Shadow inventory Armageddon – Foreclosure timeline up to an average of 599 days with 798,000 mortgages having no payment made in over 1 year and no foreclosure process initiated. Shadow inventory grows to over 6,540,000 properties.

The biggest problem facing the housing market is still the large amount of stubborn shadow inventory. The fact that this figure remains elevated is a sign that the banking system after all these years and trillions of dollars in bailouts has yet to figure out a streamlined way to unload properties. The Federal Reserve is trying to grease the wheels with historically low mortgage rates but that has done very little since this does not address the weak economy. At the latest count there are 6.54 million loans that are either delinquent or in the foreclosure process. This figure hasn’t really moved much for the entire year. Properties have been sold from the REO (bank owned) pile but this is the tiny chunk of properties that is covered by the mainstream news and also that appear in public listing services. As we will show in charts later in this article, only examining this piece of the real estate pool is like seeing the tip of an iceberg and thinking there is nothing underneath it submerged in the water.

The stagnant shadow inventory

The latest data shows that the shadow inventory has increased a bit in the last few months:

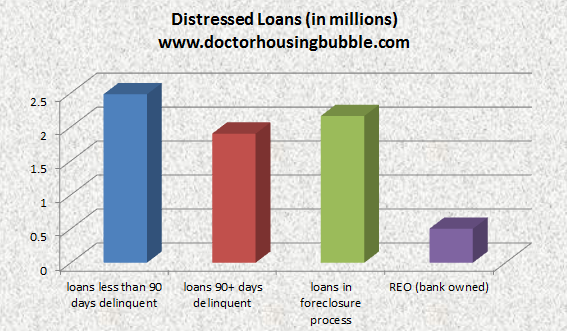

To break down the figures even further you have 2.48 million loans that are less than 90 days delinquent (3 missed payments), 1.9 million loans that are 90+ days delinquent (more than 3 missed payments), and 2.16 million loans already in the foreclosure process. In total, this adds up to over 6.54 million loans in the distressed pipeline and this is what I would categorize as the shadow inventory. As the chart above highlights, only about 500,000 properties are actually real estate owned and show up for sale in local MLS data (and not all REO show up but a lot do). The cure rates are abysmal on many of the loans and many are underwater to levels that will never cure on these properties. In fact, the latest data shows that the typical foreclosure process timeline is now up to a stunning 599 days!

“(LPS) The July Mortgage Monitor report released by Lender Processing Services, Inc. shows that foreclosure timelines continue their steady upward trend, as a payment has not been made on the average loan in foreclosure in a record 599 days. Of the nearly 1.9 million loans that are 90 or more days delinquent but not yet in foreclosure, 42 percent have not made a payment in more than a year with an average delinquency of 397 days, also a new record. At the same time, first-time foreclosure starts in June were near three-year lows, and first-time delinquencies accounted for only 25 percent of new delinquent inventory.â€

Even more disturbing you have 42 percent of the 1.9 million loans that are 90 or more days delinquent not making a payment in more than a year (approximately 798,000 mortgages are going with no mortgage payment for more than a year yet no foreclosure process has been initiated). The data doesn’t break this down further but how many of these non-payment properties are here in overpriced markets in California like Beverly Hills, Bel-Air, Manhattan Beach, Culver City, or Pasadena?  The numbers are stunning from the pieces we have gathered.

Part of the interesting market dynamics is that you see areas like Florida, Nevada, Arizona, and even the Inland Empire here in California selling well given to the crash in home prices. In other words, the market will clear properties out nicely if the price is right. Of course banks are pretending the most expensive areas are the healthiest when that is not necessarily true. Take for example the overpriced Orange County:

MLS non-distressed listings:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 16,307

Notice of default filed:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 4,721

Auction scheduled:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 6,951

REO:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 1,798

Even in a county where prices are still inflated you have nearly as many homes in the distressed shadow inventory pipeline as you do on the MLS. And keep in mind, 4.38 million properties have missed at least 3 mortgage payments and no foreclosure process has been initiated. The NOD is the first step in the foreclosure process. Also, you have 798,000 people living in homes that have not made a payment for at least one full year. How many folks in Orange County fall in these categories and are part of the shadow data?

Now the issue about the shadow inventory is the pipeline shows no signs of sizeable clearing. Why? Even though properties are being cleared out via REO sales, this is a small fraction of the pool and it also doesn’t include the fact that tens of thousands of people each month are thrown into the distressed pool because of the economy. This is why you have a tough battle ahead. What is a more “normal figure?†for shadow inventory? Hard to have an exact figure but a healthy range is within the 1 to 2 million range. 6.54 million is very far from that baseline figure.

The hidden cost of living

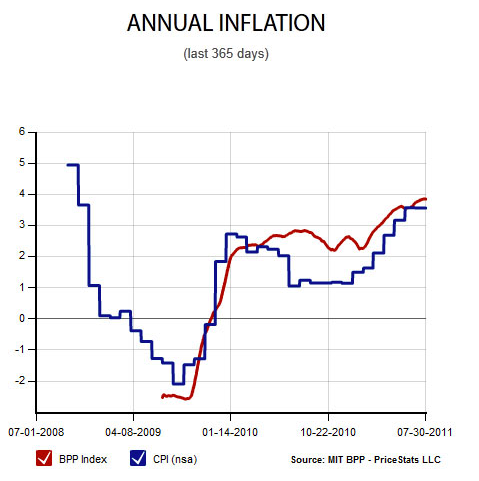

There is a good measurement tool over at MIT that is called the Billion Prices Project (BPP). This measure seeks to get a better idea of the real nature of inflation in the economy:

Source:Â Â MIT

Contrary to what we are being told the cost of living is going up. You have a variety of things happening from producers chopping down ounces or repacking goods giving you less for the same price to energy costs still being high (a gallon of gas here in L.A. County is stilling running over $3.8). You also have health premiums going up all the while people have no growth in household incomes. Yet the MIT data shows year-over-year inflation is now up over 4 percent. This figure is incredibly high when there is no added wage growth (even a 1 percent spike with no wage growth is crushing). You don’t need to be an expert here but just look at your monthly purchases to see this revealed.

The big ticket items like housing have been falling but for most other daily goods the cost has gone up. This is why the bigger issues that will push housing lower are outside of the housing arena (i.e., jobs, healthcare, education, food etc).

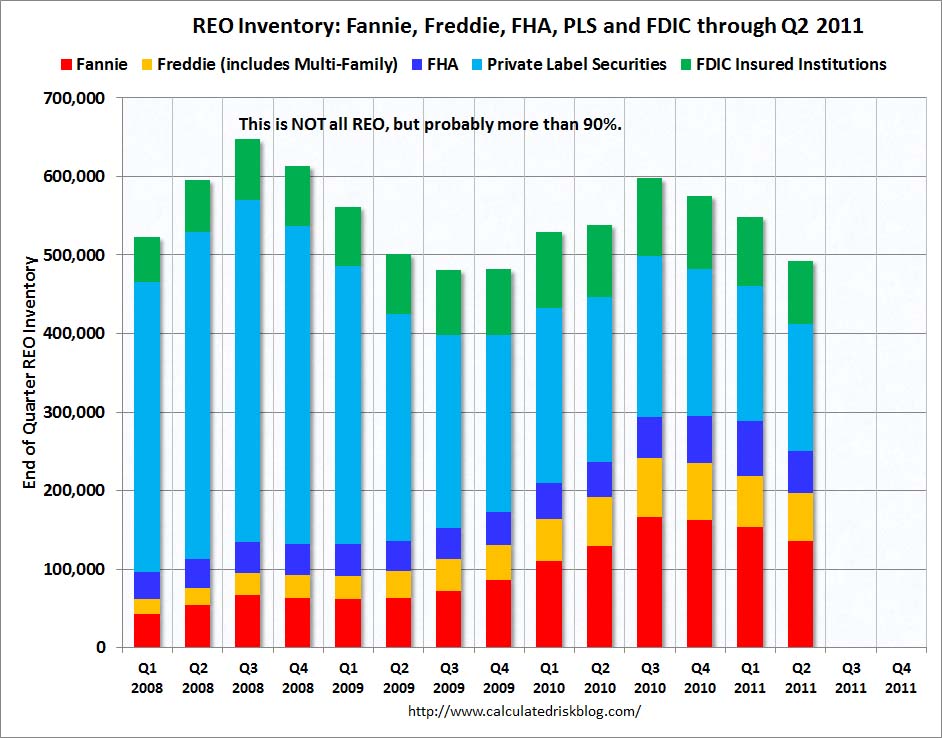

REO not reflective of overall market

As we have mentioned, the coverage in any mainstream press is heavily focused on REO inventory:

Source:Â Calculated Risk

The above snapshot is incredibly limited since it covers about 500,000 properties whereas the true shadow inventory figure is up to 6.54 million. Of course the banks are happy pretending the housing issue is only 500,000 homes but the reality is much more disastrous and given the immobility of the figure, we realize banks still have no handle on how to move the properties. Why? Because they are only focused on keeping their personal interests going at the expense of taxpayers. Most of the loans are government backed (aka taxpayers) so it is ironic that we give the same banks that caused this financial mess the obligation and power to clear out the inventory. Is it any wonder it has been a boondoggle? How many million dollar bonuses have been paid to banking executives all the while the housing market has continued to implode? It would have been better to create a RTC like entity, let too big to fail actually fail, and simply clear out the market. As we have seen, price will get sales going and also free up disposable income instead of paying the bank to live in a stucco home. Four years into the crisis and we are still at worse than square one. What do you expect when people trust the same financial and banking sector that led us into this mess to solve it with no actual change?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

80 Responses to “Shadow inventory Armageddon – Foreclosure timeline up to an average of 599 days with 798,000 mortgages having no payment made in over 1 year and no foreclosure process initiated. Shadow inventory grows to over 6,540,000 properties.”

As housing takes another trip downhill, there will be more “home owners” that find themselves under water on their loans. And so the cycle continues to unwind the housing bubble.

The perfect generation storm: Stagnant home sales (due to banks manipulating the flow to market) coupled with stagnant income (due to BIG .gov regulation, malinvestment, outsourcing of jobs, tight credit and wage arbitrage).

Batten the hatches mateys, she’s gonna blow!

Got precious metals?

Dr. Housing

Your website is by far the most informative and best written expose of the US housing market. Thank for your diligence is bring readers the truth.

True enough. But it won’t be so linear. You may have heard rumblings about bailing out underwater homeowners by giving them a refi. The plan is much bigger than that. Here’s what I think is the most significant news this week:

http://www.zerohedge.com/contributed/feds-plan-rumors-news

Not only does this buy Obama millions of votes, it solves much of the MERS fiasco so that house titles are free and clear again. And recapitalizes Freddie and Fannie. Along with $1 Trillion to the Federal Reserve to buy Treasuries.

And sticks the Taxpayer for the tab to the tune of over $1 Trillion.

Truly amazing what lengths they’ll go to. The Administration thinks it will buy them a couple of years. Only if they are lucky. The last QE lasted 6 months. I give this one a year, max, IMO.

Wow, keeping printing away. Gold and Silver and commodities will continue to go higher due to devaluation of the Dollar.

The reason why banks are dragging foreclosures out is because by law they can only have 3 percent of total bank assets be in real estate. Any amount over 3 percent has to be sold or the bank has to de-list as a lending/banking institution. If the banks don’t initiate foreclosure; the houses aren’t on their books and thus not counted in banks assets putting them over the 3 percent holding. If the banks foreclosed in a timely manner all of the banks in the U.S. would be in violation of the truth in lending laws and the Government would be forced to step in.

“The reason why banks are dragging foreclosures…”

The reason is because “They Can”.

Until the dumbed-down-to-sucumb sheeple *STOP* voting for the the (D) & (R) Free Crap Empireâ„¢, not a freakin’ thing will change!

The looting will continue until morale improves…

Thanks for the straight poop! No wonder we have such a big mess with the banks. We must really be in bad shape for the gov’t to resort to this (no mark to market). Unforutnately, it is prolonging the enevitable. The shadow inventory is piling up behind the dam and will one day explode. You can only kick the can so far down the road, until there is no more road. The government is happy to just keep monetizing the debt, slowly inflating until 90% of all consumers are renting everything, instead of owning. The government and BIG business have merged into one and are getting fatter at the expense of everyone else. Since very few are buying houses anymore, you might want to lock in a good rental at a decent price, before rents go through the roof. Then sit back and watch the slow motion train wreck. Best of all, you won’t be in it.

http://www.westsideremeltdown.blogspot.com

http://www.santamonicameltdown.blogspot.com

@lastesummer – if what you are predicting is tremendous inflation, then now, with very low rates, is the time to buy an affordable condo. As inflation rises and rates rise, your mortgage payment becomes relatively puny. Also, you lock in a low rate. With more people moving into rentals and inflation already here, rents would be expected to rise. How long term a lease can you sign on a rental , realistically? Eventually, you are going to have to pay market rent, unless you own. I just completed a short sale myself in Marina del Rey. Now renting happily. But Im worried that my credit wont be recovered in time to buy a place while rates are low and before inflation kicks into high gear. I hope things collapse in the next year to 18 months. It’ll be fun to watch… but if you are a long-term Angeleno, you have to consider all these factors. Even in a true depression, what economic activity remains would likely concentrate in the City here.

Housing has been so terribly destroyed by the Banksters that hyperinflation won’t hit it. Everyday items such as food, clothes, products, etc. are rising in prices and will accelerate.

Great comment! Here in Nevada the law requires the banks to write off a minimum of 10% of bad assets i.e. defaulted loans on homes and/or commerical businesses. However if they did that they would “appear insolvent” (they would BE insolvent) so what they did here, in Nevada was CHANGE THE LAW so that they the banks don’t have to write off the bad debt hence they will “appear solvent” problem solved. It’s a smoke and mirrors anyway, house of cards, creating something from nothing, borrowing from Peter to pay Paul, In the immortal words of George Carlin. “It’s all BS and it’s all bad for ya!”

The only way to insure a proper balance is to return to Mark To Market accounting. As long as a $1,000,000 loan that has had no payment by the borrower for over a year is still carried by a bank as an asset on the books for the full amount instead of a liability for say (on average) a %30 discount so a $700,000 liability there will be no change.

Fact is if all the banks had to write down the loans to market value there would probably only be 4 solvent banks left.

So if you do the math it works like this: a $1,000,000 non performing loan loses you about $60k a year in missed payments or you could write down the loan and lose $300k overnight. Further, the banks MUST write down the loan when it goes to sale, the new value of the loan is whatever it sold for on the courthouse steps. So $60k a year or $300k overnight, no need to tell you which one the banks have been choosing, why on earth would they do otherwise?

There was some thought originally that this might go on until the market improved and losses could be trimmed via increased home prices but a first year econ major can tell you -as we told the Japanese- you cannot put in a bottom until you reach bottom and pretending and extending only pushes that date farther out while freezing the economy.

The only good thing about a short sale or REO is it brings in a new owner and they usually paint, carpet, remodel and buy furniture all of which creates jobs and stimulates the economy and raises tax revenues across the board. A very good thing.

I am sorry but I do not feel one shred of sympathy for the folks who put nothing down, refinanced a couple times for cruises and cars and now haven’t made a payment in years while living rent free and not even paying their property taxes. Kick them out into the street and get new ownership, put a bottom into the market and create some jobs and tax revenue.

The real question now is seeing rates at Eisenhower levels has done little for prices, what happens when 6,000,000 homes come on the market over the next few years as they must do because municipalities can and will foreclose for back taxes after 5 years. Maybe the banks will step in and pay the property taxes to protect their loan and STILL not foreclose to take the big hit!!

“Gee honey, this no down loan we got is the gift that keeps on givingâ€.

Sigh.

Mark-to-market is extremely pro-cyclical and hence destructive: by implementing it, you create a situation where banks can’t survive a downturn.

Why? Imagine a bank that, for instance, that only made good loans, where the cash flow is positive and performance is adequate. It would have to revalue all of the paper it holds due to market conditions that have nothing to do with the actual loans it holds. Such a revaluation, if the average prices were heading downwards, does not reflect the loans that the bank is holding – as said, all performing and with proper returns – but rather market conditions. The bank is penalized for doing a right and proper job when the market tanks because of its competitors who haven’t been.

While I understand well the desire for accountants to have a better picture of the “true” value of a company at a given date in time, mark-to-market is a catastrophe, since it forces revaluations when it makes little or no sense to do so. If a loan becomes non-performing, that is the time to revalue it: if it is performing, then there is no necessity to revalue it.

Let me reiterate: mark-to-market as a procyclical accounting method causes business cycle swings to fluctuate much larger than would otherwise be the case, making things worse, rather than better.

Consider this: during an upswing property values increase, reducing the risk and hence capital requirements. Hence banks could loan even more money out during an upswing, but the moment that the business cycle swings back downwards and property values decline, this would force a revaluation that would lead to greater risks and increase capital requirements: this can, due to the nature of the banking system, lead to declaring banks insolvent – since their assets (reserves + paper) fail to cover their liabilities (loans made) – without anything actually changing in the real world.

Mark-to-market only makes sense if markets do not have business cycles.

“Mark-to-market only makes sense if markets do not have business cycles.”

Correct you are comrade, Mark-To-Fantasy Utopia is da bomb!

Rainbows and skittle crapping unicorns all around…LOL

http://reddogreport.com/wp-content/uploads/2011/04/Obama-Rainbow-Unicorn.jpg

Business cycle? Pro-cyclicle? ROTGLMFAO ;o) The lenders givith and the lenders taketh away. The real economy diverged from the one run by the counterfeiters quite a while ago. They decided it was every man for himself while the rest of us were deluded, still thinking this country was great thanks to the rule of law.

@Opie: Good points, but without real market value of companies’ assets, the stock market becomes a true casino without even the pretense of accounting valuations to back up prices. How will we know if BOA is really a better performing company than Bank XYZ that hired corrupt appraisers to value $50k shacks at $1MM each?

You’d only know how to value a company if you had insider information that was off the books…

Sorry, Opie. You are 100% wrong here. You are basically advocating accounting fraud.

Banks can well survive this, if they make legitimate loans. Gosh, how long have we had market-to-market accounting? And yes, Banks have survived. Over many, many business cycles.

Sure, some Banks fail. That is the entire point. They should fail if they screw up.

You are basically advocating a Communist Central Planning approach to finance. Here’s a clue: that doesn’t work. And the present American version of it isn’t going to work either.

No man, your argument is flawed because you are saying that if assets are still throwing off cash, then you shouldn’t mark to market. No one does mark to market in this case because the asset is still performing.

We are talking about non-performing assets in the 0 cash flow sense. 0 cash flow for a long time now on a lot of assets. Assets that are in fact negative cash. Those should be marked to market.

Let’s say that the banks were targeting an IRR of 5-6% over the course of the loan. Even if somehow payments are eventually made by someone down the line, the lost time due to non-payment virtually guarantees that they will never get the 5-6%. More likely closer to 0%. At this point, these should be marked to market. What about natural foreclosures? Say a house, 30 year mortgage issued in 1995 goes into foreclosure. Will this be marked to market or to model? Most likely to market since banks could probably find a buyer. Mark to model allows banks to treat similar asset classes differently and this in itself is fraud.

Imagine if all companies could do the same thing. GM could have millions of obsolete cars in inventory that wouldn’t fetch a dime on the market, and value them according to their own model. They would never have to take a loss on them EVER. As an investor, would be GM’s bondholder? Didn’t think so.

@John Opie,

Your point is interesting. I would make a counter argument. Take a bank manager in a mark to market environment. The manager will have to watch the market carefully. He/she will have to carefully consider the market before allowing a loan on a bubble asset. In mark to loan value, that consideration is not gone, but it is lessened. It strikes me that mark to loan is therefore more pro-cyclical than mark to market.

“It strikes me that mark to loan is therefore more pro-cyclical than mark to market.”

Don’t be too hard on him, he’s drunk on Keynesian kool-aid…

I really feel sorry for those saps, I can’t imagine what it’s like to live in a world where math doesn’t matter.

You can steal a lot more with a briefcase than you can with a gun, and if they know you did the crime, no worries, they won’t charge you, they’ll give you a bonus. It’s like handing bags of cash to guys who just robbed a store. You held up a liquor store…good job here’s some cash bonus. Nevermind the victim, let’s keep them invisible.

“You can steal a lot more with a briefcase…”

You can’t steal crap unless you’re part of the Ivy League Mafia.

Until the sheeple get tired of BOHICA, they won’t even start to realize they’ve been screwed blued and tattooed!

With the amount of wealth extraction that’s went unchecked from Nixon through Obama, there may be -0- chance of saving the USofA…

So glad my wife was unable to bear children!

Indeed. The top 4 executives at Lehman Brothers earned a combined $1 billion in compensation between 2000 and 2007 before Lehman suddenly went broke and dissolved. Not a single one has been tried for any crime. Not a single dime has been demanded in claw backs on their gains.

wasn’t SOX suppose to protect us from these cronies? They should all be prosecuted and clawed back, they are criminals.

When you consider that a lot of those REOs have been trashed or were already in need of significant work, it’s not hard to understand why they’ve been so hard to move. Even if you get a “good” price on them, you’ve still got to invest more money in repairs and updating, which can make them not so “cheap” after all.

On another note, it would be really interesting to find out what’s really going on with the people who haven’t been making their payments. I don’t suppose there’s any way to tell. For example, are they missing payments because of unemployment? Illness? Underemployment? Increased costs, and if so, what? Disasters? Divorce? A decision to exploit the situation and live free?

Living free as long as they can. Nothing is happening to them yet. Coffee maker goes on each morning, TV. The dogs eat steaks.

How can we put pressure on the banks to clear-out this shadow inventory? I have been waiting on the sidelines to buy for 4+ years. I know it is a stretch, but I am waiting for prices to drop another 50%. I am sitting on my savings earning .02% and getting cold feet to investing it in the volatile and over valued stock market or buying gold. I’m not so convinced gold isn’t in a bubble, but it seems like the best place to hoard my savings. I do think the stock market will have another crash this fall. I don’t know where to store my savings. The matress seems like the best spot.

It’s good to be a bankster!

With the ability to lend 100-1 against deposits (Ponzi scheme fractional reserve banking), not only do the banksters not have to balance their books, they get FREE funds from the DC politeers to keep their salaries/bonuses in the hundreds of billions!

Too bad, so sad, the poor wittle sheeple continue to vote for “Change you can bleed in”, thus consenting to the Ivy League mafia’s system of rape, pillage and plunder…

I don’t think people (besides readers of this blog) really understand how bad things are still going to get. (And I say this as someone who WORKS IN HOUSING!).

First, as the first commenter (CAE) mentioned, there will soon be more homeowners underwater on their loans as prices continue to decline. Even a 5-7% in some areas will cause huge numbers of homeowners to ‘sink’ underwater and walk away – more foreclosures.

Second, there are a HUGE number of existing owners that are holding on ‘for a year or two’ waiting for the miraculous ‘rebound’ (that will never come). Those houses will eventually be back on the market (as foreclosures, short sales or ‘standard’ sales) further depressing prices.

Third, as @Christian Stevens mentioned, most counties / municipalities don’t have the option to ‘extend and pretend’ like the banks do. If a homeowner is delinquent on property taxes, the length of time the homeowner has to pay the taxes or the state/county takes the property and auctions it off is determined statutorily. No if’s, and’s or but’s.

Fourth… In Minnesota – and I’m sure it’s happening in others states as well – we’re starting to see an increase in the number of second/junior lien holders that are seeking judgment (we’re a non-recourse state, first lender is outta luck). In Minnesota, junior lien holders can take up to SIX YEARS to decide to sue for judgment… and they are! Ex-homeowners (lost the home 4 or 5 years ago) who might now be thinking of jumping back in – – won’t be able to, as they are faced with huge judgments or bankruptcy. Another pool of buyers that will dry up.

Buckle up… we’re in for a wild ride.

Add one more scenario: Eventually equity will build for those who make 20+ years of payments.

LMAOFO!!!!

Nice to see a FB on Doc Housing Bubble 😉

Now back to your regularly scheduled lame steam media brainwashing…

It really does seem like most people are clueless about this situation. It shows when you see what some fools are still willing to pay for housing. There are still 700K properties in the South Bay selling. On the other hand, maybe we are the fools for not buying our dream homes then squatting in them for 2 years. It really angers me that these people were so irresponsible, along with the banks, and now they live free of housing costs. My life would be posh if I didn’t have to pay rent every month.

Completed my Deed in Lieu with Bank of America a few months ago after 2.5 years of non-payment. Hadn’t lived in the place in well over a year when it was finally taken back. They’ve owned the house for a few months now and it still isn’t even listed. This is a house that was only 4 years old and has no real repairs that need to be done to list and sell it. I can only imagine how many of these properties they are holding onto.

Great anecdotal insight. I’ll bet it represents a statistically significant portion of several markets, incl. here in Bubble Zone Two, So-Fla.

You’d think OFHEO/FHFA/FDIC would be able to “extract” hard data from the banks, any and all banks, and lenders of any stripe. Dang, maybe if I dig around on their websites, I’ll find it, in one form or another? Anyone know?

Am i the only one PISSED OFF reading this?? It angers me that people are squatting for free. I want to egg their house. I dont care whats their excuse, no one should be living for free for over 1 year. If they want to, its called section 8.

I think that’s called… Trickle-Down Economics, LOL/COL. 😡

Seriously, can’t let the bankSters have 100% of the graft… 97% will do… gotta toss at least a few crumbs to the sheeple. (Note that in many states–though laws are being changed at a furious pace–those missed payments WILL catch up to the borrower as a hard liability, in one or more ways.)

Also consider how this “programs” the sheeple into house-buying behavior, even in the worst markets. The NAR and MBA loves it in the long term, goes along with it in the short term.

The Sheeple have NO lobbyists, hence we always get shorn.

Seriously? You are more angry at these poor slobs squatting for a few months or a year than you are at the bazillions that slimey banksters and politicos have stolen right out of your pocket and from your children’s future?

More and more, its looking like the U.S. housing and economic fiasco is the same as that in Japan, except the U.S. dollar is the world’s reserve currency. Unfortunately, that fact will only delay, not eliminate, a final day of reckoning when it is clear to everyone that we are sliding from recession into depression.

Jason: I read this blog all the time and it also makes me want to take a bat to people’s heads. Not only the lame squatters, but the evil greedbag bankers and our whored-out elected officials who carry the water for them. They aren’t allowing the market to clear and become free and fair again.

There would BE squatters if they had not first beden victims of fraud! Do you know how many people I know, lawyers, doctors, etc that put dpown 100’s of 1000’s of dollars into homes now worth less than they owe and have since lost their jobs? Really I understand your anger and there are those that truly are taking advantage of the situation but the majority got screwed, raped, pillages and plundered and then our great government gave over quadrillion away in bail outs for the BANKS that was money that was supposedly going to help the defeauded borrower homeowners! We wouldn’t even BE in this situation if they hadn’t CHANGED the bankruptcy laws in the united states in COINCIDENTALLY 2005! where they took away the rights of judges to lower the principle on a home to CURRENT MARKET VALUE!@ You don’t think they knew the market was manipulated when they changed that law? Bankruptcy laws were CREATED to help homeowners keep their homes! If they had not changed that law, the economy wouldn’t have crashed as people would not be jobless and now homeless. I am seeing people climing abandoned homes and filing LAND CLAIMS WHY?? because the BANKS DON’T OWN THE HOMES! it is unsecured debt at BEST! Learn wtf happed people! http://theelynnchase.blogspot.com/2011/08/institutional-mortgage-frauda-guide-to.html

LOL, dude you are more than welcome to bring that bat over to the ones defaulting on their house. You may get to see the light coming from the end of the shotgun before all goes black.

If you think YOU are angry, imagine losing years of hard work, your home, and your job. So grab that bat!!! In actuality, you just might bring a smile to the person who gets to blow you away in self defense, AND there would be one less sheeple who doesn’t understand or grasp what REALLY is going down.

All this negative talk. Look on the bright side. People can stay rent free in their homes to close to 2 years. This is not only the mortgage, but the taxes and insurance. What a win fall. That is worth a lot. $30-60 K. This is a great stimulus to the economy by the regular folks. Let us keep this our little secret. The banks are winners too. They do not have to take the loss and write down their assets to the true FMV, if they did that, they would be out of business.

See folks, this is win-win. Of course, the music will stop someday. This bubble will too burst, and then God help us.

LOL… I fully catch your sarcasm, but just for completeness: here in Bubble Zone Dos, i.e. FLori-Duh, the taxes ARE being paid on squatted props, because the counties can and WILL foreclose WAY faster than the courts.

Because the escrow was dissolved to do this, I can’t tell from public records (AFAIK) whether the insurance is still being paid or not… it is hurricane season though… hmmm… good question, as rates are (once again) skyrocketing here in F-Duh, where the I-branch of the F.I.R.E. industry totally PWNS our State Gov’t.

I will have to nose around… but I’m sure the insurance issue varies from lender to lender, scam to scam. The RE Brokers in FL *are* busy… just not selling props… they’re selling scams, err, I mean “accommodations to unusual market conditions”. Some scams are sold over the table, i.e. to State.gov, and others fly under the radar, hoping Duh Feds don’t notice… or have time to prosecute. It’s dynamic. It’s shady. It’s Flori-Duh!

To increase your level of savvy on how things REALLy work (NOT the Jr. High civics version), I HIGHLY recommend a read of the most excellent and classic American novel ‘Babbit’, by Sinclair Lewis. The protagonist, George Babbit, is a glad-handing social-climbing RE Broker in Everytown, USA. Set in the Roaring 1920-23 period, virtually NOTHING has changed in 90 years!

Another big brain of that period, H.L. Mencken, had some incredibly acerbic things to say about the then-newly-coined word ‘Realtor’, and the folks who plied that trade. Screamers.

The readers of this blog are the most articulate and mega-informed on the web.

Speaks well for the Doc.

I coudn’t agree more. I real this blog every time a new post comes out and the comments are incredible. I learn more from the comments section than from the article sometimes.

Wanna talk shadow inv.?? Ok, check this out. My neighborhood is in the OC, coastal, established, kind of upscale. All foreclosures go back to the beneficiaries…not one 3rd party yet. Then they sit. They sit for 9 mo to a little over a year. I have personally been in two them, knew the families the whole deal, all strategic…beautiful well kept houses. They have ALL come on the market as fixers. Why? Been in the almost all of them once they hit the MLS. When you let a house sit for a year rodents move in, roofs leak, unkempt trees shed branches and hit things. Around here this is why ROE’s go for so much less but drag the rest of the neighborhood down with them. The banks are perpetuating the drop in property prices. Why? No clue.

Well, part of it is Duh Banks really are large, lethargic, and clueless about property mgt., even when the simplest spreadsheet would show that it’s in their bottom line interest (let alone public relations/corporate citizenship 😡 ) to keep up with the basic maintenance. Occasionally, if the commission is juicy enough, Duh Listing Realtor will pay to keep up the place.

Also, they are incredibly ARROGANT. I mean, if the all powerful FEDERAL.gov can’t make them do the right things, what chance does some county or city .gov have? 😡 Do we start to see the MULTIPLE layers and long-range ramifications of “moral hazard”? F**K them! ALL that bailout money, and they have to be FLOGGED into exercising any shred of decency in the stewardship of their reclaimed houses.

PS: I personally know someone who lives next door to a neglected REO SFR. To keep the swimming pool from becoming a rain-filled algae farm and mosquito generator, he regularly dumps used motor oil in said pool. Coats the surface, works like a charm. Eventually the oil evaporates, so he dumps in some more, lol.

I heartily endorse this practice. If the dirty oil damages the marcite or tile, that’s Duh Bank’s fault. My friend is exercising rational and ethical self-protection from thee worst kind of citizen and neighbor–Duh Banks.

@Enzo, May I suggest another possibility.

The banks have no capacity to provide that property management. Despite the fact that the uber bosses get their 100M bonuses, the rest of the bank employees are over-worked and under-resourced. I can just imagine a branch manager asking the district manager for the funds necessary to support 100 properties in the 500K range. My math may be way off, but let’s see: $5000 per year management fees, $10,000 maintenance costs, so 1.5M/yr for a branch manager just to keep his inventory shiny in a constipated market. That manager would be laughed out of the office.

Your numbers are high, even when lawn service, pool decommissioning/covering, and electricity to keep min. A/C (anti-mildew) running are thrown in (ASSuming they started the day the keys were turned in), but regardless, when they get a nastygram from a city atty, or a HOA atty with teeth, they “miraculously” FIND the money. 🙄 Duh Banks… always doing the right thing, for the right reasons. 😡

In general, it is the props that are both SHADOW and UN-squatted that fall into blight, so squatting IS “good for duh ‘hood”, egg-throwers to the contrary. Likewise, when the banks decide to release a prop from shadow into the MLS, Duh Listing Broker usually has the electric turned on, and the place spruced up, out of his end.

Why is shadow inventory such a bad thing? Ppl living rent free for two years can use the cash to pay down debt. So it helps those ppl.

The banks would be worse off if they took a bath on the mortgage write down.

Putting the excess stock on the market would bring the whole market lower. Good for new buyers, sure but not for those who don’t have a mortgage on their home.

Seems to me it would be good for the speculators.

And sooner or later the banks will find away to make us pick up the tab.

It is optimistic of you to think that the same people who used an interest only loan to buy a house way over their heads will use the cash they are saving by not paying their mortgage to pay off debt. Perhaps, but unlikely, seeing as they learned nothing from their prior poor descision making. What they are doing is probably helping the economy by shopping.

It’s still really irritating to those who didn’t get their dream home simply because they could understand loan docs and add and subtract. I would love to be able to pay off that sort of debt but I don’t have a house to squat in so I have to pay rent.

9-yarder-“Why is shadow inventory such a bad thing? Ppl living rent free for two years can use the cash to pay down debt. So it helps those ppl.”

If there was a law that said they had to use the windfall to pay down debt, that might be helpful. But the more important point is that we are facing a collapse of moral values, not that I’m perfect, by any means.

The country was founded on the Protestant work ethic. ‘Save your money. Pay cash. Don’t go into debt. Gold and silver are money. etc.’

Systems that are unsustainable, such as ponzi housing bubbles, inevitably collapse of their own weight. Now that we know that greedy developers built 6 million too many houses, it makes sense to try to figure out a an equitable way to figure out who should live in the ‘extra’ houses. But the political atmosphere is so charged, from a partisan standpoint, the country isn’t governable, not that the banking elite crony boys will permit any regulation of them anyway.

If I were living rent free in a ‘shadow inventory’ situation, I would put every possible cent into gold and silver bullion.

Thanks for your responses. I understand the frustration with those individuals who tried to game the mortgage system, but I still do not understand why a large shadow inventory per se is a problem which is supposedly holding up the housing recovery.

If there are too many houses on the market already, then I don’t see how dumping more houses on the market will make things better.

One could make the claim that the banks won’t increase lending until their inventory is cleared, but aren’t most mortgages held by the government?

So why is this a “problem” that has to be “solved”?

@Jason Emery

Moral values only hold true when both sides agree to play by the same rules and actually follow through on the deal. If the leaders, both corporate and governmental, of our nation change the rules to benefit themselves, regular folks will respond with an equal lack of morals, as you point out.

Protestant work ethic is a thing of the past. Sure, maybe the country was founded on it, but we’re so far away from that now. What were once called ethics, are now seen as millstones. But that’s what makes the USA the USA. Americans and American culture keeps changing and adapting. America is like a child that never stops growing – always different than the last time you saw it.

Foreclosure and bankruptcy are actually great things we have in the US. They allow the entire economy to renew. In most other countries, if you foreclose and house value is lower than loan amount, you still have to pay. Banks are protected, they cannot lose money in most other countries. This is part of the reason countries like Spain and Italy have such moribund economies, and this new protection of the banks is creating the same effect in the US. Markets tend to work if you let them.

They already HAVE! http://theelynnchase.blogspot.com/2011/08/institutional-mortgage-frauda-guide-to.html

What if the economy stages a modest recover and begins growing at 3-4%, unemployement drops to 7.5% in the next 18 months, and the stock market rallies 20% from current levels. All totally within the realm of possibility. Wouldn’t banks be able to ease more shadow inventory back into the market at perhaps slightly higher prices, and wouldn’t many mortgage delinquencies would be cured? People with jobs would be able to re-fi into low interest rate fixed loans (since they are not going up anytime soon).

Hey, I don’t think any of this is likely either, but it would not be the biggest shocker ever. I just wonder whether reads of this blog (myself included) are drinking their own cool-aid sometimes – like a bunch of survivalists convincing each other to build bombshelters.

A couple thoughts –

1) we are already posting some ugly growth and stalled employment with stimulus on full gear. Tighten up the governments and that’s a major headwind and requires organic growth to go from stalled to stellar to post those numbers.

2) While low probability, it could happen but it would only modestly accelerate the clearing of the shadow inventory, this is going to take years to clear even under rosy economic conditions. You add to that all the side-sitters waiting to move or sell their homes, any issues of interest rate increases or increases in Federal/State/Local/Property tax rates (guaranteed) and the very best case scenario I can figure is housing remains flat for a LONG time (this flat scenario in my mind has a much lower probability of happening than your 3-4% growth + trimmings scenario).

No so certain that the Dr is right on this one. Check out the charts on Calculated Risk. My read on the data would be that the housing mess has plateaued and on average may be starting to improve slightly. Haven’t posted a link before so here it goes: http://cr4re.com/charts/charts.html?Delinquency#category=Delinquency&chart=MBASubprimeQ22011.jpg

Dirt, it’s true there has been less foreclosure activity, but that’s totally up to the banks, not to any objective factor. The banks backed off on foreclosures in late 2010 after the “robosigning” scandal broke, particularly in the judicial foreclosure states. In the non-judicial foreclosure states, where (generally) no one has to sign anything under oath, there wasn’t much change. Although the judicial foreclosure states are also called “lien theory” states, and the non-judicial states “title theory,” I think “fraud theory” is more suited to the non-judicial foreclosure states. Although the courts in Michigan and Nevada are beginning to raise serious doubts about their oversight-free foreclosure process, California courts are largely unfazed by trustee and servicer fraud.

Does that mean I would be foolish to pay cash for a house? Will I end up in court trying to prove that I actually own it, and not some investor who bought some MBS in some convoluted wallstreet scam?

That’s what title insurance is for, unless you plan on buying at the trustee sale.

Paul is clearly not aware that the Title Insurance companies are not fools. They are well aware of the MERS situation, and now include exceptions to cover themselves. They will not cover your title in such cases. You are screwed.

It’s a risk you take when you pay in cash. The risk isn’t due to the MBS investor. The risk is that the original homeowner will realize that he’s been scammed, and will sue to recover.

Most Americans believe what they read in the news, and won’t wake up to this situation. But some might. Especially if Lawyers smell money.

@Questor. WOW! Was not aware of thatj. Can’t thank you enough for pointing that out!

I am afraid this is not entirely true. The Robosigning fiasco, tempest in a teacup that it was did in fact influence all 50 sates. The moment the story broke the major lenders declared a moratorium on foreclosures in all 50 staes, not just the 22 that require judicial oversignt and notarized declarations of value.

Irony is that even though the media blasted the banks for their paperwork disgrace, the bottom line is the folks who were foreclosed on with shoddy paperwork hadn’t actually made a payment.

On a different note and to those posters above who are waiting, things seem to be moving ahead on the foreclosure front here in SoCal, albeit slowly.

Investors who own the paper (mortgage) serviced by Wells, BofA and Chase are asking that the servicers proceed to foreclosure, they are done waiting and they would like to get their money back. 4 years in some cases without a payment, home values declining, condition deteriorating and the government strategies all bankrupt, they are saying flush the toilet, we may not get much back but it beats nothing.

I lie is a powerful thing, especially when the victims go along willingly with it assuming that somehow they’ll benefit.

No one held a gun to the head of the sheeple, who frothing at the mouth bought millions of homes that was over-priced by 2-8 times their value (in comparison to prevailing wages), in truth they too became part of the fraud because they ALL knew the only way to escape the Ponzi was to later flip their home for an immoral profit to a later knife catcher – OOPS! The music stopped!!!

No, this is not entirely the fault of the banksters and their politeers, this is entirely the fault of “We The Sheeple”, who continued to vote for the the (D) & (R) Free Crap Empireâ„¢ with the hope that they’d get a chunk of meat off the table of the rich, rather than the crumbs they legally earned…

Caveat emptor indeed!

@ Inquisitor

“they too became part of the fraud because they ALL knew the only way to escape the Ponzi was to later flip their home for an immoral profit to a later knife catcher:

In regards to flipping homes, while I never flipped one, I certainly fantasized about flipping homes, as I had seen five or six hours a week of flipping TV shows, that showed ordinary, even dumb-ass people making tens of thousands if a few short weeks. And it was legal. And at the end of the show everyone was happy. And did I mention, it was legal and even respectful. Flippers became stars. Jeff Lewis, anyone?

In the midst of the bubble I doubt anyone thought they were doing anything immoral. Rather, they were merely hypnotized by the media. and living in a new reality, a reality that didn’t last, but few people realized it. The Doc did, Nuriel Rubini did, And a few others. But mostly they were looked on as party-poopers at the time…

LOL! We are Americans, and we are NUTS!

There’s another factor at work here: the pace of change.

People who are out of work, underemployed, work at companies that aren’t investing in training, or can’t go to college because of the astronomical fee increases are falling behind and becoming less productive. In other words, what’s happening to those houses that are sitting around deteriorating is also happening to the workforce. And this is all happening at a time when technological change is accelerating at a dizzying rate. So where is the money going to come from to buy houses, fix houses, pay increased rent?

“… the pace of change.

People who are out of work, underemployed, work at companies that aren’t investing in training, or can’t go to college because of the astronomical fee increases are falling behind and becoming less productive… And this is all happening at a time when technological change is accelerating at a dizzying rate.”

Yet Another UNsustainable trend: Negative Appreciation in Human Capital… brought to you by the same amoral leadership that brought the other Crimes Against Humanity. 😡

The amazing fact of reality is that no one really knows the real number of Shadow properties sitting behind closed doors. I tracked a REO Home here in my town, going back to 09. It’s been sold twice and now once again back in foreclosure. The Gov. needs to stop worrying about all the people losing their homes, as sad as it may be, and start worrying about all of those home owners who have been making their payments and are now walking away. Over 25%+ of mortgage mods, end up back in foreclosure. Strategic defaults are close to 30%!! Now the Gov, is thinking about getting into the rental business. Who elected these idiots-Can someone please tell me?????

Judgment day has arrived. The federal agency that oversees the mortgage giants Fannie Mae and Freddie Mac is set to file suits against more than a dozen big banks, accusing them of misrepresenting the quality of mortgage securities they assembled and sold at the height of the housing bubble, and seeking billions of dollars in compensation.

The Federal Housing Finance Agency suits, which are expected to be filed in the coming days in federal court, are aimed at Bank of America , JPMorgan Chase , Goldman Sachs, and Deutsche Bank among others.

DOJ has been quietly working on this for a number of years. It is very complex so it took time. Armageddon is coming. I see a pale horse approach.

Sorry to tell you this buckeroo, but the MO on .GOV regarding this type of TBTF/TPTB CIVIL litigation ALWAYS results in a 1-3% fine (protection racket?), with no -0- admission of guilt or wrongdoing by the perps, period.

This is nothin’ but smoke & mirrors for the sheeple to keep them from stampeding off the cliffs at the edge of the pasture of blissful ignorance…

I wasn’t going to comment, as I tend to agree. I admit I’m quite jaded.

However, here’s a counterargument, putting things in a “big picture” form:

http://ampedstatus.org/full-blown-civil-war-erupts-on-wall-street-as-reality-finally-hits-the-financial-elite-they-start-turning-on-each-other/

“Full-Blown Civil War Erupts On Wall Street: As Reality Finally Hits The Financial Elite, They Start Turning On Each Other

Finally, after trillions in fraudulent activity, trillions in bailouts, trillions in printed money, billions in political bribing and billions in bonuses, the criminal cartel members on Wall Street are beginning to get what they deserve. As the Eurozone is coming apart at the seams and as the US economy grinds to a halt, the financial elite are starting to turn on each other. The lawsuits are piling up fast. Here’s an extensive roundup: …”

We may indeed be at the end of the beginning of this mess.

Believe it -or- not, I’ve had a front row seat to the legal shenigans in lower Manhattan since the early 90s, and let me tell you they don’t give two-bits mind to anything that happens West of the Hudson.

The whole country could burn into infinity, and as long as the Ivy League Mafia can scoop the cream off the top of USofA GDP, it’s all AOK.

Sure, gonna throw some scapegoats to the paparazzi to appease the appetite of the unwashed mongrels (Madoff, Rajaratnam, Milken et al.), but hey that’s why it’s called smoke & mirrors! A thug has got to earn a honest living!

Among the 100 year storm of toxic waste clogging the economic multiverse, this is nothin’ but a distraction to buy some more weeks/months for .GOV looting of the BRIC economies….

P.S. Did you know that Non-Performing Commercial Loans are now on avg. selling for $.25 cents on the dollar on the unpaid balance?

Western civilization is coming undone, and the perps are picking the bones clean, all while sheeple are waiting for Change they can believe in!

Your optimism-based humor slays me. While it SOUNDS great, the probability of FED.god bringing (and WINNING) suits of truly PUNISHING degree against the TBTF banks is, I’m sad to say, laughable.

CRIMANL perp walks? NOT gonna happen. Elites swinging from lamp posts?… TBD.

So far, I see only a single SWISS bank (UBS) named… a rather soft target. Oh, and yes, UBS will be using US TAXPAYERS’ MONEY to fight the suit… money which Ben Shalom Bernanke handed them on a platinum platter. Oi, the irony.

Have you any links citing this?

never mind. It’s all over MSM now.

NYTimes

Bloomberg

The Hill Blog

It will be interesting to see how this all pans out. Seems like many readers are championing this as a “dog and pony show” of the government to its constituents. I’d say if this drags out for a long time and eventually goes away this assessment is correct. The fact that the story is not on the front page of CNN’s website, but rather the story Kevin Smith: I smoke a ton of weed makes me think this is a dog and pony show.

The mega banks keep throwing billions of borrowed from the Fed cheap money on the futures markets, hedge funds speculations,etc.,but would not lend you a penny to start a small business.They know there is nothing for them in it.They know you wont make it, because of the ever increasing layers of gov red tape, ever increasing living costs, and your inability to compete with cheap foreign labor.No more pizza shops….get it?!On the other hand no sane wage earner needs any of the Too big to Fail banks in their present parasitic form and deceptively healthy shape.The question remains-who needs who more, and who is more important?The productive animals of the farm, or the lazy pigs that took over the farm house.

Stay tuned. Squealer at 7:00.

“. Hence banks could loan even more money out during an upswing, but the moment that the business cycle swings back downwards and property values decline, this would force a revaluation that would lead to greater risks and increase capital requirements: this can, due to the nature of the banking system, lead to declaring banks insolvent ”

Take too large risks in good times and go bankrupt when bad times come. If you can do something, it doesn’t mean you should do it.

That’s capitalism at it’s finest.

Which part of it you don’t like?

But it doesn’t work at all now: Market socialism is the current system where profits belong to the banks but losses are covered by taxes.

This is what I don’t understand about squatters and I am not talking about people losing jobs who can’t pay. But the ones who are willing to work away from homes when they have the ability to pay a mortgage. They didn’t think about it when they were using the homes as a atm and buying toys. When the homes were going up in value I never heard anyone complaining then. I mean get real people what goes up can also go down.

And for the crooks on Wall Street, I will not put into writing what should be done with them and it aint good.

Leave a Reply