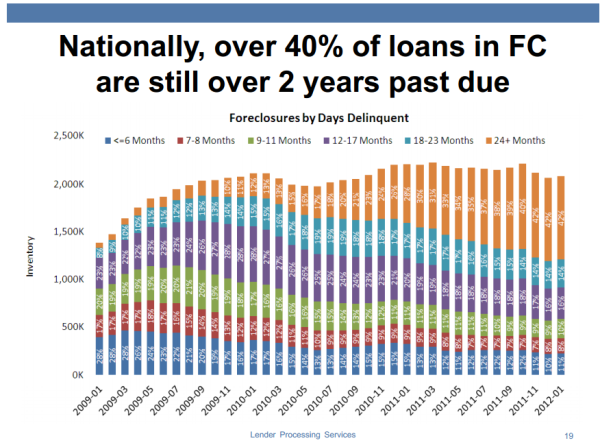

Will 2012 begin the unclogging of 6,000,000 distressed properties? Over 40 percent of the 2 million active foreclosures stand with no payment in over two years and some with three years and more. Foreclosure starts surge 28 percent in last month of data. Mid-tier markets in Los Angeles and Orange County contract severely in 2011.

The housing market is clogged like backed up plumbing in an old building. The shadow inventory is still very present even though visible inventory declined last year. It seems like we are diving back into the rabbit hole where information is disguised and bad news is spun as being good. Take for example the number of homes actively in foreclosure. Early in 2009 we had roughly 2,000,000 homes actively in foreclosure. The number today? 2,000,000. The Catch 22 of the giant bank bailouts and financial shell game was the bet (hope) that housing prices would have gone back up after five years especially with trillions of dollars funneled into the banking sector. I mean what can go wrong when you trust banks with housing right? The reality is sinking in that home prices are going nowhere but down unless household incomes rise and that is why we saw foreclosure starts surge last month. The shadow inventory is coming online and that means lower prices. Don’t think this is a shell game? Over 40 percent of the 2,000,000 foreclosures have not had a payment in two years. This isn’t even factoring in the 4 million delinquent loans that are working their way into the REO side of the equation.

The current state of shadow inventory

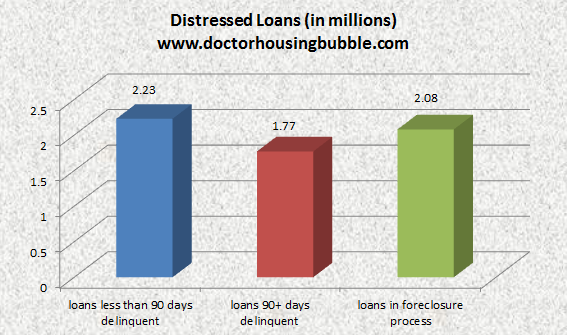

It is always helpful to see where things stand today in regards to the distressed inventory pipeline:

Over 2 million loans are actively foreclosed (ether with a notice of default filed, scheduled for auction, or flat out owned by the bank as REOs). Another 4 million are delinquent bringing the total distressed inventory pipeline to over 6 million. This number sounds familiar because it really hasn’t moved in well over a year (like pretending the toilet magically unplugged itself if you simply choose not to flush it).

The best way to envision this is by looking at the length some of the homes have been in foreclosure:

Source:Â LPS

You see the orange and blue above? This is what happens when your strategy involves ignoring the problem. Home prices are still largely inflated in many parts of the country including California. Take a look at how backed up things have gotten:

“(Chicago Tribune) Almost three years after she last paid the mortgage, Linda Ganguzza remains in her New Milford, N.J., home, one of many troubled homeowners caught in a drawn-out foreclosure process.

“I have no idea where I stand, how much longer I have,” said Ganguzza, a 58-year-old nurse, who says her divorce left her unable to afford the home where she raised three children. “Do I move, do I hang tough, do I talk to the bank?”

Trillions of dollars to banks and the best strategy they came up with was simply ignore the problem and keep paying those big bonuses to all those investment bankers that setup this mess. We’ll talk about the collapse in the mid-tier for California shortly but let us keep breaking down the distressed pipeline.

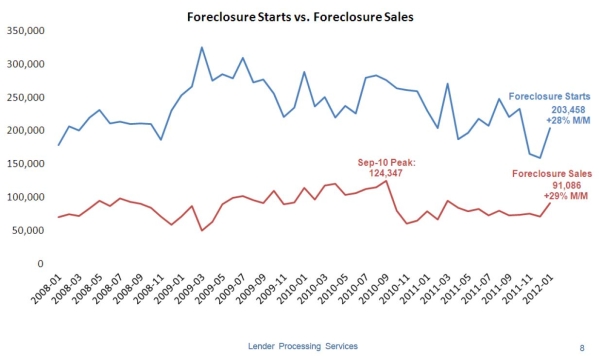

Foreclosure starts and sales sharply up

Showing signs of a movement in the distressed pipeline foreclosure starts and sales are up sharply in the latest data:

Source:Â LPS

Foreclosure starts jumped up by 28 percent showing a sign of some movement in 2012. Keep in mind that foreclosure sales typically sell for lower prices. This is what banks have been trying to avoid for half a decade now. This is also why we have millions of homes in the shadow inventory in spite of trillion dollar bailouts and artificially low interest rates. What good is a low interest rate if household incomes are stagnant or falling?

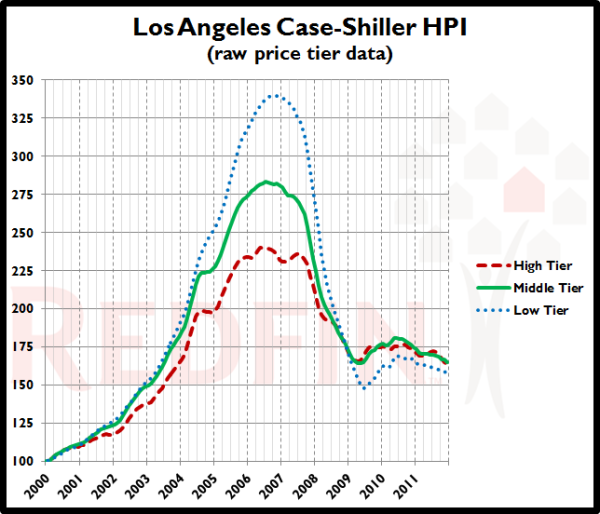

The collapse of the mid-tier market

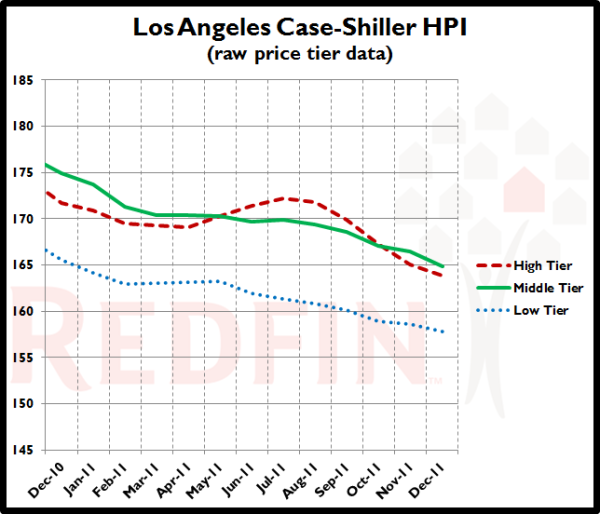

Redfin has some nice charts on the collapsing mid-tier market in Los Angeles and Orange Counties. Every tier of Los Angeles and Orange County is moving back lower again:

Source:Â Redfin

The above chart reflects this:

December 2011 (latest data)

Month to Month: Down 1.1%

Year to Year: Down 5.2%

Prices at this level in: August 2003

Peak month: September 2006

Change from Peak: Down 40.8% in 63 months

Low Tier: Under $289,982

Mid Tier: $289,982 to $474,017

Hi Tier: Over $474,017

Redfin then adds this chart that shows the obvious trend:

Tens of thousands that bought in the summer of 2010 thinking it was bottom missed the second round. Take a $400,000 home bought with a 3.5 percent FHA insured loan.  Not only is that down payment gone, but where will that 5 to 6 percent come from if they decide to sell? They are merely one of the 35 percent of California homeowners that are in negative equity or near negative equity. The property ladder days of the last decade are long gone.

All of this of course makes sense. Those that try to ignore area incomes are delusional and drinking their own Kool-Aid. Of course local household incomes count and when ratios get out of whack like they did, prices will adjust even if it means severe corrections (the Case-Shiller LA/OC data set is down 40 percent from the peak by the way). Buying volume is low because people need only look at their wages or bank accounts and home prices in certain areas will appear expensive still. People fall into manias in a lemming like pattern but gain their sanity one by one.

The housing pipeline is beginning to unclog and shadow inventory in mid-tier markets is likely to depress prices well into 2012. The only thing that will change this is a sudden surge in good paying jobs and wage increases. Nationwide with a median price home of roughly $150,000 prices may dip slightly this year but they are more in line with household incomes. In mid-tier markets like the Los Angeles/Orange County Case-Shiller range prices are very likely to fall yet again as it is clear a movement in shadow inventory is now starting and prices have a good way to go before they are in line with local income metrics.

Any predictions on where the Case-Shiller will be one year from now? Nationwide? Los Angeles?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

74 Responses to “Will 2012 begin the unclogging of 6,000,000 distressed properties? Over 40 percent of the 2 million active foreclosures stand with no payment in over two years and some with three years and more. Foreclosure starts surge 28 percent in last month of data. Mid-tier markets in Los Angeles and Orange County contract severely in 2011.”

Doc, keep up the great work. Your post and numbers are dead on. Thank you for gathering, organizing, and presenting this solid information post after post. You are a beacon of (quantitative) truth in a financial and housing world of b.s.

People who are making predictions about the housing market often cite past recessions or housing market examples as the basis for their opinions. Problem is they are assuming those “models” will hold up in the future, and they are ignoring the fact that this time really is different; we’ve never seen a bubble that big. What will happen? We don’t know. But Calculated Risk and others are overly optimistic about things recovering in an orderly manner (“just because they always have”). That’s not how financial markets work; that’s not how humans’ psychologies work. My guess? The housing market will disappoint many on the downside. It’ll drag on longer and be worse than most had hoped / expected / modeled for. Best, Tom in San Diego

Prediction: – Case-Shiller at 125 in one year from today. I keep saying this, but history is on my side: Bubbles normally give back 80% of their gains. See Nasdaq 2000, Nikkei in the 90s, Silver in 1980, etc. Case Shiller should bottom at approximately 85 within a few years.

Hi, I am not disputing your numbers, however, the 1 percent through hedge funds is buying up an enormous amount of low end real estate. So, at the low end, landlords will be competing with the 1 percent and that could be problematic. How long they continue to buy massive amounts of housing is unknown.

I say we go back to 3.5-4.0 home price/income ratio. We are not going to 3 which is the approximate national average because Californians still have a “location premium” and interest rates are still quite low.

What was the price/income ratio for mid and upper tier counties in California during the 60’s, 70’s, 80’s & 90’s? Has a “location premium” always been priced in? I’m skeptical.

I don’t know what the price income ratio in the 70’s was but I declined my sisters offer to buy a 3 bed rancher on the ocean in La Jolla for 60,000.00. Working ordinary blue collar jobs we could have afforded the house. There is nothing you can buy there today with out a pile of cash or mid to high 6 figure incomes.

When we live in a world where money can be created out of thin air, things that are unique, limited and wanted usually go up much faster than other stuff.

I think coastal real estate in this day and age is almost in the category of “collectibles”.

I believe coastal Calif will eventually come out of its bubble but forget about applying metrics from a pre fiat currency era and using that as any kind of guide.

It may have been 3 to 4 times annual income in the past but I don’t think it will get that low again( again, I am speaking about some very specific areas of Ca).

On an “average” , for the nation and for parts of California, I do agree it will return to historic norms.

Thanx for your amazing work dr. I believe we will drop 3 to5 percent more and that when the election is clearly seen as the lock it is for Obama, prices will soon bottom and begin to rise. With so much capital pumped in to the financial system there is no doubt there will be inflationary pressures during Obama’s second term. We’ll see! Thanx again for your work.

sorry. Inflation is not going to bolster housing prices in this environment

Inflation will affect prices in mid-tier bubble areas like the 310, 714, 626 and 818 area codes. With wages stagnant or declining, inflation in the non-housing sector means less money available for spending on housing. So inflation in non-housing items will lead to deflation in housing costs so long as wages are flat or declining.

Inflation will only affect necessities only. Food, Energy, etc. It will NOT affect home prices this time around as there are NO JOBS. In addition, we will have higher taxes, more unemployment, Austerity like they are having in Greece. Home prices will drop at least another 20%.

It all comes down to income. At some point, people have to earn the money to pay for their homes.

I hope prices for mid-tier California homes align with incomes quickly, but I wouldn’t be suprised if it took a decade.

This is what I’ve always thought, but working west of the 405 I am losing hope. It seems absurd that $500k homes within an hour from here (and NOT in crappy south LA neighborhoods where I’ll feel afraid to walk outside at night) are all fixers or tear downs. For a decent house you’re looking at $650k at least…and for something I consider nice on the westside, more like $800k. Who the hell is buying this??? When you see the median home income here being in the $65k range, it seems absurd that this is sustainable or rational in any way.

But recently I’ve heard the argument that median income does not matter, that it is artificially brought down by the high number of low income earners in high density housing (1960’s apartment buildings of crammed shoeboxes all over the westside). That there are enough rich people in LA wanting to live on the westside, who have enough money already or jobs that pay highly enough to support these prices forever. Could this be true? I suppose even if you don’t work on the westside, but elsewhere, you’d STILL want to live close to the beaches, so perhaps there is something to this argument after all.

As a single earner with an income just above $120k, the most I can afford is a condo at around $400k. Perhaps I should either accept that I’ll always share walls if I live in LA, or just move to Texas where 3x my income (which would probably by then be more like $85k) would buy a 4 bedroom house with a pool less than an hour from work.

Could it be that the westside will ALWAYS be like this no matter what? That the sheer amount of money in LA makes the median income irrelevant?

The key metric we’re all missing in this discussion is median homeowner income. I haven’t seen anyone with this data, so it may not even exist. The other factor to consider is that Prop 13 enables people to stay in houses that would be out of their income bracket, if they had to pay for the public works and services that they use (read: pay the current tax value on their property.) So even if we get media homeowner income, it won’t really answer the question of how much money homeowners are making to live near the beach in Santa Monica, but it would be a better metric than median income by itself. Median income includes all those people crammed 10 people to a 2-bedroom apartment in LA.

I think the sheer amount of money in the Westside, and rich parents, will sustain frothy prices in the West of the 405 areas forever. You could go rouge and buy a motorhome, one of those super fancy slide out monsters. Find an old lady who will let you park it in her driveway in exchange for security and $100 a month and you can take to the road for trips on weekends, eff the whole housing market. My husband is not game for this plan.

The short answer to your question is: Yes. Your analysis is exactly right. I’m a long-time Westsider, a 1%er and belong to a well-known Westside golf & tennis club. I never hear complaints about pricing; nobody is ever foreclosed upon and everyone pays his dues without grousing. It’s taxes they hate. The vast majority of LA’s 1%ers live on the Westside, buy the good properties and leave the median income apartments to the median income residents. There’s virtually no middle class on the Westside in financial terms.

I hope prices for mid-tier California homes align with incomes quickly, but I wouldn’t be suprised if it took a decade.

I wouldn’t either Joe. If you think about it, its been almost half a decade since the point of inflection in housing prices in SoCal, so we’ve got another half decade to go.

If you consider that prices seemed to inflate at about 20% a year on the way up, and seem to be deflating like a wrinkled balloon at 4 – 7% per annum on the way down, we’ve got at least another decade to go until prices are free of bubble froth.

“Any predictions on where the Case-Shiller will be one year from now? Nationwide? Los Angeles?”

Real estate market will go sideways for the next few years.

Doc posted a very interesting chart few months ago which compared real estate prices relative to the previous decade. It was very interesting and I have not been able to locate that chart. May be the good doc can post it again and superimpose the following in the same chart (interest rate, inflation rate, unemployment rate — guess back then underemployment terminology did not exist–, CPI, GNP/GDP, and whatever the good doc deem appropriate and necessary.) Small spikes which was seen in 2010 was very similar to the 1955/6/7 and after that real estate went sideways for the next 15-20 years.

As Mark Twain said: “History doesn’t repeat itself, but it does rhyme.â€

Doc, we really, really need someone with your insight and analysis up here in the Bay Area! (especially in the East Bay)

I’ve rented in Oakland for 15 years and would like to buy here in a half-decent neighborhood or in Berkeley (the latter is unlikely, since half-decent little renovated bungalows in less-gentrified neighborhoods start at almost $500k, and fixers get snapped up by realtors and investors).

I still see jaw-dropping listing and selling prices and low inventory, except in rougher neighborhoods under 300k. I don’t ‘get it. Maybe there really are that many high-income households – there’s no shortage of homes selling in the $500s, 600s, 700s, and up, and many seem to get snapped up quickly.

But I also wonder how much of those high prices are due to shadow inventory. I don’t know of anyone doing regular analysis and commentary up here, but it would sure help.

(I also see a sizeable number of suspicious listings – I have a hunch there’s a lot of flopping and other inside dealing going on here. It’s a tough market.)

East – I don’t have a prediction but I do feel your pain. I’ve come to realize that in these bigger coastal cities (I’m from the Midwest) the simplest way to put it is that it seems there are more big fish here, and they make more money. I get caught up in the whole L.A. thing, but after traveling to Vegas, Phoenix, etc. I remember that there is a big world out there. To focus on one city (like Berkeley) and wonder why prices are so high? I’ve done the same thing about suburbs down in L.A. and have realized that the bigger fish just plain live there because they can afford it. Middle class folk commute to suburbs and exurbs, or move to interior states with cheaper cost of living ratios.

Don’t know if I helped or not, maybe just gave another perspective

You are spot on. There’s just a lot of high-income and wealthy people out here. There just is…As I drive around SW Pasadena, I think this to myself. Still old money types and entertainment industry people snapping up the beautiful old mansions.

http://quickfacts.census.gov/qfd/states/04000.html

Phoenix median household income just under $49,000

Pasadena median household income a little over $65,000

Berkley median household income under $59,000

These are the only known facts, the rest is just speculation…

And your point is?

“There’s just a lot of high-income and wealthy people out here” What do you mean by this statement? I live in a neighborhood (coastal Nor-Cal) with the median income of just under $83,000 and the housing continues to decline. I think there are a lot of pretenders in these So-Cal neighborhoods and I think the facts show it. The banks are just not foreclosing on these pretenders as fast as they have in other areas of the country for reasons we have read on this site over and over again…

Well, I have a friend who is the heir to a famous Swiss watch co. He just paid cash for a $1.4 home. Another friend who comes from old money, she owns several homes in the Pasadena area. They are out there!

I am sure Larry Ellison is looking for a new beach front property as well… Who cares! The reality is that the majority of people are broke! Yes, there are a few billionaires out there but it will have little effect on the housing market over the long run. The real story is how real estate agents are selling shorts/foreclosures to each other (flopping). This is what I am seeing in my neighborhood. There is very little inventory because the banks are holding the properties and the ones that make it are flopped before they are listed. Who cares!!! They are saving me from myself! The prices are down over 40% here and are slowly falling. I would rather these “investors†buy up all the property and then sell into the falling market when they start to have cash flow problems. I thank these clowns every day for the price discovery service they are providing the rest of us…

@What

I don’t think it’s high income as much as people of high net worth.

Also, median income is just a split of two groups, and not so much a reflection of what most people make. As an extreme example, 101 people could earn 100K/year, and 100 people could make 1M a year. This would make the median income 100K, but there’s still roughly half the population who make 10x more. A more accurate measure would be a count of people who have the type of net worth to buy expensive homes. Those who owned before the bubble can feasibly trade up, despite the high cost because their own homes cost a lot too.

That said, I realize saying ‘a lot of pretenders’ is a blanket statement, but using that to suggest that pretty much they’re mostly pretenders who are taking up expensive homes is pretty speculative as well, don’t you think? Given your facts, you really can’t prove there aren’t enough people who have the type of money (whether by income or overall wealth) to support certain areas in southern cal.

@ ed

Median income is the only fact that we can compare. If you look at median income in Palo Alto which is around $120,000 versus Santa Monica’s $69,000. The only facts we have on “a lot of wealth out there” is to compare median income of different areas. I would have to agree that anything beyond this is speculation. But where do you think the wealth really is more likely to be and where do you suppose the perception of wealth is more likely to be?

@What

the answer to your question would just be speculative 🙂

I’m ok with speculation, but I’m just not satisfied with median income as a basis of speculation. Sometimes, the best answer is no answer at all. Take it from an agnostic point of view until we get more relevant facts.. hehe

eastbay – you might find this site interesting

http://bayarearealestatetrends.com/

The editor of this site:

“About Greg Fielding I am a longtime real estate agent…” Everything after that is suspicious….

Corrections are never orderly.

In Japan, the “we’ve bottomed” matra went on for decades. I would imagine an area like California, where optimism (delusion) is more rampant, it’s easy to conn people into thinking a “bottom” has been reached.

Start thinking about what the price should be based upon utility. What are the rents in the neighborhood? Will they cover the cost of acquiring, holding, maintaining, taxes etc? Get familiar with material and building costs. When you consider all these things, you will then know where prices have to go>> still down. In spite of what our impressions are, there arent tons of rich people, and if they are buying now, they are likely stupid. Even if you pay all cash for a mansion, if you go to sell it, or rent it out, the rent won’t cover the property tax!!! Do “smart” rich folks blow money like that? Unlikely, else theyd be poor. Fools an money soon part ways.

Could someone be kind and answer a question I have about the Inland Empire?

We are expecting a baby, and need to get a 3 BR residence. We are thinking of buying, and it would be in the more desirable areas around Victoria Gardens in Rancho, or by Wood Streets in Riverside.

Any predictions on how much further home prices will fall in these areas? I guess you could call them “mid-tier” IE neighborhoods? Rents are getting so high it’s cheaper to buy, yet we don’t wantto lose our down payment if something happens. I can handle stagnation but any prices falling 10% or more, I’d wait.

We are buying to stay for 5 years minimum…

Thanks!

Well, from reading this blog today, it really sounds as if prices may drop another 10 to 20 percent in the next while. “Word on the street” is that you should wait until the third quarter of this year for prices to drop further. It’s all speculation of course, and things like wars, elections, and earthquakes can change everything. I think you should keep reading this blog very closely, and even read the archived blogs. You will be way ahead in the guessing game

Good Luck!

Papa. There is an expression in photography and real estate. Good bones. I would advise you to envision the quality of home you want, find out what makes a good home, what you need [in terms of space, utilities, location, schools] and start looking in the neighborhoods you would be OK to be in for the rest of your life. Make offers below asking as investors do [your numbers and presentation has to be good] and be patient. Worst case scenario if in 5 years you have to move you will have a good home you can rent out while you rent in new area while waiting for things to get better. If you do buy soon put double principal down on payments. You should be able to afford that over the first five years and you won’t be negative even if the market goes down.

I live on the border of the inland empire (Chino) and it can be a great place to live, except in July-September when it tends to get really hot out there. But at other times of the year the area can have a lot of charm. I especially like the fact that there is still farmland and agriculture out here. The open spaces are nice. I like Rancho Cucamonga a lot; great schools, nice shopping centers, up against the mountains, etc. Riverside not so much because of the desert and the scummy areas that border it.

Prices may drop another 10%, but I sort of doubt it because home values have already dropped significantly in the last 4 years, and they have been hovering around where they were in the 2001-2002 timeframe. In addition, homes that have fallen to the right price are being bought, and not necessarily by flippers. Either way, if you go into it with the idea that you are going to be there for the next 10-15 years, I believe you’ll eventually get some equity in the place. Homes are always good for the long-term investment (if they were priced correctly to begin with).

If I were you, however, I would also look at some more established areas such as Chino, Chino Hills, Upland, and the Alta Loma section of Rancho. You can find some good deals there on newer homes without the Mello-Roos taxes, and you don’t have to worry so much that today’s brand-new showcase suburban neighborhood becomes tomorrow’s gang-ridden Meth slum (see Moreno Valley).

See Japan…

Just as people would hope that home prices went up forever, there are also people who hope that home prices will just free fall back to the pre-bubble days within a very short amount of time.

Currently, prices are sliding gradually, and will continue to do so until they just sort of level off. Rates will stay low for a while, and the government will keep trying to do whatever it can to prop up the market. Some would argue (and rightly so) that the government’s attempts are failing, but I could also argue that the government’s goal may not have been to fully restore what was lost, but simply to slow the bleeding without letting the housing market collapse upon itself. There’s just too much at stake to leave it to burn.

I can imagine another 10~15% cushion for prices to fall in the mid-tier markets, but really depends on the area. The cost of financing debt has decreased significantly since the pre-bubble days. It’s just a matter of whether rent prices are comparable with monthly home expenses (mortgage, insurance, etc).

I agree with your analysis, Ed. Every real estate correction involves a flattening out period, which takes at least a year or two. Additionally, I think your suggestion of looking at comparable rents is a better barometer for Southern California than incomes. We’ll never get to 3x income because So Cal is built out for the most part, and despite an exodos of some middle-income folks, big money continues to come into So Cal….if it can’t all land in Santa Monica it will seep into Culver City. There’s also Prop 13, which keeps 1950’s, 60’s and 70’s real estate lottery winners in their homes for themselves and their progeny.

The doctor has done a lot on income analysis, but not so much on rental property parity ….I’d like to see more.

http://quickfacts.census.gov/qfd/states

Culver City household median income is a little under $41,000

Santa Monica household median income is a little under $69,000

Palo Alto household median income is a little over $120,000

So-Cal is a sea of pretenders!!! The numbers will prove it over and over and over again… You can buy the BS but I am from So-Cal and know better…

“Some would argue (and rightly so) that the government’s attempts are failing, but I could also argue that the government’s goal may not have been to fully restore what was lost, but simply to slow the bleeding without letting the housing market collapse upon itself. There’s just too much at stake to leave it to burn”

The government actually made the problem much worse by delaying the inevitable collapse of the housing market. There were many knife catchers these past 5 years who have bought properties and are now underwater. They have devalued our currency, bailed out Bankers, trillions in debt, to try to prop up a falling bubble. This is crazy!

Exactly!

i agree with you, but not sure what it has to do in context of predicting the gradual fall in home prices?

Prediction – With the ongoing governmental intervention. Fair value will go to 90 on the Schiller index.

Without interference index would have already gone to as low as 80 in 2010 and would presently be sitting around 90

There is massive wage inflation and has been for a while. But only at the top. Not only that, but the top tax bracket rates are lower than they have ever been, motivating short term thinking and making gaming the system very lucrative. The result of all this money in few hands? More corruption. Is it money laundering if you work for the government and provide trillions to certain favored individuals to invest? No more so than getting people killed in a war is murder. They will tell you it’s legal, and necessary, even though it may fly in the face of reason. What I’m getting at is don’t be surprised when you find yourself renting from some faceless entity because your money is not worth enough to buy you and yours a home simply because someone with unlimited funds and connections is buying it first. It takes a while to create the justifications. And to destroy property rights as we came to know them. But it seems to be well on the road to being achieved.

Yup, this is coherent.

Complain about “low tax rates” and “property rights”.

Makes perfect sense.

Ya might want to reconcile that with the fact that history’s greatest grifter, Warren Buffet wants much higher taxes….yet does not pay his taxes.

“This number sounds familiar because it really hasn’t moved in well over a year (like pretending the toilet magically unplugged itself if you simply choose not to flush it).”

This made me laugh. Farmers in El Centro have an expression regarding fertilizer “Ah the smell of money”. The clogged toilet appears to be the smell of money to the mark to fantasy, free to hold properties and bailed bankers. Not releasing the clog allows them to claim financial soundness.

On a note of actual analysis I’d like to ask your opinion on the current jobs report that i found on MSN today; Payroll processor ADP says private employers added 216,000 jobs in February”.

Do you think this might have any effect on housing. New jobs. New sales? You also said the pipeline is beginning to unclog but your chart showing the same number of foreclosure properties as 09 says just the opposite. I’m out looking at real estate and clearly as you so often write these are not on the market. What do you make of that? Especially in light of the CA AG deal on helping home owners.

Lastly, do you think the decline in mid-tier will pressure the lower end lower?

Unless there is a big financial event similar to what happened in 2008 which results in big banks either failing completely or being nationalized I think that home prices will continue to slowly go down for years similar to what happened in Japan.

Interesting site:

http://america-underwater.tumblr.com/

I’ve been tracking # of active properties in some OC cities (FV, IR, HB…) since summer of 2010 on a monthly basis. The number of active properties are about 50% – 60% what was available in 2010. I’m waiting for the market to get unclogged and sure hope it happens soon. I’m thinking I might have to wait until the election to see some significant changes…

OC, you aren’t the only one who noticed that. There is simply no inventory right now, I looked in HB between 400K and 600K and there is little if anything available. The OC Register had an article yesterday stating this is the lowest inventory OC has had since Aug. 2005. Aren’t we already in the spring buying/selling season…I don’t think it’s officially spring yet but this usually kicks off after the Superbowl. And wouldn’t the banks start dumping their stockpile of houses knowing they are on the correct side of the supply demand equation. I guess with no inventory, you won’t have a lot of sales…maybe we’ll see those headlines soon.

Trying to wait this market out is torture, but then again losing tens of thousands of dollars a year by buying is the only alternative. 🙁

I have noticed the same thing in the Temecula and North San Diego county inland areas where I have been watching the market since 2010. Now I am actively looking to make an offer and finding that there are less listings and the asking prices are going up. Just gonna have to wait for the 2 million in REO to start showing up and the 90 plus days delinquents to get to market. This could take a while.

What are your thoughts on the Oak Park area? Are we at bottom? Inventory has gotten low in this area, is it time to buy here? Have rented for six years and thinking of getting back in.

Hey Renter, Don’t buy yet ! We sold 3 years ago and are renting on the Westside, waiting as well. It has not even bottomed out yet, way too many foreclosures banks are holding on to. Besides, do you really want to buy a house from a flipper/wannabe investor and put money into their greedy pockets ? We would rather rent until we retire than buy into the insanity of crappy construction, corupt California real estate.

People who own small businesses cheating on taxes and family money will keep prices stable in So. Cal. Mom and dad put down 200k on your $650k home it’s all good.

Joe Blow – that is EXACTLY right. What people don’t seem to realize is that the 1% have extended family networks and they help their own. You think the Persian families who dominate Beverly Hills are paying full taxes? So all of the money at the top filters out in the form of gifts and schemes to keep friends of the favored few afloat.

No one who is not cheating on taxes and who makes under 250K per year should be buying Westside realestate right now. It is a recipe for disaster.

Ken Rogoff’s book discussed the real estate bear market, and it typically lasts 6 years historically. However, the real estate is local, and the information is limited, and not readily available in the past. Today the internet is much faster, and the information is a lot more abundant and available. I wonder if the bear cycle is still the same. In another word, the effect of internet on the real estate market cycles.

People need jobs and decent wages to buy homes. We’re far from out of the woods on that one. Until true unemployment gets back in the 7% range, there’s little, if any, hope for real estate prices to rise. If prices drop another 5% to 10%, how many more mortgages would become underwater at those prices????

Robert Shiller on housing. Might be bottom.

http://video.cnbc.com/gallery/?video=3000077311

I don’t think prof Shiller really wanted to go there… it was sort of coaxed out of him. His outlook really seems to be that there’s some more downside left, and housing won’t really ‘boom’ for another 2 decades.

Shiller said housing market is all about the momentum. The momentum is still down, but slowed to flat. Also, the government debt is huge, and it will not and it cannot be paid off. The only way out is to inflat, printing a lot money, and make those debt worth less.

bubble started around 1997 – don’t see any reason why prices shouldn’t fall back to that level

because debt is cheaper?

Wages are down? Unemployment is higher? Employment is less secure? Potential buyers are saddled with debt? The economy is in the crapper? Home building exploded during the bubble?

I agree with shellz, a little bit below 1997 is the target, but it may take a few years to get there. But as Japan has shown, it eventually gets there, even with 2% interest rates.

It is very frustrating that Banks are purposefully withholding inventory to keep prices at very high ridiculous bubble levels like in Culver City. Bungalows that once went for $200,000 in 2000 are still going now for $700,000 with bidding wars. Meanwhile, behind the scenes there are some 300 foreclosures not listed on the MLS.

My area of expertise is the Coachella Valley, where prices can’t go much lower. I work in OC though and of all my friends my age (34) only the people with rich parents have houses in nice areas. Rich families give adult children money for homes, when they wouldn’t hand it over in cash or for investing. My co-workers and friends who are not making less than $300k AND do not come from money rent or live in low end IE. There are sooo many parents who give children money for houses, I think it is propping up markets in “good school districts”.

Good post DrHb. A lot of people won’t be having the mortgage “paid-off” party no matter how you slice it. What was I thinking when most if not all of my money was going for a home/house and carrying costs about 50% of the basis? There is still is: travel, education, cars, motorcycles, nice clothes, furniture, jewelry, holidays, church, gas, taxes, good food (not packed), helping less fortunate, health, kids, etc, etc. Hey that’s how I learned to love Socal…sound familiar?

My dear Doc., the front – end ratio is an idiotic concept. That’s what one gets when one combines gov. stupidity (Fannie, Freddie, FHA) with private biz. greed.(Banks) For the last ~70 years the real estate market has been distorted due to GSEs. We are looking at the results right now. If the banks had to hold the mortgages, the ‘ratio’ wouldn’t be their first concern and the ‘+ 5% yearly’ would become – 5%.

In CA it almost looks to me like the bubble is re-inflating. Out in inland Socal the prices are on the rise. Sure inventory is low, but people are still paying 6-7 median income.

To add, are the mortgage underwriting standards lower now than they were in 2010. I don’t know where all the people are who can afford this.

Hello Dr. Bubble,

Read you religiously! Love the comments from your fans, the coherent ones, well actually the others are entertaining too. IM requesting you put (+google) so I can share. Im a real estate agent and if I post you on my FB, I think I’d be fired. You see they are saying things in the office like, “Things are turning” and with this here we go attitude “This markets back in a race to the top.” I find it very uncomfortable, It’s like when your huge girlfriend struggles to get into a pair of jeans then ask, ” do these make my ass look huge?” The invitation to denial! DO you dare speak the truth?!? These people that are clearly delusional, is it even safe to be in their presence? Kidding, well kinda….mt

The inventory of homes for sale is quite low can you tell me why you think this is happening?

Well when you factor in the rate of immigration you quickly realize that housing inventory levels will continue to drop going forward. Especially while new housing starts are low.

Leave a Reply