The San Francisco housing market and tech bubble: Will a correction in the technology sector impact Bay Area home prices?

I was up in the Bay Area in the fall and people love talking about real estate just as much as they like talking about the latest startup. Housing values in the Bay Area make Southern California look affordable. The median price for a sold home in San Francisco is $1.2 million. And the market still seems to have momentum. A lot of money that has flowed into San Francisco has come from foreign investors but also wealthy tech households. Tech has been on fire since the last housing bust. While some people want to believe tech and Bay Area housing are decoupled, there is evidence that there is a deep connection between the two. Rents certainly adjust based on market forces. Depending on how deep the correction, there is likely to be an impact on housing. They always say a financial bubble is only visible once it is popped but there are clear signs when you are in one. Let us look at some figures here.

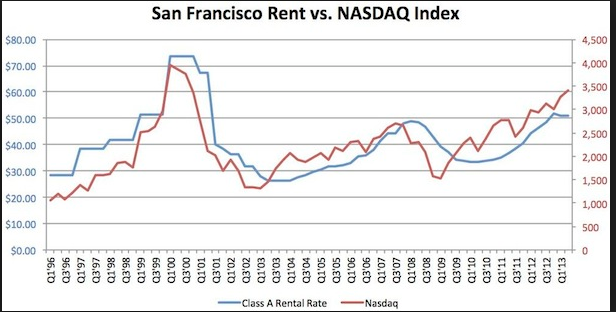

San Francisco Rents and NASDAQ

It shouldn’t come as a surprise that rents are deeply correlated with the health of the overall economy. In San Francisco, a large part of the economy is tech connected. It is interesting to look at some data on this because it does highlight a rather strong connection between rents and the NASDAQ.

Take a look at this chart:

This chart is a bit outdated since rents are now at record levels but so is the NASDAQ (a bit off recently) relative to the bubble that occurred in the late 90s and early 2000s. Since then, we’ve added many more tech companies with substance (just look at the market cap of Google, Apple, and Amazon relative to what it was then). So there is real wealth and companies here, no doubt. But we also have a massive amount of venture capital chasing after the next big hit. This has been going on for a few years now and insiders are starting to see the echoes of the past.

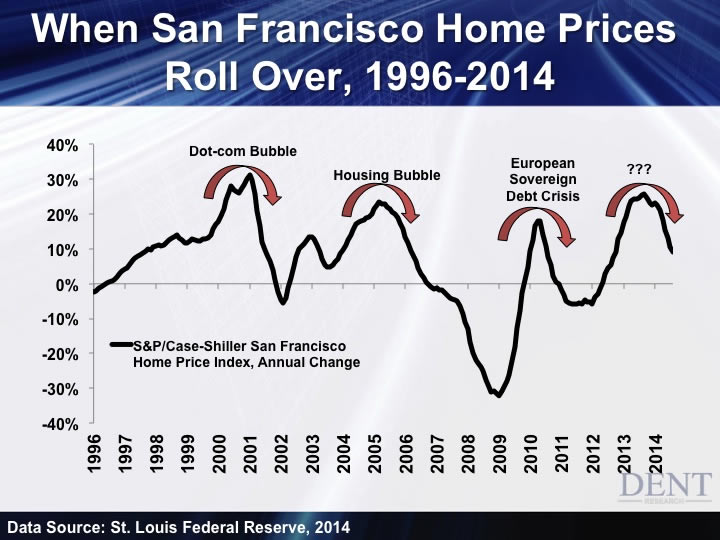

Here is an interesting chart showing the ebb and flow of prices in San Francisco real estate:

Prices do go down in San Francisco contrary to the overall mythology of the area. The argument is that in the long-run, you should buy no matter what since prices will go up. So let us see if we can find a bargain in the Bay Area:

2426 47th Ave,

San Francisco, CA 94116

2 beds, 1 bath 898 square feet

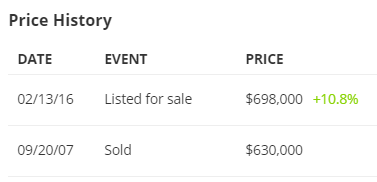

Interesting small place here. The place is listed for $698,000 which seems like a “deal†in San Francisco. Check out the price history:

This home is an example of buying at the top and selling potentially at another top. It sold for $630,000 in 2007 right when the market started to implode in California. 9 years later the asking price is $698,000. After sales commissions are factored in, this home didn’t even keep pace with inflation for nearly a decade. So when someone says the long-term, it really depends at which point in the cycle you are buying because 10 years might seem like the long-term for California buyers.

The NASDAQ has recently started to correct with the rest of global stocks. This is the first market test since the bottom hit in early 2009. How much of an impact this will have on San Francisco housing prices is yet to be seen but with a median price of $1.2 million, not many can afford to buy to begin with.

Is anyone noticing any changes to Bay Area housing due to the current market correction? Â Â

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

187 Responses to “The San Francisco housing market and tech bubble: Will a correction in the technology sector impact Bay Area home prices?”

I don’t see a correction in the housing market yet. I still see 80% of homes going at or over asking price here in the east bay. The madness is still going on..

Agree…

The east bay is hot all over, homes going for $50K over asking with a dozen offers

2500 sq ft homes in the best school districts selling for $1.1M

Also the people I know who were layed off at Twitter got higher paying jobs in a few weeks

The music will stop eventually…. not any time soon though

“not any time soon though”

little by little and then all at once.

“How did you go bankrupt?†Bill asked.

“Two ways,†Mike said. “Gradually and then suddenly.”

The Sun Also Rises

Go Jim!

That’s actually a pretty good description of the crash. I sold electronics junk at the De Anza college swapmeet (mainly it was shit that would have gone into the dumpster otherwise, and I’d clear $300-$500 to gamble with on more electronics junk) and in 06 I had guys telling me they’d screwed themselves out of $50k by waiting 6 months to sell their house …. it was a long slow decline in 06, and then the economy went into freefall in 07.

Slowly, then suddenly.

The bay area house prices are below 2007 price levels. According to CoreLogic report released several days ago, average bay area price is $625,500. The bay area average was price was $665,000 in 2007. I am not impressed.

No, we’re not at 10X Bay Area median income yet. Yet.

Some people are still driving at 100 MPH blinded by the sun and are totally unaware that the wheels are falling off. “January New Home Sales Collapse Most Since 2009 As Prices Plunge To 2-Year Lows” http://www.zerohedge.com/news/2016-02-24/january-new-home-sales-collapse-most-2009-prices-plunge-2-year-lows

But it’s a highly desirable international sun.

Those who don’t remember history or didn’t experience it are doomed to repeat it. “The Mood In Silicon Valley Is Like The “Moment After The Titanic Hit An Iceberg” – Here’s Why – As the WSJ observes, of the 48 venture-funded U.S. tech companies that went public since 2014, 35 now trade below their initial public offering prices. Since November, at least a dozen tech companies, which combined raised well over $2 billion in venture funding, have announced layoffs, letting go hundreds of people that in most cases represented at least 15% of their staffs. Other companies are closing money-losing projects and raising debt to tide them over.” Some companies are raising funding by selling shares at lower prices than they had in earlier rounds. Such “down rounds†can hurt a startup’s chances at recruiting and discourage employees who are often paid with stock options. Location-sharing mobile-app company Foursquare Labs Inc. raised cash in January selling shares at a 69% discount from the previous price, according to corporate documents provided by research firm VC Experts. Delivery startup DoorDash this week sold shares at a 16% discount. A DoorDash spokesman declined to comment.

http://www.zerohedge.com/news/2016-02-22/mood-silicon-valley-moment-after-titanic-hit-iceberg-heres-why

Speaking from the heart of the so-called Silicon Valley, tech jobs are vanishingly rare here anyway. And almost all of them pay $12-$15 an hour, what you’d make working at the tire store. Hell I’ve met people who do things like stand around being a security guard or stock trays of sodas and snacks to go out to company vending machines, who make substantially more than I do – I wish I’d never learned what a capacitor does or the difference between an NPN and a PNP transistor.

So betting on tech …. is a very bad bet.

Alex, component level electronics is not what defines “tech” as it exists today in tech hubs across the U.S. That work has long since been largely outsourced to Asia. It has enabled communications, software, and services to evolve into the current focus of technological innovation in America.

Your perspective seems akin to the gas lamp engineer bemoaning declining work and pay of the lighting industry in the 1920’s.

Hotel – An engineer comes up with a circuit on SPICE, sends the Gerber files to a place in China, the first few boards come in in 2 weeks, the engineers puts ’em on the ‘scope and power supply and tweaks them, comes up with some changes in component values, new Gerber files are sent, few more boards are sent, OK time to go into production.

No tech required. It’s cheaper to shitcan a board than repair it.

Hotel – and yes, I betted on the most losing horse in history. I’d literally be better off with a degree in something like puppetry (such exists!) ancient Greek literature, basketweaving etc.

It’s not just YAHOO. A lot others Silicon valley Tech like a top 20 employer NetAPP layoff 1500 heads

http://www.bizjournals.com/sanjose/news/2016/02/17/netapp-plans-to-slash-1-500-jobs-in-400m-cost.html?ana=twt

In SFO also start up Kabam is laying off 10% software devs…

the news are quietly rolling out on cutbacks

I think we are close to the inflection point in the Fremont. Asking prices are at nose bleed levels. Some are so high they end up pulling the property off the market when no buyers are willing to commit. There are an amazing amount of realtor signs for February. With the spring market at hand and these prices it is going to be obvious to see if these ridiculous prices have legs.

It’s “the” Fremont now? The guy I work for is in Fremont (just about 100 yards from the Milpitas border) and they’re always getting doorknob-cards and little calendars and stuff from real estate agents.

My favorite is the little calendars they get from a couple whose last name is Blood, I kid you not. “Ve only vant your blood! blahhh! blahhh!” lol

You have a perfect RE storm up in the Bay Area. Without an external trigger, there will be NO tanking hard.

1. Supply and Demand

2. No growth policies

3. NIMBYism to the extreme

4. Long time owners (Prop 13 winners) will never sell their gold mine

5. High paying tech jobs with instant millionaire carrots

6. International city status

7. Did I mention the word desirable

8. California lifestyle (climate, scenic beauty, activities)

9. All groups are accepted (minorities, gays, illegals, extremists, etc)

10. Some of the best higher education in the world

11. Etc, etc, etc, etc….

It will likely take a huge recession, tech blowout, massive stock market downturn to get any meaningful correction. Even with a 30% correction, prices will still be out of reach for the commoners. No thanks, the socal beach lifestyle is much better…and likely cheaper.

Yup kinda like Detroit ! Until the auto industry moved to China!

Any kind of software company does not need any specific location. Detroit had massive infrastructure with all its factories, and it’s mostly gone.

Yep in 1940 I’d have bet my heart and soul on Detroit.

Until it becomes a smoking crater where jobs used to be.

Absolutely: Detroit, like San Jose today, are 1-Trick towns, their economies are completely undiversified. A hit to the film industry wouldn’t kill LA, but tech moving elsewhere… Silicon Valley could well become the Detroit of the future. And looking at the light speed pace that internet companies develop, disrupt old competitors, quickly become outdated and can be outsourced anywhere in the world, a shift in SV’s fortunes could happen far faster than Detroit’s decades-long decline. Well, at least the weather’s better…

Blankfein – I agree, I think it’s cheaper in Socal and there area lot of advantages (Goat Hill water not being one of them).

Since tech is a huge loser for the average person who didn’t go to the right high school with the right people, I’d be far better off camping in the weeds around Huntington Beach and doing signs or drawing portraits on the beach. Stick my stuff into a storage unit, and just camp out. Eventually get up the “grub stake” to rent a room or something.

Bust Royale Scheduled for Insane San Francisco & Silicon Valley Housing Markets – San Francisco finds itself in one of its most phenomenal construction booms in history. High prices have lured the Big Money from all over the world. For example, Shenzhen-listed real estate company Oceanwide Holdings is planning to build a mega project with two million square feet of residential and commercial space in the center of the City. This project, its third in California, includes two towers, one of which will be the second tallest in the City.

The SF Planning Department’s new Pipeline Report lists 62,500 units at various stages in the pipeline, from “building permit filed†to “under construction.†Many will come on the market this year, on top of the thousands of units that hit the market in 2014 and 2015. Once they’re complete – if they ever get completed – they’ll increase the city’s existing housing stock of 382,000 units by over 16%.

Most of them are expensive units – because that’s where the money is. They need buyers and renters who can afford them. Homes in San Francisco are occupied on average by 2.2 people. At this ratio, the new supply would create expensive housing for 137,500 people, in a city with a population of 852,000!

San Francisco finds itself in one of its most phenomenal construction booms in history. High prices have lured the Big Money from all over the world. For example, Shenzhen-listed real estate company Oceanwide Holdings is planning to build a mega project with two million square feet of residential and commercial space in the center of the City. This project, its third in California, includes two towers, one of which will be the second tallest in the City.

The SF Planning Department’s new Pipeline Report lists 62,500 units at various stages in the pipeline, from “building permit filed†to “under construction.†Many will come on the market this year, on top of the thousands of units that hit the market in 2014 and 2015. Once they’re complete – if they ever get completed – they’ll increase the city’s existing housing stock of 382,000 units by over 16%.

Most of them are expensive units – because that’s where the money is. They need buyers and renters who can afford them. Homes in San Francisco are occupied on average by 2.2 people. At this ratio, the new supply would create expensive housing for 137,500 people, in a city with a population of 852,000!

San Francisco finds itself in one of its most phenomenal construction booms in history. High prices have lured the Big Money from all over the world. For example, Shenzhen-listed real estate company Oceanwide Holdings is planning to build a mega project with two million square feet of residential and commercial space in the center of the City. This project, its third in California, includes two towers, one of which will be the second tallest in the City.

The SF Planning Department’s new Pipeline Report lists 62,500 units at various stages in the pipeline, from “building permit filed†to “under construction.†Many will come on the market this year, on top of the thousands of units that hit the market in 2014 and 2015. Once they’re complete – if they ever get completed – they’ll increase the city’s existing housing stock of 382,000 units by over 16%.

Most of them are expensive units – because that’s where the money is. They need buyers and renters who can afford them. Homes in San Francisco are occupied on average by 2.2 people. At this ratio, the new supply would create expensive housing for 137,500 people, in a city with a population of 852,000!

http://wolfstreet.com/2016/02/25/bust-royale-for-insane-san-francisco-silicon-valley-housing-markets/

You have to remember that San Francisco is unique. The tip of a peninsula, it is built out so the only way to build more housing is highrise condos which, by their nature, will be upscale. You also have to consider that the ‘rich’ do not have a large portion of their wealth in housing. I think the figure is 10% or less thus someone with a net worth of 10 or 20 million dollars can afford to spend more on housing ( and will if it buys them a prestige address). A personal anecdote. I used to work for builder based out of Columbus, Ohio. When he had made his pile he moved to San Francisco though his only prior experience in the area was building some apartments in Fremont and Mountain View. For this reason, the trophy homes of San Francisco are fairly immune to severe price drops since there are lots of rich people in the world who can afford to buy them if they come on the market. OTOH the homes, like the one pictured, are not immune to price crashes since they are not being bought by high net worth individuals, do not have views and are not prestige properties. No rock star, business tycoon or IPO millionaire is going to spend a million dollars for a nondescript, 2 bedroom house in the fog belt just to have a San Francisco address.

Even San Francisco has vast areas of open space … I like to watch drone videos on youtube since I can’t afford to get into flying drones myself, (and frankly if I had my own drone, I’d be worried about something happening to it … watching someone else’s video, I can just sit back, relax, and watch) and lots of drone video is shot in SF …. there are very large areas that are not being used at all. I’m not talking about The Presidio, I’m talking about other areas that are simply …. abandoned.

Plus there’s “south city”, South San Francisco, which is actually pretty cheap to live in, at least by bay area standards. Tons of Filipinos, mabuhay!

True there are the former industrial areas along 101 etc. but the ‘San Francisco’ most people think of as San Francisco is the portion of the City running along a 7 mile line on the north and west of Golden Gate Park to downtown. Sea Cliff, the Presidio, Pacific Heights, Marina, Telegraph and Nob Hills , etc. or less than half the total land area of 49 square miles Since most people don’t have the resources or connections to develop land they have to buy the existing housing stock. With 800,000 people living on 49 square miles, San Francisco is one of the most densely populated cities in America.

Minus a point or two here and there it seems like housing prices are finally back to where they were before the The Great Recession. Ten years recovering doesn’t sound like the bubble it very well might be as much as a long painful recovery to values of 10 years ago. Housing feels overvalued in Coastal California as a whole but when compared with other great cities of the world it feels right in step. The other great business centers, Paris, London, Sinapore, Hong Kong and Tokyo are more expensive and not necessarily a better value.

We may be in the doldrums for a long time just inching up in value as the years roll by but I don’t see a major correction in the near future, sorry Jim Taylor. With the securities market such a poor place for money these days, real estate is still a possible place to see returns if done carefully. We just don’t have the really crazy upward pressure from the government trying to push people into real estate that don’t have the knowledge or resources to support this kind of investment. We don’t have NINJA or Option loans – yet anyway.

Um, there are offers of “NINJA” loans in the sidebar on this site.

Plus I dunno of you guys in socal are being plagued by endless “rocket mortgage” ads on the radio like we are up here in the bay area; they’re endless. Plus shit like “rich uncle dot com” and all kinds of financial scams.

Yes, Rich Uncle Dot Com does advertise on Los Angeles talk radio.

I listened to a shit-ton of Mark&Brian on KLOS while fixing circuit boards, later it was John & Ken on AM-740, remember Handel (Handel Yourself In The Morning, Handel On The Law) telling me one morning a plane had collided with the World Trade Center … was hoping it was just a Cessna and at worst only the pilot and possible passenger got hurt … by the time I got to the El Toro Y I learned it was a big deal …a big big deal … I knew there was a sports bar next to the library sale so I went in there, people were crying and I saw the second plane hit the second building… paid $5 for a glass of milk (LOL!!) the bartender was filling people’s glasses to the brim and people were crying.

San Francisco real estate is one of the safest bets if you live in that area and expect to be there for the long run. Even if the market corrects due to stock market drops and subsequent job losses, there are still so many wealthy individuals and real estate investors/companies in that area, that prices will never drop down to half or one-quarter from what current market prices are. That kind of major big drop only happens to inland cities that are undiversified and not the perpetual birthplace of the “next big thing”, everytime the next big thing comes along. Southern California might lose value with its more cookie-cutter sprawling suburbs, but for San Francisco Bay Area and San Francisco in particular – loss of value to some great extent? Huge decreases in prices? Wait and buy one day soon after the bubble bursts? Don’t make me laugh. It may burst and prices may drop in Sacramento, Reno, Carson City, Las Vegas and Inland Empire, but in San Francico, that kind of major permanent economic decline will never happen. Never.

Never say never!

I wouldn’t be so sure. I saw the last tech bust up close. I remember Berkeley, Stanford, and MIT grads go begging. Without a huge amount of investment from NYC mutual funds and the like, this bubble wouldn’t have had legs to go as far as it did. It’s cheap money that caused it, not great ideas that were making tons of money. Most of SF and surrounding areas are still pretty rundown – wouldn’t a widespread wealth effect have changed that too? There are also a ton of baby boomers in the Bay Area that will need to move out at some point in the next 10 years. Unless there’s another perfect storm of Chinese investment, low interest rates, foreclosure aids, tech bubble, and stock bubble I think prices must drop.

I was literally, not figuratively, begging in 08. One day I was wearing my Computer History Museum t-shirt and a guy remarked on it; I’d been a docent there just for the funz. And now I was begging in it.

I’ll admit: Begging paid me better than ever being an ace repair tech did.

i am literally laughing out loud at that post,

normalcy bias to the extreme if you ask me…..you talk like an earthquake will never happen there ever again as well AND like the last crash never happened.

may you live in interesting times is an understatement.

2010-11 were downright scary and homes were cheap around the bay..

it can happen fast or not at all…

I live in a nice area of the City and prop 13 owners are everywhere, they will never sell as mentioned above. Parents have a unit and kids another. A bank account for the family.

But the cloud social app tech bubble could pop and not a lot of savers in today’s world thus nothing to fall back on. A correction in housing would be healthy at this point as it’s overheated. Public transportation and the diverse culture along with natural beauty make San Francisco a tough place to leave.

crowded trades are not fun

*Any* real estate is a good bet if you’re playing the long-term game. I’ve mentioned on this site before, the house my family had on Portlock Road on the island of Oahu, Hawaii … it was overpriced, but if we’d hung onto it, we’d have a place that would be a home for all of us, and I believed valued at a couple of million now.

There would have been costs involved with its upkeep and it would have to be sold in order to realize the gain.

Hotel – 5 bedrooms 3 baths and huge yards, the idea would have, to my mind, to never ever sell. Use it as – shocking! – a place to live. Let’s say each bedroom is worth $200 a month, typical Hawaii price, that’s $1000 a month, just keep it as a “homeland” forever.

All it will take is “the Big One,” which is geologically overdue, and a LOT of housing stock — especially the expensive “historical” stuff — will be heavily damaged or destroyed outright.

That down cycle won’t be easily recovered from.

Good theories but prices in the bay area won’t go down and even if it dips a bit, it will quickly rebound. It’s impossible for bay area home prices to drop any significant amount. 2008 was unique and won’t happen again. Short of a devastating earthquake, these high prices are here to stay and will only go up. I repeat, it’s impossible for bay area homes to plummet in price. So if you’re thinking of buying a home in the Bay, don’t wait, buy now! You’ll be glad you did when you see prices double within the next 10 years.

I don’t see it. If the millennial generation had money to buy, they would have. Remember the older millennials are already in their mid 30’s. Go around the Bay Area and show me who owns houses – I’ll bet it would be 70% boomer and older, 20% X’er and the rest millennial – mostly with help from parents. The next generations coming up cannot afford these prices period. Also, not everyone can work in tech, and regular jobs are not paying any more now than before.

I understand what you’re saying so it’d be pretty crazy if what I said is true. And yet, that’s exactly what will happen. No way are prices dropping, it’s impossible.

Tech jobs are a tiny slice of the job market here, and most tech jobs pay shit.

Nope’s message simplified: Buy now or be priced out forever.

A good mark won’t believe he could be taken.

Wait, you forgot to include the Real estate company you work for and your company’s phone number.

I don’t work in Real Estate. I hate RE agents actually. Facts are still the same, home prices are going to continue to sky rocket.

And the all-important extension number so ‘Ol Gil doesn’t get the sale.

Okay, Nope, perhaps you do not work in a real estate office but in the field benefiting from home sales in another way. Flipper? I know of two types of flippers, one a 1960s TV show with a dolphin named “Flipper” and the other is one who buys and sells homes for profit. I do not see a hole on top of your head, Nope.

That couple on “Flip or Flop” are still making ungodly money on all their flips. So far the housing market hasn’t cost them, to the contrary, they continue to make huge profits. They are the canary in the coal mine, IMO. When their show is cancelled we’ll know the housing crash is underway.

I went to HS with the girl from Flip or Flop, Canyon HS in Anaheim Hills. I’m not going to pretend I really knew her but friends of mine did. Saw them at a recent wedding of a mutual friend, and at the Superbowl party they admit they still make money but it is not like before and they rather be sellers than buyers right now if they were looking for a personal home. People like them will continue to make money because they will move on to a different business when this dries up.

I’m convinced shows like Flip Or Flop, Pawn Stars, etc are pure fiction.

Even in the great crash of 2008 prime real estate didn’t go down much in the Bay Area. I’m sure median prices decreased, but as has been often pointed out here, that figure ignores the change in the mix of houses sold. Just like down here in SoCal most of the action was at the lower-middle ends of the spectrum. The well-to-do generally had the resources to just hang on until prices rebounded.

I have a personal anecdote that, while not proving my point, at least corroborates it: I have a well-to-do sibling with a nice 4BR home in the mid-Peninsula hills (view of everything from the Stanford Tower to the Bay Bridge – Zillow’s out around $2M+ these days). I checked the value of this house during the whole crash and rebound. Between 2007 and 2011 it basically barely dropped at all (maybe 3-5%) and then zoomed up 50% in the last 5 years. The same was true in the dot com crunch of 2001 (which hit the Bay Area much harder than LA). The house basically stopped appreciating for a couple of years, but never really fell in value.

I know the experience of a rich family member doesn’t prove anything, but it seems to me we’d need to see a truly apocalyptic economic collapse before the wealthy would capitulate enough for “nice” homes in prime LA/OC or SF to become even semi-affordable by ordinary folk.

“Even in the great crash of 2008 prime real estate didn’t go down much in the Bay Area.â€

These data seem to suggest otherwise: http://www.jparsons.net/housingbubble/san_francisco.html

The methodology (detailed at the site) used to obtain the data seems reasonable enough to me.

While the Case Schiller Index does control for home size and “quality” the data reported are still for the overall median of SF Bay Area sales. My contention was that prices at the upper end didn’t drop nearly as much and the data referenced doesn’t really address this as it doesn’t break out this tier of the market.

Again my information is only anecdotal based on prices I tracked in one higher end neighborhood, but it sure didn’t seem as if prices dropped much there in the crashes of 2000 and 2008 or their aftermath.

If you have been looking at Zillow numbers over time you would see that those past trends change for some reason. I bought a place in the Bay area in 2011 for half of what the previous person bought it for in 2007. Not to say that it was like that for all of them, But man 2010-2011 was a gold mine for real estate in the Bay Area.

The same thing happened n Tokyo. Wealthy areas have just bogged down. They are limited in size, have great infrastructure and amenities and there’s always a constant trickle of newly rich coming on line who want to move in. Surrounding, poorer areas were eviscerated.

I drive all over the Bay to construction sites…there is shit ton of multi-unit mega complexes going up. All over….acres and acres in Dublin, Fremont, Alameda, Millbrae, Foster City/Redwood City….smaller ones in the core areas like Berkeley and Oakland (those are single buildings that are 4-6 stories and one block). But the others are huge.

That stuff can’t stay high like they are asking. Not enough people make 200K and the ones that do don’t want to live in Dublin and grind out a commute over i-580 everyday.

This stuff is garbage and will crash….529K plus $368 HOA.

https://www.redfin.com/CA/Dublin/3245-Dublin-Blvd-94568/unit-333/home/1790382

More 700K crap in Dublin https://www.redfin.com/CA/Dublin/3685-Whitworth-Dr-94568/home/2112817

I agree. It took a while for them to start building, but I see building in Alameda, Milpitas, Oakland and holy shit in Bayview SF there’s huge plans underway. The amount of new inventory is staggering considering people are starting to leave.

They’re building like crazy in San Jose too. The old “Murky News” building is gone, they’re building apartments/condos. A very large piece of land right on Brokaw is being turned into stores (like a Sprouts health food store yay!) at ground level and all residences above. Everywhere I look there are huge apartment/condo blocks being built.

Great chart nasd vs rent. I always thought rents didn’t go down, but home prices could. Good to see rents can drop as well. I thought if rents had plateau where they were that would support home prices, but now HOUSING CAN TANK HARD FOR SURE!

In our manipulated central planned economy, more than ever you have to consider:

1. timing

2. timing

3. timing

As the graph above shows, timing is everything, no more than ever. Never in the history of the US has the economy been so manipulated as it is today, and never had a small group of people yielded so much power and control like the those in the banking cartel we have today.

Those that try to bring the prices from 30 years ago to justify continuing rise in RE prices are wilfully blind to the level of manipulation taking place today. Did we ever in the history of this country had zero percent interest? What about the soon coming NIRP?

Past performance is no guaranty for the future.

Well said Flyover! Housing to tank hard. Some people are trying hard to convince us otherwise. “buy now or be priced out forever” are the famous last words.

thanks for trying to bring a little sanity to the discussion and you are 100% correct, timing is everything in California real estate.

and the market manipulation can’t go on forever…..or can it?

Doc, you heard it here first, this place (SF) is different.

Must be why rents are rolling over – because this place is different and it’s nowhere but up from here.

But hey, just set it and forget it because insert a top 10 list of reasons and other cities that only get offered up when prices increase.

About those global, desirable, everyone wants to live there cities like Hong Kong which is currently experiencing a rapidly bursting bubble… or Tokyo, full of those rich foreigners with buckets full of money who were going to buy up the country and prop up California housing prices forever, turned lost decades… or London with it’s 365 days of surf and sunshine… interesting how we never read or hear those comparisons with prices turn down in Coastal California.

Why not add Alberta to that list of prices go up because desirable… oh wait, too late.

Oh yes, we often hear comparisons to cities like New York, Hong Kong, or London to justify current prices in California. I suspect that this real estate rhetoric will quietly disappear when falling international prices make headlines.

In that case the rhetoric will probably evolve to… this place is different because (insert top 10 reasons why this place is not like those places).

One of the reasons the Bay Area is so high priced is, tech is here.

And tech is here because tech is here.

Let me explain: If you are trying to do anything in tech, you absolutely must must MUST deal with people face-to-face. If you are not breathing the same air, things WILL NOT WORK and WILL NOT HAPPEN.

I’d love to see tech spread all over the US; I’d love to be able to buy a $150k place in podunk nowhere, but the truth of the matter is, if you’re not able to smell the other guy’s farts, BUSINESS DOES NOT HAPPEN.

I don’t expect this to change until there’s an actual Holodeck invented where you literally can’t tell you’re not in the same physical space as the other person, and it’d better come with Smellovision so you can smell their B.O./farts.

Trying to deal with other engineers/companies at any distance at all is DEATH.

So, the tech ends up concentrated here, and prices become insane.

I’ve seen it firsthand. You absolutely can’t do tech with anyone at a distance. You absolutely must do the modern-day equivalent of sitting in the teepee for hours, eating some dog soup, and passing the peace pipe. I guess that amounts to smelling the other guy’s Axe, and eating shitty bagels.

It’s too bad the average person is better off working at a tire store or in a warehouse than learning how to compensate an oscilloscope probe (and why it’s necessary: two words, circuit loading).

“The argument is that in the long run, you should buy because prices go up”

No Doc, the argument is you should buy because prices in the long run will go up AND you will increase equity and ultimately pay off the debt on the property AND secure multiple significant tax breaks, including 0% tax on profit up to $250/500K AND lock in a housing cost instead of being subjected to the massive rent swings that your chart illustrates so nicely.

Equity can be attained in alternative forms.

Tax subsidies vary by individual scenario and aren’t guaranteed, especially in the long run.

Price of principal and potentially price of debt are the only fixed costs. The multitude of other costs involved in owning a home are variable.

Real rents can move down which is a benefit of not locking in, and the largely unreliable rent price indexes are reflecting turnover price changes which overstates the impact to renewal price changes.

I have been around the Bay Area a large portion of my life. How funny the shortsightedness of people. There was a tremendous crash after 2000. The city literally emptied out and real estate stagnated. It stayed high in 2008 because of low interest rates and other shenanigans, but there were tons of layoffs at that time too.

I have to go to SF every day for a few months M-F starting last week. 2 years ago, it used to take 90 minutes to leave the office near downtown to get over the Bay Bridge. Now, it takes 15-20 minutes. Rush hour starts at 5 and peters out by 7. It used to go on from 5 till midnight just a few years ago. Getting into the city is way easier too – used to take an hour from the pileup before the bridge, now it takes less than 5 minutes. I don’t see as many startup kids hanging out, and even businesses that catered to these people have closed up shop (think artisan chocolate makers, $11 coffee places, and the like). The lack of young people was a little startling. You hear about the millennials and all their blah blah blah, but the only ones I saw looked like normal office workers, admin people on $50K/year or baristas. Yeah, there were computer people but seemed like less as a % of the total people, unlike last year when over 50% of people around downtown were tech people. There just doesn’t seem to be as much activity in general.

A few years ago I interviewed at 4 startups. They had funding ranging from a few hundred thousand to $40 million. All went out of business last year. A few other that I know with $20 million or so in funding also gone. There is a cycle to all of this. The companies that got funding spent it all by last year. There’s not a whole lot of new ones getting funded because the cheap money pushed demand forward. There’s a ton of marginal startups that barely even qualify as technology that have failed or are failing since they can’t get traction outside of SF. Many smaller companies are being bought be other startups – seems to me a last ditch effort to grow. Usually no one gets paid out in these deals except the VC because of liquidation preferences.

IMO, it’s over. I saw it end the last go-around, it feels pretty similar except there’s not 1 massive drop on the stock market. It’s going to be dribs and drabs until nothing of startup-land is left. All these 10-50 person companies are going to disappear or already are disappearing. It was all just overcapacity, now it dies.

Yet another episode of too much money desperate to find too few viable investments, whether it be tech start ups or real estate. This period of egregious mal-investments are two bubbles rolled into one.

Two things I’ve noticed the most in the last year.

All the “sharing economy” crap has runs it’s course. It kinda works for some people, most it doesn’t. Immigrant dudes can split a Pruis and drive it for Uber and Lyft 24/7 and it’s better than Uzbekistan. But the 30 different food delivery…or ride share…or task rabbit…we’re at the saturation point…and it just isn’t creating a middle class. Will the parent companies fall soon?

Second…all the restaurants that open and close…insanely fast. You go out to a nice meal that sets you back, and a few months later you decide to go again and it’s closed and something else it already there. At nice locations in Uptown Oakland, Rockridge, Downtown Berkeley, Emeryville. I can think of a dozen places I ate last year that opened last year…now closed…add in all the these crazy minimum wages laws…good luck…lol…I actually think they’re going to have to go back amend some of the minimum wages laws to allow for an “opt out” exemption for servers and bartenders.

I second that. There is a point where there is too much competition with too many coming up with similar services, which leaves little room for someone to survive on.

the Bay Area! It’s better than Uzbekistan(tm)

That’s about all I can say for this place.

About restaurants in the Bay Area …. there’s a place right downtown that I’m convinced is cursed. Right on Paseo de San Antonio, a place the average San Jose resident only walks along about 256 times a day …. no restaurant there has ever made it. Right now it’s boarded up, its natural state of being.

Last time it was open it was the Blackbird Cafe or some shit name like that. I was hangin’ at Cafe Stritch with a couple, from Hollister or some shit, Hispanic, and the guy was saying he went in there and was *not* served; I volunteered the idea that he was probably expected to go right into the back and start washing dishes, and he said that was about right.

Except for the guy I work for, who’s marginally white (Polish Catholic with a Mexican wife) my friends here tend to *not* be white. Whites here have a stick up their ass, obnoxious techbros who I want to see die in a fire. Such types start restaurants, piss in the customers’ soup and then wonder why they’re not able to make it.

I’ve been In Uzbekistan and I have to tell you for sure – it is better. The reason why is because people do own their houses there, they do have balanced life, they have morals (many American’s do not even know what that means). They do not divorce, they are always spend time in a circle of a big 50 people families sharing a mean and good times…I am sure some of them regret they are here but its hard to stop and go back to moderate slow life with little bit of money but happiness. Once again – every single family there owns a house! What about US?

Escape – I was being tongue-in-cheek about Uzbekistan, I’m sure it *is* better.

A dirty little secret is, a lot of Americans are moving, usually because they have married a gal from there, to “podunk” places like Uzbekistan and Albania and so on, because once they’ve married the gal, they have an actual, real family.

American families are the coldest-hearted MF’ers on the planet. Once you’re 18, out with you! It’s sheer competition, parents do NOT help their kids get set up in life, they do NOT pass down skills or experience they have, it’s cut-throat competition of everyone against everyone. As soon as kids are 18 they’re shot out of the family like out of a cannon, and siblings growing up in cut-throat competition with each other do *not* stick together, needless to say.

So, move to beautiful sunny Uzbekistan, and now you’re suddenly in a culture where if you’re family you’re family. If you lose your job you might have to sleep in the barn (if the house is too full of people) but there’s not this “fuck you, it’s your own fault, now go be homeless” ethos that’s the standard in the USA.

The only reason “tech” is alive at all is, there’s a lot of money owned by the 1% and they’re looking for places to invest it to make money. Remember the dot-com bomb? You could start a company, put dot-com in the name, and people would throw money at you. There’s the same sort of thing going on now, only it’s “apps”. It’s stupid shit like having an “app” to call in someone to do your dishes or some shit. It’s been called “companies that do things your mom used to do for you” and it’s rediculous.

So the 1% is throwing money into these companies, as well as throwing money into real estate. The 1% are not necessarily any smarter than a janitor or a fruit picker, because being in the 1% in the US is based on heredity, not ability. So you have stupid people with lots of money throwing money into these “tech” companies, and while the vast majority in tech make $10-$15 an hour, there *are* some making these legendary $100k+ salaries, not necessarily producing anything, but being paid as part of the “burn rate”.

Indeed, many economists are have been correlating the inflation of speculative bubbles with excess wealth being concentrated in the 1%. Its not for nothing that the 2 years of peak wealth inequality in the US (1929 and 2007 respectively) were preceded by the 2 BIGGEST financial meltdowns in history. Once the ultra-wealthy run out of yachts, Ferraris and weekend houses in the Hamptons to buy, they still have $100 million to spend. Where does it go? Investments of course! Thereby inflating real estate and the stock market as we can see today. I doubt we’ll see much of a change in how our economy runs until this type of inequality is tackled, and this will require massive political demand for change coming bottom-up from the common person…

“You have to have your money *working*” is the mantra.

So the 1% motherfuckers have all this money sloshing around looking for a place to go. Anything. Anywhere. So they invest in these start-ups which are great to be in – can only be in – if you went to the right high school with the right people. Intelligence and ability have nothing to do with it.

Just put “dot-com” in the name.

donpelon: >> Its not for nothing that the 2 years of peak wealth inequality in the US (1929 and 2007 respectively) were preceded by the 2 BIGGEST financial meltdowns in history. <<

I think you mean that the years of peak wealth were FOLLOWED — not PRECEDED — by the financial meltdown.

And "It’s not for nothing…” not “Its not for nothing…”

It’s — with the apostrophe, is a contraction of it is.

Its — no apostrophe, is the possessive form for it.

@Son of a Landlord: ‘Scuse the typos, I’m at work, writing away furiously on my lunchbreak. I think you get my point…

donpelon, they’re not typos. One of your errors is a misspelling, the other is the wrong word.

“Typo” is short for “typographical error.” It’s when fingers inadvertently hit the wrong key. A “typo” is a mechanical error.

From Wikipedia:

Historically, this referred to mistakes in manual type-setting (typography). The term includes errors due to mechanical failure or slips of the hand or finger, but excludes errors of ignorance, such as spelling errors.

https://en.wikipedia.org/wiki/Typographical_error

Misspellings and wrong words stem from ignorance. People often (mistakenly) call them “typos,” partially from further ignorance, and partially because it sounds nicer. “It’s just a typo. It’s not that I don’t know any better.”

Writing “preceded” when you mean “followed” is not a typo.

And I’ll wager that most people who confuse its and it’s (and there are many) simply don’t know the difference.

And yes, I have worked professionally (been paid for it) as an editor.

Yup, I think you hit the nail on the head. Lived in SF since I was a little kid (1984). Seen my dear city go through these community-busting changes the past 15 years, truth be told, it just breaks my heart. SF’s number one jobs provider is TOURISM and the accompanying service industries (and has been so for decades). Tech workers are only something like 8% of the workforce, yet city government bends over backwards to accommodate their every need- the rest of us (you know, the people whose grandparents actually built SF, and plan to raise our families here- can get stuffed apparently). Will these nouveau riche carpetbaggers be around for the long-term? Doubtful…

The first Dot Com explosion in 2000 was built around the then new novelty of the internet and buying and selling on it as a new platform for business. A few of these older companies (Amazon, Ebay etc) were good ideas and have prospered- most did not…

The 2nd-wave Dot Com boom seems now centered around the new novelty of the smartphone and its accompanying apps. A few companies (probably Uber) will survive the next bust, but Twitter and food delivery services, etc etc, well, can we revive the old “Fu#%ed Company.com” website?

I think it’s more like 5% of the work force, and most of those making $15 an hour or *less*.

A very-very few making in tech what a decent pipefitter makes.

Donpelon – What breaks my heart is, San Francisco was home to a lot of really neat things, from the Diggers who essentially saved the life of a gal I know, to the underground comix.

I grew up in Hawaii as a hated “haole” and I read every underground comic I could get my hands on. My mom, when we went into “town” (Haleiwa) we’d visit a store that was essentially a head shop, and she’d tell me how many comix I could get, “You can pick out three” etc.

All the undergrounds were published out of SF. There was Zap and the Fabulous Furry Freak Brothers (Fat Freddie, Frewheelin’ Franklin, and Phineas T. Freakears) but there were a lot of no-name one-offs too. Sure they were all about sex, drugs, and a pinch of rock-and-roll but I loved the art, and they were about white people who were able to walk down the street without a target on their back.

SF was where an artist could live and produce such things. In the movie Crumb, the first DVD I ever bought, Robert talks about his brother Maxon living in SF. Where’s Maxon now? In a homeless encampment? (Probably not because Crumb had the luck to marry a nice Jewish gal and among the Jews, unlike whites, you don’t let family members starve in the streets.)

The thing is, SF was a place you could be a legitimate weirdo, make a living doing something off the wall, and now you have to be a psychopathic Randian techbro to live there.

Amen: SF used to be one of the cultural/bohemian capitals of North America (along w/ NYC). Even in the 90’s, a group of friends could rent a house together and start their thrash metal band, create performance art, write a play, form a gay commune, whatever… That SF died a long time ago. I always wanted my future kids to know SF and it’s wildness and eccentricity, but I don’t think It’s a place I’ll ever invest the time in to try and live and create a life… The only thing that hasn’t changed is the homeless problem and useless bus system!

According to CNBC article last week, many parts of the bay area housing market are rapidly slowing down.

Link?

Random thoughts whilst looking at this on Zillow and Street View:

-At least it’s close to the beach.

-At least it has a back yard. A lot of these houses don’t.

-Ceasar Stone must be the new granite. Seems to be touted everywhere lately.

-Go to street view. Burglar Bars seem to abound in this neighborhood. Even this one has them. What’s that saying?

-Is is just me, of are the wide-angle beauty shots of these properties on Zillow and the like becoming ever more extreme?

Just a thought.

VicB3

Hey if you’re human trafficking you need burgler bars to keep your assets *in*.

There is still a big backlog of foreclosures in many counties. I don’t think that will help matters if anything slips further. I smell another QE coming.

The old saying people with money are smarter? How smart is it to pay these Bay area prices, I would say in the days past this may have been true, but I find people today are sheep. If they think it is cool to own a pink house they flock to it, I talked to a few of these so called money folks and found them to be in a fog ( which is fine in SF), they have little idea of what lies ahead if they make a bad investment, like one of the genius Silicon Valley up startup programmer told me, if I lose the big money I walk from the house and start over like in 2008, no big deal?

“People with money are smarter” you’re 100+ years out of date. In the US money and class are hereditary. How much you’re “worth” is totally about who you were born to, not individual ability, talent, or intelligence.

I don’t see any slowdowns in Bay area real estate yet. I see rents still out of control in the Sacramento area due to bay area commuters and transplants. 2016 will be the year of cashing in that lotto ticket, so the market will stay hot. I cant see how this market can hold itself up much longer though. Pay is not going up, stock markets are crashing. Reality will settle in as will the stock market. Layoffs will continue and tech startups will stall and be bought up by the bigger players. Those who have cash and make a profit will survive. No slow down until after the elections. A nice parting gift for Hillary.

Hillary on her worst day will still be better than any of the Republicans on their best day but let us pray Oh Holy God YHWH Ha’shem that Bernie makes it in.

I really have no clue what will happen with real estate! But, what concerns me is our constant disregard for consequences! There are certainly a number of countries and cities, where housing is unaffordable relative to incomes. But, what happen in a nation ‘known for the good life’, where stagnant incomes, slowing global GDP growth, rising costs for healthcare, and housing, are now the rule …creating household budget constraints, where credit card debt is rising again, where people have no emergency funds, they have no retirement funds, and so on? And, places like Los Angeles are so ethnically and income diverse and divided. Just drive the flatlands of L.A. … it is a series of ethnic neighborhoods, where the language on slowly decaying store-fronts changes every mile or so, ending along the beach cities, which are a strange mix of the wealthy, and beach-bum/surfer poor cram into densely packed dwellings increasingly interspersed with small lot McMansions! Are we de-evolving into a third world nation wrought with third world nation problems? Are we prepared for the consequences?

What you just described does not exist in 95% of the country. That’s why LA/SF/NYC real estate are such interesting case studies. Anybody still has the opportunity to move to (insert your flyover city name) and enjoy a nice lifestyle on a truly middle class budget.

Flyover country == no jobs.

Alex, you must be a troll right?

“most tech jobs are $12-$15 per hour”

say what???

“flyover country == no jobs”

say what???

All data says otherwise.

The median income in the US is $52K. That affords a good life style in 95% of the country.

Alex, you can buy houses in flyover country for 150K all day long. You don’t need high paying jobs for that. A couple working at the local Walmart should easily be able to afford a 150K house. The mortgage payment is less than $700/month.

LA/SF/NYC are not the norm for housing in this country. They are truly outliers.

Holo I’ve lived in flyover country, sometimes I only made $5 a MONTH.

I’d love love love to move to flyover country if it were like you people THINK it is. It’s not. There are NO FUCKING JOBS. Food stamps and welfare are a way of life.

If only, if only, flyover country were like you people dream it is.

Tech is the same, trust me, I’ve soldered God knows how many MILLION connections. The pay is SHIT.

Work at Walmart, work at walmart they say:

Do you know what kind of connections it takes to work at Walmart in flyover country? Better have gone to high school and played football with the manager, or no job for you!

Then you end up “flying a sign” at the freeway onramp and the nephew of the walmart manager who’s a cop, again through connections, throws you in jail.

If tech jobs pay $15 per hour, not clear why immigrant tech workers even come here? Check out Glassdoor and you will find out that average software engineer salary in Silicon Valley is 100K. Better engineers make 150K. Only top cream makes 200K and above (less of those needed).

Immigrant tech workers came here because it beat the hell out of being killed by Pol Pot or the Viet Cong. Plain and simple.

Indians come here (and a lot come here to live in a dorm and get paid the same $2-something they get in India; occasionally a company or two are caught doing this) because if they can get the same pay as in India, get a free bunk bed and rice and dhal, and get to see American, why not?

The smart immigrants used a tech job to keep body and soul together while doing to barber college, learning how to work on cars, *real* work.

LA has already become a third world country. Only the top 1% are truly living “the good life”. The rest are fooling themselves. Meanwhile more and more illegals and welfare recipients pour in and drain the city’s limited resources. I’ve never seen a place where wealthy people live right next door to section 8 recipients, except in LA.

Hunan – Years ago I had someone tell me “wherever there are rich people, there are poor people right nearby” and for some reason this pissed me off. But I looked around over the years and the guy was dead right. Take any affluent town, like Costa Mesa or Palo Alto, and sure enough, you’ve got seriously poor people right nearby (East Palo Alto, working-class Costa Mesa along Placentia Avenue) because the rich need people making $250 a week to do their scut work.

It’s not S. Cali, but the beaches are beautiful, weather is good, and you can buy a home for 100K

http://money.cnn.com/2016/02/21/investing/puerto-rico-foreclosure-crisis/index.html

Then you get massacred because you’re not the dominant race, NO THANKS.

Hahaha, are you a dominant race in California? Most of the time I find myself to be the only white person while waiting for Dr. appointment at Kaiser….Mexican people are all around. At the end I see Hindu doctor. One benefit – I am almost fluent in Spanish now or at least can get by….its my 4th language. Check!

I’m not of the dominant race in California, and certainly not in my area, but I’d say I’m of the race that’s about 30%. That’s enough.

As mentioned I grew up in Hawaii. I’d not wish that on any non-rich white kid. However, I noticed that once I ended up in a high school that was maybe 25% white, the fear of being jumped, beaten up, etc yadda yadda was no longer there.

It’s funny how my perspective was though … I was sitting at lunch with a gal who’d moved over from Israel, her father was an entomologist and she had this t-shirt with a close-up of a fly’s face and a saying, “Have you hugged an entomologist today?” I thought it was cool and she was cool. I said to her, “This school is great, no one beats me up”. and she replied that she thought the people there were awful – she was coming from the perspective of being in Israel where apparently people are not nearly the cold bastards they are in the US.

What’s funny is, I’m not even doing that good a job of being white. I’m kind of brownish. So I actually blend in pretty well with the Hispanic crowd. American families not only don’t talk about occupations, how much Daddy makes, how to manage money, etc but they also don’t talk about history or heritage. From what few facts I know, I’m probably Jewish and am saving up for the 23andme test because it’s kind of dumb not knowing for sure what race or ethnicity you are. Yet another stupid American “let’s be rootless and just work on screwing each other over” thing.

Look at all the millennial in San Francisco who will be buying all these expensive houses

http://recode.net/2016/02/20/yelp-customer-service-employee-protests-low-pay-in-medium-post-is-promptly-fired/

not everybody that works at start up makes 120K plus

Many App start ups will disappear, yet Yelp can actually make money with ads from restaurants and businesses as opposed to Instagram and the like.

This is my point. Those who go into “tech” thinking they’re going to make a ton of money are either misled or flat-out stupid.

I was the ace-of-the-base repair tech for a large POS terminal company. Put anything in front of me, I could fix it. I topped out at $11 an hour, back in 1990 or so, and the same job now would pay $10 only because in San Jose you can’t pay less.

I’d have literally done better with a degree in ballet or basketweaving or something.

Many review sites are worthless because of all the scam, paid reviewers. Amazon is infected with fake 5-star “reviews.”

I wouldn’t trust any reviews I read on Yelp.

CBC News did a segment about fake reviews, http://www.cbc.ca/marketplace/episodes/2014-2015/online-reviews-faking-it

Yelp actually sends people around in 3-piece suits (like Fat Tony in The Simpsons) to tell businesses that if they made a “modest contribution” they can get better reviews/make bad reviews go away.

Wow.

people buying tiny 800K so easy

http://www.ocregister.com/articles/says-704587-cottage-vibes.html

it’s nowhere near the beach. heck she couldn’t even bicycle to the beach.. NUTS

shack

https://www.google.com/maps/place/1575+Arroyo+in+Laguna+Beach/@33.554798,-117.7743324,3a,90y,105.24h,90t/data=!3m6!1e1!3m4!1sQXvbRPAo3WJ7rnZ7ewR8IA!2e0!7i13312!8i6656!4m2!3m1!1s0x0:0x30fedd842adbfa48!6m1!1e1

I love realtor euphemisms.

* Cottage — Tiny house.

* Jewel Box — Real tiny house.

* Condo Alternative — So tiny it might not even be legal to call it a house.

* Shabby Chic — Hasn’t been updated in 50 years.

* A Blank Canvas Awaiting Your Vision — Hasn’t been repaired in 50 years.

* Needs Your TLC — Hasn’t been repaired in 50 years and is about to fall down.

* Located in the Highly Sought-After [fill in name of neighborhood] — Whatever neighborhood the house is in.

* Located in the Heart of [fill in name of neighborhood] — On the very edge of that neighborhood.

* [fill in name of neighborhood] Adjacent — Nobody wants to live in the house’s actual neighborhood.

* Convenient Freeway Access — Free traffic noise, heart disease, and cancer included in purchase.

* Convenient Airport Access — Free airplane noise, heart disease, and cancer included in purchase.

Love your comment.

Did you make that up – or did you read it somewhere? It’s brilliant.

And of course no list is complete without

* Babbling brook – Builder included 10 gpm fish tank pump to spice up backyard concrete lined ditch.

* Handyman special – Do you want to spend the rest of your life fixing things? This property is for you!

* Neighborhood with character – Iron grates on doors and windows. Drive by shootings on weekends.

* Re-live a golden era – Insulated with 100% asbestos.

Jed, yes I made that up.

As I told donpelon, I have worked professionally as an editor. And also as a writer. I was paid for both services.

And don’t forget…

“Nestled” = no view

“Gardener’s delight” = overgrown with weeds

“Cozy” = small and dark

“Classic” = old

“Clean” = old and dirty

http://www.ocregister.com/articles/says-704587-cottage-vibes.html

Nice to see people still getting F’d in this old brothel.

Brings a whole new meaning to Dr. HBB’s term “house horny”

ok, that deserves an LOL

Bicycling *to* the beach not so bad, it’s bicycling back up into the canyon.

For once I agree with Alex: In my particular hunk of crapshack nirvana in Eastern Ventura County biking to the beach is a relatively easy 14 miles downhill. Plowing back up the canyon, however, particularly after messing around in the waves, is pretty taxing for this old fart.

Back sort of on topic to the Bay Area – one thing I always liked about the region was the relative remoteness of the beaches. I lived out in La Honda and would regularly go hang out on the sand in San Greg and points south. Most weekdays I wouldn’t see another soul. Try doing that in the Malibu to Hermosa glitz strip.

If there’s one thing we have up here it’s miles upon miles of coastline with beautiful little beaches and no one there. Or maybe a windsurfer/surfer or two.

This is because everyone’s working so hard to survive, they don’t have the time or even gas money to go to the beach.

Down in SoCal, the LA market is still cooking with cash offers and bidding;;;;

http://www.marketwatch.com/story/all-cash-offers-bidding-wars-dominate-los-angeles-home-market-2016-02-23

excerpts-

It will become more expensive to buy your little piece of heaven this year, as lower-than-ever inventory in the City of the Angels continues to be the big story at the beginning of 2016. And with the lack of inventory in Los Angeles comes the inevitable rise in prices. All-cash offers and bidding wars are still the rule in every sought-after neighborhood and price range, especially if properties are correctly priced

But according to the highly respected UCLA Anderson School Real Estate Forecast, our market is not in a bubble.

“L.A.’s housing market, despite becoming more expensive and unaffordable, is not in a bubble.” UCLA economist William Yu wrote. “The current rise in home prices seems to be driven by rising effective demand and limited supply, not by speculation. Therefore, the housing bubble burst we experienced several years ago is unlikely to haunt us this year or next, and the smart money will continue to invest here.”

It’s simple supply and demand, it’s not a bubble. Low supply +house-horny buyers equals high prices. In order for pricing to decrease we would need to see a huge increase in the housing inventory (foreclosures) or people would have to stop creating bidding wars for every piece of crap property they come across It’s not just LA. Same thing is happening in Riverside & San Diego counties. Semi-decent properties get listed and receive 10+ offers over listing within 48 hours.

I do see appreciation slowing. I don’t think we will see crazy appreciation like 2012-2015. I currently predict a 5-10% annual increase depending on how hot the area is.

Allow interest rates to rise and see if the pool of current buyers (institutions and investors feasting on cheap credit or lacking investment options) will be replaced by organic buyers at current prices. Only then will we know whether the current market is driven by bubble economics.

oh its only going to be 5-10% annually? Thank god. So its only what 50k per year? Good thing its so low. Now I can easily catch up with it by saving … oh wait.

Yeah Polish Paul by making $10k a year which is the wages of hi-tech, good luck with that.

Only answer I can think of is to form communities like the Hasidic/Mormons/quiverfull types and farm. Bleed the capitalist beast all you can and survive.

I honestly think something is happening like “enclosure” which ended the peasantry system in England.

It used to be, you could be poor as shit but you could still count on having a roof over your head. Source: Grew up poor at shit, never worried about the lack of a roof overhead. Was poor as shit in my 20s but *always* had a roof over my head. Lacking that was unthinkable.

Now, – and I talk with homeless people like they are people – this is not a given. Tons of people are living in their cars if they’re lucky enough to have a car, working a job, but unless they can make connected-yuppie wages, no roof over their head.

This is the same “highly respected” expert academic school of forecasting at Anderson that “didn’t see” 2008 coming.

Wasn’t it a gal working for one of the Fed Reserve banks that saw 08 coming? And in my case, 08 happened in mid-07. I was selling on Ebay and the first few months were OK, March was actually pretty good, then Jun-Jul-07 my sales just utterly crashed.

Bank of America will offer mortgages for 3% down

If you’re looking to buy a home but don’t have the 20% down payment sitting around, Bank of America is now offering mortgages with as little as 3% down.

The new loan program is aimed at helping low- and moderate- income borrowers get home loans for up to $417,000.

To qualify, borrowers can’t make more than the median income for their area and need a credit score of at least 660. And the home must be the applicant’s primary residence.

Low down payment mortgages aren’t exactly new. But borrowers won’t have to pay private mortgage insurance with this loan.

Most loans with less than 20% down, like those backed by the Federal Housing Administration, also require monthly insurance premiums on top of the mortgage payments. The premiums are used to help protect the lender in case the borrower can’t make payments.

As with most mortgages, applicants must still have a debt-to-income ratio of no more than 43%. But Bank of America will also consider non-traditional forms of credit — like daycare expenses, health club memberships and rental history — to help determine credit history.

“There are creditworthy borrowers — people who have shown good experience paying off debts who fit income restrictions — and except for the fact that they don’t have the money for a down payment, they would be good homeowners,” said Terry Francisco, a spokesman for the bank.

Interest rates on the loans will be determined by a borrower’s creditworthiness and score, and Francisco said Bank of America’s loan option will be cheaper than FHA’s rate.

First-time buyers will have to attend a homebuyer education program.

Bank of America (BAC) will sell the mortgages to nonprofit loan fund Self-Help, which will then sell them to Freddie Mac.

Low down payment loans aren’t a great fit for everyone though.

Putting less money down means you’re financing more, which leads to higher monthly payments and more money paid out in interest over the life of the loan. It also means you have less equity in the home, which could make you more vulnerable if home prices drop.

In the fourth quarter of 2015, the average down payment on a conventional 30-year mortgage was 17.5%, according to LendingTree.

http://money.cnn.com/2016/02/22/real_estate/bank-of-america-low-down-payment/index.html

Great. Now I just need to find a house for 417k and … oh wait.

That $417K is the conforming loan limit in many areas, but in LA the number is $625,500. I wonder if this new BofA thing changes that number based on location?

Oddly enough, I’m up here in Portland where prices are increasing faster than anywhere else, but they’ve yet to raise that $417K limit, which is probably a good thing.

Let’s seee … I make $10k a year and seem to be fixed at that rate until I die. I am a typical San Jose citizen.

Maybe if I robe a few Bank Of American branches? I actually have a plan in mind to knock over an armored car that might just work.

Nobody gets the money to buy a house by working. it’s all either inherited money (better hope your old man was a rum-runner like Kennedy’s was) or dealing drugs, human trafficking, etc. No wonder shows like Boardwalk Empire were so popular.

I gotta think of some scam.

I think this is a case where you need to reevaluate things and get out of your profession. I was making more than double that working a full time retail job in the ’90s as a teenager in the Midwest, where you can live a quality life for a fraction of the cost of California.

Alex,

As a person who grew up within a family with little money, I have found continued success and abundance in all areas of my life, by changing my thoughts and creating my own opportunities in life.

The library has many positive thinking/self help books (free of course). Each of us creates our own reality by our thoughts. Yes, outside factors affect our choices; but, our own happiness and prosperity is up to us. We create our realities moment by moment by our thoughts/words/actions.

It is never too late. As long as you see yourself as severely limited, this is the reality you are continuing to create for yourself.

For example, IT opportunities still abound for six figure incomes. I know. Although recently retired, I’d been in the software field since the early 1980’s; and several of my friends are still in the field. The key is to keep your skill sets current; and, yes, make networking connections that can come in handy when looking for one’s next “gig”.

I have a friend who left the field in the early aughts, was down for the count; and then managed to get back in to an entry level software position. In so doing, she got trained for a top software package that is currently desirable in the marketplace; and, now makes $100+ per hour contracting for a top U.S. firm. She is able to work from home (telecommute) from another state as well. She also has been working on the concept of “thoughts are things” and “we create our own reality”, as she strives to improve other areas of her life.

You are in a hotbed location for making key networking connections. If you befriended folks working in these firms, I wonder if you could get in to one of these firms. Maybe you’d need to train first with some local free classes…..The point is, your future is up to you and your thoughts.

And, as others have pointed out on this site….it is simply not true that IT salaries are as low as you pose them to be. High five figures and six figures is the norm; and, has been at least since the 1980s.

Best wishes for making any changes you see fit to better your life, if you are interested in doing so.

EZ – dafuq? You thinq?

Yeah, tech is utter shit.

Looking at going into sign painting because everyone needs a sign. Other possibilities include barber college and shoemaking.

If it wasn’t a promising thing 150 years ago, it’s not now.

Another possibility is calligraphy, esp. Hebrew calligraphy; so far my faves are Aleph and Yod, the biggest and the smallest.

Looking Forward – it’s ALL in WHO you know, and where I am, whites will simply NOT talk to me – most are transplants from the Midwest anyway.

It’s ALL in who you know.

Hustling in the street for tips is the best pay I’ve been able to make.

Tech is a death-hole.

There is NO money in tech unless you went to the RIGHT high school with the RIGHT kids AND your mom was super-cool.

Alex, what is holding you in San Jose? If you are on a fixed government income, travel around, have some fun….San Jose sucks!

Escape – I’m not on a fixed permenant income, I work for that $10k a year.

Right now my plan is to keep doing the shitty tech work because it includes a free place to live – no running water but at least I have “the electric” and just recently got internet. And use my extra time to work on a sign-painting business.

I’m just not convinced that, if I were to somehow borrow the money to go to college, and got a programming degree, graduating at age 57 or so, that anyone would hire a brand-new 57-year-old programmer.

Barber college would be another good bet; I could probably save up the dough in a couple-few years and just go. But sign-painting seems to have the lowest “price of entry” and like any of these real jobs, being older if anything makes you more respected.

Is BAC trying to dissuade the Fed from instituting of NIRP by lending money willy nilly?

The no PMI is intriguing for people that have a nice down but want to keep more cash. The PMI is a big reason why you put 20% in the first place.

That would put the maximum home price at $430k. I guess these loans are only available for people buying homes in Tracy, Stockton and Los Banos.

Agreed, there is slim pickings in LA in the 400K price range. But you can find a real nice home for 400K in the IE in Temecula, Murrieta, Corona, Riverside, etc. The commute to LA is a bitch though.

I think this type of loan represents a opportunity for a select number of people. I personally know reliable people with good credit who make a good income, but due to the cost of rent and what not, they are unable to save the 20% needed for a down-payment, nor can they afford the PMI payments required by FHA loans. That being said, I’m sure the program will be abused over time and BofA will regret ever introducing it. I wonder if the other big banks will jump on the sub-prime loan bandwagon (AGAIN)?

The best part…

“Bank of America (BAC) will sell the mortgages to nonprofit loan fund Self-Help, which will then sell them to Freddie Mac.”

Of course, none of the following matters because don’t worry, long term…

“Putting less money down means you’re financing more, which leads to higher monthly payments and more money paid out in interest over the life of the loan. It also means you have less equity in the home, which could make you more vulnerable if home prices drop.”

No wonder Freddie and Fannie will never be privatized again. Too big too fail. Profits are privatized while losses are socialized.

How is this dump worth $900,000?

https://www.redfin.com/CA/Los-Angeles/22935-Oxnard-St-91367/home/3218558

The listing admits the house “needs alot (sic) of TLC.”

Even the lot isn’t all that great. It’s in Woodland Hills — on the NORTH side of Ventura, on busy Oxnard Street.

This whole thing is crazy. As DHB says you don’t know you’re in a bubble until it pops, but there are strong indicators. The longer this goes on, the more people on this convince themselves prices will never fall. Yet market fundamentals always prevail in the end. Look at all the historic bubbles in the past. You can’t defy gravity forever. Jim Taylor will be right in the end. The man is grounded in reality.

Crazy is a 30 year mortgage on a median priced S.F. home at $1.2 million … $4,300/mo with 20% down, add to that taxes and insurance, and you’re over $5k/mo … that translates to an income of $12,500/mo, at 40% debt to income, without the Mercedes or BMW car payment. I guess all-cash is one thing if you have millions stashed away, otherwise, the numbers seem ridiculous! Who in their right mind …

JNS, we need to know what that 1.2M house rents for. I imagine the number would be crazy too. So you either buy at crazy prices or keep renting at crazy prices. Living in a shipping container or tent is likely not an option for most.

I know a very nice young homeless couple who live in a tent by Diridon Station and they say they’ve been getting zero hassles.

So it can work for some.

Unfortunately, they seem to just be interesting in holding their little (admittedly better lettered than most) signs. Although I did tell them about the huge call center Fry’s runs that I just found out about myself, so maybe they’ll get into jobs that way. I’ve been thinking about it myself, supposedly $12 or so an hour with benefits, and hey, it’s Fry’s. I have the same love/hate relationship with Fry’s that everyone else does, but working in a call center I could do my part to make it a better Fry’s and maybe even work up.

The thing is, though, it would torpedo the job I have now, and all I’d end up with is an addiction to Vick’s cough drops and no more sign-painting experience than I have now. I need to give the sign thing a fair go. Then if that doesn’t work I can go work in a call center.

But here’s how finding a job in the Bay Area works. I was coming back from doing a bunch of errands, and was very tired. So I stopped off at the convenience store on Brokaw and 1st and got the smallest Starbucks drink they have, because don’t drink coffee these days, and I knew that if I just took it home, I’d set it down, doze off, and then wake up wondering why I didn’t get anything done (I had internet work to do).