San Francisco tech bubble spills into mega housing bubble: San Francisco median price nears $1 million while homeownership rate falters.

I remember in the 1990s friends getting unsolicited offers for “tech†jobs where the only prerequisite was a basic understanding of computers and some common knowledge of HTML. With these simple skills, you were on your way to tech millions. San Francisco was at the hub of this insane mania. Today people will argue that we now have solid companies like Google, Apple, or Facebook pumping out great jobs for great minds. But I’m also seeing money being thrown at long-shots by venture capital just to see if something sticks. The tech bubble was spurred on by the stock market mania where the public participated. This tech mania is being spurred on by elite private capital. The first housing bubble was accessible to the masses. This housing bubble is available to Wall Street investors, uber-wealthy foreigners, and outlier households with big incomes. The San Francisco median home price now reaches $1 million and the ultimate crap shacks are to found there.

Chasing the tech dragon

The NASDAQ is up a whopping 250+ percent from the lows reached in 2009. Many of the tech money makers are located in Northern California and San Francisco is always seen as a tech magnet. But it is definitely frothy at this point. You are seeing app companies being funded for basically delivering food to your door. Not actually a revolutionary idea. Also, many of the products are dependent on people blowing disposable income. That might be hard when in San Francisco rents and housing payments continue to consume a larger portion of income.

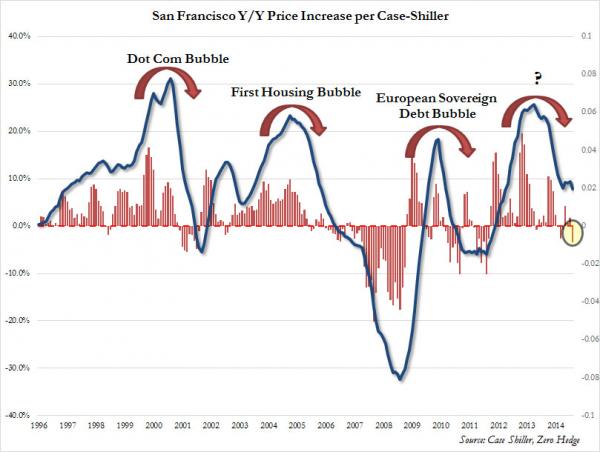

While Los Angeles County is a majority renting county with over 50 percent of households renting, San Francisco is a hardcore renting city with only 36 percent of households owning. We should also take note that in California, housing booms and busts in regular intervals. We are already seeing price appreciation slow down in San Francisco:

There is an odd sort of trend that unfolds here and it makes sense. Hot money from the stock market flows into these companies that seem to rise and fall with the whims of the economy. But for the regular grunts at these places, housing values seem so out of reach. This one sale probably epitomizes the San Francisco market:

1644 Great Hwy San Francisco, CA 94122

4 beds, 2 baths 1,832 square feet built in 1907

Set aside that this home was built 108 years ago. The home was listed in February for $799,000. Of course the listing warned that it would take a lot of work and that it was not for the “novice†aspiring flipper or investor. Take a look at some other shots of the home:

Stairway to real estate heaven

So what happened? The home ended up selling for $1.21 million or $411,000 over asking price in March. Even a high earning household would not only have to front the cash to buy this place but the massive amount of money needed to make this place livable. Then again, it is hilarious when you point out lower income cities in California and the comments are quick to point out “but of course! This is a lower income area! It will gentrify but not by me! Taco Tuesday baby boomers will save the day.â€Â Point out the same toxic turd of a home in their home turf and then it becomes an excuse fest.

San Francisco ironically grew its appeal by being a progressive city and destination for hippies and counter-culture Americans. In other words, many with little to no income. Now, the tech hipster gentrification is pushing a culture of NIMBYism and causing it to become one of the most expensive cities in the country. San Francisco is absolutely not the place for the middle class or even upper middle class. It is now a city ironically for the elite and wealthy.

Things will remain good so long as the tech and stock market keep on raging on. And as we all know, there are NEVER bubbles in housing or stocks.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

72 Responses to “San Francisco tech bubble spills into mega housing bubble: San Francisco median price nears $1 million while homeownership rate falters.”

It’s true that real estate on the SF peninsula (and beyond) has been going bonkers for a few years now. Low inventory, lots of jobs, ipo’s, foreign money combined with some genuinely nice places to live have contributed to the dynamic. Also – tech industry here didn’t suffer much back in 2009 – certainly as compared to the dot com bust. Housing on the Peninsula did finally drop after out lying areas – anecdotally I think it may have been as much as 20% for places between San Jose and SF. So what will happen going forward? dunno – but if you are not forced to sell during a down biz cycle the estimated market value of your home doesn’t matter. In the mean time the kids get to attend good public schools. Zillow says my house has appreciated 40% since I bought it a yr plus ago – and that’s nice but doesnt impact me much. I still have to clean up the black mold I found in the walls, patch the leaking stucco, and myriad other things wrong with my crap shack. 🙂

I hope you cleaned the black mold properly. It could cause a ton of health hazards…

Drew,

On the previous post you mention future projections of population growth for SoCal. That projection might be correct or it might not. Nobody knows the future because there are too many variables.

Absent salary growth and job growth of good paying jobs, even if you have population increases, all that accomplishes is lower standard of living for everyone regardless if you own or rent a place. First, if you have lots of poor people you can not tax enough from them to improve the infrastructure. You end up like in big cities from Brazil and India where they have massive poverty. High cost of living with lower wages is a sure receipy for slums and poverty.

Second, even those with paid off homes will live next to poverty and drive in congested traffic everywhere (freeways looking like parking lots).

It doesn’t mater how you look at it, CA faces a very ugly future. What happened in CA in the past is in the past. These days with a global economy the wages for most people in CA can not increase. The exceptions will be just that – exceptions.

California has light years to go before it becomes one of the favelas in Brazil. The GDP contribution alone would prevent the feds from every letting it become anything like Detroit (which is still leaps and bounds better than the slums in 3rd world nations).

Traffic is absolutely going to be one of the main issues. The public transportation system here is a joke. That is why land values in and around LA will increase even more as the population goes up. It will be impossible to drive from the Inland Empire or Orange County to LA every day for work.

I wish it wasn’t this way but I just think that unfortunately California attracts wealthier people from all around the world, including within the US. Both of the agents I work with complain about wealthy Chinese buying up tons of foreclosed and regular properties with cash. I don’t really care either way, if they have it then good for them I suppose. I’m not an agent so I don’t see this fact first hand, all I can do is take second hand information from them.

There are so many factors as to why the market is stupid expensive here. I do believe in cyclical real estate patterns and do think that prices will go down again some day but when? After 2, 3 or 6 years? Who knows. After each cycle prices never hit the bottom that they hit in the previous cycle. Which means it’s almost always smart to buy and hold for long term. Even after a few recessions, prices will be 3x what they are now, in 20 years. Just like it was 20 years ago, and the 20 before that, etc.

@Drew

RE prices only stopped falling 4 years ago because the govt and Fed stepped in with their big guns, not because of any robust economic recovery. If prices were to resume their descent, the govt and Fed would have no ammo to stop this.

The Chinese are definitely buying up the West LA area. I went to an open house on a condo I was eyeing in Westwood last Sunday, and again on Tuesday. In the 15 minutes I was there both days, there were many late teen and early 20s Asian kids touring the place too. Most drove German luxury cars. I’m assuming they were Ucla students whose parents are buying them homes.

Anyway, I put an all-cash offer on it at the asking price on Tuesday, thinking the cash offer would give me some type of advantage. I was told there were 3 other offers at the time. I get a counter offer on Wednesday for $50k over the asking price and was told there was 19 other offers. I bailed at that point. I’m curious to see the final selling price and find out whether it went to a Chinese buyer.

Chinese buying CONDOS for their kids? Losers!

This Chinese father bought his USC student son TWO MANSIONS in Pasadena for a total of $9.5 MILLION: http://www.laweekly.com/arts/when-a-chinese-gazillionaire-buys-a-chandler-estate-4574707

Let’s be realistic. Unless you are in the top 10% – 15% of wager earners in L.A., O.C., San Fran, or San Diego, you aren’t living. Instead, you are in some stage of ‘just hanging on’! Can’t understand how that can be satisfying or provide any hope for a future!!!!

“Prices will be 3 times what they are now in 20 years.” .. not sure I agree w you on that. Ex. Purchased 2600 sq.ft. home 1995 for 225,000.00 in Las Vegas. Same home today cmv of 340,000.00 but guess what the purchasing power of the dollar is less. So even if you make more money on the selling price the question is would 225,000.00 in 1995 buy more goods and services than 340,000.00 in 2015? I say no, it won’t. It will be the same or even less as the Fed destroys our money via money creation which currently only supports Wall Street interests via QE to infinity w free money loans that they have the advantage of gambling with other people’s money, and will get paid huge percentages off their gambling bets whether they win or lose, and the taxpayer gets to pay it all back. and through these collateralized securitized loan debt money they have first priority lien and are even going after country’s sovereign debt to pay it back. Once you understand how money really works you can see the predicament that we are in. the banks are systematically transferring the real value I be the underlying assets to a very small handful of people. They’ve already robbed the middle class and the poor via the housing debt bubble, and now they’re going after a little bit higher well-heeled folks. They have to steal it from somewhere and they’ll just keep going until only the upper. 00 1% have it all! And they almost already do! There is now roughly two quadrillion dollars in outstanding derivative debt, however there aren’t enough assets on the planet to pay that back. You have to look at the big picture which requires conceptual thinking. If you don’t have it ask someone who does so they can explain it its a bit too much for a comment box. Lol.

Drew,

On thing you have to keep in mind in investing is that “past performance is no guarantee for the future”.

There is fallacy in the way you extrapolate what happened in CA in the past for the future.

Whatever happened in CA in the past is not going to happen in the future. In the past you did not have the globalization you see today. With the current globalization you can’t see the number of jobs increases you saw in CA in the past. For the same reason, you are not going to see the same pace of salary increases you saw in CA in the past. Proof for that is an increase in CA population, in the last decade, of over 10 million people while the number of taxpayers increased by 150,000. Isn’t that showing you something ??? Increase in poor and uneducated masses instead of educated high income earners is not a formula for success. If there are so many rich Chinese moving in, why the discrepancy between the population increase and the increase in the number of taxpayers??

Due to the high cost of living, taxation and cost of doing business in CA, whatever companies are not leaving for other countries are leaving for other states. That is also a fact very well documented in many sources of information.

Given all these trends, you may believe what you wish; for me the picture and the trend are very clear.

The fed has a gun for the next big dip. Their tax deferred retirement accounts you signed up for. They will carve a percent of that out of your ass. They will say it’s your patriotic duty to save the nation. If you’re not patriotic they will demonize you for hoarding a subsidy.

Someone sent me this the other day. I think they’re laying on the positives a bit thickly here. (not behind the Subscription/PayWall). All these fancy tech expensive cars, for those on the asset bubble supported WIN side of things.

____

Wall Street Journal

Ford, Mercedes-Benz Set Up Shop in Silicon Valley

New nexus of car industry emerges as Apple, Uber and Google push automotive ambitions

[..]offer a glimpse into the future of connected cars. The $94,000 sedan has an app to unlock doors with a phone, back massagers and a built-in air purifier.

According to IHS, the economic value of the S550’s control software could be as much as $23,000….

+Map

http://www.wsj.com/articles/ford-mercedes-set-up-shop-in-silicon-valley-1427475558?mod=WSJ_hps_sections_business

Flyover, excellent assessment. Ever increasing people packing in (far more low skilled workers than high earners) competing for too few living wage jobs…diminishing resources and quality of life, increasing costs to do business/live, crumbling infrastructure, the wrath of Mother Nature (worsening drought, increasing chance of a major earthquake, etc.) I’m unsure if the weather/perceived “cool” culture is worth it; seems for many, it is.

“It doesn’t mater how you look at it, CA faces a very ugly future. What happened in CA in the past is in the past. These days with a global economy the wages for most people in CA can not increase. The exceptions will be just that – exceptions.”

Good statement. What will and is driving house prices in Cali are Chinese investors. This will increase. Over the past few months there has been 19 IPOs in China creating 19 more Billionaires and probably several hundred millionaires. 80% of these people will probably buy some property in California.

This is a problem in Australia right now. Chinese millionaires are buying up coastal property as such a high rate Australia is now putting into place some safe guards to slow down this land grab by Chinese investors.

“At least half a dozen Chinese real estate developers—state-owned and private-sector companies alike— are now active in the cities of Sydney, Melbourne and Brisbane. Guangzhou R&F Properties alone, a developer run by Hong Kong billionaire Li Sze Lim and his mainland billionaire partner Zhang Li, acquired three sites for over $100 million in Australia in the second half of 2014. Shanghai-based Greenland already has four projects in Australia that are worth more than $1.4 billion, and is still looking for more.

Similar to the U.S. market, where Chinese investors have gone on a buying spree, those in Australia are seeking diversification and growth prospects beyond the chilling property market back home.

Mainland Chinese form the majority of people who receive US investor visas and more of them are applying for it.

In a recent report on Chinese international migration prepared by the Centre for China and Globalisation and the state-backed Chinese Academy of Social Sciences, 9,128 Chinese received the US investor visa last year.

This is a 46 per cent increase compared to 2013.

Not everyone is following in the same footsteps — Hong Kong and Canada have either scrapped or suspended their investor immigration schemes.

In Australia, claims that foreigners were driving up property prices prompted the Government to propose an application fee on potential buyers.

Properties below $1 million would attract a fee of $5,000; those above $1 million would attract a fee of $10,000 for every million above the purchase price.

The application fee would be paid to the Foreign Investment Review Board.

“

Flyover,

I read your post with great interest. I have lived in So Ca 54 out of 58 years.

We recently downgraded from a luxury view home on a hill, to a mostly blue collar working class neighborhood. We bought a L shaped ranch fixer with a “cement pond”.

We once were banking 1/2 our net, and lived well, including European Vacations. Now the free concerts in the park is now a “vacation”. We are living on less than the 225% of the FPL stats. Being debt free (no mortgage) we can survive. Our careers have moved out of our area, but our monthly nut is so low, we’re staying put.

Ca is toast, I can’t agree more.

Housing is absurdly priced, with no relationship to income level, unlike the 80’s and 90’s. For no reason we paid the same amt for this modest cottage, than we did in 1998 for a 4,000 sq ft new construction beauty with a view. Of course, we sold into the bubble and made $, but we had to pour a lot into this cottage to bring it up to a livable condition.

This state is a mere shadow of its former self.

Keep it Real,

We are close in age and we both remember a different CA. I received my higher education in SoCal, I lived there and worked there. I still visit there friends and relatives once in a while.

Every year I go there, I witness a constant deterioration in living standards for most people. That is undeniable. Every time I come back home I feel blessed that I left CA. My stress level goes back down. I understand perfectly what you say.

When I lived there, in much better times than these, I remember how warped my thinking was. I felt like CA is the center of the universe. Now, looking back at my youth years I can see what a fool I was. I guess, that makes me more humble and have some compassion on my young fellow bloggers.

Flyover,

Just read your post. Thank you for your dialogue. I remember when the Ca UC system was almost free and if you worked hard enough, UCLA could be a valid goal. All my cousins, who were much older than me, went there. Modest family incomes and bright futures without staggering debt. Ca’s educational system was top notch.

We live in Simi Valley (east Ventura County) and you’re right, the quality of life has tanked. The 3rd world feel has permeated many of the less affluent areas, but even Westlake Village has day workers with signs.

Thanks for sharing. The “sunshine tax” is alive and well!

Flyover

Not to be nosy, but where did you move to?

Is housing in a bizarre state of euphoria like So Ca?

I live in Walla Walla, WA. I used to live in the Seattle metro area for a while till the traffic there got as bad as So Cal. Here is a slow pace of life, clean air, four seasons with very mild winters, not as rainy as Seattle and it has a nice historical downtown with lots of excellent restaurants and wineries. It is a very safe place with lots of character. Nature and mountains are a few minutes drive from downtown.

I go from angry to depression about this housing situation. I mean rents keep up up up and housing is high and every phucking home get multiple over asking bids… No inventory. how does a hard working person with a downpayment buy a home for their family?

I don’t see how housing can go down with MANY MANY homeowners and investors that have either purchased or have now refinanced and are locked into tremendously low interest rates over the past 3 years (3%) even some refi to 15 -year at 2.5% . It is highly unlikely that these homes will be coming up for sale anytime soon as a result of this favorable financing.

the few people that got lucky and bought in 2011-2012 are walking around happy… while the other people that are renting at high prices are stressed out.

2 of my co-workers are being evicted from landlords.

1. is putting on the market for spring, but first gotta pimp it up to get top dollar.

2. the 32 year old daughter is prego and has stop working to raise the child, and husband can’t pay high rent and all other bill by himself, so the owner is handling down the house as of the 4/1.

I could wish all I want but really tells me that i am phucked

Yes it’s crazy, multiple offers and sell prices $100+k over asking.

There seems to be no end in sight when there are 12-20 offers on properties. My guess is this continues for 2-3 years, then we get the normal 10% pull back.

I’ve seen several long term rentals royally screwed. Renting homes for $2000 way under valued, then the kids inherit and increase rent to $4000 or more likely sell.

Which market are you referring to?

Here in L.A. county, just in the lower half of the county I see on Redfin that today, out of 15,060 properties for sale, 4,010 have had at least one reduction. Just over 1/4 – that doesn’t seem like a bullish case for bidding war activity. Anecdotally now for months on end, I’ve observed loads of flips, REO and organic sales from the highest to the lowest end and everywhere in-between with reductions on asking price. In many cases, multiple reductions week after week and/or month after month. Even the hot nabes like Venice and Highland Park.

Maybe something changed in the last week or so that invalidates my observations going back many months.

Did they figure already where they are going to get water from for the next 20 years?

Planet earth?

Just a hunch but Planet Earth has plenty of water and CA has plenty of tax dollars

Seems like a great fit !

unfortunately, big agribusiness with plenty of money to buy politicians, consumes 80% of the water so they can make big profits(10% of the state’s water is for almonds that are exported, and 25% goes for hay that is exported). It is all about the money.

Bill Maher (youtube) interviewed a UC Irvine Professor, who is a consultant for NASA-JPL in So Pasadena. Scientific proof from space was shown to back Ca’s drought. Interesting 5+ minutes.

Although (IMHO) both parties are fos, this was an objective science (real not junk) segment.

IRA,

Could not agree more about Big Agra. When I (and hubby) learned about ALEC (American Legislative Economic Council) we became Political Atheists.

We’ll just buy our water from China until the domestic supply catches up, like everything else.

Since state usage of water for its cities and towns is only 4 percent of total usage, I don’t foresee water ever being a problem for the cites. Sure we will have water rationing but we won’t run out. It is the farmers that use it all and need to worry.

Desalination plants could provide water for all of our cities and towns.

“It is the farmers that use it all and need to worry.”

And that will impact all residents of the state. I’ve no idea where this drought thing is headed and we could end up with tons of unexpected rain at any point, but if it does indeed go to worse, it seems logical to conclude that the affects will cascade throughout the system. Ag is the other big business in California and a lot of dependencies built into the system rely on its ongoing status quo.

Someone will have to pay and if the farmers are broke, where is that money going to come from?

Desalination takes a lot of energy to run–on average use about 15,000 kilowatt-hours of power for every million gallons of fresh water that’s produced according to the Pacific Institute. Electricity prices in California are projected to rise by about 27 percent from 2008 to 2020 in inflation-adjusted dollars as power grid infrastructure is maintained or replaced, capacity is added and more renewable energy is integrated.

Desalination also requires the discharge of salt brine concentrate, sometimes contaminated with anti-corrosion cleaning agents from the pipes. The salt brine, which is heavier than seawater, can sink to the ocean bottom and harm ocean life and habitat.

How about building more dams and reservoirs to store fresh water?

Seismic,

They don’t build dams and reservoirs because the tree huggers are against them. In WA, they want to pull down even the existing one. They can’t because there is too much opposition.

Desalination plants? Really? And where does the massive amount of electricity to power them come from? Dams, in the middle of a drought? How about nuclear? Throw in a few hundreds of billions of dollars of subsidies, maybe. Where do those subsidies come from?

The key to lowering California real estate prices is immigration control. There are over 12 million illegals in California and probably five million legal children that they could take back to their own culture, which they value and respect. What a difference that many people going home would make. You’d have inexpensive rentals going begging. And that would push down all values except super mansions.

My friends son works for Google. He tests programs for flaws. He has received a 250K$ bonus last year. He bought a 4 plex in Redwood city several years ago and now wants to by a bigger apartment complex. I was listeninging to the AM radio show here in the bay area, were the real- turds were discussing all the money the Tech workers have to buy houses. They said it’s not uncommon for Tech workers in the Bay Area to have 7 or 8 Mil in an Etrade account. Really? It must be nice.

People who talk of poor millennials haven’t been to the bay area

dont underestimate the Millenials…

I read in LA Times 2 weeks ago that there are +/-80 million Millenials living in US and their mean income is $61K. some are unemployed, some living at home, but I am sure that there are plenty of gainfully employed moving to where the hi paying jobs are: LA, SF, NY, etc.

SF just over-paid tech people with huge bonuses on top, old-money, new money, China billionaires…. forever house price inflation for the money never runs out, and no one will ever need to sell for less.

Dangerous complacency imo. “I heard the Krauts got nothing but old men and children on the line.” (WWII – The Battle of Hurtgen Forest.)

Galaxy,

The problem is that yes eventually it will drop… But still only the top 10-20% of earners will have a chance to afford anything

I have to reluctantly admit the story from my sister (and photos) from her last holiday/vacation trip San Francisco (2012 or 13.. she flew over from Europe where she lives and works… a Commercial Litigation Lawyer, with another girl who is senior in recruitment), when they were there they met some of the excess and money stories of the impression I get in the comments here.

One evening they met some friendly (intelligent/respectable) guys in a bar, and took them up on an invitation to go to some other hotspots. Turns out the main guy (young 30s) had a limo outside waiting… and that he was some Chief Financial Officer of a tech firm that had properly established itself (been there from the start), and worth a lot of money. They had a good fun, (but respectable) time… (even met up with them again when they came to London in 2014). Just looking through those vacation pics now… their cycling trip with Bay City Bike over the path on Golden Gate bridge etc etc.

Maybe banks are going to go out of the mortgage lending business? Just sit back and watch mega wealthy people pay cash at super high prices. (?) All that real estate with little debt on it… (or it seems that way to me).

I picked up (and saved into notepad) a couple of posts from other forums last year – seems to be about situation going back 10 years or more. Note sure how accurate they are, just these individual’s perspectives on things then. With values/prices as they are now, I think we need a generational twist in the system, to break up cosy complacent vested interests.

1. I used to live in San Francisco, where they have rent control. Here’s what happened. Pothead baby boomers on disability for “mental health issues” occupied every single last rent controlled property, paying cents on the dollar in rent. As the landlords received no benefit from the property, other than as a speculative investment based on capital gains, they provided no maintenance for rental properties. Anyone with an actual job was forced to flat-share in squalid conditions, handing over 50%+ of income, in the few houses not covered by rent control. A completely dysfunctional, deeply unfair system that harmed just about everyone.

2. After university, I lived in San Francisco, where they had rent control for the majority of rental units. Here’s how it worked. In a city where the majority of housing was in the rented sector, there were almost no flats on the market for rent and those that did come up on the market were astronomically expensive. If you wanted to live somewhere, you had to “house share” which meant renting a room in an ageing hippy’s run-down rented flat completely outside of any legal protection. The “tenant” of this flat didn’t actually have a paying job (other than going to political demonstrations and smoking a lot of pot), and they paid almost no rent to the landlord. They simply lived off of the rent they collected from sub-letting to young people. If they decided one day that they didn’t like you any more (for instance, after you refuse to sleep with them), you’d find your stuff out on the pavement with no legal recourse what so ever. Rent control is a complete non-solution that really will only make things worse.

As someone whose been through a few ipo’s I can tell u that having 7 or 8 million in the bank for an average tech worker is just not true. There may be some who walk away with that much after taxes but they are not average and were probably early employees at a very successful company or execs. don’t believe the hype.

Yeah seemed dubious to me too. The only people I know with $7-8 million are the ones who inherited it earlier in life. Most IPO payouts I’ve heard of were in the low $100’s of 1000’s. Google seemed to be the exception in that a lot of people got rich, but after tax millionaires from IPO’s or acquisition are usually limited to founders. A lot of people get fired before their stock vests simply so their stock won’t vest.

Saying something is “not uncommon” is quite different from claiming it’s the “average”. I can easily believe that several thousand (of the many 100s of thousands) of tech workers in SF do indeed have $7-8M (or more) floating around in ready cash – even while the average worker might have roughly 1% of that.

A few thousand mega-rich youngsters would be plenty to keep a few ambitious realtors in business. The rest of us poor schlubs would simply be invisible.

it’s not that the value of housing has gone up, it’s that the value of the dollar has gone down

Curry and the Warriors. Wow.

Kobe and the Lakers. Wow.

In all fairness, the pictured house was bought not for the house but the land. It’s on the Great Highway which faces the ocean. You literally cross the street and you’re on the beach AND you’re in not just any city but SF. I’ve sen worse deals.

The beach is freezing cold and SF has gone from a colorful, artistic place to a dry, moneyed Manhattan West minus beautiful women and party scene. Woohoo!

There’s plenty of beautiful women and parties, but your correct, that is a cold foggy windy area, they close the great highway due to blowing sand and it will cost a lot to rebuild that shack, San Francisco will shake you down for anything and everything.

I live 4 miles to the east in Inner sunset and came from orange county, its damn cold here in summer but the weather is a changing and SF now reminds me of So Cal in the 70’s….Soon So Cal will look like Ensenada-San Quintin area….jet stream seems to have shifted north…

If my wife would leave I would be near a big river in the northwest where water is not an issue. Buying a home in California is not a necessity

mtampoon is correct. The Great Highway house is a teardown that will be replaced with a multi-unit complex with each unit selling for ~$1 million. That said, yes, real estate in SF is crazy.

or a very nice SFR for a tech multi-millionaire

It’s only crazy for people who cannot afford it. SF is a a beautiful, walkable island. Some of the most profitable companies in the world are based in the area. These are people with CASH, not NINJA loans. What should these people do….buy a 1,000 acre ranch in Fresno and helicopter into work?

I like SF just fine and actually enjoy the climate over SoCal in many ways, however the logic in those assertions seems a bit shallow. First of all, what is a walkable island when contrasted with an un-walkable island? As in it’s not full of quicksand? Plenty of walkable places abound in this world. I think that’s another one of those “this place is different” platitudes. Same goes for profitable corporations, tons of those based in various places all over the world.

The reason why this property is showing up in news articles and blog postings isn’t so much due to the structure being a piece of junk, even though that’s the headline and story content. Obviously the buyer is eyeing the land over the structure. It’s showing up because it so poignantly exposes imbalances in the system which in the past tend to be precursors to events which force readjustments in the same.

Siggy, by “walkable,” people mean that you can walk to the grocery, Starbucks, restaurants, shops, movies, even to their jobs, etc. The more places you can walk to, the more walkable.

New York City is very walkable. I’ve a friend in NYC, in his 50s, who’s never had a driver’s license or owned a car. Not so easy in Los Angeles.

Santa Monica is very walkable. I only use my car once or twice a month. I walk to do my grocery shopping — to most everything I want and need.

By contrast, if I lived up in the Hollywood Hills or Topanga Canyon, I’d have to drive everywhere.

It was a bit tounge in cheek. But seriously, there are absolutely loads of places on this earth with so-called walkability and some of those hills in SF are a royal bitch to be walking up and down. Just saying that the walkable thing ain’t nothin’ unique to SF and there are lots of its parts that aren’t great for walking.

I actually read a realtor’s article on “walkability” about a year ago. Apparently, walkability has become a hot item. Whereas in the past, families were seeking McMansions in the suburbs, many of today’s home buyers are very into walkability.

You’ll notice that some websites have a Walkability Rating for each house, along with crime stats and school info.

Scoring high on Walkability is right up there with granite countertops and being near a Starbucks. (This listing actually touts that a Starbucks is only a block away: https://www.redfin.com/CA/Santa-Monica/1253-11th-St-90401/unit-5/home/6773812

Derrick, you lost your credibility with “most profitable companies:. Who? Twitter? Facebook? Facebook revenue comes from selling advertising to the startups that are funded by the same groups that funded it. Real brands do not advertise there. Why No measurable ROI. So you have vc incest circle investing in startups that buy ads from Facebook so that it shows a profit. Fragile business model at best. Twitter making money yet? Name me a company outside of Google that has a viable and lasting business plan for making money? How about iCrossing or the other ad companies trying to leverage cross channel attribution models and programmatic bidding so that they can sell products to a middle class that doesn’t exist anymore. How about Clinkle? Blew through 20MM and no one knows exactly what they’re doing. Man, it is truly a house of cards based on the fact that the vc people get free money from the fed and they pay outrageous salaries to people who attend one of the 13 universities where it’s almost impossible to fail. What? They’re so smart. No they’re not. They usually come from money (Zuckerberg and Salesforce guy). They are successes because of the alumni network, Here’s the link, http://www.businessinsider.com/13-schools-where-its-really-hard-to-fail-2013-5?op=1

Tom, perhaps he means Apple, Chevron and Wells as “some” if we’re to look at the top 20. Regardless, it’s a distraction and doesn’t provide a real explanation for mania behavior in the bay area’s residential real estate market.

I get e-mails from a commentator named Harry Dent. He sends out updates on the monthly federal employment statistics that break down the statistics by income level.

https://dentresearch.s3.amazonaws.com/Press_Release/images/040315_PR.png

I didn’t think I was all that high on the income scale but it turns out I am at the low end of his uppermost income bracket ($38.33 to $48.09 / hour). So jobs making more than $48.09/hour are too rare to be in the Federal statistics?

This means that only people who own their own business and have massive capital appreciation or are executives of huge corporations could even possibly afford the cost of premium real estate in California. Having to sell to wealthy immigrants to keep up the prices of the upscale real estate market sounds like the recipe for a Minsky Moment that comes with Ponzi financing.

Not sure what to make of Dent, but in regard to the rich Chinese thing that’s been mentioned to death, it’s something that just got underway a few years back in volume and it feels like a rising tide. Problem is when the tide goes out, what does it suck back into the sea? International waters bring as many problems as they bring opportunities. People who live near beaches should be well acquainted with this. Puns intended.

“Traffic is absolutely going to be one of the main issues. The public transportation system here is a joke. That is why land values in and around LA will increase even more as the population goes up. It will be impossible to drive from the Inland Empire or Orange County to LA every day for work.”

This caught my eye because there seems to be an inference that there won’t be new forms of adaptation made in the face of said issues which makes grafting the past onto the future a foregone conclusion. That doesn’t make sense because we don’t know the future.

“After each cycle prices never hit the bottom that they hit in the previous cycle. Which means it’s almost always smart to buy and hold for long term. Even after a few recessions, prices will be 3x what they are now, in 20 years. Just like it was 20 years ago, and the 20 before that, etc.”

Here we go again with the “buy now or be priced out forever” narrative. What was stated is generally true in *nominal* terms. In real terms and after adjusting for change in equivalent rent levels, it’s a different story.

EXCELLENT ARTICLE HERE – “The incredible shrinking megacity: How Los Angeles engineered a housing crisis” What he doesn’t discuss is what happened when Wall Street was allowed to buy and trade commodities – like houses. I don’t think house prices will ever come down in the right areas — the coast from San Diego to San Francisco. I think the drought will only make these areas more valuable because the wealthy will figure out to how to have plenty of water. My vision — like a wild man in the desert — is that California will become like Monte Carlo — rich and verdant by the coast — a desert west of Pasadena. Just my .02 and visions. Here’s the link, http://www.salon.com/2015/04/05/the_incredible_shrinking_megacity_how_los_angeles_enginereed_a_housing_crisis/

Progress would be ever lower house prices, and, ever lower rents. Fubar economy.

http://riskybusiness.org/uploads/files/California-Report-WEB-3-30-15.pdf

“The South Coast region enjoys a temperate climate, with an average of only 13 days over 950F each year over the last 30 years. However, if we stay on our current path, the region will likely experience 19 to 30 extremely hot days by mid-century, and 35 to 71 such days by end of century”

Weather capital of the world!

http://www.motherjones.com/environment/2014/02/wheres-californias-water-going

“Jay Lund, a water expert at the University of California-Davis, says that water problems mean that agriculture may soon play a less important role in California’s economy, as the business of growing food moves to the South and the Midwest, where water is less expensive.”

Seems that corporations and middle class families aren’t the only thing moving east.

We’ll never see oil below $100 a barrel ever again…

LA Native here completely depressed and frustrated at the market. Made some poor decisions earlier in life and am stuck in this incredibly difficult market. Want a modest house to raise the family in but am realizing salary and cost of living cannot catch up to the current real estate market. For those who left the state at what point did you say enough is enough. I’m seriously considering throwing in the towel and getting the heck out of dodge. Beautiful homes in Austin for 400K. Hardest part as a surfer will be leaving the beach behind. The politics, traffic, and other BS can stay in LA.

I haven’t left So Cal and probably will not unless prices continually escalate for 5+ years. However, I have a friend who surfs and moved to the IE. He regretted it pretty quickly after moving, and has since relocated much nearer to the beach. Why not move to Florida? You get waves and better weather than Austin.

“…you’d also be bored out of your mind.”

Simple minds are bored minds.

If I were making 100K or less and my income was capped there, I would leave. For us, we are staying because family is here and SoCal has been great for my career (although we have contemplated leaving several times). Aside from that, what you lose at the beach, you will make up in other areas like people, culture, cost of living, less traffic etc.

“…what you lose at the beach, you will make up in other areas like people, culture, cost of living, less traffic etc.”

All of the items on your list are probably insignificant if you’re talking about any big city (except for housing costs, they’re all similar, at least in my experience traveling various places throughout the country). If you live in BFE, then you might get what you want, but you’d also be bored out of your mind.

http://ireport.cnn.com/docs/DOC-1222430

Appears the mainstream news media still thinks the SF real estate market is stable!

wow… that money would buy you some amazing properties in wonderful state of Santa Catarina, Brazil. No joke, Brazil as a country can go down, some regions will flourish – http://visa4brazil.com/

Leave a Reply