San Francisco housing market near bubble risk according to UBS report. Majority of Bay Area renters plan to leave.

The San Francisco housing market is the most overvalued market in the United States. People over inflate the market because tech is sexy and cool and many are chasing the next Google, Amazon, or Facebook. Everyone wants to strike it rich with as little work as possible. And what better way to do that than in real estate? In San Francisco the typical crap shack will cost you $1.2 to $1.5 million. The response from many housing cheerleaders is the typical logic you see in manias – hey, someone paid for it! You also get similar stories from the tulip bubble, dotcom bubble, and other bubbles where the justification for higher prices is simply that some other sucker paid for it at that level. And there is now signs that we may be in a rental bubble in the Bay Area.  83 percent of renters surveyed in the Bay Area said they plan on leaving. Tie that in with the UBS Global Real Estate Index showing that San Francisco is dangerously close to bubble territory and you have indicators that something is rotten in SF.

Riding the tech wave

Some people understand the business cycle and the waves that ripple through our economy. The housing market and economy has been booming since 2009. People forget that recessions happen. And now that we have added millions of renter households with higher rents, what happens when that next correction hits? While you can sit in a home and let it flow into foreclosure like many did during the housing crisis, there is a smaller window for renters should cash flow issues occur.

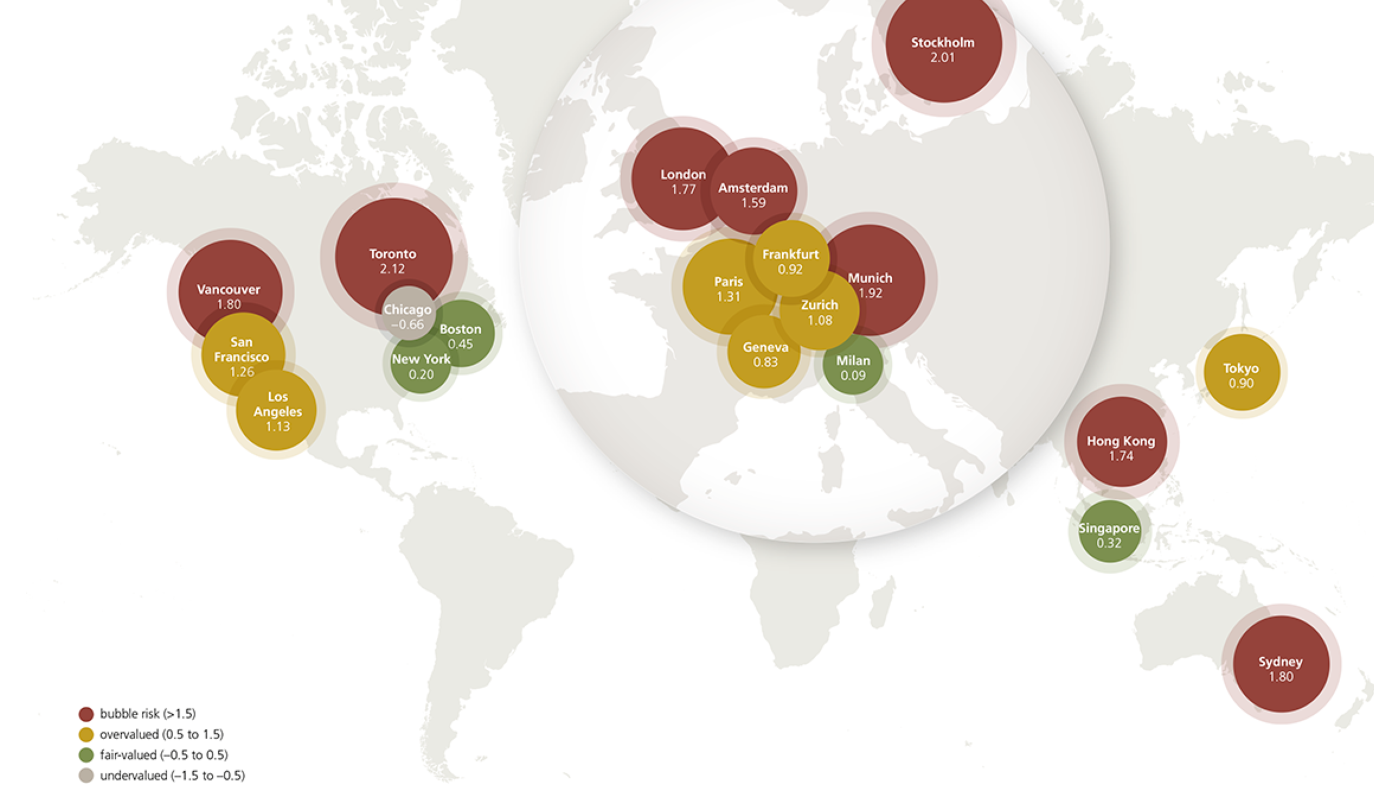

It is rather clear that San Francisco real estate is in a bubble. Even conservative UBS is showing that prices are inflated:

But our neighbors to the north in Canada are taking it to another level with their housing bubble. It is nutty how obsessed people are with real estate in the Bay Area. People are drinking the Kool-Aid by the gallons. For those that own, you have a confirmation bias occurring and who could blame them? If you owned a piece of crap house and suddenly Zillow gives you a $1.5 million Zestimate why wouldn’t you believe it? I suppose you should never ask a barber if you need a haircut.

Renters clearly think something is wrong since many are voicing their displeasure and have plans on leaving:

So why are many staying? Jobs. The Bay Area has high paying jobs and people like the wages and will accept living like sardines for that salary bump. People need to take into serious consideration cost of living when they move to an area. What use is a high salary if you are chained to a cubicle pumping out lines of code, leave work to get stuck in mind numbing traffic, and only to arrive to a toaster sized box to knock out? I’ve known people moving to places like New York earning good wages only to realize they have entered into a trap – those wages can only buy you so much real estate in certain markets. You want a big McMansion then you need to broaden your horizons or increase your paycheck. That all works well as long as the system is humming. And what is keeping the system humming right now? Apps that can deliver a Big Mac to your house while you binge out on 20 seasons of random shows? We are in a market of saturation and people need to think outside the box.

The Bay Area is great in terms of generating the next big thing. People are focused on tech and there is something alluring about putting together some great code, packaging it into an app, and suddenly becoming a wealthy individual which allows you to buy things in the real world. Things like real estate.

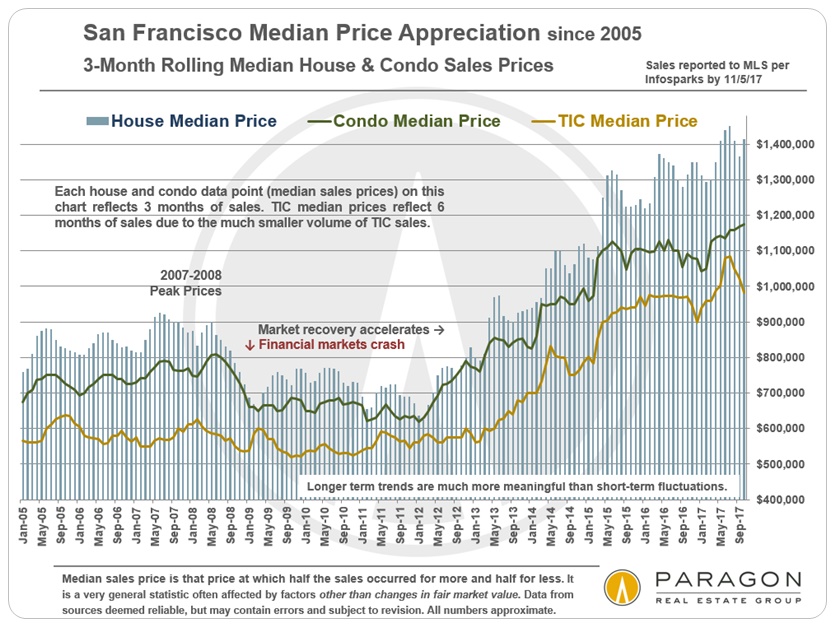

Prices are sizzling in San Francisco:

So get that down payment ready for your $1.5 million hole in the wall in San Francisco.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

233 Responses to “San Francisco housing market near bubble risk according to UBS report. Majority of Bay Area renters plan to leave.”

Actually, there are plenty of other places that make almost as much money and the housing is cheaper. Denver, Austin, just to name a few places. The Bay area also has a lot of low paying jobs since the chip companies moved overseas. This is rarely mention, Software jobs and overpriced restruant jobs because of high minimum wages. Less jobs in the middle since the chip manufacturing jobs left the bay area years ago.

As the suburbs become more popular again over cities since M generation is now having kids and blockchain becomes more popular in the internet expect business to pop up in Fresno, Riverside, in the next 20 years and leave the Bay Area and Los Angeles County.

Why is NYC the financial capital of the world? You could easily trade stocks from Omaha or Wichita as well as from Manhattan. But even though it’s possible to do it, nobody wants to do it. The industry is still by and large in NYC (and a little in NJ/CT). And it will be there no matter how much a 1 bedroom apartment costs.

Why are all the big studios in LA? Why is fashion in NY? Why is country music in Nashville? Why is insurance in Hartford? It’s how industries work. It doesn’t happen overnight, it happens organically. And you can’t just rip it apart and say OK from now on we’ll move everything to Omaha because real estate is cheaper there.

You, like all communists think central planners can run the economy. It’s cheaper to lease office space in Omaha, so we’ll move the entire Silicon Valley to Omaha. It doesn’t work like that. It can’t work like that. That’s why communism fails EVERY. SINGLE. TIME.

Sure every industry can have some operations spread out. But the core of the industry stays in one place. So yeah Google will have an outpost in Denver or St Louis or whatever. But its core operations will always be in Mountain View.

Actually, the Movie industry has moved to Atlanta GA, they are now the #1 producer in film in the world. Why did they move, because its cheaper, and Atlanta has a lower cost of living, housing, also a large work force. Not to mention they have Big City, Small Towns, Mountains, Oceans, Lakes, and the Worlds Busiest/Largest Airport.

That’s mostly just historical effects though. My manager in the tech industry moved to rural oregon and works exclusively from there now. Others have done the same. The trend will continue.

A few TV shows are filmed in Atlanta. To say it it is the #1 film producer in the world is ridiculous. Remember when Vancouver was going to take over Hollywood because of the cheap Canadian dollar? How did that work out?

Atlanta has so tax credit that at the margin will get a few productions move there. That’s it. And then soon enough Dallas or Miami will create their own tax incentive and all the Atlanta productions will move there.

Sure people can move to rural Oregon and work for home. But there will never be a Google HQ in rural Oregon. That’s my point. There will always be satellite offices and individuals working remotely. But the hub of tech will be in San Francisco / San Jose for the foreseeable future.

Teeter let’s be honest. There are no oceans anywhere reasonably near Atlanta. Busiest airport by passenger traffic. What that really means is there are mostly connecting flights and it’s a crowded hot mess of bodies. Memphis is busiest by cargo but again, big fucking deal because it’s just a pass-through. Origin and destination is what really matters and LAX is the busiest in this regard. But even that’s only somewhat useful because some metros have multiple large airports such as NYC/NJ so when you add them all up in the aggregate a different story is told. And LAX is no prize anyway, it’s another hot mess in its own right with the terrible vehicle AND flight/gate congestion, horrid layout, pathetic terminal transfers, and on and on…

Also I noticed you didn’t mention anything about Atlanta’s easy traffic… just sayin’

WTF does communism have to do with this? She brings up a valid point because it’s historical fact that industrial centers evolve and it can happen relatively quickly. 50 years ago some guy would have been crowing about Chicago’s importance as a railroad hub, Detroit’s share of auto production, and how California didn’t have anything on France in terms of wine production. Only a couple of short decades ago, Korea didn’t make anything worth a shit. Nashville has already evolved to include a rock music scene at LA’s expense and LA is coming up in fashion at NYC’s expense. NYC as financial capital of the world has been debatable for a long time.

You’re a funny guy, Mr. Landlord. It is you, in fact, who think “central planners can run the economy.” In what free-market world does the U.S. Treasury appropriate $700 billion to basically nationalize the banking system? In what free-market economy does the Federal Reserve run ZIRP and QE in what is effectively perpetuity?

DB’s derivatives strategist, Aleksandar Kocic, sums it up very well: “[Rate] accommodation and QE have acted as a free insurance policy for the owners of risk, which, given the demographics of [asset] market participation, in effect has functioned as universal basic income for the rich.

You get that — UNIVERSAL BASIC INCOME. FOR THE RICH. By your accepting these policies (since they enrich you), it is you who is inviting creeping socialism/communism to destroy the country. Chew on that for a minute before you go around pointing fingers.

For the record, as an Austrian economist and pure free-market capitalist at heart, I would have let everything that needed to fail be liquidated, leaving everyone thereafter on a level playing field to innovate the country back to prosperity.

Calling BS,

It warms my heart to actually hear a voice of reason in these threads. The rich LOVE their free shit and whine and cry when the rest of us point that out. EVERYTHING that is done in the economy is to ensure the rich stay rich…..the so called “job creators”

BRAVO “Calling BS!” A thousand times yes to all your points. I loved the quote you’d shared from Aleksander Kocic. It really sums things up, universal basic income for the rich.

Sadly, the small-potato equity holders, upper middle class retired folk or older professional, have been brainwashed into loving the FED because it brought them back from the brink of the last 2009 crash. They cannot imagine that perhaps there is a better way then “free money mostly to the super rich and little, tiny tiny trickle for them.”

Communism? Competition in many, if not most, industries is global. Businesses will have to relocate to be competitive and to be able to pay a living wage to workers. Buck Knives moved to Idaho. You can read about the move; the owners had to relocate. My GF were talking about M generation repopulating Middle Merica. I write reports, but I have offers to review the work of others. I do not have to be here to do it. You consider the cost of everything including health care and I do not see how companies and young families make ends meet. I work almost EVERY day and have been self-employed since the mid1980s, but I agree with much of what Cynthia says, except no human should every be forced to live in Fresno. 🙂

Every communist country fails? What about China?

MarkinSF,

China has a totalitarian government. There is no human rights in China unless you are a member of the communist party. At the top there is an oligarchy (0.0001%) who enriched themselves for whom no law exists. They are evil but smarter politicians. For that reason, they allowed private property and encouraged a more capitalistic economy. Without that they were not able to feed their poor not even a bowl of rice. Facing a desperate situation of being overthrown by a mass of humanity (in hundreds of millions) of starving people as a result of Mao policies, they gave up on some of their bankrupt ideology (the economic part) in order to preserve the power with an iron fist.

The leaders in Bolivia and Venezuela think the same, talk the same, but the one in Bolivia is smarter. He doesn’t walk the talk and he allowed a private sector so he can stay in power. As long as people don’t get hungry, he stays there and enriches himself. For Maduro (in Venezuela), his days are numbered because he is too dumb (even with an ocean of oil, his people go hungry).

Going back to China, whatever prosperity some people have, it is due to capitalism. Without it, they would die in starvation and the communist government established by Mao would have been overthrown long time ago. It was the economic switch which allowed them to continue to stay in power.

China hasn’t been communist for 25 years. It’s more capitalist than the US. Compare the time required to get a permit in China vs US to build a factory or a condo.

Mr. Landlord,

The rich who run companies, the highly paid executives have many homes in nice locations outside of the cities where they have their HQ’s! To these people location is only a means to an end …. a location attracts talent or has necessary business ties to a region or city. Other than that, it’s all up for grabs. You seem ignorant of the fact that one of the most successful companies on the planet, Amazon, is looking to build a second HQ, Toyota moved it’s entire North American operation to Texas, or that companies move every week … simply pickup a local business journal and read it. State taxes, the high price of talent the high cost of living, are certainly reasons to move out of California, and attractive tax incentives are good reasons to be enticed to another region!

The stock market is experiencing a little weakness. This could turn into an opportunity. If the stock market takes a hit, some people will lose their cool and sell their house for a discount. My advice … if the stock market takes a good dip, start low balling homes in good areas. You may find a doom and gloom person to take your offer. They will think the sky is falling and you will get a deal. Good luck.

That is terrible advice.

Please in your infinite wisdom tell me which RE market in history has corrected so quickly that there are immediate buying opportunities immediately when the stock market goes down.

You have terrible real estate advice, you must be a house jockey.

JT is consistent (in giving terrible advice). Everything about this guy is a fraud/fake. I believe him as much as I believe our conman Trump.

I remember the 2000 crash well. And as the bloodbath rolled on the MSM interviewed some dude who claimed that there’s some “deals” out there and he was buying all he could.

then the NASDAQ proceeded to lose another 70% of it’s value.

this is a sign of a market top.

A little weakness?

S&P500 is

Up 25% since the election.

Up 5% past 3 months

Up 2% in November.

Up 0.8% today

On what planet is this a little weakness?

There is trouble in high yield land and that usually stresses equities. Over the last few weeks, their has been some shakiness. Just watch.

I agree with JT to the extent that the credit markets are much “smarter” than the equity markets, and usually lead the equity markets on the downside. I also wouldn’t get to hung up with quoting 1- or 3-month performance on the S&P — that’s just recency bias (extrapolating the recent past to continue into the future).

First of all, the Fed has artificially kept interest rates low, causing a stampede into equities that is not justified by their financials. Many of the buyers of stocks are companies buying back their own shares to pop the price. This is also known as the first half of “pump and dump”.

The market is high, but is far from healthy. Like a bipolar patient on a high.

not news.

RE has gone insane and ……..never mind. Lets just watch the implosion……again.

Gary,

In the previous thread, you said that there is no difference between Democrats and Republicans, except on few social issues and for the most part I agree.

There is though a difference. While ALL the democrats are globalists/statists/collectivists, not ALL the republicans are. While NONE of the democrats is a conservative, FEW republicans are.

While MANY republicans are Democrats with R after their name (RINOs) some like Ron Paul are against big central government, they are against imperial wars, they are against massive taxation, they are against the FED which is the cause of most wealth INEQUALITY and globalism.

Many liberals make the mistake of calling ALL the republicans conservatives and nothing is further from the truth. Look at McCain, Romney, Bush and McConnel – there is ZERO conservative ideology in them. They are all globalists fighting for big central government, mass immigration and a FED serving a bigger and bigger central government. Whatever tax plan they produce, is not proposed by conservatives but RINOs and Democrats.

Till people listen to Ron Paul and learn from him, NOTHING is going to change – we are under one party system.

Bernie will just continue the present course on steroids – will crash the system faster. Under him expect higher taxes on producers, massive inflation and consequently less disposable income (lower quality of life). The billionaires are not going to be taxed any more under Bernie. They always employ ALL the strategies allowed by current loopholes specifically designed by them.

If you look at all the tax strategies Gates, Buffet, Soros and Bezos employ you will see that they have ZERO reason to say that they want to pay more taxes. They use any strategy possible to avoid taxes – wolves in sheep clothing. To keep that, they are the biggest donors to the Democrat politicians and Bezos owns the most important liberal/progressive paper (Washington Post) used constantly for character assassination.

They are the ones asking for more taxes and they are the biggest hypocrites out there.

Flyover,

If there were really ANY fiscal conservatives in the Republican Party why didn’t they just vote against the House tax plan. The only real no votes came from the Congressmen of blue states which were intentionally targeted under the Republican tax plan to pay higher taxes. I believe that if this plan passes the Republicans will suffer huge losses because almost everyone hates this tax plan and can see through the Republican middle class tax cut lies.

“If there were really ANY fiscal conservatives in the Republican Party” Because there are not too many. They are a minority in a party of RINOs (democrats lite).

Gary,

Why do you care either way? You pay no income tax, since your are a freeloading mooching Bernie voting socialist. Your EBT card won’t be affected, so you can relax. Now if you don’t mind, the adults in the room – TAX PAYERS – are having a discussion….

The California real estate cheerleaders are blinded! They are so focused on a narrow strip of coastal land and communities, that they fail to see how rapidly companies like Google are expanding their operations outside the State. I doubt this is simply coincidence, but is in fact recognition that high salaries can’t offset cost of living and there is growing sensitivity and realization that jobs will need to shift to other states where salaries and cost of living, combine to make a better option for the talent these companies seek! I’m sure there is an increasing realization and a depressing realization that you can earn $200k/year, be in the top 10% of wager earners, and still have to live with roommates …

That has been the case in NYC forever. And London, Paris, Hong Kong, and every other global city. And despite all the wishing upon a star, those cities will always be expensive.

People have been complaining about first tier cities being expensive forever. The solution is to move.

We’ve been looking for a rental in Eastern Ventura County. I’ve been watching the market in this area for a few years. Rent had gone nuts after about 2012. An AVERAGE 3 bedroom 1600 sq ft SFH was renting for more than $3000 and approaching $3500 in some cases. Nothing fancy mind you. Something weird happened in mid August though. Rentals listed after that point are sitting on the market and rents have started coming down to under $3000 and approaching $2800 in some cases. Also, quite a few more rentals than usual for this time of the year. I am also noticing more homes on sale than usual for this time. These are also overpriced and sellers are chopping prices once a month or so.

This is way more than a seasonal issue. Anyone else seeing this in other areas?

My source is Zillow

Forgot to mention cities I was referring to.

Newbury, Thousand Oaks, Agoura, Westlake Village.

Ventura county is different from other places, it gets cheaper as you get closer to the beach. In Oxnard / Port Hueneme I get $2300 for 1100sf, 3+2 stucco crapshacks. These are older houses without HOAs, but not in the worst areas of town.

Slumlord, in Oxnard and Hueneme, have you noticed a lot of inventory for rent or sale coming on the market since mid August?

I’m seeing tons of for sale signs in my neck of the woods and houses sitting and not selling. I’ve yet to see the “price reduced” sub-sign as yet but I think the market has turned.

I don’t know a single person who can afford a home in my area. It’s not even close.

“I don’t know a single person who can afford a home in my area. It’s not even close.”

You need to meet new people.

Where is your neck of the woods? I’m curious if it’s a widespread issue or just local to this area. I checked Camarillo also, and I’m seeing a similar pattern.

Maybe you know people who don’t make a real salary or they’re single people

Mr. Landlord: Judging from how frequently you post on this site, I would say the evidence suggests that you need to meet some new people.

“you need to meet new people”

I dunno where the fuck that comes from, class-ism maybe. But It’s been in the news daily that even a professional couple can’t afford to live in SF.

And if a single person can’t afford a home, which is my point I might add, then that screams overvalued or underpaid……sooner or later one or the other is going to adjust….it has to

I’ve been watching similar homes for rent in North OC for a few years and have noticed the same thing (I think). I can’t say for sure, but it seems the market is getting more competitive for landlords.

I’ve noticed what seems to be an increasing number of available rentals particularly at the high end of the market >= $3000/month. The more affordable rentals seem to be sitting on the market for longer, but they still rent fairly quickly.

I don’t have actual data – only my “gut” – so I could be wrong, but it does seem like the rental market is softening. At the peak of absurdity, even junkie 3/1 or 3/2 SFRs in crappy areas were listing for $2500+ per month and now nicer homes are listing for around that or a little higher.

The peak seemed to be last summer. I defer to the Dr. HB “trash can photography” indicator to support my thinking. I saw a junkie 3/2 SFR rental in the flatlands of Anaheim list for $2695 last summer and the realtor didn’t even bother to clean up the trash on the brown circa 1970 sculpted carpet for the photos.

Lots of demand to dodge homeless and needles as you make your way to work. SF and CA as a whole ruined by liberalism.

TRUTH.

In the news today, Sacramento’s McKinley Park (used to be a beautiful spot) will be installing custom ‘hypodermic needle grinding machines’ in the public restrooms because all of the heroin loaded rigs are ruining the public sewer system. Let’s keep feeding the bums and enabling this all, it has worked so well. They are not homeless, they are professional grifter bums.

The new Housing Opportunity Index for Q3 came out for LA-Glendale-Long Beach. Here’s what’s happened in the last 6 years:

• Median home prices went from 295K to 583K, basically doubling.

• Median income is exactly the same at 64K. So a doubling of housing with no income gains (actually, income losses if you factor in inflation).

• 6 years ago, someone making the median income could afford 50% of the homes sold in the area (which is the long-term historical average for LA).

• Today, someone making the median income can afford 9% of the homes sold in the area (which is close to the worst phase of the last bubble)

And the RE folks want to tell us it’s not a bubble. “It’s different this time.†It’s always different this time. Until it’s not.

Houses across the country are in a bubble because high net worth individuals have to buy houses to diversify out of the stock market and attempt to beat inflation by not holding cash. Friend just bought 3 houses and two multi-units to try and get ahead, late to the game. Real Estate corporations did the same, with investors funds, when the market bottomed out. The market should remain up and tight until the corporations find a reason to sell off their houses, followed by a massive drop, before my friend can figure out what happened to his equity. But, those corporations are making above average income for their investors, so there will be no change until there is a better way to earn 6%+ dividends. Which won’t be until interest rates go up significantly, which won’t be until hyper inflation hits. When is that?

“Houses across the country are in a bubble…”

No, they aren’t.

https://www.zillow.com/homedetails/616-Gilbert-St-Columbus-OH-43205/33848832_zpid/

https://www.zillow.com/homedetails/2-Kanazawa-Cir-Madison-WI-53718/68487930_zpid/

https://www.zillow.com/homedetails/1317-W-15th-Ave-Spokane-WA-99203/23533280_zpid/

I’ve posted several others before. They are at a high point of the cycle, but the majority of the U.S. is still perfectly affordable.

My expectation is that the hedge fund types holding large volumes of residential real estate will start selling off their holdings once interest rates rise and it starts to make more sense to hold a government bond than it does to hold a depreciating asset.

John,

not only are we in a housing bubble in all of the US, we are in fact in the biggest “everything” bubble the world has ever seen. And the good news is, its about to pop.

http://www.businessinsider.de/infographic-shows-how-close-we-could-be-to-an-economic-bubble-collapse-2017-9?r=US&IR=T

Places who have high unemployment and low income show of inflated house prices that look cheap compared to the insane prices in California. Nonetheless, these places are highly unaffordable for people who live there.

Regardless of where you buy…..buying in 2017 would be the worst decision with dramatic/negative financial impact to your finances, family and well-being.

As interest rates rise holding rental property generally becomes less attractive compared to CD’s, bonds, and other fixed income products. But there are a number of things to take into consideration. First of all we are a long way from earning 6% on a CD. I imagine it may take years. Secondly, owning rental property provides you with built in tax write-offs to offset the majority of the income they produce through depreciation, prop tax, & operating cost deductions. Most other investments don’t provide the same tax relief.

“not only are we in a housing bubble in all of the US…”

…And then you proceeded to link to a web site which not only is just a big advertisement selling doom and gloom, it only shows the Case-Shiller data for SAN FRANCISCO. Yes, SF is in a bubble, as is LA. Most of the country has elevated prices but those prices are not far above the long term trend. As in NOT in a bubble. The median selling price for the entire country (including the bubble areas, which skews it for flyover country) is $225k.

“Places who have high unemployment and low income show of inflated house prices that look cheap compared to the insane prices in California. Nonetheless, these places are highly unaffordable for people who live there.”

Unemployment is extremely low, so that argument doesn’t work. A couple working full time at the federal minimum wage ($7.25) and with low debt will qualify for a $100k condo or house with 3.5% down. $10/hour (x 2) will get that couple a $150k property. That scenario can be found in thousands of towns and cities across the country right now.

John D,

LOL, I almost fell off my chair laughing at the Columbus OH house and you implying affordable. Too fucking funny man!!!

“LOL, I almost fell off my chair laughing at the Columbus OH house and you implying affordable.”

It may or may not sell at that price – I don’t think it’s worth that much, but let’s look at the seller’s asking of $172k. The median household income in Columbus is $47k. Unemployment in Columbus is 4.4%. State income tax is low – about $1k/year for that income level.

PITI + PMI for that house would be about $1k, with 3.5% down.

Assuming $47k household income, the front end would be ~25% for that loan. They could have a couple of modest new car payments and still meet the back end requirements. And then there’s the mortgage deduction, not that they’d need it.

On what planet is that not affordable?

“On what planet is that not affordable”

On mine. And $47K HOUSEHOLD INCOME!!! WTF. Is that 2 people earning slightly over min. wage? How the fuck did real-estate become “affordable” when it FORCES everyone in the house to work?

Is to the point now where the “American dream” is over.

47,000

-12,000 (1,000/mo for house not including insurance and upkeep)

=35,000

– $5,000 state and fed taxes (not including mortgage deduction which at 3.5% ain’t much)

=30,000

-2,000 utilities

=28,000

-5,200 food, assuming $100 a week

=22,800

divide that by 52

= 438/week for everything else.

I take it back, you’re right, that is totally affordable.

facepalm.

You’re familiar with front and back end financing requirements, right? It’s how lenders determine risk. According to them, that buyer is not likely to default.

There is no going back to the 50’s. Yes, two people frequently have to work to own OR rent these days. So yes, $172k is affordable, especially considering renting the equivalent in that zip would cost the same or more. There’s a 3/2 rental available down the street for $1,100, if you think that would be the wiser choice.

If you like, focus on the median of $160k instead. Or the 400+ listings that are in the $50-150k range. Or just keep believing that everyone in the country is priced out, if that’s what makes you happy.

I live in long beach and after following this blog 4 years ago I bought in. House has appreciated $200,000 already

You mean its Zillow estimate “has appreciated already.”

I’ve seen houses that the VERY DAY their listing goes from PENDING to SOLD, their Zillow or Redfins estimates are already one to two hundred thousand above the sales price.

Think it’s true?

HoJo, the appreciation is just icing on the cake. Even with zero appreciation, it made sense to buy. You were at or below rental parity and locked into the lowest rates in history. You are paying off principal in big chunks and have Prop 13 protection as well.

California’s population is supposed to grow by approximately 4M every decade for the next 3 or 4 decades. That’s all you need to know regarding supply and demand. Good job and sleep well at night.

House prices here in Burbank dropped to an average of 400k about a 20k drop during the recession. Now those houses go for about 740k. A 260k average hasn’t been seen since the late 90’s.

260k? Millie believes he’ll buy that place at 180k!

And this is median income, correct? Not household median income. Most working stiffs need two or more incomes, so now we have 2 x 64K = 128K. Call the agent and start looking for that 500K crap shack.

Hey Doc. Interesting to see in that graph how the crash bottomed around Jan 2009 and then it bounced along then dipped slightly more Jan 2011 and then took off in Q1 of 2012. it seems to portend that when the next crash comes it will take perhaps 2 yrs before the very bottom is seen. But with Trump in office I cant imagine a crash would start in 2018… maybe 2019 when Trump euphoria ends. (I am not a Trump fan, I am simply pointing out the DC grifters will keep RE afloat as much as possible).

“Apps that can deliver a Big Mac to your house while you binge out on 20 seasons of random shows?”

hILAROUS!!

I still think property (or anything) is only worth what it can throw-off in cash/income/rent. Maybe im just weird or stupid?

Weird yes, stupid no. I think the same way when it comes to housing and we are in the minority.

What about infrastructure jobs?

For every guy/gal writing code @ $250k/year there must be at least several infrastructure jobs (service, small business) that don’t pay anywhere near that. (Unless your a trash truck driver in Santa Monica who makes $100K+/year)

If the folks keeping the lights on and filling the potholes in the streets can’t afford to live in SF then what?

Send in the national guard?

Maid service @$75/hour?

Big Mac’s @ $25?

Does anybody really think that Mark Zuckerberg is going to be caught outside his house with a broom?

Something is got to give and I think we are close to the breaking point.

You dopes never learned that RE is always location, location, location. There is never a wrong time to buy quality, only better times, for long term buyers willing to ride out bumps along the way.

Plus, the RE market is now global, part of globalization and technology. Don’t believe my followers; they are too stupid to understand. That’s what I love about them.

Is that really you Mr. Trump?

Worst mantra ever concocted by someone who is not independently wealthy from real estate. “Location location location” is so stupid, it is ”price price price.” That is all it comes down to. Any successful investor knows that.

Could of told you that long ago 😂. Either way thanks for the post, much appreciated and looking foward to more – thank you ðŸ‘

This is a BS poll. SF renters are hard core communists. Where are they going to move? Alabama? LOL.

I was going to say the same thing. Being there for the jobs is one thing…but most of them all love progressive thought, diversity, higher education, the CA lifestyle, CA weather, leftist policies, etc. There is little to no chance these same people are moving to Alabama, Texas, Montana, Kansas, etc. For every one that leaves, a new dreamer will gladly take their place.

That’s what’s so great about the tax reckoning which is currently threatening California the most! If a new tax plan passes that really sticks it to CA, we will be about to find out just how much people are willing to pay for the congestion, high crime, and overrated weather. But hey, maybe more Antifa mobs and other morons blocking the way to work is just the type of charming diversity which makes coastal CA so irresistible.

Ya know, for as much as people may hate or love the Trump, the one undeniable thing is that most people who pick a fight with him tend to lose in the end. Just ask Hillary. A dirty little secret is that leftists also tend to not want to pay more taxes than the next guy for the same thing. If the Trump gets his way, you’re gonna be fucked because CA will have no choice but to eventually dismantle Prop 13. It’ll be the only thing left to pillage and of course Sacramento will come up with creative ways to call it something by any other name, hoping you won’t notice. Good luck!

The tax bill won’t affect what the renters will pay. Landlords charge what the market will bear, which is based only supply and demand, and pocket the difference between that and their costs. If this tax bill passes, the costs for landlords in CA will go up but the market won’t change, so the landlords will have less while the renters are unaffected.

Fair economist, you are not an economist. Avi is speaking long term and you state the short term. Short term you are correct, long term he is correct. I would define long term as few years. Lack of investment for lower return will lead to shortage and higher rents. The longer it persists, the higher the shortage and the higher will be the rents.

When Rocket Boy’s ICBM’s can hit The City in a year or two, I think some people will leave.

What’s rotten in SF? The arrogant elitist Bernie Sanders voting liberal socialists of America.

Mr. Johnson speaks the troof!

And here I thought it was the bum shitpiles in any given park.

The arrogant elitist Bernie Sanders voting liberal socialists of America.

Redundant. Hard to find a Washington politician who isn’t socialist or elitist.

I am sick and tired of millennials telling us they cant afford an overpriced crapshack.

What do you mean you cant afford 1MIO for a 2 bedroom crapbox???

Stop spending 10 dollars on an Avocado toast and you can easily pay for the closing costs.

Stop spending money at Starbucks and micro breweries and you will easily have the downpayment!

California needs to follow Flagstar bank’s brilliant idea of “innovative” mortgage products.

If the bank offers zero down and covers closing costs millennials have no more excuses.

BANKS/LENDERS: WHAT ARE YOU WAITING FOR???

http://www.zerohedge.com/news/2017-11-17/michigan-bank-just-brought-back-zero-down-mortgage-theyll-even-cover-your-closing-co

Glad I reminded you about the avocado toast 🙂

Rent control advocates pushing their agenda in Inglewood, Pasadena, Glendale, & Long Beach. Looks like they want a 2018 referendum on new rent control measures. Because we need more government telling us what to do with our private property.

https://la.curbed.com/2017/11/17/16671958/rent-control-initiative-inglewood

Rent control is great…..for landlords! In the short term it may sting a little, but long term, rent control increases rents.

“83 percent of renters surveyed in the Bay Area said they plan on leaving”

Of course. Is not because of the rents or housing prices. In coastal OC/LA, Boston, and NYC, people also need to come up with more than 1M for a decent starter home in a good area. That is the same story.

However, if you are a male looking for a girl, nowhere is worse than the bay area. In fact, many males with Computer Science degrees want nothing to do with the bay area because of the girl shortage. That is the problem. So, the tech companies have to pay more money to get males to move into an area with a girl shortage.

If you are a male, giving up girls for a larger paycheck is dumb.

That is an interesting take.

However these nerds wouldn’t get laid Denver or St Louis any more than in San Jose. So if you’re going to be a lonely single male, might as well go where the income is highest. That’s part of why these guys work 12-14 hours a day. They have no other life.

You are always wrong.

As a former SF resident, it is extremely target rich there. Tons of successful hot ladies interested in non-gays.

Nope. It is so bad up there than girls who are 2 on the scale of 10 are considered hot in the bay area. That is a fact and everyone knows it.

The recession is coming and it will be brutal. RE prices are in a bubble in most of US based on local incomes. Even the FED admits that. NOBODY knows how soon the recession comes, but the FED is already looking at options.

When the FED will not stop at anything to save the TBTF banks, we will see massive inflation, especially in assets. That is the reason I am a short term bear in RE and stocks, but long term bull for RE.

https://dollarcollapse.com/monetary-policy-2/next-generation-crazy-fed-plans-recession/

But but but but…

Monthly payments today are lower than they were in 2006.

Buyers have the highest credit score ever recorded in history.

Real estate prices have reached a permanent high plateau.

Prices will drop 15% tops if at all.

Well in all fairness this exact statement could have been (and has been) repeated every year for the past 5; and has been wrong each time.

Now since you are a short term bear in RE and Stocks; which RE are you selling? How much of your stock portfolio are you shorting?

I sold few rental properties (houses) to consolidate/deleverage. I also sold all stocks I had in my IRA. I sold gradually in the last 3 years. I bought a lot 2009-2013. I was leveraged a lot back then.

Like I said before, I realize that I leave money on the table but I am happy for getting the direction right. I can never guess when is the absolute top or bottom looking forward. I can see the inflection point only looking in the past. I have my strategy which helped me over the years. If I would have inside info at the FED I would act differently, but I don’t have that. That is the reason Blackstone is making a killing and I get the crumbs. Even with crumbs, over time, it still helps.

I still have rentals (both houses and commercial) but they are paid off. I still have a very small debt on my house.

Lol… exactly Dan.

If the sky is really falling then these guys who preach doom and gloom should be selling every piece of property they own. Hell, they should be renting. But don’t stop there. Liquidate all your savings and short every REIT. Put your money where your mouth is…

I don’t know where real estate prices are going but I’m guessing higher in the future. My home is just that- a home. My mortgage will be paid off within the next 10 years and then who gives a damn. I can’t take my equity to the grave.

Yes, CA weather is overrated. I’ll be surfing tomorrow and on turkey day. High of 84 at the beach (which is a long 10 min walk).

SoCalGuy, it’s disgusting that it should be 84 degrees on Thanksgiving. Thanksgiving should have cool, crisp autumn weather. So should Halloween.

I passionately hate SoCal weather.

BTW, I too live a 10 minute walk to the beach (in Santa Monica). I went to the beach only once last year, in winter. But only because it was cold and overcast. Before that, i hadn’t been to the beach since 1993.

The beach is overrated. Maybe surfers like it. But it has nothing for those who dislike sand, sun, and dirty water.

And other people will be doing all sorts of activities they enjoy, steps from somewhere not in SoCal. Not everybody considers sweltering heat on Thanksgiving to be desirable nor festive.

Music to my ears…..I guess it’s a good thing I didn’t listen to the perma bears in 2010 who assured me home prices would tank for the next 20 years, huh? LOL.

http://www.spokesman.com/stories/2017/nov/03/spokane-countys-strong-housing-market-continues-in/

“Homes continue to sell briskly in Spokane County, with the number of sales in October rising by nearly 20 percent over last year. The Spokane Association of Realtors reported 803 sales of condos and single-family homes on less than one acre in October, compared to 671 sales during October 2016. The median sales price was $209,900, a 5.5 percent increase from October 2016.”

A lot of this is due to California refugees who sell the POS shack in the barrio for $800K, move up here and buy a $400K McMmansion with cash. So from the bottom of my heart I want to thank the insane socialist polices of CA that have allowed this to happen. May you never elect a Republican again!

Today it was 40 something degrees with freezing wind & rain in Spokane and in S. Cali it was a beautiful sunny 75 degree day. (Drop the mic)

Next up to the mic… May gray, June gloom, no sky July, Fogust, Santa Ana winds, and fire smoke with guest appearances from the wintertime SoCal Gas bills and localized flooding.

…and that’s just at the coast. Stay tuned for a very special summertime A/C bill in the valleys and landslides in the canyons!

It was 60 degrees yesterday and it’s in the upper 40s and sunny as I type.

But yeah you’re right winters suck here. But May-Sept the weather is perfect, hot dry and sunny. Dry being key since even when it’s 90 degrees, it doesn’t really feel too bad.

And if you want to pay 12% income tax, on top of paying $1M for a ghetto adjacent 40 year old house….to have a few months of nice weather, be my guest dude. I’ll take 3 months of crappy weather in exchange for 0% income tax, and an equivalent home for $400K in the best part of town.

Speaking of A/C bills…

My electric rate is 7.5 cents per kw/H. What is it in SoCal? I’m guessing 15-20? So right off the bad my electric bill is 65% lower. But wait there’s more…I barely use the A/C. As I mentioned it’s a dry heat. And since the temp drops at night into the 50s, sometimes even 40s in summer, and no humidity, you don’t need A/C. Open up the windows and the house cools way down down. Then close the windows in the morning and the house stays cool well into the afternoon. I’ll turn the A/C on at 5 or 6pm for an hour or two. Then sun goes down, rinse and repeat. A lot of people, don’t even have A/C since it’s not needed for the most part.

My electric bill is usually under $100/mo even in July/August.

But winter bills have to be outrageous since it’s so cold right? Not really. While winters are gloomy, they’re not that cold. Typical winter day gets into the upper 30s, low 40s. It’s nothing like a Minnesota or Wisconsin winter.

Funny how when people leave CA they feel they must put it down to make them feel better about their decision. Regardless, that’s a whole other story. The reality is that there is a whole lot more to CA than LA and SF. There are plenty of beautiful parts of S. Cali with semi-normal housing costs. The problem is that in these rural areas there are zero jobs.

It is noted that there was no dispute of said May Gray, June Gloom, and friends.

All markets are good markets. When the prices go up it is a good time to sell. When prices are low, it is a good time to buy. That is the way I look at it.

Well, smart real estate investors can always spot a deal. But… the many high LTV jackasses that rushed in 2010-2012 were bailed out by the FED – but they crow like Sam Zell, Jr. Its a bull market, not brains for many. Experienced investors like yourself that are not over-levered can ride it out. Buy the dip has been rewarded so often its not gonna work. You might not get torched, but an adjustment will occur, as it always eventually does. Even so, the ramp in rents in Socal has been stunning.

We are looking in South of France. Nice and Antibes, and perhaps Uzes. Next trip we check Portugal out… Daughter in London and son has offer from French firm. They both studied in UK(law), Germany & France (masters).

My neighbor across the street and one house over listed his house and had it sold the following day. He seemed happy with the price he got but I think he could have asked 40K more easily and it still would have sold quickly.

This cannot be true. Didn’t you hear? Some of the regular 50-70% crash bears on here swear that there are for sale signs everywhere, with price reductions through the roof.

There is no inventory problem and all of these houses that go into escrow quickly are realtor hype.

“Some of the regular 50-70% crash bears on here swear that there are for sale signs everywhere, with price reductions through the roof.

There is no inventory problem and all of these houses that go into escrow quickly are realtor hype.”

That is all spot on. I could not agree more except that I would add that houses that go quickly in escrow is hype, manipulation and lies.

Seller greed appears disconnected from any reality.

I saw this house in Brentwood today, mostly out of curiosity. I live in Santa Monica, so it was within walking distance: https://www.redfin.com/CA/Los-Angeles/853-S-Gretna-Green-Way-90049/home/6760373

Beautiful house. Huge, well-maintained, nice pool. Even includes a guest house with bathroom.

But in 2013 it sold for: $1.7 million.

Now they’re asking nearly $2.8 million.

Really? It increased that much in only four years?

Price includes “Plans and permit to build 3,700sf modern home designed by Renzo Zecchetto, the architect of the Broad Stage in Santa Monica.”

Why? It’s not a tear down. It’s beautiful.

I guess this house is aimed at buyers for whom money is no object. A buyer who’ll gladly pay a massive markup for a beautiful house, only to tear down that beautiful house and build a new mega-mansion.

I see SO MANY mega-mansions — and $2 million townhouses — being built north of Wilshire, there seem to be many such buyers.

Really? It increased that much in only four years?

—

Short answer: yes

SOL, I don’t know if they will get their exact price…but they will get something close to it. Homes here in the Southbay have went up about 50% in the last 5 years. In Manhattan Beach, a 2M house bought back in 2012 now goes for 3M. When you get in that rarified air, like you said “money is no object.” People will pay extra for the ideal lot, location or house and even bulldoze a perfectly good 20 year old home to build their custom dream home. There really is that much money fighting for the uber desirable parts of socal!

SOL, I looked at the redfin link you supplied. That place has teardown written all over it. Not because the house isn’t nice. The size of the lot (9000 sq ft flat) and size of house (1700 sq ft 2 bed, 2 bath) make it an ideal candidate. The house is simply too small and there is plenty of room to increase size. Anybody paying 3M plus wants square footage for living and entertaining. And there are plans and permits ready to more than double the size. Should be interesting to watch…

That tells you something about the cost of land.

https://www.theguardian.com/money/blog/2017/nov/18/house-prices-land-prices-cheaper-homes

That whole stretch of Gretna Green between Wilshire and Montana is turning into McMansion ville… a few months ago there were five being built at once. All have that Cape Cod or Modern Farmhouse thing that is so popular on the Westside right now. They are selling/sold in the 4-5 million range.

son of a landlord, the valve here is in the Brentwood location, and the south of 3M price for a 9K lot. As you know, that would be a big lot in North SM and tear downs are going for 2.8-3M there. Seems reasonable to me…sadly.

Didn’t you know? A rising central bank liquidity tide lifts all millionaire (paper) boats.

Son of a landlord…Fact checking here..if you can walk 10 minutes to the beach as you claim, AND YOU stated that you are in walking distance from the Gretna Green listing in Brentwood…?

You must be a fast walker! I live in Ocean Park and can claim the 10 minute beach walk thing….anyone North of Montana cannot.

Fact check? Check your reading comprehension.

I never said I was a 10 minute walk from Gretna Green, only that it was within walking distance.

I have a condo on Ocean Blvd. That’s walking distance to Gretna Green. I never timed it. Maybe an hour.

Son of a landlord…Fact checking here..if you can walk 10 minutes to the beach as you claim, AND you stated that you are in walking distance from the Gretna Green listing in Brentwood…?

You must be a fast walker! I live in Ocean Park and can claim the 10 minute beach walk thing….anyone North of Montana cannot.

A home in Sunnyvale sells for $800K over asking.

The house that sold for nearly $800,000 over asking price speaks to the inequity of California

The house that sold for nearly $800,000 over asking price speaks to the inequity of California. The ranch-style house in Sunnyvale that sold for $2.47 million, about $800,000 over asking price, in a bidding war. (Keller Williams Realty)

The turkey was done, or getting close.

So my Aunt Mimi and my Aunt Marie opened the oven to take a look, and decided to lift it onto the counter for closer inspection. The turkey had other ideas. It jumped out of the roasting pan and skidded across the kitchen floor as if it was trying to escape.

That was in Sunnyvale, which sits in the heart of a Silicon Valley that did not exist when I was a kid. My Uncle Pete was a mail carrier, my Aunt Mimi was a homemaker, and they lived only a mile or two from where, three months ago, a house sold for nearly $800,000 above the asking price.

The city of Sunnyvale in the 1960s. People with current mortgages in Sunnyvale and other areas of Silicon Valley are sitting on more than $239-billion worth of equity, an economist says.

The city of Sunnyvale in the 1960s. People with current mortgages in Sunnyvale and other areas of Silicon Valley are sitting on more than $239-billion worth of equity, an economist says. (City Of Sunnyvale )

Priced out, big time

The coming holiday reminded me of the turkey, and it reminded me that I meant to find out more about that house. As I wrote at the time, the three-bedroom, two-bath ranch was listed for $1.68 million and sold, in a bidding war, for $2.47 million.

According to sales records, the property tax at the time of the sale was just above $1,500. Not per month. Per year.

Thank you, Proposition 13.

The annual tax bill was so low, I figured the previous owners had lived there a long time. So I called the listing agent to see what I could find out.

Dave Clark, a Keller Williams agent who’s been in the business for 30 years, said the house had only one owner prior to this year’s sale. A couple bought it brand new in 1963, raised two kids and held onto the house until recently, when the gentleman followed his wife in death and their son and daughter sold it.

“I think they paid around $25,000,” said Clark. “So it went up in value about 100 times.”

That’s astounding. But median incomes, unfortunately, have gone up only about 10 times over the same period.

Incomes at the top of the pay scale, meanwhile, have exploded. An op-ed in the L.A. Times last week said Jeff Bezos, Bill Gates and Warren Buffett have more wealth than the bottom half of the country combined. The op-ed, by Chuck Collins and Josh Hoxie, said today’s 400 richest Americans are 10 times richer than 1983’s richest people were, but median family income has declined in that time.

Proposition 13 and the affordability crisis

For working folks in California, flat wages and housing scarcity — which drives up prices — are at the center of the affordability crisis. People are forced to live farther from where they work and pay ever-increasing percentages of their income on housing, which leaves less for education, healthcare and everything else.

My Uncle Pete, long deceased, wouldn’t be able to buy a house anywhere near Sunnyvale today on a mail carrier’s salary. News about working people living in RVs and cars has become routine in Silicon Valley, including a recent story about a San Jose State University professor whose home is her vehicle. Meanwhile, nurses, teachers and laborers are commuting great distances.

“Every day, people are on the road for an hour, two hours, each way. We’re wasting so much talent and skill and the disparity in income is just ridiculous,” said Clark. “The government’s job is defense, and building roads and schools. But another part of the government’s job is income distribution and too much of it has gone to the super-wealthy.”

Clark said it used to be that the areas with the best schools got the highest real estate prices, but now short commutes are just as coveted. That means there’s gold in Sunnyvale, which is not far from Google, Apple and Facebook.

“The buyers are almost always in high tech and they have good incomes, but not unbelievable incomes,” said Clark. “What enables them to buy houses is their stock options.”

In September, when the house sold for $782,000 above asking, dozens more sold for at least $200,000 above asking. Clark said that trend appeared to have been stabilizing, but he just had another big week.

More than $600,000 over asking price

He sold a house, also a three-bedroom in Sunnyvale, for more than $600,000 above asking. It was listed at $1.88 million and sold for $2.55 million.

“It’s in escrow,” Clark said, and the story gets crazier.

Clark said he sold that same house in May 2014 for $1.54 million.

So the house went from $1.54 million to $2.55 million in just 3½ years.

This kind of equity, by the way, is a huge source of wealth among Californians lucky enough to own houses, enjoy the benefits of Proposition 13 and mortgage deductions, and then sell to the highest bidder.

In a column coming soon, I’ll give you more on that topic and how equity wealth could help finance more housing for ordinary working folks. But I’ll give you this little teaser now:

People with current mortgages in San Jose, Santa Clara and Sunnyvale are sitting on more than $239-billion worth of equity, according to Frank Nothaft, chief economist at CoreLogic.

Clark, the real estate agent, put me in touch with Bill Malcolm, an Irvine lawyer who grew up in the Sunnyvale house that sold for $782,000 above asking.

“It was absolutely amazing,” said Malcolm.

When he has visited his old turf, Malcolm told me, “what has plagued my thoughts” is the question of where regular folks are living. “When I go into the Safeway or the gas station or Costco, I think, ‘How do these people afford it?'”

Malcolm thought about holding onto the house he grew up in, given soaring prices, but said his parents would be pleased that it was sold to a couple with three young children.

For $2.47 million.

And exactly how much did Malcolm’s parents pay for it in 1963?

The price, he said, was $27,500.

QE Abyss,

You can thank the FED for this and globalization. Actually the globalization is promoted by the FED – part of their agenda.

I did a quick estimate of Malcolm’s parents home increase in price per years since 1963. It comes out to about 10.5% per year compounded for 44 years. It shows how powerful compounding interest is. But I suspect that the home may have had some home improvements done through the years.

“where regular folks are living.”

In my experience with my cohort of older Millennials that I grew up with in OC, those that are married, where both are college educated working professionals in good stable jobs, can make it work with a little bit of help from their parents.

.

Paging Milliem, Paging Millie…

http://www.weeklystandard.com/millennials-are-buying-homes/article/2010487

What do you know? Millenials aren’t spacial snowflakes are after. They are like everyone else. They grow up, get married, have kids and buy homes. Which is what anyone with an IQ north of 76 knew already. It took the MSM 10 years to figure it out.

It’s crazy how the MSM thinks today’s 25 year old will stay 25 forever, LOL. Yeah few 25 year olds buy homes. But guess what happens to that 25 year old in 10 years? Abyone? Buehler? Fry? Anyone? The 25 year old turns 35. And then 45 10 years later. And what do 35 and 45 year olds do? They buy houses.

He’s not worried, he’ll inherit a house in 25 yrs. So, all he has to do is wait.

That’s right Dan! You seem fascinated that I came up with this easy but strategy. Save money, rent and wait fir a beautiful crash and if the crash does not come you keep saving by renting and inheritance.

Mr. Landlord,

I just want some clarification. Are you taking about national housing prices or SoCal?

I am just wondering because you often suggest moving to buy a home in less expensive parts of the US.

Do you feel that SoCal prices are sustainable long term?

OceanBreeze,

As long as the US continues to import millions of immigrants (legal and illegal) into CA, I don’t see CA real estate ever becoming cheap again. Combine that with 0% interest rates as far as the eye can see and it’s a resounding yes.

There will probably be a few dips here and there. But the long term trajectory is up up up and away.

Homeownership rate has risen to its highest levels since 2014? Great, give it a few more years until it matches that from 20 years ago.

Wait, is “This is the year when millennials will buy in droves” back already? I heard it for the last 3 years and i am still waiting patiently. By talking to the RE cheerleaders on this blog it seems it was postponed this year. Jokingly I asked if “millennials will buy in droves” will be back in January 2018. For a while it seemed the new theme is that generation Z will go out an buy in droves now?

Well..whatever it is….home ownership rates are at historic lows in the meantime:

https://www.bloomberg.com/news/articles/2016-07-28/homeownership-rate-in-the-u-s-tumbles-to-the-lowest-since-1965

So, when exactly is it that millennials (and Gen Z) will go out an buy (in droves)? Will that be this month or next month or in 2018?

Home loan interest rates would have to go above 5% to cause another real estate crash. It is all wistful thinking on our part until that happens. Will the Fed raise its discount hate by 1% or more anytime soon? It doesn’t seem likely.

When will 5%+ home loan rates arrive and how long would it take for those 5%+ rates to start a real estate decline? Common sense would suggest that it will take at least 2 years for those events to occur so the real estate crash can’t even start before 2019 and can’t bottom before 2021 at the earliest. I would guess that this site might as well close down for a couple of years because good investment opportunities is real estate are probably over 4 years away. By then, we could all be dead. So my advice: Buy an overpriced home now and enjoy it rather than wait many years for something which may never even occur.

“Eat, drink, and be merry, for tomorrow we may die” seems to be good advice right now.

“Eat, drink, and be merry, for tomorrow we may die†seems to be good advice right now.”

Buying during the biggest asset bubble in the history of this world seems like the biggest financial mistake one can make.

I do understand the drive-thru mentality in California. We need to have everything now.

What you are also saying is that by buying a highly overpriced crap shack one is somehow happier? I will never understand this logic.

Financial stress is very depressing. If you have no debt and a ton savings in the bank you live a financial STRESS-FREE life. That alone gives you peace. Paying way too much for a crap shack and having to put most of your money into that is not satisfying at all.

You should really understand how happiness works: “If you put your happiness in temporary things, your happiness will be temporary”. Buying an overpriced crapshack might be fun at the beginning when you run around and tell everyone you are living the american dream. Once the bills start coming reality sinks in. Also, dont forget what happened during the last recession. We had 7 MIO foreclosures.

Panic at PermaBear HQ:

https://www.investopedia.com/news/how-4-gdp-growth-can-fuel-stocks-2018-goldman-sachs/

“Global GDP growth is likely to be a robust 4% in 2018, giving stock prices further upward impetus. Unexpectedly strong third quarter results were delivered by the U.S., with 3% annualized GDP growth, and Germany, the largest European economy, which posted 0.8% growth. Japan, meanwhile, has posted seven straight quarters of economic expansion, CNBC adds.”

Obama didn’t have 1 year of growth above 3%. Trump will get us 4% in his first year. This is what a pro-American, pro-capitalist president does. Sorry lefties, your dream of an economic collapse will be on hold for at least the next 3 years.

#MAGA

Landlord,

Collapse in 3 years? That sounds great! 3 more years of saving money and maintaining a debt free life and than buying at 50-70% less from today’s prices…..what’s not to like?

Millie, the point of owning a house is knowing that you will have a roof over your head for a fixed payment for the foreseeable future. As long as you pay no one can throw you out. This is piece of mind. Unlike a apartment where rents can go up, building can get sold, owners can die, etc. and your future living arrangements and costs are a uknown.

Wheelie, none of what you said makes any sense. You are just suggesting to buy an overpriced crapshack because you already have a house. You bought it dirt cheap and now you want millennials to pick up the slack and keep the bubble going. You are a hypocrite and sound like these realtards with their cheap sales pitches. Rents are much cheaper than buying during the bubble. As soon as house prices collapse by 50-70% it makes sense to buy. Nice try wheelie

Mr. Landlord,

Giving huge tax cuts to corporations and the very rich, thru deficit financing, isn’t going to bring prosperity to America. The Republican tax plan will only accelerate the income inequality in America which will eventually destroy the middle class and the American economy. You better hope that the tax plan fails or you are on the way to the poor house as your income properties drop 50% in value and go into foreclosure.

“You better hope that the tax plan fails or you are on the way to the poor house as your income properties drop 50% in value”

That’s why I hope it will pass. property values dropping 50% in values is a great thing for first time home buyers. Millennials will greatly benefit from a collapsing RE market.

Gary,

You silly communist. Stop parroting MSM talking points. Tax cuts stimulate the economy and bring in higher revenues. It worked in the 60s, 80s and 00s.

If a corporations, especially multi nationals, were competently run, it would pay no taxes whatsoever — Trump tax cuts or not. The tax code is so full of holes that corporate accountants could easily drive a brinks truck through it. Both parties are complicit in promoting severe wealth disparity. Neither Democrats nor Republicans are your friend.

Landlord,

Bush Sr. raised taxes and GDP grew. Clinton raised the highest marginal tax rates and we had we had peak growth from 95-00. George Dubya cut taxes and we had a weak expansion followed by the Great Recession. So no, tax cuts don’t necessarily improve the economy.

Correlation does not equal causation. You can argue both sides but history shows it can go either way. There are too many other variables at play.

“George Dubya cut taxes and we had a weak expansion followed by the Great Recession.”

LOL. Weak expansion? The full tax cuts were enacted in 2003. He is what GDP growth was the next 4 years. On what planet is that considered weak?

2003 2.8%

2004 3.8%

2005 3.3%

2006 2.7%

Compare that to what happened under Obama’s watch his first 4 years when he raised taxes and went on a spending binge the likes of which we have never seen before.

2009 -2.8%

2010 2.5%

2011 1.6%

2012 2.2%

2013 1.7%

Landlord,

By weak, I mean the slowest job growth post war since WWII. “Dubya†averaged 1.8% GDP growth per quarter he was in office. That pales in comparison to Clinton who averaged 3.8% slightly beating Regan. Clinton also averaged adding 242,000 jobs a month. If you recall he also RAISED the highest marginal tax rate to 39.6%.

Again, my point is lowering taxes does not necessarily equal growth. I’m not an Obama fan but that guy inherited a shit storm that formed under Bush’s watch. If you want to give Bush so much credit for GDP growth then you can also give him credit for causing the worst recession since the Great Depression.

Personally, I think presidents get too much credit for economic prosperity and also get blamed when things go bad. You can thank Mr. Greenspan for GDP growth not Bush and tax cuts. In 2006, home building made up over 8% of the GDP and peaked at 1.2T dollars. Don’t you think that had something to do with the Fed dropping their pants on rates?

Generally agree with your overall assessment but come on most of us know by now that the word of Wall Street forecasters is hardly foolproof.

https://www.wsj.com/articles/SB116671139892256725

Updated Dec. 22, 2006 11:59 p.m. ET

The consensus outlook for the U.S. stock market in 2007 reads like a Southern California weather report: sunny and mild, with barely a chance of clouds.

For those who say housing in the bay area is unaffordable.

https://sfbay.craigslist.org/eby/cto/d/peterbilt-sleeper/6395846377.html

Fake real estate agent scams family out of entire savings: http://wishtv.com/2017/11/22/fake-real-estate-agent-scams-family-out-of-entire-savings/

This renter was truly dumb. She found her realtor on Craigslist.

And she’s only out $2,000, the rental deposit.

According to her own words, $2,000 is her life savings and it took her YEARS to accumulate it.

If it takes years to accumulate $2K as your life’s savings, you have bigger problems than getting scammed on Craigslist.

LOL. Some people are so stupid. I honestly have no sympathy for these dullards.

It’s all good. She now has a GoFundMe page and has taken in over $3,000. Hopefully she can hold onto it this time.

Interesting and Laura,

While Calling BS is right in his assessment, you have to make a distinction between the rich in order to avoid the confusion which the 0.0001% try to create. There are two classes of rich: the billionaires (parasitic class) which developed around the private cabal called the FED (which has all the politicians and lobbyists in their pocket and always create loopholes for themselves to avoid taxes) and the millionaires (mostly small business owners which create most jobs, doctor couples, etc. which create most value for this society). I called them the 0.0001% and the 10%. The whole history everywhere is a struggle between these 2 classes. When the 10% win, there is a good economy for most (there will always be poor). When the 0.0001% win, everyone is EQUALLY poor like in socialism/communism.

When you hear about tax increases for the rich, it ALWAYS mean tax increases for the 10% so the 0.0001% crooks have less competition, more to steal and more concentrated power. Everyone looses, including the rest of 90% who have more unemployment. Concentration of power is always bad and globalism means concentration of power like the earth never saw before. If the socialists would care about the 90% like they claim, they would stop any immigration to protect the middle class from competition for lower and lower wages. However, their actions speak louder than their talk. All they fight for is bigger government and more concentration of power. That is the reason the billionaires (0.0001%) love the socialists so much and give vast amounts of money to them, because they love concentration of powers and total control over individuals.

Both groups are rich – the 0.0001% are extremely rich, and for the middle class the 10% are still rich. However, there are vast differences between the 2 (their interests and their contribution to the society), and all groups should be aware when they speak against the “rich”. The communists succeeded to consolidate their power by eliminating (literally) the 10%. As a result, the whole society collapsed everywhere where it was implemented – for the most part, the top 10% are the best educated, with the most discipline, the most energy level, with the biggest drive and the biggest risk takers in the society. 10% in every society are born leaders and 90% are born followers. Without the 10% at the top, the society collapses. If the incentive to excel is removed, the economy collapses. For the psychopatic 0.0001% the top 10% are always a threat to their domination, because they are also leaders, think for themselves and are hard to brainwash.

Flyover,

I generally disagree with your anti-FED stance. But you’re right here. The term rich is mislabeled. Someone making $500K a year is comfortable but by no means rich. Rich is the Zuckerberg/Bezoz/Soros class. Which is night and day compared to some surgeon or high priced lawyer. Yet in the minds of the MSM and class warfare imbeciles they are indistinguishable.

But with the tax bill it’s hilarious how mags like Forbes complain that the rich don’t get any tax cuts while the left is screaming its usual tax cuts for the bullshit.

500k a year is rich, even in the richest cities. Let’s be real here.

Landlord,

I strongly suggest you read the book “The Creature from Jekyll Island” by Edward Griffin. You’ll be happy you did.

https://www.amazon.com/s/?ie=UTF8&keywords=the+creature+from+jekyll+island&tag=googhydr-20&index=aps&hvadid=234381119887&hvpos=1t2&hvnetw=g&hvrand=659828189456266776&hvpone=&hvptwo=&hvqmt=b&hvdev=c&hvdvcmdl=&hvlocint=&hvlocphy=9033829&hvtargid=kwd-403864853&ref=pd_sl_5z8il2tf1d_b

Pricedout, yeah, I agree. $500,000 is rich.

Funny thing about Americans, almost all of them think they are Middle Class. Even people making $25,000 a year, or $1 million a year, will still think of themselves as Middle Class.

Almost everyone thinks “rich” is someone who makes more than they do.

For a man making $25,000 a year, $50,000 is rich.

For a man making $1 million a year, $5 million is rich.

Fly,

I know all about that book. I disagree with the premise. We’ll just have to agree to disagree on this.

For a single dude working on Wall St, $500K is rich-ish. For a family of 4 or 5, it’s comfortable.

I agree with Mr Landlord to some extent. If you live in a high price area, 500K is comfortable. 300K is dirt poor.

1) The down payment on a 1M crap shack is 200K

2) The mortgage and property taxes on 800K is about 60K/year

3) Sending your kids to a public university (2 kids) is about 100K per year.

4) Normal expenses for food, clothing, cable, internet, car repairs/insurance can be about 100K/year

5) 40K/year for retirement savings

= 300K

I thought Trump was going to make America Great Again?

To me that meant bringing back the wages of the 1950’s. And the 91% tax rate of people making over 300K (2M in today’s dollars).

I grew up in a tract home living next door to a CEO in S. CA. CEOs didn’t make 35M back then because of the tax rate.

Trump just pushes away from when America was great and allows the wage discrepancy to widen even further.

I forgot to add, the Federal and State taxes on 500K income is about 150K today so the 500K/year earner has 350K left for the expenses above.

Trump’s been there less than a year and you expect everything to be perfect? Any objective look at the economy today vs a year ago shows it’s much better. You have to admit that. And if the spineless RINO weasels in the senate play ball with him, it can be a lot better.

It’s funny on the one hand people scream about Trump being a fascist. Then they whine that he hasn’t done anything. Well why hasn’t he done “anything”*? Because congress hasn’t allowed him to anything. So he’s a fascist, but he’s also constrained by congress. LOL

* He has done quite a bit like getting out of Paris, enforcing immigration laws, gutting regulations and reforming the EPA. The deregulation alone has been huge. Put these together and it is impactful. But you’ll never read about this stuff in the MSM so most people don’t know what’s going on.

Also in your list of expenses, you forgot private school (pre-university). In the progressive hell holes like NYC, San Francisco, LA, etc public schools are awful. Anyone who can afford it sends their kids to a private school, which runs anywhere from $10-50K per kid per year. I went to a private school and just for giggles check out the tuition these days. My jaw dropped. It’s $38K a year. That’s more than many colleges. Back in the olden days, when I went there, in the 90s, it was $12K a year, and even then I thought that was crazy expensive.

So you have 2 kids in private school, that’s $80-100K a year just there.

We drove across country last year. Other than the coasts, much of the country is fugly at least along I-20 and in particular Tejas and LA. GF is selling her home in So. Carolina. Its in an area formerly textile-industry based, that is now trying to attract new biz to relocate. There is a liberal arts college in town. She custom built a beautiful 2,300 FS home on 30 acres next to national forest. After DP and haggling, allowing $400/month per $100k of mortgage debt, you can own it for $1,200 a month P&I; that is alot of house/property for about the same monthly nut as a 1Br apt in non-coastal Socal. Its not La Jolla, but you can do alot with 30 acres and plenty of water too. So. Carolina is a right-to-work state, so salaries will not be same as Cali, but they don’t have to be.

tell me about the humidity in summer and all those bugs. Does the A/C run a lot? Are the people fat?

SoCal has suffered extremely humid summers these last few years, at least along the coast. And don’t forget, SoCal summers now extend into early November.

LOL…yeah man there are like no hot women in Dallas or Atlanta. I love comments like these. It tells me Trump will cruise to victory in 2020. You guys learned nada in 2016.

There are overweight and obese women in the south. In California, white women are not overweight like Black and Hispanic.

Yes and Yes on humidity and bugs. The house is built very well, but the A/C runs in summer. AS to weight issues – I was stunned to see the chicken fried biscuits (steak or pork) and gravy on the BREAKFAST menu at Hardees. 2 fer $5 I think. No oatmeal to be had. Lots of people calorie loading in the Hardee dining room.

it is sad to see people killing themselves with unhealthy diets.

US new home sales surge unexpectedly, hitting 10-year high in October.

LOL…unexpectedly. Every bit of good news from now until January 2025 will be “unexpected” for the MSM.

“Sales of new U.S. single-family homes unexpectedly rose in October, hitting their highest level in 10 years amid robust demand across the country.

The Commerce Department said on Monday new home sales increased 6.2 percent to a seasonally adjusted annual rate of 685,000 units last month. That was the highest level since October 2007 and followed September’s slightly downwardly revised sales pace of 645,000 units.”