The lingering legacy of the shadow inventory – homeownership rate will bottom in 2014. Goldman Sachs predicts homeownership bottom.

The banking system is starting to clear out shadow inventory and nationwide, prices are inching closer to a nominal bottom. It is important to understand how crucial a healthy housing market is for the stability of household balance sheets. Most Americans derive the bulk of their net worth from housing. The fact that nearly 10,000,000 Americans are underwater is a major drag for the economy moving forward. Goldman Sachs recently released a study looking at the housing market and attempted to analyze a bottom in regards to the homeownership rate. One of their major key figures dragging the rate lower was of course, the shadow inventory. Certainly banks can leak out properties via a variety of mechanism through short sales, REOs, rent-to-own programs, and bulk sales to big investors. The “throw everything at the wall†approach is likely to be the status quo for the housing market moving forward.

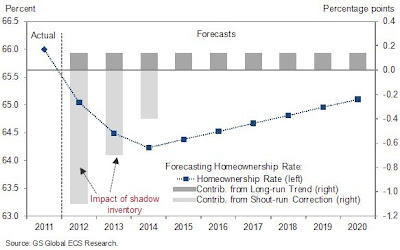

Homeownership forecast bottom at 2014

The drag of distressed inventory is definitely being felt in the homeownership arena. Think about what is happening right now. Over a decade of stagnant income and weak employment growth has created a major gap in the demand for housing. On one side, you have new household formation but many younger families are less affluent than the big baby boomer cohort that owns a good portion of current housing. The younger families are demanding lower priced homes and baby boomers are looking to cash out at higher prices. The gap is created especially with so many legacy loans still priced at face value peak prices. The report put out by Goldman Sachs understands this drag being created by the shadow inventory:

In other words, the biggest pull to the downside for the next three years is going to be the shadow inventory. So let us review the mechanisms in which shadow inventory is being cleared out:

-1. Short sales

-2. REOs

-3. Rent-to-own programs

-4. Bulk sales to investors

-5. Controlled low rate mortgage programs to help aid people underwater (i.e., HARP 2.0 etc)

All these programs essentially are part of the buffet to rectify the value disconnection brought on by the housing bubble. Yet where does the income or employment growth come from? The demographic question is important and crucial to understand. We also have data that simply does not measure reality. For example, in the latest data the California unemployment rate fell from 11 to 10.9 percent but in the process lost 4,200 jobs. This happens because people are dropping out of the labor force. Did the pool of qualified potential home buyers just increase? Unlikely. This is why with interest rates in the insane 3% range home values are still just bouncing along the bottom and sales are simply moving sideways.

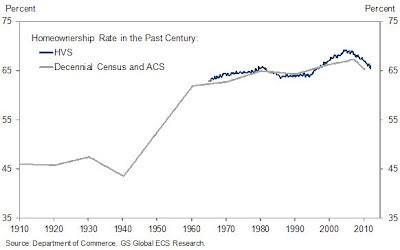

With a bottom in 2014 we would be back to the homeownership rate last seen 20 years ago:

Is this a positive development? Since the Great Depression housing has been the bedrock for wealth for most Americans deep into retirement. So this decline is likely to make it tougher for most to build wealth since very few Americans actually own any sizable amount of stocks or bonds for that matter. Even at the 2014 estimated bottom, some 64 percent of Americans will be considered homeowners. That is a sizable portion but lower from where we are even today. At retirement many can rest assured (assuming they paid off their mortgage) that their home is now fully owned or can go for a reverse mortgage if they are on the verge of eating off the dollar menu at McDonalds. It is troubling that the projections for Social Security not being able to pay out full benefits hits when many of these younger buyers will enter into their own retirement although their rate of paying into the system is the highest on record. The scary thing is that as we enter the peak of baby boomer retirements, the housing market is at its nadir in terms of price:

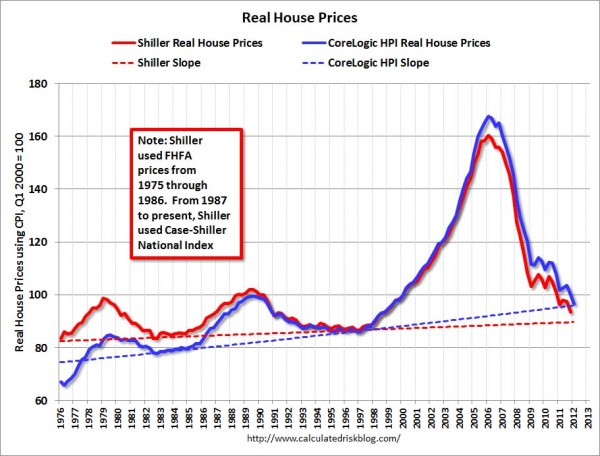

Real home prices adjusting for inflation are back to levels last seen in 1997. Japan has faced over two lost decades and we are well into our second lost decade in terms of prices and homeownership rates. Obviously each market is unique in its own respects and the above is merely looking at the nation as a whole. For well over a year I have mentioned that it is likely that nationwide we are reaching a bottom with the median home price being $163,000 and the typical household pulling in $50,000. Historically this seems to work fine and given current mortgage rates, there are many good deals to be had across the country. Yet many areas including many cities in California are still in micro-bubbles.

The comparison with Japan is apt in the following ways:

-Quantitative easing and major central bank action to keep interest rates artificially low after a housing bubble

-Younger less affluent generation needing to support older generation

-Home values losing a decade or more of worth (real adjusted prices)

Every country is different obviously but this push for a lower homeownership rate is going to come because of lingering distressed inventory but also, a new home buyer that is less affluent than the previous baby boomer generation. Is it any wonder why so many young college graduates and younger folks are moving back home with mom and dad after being on their own? Many of these actually are working in part-time gigs pulling in some income but certainly not enough to buy a home and in many cases, not even enough to rent a place of their own. The above charts merely reflect this sobering trend.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

57 Responses to “The lingering legacy of the shadow inventory – homeownership rate will bottom in 2014. Goldman Sachs predicts homeownership bottom.”

GS? lol!

Oh Rhiannon, anything that is not a doomsday scenario makes you upset?

;^)

Like we should now trust GS that caused the equity stripping ponzi scheme! I am with you. GS? Lolol

What do ya know? 15 year cycles, like clockwork. The universe works in funny ways.

If The Goldman Sacks Gang says it’s close to a bottom, I’ll believe them. They are the true masters of the evil fascist plot anyway.

If, you can get ahold of one, now does not seem like a bad time to buy given low interest rates. Of course as DHB said, there are micro-bubbles so watch out.

Maybe people are getting used to this “new normal”? Full disclosure, I do hate the new norm. It’s not what my family fought for all these years, pre WW2 even…

Excellent summary; I am more pessimistic than you might be as to Orange County and greater Los Angeles. The share of the California deficit (IF IF IF you believe any of the government statistics which seem to change, and assume that the government is correctly collecting taxes or will do so) of just Orange County is about 1.6 billion on a per person basis. That’s 24000 jobs lost if the government reduces spending; if they raise taxes it will further reduce effective take home pay with similar results. HOWEVER, that’s the easy part! The federal deficit is (rounded off and here again, the statistics are not so exacting) about a trillion cash a year; Orange County alone on a per person basis is about one percent of that, which is TEN BILLION. So if that is made up through taxes or through cuts, and Orange County has a fair average of government jobs direct or indirect (very indirect will do it) that’s 150,000 jobs (source, Christine Rohmer, others for this 15,000 per billion jobs/cash ratio). So if we get politics of no deficit (see europe) it’s austerity all around and about 25% fewer jobs when all is said and done. Most job losses will be in the younger people as in Spain. Which party or Presidential hopeful is going to tackle these issues?

As to Social Security, as a side note: right now, today, the cash flow to social security from taxes in and out, Social Security operates at a cash deficit. Not one person in a thousand understands what “cash” means here or “taxes” or “net”, but if that’s your standard that dollars are real for these narrow purposes…it’s not breaking even. THERE IS NO CASH HOARD for social security, there is and never was anything there whatsoever. The excess taxes were merely a way to soak the lower classes for taxes on their incomes (it’s nothing but a gross income tax) and then spend the money any way the government at the time wanted, merely entering a book entry saying, in essence, that how the people retiring starting…well, 2011…get their money, that’s for more printing. More printing of that trillion dollar deficit means inflation without end, and that means stagflation. Will inflation actually hit and raise (or lower?) nominal dollar denominated home values? The banks sure hope so! Inflation both compels the little people to desperately seek inflation-shelter and thus borrow money and pay interest and fees to the banks, while assuring ever ending higher home values to hide any idiotic excess mortgage no-standards underwriting…as in the bubble. This is not hypothetical ideas; these are facts, and Europe is showing us the umpteenth go round of what happens to even begin to address these issues (see Spain, 50% unemployment in the young, huge housing surplus, etc).

THERE IS NO CASH HOARD for US Treasuries, there is and never was anything there whatsoever.

You issue a meaningless strawman statement, which you eagerly refute. The SS trust fund has invested its surplus in US Treasuries, just like China, Japan, and the USA. Perhaps it should have invested at least in marketable UST’s but that would increase the national debt by 3 trillion. Perhaps it should have invested in a diversified portfolio of equities, bonds, PM’s and UST’s, but that would be “privatization.” (Horrors!)

But it is a bogus, and tired and old argument to say the money is not there. Absolutely not true. And if it is, than there are also going to be a lot of pissed off Chinese and Japanese investors, who are also holding worthless UST’s.

“But it[SOCIAL SECURITY TRUST FUND] is a bogus, and tired and old argument to say the money is not there.”

Of course it is there, in theory. And in practice, IF Congress votes the money be removed from the general fund. But are you sure there is an automatic mechanism for transferring this money?

Setting aside the legal interpretation, look at it this way. They are spending about $1.3 trillion MORE than they take in in taxes, four years in a row. On top of that, there is a lot ‘off budget’ spending, like the operation to ‘off’ Bin Laden. Finally, and this is the big one, they have unfunded liabilities of somewhere between $60 and $100 trillion. They should be paying several trillion in interest on this unfunded pile, to prevent it from growing exponentially, but obviously they are not doing so. So, if they used GAAP (generally accepted accounting practices) accounting, the deficit would be about $6 trillion per year. That is 40% of GDP!!!

The ‘unfunded’ pile is no big deal until the baby boomers start collecting ss or Medicare, which has already started to happen. In about 5 or 6 years, there will be so many boomers drawing ss benefits and running up Medicare bills, that the cash deficit of the USA will explode.

What this means for housing is pretty obvious. As the other posters have mentioned, there will be no money for government worker salaries, and lots of excuses for govt. worker layoffs. If really do get a bounce in housing prices in a couple of years, that would be a great time to get out, before the really big down draft in about 5 years.

“SS Trust Fund” — lol!

Since the ’80s, it’s been one giant accounting gimmick and of late, nothing but farce. When are you going to face the truth? We have in place a federal government with no funtional budget mechanism, and owned lock, stock, and barrel by the banking interests. Sock puppet Obama mouths platitudes while the bureaucracy works furiously to install the machinery of a Fascist state.

SS is doomed to a hand to mouth existence until they replace it with something even “better”. My guess is they will tax/cajole/sequester/confiscate retirement accounts (public and private) and use the funds to offer a government-backed annuity. Mr. Ponzi would be proud of their audacity — it’s all they have left.

“Since the ’80s, it’s been one giant accounting gimmick ..”

“Accounting gimmick” – now that is a very technical and precise term. I guess bonds are “accounting gimmicks,” too. Because of accounting, it is known how much money is credited to the SS trust fund. That is undeniable. What is happening is an extension of the retirement age. An increase in SS contributions, quite plausibly engineered by relaxing the caps on SS contributions, can easily remedy the current SS deficits.

The only troubling aspect to SS is the cattle mooing about how all is lost and futile. Grow a pair.

Thumbs up for your knowledgable comment. Most people especially Americans really know next to nothing about money, where it comes from, what gives it value, money as debt. If all understood money, and how the equity was literally stolen from them years ago now (and the banksters got away with it) there would be revolting in the streets tomorrow. So they keep feeding the confidence game by colluding with con-gress. It’s one big Con game.

Just wondering, with the unemployment numbers, do they factor in undocumented workers: Nannys/House keepers/Gardners. Many of which owned their own homes.

The real story is quite sobering Dr. HB. On the Westside of LA, prices are still bubblicous, there is no creative financing to support buyers and job loss is a real worry. Throw in the banks making 2.5% risk free from the carry-trade and the shadow inventory will only grow. The lack of people in a position to sell has ceated the illusion of an inventory shortage, wherein reality, it should be the opposite. Think of all those property taxes that are not being paid now as we have zombie houses that the banks refuse to foreclose on. Throw in the lack of transfer taxes on housing transactions and no wonder California has a $16,000,000,000 hole.

The longer they string it out the worse it gets.

http://www.westsideremeltdown.blogspot.com

Don’t forget that if one does not pay their mortgage, they do not get an income tax deduction either. Although CA may not be getting all their property taxes, the state must be getting higher income tax revenue from those not paying their mortgages.

What do you wanna bet that most of those folks are still getting interest statements and still deducting fees they haven’t actually paid?

The mortgage holder cannot issue a 1099-INT for someone who has not been paying their mortgage. That’s fraud at the level they will not do. Especially for someone who’s not paying them.

You are wrongly assuming that the majority of the ‘squatters’ are paying their taxes.

The banks pay the property taxes on the nonperforming loans. They are sooo nice!

Hey, atleast the worst is over… CA will get a federal bail out… Our economic engine is to important to the US as a whole. The rest of the US will be fine with the CA bail out as long as they keep getting their reality tv and movies delivered to them on a daily basis for entertainment.

Hopefully, this will evolve into something entertaining as well:

http://www.marketwatch.com/story/home-owners-across-the-nation-sue-all-bank-servicers-and-their-offshore-havens-spire-law-officially-announces-filing-of-landmark-lawsuit-2012-04-23

There will be no federal bailout for California. That was part of the failed attempt at Son of Stimulus last year. State and local governments are going to have to start sharing in the pain the rest of us have been enduring for 6 years. Good-riddance.

Although one could argue about the bottom call, you still have to consider how long a market can bounce along that bottom before every beginning to rise again?

Where is it written that housing must rise in price?

We’ve forgotten what a normal housing market looks like since we began to financialize this country C 1980 and went on a 30-year credit rampage that culminated in the Great Housing Rampage of the OOs.

I’ll give you an idea, though. Housing prices in most of the country, even expensive areas, rose very little between 1950 and 1977. My mother purchased a house in 1971, a 4 bed 2 bath brick Cape Cod, in an affluent St. Louis suburb, for $21, 500. The very same house had last changed hands in 1954 for $19,000 and had been bought for about that price when it was built in 1941. Suddenly, in 1978 or thereabouts, the ARM was born, and prices began to take off, followed by a wave of condo conversions of buildings whose rents would no longer cover their operating costs. My mom’s house went to $77,000 rather suddenly, and since then has “appreciated” to around $300K. Here in Chicago, it would be priced at about $350K. You’ll note that wages and salaries for all classes of workers who are not in the rarified 10% of the population have not kept up with the manic house inflation.

The credit and asset inflation of the past 30 years is now unwinding and we are perhaps a quarter of the way through the process. The road back to sanity and an honest financial system is being made a lot rougher by extend-and-pretend, so the unwinding might take quite a few more years, and it will take longer than that to rebuild an economy based on productivity rather than asset inflation and debt creation. And when we finally do, there will be no reason for house prices to inflate at all. We will be back to normal as it was defined before 1973, and our currency will retain its value, which means we will have the kind of housing market we did in the post WW2 period.

In Southern California, where I got into the home loan business in 1977, the big run up in prices from 1977 to 1980 was due to population increase and the result of many women getting into the full time workplace and making more money. Suddenly, family incomes jumped and they could afford more and demand was higher than supply. In the late 80s, rates had settled down some, demand increased again, and prices had another big jump, stopped in early 1990s by recession, job losses, riot, earthquake. The last boom was driven by easy lending, especially 100% financing, no-doc loans, option ARMs.

Great post. Housing prices started to move significantly once people could borrow money, then the borrowing got creative and people went crazy.

If the prevailing sentiment goes back to actually earning money to pay for a home, prices will normalize to historic standards, not to just the 3x income of a couple decades past.

Laura – Your comment illustrates that housing prices will go as high as the biggest fool can finance a home purchase for. Whether it be 30 year loans in the 70’s or creative financing of the late 90’s-00’s to FHA low down loans now. The rest of us have the choice of sitting on the sidelines or going on a financial kamikaze mission.

This is one of the best comments I’ve read here in a while, and that’s saying something! People have been able to drive up the real estate asset bubble through long-term 30 year financing. In many parts of the world, real estate loans are for much shorter periods and demand higher down payments, keeping prices sane.

Living in California, I was conditioned to think that $500k starter homes were the norm. Thankfully the good doctor slapped some sense into me and now I’m able to watch this mess play out while saving for a crazy down payment myself.

Brava, well-written insight. Rational and useful comments!

Don’t forget…the older homeowners mad 15 percent compounded on their stock investments duringnthe 80s and 90s. Never again. Hence……prices will never be near these levels again.

That’s funny, because i know a bunch of 20-something friends who started investing in their 401K in March 2009…

They’ve made over 100% gains in a few years… Those that kept jobs thru this recession/depression and began investing in 2009… Have a head start like no other in history.

The ultimate causes of the bubble and subsequent crash were the failure of borrowers + originators to understand the real-world meaning of the terms of mortgage loans AND the failure of institutional investment managers to understand the 30-year history of housing and mortgage markets. I find it a tragic irony that we’ve responded to the crisis by cutting education. We have only barely begun to pay for the financial crisis and our national reaction to it. The generational cost in lost growth will amount to at least $150 trillion. That’s not hyperbole, BTW.

Why is not probable that when countries starting defaulting in Europe, the biggest Real Estate bubble in world history in China (64 million empty condos) implodes, and the inevitable “double dip” occurs in the US that Real Estate prices and the Case-Shiller make new lows? Isn’t Goldman Sachs the corporation that tells all their clients that everything is good and fine and then goes behind their client’s backs and make billions shorting the crap out of the same products they have recommended to their clients? Bears still crap in the woods right?

Excellent observation. Goldman Sachs, JP Morgan, Pimco, and all other investment houses, typically play both sides of the card. If GS says that real estate is going to bottom in 2014 that means that GS has massive RE positions they must unwind around 2014 or else GS will turn into Greece II. So GS is trying to suck in Muppets to offload their positions to.

Real estate in the non-coastal areas has already bottomed and it is now cheaper to own than to rent. California, the Washington D.C to Boston metro area, Portland and Seattle remains in a bubble.

Right on Ernest. GS is taking us all for Muppets again. Look *CAREFULLY* at the Goldman Sucks chart again. IT SAYS NOTHING!!! THERE IS NO CORRELATION IN THE CHART WHATSOEVER!!!!!!! The Chart is merely a graphical representation of their own Real Estate prediction. It is a not a true Data Chart but rather a wild eyed, Polly Anna Real Estate prediction. They must have an opposite trade on the line. Who died and made Lloyd Craig ‘We are doing God’s work’ Blankfein King or Pope of anything. Nobody should believe Goldman Sachs on anything without evidence and extensive data corroboration.

Right on Ernest. GS is taking us all for Muppets again. Look *CAREFULLY* at the Goldman Sucks chart again. IT SAYS NOTHING!!! THERE IS NO CORRELATION IN THE CHART WHATSOEVER!!!!!!! The Chart is merely a graphical representation of their own Real Estate prediction. It is a not a true Data Chart but rather a wild eyed, Polly Anna Real Estate prediction. They must have an opposite trade on the line. Who died and made Lloyd Craig ‘We are doing God’s work’ Blankfein King or Pope of anything. Nobody should believe Goldman Sachs on anything without evidence and extensive data corroboration. According to Foreclosure Radar (very reliable source) there are 2,000,000 homes in CA Underwater and another 750,000 in some form of foreclosure. According to Amherst, there are over 8 million houses in the US in some form of foreclosure. The number of homes Underwater could be much higher than 10 Million. GS’s chart says the shadow inventory will stop being a drag on Housing after 2.5 years from now. At the slow rate of foreclosure absorption our State and Country are going at, the shadow inventory will take more like 14 years to absorb NOT 2.5 years!!!!! I, for one, refuse to be a Goldman Sachs Muppet.

It may take a long time, but I can’t wait until the big metros that still have bubbles find out they aren’t as special as they think they are. The “but it’s different here” attitude is driving me nuts. I still can’t believe after all of the lies that have been spewed, people who ought to know better STILL have a tendency to believe Goldman Sachs, or anyone who is even a touch optimistic. It’s disgusting.

All the self employed that made great money during the boom years, do you really think they are all current on their Federal and state income tax? As the market turned more and more people have let those payments slide thinking the market would turn around in the beggining. Now they know it will not for a long time. The undergroung ecconomy grows more and more. Just like Italy. This is a new world.

Hate to say it because I have agreed with Dr. H B all along but the facts are what they are.

Loose money created the housing bubble in the first place, even looser money can reflate the bubble. It is true that people are unable to qualify simply by fogging a mirror anymore, but it cannot be disputed that 3.7% 30 fixed is ultra loose money. In that regard, it could be argued it is looser than 2005.

And if 3.7% doesn’t reignite the bubble, 2.2% might, for sure 1% 30 year fixed. It is clear, the FED is on a path to get prices back to where they were.

I will be the first to agree, this too shall end badly, but how old will I be then?

I hate to say it, we can only hope that the u.s. suffers such a dire economic collapse that the FED is helpless to keep the house of cards together. There should have been an economic collapse in 2008 so that we could have a sound foundation to build from, but unfortunately, the FED kept the house of cards standing and the wind is still blowing.

The FED and its interventionist behaviour has warped every market out there. Market signals are not trust worthy. Any investment is pure gambling at this point.

I am hoping the stock market is signaling that the FED’s ability to screw with the economy is waning, if not, it will certainly be interesting to see how warped our economy can become, over the coming years, before the collapse does occur.

Every game of Monopoly I have played, the game is over when one person has all the money and on a macro scale, a few have it all. The game is just about over but how long can it still go on now with the lending huge sums of money for lesser and lesser amounts of interest?

The answer will be in the history books 30 years from now.

Martin, a catastrophic global reset in specialized post-industrial world has unknown implications for both geopolitical risk and right here in the US too. While I’d like a return to fundamentals…do you really want to roll those dice? I’d venture a high probability that we may have a far worse result than holding things together and gradually letting it work out over time. Obviously we don’t know for sure and we may still get a major reset but I like my life and have family and kids so I’m not too keen to take the wager. Maybe some other people feel they have less to lose.

Also, people forget but we did try the quick cleanse approach before during the last major financial crisis (Great Depression). Andrew Mellon has a wonderful quote about liquidating excess, overleveraged and poorly run businesses. He is also widely credited for making the Depression longer and deeper than it needed to be and ultimately society couldn’t take the pain of a worsening deflationary spiral (think 4%/6%/8% sequential year on year) and had to devalue currency ~50% in a single year and embark on multi-year heavy deficit spending to stimulate (look up inflation during that period, it was a non-event when they switched approach and speaks to how bad things were).

Once again, we’ll never know how this strategy might work today but we went in a separate direction just because of this experience and potential risks globally. Realize, I’m also someone who called BS on housing 2004 and on who sat on the sidelines during the boom/bust so I feel the pain/anger at financing this bailout geared to hold up unsustainable enterprises and home prices for what has been almost half a decade now.

Slim – we rarely engineer a depression by choice. It’s forced upon us by economic realities. I agree with Martin here. We can engineer another bubble, but at some point economic reality will impose a very harsh penalty for such mistakes and there is little central banks can do about it. Their only real choice will be to destroy the economy in order to save it. Either way, the game is over when it’s over.

Well, in California and Texas the younger generation is poorer since its hispanic and stats between hispanics and whites show hispanincs have a much lower income. Hispanics majority in Ca in 2013 and probably in Texas at about the same time, so in the long run, the wealthier better educated white populations in both states are in the retiring mood. In both states, othe majorities less money than whites but more than hispanics. Ca third group asians and Tx blacks, asians do better than blacks in income but I believe Tx blacks do a little better than Tx hispanics.

I wonder if GS took into account the exporting of manufacturing jobs and the rise of low pay service jobs during the past 12 years and how that would impact these trend lines? If they did great, if not then then we are not nearing a bottom yet.

It is an investment and real estate wasteland out there. I though about buying in palm springs but it really is too far away for too little return on investment. I cannot spend my time fixing up $1000 per month rental houses and still get ahead at my day job. The only money to be made is probably shorting high multiple retail stocks and social media. I think, as the continued slow motion implosion of the stock market crimps paper wealth at the top, names like Lululemon selling $100 Yoga pants at 11X gross sales will drop hard and fast. Ditto Kors. When rich Westside doctor/lawyer husband tells yoga going Mercedes SUV driving mom that their portfolio is down a few hundred grand, there is going to be a lot less demand for overpriced, non-essential crap like this.

Sad state of affairs. . .

Housing? my prediction is flat on the westside for years, but the extreme wealth and foreign demand will establish a permanent floor in the nicest areas. We are at or near the floor. Never really tanked. I agree with Dr. HB that mid-tier has further to go . . . . but these areas are being gentrified slowly, too – and that trend will continue. There is only one LA, after all, and the idea of living elsewhere is unthinkable for a great many of the rich or soon to be rich.

In the macro view, demographics strongly suggest that the generation of 20 to 30 year olds are not making much money nor forming many families. And there’s far fewer of them than the Boomer generation that owns so many of the homes today. So it looks like there’s going to be a glut of 2500-3000 sq ft homes on the market for a long time to come.

Good observation, though I think 2500-3000 sq ft homes are far too commodious for a single family just starting out. The glut should be in the 1500 sq ft homes.

I wouldn’t trust anything that GS has put out. Their spin is always tied in to making themselves richer and the rest of us poorer. I don’t see the “lost decade”. The crash was just four years ago. While other states might well have deflated, California is still in solid bubble territory. I look at the prices for those shitty little boxes and I’m still amazed that ANYONE in their right mind would pay such a price for such a POS.

Greetings from South Florida [Miami-Dade County]

Some figures of our Shadow Inventory

Miami_Dade County__Florida [As of May 19, 1012]

Properties – Total 905,322 100.00

Properties Owner-occupied 598,229 66.08

Properties Non Owner Occupied 307,093 33.92

Distressed Properties 103,165 11.40

Pre-Foreclosed Properties 86,292 9.53

Foreclosed Properties 16,873 1.86

Upside Down Properties – Not Pre-Foreclosed/Not Foreclosed 62,859 6.94

Properties – Active For Sale 17,689 1.95

Pre-Foreclosed Properties – Total 86,292 100.00

Pre-Foreclosed Properties – Active For Sale 2,607 3.02

Pre-Foreclosed Properties – Not For Sale 83,685 96.98

Guys, in about a month Europe will be in full blown crisis, as Spain an Italy fall the way of Greece. The US economy will feel it due to exports to Europe, and we will be back in recession. Mitt Romney will likely win if this happens, and we will have more job loss, and if he cuts government spending at this point, many more job losses. Then we will give tax breaks to businesses who will take the money as profit, and keep the work force lean, because that has become a good business model. They will not hire for lack of demand, after all you cant push on a string and expect it to move forward. The rich will do well with the government subsidies and the further redistribution of wealth to them, and the middle class will continue to feel the devastation. The poor will be out of luck, and those “programs” they depend on, like food and shelter will be cut.

Housing will collapse, again.

Dr. Housing Bubble, here again, you are too optimistic. CA Dept of Finance just came out with a study that shows little growth in CA population for the foreseeable future and correspondingly, no increase in home prices. Internationally, the economic activity is forecasted to decline. There will be no recovery in housing in Greco-California.

Most desirable areas in LA are still overpriced by a good 25 to 30%. I don’t expect to find a 3bdr 2 bath home in Bel Air for $500,000, but mid to upper areas in Studio City, Sherman Oaks, Encino, Hollywood Hills, Los Feliz are still way overpriced.

Anyone who wants to buy and play by the rules (20% or more down, steady income, high FICO score) should NOT buy now ’cause the market is rigged by the gov’t, banks, realtors, and Fed. Controlling the inventory, propping up high prices with low interest rates, etc.

Their game can only last for so long, so after the US election and Greek default, housing may get thrown under the bus, allowed to hit bottom, taking some of our banks with them.

Future trends and demographics all point to inflated areas like LA crashing down to where the rest of the country is price-wise.

My question is: how long can the powers- that-be continue the illusion of a housing bubble in Socal? When does it bottom out? I kinda agree with Dr. HB that 2014 may be it, and I’m prepared to wait it out and keep renting till then.

We’re currently in the new high water mark normal. The jobs are gone for good and with globalization, it will only get worse. Austerity or tax increases will further decrease the chances of a healthy economy. We’re in a financial death spiral, at some point soon, it’s all going to crash. Who wants your home now?

I agree that the only reason to live in California is if you can afford to live near the coast. Living in Victorville or Inland Empire does not have enough advantages to out weight the costs of living, low wages, etc that comes with the liberal welfare state of California. California is becoming a land of those that have it made & those that have nothing. The middle class is better off in other states that don’t suck their blood dry!

Soon, when the extravagant Gubment retirement packages & benefits become too much for the masses to support, those will be cut and real cuts will start happening!! Until then, delusion.

I beg to differ a little bit. Victorville, or anywhere in the central valley, I’ll agree with you on…but there are nice parts of the IE that are worth living in. Chino Hills, Claremont, La Verne, San Dimas, Rancho, Upland, newer parts of Fontana, and Riverside are all nice. If you count Temecula as the IE, that city too. Given that premise, there is a bit of a SoCal permium that will be paid, even in the IE. But yuo are correct, in general and materially speaking, you are better off as a middle classer by moving east…far east.

The 1800’s were all about SF and the gold rush. The 1900’s were all about SoCal. The 2000’s is/will be about the IE, as it’s the only developable place left. It’s hotter than LA/OC but it’s still SoCal, doesn’t snow, has many of the same stores and restaurant concepts, and is only 1 hr to drive into LA or the coast.

I see many move to Denver, Portland, Salt Lake…why? The weather sucks there. Phoenix is the only alternative I would personally go with, that’s a mini-L.A.

As far as the future of CA, it certainally may become more and more banana republic. But this state has pushed it for decades and the rich still come. The kids still move out here for jobs (50% turnover rate is true though). But here’s something to think about…how much overpopulation is there still? How many people can leave and still have sustained housing prices simply by still having enough people here? I suspect at least 10% could leave and we wouldn’t even notice. Case in point – I was at Victoria Gardens 2 weekends ago, Mothers Day weekend. Granted it’s a defacto holiday so people are out – but that place is usually busy anyway. I always say “what recession?” when I’m there….but Mothers Day weekend was like CHRISTMAS there. I couldn’t park after 20 minutes of circling the lot, and I left. Clearly there is currently more than enough population to support a lot of retail, and CA can stand to lose a few people. Let them keep leaving I say! Clear up the freeways, put downward pressure on rents. As long as the employed stick around, and still have the desire to buy homes, there are enough people to buy houses to sustain a healthy market. What is it, like 66% of CA rents? That’s a lot of pent up demand for buying if they could.

“The scary thing is that as we enter the peak of baby boomer retirements, the housing market is at its nadir in terms of price:”

And we are suprised by this? This is the tyranny of supply and demand. The bubble generation is going to get screwed no matter what they do. The only escape is to do the opposite of what the rest of the Boomers do. Alas, when it comes to retirement, this is not so optional. There just isn’t nough wealth to support the bubble to retire with the same prosperity as generations who went before. They had more children.

“It is troubling that the projections for Social Security not being able to pay out full benefits hits when many of these younger buyers will enter into their own retirement although their rate of paying into the system is the highest on record.”

Excellent point. At some point, there will be a massive retirement funding problem, not only in SS but in 401K savings plans. Most people are amazingly clueless about what it takes to retire and what retirement will look like for them at their current savings pace. Reverse mortgages may play a much bigger role in the years to come.

Based on the “Real Housing Prices” graph, I bought my little cheesebox in the ‘burbs in Dayton, OH at the bottom of the market, and sold it right at the top. I bought another piece of property and have sunk all my time/money into it including paying it off. However, even the tax man is lurking, and I’m afraid that those of us who do have homes paid for, are going to have trouble paying the taxes on them when push comes to shove. The consumer is still thinking the homeowner is flush with cash because they have a home – so vote in those tax increases for the schools and public programs like Mental Retardation and Street Lights!!!!

The funding problem with SS and Medicare/Medicaid is going to hit later this year – when Obamacare finally has its day in the SCOTUS, depending on the ruling, someone is going to have to justify the huge costs we are paying for medical care in this country.

SS is just a Ponzi scheme to float entitlement programs – the promises can’t ever be kept, because the way to finance it has been blown to smithereens with the downturn in the economy since 1998.

If you can, get the money OUT NOW before the Feds take what they want and give you back pennies on your own investments. Europe is going to implode and its precisely because of funding via debt unfunded entitlements.

Coming soon to us, too. 🙁

It amazes me how the RE market thinks. Surely we can see that negative real interest rates are the sign of a very sick economy. Hard to see house prices moving up. If the economy recovered and interest rates rose, where do you think asking prices go? Up? Only if we engineer an inflationary pop, which will reduce long-term funding and raise nominal rates. Sorry, less money borrowed = much lower buying power. Legacy owners are stuck with four walls and a roof, not a growing retirement fund.

Leave a Reply