Selling the Real Estate Mania Hype: Real Estate Agent Most Googled Job. Looking at the Future of Real Estate.

The hype around real estate is nothing short of a feeding frenzy and brings back memories of 2006 to 2007 when all caution was thrown into the wind. Even though sales volume is low, and inventory is historically low given growth and demand, many people are jumping at the chance to become a real estate agent. As an agent, you are paid by selling. So high volume is key here and high inventory is just as important given the product is the home. Churn is the name of the game. It may come as a surprise that “real estate agent” was the most searched for job term in Google. Is this an indication of mania? Let us explore some actual data in California and nationwide data to see if people are actually taking the leap into the industry.

Entering a Job at the Perfect Time

The Great Resignation has been a buzzword for the last couple years with the pandemic forcing people to reevaluate their life choices, especially when it comes to careers. So you can imagine people with an infinite amount of time Googling away and thinking “real estate is so easy and all of these chumps make money on something that is really easy to understand!” There is this certain glamor around the industry and the US is built to sell homes. The perfect example is the Flip or Flop couple that appears to be “winning” yet behind closed doors, is hating each other and essentially fooling you, the public that they are doing great yet are truly dysfunctional but with lots of money. If you have not learned something in the last two-years is that people want to believe in these kind of real estate fairy tales, including the math behind it. Guess what? You are making them rich by believing in the hype train, not the boring fundamentals behind the scenes.

Yet when people say “housing never goes down” their dataset is really one generation (or two at most). As if that was enough to make larger extrapolations of where the economy is heading.

So people are jumping into selling the real estate market:

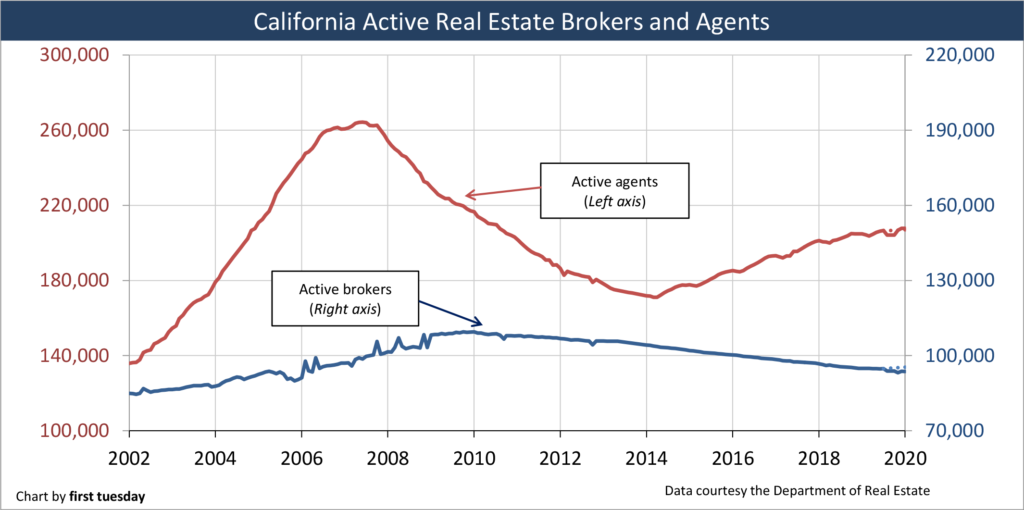

The data backs this up given that in 2019 there were 1.4 million licensed agents in the US and now, we are at 1.52 million. Let us explore California data:

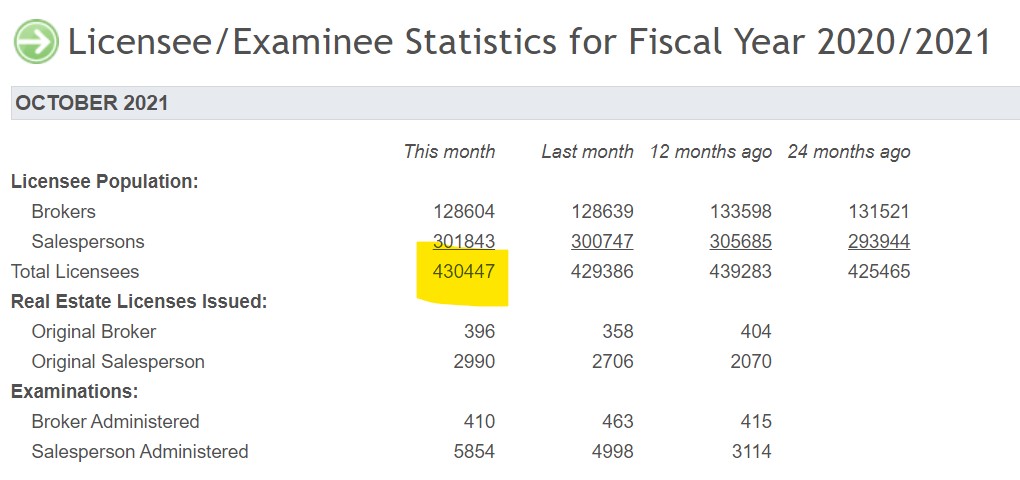

This chart is a bit old, so I went to the Department of Real Estate here in California and pulled the latest data:

In May of 2020 there were 206,000 active agents. From the latest data, it looks like we are at 301,000 agents (a 46% increase in two years). The problem of course is that inventory levels are low and sales volume is low too. People do back of the napkin math and say “if I can sell one $1M crap shack, I can pocket 5% of the proceeds! Easy math baby.” Of course, most people see it this way and the difference in 2006 and 2007 was that sales volume was incredibly high. Let us look at some data here:

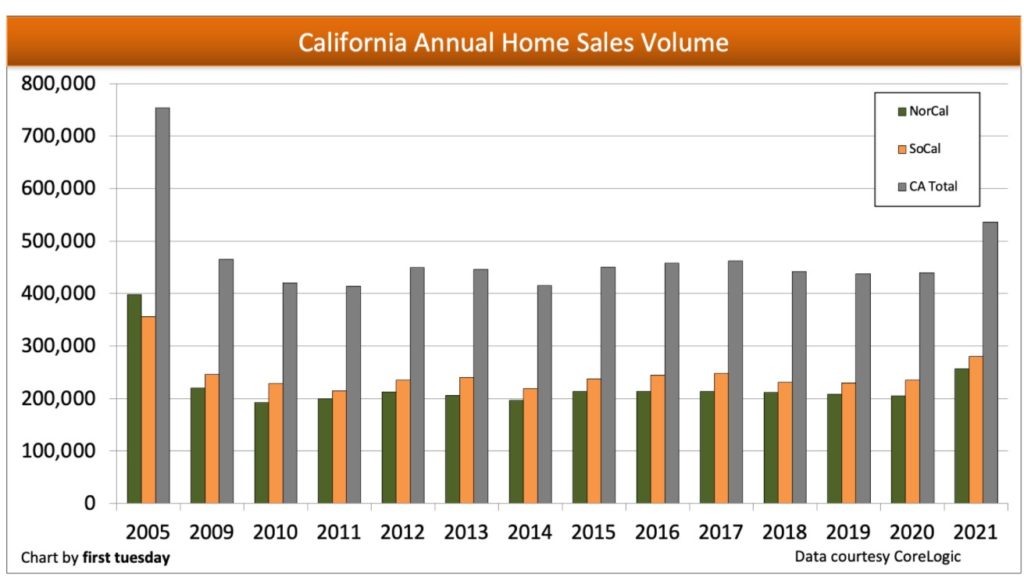

At the peak in 2005, there were 753,900 homes sold in California. Granted this can be repeat sales and new homes but you can see there was plenty of volume for agents to make commissions. Since then, we’ve been holding steady way off the peak. 2021 saw a bump up to 536,600 homes sold but this was still a decrease of 29% from the peak. So why would we need more real estate agents?

California had 35.77 million people in 2005 and the latest Census data shows we are at 39.23 million people (by today, we are probably up 4M since 2005). If you are entering as a new agent, the market is saturated based on the overall volume. Yet I think this exuberance reflects something more of a mania in the market and the Fed has juiced everything and now inflation is running rampant. So with rates likely to go up to stem inflation, it will be tougher to sell those overpriced crap shacks and with the economy slowing down, things will adjust, the question is by how much? Rates have been held at historically low levels and now we are paying the price. Two-income households in California and investors have driven up prices to insane levels. People are tapped out and with debt forecasted to be more expensive, housing is likely to take a hit. Yet somehow, we need more housing salespeople for lower inventory for an increasingly more expensive product. The market can remain irrational for very long periods.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

122 Responses to “Selling the Real Estate Mania Hype: Real Estate Agent Most Googled Job. Looking at the Future of Real Estate.”

The housing ship is taking on water, slipping beneath the water surface as passengers re arrange deck chairs and the band plays on.

RIP

On April 10, 2020 REALIST Commented:

“Nope, wrong again, Housing will see a 20-30% drop in pricing over the next 12-24 months, FACT.

Who’s gonna pay when 30% of the country is out of work ???

Nobody, the banks will come for the homes, sooner than later.

Wash, Rinse, Repeat Housing Bubble 2.0”

“FACT”

Our RE expert “realist” predicted a crash that is now overdue.

Any minute now folks! Any minute!

Realist underestimates the true power of the Fed.

Capitalism used to be somewhat predictable. I miss those days.

Headline: Bill to Tax House Flippers and Speculators 25% Moves to Assembly Committee

https://californiaglobe.com/articles/bill-to-tax-to-house-flippers-and-speculators-25-moves-to-assembly-committee/

“A bill that would massively tax house flippers and speculators who buy and sell a house within three years was moved to the Assembly Committee on Revenue and Taxation earlier this week.

Assembly Bill 1771, authored by Assemblyman Chris Ward (D-San Diego), would impose a 25% tax on all net capital gain from the sale or exchange of homes or properties. While the tax may be reduced if significant time has passed, those qualified taxpayers who buy and sell a house within 3 years would need to pay the tax.

All revenue from the tax would go to the Speculation Recapture Community Reinvestment Fund.

The bill, also known as the California Housing Speculation Act, would also take effect immediately as a tax levy for all taxable years beginning in 2023. As AB 1771 would result in a tax change, 2/3rds of each house would need to approve for passage.

Assemblyman Ward wrote the bill to specifically target short-term investors who buy homes and other properties, keep them for some time, then sell them at a profit a short time later. This includes house flippers, who renovate properties to sell back, speculators, who often outbid other buyers in the hopes that home prices rise significantly, and cash-only buyers.

“Speculators are taking gobs of tens of millions of dollars out of our community through the cumulative effect of all these transactions. That’s not fair either because the people that are left struggling are people who get outbid 30 times trying to get into their home,” said Assemblyman Ward this week. …

Is this really needed? Zillow took care of their flipping business themselves and the rest seem to be losing money yearly. I guess this hurts the individual flipper who puts mostly their own labor into the flip and has more profit.

I will miss my favorite comedy/drama/soap opera, Flip or Flop.

There is a precedent with stocks for taxes on short-term vs long-term gains.

However, I’d really like to know where this money goes: “Speculation Recapture Community Reinvestment Fund.”

I think most people on this blog are either buying a house to live in, or in it for the long term as an investment rental so it will not affect us. Even M has owned his house for over 2 years. Time flies when you are having fun.

Mr. Bob–Agreed! I’ve been sitting on sidelines with 20% down on (what was for a) $1-$1.2 Million house but Bowed out! Neither my Husband or I could write the check! We are wasting away cash, for sure–but put in Retirement slush fund and don’t have to worry about our kiddos last 4 years of Private School.

We have 2 rentals and make decent passive income on them. I used to have 5. I’m over being “that type” of Mom & Pop Landlord, but have fixed both up, have 1 great tenant and one who couldn’t pay for 6 months in Pandemic! So CA Imminent Domain took over (good stuff). So gonna move to our Townhouse in 4 years, retire in 2 yrs and call it two folks done at 54! (I have 2 more years) Husband retired for awhile. But sure wish I bought in 2014, but just started Seizures (out of blue)–maybe due to 25 yrs of 75-hour work weeks? So wasn’t sure I’d get to maintain my income and it’s decent as a Non-Profit ED. But luckily it worked out, but couldn’t put $350k down and owe $800k during early retirement & kiddo in College for 6 yrs. So CA Townhouse for us. Its nice, its in excellent hood and it is small! Who knows, may be able to get that Palm Springs Condo I’ve been wanted for 10 yrs before we retire! But I missed out, 99% due to unsure of health. But I know lots will blow up in highly leveraged peoples faces–after finally “falling” in 2012 I learned my lesson! 100% debt free except 2 tiny mortgages. So thats my story of “Owning RE” last 20 yrs. Winning, Missing and settling with more than many unfortunately have.

Still wish I didnt live above my means. You can listen to your Father that grew up in dirt poor segregated MS & retired 20 yrs ago at 54 in a lovely CA Beach Community with 2 Rentals OR live like a RE Mogul Rockstar & Let Life Teach you! Could have also listened to a (don’t

play) German Mom– “A Hard Head Makes a Soft Ass!” but I let Let Life Teach Me..Hahaha!

3 years is not flipping FFS. I like the idea of a flipper tax, but it should be more like 6 months. Lots of people legitimately buy a house and move within 3 years, having nothing to do with flipping. Military comes to mind as the most obvious. Not surprising that the most leftist state in the country will be killing military families when they sell.

Being the parent of an active duty military member, the stations are exactly 3 years (with a few months of possible delays).

If they buy within a few months of arriving and sell after after leaving, they will be OK and avoid the extra tax.

I still don’t recommend turning a house less than 10 years. In a normal market, they can make a profit after this time period.

Housing should be long term.

So, if you sell for a loss after a year, is that going to be tax deductible for 25% as well? In that case the law may come exactly at the right time. 🙂

I remember many years ago when this very blog was measuring and assessing the failing nature of the housing market by the number of agents who quitting the business and no longer maintaining their RE license. Ain’t it funny how time slips away.

Interest rate comes down: “The struggling RE market is being propped up, crash imminent”

Interest rate goes up: “Housing is doomed with decreasing affordability, crash imminent”

Housing starts down: “Builders are realizing the market is doomed and pulling out, crash imminent”

Housing starts up: “Overbuilding leads to downward pressure on housing prices, crash imminent”

Unemployment down: “At full employment, US wages still can’t no longer afford mortgage payments, crash imminent”

Unemployment up: “No job = no buy, crash imminent”

Inventory down: “People disconnected and in desperation mode buying whatever they can find driving prices up to hysteria level, crash imminent”

Inventory up: “It has begun, crash imminent”

Pandemic starts: “Everything and anything is on the verge of collapse, crash imminent”

Pandemic ends: “A torrent of mortgage delinquency following the mortgage payment grace period will flood the market, crash imminent”

A Chinese guy buys a house somewhere: “Prices are being driven up artificially by foreign investors, crash imminent”

A Chinese guy sells a house: “Foreign investors are flooding the market with housing, crash imminent”

Sunny days: “Sun hasn’t shined this hard since 2006 when the housing tide turned, crash imminent”

Cloudy days: “Upcoming rainstorm will cause flooding not seen since 5500 BC will destroy us all, crash imminent”

Crash happens: “Crash hasn’t crashed hard enough, more crashes to crash down on this crash, 99.9% discount during the crashier crash imminent”

Crash doesn’t happen: “If we keep telling ourselves the crash is coming instead of analyzing housing market and macroeconomic data, then the crash will come, crash imminent.”

Been this way since the day I started reading this blog about 10 years ago. Although seeing commenters that were once staunch naysayers break themselves away from the noise in this echochamber and make rational investments towards RE and see real prosperity makes it worth it to stick around.

Thanks for the laugh. So you’re telling me there’s a chance? ????

Ha! Thanks for the laugh.

To be fair, it is a Housing Bubble Blog. It needs people like Realist otherwise it should be renamed “Housing Prices Always Go Up Blog” and we can all agree with ourselves.

I fear that Realist may get discouraged like old Jim Taylor and either buy a house or flee to ZeroHedge.

Two things I’d like to say.

1) Never use a real estate agent who hasn’t been in the business for at least one boom/bust cycle. (Especially, never use a real estate agent without experience as a rental manager.)

2) Real estate values estimated during a long cycle should always be adjusted for inflation. Otherwise, you may think you are getting rich, but in reality, you are just treading water.

There are several good articles the OC Register today. I will deal with them one at a time.

Columnist Lansner has a new installment of his Bubble Watch series. State regulators say that 2.5 million new residences will need to be built by 2030. He states that rate would be about the rate that Florida and Texas built at over the last 6 years. The rate is triple the California rate for the last six years. There hasn’t been anything like that since 1988 to 1989 ( which were followed by a crash).

California has accounted for 3% of US resident growth over 2016 to 2021, while Texas and Florida accounted for 36% of US growth. Lansner feels that the excessive quota will incur backlash from NIMBYs, and also lead ultimately to disappointment for pro-growth lobbyists. Soaring prices in his view are as much due to low interest rates and tax breaks as to a limited supply of housing. Investors buying up houses for short and long term rentals aren’t going to go away when new housing is built, and Lansner feels they are a big factor in the short supply of housing. He also sees a short term surge in young adults entering household formation as a factor in the current situation, and sees that as transitory. Increasingly old populations are not going away. He gives 5 bubbles for the state plan but 3 bubbles for reality.

Chinese investors are laughing at this law because they don’t plan on selling within 3 years (or at all for that matter). Unless a property tax for foreign buyers is levied like what was passed in Vancouver Canada a few years ago, I don’t see this having much of an impact at all. As a matter of fact, 25% is just 10% more than the current capital gains tax so shelling out an extra 10% to have the freedom to sell an investment property within a three year time frame does absolutely nothing for homebuyers. Its just a way for the state get in on the action.

I didn’t see anything in Lansner’s article about a new law. It’s just a pipe dream quota set up by state bureaucrats for housing development in California. Both he and I think it will never happen.

OC Register columnist Lazerson has yet another article on why condo buyers need to beware. A balcony collapse in Berkeley six years before the Champlain Towers collapse in Florida killed six people, and led to SB 721 in 2018 and SB 326 in 2019. The laws cover both apartments and condos with balconies walkways and decks made of wood that are at least six feet above the ground. All such buildings will require a thorough inspection and resulting repairs before 2025. Then apartments will need inspections every 6 years and condos every 9 years. Condo associations will need to do a reserve study every three years for future maintenance funds. What the inspectors find wrong will have to be repaired, and the condo owners themselves will need fork out the money.

Salt air near the beach can cause larger assessments. Non-compliance can lead to liability and cancellation of property and liability insurance. He estimates that a 20 unit HOA with a $500K rot and water damage bill would need to be financed at about $275 per unit over the current HOA fees. If you are buying, get a financial expert to audit the HOA reserve study and hire a professional inspector. If you own a condo in a development with balconies, you’d better find out about their compliance with the state laws right now.

The Bank of International Settlements BIS controls all the other central

Banks around the world. Political leaders whether elected or not are just

Their puppets.

Hey everybody, the Real M here! This is great news since this means I will have more options to buy MoAr investment properties from daddy’s money I inherited. So many highly qualified REEEEEEaltorz to choose from! I am making a million dollars a day now so I am very busy. Have fun being broke forever losers.

Small correction: I am millionaire but don’t make millions per day. Otherwise I would have retired by now. I still work at my high paying tech job in SoCal.

Be fair to M.

M has gone from renting an apartment and sneaking into the neighbor’s pool to being a homeowner and RE investor within 2 years. Rags to Riches.

It is true that he had help from an inheritance, but that is the American Dream these days.

If you had money for investments in 2019, you are a true American Winner. Bitcoin up 500%, houses up 40%. You couldn’t lose if you had money back then.

Remember the famous Lottery quote: “If you don’t play, you can’t win”

Keep playing and maybe the lottery will come through or a rich uncle will sadly pass on into the Great CA Sunset.

You too can achieve M’s greatness. This is America where hard work will keep you alive but true success is won with inheritances, 1% parents, and being lucky with gambling.

Malcom Forbes used to say that the best way to make money is to inherit it

True words Bob! I celebrate my success daily! Work hard play hard! Invest and make it out big! That’s America! Winners win and renters continue to loose.

“and being lucky with gambling”

LOLOLOLOLOL

I’m far more successful than M and I didn’t have to have anyone in my family die in order for me to get there. I think most people do it without needing to resort to such lengths.

M basically owns foobarbear. M has by far the higher net worth.

Inheriting wealth doesn’t take brains. I don’t think this M poster is real. The guy probably has multiple accounts congratulating himself… could even be a 20 year old college student.

Most people I know who are in tech, finance, or other higher paying profession do own a home and rental(s). They don’t waste time convincing others on an internet forum of their brilliance. An individual making let@ say $150k or a couple making $250k should be able to afford the down payment unless they only started working in the last 2 years or have not been disciplined with their spending.

I do work in tech. Well, biotech. Love those RSU’s during Covid times. 🙂

And shiat, yeah I wish I would be in my 20’s. Sadly, I am well into my thirties.

I am def here to convince people. Convince them of, buy as soon as you can afford it. Don’t try to time the market! I only got lucky to but in Q1 2020. I would have never thought I will have 400k of additional equity 2 years later. Plus, everyone told me that the market will crash right after I bought.

Here it is: buy when you can afford it. Long term renting in places like SoCal is suicide. It’s that simple.

Is anyone here still really questioning whether M is real or not? LOL

Surge” Is anyone here still really questioning whether M is real or not?

There’s something about the M character (I won’t call him a person) that doesn’t ring true. He comes across as too emotionally immature.

He says he’s “well into his thirties,” married, a professional with a high paying job (and presumably serious responsibilities commensurate with the salary), and now home-ownership responsibilities.

Yet he sounds like an immature school boy, gloating over his silly pranks. Gleeful over how he fooled his landlady into thinking he was poor. Snickering about how he trespassed into his neighboring building’s swimming pool. And his silly emojis, something a school girl would be into.

Then there’s his inconsistent story about buying a house.

He was advising people not to buy all through 2019, into late January 2020. Then less then 3 week later, he suddenly announces he’s inherited money and bought “a new construction house.”

Confronted, he denies that his inheritance or home purchase were “sudden.” He says he’d been expecting it through much of 2019, had his house picked out, and even saw it being constructed (which is why, he later claimed, that he knew it had top quality materials).

But if he was expecting an inheritance and looking to buy throughout 2019, why was he still advising against buying as late as January 2020?

Then there’s his sudden tenant, found so easily soon after he bought a house. A tenant who departed only a few months later, during the height of Covid, when she might easily have decided to stay on rent-free (due to Covid rent moratoriums). M is either one Lucky Ducky, or full of sh*t.

M sounds like a prankster and a troll, rather than a serious adult.

SoaL – this was rhetorical question. M is a parody on a caricature at best.

Except for SOL with his made up stories nobody is questioning my story. I have been on this blog for many, many years. I used to be bearish and turned bullish. I bought a house during Q1 2020 and everyone (especially SOL) cheered that I bought the top.

People like him are now mad that I did the right thing and gained 400k in equity. On top of it I bought my first rental investment property!

Thank you everyone! I am proud of my accomplishments and highly recommend that people don’t try to time the market. Learn from my mistakes and buy when you can comfortably afford it! Cut out the noise (especially people that tell you that you are buying the top). Good luck everyone!

M: everyone (especially SOL) cheered that I bought the top.

You lie.

Please provide a link where I “cheered” your alleged home purchase.

You can’t, because I never did. I doubted your story from the start.

M: Except for SOL with his made up stories …

But unlike you, I provide links to prove my “stories.”

Must I do so again? Okay.

M’s Fantasy Timeline from 2020

Jan 31 — Still a bear. Advises against buying.

Feb 11 — Claims to have inherited money.

Feb 19 — Claims to have bought a house. (Fastest probate in history.)

April 16 — Discusses commute time from the new house, which is beautiful, brand new.

May 20 — Claims to have a tenant.

June 27 — Now claims he bought the house while it was under construction. House was so incomplete, he saw the materials that went into it. Considering the short time between the inheritance, the purchase, and the move in, this was the fastest probate AND fastest construction in history.

Relevant quotes:

Millennial (Jan 31): “there is an incredible amount of inventory on the market and much, much more to come. Just obvious that sales and prices fall accordingly. … Boomers need to start paying their fair share. They barely pay any property taxes.”

————–

Millennial (Feb 11): “I inherited from a boomer. A lot. Thinking of buying property. ? I have a very nice house in mind.”

—————

Millennial (Feb 19): “Just signed. … Love it here already.”

—————

M: (April 16): “Commute to my tech job isnt bad (25min). … [house] is brand new, no headaches and it looks beautiful as you can imagine.”

—————-

M: (May 20): “My stranger in the house knows she can’t have sleepovers or she will get a spanking. I do like she’s paying nearly a third of my mortgage …”

——————

Millennial (June 27): “… the top line materials were used. We watched it being built which is a cool experience itself.”

———-

Sources for the quotes:

http://www.doctorhousingbubble.com/the-cure-to-the-housing-shortage-may-be-retirement-homes-the-coming-tsunami-of-homes-over-the-next-decade-may-come-from-an-unlikely-source/

http://www.doctorhousingbubble.com/why-are-californians-moving-out-in-droves-to-texas-a-trend-that-goes-beyond-one-year-a-two-city-example/

http://www.doctorhousingbubble.com/the-forbearance-tsunami-4-7-million-mortgages-are-now-in-forbearance-with-an-unpaid-principal-of-1-trillion/

http://www.doctorhousingbubble.com/covid-19-and-the-impact-on-housing-socal-home-sales-hit-an-all-time-low-in-may-and-4-76-million-americans-are-now-actively-not-paying-their-mortgage/

M: everyone (especially SOL) cheered that I bought the top.

SOL: “You lie.“

See, that’s all he does. He calls people names and makes up wild stories.

To me, an obvious sign that he is jealous.

Buying my first house was the best move. Hopefully, buying that rental property in AZ turns out to be a similar great move. My plans is to diversify and buy more RE.

Hopefully it lets me retire in my 50’s.

M: See, that’s all he does. He calls people names and makes up wild stories.

Make up stories?

I quote you and provide links so people can verify the quotes.

Precisely, if you would just quote me and not make up stories it would all be fine.

I bought in Q1 2020 and have close to 500k in equity gain. Everyone, including you told me I bought the top. Now you seem mad about making such a bad call. Just be happy for me!

M: Everyone, including you told me I bought the top.

You lie.

I doubted your house story from the start.

Prove me wrong. Quote me saying that you bought at the top, and provide a link.

Confirmed! Son of landlord was one of the many posters who screamed the loudest that I bought the top in Q1 2020.

Now he seems mad that I made close to 500k in equity gains since then.

Instead of being jealous he should buy his own house. Learn from my story instead of being jealous!

M: Son of landlord was one of the many posters who screamed the loudest that I bought the top in Q1 2020.

Can you provide a link to where I allegedly said that you bought at the top?

Didn’t think so.

Sol: “ I allegedly said that you bought at the top?”

Correct. And now it seems you are mad that you made such a bad call.

I don’t think you are a healthy human. You seem very un-balanced.

Just think about all the time you spend in going back and forth between posts.

If you just admit you were wrong and change your attitude you will be much happier.

Picture me and my wife: we bought and sit on close to 500k of equity gain. On top of that we bought our first rental property.

What’s not to like? ??

All i need to live is to sell 1 house for $1M with a 5% commission ($50K).

That should take one weekend per year. If there is a bidding war and the price goes to $1.5M, then I’ll donate the extra $25K to charity. Then the rest of these new agents can take over for the rest of the year.

Oh wait. I’m a realist and not an optimist. It can’t be that easy.

Dallas housing on fire! Lots of SoCal refugees I guess.

“In the Dallas market, Compass agents have noted that it is not uncommon for a property to receive upwards of 50 offers, many cash, with full appraisal waivers, quick closing schedules, and no option period. Sellers in the Dallas area are getting the price they’re requesting. Homes sold in January for 100.1% of their list price, compared with 97.4% of asking price in January 2021. The median number of days on the market dropped 35.7% in Dallas in the same period, from 42 days in January 2021 to 27 days in the initial month of this year.”

https://www.wfaa.com/article/money/business/real-estate-housing-inventory-in-dallas-area-sinks-from-bad-to-worse-homes-getting-upwards-of-50-offers/287-b1f9f47e-a1f4-421d-85ad-384192eb68ce

Lots of CA multi-millionaires cashing out on their cr*p shacks and their NASDAQ/Bitcoin gains. Or as you have said, lots of CA low wage refugees desperate to afford to buy something.

Personally, I’d prefer to keep an overpriced 1960’s cr*p shack within walking distance to the beach in S.CA than to buy an overpriced nice newer house in Dallas with 3%-4% unbounded property taxes.

People have weird tastes. I prefer quality of life over a cheap house.

Imagine thinking LA quality of life is good.

LOL

What did the esteemed Governor Hair call LA? Oh yeah a 3rd world country. l I guess everyone has their own kink. For Bob it’s walking in filth produced by homeless people. I’m not judging, Bob.

I was actually referring to the beach cities of LA County.

I would prefer not to live in a packed city like LA city or Dallas city.

New studies indicate that Millennials generally want move-in houses. They don’t

want fixers or starters as much as previous generations. And they’ll pay the

move-in premium to to get it. This provides the demand for flippers to profit, otherwise

they wouldn’t even be in the market. Dem Pols and the media are aiding the cohort

that wants to purchase starter-fixer homes by eliminating their competition – (flippers,

speculators) via fait. Essentially, they want to eliminate Millennials option to purchase

move-in homes and skim off profits for the State coffers. The more they can interfere with normal supply-demand the more money they can pilfer to spend on moronic boondoggles. And mind you with no consequences, since Cali is a one party state. Hopefully, Cali homeowners will shoot down this swill as they did with the Prop 13 Cancellation on Commercial Property. And send Chris Ward back down the hole he crawled out of.

So true. I am a millennial and I could not get myself to buy a used house. My first house was brand new and the second one is brand new (investment property in AZ). For some reason I can’t stand buying used things. It’s gotta be new, smell new and has builders warranties. Those are the only houses I want. Plus you can charge higher rent, plus, if you buy in an early phase you gain equity in each future phase. My Tesla was brand new as well. The only thing I might buy used is a rare gun or rifle that I really want. But so far all of my guns were brand new as well.

This is a fun thread

“When we bought our home we made a list of everything that needed to be done to it. We decided to make it a 7 year plan and make sure everything was done right. I’m proud to say that 17 years later we are almost done with that list!”

https://www.reddit.com/r/homeowners/comments/im1hf1/anyone_buy_a_money_pit_and_regret_it_like_i_do/

I won’t waste time reading Reddit nonsense. But if the writer is complaining about owning a house for 17 years, then he/she is an imbecile. The value of the house has at least doubled and more likely tripled all while paying off 1/2 the mortgage.

But they had to do some repair work? Boo hoo.

Sell and rent instead and see how that works out for the next 17 years.

Free enterprise is not free when the government has their hand out

The day I got my license in 1989 I found out what the average Real Estate Agent makes and it AINT 5%. If you are lucky enough to double end in a dual agency State you may see a 5% gross and believe you me that’s GROSS! At the end of the day a full time pro makes around 1-1.5% net on each transaction. Not bad money for sure but when the market is over flowing with my sisters sisters aunts cousin is a Real Estate Agent and the inventory is non existent many of us are thinking that we could be making more asking if you want fries with that and don’t have to be on call 24/7 and a therapist to stressed out buyers and sellers in yet another over inflated market. Been there done that….three times. This market is headed for a big fall and probably sooner rather than later. Look out below!!!

Thanks for the Reality Check on my plan to work only one weekend a year as a RE agent.

At 1% per sale, I may have to work 5 weekends a year or sell a $5M home. 🙂

Being on call 24/7 until the sale is closed makes it hard work for 10K per sale on a million dollar house in a low inventory market.

Having both purchased and sold a few homes with good RE agents, I agree that you have to be an excellent therapist. One relative backed out on a million dollar home purchase because the seller wouldn’t include a couple of theater chairs they wanted included. The theater chairs were a few hundred dollars apiece new. The RE agent let the deal get out of control because they were poor therapists (and both the buyer and seller needed real therapists). I’m sure you have stories of your own. Write a book, it would be a bestseller.

If the Fed allows inflation to run hot (like in the late 70’s or early 80’s) house prices will not crash. They will likely level off or fall slightly with higher interest rates while inflation eats away at the home values and wages catch up. If the Fed screws up like in 2008, and housing drops 20-30% quickly, then there will be a mass of corporate investors and panicked lemming homeowners trying to unload their houses either at a loss or by walking away with a foreclosure. If that happens, I would predict home prices will crash 40-50%

.

Looking at inflation vs home prices since 2000, the bottom in 2012 was a return to the mean inflation gain. ie house prices had gone up at the same rate as inflation from 2000-2012. To return to the mean inflation gain since 2000 today, housing prices in high priced housing in S. CA would have to fall 50%. This could be a crash like 2008, or it could be a flat/slow trend with high inflation for 5-10 years. Either way will be painful. One would be sudden and extreme, the other would be some suffering over a decade.

In 2010, a teacher friend was able to buy a foreclosed house in the Bay Area that was 50% off from 2006. Another co-worker in the Bay Area walked away from their house rather than taking a 50% loss. Some gained and others lost with the fast approach.

Anyone who purchased a house in 2010-2012 could sell with a gain within 5 years. Anyone who purchased a house at the peak in 2006 had to wait 14 years to show a gain.

As the doctor pointed out back then, 10-13M people decided to walk away rather than wait. I think the same would be true today.

In the 1980’s my parent’s house rose in value far less than inflation but their wages increased dramatically with inflation. They purchased the house to live in and not as an investment. They suffered a little because wage increases lagged inflation. There were not many short term investors in RE at that time because the short term ROI was small. I think that’s a good thing.

I’d say this is a good analysis. However, TLDR is : “nobody knows which way it’s gonna go” and let’s stop pretending that any of us do.

finally someone who knows and has lived “reality”

Looks like the Federal Reserve is in the driver’s seat. Depends on how aggressively they’ll raise rates and pull back on QE. But so far, the lack of inventory and overwhelming demand is still driving up prices. Look how many times Zillow has revised its price predictions upward in just the last 3 mos.. Have to see how this all plays out and what

Powell does when Wall Street starts convulsing from lack of cheap money. He stated that inflation might be around 4% by mid-year, but I don’t know if several 1/4 rate hikes can

tame the 8% beast that quickly. If rates go near the 7s one economist said to stay near your bunker and keep your powder dry.

They probably want to work for Blackrock buying homes when the market crashes.

If “Realtor” is the most Googled job search, “crazy” is the most used word to describe the current housing bubble. Terminator has nothing on the housing market when he (it) said, “I’ll be back”. The destructive force unleashed by the very quick return of massive price increases and speculative buying by institutional investors through iBuyers where homes are being repackaged and sold on. Yes, Wall Street is back in the housing game as if there is no tomorrow. With several rate hikes expected this year alone and the 30 year mortgage already at 4%, we very well could see an implosion this year. But that’s good folks. It means prices will become affordable. The downside is the Fed and policy makers may throw all our tax dollars at it to prevent the slide. What a mess.

Affordability will not improve. If prices fall because of interest rates -> affordability remains the same (monthly payment). If prices fall because of economic crisis -> average affordability will be reduced due to economy (monthly payment).

Because of existence of 30year mortgages, the leverage will remain very very high and thus almost entire affordability is inherently linked with nothing but monthly payments.

“Yes, Wall Street is back in the housing game as if there is no tomorrow. With several rate hikes expected this year alone and the 30 year mortgage already at 4%, we very well could see an implosion this year.”

Saving rates and Treasury rates are also going up for savers/investors as rates rise.

I think the iBuyers and corporate landlords will have a hard time finding capital and investors to keep buying more homes if savings rates go to 3%-4%. Currently Black Rock and Invitation Homes are paying 2%-3% in dividends. Both have fallen ~20% in the last few months.

Today, savings rates are at 1% and corporate home investors are paying up to 3%. What happens when government insured savings rates are greater than 3%?

Will corporate investors start unloading homes? Can they raise rent to try to compensate? How fast?

Ibuyers will soon be Idead. Stocks are cratering, insiders are selling like crazy. Hard to borrow shares to short so I assume they’re heading to BK in a year or two.

Headline: Ellis Act reform bill seeks to limit rent control evictions

https://www.smdp.com/ellis-act-reform-bill-seeks-to-limit-rent-control-evictions/214744

Since passing in 1985, the Ellis Act has been the ire of rent control supporters, who are frustrated by the rate at which it drives no-fault evictions of rent controlled tenants.

After several past failed attempts at legislative reform, a bill has been reintroduced in Sacramento that aims to limit Ellis evictions and was co-authored by both Assemblymember Richard Bloom and Senator Ben Allen of Santa Monica.

The bill’s principal author is Assemblymember Alex Lee, who represents the South Bay of San Francisco between the East Bay and Silicon Valley. He initially introduced the bill as AB 864 in 2021 and is reintroducing it as AB 2050 with minor tweaks to address assemblymember concerns.

If passed, the bill would prevent landlords from utilizing the Ellis Act to evict rent controlled tenants within their first five years of ownership.

The aim of the bill is to return the Ellis Act to its original purpose, which is to assist mom and pops landlords in exiting the rental business when they are losing money on a property. …

How long before CA just outright bans private landlords? You know it’s coming. The govt knows best so they will manage all rentals. And in the name of equity rent will be $0 for the “right” people.

Yes, the actions of greedy landlords raising rents 20& in a 7% inflationary environment will provoke angry voters to vote in legislators who support cr*p bills like this.

The sad part is that if landlords weren’t so greedy, this would never happen.

Yes, there are a lot of Real Estate agents out there. Every day they are calling me, texting me, sending me letters or E-mailing me to ask if I want to sell one of my properties.

Jeff Lazerson of the OC Register has a column on Freddie Mac’s curbing automatic appraisal waivers. I looked on line for more information and found that an IT services company had posted the entire article other website:

https://haasunlimited.com/2022/03/freddie-mac-ending-automated-appraisal-waivers-on-cash-out-refinances/

I have found that one of the reasons why Freddie went to the automated system was “housing bias” . A company that designed automated appraisals says the following:

“Automated valuation models(AVMs) are more reliable tools for providing a fair valuation when compared to traditional appraisals. Our results, which can be found in the appendix, show that HouseCanary’s automated valuation tool generally outperformed our comp valuation tool in producing unbiased valuations. When sufficient data is available to support an AVM for a property, our research suggests it is a more reliable tool for providing a fair valuation than either our comp valuation tool or a traditional appraisal.

No evidence of racial bias exists in HouseCanary’s automated comp and AVM tools. Following our analysis, which can be found in the appendix, we found no evidence of racial bias in HouseCanary’s automated comp and AVM tools. This stands in stark contrast to the results of Freddie Mac’s examination of traditional appraisals, which found that “Black and Latino applicants receive lower appraisal values than the contract price more often than White applicants.””

The new procedure will need AVM but supplement it with a house inspection (not by a licensed appraiser) designed to find flaws in the house. As the first article says, this is a check box list of questions about the property.

The lack of building in California is astonishing. This state has so many BANANAS. Colorado is the same. Boulder County spent 11 million dollars fighting a much needed dam (and lost) because some rich libs didn’t want construction traffic on their roads. We need more of everything! Homes, solar, nuclear, drilling etc..

Here is the text of the tone-deaf Bloomberg advice article on how the “little people” can cope with inflation:

https://www.bloombergquint.com/gadfly/inflation-stings-most-for-those-earning-under-300-000

The main Bloomberg site wanted me to pay to read this drivel, but I resourcefully got around them.

BTW, I did have an old and feeble dog put down rather than pay for medical care that wouldn’t have saved her anyway. That might be the most controversial suggestion she made and may be the most practical too.

Good thing she didn’t delve into how to deal with a 20% increase in rent. That would’ve been a laugher.

I dealt with that by owning outright and having a rental that was where my parents lived.

Getting ready to increase the rent on one of my rental properties again. 20% this time.

I can’t repeat this often enough; renting long term is financial suicide. DO NOT DO IT!

Why don’t you change your name to Snidely Whiplash?

https://images.app.goo.gl/1o54g25Z4yb1Z8GL7

Beautiful! Congrats! I can’t wait to raise my rents for my tenants. I want them to pay me just enough to consider it still being fair and maybe even a good deal. But it has to be a lot so that they can’t save for a downpayment. I rather have the same tenant for a decade the Having to find new ones. Great long term tenants are worth digital gold (bitcoin).

M: But it has to be a lot so that they can’t save for a downpayment.

Troll.

I think what you meant to say was “I hope another one of my relatives die, so that I can continue to be relevant since I can’t do it on my own like everyone else in the world did”.

Typically for SOL. He just calls people names.

But unfortunately this is how it is nowadays, if you are successful in life and a landlord you are learning first hand how jealous some folks get.

I did inherit but I never hoped for someone to die. In our family wealth transfers from those that die to their heirs.

Maybe you don’t have relatives or maybe they are poor? I am sorry foobar.

One thing I could suggest is investing in crypto! I made over a million dollars by investing in crypto since many years.

Crypto investing:

My strategy is to dollar cost avg in quality projects like BTC, ETH, ADA etc.

during downturns/corrections you buy more.

When crypto explodes you take a few profits

The trick is to be greedy when others are fearful. When the media reports BTC’s next all time high and everyone starts talking again about Bitcoin and meme coins, that’s when you know to take some profits! ????????????????

M: He just calls people names. … you are learning first hand how jealous some folks get.

Oh, the irony.

Am I right? Spot on I assume 🙂

M:Am I right?

You’d first have to convince me that you actually bought a house.

I’m still waiting for you to provide a link to where I allegedly said you bought at the top.

You can’t, because I never said that. I doubted your alleged home purchase from the start.

Looks like sonofalandlord is living in M’s head , rent free.

That’s what I thought foobar! Skimming through the long posts by him it shows me he spends a lot of time on it. He even finds quotes from previous posts. Lol, maybe he’s retired and is bored.

I have been living in his head rent free for years now 🙂

I think what I pushed him over the edge was when I bought in Q1 2020 and when he predicted joyfully that I bought the top 🙂

500k equity gain later he’s pissed about his bad call ????

Hey guys, so my son called me up and was complaining and venting to me about this son of a landlord guy and other character, foobarbear, and asked me to stand up for him because of all the nasty comments you guys have been directing towards him. This is what he says:

M: “Good thing I have multiple properties now where I’m collecting just enough from my tenants to not piss them off but still enough for me to get filthy rich… suckers (remember – renters are losers). Plus, my cushy tech job is awesome – I generally finish coding something for work in an hour and then play COD for the remaining work day… I wouldn’t have it any other way. Arbitrage is the way to go! This way I can afford to have people living in my head rent free. I AM AWESOME! BTW, can I borrow $50k for something? It’s a Vegas trip for work… thx dad”

Foobarbear: Looks like sonofalandlord is living in M’s head , rent free.

M’s head is shabbily furnished. I only sneak in to use the pool.

When you are a self-made millionaire you gonna get some hate and jealousy!

I earned that hate and jealousy with my hard work and smart investment decisions.

My advice: invest in crypto. Think Long term, dollar cost average. Buy dips.

Invest in stocks and RE. Think long term.

And lastly, don’t try to time the market. Remember when I bought in Q1 2020 and everyone predicted the top? Let that be a lesson.

You guys keep feeding the troll. The new housing development near SD that never existed. Liars get tripped up when they provide too many details.

There are many new housing developments near SD.

I bought a new construction in a new development in north county San Diego.

We Absolutely love it here. Often ride my bike on the San Luis rey bike trail all the way to the beach and back. You guys are just jealous 🙂 makes me happy. Jealousy has to be earned

self made doesn’t mean what he think it means.. It certainly wasnt meant to include “needed someone to die in order for me to have any money”

Correct foobar, the inheritance I got was just icing in the cake. I am a self made millionaire through crypto. Now I have a market portfolio value of 1.7M in RE as well (obviously I still have loans against both houses). If I can trust Zillow and it’s zestimate. But what’s a few hundred k among friends 🙂

Sorry in advance folks, I can’t take it anymore… here’s the truth: my son has some serious mental issues.

He keeps projecting how everyone else is jealous of him and his illusions of being a self-made millionaire.

Hey M, get your @$$ up here now! It’s time for dinner – quit hiding out in the basement pretending to be a real estate expert and eat before your dinner gets cold. You need some nourishment and sleep before you go into your high paying tech job repairing arcade games at Dave & Busters tomorrow morning.

Owns primary residence (1.2m) – check

Owns a rental investment – check

Made over a 1M with crypto – check

Has accumulated haters/jealousy – check

Provides helpful advice to those who think they can time the market – check

Jealousy by others has to be earned. Nobody is jealous of people who don’t own assets and think they can time the market 🙂

Santa Monica plans to increase real estate transfer tax.

Headline: Mayor proposes new tax to fund housing and schools

https://www.smdp.com/mayor-proposes-new-tax-to-fund-housing-and-schools/216254

A trio of Santa Monica officials are mounting a campaign for a new tax on real estate sales to fund homeless services, affordable housing programs and local education efforts.

Santa Monica Mayor Sue Himmelrich, her husband Michael Soloff (who is Co-Chair of Santa Monicans for Renters Rights) and Jon Katz (President of the Santa Monica Democratic Club) are soliciting public support for an additional real estate transfer tax on property sales greater than or equal to $8 million. If their petition is successful, the question would be put to voters in November of this year.

Santa Monica already has two tiers of real estate transfer tax charging $3 per $1,000 of value transferred on transfers under $5,000,000 and $6 per $1,000 of value on transfers of $5,000,000 or more. The second tier was established in 2020 when voters approved Measure SM.

The proposed third tier would charge $56 per $1,000 of value transferred for transfers of $8,000,000 or more. …

Headline: California legislative leaders move to extend COVID rent relief, eviction protections

https://www.latimes.com/california/story/2022-03-24/california-legislative-leaders-move-to-extend-covid-rent-relief-eviction-protections

A week before California’s eviction moratorium was scheduled to expire, top Democrats in the Legislature announced a proposal on Thursday to extend COVID-19 pandemic protections for tenants by another three months so the state can finish sending out rent relief payments.

Assembly Bill 2179 would move the date on which landlords may initiate eviction proceedings from April 1 to July 1, as long as an application is submitted by March 31 to a rent relief program. Democratic legislative leaders said the extension would give applicants more time to receive the help and avoid losing their homes. …

Seventy-one percent of likely voters consider housing affordability a big problem, according to a March poll by the nonpartisan Public Policy Institute of California, and 44% of those surveyed said they were worried about making their rent or mortgage payments.

Forty-eight percent of low-income renters struggled to pay rent in January and February of this year, according to the California Budget and Policy Center. …

A 30 year conventional loan is 4.5% right now. We are entering a low activity real estate market over the next 12-24 months in my opinion but this does not necessarily mean drop in prices. It also probably won’t mean huge appreciation either. The real estate market can very much withstand higher than normal rates and low deal flow. Will be a real estate agents nightmare market due to low deal flow but the market looks solid enough in a 2-3 outlook. Not a ton of appreciation but probably not any depreciation. Many many people refinanced into low rates and the importance of keeping a house no matter what mentality is out there, so I don’t see a huge foreclosed tsunami in next 2-3 years either. Inventory will be at historic levels for many more years to come. So the Fed knows the housing market can stand up to a rate boost over next few years.

I agree with all the wise words on buying whenever you can afford to do so for your primary residence even at these pricing levels. Buy in the valley, to expensive in the valley go to Palmdale. Renting long term especially in Southern California is financial suicide. I know there any many 250k earning households in LA,SD,SF that are living very stressed let alone those under. I gotta think state gonna try and send landlords cash forever to keep people in homes. There’s will also continue to be co-habitation. 4 people living in a 2 bedroom. The only way the household revenue to make payment will make sense on the rental side.

I think people who aren’t in a home should just lower their bar. And when I say lower, I mean boohoo first world problems? If you can make 250k that’s a bring home of $15k after fed & state tax with only 2 exemptions assuming a married couple. You can buy a starter home in Huntington Beach 1300sqft 3bdroom for $750k with only ~22k down payment and $4700/monthly PITI. That’ll leave you with over 10k leftover to live with and again, boohoo that’s just an example in one of the best cities to live in the entire country.

I live in HB. You’re talking 2019 / early 2020 prices.

I see one auction home in a crap area for $750K if that’s what you are taking about. I guarantee it will sell for $150K over because the next lowest price home is another turd for $879K (which will also sell for over asking).

Also no sellers are entertaining low down buyers.

The 250k couples that are strapped but making a mortgage payment are certainly better off than the 250k couples who are renting and are barely making progress towards home ownership. Many very good salaried people living on the west side of Los Angeles who will just be renters vs homeowners somewhere else. Eventually some of these people will become homeowners on the west side and many many more will just rent forever.

You are splitting hair. Even at 1mil pita is 5k. Fairly affordable for 250k income

” Many many people refinanced into low rates and the importance of keeping a house no matter what mentality is out there, so I don’t see a huge foreclosed tsunami in next 2-3 years either.”

I agree.

I also agree that this was the same situation in 2008. Nobody I knew who foreclosed in 2008-2010, wanted to do it. They just couldn’t handle keeping the house when:

1) They lost their high salary job during the recession. They could barely make the mortgage payments with their high paying jobs.

2) Selling was a worse option since their house was worth 30%-50% less than their mortgage.

3) Many had low down payments and very little reason to stay.

So they walked away and foreclosed.

Good thing we don’t have a recession. Good thing everyone is putting 20%-30% down.

Nearly half of refis in the last 2 years were cash out. Thats a factor nobody considers. Equity may have already dried up for some.

Hopefully the cash out refi’s during the last 2 years were made at 80% LTV.

Even if housing drops 10%, they still have equity.

If housing drops 30%, I think it will be “Game Over” with a mass of foreclosures.

The other difference between then and now is that rates were dropping in 2008-2012.

Under certain programs, HARP, a homeowner could refi to get a lower rate with some relief.

A friend did this in 2009 when they became underwater, but due to the stupid government rules, they were told that either they had to be at 80% lTV to qualify OR they had to have a history of missed payments (ruined credit score). The friend pulled money out of his 401K to pay down the loan so he could qualify. Stupid rules.

If a homeowner has a 3% mortgage now and loses their job, will the Fed lower rates to below this to give some relief?

Personally, I kept my job during 2008 but due to the recession, everyone’s salaries were cut 15% at the company I worked for. Can current homeowners withstand a 15% cut in salary and still pay the mortgage? My stocks had plunged 30%. It was a tough time.

A deep recession would be very bad.

RIDDLE ME THIS

The new Cumulus project at Jefferson and LaCienega:

The 30 story tower is 80% leased. comprised of 1 and 2 bedroom apartments. THE 1 BEDROOMS ARE RENTING AT $3500 PER MONTH !!!

Please explain to me who is paying $3500 for a 1 bedroom apt 6 miles from the beach???

https://arqatcumulus.com/

I checked it out and that corner is about 7.4 miles to Playa Del Rey, 6.7 miles to Ocean Front Walk in Venice and 6.9 miles to the Ritz Carlton in Marina Del Rey. On Google maps it’s still a construction site. It’s less than a block from the See’s Candies general offices and factory. A little over a block from Ballona Creek. Definitely not beachfront property.

Headline: Hackers steal $615M from Ronin in one of largest crypto heists on record

https://nypost.com/2022/03/29/hackers-steal-615-million-in-cryptocurrency-from-ronin/

Blockchain project Ronin said Tuesday that hackers stole cryptocurrency worth almost $615 million from its systems, in what would be one of the largest cryptocurrency heists on record.

The project said that unidentified hackers on March 23 stole some 173,600 ether tokens and 25.5 million USD Coin tokens. At current exchange rates, the stolen funds are worth $615 million, but they were worth some $540 million at the time of the attack.

This makes it the second-largest crypto theft on record, according to blockchain analysis firm Elliptic. …

There is no inventory. Prices, despite significantly higher rates continue to go up. I could sell my house right now for close to 500k more than what I paid in Q1 2020. Amazing.

Every house in my community sells above asking price. My house in AZ also appreciated nicely since I signed.

Cha-Ching!!

M, that is great. You can take 500k and go back to renting.

That would be an option but not my preferred one. I rather refinance when rates go down to 1-2% and invest the pulled out money into another rental property. I like to accumulate RE to retire early.

Just sitting back sipping a cold one watching the Housing Ship slowly sink under the water, thanks for playing home debtors lmao “it never rains in southern California, but it does burn to the ground”

‘Supply is up in the Inland Empire, rising 31% in San Bernardino County’

Wa happened to my shortage California?!

‘Could we soon see 5% fixed rates? We’re not far off. If the exotic mortgage market is any indication, we are going to hit 5% and then some in the conventional mortgage market. The outside-the-box, so-called non-qualified mortgages are already north of 6% for a 30-year fixed. Yikes’

Outside-the-box, so-called non-qualified mortgages = subprime.

Home homeless people coming, enjoy 🙂

For whom will the market sink?

Those who bought within last 3 years? last 5 years?

If you purchased ahome more than 5 years ago, it seems irrelevant if housing sinks.

I would have killed for a 5% mortgage for my first house in S. CA when rates were at 12%.

I agree that houses will either flatten or decrease slightly if the Fed does things correctly and wages will have to catch up with inflation. 7% inflation for 3 years with a 3%/year drop in house prices would effectively be a 30% drop in the house cost. Get ready for a few years with 7% raises in wages.

Why do you think the Fed is moving so slowly with raising rates? They raised their rate .25% and mortgage rates jump 2%. It won’t kill inflation with .25% but it will likely cause home prices to drop 3% with a 2% rise in mortgage rates.

Fasten your seat belt for the soft landing. At least I hope. Or it will be like we all saw before in 2008.

I hope so, Bob. But the fed’s track record with soft landings isn’t all that great. The transitory bullshit theory out of Powell’s mouth just shows they are late to the party and know it. There are a lot of macroeconomic factors at play in the world.

Since I have a primary residence that’s worth we’ll over a million and my first investment property I wouldn’t mind if we get lower rates and longer fixed terms.

For instance:

Mortgage rates of 0.01% for 40years would likely push my house value over 2mio in the next few years.

If rates continue to go up and put pressure on house prices I might have to buy my second investment property sooner than I thought!

Another article in the OC Register about “racial inequity” in housing. ( See my post on March 20th about automated appraisals.) The two biggest factors in whether a family can afford to buy a median priced house are age and education (both of which generally lead to higher incomes), but the figures based on race are never weighted for that. Even so, in Orange County 10% of Black and Latino families, 22% of Asians and and 25% of Whites could afford the median priced house. That requires $201,600 in income.

Pertinent facts:

1) I don’t have that much family income.

2) I could liquidate investment accounts and come up with enough money to buy at today’s prices and interest rate with a large downpayment and my current income.

But that is because I’m older and I’ve saved a fair amount. Whites in OC are the huge majority of older people. That being said, it may or may not suck to be Black or Latino here, but it definitely sucks to be young. As long as hedge funds and other investors keep buying single family housing, I see little hope for a change.

Headline: White House to extend the student loan moratorium once again

https://www.politico.com/news/2022/04/05/white-house-to-extend-the-student-loan-moratorium-once-again-00023072

The White House plans to once again extend the moratorium on federal student loan payments through the end of August, according to multiple people familiar with the matter, including an administration official.

The announcement, expected on Wednesday, comes as the current pause on payments was set to expire May 1, potentially impacting more than 40 million Americans.

The new August 31 extension, however, is considerably shorter than what many Democrats have been requesting. It also tees up another fight over the relief just months before the midterm elections. …

These Covid relief moratoriums are entering their third year.

It’s all politics.

The Democrats promised they’d eliminate student loan debt. They found out that is not as politically easy to do as a simple drastic tax cut for most like the Republicans do. Most people, including myself, don’t believe in forgiving debt that the person actively and knowingly signed up for.

On the bright side, it will postpone any potential housing crash as the postponed student loan debt payments can now be used to pay a mortgage debt payment.

That date of August 31 will be pushed again to December 31. After all, it is an election year and Biden wants to buy votes for his fellow democrats. However, the Democrats will still lose in November in a landslide unless they do again ballot harvesting, use the Dominion machines and allow non-citizens and dead people to vote.

Flyover,

Trump had less than 50% approval ratings most of his presidency, This is a fact.

The fact that some people still think Trump won is mind-boggling. A bunch of sheep. 🙂

I fear for our great country.

Biden’s approval ratings currently are about the same as Trump’s. I agree that he probably wouldn’t win again unless he ran against Trump again.

The mortgage rate jump of 2% didn’t come from the Fed’s quarter rate hike.

It came from the market expecting the 6 or 7 rate hikes over the year that the

Fed announced. And the market built all those expected hikes into the current

mortgage rate. If the Feds don’t actually raise the prime rate as expected then

you might see mortgage rates soften a bit. Or if they raise the prime rate by

a half point vs. a quarter point, you might see rates increase slightly. It all depends

on inflation numbers when the Fed meets. They’ll adjust the rate depending upon

those inflation stats. It’s like a big feedback loop.

A big feedback loop with A LOT of leverage on mortgages.

Unfortunately, the leverage is not reflected in bank account savings rates yet. Short term interest is still in the mud.

They also stopped buying MBS and that makes mortgages a higher risk. If the FED would increase the short term rate more aggressively (they don’t control the long term rates directly), then they can get some credibility with the market that indeed they are serious about inflation. A 0.25% increase with the bogus CPI 8% (the real inflation is more than double that for everything that matters) does not send the right signal to the bond market that the FED is serious; as a result, the 30 yr mortgage rate spiked.

The FED is cornered – doomed on us either way. If they get aggressive with the rate hikes, they collapse the bond market which is 3 times bigger than the stock market (it will collapse the stock market, too). If they don’t, the inflation will collapse the market, too.

The right time was in 2008 when they should have let the system clean up the malinvestments. However, they chose to bailout the big banks at the expense of the average citizen. We still pay today and we’ll pay for many decades to come – there is no free lunch.

Headline: California Dem bill would let illegal immigrants become police officers

https://www.foxla.com/news/california-dem-bill-would-let-illegal-immigrants-become-police-officers

Oh the irony – you let law breakers enforce the laws!….However, when did the democrats make any sense?!….I know it does for some!…

Leave a Reply