The Grand Republic of Santa Monica: 932 square feet for $895,000. How housing built before the Great Depression can fetch wild prices.

The mania in certain California neighborhoods is so dramatic that my e-mail box is now filled on a daily basis with Real Homes of Genius. It isn’t as high as it was in 2007 at the apex of the last bubble but I’m seeing some pretty outrageous properties being listed for pipedream prices. Targeted markets are definitely benefitting from the investor fever. First, many of the homes being sold are actually being sold for the land. Given the headline cost plus construction costs this is a very tiny market segment here. Yet the froth is very obvious in these regions. Santa Monica is prime Westside housing. It is hard for anyone outside of the region to understand the crazy prices in Santa Monica. Even those in the region have a hard time understanding. Today we’ll focus on this area and pull up a property that only an investor could love. Welcome to the wonderful Republic of Santa Monica.

Roaring 20s built, Prohibition inspired prices

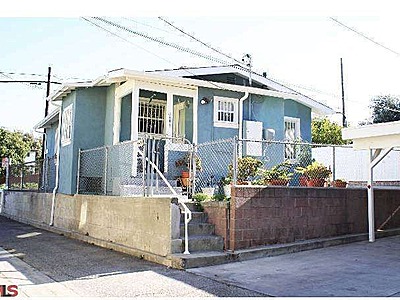

411 Ocean Park Blvd, Santa Monica, CA 90405

Bedrooms:Â Â Â Â Â Â Â Â Â 2 beds

Bathrooms:Â Â Â Â Â Â Â 1 bath

Single Family:Â Â 932 sq ft

Lot:Â Â Â Â Â Â Â 2,905 sqft

Year Built:Â Â Â Â Â Â Â Â Â Â 1920

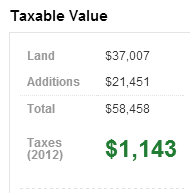

This home was built prior to the Great Depression. The home is definitely a tear down. Anyone that can afford $895,000 for a home is unlikely to live in this place as-is. As we discussed previously legislation like Prop 13 has provided golden real estate handcuffs to many baby boomers. In this case, this home that is priced at $895,000 is being assessed at $58,458.

This is how someone can live in a near million dollar home and live modestly:

Does this look like an $895,000 home to you? This is 932 square feet with 2 bedrooms and 1 bath. How much will it cost to tear it down and rebuild? I love the ad on this place:

“Great investment opportunity in a prime Santa Monica location! Beach bungalow with two bedrooms, one bathroom. Home is filled with tons of natural light and a spacious living room. Kitchen with a breakfast nook. Lots of charm. Parking for up to four cars. Huge upside potential.â€

Lots of charm – yup.

Parking for up to four cars – maybe for a rental?

Huge upside potential – only if you can flip or turn this into multi-unit housing and keep your costs controlled.

The only way this is a good investment is if you tear it down and construct more than one unit on this land. As a rental this makes absolutely no sense. A cash investor will not move on this unless they plan on tearing it down.

This home was only listed recently but this is common in terms of what is coming across my desktop. There is an absurd sense of euphoria and a notion that if you want to own in prime locations, you have to take whatever inventory is available. This year inventory has increased but at a very slow level.

Southern California as a region has seen prices boom back up. The median price in Southern California is now $384,000. Still far away from the $500,000 median price peak but a lost decade has occurred. The median price for this Santa Monica zip code is $1.5 million so maybe you are getting a great offer (only if they throw in the furniture). Many areas like Santa Monica are nearing peak prices (homes like this are a testament of the fever that is hitting prime locations in the Southland). It’ll be interesting to see what this home will sell for. No matter what the price, this seller is going to make out big time. After all, this home was built during the roaring 20s when prohibition was around. Thank goodness liquor is now legal so you can take a swig and buy this place.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

64 Responses to “The Grand Republic of Santa Monica: 932 square feet for $895,000. How housing built before the Great Depression can fetch wild prices.”

I have never lived in Santa Monica, but I did live a two blocks from the beach near Oxnard Shores and also in the Ocean Beach section of San Diego. This place appears to be seven blocks to the beach, definitely walking distance. All I can say is that if you going to live in Southern California, you might as well live within walking distance of the beach. If not, you might as well be in Tucson or even North Platte Nebraska.

So this is why the prices are so high. And if history is any guide, the current experiment with a pure fiat currency will end the same as all the others, with a bunch of fireplace kindling with what used to be legal tender.

Is it possible there is time one more push lower before the start of hyper inflation? Sure. So if I were buying gold or silver or similar, I’d be dollar cost averaging in. That is probably what these all cash buyers are doing as well. 20 houses here, 20 more the next year, and so on. For us regular folks, that will buy one or fewer houses at a time, this is a very difficult decision, but time is running out. Once a country starts buying up its own debt (QE-x) it is all over but the shouting.

If we’re really seeing incipient hyperinflation in the rising cost of homes why has gold been on the skids for the last year? By all measures I can see most if not all of the increase in nominal real estate prices is distinct from devaluation in the dollar due to QE-n.

I think a more likely culprit is the repatriation of vast numbers of dollars from foreign debt. Every dollar we lend out overseas eventually has to come back and purchase SOMETHING. A few trillion in cash looking for an outlet could substantially distort housing costs without portending the imminent destruction of our currency.

Whoops… should have said trillions to be repatriated results from our excessive borrowing and trade imbalance not “lending”. Still the result is tons of dollars looking for something on which to be spent… and we’re seeing the result.

@apolSci–Money is a store of value, as is a house or other tangible object. When a country, like the USA, wants to consume more stuff than it produces, it must borrow that extra wealth from another country.

Unfortunately, we have borrowed nearly the entire available savings from the rest of the world. Rather than live within our means and credit limit, however, we have decided to print more money, and buy our own debt (bonds). Every such experiment of this type in the past has lead to a complete loss of buying power of said currency (hyper inflation).

Since there is still leftover pockets of excess housing in some areas, it is difficult to know if housing will show this loss of buying power as readily as other goods, but it probably will anyway. Give it a year.

We know, Jason, hyperinflation is just around the corner. It’s been “just around hte corner” for about three years. So this time next year, what do you want to be that inflation is less than 3% ? If it’s less than 3% a year from now then SHUT UP ABOUT INFLATION!

The Peoples Socialist Republic of Santa Monica has some of the strictest building zoning ordinances in the U.S. Santa Barbara is even more draconian than Santa Monica. This is a major factor in the home prices in those two areas. Ask any apartment owner who tried to tear down or convert from apartments to condominiums. Until a few years ago, the Politburo over there did not allow this.

Co-worker near Olympic and Bundy paid $300k for his SFR about 20 years ago. He said comps are now $1.2 Million because of the zoning ability, in other words someone can buy his place to tear down and build condos. And even though he’s in L.A., he says he’s in Santa Monica.

Oh, yes, some of us are singing that “Woulda’, Coulda’, Shoulda’†song now, having been mesmerized by that Credit Suisse chart predicting catastrophic price falls that never came, by shadow inventory that never materialized, and by downsizing baby boomers who are actually smartly staying put in their Prop. 13 tax-protected homes, thank you very much. Imagine, that as recently as early 2012, one could have purchased for $600,000 the fixed-up 1,037sqft house/3,000 sqft lot at 1037 Hill, not that far away from today’s “Real Homes of Genius†in Santa Monica. Just imagine….

Thanks, Doctor, for your continuing housing coverage.

Perhaps some flippers are singing that tune, but for those that simply want a house to live in without the fear of taking a major loss should an unknown life event force a sale, they might figure that a bullet has been dodged.

We’ll see how much longer prop 13 protections stay in place and where the axe may fall.

http://www.redfin.com/CA/Santa-Monica/2635-6th-St-90405/home/6777571

830 sqft for 1.15 million. The lot size is bigger though. What does “Live modestly while building large!” mean? Also how does it get sold in 2007 for $65,500?

It probably got sold to a family member in 2007…

If you sell a house way below market value to a family member, I think you are legally obligated to to pay a gift tax on the transaction.

For instance, if you sell a (market value) million dollar house for $50,000, you’re really giving a gift of $950,000. Is that not how the IRS looks at it?

I realize “market value” is a squishy concept, but not THAT squishy. You might sell a million dollar house for $900,000 and not show up on the IRS’s radar, but selling it WAY below market value, as the above transaction seems to be, would set off the IRS’s warning bells.

Am I correct in this?

I lived in Santa Monica most of my life and I just smiled a little when I saw this posting. it did not surprise me one bit when I saw the price. Tear downs North of Montana Avenue in Santa Monica are going for more than $2M and apparently tear downs near the beach are going for about $1M.

I also lived in Santa Monica for many years and never bought there. I was a rent control victim and finally after 20 years being “stuck”, I happily moved on and got a life. Santa Monica used to be a blue collar town, then in the late 1980’s things started to shift and the 3rd St. Promenade really changed it forever. The real estate there is insane, but there is a huge divide between your rent control people (who never move) and your people who can afford the ridiculous prices. Oh, don’t forget your homeless. Santa Monica used to be a beautiful place, however, their 10% sales tax, highest in LA, and so many other stupid laws make that city not so pretty anymore. Oh, and don’t forget to watch where you park.

@LA Native. So true, me also a LA Native lived in SM for 20 yrs. Last apt I lived in before buying a home (outside of SM) was a 11 unit apt building and 50% of the tenants had been there for over 10 years. Some more than 20 years. The tenants who were there for over 20 yrs were paying $600 per month for a 2bd 1ba apartment (due to rent control).

Yikes! I lived in a 950 sq. ft. 1936 bungalow myself for 10 years and it was comfortable for ONE person and made sense at $115K when I bought it in 1997, net monthly outlay was the same as rent…the same thing for a million???

Hint to anyone involved in this real estate market…..learn Mandarin. That’s about 90% of the sales in Irvine. $700,000 to start at the “Great Park 5 Points Communities”. Lambert Ranch is SOLD OUT. Stonegate is PRIORITY LIST only.

And another hint, these chinese won’t be making you Moo Goo Gai Pan or washing your clothes, in fact, you or your kids will be making food and pampering chinese a$$. Good ol’ Nixon, sell secrest to Chinese and start the Drug War, lie, cheat, commit felonies, and then have people build a memorial for you. Californians are intelligent and worthy….not.

They can think that but I’d rather fight and die than do ANYTHING for a Chi-nee.

USA #1

In LA county, SGV is heavily Asian without zoning. It makes for some interesting homes and views. I don’t see this happening in OC and most of these home are likely for America born Chinese who were taken back to china to be raised. Times are changing and we are a melting pot, so no matter what we try to predict no one knows what the future holds.

In general the only way to reduce price today is to increase supply. More land needs to be opened up to builders. But it can’t go up forever, but it might go up for our entire lifetime.

Why single out Nixon? The entire Establishment applauded Nixon’s trip to China. Only the “far right-wing” thought he was selling out to Communists.

Later on, the Clintons were also accused of selling secrets to China.

For that matter, back in the 1990s, Jack Valenti of the Motion Picture Association of America was pushing for more trade with China, saying it was a huge potential market for Hollywood (while at the same time urging Congress to negotiate for tougher anti-piracy laws in China).

Boy, this sure sounds familiar. 1980’s and the Japanese come to mind. I’m not claiming that both scenarios are exactly the same, but there are similarities.

One thing we could all probably agree on is that the taxing authorities will gladly levy those Chinese owned properties just the same as any for payment in U.S. dollars only. In other words, if they want to play here, they will have to to pay here ongoing.

We know a few Chinese around Irvine. One kid 16 years who is waiting for the family house to be built and the cook and cleaner to move in. He’ll be getting a Range Rover next month. But I also know a 16 year old whose parents work day and night for him to be here to study and rents a room.

We live in Tustin because we can’t afford Irvine! It’s nice there. Very orderly and clean…

There is a huuuuuge cost of ownership premium put on anything in CA metro areas, that is remotely close to the ocean. There are still many people here making big money and or that have a lot of cash to work with, that are able to support these values.

For those lucky enough to own properties in those areas, if you don’t love living there, take the money and run would be my advice. To have so much present value tied up in a potentially depreciating asset is crazy IMO.

While I agree with you about what’s keeping coastal prices up, problem for most current owners is, what to do with the money once we sell? Nothing cheap or quality to buy, and whatever we buy will end up costing more (lower rent than coastal areas, and higher property taxes because the initial buying cost is a lot higher than what we bought original properties).

Half of nation’s foreclosed homes still occupied:

http://money.cnn.com/2013/10/24/real_estate/occupied-foreclosures/index.html

Refinancing market dying and layoffs continue at BofA:

http://www.marketwatch.com/story/bank-of-america-to-cut-3000-jobs-in-mortgage-unit-2013-10-24

Most of these are value of land only. Structure itself is a liability of anything, as it will come down the day after escrow closes.

My house appraised at land being 70% of the value and 30% being the structure, and it was a nice house in a very good shape when i bought it.

THere is only that much land in “good weather/good area” of LA.

That is not a local phenomenon. In many locales the land value is higher than the structure(s) sitting on it.

I’ve been living in Santa Monica all my life. My parents town home I grew up in (we rented) was located at 18th & Montana and we paid $600-800 a month from 1977-1988. Same unit is now listed for $4k a month. My husband and I live in a relatively nice 2 bedroom apt north of Wilshire. We started renting it in 2009 when rents were down…now rents are extremely high all around us so we feel compelled to stay while real estate is so nutty. I’d love to own a home north of Montana but we’d have to win lotto first. Living north all my life, I’m willing to even look at Sunset Park but even south of Ocean Park is pricey. I’ve seen so many changes. Back in the day it wasn’t vogue to consider south of Wilshire let alone Pico…now we can’t even fathom $900k for a dump in 9040-the higher zips of SM!

Question: when interest rates rise again, inventory increases, and investor mania slows, does anyone think SM will come down? Or is SM just one of those desirable hamlets with limited space justifying $1 million price tags for 1,000 sq feet condos?

Santa Monica prices will never come down, unless there is another big earthquake like in 94′, remember that ? I lived north of Wilshire as well, our place was trashed. People living in Santa Monica seem to forget there is a major fault line running north of Wilshire to San Vicente to 26th. Again, Santa Monica is not like it was 25+ years ago, even the less desirable south of Wilshire, Sunset Park area. Now that Santa Monica has attracted all the tech companies, prices go up again. The only ones that stay there are the rent control victims and those the new money people who think they are hip. My concern is who started buying up all the apartments for cash and have torn down most of the old beautiful homes along San Vicente, we know who they are. Because of that, would never go back to live in that city.

There is just too much money out there folks. And some people don’t have any of it. Some areas in California are just unaffordable, the doors have closed and if you are not grandfathered in, you can’t access on ordinary or even slightly above ordinary wages.

people never learn(it’s ok with me)

1)how much rent that place will yield?

2) annual income of persons willing to live there?

that pretty much gives me the real price ,just simple math

2+2 still equals 4

I’ve been keeping a close eye on my local market north of the SF bay and homes priced below half a million are selling below asking. Turn around in the market? I see flipped properties lingering and sitting, so here’s hoping.

people see what goes on today, but not the future. If the global economy survives and thrives, the future will be even higher. I bought larger(double to triple in size) SFR’s for $50K in the 70’s in LA–I think there is a short-term future in all this, as the income of the middle class is shrinking, unemployment is really around 14%, too many taxes are further eroding spendable money, etc. When the dollar is no longer the world’s reserve currency(it will not be in 10-20 years), then housing will be hit hard.

If this area was always such a premium, why was this house only $225,000 in ’98? This house was much smaller in ’98 (I know because spouse and I looked at it briefly before ultimately buying another) and rates were around 8%, but still, it wasn’t as drooled-over as now:

http://www.zillow.com/homedetails/803-Navy-St-Santa-Monica-CA-90405/20483253_zpid/

Here are two others in the same area as 411 Ocean Park. Check out the price history back in the late 90’s.

http://www.zillow.com/homedetails/420-Ocean-Park-Blvd-Santa-Monica-CA-90405/20482593_zpid/

http://www.zillow.com/homedetails/2606-5th-St-Santa-Monica-CA-90405/20482587_zpid/

We’re not talking 2 generations ago, we’re talking 15 years ago. This area was always pleasant, but didn’t have the Newport Beach cachet it’s turning into now. Yes, it’s walking distance to the beach, but then why weren’t all the real estate gurus snapping them up in ’94-’98 if it was such an obvious call? Venice even more so. This change is very recent, unlike, say, Bel Air or Beverly Hills that have been wealthy for a long time. It creates this weird dichotomy of the modest houses side-by-side with Mediterranean monsters.

From a smart-investment standpoint, the time to buy SM and Venice was in ’94 when nobody was, not in 2013 when everybody is. It’s easy to follow the crowd. The key is to find the yucky areas *now* that have potential. How about this house in Port Hueneme, so close to the ocean you can probably hear the foghorns:

http://www.redfin.com/CA/Port-Hueneme/1021-N-5th-St-93041/home/4530451

Yes, Port Hueneme is very working-class, and has the naval base, but those things can change.

Different World, 1998 was a long time ago for California RE. This was very close to the bottom of the mid to late 90s. Almost all areas in Socal were cheap, including many of the coastal communities that people are fighting over today. Fast forward 15 years and we have the following factors at play: interest rates at 4%, the Fed/Wall St./DC are all heavily vested in RE, foreigners/investors/wealthy are looking for safety for their money and areas like the featured Santa Monica house are going through ultra gentrification. This is all a recipe for sky high prices where shit boxes like the featured house fetch almost 7 figures.

This is reality and I don’t see it changing course.

We should also make note that the ’92 riots and the ’94 quake were a very recent memory.

You make a good case for how we’ve arrived at this point, but how to explain the following?

“…I don’t see it changing course.”

Is that because it’s different this time?

@ Joe,

The divide between the haves and have nots grows everyday and will continue to. I do not see a resurgence of the middle class…especially in places like Santa Monica. That being said, places like SM are forever changed. It’s not because it’s different this time, this is the new normal for many areas of coastal CA.

Santa Maria is another area that’s near the ocean and still incredibly cheap. 18,000+ sq ft lot for $189,000. Yes, Santa Maria is all farmland and very working-class right now, but so were most of the other coastal cities that are now expensive (SFV, Torrance, Orange County, Ventura, you name it). Santa Maria has beautiful weather; wonderful ocean influence but still sunny. Maybe you don’t get the surge in value for another 50 years, but what an investment to pass on to the kids?

http://www.redfin.com/CA/Santa-Maria/2266-Rayville-Ln-93455/home/21548720

How about Grover Beach for $274,000–never bet against cities with “Beach” in the name:

http://www.redfin.com/CA/Grover-Beach/1183-Baden-Ave-93433/home/51176849

These things may not go golden for another generation, but it’s worth thinking long-term. It does seem like there are still pockets to invest in. Otherwise we’re all just another chump thinking, “man, I sure wish I bought in Venice in ’94 when it was scary Dog Town!” Palos Verdes was once cheap. Goleta in Santa Barbara was definitely cheap in the 80’s. There are definitely areas that never lived up to their hype. Palmdale/Lancaster was hyped according to my parents because there was talk of making an LAX-size airport out there which never happened. Their friends lost their shirt investing out there. Those areas up north may stay working class–but they have the great coastal weather, which has helped every other city from San Francisco to San Diego.

Sorry, but in a rising interest rate environment, RE will NEVER be a good investment. I would scratch RE off the list of viable investments Farmland is a great investment. and Calif has a lot of it. Cheap.

My sister and her boyfriend just stayed a week in Santa Monica on 5th in an high-end apartment vacation-rental found on the net at $135 per night. Anyway such house prices are crazy. One real long-wave boom, with a lot of rigging along the way to protect the blessed home-owners against non-owning savers.

———————

Wikipedia: http://en.wikipedia.org/wiki/History_of_Santa_Monica,_California

Shaughraun (1875)

About One-Third The site Of Santa Monica

including business lots, residence lots, and villa farms

Will Be Offered At Public Auction,….. On Thursday, July 15, 1875.

I live in frigid Wisconsin and want to move to Southern California. Are salary levels much higher in California to compensate for the cost of living? Or are they going to be the same? I work as a pharmacist and compared to Milwaukee, my salary would only be 4% to 10% higher. Not enough to compensate for the insane cost of housing. Buying at these insane levels is just insane. I make a salary of $72,000 per year and thus for my situation renting would be the best option. If any native Southern Californian can guide me with this process, I would appreciate it greatly.

Are you sure you want to live in California? Why not Florida, Arizona or New Mexico? It would be a lot cheaper.

Eli, you will likely be making much more than 72K per year as a pharmacist in LA. Housing prices do NOT reflect local incomes for desirable areas here. That’s a factor of many things…supply and demand, lots of old money, foreign money, many very high paid professionals, many two income families (two six figure earners), etc. Throw in Prop 13 for good measure and houses in desirable areas will likely stay in families for generations.

With so much uncertainty in the world, hard assets such as real estate in highly sought after areas is very much in demand. Unlike paper assets and precious metals, a house gives many tangible benefits you use everyday. Good luck in your search, but don’t be shocked by what you get for the money here.

You’re paying for the weather premium. Few coming from Wisconsin can do Santa Monica straight in unless a wealthy aunt died leaving you in the will.

Coming from the MidWest the weather in Whittier would be exciting.

You should end up with a smaller house on a smaller property after renting for a year to get a feel for all the different communities with their different feel.

My .02 is to do just that. Move out here renting for a year as you drive around and study communities. Expect to get a much smaller house on a small piece of land.

If you want a nice big house on a bigger piece of land you will have to go to the Inland Empire and the quality of life won’t be as good and the weather will not be Westside

Troll

Hello Supply. meet Demand and his close friend, Cheap Money.

Dear pharmacist friend, salaries are not much higher in santa monica. People move here for the weather and for beach proximity

Eli the pharmacist, i make eighty thousand a year and live in a four hundred square foot studio in santa monica. I know that in wisconsin i could afford a house and in california i will never afford a house. To me, life in a studio in santa monica is better than a house in wisconsin. Just know your own preferences and choose wisely

I think–and just based on some feedback here– if I eat franks and beans for a few years, work hard and stop buying a new iPhone every week.. this slice of SoCal heaven could be mine. Who would’ve thought?

Southern California coastal towns and inland suburbs are expensive, due to what’s going on further north along the coast. Further north, between Thousand Oaks and Santa Cruz, cities have established urban growth boundaries, and/or “slow growth” policies. Demand for beach housing is very high, since most coastal and inland areas – north of Santa Monica – are off limits to development, due to a variety of factors that diminish supply.

For example, several cities in Ventura County have “slow growth,” such as Thousand Oaks and Ojai. Further north, San Luis Obispo, Buellton, Santa Cruz, and Santa Barbara County, among others, all have urban growth boundaries.

However, the solution for affordable housing is not necessarily to tear down urban growth boundaries. Instead, we need to build many more beautiful planned communities such as Thosuand Oaks, further north along the coast.

Although some Libertarians at the Cato and Heritage Institutions would say that all restrictions on growth should be eliminated, this would destroy very nice places with low traffic and low crime, such as Thousand Oaks and San Luis Obispo.

Therefore, the solution is for talented, green planners to build more low density, family friendly suburbs along the coast, north of L.A. This would require rezoning agricultural land to single family residential.

Words of caution – I have recently discovered that unplanned sprawl, under Libertarian policies, at very high densities, such as in Las Vegas, is a recipe for crime and other social problems. I have also discovered that expanding an urban growth boundary may be undesirable, when there is sufficient land nearby to create a brand new city.

Indeed, coastal cities can get too big; Thousand Oaks at 120,000 is as big as it should get. In summary, going north of L.A. and building more coastal, clean and green, master planned communities such as Ojai, Thousand Oaks, and Boulder City, NV, would solve the Southern California affordable housing problem. -Tom Lane

What you are referring to is a political problem, not a planning one. Residents in those coastal areas have voted in growth boundaries and slow growth measures. Planners cannot unilaterally overturn such laws. Also, low density suburbs and green just don’t go hand in hand.

And the last thing we need is to get rid of coastal California farmland, some of the best in the world. They don’t make that in Texas, Arizona, or Nevada. We need our locally sourced, top-notch produce.

“If these types of cities – along with high tech jobs – were located in additional areas along the coast between Santa Monica and the Bay Area, then demand for properties in greater L.A. would be less, and we wouldn’t find nearly as expensive properties in Santa Monica.”

Your premise has no precedent. There is no zero sum game to be had. Big, dynamic, global metro areas get expensive for reasons unrelated to factors outside their own special bubbles.

“If these types of cities – along with high tech jobs – were located in additional areas along the coast between Santa Monica and the Bay Area, then demand for properties in greater L.A. would be less, and we wouldn’t find nearly as expensive properties in Santa Monica.â€

Your premise has no precedent. There is no zero sum game to be had. Big, dynamic, global metro areas get expensive for reasons unrelated to factors outside their own special bubbles.

Re: Most of southern California’s population is within the Los Angeles metro, which is way too large. The area is expensive due to many factors, especially its horrible inefficiency. Medium sized east coast coastal cities (pop. 250,000 to a million) are much more efficient since they are much smaller. Markets in Virginia and North Carolina of well under a million are much more efficient, such as Raleigh-Durham-Cary.

However, the California coast lacks medium sized markets. It concentrates growth, commerce, and industry in the L.A., San Diego, and San Francisco metros. If future growth was dispersed, and the coast had more medium size metros of 250,000 to a million, then prices would theoretically stabilize in coastal L.A. areas.

And, at the same time, they would rise in growing coastal areas such as San Luis Obispo County. I’ve seen cabins for $700 on Craigs List in Morro Bay (below San Luis Obispo). If these were in Santa Monica, they would rent for thousands a month.

The coastal resistance to growth is very strong, from Thousand Oaks northward, with few exceptions such as Santa Maria. Then, it almost seems that you have to skip the bay area, and jump NE to Lincoln, CA and Rocklin, CA … and finally all the way past all of Oregon to Seattle … or east to Salt Lake City …

“Most of southern California’s population is within the Los Angeles metro, which is way too large. The area is expensive due to many factors, especially its horrible inefficiency.”

Huh? LA has horrible inefficiency precisely because it isn’t dense enough, and is too expensive particularly in the coastal area because it isn’t dense enough.

Santa Maria along the “central coast” of California was mentioned above. The “central coast” of California is developing very nicely, with several very nice “small to medium sized cities” i.e. Santa Maria, Nipomo, Arroyo Grande, San Luis Obispo, and Atascadero. Hopefully, these cities will continue to grow in a planned manner, providing jobs, affordable housing (that’s not happening in San Luis Obispo), parks, and open space. If these types of cities – along with high tech jobs – were located in additional areas along the coast between Santa Monica and the Bay Area, then demand for properties in greater L.A. would be less, and we wouldn’t find nearly as expensive properties in Santa Monica.

It’s best when each city decides how it wants to grow. It appears that Santa Maria on the central coast wants to grow and provide affordable housing, jobs, and shopping centers. At the other end of the spectrum, the Ojai Land Conservancy blocks growth, and tries to buy land whenever it’s on the market. In the middle, San Luis Obispo – home to Cal Poly – has a strict urban growth boundary, and very high housing prices, along with some smart growth building design.

Nevertheless, housing density in San Luis Obispo county, overall, has been decreasing, according to Bill Fulton, and this is a good thing for property values – http://www.cp-dr.com/node/3369

Thanks for the feedback. I am in my late twenties and love to go out and do things. In Milwaukee and even in Chicago, a lot of fun activities end when summer ends. Southern California is where the action is at. Here is my game plan: 1. Stay in L.A. area for five years and then move to Orlando, Florida. The cost of housing there is very cheap and they have nice areas. 2. Move to Orlando, Florida now. I can easily buy a house in a nice suburb for cash. The weather stinks from May to mid October. But from mid October to late April the weather is nice. But in Orlando the party scene stinks.

Living in Southern California for like the next thirty to fifty areas is NOT AN OPTION. That would be insane. California has the highest debt rate than any other state and in the long term I can see California income taxes go up and up. My finances would be completely destroyed due to expensive rents or a mortgage and increases in taxes. If anyone has some further advice, please reach out to me at eli.0017@hotmail.com Thank you very much.

I have to say ELI, think really hard before moving out here to So Cal. Its not as glamorous as it seems to be(been living her all my life 35 Years). Basically if your making about 72K in Wisconsin your going to need to be making about 90-100 to keep the same type of living standard you have in Wisconsin. Why would u want to come to a state that taxes you to death when you have many more options out there, where you have low taxes, cost of livings is much lower, and the weather is good. Trust me if your coming here only for the weather it is not worth it.

Pros

Weather, and you might have better job opportunities. (Though, there is a pharmacy on every corner in Los Angeles

Cons.

TRAFFIC Horrendous ( stuck for 2 hours just to go 15-20 miles). Cost of Living enormously high. Housing is way overpriced for what you get. TAXes TAXes and some more Taxes. Highest income tax, high state sales tax, county taxes, Registration . Be prepared to bend over for jerry brown and california politicians. Even when you have ur days off on saturday and sunday and want to go to the beach, guess what traffic over populated and to many people so you can never really enjoy the great weather.

My advice would be to think long and hard, if its only weather that your looking for there are places much cheaper. Would u rather save a lot of money living in a low cost state like say Texas(washington, Florida) and use those savings to travel to nice places and enjoy ur life, or live in so cal and overpay for every little thing and not save as much and not enjoy life as much. My 2 cents

Eli, you want to live in Orlando, but are thinking of instead living in Los Angeles for 5 years, because the L.A. “party scene” is better than the Orlando “party scene”?

I don’t know what you mean by “party scene,” since I’ve never been much of a partier. Do you mean bars, night clubs, theaters? Surely you can find plenty of that in Miami or in other places much closer to Orlando than L.A.

I’ve seen a lot of open houses lately, including one LAST NIGHT. Why on a Thursday? Who knows. But I would assume it signals cracks in the foundation of the market.

“Cracks in the foundation of the market”

Yes, it was hypothesized by Professor Shiller that premium areas that held their value for years while others cratered, would continue to do so until some person somewhere in the fortress areas decided to have an open house on a thursday night – and when that happened, prices would drop 50%.

So good job recognizing it. In 2023, when prices in SM are 300K, everyone will go back to the great PapaNow post of 10/25/2013 as irrefutable proof of when the cracks began to show…

Opens on Thursdays are broker’s opens.

I heard that some are trying to sell now because they did not have luck finding something to buy during the spring season due to the number of buyers and bidding wars. So they are trying now – they can’t sell until they buy up.

People are trying all kinds of strategies with both buying and selling in this crazy coastal market.

Eli, look in the Valley–Encino, Sherman Oaks, Tarzana, Woodland Hills. Cheaper, and still commutable to the party scene on the Westside as well as Hollywood and you have some nightlife in the Valley too.

Leave a Reply