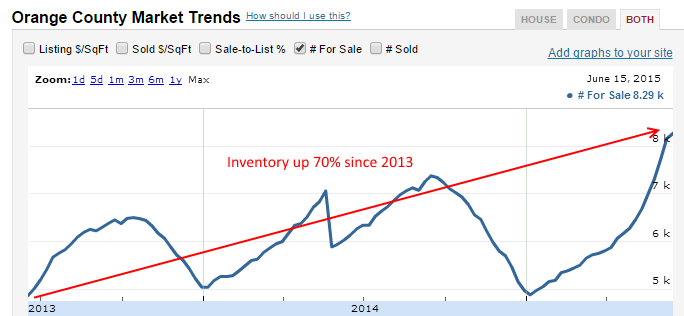

The rise of inventory in Southern California: Inventory is up 70 percent from 2013 in Orange, Riverside, and San Bernardino counties.

Real estate markets are notoriously slow when it comes to shifting momentum. While stock markets can react like a fighter jet real estate markets are more like turning around a cruise ship. They react slowly and once momentum shifts, it is hard to change course. Following previous bubbles, the turning point has always included a rise in inventory and a sudden slowdown in price appreciation. These usually go hand and hand because Taco Tuesday loving home prices usually shock some buyers and little by little inventory starts to build up as new buyers are reluctant to settle into a $700,000 crap shack with years of deferred maintenance. For the first time in many years, we are seeing a big jump in inventory in some markets. I’ve noticed a big change in inventory for Orange County and the Inland Empire. Los Angeles is seeing inventory pickup but at a slower pace. Ventura is up slightly and San Diego is virtually unchanged. Let us look at the current inventory figures.

Inventory is back this summer

It is really no surprise that 2013 is the baseline for inventory growth. This is the point where big money investors started pulling back in large numbers leaving those late to the party to join in. Little by little like a pebble turning into an avalanche, inventory has been growing in some markets. What is also feeding the flames is current prices in some markets are higher than previous peak prices set by the drunken mania we experienced. Is that truly a good baseline to use? In the eyes of some, this is the metric in which to measure current home prices.

The bottom line is that many regular households are unable to purchase homes at current prices. I’ve taken a look at a few purchases in higher priced hoods, especially hipstervilles, and many are coming in with 10 percent down (if that) just to squeeze in. We’re also seeing a continuation of the rental Armageddon theme.

With all of that said, let us look at current inventory in various SoCal counties:

For the above three counties, something is definitely going on this summer. There is a big difference in inventory out in the market. Comparing the market of today to that of 2013, you will see 70 percent more homes available for sale. These counties are interesting because the OC is the priciest in SoCal while the Inland Empire is the most affordable. You are seeing a change at both ends.

Los Angeles County has seen inventory rise but not to the level of the previous three mentioned area:

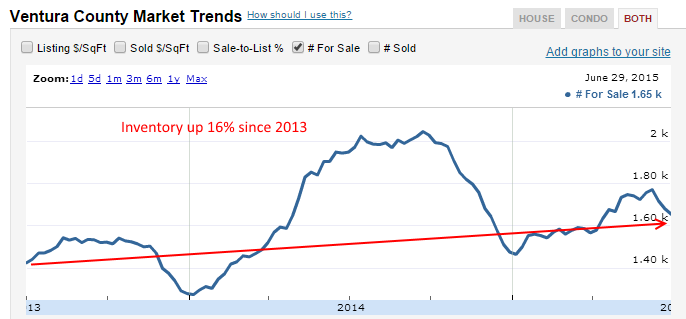

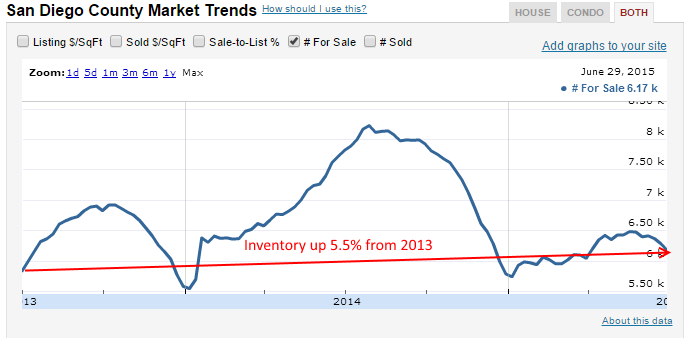

Los Angeles County is the biggest with 10 million residents and inventory here is up 30 percent since 2013. Two counties with little change are Ventura and San Diego:

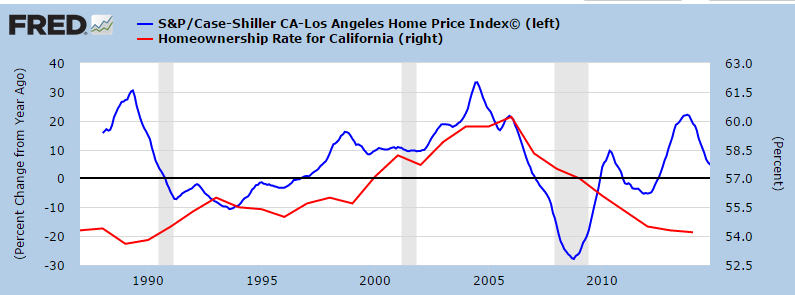

Inventory in San Diego County is virtually unchanged from 2013. What is also happening is that price momentum is shifting and the homeownership rate continues to fall:

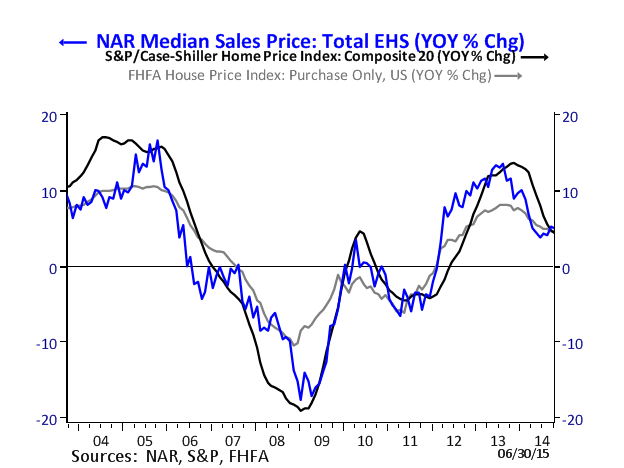

You notice that the crazy unwarranted double-digit annual gains are largely gone. In fact, we are inching closer to having a negative year-over-year price headline. And going back to the ship analogy, once the easy money train is gone and the media starts picking this up, it sets up a self-fulfilling prophecy. This story is all too familiar to those that have lived in California for more than a couple of decades. The trend we are seeing in SoCal is reflecting a national trend as well:

Prices now are wedded to these ultra-low interest rates and for California, the easy money flowing into the stock market for the last six years. But household incomes have been stagnant for many years. It has been mathematical wizardry with interest rates to keep home prices inflated. But in some areas, prices are fully into mania mode. Meaning people are buying with the mindset that prices can only go higher. The rise of inventory is something that is different this summer in SoCal.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

98 Responses to “The rise of inventory in Southern California: Inventory is up 70 percent from 2013 in Orange, Riverside, and San Bernardino counties.”

It would seem that my 2014=2007 thesis may have been off by a year. However Lehman failed in September 2008. Considering it will take a few more weeks to figure out (they’re not technically in default with the IMF as of yet) we could have this cycles “Lehman Moment” with a Greek default this September.

It seems a major financial event will PRECEDE a correction in RE this cycle. So which is worse? A fire already burning igniting even more fuel, or dropping a napalm shell on a field soaked of gasoline? The latter is more sudden than the former. The panicked escape can only add even more damage.

Greece’s GDP doesn’t even cover the catering at an IMF luncheon. EU GDP = 18.5 trillion. Greece GDP = 240 billion = 1.3% of EU GDP.

Greece GDP is not what’s of concern. The counter-party risk, CDS insanity and everything else that accompanies the failure to service their debt. These are the revenue streams that when they dry up create the dreaded “contagion”. I know it’s not truly analogous but Lehman Brothers negative position was about a third of Greece’s ($155B to €323B). VERY serious things happen when the interest payments on such debt suddenly stop.

Puerto Rico is looking to become the USA’s own Greece in short order…

Is the concern over the Greek situation based on the values of the financials or would it be the binary messages that it represents? Once a well is poisoned, the amount of water relative to the poison is of little comfort.

Do you at all remember how they down played subprime? I still remember “subprime is such a small segment of the entire market, it’s a non event”

I am not worried about Greece by itself, but if more countries default on their debts because Greece is now going to do that then we could see another global recession and that will cause a big housing slowdown and possibly see prices go down again.

No, your 2007=2014 thesis is completely bonkers. It seems that what you want to happen drives your mania that embarrasses any reasonable housing bear. You missed out on the bottom and its killing you. Hoping and wishing and blogging about it is something you need to feel better about how RE is killing the average folk.

Does redirecting the debate into unproductive assumptions about this guy’s personal motivations make you feel better?

Robert Shiller and Leslie Appleton Young disagree 🙂 As I said I think JT and I were a year early,but if you look at the inventory, what’s happening in Greece and the action in the equity and bond markets, it’s looking quite a bit like 2007 right now. If you wanna converse at the grown ups table bring more than ad hominem attacks. I’m sure that plays well with your meth-head neighbors in Fresno, but we like to keep it classy on Dr HB. The only thing “killing me” is the level of trolling around here. The trolls of HB 1.0 were a lot more interesting…

….. Said before and will Repeat it again ….

The R.E. Market is driven by HOW Desperate the RE.Agents/Brokers are .

RE Agents/Brokers need Qualified Buyers — Qualified Buyers live in Major Employment Areas , and since there are more buyers in Major Employment Areas .. The prices are higher.

RE Agents/Brokers WANT THEIR COMMISSION … THAT’S THE DRIVER.

Fewer (richer) buyers live in EAST California … prices are lower there; BUT THE PROPERTIES are LARGER THERE – more Acreage and more Sq.Footage …

… SO IT HAS NOTHING TO DO WITH THE PROPERTIES .. ” DIRT IS DIRT “.

ONCE BUYERS REFUSE TO PAY CRAZY PRICES .. THE R.E. AGENTS who MUST LIVE ON COMMISSION WILL SAY :

” HEY Mr.SELLER/OWNER … F.U. — LOWER YOUR GOD-D##M PRICES… YOUR HOUSE IS A P.O.S.” ” I NEED MY COMMISSION and that’s ALL THAT MATTERS — PAY ME ”

In the FINAL ANALYSIS …. ” DIRT IS DIRT “…. Some Idiots pay MILLIONS for “DIRT”,

and SMART RICH PEOPLE WAIT FOR PRICES TO DROP

and then SWOOP IN FOR THE KILL.

Just tired of the doomsday rhetoric that centered around the emotional premise that “housing isn’t affordable”. And of course, all RE is local and this is centered around prime SoCal but the cheerleading for a 2008-like bubble doesn’t seem very grown up at all. I liked this blog because it was bearish but various posters over the year have articulated why, while the market is completely irrational, the circumstances of this bubble is completely different than 2008. I think looking to buy in SoCal if you can live/buy elsewhere is suggestive of methamphetamine abuse.

If any area will see a correction it’ll be Fresno. Sorry, if California had an armpit that would be it.

“Just tired of the doomsday rhetoric that centered around the emotional premise that “housing isn’t affordableâ€.”

Perhaps that statement is simply projecting your own subconscious. Personally have come across a lot of housing skeptics outside of the blogs that have varied reasons for their motivations and skepticism is not mutually inclusive of an extreme outcome.

The motivating factors to be wary of would be more from someone whom self-labels as “bear” or “bearish” or “bull” or “bullish.” It gives pause because those are the entities less interested in truth discovery due to having vested interests at stake, whether financial and/or emotional.

Not really. It’s a tired narrative based on hope rather than evidence. The level of confidence on this board of another epic, never-seen-before crash ala 2008 does not scale with the evidence. That’s what is annoying. I’m hoping for a correction too, even if that adversely affects the value of my home. That may be easy for me to say since I paid so little for my home and not looking to use it as an ATM. I’ve been rooting for a correction since 2013, but buying home makes financial sense for lots of people, still, in 2015, despite the craziness of the market. This board makes it out like you’re jumping off a cliff. Maybe in prime areas of SoCal you are jumping off a cliff, and I’d probably agree.

“The level of confidence on this board…”

Whom and what defines the level? I think you’re picking up on a couple of commenters’ positions and then spinning it as if the majority of the audience here is making bold crystal ball claims.

“Maybe in prime areas of SoCal you are jumping off a cliff, and I’d probably agree.”

This blog is focused on the SoCal market, so that’s largely the perspective that’s going to read here.

“tired narrative”

Sort of like “bear” and “bull” labeling.

A question to all who beleive a Housing Crash is imminent. The housing market crashed already. Money supply is a lot more than it was in 2007. Rents are rising and as a result outside of the priciest Californian markets it is mostly cheaper to buy than rent.

So, why quantitative evidence do you have for your theory? All I ever read about is “I got a feeling”, blah blah blah.

Have you looked at prices elsewhere in the world? The $500k Compton Crap Shack might not be a good buy, but elsewhere in the country prices seem very reasonable.

Agree, but this blog is focused on the Southern California market.

Well of course the money supply is higher Mr Dean. And it taxes us every day through inflation in food,water, electricity and gas. So given that wages are DOWN for so many in BOTH inflationary and real dollars, how much longer do you think the rubber band can stretch on housing as a percentage of incomes? Because once it snaps… Well that’s when the REIT s and specuvestors get their “margin call”

For anyone who’s interested I wanted to bring back the spirit of irreverent debate we used to have on the Housing Panic blog during bubble 1.0. Since the old moderator Keith is MIA I started a blog at housingpanic.com where I’m going to try and post every other day. Comments will blonde open and in the Zero Hedge spirit will be pretty much anything goes. I wanna have some fun and hopefully share some experiences whwn those of us who are looking find places during the coming correction. DrHB was kind enough to abndnd me to his blodeelogroll under Housing Panic 2.0. I’ll still be here for DrHB academic articles but if abndndddnyone wants to join me for some unmoderated comment excitement come on over!

THEY JUST HAD IT ON THE NATIONAL NEWS… Three weeks ago.

IN THE NEXT 12 MONTHS …

There are millions of homes ready for HELOC INTEREST RATE RESETS.

The Banks are NOT REFINANCING THOSE LOANS, that means SHORT-SALES

and FORECLOSURES.

In California there are at least 250,000 HELOC Resets happening now,

that’s 250,000 homes ….

SOUNDS LIKE A POTENTIAL CRASH TO ME …. ??

That’s more like it Paul.

Doc: Inventory is back this summer

Bananarama – ♫ Cruel Summer ♫ (for owners and sellers in 2015 – maybe 2016) ♫

https://www.youtube.com/watch?v=9ePIZugahFc

Karate Kid’s San Fernando Valley and other places.

Homeowner in SoCal? “Get him a body bag – yeahhh.”

Wilfred https://www.youtube.com/watch?v=HsI-i_hUvdo

Fears of a Greek default have already driven prices up in SoCal and South Florida as the flight to safety from weaker currencies has begun in earnest. If the Eurozone deals with Greece effectively, it may actually pressure marginal home prices in those destinations. Unfortunately, all those trillions of derivatives written against all the risky debt is still growing and is very difficult to discern where that ends up once the next unraveling begins.

Ships set sail and ships return to port. For all of those “missed the boat” snarks of the past couple years, looks like another will be coming in about right on schedule. They always do.

No, some ships do not return to port. Only the life boats. The Chinese stock market is experiencing a 1929 style crash. No more Chinese money coming, even on a slow boat from China. The EU will be the next to experience grave difficulties.

Reading comprehension. Ships set sail and ships return to port every ship that sails returns back to port or the same port. It’s about the port, not the ship. When the claim is that someone “missed the boat”, big deal there will be another boat coming along soon enough.

^^ “every” – was parsed in by this site’s form – it should read “does not equal”

What propels potential buyers to take on that 30 year commitment is that belief that, if necessary, they can turn around and sell in a short period of time and make a little on the way out by selling at a 5-15% increase. Once prices stall and inventory increases, as it currently is in many parts, potential buyers will pull back and hopefully contribute to a pricing dip. Prices stalling, in and of itself, decreases the buyer population, and this combined with inventory increasing and hopefully interest rates increases will hopefully create some downward momentum in pricing.

Look — Buyers who take on 30-year mortgages, do it because they are told (brain washed) that that is the ONLY WAY TO BUY A HOUSE and that they get the Benefit of a 1040-Tax-Deduction.

What most people don’t know is that their Interest Tax Deduction is LIMITED to their PERSONAL TAX BRACKET, so all they get is 20% deduction (I just picked a Tax Bracket as an example) of the Total Annual Interest PAID against their Ordinary Income.

THINK ABOUT IT … if they paid $12,000 in Interest Expense they get $2400 Tax deduction.

THAT’S ALL THEY GET ….

Most people could find other ways to Buy a House .. mostly with Cash .. IF THEY WANTED to buy a house AWAY from a Major Employment Geographical Area.

THAT MEANS THEY BUY THEIR HOUSE MOSTLY WITH CASH … THEY OWN IT.

They have NO RISK OF FORECLOSURE … THEY KEEP MORE OF THEIR CASH OVER 30 YEARS.

If more people REFUSED TO FINANCE THEIR HOMES .. IT WOULD DRIVE THE HOME PRICES DOWN … Because fewer “higher priced” homes would or could be SOLD.

Majority of people are INNOCENT, NAIVE … SUCKERS .. BRAINWASHED FROM BIRTH.

IT’S A FACT … Sad but True..

For most people, the easy way is to borrow. If things go bad, you walk away, if they go good, you make a killing.

When things get too crazy for the money lenders, the tax payer bails them out.

Too much easy money flying around for it to ever change much.

To many manipulated markets, currency wars, a collapse is coming in many arenas.

I agree Pinot. The dollar will not be the world’s reserve currency for too much longer. I think I would rather have money in real estate than cash but there may be better places to park money than real estate.

and replaced by what?? the Chinese yuan? they have printed so much money since 2007 it would make the Bernanke blush with envy.

the “dollars end of reserve currency” people are pretty funny when you stop and think about what could/would replace it…..AND don’t start in with a gold back yuan bullshit, that would destroy the Chinese EXPORT based economy.

Everyone is expecting a sudden collapse, I believe it is going to be a long, drawn out, painful stagflation.

That is ok with me!

Southern Ca. Real estate is a costly affair, unless it is rising. Why? Because you can rent for A LOT LESS, than your house costs, not to mention yearly upkeep. Not to mention ( everyone forgot about this in the last decade) increasing renters in a neighborhood tend to reduce the desirability of that neighborhood.

Inventory is up, but the months-to-sell is still very low in Orange County, so it’s still low in an absolute sense. The real estate section of the paper said just this week it’s only 2 months, which is well below normal and indicates a tight market.

Interesting read from a silicon valley millionaire – “Why I’ll never buy a home againâ€

http://www.businessinsider.com/why-ill-never-buy-a-home-again-2015-6

AND

The American housing crisis is threatening to put us all on the streets

http://www.salon.com/2015/07/01/the_american_housing_crisis_threatening_to_put_us_all_on_the_streets_partner/

The Fed says that inflation is “too low” and yet now we learn that San Francisco has the most expensive hotel prices in the world, up 88% year over year, to a staggering average of $397 per night!

http://finance.yahoo.com/news/san-francisco-hotels-worlds-priciest-090000181.html

I posted a link to the chapwoodindex.com which showed inflation for 2014 for California coastal cities to be over 13%. We await the 1st half of 2015 report from chapwood and from reading this and from my own experiences (I pay attention lol), inflation in Cali would be appear to ramping even higher.

If San Fran hotel rooms jump 88% for another year, that would put the overnight stay at $934 a night, yet the Fed stays patient regarding raising rates! It appears that we, the middle class, are indeed on our own going forward.

I’d love to see a regular hotel room at $1000 a night. Would be hilarious to hear people defend the idea that there is no bubble with something like that.

The fed and the Govt. picked winners and losers. Middle class drew the short stick. Most of the prudent have suffered while the debtpushers and speculators were made whole…

Think about that for a minute. Everything done has been done to save bankers, not citizens. Everything! If housing was allowed to find its market price it would have wiped out the rich, bankers and govt. finances. The poor would remain the poor but the middle class, you know those people whom liked to save while trying to make the life of their children better than theirs. They were seen as the culprit. The fed is an evil organization of banks, How many of you have been in this industry?

Having been a debtpusher, your just looked at as another ass for a seat. Your a credit whore or credit criminal, your a superb credit risk….when yield is mispriced such as today, inflation is needed to cover that err in pricing. Without it, the whole grand experiment that was pre-ordained before it began by bringing in Bernanke..he is the studier of the great depression.

The issue is will the sheeple have jobs to pay for the home in 20 years….I own in SF and now looking to sell as this sanctuary city looks at illegal aliens as more important than a homeless vet. Because of their policy a young woman is dead, shot on a stroll with her dad by a 5x deported illegal scum.

California is over, and it will continue to go down the hell hole it’s digging for itself.

Signed lifelong Resident, homeowner etc….

If prices fall people will pull their homes from the market and inventory will be tighter than ever. Dont hold your collective breaths for prices to fall like they did during the recession. the game is rigged now more than ever.

@fred

Are you suggesting that investment groups, who have been a major buying demographic during the “recovery”, are willing to ride the value of their RE portfolios down instead of locking in their gains? Even if they did, would their lenders or shareholders be as patient?

Margin. Call. It’s ALL borrowed money. Those REITs are just as leveraged as every other Wall Street institution. Fred’s thesis that inventory will suddenly disappear is specious. There are ALWAYS sellers who need to sell for whatever reason. There are groups of retirees for whom it is impractical to wait for the next peak. If they see downward price action they will likely start a run for the exits among all Sellars in their demo. Market psychology is fickle. The mere hint of losses will cause individual market participants to act out of self interest. Whether that runs contradictory to their demographics greater interests is inconsequential. In the face of rising interstate rates and even slightly declining prices those who need to sell will do so as quickly as possible to lock in gains. Though not their desire they will set the market price lower and lower and before you know it you have reversion to the mean. Robert Shiller made such a prediction just this morning.

@NihilistZerO

It’s always amusing to see claims that “all cash” purchases (really non-mortgage loans) by prime buyers makes the current price run up sustainable. It’s as if they want to believe that some REIT’s were willing to blow their own cash reserves on risky assets.

The inventory is still very low in King County, WA

King county inventory has spiked up this year just like SoCal – highest in four years.

http://www.movoto.com/seattle-wa/market-trends/#city=&time=5Y&metric=Inventory&type=0

http://www.movoto.com/renton-wa/market-trends/#city=&time=5Y&metric=Inventory&type=0

http://www.movoto.com/redmond-wa/market-trends/#city=&time=5Y&metric=Inventory&type=0

Titanic’s trials indicated it would take over three minutes to stop the ship from full speed. That ship could turn fast due to the engines that powered the large rudder.

The ship is capable, it was the command to turn that took so long to be made and implemented. The modern oil tankers are another story, very different than a large passenger ship that can go twice as fast as a tanker. The passenger ships with their very power full engines and relatively low mass are far more capable of stopping in short distances.

If you start those lines at the peak in 2013 instead of the valley, the conclusions are quite different.

IMO, any correction that may or may not occur, will allow big players to come in once again and mop up the decent inventory. The transfer of wealth is only half-way through. There’s still have a lot of inventory left for them to buy for pennies on the dollar. And if Jim the Tank is predicting a tank, you can be sure it won’t happen. 🙂

@Jeff

I wonder if there will be cash available to buy up assets if the correction is instigated by a liquidity crisis despite ongoing historically unprecedented government and Fed support? In the last downturn, investors didn’t jump in until the government started backstopping the market and the Fed supplied the ammo (ZIRP). What else could the government and Fed do to backstop the next correction?

Also, a RE correction could severely damage existing RE portfolios and further drive up borrowing costs.

If rates rise .5% or so, China RMB tanks and offshore buying will fall off a cliff. Cost of holding will also increase for new institutional buyers. It would present challenges for the housing market.

The worry is that buyers of the last 10 years become hopelessly underwater and refuse to sell for another 10-20 years until nominal prices cover their losses.

The worry is that buyers of the last 10 years become hopelessly underwater and refuse to sell for another 10-20 years until nominal prices cover their losses.

I would say that in the face of the economic factors that will precipitate a downturn, “refusing to sell” won’t be a viable option for many. Those that need to sell no matter what will face serious challenges.

This correction will likely occur in the same relatively low volume environment in which Housing Bubble 2.0 grew. 5% plus mortgages and increasing inventory leading to YOY drops of 6-10% over 3 to 4 years sounds reasonable to me.It would be more analogous to the early 90’s crash than 2008. There were plenty of people who weren’t able to “ride out” the 90’s trough and sell in the 2000’s. Life Happens. I think there will be an exit of the most over leveraged participants and those that need to sell followed by smaller drops over the following years.

Ahh.. all that old belief that the world is totally awash with money; 2007/08 forgotten. There’s high asset valuations for certain – investors in market (REITs in many instances sold to yield hunting investors); I think the owner side in prime will find itself under siege with fewer proceed-able buyers at these price levels, in the near term future.

‘The dynamics of value expansion and contraction explain why a bear market can bankrupt millions of people.’

Yep! Kilo saki says it all the time, when markets go down the rich make money and when the markets go up the rich make money. It doesn’t matter. Financial education is the only thing that will save the poor and middle class.

The greater Los Angeles area Case-Shiller Index declined about 40% overall from its peak in 2006 to the recession trough. From properties I saw being swooped up – the decline on the “prime†westside was more along the lines of 25% or so. So, if the westside crap shack was $700,000 at its 2006 height and declined to about $525,000 by 2010, it looks like that crap shack may be back up to or even above $700,000 in 2015.

In 2010, when those shacks swooned to $525,000, how many people with good credit and 20% down payments wanting a home to live in were able to buy when they had to compete with either the ALL CASH guys or the SHORT SALE insiders? Not many I think.

And, when the crap does hit the fan again, does anyone on here really think the $700,000 shack will drop down again to $525,000? And, if prices do drop somewhat, won’t the ALL CASH vultures return to scarf up the crap again? For them, it’s a game. For the rest of us, it’s primarily renting and following the blogs.

In 2010, when those shacks swooned to $525,000, how many people with good credit and 20% down payments wanting a home to live in were able to buy when they had to compete with either the ALL CASH guys or the SHORT SALE insiders? Not many I think.

Not many, indeed. I was one of them. It was a rigged game then, and will be a rigged game next time.

Yep, I was one of them too. Everyone on their high horse saying I was an idiot to not but in 2009, 2010, 2011……I tried, God how I tried.

Now I could but I’d rather enjoy my money on life and be a renter than a poor tied down homeowner.

You invalidate your own thesis. After the last crash many took advantage advantage the lower prices from 2009-2011. Sure they would have been even lower if not for the flippers getting access to cheap fiat to play middle man, but you had excellent opportunities even in the most prime areas. There were drops as much as 40+ percent on some Valley and IE properties. Why would their not be opportunity for these types of reductions again when there is a generally worse economic environment for those who would actually buy said homes? You seem to admit the cyclical nature of the market while at the same time denying it… You seem to have the fundamental misconception that so many have of the amount of leverage in our economy. There is no great horde of cash buyers. The true Chinese cash buyers are insignificant to a market of SoCal size. The example I gave of a home in Hacienda Heights selling for 7% less than a comp from 6 months ago is germane. Exclusive Chinese enclave just blocks from the Temple. Where was the cash buyer to prevent such a reduction? Despite what the FED tells us,markets work and though they can manipulate them for a time,the invisible hand ALWAYS wins.

“…There is no great horde of cash buyers…”

That has been my personal, unscientific observation, also.

Even some very wealthy acquaintances who have paid $3mm+ for a home here in Irvine, *never* have paid 100% cash, even if they could.

Seems that even the wealthy are highly leveraged, but for different reasons.

But here is the *big* difference. These folks, *could* pay the mortgage if circumstances warranted. In other words, they have a plan “B”. Additionally, a primary residence does *not* represent a major share of their net worth.

Much, much different situation than Joe Sixpack who as leveraged himself up to his eyeballs and has *no* backstop.

Exactly who took advantage in 2009-2011 – any readers on this blog? I remember well the now infamous, much bandied about Credit Suisse chart of 2008 showing an impending implosion coming in 2009 – 2013 of all those new types of exotic loans (such as negative amortization and interest only loans). Did that ever happen?

By the time shellshocked buyers starting dipping their toes into the “prime†west side, the all cash vultures and the short sale insiders had swooped in for discounted crap shacks – the good Doctor here has had previous posts which showed about 33% being all cash, another percentage of short sales, etc. The regular, responsible 20% downpayer with “skin in the game†(unlike those who got in with little down during the 2003-2007 bubble) was basically left out in the cold. When the next opportunity strikes, be ready with as much cold, hard cash as you can muster or get to know a banker with insider short sale information.

I got one, and with eerily similar numbers. Previous owner “paid” $705K with 100% financing, got into trouble & had to do a short sale. I “swooped in” and put 20% down & purchased it for $535K. As I’ve said in earlier posts, I was lucky that the property (1070 square ft 2 BR SFR a few blocks from the beach) became available, and even luckier that the previous “pocket listing” buyer had to drop out. Since my 20% down payment was in cash, I went to the top of the list. I didn’t wait until they bottomed out; prices were still dropping in early 2011, and I bought a house to live in, not as an investment.

I have no advice to give about buying a house other than to save lots of money when you can, and to use rental parity as a sanity check.

I think it depends on where rates are headed. Low yields in what would otherwise be more attractive investments are suspected as the reason for driving more investors than usual to real estate over the past few years. Fed says rates are going up, some people believe they are bluffing, we should know fairly soon.

FED does not and cannot control the worldwide bond market. Investors will be forced to demand higher yields as counter party risk from soured bond investments come forward. the ONLY way many of these investment firms will be able to stay semi-solvent is to extract higher risk premiums. This can happen completely independently from any of the Fed’s machinations. That said the FED will likely lead this trend of higher yields instead of trail it as their image and credibility (such as it is) is really all the central bank has left. 7 years of QE and ZERO real economic progress have seen to that.

My house was $580k in Riverside County during the bubble. Today it is still only $360k. I actually would agree that even 360k is possibly a lot bit overpriced, but it isn’t even in the ballpark of 2007. In 2010 it was worth around 260k. There has been some inflation to account for the increases and today prices are only slightly elevated. Certainly an interest rate increase could cause prices to drop again, but it isn’t some epic megabubble like 2007. I could see a 5-15% drop happening, but without some major economic event nothing more than that. A drop would likely bring cash buyers out of the woodwork again. LA/OC/SD have recovered a lot more than Riverside imo so they are more prone to a larger drop, but obviously they are also much more desirable.

I’ve said it before – it’s a good thing the CA economy or even the national economy isn’t cyclical.

(For those of you who can’t tell, I’m being very sarcastic)

The fundamentals of economy is very weak with the erosion of full time permanent good paying middle paying jobs. This can be attributed to many factors like automation, out sourcing, cheap labor import.

The only people getting much better are the one percenter. Rest of the people are simply not seeing their salary raise.

In socal, most of the people are not in a position to afford a house. It’d be interesting to see how things turn up.

john: The only people getting much better are the one percenter. Rest of the people are simply not seeing their salary raise.

Government employees are doing very well. Cops, fire, sanitation, DWP, teachers, librarians, not to mention paper pushers of every kind. They’re the New Middle Class. Good salaries, secure jobs, early retirement, great benefits. Supported in part by others’ property taxes. Especially those who bought RE recently.

Of course, there’s always a chance that California can go the way of Greece.

They may make ok money for most of the country, but not compared to the median home price and overall cost of living in LA.

One police sergeant earns $314,360 a year (including overtime): http://smdp.com/28-cops-took-home-more-than-200k/129854

28 cops in Santa Monica earn over $200,000 a year. Other employees do nicely too. Check out the above story.

Usually it’s the federal government whose salaries are scrutinized and discussed nationally….but local and state salaries normally have not gotten as much attention….until now. And in California, those salaries are comparatively higher than for similar federal jobs. Visit the web site Transparent California for information regarding a locality near you….and borrowing from the great Mel Brooks, along with being King, it looks like nowadays “It’s good to be a Government Employee!â€

Anyone have any Conejo Balley ventura county insights? Inventory, comps, direction, Amgen impact etc? Any help much appreciated from this under reported area

The county is doing very well a healthy market. Agoura avg price around 725k, Thousand Oaks / Newbury Park 820k, Simi- Moorpark Bout 610 avg. Homes sell in about 62 days and inventory continues tight but growing in TO-Newbury Park. Overall considering some locations in LA and Orange County are starting to fell this pinch of less showings, Venture county is holding its own this summer so far?

I no longer live in Southern California, but owned a home for years there until 2014, and know the dynamics. Talk of a real estate crash is overblown. According to national statistics, sales volumes are still well below their 2006 peaks. Prices also haven’t gotten back to their peaks in a majority of locations. Local problems do exist. While Southern California has a steep gap between prices and incomes, a place like Tampa, is a hot market because it is affordable. Southern California will suffer a setback as prices try to find a support level in the absence of large investors and foreign buyers and slowly growing inventories. The other major problem few talk about in Southern California is that much of the L.A. basin is a ‘no-man’s’ land, undesirable. So much hype over real estate has made a lot of buyers make poor decisions to purchase in these marginal locations. Those are the individuals who will get hurt if the market corrects. That person who bought in Pamona, will take a much larger equity hit than the one who bought in Manhattan Beach!

“That person who bought in Pamona, will take a much larger equity hit than the one who bought in Manhattan Beach”

You mean % hit, not equity hit.

5% drop off $2mm is $100k. 20% drop off $400k is $80k.

Beach close locations with modest homes are very in demand. I have just witnessed a big move up in prices. About 10%. I am talking about South Bay, and Newport Beach, Corona Del Mar. Looking like more upside ahead.

However, I do not like this at all. This may be a big inflation jump. Eventually, inflation jumps feel good in the short term, but end very very badly.

This tech bubble will pop, and the buyers at these prices will go with it.

I have some well to do friends who.bought a condo in Santa Monica in March of 2013. They paid 1259k and just sold in April of this year for exactly 1300k.

More proof that spring 2013 was more or less the peak.

Because of the bizarre nature of current national real estate (lending) policies — ultra low interest rates being at the forefront — real estate offerings can reach amazing levels without triggering a price decline.

For those holding said properties are not being forced by lenders to unload/ exit their positions.

What we should expect is a Wile E. Coyote cliff flat pricing trend — until some liquidity shock — from out of left field — forces events.

That shock may still take the form of currency ruin, so nominal price declines may just not be possible.

A straw in the wind is Puerto Rico. Its economy, its finances, its politics, its demographics, its productivity — it’s the American ‘canary.’

Very much like Honolulu, PR is a generation ahead of the California end game.

Well, maybe California doesn’t have even that long.

Once the bull market ends, Sacramento’s budget IMPLODES.

For non-Californians: Sacramento taxes all capital gains as straight ordinary income — period. Capital gains totally evaporate during bear markets, of course.

And luckily Prop 13 is still a third rail so the only way that revenue can be made up is through sales taxes and fees.

Gray Davis found how precarious it is to raise revenue this way.

The CA GOP is dead, but that doesn’t mean a moderate or libertarian leaning Democrat won’t get the funding from business interests that would normally go to the GOP to make an end run around the CA left. I think the coming budget issues are going to effectively split the Democratic Party in half between the social spending types in the poorer areas and business friendly Dems from the West Side and other high income enclaves. Obviously the remaining GOP reps will vote with the business friendly Dems, so maybe, finally, there can be some fiscal discipline in Sacramento.

Good Point, its mention about moderate Democratic winning. The only tax increase that will probably win again is prop 30 because of school financing. The GOP had a chance back around 2,000 where the could have been fiscal cons/social liberals but they pushed for being conservative all around that works best in Kern County. In fact the dems are making public transportation more possible by using the carbon tax by giving more money to connect the surfliner with pbulc buses and so forth from San Luis Obinspo to San Diego. Also, money for a bus rapid from Santa Ana to Long Beach and a street car in Santa Ana and Garden Grove which attracts the hipster crowd. Some affordable units but I predict in 2030, Santa Ana will dripped form about 80 percent Latino to 70 percent and most of the gains are in Asians. There is a lot of house building in Westminster/Santa Ana area. There is a lot of changed the economy will swift from Tourism to E-commerce which means more warehouses and call centers and the aerospace is picking up since the Republicans spent on defense and there is the growing space program in satellites. 3- d print housing is the new mobile home that could be done in the next decade making the inland empire cheaper than it is now.

Where do all these inventory come from? Banks releasing them as the market goes up? Or people deciding to sell because of the potential profits?

But if they’re selling HIGH, they’re also going to have to BUY at a HIGH inflated bubble price.

So, where are all these properties coming from? Banks were keeping these properties and waiting for the right time to post them at auction?

Andrew, We are seeing a surge of California buyers in Arizona. Retirees can get the same home for 30-40% of the price while paying property taxes 90% lower than in California. So they can take their capital gain, use some for home replacement and live on the rest. I would assume that all the other surrounding states are seeing the same thing (again). It is helping move prices up here as Californians do not blink at million dollar price tags. Easterners are not as generous.

This blog has been predicting the housing market crash for years however you need a major economic event like the previous financial crises to trigger it not just inventory rising. Inventory will rise and fall because if sellers do not get their bottom line price they will remove the property from the market if they do not need to sell. That coupled with the change in capital controls in China will keep the bubble going in most major cities including Los Angeles. Chinese citizens want a safe place to park their cash and LA along with NY, Sidney, Tokyo, Osaka, Vancouver and SF are those places. Prices may be flat to slightly higher for the next 5 years.

@ Sam I tend to agree with you. I dont see how what happens in Greece can affect home prices in LA, LA, LAnd (recent posts claiming the crash in Greece will cause home prices to drop).

Perhaps a job-loss recession can spark a decline in home prices but unemployment is now the lowest it has been in a long time (nationally). Those who are ‘praying’ or hoping for a crash may not be in any better position this time than last time… those with cash and connections to banks will get all the short sales and foreclosures. Legitimate buyers will be too scared to purchase a fair market listed home (because they will fear not knowing where the ‘new’ bottom is).

@QE Abyss

The employment numbers are not as strong as people would claim. Lowest participation rate in several years despite population growth. Weak wage growth in keeping with inflation. Heck, even the Fed is too scared to raise interest rates despite the “robust” numbers.

With all the liquidity (cheap debt) floating around, another price downturn would mean that few if any investors would be brave enough to jump in to stabilize prices. Yields for investment loans would have to rise to compensate for falling RE portfolios of REIT’s. With the loss of investor confidence and higher costs of borrowing, who’s going to step in?

“the crash in Greece will cause home prices to drop” seems like a misinterpretation of what I’ve read in relevant comments. It’s more like potential corollary impact instead of a claim of an absolute direct outcome.

I have no idea what impact the Greek situation may or may not have on our real estate market but it’s reasonable to assume that if L.A. is such a “prime” beneficiary of international interest, it would then follow that there is increased exposure to external shocks.

Stocks have been falling of 1 month straight with no signs of going back up. I lost tons of money on this.

If it continues to drop, I just might need to cut my loses and cash out.

China also just suffered from a huge drop in stocks this week.

@Sam

I don’t recall this blog predicting a specific date for a crash. It its just describing the conditions paralleling the last downturn.

If pulling houses off the market or the rise of Chinese buyers is that it will take to prevent another crash, why didn’t that happen in the last crash? In the 80’s, the Japanese thought that American properties were safe as well — only to take a bloodbath on their investments. BTW, do you expect the Chinese to perpetually represent a healthy buying demographic when their own economy is severely stressed and their government is cracking down on international money laundering?

@Sam

It’s funny that you chastise the blog for predicting a RE crash while admitting that a bubble exists.

If sellers pulling off their properties and Chinese buying are all that it would take to prevent another crash, why didn’t that happen in 2008-2009? Speaking of major economic events, do you pay attention to what’s happening around the world? Greece is about to do the unthinkable and officially default on their debt. A lot of their bondholders will feel the sting, and yields will jump higher. Meanwhile, China’s RE market and stock market are floundering. Coupled with their government’s goal to crack down on international money laundering, do you think that the Chinese will perpetually represent a buying demographic healthy enough to support stratospheric RE prices? In the 80’s, the Japanese thought their American RE investments were safe as well — before taking a bloodbath.

I thought the same in 2006/2007 that real estate prices would never drop in price at least in prime areas like socal… A lot of media fuelled propaganda supported my thinking.. But we all know how did it end up last time

Not sure how would it look this time but insanity can’t continue for ever..

Yes I agree a bubble is forming however bubbles don’t always burst. This can go on a very long time without ever bursting. Look at London. Greece? A non- event. More emotional than financial or economic. The Chinese won’t fuel the housing market perpetually but I would be willing to bet that someone else will step up after the Chinese are done. You need an epic event such as the financial crisis and I don’t see that happening a time soon. But then again as I read in Baron’s today “the soldier never hears the mortar shell that gets them only the ones that miss”. While we are all focusing on China and Greece there could be something much bigger that happens. Could be a long wait.

Who is the someone who will step in who has as big of a cash horde and fickle investment practices as China does? Like U.S. investors, the Chinese didn’t step in until the federal government and Fed embarked on their epic bailout programs. Thus, like the Japanese, they massively overpaid.

If Greece were a non-event, why has it been allowed to be dragged out all this time? I bet that their bond holders would agree with you.

Warning signs of the last crisis were all around before it finally blew up. Huge financial and asset bubbles have formed all around the globe. Anyone of those could be pricked and provide the fuel for the fire.

“Warning signs of the last crisis were all around before it finally blew up”

Same as last time. The signs are there, but MSM doesn’t report them much. Seems to me around 60% of US news programming is gay issues or racial discrimination stories, 30% entertainment (celebrities, or some dumb video of a kid cursing or dancing that’s “gone viral”), maybe 10% actual hard news. Even those aware of Greece may think CNBS will report tomorrow pm “Greek Crisis Resolved”, details later, more credit/QE, Pisani may declare “we’re well off the lows”, market surges to Fresh New Highs.

Nothing derails this train, until the day it goes off the tracks, with a vengeance.

@WeDontMakeThoseDrinksNoMore

Monday of last week, the midday news spent all of their broadcast time reporting local events, celebrity news, and social media trends. You had to be very observant to notice the 300+ points that the Dow had lost on the lower right hand corner of the TV screen.

Meanwhile, news articles tout how great higher prices is good news for RE. But rarely if ever are rising housing costs and relatively stagnant incomes questioned.

Bubble always burst but no one knows when and under what circumstances.

It may be along wait probably..

This blog is predicting that burst for the last few years

But if anyone who bought in the last 5 years are now sitting at a good deal of equity.

The question is not if a bubble exists but it is: How can you be benefited from this ?

Equity pretty much means nothing until exchanged for currency upon sale.

I love how realtors try to make it sound as if an Old Houses will transport you back into more glamorous times. As though rather than simply being Old, the house is actually a Time Machine.

Of this house in Eagle Rock, the realtor say: “It’s cocktail time with Rock Hudson and Doris Day circa 1964 …” https://www.redfin.com/CA/Los-Angeles/1437-Wildwood-Dr-90041/home/7084234

It’s a nice house, but it’s still over 50 years old. And Rock Hudson’s been dead these past 30 years.

Not in all cases – but a lot of the time those old houses have better bones than those built in the past 20 years.

“Who is the someone who will step in who has as big of a cash horde and fickle investment practices as China does?”

Trump!

hey Doc, what do you think is the driver for all this inventory? are NoD’s increasing? foreclosures? or given the prices, are people just wanting to cash out before prices take a dip? i see extremes in the market recently. some areas seem to be selling like hotcakes, while some other areas do not. what’s your take on these differences? is it possible to see a crash in the areas east/southeast of LA, but not mid/west LA?

Leave a Reply