The return of the broke homeowner: Between 2006 and 2014 9.3 million homeowners were foreclosed on, received a DIL or short sold.

America is the land of second, third, and even fourth chances. The same applies to house lusting buyers. The National Associate of Realtors (NAR) had some interesting data regarding potential future home buyers.  Their analysis found that between 2006 and 2014 some 9.3 million homeowners were foreclosed on, received a deed-in-lieu of foreclosure or short sold. Bottom line, there were a boatload of people losing their homes when it was once thought to be the safest investment. We are a forward looking species and the NAR realizes that many of these foreclosure veterans are ready to get back on the home buying bandwagon once again. The problem of course is that most are buying inflated properties with massive mortgage leverage. Debt with low interest rates is the elixir of choice. So how big is this potential pipeline?

The broke homeowner makes a return

What is interesting about this housing recovery is that the NAR is actually lagging because of paltry sales volume. The NAR would like to see high levels of sales versus this low volume churn at higher prices. So I can understand when they run the numbers on the 9.3 million people that have scarred credit scores that somehow, they see an unlimited pool of potential “return buyers†as if this was as simple as someone getting divorced and re-married.

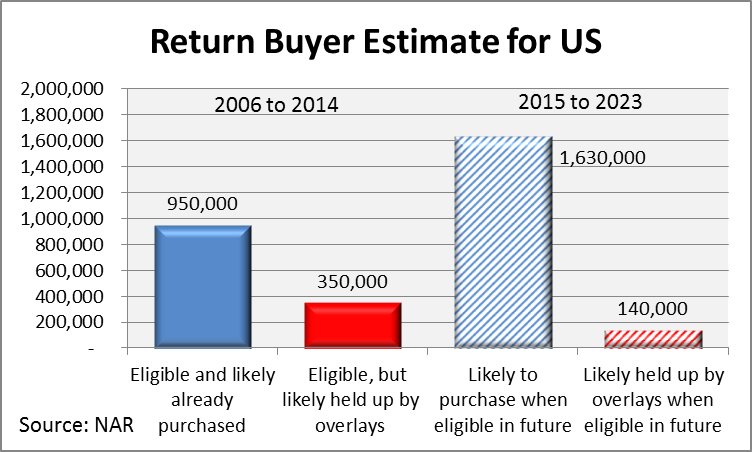

The NAR shows the following numbers:

This is an interesting proposition. I actually agree and feel many previous home buyers are itching to buy again. The question is, do they have the income to back up current home prices without toxic mortgages? So far, the answer is no. You have investors, wealthy foreigners, and high income households making up the bulk of purchases. Your typical family in high priced areas is being pushed out of the market. The numbers appear to show something like 1.6 million potential future buyers. That might seem like a big number but this is spread out over many years.

These numbers are pulled from looking at these overall timeframes:

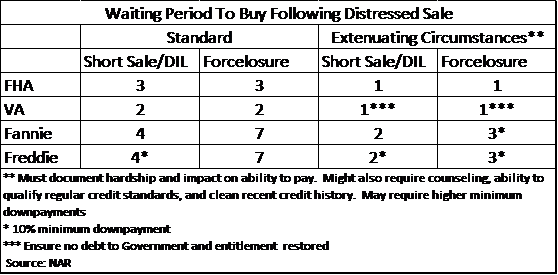

For a Fannie and Freddie backed mortgage, the waiting period is 7 years. For a FHA insured loan it is 3 years. For VA loans which make up a small portion of the pool, it is 2 years. The big pool is with Fannie Freddie, and FHA insured loans. 7 years ago was go time for the mortgage crisis. With all the home buying cheerleading and stock market joy ride, people have completely forgotten about the previous correction. The clock has now reset.

The one thing that I think will make the NAR numbers tougher to meet is the stagnant income growth. Keep in mind that most families that lost their homes via foreclosure were on vanilla 30 year fixed rate mortgages, not the toxic junk that imploded quickly. People defaulted because the income dried up. A minor recession is likely to bring this up again especially with many buying homes with pathetic down payments.

Canada is enjoying a housing bubble that puts us to shame. It seems like the psychology of home buying fever isn’t based on country alone:

“(GreaterFool) This useless social media campaign does underscore some valid points, however. First, the gap between The Few and The Most is yawning larger every day. Wealthy people in Canada (with over $2 million in investible assets, outside of real estate) make up about 1% of the population. They own stuff – businesses, financial assets and a relatively small amount of property. The rest of the people hold debt, with the bulk of their net worth in a house. It’s a self-inflicted penury.

Second, the bulk of the population is crippled by financial illiteracy (thus the fetish over real estate, “At least I can see itâ€) and riddled with mistrust. Read the comment section of this pathetic blog for a few days (have a few scotches first) and see what I mean. People don’t trust banks, realtors, CEOs, immigrants with nice cars, stock markets, central banks, politicians or financial advisors.â€

I think the financial literacy point is critical here. I have heard many people say that the stock market is “complicated†or “too hard to understand†yet dive into a $700,000 crap shack with a tiny down payment. Even the infomercials are on auto-repeat on the weekends showing “average†people making tons of money in the real estate game. “Hey, I know where Home Depot is and I can paint a wall and clean a toilet. Where do I get my $50,000 net profit from flipping for a weekend of work?â€Â In high priced areas you have older home owners carrying the vast majority of their net worth in their home and now have adult children moving back home. If you are reaching retirement age, you still need income to come from somewhere. The good news is that you can sell to these former recovering foreclosure cases and get that juicy equity out.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

80 Responses to “The return of the broke homeowner: Between 2006 and 2014 9.3 million homeowners were foreclosed on, received a DIL or short sold.”

So, What? Those rich Chinese with suit cases full of cash will never run out of money.

Wheels on the bus go round and round… round and round…

Their bubble dwarfs ours. Think entire cities, devoid of people, built just to prop up economic numbers …

Our entire neighborhood is mostly Asians now. We used to have 35%, something, Asians in the school and 55% whites, not it is 45% and 45%… It is just last 3-5 years… As long as China keeps selling us their crap and Americans keep buying made in China, will will never run out of Chinese cash…

“So, What? Those rich Chinese with suit cases full of cash will never run out of money.”

HAHA…a couple of years ago that sentence would have been chum for the “golden suitcase-carrying Chinese” shark geniuses on this board.

Now, it’s just an unquestioned lament.

Those same Chinese were around from 2008 to 2012 with those same suitcases of cash and prices were lower and trending down. We’re in another FED fueled speculative bubble. Nothing more, nothing less. The Chicoms didn’t put a floor under prices, the FED did. But the elevation they pulled off since 2012 is as unsustainable as Bubble 1, if not more so.

Well OK, it does work – but see the big caveat. You need enough equity, predicable cash flow, a good loan and lots of time. And oh, the return is unlikely to be as good as a well placed stock portfolio. In exchange you get a place to live, a home interest deduction and an average of 3% growth over the long haul – the forced savings.

Average houses in So Cal in the ’70’s were easily under $100,000, in the ’80’s under $200,000 and in the ’90’s under $300,000. I have the HUD documents for you doubting Thomases. I sure wish I still had them. Then I could trade “place to live” for a great source of income as a landlord worrying about dishwashers and toilets.

Pay attention to the price curve. Few of us are geniuses – I’m sure not. It’s too easy to buy high when everyone is excited. My uneducated guess is that we are halfway from the bottom and halfway to the top. Not great, not terrible.

It would be awesome if we were only at the 1/2 way point for me. Though I’m at the point in my mortgage where I’m paying more principal than interest, if the value ever hit the point where I would have 200k in equity (i.e. where the last peak hit for my price range and neighborhood) I would cash out and move to VA. I probably only have 120k in equity presently.

Haven’t you heard, prices are going to tank hard in 2014!?!

C’mon, give Jim Tank a break. He admitted he was wrong. I still hold to housing to tank in 2016, but it seems like I may postpone my prediction to 2017 since the rate hike are pretty much off the table now.

/i got those damn crystal balls, you know…

Time for everybody here to re-read an old classic (Or read for the first time, if you’ve never heard of it.) :

Extraordinary Popular Delusions and the Madness of Crowds

http://en.wikipedia.org/wiki/Extraordinary_Popular_Delusions_and_the_Madness_of_Crowds

PDF here:

http://www.cmi-gold-silver.com/pdf/mackaych2451824518-8.pdf

Call it a refresher course in human psychology.

Tulips anybody?

Just a thought.

VicB3

P.S. Oh, and don’t forget the French Revolution:

Causes of the French Revolution

http://en.wikipedia.org/wiki/Causes_of_the_French_Revolution#Economics_and_finances

(Yeah, it’s Wikipedia. Don’t start.)

Oh sure, would you expect an organization who’s pay relies upon increasing home sales to present a less than positive picture?

The FHA makes it easy for the previously-foreclosed-upon buyers to get back in the game. All you need is 3.5% down. Closing costs can be rolled into the loan, and PMI was recently slashed to around 0.85%. I’ve been told by an acquaintance who is a mortgage broker that the ‘trick’ he and others are currently doing is giving back a portion of the sales commissions (both the agent commission and mortgage commissions) to the new buyer to use as their down payment, effectively resulting in a loan with 0 down.

You misinterpreted what he said, SB Pirate. FHA requires a minimum contribution of 3.5% from the buyer (either direct from the buyer or a gift from a donor). What the mortgage broker was probably saying is that he can use proceeds from the lender towards the borrower’s 1.75% up front mortgage insurance which is normally added to the borrower’s loan amount. Doing it this way effectively makes the FHA loan much closer to a conventional loan since conventional has no up front MI premium and conventional monthly MI is not much lower than the recently reduced FHA monthly MI. Although the mortgage broker loses money by crediting this much back towards the borrower’s up front MI premium, he can still charge origination and recoup that via seller paid CC’s and the borrower ends up with 1.75% more equity.

“I’ve been told by an acquaintance who is a mortgage broker that the ‘trick’ he and others are currently doing is giving back a portion of the sales commissions (both the agent commission and mortgage commissions) to the new buyer to use as their down payment, effectively resulting in a loan with 0 down.”

SBP, does the money come back to the buyer after closing as part of a separate agreement or is it written into the purchase contract?

I am not sure how that FHA scam works in SoCal, but here, in Seattle, unless you got a suitcase of cash, good luck getting your offer accepted.

Great perspective, as usual. Thanks for this.

I am starting to wonder how many people around my age (30) are moving back in with their retired or semi-retired parents. My husband and I are moving in with my folks to save money; they live part-time in another state, so it is mutually beneficial: We pay them in cash to rent their home (much less than market price), giving them a little extra income when they go out of town for a few months out of the year. It’s not perfect, but with a little flexibility, we’re hoping it’ll be a good temporary solution.

At first, we were a little worried about what our friends/peers would think. But it turns out many of them are doing the same thing in order to save a few bucks. Some of them even have kids of their own. It’s difficult to build a nest egg when you’re paying a lot of money to rent a basic apartment.

We feel really fortunate/blessed to have the option of living with family.

don’t be concerned about what other people think of you. you do what’s best for you and your family

Well said. Just don’t begin to think your parents’ house is yours and create a deadline for your next move.

Where’s the inventory? I’m seeing houses that were listed last year — didn’t sell — were rented — and are up for sale again —

http://www.zillow.com/homedetails/2361-W-29th-Pl-Los-Angeles-CA-90018/20591001_zpid/

Interesting history on that house.

Sold for $179K in March 2012

Sold for $289K in December 2012

(listed then removed) Now listed for $419K

Like many houses in the 90019 and 90016 zip codes – it appears to be a chain of flips, starting with a back-room bank deal to some lucky investor for $179K.

Only problem is that it is in Jefferson Park.

http://maps.latimes.com/neighborhoods/neighborhood/jefferson-park/crime/

nevertheless, I think we underestimate how many people are willing to live in such a neighborhood to be ‘homeowners’.

I was tempted a couple of times to buy there — and it is coming up — but couldn’t get over the fact that there are still a lot of hungry desperate people there. And there is only one Safeway/Ralphs there. I don’t know — one has to drive through a lot of badness to get to the slightly gentrified areas. To be fair I know a woman who lives there and likes it. However, she bought there years ago — not when their asking 400K-700K — or about $500 a sq.ft.

II would have to say the area is still very ghetto. Lots of problems with vandalism, vagrants, crime, drugs, etc. Typically low-income kind of problems. I say give the neighborhood at least another 20 years.

Hunan,

Agreed with your 20yr assessment, but would add Highland Park and MANY other areas people are referring to as “hot” at the moment. All it’ll take is another black man shot egregiously by a white officer and some of these hoods will show their true colors.

Lots of foreclosures in that area. $400-$500K to live in that area is too much IMO. If you look at the Zillow area map you can see price reductions and pending foreclosures sometimes 2-3 per block. A lot of pricing weakness in that area and homes seem to have wild price variations based on nothing. A nicer large house can sell for $400K while a 2 bed is listed for $500K and not renovated either. Sellers are trying to cover their HELOCs and have some walking away money is my guess.

It’s no secret. When all those baddies fall off credit reports after 7 years, it’s time to jump back in and say “Goodbye” to the landlord. However, with the prices where they are now, it’s probably a good time to cash out and go off the grid for good. I’ve been stung and now I’m mere months away from a spotless credit report. But FICO scores are dropping and there’s no justification. With rate hikes on the way, I don’t see a need to rush in like a fool. Cash out. Take a seat. Grab some popcorn. I was going to jump in, but the water is cold. What chills the pool is the outrageous property tax. It doesn’t matter where you are, how much you make, or if you bought without a mortgage. The current tax bills on real estate are as much a part of the bubble. With an increasing portion of outstanding student debt (which will never fall off a bad credit report), lost wage growth, and increased cost of living (mandatory health insurance), it’s going to get a lot harder to stay above the water mark long term. Rent is the only way to achieve preservation of capital and avoidance of any property tax liability. Going forward, I look forward to rate hikes, and I am so looking forward to the liquidations.

in2dwww,

The renter always pays the property taxes through rent. A landlord who is not including the prop. tax in the rent is a dumb landlord and he deserves to go bankrupt.

Didn’t you figure yet? The fed will not raise rates in the next 5 – 10 years, unless you believe they will let the whole eCONomy tank… The .gov and the wall street addicts cannot tolerate anything above 0%. I see negative rates in the future.

Have you noticed all the other ways cities use to gain revenue? Property prices are at an all time high and recent buyers are paying through the nose. Taxes on everything at the local level, fees for things that used to be free. Layoff in 2008 haven’t been reversed yet cities are still broke and saying they need more $$$. Where’s it all going?

The town my parents live in recently paid $14 million to have a pedestrian area reverted back to a street for cars because local businesses were complaining that a walkable area was responsible for a decline in business. Never mind that it’s an area with poor people and retirees mostly. They stupid city council paid, but business on that street still sucks. Geniuses.

The current Chinese stock market rally is creating more an more Chinese Billionaires and millionaires.

China area now has over 500+ Billionaire or Billionaire families. That means there are 100x more millionaires. I am thinking coastal California will be prime real estate for this demographics?

Their stock market is a canary in the coal mine. They’re doing everything to prevent a hard landing. They talk a good game about rebalancing but then go and cut the reserve ratio 2% in just 4 months. Central planning never works – it just allocates resources inefficiently.

A lot of the rich people are the ones who scammed and stole their money from regular working folks. I know plenty of well-off, honest business people in China – they cannot even afford a home in their own country. These houses being sold here in CA are money-laundering tools. That kind of stuff never lasts.

tolucatom, I’m seeing the same thing. Are these sellers testing the market or pricing their properties too high? I also see properties with for sale signs that stay on the market for months.

Amanda Pays – Corbin LA Law actor guy bought a house in the neighborhood where I rent for 877K and tried to flip it at 1,5MM. 2 open houses — no traffic — and now 3 weeks later a price reduction. Even people with money to burn aren’t crazy stupid.

http://www.zillow.com/homedetails/4443-Strohm-Ave-Toluca-Lake-CA-91602/20044020_zpid/

Unless NINJA loans comeback it doesn’t matter. Inventory has been and will increase. The specuvestors are G O N E. They won’t return until the start of the next cycle. So you’re left with people squeezing into homes with the minimum down which leaves a high payment because of the PMI. Incomes never stopped mattering. Much like the stock market, connected RE investors and their sycophants have lived their champagne wishes and caviar dreams through the disgusting upward redistribution system of the FED. The end game was always foreseeable. Jim Taylor was right about 2015, it was the taking in already miniscule sales which led to prove reductions that signaled the end of the cycle. Now we get to watch the reversion. Maybe a frustratingly slow reversion over the next 3 or 4 years, but a reversion none the less. There is no more money to be made by the specuvestors in this faux market. Prices will be set by “retail” demand for housing. One look at the shitstorm that is our economy should give bulls pause.

What is the Fed monetizes the excess inventory? Anything is possible in the world of unicorn farts and rainbows…

Just had a call about a job yesterday with a company looking to disrupt the real estate agent system, https://www.rexchange.com/ cut out the 6% hustle.

That’s certainly long overdue, and these guys look to have the backing to pull it off. Will be interesting to see what happens when they go out of stealth mode.

Tripper…The real estate brokerage house is going away very fast, the need for a 6% agent that puts up a sign and waits for a real pro to sell it and collect a easy 3%, needs to be gone today.

Sellers can enjoy a better listing price, and buyers can actually say to themselves “I bought it without the smoke and mirrors of the lazy buyers agents.”

Hope more companies come into play nationwide!

robert, did you fall and hit your head? You don’t seem like the same poster at all. I never thought I would say this, but I completely agree with you.

It’s obvious there’s a market for brokers who work for 1 or 2%, and given high house prices in Cali, it’s also obvious that brokers who work that way can make a very good living. I met one who does, and who sold our house – for 2%, not 6%. He did everything the 6% agents do other than photos, and I supplied the photos of the house, that I had a pro shoot for me. He handled the client visits to our house, did a super write up in the MLS, etc.

But that Rexchange.com website was the most vague piece of fluff I’ve seen in a long time.

Not one bit of info on it about when and how much buyers or sellers must pay for that site’s service, just glittering generalities. Sigh. Some company really needs to organize this on a large scale. That company doesn’t look like it will.

I realize this post is more than a year old but I just ran across it. I’m sorry to hear that the site was vague. The website and maturity of our offering have changed in the past year. I hope you’ll come back and see what we have been doing. We have expanded all over So. California. We moved our intro rate to 2% all-in and have been getting great reaction from the market. For 2% we handle both sides of the transaction providing all of the same services as a traditional agent- except we don’t list on the MLS. If you have any questions please send them through the website or Facebook. All the best, Suzanne from REX Real Estate Exchange

As a bull from the past on housing, I can now safely say I don’t see anything that now encourages me to profess that belief (plain English I was wrong). No question that either a change occurs that favors the buyer in obtaining a loan with relaxed standards or inventory and eventually a collapse in the market.

Demand is a code word that the association of realtors love to use. Realtors believe you will stop at the word “demand” and read no further. Folks there is very little demand unless you take a loss or maybe break even on your home.

The treat of interest rate hikes is virtually a none issue with buyers. The only thing that matters is you as a seller come to terms with large price reduction or if you can afford to, take the house off the market.

We are now getting the picture that spring 2015 will be known as better stats as to sales, but the real tale of the tape, most didn’t recover from being under water just took a smaller loss but lost on the sale never the less.

This is like the guy who tells you he grosses a bundle, but after close examination of expenses and taxes, they lost the company?

robert,

im really shocked to see you say this. What happened to have you change your mind like this? Ive actually been more of a bear and Im actually turning more bullish on housing… although by me being more bullish, its all relative.

Hello…Don’t be shocked, I really do study these trends and wayward movements four months at a time. That is why at this early morning I’m looking at data from every region, move patterns local and regional, moving companies who is doing good, long distance and local. Furniture stores, local and national chain home improvement stores, home goods, appliance etc.

I do go to many locations open houses, new homes, business to see traffic and talk with workers. Denver for example, a total complete market of upbeat sales retail and housing new and resale hot as a firecracker ( for now)? Long run, always scared about Denver, it is always been as fickle as the weather as to investing and home buying.

Four month trend , I posted back in Oct local blog that Denver will be hot till about July (not weather wise) but the above, then see its all to familiar swan drive. Why, to many folks are set in their ways there, a very cautious group of I’m happy with my home and don’t care about profits. Inventory will rise of course right now you can find very little, Ca. or Denver please (?) Denver will never be in that class of frenzy, crazy , in Ca. you buy right will still become very wealthy, very quickly but you have to have bucks to play in that world now.

Don’t ever look at a city or region and think that is the trend in the USA, RE is controlled and very local, even one block can get hot the other block agents don’t show drive right by, buyers contrary to thought, many not to savvy or computer literate, they take what agents tell them as gospel in most cities in America especially bread basket , still happens everyday.

Ca. buyers are different, very sharp, very computer minded, CA, is the ultimate big leagues of Transit buying and selling. I continue to see a state that is becoming more lost in direction every which way. To much of anything gets out of control very fast, like a good meal you can only eat so much no matter how rich you are, and throw away the rest. Why not order smaller portion and not have waste, that is CA.

Real Estate in the Golden state yes always some opportunity by the shear size, but for the masses it has and will be a out of controlled society of mostly unhappy people who just want a nice house, at a fair price , plenty of land still but no banks want to make a deal with builders for good affordable housing. It would wreck the very few rich folks who have to have their land and location values stay high and give the people the smoke and mirrors their location is most desirable i.e. 1930’s and 40’s neighborhoods who houses need a complete gutting but want 1.5 million and up. it is CA you must pay it right? Just look at NY does anyone really think a apt there is worth 20 million dollars and up to have a view of what another old building?

I could go on but I hope hello you get the flavor I’m bullish I have to be, I’m the ultimate capitalist, this is a South West blog still nervous about Southern Nevada, like Northern part for now.

The moves of new AZ Gov. very promising, getting away from hate and bringing more high tech to Phoenix-SCOTTSDALE -Tempe look for slow but good future recovery there.

Texas is a worry sorry about that, I would not relocate there, pockets of okay but Austin has had its day and Houston always a worry. Dallas, more diverse but never my cup of tea outsiders still not welcomed. SA wants to play in the big leagues like a never will, be careful. Rest of the state forget it.

New Mexico, it is land of enchantment no question, tons of land no takers ever. It is a GOV. Gitmo, unspoken who really knows anything about it place, does it really belong to the union of states? the press never gets it any play. The young would flock there, another CA gold rush of good solid four season climates and great desert climate to the South. it is a enigma, could be a 21st century boom location but might as well be as far away as the sun.

Utah, well lets say if Texas folks are a little unhappy about outsiders then Utah is even more unhappy. Nice scenery but not progressive by any means, I would not move there for any reason and not upbeat about making any real money there.

Some Northwest people post here, not a fan of moving to Oregon, you must adapt to that mentality very tough very different forget it for most CA. folks.

Idaho, NO don’t think for the vast majority it could ever work out.

Seattle, don’t like the town, State of Wash. pockets of nice living Eastern part but again overall I still think Californians as a whole will not like the Northwest for year round living and the folks in the Northwest don’t want you anyhow for the most part.

In conclusion I see a better business climate in the US for late 2016 and beyond. Housing overall in the US will improve, but again regions will dictate, and this is a CA blog, I see many, many issues still unresolved as anyone can clearly see, you don’t have to be a late night investor to know a state with upwards of 40 million will leave a lot of folks behind and wishing it were different they really do love the state.

It is just the state, banks, and its partisan’s never understood the relationship of its citizens they want to stay but they are forcing them out. It could be different but the horse now has strayed to far from the barn. take care

Robert, regarding New Mexico, I’ve heard their drought problems are worse than even in California. And lots of poverty. One of our poorer states. Some rich people in Santa Fe and Taos, but also much poverty and property crime.

I’ve also heard that Salt Lake City prices are set to rise. Business and feds are relocating there. The NSA is building a huge complex outside of SLC.

more bullish, wow man, after nearly 7 years of bullish full retard in the realestate market its time to GET bullish, really! Fascinating! I know more than a few homeowners that are waiting to lick their chops with your life savings or even better 99.9% of your monthly earnings….good luck.

I live in Denver as well…a very fickle market, indeed, but all I hear about is how much DEMAND there is for housing here…so they build, build, build apartments — mostly luxury stuff — but who is going to rent it? Where is the affordable multi-family, the condos, the moderately priced homes in the suburbs? And by moderately priced, I mean under $300k? Most of what I am seeing in Arvada, WR, Lakewood, etc. is stuff over 400k.

imfromcolorado… Denver made me money because I watched the market there like a hawk. I mean you can’t lift your head because it changes faster then a 70 degree day that turns to snow by night.

Bought a condo in the Highlands I mean greatest view ever just below penthouses, got complacent and missed a opportunity in 2000 waited 6 long years and then sold it (small profit) during 6 week window.

2006 to now it finally made some decent money for the new owner after 15 years, two owners fair return on a very nice loft that in CA would have made me untold profits over 15 years.

Same with a house purchase in Jefferson County, waited 7 years and turned a excellent profit new owners now can make some money after 8 years but where do they go everything there is crazy at the moment.

Denver is a young persons town, renting, buying and selling, it is a place if you are young and get caught you can recover some place else, but if you invest there and about to retire, I don’t recommend CO.

Capitalism = A system of greed. It exists as long as greed exists.

A Chinese Arabic spring all because of a real estate bubble burst LOL. That’s what’ll get people going.. a real estate bubble pop hahahahahaahahhaa!!!!!!!

And 98% of art pieces are fake? The forgerer used the wrong titanium white LOL!!!!! 7 million down the drain on a fake art piece hahahaahaha!!!!

Look out below folks! Hold on to your wallets. A huge crash is coming. I haven’t laughed this hard in a long time.

https://www.youtube.com/watch?v=GaN5d1giF50

Just sad. If you say something enough times it still doesn’t make it true.

Time for a dose of reality. Sorry if this upsets all you haters.

The truth s that this spring is turning out to be the best RE season since 2013. Everything I read says that sales, inventory, prices, mortgage apps, etc are all up. Not just in CA, but all over the country. Not just on existing, but new homes as well.

http://www.latimes.com/business/la-fi-home-prices-20150416-story.html

http://www.bloomberg.com/news/articles/2015-04-22/sales-of-existing-u-s-homes-rise-to-highest-level-since-2013

http://blogs.wsj.com/economics/2015/04/22/if-resale-prices-for-homes-are-running-hot-new-home-prices-are-on-fire/

Let the hating begin……

Actually hunan only haters post links that seem to serve their purposes without giving proper perspective. Kind of like Fox News and MSNBC. Here’s a quote from the 1st link — “But whether strong price increases will continue is uncertain, economists said. If more owners don’t list their homes for sale soon, the gains could accelerate as more buyers fight over slim pickings. On the other hand, the median price — $425,000 in March — might not be able to climb much higher, constrained by lackluster wage growth, some economists said.”

See, good luck to those who buy over the 2007 bubble when there were gangs of people with loans ready to buy as opposed to now when you have a few homes and a few tech/studio types ready to buy. The bread and butter guys like me — single– 6 figures — cannot buy in a neighborhood I can rent in for about 1/2 what the mortgage would be. Also, in this thread I’ve posted 2 homes — 1 at 1.5MM and 1 at 400K that aren’t selling. If it was all so rosy why are more home owners jumping in? Why is inventory so low? Same crap as 2013. No houses again. My listing book for up to $550K is down to 6 pages and most in 90016.

From your 2nd link – ““Housing is recovering but home prices are rising too fast,†Lawrence Yun, NAR chief economist, said in a news conference as the figures were released. “The only way to relieve housing cost pressure is to have more supply coming onto the market.â€

If there were to be any hating it would be for you wasting my time with your slanted post.

@ TolucaTom. You mention 90016. I purchased a 1800 sqft home in Baldwin Vista for $470K in 2012. As a life long resident of the Westside, Baldwin Vista got me as close to the beach (and Westside) as I could get for under $500K and a reasonably nice area. And 15min drive (no traffic) to beach, downtown, hollywood). If you take the area from LaBrea to LaCienega, and South of Jefferson, that is a nice area. Even nicer are the homes in the Baldwin Hills Village Gardens Homes Assoc (very low crime). that area is South of Jefferson also but only between Carmona Ave and LaCienega. Baldwin Vista is the ‘flat’ region of Baldwin Hills and the homes are much less expensive than once you start up the hills, where the city views will tag another $200K to the home prices. Take a look at LA Times crime maps and if you seach on Baldwin Vista, you will see crime is nearly nonexistent compared to the rest of 90016. There are some nice homes in 90008 also, but mainly in the same region I describe – LaBrea to LaCienega, South of Jefferson.

Hunan,

I am not hating you or anyone else. However, all news agencies today posted that new home sales tanked. You can fight with them or tell them that they are haters. I am just telling you what they posted today.

@QE Abyss. Thank you.

@flyover. LA Times is a shill for the NAR. I posted an article from the LA Times about how great RE is and hurry now id the time to buy and someone at the LA Times photo shopped one of those standard stock For Sale” sign to read presented by “Shill. that was inserted in the article.

When the chief economist of the NAR says publically that prices are rising too fast — what does that tell potential buyers? Wait. And what happens when the word gets out? Prices come down. I’d say 90% of the stock market and RE is psychological. NAR saying prices rising too fast is a depressant.

Hunan,

This article contradicts your story:

http://globaleconomicanalysis.blogspot.ca/2015/04/new-home-sales-down-114-overall-158-in.html

Socialism is also a system of greed. The insiders who control the party/government expropriate wealth for themselves and their cronies.

Rent control is a system of greed. Greedy tenants use political force to expropriate apartments at below market rents, then rent them out on AirBnB at market rates. Out of generosity? No, but rather, out of greedy self-interest.

Everyone wants to pay as little as possible, and get as much as possible. The phenomenon is not unique to capitalism. If you want to see what greed looks like, go look in the mirror.

A+

Son of L.

A+ from me for your excellent reply.

Fool. True capitalism built America to its former greatness. What you think is capitalism today is far from it. We are drifting in some weird socialistic communist fascist abyss and our government loves the power they stole from us via taxation

Benghazi!!!!!!!!!!!!!!

California Is So Over

California has met the future, and it really doesnt work.

Some of those who might have worked in the factories, warehouses, and farms of California now help swell the numbers of the welfare recipients, who remarkably make up one-third of the nations total…

Of course, the rich and entitled, particularly in Silicon Valley have achieved unprecedented riches, but those middle-class Californians once served by Pat Brown have largely been abandoned by his son.

http://www.thedailybeast.com/articles/2015/04/19/big-idea-california-is-so-over.html

Doc: Debt with low interest rates is the elixir of choice. [..] The one thing that I think will make the NAR numbers tougher to meet is the stagnant income growth. [..] The question is, do they have the income to back up current home prices without toxic mortgages? So far, the answer is no.

__

Doc, take a look at this article, if you would please (below). Perhaps you will get something out of it… I find it of value, and you’re smarter than I am with housing/stats / math, to get more from it. More the UK/European position re the mortgage-calcs, but the math is universal language. How I would like a new crunch after the market has run out of buyers… housing market all fattened up.. all proceed-able buyers sucked in.

It is probably behind a paywall, but with free access from a web-search result: Affordability backwards | FT Alphaville

ftalphaville.ft.com › Comment › Blogs

19 Feb 2014 – You see, the logic of affordability has its roots in the 1970s, but it is the reverse effect of something most people will have to fish out of the …

Doug ..good article for sure, we talk about America and wonder about a Roman Empire scenario, just look to CA and that is a glimpse of a Empire that went so bad?

@son of a landlord

New Mexico is not in great shape, drought-wise, but is in infinitely better shape than California: http://droughtmonitor.unl.edu

I mention NM because it would give young people and lower to middle class a place to have hope. Poverty is high because no companies want to invest there. I see a great opportunity tons of Gov. land that could be freed up, excellent railroad access, nice overall climate North to South. I believe if they got the right mid to small companies with even one fortune 500 taking a jump into it would be a new start for people shut out of the same old establishment talk you must “live here mentality because there is no place else really?.

America has untold opportunities and I think NM would be a great start for the 21st century and get away from these decaying cities and narrow minded thinking. stay safe kingsnake and landlord

I love the desert climate and landscape, and in that regard, NM would be a dream for me. However, friends from NM have told me how violent and backwards most of NM is. It reminds me of parts of CA back in the 90’s with racist cops, gangbangers, Bible beaters, and bunches of roided up young men looking to fight anyone and anything. It was horrible growing up in CA during that time because of those types of attitudes. I would never want to deal with that as an adult.

I am one of the lucky few, after blowing a few years renting and saving, at 29 I bougt my first home, cash. My grandfather who grew up during the depression always told me to never owe anyone money, own your car, your house.. Everything. His family had the bank take their family’s home after the bank failed.

I say, sacrifice, work your ass off and save. Being a debtor is note wise

Howard,

The borrower is a slave to the lender – no question about it. I can not say that I was always debt free, but I am now. Big difference.

I don’t recomend anyone to be in debt, of any kind. I would probably make an exception when equity (not assessed value) is greater than debt, the debt is small and very short term (less than a year) and ONLY for income producing purposes. I should add ONLY very low interest (less than 4%) and no fees. That is the only way to build wealth over time and keep it regardless of the banksters manipulations.

Of course, many disagree only to realize later in life that I was right. I lerned this from others older and wiser than me who accumulated enourmous wealth over the years, the smart way.

“…never owe anyone money, own your car, your house.. Everything.”

As blanket advise, it’s not terrible, but obviously not always the best choice. For instance, if you can get a car loan at 1% but you can make 3% on your money elsewhere, then it would be wise to take the loan and invest your money at 3%. Generally, you just need to be smart about money. Some people are, some aren’t. For those that aren’t, “never owe anyone anything” might be good advice. Then again, you generally can’t fix stupid, so it’s probably a waste of time to dispense that advice anyway.

Unless you were a Harvard law grad in the top of your class, were a successful entrepreneur, have rich parents or lucked out financially in some other manner, buying a home in cash is probably infeasible in your 20’s unless it’s some shack for $75k. Getting a mortgage is also not bad, especially if you can buy for less that it costs you to rent.

Although I would have to say I’ve always been mature for my age and interested in money, unfortunately I traded a large part of my “youth” sacrificing to get to this point. The home I bought was 550k brand new construction in long beach, ca. I thought I got a great deal. At one point in 2007 the home appraised for 830k. I feel bad for people like me trying to afford a home, they are competing with fools who have unrealistic budgets because they are borrowing beyond a true home value, and with money the banks literally throw at them with reckless abandon. You cannot compete against a bank who gets theirs only for FREE from the fed. Wells Fargo convinced me at one point to take out a business loan for 25k to help build credit since I had no record of borrowing. They told me that the loan would be 0% for 1 year, then adjust to 18% if a balance is still owed. Well, they charged me 18% from the get go and there was no amount of arguing that they would admit fault, so I gave them all theirs Dirty money back immediately! I take my credit card seriously and only charge what I can pay at the end of the month in full. I own my cars, home and now have zero debt. I hope to keep it that way.

That’s right off of CNBC. Why go into debt in the first place ? You’re still losing that 1% on a depreciating asset. Still paying it off over the course of years while it’s value drops to zero. Still paying taxes, insurance [full coverage], maintenance and repairs.

You could put that money into a 3 year CD making 2% without that 1% loan and attendant cost of a car.

You can’t take a car loan and spend that money on something else. It’s secured by the vehicle. That’s called fraud. But then, that’s pretty much what drove us into this mess in the first place. You’re right: You can’t fix stupid.

Hardly being “smart about money” [especially when espousing CNBC “advice”]. I’ve watched the clip several times, btw. It’s nonsense.

I’m out of debt. And staying that way. I didn’t get there by buying new cars and pretending I have money playing small time games with advice gleaned from CNBC or Fox Business and their shills on Wall Street.

@ DweezilSFV:

My car loan example was given with the underlying assumption that one would have purchased the car anyway. Obviously a car is a depreciating asset, and you will have to pay taxes, insurance and maintenance/repair costs- that is not what is being debated.

Otherwise, I really have no idea what you’re ranting about. My car loan example is an extremely simple concept. I’ll try to explain it again:

1. You are going to buy, say, a $25k car. Your choices are to pay cash or get a 5-year loan at 1%.

2. You choose the loan at 1%. Over the course of the 5 year loan, you will pay the lender a total of $641 in interest for the use of their money.

3. You invest your $25k at 3%; this is the same $25k that you would have otherwise used to pay cash for the car. At the end of the 5 year period, you will have earned $3,982 in interest on your $25k.

As you can see in the example above, $3,982 – $641 = $3,341. $3,341 is money you will have in your bank account after 5 years if you took the loan instead of paying cash, and invested your money at 3%. Clearly, the choice that will result in the most money in your pocket is to take the loan at 1% and invest your money at 3%. Even if you invested your money at 2%, it’s still worthwhile. If you can’t understand that, then you should probably stick to paying cash.

I forgot to mention that, if you paid $25k cash for the car, you could obviously invest the $427/month payment that you would otherwise have to pay if you chose a 1% loan. However, it would be significantly more difficult to earn an equivalent return on such a small monthly investment, as opposed to investing a lump sum of $25k. Further, even if you did earn 3% on that monthly $427/month contribution, you would have otherwise earned more money in interest by investing a lump sum of $25k at 3%.

The agent seems to be laying on the nostalgia BS pretty thick for this shoebox located in a East Hollywood. Love the Jim Morrison references.

https://www.redfin.com/CA/Los-Angeles/916-N-Serrano-Ave-90029/home/7108996

That house commands a big “cuteness” premium. That is one beautiful little house and it’s a great prototype for “tiny” houses for one or two people. It wouldn’t sell for much less in other cities. I’ll bet it’s under contract by the end of next week.

Yes, the house has charm, but your out of your mind if you think $605 sq. ft. for that neighborhood is fair. It doesn’t even have parking and it’s no exactly the best part of Hollywood either.

The politicians are going to stop new home and new apartment construction because of the water shortage. If they get away with this, house prices will rise very strongly and no one will be able to get an affordable house. Ever. Current homeowners will benefit and renters will get hurt. Time to write or call your elected officials and tell them to keep building new stuff.

Current homeowners wouldn’t benefit because in order to lock the gain they need to sell, and then if they want a replacement home, they’re buying back in at the same inflated price level. No free ride.

They should stop building!! There’s no water!! stop the madness. Watch what happens when w get a huge quake and the water shuts off. This place will be uninhabitable

What do you think a moratorium on building would do to prices?

Leave a Reply