far more than you’re ever going to make off that 401k. You are also able to use 401k proceeds (either borrow against it or pull it out) to use as the down payment for your house. I assume you have more than ~$70k in your 401k since you claim you pay half your yearly income on it and taxes. Seriously, if I were you I’d be thinking a lot less about retirement and a lot less about setting up a solid foundation first.

Far better that he puts the money into retirement than to sink a bunch of his retirement into a house. Do not pull money out of your 401k to put into a house. Also it’s far better that he focus on keeping his housing payment low. At $150k, sure we could afford $2,000 per month, but that $2,000 or less per month payment leaves a lot of flexibility in the budget. Of course I would also recommend getting rid of all other debt.

I too think something is seriously wrong with your finances. I have few friends who make arnd 100k and have savings more than 80-90k. And yes they do have kids and rent for 2000$ a month. You seriously need to cut down on your expenses. I see you pay a lot on taxes n dont know how much you contribute to 401k…

what the heck happened with this property that recently sold in Beverly Hills?

http://www.redfin.com/CA/Beverly-Hills/1750-N-Beverly-Dr-90210/home/6823479

Sold below 1996 prices???

Did it burn down and this was for land only? Or are prices actually falling in the mid-upper tier???

this was a short sale, went all cash but it was not a tear down, buyer’s just got a good deal. sold for $1,155,000 in 2004

it’s maybe worth $900-1,000,000 fixed up,

The biggest whiners on this board have either no cash (guess who) or they’re “cash and carry” (guess who).

Ironically, that’s because they are home ownership obsessed.

Very few places in desirable Southern California have equivalent rent:PITI. This will likely be the case for many, many years to come, as the FED has telegraphed with QEInfinity. So go with renting, ride the rigged stock market up, buy a second car and enjoy a drive up the coast. If that’s not for you, follow the advice of some prior posters and re-locate to Texas if cheap home-ownership is all that life is about. There’s plenty of land. Go for it!

“How I learned to love so cal and forget the housing bubble”

Just a question or two…..I have a condo I own outright in Pasadena, 91101 zip, estimate 630K. I am thinking about selling and buying a house in San Marino, Sou. Pasa, or La Canada for 1.2 M……i have 500K in cash.

Should I buy or sell first?

There are so few houses in San Marino available…with game theory being used for pricing…where would live if you have a four year old?

Ryszard

If you have a contingecy that you need to sell to buy a home, you’ll be at the bottom of the offers. Not many buyers have that contigency right now. We are closing Monday in Ventura, and after 7 deals, not one buyer had to sell.

Regarding your 4 yr old, I would use the online school rating websites, but factor in also the libraries, clubs, and like minded area. San Mario doesn’t seem kid friendly. Just my 2 cents and opinion.

If I was a kid (or not) I’d much rather live in San Marino in a house than in a condo in 91101 Pasadena. I’d hazard the schools are much better in San Marino as well – until the kid is ready for Cal Tech that is.

I’d go with San Marino or La Cañada for the public schools, though both areas are still inflated for that very reason…and $1,000,000 will only buy you a decent (not great) place. We’ve got a five year old, so I’m making some of the same calculations. There are areas where you can buy lovely craftsman homes for much less in Pasadena, but you would want to fork out for private school. If I were you, I’d go with LC or SM.

I think LC or SM schools are excellent too. I went to private schools all my life. Just seems that there is always a price war in SM and in LC / Flintridge the sewer is not connected or something like that. The challenge is when….as the prices going up so fast and there will then be upward pressure on prices because of the lower cost of money….QE3. Just do not want to be the village idiot. Personally, I secretly feel the game is rigged and the relative winner amongst the sea of losers is he who sells first.

oops, Ventura County. I would not live in Ventura. Not my “flavor”.

Ryszard,

Google API scores and then find a school or two in the area that you are thinking of moving to. It’s not the only indication of a good school but the schools with generally the higher scores are in more affluent areas.

I understand why rents are going up in places that are booming economically like Silicon Valley, but I don’t get why rents are up elsewhere, where income is down and employment levels aren’t improving much. I hear the argument that it’s because of all the previous owners who are now having to rent, but aren’t most of those homes that were previously owned now available to be rented out?

Word is that the majority of those homes are in a giant bank warehouse near Barstow CA.

How many properties were built per year during the housing boom (say 2000-2006)?

How many properties per year have been built since the crash was in full force (say 2008)?

One reason rents may be going up is the same reason housing prices are going up – lack of inventory.

It is all just a ploy by the Fed to reinflate the bubble. Desperate measures for desperate times. Eventually it all falls apart. The fundamentals are just plain horrible with income stagnation and inflation of evefrything else making consumers less able to buy homes. We are nowhere near the bottom. If the Govt takes away the crutches we will see how fast the market declines. Then, and only then, will we be able to recover.

http://www.westsideremeltdown.blogspot.com

A ploy that us working nonetheless… Prices are flat or higher than sept 2011 in most LA neigborhoods.

The median household income in Los Angeles was $46,148 in 2011, compared with The median household income in San Diego was $60,797compared with the national figure of $50,502. La is like a lot of large cities more rich and poor and the poor in the case of LA usually are immigrants that came here because they had relatives in the us or were legalized under Reagan and some other mini-legalization. San Diego is a lot less foreign born compared to La and has immigrants that are on average more job skilled.La even falls behind Anaheim and Santa Ana for median household income. Usually Santa Ana is around 50,000 and Anaheim at 56,000.

That’s ironic , considering S.D. is on the border

In L. A. county(e.g. Glendale) a large portion of people have income off the books and pay no income tax and also get government welfare benefits and buy homes. These are the same people who drive BMW’s and MB’s.

San Diego may be near the border but a lot of illegal immigrants moved up the coast to avoid being deported. Los Angeles County 48 percent Hispanic and San Diego County only 32 percent.

Leave a Reply