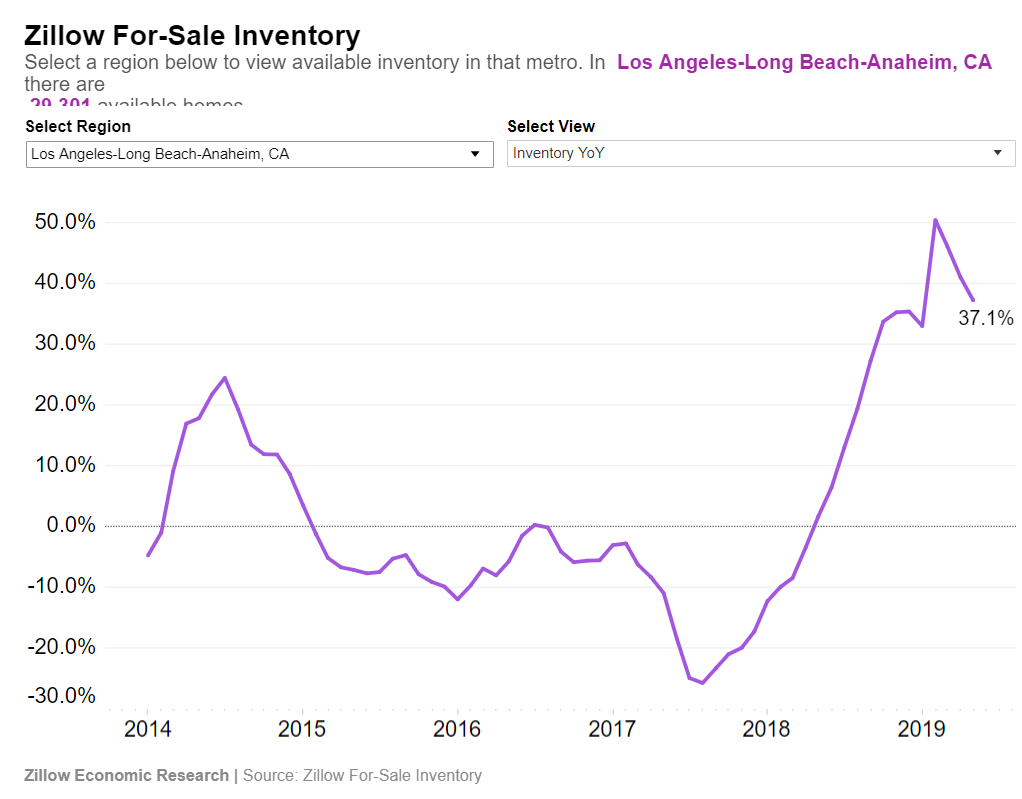

Soaring inventory in Southern California: Homes available for sale soar by 37 percent on a year-over-year basis. The plastic nature of SoCal’s housing market.

So much for the spring and early summer bounce. Southern California is seeing a large increase of inventory. And some of this inventory is coming in the form of new condos and homes. The housing bull market was so good that builders jumped back into the mix to get top price for properties. But of course these projects take time to map out and build out and here we go with this inventory coming online with inventory rising across the spectrum. But as we will see in this election, this is a time when Millennials are largely cash strapped and renting is not seeing as a ridiculous albatross. Many of these younger buyers saw their parents lose their homes in foreclosures or stress out over an inflated asset that is now going to be split multiple ways among the heirs that can’t afford to buy. Welcome to an economic market where the snake is eating its own tail. And of course this is the reality contrary to what the spin masters are trying to peddle out. This is why you hear politicians now talking about wiping out student debt as a main pillar of their platform. Mind you that the majority of Americans don’t even have a college degree. But here in SoCal housing inventory is booming and price reductions are becoming more common.

The rise in housing inventory

It was only a matter of time when the housing correction hit and inventory is now growing dramatically in SoCal. This isn’t some tiny jump, but something significant:

Buyers now have a bit more time to decide which crap shack they want. No rush. Now we have the house humpers trying to convince people to FoMo into the housing market. “Well you should of bought a few years ago!†Okay. Well what about now? Who is going to pay current asking prices on crap shacks that were built during World War II just so they can jam their family into a property with a 30-year mortgage? And let me preface this that this is a nutty geographic market symptom – the typical house in the U.S. cost $226,800 which is reasonable. In other words, in most parts of the U.S. buying a house may actually be a good move. But in SoCal? Not at current price levels.

And Millennials in the state get this. When you watch networks where the average age is 70 you have people that are fully out of touch with reality. But talk with younger professionals and college graduates and their goals are very different. They absolutely do not coincide with what is being spouted by the older generation. These people think that real estate is the only investment available to people. In a market where companies come and go in shorter durations and uncertainty is the mainstream, why should housing be built on this old school mentality where all of sudden you are going to leverage yourself to the absolute maximum level for 30-years? It makes sense in many parts of the U.S. but not at current prices in SoCal but of course this is FoMo land and reality hits people like a ton of bricks here. Just take a walk on any of our beaches and many people are trying to deny the reality of time with plastic surgery and driving European foreign cars deep into their boomer years pretending they are a 20-year old rock star. Hey, I’m all for looking good and healthy but don’t delude yourself from reality – that crap shack house needs a Beverly Hill surgeon to make it look good and that current price is not worth it.

And here in SoCal, especially in Los Angeles, the majority of households rent. Certainly many people “want†to buy – we saw this collective delusion when we offered NINJA loans to everyone. But just because people can jam in with a FHA insured loan or with a minimal down payment doesn’t mean they are better than the “NINJA†aficionados. And so many people now work in FoMo industries: real estate, finance, taco delivery apps, social media apps that turn you into a cute puppy, and other items that will get absolutely smashed when the next minor recession hits.

So here we go – the correction is now happening. You better hope that housing plastic surgery is durable because the tide is rolling out and the club lights are slowly turning on.  Â

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

280 Responses to “Soaring inventory in Southern California: Homes available for sale soar by 37 percent on a year-over-year basis. The plastic nature of SoCal’s housing market.”

Hoping the prices will fall soon. Finally paid my student debts and saved a small nugget. But prob still wont buy in LA where I currently live. Dont want a 30yr mortgage to actually last 30 yrs…

Exactly what I am thinking. We might be able to purchase a home here with a 5% down loan but a 3 bedroom 1.5 bath will cost nearly a million bucks!!! Do you have any idea how high that mortgage will be for the next 30 years??? I can’t imaging paying $6,000 a month for a crapshack “valued” at $850,000 for the next 30 years. I am too old for this %$it Moving here in our 40s was the absolute dumbest thing we could have done and I am regretting it big time now.

I recently saw a 4 unit building listed in Hawthorne for around $800k. A bargain if you

know the market there. I called the agent and there were 15 offers in about 3 days. It was obviously under priced to produce a bidding war, and it did. Never found out the final purchase price, but was probably near market or more. Investors and buyers are running toward these deals not away. The Summer RE market is heating up. The dog days are here.

To Dumb To See It All Before – 74% Of US Housing Market Unaffordable For Average American

Housing Bubble Has Popped, It’ll Continue To Deflate Over The Next 5 Years, enjoy 🙂

https://www.zerohedge.com/news/2019-06-30/74-us-housing-market-unaffordable-average-american

Hey JamesJim,

I have said this multiple times before. Do actually read my posts?

Can you read?

Seen it All Before,

Total fake news until you provide some links.

Set up a Zillow search. Prices are dropping left and right.

Where is the red hot spring selling season you promised?

Why is inventory sky rocketing?

By the 1% rule, you’d need to get $2000/Mo for the 4 units at $800000. Are rents in Hawthorne that high? I did a quick search and found rents in the $1400-2300/Mo range in Hawthorne, including a 1 Br for ~$2100. So yes, bidders would be interested in a 4 unit building especially if some units were more than 1 Br.

This is a totally different market than single family houses and townhomes, or condos for that matter. I did find a duplex for sale in Lawndale for $800K with two 3 Br 1 Ba unit (Zillow), and a 6 unit building in Hawthorne for $1.7M (Zillow), with a 3Br 2 BA owner’s unit and 3 2Br, 1 1Br and 1 studio. So the unit Market man is describing sounds like a deal.

By the 1% rule, you’d need to get $2000/Mo for the 4 units at $800000. Are rents in Hawthorne that high? I did a quick search and found rents in the $1400-2300/Mo range in Hawthorne, including a 1 Br for ~$2100. So yes, bidders would be interested in a 4 unit building especially if some units were more than 1 Br.

This is a totally different market than single family houses and townhomes, or condos for that matter. I did find a duplex for sale in Lawndale for $800K with two 3 Br 1 Ba unit (Zillow), and a 6 unit building in Hawthorne for $1.7M (Zillow), with a 3Br 2 BA owner’s unit and 3 2Br, 1 1Br and 1 studio. So the unit Market man is describing sounds like a deal.

I definitely believe it. The rental market is strong and it’s only going to get stronger with the younger generation opting out of buying.

We have been building so many new apartments that there is an excess of rental units. No surprise rents have been stagnant at best.

Hawthorne and Gardena are actually up and coming hot investment areas. The reason is those are areas that are relatively lower cost for office and industrial space outside of Silicon Beach and Silicon Beach is now growing beyond Venice, SM, Playa Vista. SO is Aerospace, thanks for SpaceX, Boring Company, etc.

We bought in Lawndale 7 years ago. I was expecting a downturn last year then this year. It did not happen according to Zillow. I believe it based on what we are seeing in the neighborhoods. It is only funny money, but our place has doubled in value.

Yes, all the way down to Huntington Beach’s rocket lab which is mainly in New Zealand but US headquarters is in HB. Maybe, why HB had less of a dropped than other OC areas.

Great made-up story LOL!

I believe MarketMan. I also believe that there is a ton of money in SoCal looking for deals. Problem is that someone will buy these deals, put money into fixing and won’t be able to generate a profit.

This is how the bubble deflates. People try to flip but are stuck in a stagnant or downward market. Prices only need to go sideways for the flipping to stop. Now that prices are turning downward they will try to dump properties faster and faster.

The inventory in SoCal is about to explode!

Thats what she said

Holy moly, this RE market is crashing harder than I thought!!! Def not buying now!!!

Who wants to catch the falling knife (falling sword would be the better description)

This is going to end badly.

Man, bitcoin is killing it this year. Bitcoin pulled a 3X in 2019.

Ahahahahaa! Looks like we skipped the spring selling season for the second year now. ROFL!!!

“Soaring inventory in Southern California: Homes available for sale soar by 37 percent on a year-over-year basis. The plastic nature of SoCal’s housing market.

So much for the spring and early summer bounce. “

Thanks Dr housing bubble

“But here in SoCal housing inventory is booming and price reductions are becoming more common.â€

That’s how the bust starts. Every ten years the same boom and bust in SoCal.

Most Americans are in financial trouble. Don’t think they are buying anytime soon.

https://on.mktw.net/2IWuP6A

Bob, Seen it all,

In the previous thread you complained about some issues in CA caused by CA politicians. Who elected those politicians? You and others thinking like you. If you did not notice, Democrats in CA have total control, like 100% control. With that super majority, they can eliminate and pass any law they want. If they didn’t, that means they are agree 100% with it. And then you complain about Tea Party like if they are in power in CA – typical liberal never taking responsibility for their own decisions.

Flyover,

You are correct Democrats control CA today and it is the 6th largest economy in the world thanks to that. Job growth and wages are significantly higher than any loser Republican state. How do you explain that? Please also explain that Great Republican Koch Brother’s Experiment in Kansas. What a Freakin Disaster for Republicans and their ideals. After that Republican experiment, Kansas moved to the bottom of all states economies in the US.

The one thing that politicians cannot touch since it was a Citizen Proposition is Prop 13. Prop 13 was a republican Tea Party Amendment. Prop 13 allows passing tax rates down to heirs. This sounds like a dictator commie ideal. Why would you defend it?

Republicans don’t make sense.

I agree with the spirit and intention of Prop. 13 – namely to decrease the wealth transfer from the middle class and home owners to parasitic politicians. I already explained that I don’t agree with the wording of that law. The low taxes should be available to ALL homeowners in the spirit of fairness. Who is stopping the Democrats to improve that law by making those low property taxes available to all homeowners????….

The size of CA economy is irrelevant. There are over 40 mil. people in that state (the highest population in the nation). The point is how much wealth PER CAPITA it has. Even then, if you take the mass of poverty and do the average with all billionaires, that average again is meaningless. The FACT is that CA has the most poor people in the country, even if you look at percentage. And they reached that performance despite having the best weather and attracting lots of rich people from other places. Notice that what attracts those rich people are not the policies of the Democrats but the weather. So, comparing the attractiveness of the climate in CA with the one from Kansas and giving credit to politicians is a very disingenuous approach and you know it. Lacking any other logical arguments, I understand why you use it.

LOL at the 6th largest economy stuff. Sure an economy that has the federal govt paying for a military, post office, highways, airports, court system, etc.

CA has the highest poverty rate in the country. That is the result of Democrat control. It’s a 3rd world country with a small slice of ultra rich, surrounded by poverty. Well done!

“By the supplemental poverty measure, California’s estimated poverty rate is 19 percent. While it is a 1.4 percent decrease from the previous year, the rate remains the highest among states. It accounts for about 7.5 million Californians. The next closest is Florida with 18.1 percent. Louisiana follows at 17.7 percent. After that, these states follow: Mississippi (15.9 percent), Arizona (15.6 percent), Georgia (15.6 percent), New York (15.5 percent), New Mexico (15.2 percent), New Jersey (15.1 percent) and Hawaii (15.0 percent).”

https://www.sandiegouniontribune.com/opinion/the-conversation/sd-california-poverty-rate-20180913-htmlstory.html

Seen This Old Angry Man Before, he’s the one who complains and never gets it right. Sad story, kinda like the useful idiot dimwit Bob is.

House 2.0 Has Started, You Are Going To Lose That Shanty, So Sorry, To Bad.

Hey! Maybe JamesJim can read. We all had our doubts as he constantly posts ZeroHedge links. JameJim, stop posting these. You look like a fool.

All I can say is that Republicans touted the Great Kansas Experiment as the grand Republican experiment that they wanted to implement for the entire U. Kansas is now economically ranked below almost all states. Even neighboring states like Nebraska, Colorado, Oklahoma, and South Dakota. Who would vote for the Republicans to repeat this disaster for our entire country? CA certainly has the advantage of having nicer weather and is doing very well economically under Democrat leadership.

CA does have one fault. It is opening the border and allowing low paid poor workers to flood in. I disagree with this. If CA shut down the borders, the number in poverty in CA would decrease. However, Trump’s hotel staff would cost him much more since wages would go up. It is simple supply and demand.

BOB: “CA certainly has the advantage of having nicer weather and is doing very well economically under Democrat leadership”

If you call the largest percent of poor in the nation and the largest income inequality in the nation “doing well under Democrat leadership” then you live in a parallel universe where up is down and down is up. With people like these, facts do not mean anything – it is faith based – faith in unicorns. I am just waisting my time.

The people in Chicago, Detroit, Baltimore and other third world enclaves say the same thing – “doing well under Democrat leadership”. Otherwise how do you explain the idiocy of doing the same thing for decades expecting different results???!!!!….

40 Million People for 6th largest economy in the WORLD. You can cut and dice and divide that number any way you want and every old poor neglected Californian looks 10x better than any other citizen of any other “red” state. And remember the solidarity payments California makes to support the other states. If we can have those back, thank you.

LOL..every state is probably in the top 100 economies in the world. CA is the largest since it has the most people. On a GDP per capita basis CA and TX are tied. If TX had as many people as CA they’d be the 5th largest in the world.

And again, it’s stupid to say that since it’s an economy that spends no money on things like military, post office, airports, etc which are provided by the federal govt.

And CA has the highest number of people in poverty, both in a raw number measurement and a per capita measurement. It’s a 3rd world country with a few rich people surrounded by squalor.

Sammy: And remember the solidarity payments California makes to support the other states. If we can have those back, thank you.

“California” makes no “solidarity payments” to other states.

California is part of the American nation. It benefits from being part of the American economy (e.g., military bases, military spending, open access to the American market, etc.).

As a result, some Californian individuals and businesses are very wealthy. They (not “California”) pay taxes into the common American pot, to be used for the benefit of Americans as a whole.

Unfortunately, California’s state government is violating American law, by failing to cooperate with federal border enforcement. This brings in lots of NON-Americans who are draining resources that rightfully belong to Americans — whether in California or Mississippi or Iowa.

That southern border is America’s border, not “California’s” personal border. California is not an independent nation, and it needs to support the American nation’s border policy.

All I can say are facts.

California under Democrat leadership is BOOMING. More new jobs and a greater economy than any other state in this GREAT Union.

Kansas under the Great Republican Experiment is a complete and TOTAL disaster.

Who would vote for Republicans with these FACTS?

Bob,

Here are the indisputable facts:

1. CA has a supermajority of Democrats where they have 100% control and are responsible 100% of what is happening there

2. CA has the biggest wealth inequality in the nation

3. CA has the largest percent poverty in the nation (worse than Kansas, Alabama or Mississipi)

4. CA has the largest amount of unfunded liabilities at the same time with the highest level of taxation

5. CA has more ocean opening than any state while Kansas is a landlocked state where it is hard to do business

6. CA along the coast has the best weather (attracting people with money) while Kansas has a miserable weather year round which does not attract or keep people with money.

Sure, in your mind you blame a political party for things beyond their control while comparing apples with oranges in order to get to a stupid conclusion which you know very well that it doesn’t hold any water. The conclusions you reach are an insult to level of intelligence of the other bloggers who read it. You know it very well but prefer to embarrass yourself with the level of comparison you make.

reasons why ca is so amazing:

(1) near zero homeless population

(2) near zero illegal population

(3) near zero crime rate

(4) no rush hour traffic anywhere

(5) extremely affordable housing

.

.

.

only dumba$$dems could be so proud of these facts.

The inventory chart from 2014-2019 looks eerily similar to the 30 year fixed int rate chart during the same period. With rates starting to go back down, does that mean inventory will follow, and go lower?

https://fred.stlouisfed.org/graph/?g=NUh

As an old fogey (see this article),

I still enjoy Dr. Housing Bubble’s snappy diagnoses. But I’m short on acronyms – what is FoMo??

Fear of missing out

Fear of Missing Out

FOMO stands for Fother Mucker

But only if you spell Mucker with an O

If Americans can’t afford a vacation how are they are buying homes?

https://on.mktw.net/2IUkQi2

I tend to agree with you in general, but no one truly knows when the market will pop. Trump wants to get re-elected. If the FED does not lower the rates to keep the bubble going, he will just make a trade deal with China and add another 3-5k to the Dow. In this case, both the economy and housing will have a few more years to go before they pop.

Here is my grumpy old liberal engineer observation on this statement from your link.

“There was once a time when a suntan was a status symbol of those who could afford to bask in the sun, Pfeffer said. “Now the status symbol is, ‘I work all the time, I am so busy, I can’t take off a second.â€

I know engineers who live in S.CA who have not been to the beach in years. I question why they live close to the beach?

Are you as pasty white as I am? 🙂

I still shake my head in disbelief when I see people baking in the sun all day. First off it’s unhealthy, second it will lead to leather skin at an early age. But mostly, it’s uncomfortable. Maybe it’s just me, but it’s a lot more pleasant to be in the shade than in the sun when it’s hot outside. When I’m out in the summer, I always slather on the sunscreen and try to be in the shade as much as possible.

Each other their own.

I suppose pasty white is considered much healthier these days.

However, your post reminded me of my favorite cartoon of the 80’s

https://www.gocomics.com/doonesbury/1980/07/14

Scroll through a few. They are still relevant and hilarious.

Once again completely wrong. Pasty white isnt appealing to anyone – vitamin D deficiency and all the ailments that go with that along with crippling depression (*cough* explains a lot about some people). It also correlates well with obesity and innumerable health problems, including cognitive function. Recognize the portrait I’m painting here? Lol!

On the other side people that sit in the sun for long periods like an old leather shoe are gross too. Ever hear of a thing called moderation, or did Reagan destroy humans ability to practice that too? Wah, the pasties will get their revenge some day – most likely when emergency care workers are forced to clean up their remains!

Another consolidation in the RE Selling business made it to the OC register Real Estate page today. Tarbell Realtors sold itself to four Berkshire Hathaway franchises. They have 20 offices in Orange, Riverside and San Bernardino Counties, down from 50 in 1990. The third generation of Tarbells are selling the business now, which the family has owned since 1926. The picture accompanying the article shows a smiling, sport shirt wearing Ron Tarbell with business attire wearing Berkshire Hathaway executives. Guess he’s happy to unload the white elephant and is planning on a nice vacation.

Hi.

I’m a long time lurker.

It is my own fault for not buying in 2012 when I had the means to.

I sincerely hope the downturn is coming soon because people around me have been talking about it coming for at least 4 years, and in that time, prices kept going up.

SP, You did great, during this next epic crash you can easily buy a beautiful home. Think about it, you were able to save tons of money by renting and not buying overpriced real estate. Buying high only benefits realtard, seller and lender.

Now, you have a big downpayment and can easily afford a house when the crash is here. Experts know that during the crash prices will go down 50-70%!

Don’t feel too bad for missing out in 2012. There are always opportunities in any market, depending on what your goal is. I bought in 09, 13, 15, and 18 thinking each of those houses was going to be the “final” house. The first three I averaged about 70k off the flip. Living very comfortably with a sub 1000/mth mortgage in a 500k home now. Might be selling this one too after 2 years if the market holds. Downsize to a cheaper home and pay all cash. Key is to be flexible, do your research on the front end, and don’t be afraid to commit if its right for YOU. Don’t worry about timing the market, that’s a set-up for failure.

There were MANY good buying opportunities. Even the folks who bought in 2015 are sitting pretty. If you had the means to buy in 2012, why didn’t you? All the numbers pointed to buying (at or below rental parity, lowest rates in history, etc). We’ll have a down turn one of these days, highly doubful we’ll see a 50-70% off sale in a neighborhood you want to live in. The number of housing investors/speculators has also increased rapidly, there will be lots of competition to get the bargains.

“If you had the means to buy in 2012, why didn’t you?”

Because places like this and other doom and gloom blogs are populated by perma bears who always see a 70% crash coming. And sadly, many people bought into it and lost out on creating hundred of thousands if not millions of dollars for themselves. It’s really sad.

50-70% is very conservative. RE experts are saying the next crash will make 2008 look like a kids birthday party.

I ignored the perma bears on this site and purchased in 2012. I took into account that home prices might be flat for 5 yrs and still decided to buy. I did have a downpayment and the thought of a $1900 / month mortgage was fine with me and the wife and got into a 1800sqft home in LA. (I was paying $1500 per month to rent a dump).

In any case, it was many factors that came together and I definitely did not ‘time the market’ nor due to my financial acumen.

It’s not only doing this in CA.

NY is experiencing the same.

Manhattan RE is stagnant.

In Eastern Long Island “The Hamptons” inventory of off the charts and prices are plummeting.

A reator friend of mine finally found a buyer for a $24 million $$ home. It sold for $9 MM.

Seller liquidated ALL of their property to move to Florida – and avoid ridiculous taxes.

If inventory is building, as so many here claim, I have not seen much if any

increase in distressed inventory. And the little that exists is purchased all cash

at a slight discount because it’s all cash. No mega bargains, no 70% price drops,

no anything to crow about. Just a few bears grousing that the house down the street

price dropped when it was overpriced to begin with, and that bodes for a crash. Ridiculous.

Time to hibernate, bears. See you next year.

Increased inventory and price reductions across the board speak for itself. A booming market would show the opposite. There are no other reasons for skyrocketing inventory than this: demand is dropping and supply is increasing. Price reductions are just additional proof. Anyone with a half brain sees it but desperate house flippers are still trying to craft a story why now is a great time to buy. It ends in tears just like every time the cycle is ending. Most experts and experience RE professionals know that we will see 50-70% price reductions soon.

The only “expert” claiming such a decline is you, Millenial.

It’s MILLENNIAL, or just Millie.

And yes, most experts are aligned with the 50-70% crash forecast. It’s a no brainer at this point.

SHould have saved those commission checks during the bubble years LOL???

LOL 6th largest economy **IN THE WORLD**!!!

Yet oddly enough, CA’s GDP per capita in 2018 was #12 in the US. Texas was #13. Wyoming is #7.

Bbbbut bbbbut bbbut muh beaches and muh wealther!!!

lol

First, CAs economy is 5th largest in the world, not 6th, so go check your data. Second, GDP per capita is meaningless. Norway has the highest GDP per capita, but I don’t see people rushing to access Norway’s economy. The size of the market is what matters most. When companies like Intel, IBM, Chevron, Medtronic etc. apply for European Patents, they don’t apply for patents in Norway, they apply for patent protection in the UK, Spain, France, and of course Germany. When you receive patent protection in the largest countries, you essentially take away the power of competitors to market their products and services in the smaller economies because the potential rewards from doing business only in smaller countries are too low.

Not sure about an epic 50-70% crash, but I would buy again at 2013 prices. Looks like it’s on the horizon. Going to keep renting, working and stacking patiently.

https://journal.firsttuesday.us/the-downward-forces-on-california-home-prices-monthly-statistical-update-july-2019/68339/

Smart man

Fact … Inventory remains at low levels. Nothing else here.

On what planet do you live? In the US, especially California, inventory is skyrocketing.

This is why you are broke. You don;t know what you are talking about. The inventory is historically low. It is higher than recent years, but in the grand scheme of things, it is historically very low.

Broke are those that buy overpriced real estate. It’s called house poor. Wealthy people rent and buy when the market crashes which happens every ten years. You can’t lose by winning big. We have historic low sales and skyrocketing inventory on beach towns. Prices are plummeting at the moment.

But Millennial, beach home prices are not falling. Plus, why would you even look at a beach house? You will never be able to afford one. Your best bet is the inland empire.

You are already cash flow negative-that says it all.

You have no idea what opportunity costs means. I could tell you several better investments than buying overpriced crapshack close to the beach with negative ROI. It wouldn’t matter though. I don’t think you are smart enough to follow the math.

Today, the media is reporting that the housing market is heating up again … and inventory is falling AGAIN. Milli, I am sure that story caught your attention. Talk about pain.

The economy is in big big trouble. We need to get rate cuts in order to keep it alive. House prices are falling left and right.

JT has been promising a hot selling season since 2018 and t hasn’t happened. He’s been making up false statement after false statement.

It’s not surprising, if you are cash flow negative since you bought high your hope is the FED will somehow save you.

The smarter thing would have been to have patience and buy low.

Some people never learn and make the same mistakes previous generations did. (Buy high and default later).

Someone who bought at the absolute peak of the last bubble, using a 15 year fixed mortgage, would have home just about free and clear. Meanwhile all the smart kids who think renting is the way to go, are paying 50-75% more rent today than in the mid 2000s and own nothing.

Which is why I keep saying renting long term is financial suicide.

Correct Landlord. Their property would also likely be worth near or above pre-recession levels. It always makes sense to try and weather the storm if you are financially able. You don’t take a loss in a down market until you actually sell. At a minimum, you still have a roof over your head.

Long term rental strategies in places like socal are equivalent to financial suicide, that is 100% the truth. The VAST majority can’t save 2 dimes, any home buying opportunity is a good one. Guys like Millie are a rarity, most people don’t have the stones to hunker down in a cheap, sketchy rental for the foreseeable future.

Homes in the South Bay are selling rapidly and rental prices keep going up, up and up. Just a few years ago, 3/2 crap boxes were renting for 3K/month. The going rate now is around 4K/month. That is the definition of pain!

“Which is why I keep saying renting long term is financial suicide.”

Just wrong. Renting is more about risk managment and mobility than fictional gains in monetary, also fictional, value. Investment you can’t sell because you live in it, isn’t an investment, it’s expenses.

Risk management of course costs money, but just like any other insurance, it pays when things go badly wrong.

I can bet mr. Landlord (like most other people) has insured his property and life.

Why is that if nothing ever goes wrong, like the statement above assumes? 30 years is all of your adult life, very long time.

Renting avoids the risk of losing your capital if you get sick or lose your jobe and can’t pay mortgage and offers an opportunity to avoid having huge debt.

Investing surplus money is totally different thing, I’m not talking about that.

I think what a lot of desk chair bandits forget is the rent/buy scenario in SoCal, especially desirable parts of LA, has changed so much that a renter is FUBAR if they have to move. Count me in that camp. We bought in 2010 adjacent to El Segundo sold 2015 to move to el Segundo with a tidy (33% profit) only to find that we were always shy about $100k (now we are $250k shy). Two rental moves later and I’m LUCKY to be paying $4500 to rent for a contemporary house in a great location. That horrendous rent is now about 20-30% below current rental prices. The only way I can see a reset is a horrific recession and mass layoffs where everyone gets hurt or “the big oneâ€. Rock meet hard place. And before you suggest I move to Hawthorne, gardena or some other some gang infested part of LA or even out of this godforsaken town rest assured those conversations have been shut down by my better half.

Thomas, that is just dumb. If you pick a great property, if you get sick and lose your job, you rent the house out and rent something much cheaper. That way your investment stays on track.

Jt, you can only rent your place out if your rent covers your expenses and generates a profit. If you buy RE high you wont be able to rent it at a profit for decades. Smart people buy low. We don’t say this out loud here but the market crashes every ten years.

Another dumb comment. If the property has a negative, you pay it. Your goal is to keep the investment in the house because if you buy in the right city, you will make money in the long term. You need to ride the short term out and hang on.

Also, with the rapid rise in rents, the negative turns in to a positive after a handful of years and you will always be grateful you kept the house as a rental.

JT comment proves to me what I expected it to be all along. He is cash flow negative and is hoping RE will magically increase further. No wonder he gets so angry about data that show that the cycle is ending.

Mr. Landlord – your scenario would be sound if the mortgage was at a 0% rate for 15 years. How much did that interest cost over those years only to break even on the selling price?

What happened to SB50? It’s as dead as Joe Biden’s chances of becoming president. Even the most hard left Democrats in CA won’t go full communist, I guess. At least not yet. So that’s good news.

SB50 was a hardcore Republican bill that allowed Republican property owners to violate long term zoning and put high-rise apartment buildings next to poor grandma’s 2 bedroom house that she lived in for 60 years. The Republicans had the opportunity to squeeze even more rent out our Millennials and make traffic and parking much worse in these quiet family neighborhoodd without paying the true cost.

It is a sound defeat for Republicans in CA.

SB50 was a hardcore Republican bill that allowed Republican property owners to violate long term zoning and put high-rise apartment buildings next to poor grandma’s 2 bedroom house that she lived in for 60 years. The Republicans had the opportunity to squeeze even more rent out our Millennials and make traffic and parking much worse in these quiet family neighborhoods without paying the true cost.

It is a sound defeat for Republicans in CA.

LOL Bob. Dude I honestly don’t know if you’re trolling if you’re real. It’s hard to tell. But thanks for the laffs.

Cali is a 1 party state and yet you think Republicans run things. Bless your heart son.

So a Bill introduced by Senator Wiener from the 11th District in San Francisco and a member of the Democratic party is a defeat for Republicans?

Are you insane?

All the other sponsors are democrats as well

https://leginfo.legislature.ca.gov/faces/billTextClient.xhtml?bill_id=201920200SB50

While growing up in S.CA, the Republican developers would have killed/murdered to be able to tear down single family homes in neighborhoods and build multi-unit apartment buildings.

The local Democrat governments continually denied this.

I’ve read the local Democrat governments are still strongly opposed to this.

I guess at the state level, no party cares about the local neighborhoods.

Inventory increases in percentage terms are meaningless. If we have inventory of 1 and now inventory is 2, we have 100% increase in inventory. Pay attention to the nominal data–that is, inventory in real numbers.

Or you could just open your eyes and see the incredible amount of houses for sales in every neighborhood. Most houses sit on the market for months and don’t sell. Expect a price crash soon.

When I look, I see less for sale today than when I bought 2 years ago. if you looking to own and occupy a house you are choosy and when there are few choices you choose nothing, so I’m not surprised houses are not selling when there’s nothing to look at and what is listed is expensive.

Tell me your zip code.

What you are saying seems like BS. Houses are not selling because they are overpriced by 50-70%. As soon as the recession hits there will be more houses than people able to buy. I get flooded with price reductions daily by Zillow and Redfin.

I have no idea what you’re talking about dude. Take Irvine, CA for example. There are about 1,200 homes for sale and that includes anything from a studio all the way up. There are also approximately 100,000 family households in the city. That is insanely low inventory for the number of family households. It’s actually quite shocking when you understand how much new housing they’ve been building in the city. So, you are simply experiencing an alternate reality. I’m sure the way you perceive the world may be completely logical to you, but it may not reflect reality, no matter how sure you are with every fiber of your being.

“Take Irvine for instance†agahahahahahaha

Irvine is one of the most unattractive places to buy. Way overpriced. There are dozens of adjacent areas where prices are falling left and right. Looked at sales data lately in Orange County? The housing market is in so much trouble that they have to cut rates right now to keep it from further crashing. This is going to be the perfect scenario. Rates keep getting lower and prices will keep getting lower, at the end of the road you have a recession and buyers will be able to purchase 50-70% below the peak plus have 1-2% mortgage rates. It really can’t be much better for renters. We wait it out and save big by renting and not buying high.smart.

Once again, the data tells a different story. Unlike you, I provided specific numbers, rather than providing generalizations without evidence. Here is another example: consider the most populous city in Orange County, CA–Anaheim, which has approximately 100,000 family households and approximately 300 home listings available. That means, there are roughly 3 homes for sale for every thousand families. Think about that for a second. 3 homes for 1,000 families. That’s high inventory? You can believe whatever you want, but the good thing about facts is that they’re true whether you believe them or not.

You are full of bs. There are 500 homes for sale in Anaheim and why in the world would houses sit 100’s of days on the market if there would be a shortage of homes? People rent because it’s a gift compared to buying sky high. Your “there is no inventory†lie has been proven wrong for two years now?

The largest crash of all times is coming…my prediction 2022 or earlier. I am not talking Real Estate only, I am predicting across the board deflation. The FEDs Central Banks all over the world have started this. Zero or even negative Interest rates with Taxes at an all time high robbing the middle class and SoCal crap shack owners of any breathing room. Future expropriation is a possible scenario and adds to Socially explosive stuff and that’s why I am renting, staying liquid and able to move quickly keeping my cash safely FX diversified and hidden. Good luck y’all!

Sammy, you just expressed how upbeat you are about CA economy in few posts above and here you are hunkering down for calamity. After all, in the 5th largest economy (“the best doesn’t mater how you slice it”), you should be OK!….Hmmmm!…something doesn’t add up!….Are you bipolar?!!!….I don’t see consistency in your statements. If you are upbeat about the CA economy and its leadership, then go ahead and buy RE. If you don’t buy at the lowest unemployment ever, when you are the most upbeat and optimistic, then When do you buy?

I don’t ask anyone to buy, but I am asking to be consistent.

I’m an elder millennial who came out of graduate school during the downturn with bad job prospects and a lot of student debt. Unfortunately I could not capitalize on the buying opportunities of the time and have been saving against a rising real estate market ever since. I now have plenty for a down payment but cannot responsibly afford the monthly payment despite having a very solid job. My question is with all these extremely polarized views of the economy/real estate market I’m left wondering do I hold on to this down payment/overextend and jump into the market or invest somewhere else? I’ve been reading this blog for many years as well as many other sources of economic/real estate info and many books but I never really had a mentor and have done all my learning about money/investing on my own so I’m hoping for some sage advice. Looking back on it I should have pushed myself beyond my comfort limits of spending when prices were lower but every year that passes makes overextending myself seem more potentially devastating to my financial trajectory. I’ve been renting for 10 years now and I’m patient but I think I’m about to lose my cool. I should add my rent is extremely low for the area I live in and quite nice (nearly half of what everyone else pays so I’m lucky in that regard and a large reason I have waited so long to buy in what seemed to me like an inflated market) Much love to bears and bulls.

My position is long term bull, short term bear (in respect to RE). That being said, I don’t know the future and nobody does. If they say they do, they lie or they are delusional. Nobody has a crystal ball.

I have most of my wealth in RE. Currently, I am not buying and I am not selling. I am in HOLD mode.

You can read all the opinions you want, but since everyone is driving blind (don’t know the future) all you can do is educate yourself, continue to read and only you and your wife can decide based on your financial conditions, risk tolerance and needs.

Most of my buys (not all) were in down markets. Most of my sales (not all) were in up markets. Of course, nobody knows the top and bottom. You find that only in rear view.

Thanks Flyover, I was glad you responded as yours and some other posters are the ones I pay attention to most. I think being in a hold position makes the most sense right now but I’m eager to invest in a primary residence and rental properties. Holding onto cash this long and renting feels wrong but I’m going to gut it out another couple years and hopefully things change. I agree long term bull short term bear is what common sense would dictate and you seem to have an abundance of that.

Chasing td, when I was very young I read a simple book about finances. They stated a fact in that book which always stuck with me. They said that 3 in 4 millionaires in the world made the wealth in RE. It is true world wide because most of the economies in the world are on debt based system (fiat system).

Given the very high odds of wining (over 75%) I thought – “Good!…, that is where I want to place my bets”. I came in this country as an adult without knowing English and penniless. First, I’ve got the education (MBA), then I always invested in RE based on ROI. Naturally, the best ROI was in down markets or close to it. Over the years, with the time factor and compounding effect, lots of work and discipline (delayed gratification) I’ve got to be a multimillionaire. I had a plan, I worked on it and I knew where I was getting eventually. Like I said, the odds in our money system were favoring people like me.

Life is full of risks. If you just look at risks, you get paralyzed, frozen to inaction. You can not eliminate risk. The best you can hope for is to manage it in such a way to have the odds in your favor.

I agree with Flyover on this.

I am in now a hold mode in both the housing and stock market also.

The only exception to buying a house now is:

1) Buying a house to hold for 10-20 years.

2) Having enough cash in the bank to survive 1-2 years if you lose your job during a recession where housing prices and stock prices crash 50%

Otherwise, rent and wait for a 20-30% drop in RE. I suspect this will happen in 1-3 years. As far as a 80% drop, like Millennial predicts, these happen every 100 years. So the next option is to wait 90 more years and buy when you are 120.

There are plenty of people on this blog, including myself, Our Millennial, and Mr Landlord, who are holding cash for this as insurance. Most are holding it for investment into rentals.

The worst case to do now is to buy an overpriced house now and lose it to foreclosure in the next recession because you were not prepared. 10’s of thousands are now living in Vans Down By The River from the 2008 crash because they were not prepared, (See the book “Nomadland”).

Buy and Survive 10 years and you will be fine.

Survive 30 years, and you will never be worried about paying the rent again when you retire. I am counting on the low low $500/month for life TI for a large comfortable house when I retire since PI will be $0. I suspect rent for the same house at that point will be 6K per month since it is now 4K per month.

Thanks for responding Bob,

I’m basically all liquid cash right now with essentially no assets. I have a healthy retirement account but I know it’s not wise to depend solely on this for retirement which is why I’ve been looking at investing in real estate as part of my portfolio for about 5 years. My thought was to educate myself for when the market dips and then I will have the knowledge and liquid cash to execute the plan. Now being in the hold position is the hard part because I know that money is getting devalued by the minute. I don’t expect a 50% price reduction like Millenial (although I love his optimism) but I think a 15% price reduction is possible within 2 years but certainly not guaranteed. In the meantime I’ll keep a watchful eye.

Chasing td, sometimes, for investment purposes it pays to look beyond your state borders. In the end, ROI is everything for any investments. In some markets, the sellers are more motivated than in others. The best investments I ever made were outside my state borders – when I say best, I mean more than 100% in two years (based on downpayment, more than 500%). Be open minded, and try to negotiate, especially if you have cash. Look at everything – residential and commercial. Based on my experience, I would not borrow money for more than 4 units property and commercial. The government is not involved in those markets and you can not get a favorable loan fixed for 30 years like you can get for 1-4 units.

Dragon,

Whatever you do, do not overextend yourself just to get into a home. Owning a home is stressful enough without the added worry of “what if”. Only buy if you can comfortably afford it. Preferably, you should be able to afford it on only a single income, that way you will never be worrying if the economy goes south and someone gets laid off. I am also an older Millenial and my wife and I just bought last autumn. Like you, I have a professional degree and salary that would cover our mortgage if my wife didn’t have an income. She makes less than me but could also cover us (just barely) if I lost my job. Sounds like you are on the right track, and if your current rent is affordable and provides a good quality of life for you, you may want to look into investing that downpayment money in other areas while waiting to see how the next year or two plays out. Being in cash is always good. Don’t worry about what anyone else or the market is doing. Don’t buy until YOU feel comfortable.

Thanks Joe,

Good advice. I would never over extend myself, if anything Ive been an under extender which has lost me investment opportunities (buying a primary residence several years ago) in an effort to be financially responsible. Right now the plan is just what you mentioned which is to afford the mortgage on my salary alone minus savings for retirement and all other life expenses. Glad you guys were able to get in the game! You make a good point home ownership is not a one way ticket to easy living 100% of the time but I still think it’s an important aspect of building wealth for most people (or least having you money keep up with inflation in the long term picture at least as tax’s laws currently stand).

Pretty clear now that we didn’t have the red hot spring selling season that the perma bulls were promising. Maybe next year lol

Despite lower interest rates we see a very pathetic spring season. That should tell you something…..well only if you are interested in data. Most perma bulls here are heavily invested in house flips, so for them it’s a state of panic at the moment.

The current market has more all-cash homeowners, investors, and foreign buyers than during previous cycles. Do those types of owners make the market more volatile and increase the rate of price decline when it corrects? Would the total decline be larger or smaller? Thoughts?

There’s a yuuuge mis understanding of how real estate investment works. When I buy properties, I buy for cash flow and ROI. When calculating whether a rental is a good buy or not, appreciation isn’t part of the equation. Any appreciation is a nice bonus. But it’s never a factor in my decision. So if appreciation stops or even turns negative, I’m not selling because my base assumption is always no appreciation to begin with.

Now obviously I can’t speak for everyone else. But if you do it “by the book” you don’t sell a nice positive cash flow property because the market value falls a little. It would be like selling a stock paying 10% yield because the value dropped. You keep that sucker forever and ever cashing in those quarterly dividend payments.

Landlord, it is interesting because I used the same strategy over decades. Obviously, my desired ROI was mostly available in down markets. Now, looking back, I could see why most of my buys were close to the bottom even if I found the bottom and top only in retrospect.

In the last few years I could not find any more good ROI properties for rent even looking at multiple states. However, more than a year ago I found a good price, flat 2.5 acres in the city with all utilities in street. Doing feasibility study with the city, I found out I can develop it any way I like in terms of density as long as it is residential. I am almost done with all engineering and approvals. If the market is good, I might sell some. If people don’t buy houses, then they rent and I can have have some duplexes available brand new, with very low maintenance cost and high rents (good area). So, regardless how the market goes, up or down, it is good. So, for now, I don’t have anything to sell and I am not buying anything. The passage of time, recession or inflation will just put me in a better position.

Investors will, historically speaking, dump under performing assets or strategically default on real estate. Your typical homeowner will attempt to keep making their mortgage payment even if the house loses value. This means the more investors the more volatile the market can be.

I think we have to talk about this 50-70% crap. I am in the inland empire so I only watch or care about the inland empire. I can’t find another home that I would want to live in that had a 50% price drop in 2009 or any year. I have seen a few people that got 30% off. Again I am talking about actually good neighborhoods where the prices were 425k at the lowest and 600k now.

If there is a 70% crash many of us will not have a job. And you’re a fool to say your job is secure.

Jordan,

You bring up an excellent point. In the last downturn there were plenty of houses that dropped 70% in price. Those were houses that nobody wanted. There were ghost towns all over the place where the value dropped to $0. But in desirable areas, with good schools, low crime, close to retail, etc prices never dropped more than 20-30%. After doubling or more in the runup.

The 50-70% is just nonsense Millie spews. Nobody believes that will happen. Not even Millie.

So let’s take the 30% off from 2009-2011. Even if you had bought at the peak of the last boom, today the house is worth more. And had you taken out a 15 year mortgage, that house would be almost paid off.

Long term, renting is financial suicide. Plain and simple.

I think we have to separate California from other places like spokanistan. In spokanistan i can buy two houses in cash. In California you can rent a mansion and pay less than a dumb buyer who’s purchases a highly over priced crapshack. Renting is a gift in California

That is a good point, Landlord. In RE I always try to buy in good areas were I would not be afraid for my wife to walk at night. I consider those good areas long term. If I like the area, my tenants will also like it and be willing to pay me top rents. Location, location and location is everything in RE. To that, for me, I add ROI. It is not easy to find properties like that, but with patience and a large geographical areas I look at I find enough when I have the money.

Millie, a decent house in LA costs $3K minimum if you don’t want a bars on the window neighborhood. $4K for something desirable. That will increase 5% a year forever, while a fixed mortgage stays the same. Renting long is financial suicide everywhere and anywhere, but especially so in higher end markets. You know this. Everyone knows this.

Speaking of Spokane, rents increased an average of 11% last year. KA-CHING for yours truly. But I am a benevolent landlord and have kept rent increased to 10% or under. It’s due to the fact at heart I’m a humanitarian. LOL. Nahh, I just like round numbers so 10% it is.

Landlord you can make up numbers all you want. The data shows the opposite. You have been wrong on every single forecast you made.

“This is the year when millennials will go out and buy in drovesâ€

“There is no inventoryâ€

“This spring selling season will be epicâ€

All trash can / RE cheerleaders sales pitches.

Looks like cash flow negative and trying to lure the last greater fools….

Jordan,

As Mr. Landlord points out, the 50-70% decline is some nonsense that Millie spews out. Areas like Vegas, Phoenix and the IE declined that much during the last housing bubble. Remember, anybody with pulse could buy multiple houses with zero down. Those days are long gone and likely won’t be seen again for decades. The people who have bought in the last decade are likely the most qualified buyers EVER. Wishing for a 50-70% decline is just that, wishing.

The desirable areas won’t go down much (just like last time). Every area is unique, the ones that are close to job centers, amenities, safe, good public schools will barely budge and will always have a plenty of buyers with every percent drop in price. I honestly think investors will swoop in scoop up all the bargains during the next downturn…be careful what you wish for.

I think Millie was too young to remember that in the last crash; cash rich investors came in in early 2012 and bought up everything that had 4 walls and a roof and flipped or held. Heck, I have even seen where the 2012 flipper fixed it up flipped it to another investor who held onto it for a couple years and the house got flipped again.

All this rambling about the next crash – well the cash rich flippers have even more cash then they did in 2012, 2013. AND you know wall street will start buying en-bloc again as well.

Many older people I know bought during the last crash. None of them are investors.

It’s a myth that only investors buy when prices are down. By the way I will be an all cash buyer once we crash hard. It’s normal that people buy when prices are down. Only dumb people buy when the market peaks. If people would be buying at the peak (right now) than none of you RE cheerleaders would be here telling us now is a great time to buy.

There has been a definite slow down here in the inland empire and homes sell once they have 1-2 price drops of 10k or so. But I am noticing it’s getting even slower it seems like lately. I am getting the number of homes sold in my area for April May and June.

Last year this time it was multiple offers and usually above asking price.

Seeing the same thing in northern SLO county 2-5% price drops any thing over 1 mill 10-15 % drop but still just less than 1/2 these home are gone in 1week to 30days slowing!

Boy oh Boy this is EPIC, I have never seen more made up information on this site before.

Oh and the folks pretending you will see 2012 pricing again here….

just Lo-Effen-L

I know, there are seriously still people who doubt that there will be a 50-70% crash happening soon. Even though we have this very ten years.

Millie, why you are trying endlessly and hopelessly to make us try to believe your 70% off madness? Why work so hard to answer every comment with your silly mantra? If YOU believe it, isn’t that good enough?

Millenial, you make up 50-70% of the made believe post…

So what exactly is “soon”

You have been posting here for 3 years as prices went up…

what has “soon” become

Complete make believe

A 50-70% crash is a given at this point. Most experts agree with me on this. Nothing silly about it, just a fact that will hurt the RE cheerleaders.

A 70% correction is ONLY a given in your brain.

No one else’s. And that’s being kind.

Still dodging the question though. Same mantra for three years straight. When is the crash? When is “soon”? When should I cash-out my 401k for the epic fire sale?

Millennial, can you reference just 2 of these experts you keep referring to that predict a 50-70% price reduction coming up? I’m not saying there won’t be a downturn…but you just keep spewing numbers out year after year but never mention your source.

Obviously, so many RE experts are calling for a 50-70% crash that you have to ask the question: which RE experts dont forecast that and only expect a 40-50% crash? Not many. Most RE experts have experience and know the drill. They have been through the rodeo a few times. They know very well the market crashes hard every ten years. We are overdue now. Epic crash is around the corner. If you buy now you will do the worst mistake in your lifetime.

Housing is disgustingly overpriced in most urban parts of California and has been made into a commodity like stocks for the wealthy and usually older generation to play with at the cost to us that want to actually use it reside in as shelter, but you acting in this way and filling this forum up with some arbitrary number you get out of your a** is not going to help anyone (that is what you are trying to do, right?). Free speech is free speech but you really are spreading information with no basis. Any inexperienced buyer reading this should really question whether it is right to listen and believe just because someone keeps repeating it over and over again. You have no source and no reason for your 50-70% predictions, and I can not find any economists or predictors with past reliability making predictions of this sort on the web. In reality, this is kind of just as bad as the guy that keeps saying this time is different and the market will never crash again.

Inventory is too low for a big downturn in housing in most markets.

The FED will do all they can to stop a drop in houses if they drop more than 20%. Like give Wall Street a bunch of cheap money to scoop up foreclosures….just like last time. They now have a playbook.

Correct ru82,

We have so much inventory now that prices are falling left and right. The fed has no choice but to cut rates to keep it from further crashing. It won’t help though. Why would someone buy now if you can buy during the crash for 50% off? Nothing goes up forever, besides the lies of RE cheerleaders. When we get a nice recession you will have low prices and low interest rates. Perfect for future buyers. In the meantime they can enjoy a bargain in rents. You can rent a mansion and still pay much less than if you would buy an apartment. Makes no sense to buy.

224k new jobs in June.

Womp Womp for the perma bears.

A friend went to a real estate investors seminar and he projected that we will enter into a stagnate period of a little up and a little down for the next 5 years or so. Obviously, supply and demand come into play, but I am starting to believe or see that now. We have a lot of small very small price reductions. In my area, (inland empire) there is a lot of reductions but less then 5% is not a reduction to me. I think RE people trying to overinflate the market as usual.

I have actually been looking to buy myself as a primary and rent mine out, but I can’t seem to land a good deal as those go to investors/people who have the inside track. Two have been foreclosures that never actually made in onto MLS or any other site for that matter until it was listed as SOLD. It is very frustrating as it happened to me twice this year.

Inland Empire is not crazy inflated like OC and LA. I will be paying about $400 more to buy than to rent that same house. I think we are seeing more people renting as they don’t have the money for a down payment and I don’t want to hear about student loan debt or any other excuse. Get on a budget, lose your cable, and you $1,000 iPhone (unless work pays for it), lose the car payment and go back to things that are a necessity and not a want.

Flyover brought up delaying gratification so he can accomplish his long term goals. I dont see society being about to delay anything, lately.

“Flyover brought up delaying gratification so he can accomplish his long term goals. I dont see society being about to delay anything, lately.”

It’s sad but true. Milenials have no self control. It’s why they can’t buy a house, it takes too long to save up. Booooring. If i have $20 I’ll spend it on avocado toast today, not a downpayment on a house tomorrow. That’s sooooo 2003 man and like what old people do.

And then Bernie and Kamala come along and say “hey Millie, it’s not your fault you’re irresponsible and have the attention span of a 5 year old. No your poor darling. You’re just a victim of racism or sexism or boomers or Wall St or Trump or fill in your favorite boogeyman. And if you’re a 28 year old loser living in mom’s basement it’s an appealing message. All I have to do is vote for Bernie and all my problems go away? That’s much easier than being a responsible adult man!! Where do I sign up?

Mr Landlord likes to victim blame.

Facts:

1) Mr Landlord and I went to college back when it was basically free. OK I had to work 4 months over summer at a minimum wage job to pay for the entire year of college tuition.

It must be Millennial’s fault they can’t do that now. Bernie and Kamala want to fix this so Millennials can get the same benefit Mr Landlord had.

2) Wages have been flat since the late 1970’s. That must be Millennials fault also. Mr Landlord was able to save money early and invest in cheap houses and stocks which went up 150% for houses and 300% for stocks under Obama. Millennials were too young to take advantage of this We need another Obama or Bernie to fix this for Millennials. How greedy can Mr Landlord get and still blame Obama for his 300% gains?

3) Health Care for my first job was free with no co-pay. Millennials better keep eating avocados to stay healthy.

I don’t know what planet Mr Landlord lives on, but it isn’t planet Earth. Don’t ever vote Republican since they are the so out of touch. That is why Bernie or Kamala will win. Mr Landlord is just clueless.

Wages are flat because of mass immigration and offshoring. Remember Perot’s “giant sucking sound†of what would happen after Clinton’s NAFTA? And more immigrants including H1B visas mean more competition for jobs, meaning lower wages. Go ask any IT worker.

Higher tuition is thanks to student loan programs, which they pass out to anyone breathing even if they shouldn’t go to college. As a response colleges raised tuition up and up. They also added layers and layers of administrators. Each UC has dozens and dozens of admins for “affirmative action†costing over $100k each. Never mind all the junk degrees in various grievance studies which also cost millions and millions a year and produce graduates who will nevertheless have a job higher than barista.

Now all these policies are democrat – a party now ruled by far leftists who think the country was founded on “white supremacy†(said Beto) and who claimed on the 4th of July that Quaker Betsy Ross was a Nazi. These are also the lunatics running California, trying real hard to turn it into Brazil, with very and very poor and no middle class.

Bob,

As you very well know, your liberal democrats in CA (the ones you voted in power) have super majority. That means they make all the decisions for that state. Most (by far) of the higher education in CA is covered by the UC and CalState systems. As a result, most of the funding is at the discretion of the CA legislature which means the funding is a function of priorities.

For these liberals, spending billions for the welfare, housing, food, education for the millions of illegals (see “sanctuary” state and cities) is a far greater priority than using the same billions for the higher education of native born Californians. When those low tuitions were in place, the governor of CA was Ronald Reagan and the republicans in that state still had a strong voice in terms of priorities. Today, the republicans in CA have exactly ZERO power, but you still blame them – how convenient!

The Democrats today are no longer your parents democrats. They are globalists and undermine the sovereignty of the US at every turn in order to establish a world wide slave plantation. But you still vote for them because you always voted democrat. Yes, in the GOP you still find many globalists, but in the Democrat Party ALL are globalists. They don’t represent your (or mine) interests. They represent the largest banks who own the FED and the illegals are just used as pawns to achieve their sick evil end.

I’ve stated the facts.

No other candidate other than the Democrats are willing to step up and solve these issues.

Trump is all MAGA, MAGA, MAGA, but he has no solutions to the issues I have stated above. He tramples on wages, his Dept of Education continues to issue student loans for Trump U type colleges(look it up. Obama tried to stop this and Trump just approved of legalizing this scam). ObamaCare was killed. Hey, Where is the HealthCare solution you promised 2 years ago, Mr Trump?? Is Trump just “Slow”???

America WAS great when Mr Landlord and I were young. I don’t see any solutions from the Republicans. Only false promises.

The next step is to vote in Democrats.

“Even though we have this very ten years.”

Millie, NO we do NOT have a 50-70% dip in home prices every

cycle dip. The 50-70% was a once in a lifetime buying opportunity that

you missed. So move on and quit crying and whining about it. It’s NOT going

to happen. Snap out of your delusion and get real.

Market man,

I am a surprised by your comment. Of course we have a 50-70% every ten years. We are about to have another one. Just have a little bit more patience. That’s not whining that’s cheering! I can’t wait for the collapse.

I have to agree with Market Man.

Here is 45 years of housing data for Silicon Valley going back to 1975. The shaded areas are recessions.

https://fred.stlouisfed.org/series/ATNHPIUS41940Q

I only see one 40-50% crash in 2008. If you believe that there is a hard crash every 10 years, you’d expect to see at least 4 significant crashes. All of the other price drops are less than 20%.

You could argue that historically housing prices have not bubbled as much as the last 20 years.

Correction to my statement. Wolf Street just posted some VERY interesting data for LA housing prices that included inflation.

The 1990-2000 housing drop in Los Angeles was actually worse than the 2008-2012 shorter crash. Our Millennial is partly correct. Housing prices did drop during over 10 years by over 50% if you count inflation.

Inflation at 4% from 1990-2000 with flat housing prices over the 10 years after a 20% housing price loss in 1991 actually makes Our Millennial correct.

If housing prices drop 20-30% over 10 years while inflation grows at 4%, Our Millennial will see a 50-60% drop. As long as Our Milleninal gets a 4% yearly raise, the time to buy will be in 10 years if this happens again.

I owned a house in S. CA in the 1990’s and the house price had dropped in 1991 by 10% but remained flat for the rest of the decade. Meanwhile, my wages and inflation were going up 4%.

I finally bought a house after waiting for the crash to arrived for 7 years. I thought it would happen with Trump presidency but never did. I had 60% down payment on a 2600 square feet home, and the seller dropped $50k when the market was on the down turn. It’s hard to find a big house like this and lot size with what my wife and I want especially my mortgage is the same as my rent with a low 15 year 3.2% interest rate. We decided to go for it.

I don’t anticipate a market to crash this year or the next. I’m already saving up for investment property if the crash does happen.

That’s great that you bought at the peak recently! Exactly what we want, more buyers buying at the peak of the bubble means they don’t competent when the market is crashing as these underwater buyers have their money tied up in a depreciating asset.

With our combined income of $350K/year and annual bonus of $50,000/yr, $700k with 60% down payment on a home isn’t stretching our budget. Paying $2000/month in mortgage is doable even if one of us lose our job. I have a high seniority union govt job. Yeah it sucks paying at the top, but I have a family with kids.

If the recession does happen in the next 2-3 years, I’ll be ready for another down payment since one spouse take care all the bills and another do the saving. I can take money from the 2 houses and saving I do in the next 2-3 years.

Gradually, I am beginning to believe that there is NOT going to be a large drop in home prices in the immediate future. Sales are slowing, inventory is increasing, but sellers are NOT dropping their prices. Rather than dropping their prices, they are letting their listings expire. Also, there is NO recession in sight.

Dreaming of a crash isn’t going to make one happen. As soon as I see ANY evidence of one happening, I will post that evidence on this site. Right now, there just appears to be the usual second half of the year slowdown, and the housing market will likely pick up steam early next year. Prices in Southern California will likely be 4-5% higher next spring than they were this spring.

I am beginning to believe that there is NOT going to be a large drop in home prices in the immediate future. Sales are slowing, inventory is increasing, but sellers are NOT dropping their prices.

Some sellers are, but only up to a point. And yes, many sellers are not dropping prices at all.

Why would they? The longer they hold the house, the greater the Prop 13 savings, the more profitable to rent than to sell at a discount.

Milli has this ridiculous notion that sellers will be offering homes for pennies on the dollar, and there’ll be so few buyers that Milli can take his pick of steeply discounted homes.

But, like some others on this forum, I don’t think Milli really believes in a 50 to 70% price drop on coastal properties.

Gary, you’ve changed your opinion pretty often in the past year that I’ve read these forums. Better than the guy that though the crash was around the corner for 6 straight years I guess but IMO you should control the impulse to further predict prices for next spring. You may change your opinion again real soon.

SDMan, your criticism is well deserved. The price declines, which I expected to see by now, have not occurred. I really don’t know why.

Something positive is happening below the surface that appears to support rising home prices and continued economic growth. The economic news is mostly bearish so I am confused by the lack of any significant decline in real estate prices or in the economy as a whole. If there is going to be a recession, it is apparently at least a year away.

The only price declines I see appear to be in homes priced over 1 million dollars. The bottom end of the real estate market is continuing to rise. Apparently, the Republican changes in SALT and interest deductions is affecting higher-end home prices.

People born in the 1930s are in the 80s now

(my mom and dad are in this group)

People born in the 1940s are in the 70s now

(Trump and Biden are in this group)

We younger generations need to wait

Until older generations to sell their homes

So we will be able to afford a home

Hopefully the housing market will be

Affordable in the 2020s and 2030s

LH: Some friends of mine have a Mother that is going to have to move out of her house in a desirable LA Co neighborhood. They are cleaning her trash collection out of it, and I think they’ll probably try to talk her into selling it. She is in your parent’s age group (on the older side of the group). But young couples who aren’t in the mid six figure income bracket can forget about that one. And if they rent it out, they’ll get more than $4K/Mo, maybe $5-6K. I saw a similar size house in a less desirable area within a couple of miles of this one for about $5K/Mo.

If elected president, Kamala Harris wants to spend $100 Billion to assist blacks in buying homes: https://www.foxnews.com/politics/kamala-harris-announces-100b-plan-for-black-homeownership-tackling-racial-wealth-gap

As of today, I officially identify as a black person.

Where’s my check Kammy?

Another racist democrat candidate discriminating people based on percent melanin in the skin. So, based on that if a latino man has enough melanin in his skin (dark enough skin for working out in the sun), can he benefit from that or will he be discriminated based his country of origin?!?….

If the white men are a very small minority in some CA cities, are they going to benefit for government jobs employment? After all, they are a very tiny minority in some of those jobs. Or are the democrat politicians saying indirectly “you have enough high IQ to fend for yourself, we have to help handicapped people”. Directly or indirectly, the democrat politicians show that they are the more racist people and scream racist at others due to “projection”. The whole “affirmative action” is one big racist statement the liberals are making. Some of the black politicians try to monetize if the difference in percent melanin – they are sick!!!!….They treat their own people, more than 100 years after slavery like they are handicapped. I know many black people who resent these politicians who rob them of their dignity and I know many black business owners who are very successful with no help from the government – just by studying and working hard, the same like all the successful people.

To Kamala Harris…that would be a big ‘WTF?’????

How about incentivizing black men to stay with their families and not allow single black mothers to raise their children alone? Its well documented that the demise of the black family with 2 supportive parents leads to poverty and the cycle continues with the children…

It happens also in white families, if the parents divorce, especially when children are teenagers. There are lots of psychological problems, financial ruin and other negative consequences. Like with everything else, parents are free to chose but they can not chose the consequences. They are the same regardless if the disintegrating family is white or black. It is true though that it happens in larger percentage in black families.

Oh wow, what could possibly go wrong here…

Market is crashing left and right

https://www.zerohedge.com/news/2019-06-30/bay-area-home-prices-plunge-may-largest-7-years

Zero Hedge…., Bwahahahahahaha…..!!!!!!!

According to ZeroHedge, the apocalypse has been well under way for over a decade. Nothing new there.

Damn, prices are crashing hard in the Bay Area

https://www.zerohedge.com/news/2019-06-30/bay-area-home-prices-plunge-may-largest-7-years

It will soon trickle down to the rest of the west coast. Bay Area home prices crashing is a great indicator of what’s to come. Good data by zero hedge!

It’s a day that end in “y” so it must be a day ZH is predicting a great depression.

Dumb Enough To See It All Again, And To Dumb To Not See It Coming Again- Bay Area Home Prices Plunge In May, Largest In 7 Years

https://www.zerohedge.com/news/2019-06-30/bay-area-home-prices-plunge-may-largest-7-years

Newest data from Black Knight Analytics:

– Mortgage delinquencies (loans 30 or more days past due, but not in foreclosure) down 3% in May

– Delinquencies at lowest level since January 2000

– 39k foreclosure starts—lowest number in 18 years

– Number of loans in active foreclosure lowest in 13 years

– Expensive real estate markets of San Francisco, San Jose, and Seattle have lowest delinquency rates

= No tank in sight.