Reversal of real estate fortune – How option ARMs went from low grade toxic mortgages to boon for home debtors and banks. Financial generosity of moral hazard.

Option ARMs are arguably the most devious, insidious, and deceptive mortgage products to spawn out of the housing bubble mania. For those of you only starting to follow the housing market in the last year or so, an option ARM was essentially a mortgage product that sought to lower the monthly payments with extremely high commissions for mortgage brokers and Wall Street and gave the illusion to borrowers of a buffet of reasonable monthly payments. Wall Street loved the option ARM because it allowed incredible leverage and this added billions of dollars in mortgages to their pot to speculate on. One feature of a traditional mortgage, actually paying principal and interest on a monthly basis was actually removed from many option ARMs. This negative amortization actually increased the balance owed on a mortgage. Think about how financially backwards that is. This is like the dark ages version of a mortgage. The option ARM was a loan designed to function only in a bubble. It could only succeed in a market with incredible manic real estate appreciation. Most that took on option ARMs (unlike subprime borrowers) realized what they were doing. They were fixated on a low monthly cost even though it meant long-term disaster if they were unable to sell. They never expected home prices to crater. Banks have kept the implosion of option ARMs under wraps. In fact, many are now implementing shadow bailouts of those who entered into option ARMs while putting the screws on those who diligently pay on prime mortgages.

Rewarding the speculators

Many of you sent over a New York Times piece discussing the principal reductions being conducted by some of the too big to fail banks. If you wonder what is occurring with some option ARMs, take a look below:

“(NY Times) I used to say every day, ‘Why doesn’t anyone get rewarded for doing the right thing and paying their bills on time?’ †said Ms. Giosmas, who is an acupuncturist and real estate investor. “And I got rewarded.â€

Option ARM loans like Ms. Giosmas’s gave borrowers the option of skipping the principal payment and some of the interest payment for an introductory period of several years. The unpaid balances would be added to the body of the loan.â€

The “option†in an option ARM meant borrows had the ability to pay varying amounts each month. They could pay the principal and interest and have it function like a regular mortgage, they could pay the interest only and have the loan work out like an interest only loan, or they could go for what the vast majority went for and go into the negative amortization dark waters. Not much interest has been shed on option ARMs in the last year even though 2011 and 2012 would be the worst years for these products (and it still is for those loans that haven’t already imploded). The reason for this is:

-Many have flat out imploded

-Banks are implementing a new strategy of simply ignoring loans (so who really cares what kind of loan you have if banks take up to two years on foreclosing on properties)

-Lowering the principal on many option ARMs

First, we should examine some data on the current state of option ARMs:

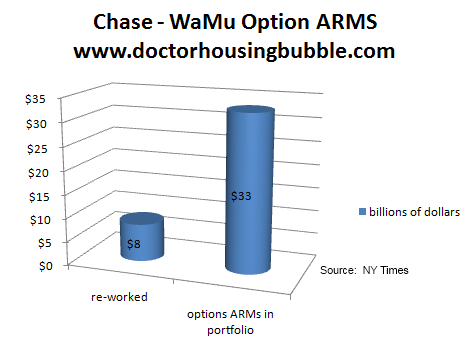

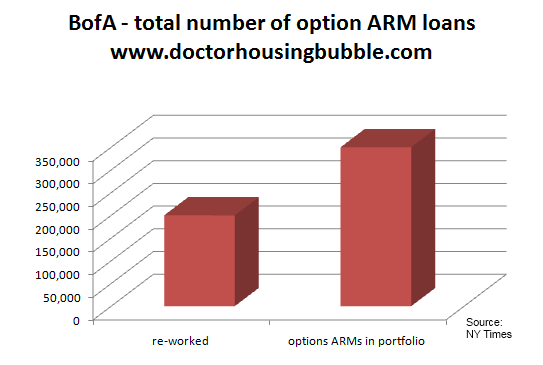

Let us be clear to begin with. Option ARMs have the highest default rates even passing up many subprime products. So it isn’t like these loan products are being remedied over time. What has changed over time is the trillions of dollars injected into banks (remember when a billion dollars actually meant something?). The same banks that benefitted from dishing out questionable loans have inherited these options ARMs through their acquisitions of Countrywide Financial, Washington Mutual, and Wachovia. From the NY Times article, we are told that Chase has re-worked $8 billion in option ARMs leaving $33 billion left in the portfolio. We are also given the data that Bank of America has re-worked over 200,000 loans but still has a portfolio of 350,000 option ARMs. We should also be clear that over 50 percent of option ARMs were made in California in terms of mortgage balance. This is not a nationwide problem.

The article was sent over many times and what I believe has infuriated people is simply the lottery like dolling out of modifications from banks that have been bailed out by taxpayers. Many of these taxpayers have loans with these too big to fail banks and they have received little reprieve during this crisis. So when they see banks being rewarded for bad behavior and then these same banks reward mortgage holders who are the biggest speculators many questions have to be asked:

“(NY Times) Meanwhile, the value of the apartment nosedived. By the time Ms. Giosmas got the letter from Chase, the condominium was worth less than half what she paid. “I would not have defaulted,†she said. “But they don’t know that.â€

The letter, which Ms. Giosmas remembers as brief and “totally vague,†said Chase was cutting her principal by $150,000 while raising her interest rate to about 5 percent. Her payments would stay roughly the same.

A few months ago, Ms. Giosmas sold the place for $170,000, making a small profit. Having a loan that her lender considered toxic, she said, “turned out to be a blessing in disguise.â€

The article states the place was purchased for $359,000 in Florida with a “large†down payment. The mortgage of $300,000 was cut in half automatically and in the end, a speculator made a profit on this investment courtesy of taxpayer bailouts even though the property value has fallen by 50 percent. I know this appears on the surface as a giant moral hazard (it is). The too big to fail banks realize this and that is why they are keeping it under wraps. It looks like they are simply hand picking certain borrowers to reward (ironically the majority of borrowers who diligently pay their mortgage get no aid and actually now have to deal with more banking fees and hassles). What do you expect from the same financial industry that profited from the housing bubble?

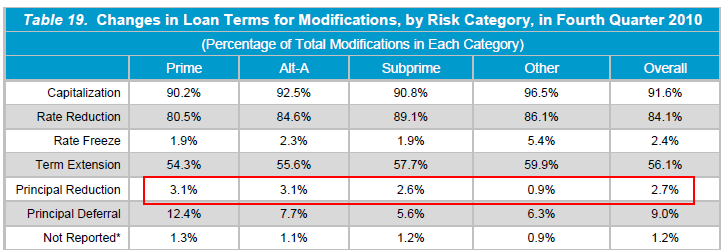

The silver lining (if you can even call it that) in all of this is that looking at the data closely we see that principal reductions are still a very rare form of modifying loans:

Out of all loan modifications roughly 2.7 percent are being modified via principal reductions. Now for those that are claiming that things are looking up for housing even the big banks realize there is little hope for some markets. Why else would they offer, right off the bat a 50 percent cut in principal in Florida for this person? This will actually add lower priced properties on the market and this speculator eventually sold the home for $170,000 (a far cry from $359,000).

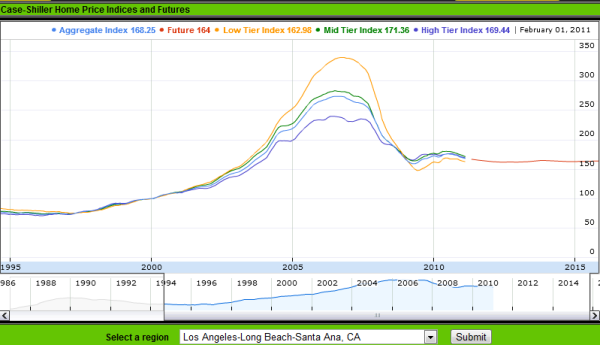

If we look at the futures market, many see no rise in home prices in expensive locations:

Source:Â ZoyZoy

For some locations in California those placing bets with money see no rise in home prices well into 2015. And why would prices rise? Household incomes show no sign of going up. In fact, option ARMs were a symptom of weak household incomes and big housing appetites. There were countless stories of households barely making $100,000 but taking on option ARMs that were $600,000, $800,000, or even higher during the boom. In the end the only salvation for home prices is higher household incomes or lower home prices to reflect actual incomes. My bet was always on lower prices and that is what we currently have. There is no sign of rising incomes so to expect home prices to rise because of cutting loan principal makes absolutely no sense. Given what we have lived through in the last decade, there is little that surprises me at this point when it comes to our financial sector.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

31 Responses to “Reversal of real estate fortune – How option ARMs went from low grade toxic mortgages to boon for home debtors and banks. Financial generosity of moral hazard.”

Good story doc. I did notice a discrepancy between the final sales price and claim of a small profit on Gisoma’s house err condo (I think she probably shelled a bundle in HOAs as well). The article notes that the bank lowered the $300,000 mortgage by half and she claims a small profit on the sale at $170,000. That twenty thousand of profit is wiped out by the $59,000 she put down giving her an actual capital loss of $39,000 not even factoring those HOAs and other purchase and ownership costs. Knife catcher indeed and not a successful speculator.

It is no matter that she ‘only’ made out w/ $20k. The facts that really bother everyone is that she was forgiven such a large amount of debt and that the bank and govt didn’t have a clause that any profit made from the sale of the asset within specified time period, would be taken by the bank or govt for the forgiven debt. On top of it, they should only allow this type of modification to non-investors. Forgiving debt with no strings attached at the expense of everyone who is responsible is the pandora’s box that everyone was hoping would not happen. It’s the worst thing that can happen to our society.

How about NO modifications at all? How about NO principal reductions at all? How about ZERO mortgage interest deduction?

I say let the banksters fail, the world enter a depression, and start anew with trustworthy financial institutions.

@Swiller: Of course! If I were to have it my way, principal reductions would happen only after mass executions.

Actually less than $20,000.

Sale price = $170,000

Realtor commission of 6% = $10,200

Seller title incurance (estimated as varies state by state) = $1600

Closing fees, doc prepr etc = $500

Recordation of releases and state/county transfer taxes = $1000

Proration of real estate taxes (assuming treated as paid in arrears and 6 months passed since taxes were due) = $1700

Net closing expenses = $13,400

Sale price $170K – mortgage balance $150K – closing costs $13.4K = $6,600.

Downpayment $59000 – actual net of $6600 =

Do she is probaly in the hole $52,400 when the numbers add up.

Now on the other hand she had a place to live from “early 2006” to probably early 2011. That is around 5 years or 60 months. If she rented it, assume it would have been betweeen $2500 – 1500 a month. She would have spend $90,000 – 150,000 in rent over those 60 months.

Of course she is out the money she spent on the minimum payments she did make and is out $52,000+ from the downpayment and is out the insurance, taxes and HOA fees.

Still she is probably in the hole – minimum payments plus taxes, insurance and HOA fees would not have been so much less than renting that she would make up the $59K downpayment she lost. It seems like it would be pretty close to a wash with rent of $90 -120 K versus being out $59K plus all the associated costs.

She also owes the IRS taxes on the $150,000 in principal reduction.

Ann:

I’m not trained enough to have figured out all those costs. For me it was enough to point out that a doe eyed home buyer even with a $150,000 write off from the bank still lost a bucket of money. Caveat Emptor and all that DHB has been pointing out for years.

Sigma, who on some levels I agree with regarding the bailout of the homeowner takes a darker view of this “investor” or her position in that the bank is writing down the mortgage out of whole cloth. I think for those of thus who deign to act with prudence it is a wash. Either way as DHB has said housing prices will correct. The condo has corrected more than 50% bringing real estate more in line with incomes. In a perfect world I would rather the banks had not been bailed out but left to fall perhaps bringing about the bottom quickly and letting us all get on with so called normal life.

Jake, Normally yes, she would owe tax on the 150,000. But, there is a moratorium in place so that 150,000 is not taxed. The moratorium ends soon (don’t remember when), so if you are thinking of taking a short sale or modification, then find out about the tax issues and move soon.

A speculator got off the hook…this makes me sick. First we do not know were this person recieve the down payment, maybe she refi’d equity out or sold a home at the height of the market which means she had no invested interest as she took advantage of loose lending value spike. instead of investing in other another tangable sector, she “choose” to speculate in real estate. 59k down means nothing….faux equity. I argue this point all the time, ie. xyz borrower put 200k downpaymnt in 2006 from proceed of a sale in 2006, they just past faux equity from on unit to another…..this is not free money, somewhere it effect us all. losses will be past on down to main street. believe me, bailout this person we all get our toes step on…..btw way she said she would pay and not default. i call BS on this lady, sound like ths person still has not really looked in her payment and program.all sh is worried about is today’s payment and xactly why she speculated with this program, she had choice. thse option arm recast at either 5y or 10y, this means th borrower nw minimum paymnt will be fully amortised at 20y or 25y term. jezz the govrment is already bailing her out with the Tbill and Libor being artificaly surpressed. normal market tbill is 4-6% and libor is 4-7%, today both are sub 1%. depending on margin this lady is enjoing atmost a 4% interest rate. the saver non specultor in todays market a 30y fixed is 4.75%. i am pissed off………..

I myself did not see the original NY Times article but from what I saw quoted here it sounded like she was a principal buyer, ie., owner occupant and not a flipper. The most speculation seems to be on your part. By the way before you begin ranting about the alleged actions of others you will gain credibility by learning some grammar and spelling. Then when you say call BS we’ll know it’s not your loost bowels.

She would have had selling costs of around 10% of the deal. Also, she would have had a really wonderful present from the likes of Chase, it’s called “Gain on Debt Foregiveness of around $150,000. Man, I would not want to be in her shoes at tax time. Hey! the Gobernmint needs to recover that bail out money from somewhere, right?

@R.F.,

Please see http://www.irs.gov/individuals/article/0,,id=179414,00.html . The relief ends Dec 31 2012. I am not a tax attorney, but it looks like there is tax relief for debt forgiveness. Natch, there are limits and conditions, but many if not most short sellers will benefit. Take a look.

If the TBTF were allowed to fail, I think we would have seen major principle reductions for all. The toxic crap would have been sold for pennies on the dollar and the purchasers could have made a huge profit marking down mortgages, allowing people to stay in there homes, or they could have foreclosed and put the properties on the market.

In this scenario “capitalism” would have worked. The TBTF would be gone, “investors” would have bought up the toxic mortgages and made the financial decision that is their best interest. If it makes sense to foreclose than foreclosure would have happened, if it made sense to write down the mortgage and negotiate with the borrower then that would have occurred as well. There would have been winners and losers, but that is how “free” markets work. But the banksters would be gone and new institutions would have taken there place. Real estate would have bottomed out quickly and there would be no stock market bubble/real-estate bubble/ student loan bubble/ bond bubble……………… The “speculators would have lost (more the lenders than borrowers) and maybe even the Federal Reserve would have collapsed…. yahooooo… In the above your bank deposits would have been written down as well. There would have been a severe overnight deflation, but everything would have “reset” quickly. Banksters and the governmint hate the word deflation, because they can’t continue to borrow $$$ they don’t have and create $$$ out of thin air. Fractional reserve banking would have ended in one day and the U.S. would have defaulted on its debt (we can’t repay it anyway).

The consequences will be extremely fierce one day, so to continue to “extend and pretend” benefits no one except the crony elite. The world will not end when this does occur. Commerce will not stop, but the way we do business will one day change. Farmers will still farm and bring there food to market, store owners will still stock there shelves and sell there wears, but you might need something of real value to trade for what you need (no fiat $$$ will be wanted). There is a day of reckoning on the horizon for U.S. ALL fiat (central bank fueled) bubbles and currencies fail, there is no option. Many of our founders FEARED the creation of a central bank and for good reason, they enrich a few at the expense of the many. Isn’t it interesting that the Federal Reserve and the Income Tax were created at the same time and ever since then there is never enough to pay the bills!!!

Thankfully, “America” (not the U.S.) its ideals and ideas still has a beating heart and as long as America’s heart beats there is hope.

I’d add that:

1. We’d be coming out of this mess right now, instead of still looking at seeing the worst ahead.

2. The political power structure would’ve have been seriously damaged, in favour of the average American. The problem with having just a few big banks is that the power and money is in the hands of a few, rather than more equally distributed. Which is why our politicians forget about the average American voter after they get re-elected.

It also means less community financial options. And the financing decisions for your community goes into the hands of booze-n-hooker addled banksters in New York, instead of being made at the local level.

Actually the TBTF banks had trillions in deposits and we would have had massive bank runs if we let them fail. The FDIC had no money to insure the deposits and the federal government would then bail out FDIC in the trillions. Instead, the Federal Reserve created money out of thin air and became lender of last resort and bailed out Banks.

The problem is that when you create money out of thin air the currency weakens. USA government and the media have been engaged in a 3 year smear campaign against Gold, Silver, and Euro. It is not working as the World is understanding USA’s crazy money printing everyday.

Just for completeness here we need to look at a few things.

First – money in the economy is not fixed although the currency base is. Lending accelerates and multiplies the amount of capital flowing in the system. We can impact velocity/money multiplier via reserve requirements, interest rates etc… This is basic economics and if you look up definitions of M1/M2/M3/MZM as well as velocity/multiplier you can confirm it.

Second – we have two huge problems. The first is that velocity has been destroyed so we don’t have nearly the multiplier we did previously. To avoid a deflationary outcome spreading you need to increase the base to offset a lower multiplier as zero interest rates aren’t enough to get lending moving. This roughly allows you to keep pricing across the system constant. The second issue is in conjunction with velocity cratering, we destroyed a MASSIVE amount of money in 2007-2009 the likes of which are not even remotely fully realized and to a large degree are future dependent. While that added added monetary base sits in historically high bank reserves right now, those reserves as a % of non-performing loans are historically low. Basically, that money doesn’t exist (there are no excess reserves – we are just holding up the banks for now) and will not be lent until banks can gradually work off those assets with some profit over time.

They no longer calculate M3, MZM is not a good equivalent IMO, and even M3 does not take into account the complete carnage of the banking failure but it’s useful to look at this graph to see the impact of destroyed velocity even while M1 and base aggregates increase.

http://www.shadowstats.com/alternate_data/money-supply-charts. They don’t have monetary base but they do have M1 and you can see that despite M1 heading north in epic proportions, M3 was negative the entire time and only recently turned slightly positive. In the concept of fully circulating money we have yet to even begun filling in the hole left by 2008-2009. A logical conclusion would be that gold as a currency constant (not a risk premium) should be priced lower than 2007 or otherwise implies a massive increase in velocity at some point, and fundamentals as of yet do not remotely support that.

I don’t want to get anti-Europe here as we all have issues but for the sake of balance I’ll also point out that Euro base has increased significantly during the same timeframe with M1 up over 24% from early 2008. As can be seen from recently released data, the very biggest borrowers from the US central bank in 2008 were…large European financials (who even without sovoreign debt issues have not been nearly as well recap’d as US banks), wade through those and you eventually get to Goldman. The US has never closed international USD swap lines – this is not an accident. Total debt (public/private etc..) in the EU as a % of GDP is far higher than the US and while the US has brought it down a bit in the past 2 years (kind of a shocker but illustrative of all the credit market carnage) the EU has continued to climb (Japan is holding steady but another level above the others).

Hope that helps shed a bit of light on some things that are not quite as simple as they appear.

@Matt: All we needed to do was to nationalize the Banks, and thus guaranteeing access to deposits. And then split up the banks and sell off the assets. This would have solved the problem much better than just letting them go under. Had we added a law limiting the size of banks, we would have set up a very nice future for our children for generations to come.

Also, I have to question whether bank runs can really occur these days. Yes, people can queue up, but banks have limited amounts of cash on hand. If you withdraw all of your funds via cash, they start to look at you funny. If it’s a fair amount, they’ll just tell you “no”; you’ll need to make an appointment first. Keep in mind that it’s not *your* money when it’s in the bank. You have given them a loan, and it’s their money. And that’s according to the Supreme Court. Hopefully they’ll pay you back.

It’s no longer like the movie “It’s a wonderful life”.

@slim:

I’d also add in the $300 Trillion that the Feds use via the derivatives market to keep interest rates and commodity prices low (I posted that link in the previous article comments section). They start to get panicky when those rise; as witnessed by the recent uncapping of the Strategic Petroleum Reserve, and selling much of the oil to JPM.

And don’t forget Z.1. It’s been decreasing since 2008, even in spite of the Trillions spent and promised in order to keep things propped up.

Well hold on a minute there hoss.

I think if you looked at the bank runs that would have happened, it would have been FAR cheaper to bail out the insured depositors than to bail out the banksters and bondholders and stockholders.

Seriously, the leverage works the other way as well. The total deposits for these banks were on the order 1/30th the value of the loans.

The other people that should have taken it in the shorts… oh the rich guys holding the bonds. Who ended up being put into the ground? Oh, right around now the govt is figuring out how to kill off the last of the middle class with taxes.

You could research and see how much base currency was available and what insured deposits were or… throw out some fear mongering remark about how bailouts were unavoidable.

@James: Last time I checked, there were about $8 Trillion in deposits for all of the banks. The biggest 6-8 banks had about $5 Trillion of those. These are mostly uninsured deposits, with the insured deposits making about about $2 Trillion(?). That’s from memory from a couple of years ago. I might be off on the insured deposits number, but it’s still far, far bigger than what the FDIC can cover.

Most of the uninsured deposits are due to local and state governments, along with corporations. so wiping those out has very significant consequences, indeed.

Please feel free to correct me if I’m wrong; but please do provide a reference. Thanks.

My heart feels the TBTF banks should have been allowed to collapse. But, It would have wiped me and my family out. There would have been runs on the banks. I live in England. I saw the lines outside Northern Rock, a bank that went under. Not pretty at all.

In a complete meltdown, all my paper assets would have been lost. Including stock, etf, and fund assets. 35 years as a physician with little to show for it. Many would be in far worse shape since my house is paid and I am still employable.

I guess what I am saying is that is pains me to think that the flippers and banksters are getting off light when I did all the right stuff. Saved. Modest house. Paid my mortgage. But, a complete collapse is just too scary to contemplate. Pretty sure Obama and Bernanke lose a lot of sleep over the thought of a complete meltdown.

Our Bornstein & Song Small Business Toxic Mortgage Surveys, U.S. National (Nov. 2008), California (April 2009), and California Hispanic (June 2009), provide the first compelling evidence that a significant number of small business owners are stuck with toxic mortgages such as Alternative-A (Alt-A), Option ARMs (Adjustable-Rate Mortgages), Interest-Only, Subprime etc., which they acquired by refinancing their home equity during the Housing Bubble in order to quench their continuous need for cash for their newly created or existing businesses. These small business owners placed themselves at-risk of payment shock at the resetting of these negative amortization mortgages in 2009 to 2012 and beyond. They are now at-risk of financial distress, default, and foreclosure. The resulting job loss for their employees will impact unemployment and the housing crisis.

In order to determine the extent of small business owner involvement in these toxic mortgages, we authored three Small Business Toxic Mortgage Surveys. In November 2008, after concluding our U.S. National survey, we selected California because more than 58 percent of all toxic mortgages in the U.S. originated in the State of California, and its small business owners were at greatest risk. These Surveys confirmed the 2nd “Tsunami†Wave of Foreclosures & Job Loss in 2009 to 2012, related to small business owner involvement in the toxic mortgage crisis.

Small Business Toxic Mortgage Surveys Highlights:

• Respondents took out mortgages after 2004: U.S. 60.1%; California 55.4%; California Hispanic 53.3%.

• Respondents cashed-out the equity in their homes as home values spiked during the 2004-2007 housing bubble: U.S. 33.9%; California 34.3%; California Hispanic 36.9%.

• Respondents have toxic mortgages: U.S. 31.9%; California 51.8%; California Hispanic 52.6%.

• Respondents are expecting resets between 2009 and 2012: U.S. 22.9%; California 34.9%; California Hispanic 44.7%.

• Respondents are “very worried” about their monthly mortgage payment at reset: U.S. 18.4%; California 29.9%; California Hispanic 49.3%.

It is imperative that Bank of America, JPMorgan Chase, Wells Fargo and other financial institutions recognize that their Alt-A and Option ARMs mortgages are held by a significant number of small business owners who are now at-risk as these Option ARMs mortgages reset in 2009-2012 and beyond. The success of these mortgages and their derivative investments depend upon the ability of these small business owners to continue making monthly mortgage payments. We suggest that these financial institutions should seek out and identify these small business owners to make loan modifications, which will lower their monthly payments to help get through the sluggish economic recovery.

It would be very helpful if these banks realized that small business owning households should be identified and targeted for these modifications because…

It is a tragedy when an individual borrower defaults on the mortgage and loses his/her home. The tragedy is magnified when the borrower is a small business owner employing from 1 to 19+ employees. The loss of jobs due to the small business owner’s financial distress related to mortgage delinquency and default and the resulting possible business failure will have a multiplying affect on unemployment and contribute to further foreclosures and falling home prices and exacerbate the housing crisis.

Samuel D. Bornstein

Professor of Accounting and Taxation

Kean University, School of Business, Union, NJ

Partner-Bornstein & Song, CPAs & Consultants, Oakhurst, NJ

bornsteinsong@aol.com

Tel: (732) 493 – 4799

Fax: (732) 493 – 3399

The reason the USA has chapter 11 and not debtors prison is what you describe above. If a small businessman (I qualify) takes a risk and fails there are options available. My business is one of the few Ch11 success stories. I had to layoff/downsize/ take less $$$/ work, work ,work………. I have been out of ch11 for 18 months and reorganized my business.

It is all about risk. Big business/small business. If you take a risk and fail, you fail. At least you tried. Ch11 is a great tool for for small and big business. It gives you space to breath and reorganize IF you have a business. When we entered Ch11 we still had sales and receivables, the court saw that and we were able to work out a plan with our creditors and that plan is in place today. If you don’t really have a business any longer (little to no receivables and little to no sales) it’s called Ch7 and there will be someone else to take your place.

What is wrong is capitalized profits and socialized losses. The taxpayer is not on the hook for my losses. My vendors and creditors who took risk on my business lost and I lost a LOT. My savings…… gone, my house……. gone. My family…… still with me!! That’s America. I am now working my ass off to gain what I lost. I took the risk and I reaped the “rewards”, both the good and bad!!

Second chances aren’t for pussies, but taxpayer bailouts are!!

I don’t follow you, Prof. Samuel. You appear to be saying that small business owners, as a way to raise funds for their businesses, took out home equity loans. Also, instead of buying a house with a lot of money down, they bought a house with option ARM’s or with other ‘no money down’ gimmicks, and therefore conserved cash for their businesses. If so, then what is the problem?

The collateral for those b.s. loans is the houses that were encumbered. How are the businesses that were funded with that extracted (or saved) capital now at risk? The banks can foreclose and seize those houses, and the owner can rent an apartment, or sleep on the storeroom floor.

Seems like a great way to protect the business. What if the business had into direct debt, like a small business loan. Those are the businesses that are in jeopardy, not the ones you mentioned, unless I read you incorrectly.

Now if someone bought a business (or a building for a business) with an option ARM, that would prove your point, but I didn’t see you mention that angle.

Does any one know if these principle reductions are reflected in local comps? I’m guessing the answer is no because it would be detrimental to the RE game, but I would want to know if a house that was purchased for 650k in 2007 is actually on the books now for 500k. Is there any way to track or find out this kind of information when house hunting?

How about this… interest free loans are being offered through a program to assist “homeowners” that are behind on their mortgage.

Video: $50,000 TO HOMEOWNERS BEHIND ON MORTGAGE

I wonder do the high schools and colleges teach the next generations about loans and especially option arm loans. I bet good money they are not. Hence the cycle repeats.

After such a huge destruction in this economy, how many Joes walking down the street would even know what an option arm is.

Of course not….who do you think is running the schools? And why would they then put off their next group of victims…er loan applicants?

Always nice to go to reno and when you lose someone else pays the bills, but when you win you keep the winnings. The government has screwed all responsible people, save save save that’s all we ever did, did without fancy cars, vacations ect. so we would have something in our later years, now interest rates so low, we the responsible people get screwed.

I think the sea change here is that many golden cows will be sent to the slaughter:

Housing prices always go up, deficits don’t matter, US Dollar is a safe haven…your money is safe in the FDIC bank….

Great insight, darkages. Lots of sea change, for sure. The biggest will be social security and medicare. The media is doing its best to label social security as an ‘entitlement’, rather than a retirement account.

What happens to the apartment rental market, when they somehow manage to push through a substantial social security benefit cut? They will be tricky about it, perhaps using some new measure to calculate COLA (cost of living adjustment).

They will say, “we were wrong to exclude house prices from the index. We are going to go back to 2007 and put house prices into the metric, lol!!!

It is a sure pleasure to read some of the inputs by people who have both feet on the ground.

I am not an expert on financial matters, but I would like to deal in facts. If I do not have facts I am offering ideas which should be investigated for the validity.

a) It is a fact that irresponsible spending on all levels of

Government, over many years, has ended up with this fiscal imbalance.

b) Unreasonable high unemployment has been artificially induced.

c) While fair trade is welcomed, lopsided and unequal business transactions are not in the interest of the US Population

d) The Housing bubble was also programmed to harm the majority of low income home owners and add prosperity for the benefit of the Banks, Finance Companies, Insurance companies to mention a few

e) Interest has been kept low to make people believe that this would help bring the economy back to a healthy level. Well, as we have seen it did not work. The result of the low interest rates was disastrous. Firstly, most people depending on their interest money from the banks no longer could manage a decent living standard. Secondly, People who would have invested their money into banks, Credit Unions no longer did so because it was not worth to receive 1 ½ cents on their investment.

f) People who should be in jail, because of their lying under Oath, and other misdeeds, are traveling all over the world, pretending to speak for the citizens of the USA.

g) Immigration – I mean ILLEGAL Immigration is a farce. Who is benefiting from the Illegal influx? I don’t need to point it out, we all know it.

h) The worst of it all is that we have a rudder less ship called Federal Government. In addition to the missing rudder the Ship does not even have a motor.

If some or all of the above would have been avoided or implemented (depending on the subject) this financial disaster would not be present.

WB

Leave a Reply