Short sales and foreclosures made up 52 percent of all recent Southern California home sales – Lenders aggressively pricing lower-end properties to move. Two Pasadena examples.

The Southern California housing market is starting to have fewer places to hide in regards to zip codes immune to the correction. The latest data shows a fractured market where over 52 percent of all home sales in the last month were distressed properties. This is clearly not your father’s housing market. We are deep into uncharted waters and as the shadow inventory begins to leak out into the market, we are starting to get a sense of how lenders are approaching the clearing out of inventory. Much is being made about the recent jump in sales but put into context as you will see, is nothing more than bouncing along the bottom. Some tend to think that once a bottom is reached that we will somehow have another boom. That is highly unlikely unless the overall economy and more importantly, wages improve. No one is going to buy a McMansion with a McDonald’s income anymore. The boom lasted for a decade but was completely based on artificial mortgage products that no longer exist (and likely will never come back). We will also look at the low end of the correction in mid-tier cities like Pasadena.

Southern California by the numbers

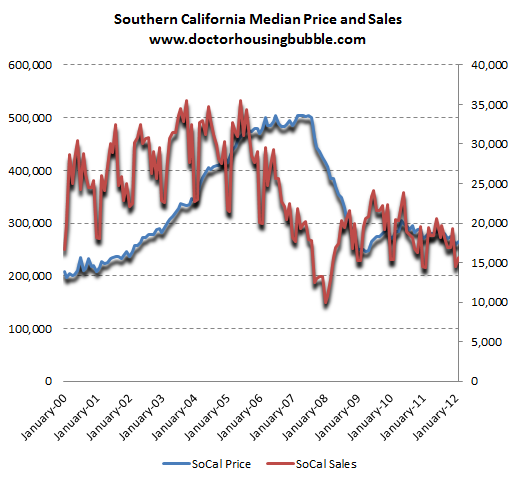

Southern California home sales are up by 8 percent year-over-year but what wasn’t in most headlines was that the median home price fell at the same time by 3.7 percent driven by investors and FHA first time home buyers looking at cheaper starter homes. If you look at the chart, that jump barely even registers:

To put the current sales rate in perspective 23,000 homes sold in February of 2004 (over 50 percent more sales 8 years ago). The shadow inventory is still large with properties with high mortgage balances:

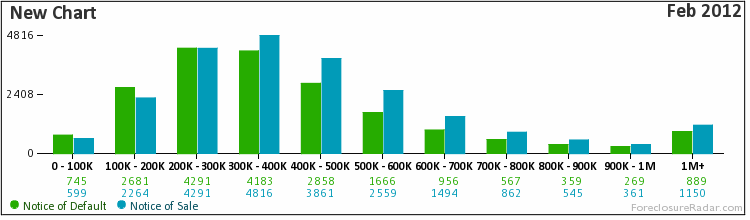

*California foreclosures

The bottom line is the market is hungry for cheaper properties however many sellers do not want to accept this fact so demand has shifted to short sales and REOs for the past couple of years. If you want to see delusion in action take a look at Zillow’s “make me move†option and you will see it in full force. Even with mortgage rates at record low prices and very generous products like FHA insured loans that only require 3.5 percent down, the market seems to be moving lower in mid-tier to upper-tier areas.

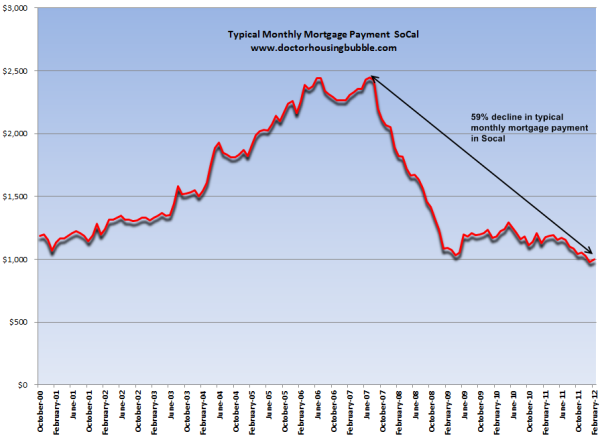

If we look at how much Southern California home buyers are committing to their mortgage payment we see that it has completely collapsed:

Californians are committing to roughly a 60 percent lower mortgage payment than they were from 2005 to 2007. Let us look at Pasadena to see what is happening at the lower-end.

372 East Ashtabula Street #204 Pasadena, CA 91104

2 bedroom, 2 bathroom, 0 partial bath, 820 square feet, CONDO

This condo is listed as a short sale. I’ve noticed more properties being listed as short sales on the MLS recently. A big move has come from the condo section in various markets. Not sure if banks are triaging the movement in shadow inventory and are choosing to move quicker on condo inventory. The above condo is listed as a short sale.

The list price is $199,500. Even with that price it has been on the MLS for over 200 days. A few years ago it was:

“Prices only go up in Pasadenaâ€

Then it was…

“Prices will remain steady in Pasadenaâ€

Then it was…

“Prices will only go down a little in certain areasâ€

Then it was…

“Prices will only go down in bad areasâ€

Then it was…

“Prices will only go down on condos and a little on mid-tier areasâ€

You get the point. The circles are closing in and problems hit from the bottom first. A sub $200k condo with 2 beds and 2 bathrooms would have been snatched up in minutes anywhere in Pasadena only a few years ago.  Today it has lingered for over 200+ days.

Or take a look at the big price cuts now being done by banks on lower-end single family homes:

1430 Forest Ave Pasadena, CA 91103

2 beds, 1 bath 582 square feet

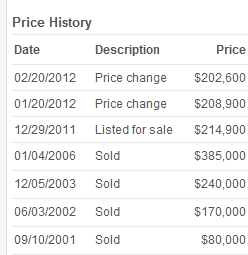

This is an example of how banks are now operating in 2012. The place was listed for $214,900 on December 2011. They reduced the price by $6,000 on January 2012. It was reduced by another $6,300 in February of 2012. The current list price is $202,600.

Look at the pricing history here:

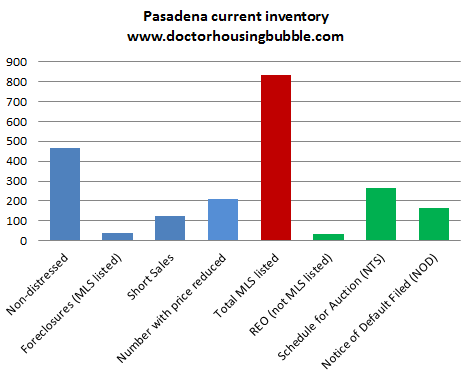

Someone paid $385,000 for this place in 2006. As we have been saying, corrections take many years to play out and trust the data, Pasadena has a pipeline of distressed properties:

This is one example of the many cities in Los Angeles that will face volatile price corrections in the next few years. Banks in the last year have become more realistic. Even in 2010 you would see lenders listing places for the actual balance and letting homes linger for months. Now, on short sales and REOs that do hit the market they seem to be priced to move. The shadow inventory is large and California mid-tier markets are in the process of seeing lower prices.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

71 Responses to “Short sales and foreclosures made up 52 percent of all recent Southern California home sales – Lenders aggressively pricing lower-end properties to move. Two Pasadena examples.”

This sucks. No one (self included) has job security so everyone wants to rent. Rents are too high for what you get. $1500 to $2000 for an average 3 bedroom spot in the the IE? And closer to $3000 in L.A. County. Ridiculous.

Yes it is cheaper to buy. If you can get qualified, get an accurate apprasial, and don’t feel like your job is going anywhere in the next 18 months, you can save a few hundred a month. But come on, not many can say that…

so what if job flops, rent it out!!!

And then where do they live? Very funny.

They will live in the garage if they want to save.

You’re assuming current rental rates hold up long term.

$3k in LA County? For an average 3 bedroom home? You’re joking right? You can find scores of homes in the SGV for $2k a month – 3 bed/2 bath. If you’re paying $2k in IE and commuting to DTLA or the westside, you are insane. It’s still cheaper to rent, and wiser as well. If you lose your job, you can remain mobile. Not to mention you just saved yourself a 20% down payment.

Haha – $200k for that dump. You could add a bathroom by dropping an outhouse in the yard and tack on another $30k. Since Zillow doesn’t count foreclosure-related sales in their algorithms the whole site is useless in markets like these where distressed sales literally ARE the market. Woe to the average Joe’s who buy non-distressed properties these days as they are paying a ridiculous premium. Right now if you can’t play the distressed game you should forget that buying a home in SoCal is even an option, as your pickings are going to be slim and dominated by insane wishing prices that desperate sellers won’t budge on. Let’s all order another round as this party’s got a long way to go…

does under contract include the contractual offer,…or is that just more manipulations and misinformations to drive prices using bogosities by front runners who want the houses at a pennies cash on the last sale also, yet dollars in the bank earn nothing,…..

I’ll say it again: Look at the price the house was valued at in 1985…that will be the bottom, or close to it. The beginning of the previous R.E. bubble under Reagan. Prices went stupid from 1985-1990…and barely dropped when the bubble popped.

But then, we weren’t running a trade imbalance like today, we still had a strong manufacturing base…still in Reagan’s military buildup without never-ending wars overseas, and Reagan was only 4 year into running up more debt than all presidents before him. Like G.H.W. Bush also did. Like George W. Bush also did. Like Obama is doing…don’t know if it can be overstated how scary that fact is.

The only adjustment upward I would make on pricing is if area income averages and the amount of area jobs went up….factor that in. In other words…no upward adjustments allowed.

Have to agree with Farang on this point. I remember living in Bakersfield in the 1980’s, with our houses barely inching up in price. And then folks would come up from LA/Orange County yakking about how their houses went up $100,000 over a few short years.

There was a short lived correction in the early to mid 90’s, but you really gotta go back further, I believe.

Look at it this way. What is the typical, inflation adjusted, salary now? Nominal wages have been flat for a decade. Then, if you adjust that for inflation, and the lack of HELOC, we’re back in the 1980’s.

We just had our offer accepted on a beautiful 2B/2B condo in Long Beach on the 1600 block of E. 2nd Street. Originally listed at $200K as a short sale just last month, they quickly dropped it to $150K and we snatched it up. It’s becoming a free-for-all out there, with absolutely no consistency in pricing. If you can’t find anything to your liking, just wait a week or two….

If you are buying it as the place you want to live, love the area, love the location, can afford the mortgage, that’s great.

But if like you say, it is crazy out there…hope you don’t mind being underwater when the price drops to $125,000. Because, it is crazy out there…and no relief in sight.

I live in Borrego Springs, CA in rural NE San Diego County. A week or so ago a guy just closed on the rundown but not distressed 3 BR SFH next door along with its two adjacent 1/4 acre lots. Everything $30,000.

I lived in Long Beach about 20 years ago. I was near the traffic circle on 15th street. It was a ghetto then, what is it now? I remember reading about a pregnant woman being stabbed over on 7th street. Then there was the drug house where the gangs were evicted by the landlord because of a police order. The gangs came back and shot the place up so it was unusable. 50 years ago Long Beach was a nice place. What is it now?

I would never live in that area again.

Snatched up a short sale? Are you saying that you closed? because it don’t mean nothin till it closes!

$2000 in the ie for a 3bdrm? But its probably 2700+ sq ft right?

No, $2k on a 3bdrm house rental in so cal get’s you about 1200 sq ft, if that.

Shawn,

You are wrong. I’m living proof of it. $2k a month in 1700 sq ft SFR in the heart of SGV, in a very quiet area. All you need to do is look at the current listings on MLS and you can see the numbers of homes listed for around $2k a month. Not to mention the fact that some of these offer to pay for utilities and gardening services. Plus, you can always negotiate down if you have excellent credit. The number of homes for rent will increase as summer rolls around and people move to prepare for the school year.

Ha! Try the 91105 zip code in Pasadena. Best part of town.

As a result of undetailed research on the Forest Ave. property, I have done a back-of-the-napkin appraisal of….. $ 80,000, assuming they throw in the fridge..

i thought the same also, not the 1.2 mill they once asked…..and the electric stove………………..

Just looked at a short sale today (non-approved -said docs “sent” to bank- send us your offer ASAP). Priced to either start a bidding war @ $325K, or the place is in worse shape than we think (and pre-viewed). They are even going to pull the solar panels off the roof. Pool issues, needs new inners, etc…, but really nice blue collar area. All the homes are nicely maintained and the tree lined street was lovely. I would guestimate another $50K minimum after coe. We passed due to two-story looking into yard, and no way of fixing it with trees. (yard was too small) Besides 50% of SS’s don’t close and they are taking 8 months if they do.

The deal breaker is usually yard privacy or noise. I like tanning nude sometimes. Gotta have some privacy.

Shop pending short sales!! Once you have an area or ZIP get a list of pending short sales over 60 days old and look for houses you might like and then contact the listing agent to put in a backup offer with inspection etc. Find several houses as buyers now are making pending offers on several short sales waiting for any of them to close along with financing issues jobs etc many deal never happen. By looking at SS over 60 days you will have less waiting as most of the seller driven paper work has been done.

sonomapotter

Thank you for the advice. I actually appreciated it, and in fact nudged my husband we should do that. His concern is that if the deposit check of 3% is cashed and trying to get it back would be hell. We’re a cash and close for our final home, and would win no doubt on a back-up offer, and maybe we’ll reconsider.

Do you think that might flag a stubbon lender not willing to give up some recovery $, even if the home is in need of a bucket of fix-up/maintenance money?

sonomapotter

Just wanted to add, a short sale home we looked at last April (2011) is still showing pending on redfin. 11 months. WTH is that all about? The place is vacant. The owner had a refi orgy, and his daddy bought him a house cash to bail the spoiled brat out. It has a 2nd for sure, and maybe a 3rd. I think that’s a record for a “pending” on a short sale. I wonder how many back-ups are waiting in the wings?

The pool went to the center of the earth, and there’s a fix (expensive, but can be done), but it was an adobe front, and my husband wants a traditional looking home.

We’re boring folks. What can I say. A one-story Craftsman with a wrap around porch is really our desire, but we’re po’ folks.

A very dumb question. How do you find a list for pending short sales? Will MLS show you that? We do not have redfin in our area.

That Pasadena Condo doesn’t have a sale listed on Redfin or Zillow since 1993. Propertyshark shows the original owners since 1993…I guess they took out some sort of HELOC at the bubble peak? Went out and bought who knows what, now they want the bank to eat that loss. Great.

Maybe they bought and paid cash for a huge mansion located within an area of fully modern local infrastructure somewhere down in central Mexico. Then waved thanks and goodbye. Sometimes I think that that is what some of my former neighbors did.

Doc you have nailed it once again. Back in 2007, it was a “subprime” problem that was “contained”. The IE got beat down first. Then the slow bleed West and South, but we still heard the same “containment” language being used – only condos are being affected, only junker properties are being affected, etc etc. Now we have almost a full-blown meltdown including prime borrowers in prime zip codes. The last holdouts seem to be the best properties on the best lots in the best zip codes. The RE bulls have been wrong from the beginning and have zero credibility at this point. This is a universal crushing devaluation that is simply not going to stop at the entrances to swank subdivisions. It is going to be all-encompassing. It is just stupifying that anyone can keep back-pedaling and continue to believe there is any containment of this crash.

So true. We are now seeing it on the Westside of LA. Banks are strategically leakig out shadow inventory from cheapest to more expensive. To think that high tier property will not be affected is crazy. The real economy of working people necessary to buy homes has only deteriorated since 2008. Layoffs, not expansion still dominates in businesses. With a few weak hands fighting over scraps of crappy starter or marginal homes, my guess is the banks will release more homes this spring/summer before housing is thrown under the bus, after the presidential election.

http://Www.westsideremeltdown.blogspot.com

You’ve certainly got that right. My parents live in one of the best neighborhoods of Scottsdale, AZ. The price chopping/shortsale/REO bloodbath going on there now is just as devastating to their neighborhood as it was here in my lowly subprime one a few years ago.

Dr. HB:

Great post as usual. To you and the fellow followers (especially the RE lawyers) I have a question…Are Condo’s being brought to market faster because the carrying costs are higher due to HOA fees? I was under the impression that for a REO Condo [or any unit with HOA fees] the lender was not liable for HOA fees, however I admit this maybe be a mistaken belief.

Thanks to all.

Whoever owns the unit; bank, people, whoever.

“Some tend to think that once a bottom is reached that we will somehow have another boom. That is highly unlikely unless the overall economy and more importantly, wages improve. No one is going to buy a McMansion with a McDonald’s income anymore.”

I’m usually 100% agreement with you Doc. However, the govt has skyrocketed Wall Street to “fresh new highs!” almost daily with money falling from the sky…S&P back at May 2008 pre-collapse levels. Inflation, of course, is tame, controlled, a non-issue; $4+ gal/gas is manageable, people get used to it; everybody’s getting back to work. Par-tay!

I imagine the powers that be retraining the big gtuns on housing now, cranking out monopoly money for govt loans, get everybody back into home ownership, people need to live like millionaires again. Get ’em out shopping for furniture, appliances, 1000 thread count sheets, stimulate the economy. Granite countertops and man caves mandatory. Austerity and prudence are downers. I believe this game will end very badly someday, but likely I’ll be dead by then; I’m no longer upset about the absurdity of it all anymore.

Acceptance is the final stage of mourning.

In my case, I’m sill fighting, and kicking butt.

Two factors affect house buying, more than others, the first being the median income of the upper 60% of California households, the second being the total number of employed people in a geographic market. Many other factors apply, but these are the first and primary driving factors. Now, the following official numbers are startling: California has huge increases in population BUT almost no increase in total employment over the last twenty five years: a population growth without more workers of an immense scale. Look for yourself: http://www.calrecycle.ca.gov/lgcentral/goalmeasure/DisposalRate/Graphs/PopEmploy.htm

I have not looked it up, but apparently California has had a huge surge in those receiving government transfer payments over this same time. While that welfare money helps households in the bottom 30%, those folks don’t generally receive enough welfare to go out and buy homes based on that. Now look to the future, if there is no increase in raw numbers of those employed (or little) in 25 years, and median effective wage is DOWN for those who work, why would homes go up in value in the next ten years?

If you believe some commentors on this site, moneybags from China are arriving daily.

Unfortunately your comment about those receiving public assistance not buying houses is not correct. I don’t know the numbers, but I know it’s possible and has happened. I know of a case where folks on Section 8 purchased a home. However, before you get upset about the government buying a home for people who receive your hard earned money for nothing, Section 8 doesn’t make all 360 payments. They only make the first 240 payments.

Yes, i would believe them!

Great post as usual, love that 80k place going for 385k, i have traveled the world and always thought of India as the land of scam. Well they could learn something from the California real estate industry. Well i guess that’s the way it goes, somebody walks with a pocket full of money, and the tax payer picks up the tab.

Short sales are a joke. You have about a 1/100 chance of actually completing one if you make an offer. They are next to pointless. Anything REO or Standard sale right now in Southern Riverside county is getting multiple offers left and right. We’ve put offers on 5 properties and they have all turned into bidding wars that we jumped out of. Sure doesn’t seem like a buyers market right now.

Kinda like the entire RE market in 2006 right before the bottom fell out!

It appears that both the banks and the buyers are at the merci of the seller real estate agent.

My offer for a property was short circuited because the seller real estate agent told my agent (nice and honest person by the way) — on the day I was going to place an offer for — that the property was no longer available and it is “pending” sale. I wanted to place a back up offer but it was refused.

By the way, the property which I was interested at seems to be the only one in zillow / redfin that does not state back up offers accepted. All others REO’s accept back up offers. Kind of strange!

Maybe this issue need to be looked at and the seller and buyer real estate agents should not be the same person. Maybe banks need to offer the REO’s to several agent(s) for selling a property. If one agent represent both the buyer and seller, then the commission goes only to one person vs…

So, may be the banks are not to be blamed for SS’s, and REO’s.

Maybe Doc can do article on this subject and find out what percentage of REO’s and SS’s had the same real estate agent in the past six months to a year.

What do you think?

what exactly changed that drove that 80 thousand dollar house to 385,000 in a few short 5 years..? they want 385,000 the same as i want it for 25,000 .pennies on the last sales price…….oddly a reversion to the mean of 1967 when average wage for an individual and average house price were 8700 dollars, where todays household wage (2 people?) is 44,000…a price i would offer if the damn associatives and taxes were not so high, what drove prices….fractional reserve lending printing up 10 to 100 debt dollars for every dollar borrowed and that competed equally with a dollar of savings and drove prices……all those prices were paid by the fed printing dollars when the “credit collapse” came, at foreclosure …they realy already belong to taxpayers, who as non walking debtors will not destroy those competive dollars, and make their dollars worth the value ripped off from them, by buying low priced cash repos…….zirp rip off, to sustain debt dollars is not a good thing…………………………

I think you need to realize that RE agents are several rungs below used car salesmen on the ethics ladder.

I’ve had several stunts worse than what you describe pulled on me by RE agents. As well, I have noticed that the ones who man both sides of a sale are often the biggest problem causers. RE agents and their corrupt antics go together like a dog and his fleas.

I agree that the seller’s agent may not be totally above board. I put in an offer on a SS, and the owner’s agent refused it — even though the property had been on the market for 9 months. It was apparent to me that they just wanted to live free for as long as possible.

When are the banks going to wise up and cut the owner out? This is a process that only works when the owner has to accept liability for the difference. That surely isn’t the case in this market.

Short sellers will continue to slowly lower their listing price because time is money — money in their pocket. I never thought I’d say it, but the banks are getting beat up on this one.

Why don’t you contact the seller directly? You’re not a Realtor are you? I don’t understand why anyone would allow an agent to get in their way.

Dr. HB keeps harping on FHA loans at 3.5%.

Let’s do some math.

If FHA (and VA and other 3.5% down or less) mortgages constitute 30% of all new loans, and the average down payment in California is 13.25% (Lending Tree’s number, not mine), what this means is that 18% of new loans are with a 10% down payment, and 52% of new loans have a 20% down payment.

However, when it comes to condos, a condo complex will become disqualified from FHA, VA, Freddie Mac and Fanny Mae loans when 15% or more of the owners in the association owe more than 30 days worth of HOA dues (aka monthly assessment, monthly maintenance fee, maintenance fee, association dues, etc). A growing number of condo associations in SoCal have breached this 15% HOA dues delinquency threshold so that means no FHA/VA loans at those places. This is turn means that a 10% down payment or 20% down payment will be necessary for a condo. That in turn leads to a death price spiral for condo selling prices since many people simply do not have this 10% or 20% cash down payment.

In 1997, in the mid-tier areas like Pasadena, Culver City, Sherman Oaks, Burbank, Glendale, etc, $75K was the average price for a one bedroom condo. $100K was the average price for a two bedroom condo. Factoring in cumulative inflation at 40%

since 1997, the Pasadena condo should be going for $140K, not $200K. Blame the Federal Reserves ZIRP policy for the price differential.

There has not been wage inflation of 40% since 1997, but there HAS been inflation in prices of commodities we need (food/gas/etc). So that $75K condo should definitely not be worth $200K or $140K for that matter.

There hasn’t been 40% inflation but with all time low rates, the monthly payment would be about the same.. perhaps slightly higher but offset with FHA down..

California house prices were as manipulated bogosly as Enrons electric bills fraud……..have they ever been reversed, remember they also paid Bushes campaign funds.?………

I’ve looked at some condos with great low, low pricing (REO) but if several condos in the development are distressed, doesn’t that put a burden on the rest of the owners to maintain the complex? Sounds like an invitation to a big assessment down the line.

The money has got to come from somewhere and that somewhere is the HOA.

California revenue plunges 22% in Feb 2012 – YOY figures:

http://www.calwatchdog.com/2012/03/13/eureka-california-revenue-plunges-22/

Tell me again how the economy is recovering?

Never understood California real estate. Are there laws against tear downs? Small houses on desirable/expensive locations would have been replaced by large houses here in Texas. Not like California has a shortage of Mexicans to do the construction work, so why do tiny 2 bedroom homes still exist?

Increased property taxes. These old homes are paying next to nothing under Prop 13. Once they rebuild, the govie comes in and values your house at market and your property taxes will go from $1500 a year to $15k.

As more and more people in CA become renters, I think there’s a very good chance that Prop 13 will be repealed. All the low-end homes are being bought by non-owner occupied people that want to be land lords.

There actually IS a law that you can’t Mansionize a small home. I don’t know if it’s just LA County or all of California, but when I bought my small place I had to sign a paper that included such a law. If the lot was zoned for one size, you can’t build it out big. Anyone know the details on that? It actually said “mansionize” — I guess this is a word!

In LA and Ventura counties, rents have been coming down slowly and steadily. Compared to a few years ago, many landlords are now willing to negotiate and the properties that are priced right for rent are rented out in a few days. We negotiated a 15% reduction in rent with our landlord from $2300 to $1950 for a 3 bedroom house in Thousand Oaks. We’ve been living in this house for 2 years and started looking around in January. He didn’t want to lose us as tenants as we are always doing small home improvement projects for just the cost of parts. It was a win-win situation in the end but he was not happy at first.

Yup, rents are trending downwards in Newbury, Agoura, TO, Westlake also. My buddies are reporting lower rents in Camarillo and Oxnard also. Going forward, an increase in Summer rental inventory should drop rents even more. LynnR, good job on the rent negotiation.

We are renting in a sec 8 illegal tenement in Thousand Oaks on Erbes Rd. We have all our belongings in storage, and had no idea our MTM $1,195 2+2 rental nightmare would go on for years. Now our rental is $1,395- (utilities excluding phone included). If anyone calls me a bigot for not wanting to live around “those” people, I’ll curse them into living among them.

Anyway, once we find a suitable home, we’re in it mortgage free. I’ll tell you, I am now a humbled human. The downtown of Thousand Oaks is truly Van Nuys West.

I’m curious, you must have known that it was Section 8 housing when you first moved in, so why the complaint? If nothing else, the low rent must have been a clue. Not being rude, just wondering why you are mad if you chose to live in that area.

Look at it this way, rents are coming down enough that you could probably get into a 2/2 Townhouse in a slightly better area for $1600ish. $1800 gets you a 3/2 in reasonably good shape.

I’m with you though, I would not rent in a Section 8 area if I could help it.

Patiently Waiting and Waiting

We thought it would be a 3-6 month stay and we’d be in our next home. Not so lucky, and the building had a different “flavor” and turned sec 8 after we moved in. It wasn’t so filthy, 10 people in a 2+2, etc… One day, I asked some older anchors to pick up trash and use a trash can. The next morning, I found dead rodents hanging in my car’s door knobs as a thank you for the life lesson.

Hopefully our little cottage will show up soon, and we’ll be gone. You’re right about complaining for things you are responsible for. But this is one of those experiences that just happened thanks to the powers that be. I’ll tell you one thing, I’ll never take a home for granted again. There is no place like home. (tapping my ruby slippers three times)

I rent in Pasadena, a 2 bedroom house with bonus room, 1 full bath with rear carport and we pay around $1600 per month but its not a nice part of Pasadena. When we looked around we did find nice 3 bedroom houses 1 bath for under 2K per month with front and back yard in nice parts of Pasadena. WLA same houses were $2700 +

Big money is buying up foreclosed homes:

http://www.rollingstone.com/politics/blogs/taibblog/another-hidden-bailout-helping-wall-street-collect-your-rent-20120319

Only in America.

Here in the Uk our bankers are widelly hated and seen as totally corrupt, over-powerful and self-serving, but even they wouldn’t get away with a stunt like that. Unbelievable.

Besides the insanity of short sales, now we have the scavenger flippers (they actually call themselves investors). The only properties here in Los Angeles on the market are either short sales, foreclosures, very damaged properties and the house flippers. We are buyers, buyers to live in a house, not to flip. These flippers are ruining the market for “real” buyers. Why would any real home buyer want to put their hard earned money in the pockets of these greedy flippers ? Let them sit on the market…..

I think the bottom is finally in place in riverside. Check this 3 unit not-a-total-dump rental in an okay neighborhood for 120K.

http://www.redfin.com/CA/Riverside/3550-Dwight-Ave-92507/home/4934848

There are a ton of these. I wonder if I could manage them from LA with the help of a local property management company and still come out with a surplus every month? What am I missing becasue these places seem like deals to me . . .

If you don’t see what your missing in those pictures you don’t want to be a landlord. Or in other words buy that place and you are a slumlord. You will have positive cash flow though along with it you may find dead rodents hanging on your door handles.

I bought a couple 4 plexes in Bakersfield in 2008 and 2009. It’s been an interesting experience. Though the returns have not been what I anticipated, I’m still making 10% on my money and have someone else do the managing. My suggestion to those wanting to buy in poorer areas is, leave a ton of room for error in your purchase price. That way, when it doesn’t work out like you expected, you still do okay

All levels will be affected I couldn’t agree more. It seems business owners are down to minimum amounts of employees. Since business seems to recover and then stall this keeps the hope alive(bouncing along the bottom)

. They would have been better off closing sooner and selling homes, cars, boats, planes. But ego is larger than reality. I now am seeing more business’s close doors and many of those business owners have taken 2nd, 3rd’s to feed the dying business and crumbling life style.

Wow, I find it amazing how these prices can soar in such sketchy neighborhoods. After reading this I find that I am truly blessed to not live in an area where this is the norm. I can get a 3 bedroom 2 bath family home with beautiful front and backyard landscaping for 160,000 to 180,000. Now I am a realist and understand that the demand is not in my area for housing as SoCal is a more popular place for big business.

Leave a Reply